Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Chemomab Therapeutics Ltd. | tm2112883d1_ex99-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 2

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 14, 2021 (March 17, 2021)

Chemomab Therapeutics Ltd.

(Exact name of Registrant as Specified in Its Charter)

| State of Israel | 001-38807 | 81-3676773 |

| (State or Other Jurisdiction | (Commission | (IRS Employer |

| of Incorporation) | File Number) | Identification No.) |

| Kiryat Atidim, Building 7 | |

| Tel Aviv, Israel | 6158002 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: +972-77-331-0156

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) |

Name of each exchange on which registered | ||

| American Depositary Shares, each representing twenty (20) ordinary shares, no par value per share | CMMB | Nasdaq Capital Market | ||

| Ordinary shares, no par value per share | N/A | Nasdaq Capital Market* |

* Not for trading; only in connection with the registration of American Depositary Shares.

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

- 2 -

EXPLANATORY NOTE

On March 17, 2021, Chemomab Therapeutics Ltd., formally known as Anchiano Therapeutics Ltd. (the “Company” or the “Registrant”) filed a Current Report on Form 8-K (the “Initial Filing”) disclosing the closing of the merger transaction, which closed on March 16, 2021 (the “Closing Date”) pursuant to the Agreement and Plan of Merger by and among the Registrant, Chemomab Ltd. (“Chemomab”) and CMB Acquisition Ltd., an Israeli limited company and wholly-owned subsidiary of the Company (the “Merger”).

On March 19, 2021, the Company filed Amendment No. 1 on Form 8-K/A to amend the Initial Filing to include the required historical financial statements of Chemomab. This Amendment No. 2 on Form 8-K/A (“Amendment No. 2”) amends the Initial Filing to include the required pro forma financial statements as of and for the twelve months ended December 31, 2020 (the “Pro Forma Financial Information”), giving effect to the Merger as required under Item 9.01(b) under cover of Form 8-K/A.

Prior to the Closing Date, and on March 9, 2021, the Registrant filed its Annual Report on Form 10-K (the “Annual Report”) with the Securities and Exchange Commission (the “SEC”), which included disclosures pertinent to Anchiano, which was the operating company of the Registrant prior to the Closing Date. In parallel with the filing of this Amendment No. 2, the Registrant is filing a Registration Statement on Form S-3 to cover the resale of certain issued securities. In addition to filing the Pro Forma Financial Information, the Registrant is filing this Amendment No. 2 in order to update certain disclosures included in the Annual Report, such that the disclosures will relate to Chemomab, which is the current operating company of the Registrant.

Unless the context otherwise requires, all references in this section to “we,” “us,” “our”, the “Registrant” or the “Company” refer to Chemomab and its subsidiaries.

BUSINESS

Overview

Chemomab is a clinical-stage biotech company discovering and developing innovative therapeutics for conditions with high unmet medical need that involve inflammation and fibrosis. CM-101, the company’s lead clinical product candidate, is a first-in-class humanized monoclonal antibody which hinders the fundamental function of the soluble chemokine CCL24, also known as eotaxin-2, as a regulator of major inflammatory and fibrotic pathways. Chemomab has shown that CM-101 interferes with the underlying biology of inflammation and fibrosis using a novel and differentiated mechanism of action and is actively advancing CM-101 into a staggered Phase 2 clinical studies to treat patients with liver, skin, and lung fibrosis. Chemomab has completed two Phase 1a clinical studies at varying doses using different administration methods, as well as a Phase 1b safety, tolerability and proof-of-mechanism clinical study of CM-101 in non-alcoholic fatty liver disease, or NAFLD, patients. Chemomab is currently conducting a Phase 2a clinical study in primary sclerosing cholangitis, or PSC, a rare obstructive and cholestatic liver disease, in Europe and Israel and Chemomab is planning a Phase 2 study in systemic sclerosis, or SSc, a rare autoimmune rheumatic disease characterized by accumulation of collagen, or fibrosis, by the end of this year. Although the primary focus of Chemomab relates to these two rare indications, an additional Phase 2a clinical study expanding the understanding of CM-101 in non-alcoholic steatohepatitis, or NASH, has been initiated and will provide important safety and PK data designed to support the development of CM-101 subcutaneous formulation.

Fibrosis is the abnormal and excessive accumulation of collagen and extracellular matrix, the non-cellular component in all tissues and organs, consisting of macromolecules such as collagen, that provide structural and biochemical support to surrounding cells, leading to scarring and thickening of connective tissues, affecting tissue properties and potentially leading to organ failure. Fibrosis can occur in many different tissues, including lung, liver, kidney, muscle, skin, and the gastrointestinal tract, resulting in a growing number of progressive fibrotic conditions. A healthy inflammatory response is necessary for efficient tissue repair. However, fibrosis and inflammation are intrinsically linked and a prolonged inflammatory response can contribute to the pathogenesis of fibrosis.

- 3 -

Chemomab has pioneered the therapeutic targeting of CCL24, a chemokine that promotes various types of cellular processes that regulate inflammatory and fibrotic activities through the CCR3 receptor. The chemokine is expressed in monocytes, macrophages, activated T cells, fibroblasts, endothelial cells, and epithelial cells, including the bile duct epithelial cells called cholangiocytes. Chemomab has developed a novel CCL24 inhibiting product candidate with dual anti-fibrotic and anti-inflammatory activity allowing it to challenge the complex interplays of both of these inflammatory and fibrotic mechanisms that drive fibrotic indications. This innovative approach is being developed for difficult to treat rare diseases, also known as orphan indications or diseases, such as PSC and SSc, for which patients have no established standard of care treatment options.

Pipeline

Chemomab’s lead product candidate, CM-101, is a first-in-class humanized monoclonal antibody targeting CCL24 that is being advanced in two orphan indications: PSC and SSc. CCL24 has been extensively studied in airway inflammation and, more recently, Chemomab has demonstrated in pre-clinical studies and early clinical studies that it plays an important role in additional indication areas, including inflammation and fibrosis of the liver, skin and lung. Although found in low levels in blood or tissue samples taken from healthy volunteers, elevated levels of both CCL24 and its receptor CCR3, have been found in patients with PSC, SSc and NASH. CCL24 levels have even been correlated to different phases of disease. Chemomab expects that neutralizing CCL24 with an antibody will exert anti-fibrotic and anti-inflammatory effects in patients. CM-101 has been granted orphan drug designation by both the FDA and the EMA in its primary indications of PSC and SSc based on extensive preclinical and non-clinical data. This designation provides multiple benefits, including exclusive marketing and development rights for a period of time for these indications.

PSC is a rare, chronic cholestatic liver disease characterized by progressive inflammation, fibrosis, and destruction of the intrahepatic and extra-hepatic bile ducts with no identifiable cause. Cholestasis is a symptom of liver injury and is characterized as the interruption of bile flow from hepatocytes to the intestine, which leads to bile acid accumulation in the liver, resulting in oxidative stress, inflammation, apoptosis, and fibrosis. PSC affects approximately 30,000-45,000 patients in the United States and is commonly associated with inflammatory bowel disease. Median survival is between 10-12 years. Fibrosis and inflammatory responses induce a progressive spread of the fibrotic condition. No treatment aside from a liver transplant has been associated with change of the disease course or significant long term improvement in the clinical outcome. PSC is a clear serious unmet medical need with no FDA-approved therapeutics and for which the current standard of care is inadequate.

SSc is a connective tissue disease characterized by excessive fibrosis and extracellular matrix accumulation in the skin, lung, and other visceral organs. The disease initiates with an early inflammatory phase involving the immune cell network, as well as endothelial cells. As the disease progresses, the inflammation increase, fibroblasts and myofibroblasts generate tissue fibrosis and endothelial cells promote vascular injury, which leads to skin fibrosis, interstitial lung disease, myocardial insufficiency, vascular obliteration, distal ulcerations, and gangrene. SSC affects approximately 75,000-100,000 patients in the United States. SSc has the highest mortality rate among the systemic rheumatic diseases with high unmet need, as current treatments managing only disease manifestations and there is no disease modifying drug available.

- 4 -

Chemomab is primarily focused on the orphan indications PSC and SSc, and believes that it has additional opportunities in neighboring fibrotic-inflammatory disease areas such as idiopathic pulmonary fibrosis, or IPF and Nonalcoholic steatohepatitis, or NASH. CM-101 has shown promising anti-fibrotic and anti-inflammatory effects in preclinical studies of liver fibrosis and PSC, with significant reductions in fibrotic genes, liver enzymes, bile acid and cholangiocyte proliferation, all reflecting an improvement in disease status. In preclinical studies of SSc, CM-101 reduces inflammatory and fibrotic injury resulting in reductions in dermal thickness, collagen concentration in the skin and the lung and immune cell infiltration in the lung.

Chemomab has completed two Phase 1a single ascending dose studies with intravenous, or IV, and subcutaneous, or SC, administrations of CM-101 in 40 healthy volunteers. The drug was shown to be safe and well-tolerated, with a PK profile supporting dosing once every 2-4 weeks. The company also recently completed a Phase 1b multiple administrations ascending dose study in 16 NAFLD patients, expanding its safety, tolerability, and pharmacodynamics database into patients where an initial confirmation of an anti fibrotic effect was already seen.

Chemomab is currently recruiting patients, in Europe and Israel, for a Phase 2a randomized, double-blind, placebo-controlled study in PSC patients. The company plans to enroll 45 patients over a 15-week treatment window. Two independent-primary endpoints for the clinical study will be changes in alkaline phosphatase, or ALP, liver enzyme levels and enhanced liver fibrosis, or ELF, score, both established parameters for the evaluation of liver health and fibrosis in PSC patients. Secondary and exploratory endpoints will include other liver enzymes, fibrotic and inflammatory markers, and liver stiffness measured by elastography (FibroScanTM). Chemomab intends to initiate a global randomized, double-blind, placebo-controlled Phase 2 clinical study in SSc by the end of this year. The company will evaluate the Combined Response Index in diffuse cutaneous Systemic Sclerosis, or ACR CRISS, score as a primary endpoint. Safety and tolerability, as well as lung function, skin thickness and fibrotic biomarkers, will be secondary and exploratory endpoints. Chemomab may also explore CM-101 in other indications, where the dual activity of CM-101 acting on both inflammation and fibrosis could provide new avenues for treating conditions like IPF and NASH.

Chemomab was founded in 2011, based on a novel discovery originating from the Sourasky Medical Center in Tel-Aviv, Israel, where Professor Jacob George first identified CCL24 as a key regulator of unstable plaque formation in atherosclerotic patients. In its early years, Chemomab focused on research directed at clarifying the role and effectiveness of a CCL24 blockade. In 2015, Chemomab selected its proprietary lead product candidate, CM-101, and started product development directed towards human testing.

Chemomab has assembled an executive team with highly relevant experience in inflammation and fibrosis, and biologics drug discovery and clinical development. Adi Mor, Ph.D., Chemomab’s Chief Executive Officer and Co-founder has 15 years of experience in Immunology and has led the CM-101 program from discovery stage into Phase 2 clinical studies. Arnon Aharon, M.D., Chemomab’s Chief Medical Officer, brings deep experience in clinical development. He previously served as the Chief Medical Officer to BiolineRx where he directed the oncology and immunology pipeline. Dr. Aharon’s professional experience also includes multiple senior management positions at private and publicly traded biotechnology companies, such as Pharmos Ltd. and Thrombotech Ltd. Michal Segal Salto, Ph.D, our VP of R&D, has over 15 years of experience in cell biology, molecular biology and biochemistry and has successfully led the R&D team from early preclinical stages through clinical translation. Sharon Elkobi serves as our VP of Business Development and holds 15 years of experience in prior business development positions, both at Neurim Pharmaceuticals and Teva.

- 5 -

Company strategy

Chemomab aims to become a world-leading company for the treatment of fibrosis, developing novel therapies across a wide range of fibrotic indications. To achieve this, the company is focused on the following key strategies:

• Advance Chemomab’s lead product, CM-101, for the treatment of PSC and SSc, through clinical development to approval

Chemomab is developing CM-101 as a novel therapy for PSC and SSc, two orphan indications with high unmet medical need. Chemomab has completed the Phase 1 clinical studies (single and multiple administration safety and tolerability studies). Chemomab is currently conducting a Phase 2a study in PSC and it intends to commence a Phase 2 study in SSc this year. Following completion of the Phase 2 studies, Chemomab will engage with the FDA and comparable foreign authorities to discuss the requirements from the pivotal study(ies) needed to obtain approval. CM-101 was granted orphan designation for both PSC and SSc from Food and Drug Administration, or FDA and European Medicine Agency, or EMA and, based on the Phase 2 results, will seek expedited regulatory approval such as the Fast Track, Breakthrough Therapy, and Priority Review designations. Chemomab expects that in order to obtain regulatory approval for the use of CM-101 to treat these indications, it will be required to conduct only one Phase 3 pivotal study for each such orphan indication.

• Expand Chemomab’s next generation pipeline

Based on the know-how, knowledge and experience it has gathered in fibrosis and fibrotic diseases, Chemomab intends to expand its pipeline with next generation products developed against new targets. Chemomab will also explore targeting CCL24 with additional, complementary fibrotic or inflammatory mechanisms, including acquiring or in-licensing innovative product candidates.

• Selectively evaluate partnership opportunities

Chemomab continuously explores partnership opportunities to advance CM-101 development in PSC and SSc, identifying companies with drugs (either approved or in development) that could possibly be combined with CM-101, extending the development of CM-101 to new indications beyond PSC and SSc, and seeking additional significant commercial or drug development capabilities that may accelerate CM-101’s time to market.

• Explore opportunities for CM-101 in additional fibrotic indications

Chemomab continuously evaluates the potential benefit of CM-101 outside of its two lead indications, PSC and SSc, in order to maximize the product’s potential. CM-101 has shown anti-fibrotic activity in animal models and human tissue studies of IPF and NASH. The dual activity of CM-101 will continue to drive Chemomab into new disease areas and to build new collaborations with global medical researchers.

• Strengthen Chemomab’s intellectual property portfolio

Chemomab believes that it has developed a strong intellectual property portfolio and will continue to seek, maintain, and defend patent rights, whether developed internally or licensed to protect and enhance the proprietary technology, inventions, and improvements that are commercially important to the development of its business proprietary position in the field of inflammation and fibrosis.

Fibrosis and inflammation

Tissue damage activates a repair process that includes acute inflammation followed by either successful complete repair or tissue replacement by fibrosis. However, persistent and repeated damage results in continuous activation of the repair process leading to chronic inflammation, progressive tissue fibrosis and sclerosis.

Fibrosis is an accumulation of non-functional tissue and can occur in many different tissues, including lung, liver, kidney, muscle, skin and the gastrointestinal tract, resulting in a growing number of chronic fibrotic conditions. Liver fibrosis is the process of excessive accumulation of extracellular matrix proteins, predominantly collagen, which occurs as results of liver injury. In cases of acute temporary damage, these changes are transient and liver fibrosis may resolve. In chronic cases, however, the liver damage persists and chronic inflammation and accumulation of the extracellular matrix eventually leads to cirrhosis. The various fibrotic manifestations in conditions like SSc are still not well understood. Disease progression is characterized by an early inflammatory onset followed by tissue fibrosis, vascular injury and organ damage. Fibrosis, and specifically lung fibrosis, is the main cause of disease progression and mortality.

- 6 -

Fibrosis and inflammation are intrinsically linked; a healthy inflammatory response is necessary for efficient wound healing, however, a prolonged response can contribute to the pathogenesis of fibrosis. The inflammatory response during chronic liver injury is a dynamic process with intrahepatic accumulation of diverse immune cells. Recruitment and infiltration of these cells to the liver and their localization is mainly determined by chemokines and cytokines that are produced by hepatocytes, immune cells, biliary epithelial cells, and endothelial cells. Notably, activated liver fibroblasts, the hepatic stellate cells, or HSCs, secrete various chemokines, thereby contributing to the ongoing immune response during fibrotic liver diseases. Similarly, for SSc, the early inflammatory phase leading to fibrosis in multiple organs of the body include activation of the immune cell network of lymphocytes, eosinophils, and monocytes, as well as endothelial and endothelial progenitor cells. In the advanced SSc phase, fibroblasts and myofibroblasts take the lead to generate tissue fibrosis.

Chemokine involvement in inflammation and fibrosis

Chemokines are a group of small signaling proteins thought to be involved in the etiology, or causation, of multiple inflammatory diseases. They are not only implicated in immune cell recruitment during inflammation, but also contribute to immune surveillance, direct cells to target organs in homeostasis, and exert pleiotropic, or diverse, effects on nonimmune cells, for instance, directly influencing the functionality of fibrogenic cells. Chemokines and their corresponding chemokine receptors are key players in orchestrating the sequential influx of immune cells into damaged or disease organs, driving inflammatory responses to specific triggers.

In the liver, chemokines have a key role in the development of inflammation and wound healing responses, which can lead to either resolution of liver injury or promote, if ongoing, maladaptive responses with chronic inflammation, fibrosis, and development of clinically manifest liver disease. Although the pathophysiology underlying PSC has not yet been fully clarified, animal models of PSC have provided contributions in dissecting the molecular basis of this disease and focusing on the role of cytokines and chemokines as important pathogenetic mediators of liver inflammation and fibrosis. Recently published studies demonstrated that in most of the processes suggested for the onset and the development of PSC, chemokines and chemokine receptors play a key role. HSCs may be the main producers of cytokines and play the initial role in the progression of liver fibrosis by attracting different types of immune cells, resulting in further production of cytokines and liver injury in a vicious disease cycle. Extensive proliferation, transdifferentiation and activation of HSCs results in ongoing chronic tissue remodeling and severe fibrosis. In addition, chemokines are also involved in promoting polarization of the recruited immune cells. Therefore, chemokines may participate in PSC by either promoting migration of inflammatory and fibrotic cells, by activating inflammatory and fibrotic cells locally, or by inducing cytokines that promote collagen and matrix deposition.

Likewise, in SSc pathogenesis, chemokines foster migration and activation of inflammatory and fibrotic cells, inducing the secretion of cytokines that promote collagen and matrix deposition in affected organs. Indeed, patients with SSc exhibit increased systemic levels of proinflammatory chemokines and some have also been shown to correlate with limited or diffuse cutaneous disease phenotype and/or to organ-specific pathology as lung disease or skin vascular inflammation.

The role of CCL24

CCL24 is a chemokine that promotes various types of cellular processes that regulate inflammatory and fibrotic activities through the CCR3 receptor. This chemokine is known to be expressed by activated T cells, monocytes, epithelial cells and endothelial cells, as well as by activated fibroblasts. CCL24 induces chemotaxis and activation of CCR3-expressing cells, including immune cells and fibroblasts.

- 7 -

Chemomab has been the driving force in establishing the role of CCL24 in the pathogenesis of PSC and SSc, however, others have proven its contribution in other indications. For example, published work has shown that both CCL24 and CCR3 are involved in lung and skin inflammation and fibrosis. CCR3 is robustly expressed on eosinophils and recent data has suggested that eosinophilic inflammation may be involved in the pathogenesis and progression of SSc. For example, in SSc patients, eosinophil counts, but not total leukocytes, were significantly higher than in patients with other connective autoimmune diseases. Eosinophil counts correlated positively with both interstitial lung disease severity and the modified Rodnan skin thickness score, or mRSS. Notably, CCR3 was demonstrated to be expressed on oral and dermal fibroblasts where it modulates wound healing and tissue remodeling processes. A recent academic study also demonstrated overexpression of CCR3 on monocyte populations isolated from SSc patients. CCL24 was shown to be involved in proinflammatory reactions, specifically contributing to the type 2 immune reaction involving Th2 lymphocytes and M2 macrophages that were shown to be present in skin lesions of SSc patients. Accordingly, CCL24 was found to play a dominant role in inducing profibrotic effects and to be overexpressed in fibrotic lungs and bronchoalveolar lavage fluid from patients with idiopathic pulmonary fibrosis (IPF), a disease sharing similar lung dysfunction features with SSc. Furthermore, CCL24 was shown to promote collagen production in human lung fibroblasts and to be constitutively expressed by dermal fibroblasts.

Prior studies support the role of CCL24/CCR3 signaling in the pathogenesis of SSc and these findings have been further explored by Chemomab in SSc and for the first time, in PSC.

CCL24 is a critical mediator promoting inflammation and fibrosis

Challenges to drug development in fibrosis and inflammation

Successful treatment of fibrotic disorders has in large part remained elusive, primarily due to incomplete understanding of the complexity and multi-mechanism contributions to disease progression. This has complicated preclinical investigations for new products and new targets, with animal models having limited resemblance to human disease. As such, preclinical animal data is often of short treatment duration and does not capture the effects of treating chronic fibrotic indications. This is particularly applicable to complex, orphan indications like SSc, where there is still no approved standard of care or proven target mechanism. Most drug approvals in this space have been focused on fibrosis of the lungs i.e., idiopathic pulmonary fibrosis, or IPF, interstitial lung disease, or ILD, and pulmonary arterial hypertension, or PAH.

Most approved anti-fibrotic products target extracellular components, given their biological accessibility, and inhibition of receptors and ligands preventing downstream signaling is considered to be an effective choice to alleviate fibrosis. PDGF and TGF-β are commonly studied targets in fibrosis and there are two approved products that target these pathways, pirfenidone and nintedanib. Both pirfenidone and nintedanib are approved for the treatment of IPF, with nintedanib also recently approved for treatment of systemic sclerosis associated interstitial lung disease and chronic fibrosing interstitial lung diseases. Due to the strong associations between inflammation and fibrosis, companies have devoted efforts to anti-inflammatory drugs with the hope that reduction in inflammation will attenuate fibrosis. For example, companies have targeted TNF-α, a commonly explored anti-inflammatory mechanism in fibrotic indications. This has yet to result in any product approvals in fibrosis. Despite the success of targeting cytokines, inflammatory factors and immune cells in pure inflammatory autoimmune diseases, like blocking TNF and IL-6, these results have not been reproduced in studies targeting inflammatory fibrotic indications. Treatments that inhibit certain pure anti fibrotic pathways, such as nintedanib and pirfenidone, have resulted in limited clinical benefit. Chemomab believes that these results highlight the importance of a dual mechanism that, with adequate selectivity, will target inflammatory processes and will directly prevent fibrosis resulting in blockage of multiple disease-contributing mechanisms.

- 8 -

Notwithstanding challenges in the field of fibrosis and inflammation, there is still significant industry interest given the associated unmet medical needs and the open field to identifying optimal therapeutic targets. For example, in 2019 Novartis completed two transactions related to the treatment of NASH, a liver metabolic fibrotic disease. It acquired IFM Tre for NLRP3 antagonists for a $310 million upfront payment and total potential consideration of $1.5 billion and licensed an integrin inhibitor from Pliant Therapeutics for an $80 million upfront payment. Additionally, Gilead Sciences licensed two preclinical programs, one in NASH for a $15 million upfront payment (total potential consideration of $785 million) and the other for TGF-β inhibitors in fibrosis for an $80 million upfront payment and total potential consideration of $1.4 billion. In 2020, Roche acquired Promedior Inc. for a $390 upront payment and total potential consideration of $1 billion in milestones for its Phase 2 product in pulmonary fibrosis and Bayer partnered with Recursion Pharmaceuticals to develop and commercialize preclinical-stage small molecule treatments for fibrotic conditions for a $30 million upfront payment and total potential consideration of $1 billion. Boehringer Ingelheim also acquired Enleofen Bio in a deal worth $1 billion for its NASH and ILD anti-IL11 platform.

Targeting chemokines as a treatment for fibrotic indications

Chemomab believes that its approach, selectively targeting fibrotic conditions by attenuating both inflammation and fibrosis, may be an optimal approach for both effectiveness and reduction of toxicity. As central regulators of initiation and progression of fibrotic disorders, chemokines are an ideal target to impact both inflammation and fibrosis. Some chemokines are also disease-specific, allowing for potential selectivity.

Chemokine receptors, or CCRs, have been more extensively studied as drug targets in fibrotic conditions compared to chemokine ligands, however, the therapeutic effects of CCR inhibitors have generally fallen short in the clinic. Pharmaceutical companies have previously explored the CCL24 ligand receptor, CCR3, and its other ligands CCL7 and CCL11, with small or large molecule inhibitors. These programs were directed at inhibiting eosinophilic trafficking in respiratory and allergic inflammation, however, despite promising preclinical data, most programs were discontinued largely due to poor safety profiles and limited efficacy of the antagonist used. To Chemomab’s knowledge, only Alkahest has an active program that explores CCR3 inhibition, which is under license from Boehringer Ingelheim and is being developed as a treatment for wet AMD. In contrast, Chemomab believes CCL24 presents a more promising opportunity. Unlike other CCR3 ligands, CCL24 binds only to the CCR3 receptor and is also organ/disease-specific which together could provide enhanced selectivity and tolerability. For example, CCL24 is elevated in the liver and cholangiocytes (bile duct epithelia) in PSC patients and is specifically related to fibrosis-related inflammation and not generalized eosinophilic inflammation as its receptor. Likewise, elevation of CCL24 has been shown in fibrotic lungs and bronchoalveolar lavage fluid from patients with idiopathic pulmonary fibrosis, or IPF, a disease sharing similar lung dysfunction features with SSc and which recently was correlated, by Chemomab, with disease severity and lung involvement in a cohort of SSc patients from the United Kingdom. Furthermore, CCL24 is constitutively expressed by skin and dermal fibroblasts. The use of an antibody in targeting this chemokine is a novel approach to targeting fibrosis.

Chemomab’s expertise and approach to drug discovery

Chemomab is a clinical stage biotechnology company focused on the discovery and development of novel drugs to address fibrotic indications with unmet medical needs. CCL24 is a key target promoting fibrosis as it regulates the two main processes that drive fibrosis: fibroblast activation and immune cell migration and activation. Using Chemomab’s expertise in monoclonal antibody, or mAb, development and deep knowledge of chemokines biology. Chemomab is developing CM-101, a proprietary, first-in-class, fully humanized mAb that through research and studies to date, is found to neutralize CCL24 and by so doing inhibits its disease-related functions in both inflammation and fibrosis. This represents an innovative approach to anti-fibrotic drug discovery and a key differentiator for Chemomab. The ability of CM-101 to directly attenuate fibroblast activation and concurrently attenuate recruitment of immune cells is novel and could address a wide-range of hard-to-treat fibrotic diseases.

- 9 -

Chemomab’s ongoing collaborations are complementary in both preclinical and clinical aspects of research and development. Chemomab has created an extensive panel of in vitro, ex vivo and in vivo assays which it has used to further the understanding of fibrotic processes together with the role of CCL24 in various diseases and the effects of its neutralization with CM-101. These assays have allowed Chemomab to sequentially explore target validation and proof of mechanism in disease relevant human and animal samples which continues to de-risk the translation of CM-101 into the clinic.

Target expression and engagement

Chemomab regularly collaborates with leading academic centers around the world to investigate the role of CCL24 and CM-101 in various indications. For example, Chemomab works with The Royal Free Hospital, or RFH, in London, United Kingdom to access liver biopsy and serum samples from patients with PSC. Using immunohistochemistry and florescence microscopy to stain CCL24 and CCR3 it explores the expression patterns of these targets in disease relevant human samples and compares them to healthy volunteers. Similarly, Chemomab has tested biopsies of SSc patients through a collaboration with Florence University in Italy.

Proof of mechanism

Chemomab explores fibroblast activation and immune cell recruitment in response to CM-101 treatment through in house ex vivo and in vitro assays. Chemomab executed a multitude of validated genetic and treatment-based disease models in fibrotic and inflammatory indications in which it has investigated CM-101’s effects. Additionally, as part of a collaboration with Nordic Biosciences, Copenhagen, Denmark, Chemomab has gained access to proprietary tools and expertise to explore the effects of CM-101 on key fibrogenesis and fibrolysis biomarkers. Nordic Biosciences is a world-leading extracellular matrix specialist and continues to contribute as Chemomab analyses its clinical samples.

Chemomab has created a landscape of biological assays to explore CCL24 and CM-101

Chemomab plans to explore next generation biologic products, and, based on its wide database of patient samples and extensive knowledge and experience in fibrosis, aims to identify targets that could complement CCL24 inhibition. Next generation assets may therefore be dual targeting and will be screened through the panel of assays available at Chemomab evaluating target expression in fibrotic tissues as well as the anti-fibrotic activity of potential candidates. Similar to CM-101, this process will establish proof-of-biological-mechanism in both animal models and human tissue prior to commencing product development and initiating clinical studies.

- 10 -

The Chemomab pipeline

CM-101 in PSC and SSc

Chemomab’s lead product, CM-101, is a first-in-class humanized monoclonal antibody targeting CCL24 and being developed initially for treatment of PSC and SSc, with potential future opportunity in other fibrotic-inflammatory indications. Chemomab has completed two Phase 1a studies of CM-101 in healthy volunteers as well as a Phase 1b safety, tolerability and proof-of-mechanism study in NAFLD patients. A Phase 2a study in PSC is now ongoing in Europe and Israel and a Phase 2 study in SSc will follow this year. Although the primary focus of Chemomab is these two orphan indications, a Phase 2a study expanding the safety, tolerability and mechanistic dataset for CM-101 is also planned in NASH patients.

Primary Sclerosing Cholangitis

PSC is a progressive, rare, and chronic cholestatic liver disorder that is characterized by thickening, inflammation, and fibrosis of the bile ducts in which both intra- and extra-hepatic bile ducts are affected. This generally leads to cholestasis, liver damage, cirrhosis, and eventually to liver failure. The exact cause of PSC remains mostly known; however, immune system dysregulation, genes, viruses, and bacteria may be involved. PSC is commonly associated with inflammatory bowel disease, or IBD. Approximately three in every four individuals with PSC also have ulcerative colitis. Most individuals affected with PSC are adults with an average age of diagnosis being 40 years; however, it may also occur in children. Disease progression, symptoms, and severity may vary greatly between individuals. Patients in the initial stages of PSC are generally asymptomatic or have only mild symptoms.

Abdominal discomfort, fatigue, and pruritus, or itching, are common initial symptoms of PSC which can be severe and debilitating. The initial step in diagnosing PSC is to evaluate liver enzyme levels through blood tests. Physicians will then confirm a diagnosis with cholangiography ultrasound and, in rare cases, a liver biopsy. As the disease progresses, bile flow from the liver is obstructed and is subsequently absorbed into the bloodstream leading to the yellowing of the mucous membranes, whites of the eyes, and skin. Furthermore, individuals may also experience abdominal pain, malaise, light-colored stools, nausea, dark urine, weight loss, and/or hepatomegaly or splenomegaly. PSC patients have a 40-fold increased risk of liver cancer and a 400-fold increased risk of cholangiocarcinoma, and the disease may lead to other conditions including osteoporosis, bacterial cholangitis, portal hypertension, bleeding, as well as vitamin deficiencies.

There are currently no specific medical therapies that can alter or cure the course of the disease; instead, available treatments are directed towards slowing the progression of PSC and treating symptoms. In certain individuals, endoscopic surgery may be performed to enlarge the narrowed bile ducts and to remove blockages. Complications due to vitamin deficiencies can be prevented with the help of vitamin supplements, while infections and inflammation can be controlled by using antibiotics. Cholestyramine and UCDA can be effective in managing itching and can be used with or without antihistamines. Patients with advanced symptoms such as end-stage liver disease, recurent bacterial cholangitis and intractable pruritus, will undergo liver transplantation, however, in 30% of cases, PSC will recur even after liver transplantation. The median survival is 10-12 years without intervention.

Systemic Sclerosis

SSc is an autoimmune inflammatory condition which results in widespread fibrosis and vascular abnormalities affecting the skin, lungs, gastrointestinal tract, heart and kidneys. Other key features of SSc include thickening and hardening of the skin, autoantibody production and abnormal nail fold capillaries. The underlying mechanisms that cause SSc are complex and for the most part unknown but most likely involve a combination of factors including the immune system, genetics, and environmental triggers. Various pathways are involved in the pathogenesis of SSc including cytokines that injure blood vessels, growth factors that stimulate collagen, integrin signaling, morphogen pathways, and co-stimulatory pathways. SSc is generally diagnosed between the age of 30 and 50 years and is most prevalent in women.

- 11 -

Given that SSc can affect many different parts of the body there are a multitude of different symptoms of the disease. The most widely observed symptoms include fatigue, arthralgia, and myalgia. However, the earliest sign is often the Raynaud phenomenon in which the body’s normal response to cold or emotional stress is exaggerated, resulting in abnormal spasms in arterioles. Cutaneous features include sclerosis of the skin, particularly the face and hands. Gastrointestinal symptoms of the upper tract include acid reflux and of the lower tract include bloating, nausea and incontinence. Cardiopulmonary presentations include interstitial lung disease, pulmonary arterial hypertension and cardiac scleroderma. Renal and ocular symptoms can also present and 20% of SSc patients have an overlapping diagnosis with other connective tissue diseases and can develop arthritis, lupus or myositis. SSc is subdivided into two main types related to the distribution of skin involvement: diffuse cutaneous (two-thirds of cases) and limited cutaneous. Diffuse SSc, or dcSSc, is rapidly progressive with more significant organ involvement.

There is no cure for SSc. Established treatments can help with symptoms and may only modify the disease outcome if given early in the disease course. Prescribed medications, used off-label, primarily focus on suppressing inflammation with NSAIDs and dilating abnormal or constricted blood vessels with losartan, sildenafil, iloprost and SSRIs, as well as treatments to manage individual organ involvement. The only two drugs that are approved for the treatment of SSc symptoms are Bosentan by Actelion Pharmaceuticals, approved in Europe for the prevention of digital ulcer development, and nintedanib by Boehringer Ingelheim, recently approved in the United States, Europe and Japan for the treatment of SSc associated interstitial lung disease. The clinical course of SSc is determined by the extent of vascular and fibrosis complications and has the highest mortality rate among the systemic rheumatic diseases as 40% of patients die within 10 years from disease onset, with pulmonary involvement being the leading cause of death.

Chemomab’s solution is CM-101

The dual anti-fibrotic and anti-inflammatory activity of CM-101 enables the targeting of a wide range of pathogenic mechanisms and affords patients a new treatment that may have a more impactful effect on disease progression.

Targeting CCL24 offers a dual activity approach

In order to understand CCL24’s role in disease pathophysiology, Chemomab has collected data on CCL24 levels from patient with multiple fibrotic-inflammatory indications, including those with PSC, SSc and NASH. PSC patients’ liver biopsies and SSc skin samples were stained for CCL24 and its receptor, CCR3. Blood samples taken from PSC and SSc patients were used to further evaluate the role of the CCL24-CCR3 axis exploring levels of circulating CCL24 and CCR3. To explore the influence of CCL24 on disease status, CCL24 serum levels were correlated with fibrotic biomarkers and disease severity markers.

- 12 -

CCL24 levels in liver biopsies from PSC patients

PSC pathology generally initiates with bile duct damage leading to cholestasis, bile duct inflammation and fibrosis and finally to substantial liver damage. Chemomab assessed the accumulation and cellular localization of CCL24 in livers of PSC patients focusing on CCL24 levels in the periductal damaged zone that is most relevant to disease pathology. CCL24 was mainly found in inflammatory cells in the liver of PSC patients and due to the robust liver inflammatory insult in PSC, reflected by massive accumulation of resident and recruited immune cells in the periductal space, CCL24 positive staining was extensive. Specific and robust CCL24 staining was also shown in cholangiocytes, the epithelial cells of the bile ducts. Activated myofibroblasts that surround the bile ducts, whether they originate from hepatic stellate cells or portal fibroblasts, are the main drivers of the excess extracellular matrix accumulation in this area, comprising the unique “onion ring” shape seen in PSC liver sections. The collective expression pattern shows high CCL24 levels in areas that are most affected in PSC and highlights its central role in PSC related liver pathology.

Elevated CCL24 staining in liver biopsies from PSC patients

CCR3 levels in liver biopsies from PSC patients

To evaluate the levels of CCR3, the receptor of CCL24, and identify the cells that can potentially respond to CCL24 secretion, biopsies were stained for CCR3 As seen for CCL24, specific CCR3 staining was evident in cholangiocytes, surrounding immune cells and fibroblasts.

Elevated CCR3 staining in liver biopsies from PSC patients

CCL24 levels in serum and correlation to a fibrotic biomarker in PSC patients

Together with RFH, Chemomab analyzed serum levels of CCL24 in PSC patients at various stages of disease. CCL24 levels showed a positive correlation to the liver fibrosis biomarker ELF score, which is a commercially available test that reflects liver fibrosis stage based on serum concentrations of several fibrosis-related proteins. When dividing this cohort of PSC serum samples by ALP levels, a circulating parameter used for monitoring PSC activity, there was a stronger relation of the fibrotic biomarker and CCL24 with increased ALP reflected.

- 13 -

CCL24 levels correlate with ELF score

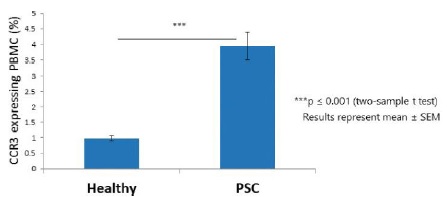

CCR3 levels in circulating PBMCs in PSC patients

Chronic liver inflammation is driven in most hepatic injuries by several different immune cell populations originating from either resident hepatic immune cells or recruited cells from the circulation to the damaged site. In collaboration with the Kaplan Medical Center, Israel, Chemomab explored systemic changes of CCR3, given that this could impact cell recruitment to the PSC damaged liver. PBMCs from ten PSC patients and healthy controls were stained for expression of CCR3 and demonstrated that levels were significantly higher in PSC patient samples compared to healthy donors.

PSC patients showed significantly higher expression of CCR3 on PBMCs

CCL24 and CCR3 levels in skin biopsies from SSc patients

Chemomab analyzed skin samples from diffuse SSc patients and healthy volunteers and the SSc samples showed elevations in CCL24 and CCR3. Specifically, higher accumulation of CCL24 on immune cells skin infiltration was shown in the SSc samples and CCR3 was evident in skin fibroblasts, immune cells and endothelial cells. These elevations led to a CCL24 mediated robust activation of CCR3 expressing cells which enhances the recruitment of immune cells and fibroblasts to the diseased organ.

- 14 -

SSc patients showed elevated levels of CCL24 in skin tissue

SSc patients showed elevated levels of CCR3 in skin tissue

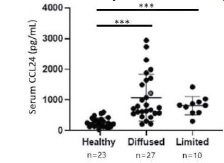

CCL24 levels in serum samples from SSc patients and correlation with fibrotic biomarkers

Chemomab analyzed SSc serum samples which showed that CCL24 levels were significantly increased in SSc patients compared with healthy individuals. Notably, in diffuse SSc patients, CCL24 levels were fourfold higher than in healthy control patients, while in limited SSc patients, a threefold elevation was found compared with healthy controls. Additionally, the levels of CCL24 were correlated with a biomarker of SSc severity, anti-topoisomerase, an autoantibody seen in diffuse SSc patients.

SSc patients showed elevated levels of CCL24 in serum samples

Clinical Development of CM-101

Completed studies

The CM-101 Phase 1 program included two Phase 1a single administration, or SAD, studies, using IV and SC administration with doses ranging from 0.75-10 mg/kg, in healthy volunteers and a Phase 1b multiple administration (MAD) study (5 administrations) in NAFLD patients with normal liver function, testing 2.5 mg/kg IV and 5 mg/kg SC. To date 42 subjects have received at least one CM-101 dose, the majority by IV infusion (12/42 subjects received SC).

- 15 -

Safety

The first Phase 1a study, which was a single-center, randomized double-blind, placebo-controlled, single-dose, dose-escalation study, included four escalating dose groups of eight subjects each. In each dose group subjects were randomized in a 3:1 ratio to receive a single IV infusion of either CM-101 (n=6) or placebo (n=2). A total of 24 subjects were enrolled into the study and randomized to the treatment groups (0.75 mg/ kg, 2.5 mg/kg, 5.0 mg/kg, 10 mg/kg) and eight subjects received a placebo. All 32 subjects completed the study as planned. Single, IV doses of CM-101 were safe and well tolerated up to the highest dose level (10 mg/ kg) in healthy subjects. No severe or serious adverse events, or AEs, occurred during the study and all CM-101 related AEs were mild, with one moderate AE reported in the placebo group (myalgia).

The second Phase 1a study was also a single-center, randomized double-blind, placebo-controlled, single-dose study, but evaluated only one dose group. Subjects were randomized in a 3:1 ratio to receive a single SC injection of either CM-101 5 mg/kg (n=6) or matching placebo (n=2). A total of eight subjects were enrolled into the study and randomized; all eight subjects completed the study as planned. Single, SC administration of 5 mg/kg of CM-101 was safe and well tolerated with no severe or serious AEs occurring during the study. A total of 6 AEs were reported in two subjects treated with CM-101; only one AE was classified as related to CM-101 (change in diastolic blood pressure) and that AE was classified as mild in intensity.

In both Phase 1a studies, all AEs reported were resolved; no subjects discontinued the study prematurely due to AEs, and no concomitant medications were required for treatment of any drug-related AEs. No clinically significant changes in laboratory tests (hematology, chemistry or urinalysis), vital signs, ECG, physical examination or infusion site examination were observed. In the first Phase 1a study with CM-101 delivered by IV administration, the effect on cytokine secretion was tested pre-treatment and one hour, eight hours and 24 hours post drug administration. Serum levels of a panel of cytokines including IL-6, IFNγ, GM-CSF, TNF-α, IL-2, IL-4, IL-8 and IL-10 showed no significant change at all tested CM-101 doses and timepoints. These findings suggest that single CM-101 administration does not cause immune activation nor cytokine secretion. Additionally, none of the subjects in either of the Phase 1a studies tested positive for anti-drug antibodies (ADA).

The multiple administrations randomized, placebo-controlled, Phase 1b study in NAFLD patients with normal liver function tests evaluated two dose levels. The first dose level of 2.5 mg/kg CM-101 was administered as IV infusions and the second dose level of 5 mg/kg was administered as SC injections. Both dose levels involved five drug administrations over 12 weeks (Q3W) providing 15 weeks of treatment coverage. At both dose levels, subjects were randomized in a 3:1 ratio to receive either CM-101 (n=6 per cohort) (2.5 mg/kg IV or 5 mg/kg SC) or matching placebo (n=2 per cohort). Five repeated IV and SC CM-101 administrations were safe and well tolerated and there were no deaths, or severe or serious drug related AEs reported throughout the study. Only mild to moderate AEs were reported in the CM-101 treatment groups of which only two AEs were classified as possibly related to CM-101. No injection site reactions or clinically significant trends in laboratory tests (hematology, chemistry, or urinalysis), vital signs, ECG or physical examination were observed. One patient experienced a non-drug-related SAE. This patient was a 61-year-old female that was subsequently diagnosed with a non-treatment related meningioma. The tumor was treated surgically, and the patient was discontinued from the study.

Pharmacokinetics with single-dose administration

PK analysis was conducted for the Phase 1 studies and the quantification of CM-101 in plasma samples was performed using a validated ELISA-based assay by Eurofins (UK). Following IV infusion in healthy volunteers, CM-101 exhibited a biphasic serum concentration vs. time curve (rapid distribution phase and slow elimination phase) which is typical for monoclonal antibodies. Target-mediated drug disposition (TMDD), or presence of ADAs, was not evident in the analyzed concentration vs. time curves of CM-101, which exhibited linear terminal slope without apparent TMDD kinetics or other concentration-dependent changes of the elimination kinetics. Comparison of the PK data of 5 mg/kg CM-101 using IV administration against SC administration indicates consistent distribution and elimination behavior of CM-101.

At either IV or SC administration, the values of the PK parameters obtained in the non-compartmental and compartmental analysis of CM-101 concentration vs. time data appear to be typical for monoclonal antibodies that undergo FcRn-mediated recycling. The terminal half-life of CM-101 was long for both SC and IV formulations which supports administration of CM-101 at a frequency of once every 2-4 weeks.

- 16 -

Pharmacokinetics with multiple-dose administration

PK analysis of the data from the Phase 1b study was conducted to evaluate CM-101 following multiple IV infusion of 2.5 mg/kg or 5 mg/kg SC injections of CM-101 in NAFLD patients. Following repeated IV infusions (2.5 mg/kg Q3W) and SC injection (5 mg/kg Q3W), CM-101 exhibited a long terminal half-life, similar to the terminal half life seen in the single dose studies. CM-101 accumulated over time, resulting in significant systemic exposure over time and potentially reaching a steady state.

Overall, CM-101 reached steady state conditions more slowly following SC injection, as compared to IV infusion. The inter-patient variability in CM-101 serum concentrations was higher for SC dosing injection, as compared to IV. The trough CM-101 serum concentrations after repeated 5 mg/kg SC injections were proportionally higher than those after 2.5 mg/kg IV infusions, considering the difference in administration modes. Comparison of the PK data of CM-101 in the Phase 1b to the Phase 1a studies indicates a consistency in PK behavior of CM-101.

Pharmacodynamics and target engagement of CM-101

Serum was taken from patients in all three Phase 1 studies at different times and the levels of both CCL24 and CM-101 were measured. Total CCL24 levels represent CM-101’s engagement to its target. Total CCL24 levels were increased following administration of the drug, which indicates that CM-101 is effective in target engagement, as the higher levels of CCL24 correlated significantly with greater doses of CM-101, and such levels decreased gradually from the peak of CM-101 administration. These findings demonstrate that CM-101 effectively binds to CCL24 in the circulation, which reflects a strong drug-target interaction.

In the Phase 1b study, CM-101 treatment of 2.5mg/kg IV attained the highest levels of total CCL24 by the third administration, maintaining such levels until the end of treatment. CM-101 5mg/kg administered by SC injection reached the highest levels of CCL24 by the fourth treatment, and maintained such levels until the end of treatment. The matching placebo did not have any effect on CCL24 levels.

As exemplified in the in-vitro studies, binding of CCL24 by CM-101 attenuates the binding of CCL24 to its cognate CCR3 receptor, thereby reducing its downstream activation. Altogether, CCL24 levels following treatment with CM-101 provide strong evidence for target engagement and pharmacodynamic response of CM-101 in healthy volunteers and patients.

Phase 1b exploratory endpoints- preliminary results

Fibrotic biomarkers were analyzed as part of the Phase 1b study in NAFLD patients with normal liver function. Circulating fibrotic biomarkers were tested in serum pre- and post-treatment. The analysis included data from patients that presented with a more active disease, reflected by baseline elastography (FibroScanTM) score >4 kPa. Tissue inhibitor of metalloproteinases-1 (TIMP-1) and tissue inhibitor of metalloproteinases-2 (TIMP-2), considered well established fibrotic biomarkers, were evaluated, and showed that CM-101 treatment led to reductions of both markers by week 15. The growth factor PDGF-AA, known as a pro-fibrotic secreted factor, was also reduced in CM-101 treated patients. Conversely, in the placebo group TIMP-1, TIMP-2 and PDGF-AA all increased.

Evaluation of the fibrogenesis and fibrolysis/inflammatory biomarkers, Pro-C3, Pro-C4 and C3M measured in serum, conducted by Nordic Bioscience, Copenhagen, Denmark, were also used as sensitive indicators of the liver’s fibrotic state. In accordance with reduced liver stiffness, Pro-C3, Pro-C4 and C3M were all reduced in the CM-101 treated groups. No reductions were identified in the placebo control group.

Changes in liver stiffness, a measurement of liver fibrosis, were also evaluated using FibroScanTM measurements taken at screening and end of treatment (EoT) following 15 weeks of treatment coverage. 80% of CM-101 treated patients had significant decreases in FibroScanTM measurements, unlike placebo patients where there was no significant change from baseline

Overall, these encouraging results provide initial support for CM-101 anti-fibrotic and anti-inflammatory mechanism in humans and support further testing of CM-101 in PSC and SSc patients.

- 17 -

Current and planned clinical studies for PSC and SSc

Chemomab is currently recruiting for a Phase 2a study at multiple sites in Europe and Israel for the study of CM-101 in patients with PSC and is also planning to conduct a Phase 2 study this year across 25 sites in the United States and Europe in SSc.

The ongoing Phase 2a study in PSC is a randomized, double-blind, placebo-controlled, study aimed to evaluate the safety and efficacy of CM-101 in adult subjects with PSC. Recruited subjects will have a serum alkaline phosphatase,or ALP, level of at least 1.5 times the upper limit of normal (x 1.5 ULN). Subjects with concomitant IBD are eligible for recruitment if their disease is stable and there is an absence of high-grade dysplasia in colonic biopsies within 18 months of randomization. Up to 45 subjects will be randomized to receive 10 mg/kg CM-101 IV, or placebo, in a 2:1 ratio. Randomization will be stratified based on ongoing Ursodeoxycholic Acid, or UDCA, treatment and concomitant IBD diagnosis. Subjects will receive a dose of investigational product once every three weeks for a total of five administrations resulting in a total coverage of 15 weeks.

The primary endpoints for the study are changes from baseline in serum alkaline phosphatase, or ALP, levels and the fibrotic marker enhanced liver function, or ELF, score at week 15. ALP is a liver enzyme that is elevated in cholestasis and the ELF score is a biochemical test panel made up of serum markers that are indicators of the extracellular matrix. Secondary endpoints include evaluation of safety and tolerability, changes from baseline in other liver enzymes and additional fibrotic markers, to include AST, ALT, Pro-C3 and Pro-C5. PK, PD and ADA parameters will also be collected.

The measurement of ALP as a primary endpoint is common in other PSC studies, for example the Phase 2 and Phase 3 studies for norUrsodeoxycholic acid (Dr. Falk Pharma GmbH, Freiburg, Germany). However, some studies have shown that improvements in ALP do not always correlate with improved outcomes. Accordingly, Chemomab has included the ELF score as an additional-primary endpoint, a measurement which has also shown successful reductions in other Phase 2 PSC clinical studies, such as one being conducted by NGM Biopharmaceuticals in connection with its development of NGM 282.

The planned Phase 2 study in SSc will be a global randomized, double-blind, placebo-controlled study aimed to evaluate the safety and efficacy of CM-101 in adult subjects with diffuse SSc. Recruited subjects will have had a disease duration of ≤ five years from the first non-Raynaud’s phenomenon manifestation and a modified Rodnan skin score (mRSS) of 15 to 35 units at baseline. Subjects will be randomized to receive either 5 mg/kg or 10 mg/kg CM-101 IV, or placebo, in a 1:1 ratio. Subjects will receive a dose of investigational product once every three weeks for a total duration of 24-52 weeks.

The study plans evaluate the safety and tolerability of multiple doses of CM-101 and the change from baseline in the ACR CRISS composite score. The CRISS score includes core items that assess changes in two common and prominent manifestations of early SSc (skin and lung damage), functional disability (as assessed by the HAQ DI), and patient and physician global assessments. In addition, the ACR CRISS score captures clinically meaningful worsening of internal organ involvement requiring treatment, that classifies the patient as having not improved. ACR CRISS is a commonly used endpoint in clinical studies of SSc and has previously shown meaningful reductions. Chemomab will also include secondary endpoints for change from baseline in the mRSS, a score of skin thickness in 17 body sites, lung function tests, inflammatory and fibrotic markers, PK, ADA and target engagement.

- 18 -

Other clinical development plans for CM-101

To further explore CM-101’s mechanistic effect in liver fibrosis, and given the string of effects seen preclinically, Chemomab is conducting a Phase 2a study in NASH patients to further explore the safety, tolerability and effects of CM-101 on relevant fibrosis related biomarkers using the SC formulation. The study will be initiated early this year and will be conducted across multiple sites in Israel and aims to recruit 40 patients with confirmed NASH and fibrosis without cirrhosis, liver fat content > 10% and at least one associated risk factor. Patients will have a total of eight administrations of CM-101, every two weeks, given at two mg/kg by SC injection.

Primary endpoints for the study will be safety and tolerability, however, Chemomab will explore multiple efficacy markers in its secondary endpoints, namely changes in liver enzymes, fibrotic markers, liver stiffness, liver fat content, PK, ADA, target engagement and PD.

Preclinical safety and toxicology of CM-101

Pre-clinical safety evaluation of CM-101 included tissue cross reactivity, assessment of the effect of CM-101 on pro-inflammatory cytokine secretion ex-vivo, and in vivo GLP toxicology studies in mice and non-human primates. No safety concerns were observed in these pre clinical assessments.

Immunogenicity may be triggered following administration of humanized monoclonal antibodies, an effect that is frequently seen with approved mAbs. Chemomab conducted an immunogenicity analysis and identified few potential non germline residues in CM-101. The company also completed a T-cell proliferation assay, to investigate these findings in vitro. Chemomab observed that T cell proliferation was not induced using the whole antibody (CM-101) while few specific fragments of the mAb were found to induce T cell proliferation. Overall, the fact that no ADA were identified three clinical studies performed to date supports a preliminary conclusion of low immunogenic potential of CM-101.

As summarized below, there were no safety concerns related to CM-101 in any of the other safety experiments.

Summary of key preclinical safety experiments

| Preclinical findings | | | Observation |

| Ex vivo | | | |

| Antibody dependent cell-cytotoxic (ADCC) and complement dependent cell-cytotoxic (CDC) activity was tested in PBMCs from healthy volunteers | | | CM-101 did not have Fc-related effector functions such as ADCC and CDC |

| Cytokine release was assessed in human whole blood from healthy volunteers. | | | CM-101 did not induce pro-inflammatory cytokine secretion |

| Tissue cross reactivity was evaluated from healthy human tissues. | | | CM-101 does not bind non-specifically to healthy tissues, and therefore is expected to only bind to its target, circulating CCL24 |

| In vivo | | | |

| GLP repeated dose 4-week toxicity study of CM-101 (IV) in mice | | |

1. No obvious treatment related adverse reactions 2. No gross or microscopic pathological findings 3. No cases of treatment related mortality were observed 4. No significant elevation was seen in IL1β, IL2, IL4, IL5, IL10, GM-CSF, IFN and TNFα |

- 19 -

| GLP repeated dose (up to 50 mg/kg) 6-month toxicity study of CM-101 (SC) in Cynomolgus Monkey | | |

1. No obvious treatment related adverse reactions 2. No clinical signs or injection site reactions 3. No cases of treatment related mortality were observed 4. Blood and urine tests were found to be within normal ranges for monkeys 5. No treatment-related organ weight changes and no treatment-related necropsy findings 6. No treatment-related histopathology findings 7. Three samples from treated animals were confirmed ADA positive and there was no obvious correlation between positive ADA results and CM-101 serum concentrations or systemic exposure |

Preclinical proof of mechanism studies for CM-101

Chemomab conducted a series of in vitro and in vivo studies to demonstrate the proposed mechanism of action and provide proof-of-concept for administering CM-101 in the clinic for target indications.

Affinity, selectivity, and binding kinetics

Chemomab evaluated the kinetic binding parameters of CM-101 to human CCL24, as well as the specificity of CM-101 binding to other chemokines using commercial binding assays. CM-101 demonstrated a strong and stable, high affinity, binding to CCL24.

CM-101 reduced CCL24 dependent CCR3 activation

In an in vitro assay, CM-101 was shown to robustly attenuate the ability of CCL24 to induce activation of the CCR3 receptor following pre-incubation of CCL24 with CM-101.

CM-101 reduces CCL24 dependent CCR3 activation dose dependently

- 20 -

Pre-clinical Efficacy of CM-101 in models of PSC

| Preclinical experiments in models of PSC |

| Human hepatic stellate cells demonstrated reduced transition to myofibroblasts following incubation of CM-101 with CCL24. |

| Human hepatic stellate cells showed reduced motility towards CCL24 following treatment with CM-101 |

| CM-101 demonstrated in vivo activity on liver fibrosis and cholangiocytes proliferation induced by bile duct ligation in Sprague Dawley rat model. |

| CM-101 (D8) inhibits the progression of liver fibrosis and bile duct damage in a chronic cholangitis cholestasis model using the hepatobiliary toxin ANIT. |

| CM-101 (D8) reduces liver enzymes, bile acid and circulating inflammatory monocytes in an experimental cholangitis model in MDR2 knock out mice. |

| CM-101 reduces liver enzymes, fibrosis, collagen, and fibrotic gene expression in a TAA-induced liver fibrosis model in rats. |

| CM-101 (D8) prevented fibrosis and inflammation in a TAA-induced liver fibrosis model in mice. |

Of the experiments performed above, results from the multi drug resistant 2, or MDR2, knock out mouse model that reflects sclerosing cholangitis and the thioacetamide (TAA) rat model reflecting liver fibrosis are described below.

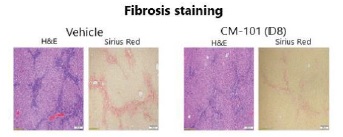

CM-101 demonstrates anti-cholestatic and anti-fibrotic activity in MDR2 knock out mouse model in vivo

Mice with targeted disruption of the MDR2, transporter gene develop chronic and progressive hepatic sclerosing cholangitis that closely resembles PSC and therefore this model has been extensively used to study the pathogenesis and progression of PSC. Using MDR2 knockout mice (six weeks of age), Chemomab tested the ability of CM-101 (D8) (murine surrogate of CM-101) to attenuate PSC related symptoms. Mice (n=15/group) received either vehicle control, or CM-101 5 mg/kg SC twice weekly during weeks 6-12 following established disease and were sacrificed at the end of week 12. In this study mice were tested for changes in alkaline phosphatase, orALP, bile acid levels, collagen deposition (histology, Sirius red) and circulating inflammatory populations. Chemomab observed a significant decrease in serum collagen deposition, ALP and bile acid levels after CM-101 (D8) treatment compared to non-active treatment.

CM-101 reduces liver fibrosis in an MDR2 knockout model

In MDR2 knockout mice during chronic inflammation circulating Ly6Chi monocytes were shown to infiltrate the liver and have a significant role in hepatic damage. In these mice, circulating CD11b+ Ly6Chi monocytes were increased in numbers when compared to healthy mice and CM-101 (D8) treatment was able to normalize the number of inflammatory Ly6Chi monocytes back to normal levels seen in the healthy mice.

- 21 -

CM-101 reduces circulating inflammatory monocytes in MDR2 knockout model

CM-101 demonstrates in vivo activity in a thioacetamide induced liver fibrosis model in rats

To assess potential efficacy of CM-101 on liver fibrosis, Chemomab used the TAA-induced liver fibrosis model. Liver fibrosis was induced by intraperitoneal administration of TAA at a dose of 250 mg/kg twice weekly for eight weeks. Rats (n=10/group) received either vehicle control or CM-101 2.5 mg/kg IV twice weekly during weeks four-eight following established fibrosis and were sacrificed at week eight. After eight weeks of TAA treatment, all vehicle-treated animals had developed liver fibrosis, as confirmed by Sirius-red-stained liver histology.

CM-101 reduces fibrosis in rat livers

Plasma ALP, ALT, and AST levels decreased in the CM-101 study arm. Liver collagen content and fibrotic areas were significantly reduced in the CM-101 treated group compared to non-active treatment. CM-101 was also shown to reduce fibrotic markers in the TAA treated rats.

Efficacy CM-101 in models of SSc

| Preclinical experiments in models of SSc |

| CM-101 reduces SSc serum-induced dermal fibroblast activation and transition to myofibroblasts and interferes with endothelial cell activation. |

| CM-101 treatment attenuated skin fibrotic remodelling in the bleomycin (BLM)-induced dermal fibrosis mouse model. |

| CM-101 attenuated lung fibrosis and inflammation in the bleomycin (BLM)-induced pulmonary fibrosis mouse model. |

Of the experiments listed above, results from the bleomycin (BLM)-induced dermal and lung fibrosis mouse models are set forth below in more detail.

- 22 -

CM-101 treatment attenuates skin fibrotic remodeling in the bleomycin (BLM)-induced dermal fibrosis mouse model

The activity of CM-101 (D8) (murine surrogate of CM-101) in SSc was tested in the dermal bleomycin model. Treatment started after the onset of fibrotic signs, eight days following the first BLM injection. Histological assessment of skin lesions stained with H&E and Masson’s trichrome revealed significant elevation of dermal thickness and collagen deposition following 21 days of BLM administration. This elevation was significantly reduced when mice were treated with 2.5 mg/kg CM-101 with significant reductions in both skin thickness and collagen deposition compared with the mouse group treated with BLM alone.

CM-101 treatment attenuates skin fibrotic remodeling in the bleomycin-induced dermal fibrosis mouse model

Another feature that characterizes the BLM model and is representative of human SSc is the development of bronchoalveolar inflammation. To evaluate the effect of CM-101 on lung inflammation, Chemomab collected bronchoalveolar lavage, or, BAL, fluid, and assessed the number of white blood cells, or WBC, and mononuclear cells. Treatment with BLM for 21 days significantly increased WBC and mononuclear cells in BAL fluid and the number of WBC and mononuclear cells was decreased significantly following CM-101 treatment compared with the group that was administered only with BLM. This data supports the anti inflammatory effect of CM-101 in SSc.

CM-101 inhibits lung fibrosis in the BLM-induced pulmonary fibrosis mouse model

Chemomab also tested CM-101 in the experimental lung SSc model where mice were given a single intratracheal administration of BLM followed by either CM-101, non-active treatments (PBS or control immunoglobulin G (IgG)) or the approved anti-fibrosis drugs, pirfenidone and nintedanib. CM-101 had a significant anti-fibrotic and anti-inflammatory effect in the experimental BLM-induced lung fibrosis model as compared with non-active tratments treated animals. BLM animals treated with non-active treatments showed massive immune cell infiltration, extensive fibrosis and severe tissue injury. CM-101-treated mice exhibited significantly reduced levels of lung fibrosis down to similar levels in healthy animals and showed superior effects compared to approved fibrosis drugs pirfenidone and nintedanib.

CM-101 attenuates lung fibrosis and collagen deposition in the bleomycin (BLM)-induced pulmonary fibrosis mouse model

- 23 -

Competition

The development and commercialization of new drug products is highly competitive across major pharmaceutical companies, specialty pharmaceutical companies and biotechnology companies worldwide. Chemomab faces competition with respect to its current product and expects to face competition with respect to any product candidates that it may develop or commercialize in the future. Specifically, there are a number of companies developing treatments for fibrotic/inflammatory diseases, including multiple major pharmaceutical and biotechnology companies with substantially greater resources than Chemomab. Chemomab is a small biotech company with limited resources compared to the major pharmaceutical companies, however, Chemomab believes that the unique CM-101 platform together with its knowledge and experience in inflammatory fibrotic research provides the company with competitive advantages.

Therapeutic options for PSC and SSc are limited and despite significant biopharmaceutical industry investment, the FDA has not approved any disease modifying therapies for the treatment of PSC or SSc. Liver transplant is currently the only treatment shown to improve clinical outcomes for PSC patients while SSc patients are being treated with drugs that were approved for different manifestations of the disease like interstitial lung disease (Nintedanib, Boehringer Ingelheim and Tocilizumab, Hoffmann-La Roche).

Chemomab is advancing CM-101, a first in class monoclonal antibody that interferes directly with both inflammation and fibrosis, into clinical development for the treatment of PSC and SSc. There are a number of large biopharmaceutical and biotechnology companies that are currently pursuing the development of products for the treatment of fibrotic indications like PSC and SSc such as Gilead Sciences, Inc., Mitsubishi Tanabe Pharma Corporation, Horizon Therapeutics plc, Pliant Therapeutics, Inc., Kadmon Holdings, Inc and others. However, Chemomab knows of no other companies currently in clinical development with a monoclonal antibody that targets CCL24.

Although the approach is novel with respect to targeting both inflammation and fibrosis, Chemomab will need to compete with products further advanced in the pipeline towards market approval. Investigational products in the leading disease areas, include:

• PSC

There are currently no FDA-approved therapies for the treatment of PSC. Companies currently developing product candidates in Phase 3 clinical studies include Gilead and Dr. Falk Pharma, targeting cholestasis and liver metabolism (Gilead; Cilofexor, Dr. Falk; norUrso). Additional companies with clinical candidates in earlier stages of development include HighTide Biopharmaceutical, Mirum Pharmaceuticals and Pliant Inc.

• SSc

There are currently two FDA approved products for the treatment of clinical manifestations of SSc, Nintedanib, marketed by Boehringer Ingelheim GmbH and Tocilizumab, marketed by Hoffmann-La Roche for the treatment of interstitial lung disease. Companies currently developing product candidates in SSc in early clinical stage include Kadmon Holdings, Inc., Horizon, BMS, GSK, Vicore, Sanofi and Emerald Health Sciences Inc.

The availability of reimbursement from government and other third-party payors will affect the pricing and competitiveness of CM-101 and any future products. More advanced competitors also may obtain regulatory approval for their products more rapidly than Chemomab, which could result in competitors establishing a strong market position.

Intellectual Property

Overview

Chemomab strives to protect and enhance the proprietary technology, inventions, and improvements that are commercially important to the development of its business, including seeking, maintaining, and defending patent rights, whether developed internally or licensed from third parties. Chemomab also relies on trade secrets relating to its proprietary technology platform and know-how, continuing technological innovation and in-licensing opportunities to develop, strengthen, and maintain its proprietary position in the field of inflammation and fibrosis that may present areas of opportunity for the development of its business. Chemomab may also rely on regulatory protection afforded through data exclusivity, market exclusivity, and patent term extensions, where available.

- 24 -

Chemomab’s commercial success may depend in part on its ability to: obtain and maintain patent and other proprietary protection for commercially important technology, inventions and know-how related to its business; defend and enforce its patents; preserve the confidentiality of its trade secrets; and operate without infringing the valid enforceable patents and proprietary rights of third parties. Chemomab’s ability to prevent third parties from making, using, selling, offering to sell, or importing Chemomab’s products may depend on the extent to which it has rights under valid and enforceable licenses, patents, or trade secrets that cover these activities. In certain cases, enforcement of these rights may depend on third party licensors. With respect to both licensed and company-owned intellectual property rights, Chemomab cannot be sure that patents will be granted with respect to any of its pending patent applications or with respect to any patent applications that may be filed by Chemomab in the future, nor can Chemomab be sure that any of its existing patents or any patents that may be granted to it in the future will be commercially useful in protecting its commercial products and methods of manufacturing the same.