Attached files

| file | filename |

|---|---|

| EX-32.1 - Power REIT | ex32-1.htm |

| EX-31.1 - Power REIT | ex31-1.htm |

| EX-23.1 - Power REIT | ex23-1.htm |

| EX-21.1 - Power REIT | ex21-1.htm |

| EX-4.1 - Power REIT | ex4-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OFTHE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2020

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number: 001-36312

POWER REIT

(Exact name of registrant as specified in its charter)

| Maryland | 45-3116572 | |

(State or Other Jurisdiction of Incorporation or organization) |

(I.R.S. Employer Identification No.) |

301 Winding Road, Old Bethpage, New York 11804

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (212) 750-0371

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered | ||

| Common Shares | PW | NYSE American, LLC | ||

| 7.75% Series A Cumulative Redeemable Perpetual Preferred Stock, Liquidation Preference $25 per Share | PW.A | NYSE American, LLC |

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirement for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | [ ] | Accelerated filer | [ ] |

| Non-accelerated filer | [X] | Smaller reporting company | [X] |

| Emerging growth company | [ ] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes [ ] No [X]

The aggregate market value of the voting and non-voting common equity of the Registrant held by non-affiliates as of June 30, 2020, the Registrant’s most recently completed second fiscal quarter, was approximately $39,752,194 computed by reference to the closing price of the Registrant’s shares of beneficial interest (“common shares” or “common stock”) on June 30, 2020 of $28.75.

As of March 24, 2021, there were 3,299,233 common shares outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None

TABLE OF CONTENTS

POWER REIT AND SUBSIDIARIES

| 2 |

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Annual Report”) document contains forward-looking statements within the meaning of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. Forward-looking statements are those that predict or describe future events or trends and that do not relate solely to historical matters. You can generally identify forward-looking statements by the use of words such as “believe,” “expect,” “will,” “anticipate,” “intend,” “estimate,” “would,” “should,” “project,” “plan,” “assume” or other similar words or expressions, or negatives of such words or expressions, although not all forward-looking statements can be identified in this way. All statements contained in this document regarding strategy, plans, future operations, projected financial condition or results of operations, prospects, the future of Power REIT’s industries and markets, outcomes that might be obtained by pursuing management’s plans and objectives, and similar subjects, are forward-looking statements. Over time, Power REIT’s actual performance, results, financial condition and achievements may differ from the anticipated performance, results, financial condition and achievements that are expressed or implied by Power REIT’s forward-looking statements, and such differences may be significant and materially adverse to Power REIT and its security holders.

All forward-looking statements reflect Power REIT’s good-faith beliefs, assumptions and expectations, but they are not guarantees of future performance. Furthermore, Power REIT disclaims any obligation to publicly update or revise any forward-looking statements to reflect changes in underlying assumptions or factors, new information, data or methods, future events or other changes. For a further discussion of factors that could cause Power REIT’s future performance, results, financial condition or achievements to differ materially from that which is expressed or implied in Power REIT’s forward-looking statements, see “Risk Factors” under Item 1A of this document.

Summary Risk Factors

The following is a summary of the risks relating to the Company. A more detailed description of each of the risks can be found below under the section captioned “Risk Factors”.

Risks Related to our Operations

| ● | Our business activities, and the business activities of our cannabis tenant, while believed to be compliant with applicable U.S. state and local laws, are currently illegal under U.S. federal law. | |

| ● | Our business strategy includes growth plans. Our financial condition and results of operations could be negatively affected if we fail to grow or fail to manage our growth or investments effectively. | |

| ● | Even if we are able to execute our business strategy, that strategy may not be successful. | |

| ● | We operate in a highly competitive market for investment opportunities and we may be unable to identify and complete acquisitions of real property assets. | |

| ● | Because we may distribute a significant portion of our income to our stockholders or lenders, we will continue to need additional capital to make new investments. If additional funds are unavailable or not available on favorable terms, our ability to make new investments will be impaired. | |

| ● | The investment portfolio is, and in the future may continue to be, concentrated in its exposure to a relatively few number of investments, industries and lessees. | |

| ● | Our Property portfolio has a high concentration of properties located in certain states. | |

| ● | If our acquisitions or our overall business performance fail to meet expectations, the amount of cash available to us to pay dividends may decrease and we could default on our loans, which are secured by collateral in our properties and assets. | |

| ● | Our operating results may be negatively affected by potential development and construction delays and resultant increased costs and risks. |

| 3 |

| ● | The issuance of securities with claims that are senior to those of our common shares, including our Series A Preferred Stock, may limit or prevent us from paying dividends on its common shares. There is no limitation on our ability to issue securities senior to the Trust’s common shares or incur indebtedness. | |

| ● | The ability of the Trust to service its obligations and pay dividends depends on the ability of its wholly-owned subsidiaries to make distributions to it. | |

| ● | We are dependent upon Mr. David H. Lesser for our success. On occasion, his interests may conflict with ours. | |

| ● | From time to time, our management team may own interests in our lessees or other counterparties, and may thereby have interests that conflict or appear to conflict with the Trust’s interests. | |

| ● | Our lessees and many future lessees will likely be structured as special purpose vehicles (“SPVs”), and therefore their ability to pay us is expected to be dependent solely on the revenues of a specific project, without additional credit support. | |

| ● | Some losses related to our real property assets may not be covered by insurance or indemnified by our lessees, and so could adversely affect us. | |

| ● | Discovery of previously undetected environmentally hazardous conditions may adversely affect our operating results. | |

| ● | Legislative, regulatory, accounting or tax rules, and any changes to them or actions brought to enforce them, could adversely affect us. | |

| ● | Changes in interest rates may negatively affect the value of our assets, our access to debt financing and the trading price of our securities. | |

| ● | Our quarterly results may fluctuate. | |

| ● | We may not be able to sell our real property assets when we desire. In particular, in order to maintain our status as a REIT, we may be forced to borrow funds or sell assets during unfavorable market conditions. | |

| ● | We may fail to remain qualified as a REIT, which would reduce the cash available for distribution to our shareholders and may have other adverse consequences. | |

| ● | If an investment that was initially believed to be a real property asset is later deemed not to have been a real property asset at the time of investment, we could lose our status as a REIT or be precluded from investing according to our current business plan. | |

| ● | If we were deemed to be an investment company under the Investment Company Act of 1940, applicable restrictions could make it impractical for us to continue our business as contemplated and could have a material adverse effect on the price of our securities. | |

| ● | Net leases may not result in fair market lease rates over time. | |

| ● | If a sale-leaseback transaction is recharacterized in a lessee’s bankruptcy proceeding, our financial condition could be adversely affected. | |

| ● | Provisions of the Maryland General Corporation Law and our Declaration of Trust and Bylaws could deter takeover attempts and have an adverse impact on the price of our common shares. |

Risks Related to Our Investment Strategy

| ● | Our focus on non-traditional real estate asset classes including CEA, alternative energy and transportation infrastructure sectors will subject us to more risks than if we were broadly diversified to include other asset classes. | |

| ● | Renewable energy resources are complex, and our investments in them rely on long-term projections of resource and equipment availability and capital and operating costs; if our or our lessees’ projections are incorrect, we may suffer losses. | |

| ● | Infrastructure assets may be subject to the risk of fluctuations in commodity prices and in the supply of and demand for infrastructure consumption. |

| 4 |

| ● | Infrastructure investments are subject to obsolescence risks. | |

| ● | Renewable energy investments may be adversely affected by variations in weather patterns. | |

| ● | If the development of renewable energy projects slows, we may have a harder time sourcing investments. | |

| ● | Investments in renewable energy may be dependent on equipment or manufacturers that have limited operating histories or financial or other challenges. |

Risks Related to our Securities

| ● | There is a 9.9% limit on the amount of our equity securities that any one person or entity may own. | |

| ● | Factors could lead to the Trust losing one or both of its NYSE listings. | |

| ● | Low trading volumes in the Trust’s listed securities may adversely affect holders’ ability to resell their securities at prices that are attractive, or at all. | |

| ● | Our stock price has fluctuated in the past, has recently been volatile and may be volatile in the future, and as a result, investors in our common stock could incur substantial losses. | |

| ● | Our ability to issue preferred stock in the future could adversely affect the rights of existing holders of our equity securities. | |

| ● | The issuance of additional equity securities may dilute existing equity holders. | |

| ● | Our equity securities is subject to interest rate risk. | |

| ● | Inflation may negatively affect the value of our equity securities and the dividends we pay. | |

| ● | Our Series A Preferred Stock has not been rated and is junior to our existing and future debt, and the interests of holders of Series A Preferred Stock could be diluted by the issuance of additional parity-preferred securities and by other transactions. | |

| ● | Holders of Series A Preferred Stock have limited voting rights. | |

| ● | The change of control conversion and delisting conversion features of our Series A Preferred Stock may not adequately compensate a holder of such securities upon a Change of Control or Delisting Event (as such terms as defined in regard to our Series A Preferred Stock), and the change of control conversion, delisting conversion and redemption features of our Series A Preferred Stock may make it more difficult for a party to take over our trust or may discourage a party from taking over our trust. | |

| ● | We may issue additional Series A Preferred Stock at a discount to liquidation value or at a discount to the issuance value of shares of Series A Preferred Stock already issued. |

Risks Related to Regulation

| ● | We cannot assure you that our equity securities will remain listed on the NYSE American. | |

| ● | The U.S. federal government’s approach towards cannabis laws may be subject to change or may not proceed as previously outlined. | |

| ● | Laws, regulations and the policies with respect to the enforcement of such laws and regulations affecting the cannabis industry in the United States are constantly changing, and we cannot predict the impact that future regulations may have on us. | |

| ● | We may be subject to anti-money laundering laws and regulations in the United States. | |

| ● | Litigation, complaints, enforcement actions and governmental inquiries could have a material adverse effect on our business, financial condition and results of operations. | |

| ● | We and our cannabis tenant may have difficulty accessing the service of banks, which may make it difficult for us and for them to operate. |

Overview

Power REIT (the “Registrant” or the “Trust”, and together with its consolidated subsidiaries, “we”, “us”, or “Power REIT”, unless the context requires otherwise) is a Maryland-domiciled real estate investment trust (a “REIT”) that owns a portfolio of real estate assets related to transportation, energy infrastructure and Controlled Environment Agriculture (“CEA”) in the United States. In 2019, we expanded the focus of our real estate acquisitions to include CEA properties in the United States. CEA is an innovative method of growing plants that involves creating optimized growing environments for a given crop indoors. CEA in the form of a greenhouse uses approximately 70% less energy than indoor growing, 95% less water usage than outdoor growing, and does not have any agricultural runoff of fertilizers or pesticides. We typically enter into long-term triple net leases where our tenants are responsible for all costs related to the property, including insurance, taxes and maintenance.

Our growth strategy focuses on identifying attractive real estate opportunities that exhibit attractive risk adjusted yields on investment relative to traditional real estate sectors. We are currently focused on making new acquisitions of real estate within the CEA sector related to cannabis cultivation. We believe there will be continued strong demand for cannabis related CEA in the form of greenhouses which we believe is the sustainable business model that can produce plants at a lower cost in an environmentally friendly way. We believe a convergence of changing public attitudes and increased cannabis legalization momentum in certain states creates an attractive opportunity to invest in cannabis related real estate. We expect that acquisition opportunities will continue to expand as additional states legalize the use of cannabis.

| 5 |

We believe there is strong demand for capital from licensed cannabis cultivators that currently do not have access to traditional financing sources such as bank debt. Our construction financing and sale leaseback solutions provide attractive financing that allows cannabis operators to add additional growing capacity and/or invest in the growth of their business. Our tenants that are cannabis operators are able to achieve strong rent coverage based on the growing capacity of their facilities and the current wholesale price of cannabis. In addition, we believe our unique and flexible lease structure for cannabis operators, which typically includes a period of higher rent in the initial years of the lease and a reset to a lower rent for the remainder of the lease term provides strong protection to our investment basis while setting the tenant up for long-term success in the event cannabis prices decrease or federal legalization of cannabis is enacted.

Corporate Structure

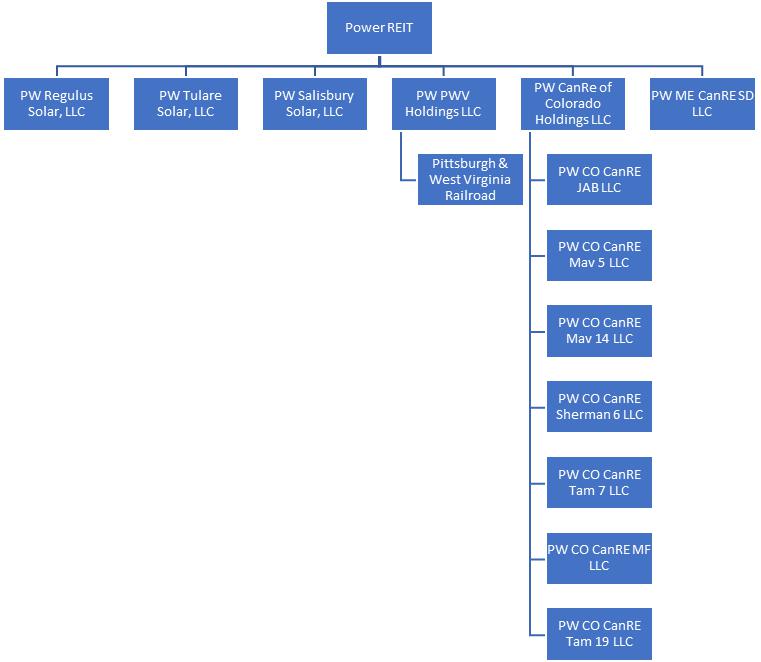

Power REIT was formed as part of a reorganization and reverse triangular merger of P&WV that closed on December 2, 2011. P&WV survived the reorganization as a wholly-owned subsidiary of the Registrant. Currently, the Trust is structured as a holding company and owns its assets through fourteen wholly-owned, special purpose subsidiaries that have been formed in order to hold real estate assets, obtain financing and generate lease revenue.

The chart below shows the organizational structure of the Trust as of December 31, 2020.

| 6 |

2020 Highlights

During 2020, we acquired nine CEA properties in Colorado and Maine totaling approximately 187,000 square feet of greenhouses and cultivation/processing buildings representing a total capital commitment of approximately $17.9 million (consisting of purchase price and development costs but excluding transaction costs). Power REIT entered into seven new triple-net leases and three lease amendments with state-licensed medical cannabis operators related to these acquisitions which generate straight-line annualized rent of approximately $3.4 million, representing greater than over 18% yield on invested capital.

| Year Ended December 31, | Three Months Ended December 31, | |||||||||||||||

| 2020 | 2019 | 2020 | 2019 | |||||||||||||

| Revenue | $ | 4,272,709 | $ | 2,180,898 | $ | 1,394,613 | $ | 626,823 | ||||||||

| Net Income Attributable to Common Shareholders | $ | 1,891,644 | $ | 666,662 | $ | 793,914 | $ | 192,440 | ||||||||

| Net Income per Common Share (diluted) | 0.96 | 0.36 | 0.40 | 0.10 | ||||||||||||

| Core FFO Available to Common Shareholders | $ | 2,560,225 | $ | 1,173,958 | $ | 973,578 | $ | 327,070 | ||||||||

| Core FFO per Common Share | 1.34 | 0.63 | 0.51 | 0.17 | ||||||||||||

| Growth Rates: | ||||||||||||||||

| Revenue | 96 | % | 122 | % | ||||||||||||

| Net Income Attributable to Common Shareholders | 184 | % | 313 | % | ||||||||||||

| Net Income per Common Share (diluted) | 167 | % | 300 | % | ||||||||||||

| Core FFO Available to Common Shareholders | 118 | % | 198 | % | ||||||||||||

| Core FFO per Common Share | 113 | % | 200 | % | ||||||||||||

*see Net Income to Core FFO reconciliation in Item 7 below.

2020 Acquisitions

On January 31, 2020, PW CO CanRe Mav 14, LLC (“PW Mav 14”), one of our indirect subsidiaries, acquired 5.54 acres of land in Colorado (the “Mav 14 Property”) with an existing greenhouse and processing facility totaling 9,300 square-feet for the cultivation of cannabis for $850,000. Concurrent with the closing, PW Mav 14 entered into a triple-net lease (the “Mav 14 Lease”) with its current tenant (the “Mav 14 Tenant”) who is responsible for paying all expenses related to the Mav 14 Property including maintenance expenses, insurances and taxes. As part of the transaction, PW Mav 14 agreed to fund the construction of 15,120 square feet of greenhouse space for $1,058,400 and the Mav 14 Tenant has agreed to fund the construction of approximately 2,520 additional square feet of head-house/processing space on the Mav 14 Property. Accordingly, the Trust’s total capital commitment is $1,908,400. The term of the Mav 14 Lease is 20 years and provides two options to extend for additional five-year periods. The Mav 14 Lease also has financial guarantees from affiliates of the Mav 14 Tenant. The Mav 14 Tenant intends to operate as a licensed medical cannabis cultivation and processing facility. The rent for the Mav 14 Lease is structured whereby after a six-month deferred-rent period, the rental payments provide PW Mav 14 a full return of invested capital over the next three years in equal monthly payments. Thereafter, rent is structured to provide a 12.5% return based on invested capital with annual rent increases of 3% rate per annum. At any time after year six, if cannabis is legalized at the federal level, the rent will be adjusted down to an amount equal to a 9% return on the original invested capital amount and will increase at a 3% rate per annum based on a starting date of the start of year seven. The Mav 14 Lease requires the Mav 14 Tenant to maintain a medical cannabis license and operate in accordance with all Colorado and local regulations with respect to its operations. The Mav 14 Lease prohibits the retail sale of cannabis and cannabis-infused products from the Mav 14 Property. The straight-line annual rent of approximately $354,000 represents an estimated yield of over 18%. The construction on the project is substantially completed and the project is currently operational.

| 7 |

On February 20, 2020, PW CO CanRe Sherman 6, LLC (“PW Sherm 6”), one of our indirect subsidiaries, closed on the acquisition of 5.0 acres of vacant land in Colorado (the “Sherman 6 Property”) for $150,000. As part of the transaction, PW Sherm 6 agreed to fund the immediate construction of 15,120 square feet of greenhouse space and 8,776 square feet of head-house/processing space on the Sherman 6 Property for $1,693,800. Accordingly, Power REIT’s total capital commitment is $1,843,800. On February 1, 2020, PW Sherm 6 entered into a triple-net lease (the “Initial Sherman Lease”) with its tenant (the “Sherman 6 Tenant”) such that the Sherman 6 Tenant is responsible for paying all expenses related to the Sherman 6 Property including maintenance expenses, insurances and taxes. The term of the Initial Sherman Lease is 20 years and provides two options to extend for additional five-year periods. The Initial Sherman Lease also has financial guarantees from affiliates of the tenants. The tenant intends to operate as a licensed cannabis cultivation and processing facility. The rent for the Initial Sherman Lease is structured whereby after a nine-month deferred-rent period, the rental payments provide PW Sherm 6 a full return of invested capital over the next three years in equal monthly payments. Thereafter, rent is structured to provide a 12.9% return based on invested capital with annual rent increases of 3% rate per annum. At any time after year six, if cannabis is legalized at the federal level, the rent will be adjusted down to an amount equal to a 9% return on the original invested capital amount and will increase at a 3% rate per annum based on a starting date of the start of year seven. The Initial Sherman Lease requires the tenant to maintain a medical cannabis license and operate in accordance with all Colorado and local regulations with respect to its operations. The Initial Sherman Lease prohibits the retail sale of the tenant’s cannabis and cannabis-infused products from the Sherman 6 Property. The additional straight-line annual rent of approximately $346,000 represents an estimated yield of over 18%. The construction on the project is substantially completed and the project is currently operational.

On August 25, 2020, PW Sherm 6 entered into an agreement (as amended, the “Sherman Lease”) for the expansion of the Sherman 6 Property with the Sherman 6 Tenant. The expansion consists of approximately 2,520 square feet of additional greenhouse/headhouse space. The Sherman 6 Tenant is responsible for implementing the expansion and PW Sherm 6 will fund the cost of such expansion up to a total of $151,301, with any additional amounts funded by the Sherman 6 Tenant. Once completed, Power REIT’s total investment in the Sherman 6 Property will be $1,995,101. As part of the agreement, PW Sherm 6 and the Sherman 6 Tenant have amended the Lease whereby after a nine month period, the additional rental payments provide PW Sherm 6 with a full return of its original invested capital over the next three years and thereafter, provide a 12.9% return increasing 3% rate per annum. The additional straight-line rent of approximately $29,000 represents an estimated yield of over 18%.

On March 19, 2020, PW CO CanRe Mav 5, LLC (“PW Mav 5”), one of our indirect subsidiaries purchased a 5.2 acre of vacant land in Colorado for $150,000 (the “Mav 5 Property”). As part of the acquisition, the Trust agreed to fund the immediate construction of 5,040 square feet of greenhouse space and 4,920 square feet of head-house/processing space for $868,125. Accordingly, Power REIT’s total capital commitment is $1,018,125. Concurrent with the closing, PW Mav 5 entered into a triple-net lease (the “Mav 5 Lease”) with its current tenant (the “Mav 5 Tenant”) who is responsible for paying all expenses related to the property including maintenance expenses, insurances and taxes. The term of the Mav 5 Lease is 20 years and provides two options to extend for additional five-year periods. The Mav 5 Lease also has financial guarantees from affiliates of the Mav 5 Tenant. The Mav 5 Tenant intends to operate as a licensed cannabis cultivation and processing facility. The rent for the Mav 5 Lease is structured whereby after a six-month deferred-rent period, the rental payments provide PW MAV 5 a full return of invested capital over the next three years in equal monthly payments. Thereafter, rent is structured to provide a 12.5% return based on invested capital with annual rent increases of 3% rate per annum. At any time after year six, if cannabis is legalized at the federal level, the rent will be adjusted down to an amount equal to a 9% return on the original invested capital amount and will increase at a 3% rate per annum based on a starting date of the start of year seven. The lease requires the tenant to maintain a medical cannabis license and operate in accordance with all Colorado and local regulations with respect to its operations. The Mav 5 Lease prohibits the retail sale of cannabis and cannabis-infused products from the Mav 5 Property. The straight-line annual rent of approximately $193,000 represents an estimated yield of over 18%.

| 8 |

On May 1, 2020, PW Mav 5, entered into an agreement for a 5,040 square-foot greenhouse expansion. Our investment in the expansion is $340,539 and a lease amendment, entered into on May 1, 2020 is structured to provide rent on similar economics to the original Mav 5 Lease and provides additional straight-line annual rent of approximately $63,000, representing an estimated yield of over 18%. The construction on the project is substantially completed and the project is currently operational.

On May 15, 2020, PW ME CanRe SD, LLC (“PW SD”), one of our indirect subsidiaries, acquired a 3.06-acre property in York County, Maine for $1,000,000 (the “495 Property”). The SD Property includes a 32,800 square-foot greenhouse and 2,800 square foot processing/distribution building that are both under active construction. Simultaneous with the acquisition, PW SD entered into a lease (the “SD Lease”) with an operator (“Sweet Dirt”). As part of the acquisition, PW SD reimbursed Sweet Dirt for $950,000 of the approximately $1.5 million Sweet Dirt has incurred related to the construction and agreed to fund up to approximately $2.97 million of costs to complete the construction. Accordingly, our total investment in the 495 Property will be approximately $4.92 million which translates to approximately $138 per square foot for a state-of-the-art Controlled Environment Agriculture Greenhouse (“CEAG”). The rent for the Sweet Dirt Lease is structured whereby after a six-month deferred-rent period, the monthly rental payments over the next three years will provide us with a full return of invested capital. Thereafter, rent is structured to provide a 12.9% return based on invested capital with annual rent increases of 3% rate per annum. At any time after year six, if cannabis is legalized at the federal level, we have agreed to decrease the rent to an amount equal to a 9% return on the original invested capital amount with increases at a 3% rate per annum based on a starting date of the start of year seven. SD Lease is structured to provide straight-line annual rent of approximately $920,000, representing an estimated yield of over 18.5% with the tenant responsible for all operating expenses. The SD Lease requires Sweet Dirt to maintain a medical cannabis license and operate in accordance with all Maine and local regulations with respect to its operations. In addition, we received an option to acquire an adjacent 3.58 vacant parcel (the “505 Property”) that is owned by Sweet Dirt for $400,000 which provides us the option to finance additional cultivation and processing space for Sweet Dirt.

On September 18, 2020, PW SD completed the acquisition of the 505 Property in York County, Maine by exercising its option received at the time of the 495 Property acquisition. The 505 Property is a 3.58-acre property purchased for $400,000 plus closing costs and is adjacent to the 495 Property. Concurrently with the closing of the acquisition of the 505 Property, PW SD and Sweet Dirt entered into an amendment to the SD Lease whereby after a nine-month deferred-rent period, the rental payments provide PW SD a full return of invested capital over the next three years. Thereafter, rent is structured to provide a 13.2% return based on invested capital with annual rent increases of 3% per annum. At any time after year six, if cannabis is legalized at the federal level in the United States, the rent will be adjusted down to an amount equal to a 9% return on the original invested capital amount and will increase at a 3% rate per annum based on a starting date of the start of year seven. The amended SD Lease provides for a straight-line annual rent of approximately $373,000, representing an estimated yield of over 18.5% with the tenant responsible for all operating expenses. As part of the transaction, the Trust agreed to fund the construction of an additional 9,900 square feet of processing space and renovate an existing 2,738 square foot building for approximately $1.56 million. Accordingly, the Trust’s total investment in the 505 Property will be approximately $1.96 million.

| 9 |

On September 18, 2020, PW CO CanRE Tam 7, LLC (“Tam 7”), one of our indirect subsidiaries, acquired a 4.32-acre property in Crowley County, Colorado for $150,000 (the “Tam 7 Property”). As part of the transaction, Tam 7 agreed to fund the immediate construction of 18,000 square feet of greenhouse and processing space on the Tam 7 Property for approximately $1.22 million. Accordingly, the Trust’s total capital commitment will be $1,364,585. Concurrent with the closing, Tam 7 entered into a triple-net lease (the “Tam 7 Lease”) with its current tenant (the “Tam 7 Tenant”) who is responsible for paying all expenses related to the Tam 7 Property including maintenance expenses, insurances and taxes. The term of the Tam 7 Lease is 20 years and provides two options to extend for additional five-year periods. The Tam 7 Lease also has financial guarantees from affiliates of the Tam 7 Tenant. The Tam 7 Tenant intends to operate as a licensed cannabis cultivation and processing facility. The rent for the Tam 7 Lease is structured whereby after a six-month deferred-rent period, the rental payments provide Tam 7 a full return of invested capital over the next three years in equal monthly payments. Thereafter, rent is structured to provide a 12.9% return based on invested capital with annual rent increases of 3% rate per annum. At any time after year six, if cannabis is legalized at the federal level in the United States, the rent will be adjusted down to an amount equal to a 9% return on the original invested capital amount and will increase at a 3% rate per annum based on a starting date of the start of year seven. The Tam 7 Lease requires the Tam 7 Tenant to maintain a medical cannabis license and operate in accordance with all Colorado and local regulations with respect to its operations and prohibits the retail sale of cannabis and cannabis-infused products from the property. The additional straight-line annual rent of approximately $262,000 represents an estimated yield of over 18.5% on invested capital. The project is currently under construction and should be completed by May 2021.

On October 2, 2020, PW CO CanRE MF, LLC (“PW MF”), one of our indirect subsidiaries, acquired two properties in Crowley County, Colorado approved for cannabis cultivation for $150,000 (the “PW MF Properties”). One parcel is 2.37 acres, and the other parcel is 2.09 acres. As part of the transaction, the PW MF agreed to fund the immediate construction of 33,744 square feet of greenhouse and processing space on the PW MF Properties for $2,912,300. Accordingly, the Trust’s total capital commitment will be approximately $3,062,000. On October 15, 2020, PW MF entered into a triple-net lease (the “PSP Lease”) with PSP Management LLC (“PSP”) who is responsible for paying all expenses related to the PW MF Properties including maintenance expenses, insurances and taxes. The term of the lease is 20 years and provides two options to extend for additional twenty-year periods. The PSP Lease also has financial guarantees from affiliates of PSP. PSP intends to operate as a licensed cannabis cultivation and processing facility. The rent for the PSP Lease is structured whereby after deferred-rent period, the rental payments provide PW MF a full return of invested capital over the next three years in equal monthly payments. Thereafter, rent is structured to provide a 13.3% return based on invested capital with annual rent increases of 3% rate per annum. At any time after year six, if cannabis is legalized at the federal level in the United States, the rent will be adjusted down to an amount equal to a 9% return on the original invested capital amount and will increase at a 3% rate per annum based on a starting date of the start of year seven. The PSP Lease requires the tenant to maintain a medical cannabis license and operate in accordance with all Colorado and local regulations with respect to its operations. The PSP Lease prohibits the retail sale of the tenant’s cannabis and cannabis-infused products from the PW MF Properties. The additional straight-line annual rent of approximately $579,000 represents an estimated yield of approximately 18.9%. The project is currently under construction and should be completed by August 2021.

| 10 |

On December 4, 2020, PW CO CanRE Tam 19, LLC (“PW Tam 19”), one of our indirect subsidiaries, acquired a 2.11 parcel of land in Crowley County, Colorado approved for cannabis cultivation for $75,000 (the “PW Tam 19 Property”). As part of the transaction, PW Tam 19 agreed to fund the immediate construction of 18,528 square feet of greenhouse and processing space on the PW Tam 19 Property for $1,236,116. Accordingly, the Trust’s total capital commitment will be approximately $1,311,000. Concurrent with the closing, PW Tam 19 entered into a triple-net lease (the “Tam19 Lease”) with Green Mile Cultivation, LLC (“Tam 19 Tenant”) who is responsible for paying all expenses related to PW Tam 19 Property including maintenance expenses, insurances and taxes. The term of the lease is 20 years and provides two options to extend for additional five-year periods. The Tam 19 Lease has financial guarantees from affiliates of Tam 19 Tenant. The Tam 19 Tenant intends to operate as a licensed cannabis cultivation and processing facility. The rent for the Tam 19 Lease is structured whereby after a deferred-rent period, the rental payments provide PW Tam 19 a full return of invested capital over the next three years in equal monthly payments. Thereafter, rent is structured to provide a 12.9% return based on invested capital with annual rent increases of 3% rate per annum. At any time after year six, if cannabis is legalized at the federal level in the United States, the rent will be adjusted down to an amount equal to a 9% return on the original invested capital amount and will increase at a 3% rate per annum based on a starting date of the start of year seven. The Tam 19 Lease requires the tenant to maintain a medical cannabis license and operate in accordance with all Colorado and local regulations with respect to its operations. The Tam 19 Lease prohibits the retail sale of the tenant’s cannabis and cannabis-infused products from the PW Tam 19 Property. The additional straight-line annual rent of approximately $252,000 represents an estimated yield of approximately 18.5%. The project is currently under construction and should be completed by August 2021.

2021 Acquisitions

On January 4, 2021, we acquired two properties located in southern Colorado through a newly formed wholly owned subsidiary (“PW Grail”) of our wholly owned subsidiary for $150,000. The properties (the “Grail Properties”) are comprised of 4.41 acres. As part of the transaction, we agreed to fund the immediate construction of an approximately 21,732 square foot greenhouse and processing facility for approximately $1.84 million including the land acquisition cost. Concurrent with the acquisition, PW Grail entered into a 20-year “triple-net” lease (the “Grail Project Lease”) with The Grail Project LLC (“Grail Project”) which will operate a cannabis cultivation facility. The lease requires Grail Project to pay all property related expenses including maintenance, insurance and taxes. After the initial 20-year term, the Grail Project’s Lease provides four, five-year renewal options. The lease also has a personal guarantee from the owner of Grail Project. Grail Project intends to operate the Grail Properties as licensed cannabis cultivation and processing facilities. The rent for the Grail Project Lease is structured whereby after a six-month free-rent period, the rental payments provide Power REIT a full return of invested capital over the next three years in equal monthly payments. After the 42nd month, rent is structured to provide a 12.9% return on the original invested capital amount which will increase at a 3% rate per annum. At any time after year six, if cannabis is legalized at the federal level, the rent will be readjusted down to an amount equal to a 9% return on the original invested capital amount and will increase at a 3% rate per annum based on a starting date of the start of year seven. On February 23, 2021 PW Grail amended the Grail Project Lease making approximately $518,000 of more funds available to construct an additional 6,256 square feet to the cannabis cultivation and processing space. Accordingly, the Trust’s total capital commitment is approximately $2.4 million.

On January 14, 2021, we acquired a property (the “Apotheke Property”) for $150,000 located in southern Colorado through a newly formed wholly owned subsidiary (“PW Apotheke”) of our wholly owned subsidiary which is comprised of 4.31 acres. As part of the transaction, we agreed to fund the immediate construction of an approximately 21,548 square foot greenhouse and processing facility for approximately $1.8 million including the land acquisition cost. Concurrent with the acquisition, PW Apotheke entered into a 20-year “triple-net” lease (the “Apotheke Lease”) with DOM F, LLC (“Dom F”) which will operate a cannabis cultivation facility. The lease requires Dom F to pay all property related expenses including maintenance, insurance and taxes. After the initial 20-year term, Apotheke Lease provides two, five-year renewal options. The lease also has a personal guarantee from the owner of Dom F. and Dom F intends to operate the Apotheke Property as a licensed cannabis cultivation and processing facility. The rent for the Apotheke Lease is structured whereby after an eight-month free-rent period, the rental payments provide Power REIT a full return of invested capital over the next three years in equal monthly payments. After the 44th month, rent is structured to provide a 12.9% return on the original invested capital amount which will increase at a 3% rate per annum. At any time after year six, if cannabis is legalized at the federal level, the rent will be readjusted down to an amount equal to a 9% return on the original invested capital amount and will increase at a 3% rate per annum based on a starting date of the start of year seven.

| 11 |

On January 29, 2021, we acquired a property located in Riverside County, CA (the “Canndescent Property”) through a newly formed wholly owned subsidiary (“PW Canndescent”). The purchase price was $7.685 million and we paid for the property with $2.685 million cash on hand and the issuance of 192,678 shares of Power REIT’s Series A Preferred Stock. PW Canndescent received an assignment of a lease (the “Canndescent Lease”) to allow the tenant (“Canndescent”) to operate the 37,000 square foot greenhouse cultivation facility on the Canndescent Property. Canndescent is a premium flower brand for luxury cannabis in California. The Canndescent Lease requires Canndescent to pay all property related expenses including maintenance, insurance and taxes. The rent for the Canndescent Lease is structured to provide straight-line annual rent of approximately $1,074,000.

On March 12, 2021, we acquired a property (the “Gas Station Property”) for $85,000 located in southern Colorado through a newly formed wholly owned subsidiary (“PW Gas Station”) of our wholly owned subsidiary which is comprised of 2.2 acres. As part of the transaction, we agreed to fund the immediate construction of an approximately 24,512 square foot greenhouse and processing facility for approximately $2.1 million including the land acquisition cost. Concurrent with the acquisition, PW Gas Station entered into a 20-year “triple-net” lease (the “Gas Station Lease”) with The Gas Station, LLC (“Gas Station”) which will operate a cannabis cultivation facility. The lease requires Gas Station to pay all property related expenses including maintenance, insurance and taxes. After the initial 20-year term, Gas Station Lease provides two, five-year renewal options. The lease also has a personal guarantee from the owners of Gas Station and they intend to operate the Gas Station Property as a licensed cannabis cultivation and processing facility. The rent for the Gas Station Lease is structured whereby after an eight-month free-rent period, the rental payments provide Power REIT a full return of invested capital over the next three years in equal monthly payments. After the 43rd month, rent is structured to provide a 13.3% return on the original invested capital amount which will increase at a 3% rate per annum. At any time after year six, if cannabis is legalized at the federal level, the rent will be readjusted down to an amount equal to a 9% return on the original invested capital amount and will increase at a 3% rate per annum based on a starting date of the start of year seven.

Management and Trustees - Human Capital

Mr. David H. Lesser serves as a member and Chairman of our Board of Trustees. He also serves as our Chief Executive Officer, Chief Financial Officer, Secretary and Treasurer. In July, 2020 Susan Hollander was named Chief Accounting Officer with responsibility for all strategic accounting, compliance and financial reporting functions. In July, 2020 we also announced the appointment of Paula Poskon to our board of Trustees. Ms. Poskon has 20+ years expertise in real estate and capital markets with a particular focus on REITS. Currently, Power REIT has no other officers or employees but as Power REIT’s business grows, the Trust will from time to time evaluate its staffing and third-party service needs and adjust its staffing as necessary.

We believe that our success depends on our ability to retain our key personnel, primarily David Lesser, our Chairman and Chief Executive Officer. We believe that the skills, experience and industry knowledge of our key employees significantly benefit our operations and performance.

Employee health and safety in the workplace is one of our core values. The COVID-19 pandemic has underscored for us the importance of keeping our employees safe and healthy. In response to the pandemic, we have taken actions aligned with the World Health Organization and the Centers for Disease Control and Prevention in an effort to protect our workforce so they can more safely and effectively perform their work.

Employee levels are managed to align with the pace of business and management believes it has sufficient human capital to operate its business successfully.

| 12 |

Growth and Investment Strategies

In 2019 and 2020, we expanded the focus of our real estate acquisitions to include CEA properties in the United States. CEA is an innovative method of growing plants that involves creating optimized growing environments for a given crop indoors. CEA uses approximately 70% less energy than indoor growing, 95% less water usage than outdoor growing, and does not have any agricultural runoff of fertilizers or pesticides. We typically enter into long-term triple net leases where our tenants are responsible for all costs related to the property, including insurance, taxes and maintenance.

Our growth strategy focuses on identifying attractive real estate opportunities that exhibit attractive risk adjusted yields on investment relative to traditional real estate sectors. We are currently focused on making new acquisitions of real estate within the CEA sector related to cannabis cultivation. We believe there will be continued strong demand for cannabis related CEA which we believe is the sustainable business model that can produce plants at a lower cost in an environmentally friendly way. We believe a convergence of changing public attitudes and increased cannabis legalization momentum in certain states creates an attractive opportunity to invest in cannabis related real estate. We expect that acquisition opportunities will continue to expand as additional states legalize the use of cannabis.

We believe there is strong demand for capital from licensed cannabis cultivators that currently do not have access to traditional financing sources such as bank debt. Our construction financing and sale leaseback solutions provide attractive financing that allows cannabis operators to add additional growing capacity and/or invest in the growth of their business. Our tenants that are cannabis operators are able to achieve strong rent coverage based on the growing capacity of their facilities and the current wholesale price of cannabis. In addition, we believe our unique and flexible lease structure for cannabis operators, which typically includes a period of higher rent in the initial years of the lease and a reset to a lower rent for the remainder of the lease term provides strong protection to our investment basis while setting the tenant up for long-term success in the event cannabis prices decrease or federal legalization of cannabis is enacted.

Properties

As of December 31, 2020, the Trust’s assets consisted of a total of approximately 112 miles of railroad infrastructure plus branch lines and related real estate, approximately 601 acres of fee simple land leased to seven utility scale solar power generating projects with an aggregate generating capacity of approximately 108 Megawatts (“MW”), and approximately 41 acres of land with 216,278 square feet of greenhouse/processing space for medical cannabis cultivation. We are actively seeking to grow our portfolio of real estate related to CEA for food and cannabis cultivation.

| 13 |

Below is a chart that summarizes our properties as of December 31, 2020:

| Property Type/Name | Location | Acres | Size1 | Lease Start | Term (yrs)2 | Rent ($) | Gross Book Value | |||||||||||||||||

| Railroad Property | ||||||||||||||||||||||||

| P&WV (Norfolk Southern) | PA/WV/OH | 112 miles | Oct-64 | 99 | $ | 915,000 | $ | 9,150,000 | ||||||||||||||||

| Solar Farm Land | ||||||||||||||||||||||||

| PWSS | Salisbury, MA | 54 | 5.7 | Dec-11 | 22 | 89,494 | 1,005,538 | |||||||||||||||||

| PWTS | Tulare County, CA | 18 | 4.0 | Mar-13 | 25 | 32,500 | 310,000 | |||||||||||||||||

| PWTS | Tulare County, CA | 18 | 4.0 | Mar-13 | 25 | 37,500 | 310,000 | |||||||||||||||||

| PWTS | Tulare County, CA | 10 | 4.0 | Mar-13 | 25 | 16,800 | 310,000 | |||||||||||||||||

| PWTS | Tulare County, CA | 10 | 4.0 | Mar-13 | 25 | 29,900 | 310,000 | |||||||||||||||||

| PWTS | Tulare County, CA | 44 | 4.0 | Mar-13 | 25 | 40,800 | 310,000 | |||||||||||||||||

| PWRS | Kern County, CA | 447 | 82.0 | Apr-14 | 20 | 803,117 | 9,183,548 | |||||||||||||||||

| Solar Farm Land Total | 601 | 107.7 | $ | 1,050,111 | $ | 11,739,086 | ||||||||||||||||||

| CEA (Cannabis) Property34 | ||||||||||||||||||||||||

| JAB - Tam Lot 18 | Crowley County, CO | 2.11 | 12,996 | Jul-19 | 20 | 201,810 | 1,075,000 | |||||||||||||||||

| JAB - Mav Lot 1 | Crowley County, CO | 5.20 | 16,416 | Jul-19 | 20 | 294,046 | 1,594,582 | |||||||||||||||||

| Grassland - Mav Lot 14 | Crowley County, CO | 5.54 | 26,940 | Feb-20 | 20 | 354,461 | 1,908,400 | |||||||||||||||||

| Chronic - Sherman Lot 6 | Crowley County, CO | 5.00 | 26,416 | Feb-20 | 20 | 375,159 | 1,995,101 | |||||||||||||||||

| Original - Mav Lot 5 | Crowley County, CO | 5.20 | 15,000 | Apr-20 | 20 | 256,743 | 1,358,664 | |||||||||||||||||

| Sweet Dirt 495 | York County, ME | 3.06 | 35,600 | May-20 | 20 | 919,849 | 4,917,134 | |||||||||||||||||

| Sweet Dirt 505 | York County, ME | 3.58 | 12,638 | Sep-20 | 20 | 373,055 | 1,964,723 | |||||||||||||||||

| Fifth Ace - Tam Lot 7 | Crowley County, CO | 4.32 | 18,000 | Sep-20 | 20 | 261,963 | 1,364,585 | |||||||||||||||||

| Monte Fiore - Tam Lot 13 | Crowley County, CO | 2.37 | 9,384 | Oct-20 | 20 | 87,964 | 425,000 | |||||||||||||||||

| Monte Fiore - Tam Lot 14 | Crowley County, CO | 2.09 | 24,360 | Oct-20 | 20 | 490,700 | 2,637,300 | |||||||||||||||||

| Green Mile - Tam Lot 19 | Crowley County, CO | 2.11 | 18,528 | Dec-20 | 20 | 252,061 | 1,311,116 | |||||||||||||||||

| CEA Total | 40.58 | 216,278 | $ | 3,867,811 | $ | 20,551,605 | ||||||||||||||||||

| Grand Total | $ | 5,832,922 | $ | 41,440,691 | ||||||||||||||||||||

| 1 | Solar Farm Land size represents Megawatts and CEA property size represents square feet | |

| 2 | Not including renewal options | |

| 3 | Rent represents straight line net rent | |

| 4 | Gross Book Value represents total commitment | |

| Note: Size, Rent and Gross Book Value assume completion of approved construction |

Railway Properties

Pittsburgh & West Virginia Railroad (“P&WV”) is a business trust organized under the laws of Pennsylvania for the purpose of owning railroad assets that are currently leased to Norfolk Southern Railway (“NSC”) pursuant to a 99-year lease that became effective in 1964 and is subject to an unlimited number of 99-year renewal periods under the same terms and conditions, including annual rent payments, at the option of NSC (the “Railroad Lease”). Norfolk Southern Corporation has an investment grade rating of Baa1 by Moody’s Investor Services. P&WV’s assets consist of a railroad line of approximately 112 miles in length plus branch lines, extending through Connellsville, Washington and Allegheny Counties in the Commonwealth of Pennsylvania, through Brooke County in the State of West Virginia and through Jefferson and Harrison Counties in the State of Ohio, to Pittsburgh Junction in Harrison County, Ohio. There are also branch lines that total approximately 20 miles in length located in Washington and Allegheny Counties in Pennsylvania and Brooke County in West Virginia. NSC pays P&WV base cash rent of $915,000 per year, payable in quarterly installments.

Solar Properties

PW Salisbury Solar, LLC (“PWSS”) is a Massachusetts limited liability company and a wholly owned subsidiary of the Trust that owns approximately 54 acres of land located in Salisbury, Massachusetts that is leased to a 5.7 Megawatts (MW) utility scale solar farm. Pursuant to the lease agreement, PWSS’ tenant was required to pay PWSS rent of $80,800 cash for the year December 1, 2012 to November 30, 2013, with a 1.0% escalation in each corresponding year thereafter. Rent is payable quarterly in advance and is recorded by Power REIT for accounting purposes on a straight-line basis. At the end of the 22-year lease period, which commenced on December 1, 2011 (prior to being assumed by PWSS), the tenant has certain renewal options, with terms to be mutually agreed upon.

| 14 |

PW Tulare Solar, LLC (“PWTS”) is a California limited liability company and a wholly owned subsidiary of the Trust that owns approximately 100 acres of land leased to five (5) utility scale solar farms, with an aggregate generating capacity of approximately 20MW, located near Fresno, California. The solar farm tenants pay PWTS an aggregate annual rent of $157,500 cash following an abatement period, payable annually in advance, and without escalation during the 25-year term of the leases. The tenants have up to two renewal options, the first of which is for 5 years, and the second of which is for 4 years and 11 months. At the end of the 25-year terms, which commenced in March 2013 (prior to being assumed by PWTS), the tenants have certain renewal options, with terms to be mutually agreed upon.

PW Regulus Solar, LLC (“PWRS”) is a California limited liability company and a wholly owned subsidiary of the Trust that owns approximately 447 acres of land leased to a utility scale solar farm with an aggregate generating capacity of approximately 82 Megawatts in Kern County, California near Bakersfield. PWRS’s lease was structured to provide it with initial quarterly rental payments until the solar farm achieved commercial operation which occurred on November 11, 2014. During the primary term of the lease which extends for 20 years from achieving commercial operations, PWRS receives an initial annual rent of approximately $735,000 per annum which grows at 1% per annum. The lease is a “triple net” lease with all expenses to be paid by the tenant. At the end of the primary term of the lease, the tenants have three options to renew the lease for 5-year terms in the first two options, and 4 years and 11 months in the third renewal option. With each such extension option are required to be undertaken by tenant under certain circumstances. Rent during the renewal option periods is to be calculated as the greater of a minimum stated rental amount or a percentage of the total project-level gross revenue. The acquisition price, not including transaction and closing costs, was approximately $9.2 million. For each of the twelve months ended December 31, 2020 and 2019, PWRS recorded rental income of $803,116.

CEA Properties

In July 2019, PW CO CanRE JAB, LLC (“PW JAB”), one of our indirect subsidiaries, acquired two properties (the “JAB Properties”) in southern Colorado that have approximately 7.3 acres with 18,612 square feet of greenhouse cultivation and processing space. At the time of the acquisition, PW JAB entered into two cross-collateralized and cross-defaulted triple-net leases with JAB Industries Ltd. (doing business as Wildflower Farms) (the “JAB Tenant”) for the JAB Properties. The leases provide that the JAB Tenant is responsible for paying all expenses related to the JAB Properties, including maintenance expenses, insurance and taxes. The term of each of the leases is 20 years and provides two options to extend for additional five-year periods. The leases also have financial guarantees from affiliates of the JAB Tenant. The JAB Tenant intends to operate the JAB Properties as licensed medical cannabis cultivation and processing facilities. The rent for each of the leases is structured whereby after a six-month free-rent period, the rental payments provide the PW JAB a full return of invested capital over the next three years in equal monthly payments. Thereafter, rent is structured to provide a 12.5% return on invested capital, which will increase at a 3% rate per annum. At any time after year six, if cannabis is legalized at the federal level, the rent will be adjusted down to an amount equal to a 9% return on the original invested capital amount and will increase at a 3% rate per annum based on a starting date of the start of year seven. The JAB Tenant is an affiliate of a company that owns and operates two indoor cannabis cultivation facilities and five dispensary locations in the State of Colorado along with several other cannabis related projects under development. The leases require the JAB Tenant to maintain a medical cannabis license and operate in accordance with all Colorado and local regulations with respect to its operations. The leases prohibit the retail sale of the JAB Tenant’s cannabis and cannabis-infused products from the JAB Properties. The straight-line annual rent of approximately $331,000 represents an estimated yield of over 18%.

| 15 |

On November 1, 2019, PW JAB, entered into an agreement with the JAB Tenant to expand the greenhouse at the 5.2-acre property from approximately 5,616 rentable square feet of greenhouse to approximately 16,416 square feet. Our investment in the expansion was $900,000 and the lease amendment is structured to provide rent on similar economics to the original leases and provides additional straight-line annual rent of approximately $165,000, representing an estimated yield of over 18%. The completion of this expansion occurred in July 2020.

On January 31, 2020, PW CO CanRe Mav 14, LLC (“PW Mav 14”), one of our indirect subsidiaries, acquired 5.54 acres of land in Colorado (the “Mav 14 Property”) with an existing greenhouse and processing facility totaling 9,300 square-feet for the cultivation of cannabis for $850,000. Concurrent with the closing, PW Mav 14 entered into a triple-net lease (the “Mav 14 Lease”) with its current tenant (the “Mav 14 Tenant”) who is responsible for paying all expenses related to the Mav 14 Property including maintenance expenses, insurances and taxes. As part of the transaction, PW Mav 14 agreed to fund the construction of 15,120 square feet of greenhouse space for $1,058,400 and the Mav 14 Tenant has agreed to fund the construction of approximately 2,520 additional square feet of head-house/processing space on the Mav 14 Property. Accordingly, the Trust’s total capital commitment is $1,908,400. The term of the Mav 14 Lease is 20 years and provides two options to extend for additional five-year periods. The Mav 14 Lease also has financial guarantees from affiliates of the Mav 14 Tenant. The Mav 14 Tenant intends to operate as a licensed medical cannabis cultivation and processing facility. The rent for the Mav 14 Lease is structured whereby after a six-month deferred-rent period, the rental payments provide PW Mav 14 a full return of invested capital over the next three years in equal monthly payments. Thereafter, rent is structured to provide a 12.5% return based on invested capital with annual rent increases of 3% rate per annum. At any time after year six, if cannabis is legalized at the federal level, the rent will be adjusted down to an amount equal to a 9% return on the original invested capital amount and will increase at a 3% rate per annum based on a starting date of the start of year seven. The Mav 14 Lease requires the Mav 14 Tenant to maintain a medical cannabis license and operate in accordance with all Colorado and local regulations with respect to its operations. The Mav 14 Lease prohibits the retail sale of cannabis and cannabis-infused products from the Mav 14 Property. The straight-line annual rent of approximately $354,000 represents an estimated yield of over 18%. The construction on the project is completed and the project is currently operational.

On February 20, 2020, PW CO CanRe Sherman 6, LLC (“PW Sherm 6”), one of our indirect subsidiaries, closed on the acquisition of 5.0 acres of vacant land in Colorado (the “Sherman 6 Property”) for $150,000. As part of the transaction, PW Sherm 6 agreed to fund the immediate construction of 15,120 square feet of greenhouse space and 8,776 square feet of head-house/processing space on the Sherman 6 Property for $1,693,800. Accordingly, Power REIT’s total capital commitment is $1,843,800. On February 1, 2020, PW Sherm 6 entered into a triple-net lease (the “Initial Sherman Lease”) with its tenant (the “Sherman 6 Tenant”) such that the Sherman 6 Tenant is responsible for paying all expenses related to the Sherman 6 Property including maintenance expenses, insurances and taxes. The term of the Initial Sherman Lease is 20 years and provides two options to extend for additional five-year periods. The Initial Sherman Lease also has financial guarantees from affiliates of the tenants. The tenant intends to operate as a licensed cannabis cultivation and processing facility. The rent for the Initial Sherman Lease is structured whereby after a nine-month deferred-rent period, the rental payments provide PW Sherm 6 a full return of invested capital over the next three years in equal monthly payments. Thereafter, rent is structured to provide a 12.9% return based on invested capital with annual rent increases of 3% rate per annum. At any time after year six, if cannabis is legalized at the federal level, the rent will be adjusted down to an amount equal to a 9% return on the original invested capital amount and will increase at a 3% rate per annum based on a starting date of the start of year seven. The Initial Sherman Lease requires the tenant to maintain a medical cannabis license and operate in accordance with all Colorado and local regulations with respect to its operations. The Initial Sherman Lease prohibits the retail sale of the tenant’s cannabis and cannabis-infused products from the Sherman 6 Property. The additional straight-line annual rent of approximately $346,000 represents an estimated yield of over 18%. The construction is complete and the project is currently operational.

| 16 |

On August 25, 2020, PW Sherm 6 entered into an agreement (as amended, the “Sherman Lease”) for the expansion of the Sherman 6 Property with the Sherman 6 Tenant. The expansion consists of approximately 2,520 square feet of additional greenhouse/headhouse space. The Sherman 6 Tenant is responsible for implementing the expansion and PW Sherm 6 will fund the cost of such expansion up to a total of $151,301, with any additional amounts funded by the Sherman 6 Tenant. Once completed, Power REIT’s total investment in the Sherman 6 Property will be $1,995,101. As part of the agreement, PW Sherm 6 and the Sherman 6 Tenant have amended the Lease whereby after a nine-month period, the additional rental payments provide PW Sherm 6 with a full return of its original invested capital over the next three years and thereafter, provide a 12.9% return increasing 3% rate per annum. The additional straight-line rent of approximately $29,000 represents an estimated yield of over 18%.

On March 19, 2020, PW CO CanRe Mav 5, LLC (“PW Mav 5”), one of our indirect subsidiaries purchased a 5.2 acre of vacant land in Colorado for $150,000 (the “Mav 5 Property”). As part of the acquisition, the Trust agreed to fund the immediate construction of 5,040 square feet of greenhouse space and 4,920 square feet of head-house/processing space for $868,125. Accordingly, Power REIT’s total capital commitment is $1,018,125. Concurrent with the closing, PW Mav 5 entered into a triple-net lease (the “Mav 5 Lease”) with its current tenant (the “Mav 5 Tenant”) who is responsible for paying all expenses related to the property including maintenance expenses, insurances and taxes. The term of the Mav 5 Lease is 20 years and provides two options to extend for additional five-year periods. The Mav 5 Lease also has financial guarantees from affiliates of the Mav 5 Tenant. The Mav 5 Tenant intends to operate as a licensed cannabis cultivation and processing facility. The rent for the Mav 5 Lease is structured whereby after a six-month deferred-rent period, the rental payments provide PW MAV 5 a full return of invested capital over the next three years in equal monthly payments. Thereafter, rent is structured to provide a 12.5% return based on invested capital with annual rent increases of 3% rate per annum. At any time after year six, if cannabis is legalized at the federal level, the rent will be adjusted down to an amount equal to a 9% return on the original invested capital amount and will increase at a 3% rate per annum based on a starting date of the start of year seven. The lease requires the tenant to maintain a medical cannabis license and operate in accordance with all Colorado and local regulations with respect to its operations. The Mav 5 Lease prohibits the retail sale of cannabis and cannabis-infused products from the Mav 5 Property. The straight-line annual rent of approximately $193,000 represents an estimated yield of over 18%.

On May 1, 2020, PW Mav 5, entered into an agreement for a 5,040 square-foot greenhouse expansion. Our investment in the expansion is $340,539 and a lease amendment, entered into on May 1, 2020 is structured to provide rent on similar economics to the original Mav 5 Lease and provides additional straight-line annual rent of approximately $63,000, representing an estimated yield of over 18%. The construction on the project is complete and the project is currently operational.

On May 15, 2020, PW ME CanRe SD, LLC (“PW SD”), one of our indirect subsidiaries, acquired a 3.06-acre property in York County, Maine for $1,000,000 (the “495 Property”). The SD Property includes a 32,800 square-foot greenhouse and 2,800 square foot processing/distribution building that are both under active construction. Simultaneous with the acquisition, PW SD entered into a lease (the “SD Lease”) with an operator (“Sweet Dirt”). As part of the acquisition, PW SD reimbursed Sweet Dirt for $950,000 of the approximately $1.5 million Sweet Dirt has incurred related to the construction and agreed to fund up to approximately $2.97 million of costs to complete the construction. Accordingly, our total investment in the 495 Property will be approximately $4.92 million which translates to approximately $138 per square foot for a state-of-the-art Controlled Environment Agriculture Greenhouse (“CEAG”). The rent for the Sweet Dirt Lease is structured whereby after a six-month deferred-rent period, the monthly rental payments over the next three years will provide us with a full return of invested capital. Thereafter, rent is structured to provide a 12.9% return based on invested capital with annual rent increases of 3% rate per annum. At any time after year six, if cannabis is legalized at the federal level, we have agreed to decrease the rent to an amount equal to a 9% return on the original invested capital amount with increases at a 3% rate per annum based on a starting date of the start of year seven. SD Lease is structured to provide straight-line annual rent of approximately $920,000, representing an estimated yield of over 18.5% with the tenant responsible for all operating expenses. The SD Lease requires Sweet Dirt to maintain a medical cannabis license and operate in accordance with all Maine and local regulations with respect to its operations. The construction on the 495 property is complete and the property is operational. In addition, we received an option to acquire an adjacent 3.58 vacant parcel (the “505 Property”) that is owned by Sweet Dirt for $400,000 which provides us the option to finance additional cultivation and processing space for Sweet Dirt.

| 17 |

On September 18, 2020, PW SD completed the acquisition of the 505 Property in York County, Maine by exercising its option received at the time of the 495 Property acquisition. The 505 Property is a 3.58-acre property purchased for $400,000 plus closing costs and is adjacent to the 495 Property. Concurrently with the closing of the acquisition of the 505 Property, PW SD and Sweet Dirt entered into an amendment to the SD Lease whereby after a nine-month deferred-rent period, the rental payments provide PW SD a full return of invested capital over the next three years. Thereafter, rent is structured to provide a 13.2% return based on invested capital with annual rent increases of 3% per annum. At any time after year six, if cannabis is legalized at the federal level in the United States, the rent will be adjusted down to an amount equal to a 9% return on the original invested capital amount and will increase at a 3% rate per annum based on a starting date of the start of year seven. The amended SD Lease provides for a straight-line annual rent of approximately $373,000, representing an estimated yield of over 18.5% with the tenant responsible for all operating expenses. As part of the transaction, the Trust agreed to fund the construction of an additional 9,900 square feet of processing space and renovate an existing 2,738 square foot building for approximately $1.56 million. Accordingly, the Trust’s total investment in the 505 Property will be approximately $1.96 million.

On September 18, 2020, PW CO CanRE Tam 7, LLC (“Tam 7”), one of our indirect subsidiaries, acquired a 4.32-acre property in Crowley County, Colorado for $150,000 (the “Tam 7 Property”). As part of the transaction, Tam 7 agreed to fund the immediate construction of 18,000 square feet of greenhouse and processing space on the Tam 7 Property for approximately $1.22 million. Accordingly, the Trust’s total capital commitment will be $1,364,585. Concurrent with the closing, Tam 7 entered into a triple-net lease (the “Tam 7 Lease”) with its current tenant (the “Tam 7 Tenant”) who responsible for paying all expenses related to the Tam 7 Property including maintenance expenses, insurances and taxes. The term of the Tam 7 Lease is 20 years and provides two options to extend for additional five-year periods. The Tam 7 Lease also has financial guarantees from affiliates of the Tam 7 Tenant. The Tam 7 Tenant intends to operate as a licensed cannabis cultivation and processing facility. The rent for the Tam 7 Lease is structured whereby after a six-month deferred-rent period, the rental payments provide Tam 7 a full return of invested capital over the next three years in equal monthly payments. Thereafter, rent is structured to provide a 12.9% return based on invested capital with annual rent increases of 3% rate per annum. At any time after year six, if cannabis is legalized at the federal level in the United States, the rent will be adjusted down to an amount equal to a 9% return on the original invested capital amount and will increase at a 3% rate per annum based on a starting date of the start of year seven. The Tam 7 Lease requires the Tam 7 Tenant to maintain a medical cannabis license and operate in accordance with all Colorado and local regulations with respect to its operations and prohibits the retail sale of cannabis and cannabis-infused products from the property. The additional straight-line annual rent of approximately $262,000 represents an estimated yield of over 18.5% on invested capital. The project is currently under construction and should be completed by May 2021.

| 18 |

On October 2, 2020, PW CO CanRE MF, LLC (“PW MF”), one of our indirect subsidiaries, acquired two properties in Crowley County, Colorado approved for cannabis cultivation for $150,000 (the “PW MF Properties”). One parcel is 2.37 acres, and the other parcel is 2.09 acres. As part of the transaction, the PW MF agreed to fund the immediate construction of 33,744 square feet of greenhouse and processing space on the PW MF Properties for $2,912,300. Accordingly, the Trust’s total capital commitment will be approximately $3,062,000. On October 15, 2020, PW MF entered into a triple-net lease (the “PSP Lease”) with PSP Management LLC (“PSP”) who is responsible for paying all expenses related to the PW MF Properties including maintenance expenses, insurances and taxes. The term of the lease is 20 years and provides two options to extend for additional twenty-year periods. The PSP Lease also has financial guarantees from affiliates of PSP. PSP intends to operate as a licensed cannabis cultivation and processing facility. The rent for the PSP Lease is structured whereby after deferred-rent period, the rental payments provide PW MF a full return of invested capital over the next three years in equal monthly payments. Thereafter, rent is structured to provide a 13.3% return based on invested capital with annual rent increases of 3% rate per annum. At any time after year six, if cannabis is legalized at the federal level in the United States, the rent will be adjusted down to an amount equal to a 9% return on the original invested capital amount and will increase at a 3% rate per annum based on a starting date of the start of year seven. The PSP Lease requires the tenant to maintain a medical cannabis license and operate in accordance with all Colorado and local regulations with respect to its operations. The PSP Lease prohibits the retail sale of the tenant’s cannabis and cannabis-infused products from the PW MF Properties. The additional straight-line annual rent of approximately $579,000 represents an estimated yield of approximately 18.9%. The project is currently under construction and should be completed by August 2021.

On December 4, 2020, PW CO CanRE Tam 19, LLC (“PW Tam 19”), one of our indirect subsidiaries, acquired a 2.11 parcel of land in Crowley County, Colorado approved for cannabis cultivation for $75,000 (the “PW Tam 19 Property”). As part of the transaction, PW Tam 19 agreed to fund the immediate construction of 18,528 square feet of greenhouse and processing space on the PW Tam 19 Property for $1,236,116. Accordingly, the Trust’s total capital commitment will be approximately $1,311,000. Concurrent with the closing, PW Tam 19 entered into a triple-net lease (the “Tam19 Lease”) with Green Mile Cultivation, LLC (“Tam 19 Tenant”) who is responsible for paying all expenses related to PW Tam 19 Property including maintenance expenses, insurances and taxes. The term of the lease is 20 years and provides two options to extend for additional five-year periods. The Tam 19 Lease has financial guarantees from affiliates of Tam 19 Tenant. The Tam 19 Tenant intends to operate as a licensed cannabis cultivation and processing facility. The rent for the Tam 19 Lease is structured whereby after deferred-rent period, the rental payments provide PW Tam 19 a full return of invested capital over the next three years in equal monthly payments. Thereafter, rent is structured to provide a 12.9% return based on invested capital with annual rent increases of 3% rate per annum. At any time after year six, if cannabis is legalized at the federal level in the United States, the rent will be adjusted down to an amount equal to a 9% return on the original invested capital amount and will increase at a 3% rate per annum based on a starting date of the start of year seven. The Tam 19 Lease requires the tenant to maintain a medical cannabis license and operate in accordance with all Colorado and local regulations with respect to its operations. The Tam 19 Lease prohibits the retail sale of the tenant’s cannabis and cannabis-infused products from the PW Tam 19 Property. The additional straight-line annual rent of approximately $252,000 represents an estimated yield of approximately 18.5%. The project is currently under construction and should be completed by August 2021.

Revenue Concentration

Historically, the Trust’s revenue has been concentrated to a relatively limited number of investments, industries and lessees and may continue to remain concentrated in a limited number of investments as the Trust grows. During the twelve months ended December 31, 2020, consolidated rental revenues from CEA properties surpassed the railroad and solar properties as CEA tenants represented 52%, while rents from NSC to P&WV under the railroad lease and from PWRS’s tenant represented 21% and 19% of total revenue, respectively. Payments from NSC to P&WV under the railroad lease and payments from PWRS’s tenant represented approximately 42% and 37% of Power REIT’s consolidated revenues for the twelve months ended December 31, 2019, respectively.

| 19 |

Dividends

During the year ended December 31, 2020, the Trust paid dividends of approximately $280,000 (or $0.484375 per share per quarter for a total of $1.9375 per share total) on Power REIT’s 7.75% Series A Cumulative Redeemable Perpetual Preferred Stock.