Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Tempest Therapeutics, Inc. | tm2111026d1_ex99-1.htm |

| EX-10.3 - EXHIBIT 10.3 - Tempest Therapeutics, Inc. | tm2111026d1_ex10-3.htm |

| EX-10.2 - EXHIBIT 10.2 - Tempest Therapeutics, Inc. | tm2111026d1_ex10-2.htm |

| EX-10.1 - EXHIBIT 10.1 - Tempest Therapeutics, Inc. | tm2111026d1_ex10-1.htm |

| EX-2.1 - EXHIBIT 2.1 - Tempest Therapeutics, Inc. | tm2111026d1_ex2-1.htm |

| 8-K - FORM 8-K - Tempest Therapeutics, Inc. | tm2111026d1_8k.htm |

Exhibit 99.2

Proposed Merger of Tempest and Millendo March 29, 2021

2 Forward - Looking Statements This communication contains forward - looking statements (including within the meaning of Section 21 E of the Securities Exchange Act of 1934 , as amended, and Section 27 A of the Securities Act of 1933 , as amended (the “Securities Act”)) concerning Millendo Therapeutics, Inc . (“ Millendo ”), Tempest Therapeutics, Inc . (“Tempest”), the proposed transaction and other matters . These statements may discuss goals, intentions and expectations as to future plans, trends, events, results of operations or financial condition, or otherwise, based on current beliefs of the management of Millendo , as well as assumptions made by, and information currently available to, management of Millendo . Forward - looking statements generally include statements that are predictive in nature and depend upon or refer to future events or conditions, and include words such as “may,” “will,” “should,” “would,” “expect,” “anticipate,” “plan,” “likely,” “believe,” “estimate,” “project,” “intend,” and other similar expressions . Statements that are not historical facts are forward - looking statements . Forward - looking statements are based on current beliefs and assumptions that are subject to risks and uncertainties and are not guarantees of future performance . Actual results could differ materially from those contained in any forward - looking statement as a result of various factors, including, without limitation : the risk that the conditions to the closing of the transaction are not satisfied, including the failure to obtain stockholder approval for the transaction or to complete the financing in a timely manner or at all ; uncertainties as to the timing of the consummation of the transaction and the ability of each of Millendo and Tempest to consummate the transaction, including the PIPE financing ; risks related to Millendo’s continued listing on the Nasdaq Stock Market until closing of the proposed transaction ; risks related to Millendo’s and Tempest’s ability to correctly estimate their respective operating expenses and expenses associated with the transaction, as well as uncertainties regarding the impact any delay in the closing would have on the anticipated cash resources of the combined company upon closing and other events and unanticipated spending and costs that could reduce the combined company’s cash resources ; the ability of Millendo or Tempest to protect their respective intellectual property rights ; competitive responses to the transaction ; unexpected costs, charges or expenses resulting from the transaction ; potential adverse reactions or changes to business relationships resulting from the announcement or completion of the transaction ; and legislative, regulatory, political and economic developments . The foregoing review of important factors that could cause actual events to differ from expectations should not be construed as exhaustive and should be read in conjunction with statements that are included herein and elsewhere, including the risk factors included in Millendo’s most recent Annual Report on Form 10 - K, Quarterly Reports on Form 10 - Q and Current Reports on Form 8 - K filed with the U . S . Securities and Exchange Commission (the “SEC”) . Millendo can give no assurance that the conditions to the transaction will be satisfied . Except as required by applicable law, Millendo undertakes no obligation to revise or update any forward - looking statement, or to make any other forward - looking statements, whether as a result of new information, future events or otherwise . No Offer or Solicitation This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote in any jurisdiction pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law . No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act . Subject to certain exceptions to be approved by the relevant regulators or certain facts to be ascertained, the public offer will not be made directly or indirectly, in or into any jurisdiction where to do so would constitute a violation of the laws of such jurisdiction, or by use of the mails or by any means or instrumentality (including without limitation, facsimile transmission, telephone and the internet) of interstate or foreign commerce, or any facility of a national securities exchange, of any such jurisdiction . Important Additional Information Will be Filed with the SEC In connection with the proposed transaction between Millendo and Tempest, Millendo intends to file relevant materials with the SEC, including a registration statement on Form S - 4 that will contain a proxy statement/prospectus of Millendo and information statement of Tempest . MILLENDO URGES INVESTORS AND STOCKHOLDERS TO READ THESE MATERIALS CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT MILLENDO, TEMPEST, THE PROPOSED TRANSACTION AND RELATED MATTERS . Investors and shareholders will be able to obtain free copies of the proxy statement/prospectus/information statement and other documents filed by Millendo with the SEC (when they become available) through the website maintained by the SEC at www . sec . gov . In addition, investors and shareholders will be able to obtain free copies of the proxy statement/prospectus/information statement and other documents filed by Millendo with the SEC by contacting Jack Hildick - Smith of Stern IR at Jack . Hildick - Smith@Sternir . com or 212 - 698 - 8690 . Investors and stockholders are urged to read the proxy statement/prospectus/information statement and the other relevant materials when they become available before making any voting or investment decision with respect to the proposed transaction . Participants in the Solicitation Millendo and its directors and executive officers may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction . Information about Millendo’s directors and executive officers is included in Millendo’s most recent Annual Report on Form 10 - K, including any information incorporated therein by reference, as filed with the SEC, and the proxy statement for Millendo’s 2020 annual meeting of stockholders, filed with the SEC on April 24 , 2020 . Additional information regarding these persons and their interests in the transaction will be included in the proxy statement/prospectus/information statement relating to the transaction when it is filed with the SEC . These documents can be obtained free of charge from the sources indicated above . . Information Regarding Disclosures

3 Transaction Summary Ownership • Combined company to be renamed “Tempest Therapeutics” and trade under the ticker “TPST” • Issuance of Millendo stock to Tempest stockholders • Concurrent $30M PIPE financing • Ownership split at closing = 81.5% Tempest / 18.5 % Millendo Programs & Management • Existing Tempest management will lead combined company and further develop existing Tempest programs • Headquarters will be in South San Francisco, CA • Board of directors will include 7 members (6 from TPST, 1 from MLND) Approvals & Closing • Transaction has been unanimously approved by the Board of Directors of each company • Subject to Millendo and Tempest stockholder approvals, and completion of PIPE financing • Expected closing in 1H 2021

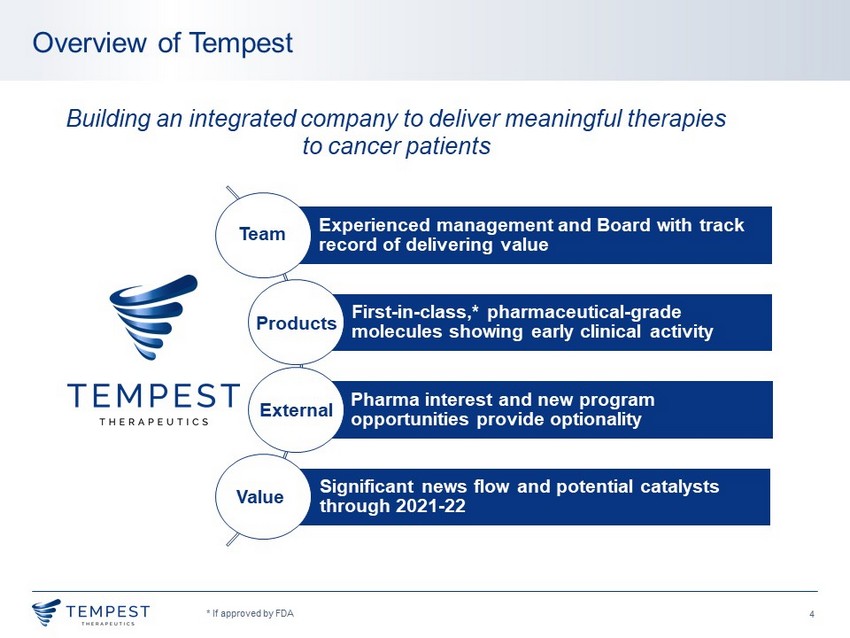

4 Overview of Tempest * If approved by FDA Building an integrated company to deliver meaningful therapies to cancer patients Experienced management and Board with track record of delivering value First - in - class,* pharmaceutical - grade molecules showing early clinical activity Pharma interest and new program opportunities provide optionality Significant news flow and potential catalysts through 2021 - 22 Products Team External Value

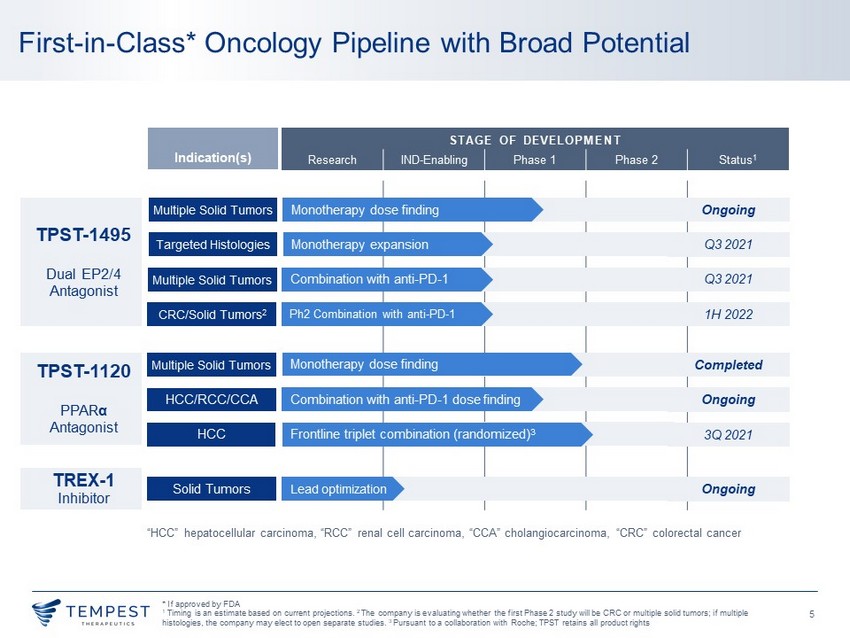

5 STAGE OF DEVELOPMENT Research IND - Enabling Phase 1 Phase 2 Status 1 First - in - Class* Oncology Pipeline with Broad Potential Indication(s) “HCC” hepatocellular carcinoma, “RCC” renal cell carcinoma, “CCA” cholangiocarcinoma, “ CRC” colorectal cancer TPST - 1120 PPAR α Antagonist Multiple Solid Tumors Completed HCC/RCC/CCA Ongoing HCC 3Q 20 21 Monotherapy dose finding Combination with anti - PD - 1 dose finding Frontline triplet combination (randomized) 3 TREX - 1 I nhibitor Solid Tumors Ongoing Lead optimization TPST - 1495 Dual EP2/4 Antagonist Multiple Solid Tumors Ongoing Targeted Histologies Q3 2021 Multiple Solid Tumors Q3 2021 CRC/Solid Tumors 2 1H 20 22 Monotherapy dose finding Monotherapy expansion Combination with anti - PD - 1 Ph2 Combination with anti - PD - 1 * If approved by FDA 1 Timing is an estimate based on current projections. 2 The company is evaluating whether the first Phase 2 study will be CRC or multiple solid tumors; if multiple histologies , the company may elect to open separate studies. 3 Pursuant to a collaboration with Roche; TPST retains all product rights

6 Leadership Team Experienced in Drug Development Sharon Sakai, Ph.D. SVP Regulatory Affairs Sam Whiting, M.D., Ph.D. Chief Medical Officer Tom Dubensky, Ph.D. CEO Steve Brady President and COO Peppi Prasit, Ph.D. Medicinal Chemistry Chan Whiting, Ph.D. SVP R&D Anne Moon, Ph.D. SVP Project Leadership

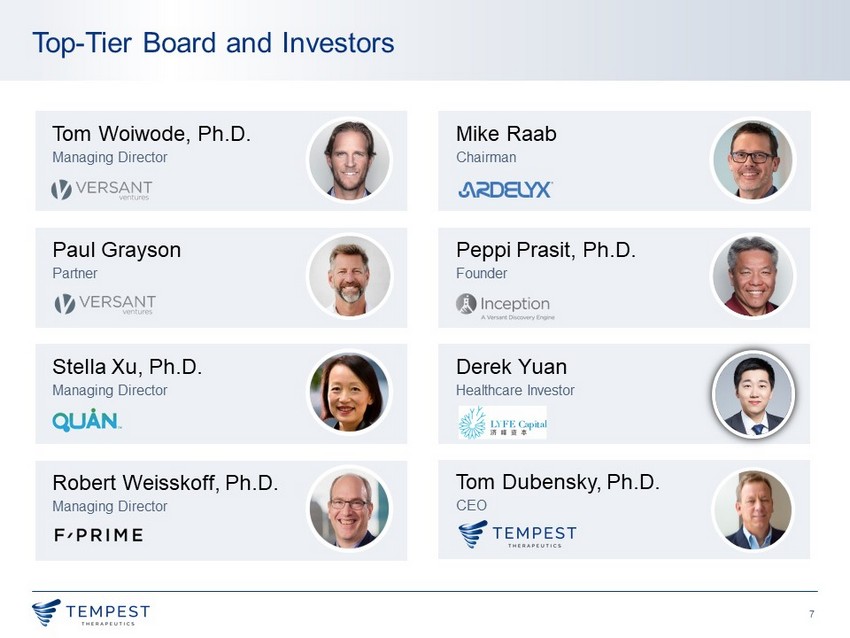

7 Top - Tier Board and Investors Stella Xu, Ph.D. Managing Director Paul Grayson Partner Tom Woiwode, Ph.D. Managing Director Robert Weisskoff , Ph.D. Managing Director Tom Dubensky, Ph.D. CEO Peppi Prasit, Ph.D. Founder Mike Raab Chairman Derek Yuan Healthcare Investor

8 TPST - 1495 First - in - Class Dual EP2/4 Antagonist

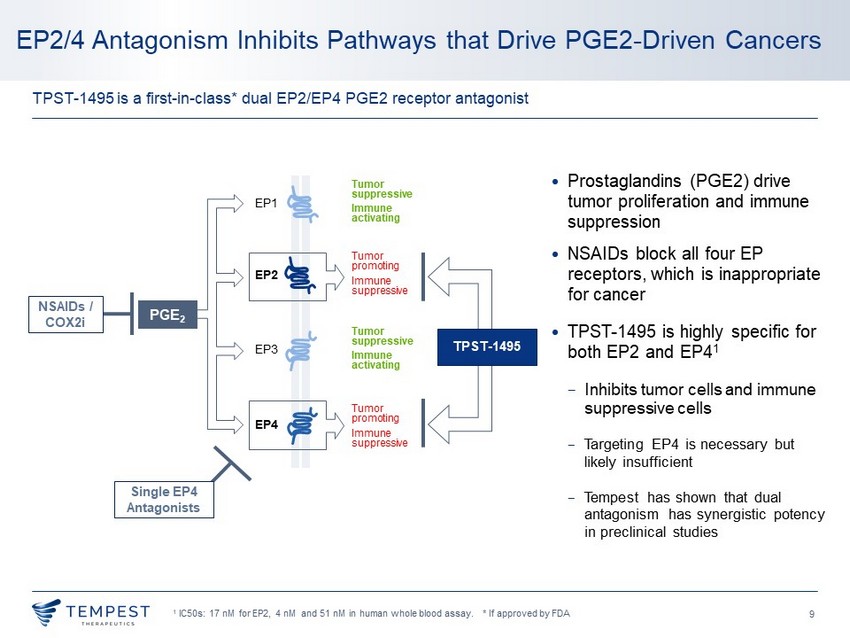

9 • Prostaglandins (PGE2) drive tumor proliferation and immune suppression • NSAIDs block all four EP receptors, which is inappropriate for cancer • TPST - 1495 is highly specific for both EP2 and EP4 1 − Inhibits tumor cells and immune suppressive cells − Targeting EP4 is necessary but likely insufficient − Tempest has shown that dual antagonism has synergistic potency in preclinical studies 1 IC50s: 17 nM for EP2, 4 nM and 51 nM in human whole blood assay. * If approved by FDA EP2/4 Antagonism Inhibits Pathways that Drive PGE2 - Driven Cancers TPST - 1495 is a first - in - class* dual EP2/EP4 PGE2 receptor antagonist EP1 EP2 EP3 EP4 Tumor promoting Immune suppressive Tumor suppressive Immune activating Tumor promoting Immune suppressive PGE 2 Tumor suppressive Immune activating TPST - 1495 Single EP4 Antagonists NSAIDs / COX2i

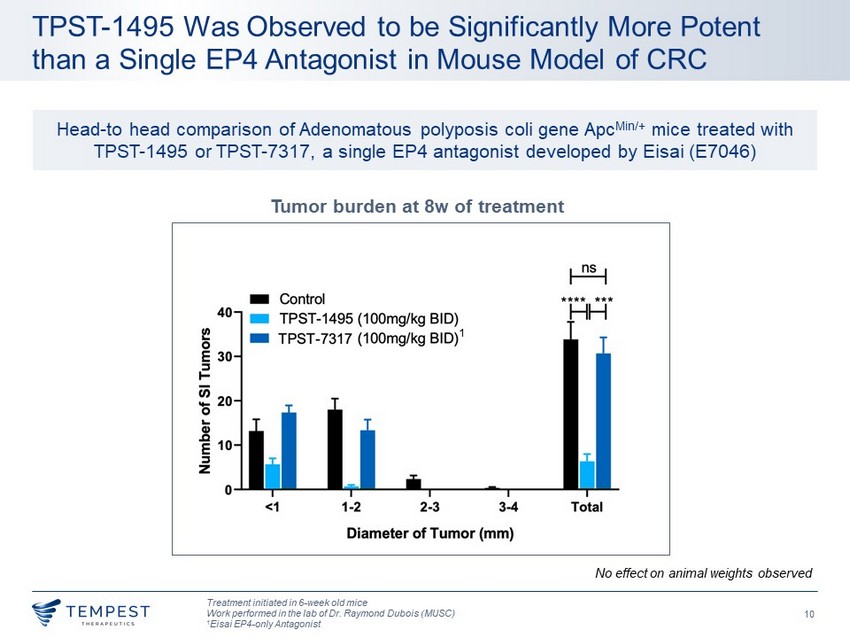

10 TPST - 1495 Was Observed to be Significantly More Potent than a Single EP4 Antagonist in Mouse Model of CRC Treatment initiated in 6 - week old mice Work performed in the lab of Dr. Raymond Dubois (MUSC) 1 Eisai EP4 - only Antagonist Tumor burden at 8w of treatment No effect on animal weights observed 1 Head - to head comparison of Adenomatous polyposis coli gene Apc Min /+ mice treated with TPST - 1495 or TPST - 7317, a single EP4 antagonist developed by Eisai (E7046)

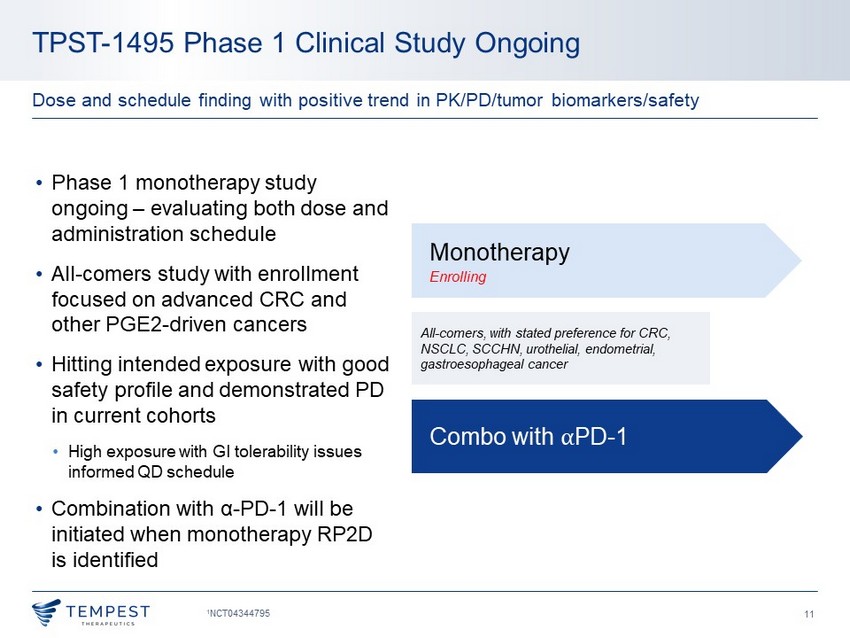

11 TPST - 1495 Phase 1 Clinical Study Ongoing 1 NCT04344795 Dose and schedule finding with positive trend in PK/PD/tumor biomarkers/safety All - comers, with stated preference for CRC, NSCLC, SCCHN, urothelial, endometrial, gastroesophageal cancer Monotherapy Enrolling Combo with ⍺ PD - 1 • Phase 1 monotherapy study ongoing – evaluating both dose and administration schedule • All - comers study with enrollment focused on advanced CRC and other PGE2 - driven cancers • Hitting intended exposure with good safety profile and demonstrated PD in current cohorts • High exposure with GI tolerability issues informed QD schedule • Combination with α - PD - 1 will be initiated when monotherapy RP2D is identified

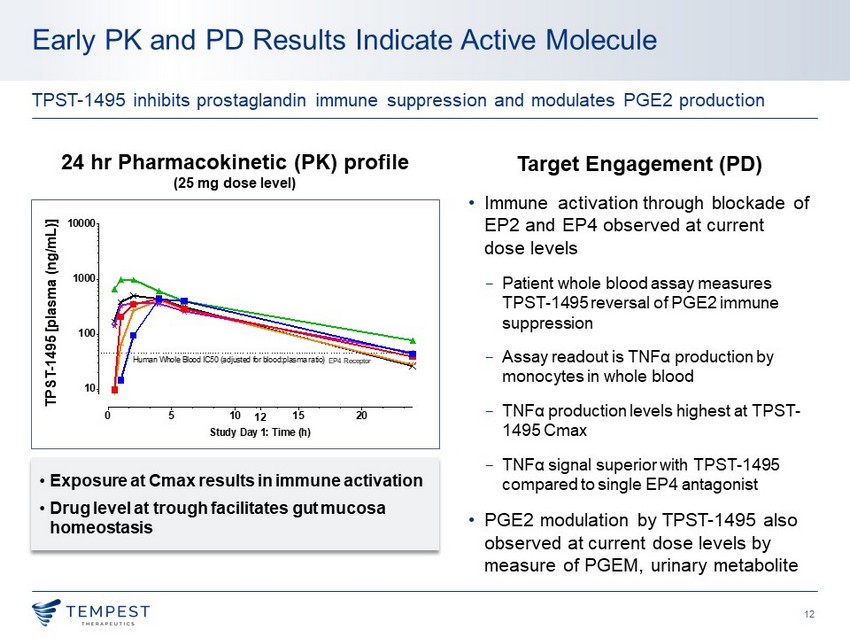

12 Early PK and PD Results Indicate Active Molecule TPST - 1495 inhibits prostaglandin immune suppression and modulates PGE2 production 24 hr P harmacokinetic (PK) profile (25 mg dose level) 0 5 10 15 20 12 10 100 1000 10000 Study Day 1: Time (h) T P S T - 1 4 9 5 C o n c e n t r a t i o n i n P l a s m a o f H u m a n s ( n g / m L ) Human Whole Blood IC50 (adjusted for blood:plasma ratio) Pt 1 Pt 2 Pt 3 Pt 4 Pt 5 Pt 6 TPST - 1495 [plasma (ng/mL)] Target Engagement (PD) • I mmune activation through blockade of EP2 and EP4 observed at current dose levels − Patient whole blood assay measures TPST - 1495 reversal of PGE2 immune suppression − Assay readout is TNF α production by monocytes in whole blood − TNF α production levels highest at TPST - 1495 Cmax − TNF α signal superior with TPST - 1495 compared to single EP4 antagonist • PGE2 modulation by TPST - 1495 also observed at current dose levels by measure of PGEM, urinary metabolite • Exposure at Cmax results in immune activation • Drug level at trough facilitates gut mucosa homeostasis EP4 Receptor

13 TPST - 1495 Summary and Next Steps *Grade 3 AEs 26.3%, no Grade 4 or 5 AEs. Data as of March 23, 2021, n=19 Early clinical results indicate drug exposure, target engagement and tumor marker reduction Once daily dosing to optimize Cmax and Cmin Clinical Development Strategy • Indication specific monotherapy expansion cohorts focused on PGE2 driven cancers e.g., CRC, NSCLC and urothelial carcinoma • Combination development with immune checkpoint inhibitors • Initial clinical results indicate active molecule − Dose - proportional exposure and on target PD − Predominantly Grade 1 - 2 related AEs* − Tumor marker reductions and shrinkage (stable disease) − Dose and schedule optimization is ongoing Cmax Cmin

14 TPST - 1120 First - in - Class PPAR � Antagonist

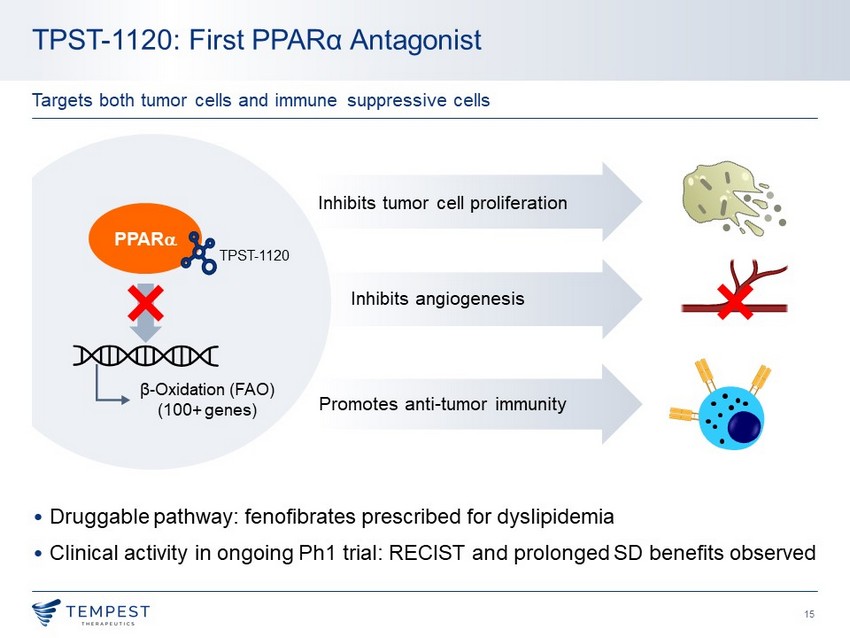

15 Promotes anti - tumor immunity Inhibits angiogenesis Inhibits tumor cell proliferation • Druggable pathway: fenofibrates prescribed for dyslipidemia • Clinical activity in ongoing Ph1 trial: RECIST and prolonged SD benefits observed TPST - 1120: First PPAR α Antagonist Targets both tumor cells and immune suppressive cells PPAR a β - Oxidation (FAO) (100+ genes) TPST - 1120

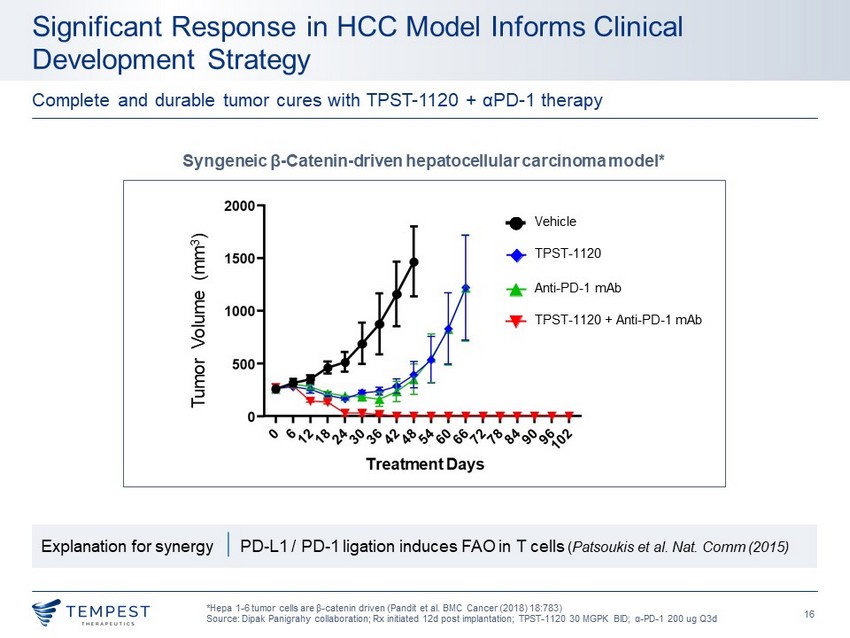

16 Significant Response in HCC Model Informs Clinical Development Strategy * Hepa 1 - 6 tumor cells are β - catenin driven (Pandit et al. BMC Cancer (2018) 18:783) Source: Dipak Panigrahy collaboration; Rx initiated 12d post implantation; TPST - 1120 30 MGPK BID; α - PD - 1 200 ug Q3d Complete and durable tumor cures with TPST - 1120 + α PD - 1 therapy Syngeneic β - Catenin - driven hepatocellular carcinoma model* Tumor Volume (mm 3 ) Vehicle Anti - PD - 1 mAb TPST - 1120 TPST - 1120 + Anti - PD - 1 mAb Explanation for synergy | PD - L1 / PD - 1 ligation induces FAO in T cells ( Patsoukis et al. Nat. Comm (2015)

17 TPST - 1120 Accelerating to Frontline HCC Randomized Study Dose Finding Cohorts Additional Studies Under Consideration • TPST - 1120 + VEGF TKI in RCC • TPST - 1120 + IDH inhibitor in cholangiocarcinoma HCC: hepatocellular carcinoma; RCC: renal cell cancer; CCA: cholangiocarcinoma 1 NCT03829436 Randomized Phase 1b/2 atezolizumab + bevacizumab TPST - 1120 + atezolizumab + bevacizumab 1L HCC • Clinical collaboration • Triplet vs. HCC standard of care • Global study • Roche to operationalize Combo with ⍺ PD - 1 ( nivo ) HCC, CCA & RCC Up to 600 mg BID Full dose nivolumab Combo Enrolling Monotherapy FAO - associated solid tumors Up to 600 mg BID Mono Completed 1

18 * These results may not be indicative of results to be achieved with other patients TPST - 1120 + Nivolumab Partial Response Heavily pre - treated patient with deep response:* 54yo F with metastatic RCC • Sites of metastatic disease: pulmonary; multiple soft tissue (chest, peri - renal, peri - vaginal); bone • Prior therapy (best response and reason for discontinuation) • 1L: ipilimumab + nivolumab (SD, PD) • 2L: cabozantinib (SD, PD) • 3L: everolimus (SD, PD) Dec 14 2020 Feb 8 2021

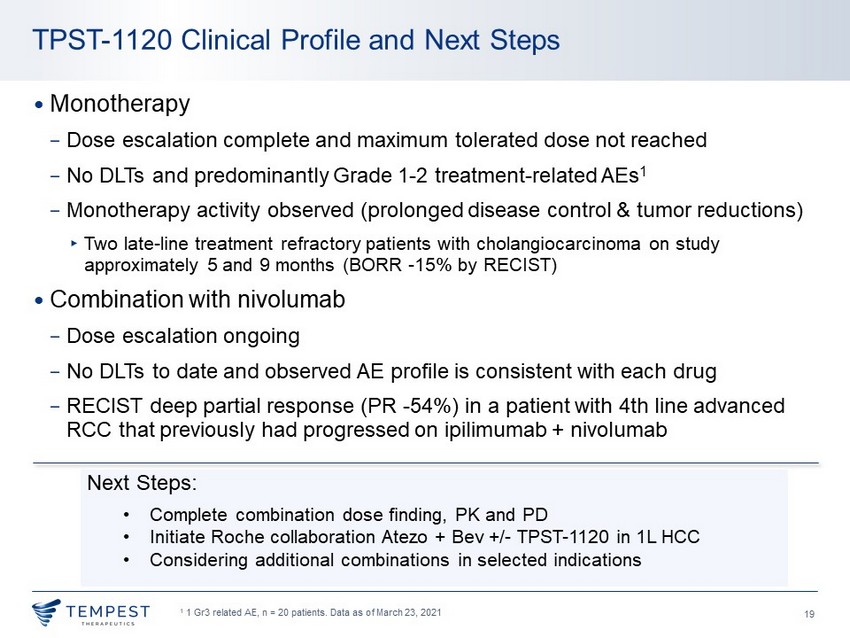

19 • Monotherapy − Dose escalation complete and maximum tolerated dose not reached − No DLTs and predominantly Grade 1 - 2 treatment - related AEs 1 − Monotherapy activity observed (prolonged disease control & tumor reductions) ▸ Two late - line treatment refractory patients with cholangiocarcinoma on study approximately 5 and 9 months (BORR - 15% by RECIST) • Combination with nivolumab − Dose escalation ongoing − No DLTs to date and observed AE profile is consistent with each drug − RECIST deep partial response (PR - 54%) in a patient with 4th line advanced RCC that previously had progressed on ipilimumab + nivolumab TPST - 1120 Clinical Profile and Next Steps Next Steps: • Complete combination dose finding, PK and PD • Initiate Roche collaboration Atezo + Bev +/ - TPST - 1120 in 1L HCC • Considering additional combinations in selected indications 1 1 Gr3 related AE, n = 20 patients. Data as of March 23, 2021

20 TREX - 1 Optimal Approach to Target STING

21 • STING is a genetically - validated drug target in humans − Critical pivot point in immune decisions − Tumors modulate STING signaling to avoid immune recognition • TREX1 regulates STING activity − DNA exonuclease − Previously un - drugged target in pathway − Upregulated in tumors → enables systemic dosing − Broad potential across tumor types − Development candidate by Q1 2022 TREX1: The Right Approach to Target STING TREX - 1 controls activation of STING Ds - DNA cGas TBK1 Nucleus Cytosol 2’, 3’ cGAMP IRF - 3 Chemoradiotherapy/ MMR TREX - 1 STING IFN - β Promise of global innate immune activation partitioned to TME

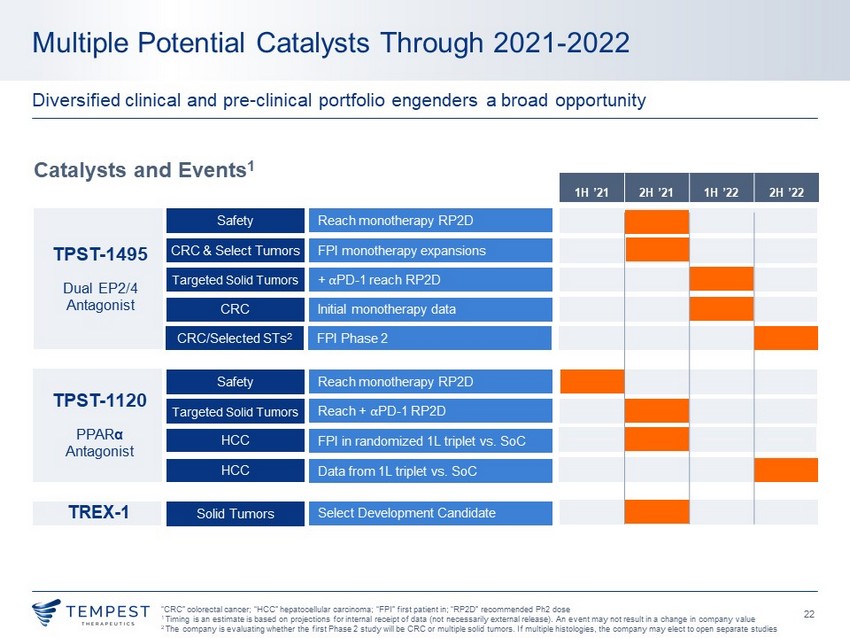

22 Multiple Potential Catalysts Through 2021 - 2022 Diversified clinical and pre - clinical portfolio engenders a broad opportunity Catalysts and Events 1 “CRC” colorectal cancer; “ HCC” hepatocellular carcinoma; “FPI” first patient in; “RP2D” recommended Ph2 dose 1 Timing is an estimate is based on projections for internal receipt of data (not necessarily external release). A n event may not result in a change in company value 2 The company is evaluating whether the first Phase 2 study will be CRC or multiple solid tumors. If multiple histologies , the company may elect to open separate studies TPST - 1495 Dual EP2/4 Antagonist TPST - 1120 PPAR α Antagonist TREX - 1 Safety Reach monotherapy RP2D CRC & Select Tumors FPI monotherapy expansions Targeted Solid Tumors + ⍺ PD - 1 reach RP2D Safety Reach monotherapy RP2D Targeted Solid Tumors Reach + ⍺ PD - 1 RP2D Solid Tumors Select Development Candidate HCC FPI in randomized 1L triplet vs. SoC HCC Data from 1L triplet vs. SoC CRC Initial monotherapy data 1H ’21 2H ’21 1H ’22 2H ’22 CRC/Selected STs 2 FPI Phase 2

23 • Registration Statement on Form S - 4 to be filed with SEC by Millendo • Proxy statement for Millendo (to be included in Form S - 4) • Stockholder approvals • Target closing in 1H 2021 Next Steps