Attached files

FIRST AMENDMENT TO CONTRIBUTION AGREEMENT

This FIRST AMENDMENT TO CONTRIBUTION AGREEMENT (this “First Amendment”) is effective as of November 30, 2020 (the “Amendment Date”) between Lodging Fund REIT III OP, LP a Delaware limited partnership (the “Operating Partnership”) and LN Hospitality Denver, LLC a Colorado limited liability company (the “Contributor”).

A. Operating Partnership and Contributor entered into that certain Contribution Agreement dated September 1, 2020 (the “Agreement”) for the acquisition and contribution of a 141-room Courtyard by Marriot located at 255 North Blackhawk Street, Aurora, Colorado 80011 (the “Property”);

B. Unless otherwise modified by this First Amendment, the Agreement is hereby ratified and remains in full force and effect. All capitalized terms used herein will have the meanings ascribed to those terms in the Agreement, unless otherwise specified in this First Amendment.

For valuable consideration the parties agree as follows:

1. Section 2.7.1. The original loan amount stated as “19,500,000.00” shall be replaced with “20,200,000.00.”

The last sentence of Section 2.7.1 is replaced with the following:

“The Operating Partnership will indemnify the guarantors not to exceed a total of $11,000,000.00, from and against all Losses arising with respect to the Access Point Financial, Inc. loan from and after the Closing.”

2. Section 2.11. The following shall be added to the end of Section 2.11.

“In the event that the Operating Partnership undergoes a conversion event that results in complete divestment of outstanding units, then Contributor’s Limited T-Units shall be included in such conversion event. The Operating Partnership shall consent to Limited T-Units being used as collateral against any secondary debts mortgaged or documented against the Property. Subject to the Operating Partnership’s review and approval of documentation between the Contributor and the holder of any such secondary debts, which shall not be unreasonably delayed, withheld or conditioned, proceeds from the Limited T-Units may be paid directly to the holder of the secondary debts. Upon conversion of Limited T-Units to Common Units, the Operating Partnership, or an affiliate of Operating Partnership, shall loan up to 50% of value of common units to Contributor to be applied to any amounts held in a secondary position on the Property, contingent upon Operating Partnership’s, or its affiliate, credit approval and receipt a first priority and perfected security interest in such Common Units.”

3. Section 2.17.1. Section 2.17.1 shall read as follows:

“2.17.1 The Operating Partnership. Upon execution of this First Amendment the Contributor shall be deemed to have provided all Due Diligence Documents required for Operating Partnership to begin its due diligence review, however this sentence shall not limit the Operating Partnership in requesting additional or supporting documents, including the debt service costs discussed in Section 3.2 below, which must be disclosed by Contributor (the “Due Diligence Documents”). The Operating Partnership shall have until 11:59 PM EST on the date which is 21 days (not including the date of execution) following after the Amendment Date (the “Due Diligence Period”) to review the Due Diligence Documents. The Operating Partnership may extend the Due Diligence Period to accommodate any delays on third-party reports, without limitation inspections, appraisals, and needs of the franchise; the Contributor hereby grants immediate onsite access to all third parties, including the Management Company, to perform tasks affiliated with relevant third-party reports. During the Due Diligence Period, the Operating Partnership may cancel this Agreement for any

reason or no reason by delivering a cancellation notice to the Contributor and Closing Agent on or before the expiration of the Due Diligence Period and the Earnest Money shall be immediately returned in full to the Operating Partnership and neither party shall have any further duties or obligations to the other hereunder (except for any obligation expressly surviving the termination of this Agreement). If the Operating Partnership does not notify the Contributor and Closing Agent in writing, signed only by Norman H. Leslie or David R. Durell, on or before the expiration of the Due Diligence Period that the Operating Partnership is satisfied with the Due Diligence Period (the “Satisfaction Notice”), the Operating Partnership will be deemed to have exercised its right of termination and this Agreement will terminate and the Earnest Money shall be immediately returned in full to the Operating Partnership and neither party shall have any further duties or obligations hereunder (except for any obligation expressly surviving the termination of this Agreement). Notwithstanding anything herein to the contrary, if, after the end of the Due Diligence Period, any new matters arise which were not disclosed in the Due Diligence Documents and such matters materially or adversely affect the Property or render incomplete or inaccurate any of the Due Diligence Documents or if any new matters appear on updates to the Preliminary Title Report (an “Adverse Change”), the Operating Partnership shall have 5 business days from notice of the Adverse Change (the “Adverse Change Review Period”) to review and to accept or reject the Adverse Change. The Operating Partnership may cancel this Agreement during the Adverse Change Review Period if any Adverse Change is not acceptable to the Operating Partnership. If this Agreement is so terminated, the Earnest Money shall be returned immediately returned in full to the Operating Partnership and neither party shall have any further duties or obligations to the other hereunder (except for any obligation expressly surviving the termination of this Agreement).”

4. Section 3.2. Section 3.2 is replaced with the following:

“3.2Time and Place. The closing date of the Operating Partnership’s acquisition of the Property shall occur not later than five (5) business days after the Operating Partnership’s satisfaction of any required third party reports, or contracts (i.e. the Franchise Agreement) (the “Closing” or the “Closing Date” as the context may require) or after the expiration of the Contributor’s Cure Period, unless extended in accordance with the Adverse Change Review Period pursuant to Section 2.17.1. The Closing Date may be extended for two 30-day periods at no cost as necessary or helpful to complete negotiations and/or execute agreements with third parties as required for Closing.”

5. Section 6.1.7. Section 6.1.7 shall read as follows:

“Except for as provided on attached Exhibit E, neither the Contributor nor any owner, subsidiary or affiliate of the Contributor shall establish, engage in, or become interested in, directly or indirectly, as an owner, partner, agent, shareholder, employee, independent contractor, consultant, or otherwise, within a radius of 25 miles from the Property in the operation, construction, renovation, and any direct or indirect affiliation of a hotel for a period 48 months. At the Closing, the Contributor shall execute the Non-Competition and Non-Solicitation Agreement set forth as Exhibit E (the “Non-Competition Agreement and Non-Solicitation Agreement”).”

6. Section 2.13. Shall read as follows:

“The Operating Partnership shall engage NHS, LLC dba National Hospitality Services as the management company to manage the Property. Neither the Operating Partnership nor the selected management company shall be liable to the Contributor for, and the Contributor hereby waives, any claims, damages or losses incurred under any theory of liability as a result of, arising out of, in connection with, or related to the management company’s management and operation of the Property or the Property’s performance after the Closing Date.”

7. Financing; Third Party Reports. Three (3) Business Days after the Amendment Date, the Operating Partnership shall execute or agree to a substantially complete term sheet with Access Point Financial, Inc. After the satisfaction of the Financing Contingency, the

Operating Partnership shall expedite all third-party reports, engage the appraiser, and apply for the franchise.

8. Title Matters. Within 3 business after the Amendment Date, Contributor shall request an updated Preliminary Title Report from the Title Company or provide Operating Partnership with all relevant discharges, lien terminations, and all other documents required to satisfy the Operating Partnership’s title objection letter dated September 4, 2020.

9. Debt Service Payment. Through a participation agreement negotiated and executed with Access Point Financial, Inc. (“Access Point”), on or around November 30, 2020, the Operating Partnership shall pay $170,855.16 to cover the Contributor’s debt service payment on its pledge note with Access Point. The $170,855.16 shall be repaid on terms as described in the participation agreement.

10. Schedule 2.2. Schedule 2.2 is replaced with the attached Schedule 2.2.

11. Exhibit D. Exhibit D is replaced with the attached Exhibit D.

12. Exhibit E. Exhibit E is replaced with the attached Exhibit E.

13. Conflict; Counterparts. In the event of any conflict between the terms of this First Amendment and the Agreement, this First Amendment shall control. This First Amendment may be executed in multiple counterparts via facsimile or email in .PDF format, each of which shall be deemed to be an original, but such counterparts when taken together shall constitute but one First Amendment.

14. Successors and Assigns. This First Amendment shall be binding upon, and inure to the benefit of, the parties hereto and their respective successors, administrators and assigns.

15. Ratification. Except as set forth above, the terms of the Agreement are hereby ratified and confirmed in their entirety.

[Signature Page to Follow]

IN WITNESS WHEREOF, this First Amendment has been duly executed by the parties hereto as of the day and year first above written.

| CONTRIBUTOR: | |

| | |

| LN Hospitality Denver, LLC, a Colorado limited liability company | |

| | |

| | |

| By: | /s/ Robert Patel |

| Name: Robert Patel | |

| Title: Managing Member | |

[OPERATING PARTNERSHIP’S SIGNATURE PAGE TO FOLLOW]

| OPERATING PARTNERSHIP: | |

| | |

| LODGING FUND REIT III OP, LP | |

| A Delaware limited partnership | |

| | |

| By: Lodging Fund REIT III, Inc. | |

| Its: General Partner | |

| | |

| | |

| By: | /s/ David R. Durell |

| Name: David R. Durell | |

| Title: Chief Acquisition Officer | |

Exhibit D

Total Consideration pursuant to Section 2.8 of the Agreement shall be $33,100,000, consisting of:

$15,000,000 via assumption and modification of Contributor’s current financing

Limited top guaranty on $5,200,000 in debt that remains between Access Point Financial, Inc. (“Access Point”) and Contributor1

$11,450,000 in Series T Limited Units, equivalent to 1,145,000 Series T Limited Units

$1,450,000 in cash at Closing (approximately $170,855.16 of which shall be paid to an affiliate of the Operating Partnership; $300,000 of which shall be paid to Access Point on behalf of an affiliate of the Operating Partnership; and $788,000 of which shall be multiplied by 1.5 at the time of re-valuation and conversion). Accordingly, the Series T Value will be reduced at the time of re-valuation and conversion by $1,844,000 for cash infused at Closing.

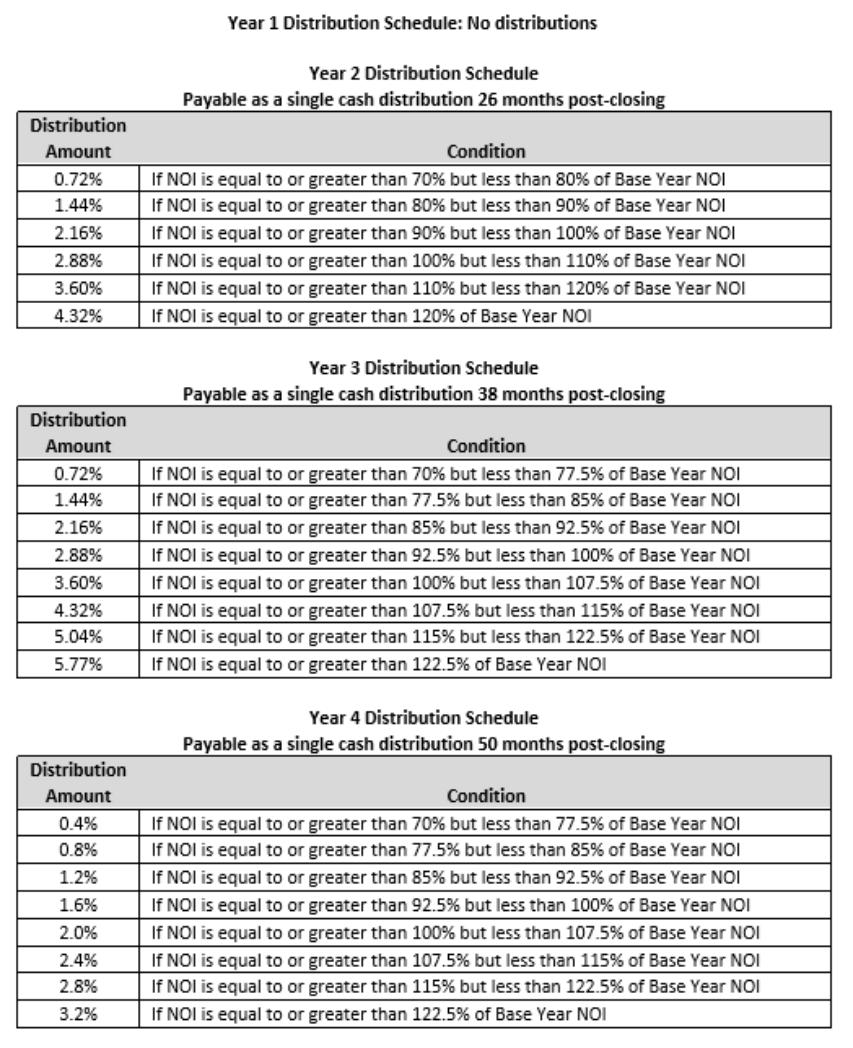

[Distribution Table on Next Page]

1 The Contributor has obtained certain financing from Access Point at an original loan balance of $5,200,000 (the “B Note”). The B Note shall remain as debt between Access Point and the Contributor. Subject to this Exhibit and the conditions and limitations herein, the Operating Partnership (after this Agreement is assigned to an affiliate, the “Lender” and such affiliate, the “SPE” or the “Borrower”) consents to assign payment of any distributable cash that becomes available as distributions to Contributor (the “Limited Top Guaranty”) as follows:

| a. | Subject to Section (b) below, during the current term of the B Note and after the Operating Partnership has obtained a 10% annual return on all capital contributed into the project (the “Preferential Return”), the Operating Partnership shall make distributions to the Contributor, to be applied toward the principal balance of the B Note, equal to 30% of annual Net Cash Flow from Property. In the event that the Operating Partnership refinances the assumed debt on the Property (the “A Note”) during the current term of the B Note, if such refinance provides proceeds in excess of A Note balance, the Operating Partnership shall make an additional distribution to the Contributor, to be applied toward the principal balance of the B Note, equal to the amount of any excess proceeds from the new loan balance in excess of 60% LTV with respect to the Property but not to exceed the existing principal balance of the B Note. |

| b. | The distributions to be made by the Operating Partnership to the Contributor in Section (a) above are subject to the following additional restrictions: |

1. | The total capital contribution by the Operating Partnership will not to exceed $3 million. Any capital contribution amounts above $3 million shall be evidenced by a promissory note in favor of the Borrower by the Lender on terms to be defined in then-executed loan documents (the “Loan Documents”). The Loan Documents shall require interest only debt service payments until the Lender achieves a Combined Yield of 20% on its total invested equity. Once such 20% Combined Yield is achieved, principal and interest payments shall be required by the Loan Documents. |

Distributions pursuant to Section 2.11 of the Agreement shall be made in accordance with Contributor’s distributable cash flow as defined below:

The number of Common Limited Partnership Units in the Operating Partnership received upon conversion of the Series T Limited Units shall be determined based on the formula below, which shall constitute the Series T Value. The Series T Value shall be determined upon the first to occur of (i) 36 months after the

Closing Date or, at the option of the Contributor, up to 48 months after the Closing Date or (ii) the sale of (a) the Property or (b) sale of substantially all of the Operating Partnership’s assets.

The Applicable Cap Rate when applied to the then current trailing 12 month net operating income of the Property, less amounts incurred or accrued by the Partnership for (i) $100,000 contribution towards closing costs, (ii) the loan balance outstanding as of the Closing Date as assumed by Operating Partnership, (iii) loan assumption fees and related expenses, (iv) if applicable, costs of defeasance and related expenses, (v) PIP and capital expenditures, (vi) operating cash infused by the Partnership, (vii) any shortfall of the 10% minimum cumulative yield on General Partner’s invested capital, and (viii) any other unrealized or unreimbursed costs of operating the Property.

“Applicable Cap Rate” shall mean: 9.5%

“12-month net operating income of the Contributed Asset” shall mean: (a) the Gross Revenue of the Property, minus (b) Operating Expenses for the Property, for the current trailing twelve (12)-month period.

“Gross Revenue” shall include the following amounts recorded in accordance with generally accepted accounting principles consistently applied:

(a)The entire amount of the price charged, whether wholly or partly for cash or on credit, or otherwise, for the rental of all rooms, suites, conference rooms, restaurants, banquet facilities, and any other facilities and for all goods, wares, and merchandise sold, leased, licensed, or delivered, and all charges for services sold or performed in, at, upon, or from any part of, the Property;

(b)All gross income from parking fees and valet service fees billed to guests of or visitors to the Property or any transient use of parking facilities by anyone;

(c)Without duplication, all deposits received and not refunded to the person or entity making the deposit in connection with any transactions at such time as the Operating Partnership becomes entitled to such deposit or the expiration of one (1) year from the date of such deposit, whichever first occurs;

(d)In-room entertainment services, communication services, Internet services, in-room masseur/masseuse services, and the like, if charged to a guest of the Property.

“Operating Expenses” shall mean: all of the ordinary and normal expenses of operation of the Property, determined on an annualized accrual basis, including annualized property taxes, insurance premiums (or taxes and/or insurance impounds, if taxes and/or insurance are impounded by Lender), reserve account equal to 4 percent (4%) of Gross Revenue for furniture, fixtures and equipment reserves, franchise fees and royalties, telephone and internet expenses, administrative and general expenses, management fees, utilities, repair and maintenance, salaries and wages, and advertising and marketing expenses; provided, however, that Operating Expenses will not include:

| a. | depreciation and amortization; |

| b. | non-cash items; |

| c. | all capital items or expenditures, including construction costs and professional fees and other expenses relating thereto and any amortization thereof; |

| d. | costs of repair or restoration after a casualty or condemnation; |

| e. | debt service payments made to lenders; |

| f. | income or franchise taxes; and |

| g. | extraordinary one-time expenses that are not reasonably expected to be incurred in future periods. |

“Net Cash Flow” means the Property Net Operating Income (including any FF&E Reserves) less Principal and Interest, less any distributions provided on T-Unit Equity, less Borrower’s Fund Level Expenses attributable to Property.

“Combined Yield” means the sum of the total net cash flow retained by the Borrower, including the Preferential Returns and the Borrower’s share of the remaining cash flow, plus the interest payments received on the Loan Documents, divided by all of Borrower’s invested capital, annualized.

EXHIBIT E

TO

CONTRIBUTION AGREEMENT

NON-COMPETITION AGREEMENT AND NON-SOLICITATION AGREEMENT

This NON-COMPETITION AND NON-SOLICITATION AGREEMENT (this “Agreement”) is dated as of _____________, 20__ (the “Effective Date”), between Lodging Fund REIT III OP, LP a Delaware limited partnership with an address of 1635 43rd Street South, Suite 205, Fargo, North Dakota 58103 (“Operating Partnership”), L N Hospitality Denver LLC, a Colorado limited liability company, with an address of ________________________ (“Contributor”), and Chuck Patel, its manager and _________________, operating officers of the Contributor (the “Interested Parties”). The Contributor and Interested Parties are collectively referred to herein as the “Restricted Parties.”

R E C I T A L S:

A.The Operating Partnership and Contributor have entered into a Contribution Agreement, dated as of September 1, 2020, as amended (the “Contribution Agreement”), pursuant to which the Contributor has agreed to contribute property to the Operating Partnership, such property located at 255 North Blackhawk Street, Aurora, CO 80011 (the “Hotel”).

B.The agreement of the Restricted Parties to deliver this Agreement was a material inducement to Operating Partnership in entering into the Purchase Agreement.

C.The Operating Partnership, as the owner of the Hotel from and after the date of closing of the Contribution Agreement, desires to preclude the Restricted Parties from competing against it during the term of this Agreement.

A G R E E M E N T

For valuable consideration, the parties agree to the following covenants and agreements set forth in this Agreement and in the Contribution Agreement:

1.1Non-Competition. The Restricted Parties covenant and agree that, for a period of 4 years beginning on the closing date of the Purchase Agreement (the “Closing Date”), neither the Restricted Parties, nor any entity controlled by the Restricted Parties (an “Affiliate”) will, without the prior written consent of the Operating Partnership, directly or indirectly, own, manage, operate, join, control, renovate (or otherwise build) or engage or participate in the ownership, management, operation, or control of, or be connected as a shareholder, director, officer, agent, partner, joint venturer, lender, employee, consultant or advisor with, any business or organization any part of which engages in the business of hotel or motel ownership or management or is in competition with any of the business activities of the Operating Partnership, or any affiliate of the Operating Partnership within the Non-Competition Area.

1.2Geographic Restriction. The term “Non-Competition Area” in this Agreement means the area within a 25-mile radius of the Hotel. This provision will not apply to any property that was owned by the Contributor or the Interested Parties, either directly or indirectly through an affiliated entity, prior to the Effective Date of the Contribution Agreement, and will not restrict the Interested Parties, individually or as

owners or employees of an entity from managing or consulting regarding one or more hotel(s) or motel(s) under management agreement for owner(s) or lender(s) which either or both Interested Parties: (a) do business with prior to the Effective Date, (b) are part of a multi-property management relationship with owner(s); or a lender(s); or (c) is a property in receivership or foreclosure controlled by a lender.

1.3Confidential Information.

(a)On and after the Closing Date, the Restricted Parties will not use or disclose to anybody, and will cause all of their respective Affiliates to refrain from disclosing, any Confidential Information except: (a) where necessary to comply with any legal obligation, such as a court order or subpoena, provided the Restricted Parties will first promptly notify the Operating Partnership prior to any such disclosure and permit Operating Partnership to intervene to block such disclosure; (b) where necessary, to the Restricted Parties’ attorneys and accountants, provided that they will have first been apprised of the limitations of this Agreement and will have agreed to be comply with and be bound by such limitations; or (c) where the Restricted Parties have obtained the express, prior written consent from the Operating Partnership.

(b)The term “Confidential Information” includes but is not limited to information specific to the Hotel, including but not limited to: customer lists, contact information, needs, preferences and history of service; business operations and methods; training materials; marketing plans; customer relations information; service and operations forms; practices, procedures, policies and guidelines; sales information; supplier/vendor agreements and information; and all other information, lists, records and data relating to or dealing with the business operations or activities of the Hotel, the disclosure of which may provide valuable benefits to any other person or entity or which would embarrass or damage the Hotel, Operating Partnership or their affiliates, monetarily or otherwise. Furthermore, the term “Confidential Information” is intended to be construed broadly, including information in all forms, written or oral, on paper or stored electronically or in any other medium, and includes all originals, summaries, portions and copies of any such information. Confidential Information does not include information that: (i) was widely known in the industry at the time of disclosure to the Restricted Party, or (ii) becomes widely known or readily available other than by a breach of this Agreement.

1.4Non-Solicitation; Non-Interference. Except with the prior written approval of the Operating Partnership, for a period of 4 years after the Closing Date, neither the Restricted Parties nor their respective Affiliates will (a) employ or offer to employ any person who was principally employed at the Hotel on the Closing Date, (b) solicit, recruit, or encourage any employee or independent contractor of the Hotel or Operating Partnership to leave his or her employment, (c) hire, employ or cause to be hired, or establish a business with, any person who was employed at the Hotel, within the 12-month period preceding the Closing Date, (d) solicit any business clients of the Hotel or encourage them to terminate any contracts, and (e) interfere with or encourage any adjustments to long term negotiated rate clientele. In addition, any attempt by any Restricted Party to induce others to terminate any contracts, employment, or independent contractor relationship with Operating Partnership or the Hotel, or any effort by any Restricted Party to interfere with any of the relationships between each of the Operating Partnership and the Hotel and any of their business clients, employees, or independent contractors, would be harmful and damaging to the Operating Partnership. For purposes of this Section 1.3, an “employee” will include any person who is a common law employee or who is an independent contractor providing personal services.

1.5Non-Disparagement. The Restricted Parties will not: (a) make any disparaging or defamatory statements about Operating Partnership, the Hotel or their affiliates, or (b) authorize, encourage or participate with anyone to make such statements.

1.6Reasonableness; Independent Covenants. The Restricted Parties acknowledge that the restrictions set forth in this Agreement are reasonable and necessary to protect the legitimate business interests of Operating Partnership and the Hotel from and after the Closing Date. The Restricted Parties further acknowledge that all restrictions in this Agreement are reasonable in all respects, including duration, territory and scope of activity restricted.

1.7Remedies.

(a)The Restricted Parties agree that if they or any of their Affiliates engage or threaten to engage in any activity that constitutes a violation of any of the provisions of this Agreement, Operating Partnership will have the right and remedy to have the provisions of this Agreement specifically enforced by law or by any court having jurisdiction.

(b)The Restricted Parties agree a breach of this Agreement would cause immediate irreparable injury to Operating Partnership and/or the Hotel and that money damages would not provide an adequate remedy at law for any breach. Further, without limiting any other legal or equitable remedies available to it, Operating Partnership will be entitled to obtain equitable relief by temporary restraining order, preliminary and permanent injunction or otherwise from any court of competent jurisdiction (without the requirement of posting a bond or other security), including, without limitation, injunctive relief to prevent the Restricted Parties’ failure to comply with the terms and conditions of Section 1 of this Agreement. Such right and remedy will be in addition to, and not in lieu of, any other rights and remedies available to Operating Partnership at law or in equity, including the right to seek monetary damages.

(c)The applicable 4-year period of the covenants contained in Section 1.4 above will be extended on a day for day basis for each day during which a Restricted Party is in violation of the covenant, so that each Restricted Party is restricted from engaging in the activities prohibited by the covenant for the full 4-year time period.

(d)The Restricted Parties agree that the existence of any claim or cause of action by a Restricted Party against Operating Partnership, whether predicated on this Agreement or otherwise, will not constitute a defense to the enforcement by Operating Partnership of the covenants and restrictions in this Agreement.

1.8Construction. The parties acknowledge that the parties and their counsel have reviewed and revised this Agreement and that the normal rule of construction to the effect that any ambiguities are to be resolved against the drafting party will not be employed in the interpretation of this Agreement or any exhibits or amendments hereto.

1.9Severability. If any provision of this Agreement will, for any reason, be adjudged by any court of competent jurisdiction to be invalid or unenforceable, such judgment will not affect, impair or invalidate the remainder of this Agreement but will be confined in its operation to the provision or provisions hereof directly involved in the controversy in which such judgment will have been rendered, and this Agreement

will be construed as if such provision had never existed, unless such construction would operate as an undue hardship on Contributor or Operating Partnership or would constitute a substantial deviation from the general intent of the parties as reflected in this Agreement.

1.10Notices. All notices, requests, demands, and other communications under this Agreement will be in writing and will be sent by hand messenger, electronic facsimile transmission, electronic mail (e-mail), reputable overnight courier, or certified mail, postage prepaid, return receipt requested. Notices and other communications will be deemed to have been duly given, as applicable (i) if by hand delivery, on the date of delivery, if such date is a business day (or if such date is not a business day, then on the first business day following such date), (ii) if by electronic facsimile transmission, the date of transmission as evidenced by automated date and time confirmation from sender’s machine, (iii) if given by e-mail, the communication is instantaneous and the day of receipt can be designated to be the same day as sending and a written copy must also be sent via certified mail, (iv) if given by overnight courier, 1 business day after deposit with the overnight courier, or (v) if given by certified mail, 1 business day after deposit with the United States Post Office. Notices will be addressed as set forth below, or to any other address that the parties will designate in writing:

If to the Restricted Parties:

LN Hospitality Denver, LLC

3657 Old Santa Rita Road

Pleasanton, California 94588

Attention: Charles Patel, Manager

E-mail: omjai21@gmail.com

With copy to:

Lubin Olson LLP

200 Pringle Ave., Suite 470

Walnut Creek, CA 94596

Attention: Robert Miller, Esq.

Fax: (415) 981-4343

Email: rmiller@lubinolson.com

If to Operating Partnership:

Lodging Fund REIT III OP, LP

Attn: Linzey Erickson

1635 43rd Street S, Suite 205

Fargo, ND 58103

Fax: (701) 532-3369

Email: lerickson@lodgingfund.com

With copy to:

Legendary Capital

Attn: David Durell

644 Lovett SE, Suite A

Grand Rapids, MI 49506

Fax: (701) 532-3369

Email: ddurell@lodgingfund.com

1.11Other Legal Obligations. Nothing in this Agreement shall be construed to limit or otherwise waive any other legal obligations of the Restricted Parties in favor of the Operating Partnership.

1.12Benefit and Binding Effect. The Restricted Parties may not assign this Agreement without the prior written consent of Operating Partnership. The Operating Partnership may assign to an entity of which the Operating Partnership or one of its affiliates is a constituent. This Agreement will be binding upon and inure to the benefit of the parties and their respective successors and permitted assigns.

1.13Further Assurances. The parties will execute upon request any other documents that may be necessary and helpful for the effectiveness and enforceability desirable to the implementation and consummation of this Agreement.

1.14Governing Law. This Agreement will be governed by the laws of the State of New York, without giving effect to the conflict of laws provisions thereof.

1.15Entire Agreement. This Agreement constitutes the entire agreement and understanding between the parties hereto concerning the subject matter hereof.

1.16Headings. The headings herein are included for ease of reference only and will not control or affect the meaning or construction of the provisions of this Agreement.

1.17Amendments/Waivers. This Agreement cannot be amended except by an agreement in writing that makes specific reference to this Agreement and which is signed by the party against which enforcement of any such amendment is sought. Any waiver of any provision of this Agreement must be in writing and signed by the party granting the waiver.

1.18Counterparts. This Agreement may be signed in counterparts with the same effect as if the signature on each counterpart were upon the same instrument.

[signature page follows]

IN WITNESS WHEREOF, the parties hereto have duly executed this Agreement as of the day and year first above written.

| OPERATING PARTNERSHIP: | ||

| | ||

| Lodging Fund REIT III OP, LP, a Delaware limited partnership | ||

| | ||

| By: | Lodging Fund REIT III, Inc., a Delaware corporation, its General Partner | |

| | ||

| | ||

| By: | | |

| Name: | ||

| Title: | ||

[CONTRIBUTOR AND RESTRICTED PARTIES SIGNATURE PAGE TO FOLLOW]

| CONTRIBUTOR: | ||

| | ||

| L N Hospitality Denver LLC, a Colorado limited liability company | ||

| | ||

| | ||

| By: | | |

| | Name: | Robert Patel |

| | Title: | Managing Member |

| | ||

| | ||

| RESTRICTED PARTIES: | ||

| | ||

| | ||

| By: | | |

| | Chuck Patel | |

Schedule 2.2

List of Contributed Assets, Assumed Agreements and Leases

| 1. | 141-room hotel business known as the Courtyard by Marriott Denver-Aurora located at 255 North Blackhawk Street, Aurora, CO 80011. |