Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Lonestar Resources US Inc. | lone-8xkmarch2021investorp.htm |

1 Presentation to Investors March 2021 Lonestar Resources

Lonestar Resources 2 Forward Looking Statements The information in this presentation includes “forward‐looking statements” that are made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact included in this presentation, regarding our strategy, future operations, financial position, projected costs, prospects, plans and objectives of management are forward‐looking statements. When used in this presentation, the words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “may,” “continue,” “predict,” “potential,” “project” and similar expressions are intended to identify forward‐looking statements, although not all forward‐looking statements contain such identifying words. These forward‐looking statements are based on Lonestar Resources US Inc.’s (“LONE” or the “Company”) current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. We caution you that these forward‐looking statements are subject to all of the risks and uncertainties, most of which are difficult to predict and many of which are beyond our control, incident to the exploration for and development, production, gathering and sale of oil and natural gas. These risks include, but are not limited to, variations in the market demand for, and prices of, crude oil, NGLs and natural gas, lack of proved reserves, estimates of crude oil, NGLs and natural gas data, the adequacy of our capital resources and liquidity including, but not limited to, access to additional borrowing, borrowing capacity under our credit facilities, general economic and business conditions, failure to realize expected value creation from property acquisitions, uncertainties about our ability to replace reserves and economically develop our reserves, risks related to the concentration of our operations, drilling results, potential financial losses or earnings reductions from our commodity price risk management programs, potential adoption of new governmental regulations, our ability to satisfy future cash obligations and environmental costs and the risk factors discussed in or referenced in our filings with the United States Securities and Exchange Commission (“SEC”), including our 2019 Annual Report on Form 10‐K, our Quarterly Reports on Form 10‐Q fpr the periods ended March 31, 2020, June 30, 2020 and September 30, 2020, respectively and our Current Reports on Form 8‐K in each case as amended. You are cautioned not to place undue reliance on any forward‐looking statements, which speak only as of the date of this presentation. Except as otherwise required by applicable law, we disclaim any duty to update any forward‐looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this presentation. Our production forecasts and expectations for future periods are dependent upon many assumptions, including estimates of production decline rates from existing wells and the undertaking and outcome of future drilling activity, which may be affected by significant commodity price declines or cost increases. Reconciliation of Non‐GAAP Financial Measure EBITDAX is a financial measure that is not presented in accordance with generally accepted accounting principles in the United States (“GAAP”). Reconciliations of this non‐ GAAP financial measure can be found in this presentation. Industry and Market Data This presentation has been prepared by LONE and includes market data and other statistical information from third‐party sources, including independent industry publications, government publications or other published independent sources. Although LONE believes these third‐party sources are reliable as of their respective dates, LONE has not independently verified the accuracy or completeness of this information. Some data are also based on the LONE’s good faith estimates, which are derived from its review of internal sources as well as the third‐party sources described above. This document and any related presentation do not constitute an offer or invitation to subscribe for or purchase any securities, and it should not be construed as an offering document. Any decision to purchase securities in the context of a proposed offering, if any, should be made on the basis of information contained in the offering document related to such an offering. This presentation does not constitute a recommendation regarding any securities of Lonestar Resources America, Inc. or Lonestar Resources US Inc. Disclaimer and Forward‐Looking Statements

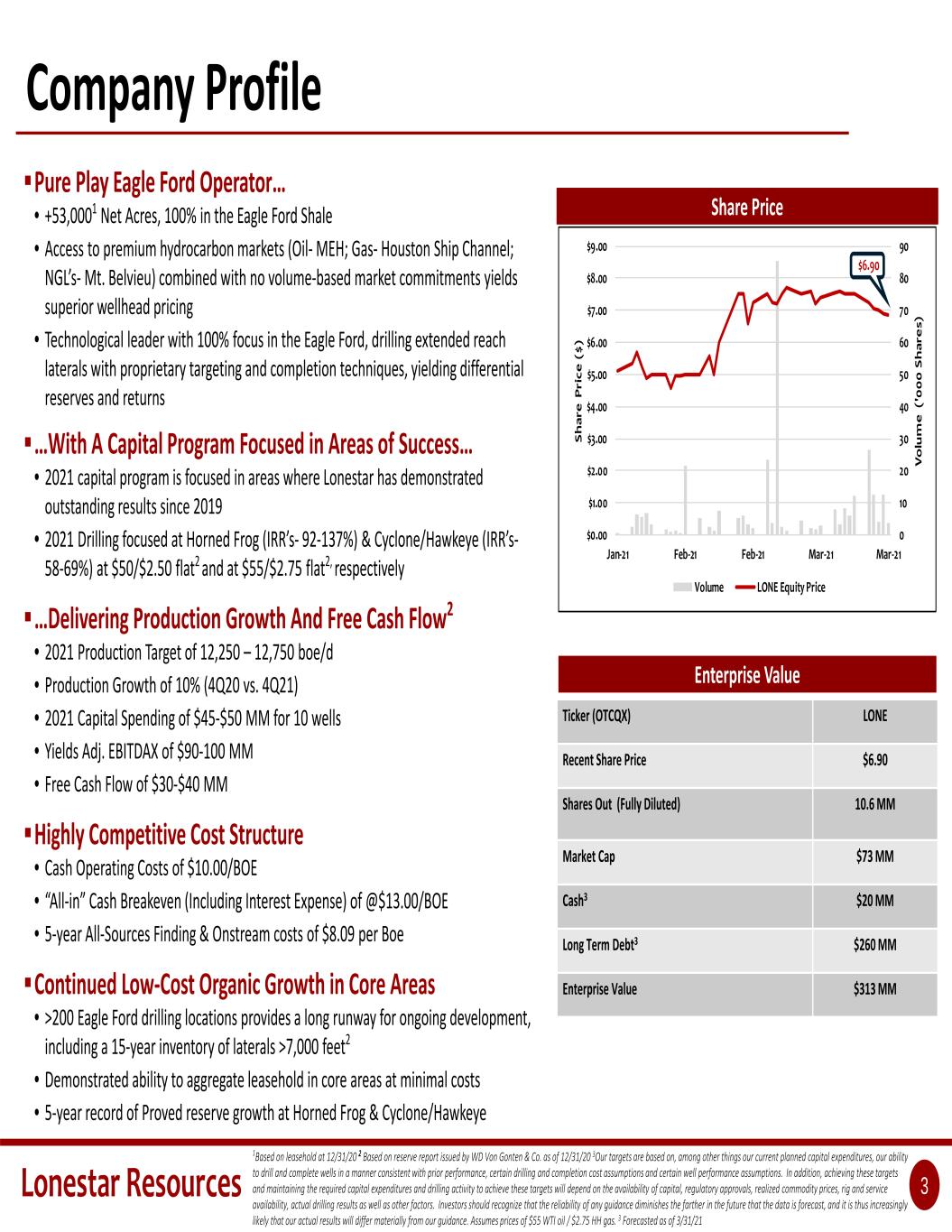

Lonestar Resources 3 0 10 20 30 40 50 60 70 80 90 $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 $8.00 $9.00 Jan‐21 Feb‐21 Feb‐21 Mar‐21 Mar‐21 Vo lu m e (' 00 0 Sh ar es ) Sh ar e Pr ic e ($ ) Volume LONE Equity Price Share Price Ticker (OTCQX) LONE Recent Share Price $6.90 Shares Out (Fully Diluted) 10.6 MM Market Cap $73 MM Cash3 $20 MM Long Term Debt3 $260 MM Enterprise Value $313 MM Enterprise Value 1Based on leasehold at 12/31/20 2 Based on reserve report issued by WD Von Gonten & Co. as of 12/31/20 3Our targets are based on, among other things our current planned capital expenditures, our ability to drill and complete wells in a manner consistent with prior performance, certain drilling and completion cost assumptions and certain well performance assumptions. In addition, achieving these targets and maintaining the required capital expenditures and drilling activity to achieve these targets will depend on the availability of capital, regulatory approvals, realized commodity prices, rig and service availability, actual drilling results as well as other factors. Investors should recognize that the reliability of any guidance diminishes the farther in the future that the data is forecast, and it is thus increasingly likely that our actual results will differ materially from our guidance. Assumes prices of $55 WTI oil / $2.75 HH gas. 3 Forecasted as of 3/31/21 Pure Play Eagle Ford Operator… • +53,0001 Net Acres, 100% in the Eagle Ford Shale • Access to premium hydrocarbon markets (Oil‐MEH; Gas‐ Houston Ship Channel; NGL’s‐Mt. Belvieu) combined with no volume‐based market commitments yields superior wellhead pricing • Technological leader with 100% focus in the Eagle Ford, drilling extended reach laterals with proprietary targeting and completion techniques, yielding differential reserves and returns …With A Capital Program Focused in Areas of Success… • 2021 capital program is focused in areas where Lonestar has demonstrated outstanding results since 2019 • 2021 Drilling focused at Horned Frog (IRR’s‐ 92‐137%) & Cyclone/Hawkeye (IRR’s‐ 58‐69%) at $50/$2.50 flat2 and at $55/$2.75 flat2, respectively …Delivering Production Growth And Free Cash Flow2 • 2021 Production Target of 12,250 – 12,750 boe/d • Production Growth of 10% (4Q20 vs. 4Q21) • 2021 Capital Spending of $45‐$50 MM for 10 wells • Yields Adj. EBITDAX of $90‐100 MM • Free Cash Flow of $30‐$40 MM Highly Competitive Cost Structure • Cash Operating Costs of $10.00/BOE • “All‐in” Cash Breakeven (Including Interest Expense) of @$13.00/BOE • 5‐year All‐Sources Finding & Onstream costs of $8.09 per Boe Continued Low‐Cost Organic Growth in Core Areas • >200 Eagle Ford drilling locations provides a long runway for ongoing development, including a 15‐year inventory of laterals >7,000 feet2 • Demonstrated ability to aggregate leasehold in core areas at minimal costs • 5‐year record of Proved reserve growth at Horned Frog & Cyclone/Hawkeye $6.90 Company Profile

Lonestar Resources 4 Eastern Central Western Lonestar Acreage* 1 Acreage values at of 12/31/20. Horned Frog Sooner Georg Cyclone Hawkeye Marquis

Producing Undeveloped Net % % Avg. Region Wells Locations Acres Operated HBP WI Western 67 35 14,928 100% 88% 88% Central 189 160 31,591 90% 95% 69% Eastern 24 21 6,499 97% 100% 67% Total 280 216 53,018 97% 93% 69% Lonestar’s Eagle Ford Footprint

Lonestar Resources 5 Why Lonestar? • Petrophysics‐driven evaluation has allowed Lonestar to identify high‐return opportunities in parts of the Eagle Ford Shale that have been neglected or abandoned by the industry • Lonestar has aggregated core positions at minimal upfront costs in sizes that allow operational scale • Geo‐Engineered Completions‐ Lonestar’s proprietary targeting, drilling & completion process have yielded step‐change increased reserves recoveries and deep inventory of high‐return drilling inventory Technology Differentiated Value Creation • Outstanding wellhead realizations for crude oil & gas, with unfettered pipeline access to premium Gulf Coast markets, with 87% of revenues from crude oil and natural gas liquids • 2021E Cash Operating Expenses of $10.00/BOE, best‐in‐class among our oil‐weighted peers • Extended‐reach drilling inventory yields superior returns on invested capital‐@$9.00/BOE onstream costs Premium Profitability • Net Long‐Term Obligations have been reduced from $635 MM to $240 MM • Interest & Preferred Dividend Expense has been reduced from $45 MM to $14 MM • Sufficient liquidity to pursue additional opportunities through cycles • Allows High Return Capital Program to flow through to the bottom line, benefitting equity holders Improved Balance Sheet Allows Drilling Returns To Shine • 2021 Capital Budget of $45‐$50 MM focused Hawkeye & Horned Frog, where IRR’s range from 60‐100% • 2021 Program yields 10% production growth2 and generates Adj. EBITDAX of $90 ‐ $100 MM, equating to Free Cash Flow of $30‐$40 MM, and a FCF Yield of @40% • Free Cash Flow will be prioritized for Debt repayment. Long‐term goal to cut leverage ratio from 2.1x to 1.5x3 High Return Capital Program Yields FCF1 1Our targets are based on, among other things our current planned capital expenditures, our ability to drill and complete wells in a manner consistent with prior performance, certain drilling and completion cost assumptions and certain well performance assumptions. In addition, achieving these targets and maintaining the required capital expenditures and drilling activity to achieve these targets will depend on the availability of capital, regulatory approvals, realized commodity prices, rig and service availability, actual drilling results as well as other factors. Investors should recognize that the reliability of any guidance diminishes the farther in the future that the data is forecast, and it is thus increasingly likely that our actual results will differ materially from our guidance2 As measured from 4Q20 to 4Q21 . 3 Assumes 10 gross completions annually in Horned Frog, Cyclone/Hawkeye & Karnes

Lonestar Resources 6 $0 $100 $200 $300 $400 $500 $600 $700 Prior 3/31/2021 $M M Revolver $285 MM Revolver $190 MM1 Sr. Unsec. Notes $250 MM Preferred $100 MM Term Loan‐ $55 MM $635 MM $240 MM Term Loan‐ $50 MM Reduced Leverage Underpinned by NAV Sharply Reduced Long‐Term Obligations ~$400 Million Reduction in Long‐Term Obligations • November 30, 2020‐ Value‐preserving and consensual reorganization • $250 MM Senior Unsecured Notes exchanged for 9.6 million shares • $100 MM of Preferred Equity exchanged for 0.3 million shares • Existing common shareholders received 0.1 million shares • Free Cash Flow has reduced net Bank Debt by $45 MM since 7/1/20 …Equity Underpinned By Robust Reserves Value2 • Proved Developed PV‐10 • @$50 oil/$2.50 gas‐ $315 MM, exceeding Net Debt by $76 MM • @$55 oil/$2.75 gas, exceeds Net Debt by $123 MM • Proved PV‐10 • @$50 oil/$2.50 gas‐ $607 MM • @$55 oil/$2.75 gas‐ $724 MM • Proved & Probable PV‐10 • @$50 oil/$2.50 gas‐ $668 MM • @$55 oil/$2.75 gas‐ $817 MM Long Term Debt vs. PV‐101 Reserves as of December 31, 20202 Operating Highlights 1 Net of cash 2 All reserves values are based on reserve report from Lonestar’s 12/31/20 reserve report, independently engineered by WD Von Gonten & Co., and present values are calculated using price decks of: i) $50/bbl for WTI crude oil and $2.50/Mcf for Henry Hub natural gas, and ii) $55/bbl for WTI crude oil and $2.75/Mcf for Henry Hub Crude Natural Natural $50/$2.50 $55/$2.75 Oil Gas Liquids Gas Equivalent PV‐10 PV‐10 Category (MMBbls) (MMBbls) (Bcf) (MMBoe) ($MM) ($MM) PDP 15.2 7.5 47.6 30.6 $313.6 $358.0 PDNP 0.2 0.2 1.2 0.6 $2.2 $2.9 PUD 25.6 12.6 79.7 51.5 $291.2 $362.9 Proved 41.0 20.3 128.4 82.7 $607.0 $723.8 PROB 20.8 5.1 29.6 30.8 $61.1 $93.2 P+P 61.8 25.4 158.0 113.5 $668.1 $817.0 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 Debt $55/$2.50 $55/$2.75 $M M Proved Developed $316 MM Revolver $190 MM1 $668 MM $817 MM Term Loan‐$50 MM Proved Developed $361 MM Proved Undeveloped $291 MM Proved Undeveloped $363 MM Probable‐ $61 MM Probable‐ $93 MM PV‐10 PV‐10 $240 MM

Lonestar Resources 7 Free Cash Flow‐ 2021 Target High Free Cash Flow Yield Sharply Reduced Interest & Preferred Dividends 1 Estimates as of 3/31/21. 2 Based on $55 WTI oil price & $2.75 HH gas price and based on current hedge positions, assumes hedging loss of ~$15 ‐ $20 MM Sharp Reduction in Interest Expense… • Eliminated 11.25% coupon on $250 MM of Sr. Unsec. Notes ($28 MM) • Eliminated 9% dividend on $100 MM of Preferred Equity ($9 MM) • Interest expense on Bank Debt is 5.50% ($14 MM) • Expect to reduce interest as Bank Debt is repaid …Sets Up Significant Free Cash Flow to Reduce Debt2 • 2021 Production Target of 12,250–12,750 BOE/d • Adj. EBITDAX Target of $90‐$100 MM = Cash Flow of $75‐$85 MM • 2021 Capital Spending Target of $45‐$50 MM sets up higher volumes & EBITDAX in 2022 • 2021 Free Cash Flow Target of $30‐$40 MM (FCF Yield= 30‐40%) Sufficient Initial Liquidity Which Can Expand • $210 MM drawn on $225 MM Borrowing Base, $20 MM of cash • Free Cash Flow will be prioritized for debt reduction Balance Sheet Detail 1 Balance Sheet Highlights November 30, 2023 $5 MM principal paid quarterly Long Term Debt $260 5.50% Maturity Term Loan $50 5.50% Instrument Amount Rate Cash $20 N/M Sr. Secured Revolver $210 5.50% November 30, 2023 $0 $10 $20 $30 $40 $50 Prior 3/31/2021 $M M Preferred $9 MM Sr. Unsec. Notes $28 MM Revolver $6 MM Revolver $12 MM Term Loan‐ $2 MM $44 MM $14 MM $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 $110 EBITDAX / Cash Flow Interest Expense $M M $14 MM Capital Expenditures $45‐$50 MM Interest Expense $14 MM Free Cash Flow ~$30‐$35 MM EBITDAX $90‐100MM

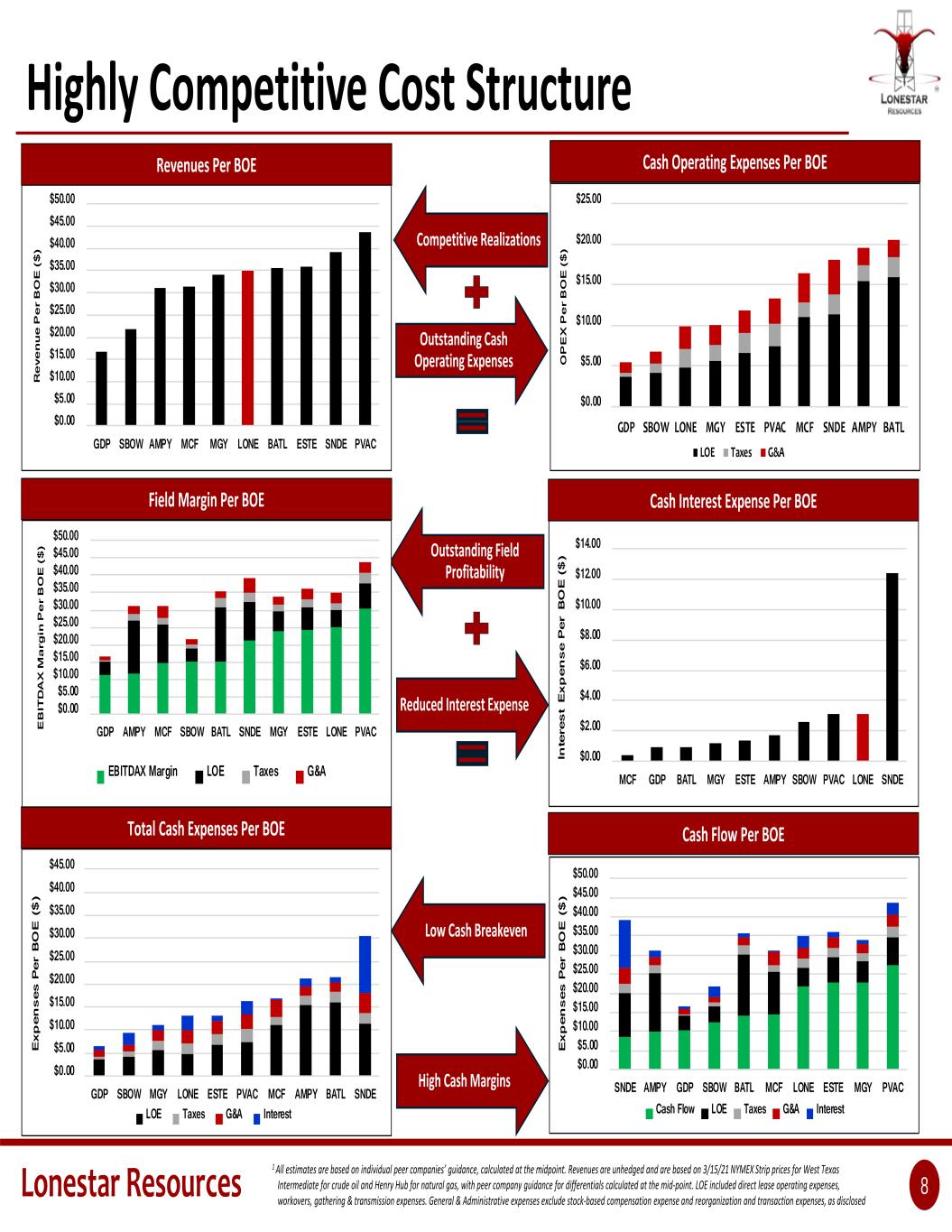

Lonestar Resources 8 $0.00 $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 $35.00 $40.00 $45.00 $50.00 GDP SBOW AMPY MCF MGY LONE BATL ESTE SNDE PVAC R ev en ue P er B O E ($ ) $0.00 $5.00 $10.00 $15.00 $20.00 $25.00 GDP SBOW LONE MGY ESTE PVAC MCF SNDE AMPY BATL O P E X P er B O E ($ ) LOE Taxes G&A $0.00 $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 $14.00 MCF GDP BATL MGY ESTE AMPY SBOW PVAC LONE SNDE In te re st E xp en se P er B O E ($ ) $0.00 $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 $35.00 $40.00 $45.00 GDP SBOW MGY LONE ESTE PVAC MCF AMPY BATL SNDE Ex pe ns es P er B O E ($ ) LOE Taxes G&A Interest $0.00 $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 $35.00 $40.00 $45.00 $50.00 SNDE AMPY GDP SBOW BATL MCF LONE ESTE MGY PVAC Ex pe ns es P er B O E ($ ) Cash Flow LOE Taxes G&A Interest Revenues Per BOE Cash Operating Expenses Per BOE Field Margin Per BOE Cash Interest Expense Per BOE Total Cash Expenses Per BOE Cash Flow Per BOE Competitive Realizations Outstanding Cash Operating Expenses Outstanding Field Profitability Reduced Interest Expense Low Cash Breakeven High Cash Margins $0.00 $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 $35.00 $40.00 $45.00 $50.00 GDP AMPY MCF SBOW BATL SNDE MGY ESTE LONE PVACE B IT D A X M ar gi n P er B O E ($ ) EBITDAX Margin LOE Taxes G&A Highly Competitive Cost Structure 1 All estimates are based on individual peer companies’ guidance, calculated at the midpoint. Revenues are unhedged and are based on 3/15/21 NYMEX Strip prices for West Texas Intermediate for crude oil and Henry Hub for natural gas, with peer company guidance for differentials calculated at the mid‐point. LOE included direct lease operating expenses, workovers, gathering & transmission expenses. General & Administrative expenses exclude stock‐based compensation expense and reorganization and transaction expenses, as disclosed

Lonestar Resources 9 Lonestar’s Differentiated Approach To Shale Assess Rock Fabric Use Science to Quantify Identify Economic Opportunity in The Eagle Ford Shale • Apply our basin‐wide petrophysical database to characterize hydrocarbon potential, allowing for detailed mapping of Eagle Ford Shale in areas of opportunity • Identify areas where the targeting, drilling, completion & production practices of other operators has generated economic results that are inferior to our view of the local reserves potential of the Eagle Ford Shale • Drilling results have proven our strategy through increased EUR’s and high IRR’s Engineered Completions Maximize Stimulation Efficiency & EUR/ft With Engineered Completions & Diverters • Run Thru‐Bit lateral logs to collect data for reservoir characterization; model vertical and lateral rock heterogeneity; identify planar/non‐planar fractures and calculate mechanical properties to design engineered completions • Model multi‐well stress shadows in zipper fracs • Extensive use of near‐field and far‐field diverters to optimize perforation efficiency, develop frac complexity and increase reserves recovery at a lower cost than more fashionable slickwater fracs Engineered Flowback Apply Analytics During Flowback to Optimize Recoveries While Minimizing Damage • While it doesn’t always make for great press releases, Lonestar has increasingly applied controlled flowbacks • Implemented Rate Transient Analysis to prevent formation damage and maintain permeability while maximizing ultimate recovery • Maximize condensate recoveries in higher GOR areas and maximize black oil recoveries where bubble point is an issue Combine Petrophysical & Geophysical Analysis to Optimize Well Placement For Maximum Recoveries • Develop Earth Models on core assets, utilizing 622,000’ of thru‐bit lateral logs and >150 mi2 of 3‐D seismic to predict reservoir & mechanical properties to optimize selection of geo‐steering target within Lower Eagle Ford • Integrate in‐house geo‐ steering software into 3‐ D pre‐stack depth migration to stay in optimal target • Use thru‐bit laterals on same pad to fine‐tune targeting on successive wells on the same pad Targeting Drill Longer Laterals To Achieve Highest Recoveries At Lowest Cost Per Lateral Foot • Lonestar has acquired most of its leases since 2015, in geometries that allow for extended reach laterals and higher returns, which yield better returns • Combine technologies including Earth Models, 3‐D seismic, azimuthal gamma ray and in‐house geo‐steering software to stay in narrow targets while maintaining drilling efficiency • To date, Lonestar has drilled 30 wells > 10,000’ • In 2021, Lonestar’s 10‐well capital plan has an average lateral length of >10,000’ Extended Reach Laterals

Lonestar Resources 10 12,000’5,000’ 6,000’ 7,000’ 8,000’ 9,000’ 10,000’ 11,000’4,000’3,000’2,000’1,000’ Karnes Horned Frog Cyclone Hawkeye 1 All reserves and economic data sourced from Lonestar’s 12/31/20 reserve report, independently engineered by WD Von Gonten & Co. Assumes $50 flat oil price and $2.50 flat gas deck and $55 flat oil price and $2.75 flat gas deck. 2 Lateral Lengths are approximate NorthSouth Extended Reach Laterals Supercharge Returns Oil 14% NGL's 42% Gas 44% Product Mix Oil 37% NGL's 31% Gas 33% Product Mix Oil 88% NGL's 7% Gas 5% Product Mix Oil 89% NGL's 6% Gas 5% Product Mix Lateral Length2 Capital Cost : $4.9 MM Gross Reserves : 1,076 MBOE $50/$2.50 IRR : 39% $55/$2.75 IRR : 49% 5,000' Capital Cost : $5.1 MM Gross Reserves : 431 MBOE $50/$2.50 IRR : 33% $55/$2.75 IRR : 38% 5,000' Capital Cost : $4.6 MM Gross Reserves : 360 MBOE $50/$2.50 IRR : 34% $55/$2.75 IRR : 43% 5,000' Capital Cost : $7.4 MM Gross Reserves : 2,647 MBOE $50/$2.50 IRR : 92% $55/$2.75 IRR : 137% 12,000' Capital Cost : $7.5 MM Gross Reserves : 819 MBOE $50/$2.50 IRR : 58% $55/$2.75 IRR : 69% 12,000' Capital Cost : $5.8 MM Gross Reserves : 603 MBOE $50/$2.50 IRR : 58% $55/$2.75 IRR : 75% 8,000'

Core Areas Horned Frog‐ La Salle County, Texas

Lonestar Resources 12 In 2015, Lonestar Identified An Opportunity In SW LaSalle County • High quality Lower Eagle Ford Shale with attractive Hydrocarbon Pore Thickness • Industry’s poor drilling results across 98 wells generated EUR’s averaging 0.3 MMBOE, 63% of which was natural gas. • Lonestar believed that the rock quality indicated much higher potential recoveries Legend Eagle Ford – Before 2016 Eagle Ford – After 2016 Austin Chalk LONE Acreage EUR Crude Oil (MMBbls) EUR NGL (MMBbls) EUR Natural Gas (Bcf) Horned Frog Lonestar Acquired 4,402 Acres From Conoco‐Phillips Via Farm‐In • Drilled the Horned Frog A1H/B1H wells, EUR’s averaging 0.750 MMBOE, exceeding offsetting Avg. EUR by 130%. Lonestar Continues to Expand Its Leasehold Position In Its Horned Frog Core • Increased position to @8,000 gross acres in more than 15 separate transactions at a total cost of $3.6 MM, or less than $500 per acre. Lonestar Has Applied its Geo‐Engineered Drilling & Completion Process, Boosting EURs in the Horned Frog Area • Since 2018, Lonestar has completed 10 wells at Horned Frog with laterals averaging 10,533’. • These 10 wells have average EURs of 1.6 MMBOE1, which is 140% greater than offset operators’ modern‐vintage wells (and 68% higher on EUR/ft) 1 All reserves and economic data sourced from Lonestar’s 12/31/20 reserve report, independently engineered by WD Von Gonten & Co. Assumes $50 flat oil price and $2.50 flat gas deck. *All wells shown are completed in the Lower Eagle Ford Shale

Lonestar Resources 13 Lonestar Acquired 4,402 Acres From Conoco‐Phillips Via Farm‐In • In 1995, Lonestar Drilled the Horned Frog A1H/B1H wells, EUR’s averaging 0.750 MMBOE, exceeding Avg. EUR by 130%. Horned Frog South Legend Eagle Ford – Before 2016 Eagle Ford – After 2016 Austin Chalk LONE Acreage EUR Crude Oil (MMBbls) EUR NGL (MMBbls) EUR Natural Gas (Bcf) Lonestar’s Targeting Strategy Has Boosted Oil Recoveries in This High GOR Area • LONE’s oil EUR/ft of 32 bbl/ft nearly 3 times their direct offsets Lonestar Continues to Lease New Acreage in Horned Frog South • Recently added >1,000 acres at <$1,000/acre • Organically expanding drilling inventory for minimal capital outlay Current Well Economics • Current AFE’s for 11,000’ lateral are $7.5 MM vs. $9.5 MM in 2020 • At $50 oil / $2.50 gas, EURs of 2.0 MMBOE1 yield IRRs of 92% • At $55 oil / $2.75 gas, EURs of 2.0 MMBOE1 yield IRRs of 137% Lonestar Has Optimized its Geo‐ Engineered Drilling & Completion Process, Doubling EURs in Horned Frog South Area • Since 2018, Lonestar has completed 6 wells at Horned Frog South with laterals averaging 11,929’. • LONE’s 6 wells have avg. EURs of 1.9 MMBOE1 • >100% improvement over LONE’s prior wells • 33% greater than offset operators’ modern‐vintage wells (28% higher than modern‐vintage wells based on EUR/ft) 1 All reserves and economic data sourced from Lonestar’s 12/31/20 reserve report, independently engineered by WD Von Gonten & Co. Assumes $50 flat WTI oil price and $2.50 flat HH gas price deck and a $55 flat WTI oil price and $2.75 HH gas price deck *All wells shown are completed in the Lower Eagle Ford Shale

Lonestar Resources 14 Lonestar Continues to Organically Build Its Leasehold Position in Horned Frog North • Continue to add drillable leasehold at <$1,000/acre • Currently drilling Horned Frog North #1H &2H on leasehold acquired in 4Q20 after offset operator relinquished it. Lonestar Established Its Position in 2018 After Leasing An Equinor Relinquishment • In 2018, Lonestar Drilled the Horned Frog NW #2H & #3H wells, EUR’s averaging 0.830 MMBOE, exceeding Avg. EUR by 204%. Horned Frog North Legend Eagle Ford – Before 2016 Eagle Ford – After 2016 Austin Chalk LONE Acreage EUR Crude Oil (MMBbls) EUR NGL (MMBbls) EUR Natural Gas (Bcf) Current Well Economics • Current AFE’s for 7,500’ lateral are $5.9 MM vs. $6.8 MM in 2020 • At $50 oil / $2.50 gas, EURs of 0.8 MMBOE1 yield IRRs are 95% • At $55 oil / $2.75 gas, EURs of 0.8 MMBOE1 yield IRRs of 124% Lonestar Significantly Improved Its Results on Its Next Pad… • In 2019, Lonestar drilled the Horned Frog NW #4H & 5H, direct offsets its prior wells. •EURs are 1.3 MMBOE1, or 137 BOE/ft •>23% EUR improvement over LONE’s prior wells •240% higher EUR than offset operators’ modern‐ vintage wells •Generating a geo‐target with petrophysics improved Oil EUR/ft by 233% vs. average offset wells. 1 All reserves and economic data sourced from Lonestar’s 12/31/20 reserve report, independently engineered by WD Von Gonten & Co. Assumes $50 flat oil price and $2.50 flat gas deck. *All wells shown are completed in the Lower Eagle Ford Shale

Lonestar Resources 15 0 500 1,000 1,500 2,000 2,500 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 3‐ St re am P ro du ct io n (B o e/ d) Months WDVG 12,000' 0 200 400 600 800 1,000 1,200 1,400 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 3‐ St re am P ro du ct io n (B o e/ d) Months WDVG‐LONE 7,500' Horned Frog‐ High Return Growth Engine Horned Frog South Type Well 1 Horned Frog North Type Well 1Horned Frog Reserves Summary 1 Horned Frog Is A Hub For Organic Reserves Growth • Established foothold via farm‐in and applied our drilling & completion practices to more than double EUR’s in the area • Lonestar has built out Company‐owned gathering & processing infrastructure to support future drilling, entered into new downstream contracts that yield best‐in‐market wellhead pricing • Lonestar has organically assembled leasehold at a cost of $3.6 million to establish a reserve base in excess of 30 million BOE with PV‐10 of $193 million 2 • At current prices, well economics compete with super‐core Eagle Ford • In 2021, Lonestar has continued to add acreage to expand its inventory of extended reach lateral locations • Current inventory equals 5 years of extended reach laterals at current pace of drilling 0.0 5.0 10.0 15.0 20.0 25.0 30.0 35.0 YE14 YE15 YE16 YE17 YE18 YE19 YE20 M M Bo e PDP PUD PROB 7,500' 845 Est. AFE Well Cost ($MM) $5.7 $50/$2.50 PV‐10 ($MM) $6.9 $50/2.50 IRR 96% $8.3 124% Type Curve Statistics Avg. Lat. Length Gross EUR (Mboe) $55/$2.75 IRR $55/$2.75 PV‐10 ($MM) 1 All reserves and economic data sourced from Lonestar’s 12/31/20 reserve report, independently engineered by WD Von Gonten & Co. 2 Assumes 3/1/21 NYMEX Strip pricing 12,000' 2,647 $7.4 $12.2 92% $14.4 137% $55/$2.75 PV‐10 ($MM) $50/$2.50 PV‐10 ($MM) $50/$2.50 IRR1 $55/$2.75 IRR Est. AFE Well Cost ($MM) Type Curve Statistics Avg. Lat. Length Gross EUR (Mboe)

Core Areas Cyclone/Hawkeye‐ Gonzales County, Texas

Lonestar Resources 17 Legend Eagle Ford – Before 2018 Eagle Ford – After 2018 Austin Chalk well LONE Acreage EUR Crude Oil (MMBbls) EUR NGL (MMBbls) EUR Natural Gas (Bcf) Lonestar Identified An Eagle Ford Shale Opportunity In Gonzales County, Texas • Minimal Eagle Ford Shale development upthrown from the Gonzales Graben… • …despite Lower Eagle Ford Shale thickness of 100’ and depths exceeding 9,000’ • Most of the acreage was HBP’d by Austin Chalk wells, operated by small operators, who lacked the capital & technology to drill & complete Eagle Ford Shale wells, creating an entry point. In 2014, Gained A Foothold Drilling Wells In a Marathon Austin Chalk Unit • Lonestar operated 6 Eagle Ford Shale wells, with lateral lengths of 6,000’ • >700 bbl/day • Average EUR’s of >0.4 MMBOE (69 BOE/ft) • Offset wells drilled by large independents averaged 0.2 MMBOE, (43 BOE/ft) • Despite scant well control (8 wells over 140 mi2), LONE’s results gave us confidence that if we could solve targeting issues and depletion in the Austin Chalk, it could generate attractive returns. Lonestar Has Since Built a 12,000‐Acre Position Across The Area • Through 2019, position built via a combination farm‐ in, primary term leasehold, and producing property purchases via a bankruptcy • In 2020, Lonestar boosted its position in the Hawkeye area with a 15,000‐acre JV with Marathon, expanding our position in acreage with better rock properties • 57 total drilling locations • Average lease acquisition cost= $523/net acre Built Its Leasehold P sition As It Solved Key Technical Hurdles & Optimized Its Drilling & Completion Techniques… • On acreage with Hydrocarbon Pore Thickness >3.0, Lonestar has used 3‐D seismic to solve for: • Austin Chalk d pletion which creates drilling challenges • Predict dip changes to stay in narrow geo‐targets • On this same acreage, Lonestar has used vertical and horizontal petrophysical logs to: • Map reservoir properties of multip e distinct zones withi the Lower Eagle Ford Shale • Improve geo‐steering precision on successive wells on each pad • Execute engineered completions with diverters to enhance ffective fracked porosity, achieve optimal perforation efficiency and constrain frac within Eagle Ford, minimizing growth into depletion in the overlying Austin Chalk …Generating Sup rior Results Across Its Lease Position Since 2018 • Updip Section‐ (HCPT>1.5 & <3.0), other operators have drilled 8 wells offsetting LONE’s position, yielding EUR’s averaging 0.7 MMBOE (48 BOE/ft), while LONE has drilled 6 wells with EUR’s averaging 0.6 MMBOE (66 BOE/ft) • Downdip Section‐ (HCPT>3.0), other operators have drilled 61 wells offsetting LONE’s position, yielding EUR’s averaging 0.5 MMBOE (65 BOE/ft), while LONE has drilled 3 wells with EUR’s averaging 0.9 MMBOE (85 BOE/ft) Cyclone / Hawkeye

Lonestar Resources 18 0 200 400 600 800 1,000 1,200 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 3‐ St re am P ro d u ct io n (B o e/ d ) Months WDVG 12,000' 0 200 400 600 800 1,000 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 3‐ St re am P ro du ct io n (B o e/ d) Months WDVG 10,000' Cyclone/Hawkeye‐High Return Growth Engine Cyclone/Hawkeye Reserve Summary 1 Cyclone/Hawkeye Is a Hub For Organic Reserves Growth • Established foothold via farm‐in and applied our drilling & completion practices to more than double EUR’s in the area • Lonestar has built out Company‐owned water transfer, gathering & processing infrastructure to support future drilling, entered into new downstream contracts that yield best‐in‐market wellhead pricing • Lonestar’s JV with Marathon Oil validates its capabilities as an operator and significantly expands the number of drilling locations and avg. lateral length • Lonestar has organically assembled leasehold to establish a reserve base in excess of 20 million BOE with PV‐10 of $172 million 2 • At current prices, new well economics yield returns that command capital, and Lonestar current plans 6 completions in 2021 • Inventory equals ~10 years of extended reach laterals at current pace of drilling • Lonestar continues to pursue additional opportunities in the area 0.0 5.0 10.0 15.0 20.0 25.0 YE14 YE15 YE16 YE17 YE18 YE19 YE20 M M Bo e PDP PUD PROB Cyclone/Hawkeye 10,000’ Type Well 1 Cyclone/Hawkeye 12,000’ Type Well 1 10,000' 676 $6.9 $4.5 $50/$2.50 IRR 45% $6.1 58% Est. AFE Well Cost ($MM) $55/$2.75 IRR $50/$2.50 PV‐10 ($MM) Gross EUR (Mboe) Type Curve Statistics Avg. Lat. Length $55/$2.75 PV‐10 ($MM) 12,000' 819 $7.5 $6.8 $50/$2.50 IRR 58% $8.3 69% Est. AFE Well Cost ($MM) $55/$2.75 IRR $55/$2.75 PV‐10 ($MM) Gross EUR (Mboe) Type Curve Statistics Avg. Lat. Length $50/$2.50 PV‐10 ($MM) 1 All reserves and economic data sourced from Lonestar’s 12/31/20 reserve report, independently engineered by WD Von Gonten & Co. 2 Assumes 3/1/21 NYMEX Strip pricing

Lonestar Resources 19 Free Cash Flow = Targeted Path To 1.5x Leverage Free Cash Flow1 Significant Free Cash Generation1… • Targeted Capital Expenditures for 10 wells/year = $45‐$50 MM • Production Growth‐ from 12,500 BOE/day2 to 14,000 BOE/day2, then flat • EBITDAX Target of $90‐100 MM = Cash Flow of $75‐85 MM • Free Cash Flow of $35 MM • Annual Interest Expense reduced through debt reduction …Free Cash Flow Reduces Debt1 • Pay down Term Loan by $20 MM per year • Would result in fully repayment of Term Loan 2H23 • Pay Down Revolver with remaining Cash Flow, totaling $50 MM • Yields $100 MM repaying of Long‐Term Debt over 3 years • Targeting Leverage Ratio of 1.5x Debt Reduction1 Deleveraging Story $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 $110 2021 2022 2023 $M M Interest Expense Capex FCF 0.0x 0.5x 1.0x 1.5x 2.0x 2.5x $0 $50 $100 $150 $200 $250 2021 2022 2023 $M M Revolver Drawn Term Loan Balance Debt/LTM EBITDAX 1Our targets are based on, among other things our current planned capital expenditures, our ability to drill and complete wells in a manner consistent with prior performance, certain drilling and completion cost assumptions and certain well performance assumptions. In addition, achieving these targets and maintaining the required capital expenditures and drilling activity to achieve these targets will depend on the availability of capital, regulatory approvals, realized commodity prices, rig and service availability, actual drilling results as well as other factors. Investors should recognize that the reliability of any guidance diminishes the farther in the future that the data is forecast, and it is thus increasingly likely that our actual results will differ materially from our guidance. Assumes 10 gross completions annually in Horned Frog, Cyclone/Hawkeye & Karnes. 2 mid‐point of targets

Lonestar Resources 20 Why Lonestar? • Petrophysics‐driven evaluation has allowed Lonestar to identify high‐return opportunities in parts of the Eagle Ford Shale that have been neglected or abandoned by the industry • Lonestar has aggregated core positions at minimal upfront costs in sizes that allow operational scale • Geo‐Engineered Completions‐ Lonestar’s proprietary targeting, drilling & completion process have yielded step‐change increased reserves recoveries and deep inventory of high‐return drilling inventory Technology Differentiated Value Creation • Outstanding wellhead realizations for crude oil & gas, with unfettered pipeline access to premium Gulf Coast markets, with 87% of revenues from crude oil and natural gas liquids • 2021E Cash Operating Expenses of $10.00/BOE, best‐in‐class among our oil‐weighted peers • Extended‐reach drilling inventory yields superior returns on invested capital‐@$9.00/BOE onstream costs Premium Profitability • Net Long‐Term Obligations have been reduced from $635 MM to $240 MM • Interest & Preferred Dividend Expense has been reduced from $45 MM to $14 MM • Sufficient liquidity to pursue additional opportunities through cycles • Allows High Return Capital Program to flow through to the bottom line, benefitting equity holders Improved Balance Sheet Allows Drilling Returns To Shine • 2021 Capital Budget of $45‐$50 MM focused Hawkeye & Horned Frog, where IRR’s range from 60‐100% • 2021 Program yields 10% production growth2 and generates Adj. EBITDAX of $90 ‐ $100 MM, equating to Free Cash Flow of $30‐$40 MM, and a FCF Yield of @40% • Free Cash Flow will be prioritized for Debt repayment. Long‐term goal to cut leverage ratio from 2.1x to 1.5x3 High Return Capital Program Yields FCF1 1Our targets are based on, among other things our current planned capital expenditures, our ability to drill and complete wells in a manner consistent with prior performance, certain drilling and completion cost assumptions and certain well performance assumptions. In addition, achieving these targets and maintaining the required capital expenditures and drilling activity to achieve these targets will depend on the availability of capital, regulatory approvals, realized commodity prices, rig and service availability, actual drilling results as well as other factors. Investors should recognize that the reliability of any guidance diminishes the farther in the future that the data is forecast, and it is thus increasingly likely that our actual results will differ materially from our guidance2 As measured from 4Q20 to 4Q21 . 3 Assumes 10 gross completions annually in Horned Frog, Cyclone/Hawkeye & Karnes

Appendix

Lonestar Resources 22 Hedge Position‐ Crude Oil 4,822 6,150 5,150 4,900 5,255 3,250 3,000 3,000 3,000 3,062 $43.98 $46.66 $44.53 $47.63 $46.99 $46.69 $46.76 $47.03 $40.00 $41.00 $42.00 $43.00 $44.00 $45.00 $46.00 $47.00 $48.00 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 1Q21 2Q21 3Q21 4Q21 Cal '21 1Q22 2Q22 3Q22 4Q22 Cal '22 W ei gh te d A vg . S tr ik e Cr ud e O il (B bl s/ d) Tenor Bbls/d Total Bbls Weighted‐Avg. Strike 1Q21 4,822 434,000 $43.98 2Q21 6,150 559,650 $46.66 3Q21 5,150 473,800 $45.11 4Q21 4,900 450,800 $44.53 Cal '21 5,255 1,918,250 $48.85 1Q22 3,250 292,500 $47.63 2Q22 3,000 273,000 $46.99 3Q22 3,000 276,000 $46.69 4Q22 3,000 276,000 $46.76 Cal '22 3,062 1,117,500 $47.03 Crude Oil Hedge Book1 Crude Oil Hedge Book1 …Ensuring Free Cash Flow Through Active Hedging Strategy • >100% of PDP Hedged for Cal ’21 • >80% of PDP Hedged for Cal ‘22 1 All hedges are West Texas Intermediate swap contracts, as of 3/9/21

Lonestar Resources 23 Hedge Position‐ Natural Gas Natural Gas Hedge Summary1 Natural Gas Contract Summary1 …Ensuring Free Cash Flow Through Active Hedging Strategy • >100% of PDP Hedged for Cal ’21 • >80% of PDP Hedged for Cal ‘22 13,500 12,400 16,400 10,700 13,251 10,000 5,000 5,000 5,000 6,233 $3.23 $2.88 $2.93 $3.05 $3.02 $2.88 $2.70 $2.70 $2.70 $2.77 $2.00 $2.10 $2.20 $2.30 $2.40 $2.50 $2.60 $2.70 $2.80 $2.90 $3.00 $3.10 $3.20 $3.30 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000 18,000 1Q21 2Q21 3Q21 4Q21 Cal '21 1Q22 2Q22 3Q22 4Q22 Cal '22 W ei gh te d A vg . S tr ik e N at ur al G as ( M cf /d ) Tenor Mcf/d Total Mcf Weighted‐Avg. Strike 1Q21 13,500 1,215,000 $3.23 2Q21 12,400 1,128,400 $2.88 3Q21 16,400 1,508,800 $2.93 4Q21 10,700 984,400 $3.05 Cal '21 13,251 4,836,600 $3.02 1Q22 10,000 900,000 $2.88 2Q22 5,000 455,000 $2.70 3Q22 5,000 460,000 $2.70 4Q22 5,000 460,000 $2.70 Cal '22 6,233 2,275,000 $2.77 1 All hedges are Henry Hub swap contracts, as of 3/9/21