Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - SEACOAST BANKING CORP OF FLORIDA | sbcfpressrelease20210323.htm |

| 8-K - 8-K - SEACOAST BANKING CORP OF FLORIDA | sbcf-20210323.htm |

ACQUISITION OF LEGACY BANK OF FLORIDA March 23, 2021

2 Cautionary Notice Regarding Forward-Looking Statements This presentation contains “forw ard-looking statements” w ithin the meaning, and protections, of Section 27A of the Securit ies Act of 1933 and Section 21E of the Securit ies Exchange Act of 1934, including, w ithout limitation, statements about future financial and operating results, cost savings, enhanced revenues, economic and seasonal condit ions in our markets, new initiatives and improvements to reported earnings that may be realized from cost controls, tax law changes, and for integration of banks that w e have acquired, or expect to acquire, as w ell as statements w ith respect to Seacoast's objectives, strategic plans, expectations and intentions and other statements that are not historical facts. Actual results may differ from those set forth in the forw ard-looking statements. Forw ard-looking statements include statements w ith respect to our beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates and intentions about future performance, and involve know n and unknow n risks, uncertainties and other factors, w hich may be beyond our control, and w hich may cause the actual results, performance or achievements of Seacoast to be materially different from future results, performance or achievements expressed or implied by such forw ard-looking statements. You should not expect us to update any forw ard-looking statements. All statements other than statements of historical fact could be forw ard-looking statements. You can identify these forw ard-looking statements through our use of w ords such as “may”, “w ill”, “anticipate”, “assume”, “should”, “support”, “indicate”, “w ould”, “believe”, “contemplate”, “expect”, “estimate”, “continue”, “further”, “plan”, “point to”, “project”, “could”, “intend”, “target” or other similar w ords and expressions of the future. These forward-looking statements may not be realized due to a variety of factors, including, w ithout limitation: the effects of future economic and market condit ions, inc luding seasonality; governmental monetary and fiscal polic ies, including interest rate policies of the Board of Governors of the Federal Reserve, as w ell as legislative, tax and regulatory changes; changes in accounting policies, rules and practices; the risks of changes in interest rates on the level and composition of deposits, loan demand, liquidity and the values of loan collateral, securities, and interest sensitive assets and liabilities; interest rate risks, sensit ivit ies and the shape of the yield curve; uncertainty related to the impact of LIBOR calculations on securit ies and loans; changes in borrow er credit risks and payment behaviors; changes in the availability and cost of credit and capital in the financial markets; changes in the prices, values and sales volumes of residential and commercial real estate; our ability to comply w ith any regulatory requirements; the effects of problems encountered by other financial institutions that adversely affect us or the banking industry; our concentration in commercial real estate loans; the failure of assumptions and estimates, as w ell as differences in, and changes to, economic, market and credit conditions; the impact on the valuation of our investments due to market volatility or counterparty payment r isk; statutory and regulatory dividend restrict ions; increases in regulatory capital requirements for banking organizations generally; the risks of mergers, acquisitions and divestitures, including our ability to continue to identify acquisition targets and successfully acquire desirable financial institutions; changes in technology or products that may be more diff icult, costly, or less effective than anticipated; our ability to identify and address increased cybersecurity risks; inability of our ris k management framew ork to manage risks associated w ith our business; dependence on key suppliers or vendors to obtain equipment or services for our business on acceptable terms; reduction in or the termination of our ability to use the mobile-based platform that is critical to our business grow th strategy; the effects of war or other conflicts, acts of terrorism, natural disasters or other catastrophic events that may affect general economic condit ions; unexpected outcomes of, and the costs associated w ith, existing or new litigation involving us; our ability to maintain adequate internal controls over financial reporting; potential c laims, damages, penalt ies, f ines and reputational damage resulting from pending or future litigation, regulatory proceedings and enforcement actions; the r isks that our deferred tax assets could be reduced if estimates of future taxable income from our operations and tax planning strategies are less than currently estimated and sales of our capital stock could trigger a reduction in the amount of net operating loss carryforwards that w e may be able to utilize for income tax purposes; the effects of competition from other commercial banks, thrif ts, mortgage banking firms, consumer finance companies, credit unions, securities brokerage firms, insurance companies, money market and other mutual funds and other financial institutions operating in our market areas and elsew here, including institutions operating regionally, nationally and internationally, together w ith such competitors offering banking products and services by mail, telephone, computer and the Internet; and the failure of assumptions underlying the establishment of reserves for possible loan losses. The r isks relating to the proposed Legacy Bank of Florida merger include, w ithout limitation, failure to obtain the approval of shareholders of Legacy Bank of Florida in connection w ith the merger; the timing to consummate the proposed merger; changes in Seacoast’s share price before clos ing, the risk that a condition to the clos ing of the proposed merger may not be satisfied; the risk that a regulatory approval that may be required for the proposed merger is not obtained or is obtained subject to condit ions that are not anticipated; the parties' ability to achieve the synergies and value creation contemplated by the proposed merger; the parties' ability to promptly and effectively integrate the businesses of Seacoast and Legacy Bank of Florida, including unexpected transaction costs, the costs of integrating operations, severance, professional fees and other expenses; the diversion of management time on issues related to the merger; the failure to consummate or any delay in consummating the merger for other reasons; changes in laws or regulations; the risks of customer and employee loss and bus iness disruption, including, w ithout limitation, as the result of diff iculties in maintaining relationships w ith employees; increased competitive pressures and solic itations of customers and employees by competitors; the diff iculties and risks inherent w ith entering new markets. Given the many unknow ns and risks being heavily w eighted to the dow nside, our forw ard-looking statements are subject to the risk that conditions w ill be substantially different than w e are currently expecting. If efforts to contain COV ID-19 are unsuccessful and restrictions on movement last into the second half of 2021 and beyond, the recession w ould be much longer and much more severe. Ineffective fiscal stimulus, or an extended delay in implementing it, are also major dow nside risks. The deeper the recession is, and the longer it lasts, the more it w ill damage consumer fundamentals and sentiment. This could both prolong the recession, and/or make any recovery w eaker. Similar ly, the recession could damage business fundamentals. And an extended global recession due to COVID-19 w ould w eaken the U.S. recovery. As a result, the outbreak and its consequences, including responsive measures to manage it, have had and are likely to continue to have an adverse effect, possibly materially, on our business and financial performance by adversely affecting, possibly materially, the demand and profitability of our products and services, the valuation of assets and our ability to meet the needs of our customers. All w ritten or oral forward-looking statements attributable to us are expressly qualif ied in their entirety by this cautionary notice, including, w ithout limitation, those risks and uncertainties described in our annual report on Form 10-K for the year ended December 31, 2020 under “Special Cautionary Notice Regarding Forw ard-Looking Statements” and “Risk Factors”, and otherw ise in our SEC reports and filings. Such reports are available upon request from the Company, or from the Securities and Exchange Commission, including through the SEC’s Internet w ebsite at w ww.sec.gov.

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. Seacoast Banking Corporation of Florida ("Seacoast") will file with the Securities and Exchange Commission (the "SEC") a registration statement on Form S-4 containing a proxy statement of Legacy Bank of Florida (“Legacy”) and a prospectus of Seacoast, and Seacoast will file other documents with respect to the proposed merger. A definitive proxy statement/prospectus will be mailed to shareholders of Legacy Bank of Florida. Investors and security holders of Seacoast and Legacy Bank of Florida are urged to read the entire proxy statement/prospectus and other documents that will be filed with the SEC carefully and in their entirety when they become available because they will contain important information. Investors and security holders will be able to obtain free copies of the registration statement and the proxy statement/prospectus (when available) and other documents filed with the SEC by Seacoast through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Seacoast will be available free of charge on Seacoast's internet website or by contacting Seacoast. Seacoast, Legacy Bank of Florida, their respective directors and executive officers and other members of management and employees may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of Seacoast is set forth in its proxy statement for its 2020 annual meeting of shareholders, which was filed with the SEC on April 10, 2020 and its Current Reports on Form 8-K. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available. 3 Important Information For Investors And Shareholders 3

• Companies and individuals seeking real estate affordability, lower taxes, warmer weather, and easy flights back to the Northeast are migrating to Florida. • Florida's population forecast was revised in November 2020 to reflect a larger 2020 base and stronger net-migration projections. Source: Office of Economic & Demographic Research – Florida's population will surpass 23 million by late 2024 or 2025 (21.6 million at Year End 2020). – This increase is equivalent to adding a city larger than Orlando every year. • Financial institutions and other major corporations have announced plans to relocate some or all of their operations to Florida in the near future: Florida to Benefit from the Work-from-Anywhere Future Accelerated by COVID-19 4

Source: S&P Global Market Intelligence, Claritas, pbggov.org, Forbes, https://www.foxbusiness.com/real-estate/florida-american-movers, http://edr.state.fl.us/content/area-profiles/county/PalmBeach.pdf, https://www.bdb.org/targeted-industries/financial-services-and-hedge- funds/, https://www.gflalliance.org/ • Broward is the 2nd largest county in Florida;2020 population of 2.0 million, representing 9.0% of Florida’s population • Palm Beach is the 3rd largest county in Florida; 2020 population of 1.5 million, representing 6.9% of Florida’s population • Broward and Palm Beach are part of the South Florida MSA, which is 7th largest in the United States • Benefiting from continued in-migration from Northeast and Midwest states • Palm Beach had the highest median household income for all FL counties in 2019 ‒ Over 9.7% of households have median household income of $200K+ (largest percentage for all Florida counties by almost 2%) • Strong mix of professional and business services firms (nearly 15K) • Palm Beach vying to become “Wall Street South”, with over 300 hedge funds, private equity, and financial services firms already in the area • Development of the Flagler Financial District, South Florida’s newest urban corporate zone dedicated to business and financial enterprise located in the City of West Palm Beach • Broward County and 22 of its municipalities have been named “Platinum Cities” after approving a permitting excellence process recommended by the Greater Fort Lauderdale Alliance – Designed for high-impact, targeted industry businesses that are relocating or expanding in Broward County – Purpose of the permitting excellence process is to provide businesses with a transparent, first-rate experience when going through the development, permitting and inspection process for office and industrial properties Population & Income Business Environment Broward and Palm Beach Are The Second and Third Largest Counties In Florida, With Continuing In-Migration And A Healthy Business Environment 5

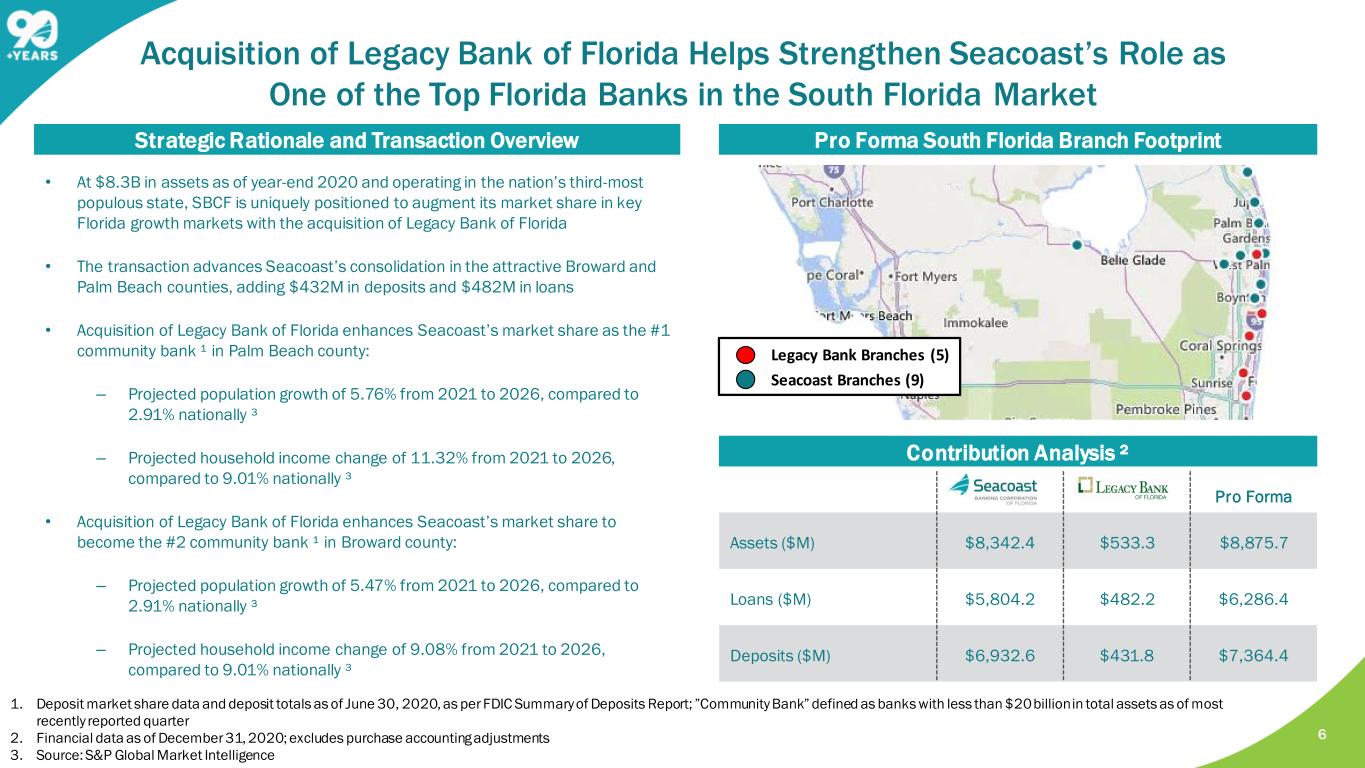

Pro Forma Assets ($M) $8,342.4 $533.3 $8,875.7 Loans ($M) $5,804.2 $482.2 $6,286.4 Deposits ($M) $6,932.6 $431.8 $7,364.4 Acquisition of Legacy Bank of Florida Helps Strengthen Seacoast’s Role as One of the Top Florida Banks in the South Florida Market 1. Deposit market share data and deposit totals as of June 30, 2020, as per FDIC Summary of Deposits Report; ”Community Bank” defined as banks with less than $20 billion in total assets as of most recently reported quarter 2. Financial data as of December 31, 2020; excludes purchase accounting adjustments 3. Source: S&P Global Market Intelligence • At $8.3B in assets as of year-end 2020 and operating in the nation’s third-most populous state, SBCF is uniquely positioned to augment its market share in key Florida growth markets with the acquisition of Legacy Bank of Florida • The transaction advances Seacoast’s consolidation in the attractive Broward and Palm Beach counties, adding $432M in deposits and $482M in loans • Acquisition of Legacy Bank of Florida enhances Seacoast’s market share as the #1 community bank ¹ in Palm Beach county: – Projected population growth of 5.76% from 2021 to 2026, compared to 2.91% nationally ³ – Projected household income change of 11.32% from 2021 to 2026, compared to 9.01% nationally ³ • Acquisition of Legacy Bank of Florida enhances Seacoast’s market share to become the #2 community bank ¹ in Broward county: – Projected population growth of 5.47% from 2021 to 2026, compared to 2.91% nationally ³ – Projected household income change of 9.08% from 2021 to 2026, compared to 9.01% nationally ³ Strategic Rationale and Transaction Overview Pro Forma South Florida Branch Footprint Contribution Analysis ² 6 Legacy Bank Branches (5) Seacoast Branches (9)

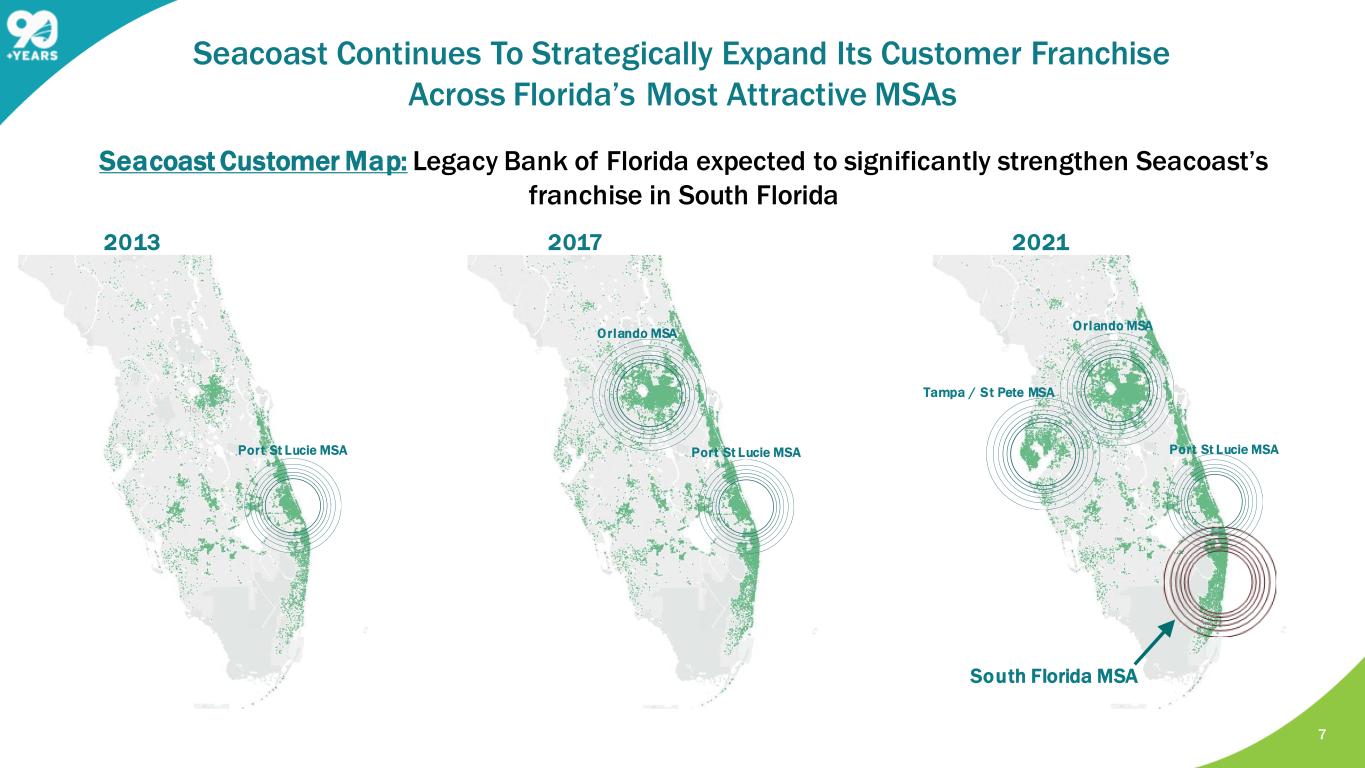

2013 Seacoast Customer Map: Legacy Bank of Florida expected to significantly strengthen Seacoast’s franchise in South Florida 2017 2021 Orlando MSA Orlando MSA Port St Lucie MSAPort St Lucie MSA South Florida MSA Tampa / St Pete MSA Port St Lucie MSA Seacoast Continues To Strategically Expand Its Customer Franchise Across Florida’s Most Attractive MSAs 7

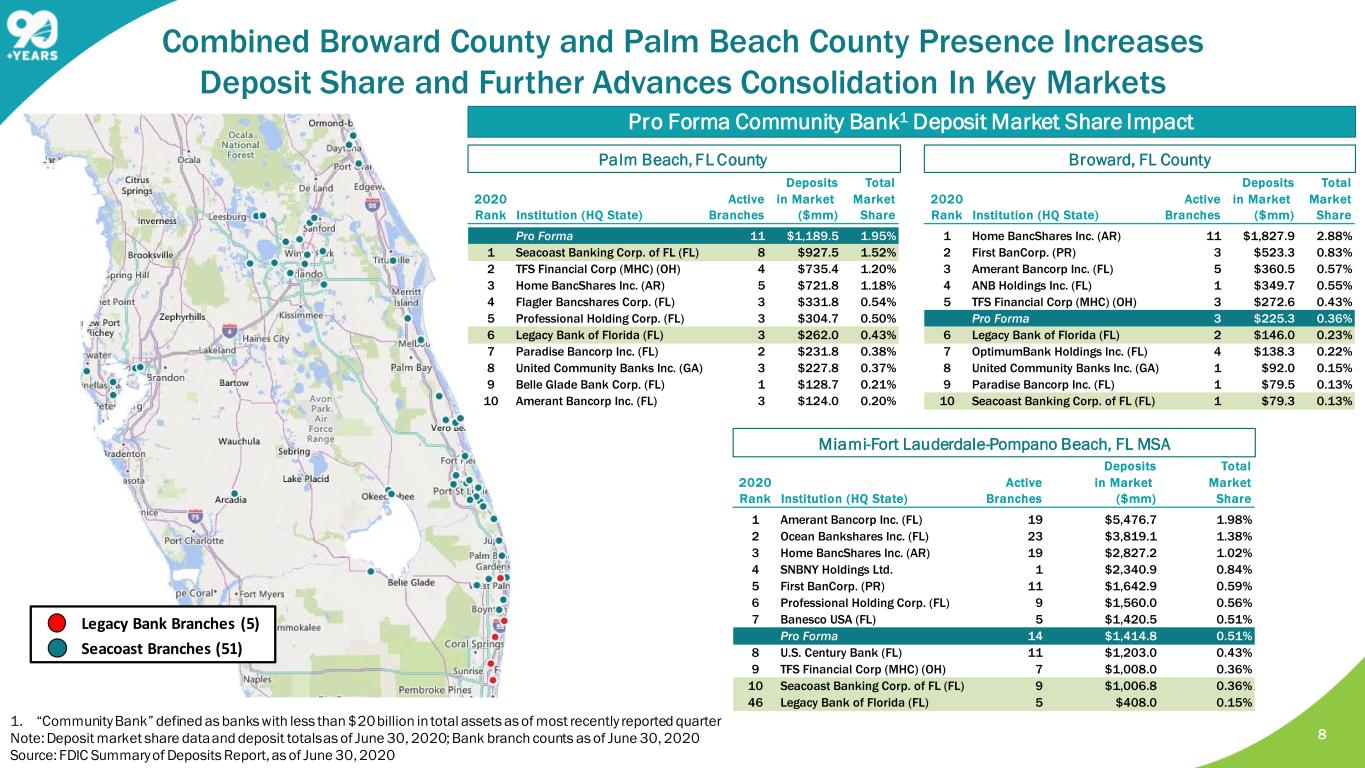

Miami-Fort Lauderdale-Pompano Beach, FL MSA Broward, FL County Combined Broward County and Palm Beach County Presence Increases Deposit Share and Further Advances Consolidation In Key Markets Pro Forma Community Bank1 Deposit Market Share Impact 1. “Community Bank” defined as banks with less than $20 billion in total assets as of most recently reported quarter Note: Deposit market share data and deposit totals as of June 30, 2020; Bank branch counts as of June 30, 2020 Source: FDIC Summary of Deposits Report, as of June 30, 2020 Palm Beach, FL County Deposits Total 2020 Active in Market Market Rank Institution (HQ State) Branches ($mm) Share Pro Forma 11 $1,189.5 1.95% 1 Seacoast Banking Corp. of FL (FL) 8 $927.5 1.52% 2 TFS Financial Corp (MHC) (OH) 4 $735.4 1.20% 3 Home BancShares Inc. (AR) 5 $721.8 1.18% 4 Flagler Bancshares Corp. (FL) 3 $331.8 0.54% 5 Professional Holding Corp. (FL) 3 $304.7 0.50% 6 Legacy Bank of Florida (FL) 3 $262.0 0.43% 7 Paradise Bancorp Inc. (FL) 2 $231.8 0.38% 8 United Community Banks Inc. (GA) 3 $227.8 0.37% 9 Belle Glade Bank Corp. (FL) 1 $128.7 0.21% 10 Amerant Bancorp Inc. (FL) 3 $124.0 0.20% Deposits Total 2020 Active in Market Market Rank Institution (HQ State) Branches ($mm) Share 1 Amerant Bancorp Inc. (FL) 19 $5,476.7 1.98% 2 Ocean Bankshares Inc. (FL) 23 $3,819.1 1.38% 3 Home BancShares Inc. (AR) 19 $2,827.2 1.02% 4 SNBNY Holdings Ltd. 1 $2,340.9 0.84% 5 First BanCorp. (PR) 11 $1,642.9 0.59% 6 Professional Holding Corp. (FL) 9 $1,560.0 0.56% 7 Banesco USA (FL) 5 $1,420.5 0.51% Pro Forma 14 $1,414.8 0.51% 8 U.S. Century Bank (FL) 11 $1,203.0 0.43% 9 TFS Financial Corp (MHC) (OH) 7 $1,008.0 0.36% 10 Seacoast Banking Corp. of FL (FL) 9 $1,006.8 0.36% 46 Legacy Bank of Florida (FL) 5 $408.0 0.15% Deposits Total 2020 Active in Market Market Rank Institution (HQ State) Branches ($mm) Share 1 Home BancShares Inc. (AR) 11 $1,827.9 2.88% 2 First BanCorp. (PR) 3 $523.3 0.83% 3 Amerant Bancorp Inc. (FL) 5 $360.5 0.57% 4 ANB Holdings Inc. (FL) 1 $349.7 0.55% 5 TFS Financial Corp (MHC) (OH) 3 $272.6 0.43% Pro Forma 3 $225.3 0.36% 6 Legacy Bank of Florida (FL) 2 $146.0 0.23% 7 OptimumBank Holdings Inc. (FL) 4 $138.3 0.22% 8 United Community Banks Inc. (GA) 1 $92.0 0.15% 9 Paradise Bancorp Inc. (FL) 1 $79.5 0.13% 10 Seacoast Banking Corp. of FL (FL) 1 $79.3 0.13% Legacy Bank Branches (5) Seacoast Branches (51) 8

Financially Attractive Transaction With Compelling Pro Forma Financial Impact and Conservative Approach Limiting Downside Risk • Financially attractive acquisition of a high quality franchise: – The transaction has minimal upfront dilution to tangible book value (TBV) per share, earnback period of 0.25 years, and EPS accretion of 5.9% in 2022 and 6.6% in 2023 – Legacy Bank of Florida achieved ROAA’s of 1.15% and 0.99% in 2020 and 2019 ² • Conservative transaction assumptions and limited upfront TBV dilution limit risk: – Seacoast conducted thorough loan diligence on Legacy Bank, with conservative CECL modeling driving total pre-tax marks on the loan books of 3.71% – Market protection provided by a fixed exchange ratio in the transaction – Seacoast’s “pay-to-trade” ratio4 is 76% for Legacy – In 2019, transactions with disclosed deal value greater than $15M had a median “pay-to-trade” ratio of 95%; 2020 deals had a median of 102% 5 – Negligible impact on Seacoast’s capital base, maintaining robust pro forma capital ratios following the transaction, and increasing ROAA and ROATCE • In-market acquisition in two strong markets where Seacoast has existing familiarity and a strong market position: – Transaction should allow Seacoast to add a strong leadership team with a long history of operating successfully in its markets – Advances Seacoast’s consolidation of Broward and Palm Beach counties, which are the second and third largest counties in Florida, respectively Transaction Multiples & Metrics ¹ Deal Price Per Share $6.05 Price / Tangible Book Value Per Share 167% Price / 2022E Earnings Per Share ³ 13.4x Price / 2022E Earnings Per Share ³ + Cost Savings 8.7x Transaction Pricing TBV Accr. / (Dilu.) (0.1%) 2022E EPS Accr. 5.9% 2023E EPS Accr. 6.5% TBV Earnback 0.25 yrs. 1. Based on Seacoast’s closing price of $35.53 as of March 23, 2021 2. Bank-level regulatory data for the year ended December 31, 2020 3. Estimated 2022 net income for Legacy Bank of Florida 4. Defined as deal P/TBV divided by trading P/TBV, based on Seacoast’s closing price of $35.53 as of March 23, 2021 5. Includes nationwide U.S. bank and thrift transactions announced in 2019 or 2020 with disclosed deal value greater than $15 million; Source: S&P Global Market Intelligence Key Transaction Metrics Key Assumptions Cost Savings 45% Pre-tax Mark on Loan Book 3.71% 9

TCE Ratio 16.17% 11.33% 16.01% SBCF at 12/31/2020 Legacy at 12/31/2020 Pro Forma at Closing Tier 1 Common Ratio Total Capital Ratio Tier 1 Ratio Leverage Ratio 6.5% Well Capitalized 18.51% 11.97% 18.32% SBCF at 12/31/2020 Legacy at 12/31/2020 Pro Forma at Closing 17.46% 11.33% 17.16% SBCF at 12/31/2020 Legacy at 12/31/2020 Pro Forma at Closing 11.92% 10.49% 12.47% SBCF at 12/31/2020 Legacy at 12/31/2020 Pro Forma at Closing Tangible Common Equity ($M) 11.01% 10.70% 11.59% SBCF at 12/31/2020 Legacy at 12/31/2020 Pro Forma at Closing $892,481 $57,063 $990,587 SBCF at 12/31/2020 Legacy at 12/31/2020 Pro Forma at Closing 10% Well Capitalized 8% Well Capitalized 5% Well Capitalized 1 Amounts in mill ions Negligible Impact on Seacoast’s Capital Base – Maintaining Robust Pro Forma Capital Ratios Following The Transaction Note: Bank-level regulatory data as of December 31, 2020 used for Legacy Bank of Florida Source: S&P Global Market Intelligence 10

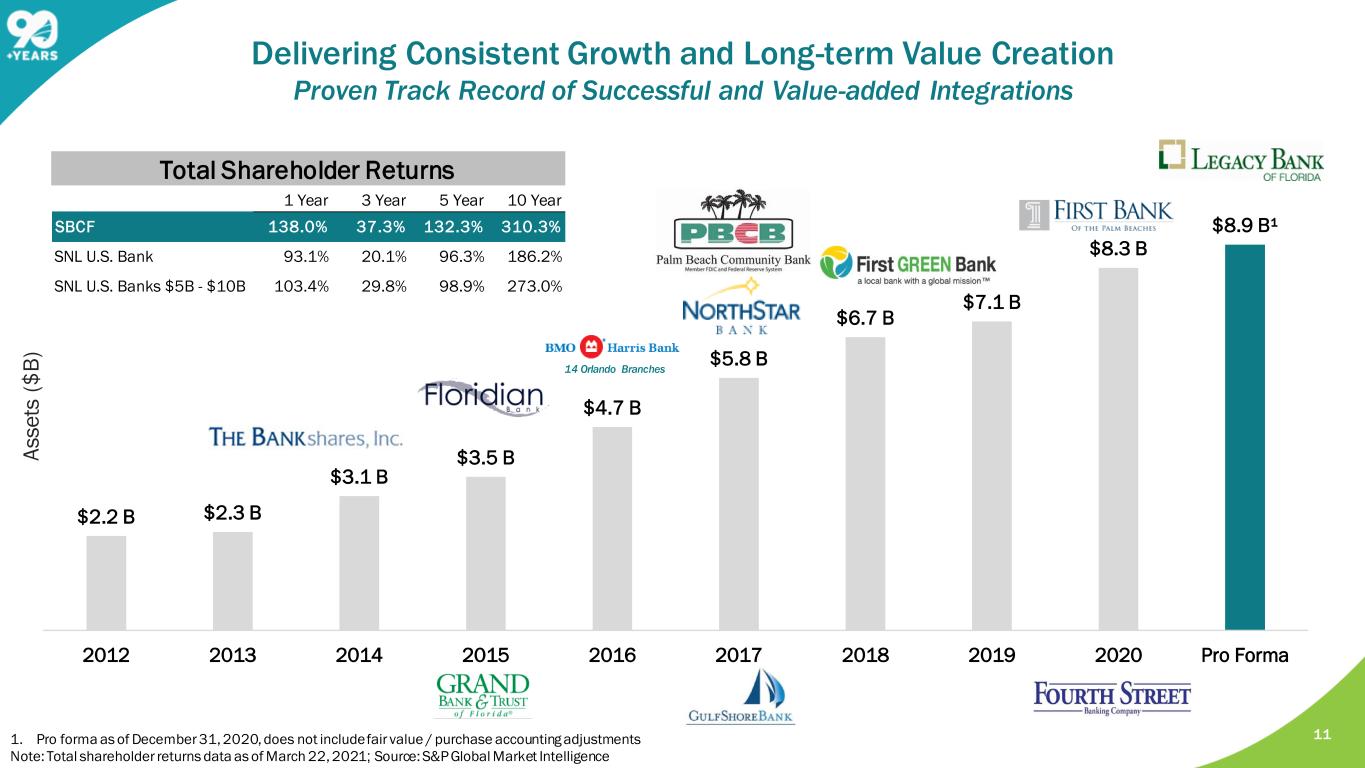

$2.2 B $2.3 B $3.1 B $3.5 B $4.7 B $5.8 B $6.7 B $7.1 B $8.3 B $8.9 B¹ 2012 2013 2014 2015 2016 2017 2018 2019 2020 Pro Forma Total Shareholder Returns A s s e ts ( $ B ) Delivering Consistent Growth and Long-term Value Creation Proven Track Record of Successful and Value-added Integrations 1 Year 3 Year 5 Year 10 Year SBCF 138.0% 37.3% 132.3% 310.3% SNL U.S. Bank 93.1% 20.1% 96.3% 186.2% SNL U.S. Banks $5B - $10B 103.4% 29.8% 98.9% 273.0% 1. Pro forma as of December 31, 2020, does not include fair value / purchase accounting adjustments Note: Total shareholder returns data as of March 22, 2021; Source: S&P Global Market Intelligence 11 14 Orlando Branches

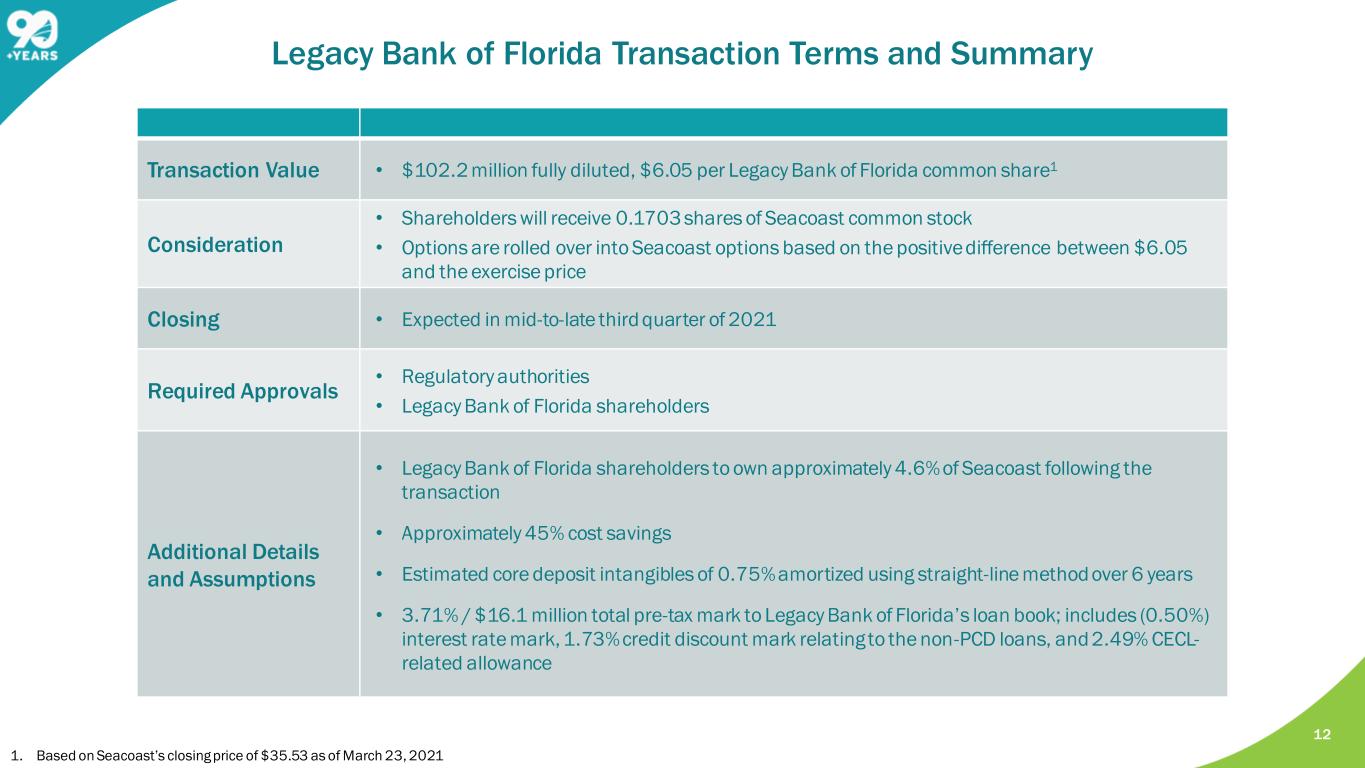

Transaction Value • $102.2 million fully diluted, $6.05 per Legacy Bank of Florida common share1 Consideration • Shareholders will receive 0.1703 shares of Seacoast common stock • Options are rolled over into Seacoast options based on the positive difference between $6.05 and the exercise price Closing • Expected in mid-to-late third quarter of 2021 Required Approvals • Regulatory authorities • Legacy Bank of Florida shareholders Additional Details and Assumptions • Legacy Bank of Florida shareholders to own approximately 4.6% of Seacoast following the transaction • Approximately 45% cost savings • Estimated core deposit intangibles of 0.75% amortized using straight-line method over 6 years • 3.71% / $16.1 million total pre-tax mark to Legacy Bank of Florida’s loan book; includes (0.50%) interest rate mark, 1.73% credit discount mark relating to the non-PCD loans, and 2.49% CECL- related allowance Legacy Bank of Florida Transaction Terms and Summary 1. Based on Seacoast’s closing price of $35.53 as of March 23, 2021 12

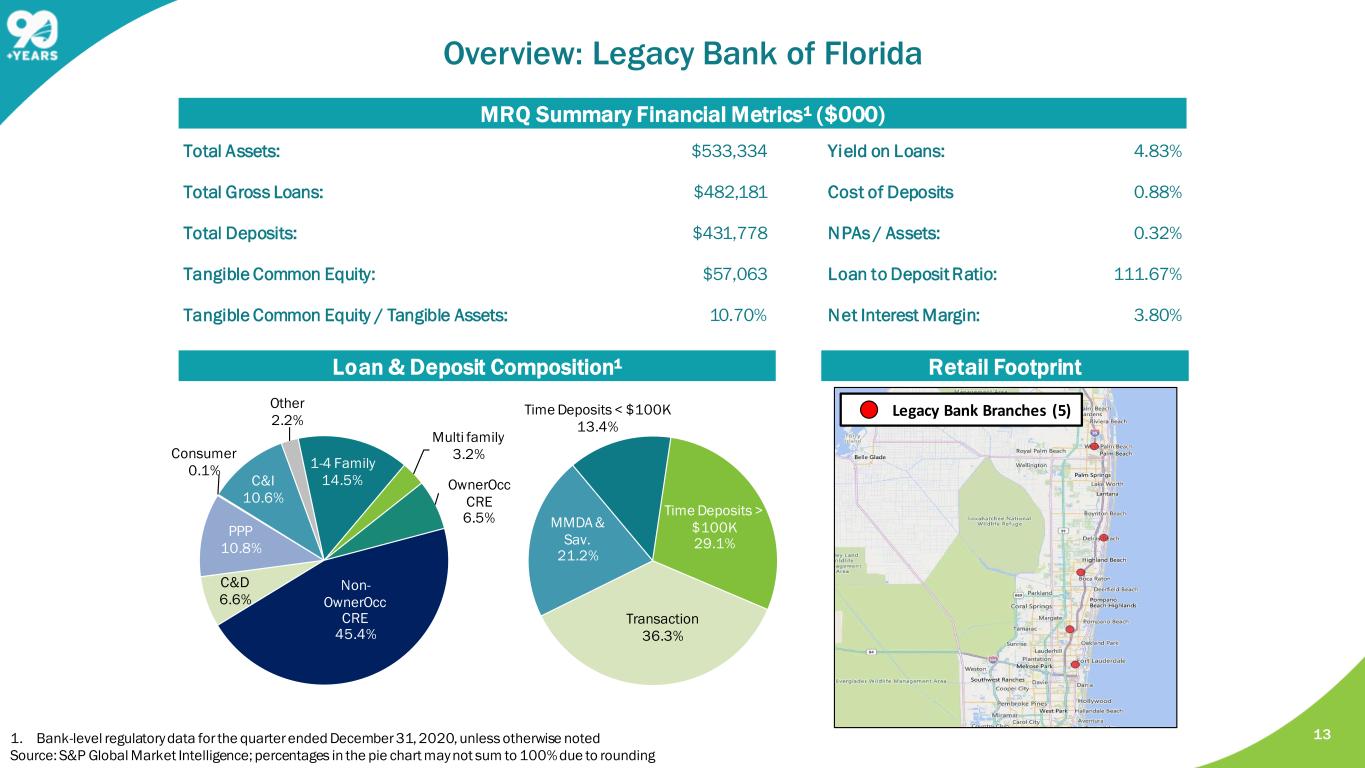

Total Assets: $533,334 Total Gross Loans: $482,181 Total Deposits: $431,778 Tangible Common Equity: $57,063 Tangible Common Equity / Tangible Assets: 10.70% Overview: Legacy Bank of Florida 1. Bank-level regulatory data for the quarter ended December 31, 2020, unless otherwise noted Source: S&P Global Market Intelligence; percentages in the pie chart may not sum to 100% due to rounding MRQ Summary Financial Metrics¹ ($000) Loan & Deposit Composition¹ Retail Footprint Time Deposits < $100K 13.4% Time Deposits > $100K 29.1% Transaction 36.3% MMDA & Sav. 21.2% Yield on Loans: 4.83% Cost of Deposits 0.88% NPAs / Assets: 0.32% Loan to Deposit Ratio: 111.67% Net Interest Margin: 3.80% 1-4 Family 14.5% Multi family 3.2% OwnerOcc CRE 6.5% Non- OwnerOcc CRE 45.4% C&D 6.6% PPP 10.8% Consumer 0.1% C&I 10.6% Other 2.2% Legacy Bank Branches (5) 13

o In-market acquisition of a high quality franchise with a high-yielding loan portfolio in attractive South Florida markets o Improves Seacoast’s projected profitability and returns ~6% EPS accretion in 2022 o Minimal upfront dilution to tangible book value per share, earned back in approximately 0.25 years (crossover method, inclusive of the impact of CECL) o Leverages Seacoast’s proven integration capabilities o Strengthens Seacoast’s attractive Florida franchise and position within the desirable Broward County and Palm Beach County markets Transaction Summary: Legacy Bank of Florida 14

Appendix 15

CECL Impact • Loans to be separated into purchased credit deteriorated (PCD) and non-purchased credit deteriorated (non-PCD) PCD Loans • The credit mark from purchase accounting relating to PCD loans will be recorded as allowance Non-PCD Loans • The credit mark from purchase accounting relating to the non-PCD loans will be recorded on a net basis (a contra loan balance without any allowance), and in addition to this purchase accounting discount, will require a separate allowance established through provision • The non-PCD credit mark relating to the purchase accounting is assumed to be accreted back through income over the life of the loans Credit and Interest Rate Mark • 1.99% / $8.6 million gross pre-tax credit and interest rate mark on the loan portfolio ‒ $3.3 million pre-tax, or 3.59% mark on PCD loans (0.76% of gross loans excl. PPP loans), recorded as allowance ‒ $7.5 million pre-tax, or 2.19% mark on non-PCD loans (1.73% of gross loans excl. PPP loans), recorded as a contra-loan discount; assumed to be accreted through income over 4.0 years ‒ ($2.2) million pre-tax, or (0.50%) interest rate mark on total loans (excl. PPP loans), recorded as a contra loan discount • $7.5 million pre-tax, or 2.23% recorded in provision expense through the income statement, established on Day One on the Legacy Bank of Florida non-PCD loans (in addition to the non-PCD credit mark above) • 3.71% / $16.1 million total pre-tax mark to Legacy Bank of Florida’s loan book; includes (0.50%) interest rate mark, 1.73% credit discount mark relating to the non-PCD loans, and 2.49% CECL-related allowance ‒ $5.3 million of the mark is accreted back through income (mark equal to 1.23% of total loans excl. PPP) ‒ $10.8 million of the mark is not accreted back through income (mark equal to 2.49% of total loans excl. PPP); recorded as allowance Transaction Summary: Loan Portfolio Mark and CECL Assumptions 16

23.5% 2.6% 18.6% 23.0% 4.4% 9.8% 3.0% 12.8% 2.2% Prudent Loan Portfolio Mix Maintained Post Consolidation $432M 24.3% 2.5% 19.7% 21.1% 4.2% 9.8% 3.3% 13.0% 2.2% $5.8B C&DNon-OO CRE PPPOwner Occupied CRE1-4 Family Multi family C&IConsumer Other 14.5% 3.2% 6.5% 45.4% 6.6% 10.8% 0.1% 10.6% 2.2% $482M 1. Does not include fair value adjustments 2. Adjusted for reversal of Legacy Bank of Florida’s allowance included in total capital; excludes other purchase accounting adjustments Note: Data reflects bank-level regulatory data as of December 31, 2020; Source: S&P Global Market Intelligence; percentages in the pie chart may not sum to 100% due to rounding MRQ Yield on Loans: 4.83% C&D Ratio: 52.9% Non-OO CRE Ratio: 442.5% MRQ Yield on Loans: 4.44% C&D Ratio: 25.6% Non-OO CRE Ratio: 169.1% MRQ Yield on Loans: 4.47% C&D Ratio: 27.3%³ Non-OO CRE Ratio: 185.9%2 Pro Forma Portfolio Mix L o a n C o m p o s it io n D e p o s it C o m p o s it io n Jumbo Time (> $100K)Retail Time (< $100K)Transaction Savings & MMDA $6.3B1 MRQ Cost of Deposits: 0.88% Noninterest Bearing %: 22.9% MRQ Cost of Deposits: 0.19% Noninterest Bearing %: 33.0% 15.9% 70.3% 6.6% 7.2%14.6% 73.4% 6.1% 5.8% 17 $6.9B $7.4B1 MRQ Cost of Deposits: 0.23% Noninterest Bearing %: 32.4 36.3% 21.2% 13.4% 29.1%

1. Loan data for Seacoast and Legacy as of December 31, 2020 2. All portfolios excluding PPP loans Selected COVID-19 Sensitive Sectors 18 Hotel Retail Office Restaurant $131 million 2.3% of portfolio $455 million 7.9% of portfolio $761 million 13.3% of portfolio $50 million 0.9% of portfolio • Average Hotel loan is $2.8 million • Diversity obtained through Florida geographic markets, locations along major corridor or near beach, nominal exposure near theme park or convention centers • Average Retail loan is $1.3million • Diversity via geography and tenancy, multi-bay shopping centers that does not include regional malls, outlet malls, movie or entertainment venues • Average Office loan is $629,000 • Geographically diverse, no high-rise buildings • Average Restaurant loan is $808 thousand • Range from national franchise to local operators Seacoast Legacy Pro forma $49 million 10.2% of portfolio $104 million 21.4% of portfolio $25 million 5.1% of portfolio $8 million 1.6% of portfolio $180 million 2.9% of portfolio $559 million 9.0% of portfolio $786 million 12.6% of portfolio $58 million 0.9% of portfolio