Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Jazz Pharmaceuticals plc | d112331d8k.htm |

Exhibit 99.1 Forward-Looking Statements “Safe Harbor” Statement Under The Private Securities Litigation Reform Act of 1995 This communication contains forward-looking statements regarding Jazz Pharmaceuticals and GW Pharmaceuticals, including, but not limited to, statements related to the anticipated acquisition of GW Pharmaceuticals and the anticipated timing and benefits thereof, including the potential for Jazz Pharmaceuticals to broaden its neuroscience portfolio, further diversify its revenue and drive sustainable, long-term growth and value creation opportunities; Jazz Pharmaceuticals’ expected financing for the transaction; Jazz Pharmaceuticals’ ability to deleverage; potential new product approvals and launches and the anticipated timing thereof; the commercial and growth potential of Jazz’s and the combined company’s products and product candidates; Jazz’s expectations with respect to the launch of authorized generic and generic versions of Xyrem, the anticipated timing thereof and its receipt of royalties on authorized generic versions of Xyrem; and other statements that are not historical facts. These forward-looking statements are based on each of the companies’ current plans, objectives, estimates, expectations and intentions and inherently involve significant risks and uncertainties. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without limitation, risks and uncertainties associated with: Jazz Pharmaceuticals’ and GW Pharmaceuticals’ ability to complete the acquisition on the proposed terms or on the anticipated timeline, or at all, including risks and uncertainties related to securing the necessary regulatory and shareholder approvals, the sanction of the High Court of Justice of England and Wales and satisfaction of other closing conditions to consummate the acquisition; the occurrence of any event, change or other circumstance that could give rise to the termination of the definitive transaction agreement relating to the proposed transaction; risks related to diverting the attention of GW Pharmaceuticals and Jazz Pharmaceuticals management from ongoing business operations; failure to realize the expected benefits of the acquisition; significant transaction costs and/or unknown or inestimable liabilities; the risk of shareholder litigation in connection with the proposed transaction, including resulting expense or delay; the risk that GW Pharmaceuticals’ business will not be integrated successfully or that such integration may be more difficult, time-consuming or costly than expected; Jazz Pharmaceuticals’ ability to obtain the expected financing to consummate the acquisition; risks related to future opportunities and plans for the combined company, including the uncertainty of expected future regulatory filings, ability to obtain approval for JZP-258 and JZP-458, product launches, financial performance and results of the combined company following completion of the acquisition; GW Pharmaceuticals’ dependence on the successful commercialization of Epidiolex/Epidyolex and the uncertain market potential of Epidiolex; pharmaceutical product development and the uncertainty of clinical success; the regulatory approval process, including the risks that GW Pharmaceuticals may be unable to submit anticipated regulatory filings on the timeframe anticipated, or at all, or that GW Pharmaceuticals may be unable to obtain regulatory approvals of any of its product candidates, including nabiximols and Epidiolex for additional indications, in a timely manner or at all; disruption from the proposed acquisition, making it more difficult to conduct business as usual or maintain relationships with customers, employees or suppliers; effects relating to the announcement of the acquisition or any further announcements or the consummation of the acquisition on the market price of Jazz Pharmaceuticals’ ordinary shares or GW Pharmaceuticals’ American depositary shares or ordinary shares; the possibility that, if Jazz Pharmaceuticals does not achieve the perceived benefits of the acquisition as rapidly or to the extent anticipated by financial analysts or investors, the market price of Jazz Pharmaceuticals’ ordinary shares could decline; potential litigation associated with the possible acquisition; regulatory initiatives and changes in tax laws; market volatility; maintaining or increasing sales of and revenue from Jazz’s oxybate products and Jazz’s and the combined company’s other key marketed products; effectively launching and commercializing Jazz’s and the combined company’s other products and product candidates; protecting and enhancing the combined company’s intellectual property rights; delays or problems in the supply or manufacture of the combined company’s products and product candidates; complying with applicable U.S. and non-U.S. regulatory requirements; government investigations, legal proceedings and other actions, including risks related to Jazz’s settlement agreements with abbreviated new drug application filers and litigation challenging such settlements; obtaining and maintaining adequate coverage and reimbursement for the company’s products; identifying and acquiring, in-licensing or developing additional products or product candidates, financing these transactions and successfully integrating acquired product candidates, products and businesses; Jazz’s ability to realize the anticipated benefits of its collaborations and license agreements with third parties; Jazz’s and the combined company’s ability to achieve expected future financial performance and results; and other risks and uncertainties affecting Jazz Pharmaceuticals and GW Pharmaceuticals, including those described from time to time under the caption “Risk Factors” and elsewhere in Jazz Pharmaceuticals’ and GW Pharmaceuticals’ Securities and Exchange Commission (SEC)filings and reports, including Jazz Pharmaceuticals’ Annual Report on Form 10-K for the year ended December 31, 2020, GW Pharmaceuticals’ Annual Report on Form 10-K for the year ended December 31, 2020, GW Pharmaceuticals’ definitive proxy statement filed with the SEC on March 15, 2021 and future filings and reports by either company. In addition, while Jazz Pharmaceuticals expects the COVID-19 pandemic to continue to adversely affect its business operations and financial results, the extent of the impact on the combined company’s ability to generate sales of and revenues from its approved products, execute on new product launches, its clinical development and regulatory efforts, its corporate development objectives and the value of and market for its ordinary shares, will depend on future developments that are highly uncertain and cannot be predicted with confidence at this time. Moreover, other risks and uncertainties of which Jazz Pharmaceuticals or GW Pharmaceuticals are not currently aware may also affect each of the companies’ forward-looking statements and may cause actual results and the timing of events to differ materially from those anticipated. The forward- looking statements made in this communication are made only as of the date hereof or as of the dates indicated in the forward-looking statements, even if they are subsequently made available by Jazz Pharmaceuticals or GW Pharmaceuticals on their respective websites or otherwise. Neither Jazz Pharmaceuticals nor GW Pharmaceuticals undertakes any obligation to update or supplement any forward-looking statements to reflect actual results, new information, future events, changes in its expectations or other circumstances that exist after the date as of which the forward-looking statements were made. 1 ConfidentialExhibit 99.1 Forward-Looking Statements “Safe Harbor” Statement Under The Private Securities Litigation Reform Act of 1995 This communication contains forward-looking statements regarding Jazz Pharmaceuticals and GW Pharmaceuticals, including, but not limited to, statements related to the anticipated acquisition of GW Pharmaceuticals and the anticipated timing and benefits thereof, including the potential for Jazz Pharmaceuticals to broaden its neuroscience portfolio, further diversify its revenue and drive sustainable, long-term growth and value creation opportunities; Jazz Pharmaceuticals’ expected financing for the transaction; Jazz Pharmaceuticals’ ability to deleverage; potential new product approvals and launches and the anticipated timing thereof; the commercial and growth potential of Jazz’s and the combined company’s products and product candidates; Jazz’s expectations with respect to the launch of authorized generic and generic versions of Xyrem, the anticipated timing thereof and its receipt of royalties on authorized generic versions of Xyrem; and other statements that are not historical facts. These forward-looking statements are based on each of the companies’ current plans, objectives, estimates, expectations and intentions and inherently involve significant risks and uncertainties. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without limitation, risks and uncertainties associated with: Jazz Pharmaceuticals’ and GW Pharmaceuticals’ ability to complete the acquisition on the proposed terms or on the anticipated timeline, or at all, including risks and uncertainties related to securing the necessary regulatory and shareholder approvals, the sanction of the High Court of Justice of England and Wales and satisfaction of other closing conditions to consummate the acquisition; the occurrence of any event, change or other circumstance that could give rise to the termination of the definitive transaction agreement relating to the proposed transaction; risks related to diverting the attention of GW Pharmaceuticals and Jazz Pharmaceuticals management from ongoing business operations; failure to realize the expected benefits of the acquisition; significant transaction costs and/or unknown or inestimable liabilities; the risk of shareholder litigation in connection with the proposed transaction, including resulting expense or delay; the risk that GW Pharmaceuticals’ business will not be integrated successfully or that such integration may be more difficult, time-consuming or costly than expected; Jazz Pharmaceuticals’ ability to obtain the expected financing to consummate the acquisition; risks related to future opportunities and plans for the combined company, including the uncertainty of expected future regulatory filings, ability to obtain approval for JZP-258 and JZP-458, product launches, financial performance and results of the combined company following completion of the acquisition; GW Pharmaceuticals’ dependence on the successful commercialization of Epidiolex/Epidyolex and the uncertain market potential of Epidiolex; pharmaceutical product development and the uncertainty of clinical success; the regulatory approval process, including the risks that GW Pharmaceuticals may be unable to submit anticipated regulatory filings on the timeframe anticipated, or at all, or that GW Pharmaceuticals may be unable to obtain regulatory approvals of any of its product candidates, including nabiximols and Epidiolex for additional indications, in a timely manner or at all; disruption from the proposed acquisition, making it more difficult to conduct business as usual or maintain relationships with customers, employees or suppliers; effects relating to the announcement of the acquisition or any further announcements or the consummation of the acquisition on the market price of Jazz Pharmaceuticals’ ordinary shares or GW Pharmaceuticals’ American depositary shares or ordinary shares; the possibility that, if Jazz Pharmaceuticals does not achieve the perceived benefits of the acquisition as rapidly or to the extent anticipated by financial analysts or investors, the market price of Jazz Pharmaceuticals’ ordinary shares could decline; potential litigation associated with the possible acquisition; regulatory initiatives and changes in tax laws; market volatility; maintaining or increasing sales of and revenue from Jazz’s oxybate products and Jazz’s and the combined company’s other key marketed products; effectively launching and commercializing Jazz’s and the combined company’s other products and product candidates; protecting and enhancing the combined company’s intellectual property rights; delays or problems in the supply or manufacture of the combined company’s products and product candidates; complying with applicable U.S. and non-U.S. regulatory requirements; government investigations, legal proceedings and other actions, including risks related to Jazz’s settlement agreements with abbreviated new drug application filers and litigation challenging such settlements; obtaining and maintaining adequate coverage and reimbursement for the company’s products; identifying and acquiring, in-licensing or developing additional products or product candidates, financing these transactions and successfully integrating acquired product candidates, products and businesses; Jazz’s ability to realize the anticipated benefits of its collaborations and license agreements with third parties; Jazz’s and the combined company’s ability to achieve expected future financial performance and results; and other risks and uncertainties affecting Jazz Pharmaceuticals and GW Pharmaceuticals, including those described from time to time under the caption “Risk Factors” and elsewhere in Jazz Pharmaceuticals’ and GW Pharmaceuticals’ Securities and Exchange Commission (SEC)filings and reports, including Jazz Pharmaceuticals’ Annual Report on Form 10-K for the year ended December 31, 2020, GW Pharmaceuticals’ Annual Report on Form 10-K for the year ended December 31, 2020, GW Pharmaceuticals’ definitive proxy statement filed with the SEC on March 15, 2021 and future filings and reports by either company. In addition, while Jazz Pharmaceuticals expects the COVID-19 pandemic to continue to adversely affect its business operations and financial results, the extent of the impact on the combined company’s ability to generate sales of and revenues from its approved products, execute on new product launches, its clinical development and regulatory efforts, its corporate development objectives and the value of and market for its ordinary shares, will depend on future developments that are highly uncertain and cannot be predicted with confidence at this time. Moreover, other risks and uncertainties of which Jazz Pharmaceuticals or GW Pharmaceuticals are not currently aware may also affect each of the companies’ forward-looking statements and may cause actual results and the timing of events to differ materially from those anticipated. The forward- looking statements made in this communication are made only as of the date hereof or as of the dates indicated in the forward-looking statements, even if they are subsequently made available by Jazz Pharmaceuticals or GW Pharmaceuticals on their respective websites or otherwise. Neither Jazz Pharmaceuticals nor GW Pharmaceuticals undertakes any obligation to update or supplement any forward-looking statements to reflect actual results, new information, future events, changes in its expectations or other circumstances that exist after the date as of which the forward-looking statements were made. 1 Confidential

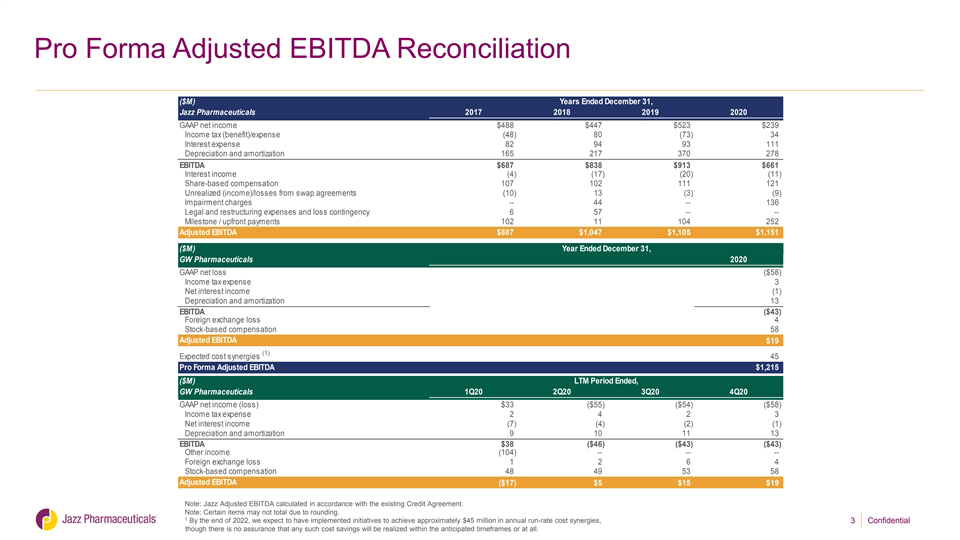

Non-GAAP Financial Measures This document includes certain non‐GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. The company believes that each of these non-GAAP financial measures provides useful supplementary information to, and facilitates additional analysis by, investors and potential investors. Specifically, this document includes Jazz Adjusted EBITDA, GW Adjusted EBITDA and Pro Forma Adjusted EBITDA. In the case of Jazz Pharmaceuticals, Adjusted EBITDA included herein is as calculated to determine covenant compliance under Jazz Pharmaceuticals’ existing credit agreement, dated as of June 18, 2015, as amended. EBITDA is defined as net income (loss) before income taxes, interest expense, depreciation and amortization. Adjusted EBITDA is defined as EBITDA further adjusted to exclude certain other charges and adjustments as shown in the GAAP to non-GAAP reconciliations. Pro-Forma Adjusted EBITDA is calculated by combining the Adjusted EBITDA of Jazz Pharmaceuticals and GW Pharmaceuticals and assuming certain expected cost synergies in connection with the anticipated acquisition of GW Pharmaceuticals. Reconciliations of non‐GAAP financial measures to the comparable GAAP financial measures are provided within this document. These non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP measures; should be read in conjunction with Jazz Pharmaceuticals’ and GW Pharmaceuticals’ respective consolidated financial statements prepared in accordance with GAAP; have no standardized meaning prescribed by GAAP; and are not prepared under any comprehensive set of accounting rules or principles. Because of the non-standardized definitions of non-GAAP financial measures, the non- GAAP financial measures as used by Jazz Pharmaceuticals in this document have limits in their usefulness to investors and may be calculated differently from, and therefore may not be directly comparable to, similarly titled measures used by other companies. 2 ConfidentialNon-GAAP Financial Measures This document includes certain non‐GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. The company believes that each of these non-GAAP financial measures provides useful supplementary information to, and facilitates additional analysis by, investors and potential investors. Specifically, this document includes Jazz Adjusted EBITDA, GW Adjusted EBITDA and Pro Forma Adjusted EBITDA. In the case of Jazz Pharmaceuticals, Adjusted EBITDA included herein is as calculated to determine covenant compliance under Jazz Pharmaceuticals’ existing credit agreement, dated as of June 18, 2015, as amended. EBITDA is defined as net income (loss) before income taxes, interest expense, depreciation and amortization. Adjusted EBITDA is defined as EBITDA further adjusted to exclude certain other charges and adjustments as shown in the GAAP to non-GAAP reconciliations. Pro-Forma Adjusted EBITDA is calculated by combining the Adjusted EBITDA of Jazz Pharmaceuticals and GW Pharmaceuticals and assuming certain expected cost synergies in connection with the anticipated acquisition of GW Pharmaceuticals. Reconciliations of non‐GAAP financial measures to the comparable GAAP financial measures are provided within this document. These non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP measures; should be read in conjunction with Jazz Pharmaceuticals’ and GW Pharmaceuticals’ respective consolidated financial statements prepared in accordance with GAAP; have no standardized meaning prescribed by GAAP; and are not prepared under any comprehensive set of accounting rules or principles. Because of the non-standardized definitions of non-GAAP financial measures, the non- GAAP financial measures as used by Jazz Pharmaceuticals in this document have limits in their usefulness to investors and may be calculated differently from, and therefore may not be directly comparable to, similarly titled measures used by other companies. 2 Confidential

Pro Forma Adjusted EBITDA Reconciliation ($M) Years Ended December 31, Jazz Pharmaceuticals 2017 2018 2019 2020 GAAP net income $488 $447 $523 $239 Income tax (benefit)/expense (48) 80 (73) 34 Interest expense 82 94 93 111 Depreciation and amortization 165 217 370 278 EBITDA $687 $838 $913 $661 Interest income (4) (17) (20) (11) Share-based compensation 107 102 111 121 Unrealized (income)/losses from swap agreements (10) 13 (3) (9) Impairment charges -- 44 -- 136 Legal and restructuring expenses and loss contingency 6 57 -- -- Milestone / upfront payments 102 11 104 252 Adjusted EBITDA $887 $1,047 $1,105 $1,151 ($M) Year Ended December 31, GW Pharmaceuticals 2020 GAAP net loss ($58) Income tax expense 3 Net interest income (1) Depreciation and amortization 13 EBITDA ($43) Foreign exchange loss 4 Stock-based compensation 58 Adjusted EBITDA $19 Expected cost synergies (1) 45 Pro Forma Adjusted EBITDA $1,215 ($M) LTM Period Ended, GW Pharmaceuticals 1Q20 2Q20 3Q20 4Q20 GAAP net income (loss) $33 ($55) ($54) ($58) Income tax expense 2 4 2 3 Net interest income (7) (4) (2) (1) Depreciation and amortization 9 10 11 13 EBITDA $38 ($46) ($43) ($43) Other income (104) -- -- -- Foreign exchange loss 1 2 6 4 Stock-based compensation 48 49 53 58 Adjusted EBITDA ($17) $5 $15 $19 Note: Jazz Adjusted EBITDA calculated in accordance with the existing Credit Agreement. Note: Certain items may not total due to rounding. 1 By the end of 2022, we expect to have implemented initiatives to achieve approximately $45 million in annual run-rate cost synergies, though there is no assurance that any such cost savings will be realized within the anticipated timeframes or at all. 3 Confidential