Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - ZW Data Action Technologies Inc. | exh_321.htm |

| EX-31.2 - EXHIBIT 31.2 - ZW Data Action Technologies Inc. | exh_312.htm |

| EX-31.1 - EXHIBIT 31.1 - ZW Data Action Technologies Inc. | exh_311.htm |

| EX-23.1 - EXHIBIT 23.1 - ZW Data Action Technologies Inc. | exh_231.htm |

| EX-21.1 - EXHIBIT 21.1 - ZW Data Action Technologies Inc. | exh_211.htm |

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 10-K

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE | |

| SECURITIES EXCHANGE ACT OF 1934 | ||

| For the Fiscal Year Ended December 31, 2020 | ||

| OR | ||

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE | |

| SECURITIES EXCHANGE ACT OF 1934 | ||

|

For the transition period from ____ to ____ |

;

COMMISSION FILE NO. 001-34647

ZW DATA ACTION TECHNOLOGIES INC.

(Exact name of registrant as specified in its charter)

| NEVADA | 20-4672080 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

Room 1106, Xinghuo Keji Plaza, No. 2 Fengfu Road, Fengtai District, Beijing, PRC

(Address of principal executive offices)

+86-10-6084-6616

(Issuer’s telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Exchange On which Registered | ||

| Common Stock, par value $0.001 | CNET | Nasdaq Capital Market |

Securities Registered Pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer,

as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports

pursuant to Section 13 or 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports

required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter

period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically

every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a “smaller reporting company, or an emerging growth company. See the definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | ☐ | Accelerated Filer | ☐ | |

| Non-Accelerated Filer | ☒ | Smaller Reporting Company | ☒ | |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as

defined in Rule 12b-2 of the Act).

Yes ☐ No ☒

The aggregate market value of the 15,866,895 shares of common equity stock held by non-affiliates of the Registrant was approximately $15,866,895 on the last business day of the Registrant’s most recently completed second fiscal quarter, based on the last sale price of the registrant’s common stock on such date of $1.00 per share, as reported on the Nasdaq Capital Market.

The number of shares outstanding of the Registrant’s common stock, $0.001 par value as of April 13, 2021 was 31,304,915.

| 2 |

TABLE OF CONTENTS

| 3 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. These statements relate to future events or our future financial performance. We have attempted to identify forward-looking statements by terminology including “anticipates”, “believes”, “expects”, “can”, “continue”, “could”, “estimates”, “expects”, “intends”, “may”, “plans”, “potential”, “predict”, “should” or “will” or the negative of these terms or other comparable terminology. These statements are only predictions. Uncertainties and other factors, including the risks outlined under Risk Factors contained in Item 1A of this Form 10-K, may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels or activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Our expectations are as of the date this Form 10-K is filed, and we do not intend to update any of the forward-looking statements after the filing date to conform these statements to actual results, unless required by law.

We file annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and proxy and information statements and amendments to reports filed or furnished pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended. The SEC also maintains a website (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding us and other companies that file materials with the SEC electronically. You may also obtain copies of reports filed with the SEC, free of charge, via a link included on our website at www.zdat.com.

| ITEM 1 | BUSINESS |

We are a holding company that conducts our primary businesses through our PRC subsidiaries and operating entities (the “VIEs”). We primarily operate a one-stop services for our clients on our Omni-channel advertising, precision marketing and data analysis management system.

We derive our revenue principally by:

| l | distributing the right to use search engine marketing service we purchased from key search engines to increase the sales lead conversion rate for our clients’ business promotion on both mobile and PC searches; |

| l | selling Internet advertising space on our advertising portals and providing related data service to our clients through the Internet advertising management systems developed and managed by us; |

| l | selling effective sales lead information; and |

| l | providing other e-commerce O2O advertising and marketing and related value-added technical services. |

We generated total revenues of US$38.4 million for the year ended December 31, 2020, compared with US$58.1 million in 2019. Net loss attributable to our stockholders was US$5.22 million and US$1.26 million for the years ended December 31, 2020 and 2019, respectively.

In early 2018, we commenced to expand our business into the blockchain industry and the related technology. In January 2018, we announced our strategic partnership with Wuxi Jingtum Network Technology ("Jingtum”), a credible blockchain ecology builder. This strategic partnership with Jingtum is focused on blockchain technology to build a credible, fair and transparent platform for business opportunities and transactions. We aim to build a credible, traceable, and highly secured blockchain application infrastructure platform and develop effective business applications, including both mobile and web applications, to meet the large demand from the small and medium enterprises (“SMEs”). We believe that the applications of blockchain in the field of business development and marketing can help SMEs build a new business ecosystem based on algorithmic trust. With the introduction of blockchain technology, we will gradually shift our platform-centric services in the past towards decentralizing services, solving trust issues in business cooperation and services and enhancing user vitality and loyalties. We also plan to gradually shift from providing information services to providing transaction services for business opportunities so as to create a multi-industry and cross-chain value-based internet sharing business.

For the years ended December 31, 2020 and 2019, as we initiated our Business Opportunity Social Ecosystem (“BOSE”), we were in the process of developing two blockchain-technology powered platform applications named BO!News and OMG, respectively. Our blockchain-powered platform together with the applications aim to build a social community which facilitates various types of users, such as business owners, entrepreneurs, suppliers and customers or any individual who is interested in starting up a business, to share business opportunities and related information and allows users to conduct certain business transactions that can be recorded and verified through the blockchain-technology applied by our applications. In return, our platform will use a reward point mechanism generated on blockchain in the form of token to keep track and award the users for their contributions to our platform applications. These reward points are not associated with any cryptocurrency and will not be listed in any crypto exchange can only be used within our BOSE, such as, exchange for our advertising and marketing services.

We have engaged RedRun Limited (“RedRun”) and Beijing Shengshi Kaida Technical Service Co., Ltd. (“Shengshi Kaida”) for the development of OMG and Bo!News, respectively. Total contract amounts for OMG and Bo!News is US$4.5 million and US$0.46 million, respectively. The following table summarized the material remaining development costs of these blockchain-powered applications as of December 31, 2020.

| 2 |

| Total |

Estimated Payment Schedule | |||||||||||

|

Amount |

Q3 2021 | Q4 2021 | ||||||||||

| (US$’000) | (US$’000) | (US$’000) | ||||||||||

| Remaining development costs under RedRun Agreement: | 462 | 300 | 162 | |||||||||

| Remaining development costs under Shengshi Kaida Agreement | 92 | - | 92 | |||||||||

| Total Remaining Development Costs: | 554 | 300 | 254 | |||||||||

Our platform will support two blockchain-powered Apps: BO!News and OMG.

Our users will use BO!News on account of that we publish it as an App for life and entrepreneurial social interaction app, which enables its future users an much easier access to daily news, social medias and social information associating with daily life events and entrepreneurship. In chorus, they can contribute and share their own experiences by generating their personal contents in writing, forwarding from other medias, streaming or short videos. In return, they would be rewarded with reward points in form of token, which are recorded on the blockchain for a transparent and creditable proof with a fixed value (which value is not finally determined yet). The reward points in form of token issued by the BO!News App, are not associated with cryptocurrency and will not be listed in any crypto exchange. These reward points are also not transferrable and can only be used to exchange goods or products within our ecosystem, i.e. the BOSE, of ChinaNet. For example, to exchange for advertising service, or other gifts offered on the App, which will be further identified to the public when the DAU (“Daily Active User”) of BO!News App reaches sustainable level. With the anticipated sustainable level of DAU on the App, we would also be able to introduce BO!News as a new marketing channel for our existing client base, as well as acquisition of new clients, and to generate additional recurring internet advertising revenues accordingly.

OMG is developed for a larger business scope than BO!News, and is similar to an App called StorCard in Germany, but with more functions. OMG App will enable users (consumers and merchants) to integrate other stores’ reward/loyalty point cards into OMG point consolidation and exchange system built on the blockchain infrastructure platform. OMG will be also featured with its blockchain-powered CRM plus and Advertising sharing system that combines with all previous advertising technology we have developed and sourced throughout years. It will provide both consumers and merchants a very easy in-and-cross store spending experience through a combined reward card, which will help consumers managing all of their different reward/loyalty points cards in a single way. Merchants will also get benefit of using it as a marketing platform to push their advertising or promotion to their and non-competitors’ customer bases. For example: Merchant A and B are both OMG App’s participating merchants, as a result, their customers’ loyalty points databases are connected to OMG through secured API system. User X is a customer of both Merchant A and Merchant B, who wants to redeem a gift card with Merchant B’s loyalty/reward points, however, he does not have enough Merchant B’s loyalty/reward points. Through the OMG App, User X makes an offer of exchange Merchant A’s loyalty/reward points for Merchant B’s loyalty/reward points, and the OMG App matching system has found User Y, who wants to exchange Merchant B’s loyalty/reward points for Merchant A’s points for redeeming a reward gift in Merchant A. User X and Y are then acknowledged by the OMG App interactively, and then are able to exchange the loyalty/reward points for their specific needs based on their own negotiated exchange rate between Merchant A and Merchant B’s loyalty/reward points. Their transaction will be executed by the agreed terms input onto smart contract through the OMG App and recorded on the public chain for transaction authentication and verification. In addition, this transaction activity will be recorded by the OMG App, and User X and Y will also be rewarded with the loyalty points issued by OMG for conducting this transaction on OMG, which will be recorded and stored on our hyperledger blockchain in the form of token.

Hence, all the behaviors, including the merchants’ reward/loyalty points exchange transaction mentioned previously, conducted both personal or business-oriented within OMG will be rewarded with points issued by the platform in form of token (“OMG reward points”). Same as the points rewarded to the users of the BO!News App, the OMG reward points issued in form of token are also not associated with cryptocurrency, and will not be listed in any crypto exchange. These reward points will grant privileges on higher sales discount, better point consumption rate, credit rating, faster matching and so forth, which rules will be finalized before our final commercial release of the OMG App, and will only be used for the business or consumption purposes within the BOSE of ChinaNet. Our final blockchain platform has been designed and is developing to adopt both hyperledger and public chains in a hybrid structure.

| 3 |

We anticipant to generate service revenues from our participating merchants for using our blockchain-powered OMG application. With sustainable level of DAU on this App, we also anticipant to generate additional recurring internet advertising service revenues on OMG application from our existing client base, as well as from new customers in future periods.

We have been building our blockchain infrastructure platform on Ethereum platform, and is now integrating with hyperledger solution to ensure the openness and easiness of the blockchain platform. The risks involved in our blockchain platform including but not exclusive to, the security risk, infrastructure risk, transition (blackhole) risk and so forth. As such, any malfunction, breakdown, divergence or abandonment of the Ethereum platform may have an adverse effect on the our blockchain-powered platform. As a result, we are in the process of testing and integrating with hyperledger and other public cross-chain solution, to minimize related risks and challenges.

As in our planning, we intend to issue reward points in the form of token for user interactions within our Apps and it is NOT officially implemented yet. As previously mentioned, when users of our Apps (i.e. BO!News or OMG) post and share some contents, or conduct a transaction within the App, they can get some rewards in the form of token as a proof recorded on the blockchain. The reward points will also be given to the users when their article attracts internet traffics (i.e. clicks and viewings) and interactions (i.e. messages or the click on the ads within the content). The reason of using blockchain is to improve the social credibility of activities recorded and transactions conducted. All the points received by the users are stored in the wallet of the Apps on the hyperledger chain, which is in a closed environment. If a person mobile phone got stolen and his password of the mobile phone and App got cracked, then his or her points will likely be stolen. But as these points can only be used within our BOSE ecosystem, hence it means zero value outside of this ecosystem, and if we got informed in advance, we can manage to cancel the points and reissue the points to them to prevent the owner’s possible losses. Finally, as stated previously, the reward point issued in form of token is not equivalent to any cryptocurrency and will not be listed on any exchange.

In early December 2020, we completed our Blockchain Integrated Framework, or BIF, for retail business, to provide a framework platform for more accessible and efficient integration of small and medium sized retail business users. BIF provides on-time delivery, real-time information, and record-time service for retail business users while consolidating both Key Opinion Leader (“KOL”) and Online-to-Offline marketing and advertising information. Harnessing the benefits of blockchain-powered technology, we believe BIF could improve security, give retailers more control over their data, and create new forms of marketing to help retailers meet consumer needs with higher precision and capture the value otherwise missed. We plan to complete the integration of BO!News and OMG onto BIF for commercial release by the first half of 2021 and launch BIF to retail business users before the end of the third fiscal quarter of 2021.

To enhance the reliability of our future blockchain services and optimize location for client proximity, we incorporated a new wholly-owned subsidiary, ChinaNet Online (Guangdong) Technology Co., Ltd. (“ChinaNet Online Guangdong”) in May 2020 as we are in the process of expanding our corporate business and technology headquarters to the city of Guangzhou in Southern China. ChinaNet Online Guangdong has officially commenced its operations since July 2020. Along with the development of new customer base in southern China in future periods, we plan to gradually transfer a portion of our core business activities to ChinaNet Online Guangdong. We are also currently seeking for new local business partners to develop new high-technology related business, including blockchain services.

In early December 2020, we announced the official opening of our first live streaming platform in Guangzhou, China. It features livestreaming ecommerce, ecommerce support service, influencer stream shopping, private traffic boosting, supply chain service, and supply chain finance.

With further enhancement of technology on both blockchain development and internet traffic and data analytics for the implementation of BOSE, in January and February 2021, we have initiated and executed a series of partnerships and cooperation to execute our business plans on building up BOSE to capture the business opportunity with the opening of our live steaming platform. Our preliminary business plans include: connecting BOSE to Enterprise Wechat and CRM SaaS for consolidating and accumulating behavior data in social media; enhancing online branding and management service and aggregating more efficient ROI and cost-effective advertising and marketing services to our clients; offering services for the supply chain finance with the focus on the target audiences of KOLs and O2O e-commerce merchants, with options and selections of digital assets, and adopting crypto payment gateways with licensed partners; utilizing upgraded decentralized financial technology and building Defi service on BIF platform for intellectual property rights with expansion of the BIF technology on blockchain mining.

| 4 |

In December 2020, we completed an offering of shares of our common stock together with warrants which resulted in gross proceeds of $7.0 million (the “2020 Financing”). In February 2021, we completed an additional offering of shares of common stock and a concurrent private placement of warrants to purchase common stock which results in gross proceeds of $18.7 million (the “February 2021 Financing”).

Impact of COVID-19 on Our Operations and Financial Performance

Our business is subject to the impact of natural catastrophic events, such as earthquakes, or floods, public health crisis, such as disease outbreaks, epidemics, or pandemics in China, and all these could result in a decrease or sharp downturn of economies, including our markets and business locations in the current and future periods. The outbreak of the coronavirus (COVID-19) pandemic in China resulted in increased travel restrictions, and shutdown of businesses, which has caused slower recovery of the China economy. We may experience impact from quarantines, market downturns and changes in customer behavior related to pandemic fears and impact on our workforce if the virus continues to spread. We experienced a decrease in revenue in 2020 due to the outbreak. COVID-19 affected a significant number of our workforce employed in our operations, and as a result we are experiencing a slow resumption of operations and may experience delays or the inability to delivery our service on a timely basis. In addition, one or more of our customers, partners, service providers or suppliers may experience financial distress, delayed or defaults on payment, file for bankruptcy protection, sharp diminishing of business, or suffer disruptions in their business due to the outbreak. The extent to which the COVID-19 pandemic impacts our results will depend on future developments and reactions in China, which are highly uncertain and will include emerging information concerning the severity of the COVID-19 pandemic and the actions taken by governments and private businesses to attempt to contain the coronavirus. The COVID-19 situation is likely to result in a potential material adverse impact on our business, results of operations and financial condition in the short run if it has become worse in China. Wider-spread COVID-19 in China and globally could prolong the deterioration in economic conditions and could cause decreases or delays in advertising spending and reduce and/or negatively impact our short-term ability to grow our revenues. Any decreased collectability of accounts receivable, bankruptcy of small and medium businesses, or early termination of agreements due to deterioration in economic conditions could negatively impact our results of operations.

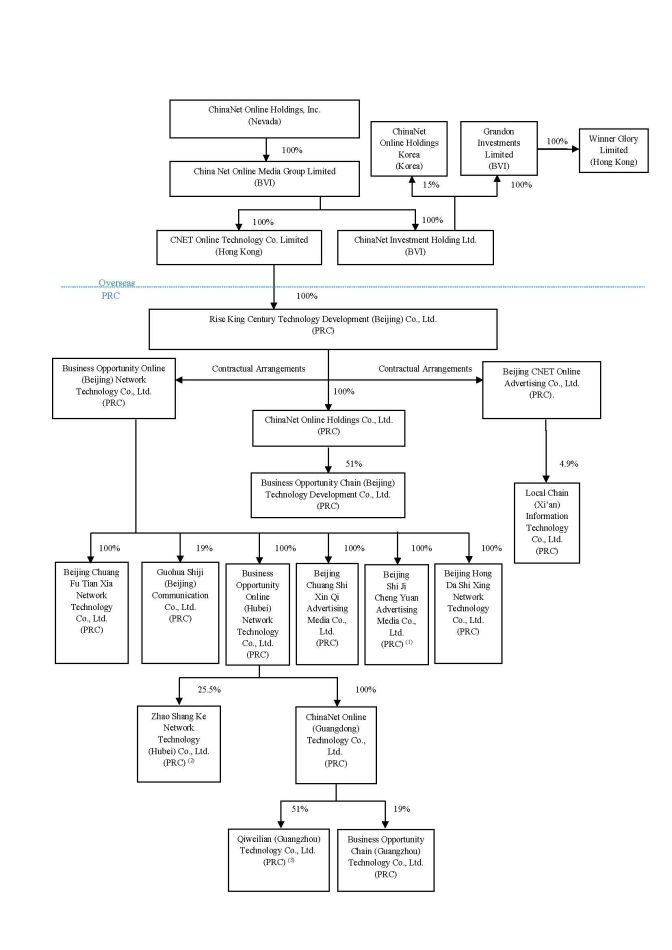

Our Subsidiaries, Variable Interest Entities (VIEs) and Ownership Interest Investment Affiliates

As of December 31, 2020, our corporate structure is set forth below:

| (1) | We sold the entity to unrelated parties in January 2021. |

| (2) | The entity was liquidated and deregistered with the local authorities in February 2021. |

| (3) | We sold the entity to unrelated parties in March 2021. |

| 5 |

We were incorporated in the State of Texas in April 2006 and re-domiciled to become a Nevada corporation in October 2006. On June 26, 2009, we consummated a share exchange transaction with China Net Online Media Group Limited (“China Net BVI”) (the “Share Exchange”). As a result of the Share Exchange, China Net BVI became a wholly owned subsidiary of ours and we are now a holding company, which, through certain contractual arrangements with operating companies in the People’s Republic of China (the “PRC”), is primarily engaged in providing Internet advertising, precision marketing, e-commerce online to offline (“O2O”) advertising and marketing and the related data and technical services to SMEs in the PRC.

Effective October 14, 2020, we changed our corporate name from ChinaNet Online Holdings, Inc. to ZW Data Action Technologies Inc.

Our subsidiaries and our VIE Structure

Our direct wholly owned subsidiary, China Net BVI, was incorporated in the British Virgin Islands on August 13, 2007. On April 11, 2008, China Net BVI became the parent holding company of a group of companies comprised of CNET Online Technology Co. Limited, a Hong Kong company (“China Net HK”), which established, and is the parent company of, Rise King Century Technology Development (Beijing) Co., Ltd., a wholly foreign-owned enterprise (“WFOE”) established in the PRC (“Rise King WFOE”). In October 2008, Rise King WFOE acquired control over Business Opportunity Online (Beijing) Network Technology Co., Ltd. (“Business Opportunity Online”) and Beijing CNET Online Advertising Co., Ltd. (“Beijing CNET Online”) (collectively the “PRC Operating Entities” or the “VIEs”) by entering into a series of contracts (the “Contractual Agreements” or the “VIE Agreements”), which enabled Rise King WFOE to operate the business and manage the affairs of the PRC Operating Entities.

China has adopted a reformed system with respect to foreign investment administration, under which the Chinese government applies national treatment to foreign investors in terms of investment entry and the foreign investor needs to comply with the requirements as provided in The Special Administrative Measures for Foreign Investment (the “Negative List”). The Negative List will be issued by, amended or released upon approval by the State Council, from time to time. The Negative List will consist of a list of industries in which foreign investments are prohibited and a list of industries in which foreign investments are restricted. Foreign investors will be prohibited from making investments in prohibited industries, while foreign investments must satisfy certain conditions for investments in restricted industries, such as: there always a limitation on foreign investment and ownership. Foreign investments and domestic investments in industries outside the scope of the prohibited industries and restricted industries will be treated equally. The most recent version of the Negative List was promulgated jointly by the Ministry of Commerce (“MOFCOM”) and the National Development and Reform Commission (“NDRC”) on June 23, 2020, which came into effective on July 23, 2020 (the “2020 Negative List”).

The business of the PRC Operating Entities falls under the class of a business that provides Internet content or information services, a type of value-added telecommunication services, for which restrictions upon foreign ownership apply. The 2020 Negative List retains the restrictions on foreign ownership related to value-added telecommunication services. As a result, Rise King WFOE is not allowed to conduct the business the PRC Operating Entities companies are currently pursuing. Advertising business is open to foreign investment but used to require that the foreign investors of a WFOE should have been carrying out advertising business for over three years pursuant to the Foreign Investment Advertising Measures as amended by MOFCOM and the State Administration of Industry and Commerce (“SAIC”, currently known as the State Administration for Market Regulations, (“SAMR”)) on August 22, 2008, which was repealed in June 29, 2015. Before June 29, 2015, Rise King WFOE was not allowed to engage in the advertising business because its shareholder, China Net HK, did not meet such requirements. As a result, in order to control the business and operations of the PRC Operating Entities and consolidate the financial results of the two companies in a manner that does not violate the related PRC laws, Rise King WFOE executed the Contractual Agreements with the PRC Shareholders and each of the PRC Operating Entities.

Summary of the material terms of the VIE Agreements:

Exclusive Business Cooperation Agreements:

Pursuant to the Exclusive Business Cooperation Agreements entered into by and between Rise King WFOE and each of the PRC Operating Entities, Rise King WFOE has the exclusive right provide to the PRC Operating Entities complete technical support, business support and related consulting services during the term of these agreements, which includes but is not limited to technical services, business consultations, equipment or property leasing, marketing consultancy, system integration, product research and development, and system maintenance. In exchange for such services, each PRC Operating Entity has agreed to pay a service fee consisting of a management fee and a fee for services provided, to Rise King WFOE, which shall be determined by Rise King WFOE according to the following factors: the complexity and difficulty of the services, seniority of and time consumed by the employees, specific contents, scope and value of the services, market price of the same type of services, and operation conditions of the PRC Operating Entities. Each agreement shall remain effective unless terminated in accordance with the provisions thereof or terminated in writing by Rise King WFOE.

| 6 |

Exclusive Option Agreements:

Under the Exclusive Option Agreements entered into by and among Rise King WFOE, each of the PRC Shareholders irrevocably granted to Rise King WFOE, or its designated person, an exclusive option to purchase, to the extent permitted by PRC law, a portion or all of their respective equity interest in any PRC Operating Entities for a purchase price of RMB10, or a purchase price to be adjusted to be in compliance with applicable PRC laws and regulations. Rise King WFOE, or its designated person, has the sole discretion to decide when to exercise the option, whether in part or in full. Each of these agreements shall become effective upon execution and remain effective until all equity interests held by the relevant PRC Shareholder(s) in the PRC Operating Entities have been transferred or assigned to Rise King WFOE and/or any other person designated by Rise King WFOE.

Equity Pledge Agreements:

Under the Equity Pledge Agreements entered into by and among Rise King WFOE, the PRC Operating Entities and each of the PRC Shareholders, the PRC Shareholders pledged all of their equity interests in the PRC Operating Entities to guarantee the PRC Operating Entities’ and the PRC Shareholders’ performance of the relevant obligations under the Exclusive Business Cooperation Agreements and other Contractual Agreements. If the PRC Operating Entities or any of the PRC Shareholders breaches its/his/her respective contractual obligations under these agreements, or upon the occurrence of one of the events regarded as an event of default under each such agreement, Rise King WFOE, as pledgee, will be entitled to certain rights, including the right to dispose of the pledged equity interests. The PRC Shareholders of the PRC Operating Entities agreed not to dispose of the pledged equity interests or take any actions that would prejudice Rise King WFOE's interest, and to notify Rise King WFOE of any events or upon receipt of any notices which may affect Rise King WFOE's interest in the pledge. Each of the equity pledge agreements will be valid until all the obligations under the Exclusive Business Cooperation Agreements and other Contractual Agreements have been fulfilled, including the service fee payments related to the Exclusive Business Cooperation Agreement are paid in full.

Irrevocable Powers of Attorney:

The PRC Shareholders have each executed an irrevocable power of attorney to appoint Rise King WFOE as their exclusive attorneys-in-fact to vote on their behalf on all PRC Operating Entities matters requiring shareholder approval. The term of each power of attorney is valid so long as such shareholder is a shareholder of the respective PRC Operating Entity.

As a result of these Contractual Agreements, we through our wholly-owned subsidiary, Rise King WFOE, were granted with unconstrained decision making rights and power over key strategic and operational functions that would significantly impact the PRC Operating Entities or the VIEs’ economic performance, which includes, but is not limited to, the development and execution of the overall business strategy; important and material decision making; decision making for merger and acquisition targets and execution of merger and acquisition plans; business partnership strategy development and execution; government liaison; operation management and review; and human resources recruitment and compensation and incentive strategy development and execution. Rise King WFOE also provides comprehensive services to the VIEs for their daily operations, such as operational technical support, office administration technical support, accounting support, general administration support and technical support for products and services. As a result of the Exclusive Business Cooperation Agreements, the Equity Pledge Agreements and the Exclusive Option Agreements, we will bear all of the VIEs’ operating costs in exchange for the net income of the VIEs. Under these agreements, we have the absolute and exclusive right to enjoy economic benefits similar to equity ownership through the VIE Agreements with our PRC Operating Entities and their shareholders. Due to the fact that Rise King WFOE and its indirect parent are the sole interest holders of the VIEs, we included the assets, liabilities, revenues and expenses of the VIEs in our consolidated financial statements, which is consistent with the provisions of FASB Accounting Standards Codification ("ASC") Topic 810 “Consolidation”, subtopic 10.

| 7 |

Please refer to the discussion of uncertainties and risks in relation to our VIE Structure on page 14 under Business-Government Regulation contained in Item 1 and page 24 under Risk Factors-Risks Relating to Regulation of Our Business and to Our Structure contained in Item 1A of this Annual Report.

As of December 31, 2020, besides China Net BVI, China Net HK and Rise King WFOE, as discussed above, we also have four other indirectly wholly-owned subsidiaries, ChinaNet Investment Holding Ltd, a British Virgin Islands company (“ChinaNet Investment BVI”), Grandon Investments Limited, a British Virgin Islands company (“Grandon BVI”), Winner Glory Limited, a Hong Kong company and ChinaNet Online Holdings Co., Ltd., a PRC company (“ChinaNet Online PRC”). ChinaNet Investment BVI co-founded ChinaNet Online Holdings Korea, a Korean company (“ChinaNet Korea”) with four unaffiliated individuals and beneficially owns 15% equity interest in ChinaNet Korea. The business activities of ChinaNet Korea are currently dormant. ChinaNet Online PRC co-founded Business Opportunity Chain (Beijing) Technology Development Co., Ltd., a PRC company (“Business Opportunity Chain Beijing”) with three unrelated parties, of which ChinaNet Online PRC owns 51% equity interest. Business Opportunity Chain Beijing was established to perform research and develop and provide other technical support for our blockchain business unit.

Our VIEs, VIEs’ subsidiaries and other ownership interest investment affiliates

As discussed above, through Rise King WFOE, we beneficially own two VIEs: Business Opportunities Online and Beijing CNET Online. Business Opportunities Online is primarily engaged in providing Internet advertising, precision marketing and related data service to the SMEs. The business activities of Beijing CNET Online are currently dormant.

As of December 31, 2020, Business Opportunity Online has the following directly or indirectly wholly-owned subsidiaries in the PRC: Beijing Chuang Fu Tian Xia Network Technology Co., Ltd. (“Beijing Chuang Fu Tian Xia”), Business Opportunity Online (Hubei) Network Technology Co., Ltd. (“Business Opportunity Online Hubei”), Beijing Chuang Shi Xin Qi Advertising Media Co., Ltd. (“Beijing Chuang Shi Xin Qi”), Beijing Hong Da Shi Xing Network Technology Co., Ltd. (“Beijing Hong Da Shi Xing”) and Beijing Shi Ji Cheng Yuan Advertising Media Co., Ltd. (“Beijing Shi Ji Cheng Yuan”), all of which are engaged in providing Internet advertising, precision marketing and related data service to the SMEs. Beijing Shi Ji Cheng Yuan was subsequently sold by us to unrelated parties in January 2021.

To enhance the reliability of our future blockchain services and optimize location for client proximity, we expanded our corporate business and technology headquarters to the city of Guangzhou in Southern China. As a result, in May 2020, we incorporated a new wholly-owned subsidiary, ChinaNet Online (Guangdong) Technology Co., Ltd. (“ChinaNet Online Guangdong”), which primarily focuses on the overall business and technology development of our company and developing and operating blockchain technology-based products and services. In October 2020, we co-founded Qiweilian (Guangzhou) Technology Co., Ltd. (“Qiweilian Guangzhou”), in which we beneficially owned a 51% equity interest. In March 2021, due to changes in business strategy of the minority shareholder, we suspended the cooperation with the minority shareholder and sold our 51% equity interest in Qiweilian to unrelated parties.

As of December 31, 2020, we also beneficially own a 4.9% equity interest in Local Chain Xi’an Information Technology Co., Ltd. (“Local Chain Xi’an), a 19% equity interest in both Guohua Shiji (Beijing) Communication Co., Ltd. (“Guohua Shiji”) and Business Opportunity Chain (Guangzhou) Technology Co., Ltd. (“Business Opportunity Chain Guangzhou”) and a 25.5% equity interest in Zhao Shang Ke Network Technology (Hubei) Co., Ltd. (“Zhaoshangke Hubei”). Except for Business Opportunity Chain Guangzhou, which is primarily engaged in the development of webcast platform based business promotion service and franchise consultancy service, the business activities of all other investee entities of us are dormant. Zhaoshangke Hubei was subsequently liquidated and deregistered with the local authorities in February 2021.

| 8 |

Industry

and Market Overview

Overview of the Advertising Market in China

According to the advertising spend forecasts released by Dentsu International in January 2021, the global advertising spend will reach US$579 billion, with an estimated growth rate of 5.8% in 2021. Ad spend in the Asia Pacific is expected to grow by 5.9%, with share of digital forecast to increase 9.1% to a share of 57.5% of all spend.

China’s advertising market is slowing in step with its economy and was also adversely affected by the COVID-19 outbreak in the first fiscal quarter of 2020, however, still remains one of the key drivers of global growth of advertising. Dentsu International forecasts that China’s total advertising spend will grow by 5.3% and 5.0% in 2021 and 2022, respectively.

The growth of China’s advertising market is driven by a number of factors, including the sustained economic growth and increases in disposable income and consumption in China. China was the second largest economy in the world in terms of gross domestic product (“GDP”), which amounted to US$15.5 trillion in 2020, grew by 2.3% year over year. China is the only major economy in the world that achieved positive economic growth in 2020. According to the National Bureau of Statistics of China, the annual disposable income per capita in urban households increased to RMB43,834 in 2020, adjusted by the price factors, the actual increase was 1.2%.

Overview of the Internet Advertising Industry

According to the advertising spend forecasts released by Dentsu International in January 2021, global ad-spend growth continues to be dominated by digital channels, which is expected to reach US$289.5 billion and 50.0% of the total ad-spend in 2021, and further increase to 51.2% of the total ad-spend in 2022.

In China, the Internet advertising market growth is expected to stem primarily from a higher internet penetration rate of just 70.4% by the end of December 2020, compared with 64.5% by the end of March 2020. Total internet users reached to approximately 989 million people by the end of December 2020, increased by approximately 85.4 million people, compared with that as of March 2020. (According to the 47th China Internet Network Development Statistical Report issued by China Internet Network Information Center (the “CNNIC”) in February 2021). According to the 47th CNNIC report, as of December 2020, the mobile internet user reached to 986 million people, compared with 897 million people as of March 2020, which accounted for 99.7% of the total internet users, as compared with 99.3% as of March 2020.

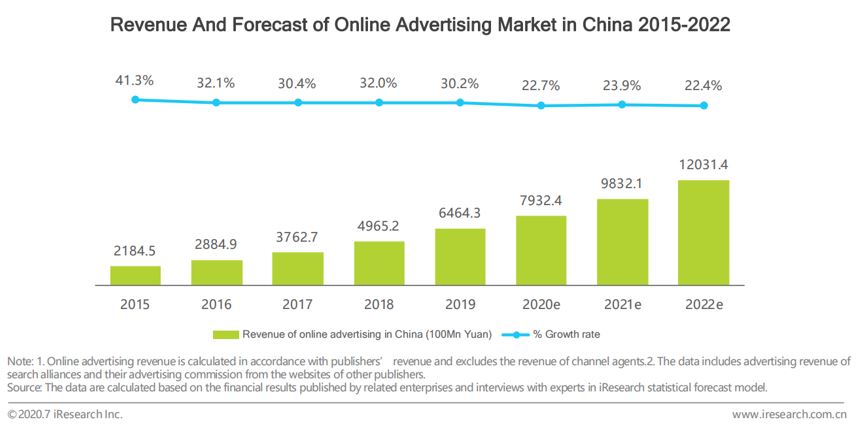

According to a report published by iResearch Inc. in July 2020, online advertising revenue in China reached RMB646.43 billion Yuan (approximately US$93.7 billion) in 2019 and was estimated to hit RMB793.24 billion Yuan (approximately US$115.0 billion) in 2020, up 22.7% year-over-year. Its growth is forecasted to slow in step with its economy in the next few years, with an estimation of a year-over-year increase of 23.9% and 22.4% in 2021 and 2022, respectively.

| 9 |

The diagram below depicts the Market Scale of China’s Online Advertising from 2015 to 2022:

High Demand for the Internet Advertising from SMEs and O2O Business in China

We believe that the Internet advertising market in China has significant potential for future growth due to high demand from the rapid development of SMEs and O2O business.

The development of the SME market is still in its early stages in China. Since their sales channels and distribution networks are still underdeveloped, they are driven to search for new participants by utilizing Internet advertising and precision marketing. The SMEs tend to be smaller, less-developed brands primarily focused on restaurants, garments, building materials, home appliances, and entertainment with low start-up costs. The Chinese government has promulgated a series of laws and regulations to protect and promote the development of SMEs which appeals to entrepreneurs looking to benefit from the central government’s support of increased domestic demand. SMEs are now responsible for about 50% of China’s tax revenues, 60% of China’s GDP and employment of approximately 80% of the urban Chinese workforce. SMEs are creating new urban jobs, and they are the main destination for new graduates entering the workforce and workers laid-off from state-owned enterprises (SOEs) that re-enter the workforce.

In recent years, the capital market, Internet giants and traditional offline services business in China have all accelerated their O2O business arrangement and development. With the advent of the mobile Internet era, the innovation of user needs, and applications have become the main trend of the Internet, including online payments, location-based services, online and offline interaction and more. Due to the slowdown of China’s economy growth in recent years, the competitive market pressure within the local life services industry has increased. Under these circumstances, more and more traditional offline service providers started to use the Internet-based tools (PC, tablet and mobile) to market and promote their products and services. The rapid development of social media and tools, such as: WeChat and Weibo, also have had a very important influence on the development of the O2O market, and using social media and tools to promote brands and maintain customer relationships has become an important adverting and marketing trend for all offline business.

Our Principal Products and Services

Internet Advertising, Precision Marketing and Related Data Services

Founded in 2003 and 2011, respectively, 28.com and liansuo.com are two of the leading Internet portals for information relating to small business opportunities in China, and 28.com is one of the earliest entrants in this sector. In the past few years, we further developed and upgraded the system and tools of our advertising portals, including customer user interface, and integrated our mobile functions. Besides our advertising portals, we also have established solid partnership relations with key search engines in China which entitle us to the distribution of the right to use their search engine marketing service which allows our customers to invest in their online advertising and marketing campaign through multi-channel to maximize market exposure and effectiveness.

| 10 |

Our Internet advertising, precision marketing and related data services provide advertisers with tools to build sales channels directly in the form of franchisees, sales agents, distributors, and/or resellers, and have the following features which enable them to be attractive to the advertisers:

| · | Allowing potential entrepreneurs interested in inexpensive franchise and other business ventures to find in-depth details about these businesses in various industries and business categories, with real-time and online assistance through an instant messenger; |

| · | Providing one-stop integrated Internet marketing and advertising services for SMEs by offering customized services and advertisement placement on various communication channels through intelligent based promotion systems; |

| · | Generating effective sales leads information; and |

| · | Bundling with advanced traffic generation techniques, search-engine optimization and marketing and other Internet advertising management tools to assist our clients with monitoring, analyzing and managing their advertising and data collected on our web portal. |

We typically charge our clients a fixed monthly fee for the Internet advertising and related data services that we provide on our ad portals. For distribution of the right to use the search engine marketing service, revenue is recognized on a monthly basis and at a gross amount, based on the direct cost consumed through search engines for providing such services with a premium, which typically is 3%-8%. A certain group of our clients also purchase effective sales lead information collected by our online advertising system, and we charge a fixed fee, which varies for different business types, for each effective sales lead information delivered to clients.

For the year ended December 31, 2020, we had approximately 660 clients who used our Internet advertising, marketing and data services, compared with 1,100 clients for the year ended December 31, 2019. We achieved US$35.6 million and US$56.9 million of Internet advertising, precision marketing and related data and technical services revenues for the years ended December 31, 2020 and 2019, respectively, which accounted for 92.7% and 97.9% of our total revenues for the years ended December 31, 2020 and 2019, respectively. The overall gross profit margin of this business segment decreased significantly to -0.2% for the year ended December 31, 2020 from 8% for the year ended December 31, 2019. The decrease in performances of this business segment was directly resulted from the COVID-19 outbreak and business shutdown during the first fiscal quarter of 2020 in China, and slow recovery of economy in the following quarters.

Other services revenues

For the year ended December 31, 2020, we achieved US$1.55 million e-commerce O2O advertising and marketing service revenues and US$1.25 million other technical solution service revenues. For the year ended December 31, 2019, we achieved US$1.2 million non-recurring software sales revenue.

Sales and Marketing

For the year ended December 31, 2020, we derived 92.7% of total net revenues from our Internet advertising and the provision of related data and technical services, compared with 97.9% for the year ended December 31, 2019.

We employ experienced advertising sales people and provide in-house education and training to our sales people to ensure that they provide our current and prospective clients with comprehensive information about our services, the benefits of using our advertising, marketing and data services and relevant information regarding the advertising industry. We also market our advertising services from time to time by placing advertisements on television and other well-known portals in China, participating in domestic and international franchise exhibitions in China and other countries and acting as a sponsor to third-party programming and shows.

| 11 |

Suppliers

Our suppliers are major search engines, Internet gateways, other advertising resources suppliers and technical service providers. Among these suppliers, for the year ended December 31, 2020, resources purchased from one of the largest search engines in China counted for approximately 78% of our search engine resource cost, compared with 89% for the year ended December 31, 2019.

Research and Development

We plan to increase expenditures to enhance the safety of our hardware and server that we depend on to support our network and manage and monitor programs on the network in future years. Whether we continue to further deploy newer technology will depend upon cost and network security. We also focus on enhancing related software systems enabling us to track and monitor advertiser demands and the related data collection and analysis. In the next few years, we intend to move our research and development efforts to mobile-based application system and data collection and analysis tools, and our new blockchain-technology powered Business Opportunity Social Ecosystem.

Intellectual Property

As of December 31, 2020, we had twenty-four software copyright certificates issued by the State Copyright Office of the PRC, including, but not limited to, software systems covering monitor and management platforms on Internet advertising effects, analysis systems on Internet traffic statistics and Internet user behavior, analysis systems on log-based visit hotspot and browsing trails, analysis systems on mobile advertising platform and cloud-compute technology.

Competition

We compete with other Internet advertising companies for business opportunities in China, including companies that also distribute the right to use the search engine marketing services provide by key search engines in China, such as: Media Linkage Technology (Beijing) Co., Ltd., Guangzhou Jiuxing Hudong Technology Co., Ltd., and Guangzhou Chengzhi Mingyuan Network Technology Co., Ltd, and companies that operate Internet advertising portals, such as u88.cn, 3158.cn and 78.cn. We compete for clients primarily on the basis of network size and coverage, location, price, the range of services that we offer and our brand name. We also compete for overall advertising spending with other alternative advertising media companies, such as wireless telecommunications, street furniture, billboards, frame and public transport advertising companies, and with traditional advertising media, such as newspapers, magazines and radio.

Government Regulation

The PRC government imposes extensive controls and regulations over the media industry, including on internet, television, radio, newspapers, magazines, advertising, media content production, and the market research industry. This section summarizes the principal PRC regulations that are relevant to our lines of business.

Regulations on the Value-added Telecommunication Services and Advertising Industry in China

Foreign Investments in Value-added Telecommunication Services

The Negative List restricts foreign investments in value-added telecommunication services, including providing Internet information services (“ICP”). In accordance with the Regulations for the Administration of Foreign-Invested Telecommunications Enterprises (“FITE Regulations”), which were issued by the State Council of the PRC on December 11, 2001, became effective on January 1, 2002 and was subsequently amended on September 10, 2008 and February 6, 2016, respectively. The FITE Regulations stipulate that foreign invested telecommunications enterprises in the PRC (“FITEs”) must be established as Sino-foreign equity joint ventures. Under the FITE Regulations and in accordance with WTO-related agreements, the foreign party to a FITE engaging in value-added telecommunications services may hold up to 50% of the equity of the FITE, with no geographic restrictions on the FITE’s operations. On June 30, 2016, the MIIT issued an Announcement of the Ministry of Industry and Information Technology (the “MIIT”) on Issues concerning the Provision of Telecommunication Services in the Mainland by Service Providers from Hong Kong and Macao, which provides that investors from Hong Kong and Macau may hold more than 50% of the equity in FITEs engaging in certain specified categories of value-added telecommunications services.

| 12 |

For a FITE to acquire any equity interest in a value-added telecommunications business in China, it must satisfy a number of stringent performance and operational experience requirements, including demonstrating a track record and experience in operating a value-added telecommunications business overseas. FITEs that meet these requirements must obtain approvals from the MIIT and the MOFCOM or their authorized local counterparts, which retain considerable discretion in granting approvals.

On July 13, 2006, the Notice of the Ministry of Information Industry on Intensifying the Administration of Foreign Investment in Value-added Telecommunications Services (the “MIIT Notice”), which reiterates certain provisions of the FITE Regulations, was issued. Under the MIIT Notice, if a FITE intends to invest in a PRC value-added telecommunications business, the FITE must be established and must apply for a telecommunications business license applicable to the business. Under the MIIT Notice, a domestic company that holds a license for the provision of Internet content services, or an ICP license, is considered to be a type of value-added telecommunications business in China, and is prohibited from leasing, transferring or selling the license to foreign investors in any form, and from providing any assistance, including providing resources, sites or facilities, to foreign investors to conduct value-added telecommunications businesses illegally in China. Trademarks and domain names that are used in the provision of Internet content services must be owned by the ICP license holder or its shareholders. On November 27, 2017, the MIIT promulgated the Notice Regulating the Use of Domain Names in the Provision of Internet-based Information Services, or the Domain Names Notice, which became effective on January 1, 2018. Under the Domain Names Notice, a domain name used by a provider of Internet-based information services must be registered and owned by the provider or, if the provider is an entity, by a shareholder or senior management of the provider.

Foreign Investments in Advertising

In accordance with the Administrative Provision on Foreign Investment in the Advertising Industry, jointly promulgated by the SAMR and MOFCOM on August 22, 2008 and became effective on October 1, 2008, foreign investors can invest in PRC advertising companies either through wholly owned enterprises or joint ventures with Chinese parties. However, the foreign investor must have at least three years of direct operations outside China in the advertising industry as its core business. This requirement was reduced to two years if foreign investment in the advertising company is in the form of a joint venture. The Administrative Provision on Foreign Investment in the Advertising Industry was subsequently repealed by the SAMR and MOFCOM on June 29, 2015.

In consideration of the above discussed restrictions on foreign investments in ICP and advertising business, our whole-owned subsidiary in China, Rise King WFOE, is ineligible to apply for the required licenses for providing Internet information services and was ineligible to apply for the required licenses for providing advertising services in China before June 29, 2015. Our ICP business and advertising business are operated by Business Opportunity Online and Beijing CNET Online in China. We have been, and are expected to continue to be, dependent on these companies to operate our ICP business and advertising business. We do not have any equity interest in our PRC Operating Entities, but Rise King WFOE receives the economic benefits of the same through the Contractual Arrangements.

We have been advised by our PRC counsel, as of the date hereof, our current contractual arrangements with our VIEs and their respective shareholders are valid, binding and enforceable. However, there exist substantial uncertainties regarding the application, interpretation and enforcement of current and future PRC laws and regulations and their potential effect on our corporate structure and contractual arrangements.

| 13 |

On March 15, 2019, the National People’s Congress of the PRC approved the Foreign Investment Law, which came into effect on January 1, 2020, replaced the trio of existing laws regulating foreign investment in China, namely, the Sino-foreign Equity Joint Venture Enterprise Law, the Sino-foreign Cooperative Joint Venture Enterprise Law and the Wholly Foreign-invested Enterprise Law, together with their implementation rules and ancillary regulations. The Foreign Investment Law embodies an expected PRC regulatory trend to rationalize its foreign investment regulatory regime in line with prevailing international practice and the legislative efforts to unify the corporate legal requirements for both foreign and domestic investments. However, since it is relatively new, uncertainties still exist in relation to its interpretation and implementation. For instance, under the Foreign Investment Law, “foreign investment” refers to the investment activities directly or indirectly conducted by foreign individuals, enterprises or other entities in China. Though it does not explicitly classify contractual arrangements as a form of foreign investment, there is no assurance that foreign investment via contractual arrangements would not be interpreted as a type of indirect foreign investment activities under the definition in the future. In addition, the definition contains a catch-all provision which includes investments made by foreign investors through means stipulated in laws or administrative regulations or other methods prescribed by the State Council. Therefore, it still leaves leeway for future laws, administrative regulations or provisions promulgated by the State Council to provide for contractual arrangements as a form of foreign investment. In any of these cases, it will be uncertain whether our contractual arrangements will be deemed to be in violation of the market access requirements for foreign investment under the PRC laws and regulations. Furthermore, if future laws, administrative regulations or provisions prescribed by the State Council mandate further actions to be taken by companies with respect to existing contractual arrangements, we may face substantial uncertainties as to whether we can complete such actions in a timely manner, or at all. Failure to take timely and appropriate measures to cope with any of these or similar regulatory compliance challenges could materially and adversely affect our current corporate structure, corporate governance and business operations.

Business License and permits for ICP and Advertising Companies

All PRC legal entities may commence operations only upon obtaining a business license from the relevant local branch of the SAMR.

On October 27, 1994, the Tenth Session of the Standing Committee of the Eighth National People’s Congress adopted the Advertising Law, which became effective on February 1, 1995, and was subsequently amended on April 24, 2015 by the Fourteenth Session of the Standing Committee of the Twelfth National People’s Congress, and on October 26, 2018 by the Sixth Session of the Standing Committee of the Thirteenth National People’s Congress, respectively. The latest Revised Advertising Law became effective on October 26, 2018. According to the Revised Advertising Law and its various implementing rules, companies engaging in advertising activities must obtain from the SAMR or its local branches a business license which specifically includes within its scope the operation of an advertising business. Companies conducting advertising activities without such a license may be subject to penalties, including fines, confiscation of advertising income and orders to cease advertising operations. The business license of an advertising company is valid for the duration of its existence, unless the license is suspended or revoked due to a violation of any relevant law or regulation. We have obtained such a business license from the local branches of the SAMR as required by existing PRC regulations. We do not expect to encounter any difficulties in maintaining the business license. However, if we seriously violate the relevant advertising laws and regulations, the SAMR or its local branches may revoke our business licenses.

On September 25, 2000, the State Council issued the Measures for the Administration of Internet Information Services (“ICP Measures”). Under the ICP Measures, entities that provide information to online users on the Internet, or ICPs, are obliged to obtain an operating permit from the “MIIT or its local branch. ICP permits are subject to annual inspection. Our PRC operating VIEs engaged in ICP business have obtained their respective ICP permits and comply with the annual inspection and other related provisions. We do not expect to encounter any difficulties in maintaining the ICP operating permits. However, if we seriously violate the relevant ICP laws and regulations, the SAMR or its local branches may revoke our permits.

Advertising Content

PRC advertising laws, rules and regulations set forth certain content requirements for advertisements in China including, among other things, prohibitions on false or misleading content, superlative wording, socially destabilizing content or content involving obscenities, superstition, violence, discrimination or infringement of the public interest. Advertisements for anesthetic, psychotropic, toxic or radioactive drugs are prohibited. There are also specific restrictions and requirements regarding advertisements that relate to matters such as patented products or processes, pharmaceutical products, medical procedures, alcohol, tobacco, and cosmetics. In addition, all advertisements relating to pharmaceuticals, medical instruments, agrochemicals and veterinary pharmaceuticals, together with any other advertisements which are subject to censorship by administrative authorities according to relevant laws or regulations, must be submitted to relevant authorities for content approval prior to dissemination.

| 14 |

Advertisers, advertising operators, including advertising agencies, and advertising distributors are required by PRC advertising laws and regulations to ensure that the content of the advertisements they prepare or distribute is true and in full compliance with applicable laws. In providing advertising services, advertising operators and advertising distributors must review the supporting documents provided by advertisers for advertisements and verify that the content of the advertisements complies with applicable PRC laws, rules and regulations. Prior to distributing advertisements that are subject to government censorship and approval, advertising distributors are obligated to verify that such censorship has been performed and approval has been obtained. Violation of these regulations may result in penalties, including fines, confiscation of advertising income, orders to cease dissemination of the advertisements and orders to publish an advertisement correcting the misleading information. In circumstances involving serious violations, the SAMR or its local branches may revoke violators’ licenses or permits for their advertising business operations. Furthermore, advertisers, advertising operators or advertising distributors may be subject to civil liability if they infringe on the legal rights and interests of third parties in the course of their advertising business.

In October 2013, the SARFT issued a notice to enhance the management of TV shopping infomercials broadcasted in provincial satellite television stations, which further restricts the contents, air time and duration of these infomercials. These restrictions have had and may continue to have a negative impact on our TV advertising business.

We do not believe that advertisements containing content subject to restriction or censorship comprise a material portion of the advertisements displayed on our media network. However, there can be no assurance that each advertisement displayed on our network complies with relevant PRC advertising laws and regulations. Failure to comply with PRC laws and regulations relating to advertisement content restrictions governing the advertising industry in China may result in severe penalties.

Regulation on Intellectual Property

Regulation on Trademark

The Trademark Law of the PRC was adopted at the 24th meeting of the Standing Committee of the Fifth National People’s Congress on August 23, 1982 and amended on February 22, 1993, October 27, 2001, August 30, 2013 and November April 23, 2019, respectively. The Trademark Law sets out the guidelines on administration of trademarks and protection of the exclusive rights of trademark owners. In order to enjoy an exclusive right to use a trademark, one must register the trademark with the Trademark Office of China National Intellectual Property Administration under the SAMR and obtain a registration certificate.

Regulation on Patents

The Patent Law of the PRC was adopted at the 4th Meeting of the Standing Committee of the Sixth National People’s Congress on March 12, 1984 and subsequently amended in 1992 and 2000 and 2008. The Patent Law extends protection to three kinds of patents: invention patents, utility patents and design patents. According to the Implementing Regulations of the Patent Law, promulgated by the State Council of the PRC on June 15, 2001, and subsequently amended in December 28, 2002 and January 9, 2010, respectively, an invention patent refers to a new technical solution relating to a product, a process or improvement. When compared to existing technology, an invention patent has prominent substantive features and represents notable progress. A utility patent refers to any new technical solution relating to the shape, the structure, or their combination, of a product. Utility patents are granted for products only, not processes. A design patent (or industrial design) refers to any new design of the shape, pattern or color of a product or their combinations, which creates an aesthetic feeling and are suitable for industrial application. Inventors or designers must register with the State Intellectual Property Office to obtain patent protection. The term of protection is twenty years for invention patents and ten years for utility patents and design patents. Unauthorized use of patent constitutes an infringement and the patent holders are entitled to claims of damages, including royalties, to the extent reasonable, and lost profits.

| 15 |

Regulation on Copyright

The Copyright Law of the PRC was adopted at the 15th Meeting of the Standing Committee of the Seventh National People’s Congress on September 7, 1990 and amended on October 27, 2001, February 26, 2010, and November 11, 2020, respectively. Unlike patent and trademark protection, copyrighted works do not require registration for protection in China. However, copyright owners may wish to voluntarily register with the China Copyright Protection Center to establish evidence of ownership in the event enforcement actions become necessary. Consent from the copyright owners and payment of royalties are required for the use of copyrighted works. Copyrights of movies or other audio or video works usually expire fifty years after their first publication. The amended Copyright Law extends copyright protection to Internet activities, products disseminated over the Internet and software products. The amended Copyright Law also requires registration of the pledge of a copyright.

Regulations on Foreign Currency Exchange

Foreign Currency Exchange

Pursuant to the Foreign Currency Administration Rules promulgated in1996 and most recently amended in August 2008 and various regulations issued by SAFE and other relevant PRC government authorities, the Renminbi is freely convertible only to the extent of current account items, such as trade-related receipts and payments, interest and dividends. Capital account items, such as direct equity investments, loans and repatriation of investment, unless expressly exempted by laws and regulations, require the prior approval from SAFE or its local branch for conversion of the Renminbi into a foreign currency, such as U.S. dollars, and remittance of the foreign currency outside the PRC.

Payments for transactions that take place within the PRC must be made in Renminbi. Domestic companies or individuals can repatriate foreign currency payments received from abroad or deposit these payments abroad subject to applicable regulations that expressly require repatriation within certain period. Foreign-invested enterprises may retain foreign exchange in accounts with designated foreign exchange banks subject to a cap set by SAFE or its local branch. Foreign currencies received under current account items can be either retained or sold to financial institutions engaged in the foreign exchange settlement or sales business without prior approval from SAFE by complying with relevant regulations. Foreign exchange income under capital account can be retained or sold to financial institutions engaged in foreign exchange settlement and sales business, with prior approval from SAFE unless otherwise provided.

After a Notice on Further Simplifying and Improving Foreign Exchange Administration Policy on Direct Investment, or SAFE Notice 13, became effective on June 1, 2015, instead of applying for approvals regarding foreign exchange registrations of foreign direct investment and overseas direct investment from SAFE, entities and individuals will be required to apply for such foreign exchange registrations from qualified banks. The qualified banks, under the supervision of SAFE, directly examine the applications and conduct the registration. On October 23, 2019, SAFE issued the Circular on Further Promoting Cross-border Trade and Investment Facilitation, or SAFE Circular 28. Among others, SAFE Circular 28 relaxes the prior restrictions and allows the foreign-invested enterprises without equity investment as in their approved business scope to use their capital obtained from foreign exchange settlement to make domestic equity investment as long as the investments are real and in compliance with the foreign investment-related laws and regulations. In addition, SAFE Circular 28 stipulates that qualified enterprises in certain pilot areas may use their capital income from registered capital, foreign debt and overseas listing, for the purpose of domestic payments without providing authenticity certifications to the relevant banks in advance for those domestic payments.

Our business operations, which are subject to the foreign currency exchange regulations, have all been implemented in accordance with these regulations. We will take steps to ensure that our future operations comply with these regulations.

| 16 |

Dividend Distribution

The principal laws, rules and regulations governing dividends paid by PRC operating subsidiaries and VIEs include the Company Law of the PRC (1993), as amended in 2018 and the Foreign Investment Law and its Implementation Rules (2019). Under these laws and regulations, PRC subsidiaries and VIEs, including wholly owned foreign enterprises, or WFOEs, and domestic companies in China, may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, its PRC subsidiaries and VIEs, including WFOEs and domestic companies, are required to set aside at least 10% of their after-tax profit based on PRC accounting standards each year to their statutory capital reserve fund until the cumulative amount of such reserve reaches 50% of their respective registered capital. These reserves are not distributable as cash dividends.

Tax

On March 16, 2007, the Fifth Session of the Tenth National People’s Congress of PRC passed the Enterprise Income Tax Law of the People’s Republic of China, or EIT Law, which became effective on January 1, 2008 and was subsequently amended on February 24, 2017 and December 29, 2018, respectively. On November 28, 2007, the State Council at the 197th Executive Meeting passed the Regulation on the Implementation of the Income Tax Law of the People’s Republic of China, which became effective on January 1, 2008 and was subsequently amended on April 23, 2019. The EIT Law adopted a uniform tax rate of 25% for all enterprises (including foreign-invested enterprises).

Under the EIT Law, enterprises are classified as either “resident enterprises” or “non-resident enterprises.” Pursuant to the EIT Law and the Implementation Rules, enterprises established under PRC laws, or enterprises established outside China whose “de facto management bodies” are located in China, are considered “resident enterprises” and subject to the uniform 25% enterprise income tax rate for their global income. According to the Implementation Rules, “de facto management body” refers to a managing body that in practice exercises overall management and control over the production and business, personnel, accounting and assets of an enterprise. Our management is currently based in China and is expected to remain in China in the future. In addition, although the EIT Law provides that “dividends, bonuses and other equity investment proceeds between qualified resident enterprises” is exempted income, and the Implementation Rules refer to “dividends, bonuses and other equity investment proceeds between qualified resident enterprises” as the investment proceeds obtained by a resident enterprise from its direct investment in another resident enterprise, however, it is unclear whether our circumstance is eligible for exemption.

Furthermore, the EIT Law and Implementation Rules provide that the “non-resident enterprises” are subject to the enterprise income tax rate of 10% on their income sourced from China, if such “non-resident enterprises” (i) do not have establishments or premises of business in China or (ii) have establishments or premises of business in China, but the relevant income does not have actual connection with their establishments or premises of business in China. Such income tax may be exempted or reduced by the State Council of the PRC or pursuant to a tax treaty between China and the jurisdictions in which its non-PRC shareholders reside. Under the Double Tax Avoidance Arrangement between Hong Kong and Mainland China, if the Hong Kong resident enterprise owns more than 25% of the equity interest in a company in China, the 10% withholding tax on the dividends the Hong Kong resident enterprise received from such company in China is reduced to 5%. If China Net HK is considered to be a Hong Kong resident enterprise under the Double Tax Avoidance Arrangement and is considered to be a “non-resident enterprise” under the EIT Law, the dividends paid to us by Rise King WFOE may be subject to the reduced income tax rate of 5% under the Double Tax Avoidance Arrangement. However, based on the Notice on Certain Issues with Respect to the Enforcement of Dividend Provisions in Tax Treaties, issued on February 20, 2009 by the State Administration of Taxation, if the relevant PRC tax authorities determine, in their discretion, that a company benefits from such reduced income tax rate due to a structure or arrangement that is primarily tax-driven, such PRC tax authorities may adjust the preferential tax treatment.

| 17 |

Provisions Regarding Mergers and Acquisitions of Domestic Enterprises by Foreign Investors

On August 8, 2006, six PRC regulatory agencies, including CSRC, MOFCOM, SAT, SASAC, SAMR and SAFE, jointly promulgated the M&A Rules, which became effective on September 8, 2006, and was subsequently amended on June 22, 2009, to regulate foreign investment in PRC domestic enterprises. The M&A Rules provide that the MOFCOM must be notified in advance of any change-of-control transaction in which a foreign investor takes control of a PRC domestic enterprise and any of the following situations exist: (i) the transaction involves an important industry in China; (ii) the transaction may affect national “economic security”; or (iii) the PRC domestic enterprise has a well-known trademark or historical Chinese trade name in China. The M&A Rules also contain a provision requiring offshore SPVs formed for the purpose of the overseas listing of equity interests in PRC companies and controlled directly or indirectly by PRC companies or individuals, to obtain the approval of the CSRC prior to publicly listing their securities on an overseas stock exchange. On September 21, 2006, the CSRC issued a clarification that sets forth the criteria and procedures for obtaining any required approval from the CSRC. In December 2020, the NDRC and the MOFCOM promulgated the Measures for the Security Review of Foreign Investment, which came into effect on January 18, 2021. As these measures are recently promulgated, official guidance has not been issued by the designated office in charge of such security review yet.

To date, the application of the M&A Rules is unclear. Our PRC counsel has advised us that: