Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Modular Medical, Inc. | modular_8k.htm |

Exhibit 99.1

MODULAR MEDICAL Investor Presentation. OTCQB:MODD

Forward Looking Statements, Other Disclaimers. THIS SUMMARY IS PROVIDED ON A CONFIDENTIAL AND LIMITED BASIS, SOLELY FOR YOUR USE AS A PART OF YOUR DETERMINATION OF WHETHER TO INVEST IN THE OPPORTUNITY. THIS SUMMARY IS BEING PROVIDED IN RELIANCE UPON SECTION 105(C) OF THE JUMPSTART OUR BUSINESS STARTUPS ACT OF 2012 AND SEC RULE 506 OF REGULATION D, AS AMENDED, AND IS INTENDED SOLELY FOR INVESTORS THAT ARE EITHER QUALIFIED INSTITUTIONAL BUYERS OR INSTITUTIONS THAT ARE ACCREDITED INVESTORS (AS SUCH TERMS ARE DEFINED UNDER SECURITIES AND EXCHANGE COMMISSION (SEC) RULES). THE DISTRIBUTION TO YOU IS MADE FOR INFORMATIONAL PURPOSES ONLY AND DOES NOT CONSTITUTE AN OFFER TO SELL OR A SOLICITATION OF AN OFFER TO BUY SECURITIES, NOR SHALL THERE BE ANY SALE OF ANY OF SECURITIES IN ANY STATE OR JURISDICTION IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL PRIOR TO REGISTRATION OR QUALIFICATION UNDER THE SECURITIES LAWS OF ANY SUCH STATE OR JURISDICTION. ANY SUCH OFFER OR SOLICITATION WILL BE MADE ONLY TO QUALIFIED INVESTORS PURSUANT TO THE CONFIDENTIAL OFFERING AND SUBSCRIPTION DOCUMENTS AND WILL BE SUBJECT TO THE TERMS AND CONDITIONS CONTAINED IN SUCH DOCUMENTS. STATEMENTS CONTAINED HEREIN ARE MADE AS OF THE DATE OF THIS DOCUMENT UNLESS STATED OTHERWISE, AND NEITHER THE DELIVERY OF THIS SUMMARY AT ANY TIME, NOR ANY SALE OF SECURITIES, SHALL UNDER ANY CIRCUMSTANCES CREATE AN IMPLICATION THAT THE INFORMATION CONTAINED HEREIN IS CORRECT AS OF ANY TIME AFTER SUCH DATE OR THAT INFORMATION WILL BE UPDATED OR REVISED TO REFLECT INFORMATION THAT SUBSEQUENTLY BECOMES AVAILABLE OR CHANGES OCCURING AFTER THE DATE HEREOF. This summary may contain forward-looking statements. All statements other than statements of historical facts contained in this presentation, including statements regarding future results of operations and financial position, business strategy, current and prospective products, planned development activities, product approvals, research and development costs, grants, current and prospective collaborations, timing and likelihood of success, plans and objectives of management for future operations, and future success of anticipated products, are forward-looking statements. New risk factors and uncertainties may emerge from time to time, and it is not possible to predict all risk factors and uncertainties. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise. Although we believe the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Accordingly, readers are cautioned not to place undue reliance on these forward-looking statements. No representations or warranties (expressed or implied) are made about the accuracy of any such forwardlooking statements. There can be no assurance that the opportunity will meet your investment objectives, that you will receive a return of all or part of such investment. Investment results may vary significantly over any given time period. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives. We recommend that investors independently evaluate specific investments and strategies.

Diabetes Care for the Rest of Us. Despite decades of advances in insulin delivery technology, only a minority of individuals with Type 1 diabetes use a pump. The cost and complexity of today’s offerings mean that, for many, multiple daily injections remain the only practical solution. At Modular Medical, we are dedicated to helping people with diabetes gain access to high quality care by making it affordable and easy to use. Diabetics want their lives back. We aim to help.

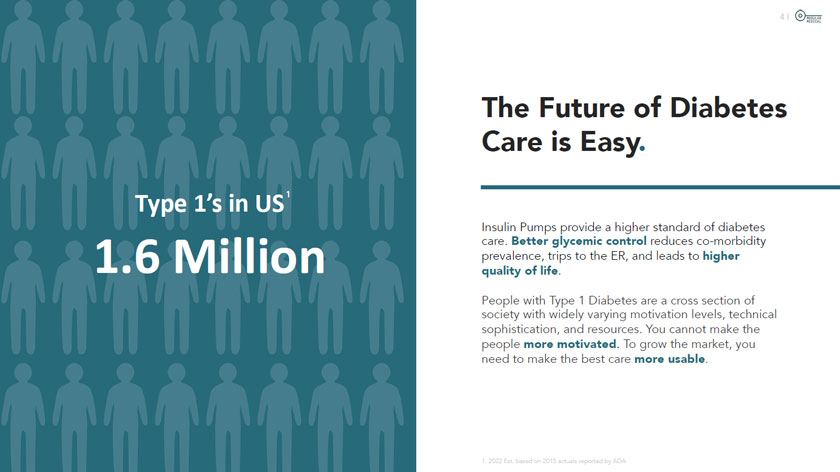

Type l’s in US 1.6 Million Cpj MODULAR MEDICAL The Future of Diabetes Care is Easy. Insulin Pumps provide a higher standard of diabetes care. Better glycemic control reduces co-morbidity prevalence, trips to the ER, and leads to higher quality of life. People with Type 1 Diabetes are a cross section of society with widely varying motivation levels, technical sophistication, and resources. You cannot make the people more motivated. To grow the market, you need to make the best care more usable. 1.2022 Est. based on 2015 actuals reported by ADA

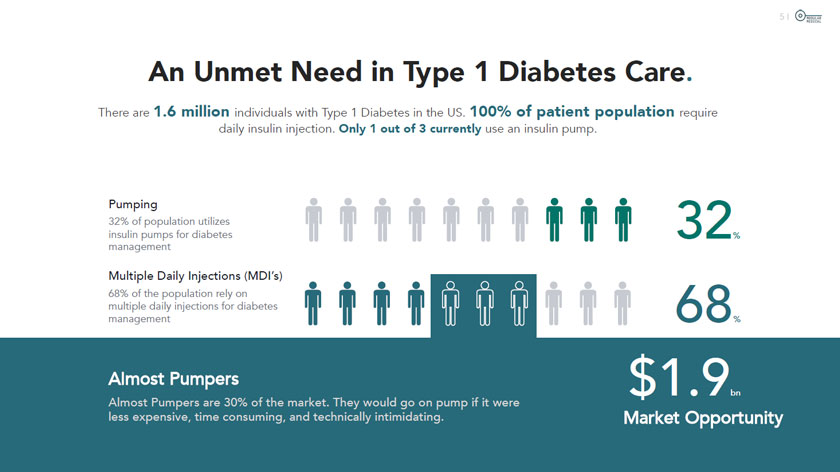

I © MODULAR MEDICAL An Unmet Need in Type 1 Diabetes Care. There are 1.6 million individuals with Type 1 Diabetes in the US. 100% of patient population require daily insulin injection. Only 1 out of 3 currently use an insulin pump. Pumping 32% of population utilizes insulin pumps for diabetes management VfTVfTTTTV 32, Multiple Daily Injections (MDI’s) 68% of the population rely on multiple daily injections for diabetes management It!! ft A A ÜU 68 % Almost Pumpers Almost Pumpers are 30% of the market. They would go on pump if it were less expensive, time consuming, and technically intimidating. $1.9 Market Opportunity bn

Time Insulin pumps on the market today require a substantial amount of time to manage therapy Money High out of pocket costs of today’s pumps place these technologies out of reach for a large part of the population Technology Feature-heavy and complex systems have hampered adoption. These products are for “superusers” not for “the rest of us” Time to Change. Today, insulin-requiring individuals with diabetes must invest significant time to manage therapy, cover high out-of- pocket expenses, and operate complicated “advanced” pump systems. Our Mission At Modular Medical, our mission is to simplify diabetes management and expand access to the higher quality of care that insulin pumps provide. Our Vision We aspire to develop technology that liberates and empowers people to improve their health and well-being and take back more of their lives.

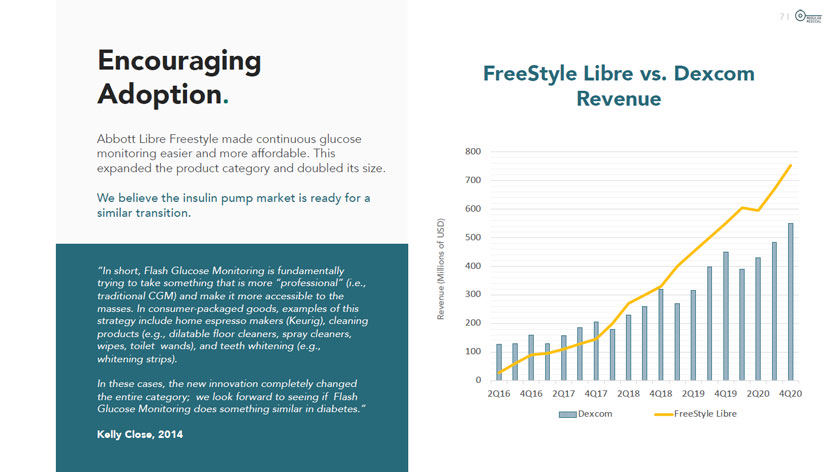

Encouraging Adoption. Abbott Libre Freestyle made continuous glucose monitoring easier and more affordable. This expanded the product category and doubled its size. We believe the insulin pump market is ready for a similar transition. “In short, Flash Glucose Monitoring is fundamentally trying to take something that is more “professional” (i.e., traditional CGM) and make it more accessible to the masses. In consumer-packaged goods, examples of this strategy include home espresso makers (Keurig), cleaning products (e.g., dilatable floor cleaners, spray cleaners, wipes, toilet wands), and teeth whitening (e.g., whitening strips). In these cases, the new innovation completely changed the entire category; we look forward to seeing if Flash Glucose Monitoring does something similar in diabetes.” Kelly Close, 2014 Revenue (Millions of USD) 71 MODULAR MEDICAL FreeStyle Ubre vs. Dexcom Revenue 800 700 600 500 400 300 200 100 0 i I Dexcom FreeStyle Libre

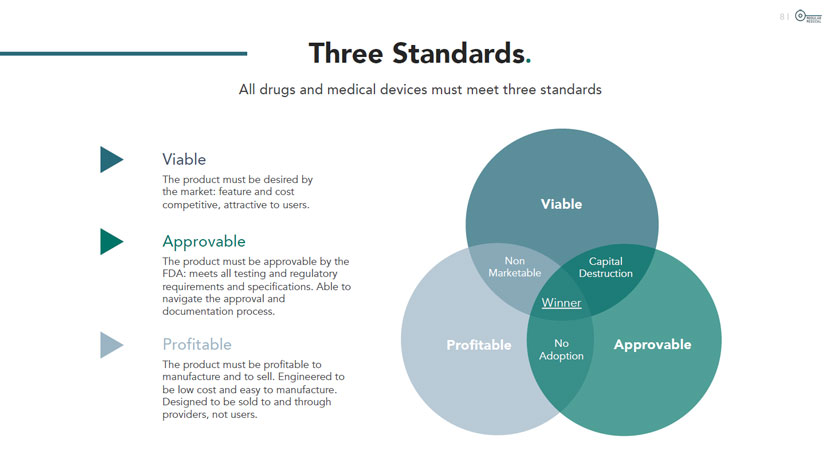

I MODULAR MEDICAL Three Standards. All drugs and medical devices must meet three standards ? ? ? Viable The product must be desired by the market: feature and cost competitive, attractive to users. Approvable The product must be approvable by the FDA: meets all testing and regulatory requirements and specifications. Able to navigate the approval and documentation process. Profitable The product must be profitable to manufacture and to sell. Engineered to be low cost and easy to manufacture. Designed to be sold to and through providers, not users.

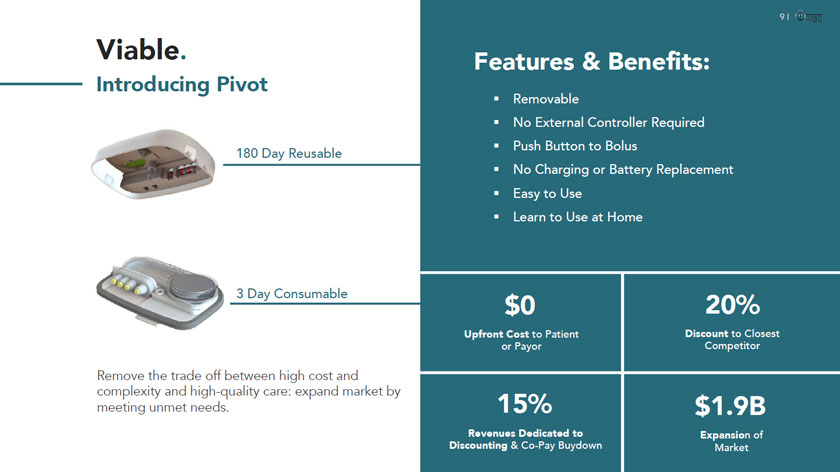

Viable. Introducing Pivot 180 Day Reusable 3 Day Consumable Remove the trade off between high cost and complexity and high-quality care: expand market by meeting unmet needs. Features & Benefits: Removable No External Controller Required Push Button to Bolus No Charging or Battery Replacement Easy to Use Learn to Use at Home $0 20% Upfront Cost to Patient Discount to Closest or Payor Competitor 15% $1.9B Revenues Dedicated to Expansion of Discounting &Co-Pay Buydown Market

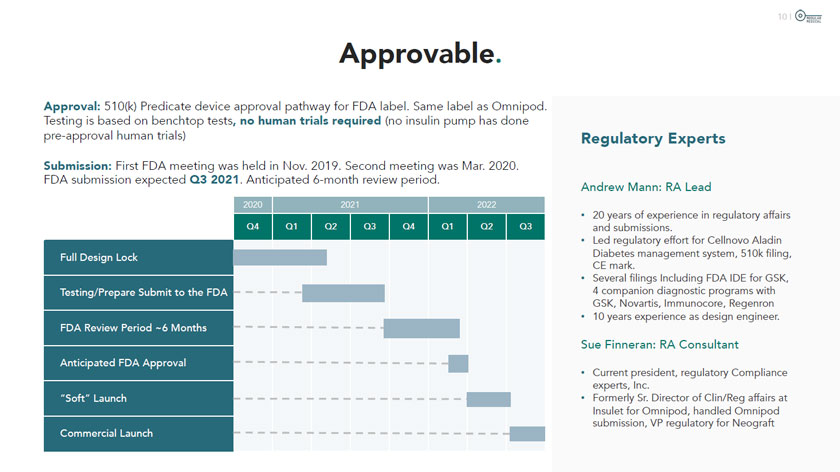

Approvable. Approval: 510(k) Predicate device approval pathway for FDA label. Same label as Omnipod. Testing is based on benchtop tests, no human trials required (no insulin pump has done pre-approval human trials) Submission: First FDA meeting was held in Nov. 2019. Second meeting was Mar. 2020. FDA submission expected Q3 2021. Anticipated 6-month review period. 2020 2021 2022 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Full Design Lock Testing/Prepare Submit to the FDA FDA Review Period ~6 Months Anticipated FDA Approval “Soft” Launch Commercial Launch Regulatory Experts Andrew Mann: RA Lead 20 years of experience in regulatory affairs and submissions. Led regulatory effort for Cellnovo Aladin Diabetes management system, 510k filing, CE mark. Several filings Including FDA IDE for GSK, 4 companion diagnostic programs with GSK, Novartis, Immunocore, Regenron 10 years experience as design engineer. Sue Finneran: RA Consultant Current president, regulatory Compliance experts, Inc. Formerly Sr. Director of Clin/Reg affairs at Insulet for Omnipod, handled Omnipod submission, VP regulatory for Neograft

Profitable. New microfluidics technology allows for low-cost pumping of insulin. New design philosophy makes product simple enough for provider driven sales. Traditional Pumps Use Expensive Machining and Complex Modalities To Pump Insulin 5 Years Development: Same Precision, Off the Shelf, High Volume Components 11 I ® $4,249 78% Revenue Per Patient/Year1 Gross Margins 70% 15% Less Expensive to Manufacture Than Omnipod2 Of Revenue Spent on Discounting and Free Samples $123M 25% Recurring Revenue Per 1% Market Share Operating Margin at 1% Market Share $1.9B Expansion of Market 1. Based on 20% discount to published CPT codes for Omnipod. 2. Calculation based on Omnipod US data from SGP 2019 diabetes bluebook and internal cost estimates.

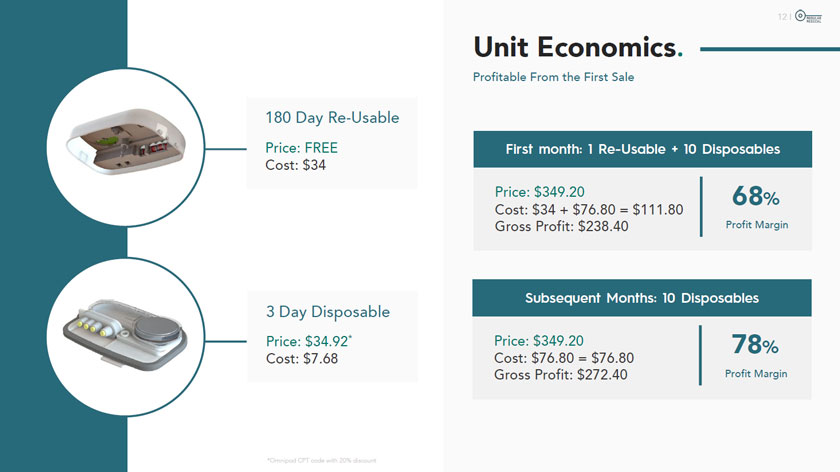

180 Day Re-Usable Price: FREE Cost: $34 3 Day Disposable Price: $34.92* Cost: $7.68 *Omnipod CPT code with 20% discount MODULAR MEDICAL Unit Economics. Profitable From the First Sale First month: 1 Re-Usable + 10 Disposables Price: $349.20 Cost: $34 + $76.80 = $111.80 Gross Profit: $238.40 68% Profit Margin Subsequent Months: 10 Disposables 78% Price: $349.20 Cost: $76.80 = $76.80 Gross Profit: $272.40 Profit Margin

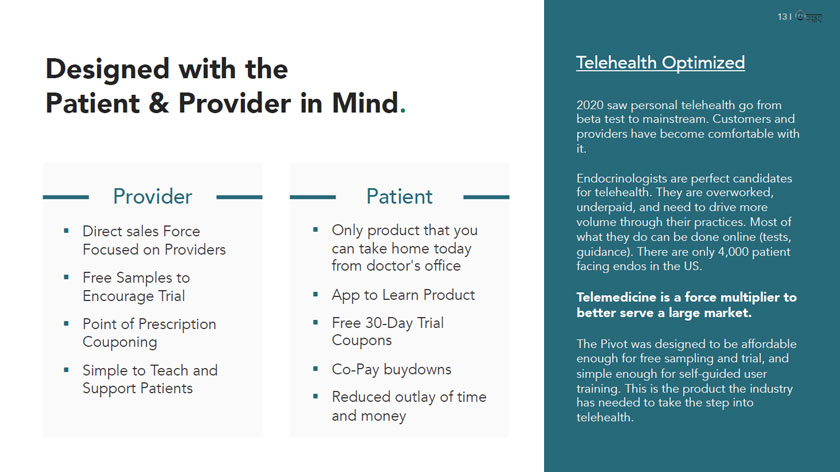

13 I 0i Designed with the Patient &Provider in Mind. - Provider - Direct sales Force Focused on Providers Free Samples to Encourage Trial Point of Prescription Couponing Simple to Teach and Support Patients - Patient — Only product that you can take home today from doctor’s office App to Learn Product Free 30-Day Trial Coupons Co-Pay buydowns Reduced outlay of time and money Telehealth Optimized 2020 saw personal telehealth go from beta test to mainstream. Customers and providers have become comfortable with it. Endocrinologists are perfect candidates for telehealth. They are overworked, underpaid, and need to drive more volume through their practices. Most of what they do can be done online (tests, guidance). There are only 4,000 patient facing endos in the US. Telemedicine is a force multiplier to better serve a large market. The Pivot was designed to be affordable enough for free sampling and trial, and simple enough for self-guided user training. This is the product the industry has needed to take the step into telehealth.

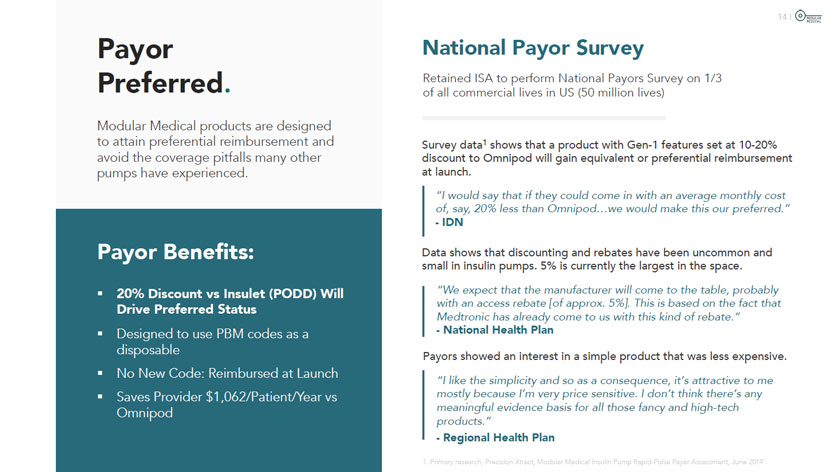

Payor Preferred. Modular Medical products are designed to attain preferential reimbursement and avoid the coverage pitfalls many other pumps have experienced. Payor Benefits: 20% Discount vs Insulet (PODD) Will Drive Preferred Status Designed to use PBM codes as a disposable No New Code: Reimbursed at Launch Saves Provider $1,062/Patient/Year vs Omnipod (s)hÔdÛÜr MEDICAL National Payor Survey Retained ISA to perform National Payors Survey on 1/3 of all commercial lives in US (50 million lives) Survey data1 shows that a product with Gen-1 features set at 10-20% discount to Omnipod will gain equivalent or preferential reimbursement at launch. “I would say that if they could come in with an average monthly cost of, say, 20% less than Omnipod...we would make this our preferred.” - IDN Data shows that discounting and rebates have been uncommon and small in insulin pumps. 5% is currently the largest in the space. “We expect that the manufacturer will come to the table, probably with an access rebate [of approx. 5%]. This is based on the fact that Medtronic has already come to us with this kind of rebate.” - National Health Plan Payors showed an interest in a simple product that was less expensive. “I like the simplicity and so as a consequence, it’s attractive to me mostly because I’m very price sensitive. I don’t think there’s any meaningful evidence basis for all those fancy and high-tech products.” - Regional Health Plan 1. Primary research, Precision Xtract, Modular Medical Insulin Pump Rapid-Pulse Payer Assessment, June 2019.

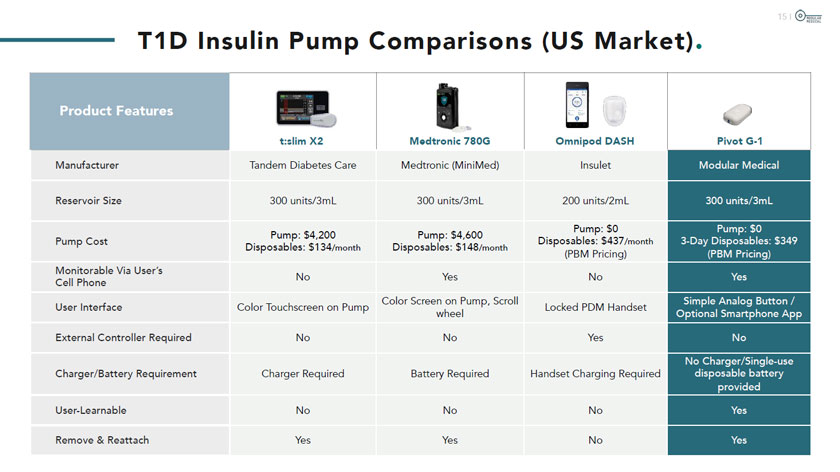

T1D Insulin Pump Comparisons (US Market). Product Features Manufacturer t:slim X2 Medtronic 780G Tandem Diabetes Care Medtronic (MiniMed) Reservoir Size 300 units/3mL 300 units/3mL Pump Cost Monitorable Via User’s Cell Phone User Interface External Controller Required Pump: $4,200 Disposables: $134/month No Color Touchscreen on Pump No Pump: $4,600 Disposables: $148/month Yes Color Screen on Pump, Scroll wheel No Charger/Battery Requirement Charger Required Battery Required User-Learnable No No Remove &Reattach Yes Yes Omnipod DASH Insulet 200 units/2mL Pump: $0 Disposables: $437/month (PBM Pricing) No Locked PDM Handset Yes Handset Charging Required No No Pivot G-1 Modular Medical 300 units/3mL Pump: $0 3-Day Disposables: $349 (PBM Pricing) Yes Simple Analog Button / Optional Smartphone App No No Charger/Single-use disposable battery provided Yes Yes

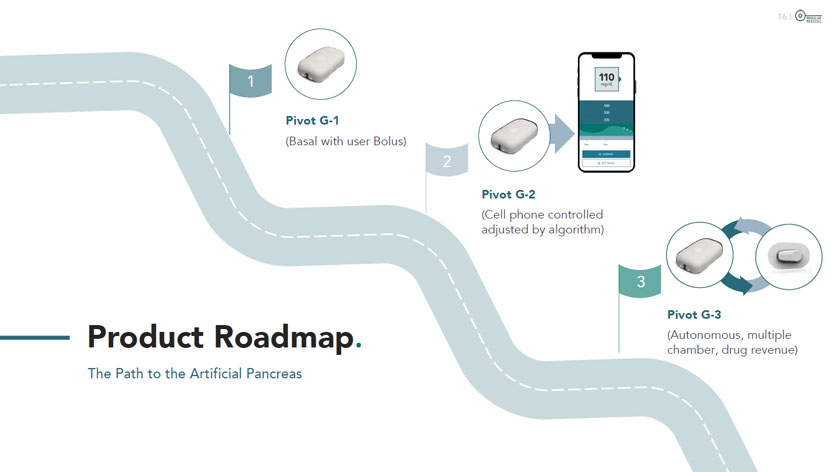

Product Roadmap. The Path to the Artificial Pancreas (Cell phone controlled adjusted by algorithm) Pivot G-3 (Autonomous, multiple chamber, drug revenue)

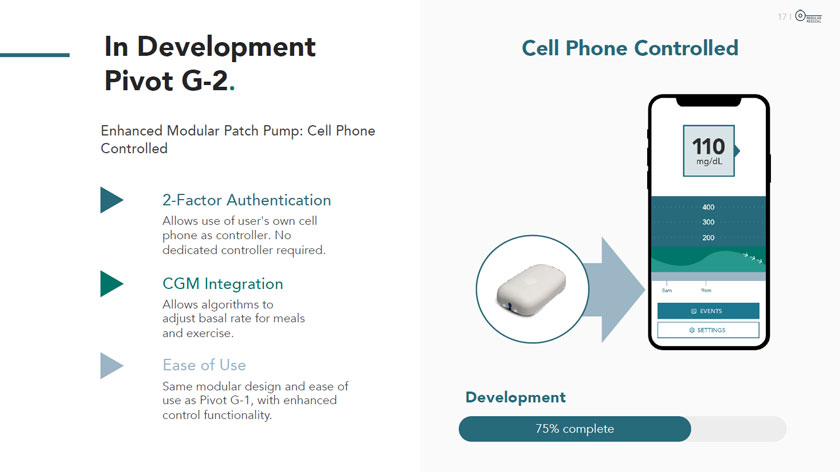

In Development Pivot G-2. Enhanced Modular Patch Pump: Cell Phone Controlled 2-Factor Authentication Allows use of user’s own cell phone as controller. No dedicated controller required. CGM Integration Allows algorithms to adjust basal rate for meals and exercise. Ease of Use Same modular design and ease of use as Pivot G-1, with enhanced control functionality. MODULAR MEDICAL Cell Phone Controlled 110 mg/dL 400 300 Development 75% complete

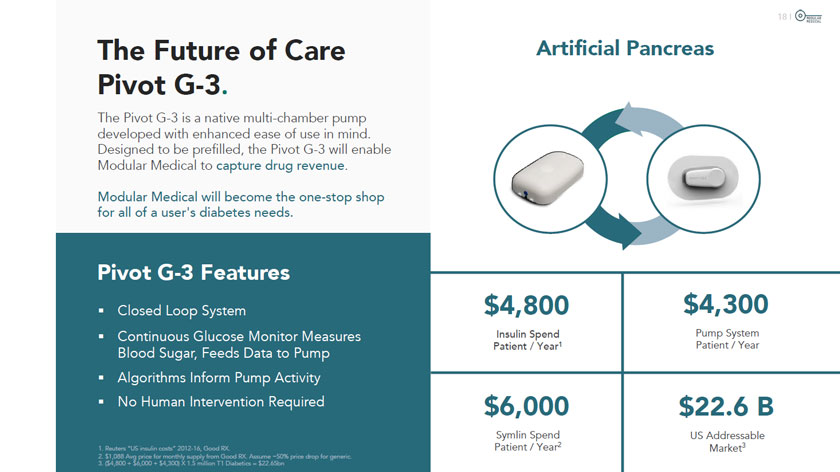

The Future of Care Pivot G-3. The Pivot G-3 is a native multi-chamber pump developed with enhanced ease of use in mind. Designed to be prefilled, the Pivot G-3 will enabl Modular Medical to capture drug revenue. Modular Medical will become the one-stop shop for all of a user’s diabetes needs. Pivot G-3 Features Closed Loop System Continuous Glucose Monitor Measures Blood Sugar, Feeds Data to Pump Algorithms Inform Pump Activity No Human Intervention Required 1 2 3 1. Reuters “US insulin costs” 2012-16, Good RX. 2. $1,088 Avg price for monthly supply from Good RX. Assume -50% price drop for generic. 3. ($4,800 + $6,000 + $4,300) X 1.5 million T1 Diabetics = $22.65bn Artificial Pancreas $4,800 $4,300 Insulin Spend Pump System Patient / Year1 Patient / Year $6,000 $22.6 B Symlin Spend US Addressable Patient / Year2 Market3

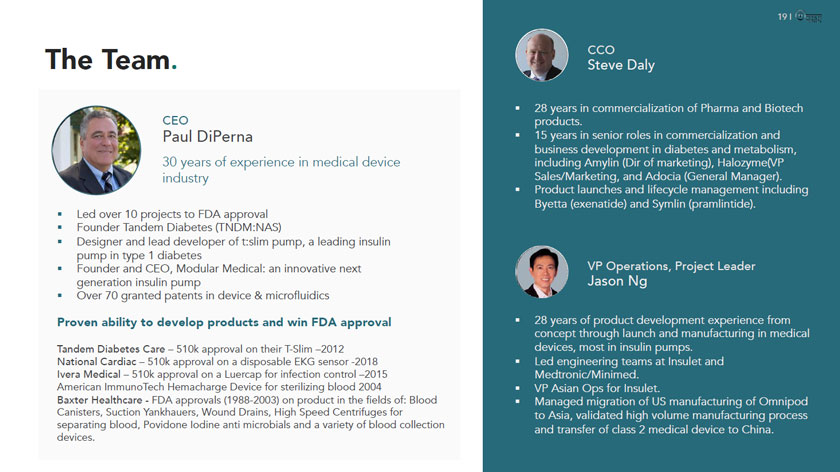

The Team. CEO Paul DiPerna 30 years of experience in medical device industry Led over 10 projects to FDA approval Founder Tandem Diabetes (TNDM:NAS) Designer and lead developer of t:slim pump, a leading insulin pump in type 1 diabetes Founder and CEO, Modular Medical: an innovative next generation insulin pump Over 70 granted patents in device µfluidics Proven ability to develop products and win FDA approval Tandem Diabetes Care - 510k approval on their T-Slim -2012 National Cardiac - 51 Ok approval on a disposable EKG sensor -2018 Ivera Medical - 510k approval on a Luercap for infection control -2015 American ImmunoTech Hemacharge Device for sterilizing blood 2004 Baxter Healthcare - FDA approvals (1988-2003) on product in the fields of: Blood Canisters, Suction Yankhauers, Wound Drains, High Speed Centrifuges for separating blood, Povidone Iodine anti microbials and a variety of blood collection devices. 191 0; Steve Daly 28 years in commercialization of Pharma and Biotech products. 15 years in senior roles in commercialization and business development in diabetes and metabolism, including Amylin (Dir of marketing), Halozyme(VP Sales/Marketing, and Adocia (General Manager). Product launches and lifecycle management including Byetta (exenatide) and Symlin (pramlintide). VP Operations, Project Leader Jason Ng 28 years of product development experience from concept through launch and manufacturing in medical devices, most in insulin pumps. Led engineering teams at Insulet and Medtronic/Minimed. VP Asian Ops for Insulet. Managed migration of US manufacturing of Omnipod to Asia, validated high volume manufacturing process and transfer of class 2 medical device to China.

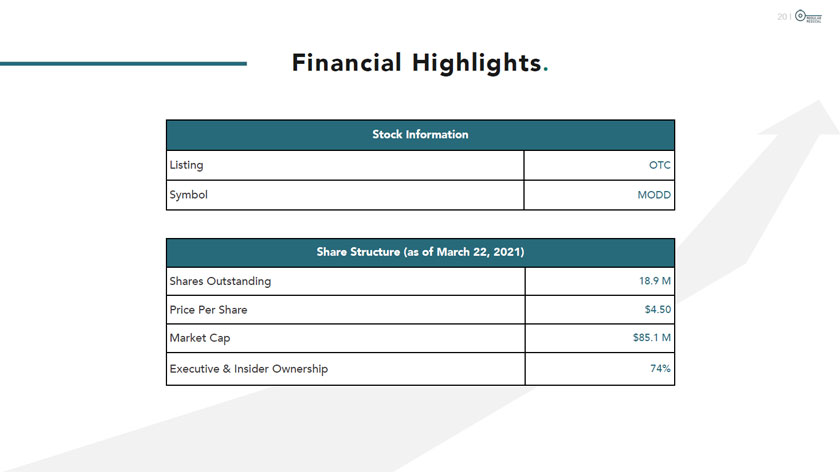

(s)hÔdÛÜr MEDICAL Financial Highlights. Stock Information Listing OTC Symbol MODD Share Structure (as of March 22, 2021) Shares Outstanding 18.9 M Price Per Share $4.50 Market Cap $85.1 M Executive &Insider Ownership 74%

MODULAR MEDICAL Investor Relations r@modular-medical.com OTCQB:MODD

Appendix.

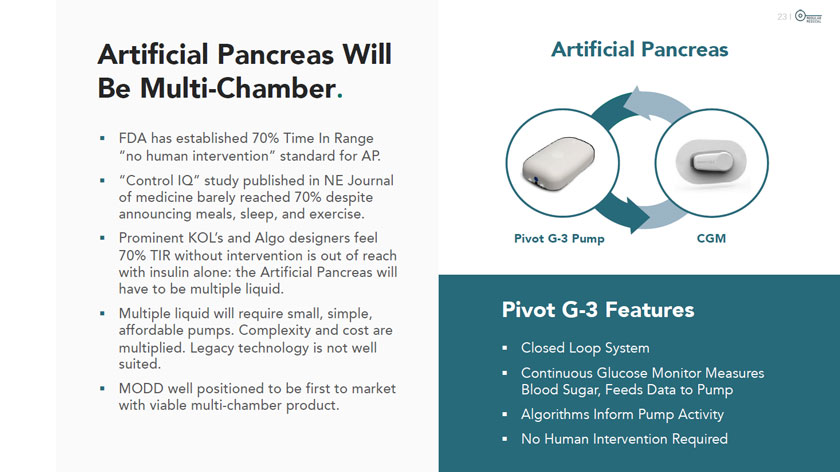

(s)hÔdÛÜr MEDICAL Artificial Pancreas Will Be Multi-Chamber. FDA has established 70% Time In Range “no human intervention” standard for AR “Control IQ” study published in NE Journal of medicine barely reached 70% despite announcing meals, sleep, and exercise. Prominent KOL’s and Algo designers feel 70% TIR without intervention is out of reach with insulin alone: the Artificial Pancreas will have to be multiple liquid. Multiple liquid will require small, simple, affordable pumps. Complexity and cost are multiplied. Legacy technology is not well suited. MODD well positioned to be first to market with viable multi-chamber product. Artificial Pancreas Pivot G-3 Features Closed Loop System Continuous Glucose Monitor Measures Blood Sugar, Feeds Data to Pump Algorithms Inform Pump Activity No Human Intervention Required