Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - JMP GROUP LLC | ex_216723.htm |

| EX-32.1 - EXHIBIT 32.1 - JMP GROUP LLC | ex_216722.htm |

| EX-31.2 - EXHIBIT 31.2 - JMP GROUP LLC | ex_216721.htm |

| EX-31.1 - EXHIBIT 31.1 - JMP GROUP LLC | ex_216720.htm |

| EX-23.2 - EXHIBIT 23.2 - JMP GROUP LLC | ex_234222.htm |

| EX-23.1 - EXHIBIT 23.1 - JMP GROUP LLC | ex_216719.htm |

| EX-21 - EXHIBIT 21 - JMP GROUP LLC | ex_216718.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2020

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-36802

JMP Group LLC

(Exact name of registrant as specified in its charter)

|

Delaware |

47-1632931 |

|

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

600 Montgomery Street, Suite 1100, San Francisco, California 94111

(Address of principal executive offices)

(415) 835-8900

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

Trading Symbol |

Name of Each Exchange on Which Registered |

|

Shares representing limited liability company interests in JMP Group LLC JMP Group LLC 6.875% Senior Notes due 2029 JMP Group Inc. 7.25% Senior Notes due 2027 |

JMP JMPNZ JMPNL |

New York Stock Exchange The Nasdaq Global Market The Nasdaq Global Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer ☐ Accelerated Filer ☐ Non-Accelerated Filer ☒ Smaller Reporting Company ☒ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the registrant on the last business day of the registrant’s most recently completed second fiscal quarter, based upon the closing sale price of the registrant’s common share on June 30, 2020 as reported on The New York Stock Exchange was $22. 2 million.

JMP Group LLC shares representing limited liability company interests outstanding as of March 19, 2021: 19,823,354

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement to be delivered to shareholders in connection with the 2020 annual meeting of shareholders to be held in June 2021 are incorporated by reference in this Annual Report on Form 10-K (“Form 10-K”). Such proxy statement will be filed with the U.S. Securities and Exchange Commission (the “SEC”) within 120 days of the registrant’s fiscal year ended December 31, 2020.

|

PART I |

||

|

Item 1. |

6 | |

|

Item 1A. |

12 | |

|

Item 1B. |

28 | |

|

Item 2. |

28 | |

|

Item 3. |

28 | |

|

Item 4. |

28 | |

|

PART II |

||

|

Item 5. |

29 | |

|

Item 6. |

30 | |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

30 |

|

Item 7A. |

54 | |

|

Item 8. |

55 | |

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

95 |

|

Item 9A. |

95 | |

|

Item 9B. |

95 | |

|

PART III |

||

|

Item 10. |

96 | |

|

Item 11. |

96 | |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters |

96 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

96 |

|

Item 14. |

96 | |

|

PART IV |

||

|

Item 15. |

97 | |

|

Item 16. |

97 | |

| 98 | ||

| 101 | ||

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

We make forward-looking statements, as defined by the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, in this Form 10-K that are subject to risks and uncertainties. When we use the words “could,” “will likely result,” “if,” “in the event,” “may,” “might,” “should,” “shall,” “will,” “believe,” “expect,” “anticipate,” “plan,” “predict,” “potential,” “project,” “intend,” “estimate,” “goal,” “objective,” “continue,” or the negatives of these terms and other similar expressions, we intend to identify forward-looking statements. These forward-looking statements include information about possible or assumed future results of our business, financial condition, liquidity, results of operations, plans and objectives. They also include statements concerning anticipated revenues, income or loss, capital expenditures, distributions, capital structure or other financial terms. The statements we make regarding the following subject matters are forward-looking by their nature:

|

• |

the opportunity to grow our investment banking and sales and trading businesses because of the prevalent demand for our services in our three target industries; |

|

• |

the potential for impaired performance of our investment banking and sales and trading businesses due to a declining demand for our services or a declining market for securities of companies in our three target industries; |

|

• |

our ability to depend on follow-on offerings, PIPEs and registered direct offerings to generate corporate finance revenues; |

|

• |

the growth of our mergers and acquisitions and other strategic advisory business derived from our positions as a lead manager or senior co-manager of public and private securities offerings; |

|

• |

the opportunity to increase our representation of corporate clients as buyers and to grow our mergers and acquisitions and strategic advisory businesses; |

|

• |

our ability to succeed as a strategic advisor due to our ability to structure and execute complex transactions; |

|

• |

the possibility of generating stable or growing investment banking revenues due to our ability to engage in multiple types of transactions; |

|

• |

our plans to continue to focus our equity research and sales and trading products and services on small- and mid-capitalization companies in order to benefit institutional investors; |

|

• |

our expectations regarding the impact of the trend toward alternative trading systems and downward pricing pressure on trading commissions and spreads in the sales and trading business; |

|

• |

the characteristics of the asset management business, including its comparatively high margins, the recurring nature of its fee-based revenues and its dependence on intellectual capital, and our belief that this makes our asset management business less susceptible to competitive threats from larger financial institutions; |

|

• |

our expectations of a heightened demand for alternative asset management products and services; |

|

• |

our ability to increase assets under management and to develop new asset management products; |

|

• |

the fact that the past performance of our funds is not indicative of our future performance; |

|

• |

our plans to generate principal investing opportunities from our investment banking and asset management relationships; |

|

• |

the emergence of investment opportunities that offer attractive risk-adjusted returns on our investable assets; |

|

• |

our plans to grow our businesses both through internal expansion and through strategic investments, acquisitions or joint ventures; |

|

• |

our ability to take advantage of market opportunities as they arise, based on the strength of our capital position and the low level of leverage that we have traditionally employed; |

|

• |

our ability to realize revenues through gain on repurchase of Senior Notes; |

|

• |

the impact of changes in interest rates on the value of interest-bearing assets in which we invest; |

|

• |

the nature of the competition faced in the financial services industry, particularly among investment banks and asset managers, and our expectations regarding trends and changes with respect to competing entities; |

|

• |

our ability to attract, incentivize and retain top professionals and to retain valuable relationships with our clients; |

|

• |

our ability to avoid restrictions imposed by the Investment Company Act of 1940; |

|

• |

our expectations regarding the likelihood of increased scrutiny of financial services firms from regulators; |

|

• |

the fact that we do not anticipate that any tax adjustments will result in a material adverse effect on our financial condition; |

|

• |

the impact of existing claims and currently known threats against us on our business or financial condition; |

|

• |

the impact of bonus compensation payments to our employees on our cash position; |

|

• |

our ability to satisfy our funding needs with existing internal and external financial sources; |

|

• |

our beliefs regarding the impact of interest rate, credit and inflation risks; and |

|

• |

the fact that we believe that our available liquidity and current level of equity capital will be adequate to meet our liquidity and regulatory capital requirements for the next twelve months. |

The forward-looking statements are based on our beliefs, assumptions and expectations of future performance, taking into account the information currently available to us. These statements are only predictions, based upon our current expectations and projections about future events. Any projections of our future financial performance may be based upon expected outcomes of our growth strategies and anticipated trends in our business. There are important factors that could cause our actual results, levels of activity, performance or achievements to differ materially from the results, levels of activity, performance or achievements expressed or implied by the forward-looking statements. In particular, you should consider the numerous risks including, but not limited to, the following factors:

|

• |

the impact of multiple bookrunners, co-managers and multiple financial advisors on the competitive landscape and, in turn, on our revenues; |

|

• |

our ability to remain competitive with larger investment banks that provide commercial financing; |

|

• |

the impact of unsettled market conditions on our ability to serve as underwriter or placement agent; |

|

• |

the potential for uncertainty related to creditworthiness, volatility in the equity markets and diminished access to financing to impact our mergers and acquisitions and strategic advisory businesses; |

|

• |

the potential for volatility and weakness in the equity markets to adversely impact our sales and trading business, investment banking business and ability to manage exposure to market risks; |

|

• |

the impact of conditions in the global financial markets, such as the level and volatility of interest rates, investor sentiment, the availability and the cost of credit, the U.S. mortgage market, the U.S. real estate market, energy prices, consumer confidence, unemployment, and geopolitical issues on our business and revenues; |

|

• |

the impact of any deterioration in the business environment of our target sectors on our revenues; |

|

• |

our expectations regarding the effect of a market downturn on transaction volume and, therefore, our revenues; |

|

• |

our expectations regarding the impact of bankruptcies on our investment banking revenues; |

|

• |

the impact of securities-related write-downs on our securities trading revenues; |

|

• |

the impact of a market downturn on asset management fees; |

|

• |

the impact of the inability of companies to repay their borrowings on our CLO investment; |

|

• |

the potential for market declines to lead to an increase in litigation and arbitration claims; |

|

• |

our ability to pursue business opportunities in an environment of increased legislative or regulatory initiatives; |

|

• |

the potential for governmental fiscal and monetary policy to have a negative impact on our business; |

|

• |

our expectation that the ability to recruit and retain professionals impacts our reputation, business, results of operations and financial condition; |

|

• |

the impact of larger firms on our ability to grow our business; |

|

• |

the impact of increased competition in the middle-market investment banking space on our market share and revenues; |

|

• |

the impact on brokerage revenues of pricing arrangements with certain institutional sales and trading clients; |

|

• |

the potential for larger and more frequent capital commitments in our trading and underwriting business to increase losses; |

|

• |

the potential for increased competition in the asset management sector to affect our ability to raise capital and generate positive economic results; |

|

• |

the impact of investment performance and redemptions on our asset management business; |

|

• |

the potential for fluctuations in the global credit markets to affect our CLO investments; |

|

• |

any fluctuations in the credit markets, including reduced access to capital and liquidity, and the costs of credit; |

|

• |

any exposure to volatile and illiquid securities and their impact on our business; |

|

• |

the impact of principal investment activities on our capital base; |

|

• |

the challenges posed when valuing non-marketable investments; |

|

• |

the impact of our increased leverage as a result of our September 2019 offering of 6.875% Senior Notes due 2029 (the “2029 Senior Notes”) and the November 2017 offering of 7.25% Senior Notes due 2027 (the “2027 Senior Notes,” together with the 2029 Senior Notes, the “Senior Notes”); |

|

• |

the impact of requirements by the SEC, the Financial Industry Regulatory Authority and various other self-regulatory organizations on our business; |

|

• |

the potential for increased scrutiny of financial services firms to adversely impact our business; |

|

• |

the business risks posed by potential conflicts of interest, employee misconduct and business partner misconduct; |

|

• |

the risks posed by using estimates to prepare our consolidated financial statements and new accounting standards; |

|

• |

the potential for risks related to infrastructure and operations to impact our business; |

|

• |

the potential for interest rate, credit and inflation risks to impact our business; |

|

• |

the potential for market and non-market factors to impact our share price; and |

|

• |

any fluctuations in our share price related to the performance of our investment banking department. |

The foregoing list of risks is not exhaustive. Other sections of this Form 10-K may include additional factors that could adversely impact our business and financial performance. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time, and it is not possible for us to predict all risks, nor can we assess the impact of all factors or the effect that any factor, or combination of factors, may have on our business. Actual results may differ materially from those contained in any forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. You should not rely upon forward-looking statements as predictions of future events. We undertake no duty to update any of these forward-looking statements after the date of this Form 10-K to conform prior statements to actual results or revised expectations unless otherwise required by law.

|

Business |

Overview

Corporate Information

JMP Group LLC, together with its subsidiaries (collectively, “the Company”, “we” or “us”), is a diversified capital markets firm. We provide investment banking, sales and trading, and equity research services to corporate and institutional clients as well as alternative asset management products and services to institutional investors and high-net-worth individuals. In addition, we invest in corporate credit instruments through collateralized loan obligations and direct investments, and we serve as the investment advisor to a business development company under the Investment Company Act of 1940 (the “Investment Company Act”).

JMP Group Inc. was incorporated in Delaware in January 2000, and JMP Group LLC was formed in Delaware in August 2014. Our headquarters are located at 600 Montgomery Street, Suite 1100, San Francisco, California 94111. Our telephone number is (415) 835-8900, and our internet address is http://www.jmpg.com.

We completed an initial public offering in May 2007 and a reorganization transaction (the "Reorganization Transaction") in January 2015. References to JMP Group LLC in this Annual Report on Form 10-K that include any period before the effectiveness of the Reorganization Transaction shall be deemed to refer to JMP Group Inc.

In January 2019, the Company filed an election with the U.S. Internal Revenue Service to be treated as C corporation for tax purposes, rather than a partnership. The IRS subsequently approved the election, with an effective date of January 1, 2019. Irrespective of the change in tax treatment, the Company remains a limited liability company.

Our common shares representing limited liability company interests are currently listed on the New York Stock Exchange (the “NYSE”) under the symbol “JMP”. Our 7.25% Senior Notes due 2027 and 6.875% Senior Notes due 2029 are each listed on the Nasdaq Global Market under the symbols “JMPNL” and “JMPNZ”, respectively.

Principal Business Lines

We conduct our investment banking and institutional brokerage business through JMP Securities LLC (“JMP Securities”); conduct our asset management business through Harvest Capital Strategies LLC (“HCS”), JMP Asset Management LLC (“JMPAM”) and HCAP Advisors LLC ("HCAP Advisors"); and make certain principal investments through JMP Investment Holdings LLC ("JMP Investment Holdings"), JMP Capital LLC ("JMP Capital") and other subsidiaries.

JMP Securities is a U.S. registered broker-dealer under the Exchange Act and is a member of FINRA. JMP Securities provides equity research and sales and trading services to institutional brokerage clients, as well as capital raising and strategic advisory services to corporate clients. JMP Securities operates as an introducing broker and does not hold funds or securities for, or owe any money or securities to, customers and does not carry accounts for customers. All customer transactions are cleared through another broker-dealer on a fully disclosed basis.

HCS is a registered investment advisor under the Investment Advisers Act of 1940, as amended (the “Investment Advisers Act”), and provides investment management services for sophisticated investors through investment partnerships and other entities managed by HCS, including venture and private equity funds. JMPAM is the investment manager of private equity funds that invest in real estate and real estate related enterprises and provides credit to small and midsize private companies. HCAP Advisors is a majority-owned subsidiary that manages the investment activities of Harvest Capital Credit Corporation ("HCC"), a publicly-traded business development company ("BDC") offering customized financing solutions to small and middle-market companies.

We currently operate from our headquarters in San Francisco and from additional offices in New York, Boston, Chicago, Palm Beach, and the Minneapolis area. Our four revenue-producing business lines—investment banking, sales and trading, equity research, and asset management—across three target industries—technology, healthcare, and financial services and real estate—combine to form a diversified business model, especially when compared to that of our more specialized competitors.

Investment Banking

Our investment banking department provides capital raising services, mergers and acquisitions transaction services, and other strategic advisory services to corporate clients. We focus our efforts on small and middle-market companies in three broad industries: technology, healthcare, and financial services and real estate. Our specialization in these areas has enabled us to develop well recognized expertise and to cultivate extensive industry relationships.

Our investment bankers are arranged in dedicated industry coverage groups, enabling them to develop expertise in specific markets and to form close relationships with corporate executives, private equity investors, venture capitalists and other key industry participants. We offer our clients a high level of attention from senior personnel and have designed our organizational structure so that the investment bankers who are responsible for securing and maintaining client relationships also actively participate in providing transaction execution services to those clients.

By focusing consistently on our three target industries, we have developed a comprehensive understanding of the unique challenges and demands involved in executing corporate finance and strategic advisory assignments in these sectors. A significant portion of our corporate finance revenue is earned from small- and mid-capitalization public companies, and the balance is earned from private companies. Some of our corporate clients retain us for our advisory and capital raising capabilities during an accelerated growth phase as a private company and then continue to work with us through an initial public offering or sale of the company. We maintain exceptional client focus both during and following a transaction, leading to a true advisory relationship and a pattern of assisting companies with multiple transactions.

Corporate Finance

We assist our publicly traded and privately held corporate clients with capital raising activities, which include the underwriting and private placement of a wide range of equity and debt securities, including common, preferred, and convertible securities. Our public equity underwriting capabilities include initial public offerings, follow-on offerings, and at-the-market offerings. We also arrange private investments in public equity (“PIPE”) transactions and privately negotiated, registered direct stock offerings on behalf of our publicly traded clients. For our privately held clients, we act as an agent in private placements of equity and debt securities. We typically place securities with our client base of institutional investors, private equity and venture capital funds, and high net-worth individuals.

Because our corporate clients are generally high-growth companies, they are frequently in need of new capital. Many of our client relationships develop early, when a client company is still privately held, in which case we may facilitate private placements of the company's securities. Our ability to structure innovative private offerings and to identify the likely buyers of such offerings makes us a valuable advisor for many small and middle-market companies, as does our industry specialization. Thereafter, if our client prepares for an initial public offering, we may be selected to serve as an underwriter of that offering and of any subsequent follow-on offerings. We expect that, while the environment for initial public offerings may not be consistently favorable in the future, we should be able to depend on follow-on offerings, at-the-market offerings, PIPEs, registered direct offerings, and private placements to continue to generate corporate finance revenues.

Mergers and Acquisitions and Other Strategic Advisory

We work with corporate clients on a broad range of strategic matters, including mergers and acquisitions, divestitures and corporate restructurings, valuations of businesses and assets, and fairness opinions and special committee assignments. We provide our advice to senior executives and boards of directors of client companies in connection with transactions that are typically of significant strategic and financial importance to these companies. We believe that our success as a strategic advisor stems from our ability to structure and execute complex transactions that create long-term shareholder value. Because we serve a variety of corporate clients, from private companies in early stages of growth to mature businesses either publicly or privately held, the values of these transactions range in size.

Because of our focus on innovative and fast-growing companies, we are most often an advisor in company sale transactions, although we are taking steps to create equilibrium in our advisory business and expect to increasingly represent corporate clients as buyers over time. We believe that our position as a lead manager or senior co-manager of public and private equity offerings will facilitate the growth of our mergers and acquisitions and strategic advisory businesses, as companies that have been issuers of securities become more mature and pursue acquisitions or other exit events for their investors. We further believe that we have been able to elevate our profile as a strategic advisor in recent years as a result of a build-out of our firm’s advisory capabilities and our demonstrated success as an advisor in an increasing number of mergers and acquisitions with increasing transaction values and industry recognition. By gaining additional visibility among corporate clients with respect to our firm’s strategic advisory capabilities, we anticipate that advisory revenues will be a growing component of our company’s total revenue over time.

Sales and Trading

Our sales and trading department provides institutional investors with capital markets intelligence and distributes our equity research product, communicating investment recommendations about individual equities that are often not widely followed or well understood. In addition, our sales and trading staff executes securities trades on behalf of our institutional clients and markets the securities of companies for which we act as an underwriter.

We have established a broad institutional client base rooted in longstanding relationships, which have been developed through a consistent focus on the investment and trading objectives of our customers. Our sales and trading professionals work closely with our equity research staff to provide insight and differentiated investment advice to brokerage clients nationwide.

We believe that our sales and trading clients turn to us for timely, informed investment advice. Our equity research features proprietary themes and actionable ideas about industries and companies that are often not evaluated by many other research providers. Many peer firms focused on small- and mid-capitalization companies have shut down or have been purchased by larger firms over the past two decades, while several of the very largest investment banking firms failed or consolidated during that time. As a result, the amount of market-making activity, liquidity and research coverage for smaller companies has decreased significantly. However, we continue to commit sales and trading resources to these companies with the belief that institutional investors require and value such specialized knowledge and service.

Our sales and trading personnel are central to our ability to market securities offerings and provide after-market support. Our capital markets group manages the syndication, marketing, execution and distribution of the securities offerings we manage. Our syndicate activities include coordinating the marketing and order-taking process for underwritten transactions and conducting after-market stabilization and initial market-making. Our syndicate staff is also responsible for developing and maintaining relationships with the syndicate departments of other investment banks.

Equity Research

Our research department is charged with developing proprietary investment themes, anticipating secular and cyclical changes, and producing action-oriented reports that will assist our institutional brokerage clients with their investment decisions. Our analysts cultivate primary sources of information in order to refine their quantitative and qualitative assessments. Our objective is to provide institutional investors with a clear understanding of industry-specific and company-specific issues that can impact their portfolio returns.

Our equity research encompasses three industries—technology, healthcare, and financial services and real estate—and is concentrated on the following sectors within each industry:

|

Technology

• Cybersecurity

• Digital Media

• Energy Technology & Services

• Industrial Technology

• Internet

• IT Infrastructure

• Software |

Healthcare

• Biopharmaceuticals

• Biotechnology

• Medical Devices & Supplies |

Financial Services & Real Estate

• Alternative Asset Managers

• Commercial Finance

• Consumer Finance

• Financial Technology

• Housing

• Insurance

• Investment Banks & Brokers

• Land Development

• Mortgage Finance

• Real Estate Investment Trusts (REITs)

• Real Estate Services & Technology

|

|

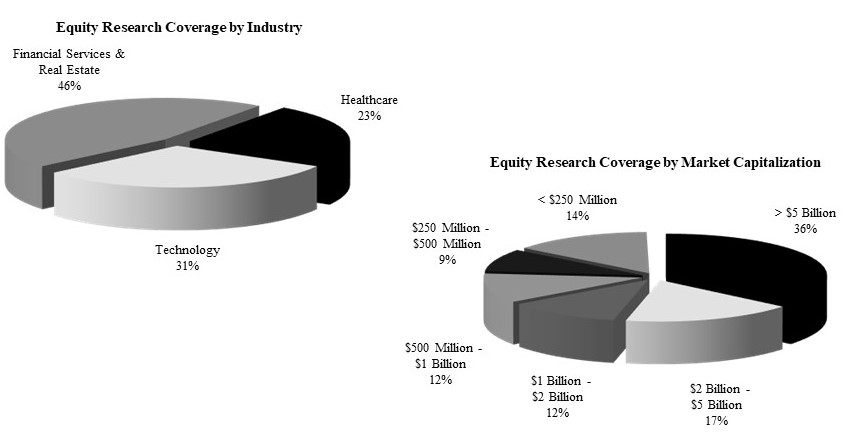

As of December 31, 2020, our research department included 20 publishing research analysts providing investment recommendations on 364 public companies divided among our three target sectors. Approximately 35% of the stocks under coverage had market capitalizations of less than $1.0 billion.

Through HCS, JMPAM and HCAP Advisors, we actively manage venture capital funds, private equity funds, a private debt fund, real estate funds, and a publicly-traded BDC that provides customized financing solutions to small and midsize companies.

As of December 31, 2020, we had a total of $5.6 billion in assets under management including $4.9 billion in assets under management of “sponsored” funds. Sponsored funds are asset management strategies in which JMP Group owns an economic interest and includes assets managed by Medalist Partners Corporate Finance, the former JMP Credit Advisors.

On March 20, 2019, we announced the sale of a majority interest in our corporate credit business, JMP Credit Advisors LLC (“JMPCA”), a platform established to underwrite and manage investments in senior secured debt, to Medalist Partners LP and to certain employees of JMPCA, leaving us with a minority interest of 45.0% in the since renamed Medalist Partners Corporate Finance LLC. Medalist Partners Corporate Finance currently manages three CLOs—JMP Credit Advisors CLO III(R) Ltd. (“CLO III”), JMP Credit Advisors CLO IV Ltd. (“CLO IV”), JMP Credit Advisors CLO V Ltd. (“CLO V”)—in which we have a remaining aggregate equity interest of $48 million as of December 31, 2020.

In the course of advising corporate clients on strategic or private capital raising transactions, our investment bankers may identify instances in which we could commit our own capital to transactions for which we are acting as an agent. In addition, other opportunities to invest equity and debt capital are frequently brought to the attention of our asset management professionals. As a result, in certain cases in the past we have made principal investments, and in some of those cases we have earned attractive returns on the capital we have committed. We expect that we will continue to make such investments in the future and believe that we may continue to earn attractive returns in some instances.

The objective of our multiple investment strategies is to diversify both revenue and risk while maintaining the attractive economics of the alternative asset management model. We view asset management as an attractive business due to its high margins and the recurring nature of its fee-based revenues, as well as its dependence on intellectual capital, which we believe is less susceptible to competitive threats from larger financial institutions.

Competition

All areas of our business are subject to a high level of competition. The principal competitive factors influencing our business include the capabilities of our professionals, our industry focus and expertise, our client relationships, our professional reputation, our product and service offerings, and the quality and price of our products and services.

Since the mid-1990s, there has been substantial consolidation among U.S. and global financial institutions. In particular, a number of large commercial banks, insurance companies and other diversified financial services firms have merged with other financial institutions or have established or acquired broker-dealers. During 2008, the failure or near-collapse of a number of very large financial institutions led to the acquisition of several of the most sizeable U.S. investment banking firms, consolidating the financial services industry to an even greater extent. Currently, our competitors are other investment banks, bank holding companies, securities brokerage firms, merchant banks and financial advisory firms. In addition, our focus on three specific industries subjects us to direct competition from a number of institutional brokerage firms and investment banking boutiques that also specialize in providing services to these industries and their investors.

The trend toward consolidation within the financial services sector has significantly increased the capital base and geographic reach of many of our competitors. Our larger and better-capitalized competitors may be more able than we are to respond to changes in the investment banking industry, to recruit and retain skilled professionals, to finance acquisitions, to fund internal growth and to compete for market share generally. Many of these firms have the ability to offer a wider range of products than we do, including lending, deposit-taking and insurance, all of which may enhance their competitive position relative to us. These firms also have the ability to support investment banking and capital markets products with commercial banking, insurance and other financial products in an effort to gain market share. This approach could result in downward pricing pressure across some or all of our businesses, as our competitors may be able to withstand losses in the areas in which we compete due to offsetting revenues and profits derived from other, complementary services that we do not offer. In particular, the trend in the equity underwriting business toward multiple bookrunners and co-managers, with bookrunners earning a disproportionately large portion of underwriting fees, has increased competition in the investment banking industry, while placing downward pressure on average transaction fees.

In our asset management business, we face competition in the pursuit of investors for our investment funds; in the identification of attractive investment opportunities and the completion of investments in portfolio companies, securities or real estate assets; and in the recruitment and retention of skilled asset management professionals.

Employees

As of December 31, 2020, we had 180 full time employees, including 68 managing directors. We believe that our managing directors and other professionals are attracted to our firm because of our reputation, our entrepreneurial culture, and our dedication to providing growth companies and growth investors with exceptional client service, objective advice and innovative solutions. None of our employees are subject to any collective bargaining agreements, and we believe our relationship with our employees to be satisfactory.

Risk Management and Compliance

Because we operate an investment bank and several different asset management platforms, risk is an inherent part of our business. Global markets, by their nature, are prone to uncertainty and subject participants to a variety of risks. The principal risks we face are market, liquidity, credit, operational, legal and reputational risks. We believe that we exercise sound practical judgment and undertake rigorous quantitative analysis before engaging in transactions to ensure that appropriate risk mitigators are in place. We mitigate risk by carefully considering the amount of capital allocated to each of our businesses, establishing trading limits, setting credit limits for individual counterparties and, to the extent that we make principal investments, committing capital to transactions in instances when we believe we have the advantage of industry- or company-specific expertise. Our focus is always on balancing risk and return, in that we attempt to achieve returns from each of our businesses that are commensurate with the risks we assume. Our participation in any underwritten securities offering is submitted for approval to a committee consisting of capital markets, investment banking, compliance and legal professionals. As part of our corporate credit and principal investment activities, we conduct due diligence before making any significant capital commitment, and all significant investments must be approved by our executive committee and/or board of directors. Nonetheless, the effectiveness of our approach to managing risks can never be completely assured. For example, unexpected large or rapid movements or disruptions in one or more markets or other unforeseen developments could have an adverse effect on our results of operations and financial condition. The consequences of these developments can include losses due to adverse changes in our principal investments and marketable security values, decreases in the liquidity of trading positions, increases in our credit exposure to customers and counterparties, and increases in general systemic risk.

Regulation

As a participant in the financial services industry, we are subject to complex and extensive regulation of most aspects of our business by U.S. federal and state regulatory agencies, self-regulatory organizations and securities exchanges. The laws, rules and regulations comprising the regulatory framework are constantly changing, as are the interpretation and enforcement of existing laws, rules and regulations. The effect of any such changes cannot be predicted and may impact our operations and affect our profitability.

Our broker-dealer subsidiary, JMP Securities, is subject to regulations governing every aspect of the securities business, including the execution of securities transactions; capital requirements; record-keeping and reporting procedures; relationships with customers, including the handling of cash and margin accounts; the experience of and training requirements for certain employees; and business interactions with firms that are not members of regulatory bodies.

JMP Securities is registered as a securities broker-dealer with the SEC and is a member of FINRA. FINRA is a self-regulatory body composed of members such as our broker-dealer subsidiary that have agreed to abide by the rules and regulations of FINRA. FINRA may expel, fine and otherwise discipline member firms and their employees. JMP Securities is also licensed as a broker-dealer in each of the 50 states in the U.S., requiring us to comply with the laws, rules and regulations of each state. Each state may revoke the license to conduct securities business, fine, and otherwise discipline broker-dealers and their employees.

JMP Securities is subject to the SEC’s Uniform Net Capital Rule, Rule 15c3-1, which may limit our ability to make withdrawals of capital from our broker-dealer subsidiary. The Uniform Net Capital Rule sets the minimum level of net capital a broker-dealer must maintain and also requires that a portion of a broker-dealer's assets be relatively liquid. In addition, JMP Securities is subject to certain notification requirements related to withdrawals of excess net capital.

We are also subject to the USA PATRIOT Act of 2001 (the “Patriot Act”), which imposes obligations regarding the prevention and detection of money-laundering activities, including the establishment of customer due diligence, customer verification and other compliance policies and procedures. The conduct of research analysts is also the subject of rule-making by the SEC, FINRA and the federal government through the Sarbanes-Oxley Act. These regulations require certain disclosures by, and restrict the activities of, research analysts and broker-dealers, among others. Failure to comply with these requirements may result in monetary, regulatory and, in the case of the USA Patriot Act, criminal penalties.

Our asset management subsidiaries, HCS, JMPAM, and HCAP Advisors, are SEC-registered investment advisers, or in the case of JMPAM, a relying advisor, and are accordingly subject to regulation by the SEC. Requirements under the Investment Advisors Act of 1940 include record-keeping, advertising and operating requirements, as well as prohibitions on fraudulent activities.

Various regulators, including the SEC, FINRA and state securities regulators and attorneys general, conduct both targeted and industry-wide investigations of certain practices relating to the financial services industry, including sales and marketing practices, valuation practices, and compensation arrangements. These investigations have involved mutual fund companies, broker-dealers, hedge funds, investors and others.

In addition, the SEC staff has conducted studies with respect to soft dollar practices in the brokerage and asset management industries and proposed interpretive guidance regarding the scope of permitted brokerage and research services in connection with soft dollar practices.

Accounting, Administration and Operations

Our accounting, administrative and operations personnel are responsible for financial controls, internal and external financial reporting, compliance with regulatory and legal requirements, office and personnel services, management information and telecommunications systems, and the processing of our securities transactions. We use a third-party service provider for payroll processing and our clearing operations are currently performed by National Financial Services LLC and Mirae Asset Securities (USA) Inc. All of our data processing functions are performed by our management information systems personnel.

Available Information

We are required to file current, annual and quarterly reports, proxy statements and other information required by the Exchange Act with the SEC. The SEC maintains an internet website at http://www.sec.gov from which interested persons can electronically access our SEC filings.

We provide our annual reports on Form 10-K; quarterly reports on Form 10-Q; current reports on Form 8-K; proxy statements; Forms 3, 4 and 5 filed by or on behalf of directors, executive officers and certain large shareholders; and any amendments to those documents filed or furnished pursuant to the Exchange Act free of charge in the Investor Relations section of our website, at http://www.jmpg.com. These filings will become available as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC. From time to time we may use our website as a channel of distribution of material company information.

We also make available in the Investor Relations section of our website and will provide print copies to shareholders upon request (i) our corporate governance guidelines, (ii) our code of business conduct and ethics, and (iii) the charters of the audit, compensation, and corporate governance and nominating committees of our board of directors. These documents, as well as the information on our website, are not intended to be part of this Form 10-K, and inclusions of our internet address in this Form 10-K are inactive textual references only.

|

Risk Factors |

Risks Related to Our Business

Our operations and financial results are subject to various risks and uncertainties, including those described below, which could adversely affect our business, financial condition, results of operations, cash flows, and the trading price of our shares.

We focus principally on specific sectors of the economy, and deterioration in the business environment in these sectors or a decline in the market for securities of companies within these sectors could harm our business.

We focus our business activities principally in three target industries: technology, healthcare, financial services and real estate. Volatility in the business environment in these industries or in the market for securities of companies within these industries could adversely affect our financial results and the market value of our shares. The business environment for companies in some of these industries has been subject to high levels of volatility in recent years, and our financial results have consequently been subject to significant variations from year to year. The mix of our investment banking revenues has shifted over time. In 2007, the year of our initial public offering, the financial services and real estate sectors, together, represented 48% of our total investment banking revenues; in 2020, these two sectors represented 20% of such revenues. While the healthcare sector constituted 23% of our total investment banking revenues in 2007, the sector constituted 45% of such revenues in 2020.

The market for securities in each of our target industries may also be subject to industry-specific risks. For example, we have research, investment banking and principal investments focused in the areas of financial services and real estate. These industries have been negatively impacted at times by disruption in the financial markets, the COVID-19 pandemic and the broader economy, leading to severe downturns in real estate values, upheaval in the mortgage, credit and equity markets, and the distress or failure of both major and minor financial institutions. Volatility or prolonged dislocation in one or more of the industries on which we focus our efforts could impair our ability to conduct business and generate revenues in those sectors. Underwriting and other corporate finance activities, strategic advisory engagements, and sales and trading activities in our target industries represent a significant portion of our business. This concentration exposes us to the risk of a decline in revenue in the event of a downturn in any one of our three target industries, should our corporate clients in these industries or our institutional clients focused on these industries become unable or unwilling to continue to engage us for our services.

As an investment bank with an emphasis on certain growth sectors of the economy, we depend significantly on private company transactions for sources of revenue and potential business opportunities. Most of these private company clients are initially funded and controlled by venture capital funds and private equity firms. To the extent that the pace of these private company transactions slows or the average transaction size declines due to a decrease in venture capital and private equity financings, difficult market conditions in our target industries or other factors, our business and results of operations may be harmed.

Our ability to retain our senior professionals and recruit additional professionals is critical to the success of our business, and our failure to do so may adversely affect our reputation, business, results of operations and financial condition.

Our people are our most valuable resource. Our ability to generate and successfully execute the transactions that account for a significant portion of our revenues depends upon the reputation, judgment, business generation capabilities and project execution skills of our senior professionals, particularly our managing directors and the members of our executive committee. The reputations and relationships of our senior professionals with our clients are a critical element in obtaining and executing client engagements. Turnover in the investment banking industry is high, and we encounter intense competition for qualified employees from other companies in the investment banking industry, as well as from businesses outside the investment banking industry, such as hedge funds and private equity funds.

To the extent we continue to have annual compensation and benefits expense targets, we may not be able to retain our professionals or recruit additional professionals at compensation levels that are within our target range for compensation and benefits expense. If we were to lose the services of any of our investment bankers, senior equity research, sales and trading professionals, senior investment management personnel or executive officers to a new or existing competitor or otherwise, we may not be able to retain valuable relationships, and some of our clients could choose to use the services of a competitor instead of our services. If we are unable to retain our senior professionals or recruit additional professionals, our reputation, business, results of operations and financial condition will be adversely affected. Further, new business initiatives and efforts to expand existing businesses generally require that we incur compensation and benefits expense before generating additional revenues.

Our growth strategy relies on our ability to attract and retain productive senior professionals across all of our businesses. Due to the relatively early stage of development of many of our businesses and competition from other firms, we may face difficulties in recruiting and retaining professionals of a caliber consistent with our business strategy. In particular, many of our competitors are significantly larger, with greater financial resources, and may be able to offer more attractive compensation packages and broader career opportunities. Additionally, it may take more than one year for us to determine whether new professionals will be effective and will generate revenues, during which time we may incur significant expenses and expend significant time and resources on training, integration and business development.

Certain aspects of our cost structure are largely fixed, and we may incur costs associated with new or expanded lines of business prior to these lines of business generating significant revenue. If our revenue declines or fails to increase commensurately with the expenses associated with new or expanded lines of business, our profitability may be materially adversely affected.

We may incur costs associated with new or expanded lines of business, including guaranteed or fixed compensation costs, prior to generating significant revenue from these lines of business. In addition, certain aspects of our cost structure, such as costs for occupancy, communication and information technology services, and depreciation and amortization are largely fixed, and we may not be able to adjust these costs quickly enough to match fluctuations in revenue. If our revenue declines, or fails to increase commensurately with the expenses associated with new or expanded lines of business, our profitability may be materially adversely affected.

We face strong competition from larger firms, some of which have greater resources and name recognition than we do, which may impede our ability to grow our business.

The investment banking industry is intensely competitive, and we expect it to remain so. We compete on the basis of a number of factors, including client relationships, reputation, the abilities of our professionals, transaction execution, innovation, market focus and the relative quality and price of our services and products. We have experienced intense price competition in our various businesses. Pricing and other competitive pressures in investment banking, including the trends toward multiple book runners, co-managers and financial advisors handling transactions, could adversely affect our revenues, even if the size and number of our investment banking transactions increases.

Our investment bank subsidiary had 180 employees as of December 31, 2020. Many of our competitors have a broader range of products and services, greater financial and marketing resources, larger customer bases, greater name recognition, more senior professionals to serve their clients’ needs, greater global reach and more established relationships with clients than we have. These larger and better-capitalized competitors may be more able to respond to changes in the investment banking industry, compete for skilled professionals, finance acquisitions, fund internal growth and compete for market share generally. These firms have the ability to support investment banking with commercial banking, insurance and other financial services in an effort to gain market share, which has resulted, and could further result, in pricing pressure in our businesses. In particular, the ability to provide commercial financing has become an important advantage for some of our larger competitors; and, because we do not provide such financing, we may be unable to compete as effectively for clients in a significant part of the investment banking industry. In addition, if the number of capital markets and financial advisory transactions were to decline, larger investment banking firms could seek to enter into engagements with smaller companies and to execute transactions that traditionally would have been considered too small for these firms.

If we are unable to compete effectively with our competitors, our business, results of operations and financial condition will be adversely affected.

We face strong competition from middle-market investment banks.

We compete with specialized investment banks to provide access to capital and strategic advice to small and middle-market companies in our target industries. We compete with those investment banks on the basis of a number of factors, including client relationships, reputation, the abilities of our professionals, transaction execution, innovation, market focus and the relative quality and price of our services and products. We have experienced intense competition from similarly-sized firms over obtaining advisory mandates in recent years, and we may experience pricing pressures in our investment banking business in the future as some of our competitors seek to gain increased market share by reducing fees. Competition in the middle market may further intensify if larger Wall Street investment banks expand their focus farther into this sector of the market. Increased competition could reduce our market share and our ability to generate investment banking fees.

We also face increased competition due to a trend in recent years toward consolidation among companies in the financial services industry. This trend was amplified by the disruption and volatility in the financial markets in 2015 and 2016 and, before that, to a much greater degree in 2008 and 2009. As a result, a number of financial services companies have merged, been acquired or have fundamentally changed their business models. Many of these firms may have the ability to support investment banking, including financial advisory, with commercial banking, insurance and other financial services in an effort to gain market share, which could result in pricing pressure in our businesses.

Our share price has been volatile, and it may continue to be volatile in the future.

The market price of our shares could be subject to significant fluctuations due to factors such as:

|

• |

changes in book value due to principal investment valuations; |

|

• |

actual or anticipated fluctuations in our financial condition or results of operations; |

|

• |

failure to meet the expectations of securities analysts; |

|

• |

a decline in the stock prices of peer companies; |

|

• |

a discount in the trading multiple of our shares relative to that of shares of certain of our peer companies, due to perceived risks associated with our smaller size; |

|

• |

the success or failure of potential acquisitions, our operating strategies and our perceived prospects and those of the financial services industry in general; |

|

• |

changes in our distribution policy; |

|

• |

sales of substantial numbers of our shares by our employees or other shareholders, or the possibility of such sales; and |

|

• |

the realization of any of the other risks described in this section. |

Our financial results from investment banking activities may fluctuate substantially from period to period, which may impair our share price.

We have experienced, and expect to experience in the future, significant variations from period to period in our revenues and results of operations from investment banking activities. Future variations in investment banking revenues may be attributable in part to the fact that our investment banking revenues are typically earned upon the successful completion of a transaction, the timing of which is uncertain and beyond our control. In most cases, we receive little or no payment for investment banking engagements that do not result in the successful completion of a transaction. As a result, our business is highly dependent on market conditions as well as the decisions and actions of our clients and interested third parties. For example, a client’s acquisition transaction may be delayed or terminated because of a failure to agree upon final terms with the counterparty, failure to obtain necessary regulatory consents or board or shareholder approvals, failure to secure necessary financing, adverse market conditions or unexpected financial or other problems in the business of a client or a counterparty. If the parties fail to complete a transaction on which we are advising or an offering in which we are participating, we will earn little or no revenue from the contemplated transaction. In addition, we incur significant expenses related to a contemplated transaction, regardless of whether or not the contemplated transaction generates revenue. This risk may be intensified by our focus on growth companies in the technology, healthcare, financial services and real estate industries, as the market for securities of these companies has experienced significant variations in the number and size of equity offerings. In addition, our investment banking revenues are highly dependent on the level of merger and acquisition and capital raising activity in the U.S., which fluctuates substantially from period to period. Our investment banking revenues would be adversely affected in the event that the number and size of mergers and acquisitions and capital raising transactions in our sectors of focus decline. As a result, we may not achieve steady and predictable earnings on a quarterly basis, which could in turn adversely affect our share price.

Further, because a significant portion of our revenue is derived from investment banking fees and brokerage commissions, severe market fluctuations, weak economic conditions, or a decline in stock prices, trading volumes or liquidity could cause our financial results to fluctuate from period to period as a result of the following, among other things:

|

• |

the number and size of transactions for which we provide underwriting and merger and acquisition advisory services may decline; |

|

• |

the value of the securities we hold in inventory as assets, which we often purchase in connection with market-making and underwriting activities, may decline; and |

|

• |

the volume of trades we execute for our clients may decrease. |

To the extent our clients, or counterparties in transactions with us, are more likely to suffer financial setbacks in a volatile stock market environment, our risk of loss during these periods would increase.

Our corporate finance and strategic advisory engagements are singular in nature and do not generally provide for subsequent engagements.

Our investment banking clients generally retain us on a short-term, engagement-by-engagement basis in connection with specific corporate finance activities, merger and acquisition transactions (often as an advisor in the sale of a company) or other strategic advisory services, rather than on a recurring basis under long-term contracts. As these transactions are typically singular in nature and our engagements with these clients may not recur, we must seek new engagements when our existing engagements are successfully completed or terminated. As a result, high activity levels in any period are not necessarily indicative of continued high activity levels in any subsequent period. If we are unable to generate a substantial number of new engagements that generate fees from new or existing clients, our business, results of operations and financial condition could be adversely affected.

We are a “smaller reporting company,” and we cannot be certain if the reduced disclosure requirements applicable to smaller reporting companies will make our common stock less attractive to investors.

We are a “smaller reporting company,” as defined in Rule 12b-2 of the Exchange Act. As a smaller reporting company, we are planning to rely on an exemptions from certain disclosure requirements that are applicable to other public companies that are not smaller reporting companies. These exemptions include reduced financial disclosure and reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements. We may continue to rely on such exemptions for so long as we remain a smaller reporting company under applicable SEC rules and regulations. Accordingly, we cannot predict if investors will find our common stock less attractive because we rely on these exemptions. If some investors find our common stock less attractive as a result of our reduced disclosures, there may be less active trading in our common stock and our stock price may be more volatile.

Pricing and other competitive pressures may impair the revenues of our sales and trading business.

We derive a significant portion of our revenues from our sales and trading business, which accounted for 16% and 17% of our net revenues for the years ended December 31, 2020 and 2019, respectively. Along with other investment banking firms, we have experienced intense price competition and trading volume reduction in this business in recent years. In particular, the ability to execute trades electronically and through alternative trading systems has increased the downward pressure on trading commissions and spreads. We expect these trends toward alternative trading systems and downward pricing pressure in the business to continue. We believe we may experience competitive pressures in these and other areas in the future, as some of our competitors seek to obtain market share by competing on the basis of price or by using their own capital to facilitate client trading activities. In addition, we face pressure from our larger competitors, which may be better able to offer a broader range of complementary products and services to clients in order to win their trading business. Since we are committed to maintaining and improving our comprehensive research coverage in our target sectors to support our sales and trading business, we may be required to make substantial investments in our research capabilities to remain competitive. If we are unable to compete effectively in these areas, the revenues of our sales and trading business may decline, and our business, results of operations and financial condition may be harmed.

Some of our large institutional sales and trading clients as measured by brokerage revenues have entered into arrangements with us and with other investment banks, under which they separate payments for research products or services from trading commissions for sales and trading services and pay for research directly in cash, instead of compensating the research providers through trading commissions (referred to as “soft dollar” practices). In addition, we have entered into certain commission sharing arrangements in which institutional clients execute trades with a limited number of brokers and instruct those brokers to allocate a portion of their commissions directly to us, to another broker-dealer or to an independent research provider. If more such arrangements are reached between our clients and us, or if similar practices are adopted by more firms in the investment banking industry, it may further increase the competitive pressures on trading commissions and spreads and reduce the value our clients place on high-quality research. Conversely, if we are unable to make similar arrangements with other investment managers that insist on separating trading commissions from research products, volumes and trading commissions in our sales and trading business also would likely decrease.

Larger and more frequent capital commitments in our trading and underwriting businesses increase the potential for significant losses.

There is a trend toward larger and more frequent commitments of capital by financial services firms in many of their activities. For example, in order to win business, investment banks are increasingly committing to purchase large blocks of stock from publicly traded issuers or significant stockholders, instead of undertaking the more traditional underwriting process in which marketing is typically completed before an investment bank commits to purchase securities for resale. We may participate in this trend and, as a result, we may be subject to increased risk. Conversely, if we do not have sufficient regulatory capital to do so, our business may suffer. Furthermore, we may suffer losses as a result of the positions taken in these transactions, even when economic and market conditions are generally favorable for others in the industry.

We may increasingly commit our own capital as part of our trading business to facilitate client sales and trading activities. The number and size of these transactions may adversely affect our results of operations in a given period. We may also incur significant losses from our sales and trading activities due to market fluctuations and volatility in our results of operations. To the extent that we own assets (i.e., have long positions) in any of those markets, a downturn in the value of those assets or in those markets could result in losses. Conversely, to the extent that we have sold assets we do not own (i.e., have short positions) in any of those markets, an upturn in those markets could expose us to potentially large losses as we attempt to cover our short positions by acquiring assets in a rising market.

The asset management business is intensely competitive.

Over the past several years, the size and number of asset management funds, including hedge funds and private equity funds, has continued to increase. If this trend continues, it is possible that it will become increasingly difficult for our funds to raise capital. More significantly, as institutional and individual investors allocate increasing amounts of capital to alternative investment strategies, the size and duration of pricing inefficiencies is reduced. Many alternative investment strategies seek to exploit these inefficiencies, and in certain industries this trend drives prices for investments higher. Both of these situations can increase the difficulty of achieving targeted returns. In addition, if interest rates were to rise or there were to be a prolonged bull market in equities, the attractiveness of our funds relative to other investment products could decrease. Competition is based on a variety of factors, including:

|

• |

investment performance; |

|

• |

investor perception of the drive, focus and alignment of interest of an investment manager; |

|

• |

quality of service provided to, and duration of relationship with, investors; |

|

• |

business reputation; and |

|

• |

level of fees and expenses charged for services. |

We compete in the asset management business with a large number of investment management firms, private equity fund sponsors, hedge fund sponsors and other financial institutions. A number of factors serve to increase our competitive risks, as follows:

|

• |

Investors may develop concerns that we will allow a fund to grow to the detriment of its performance. |

|

• |

Some of our competitors have greater capital, lower targeted returns or greater sector or investment strategy-specific expertise than we do, which creates competitive disadvantages with respect to investment opportunities. |

|

• |

Some of our competitors may perceive risk differently than we do, which could allow those competitors either to outbid us for investments in particular sectors or to consider a wider variety of investments. |

|

• |

There are relatively few barriers to entry impeding new asset management firms, and the successful efforts of new entrants into our various lines of business, including former “star” portfolio managers at large diversified financial institutions as well as such institutions themselves, will continue to result in increased competition. |

|

• |

Other industry participants in the asset management business continuously seek to recruit our best and brightest investment professionals away from us. |

These and other factors could reduce our earnings and revenues and adversely affect our business. In addition, if we are forced to compete with other alternative asset managers on the basis of price, we may not be able to maintain our current base management and incentive fee structures. We have historically competed primarily on the performance of our funds, and not on the level of our fees relative to those of our competitors. However, there is a risk that fees in the alternative investment management industry will decline, without regard to the historical performance of a manager, including our managers. Fee reductions on our existing or future funds, without corresponding decreases in our cost structure, would adversely affect our revenues and distributable earnings.

Poor investment performance may decrease assets under management and reduce revenues from, and the profitability of, our asset management business.

Revenues from our asset management business are primarily derived from asset management fees. Asset management fees are comprised of base management and incentive fees. Management fees are typically based on assets under management, and incentive fees are earned on a quarterly or annual basis only if the return on our managed accounts exceeds a certain threshold return, or “high-water mark,” for each investor. We will not earn incentive fee income during a particular period, even when a fund had positive returns in that period, if we do not generate cumulative performance that surpasses a “high-water mark.” If a fund experiences losses, we will not earn incentive fees with regard to investors in that fund until its returns exceed the relevant “high-water mark.”

Our asset management fees may also decline over time due to factors such as increased competition and the renegotiation of contracts. In addition, investment performance is one of the most important factors in retaining existing investors and competing for new asset management business. Investment performance may be poor as a result of current or future difficult market or economic conditions, including changes in interest rates or inflation, terrorism or political uncertainty, our investment style, the particular investments that we make, and other factors. Poor investment performance may result in a decline in our revenues and income by causing (i) the net asset value of the assets under our management to decrease, which would result in lower management fees to us, (ii) lower investment returns, resulting in a reduction of incentive fee income to us, and (iii) investor redemptions, which would result in lower fees to us, because we would have fewer assets under management.

To the extent that our future investment performance is perceived to be poor in either relative or absolute terms, the revenues and profitability of our asset management business will likely be reduced, and our ability to grow existing funds and raise new funds in the future will likely be impaired. In addition, the market environment in recent years has resulted in a shift to passive investment products, which generate lower fees than actively managed products. A continued trend toward passive investments or changes in market values or in the fee structure of asset management accounts would affect our revenues, business, and financial condition.

The historical returns of our funds may not be indicative of the future results of our funds.

The historical returns of our funds should not be considered indicative of the future results that should be expected from such funds or from any future funds we may raise. Our rates of return reflect unrealized gains, as of the applicable measurement date, which may never be realized due to changes in market and other conditions not in our control that may adversely affect the ultimate valuation of the investments in a fund. The returns of our funds may have also benefited from investment opportunities and general market conditions that may not repeat themselves, and there can be no assurance that our current or future funds will be able to avail themselves of profitable investment opportunities. Furthermore, the historical and potential future returns of the funds we manage also may not necessarily bear any relationship to potential returns on our shares.

There is increasing regulatory supervision of alternative asset management companies, which may increase the risk of financial liability and reputational harm resulting from adverse regulatory actions.

As noted above, in the past several years, the financial services industry has been the subject of heightened scrutiny by regulators around the globe. The industry has experienced an extended period of significant change in laws and regulations governing the financial services industry, as well as increased scrutiny from various regulators, including the SEC, the Federal Reserve, the OCC, and the CFPB, in addition to stock exchanges, FINRA, and state attorneys general. For example, the Dodd-Frank Act resulted in sweeping changes to the regulatory regime, including a significant increase in the supervision and regulation of the financial services industry. Penalties and fines imposed by regulatory authorities have increased substantially in recent years. We may be adversely affected by changes in the interpretation or enforcement of existing laws, rules, and regulations.