Attached files

| file | filename |

|---|---|

| 8-K - Ault Global Holdings, Inc. | r4152128k.htm |

| EX-99.1 - EXHIBIT 99.1 - Ault Global Holdings, Inc. | ex99_1.htm |

Exhibit 99.2

Ault Global Holdings, Inc YE 12/31/2020 Financial Results April 15, 2021

Safe Harbor FINANCIAL RESULTS 2 This presentation and other written or oral statements made from time to time by representatives of Ault Global Holdings Inc. (s ometimes referred to as “AGH”) contain “forward - looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Ex cha nge Act of 1934. Forward - looking statements reflect the current view about future events. Statements that are not historical in nature, such as forecasts for the industry in which we operate, and which may be identified by the use of words like “expects,” “assumes,” “projects,” “anticipates,” “estimates,” “we believe,” “could be,” "future" or the negative of these terms and other words of similar meaning, are forward - looking statements. Such statements include, but are not limited to, statements contained in this presentation relating to our business, business strategy, expansion, growth, products and services we may offer in the future and the timing of their development, sales and marketing strategy and capital outlook. Forward - looking s tatements are based on management’s current expectations and assumptions regarding our business, the economy and other future conditions and are subject to inherent risks, uncertainties and changes of circumstances that are difficult to predict and may cause actual results to differ materially from those contemplated or expressed. We caution you therefore against relying on any of these forward - looking statements. These risks and uncertainties include those risk factors discussed in Part I, “Item 1A. Risk Factors” of our Annual Report on Form 10 - K for the fiscal year ended December 31, 2020 (the “2020 Annual Report”) and other information contained in subsequently filed current and periodic reports, each of which is availabl e o n our website and on the Securities and Exchange Commission’s website ( www.sec.gov ). Any forward - looking statements are qualified in their entirety by reference to the factors discussed in the 2020 Annual Repor t. Should one or more of these risks or uncertainties materialize (or in certain cases fail to materialize), or should the underlying assumptions p rov e incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned. Important factors that could cause actual results to differ materially from those in the forward looking statements include: a d ecline in general economic conditions nationally and internationally; decreased demand for our products and services; market acceptance of our products; the ability to protect ou r i ntellectual property rights; impact of any litigation or infringement actions brought against us; competition from other providers and products; risks in product development; inabili ty to raise capital to fund continuing operations; changes in government regulation, the ability to complete customer transactions and capital raising transactions. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us t o p redict all of them. We cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States , we do not intend to update any of the forward - looking statements to conform these statements to actual results. All forecasts are provided by management in this presentation and are based on information available to us at this time and m ana gement expects that internal projections and expectations may change over time. In addition, the forecasts are based entirely on management’s best estimate of our future financial perfo rmance given our current contracts, current backlog of opportunities and conversations with new and existing customers about our products.

Q4 2020 Highlights FINANCIAL RESULTS 3 • Revenue of $ 7 . 2 million, an increase of 14 . 8 % from the prior fourth fiscal quarter ; • Gross profit of $ 1 . 9 million, an increase of 374 . 9 % from the prior fourth fiscal quarter ; • Loss from continuing operations of $ 709 , 361 , compared to a loss from continuing operations of $ 8 . 9 million during the prior fourth fiscal quarter ; and • Net loss of $ 10 . 4 million for the quarter, including non - cash charges of $ 11 . 2 million .

Year ended December 31, 2020 Highlights FINANCIAL RESULTS 4 • Revenue of $ 23 . 9 million, an increase of 6 . 7 % from the prior fiscal year ; • Gross profit of $ 7 . 5 million, an increase of 145 . 6 % from the prior fiscal year ; • Loss from continuing operations of $ 6 . 0 million, an 75 . 6 % decrease from the loss from continuing operations of $ 24 . 7 million in the prior fiscal year ; • Net loss of $ 32 . 7 million, including non - cash charges of $ 29 . 3 million, and • For the first time under current management, there will be no going concern qualification in the report of our independent registered public accounting firm .

Revenues FINANCIAL RESULTS 5 Our revenues increase by $ 1 , 509 , 238 or 7 % , to $ 23 , 871 , 277 for the year ended December 31 , 2020 from $ 22 , 361 , 994 for the year ended December 31 , 2019 . Gresham Worldwide Gresham Worldwide’s revenues increased by $ 2 , 980 , 878 , or 20 % , to $ 18 , 212 , 721 for the year ended December 31 , 2020 , from $ 15 , 231 , 843 for the year ended December 31 , 2019 . The increase in revenue from our Gresham Worldwide segment for customized solutions for the military markets reflected the benefit of capital that was allocated to our defense business during the second half of 2019 . Gresham Worldwide revenue in 2020 includes $ 598 , 500 from Relec Electronics, which was acquired on November 30 , 2020 . Coolisys Coolisys revenues decreased by $ 409 , 528 , or 7 % , to $ 5 , 416 , 138 for the year ended December 31 , 2020 , from $ 5 , 825 , 666 for the year ended December 31 , 2019 . Ault Alliance Revenues from our cryptocurrency mining operations revenues decreased by $ 641 , 745 , or 100 % from the year ended December 31 , 2019 , due to our decision to cease our cryptocurrency mining operations in 2020 . We announced in March of 2021 that we resumed bitcoin mining as we believe that we are now in a position to better withstand the volatility associated with cryptocurrency mining, as we have and improved capital structure and have secured a low - cost energy source that we control . Revenues from our lending and investing activities at Digital Power Lending decreased by $ 420 , 322 , or 63 % , to $ 242 , 418 for the year ended December 31 , 2020 , from $ 662 , 740 for the year ended December 31 , 2019 , which is attributable to a reduction in our loan portfolio . During 2021 , we have provided significant new funding to expand Digital Power Lending’s loan and investment portfolio .

Non - Cash Charges FINANCIAL RESULTS 6 During the three months ended December 31, 2020 and 2019, our reported net loss included non - cash charges of $11,225,420 and $1, 236,731, respectively. During the year ended December 31, 2020 and 2019, our reported net loss included non - cash charges of $29,325,236 a nd $12,401,816, respectively. A summary of these non - cash charges is shown below: The Company’s Chief Financial Officer, Kenneth S. Cragun, said, “The financial results for 2020 demonstrate that we are achie vin g our objectives to grow revenue and improve operating results. In spite of the disruption from the COVID - 19 pandemic, we were able to increase fourth quarter revenues by 14.8% from the prior year period, driven by our defense business. Our gross margins for the year e nde d December 31, 2020 improved considerably, up $4.5 million, or 145.6% from the prior year. Combined with a reduction in operating expenses, our loss from continuing operations for the year ended December 31, 2020 decreased by $18.7 million from the prior year. We significantly i mpr oved our balance sheet as well, ending fiscal year 2020 with positive working capital of $12.5 million, due to our ability to raise ca pit al in the public market, compared to a working capital deficit of $19.2 million at the end of 2019.”

Executive Chairman Commentary FINANCIAL RESULTS 7 Ault Global’s Founder and Executive Chairman, Milton “Todd” Ault, III said, “The past year has been extremely rewarding and is the result of years of strategic planning. During this time, we have strengthened our operating businesses, improved our balance sheet tremendously and positioned the Company to capitalize on the very promising technologies at our subsidiaries. We anticipate significant revenue growth and profitability within the foreseeable future. With the strongest balance sheet in the Company’s history, a capable team at the Company, and a talented group of CEOs at the subsidiary level, the future prospects look bright for the Company in the short and long term.” Mr. Ault added “Our holding company platform transformation is developing rapidly. Our recent capital raise of approximately $165 million has enabled us to fund our subsidiaries while virtually eliminating our net debt. I am more confident than ever that the decision to become a holding company was correct. We see strength across all our subsidiaries and expect the completion of the lending and investment platform by the end of the second quarter. Simply stated, we are in the strongest position of our company’s 52 - year history. To all who stood behind our company and me during some tough times, I deeply thank you. From my perspective, the road ahead is bright.”

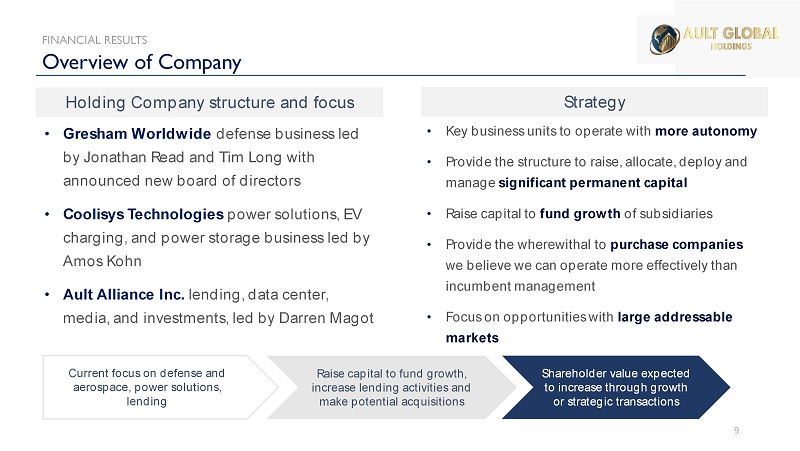

Overview of Company FINANCIAL RESULTS Raise capital to fund growth, increase lending activities and make potential acquisitions Shareholder value expected to increase through growth or strategic transactions Current focus on defense and aerospace, power solutions, lending Holding Company structure and focus Strategy • Key business units to operate with more autonomy • Provide the structure to raise, allocate, deploy and manage significant permanent capital • Raise capital to fund growth of subsidiaries • Provide the wherewithal to purchase companies we believe we can operate more effectively than incumbent management • Focus on opportunities with large addressable markets • Gresham Worldwide defense business led by Jonathan Read and Tim Long with announced new board of directors • Coolisys Technologies power solutions, EV charging, and power storage business led by Amos Kohn • Ault Alliance Inc. lending, data center, media, and investments, led by Darren Magot 9

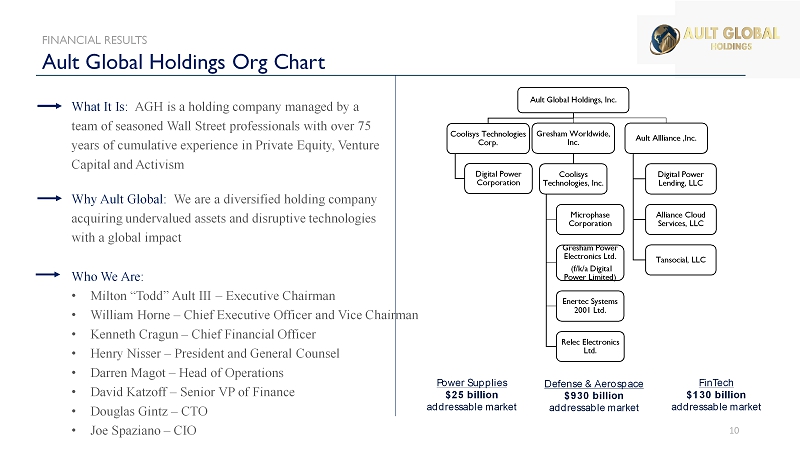

Ault Global Holdings Org Chart FINANCIAL RESULTS Who We Are: • Milton “Todd” Ault III – Executive Chairman • William Horne – Chief Executive Officer and Vice Chairman • Kenneth Cragun – Chief Financial Officer • Henry Nisser – President and General Counsel • Darren Magot – Head of Operations • David Katzoff – Senior VP of Finance • Douglas Gintz – CTO • Joe Spaziano – CIO What It Is: AGH is a holding company managed by a team of seasoned Wall Street professionals with over 75 years of cumulative experience in Private Equity, Venture Capital and Activism Why Ault Global: We are a diversified holding company acquiring undervalued assets and disruptive technologies with a global impact 10 Defense & Aerospace $930 billion addressable market Power Supplies $25 billion addressable market FinTech $130 billion addressable market Ault Global Holdings, Inc. Coolisys Technologies Corp. Digital Power Corporation Gresham Worldwide, Inc. Coolisys Technologies, Inc. Microphase Corporation Gresham Power Electronics Ltd. (f/k/a Digital Power Limited) Enertec Systems 2001 Ltd. Relec Electronics Ltd. Ault Allliance ,Inc. Digital Power Lending, LLC Alliance Cloud Services, LLC Tansocial, LLC

Thank you! Comments/Questions Year Ended December 31, 2020