Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - Houghton Mifflin Harcourt Co | hmhc-ex993_47.htm |

| EX-99.1 - EX-99.1 - Houghton Mifflin Harcourt Co | hmhc-ex991_86.htm |

| EX-2.1 - EX-2.1 - Houghton Mifflin Harcourt Co | hmhc-ex21_24.htm |

| 8-K - 8-K - Houghton Mifflin Harcourt Co | hmhc-8k_20210326.htm |

Divestiture of HMH Books & Media March 29, 2021 Exhibit 99.2

Forward-Looking Statements and Non-GAAP Measures This presentation and oral statements made in connection with this presentation contain certain statements that are not historical facts, including information regarding our intentions, beliefs or current expectations concerning, among other things, our results of operations, including billings and net sales; financial performance and condition; liquidity; products and services, including for new adoptions; outlook for full year 2021; prospects; growth; markets and market share; strategies, including with respect to investing in our core solutions and extensions businesses and operational excellence; efficiency and cost savings initiatives; the industry in which we operate; the expected impact of the COVID-19 pandemic and potential business decisions. Those statements constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause our actual results to differ materially from the results expressed in or implied by our forward-looking statements, including, but not limited to, those identified under the caption “Forward-Looking Statements” in our news release issued on March 29, 2021 and in the “Special Note Regarding Forward-Looking Statements” and “Risk Factors” in our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. We undertake no obligation, and do not expect, to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. In addition, this presentation and oral statements made in connection with this presentation reference non-GAAP financial measures, such as adjusted EBITDA and free cash flow, and operating measures, such as billings and annual recurring revenue. The use of non-GAAP measures are limited as they include and/or do not include certain items not included and/or included in the most directly comparable GAAP measure. A reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures (to the extent available without unreasonable efforts) and a calculation of operating measures are provided in the appendix to this presentation and in our news release issued on March 29, 2021, which is posted on hmhco.com under the Investors section. 2

3 HMH to divest HMH Books & Media to HarperCollins, a division of News Corp for $349 million in cash Transaction expected to close in 2Q 2021, after HSR review Divestiture creates pure-play K-12 learning technology company Accelerates growth momentum in digital sales, annual recurring revenue and free cash flow Expect to use net proceeds from the transaction to pay down a significant portion of debt HMH Books & Media Divestiture Overview

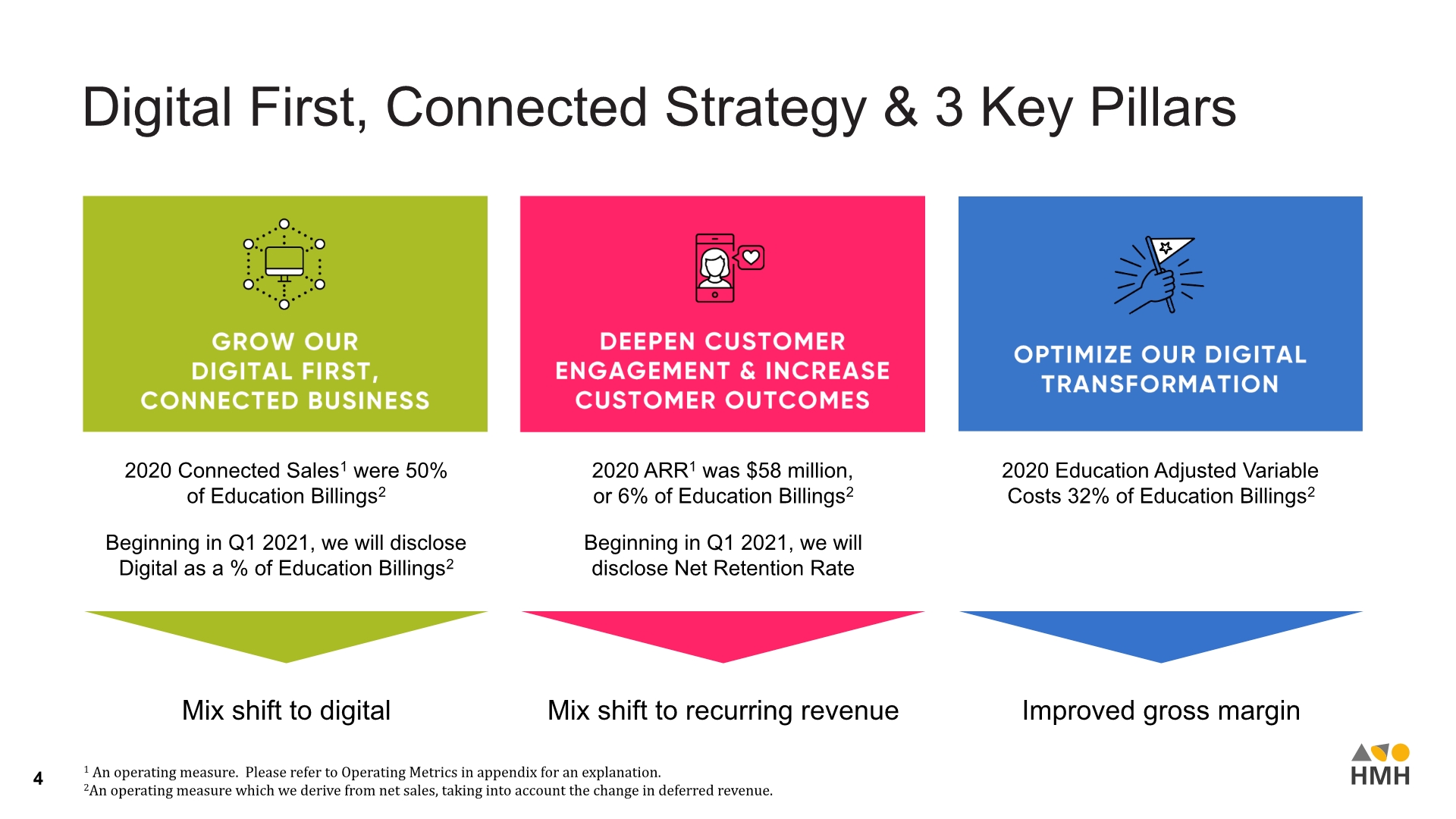

Digital First, Connected Strategy & 3 Key Pillars 2020 ARR1 was $58 million, or 6% of Education Billings2 Beginning in Q1 2021, we will disclose Net Retention Rate 2020 Education Adjusted Variable Costs 32% of Education Billings2 2020 Connected Sales1 were 50% of Education Billings2 Beginning in Q1 2021, we will disclose Digital as a % of Education Billings2 4 Mix shift to digital Mix shift to recurring revenue Improved gross margin 1 An operating measure. Please refer to Operating Metrics in appendix for an explanation. 2An operating measure which we derive from net sales, taking into account the change in deferred revenue.

5 HMH Books & Media is focused on consumer publishing, including print and multi-channel delivery of leading general interest and young readers titles Outside of our core K-12 Digital First, Connected Strategy HMH Books & Media employees will join HarperCollins, a division of News Corp As part of the transaction, HMH has also reduced its physical footprint by exiting one of its distribution facilities, which will go with the sale HMH Books & Media Divestiture Additional Detail

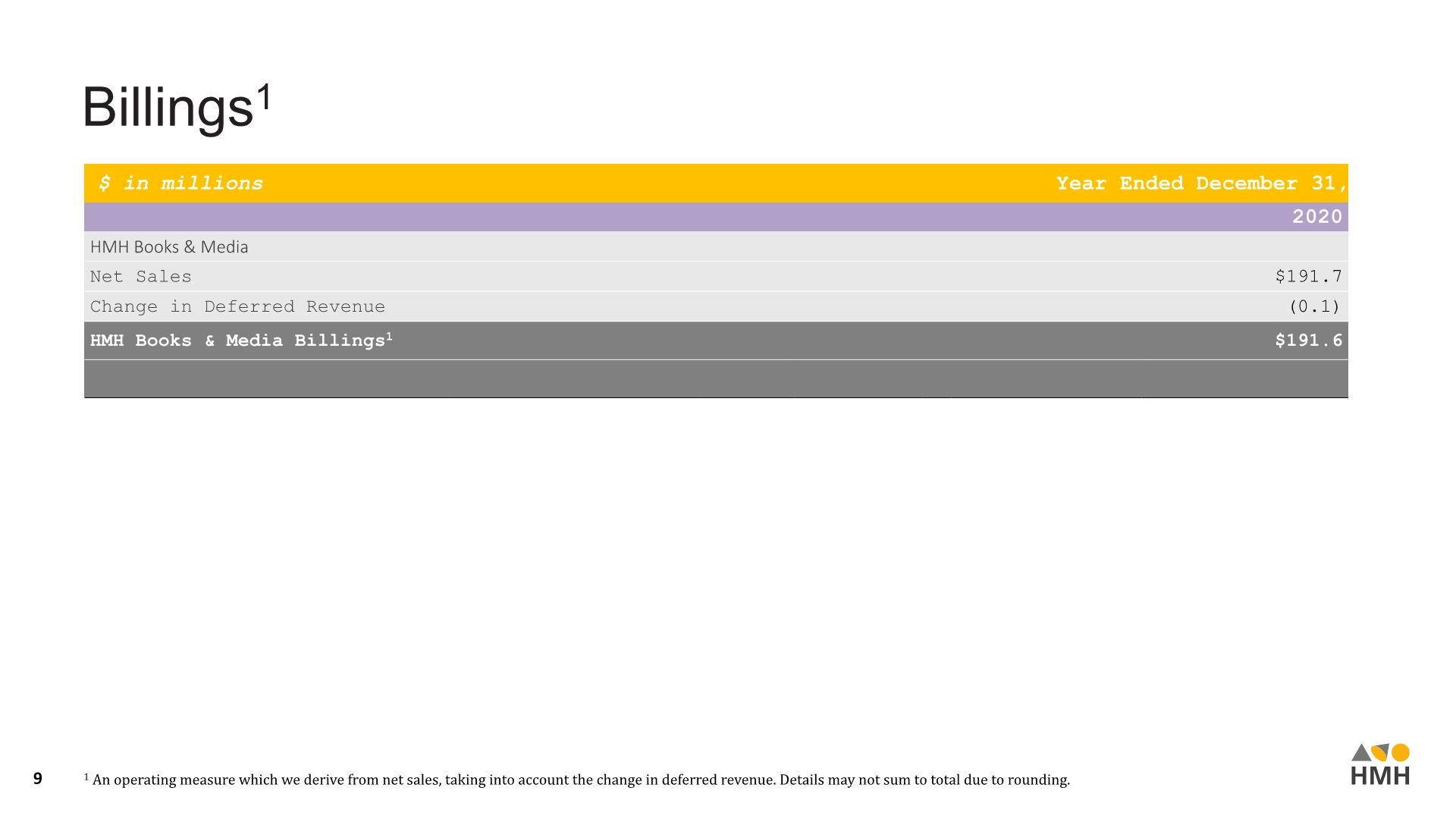

6 HMH Books & Media generated billings1 of $192 million in 2020 Expect to use net proceeds of $337 million to pay down debt, further aligning capital structure with Digital First, Connected strategy Net of estimated transaction fees and expenses Adequate NOL carry forwards offset any potential taxable gains from the sale HMH will report the HMH Book & Media business as discontinued operations beginning with the quarter ending March 31, 2021 HMH Books & Media Divestiture Financial Impact 1 An operating measure which we derive from net sales taking into account the change in deferred revenue, please refer to appendix for reconciliation

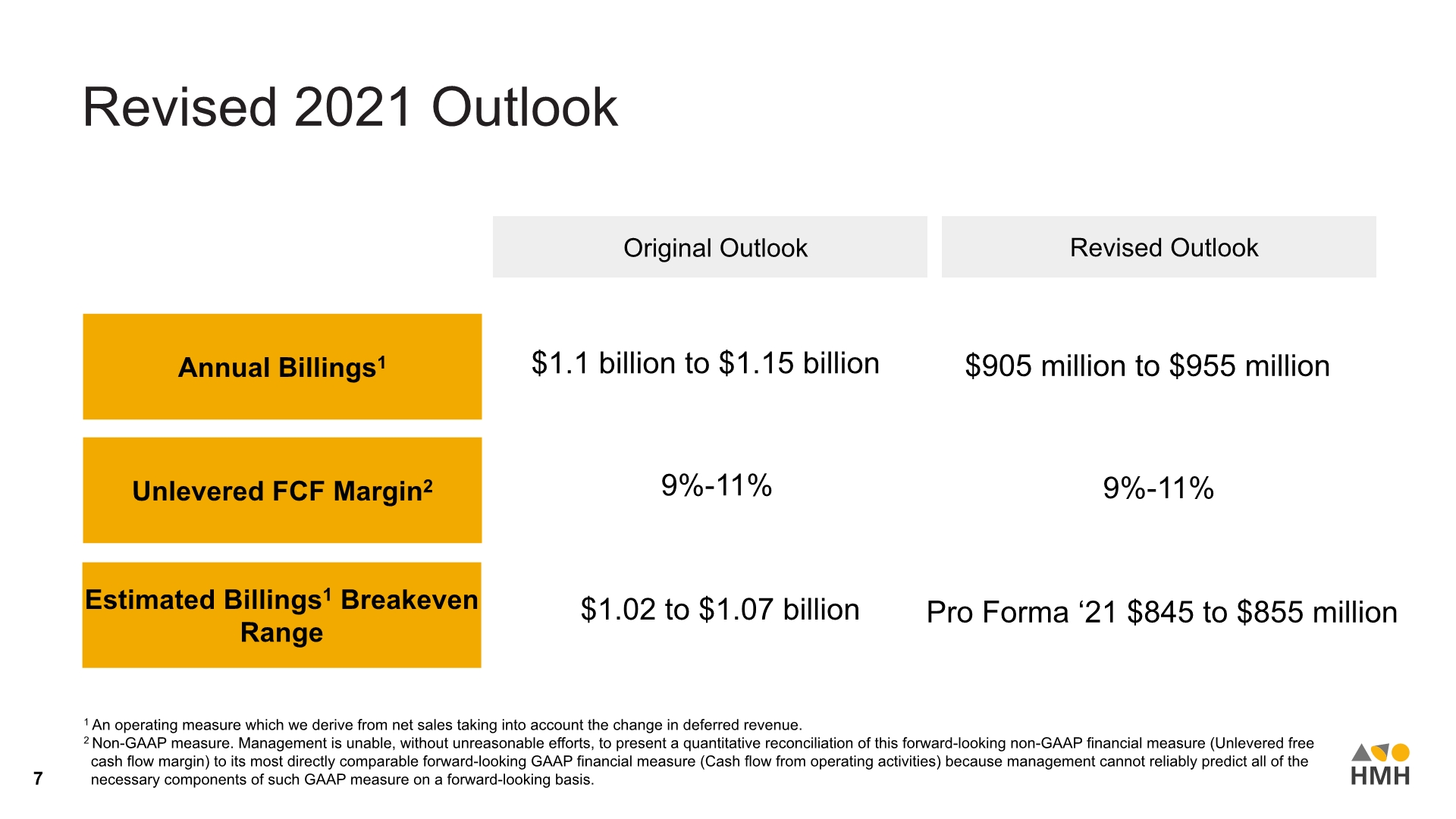

Revised 2021 Outlook Annual Billings1 Unlevered FCF Margin2 Original Outlook Revised Outlook 7 1 An operating measure which we derive from net sales taking into account the change in deferred revenue. 2 Non-GAAP measure. Management is unable, without unreasonable efforts, to present a quantitative reconciliation of this forward-looking non-GAAP financial measure (Unlevered free cash flow margin) to its most directly comparable forward-looking GAAP financial measure (Cash flow from operating activities) because management cannot reliably predict all of the necessary components of such GAAP measure on a forward-looking basis. $905 million to $955 million 9%-11% $1.1 billion to $1.15 billion 9%-11% Estimated Billings1 Breakeven Range Pro Forma ‘21 $845 to $855 million $1.02 to $1.07 billion

8 Questions answers

Billings1 9 1 An operating measure which we derive from net sales, taking into account the change in deferred revenue. Details may not sum to total due to rounding.

Operating Metrics 10 Annualized Recurring Revenue (ARR) for a given period is the annualized revenues derived from termed subscription contracts existing at the end of the period. ARR excludes contracts that are one-time in nature. ARR is currently one of the key performance metrics being used by management to assess the health and trajectory of our business. ARR does not have a standardized definition and is therefore unlikely to be comparable to similarly titled measures presented by other companies. ARR should be viewed independently of U.S. GAAP revenue, deferred revenue and unbilled revenue and is not intended to be combined with or to replace those items. ARR does not represent revenue for any particular period or remaining revenue that will be recognized in future periods. ARR is not a forecast and the active contracts at the end of a reporting period used in calculating ARR may or may not be extended or renewed by our customers. Connected Sales are billings from the sale of core, intervention, supplemental, assessment and service offerings hosted on or transitioning to be hosted on our Ed: Your Friend in Learning® teaching and learning platform.