Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - Babcock & Wilcox Enterprises, Inc. | tm2111098d1_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Babcock & Wilcox Enterprises, Inc. | tm2111098d1_ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2020

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 001-36876

BABCOCK & WILCOX ENTERPRISES, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 47-2783641 | |

| (State or other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

| 1200 East Market Street, Suite 650 | ||

| Akron, Ohio | 44305 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

Registrant's Telephone Number, Including Area Code: (330) 753-4511

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | BW | New York Stock Exchange |

| 8.125% Senior Notes due 2026 | BWSN | New York Stock Exchange |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x | Smaller reporting company | x | |||

| Emerging growth company | ¨ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extension transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the registrant's common stock held by non-affiliates of the registrant on the last business day of the registrant's most recently completed second fiscal quarter (based on the closing sales price on the New York Stock Exchange on June 30, 2020) was approximately $52.6 million.

The number of shares of the registrant's common stock outstanding at March 23, 2021 was 85,663,813.

DOCUMENTS INCORPORATED BY REFERENCE

None.

EXPLANATORY NOTE

Babcock & Wilcox Enterprises, Inc. (the “Company,” “we,” “us” or “our”) filed its Annual Report on Form 10-K for the fiscal year ended December 31, 2020 (the “Form 10-K”) with the U.S. Securities and Exchange Commission (“SEC”) on March 8, 2021. We are filing this Amendment No. 1 to the Form 10-K (“Form 10-K/A”) solely for the purpose of including in Part III the information that was to be incorporated by reference from our definitive proxy statement for the 2020 annual meeting of stockholders. This Form 10-K/A hereby amends and restates in their entirety the Form 10-K cover page and Items 10 through 14 of Part III.

Pursuant to Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), this Form 10-K/A also contains new certifications by the principal executive officer and the principal financial officer as required by Section 302 of the Sarbanes-Oxley Act of 2002. Accordingly, Item 15(a)(3) of Part IV is amended to include the currently dated certifications as exhibits. Because this Form 10-K/A does not contain or amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraphs 4 and 5 of the certifications have been omitted.

Except as expressly noted in this Form 10-K/A, this Form 10-K/A does not reflect events occurring after the original filing of our Form 10-K or modify or update in any way any of the other disclosures contained in our Form 10-K including, without limitation, the financial statements or other financial information included therein. Accordingly, this Form 10-K/A should be read in conjunction with our Form 10-K and our other filings with the SEC.

2

PART III

Item 10. Directors, Executive Officers and Corporate Governance

BOARD OF DIRECTORS

The Company’s Board of Directors (the “Board”) currently includes six highly qualified directors with skills aligned to our business and strategy who bring significant value and diversity to the Company. The Board is comprised of the following members:

| NAME | CLASS | YEAR TERM EXPIRES | ||

| Henry E. Bartoli | Class III | 2021 | ||

| Alan B. Howe | Class II | 2023 | ||

| Philip D. Moeller | Class III | 2021 | ||

| Rebecca Stahl | Class II | 2023 | ||

| Joseph A. Tato | Class I | 2022 | ||

| Kenneth M. Young | Class I | 2022 |

The Board currently consists of three classes of directors with each director serving a staggered three-year term. The Class I directors are Joseph A. Tato, Kenneth M. Young. The Class II directors are Alan B. Howe and Rebecca Stahl. The Class III directors are Henry E. Bartoli and Philip D. Moeller.

Kenneth M. Young, a non-independent director, currently serves as Chairman of the Board. Because the Chairman is not an independent director, Alan B. Howe has been designated by the Board as Lead Independent Director.

The following section provides information with respect to each of our directors. It includes the specific experience, qualifications and skills considered by the Governance Committee and the Board in assessing the appropriateness of the person to serve as a director (ages are as of April 1, 2021).

Henry E. Bartoli, 74, Director since 2020, a seasoned executive with more than 35 years of experience in the global power industry, served as Chief Strategy Officer for Babcock & Wilcox from 2018 to 2020. Before that, he was President and Chief Executive Officer of Hitachi Power Systems America, LTD from 2004 to 2014. From 2002 to 2004, he was Executive Vice President of The Shaw Group, after serving in a number of senior leadership roles at Foster Wheeler Ltd. from 1992 to 2002, including Group Executive and Corporate Senior Vice President, Energy Equipment Group, and Group Executive and Corporate Vice President and Group Executive, Foster Wheeler Power Systems Group. Before that, from 1971 to 1992, he served in a number of positions of increasing importance at Burns and Roe Enterprises, Inc.

Mr. Bartoli also serves as a member of the Board of Directors of FERMILAB, United States’ premier particle physics laboratory owned by the U.S. Department of Energy.

Mr. Bartoli received a Bachelor of Science Degree in Mechanical Engineering from Rutgers University and a Master of Science Degree in Mechanical Engineering from New Jersey Institute of Technology.

In addition, Mr. Bartoli has held professional engineering licenses in California, Kentucky and New Jersey and is a former member of the Board of Trustees of Rutgers University. Mr. Bartoli is also former member of the Board of Directors of the Nuclear Energy Institute.

Philip D. Moeller, 59, Director since 2020, is Executive Vice President, Business Operations Group and Regulatory Affairs, at the Edison Electric Institute (EEI). EEI is the association that represents all of the nation’s investor-owned electric companies. In his role at EEI, he has significant responsibility over a broad range of issues that affect the future structure of the electric power industry and new rules in evolving competitive markets including energy supply and finance, environment, energy delivery, energy services, federal and state regulatory issues, and international affairs.

Prior to joining EEI in February 2016, Mr. Moeller served as a Commissioner on the Federal Energy Regulatory Commission (FERC), ending his tenure as the second-longest serving member of the Commission. In office from 2006 through 2015, Mr. Moeller ended his service as the only Senate-confirmed member of the federal government appointed by both President George W. Bush and President Barack Obama.

3

Earlier in his career, Mr. Moeller headed the Washington, D.C., office of Alliant Energy Corporation. He also served as a Senior Legislative Assistant for Energy Policy to U.S. Senator Slade Gorton (R-WA), and as the Staff Coordinator of the Washington State Senate Energy and Telecommunications Committee in Olympia, Washington.

Mr. Moeller received a Bachelor of Arts in Political Science from Stanford University.

Alan B. Howe, 59, Director since 2019, has almost 30 years of extensive hands-on operational expertise combined with corporate finance, business development and corporate governance experience. His broad business background includes exposure to a wide variety of complex business situations within large corporations, financial institutions, start-ups, small-caps and turnarounds.

Currently, Alan is Managing Partner of Broadband Initiatives, LLC, a small boutique corporate advisory firm that he manages. His specialty is in providing board and C-level leadership working with small-cap and micro- cap companies (both public and private) particularly in turnaround situations. Alan has served both as a director and as a board chairman in multiple companies in a variety of industries including telecom and wireless equipment, software, IT services, wireless RF services, manufacturing, semiconductors, and storage. In two situations, Alan was appointed interim CEO of difficult situations where he previously served on the Board of Directors.

He earned a bachelor’s degree in business administration and marketing from the University of Illinois and a Master of Business Administration and finance from Indiana University.

Rebecca Stahl, 47, Director since 2020, has 25 years’ experience in finance and accounting and currently serves as Chief Financial Officer of The Association For Manufacturing Technology (AMT), an organization that represents and promotes U.S.-based manufacturing technology and its members who design, build, sell, and service the industry. Before joining AMT, she held positions of increasing responsibility at Lightbridge Communications Corporation (LCC), a multinational wireless engineering company, including serving as Chief Financial Officer from 2008 to 2015. While at LCC, she led several financing rounds, senior bank refinancing and M&A transactions that led to an eventual sale of the company in 2015.

Prior to LCC, Ms. Stahl was with BT Infonet, a multinational data communications company, as a senior finance professional supporting a $600 million operation. From 1998-2000, she served in corporate finance for The Walt Disney Company in Burbank, Calif. She started her career at Arthur Anderson LLP serving clients of public and private companies in the real estate and financial services industries.

Ms. Stahl is a certified public accountant. She earned a Bachelor of Science in Accounting from The Pennsylvania State University, and a Master of Business Administration from the Anderson School of Management at University of California Los Angeles, with an emphasis in Finance. Her professional affiliations include Women Corporate Directors, the American Institute of Certified Public Accountants and Virginia Society of Certified Public Accountants.

Joseph A. Tato, 67, Director since 2020, has significant leadership experience in the areas of energy and natural resources, infrastructure project development and finance, and has been counsel in some of the largest public private partnership transactions completed to date including energy and water projects in the U.S. and globally.

Mr. Tato currently is a Partner with Covington & Burling, LLP, responsible for Project Development & Finance, and is a member of its Africa and Latin America Practice Groups. From 2012 to 2020, he was a Partner with DLA Piper, LLP, and Chair of Projects and Infrastructure, as well as Co-Chair of its Energy Sector and a member of its Africa Committee. Before that, from 1983 to 2012, Mr. Tato was an associate and since 1998 a Partner with LeBoeuf, Lamb, Greene, & MacRae, LLP (now Dewey & LeBoeuf LLP), and served as Chair of Global Project Finance and its Africa Practice.

He has served as Director, Cameroon Enterprises, since 2017. Additionally, he has served as Director, Covanta Energy Corporation, from 2000 to 2004, and as Assistant Secretary and Counsel to the Board of Directors of SITA U.S.A., a subsidiary of Suez, from 1996 to 1999.

Kenneth M. Young, 57, Director since 2020, is Chairman and Chief Executive Officer of Babcock & Wilcox (B&W), a leader in energy and environmental products and services for power and industrial markets worldwide.

Mr. Young, who has served as Chief Executive Officer since November 2018 and Chairman since September 2020, has more than 30 years of operational, executive and director experience primarily within the energy, communications and finance industries, on a global basis. He currently serves as President of B. Riley Financial, Inc., and Chief Executive Officer for B. Riley Principal Investments, a wholly owned subsidiary of B. Riley Financial.

4

Before joining B. Riley, he held executive leadership positions with Lightbridge Communications Corporation (LCC), which was the largest independent telecom construction and services company in the world and a recognized leader in providing network services. Initially serving as President and Chief Operating Officer of the Americas for LCC, he was named President and CEO in 2008, serving in that position until he led the company’s sale in 2015. Under his leadership, LCC’s revenues grew more than 200 percent and the company expanded its geographical presence into more than 50 countries.

Prior to joining LCC, Mr. Young was Chief Marketing and Operations Officer with Liberty Media’s TruePosition and held various senior executive positions with multiple corporations, including Cingular Wireless, SBC Wireless, Southwestern Bell Telephone and AT&T as part of his 16-year tenure within the now-combined AT&T Corporation.

Mr. Young holds a Bachelor of Science in Computer Science from Graceland University and a Master of Business Administration from the University of Southern Illinois.

Mr. Young has previously served on seven public company boards and is currently a member of the Board of Directors for Sonim Technologies NASDAQ: (SONM).

EXECUTIVE OFFICERS

The information set forth under “Executive Officers” in Part III of our Form 10-K is incorporated herein by reference.

We have adopted a Code of Business Conduct for our employees and directors, including, specifically, our chief executive officer, our chief financial officer, our chief accounting officer, and our other executive officers. Our code satisfies the requirements for a “code of ethics” within the meaning of SEC rules. A copy of the code is posted on our web site, www.babcock.com under “Investor Relations – Corporate Governance – Governance Documents.” We intend to disclose promptly on our website any amendments to, or waivers of, the code covering our chief executive officer, chief financial officer and chief accounting officer.

Vintage and B. Riley Investor Rights Agreement

On January 3, 2018, we entered into an agreement with Vintage Capital Management, LLC (together with its affiliates, “Vintage”) and certain related parties, pursuant to which we agreed, among other things, to add Henry E. Bartoli, Matthew E. Avril and Brian R. Kahn to the Board to serve as Class I, Class II and Class III directors, respectively. This agreement expired pursuant to its terms in 2019.

On April 30, 2019, we entered into an investor rights agreement (the “Investor Rights Agreement”) with Vintage and B. Riley Financial, Inc. (together with its affiliates, “B. Riley”). As part of the Investor Rights Agreement, we agreed to appoint three directors nominated by each of Vintage and B. Riley to the Board, with the size of the full Board to remain at six directors. Henry E. Bartoli, Matthew E. Avril and Kenneth Siegel were nominated by Vintage at our 2020 annual meeting of stockholders to serve as directors pursuant to the Investor Rights Agreement. Alan B. Howe, Brian R. Kahn and Bryant R. Riley were nominated by B. Riley at our 2020 annual meeting of stockholders to serve as directors pursuant to the Investor Rights Agreement.

Pursuant to the Investor Rights Agreement, each of Vintage and B. Riley retains their right to nominate directors to serve on the Board so long as they continue to meet certain quantitative thresholds with regard to the amount of our common stock and debt they beneficially own. B. Riley’s contractual rights to nominate directors will continue with respect to:

| 1. | three Board members, for so long as B. Riley beneficially owns at least 75% of our common stock that it beneficially owned as of July 24, 2019 (the “Closing B. Riley Stock Ownership”) and at least 75% of the Tranche A-2 Term Loan and Tranche A-3 Term Loan, combined, that it beneficially owned as of July 24, 2019 (the “Closing Loan Ownership”); |

| 2. | two Board members, after the first time that B. Riley beneficially owns less than 75% of the Closing B. Riley Stock Ownership or less than 75% of the Closing Loan Ownership, but for so long as B. Riley continues to beneficially own at least 50% of the Closing B. Riley Stock Ownership and at least 50% of the Closing Loan Ownership; and |

| 3. | one Board member, after the first time that B. Riley beneficially owns less than 50% of the Closing B. Riley Stock Ownership or less than 50% of the Closing Loan Ownership. |

5

Vintage’s contractual rights to nominate directors would continue with respect to:

| 1. | three Board members, for so long as Vintage beneficially owns 75% of our common stock that it beneficially owned as of May 8, 2019 (the “Closing Vintage Stock Ownership”); |

| 2. | two Board members, after the first time that Vintage beneficially owns less than 75% of the Closing Vintage Stock Ownership but so long as Vintage continues to beneficially own at least 50% of the Closing Vintage Stock Ownership; and |

| 3. | one Board member, after the first time that Vintage beneficially owns less than 50% of the Closing Vintage Stock Ownership; |

In all instances, Vintage and B. Riley, respectively, must each beneficially own at least 5% of the outstanding voting power of all of our common stock to retain their director nomination rights with regard to any directors. As of the date hereof, B. Riley satisfied the conditions of clause 1 above, retaining the right to nominate three members of the Board, and Vintage did not satisfy any of the clauses above, and therefore did not retain the right to nominate any members to the Board at the Annual Meeting.

The Investor Rights Agreement also provides pre-emptive rights to B. Riley with respect to certain future issuances of our equity securities. We also agreed as part of the Investor Rights Agreement to reimburse B. Riley and Vintage for all reasonable out-of-pocket costs and expenses they incurred, including fees for legal counsel, in the 2019 Rights Offering (as defined and described under “Certain Relationships and Related Transaction — Transactions with Vintage, B. Riley and Their Respective Affiliates”).

On March 26, 2021, Vintage and B. Riley completed a transaction pursuant to which B. Riley agreed to purchase from Vintage, and Vintage agreed to sell to B. Riley, all 10,720,785 shares of our common stock owned by Vintage.

CORPORATE GOVERNANCE

Our corporate governance policies and structures provide the general framework for how we run our business. They demonstrate our commitment to ethical values, to strong and effective operations and to assuring continued growth and financial stability for our stockholders.

The corporate governance section on our website contains copies of our principal governance documents. It is found at www.babcock.com at “Investors — Corporate Governance — Governance Documents” and contains the following documents:

Amended and Restated Bylaws

Corporate Governance Principles

Code of Business Conduct

Code of Ethics for Chief Executive Officer and Senior Financial Officers

Audit and Finance Committee Charter

Compensation Committee Charter

Governance Committee Charter

Conflict Minerals Policy

Related Party Transactions Policy

Modern Slavery Transparency Statement

Director Independence

The New York Stock Exchange (“NYSE”) listing standards require the Board to consist of at least a majority of independent directors, and our Corporate Governance Principles require the Board to consist of at least 66% independent directors who satisfy all NYSE listing standards for independence other than Section 303A.02(b)(iv) of the NYSE listed company manual. For a director to be considered independent, the Board must determine that the director does not have any direct or indirect material relationship with us. The Board has established categorical standards, which conform to the independence requirements in the NYSE listing standards, to assist it in determining director independence. These standards are contained in the Corporate Governance Principles found on our website at www.babcock.com under “Investors — Corporate Governance — Governance Documents.”

6

Based on these independence standards, the Board has determined that the following directors are independent and meet our categorical standards:

| Alan B. Howe | Rebecca Stahl |

| Philip D. Moeller | Joseph A. Tato |

Effective September 2, 2020, Matthew E. Avril, Cynthia S. Dubin, Brian R. Kahn, Bryant R. Riley and Kenneth M. Siegel resigned as directors. The Board previously determined that Matthew E. Avril, Cynthia S. Dubin, and Kenneth M. Siegel were independent and met our categorical standards during the applicable periods that they served in 2020.

In determining the independence of the directors, the Board considered transactions between us and other entities with which each of our directors are associated. Those transactions are described below, as well as the related party transactions discussed elsewhere in this Annual Report on Form 10-K. None of these transactions was determined to constitute a material relationship with us with respect to any director held to be independent. Vintage designated Mr. Bartoli to serve on the Board, and B. Riley designated Mr. Howe to serve on the Board pursuant to the Investor Rights Agreement. Vintage and B. Riley are significant stockholders. B. Riley is also a significant lender to us and has also entered into a consulting agreement with us in connection with Mr. Young's appointment as our Chief Executive Officer.

Board Function, Leadership Structure and Executive Sessions

The Board oversees, counsels and directs management in the long-term interest of us and our stockholders. The Board’s responsibilities include:

| · | overseeing the conduct of our business and assessing our business and enterprise risks; |

| · | reviewing and approving our key financial objectives, strategic and operating plans, and other significant actions; |

| · | overseeing the processes for maintaining the integrity of our financial statements and other public disclosures, and our compliance with law and ethics; | |

| · | evaluating CEO and senior management performance and determining executive compensation; |

| · | planning for CEO succession and monitoring management’s succession planning for other key executive officers; and |

| · | establishing our governance structure, including appropriate board composition and planning for board succession. |

The Board does not have a policy requiring either that the positions of Chairman and Chief Executive Officer should be separate or that they should be occupied by the same individual. The Board believes that this issue is properly addressed as part of the succession planning process and that it is in our best interests for the Board to make a determination on these matters when it elects a new Chief Executive Officer or Chairman of the Board or at other times consideration is warranted by circumstances. We currently have Mr. Young serving as our Chief Executive Officer and as our Chairman.

Pursuant to our Corporate Governance Principles, in the event the Chairman of the Board is not an independent director, the independent directors will annually appoint a Lead Independent Director with such responsibilities as the Board shall determine from time to time. If appointed, the Lead Independent Director has the following responsibilities:

| · | presides over all Board meetings at which the Chairman of the Board is not present and all executive sessions attended only by independent directors; |

| · | serves as liaison between the independent directors and the Chairman of the Board and Chief Executive Officer (including advising the Chairman of the Board and Chief Executive Officer of discussions held during executive sessions of the non-employee and independent directors, as appropriate); |

| · | reviews and approves the Board meeting agendas and meeting schedules to assure that there is sufficient time for discussion of all agenda items; |

| · | advises the Chairman of the Board and Chief Executive Officer regarding the quality, quantity and timeliness of information sent by management to the directors; |

| · | has the authority to call meetings of the independent directors; and |

| · | if requested by major stockholders, ensures that he or she is available for consultation and direct communication. |

7

Because the Chairman is not an independent director, the Board has designated Mr. Howe as Lead Independent Director. The Board believes that this leadership structure is appropriate for us at this time because it provides our Chairman with the readily available resources to manage the affairs of the Board. Our Chairman and Chief Executive Officer ensure that the views of the Board are taken into account as management carries out the business of the Company and vice-versa. Our independent directors, led by our Lead Independent Director, retain the opportunity to meet in executive session without management at the conclusion of each regularly scheduled Board meeting.

Director Nomination Process

Our Governance Committee is responsible for assessing the qualifications, skills and characteristics of candidates for election to the Board. The Board, after taking into account the assessment provided by our Governance Committee, is responsible for considering and recommending to stockholders the nominees for election as directors at each annual meeting. In making their assessments, the Governance Committee and the Board generally consider a number of factors, including each candidate’s:

| · | professional and personal experiences and expertise in relation to (1) our businesses and industries, and (2) the experiences and expertise of other Board members; |

| · | integrity and ethics in his or her personal and professional life; |

| · | professional accomplishment in his or her field; |

| · | personal, financial or professional interests in any competitor, customer or supplier of ours; |

| · | preparedness to participate fully in Board activities and to devote sufficient time to carry out the duties as a director on the Board, including active membership on Board committees as requested and attendance at, and active participation in, meetings of the Board and the committee(s) of which he or she is a member, and a lack of other personal or professional commitments that would, in the Governance Committee’s sole judgment, interfere with or limit his or her ability to do so; |

| · | ability to contribute positively to the Board and any of its committees; |

| · | whether the candidate meets the independence requirements applicable to the Board and its committees established by the NYSE and the SEC; |

| · | whether the candidate meets our Corporate Governance Principles, including the independence requirements set forth therein; and |

| · | all other information deemed relevant in the Governance Committee’s and the Board’s, as applicable, business judgment impacting the candidate’s service as a member of the Board and any of its committees, including a candidate’s professional and educational background, reputation, industry knowledge and business experience. |

While the Board does not have a specific policy regarding diversity among directors, both the Governance Committee and the Board recognize the benefits of a diverse board and believe that any evaluation of potential director candidates should consider diversity as to gender, racial and ethnic background, age, cultural background, education, viewpoint and personal and professional experiences.

Our Governance Committee takes these same factors into account when assessing the performance and skills of an incumbent director being nominated for re-election. In the case of an incumbent director being nominated for re-election to the Board, our Governance Committee also considers the incumbent director’s attendance at meetings, contributions to the Board and its committees during and in between regularly scheduled meetings (as well as part of any working groups formed to assist management with strategic or other priorities), the contributions of the incumbent director based on the Board’s self-evaluation processes described below and the benefits associated with the institutional knowledge derived from the incumbent director’s prior service on the Board.

To help ensure the ability to devote sufficient time to board matters, no director may serve on the board of more than three other public companies while continuing to serve on the Board, and no director that serves as an executive officer of the Company may serve on the board of more than one other public company while continuing to serve on the Board. The Board is authorized to grant exceptions to these rules on a case-by-case basis.

8

Our bylaws provide that (1) a person will not be nominated for election or re-election to the Board if such person will have attained the age of 75 prior to the date of election or re-election and (2) any director who attains the age of 75 during his or her term will be deemed to have resigned and retired at the first annual meeting following his or her attainment of the age of 75. Accordingly, a director nominee may stand for election if he or she has not attained the age of 75 prior to the date of election or re-election.

When the need for a new director arises (whether because of a newly created seat or vacancy), the Governance Committee and the Board proceed to identify a qualified candidate or candidates and to evaluate the qualifications of each candidate identified. Our Governance Committee and the Board generally solicit ideas for possible candidates from a number of sources — including members of the Board, our Chief Executive Officer and other senior-level executive officers, significant stockholders, individuals personally known to the members of the Board and independent director candidate search firms. Final candidates are generally interviewed by one or more members of our Governance Committee or other members of the Board before a decision is made. Ms. Stahl and Messrs. Bartoli, Moeller, Tato and Young, who were appointed to the Board in September 2020, were recommended to the Board. Mr. Bartoli resigned from the Board in 2020 and subsequently re-joined the Board later in 2020, solely to ensure that at least 66% of our Board remained independent at all times in 2020, as required by our Corporate Governance Principles. Absent Mr. Bartoli’s temporary resignation, the Company would have been required to expand temporarily the Board by at least two additional members during the same temporary period.

In addition, any stockholder may nominate one or more persons for election as one of our directors at an annual meeting of stockholders if the stockholder complies with the notice, information and consent provisions contained in our bylaws. Stockholder nominees are evaluated under the same standards as other candidates for board membership described above. In evaluating stockholder nominees, our Governance Committee and the Board may consider any other information they deem relevant, including (i) whether there are or will be any vacancies on the Board, (ii) the size of the nominating stockholder’s ownership of our debt and equity interests, (iii) the length of time such stockholder has owned such interest and (iv) any statements by the nominee or the stockholder regarding proposed changes in our operation.

Our bylaws provide for a plurality voting standard for directors, but each nominee for director is required to sign an irrevocable contingent resignation letter. If a nominee for director in an uncontested election does not receive a majority of the votes cast “FOR” his or her election (not counting any abstentions or broker non-votes as being cast), the Board will act on an expedited basis to determine whether to accept the resignation.

Communication with the Board

Our stockholders or other interested persons may communicate directly with the Board or its independent members. Written communications to the independent members of the Board can be sent to the following: Board of Directors (independent members), c/o Babcock & Wilcox Enterprises, Inc., Corporate Secretary’s Office, 1200 East Market Street, Suite 650, Akron, Ohio 44305. All such communications are forwarded to the independent directors for their review, except for communications that (1) contain material that is not appropriate for review by the Board based upon our bylaws and the established practice and procedure of the Board, or (2) contain improper or immaterial information. Information regarding this process is posted on our website at www.babcock.com under “Investors — Corporate Governance — Governance Documents.”

Board Orientation and Continuing Education

Each new director participates in an onboarding and orientation program developed and implemented with the oversight of the Governance Committee. This orientation includes information to familiarize new directors with the Company’s governance requirements, the structure and procedures of the Board and its committees on which the new director will serve, the Company’s industry, management structure, and significant operational, financial, accounting, risk management and legal issues, compliance programs, Code of Business Conduct, principal officers and internal and independent auditors. All directors are welcome to attend any of these orientation programs.

Directors are also required to participate in Company-sponsored and external continuing education programs at least once every two years. These programs are intended to help directors stay current on, among other topics, corporate governance and boardroom best practices, financial reporting practices, ethical issues confronting directors and management, and other similar matters. The Board believes it is appropriate for directors, at their discretion, to have access to educational programs related to their duties as directors on an ongoing basis to enable them to better perform their duties and to recognize and deal appropriately with issues as they arise. The Company provides appropriate funding for any such program in which a director participates.

9

Board Self-Evaluation Process

The Board and each of its committees conducts an annual evaluation, which includes a qualitative assessment by each director of the performance of the Board and each committee on which he or she serves. The Governance Committee oversees this evaluation and solicits comments from all directors. Each committee’s chairperson summarizes and reviews the responses with the members of his or her respective committees. Each committee chairperson then reports to the Board with an assessment of the performance of his or her respective committees as well as any suggestions for improvement. The chairperson of the Governance Committee summarizes and reviews with the Board the evaluation results for the Board.

The Role of the Board in Succession Planning

The Board believes effective succession planning, particularly for the Chief Executive Officer, is important to the continued success of the Company. As a result, the Board periodically reviews and discusses succession planning with the Chief Executive Officer during executive sessions of Board meetings. The Compensation Committee assists the Board in the area of succession planning by reviewing and assessing the management succession planning process and reporting to the Board with respect to succession planning for the Chief Executive Officer and our other executive officers.

The Role of the Board in Risk Oversight

As part of its oversight function, the Board monitors various risks that we face. We maintain an enterprise risk management program that facilitates the process of reviewing key external, strategic, operational (e.g., cyber security) and financial risks, as well as monitoring the effectiveness of risk mitigation. Information on the enterprise risk management program is presented to senior management and the Board. The Audit and Finance Committee assists the Board in fulfilling its oversight responsibility for financial reporting and meets as necessary (and in any event at least quarterly) with management to review material financial risk exposures. The Audit and Finance Committee also meets at least annually to review reports from management regarding all material risk exposures and to assess the steps taken by management to monitor and control these exposures. The Audit and Finance Committee presents its assessment of these risks and management’s mitigation initiatives, along with any recommendations, to the Board.

The Compensation Committee also assists the Board with this function by meeting as necessary with management to review and discuss the significant risks impacting our company that potentially affect executive compensation in a material way. The Compensation Committee assesses whether and how assess these risks as part of our compensation programs in consultation with management and its outside compensation consultant, as more fully described in “Compensation Discussion and Analysis — Compensation Philosophy and Process.”

Board of Directors and Its Committees

The Board met 20 times during 2020. All directors attended 75% or more of the meetings of the Board and of the committees on which they served during their respective periods of service in 2020. Ms. Dubin and Messrs. Avril, Siegel, Kahn and Riley resigned as members of the Board in September 2020 and Ms. Stahl and Messrs. Moeller, Tato and Young joined as members of the Board in September 2020. Mr. Bartoli resigned from the Board in April 2020 and subsequently re-joined the Board in September 2020. Directors are encouraged to make all reasonable efforts to attend the Annual Meeting. With the exception of Mr. Avril, all of our then-directors attended our 2020 annual meeting on June 15, 2020.

The Board currently has, and appoints the members of, standing Audit and Finance, Compensation and Governance Committees. Each of those committees has a written charter approved by the Board. The current charter for each standing Board committee is posted on our website at www.babcock.com under “Investors — Corporate Governance — Governance Documents.”

The current members of the committees are identified below. NYSE listing standards require that all members of our Audit and Finance, Compensation and Governance Committees be independent. The Board has affirmatively determined that each member of such committees is independent in accordance with the NYSE listing standards.

10

Committee Composition:

| Committee Member | Audit & Finance | Compensation | Governance | |||

| Henry E. Bartoli | ||||||

| Alan B. Howe | Member | Chair | Member | |||

| Philip D. Moeller | Member | Member | ||||

| Rebecca Stahl | Chair | Member | ||||

| Joseph A. Tato | Member | Chair | ||||

| Kenneth M. Young |

Audit and Finance Committee:

Ms. Stahl (Chair)

Mr. Howe

Mr. Tato

The Audit and Finance Committee met 13 times during 2020. The Audit and Finance Committee’s role is financial oversight. Our management is responsible for preparing financial statements, and our independent registered public accounting firm is responsible for auditing those financial statements.

The Audit and Finance Committee is directly responsible for the appointment, compensation, retention and oversight of our independent registered public accounting firm. The committee, among other things, also reviews and discusses our audited financial statements with management and the independent registered public accounting firm. The Audit and Finance Committee provides oversight of: (1) our financial reporting process and internal control system; (2) the integrity of our financial statements; (3) our compliance with legal and regulatory requirements; (4) the independence, qualifications and performance of our independent auditors; (5) the performance of our internal audit function; and (6) our financial structure and strategy. The Audit and Finance Committee also has oversight of the Company’s ethics and compliance program and receives regular reports on program effectiveness.

The Board has determined that Mr. Howe, Ms. Stahl and Mr. Tato qualify as “audit committee financial experts” within the definition established by the Securities and Exchange Commission (“SEC”). For more information on the backgrounds of these directors, see their biographical information under “Information Regarding Directors and Director Nominees.”

Compensation Committee:

Mr. Howe (Chair)

Mr. Moeller

Ms. Stahl

The Compensation Committee met 10 times during 2020. The Compensation Committee has overall responsibility for our executive and non-employee director compensation plans, policies and programs including our executive and management incentive compensation plans and our Amended and Restated 2015 Long-Term Incentive Plan (the “2015 LTIP”).

The Compensation Committee has the authority to retain, terminate, compensate and oversee any compensation consultant or other advisors to assist the committee in the discharge of its responsibilities. The Compensation Committee may form and delegate authority to subcommittees consisting of one or more independent directors as the Compensation Committee deems appropriate. See the “Compensation Discussion and Analysis – Compensation Philosophy and Process” and “Compensation Discussion and Analysis – Key 2020 Compensation Decisions” sections of this Annual Report on Form 10-K for information about our 2020 named executive officers (“NEOs”) compensation, including a discussion of the role of management and the compensation consultant.

11

Compensation Committee Interlocks and Insider Participation

No director who served as a member of the Compensation Committee during the year ended December 31, 2020 (Messrs. Avril, Howe, Kahn, Siegel and Tato, and Ms. Stahl) (1) was during such year, or had previously been, an officer or employee of the Company or any of its subsidiaries, or (2) other than transactions in the ordinary course, had any material interest in a transaction of the Company or a business relationship with, or any indebtedness to, the Company. None of our executive officers have served as members of a compensation committee (or other board committee performing equivalent functions) or the board of directors of any other entity that has an executive officer serving as a member of the Board.

Governance Committee:

Mr. Tato (Chair)

Mr. Howe

Mr. Moeller

The Governance Committee met five times during 2020. This committee, in addition to other matters, has overall responsibility to (1) establish and assess director qualifications; (2) recommend nominees for election to the Board; and (3) oversee the annual evaluation of the Board and management, including the Chief Executive Officer in conjunction with our Compensation Committee. This committee will consider individuals recommended by stockholders for nomination as directors in accordance with the procedures described under “Stockholders’ Proposals.” This committee also assists the Board with management succession planning and director and officer insurance coverage.

Item 11. Executive Compensation

COMPENSATION DISCUSSION AND ANALYSIS

Table of Contents

| · | Executive Summary |

| · | We are Committed to Compensation Best Practices |

| · | Compensation Philosophy and Process |

| · | Key 2020 Compensation Decisions |

| · | Other Compensation Practices and Policies |

Executive Summary

2020 Performance

Our results for the full year 2020 reflect the ongoing positive impact of our strategic actions, cost savings initiatives, and strong management and operational effectiveness, despite the impacts of COVID-19 across our segments. Our actions in 2020 and year-to-date, which have included launching new segments, expanding internationally, implementing additional cost savings initiatives, and most recently closing successful common stock and senior notes offerings, have provided a strong foundation for the continued execution of our growth strategy.

Full year 2020 GAAP net income was a loss of $10.3 million, an improvement of $111.7 million compared to a loss of $122.0 million in 2019. Adjusted EBITDA improved to $45.1 million compared to $45.0 million in 2019. Total bookings in 2020 were $645.0 million, and backlog at December 31, 2020 was $535.0 million, a 21.3% increase in backlog. compared to December 31, 2019. Additional information regarding adjusted EBITDA, a non-GAAP financial measure, can be found in Appendix A.

Consolidated revenues in 2020 were $566.3 million, down 34% compared to 2019. Revenues in all segments were adversely impacted by COVID-19, including the postponement and delay of several projects. Full year GAAP operating loss in 2020 was $1.7 million, inclusive of an insurance loss recovery of $26.0 million offset by restructuring and settlement costs and advisory fees of $24.7 million, compared to an operating loss of $29.4 million in 2019. The improvement in operating loss was primarily due to the insurance loss recovery, the positive impact of cost savings initiatives and a lower level of losses on the EPC loss contracts, partially offset by the 2019 divestiture of Loibl and the impacts of COVID-19 on revenue in all three segments.

12

We have continued to identify and implement cost-savings initiatives. In addition to the $119 million of cost savings initiatives previously disclosed, we implemented approximately $8 million of additional cost savings initiatives in 2020, for a total of $127 million, and have identified another $11 million of cost savings actions expected to be implemented beginning in the first quarter of 2021.

Our recent common stock and senior notes offerings resulted in net proceeds of approximately $283 million after deducting underwriting discounts and commissions, but before expenses, and significantly reduced our secured debt and future cash interest payments. Combined with a reduction in our required pension contributions, we expect to save more than $40 million annually in cash expenses on a pro-forma basis, while also providing capital to support the expansion of our clean energy technologies portfolio as we continue to pursue more than $5 billion of identified pipeline opportunities over the next three years, in addition to our high-margin parts and services business. Looking forward, we remain focused on growing our B&W Renewable and B&W Environmental segments, including deploying our waste-to-energy and carbon capture technologies to help meet the increasing global demand for carbon and methane reductions. The next-generation B&W is positioned to power the global energy and environmental transformation.

2020 PAY-FOR-PERFORMANCE

Our executive compensation programs are based on a strong alignment between pay and performance, and this is reflected in the payout amounts under our annual incentive program and the value of earned awards granted under our long-term incentive program. Decisions by the Compensation Committee of the Board, which we refer to in this discussion as the “Compensation Committee,” in 2020 also took into account prior feedback from our stockholders and concern for retention of key personnel while we address operational issues.

We again did not perform as expected in 2020. For the third year in a row, no payment was earned under the financial component of the annual cash incentive program. See “2020 Summary Compensation Table” for a comparison of the total compensation received by our NEOs in 2020 versus 2019 and 2018, as applicable. We also determined in 2020 that the financial performance goals (relative total stockholder return, earnings per share and return on invested capital) for the 2017-2019 performance period used to determine vesting of certain long-term incentive awards we granted in 2017 had not been met and, accordingly, those 2017 awards terminated without vesting.

For our 2020 equity program, in order to provide additional incentives to create value for our stockholders, we made grants of PSUs that would vest based on achievement a specific closing share price which was a significant increase over the stock price at the time of grant. See “Equity Incentive Awards” below.

MANAGEMENT OVERVIEW

Compensation decisions for our NEOs are made by the Compensation Committee. Key features of our executive compensation program for the NEOs are outlined in this “Compensation Discussion and Analysis”.

During 2020, we saw turnover in our executive team, as outlined below:

| · | Officer Transitions: Effective January 31, 2020, Robert P. McKinney, stepped down as our Senior Vice President, General Counsel and Corporate Secretary. Effective September 11, 2020, Dwyane M. Petish, stepped down as Corporate Treasurer. Effective December 31, 2020, Henry E. Bartoli resigned as Chief Strategy Officer. |

13

The following five NEOs were still serving as our executive officers as of December 31, 2020.

| NAME | TITLE (AS OF LAST DAY OF 2019) | |

| Kenneth M. Young | Chief Executive Officer | |

| Louis Salamone | Chief Financial Officer | |

| John J. Dziewisz | Senior Vice President & Corporate Secretary | |

| Robert M. Caruso* | Chief Implementation Officer | |

| Jimmy B. Morgan | Chief Operating Officer |

* Mr. Caruso stepped down as our Chief Implementation Officer effective March 4, 2021.

THIRD-PARTY COMPENSATION ARRANGEMENTS

We are party to contractual arrangements with third parties with respect to the services of Messrs. Young and Caruso.

While serving as our Chief Executive Officer, Mr. Young continues to receive his salary and benefits from B. Riley Financial, Inc. and its affiliates. Pursuant to a consulting agreement between us and an affiliate of B. Riley Financial, Inc. (the “B. Riley Affiliate”), we paid the B. Riley Affiliate $62,500 per month in return for Mr. Young’s services as Chief Executive Officer during 2020. In 2020 we granted Mr. Young RSUs and PSUs that are further described below. In addition, we provided commuting expenses to Mr. Young for travel between his home in Washington DC and our corporate headquarters in Akron, OH.

Mr. Caruso has served as a Managing Director with Alvarez & Marsal since September 2006. Pursuant to an existing professional services agreement between us and Alvarez & Marsal, Mr. Caruso received a salary and benefits from Alvarez & Marsal for 2020. In connection with Mr. Caruso’s service as Chief Implementation Officer of the Company, we paid Alvarez & Marsal an additional $1,000 per hour subject to a maximum of $150,000 per month under the professional services agreement. If, at the end of the month, actual fees incurred for Mr. Caruso’s services exceed $150,000, such excess (up to a maximum of $75,000 per month) will be reserved and applied to any future month in which the actual fees for Mr. Caruso’s services do not reach $150,000. In addition, we will pay Alvarez & Marsal additional incentive fees, including a $500,000 incentive fee upon the closing of certain refinancing transactions with respect to our credit facilities and a fee equal to 5% of annualized cost-savings initiated by Mr. Caruso. We also retain Alvarez & Marsal for other professional services not directly related to the services of Mr. Caruso.

2020 SAY-ON-PAY VOTE

At our 2020 annual meeting, we received roughly 77% approval on our advisory vote to approve NEO compensation. We considered this in general as an affirmation that our stockholders support our executive compensation program, but we hope to achieve higher levels of support in future votes and intend to continue our efforts to engage with our stockholders for their views on our compensation programs.

WE HAVE ENGAGED WITH OUR STOCKHOLDERS

Our board of directors contains two individuals designated to the board by our two largest stockholders, Vintage and B. Riley. Each of Vintage and B. Riley has designated one of the six directors serving on the Board, with Mr. Bartoli being nominated by Vintage and Mr. Howe being nominated by B. Riley. These directors provide valuable ongoing feedback on behalf of Vintage and B. Riley, respectively, feedback we believe is consistent with the views held by a number of our other stockholders on the best ways to align our executive compensation program and strategies to strengthen the Company and better position us for success. Generally, these investors have supported our executive compensation program goals, encouraged us to focus on paying for demonstrable performance, and asked that we carefully consider eliminating our classified board structure.

2020 COMPENSATION PROGRAM DESIGN

The Compensation Committee took the following key actions with respect to the 2020 executive compensation program design, each as further described below:

| · | modified the annual cash incentive program by aligning of the annual cash incentives to the achievement of adjusted EBITDA and Company bookings as well as Company refinancing and rebranding, which we believe motivates our executives to maximize our operational performance, and, consequently, stockholder value; |

| · | providing an annual cash incentive program for all NEOs except Mr. Caruso to properly motivate these executives, in particular, to improve our financial performance as measured with respect to adjusted EBITDA; |

| · | modified our compensation practices with respect to long-term equity compensation by transitioning away from stock options and making equity grants in 2020 in the form of time-based restricted stock units (“RSUs”) and performance-based restricted stock units (“PSUs”) which align the interests of our executives with our stockholders and enhances our ability to retain our executives; |

| · | reviewed and approved certain changes to the Compensation Committee Charter. |

14

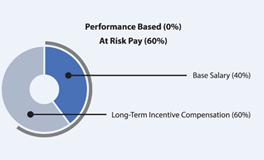

2020 COMPENSATION MIX

The following charts illustrate the target mix of base salary, annual incentive awards and equity incentive awards (based on the grant date fair value of the award as determined for accounting purposes) for Mr. Young and our other NEOs who were serving as executive officers as of the end of 2020 (other than Mr. Caruso who is compensated pursuant to a consulting agreement as described above), highlighting the performance-driven focus of the compensation opportunities:

2020 Target Total Direct Compensation

| Mr. Young, Chief Executive Officer(1) | Other NEOs | |

|  |

| (1) | Mr. Young serves as chief executive officer pursuant to a third-party consulting agreement with the B. Riley Affiliate. Base salary is payable to the B. Riley Affiliate. Long-term incentive compensation is payable directly to Mr. Young. |

KEY 2020 PROGRAM ELEMENTS

The main elements of our 2020 executive compensation program, a description of each element, and an explanation as to why we pay each element, are provided below (although not all NEOs received some or all of these compensation elements, as discussed above):

| Compensation Element | Description | Objectives | ||

| Base Salary | Fixed cash compensation; reviewed annually and subject to adjustment | Attract, retain and motivate the NEO | ||

| Annual Cash Incentive Compensation | Short-term cash incentive compensation paid based on performance against annually established financial performance goals | Reward and motivate the NEO for achieving key short-term performance objectives | ||

| Long-Term Equity Compensation | Annual equity compensation awards of restricted stock units and performance-based restricted stock units | Align NEO interests with those of our stockholders by rewarding the creation of long-term stockholder value and encouraging stock ownership | ||

| Health, Welfare and Retirement Benefits | Qualified retirement plans and health care and insurance | Attract and retain the NEO by providing market-competitive benefits | ||

| Severance and Change in Control Arrangements | Reasonable severance payments and benefits provided upon an involuntary termination, including an involuntary termination following a change in control of the Company | Help attract and retain high quality talent by providing market-competitive severance protection, and help encourage the NEO to direct his or her attention to stockholders’ interests, notwithstanding the potential for loss of employment in connection with a change in control | ||

| Limited Perquisites | Airline club memberships and commuting expenses to including transportation and lodging | Attract and retain high quality talent |

15

We Are Committed to Compensation Best Practices

The Compensation Committee believes that our executive compensation program follows best practices aligned to stockholder interests, summarized below:

| WHAT WE DO | WHAT WE DON’T DO | |

| Pay-for-performance philosophy emphasizes compensation tied to creation of stockholder value, with a significant portion of NEOs’ overall compensation tied to our performance | No excise tax gross-ups upon a change in control | |

| Robust compensation governance practices, including annual CEO performance evaluation process by independent directors, thorough process for setting rigorous performance goals, compensation committee comprised solely of independent directors and use of an independent compensation consultant | No discounting, reloading or re-pricing of stock options without stockholder approval | |

| Limited perquisites and reasonable severance and change in control protection that requires involuntary termination | ||

| Mix of short-term and long-term incentives | No guaranteed incentive awards for executives | |

| Clawback provisions in annual and equity incentive compensation plans | ||

| Policies prohibiting executives from hedging or pledging our stock | No “single trigger” change in control acceleration of equity awards or severance payments | |

| Strong stock ownership guidelines for executives (five times base salary for CEO and three times base salary for other NEOs) |

||

| Annual say-on-pay vote to approve compensation paid to our NEOs. | ||

| Annual say-on-pay vote to approve compensation paid to our NEOs. |

OUR COMPENSATION PHILOSOPHY

We emphasize pay-for-performance, rewarding those who achieve or exceed their goals, and we use annual cash incentives and equity incentives to drive for strong results for our stockholders.

Our compensation program is designed to:

| · | Incent and reward annual and long-term performance; |

| · | Set rigorous, but motivating goals; |

| · | Align interests of our executives with our stockholders; and |

| · | Attract and retain well-qualified executives. |

The Compensation Committee generally works with management to help ensure the compensation program aligns with industry standards and has a balanced design that will achieve the desired objectives.

The roles and the responsibilities of the Compensation Committee, management and our independent compensation consultant for 2020 are summarized here.

Compensation Committee (Three Independent Directors)

| · | Established and implemented our executive compensation philosophy; |

| · | Aimed to ensure the total compensation paid to our NEOs was fair and competitive, and motivated high performance; and |

| · | Subscribed to a “pay-for-performance” philosophy when designing executive compensation programs that intended generally to place a substantial portion of each executive’s target compensation “at risk” and make it performance-based, where the value of one or more elements of compensation was tied to the achievement of financial or other measures we considered important drivers in the creation of stockholder value. |

B&W Management

| · | Prepared information and materials for the Compensation Committee relevant to matters under consideration by the Compensation Committee; |

| · | Messrs. Young and Salamone each provided recommendations regarding compensation of certain of the other NEOs (Messrs. Morgan, Dziewisz and Caruso); and |

| · | Messrs. Young and Salamone and senior human resources personnel attended Compensation Committee meetings and, as requested by the Compensation Committee, participated in deliberations on executive compensation (other than their own). |

16

Consultant to our Compensation Committee

In 2020, we hired Willis Towers Watson (WTW) as an independent compensation consultant to:

| · | Provide the Compensation Committee with information and advice on the design and structure of executive and director compensation; |

| · | Review market survey and proxy compensation data for comparative market analysis; |

| · | Advise the Compensation Committee on external market factors and evolving compensation trends; and |

| · | Provide the Company assistance with regulatory compliance and changes regarding compensation matters. |

During 2020, WTW did not perform work for the Company other than pursuant to its engagement by the Compensation Committee therefore the engagement of WTW does not raise any conflict of interest with the Company or any of its directors or executive officers.

Plan Design and Risk Management

We subscribe to a “pay-for-performance” philosophy. As such:

| · | Incentive Compensation Tied to Performance – Generally, our participating NEOs’ annual cash incentive compensation is “at risk,” with the value tied to the achievement of financial and other measures we consider important drivers of stockholder value. For 2020, equity incentive awards were granted in the form of time-based RSUs and PSUs which would vest only if we achieve a $7 or higher closing stock price, which we believe aligns management’s interests with our shareholders’ interests and provides incentives for long-term value creation. |

| · | Equity Incentive Compensation Subject to Forfeiture for Certain Acts — The Compensation Committee may generally terminate outstanding equity awards if the recipient (1) is convicted of a misdemeanor involving fraud, dishonesty or moral turpitude or a felony, or (2) engages in conduct that adversely affects or may reasonably be expected to adversely affect the business reputation or economic interests of the Company. |

| · | Annual and Equity Compensation Subject to Clawbacks — Incentive compensation awards include provisions allowing us to recover excess amounts paid to individuals who knowingly engaged in a fraud resulting in a restatement. |

| · | Use of Appropriate Performance Measures — Our annual incentive program was based on adjusted EBITDA to align with the way we and our investors generally measure our profitability. |

| · | Stock Ownership Guidelines — Our executive officers and directors are subject to stock ownership guidelines, which help to promote longer-term perspectives and align the interests of our executive officers and directors with those of our stockholders. |

The Compensation Committee reviewed the risks and rewards associated with our compensation programs. The programs were designed with features that mitigate risk without diminishing the incentive nature of the compensation. We believe our compensation programs encourage and reward prudent business judgment and appropriate risk-taking over the short term and the long term. Management and the Compensation Committee do not believe any of our compensation policies and practices create risks that are reasonably likely to have a material adverse effect on us.

Key 2020 Compensation Decisions

BASE SALARIES

The Compensation Committee believes that the payment of a competitive base salary is a necessary element of any compensation program. Base salary levels also affect short-term cash incentive compensation because each NEO’s target opportunity is expressed as a percentage of base salary.

In setting base salaries, the Compensation Committee considers, among other things, comparability to compensation practices and compensation data from companies with whom we compete for executive talent from the engineering and construction, aerospace and defense, heavy electrical equipment and industrial machinery industries, our financial resources, our contractual obligations to our NEO’s and certain third party service providers, as well as the level of experience and expertise of individuals. No particular weight is assigned to any individual item.

The Compensation Committee increased Mr. Morgan’s salary to $500,000 per year effective April 1, 2020, in recognition of the scope of Mr. Morgan’s responsibilities as the newly named Chief Operating Officer.

On January 1, 2020, the Compensation Committee increased Mr. Dziewisz’s salary to $325,000 in connection with being named Senior Vice President and Corporate Secretary of the Company, and General Counsel of The Babcock & Wilcox Company. Mr. Dziewisz’s salary was once more increased on November 15, 2020 to $365,000 in recognition of his taking on increased responsibilities which allowed the Company to reduce its reliance on outside firms for certain aspects of reporting.

17

The following table shows the 2020 annual base salary approved by the Compensation Committee for each of the NEOs.

| NAME | ANNUAL BASE SALARY AS DECEMBER 31, 2020 | ANNUAL BASE SALARY AS OF DECEMBER 31, 2019 | PERCENTAGE INCREASE | |||||||||

| Louis Salamone Jr. | $ | 475,000 | $ | 475,000 | — | |||||||

| Jimmy B. Morgan | $ | 500,000 | $ | 475,000 | 5.26 | % | ||||||

| John J. Dziewisz | $ | 365,000 | $ | 252,500 | 44.55 | % | ||||||

As discussed above, Mr. Young continued to receive his annual salary from B. Riley Financial, Inc., and Mr. Caruso was paid his annual salary by Alvarez & Marsal, while we paid compensation with respect to these individuals pursuant to third-party arrangements.

ANNUAL CASH INCENTIVES

The Compensation Committee believes that providing an annual cash incentive opportunity is a necessary element of any compensation program, which motivates management to achieve thoughtfully determined strategic objectives, including financial performance objectives.

Executives such as Mr. Caruso, who serve us as consultants through third party relationships are not generally invited to participate in the annual cash incentives provided to our employee-executives. In addition, executives who serve on our board of directors, such as Mr. Bartoli are also not considered eligible for annual cash incentives. As described below, the Compensation Committee did establish an annual cash incentive opportunity for Mr. Young, despite Mr. Young’s consultancy arrangement with us.

2020 Executive Cash Incentive Plan

For 2020, we provided participating NEOs with a performance bonus opportunity called the Executive Cash Incentive Plan (the “2020 ECIP”) that challenged them to enhance Company performance with respect to adjusted EBITDA and Company bookings as well as Company refinancing and rebranding. The Committee structured 100% of their incentive opportunities based on the achievement of these initiatives.

Target Awards. Each participating NEO had a target annual incentive award. The target award amounts were established by the Compensation Committee taking into account each participating NEO’s experience, role and scope of duties.

All NEOs except Mr. Caruso were participants in the 2020 ECIP.

2020 Performance Bonus Payout. As described in more detail below, based on our 2020 performance, no payments were made under the 2020 ECIP.

2020 ECIP Design. The Compensation Committee determined that, in order to better align our executives’ interests with those of our investors with respect to enhanced financial performance and to align our compensation regime with investor communications and internal management of our business, the awards under the 2020 ECIP would be based on adjusted EBITDA, a booking target, completion of the Company’s refinancing and the overall rebranding of the Company. There were no specific weights given to any of the measures since all goals needed to be met in order for a payout to occur.

For purpose of the 2020 performance bonus adjusted EBITDA meant our adjusted earnings before interest, taxes, depreciation and amortization. In order for these measures to reflect core operating results, the Compensation Committee determined that adjusted EBITDA be calculated according to generally accepted accounting principles but should be adjusted for the following items: (1) acquisition, disposition and divestiture costs; (2) restructuring expenses (including termination costs and advisor fees); (3) expenses associated with the spin-off; (4) pension mark-to market adjustments; (5) acquisition related amortization; (6) losses from divestitures; (7) impairments of tangible and intangible assets; (8) losses in respect of legal proceedings and dispute resolutions; (9) changes in accounting policies/standards and tax regulations; and (10) foreign exchange impacts recorded in “Other Income.” Adjusted EBITDA excludes the results of our EPC subsidiary. These adjustments allowed for changing business strategies, fostered consistency in the incentive plan, facilitated flexibility in assessing goal attainment, and promoted objective business decision making.

The Compensation Committee believes that our forecasting process produces rigorous goals that are reasonably achievable if the businesses perform as expected. As a result, the Compensation Committee set the target level of performance based on forecast.

The Compensation Committee established the following goals for the 2020 ECIP.

| · | Adjusted EBITDA of $20M |

| · | Company bookings of $500M |

| · | Completion of Company refinancing |

| · | Completion of Company rebranding |

18

In early 2021, our Compensation Committee reviewed the 2020 financial performance results and determined that for purposes of our 2020 ECIP, our adjusted EBITDA was $19.1 million. Accordingly, we did not achieve the adjusted EBITDA goal, and as a result, the 2020 ECIP payout percentage was determined to be 0% for all participants.

LONG-TERM CASH INCENTIVE AWARDS

On September 11, 2020, the Compensation Committee approved and established a long-term cash incentive structure for certain eligible employees including all of the NEOs. The long-term cash incentive awards are to incentivize growth in our adjusted EBITDA over the next two years. Each recipient of a long-term cash incentive award has a bonus opportunity based 50% on our adjusted EBITDA for 2021 and 50% on our adjusted EBITDA for 2022. To the extent a award recipient is eligible for a bonus based on our adjusted EBITDA for 2021 or 2022 and except as the Compensation Committee may otherwise provide, the participant will only earn the bonus if the participant remains employed with us or one of our subsidiaries through December 31, 2023; provided that the Compensation Committee may pay up to half of any such bonus opportunity corresponding to 2021 or 2022 following the end of that year (subject to clawback, unless otherwise provided by the Compensation Committee, if the participant ceases to be employed with us or one of our subsidiaries prior to December 31, 2023). The total long-term cash incentive opportunity for each of our NEOs is as follows: Kenneth M. Young- $1,500,000; Jimmy B. Morgan- $1,500,000; Louis Salamone- $950,000; and John Dziewisz- $650,000.

EQUITY INCENTIVE AWARDS

The Compensation Committee believes that it is important to attract and retain qualified personnel by offering an equity-based program that is competitive and that is designed to encourage each of our NEOs to balance short-term Company goals with long-term performance and to foster executive retention.

In 2020, we provided equity incentive compensation awards to our NEOs in the form of (1) time-based RSUs and (2) PSUs that vest based on the attainment of a $7 or higher closing stock price, which represented almost a 200% increase from the stock price at the time of grant. The decision by the Compensation Committee to grant restricted stock units and performance stock units rather than stock options was based on the belief that fewer RSUs and PSUs could be granted (relative to stock options) to deliver the same grant date fair value, RSUs have retentive value even if our stock price does not appreciate, the value of PSUs remains subject to the attainment of a performance-based vesting goals, and both RSUs and PSUs continue to align the executives’ interests with the interests of stockholders as the value of the awards is dependent upon our stock price. In determining to grant RSUs and PSUs to our executives, the Compensation Committee took into account the need to provide meaningful long-term incentives to our executives and employees in light of the fact that previously issued performance stock units granted in 2016 had not paid out and our outstanding stock options and SARs were underwater, and therefore had limited incentive and retention value. For all executives, the time-based RSU awards vest ratably over three years and the PSUs have a five year timeline to achieve the defined closing stock price goal. The 2020 RSU and PSU awards were generally granted by the Compensation Committee effective August 25, 2020.

The aggregate value of the awards granted in 2020 was generally based on the Compensation Committee’s review of each participating NEO’s experience, role and scope of duties, in order to provide competitive equity incentive opportunities. Use of equity-based awards, together with our meaningful stock ownership requirements, was intended to further align the interests of participating NEOs with the interests of our stockholders, which is another important objective of our executive compensation program.

The following table summarizes the number of shares subject to the 2020 equity incentive awards for each participating NEO:

2020 Long-Term Incentive Awards

| NAME | RESTRICTED STOCK UNITS | PERFORMANCE-BASED STOCK UNITS | ||||||

| Kenneth M. Young | 200,000 | 250,000 | ||||||

| Louis Salamone Jr. | 150,000 | 200,000 | ||||||

| Jimmy B. Morgan | 150,000 | 200,000 | ||||||

| John J. Dziewisz | 100,000 | 150,000 | ||||||

Executives such as Mr. Caruso who serve us as consultants through third party relationships are not generally eligible annual equity incentive awards from us. As described below, the Compensation Committee did grant RSUs and PSUs to Mr. Young, despite Mr. Young’s consultancy arrangement with us, in order to better retain his services and align his interests with those of our shareholders. Such RSUs and PSUs were granted to Mr. Young directly and not the B. Riley Affiliate, in order to provide an incentive directly to Mr. Young.

19

In February 2021, our closing stock price exceeded the $7 per share target set for the PSUs granted to the NEOs in 2020 and, accordingly, each of the PSU awards described above vested in full at that time.

2020 Long-Term Incentive Performance Update

In April 2020, the Compensation Committee reviewed our performance against the goals established for performance-based RSUs granted to certain of our NEOs in 2017 (“2017 PSUs”). From 0% to 200% of the target levels of the 2017 PSU awards could have been earned based on achievement with respect to cumulative adjusted diluted earnings per share (“Cumulative EPS”), average annual return on invested capital (“ROIC”), and relative total shareholder return (“RTSR”) performance for the period beginning on January 1, 2017 and ending on December 31, 2019 (the “2017-2019 Performance Period”).