Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Arcosa, Inc. | exh991pressrelease-stonepo.htm |

| 8-K - 8-K - Arcosa, Inc. | aca-20210322.htm |

Arcosa to Acquire StonePoint Materials March 22, 2021 Exhibit 99.2

/ Moving Infrastructure Forward2 Forward-Looking Statements Some statements in this presentation, which are not historical facts, are “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements about Arcosa’s estimates, expectations, beliefs, intentions or strategies for the future. Arcosa uses the words “anticipates,” “assumes,” “believes,” “estimates,” “expects,” “intends,” “forecasts,” “may,” “will,” “should,” “guidance,” “outlook,” “strategy,” and similar expressions to identify these forward-looking statements. Forward-looking statements speak only as of the date of this release, and Arcosa expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein, except as required by federal securities laws. Forward-looking statements are based on management’s current views and assumptions and involve risks and uncertainties that could cause actual results to differ materially from historical experience or our present expectations, including but not limited to assumptions, risks and uncertainties regarding the impact of the COVID-19 pandemic on Arcosa’s customer demand for Arcosa’s products and services, Arcosa’s supply chain, Arcosa’s employees ability to work because of COVID-19 related illness, the health and safety of our employees, the effect of governmental regulations imposed in response to the COVID-19 pandemic; assumptions, risks and uncertainties regarding achievement of the expected benefits of Arcosa’s spin-off from Trinity; tax treatment of the spin-off; failure to successfully integrate acquisitions, or failure to achieve the expected benefit of acquisitions; market conditions and customer demand for Arcosa’s business products and services; the cyclical nature of, and seasonal or weather impact on, the industries in which Arcosa competes; competition and other competitive factors; governmental and regulatory factors; changing technologies; availability of growth opportunities; market recovery; ability to improve margins; and Arcosa’s ability to execute its long-term strategy, and such forward-looking statements are not guarantees of future performance. For further discussion of such risks and uncertainties, see "Risk Factors" and the "Forward-Looking Statements" section of "Management's Discussion and Analysis of Financial Condition and Results of Operations" in Arcosa's Form 10-K for the year-ended December 31, 2020, and as may be revised and updated by Arcosa's Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Non-GAAP Financial Measures This presentation contains financial measures that have not been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). Reconciliations of non-GAAP financial measures to the closest GAAP measure are provided in the Appendix.

/ Transaction Summary Moving Infrastructure Forward 3 Arcosa to acquire StonePoint Materials, a top 25 U.S. construction aggregates company StonePoint Overview Strategic Rationale Timing and Financing Premier, scaled aggregates platform that continues Arcosa’s evolution to a higher margin, higher growth, and less cyclical portfolio Attractive geographic operations that expand current aggregates footprint in Texas and Louisiana while providing entry into new regions of Tennessee, Kentucky, Pennsylvania, and West Virginia Provides new pipeline of organic growth projects and bolt-on acquisitions with attractive returns Expected to be accretive to earnings and margins in 2021 Transaction has received HSR clearance and is expected to close in April, subject to customary closing conditions Initially funded with cash on-hand and availability under revolving credit facility; we expect to refinance with long-term debt Pro Forma net leverage estimated to be ~1.7x Adjusted EBITDA (as of 12/31/2020), below our long-term target of 2.0-2.5x Leading supplier of aggregates and related products, with approximately 9 million tons of annual aggregates production Operations: 4 active limestone quarries, 10 sand & gravel mines, 4 asphalt plants with related paving services, 2 marine terminals Regions: Operations conducted across three regions: Gulf Coast, Tennessee/Kentucky, and Pennsylvania/West Virginia Reserves: Approximately 380 million tons of high-quality reserves with expected life of 40+ years Key Financials Trailing-Twelve Months (Q1-2021): ~$117M Revenue and $28M EBITDA (24% margin), in a period that was impacted by COVID-related construction delays in a number of key markets 2021-2022: StonePoint is expected to generate at least $30M of Adjusted EBITDA in 2021 and return to 2019’s pre-pandemic level of $33M by 2022, through operating synergies and construction market recovery in several of its geographies Tax Benefits: We project an NPV of ~$15 million from tax benefits from the transaction, which would be realized over the next 4-5 years

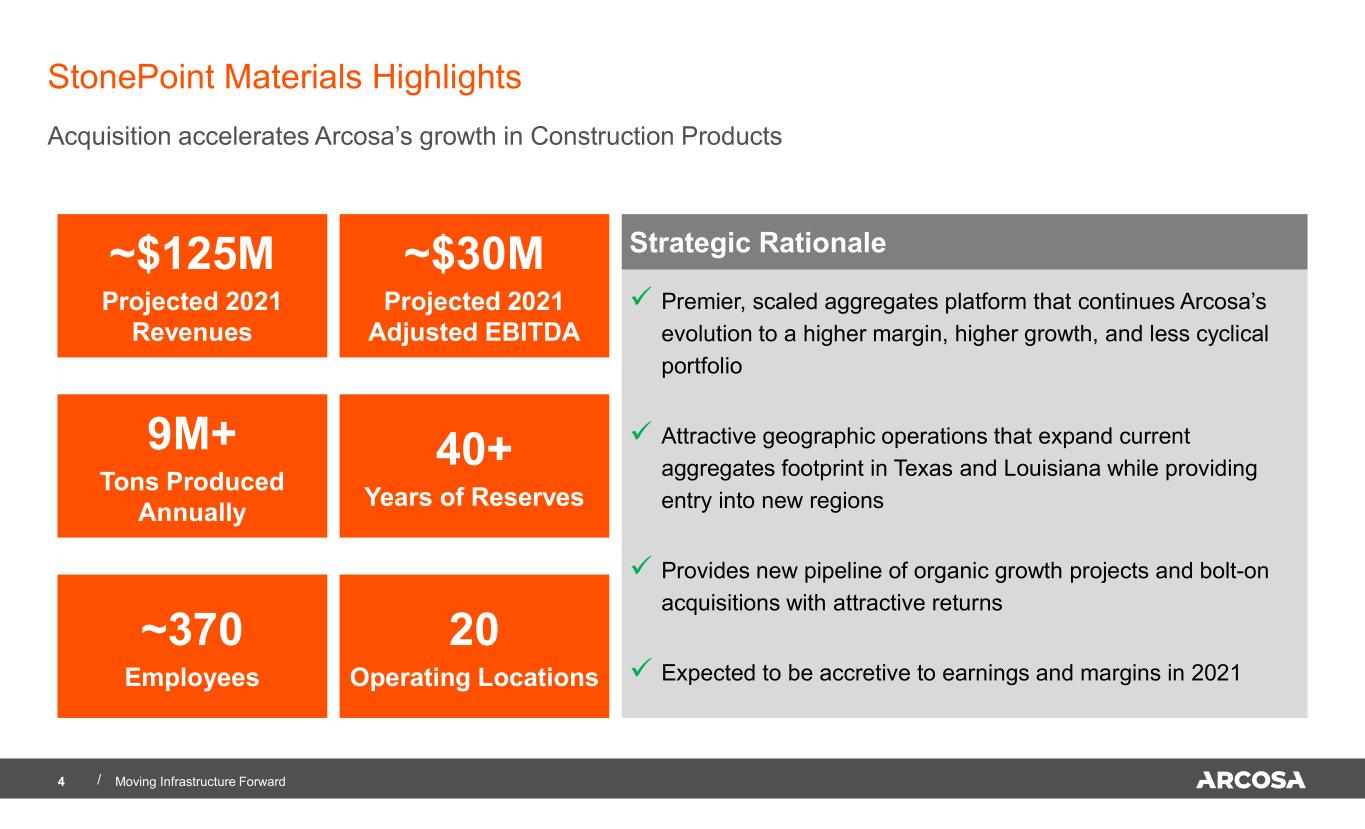

/ StonePoint Materials Highlights Moving Infrastructure Forward 4 Acquisition accelerates Arcosa’s growth in Construction Products ~$125M Projected 2021 Revenues ~$30M Projected 2021 Adjusted EBITDA 9M+ Tons Produced Annually 40+ Years of Reserves Strategic Rationale Premier, scaled aggregates platform that continues Arcosa’s evolution to a higher margin, higher growth, and less cyclical portfolio Attractive geographic operations that expand current aggregates footprint in Texas and Louisiana while providing entry into new regions Provides new pipeline of organic growth projects and bolt-on acquisitions with attractive returns Expected to be accretive to earnings and margins in 2021 ~370 Employees 20 Operating Locations

/ Strong Position in Aggregates and Related Offerings Moving Infrastructure Forward 5 StonePoint sells a range of construction materials used in infrastructure, residential, and non-residential markets 80% 16% 4% Marine Transloading EBITDA by Product Type Estimated 2021 Asphalt Aggregates AsphaltLimestone Sand & Gravel Marine Terminals 3 limestone quarries in TN / KY 1 limestone mine in PA 10 sand and gravel mines in Texas and Louisiana 4 asphalt plants in TN/KY 2 Marine Terminals in TN/KY, located adjacent to quarries

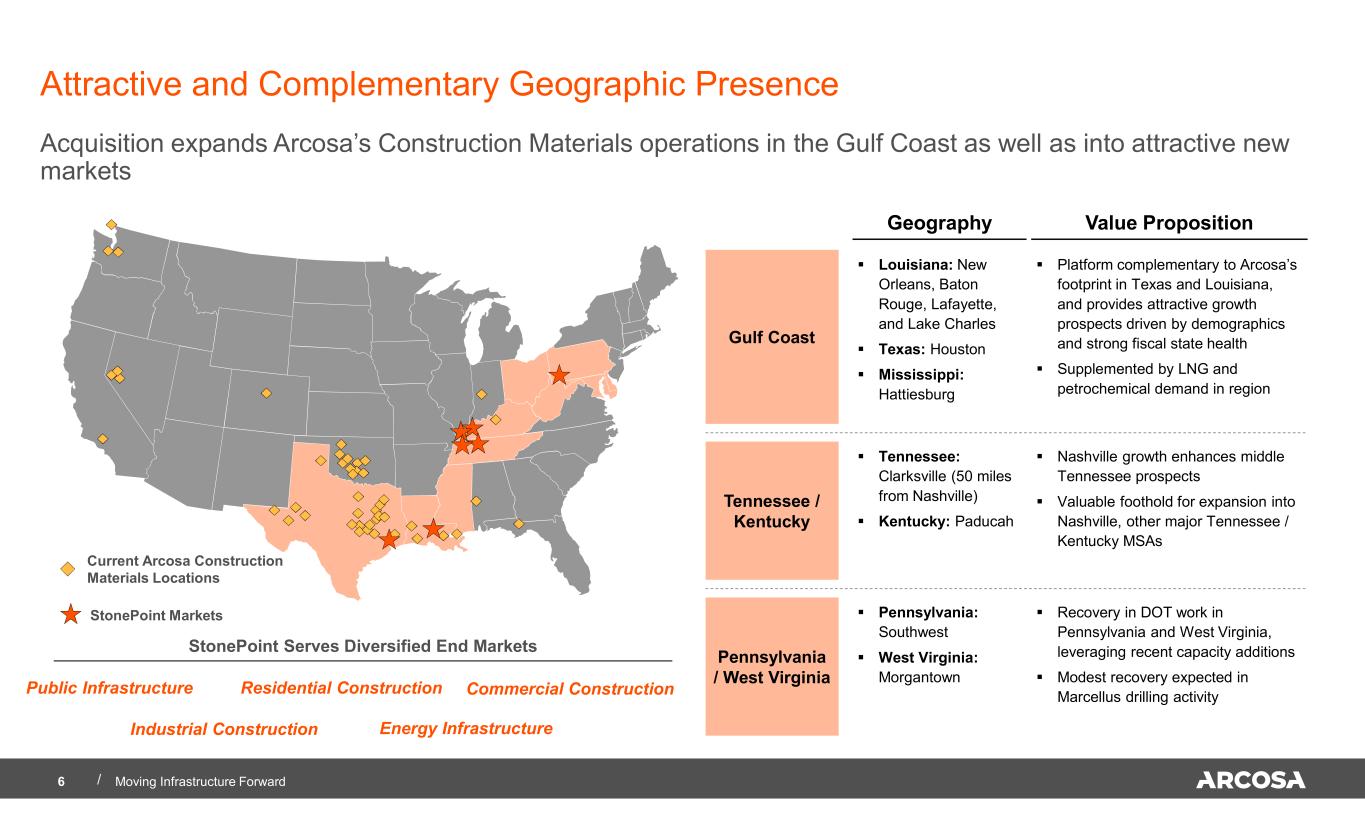

/ Attractive and Complementary Geographic Presence Moving Infrastructure Forward 6 Acquisition expands Arcosa’s Construction Materials operations in the Gulf Coast as well as into attractive new markets Gulf Coast Louisiana: New Orleans, Baton Rouge, Lafayette, and Lake Charles Texas: Houston Mississippi: Hattiesburg Platform complementary to Arcosa’s footprint in Texas and Louisiana, and provides attractive growth prospects driven by demographics and strong fiscal state health Supplemented by LNG and petrochemical demand in region Tennessee / Kentucky Pennsylvania / West Virginia Tennessee: Clarksville (50 miles from Nashville) Kentucky: Paducah Nashville growth enhances middle Tennessee prospects Valuable foothold for expansion into Nashville, other major Tennessee / Kentucky MSAs Pennsylvania: Southwest West Virginia: Morgantown Recovery in DOT work in Pennsylvania and West Virginia, leveraging recent capacity additions Modest recovery expected in Marcellus drilling activity Public Infrastructure Current Arcosa Construction Materials Locations StonePoint Markets Residential Construction Commercial Construction Industrial Construction Energy Infrastructure StonePoint Serves Diversified End Markets Geography Value Proposition

/7 Strengthens Arcosa’s Construction Materials Platform StonePoint enhances the scale of our constructions materials platform and accelerates the shift to a higher margin, more stable portfolio Moving Infrastructure Forward Note: % of Total EBITDA excludes Corporate Costs. Pro Forma 2020 using TTM through Q1 2021 for StonePoint. See reconciliation in Appendix 116 (32%) 73 (33%) 64 (29%) 2020 Pro-Forma with StonePoint 360 82 (38%) 78 (22%) 219 2018 167 (46%) Transportation Engineered Structures Construction Adjusted EBITDA, excluding Corporate Costs $ Millions We have continued to build out a world-class construction materials platform… Key Construction Materials Acquisitions December 2018 January 2020 October 2020 Solid Organic Growth Announced March 2021 …and the StonePoint acquisition further accelerates the shift to a higher margin, more stable portfolio Almost half of Arcosa EBITDA from more stable Construction Products segment Geographic exposure has broadened within Texas and also extended into new states, providing solid fundamentals for organic growth Overall Arcosa margin has improved from 12.8% in 2018 to ~15% in 2020, pro-forma for StonePoint Key highlights of repositioning

/ StonePoint Investment Highlights Moving Infrastructure Forward 8 Expands roster of talent with extensive experience in aggregates space Market-leading aggregate positions in attractive Gulf Coast and Tennessee / Kentucky Regions Significant amount of high-quality reserves (40+ years) Premier asset that accelerates growth and scale of Arcosa’s construction materials platform Supplements pipeline of organic projects and bolt-on acquisitions with high expected ROIC Accretive to earnings and margins in 2021

/9 Arcosa’s Long-Term Strategy Grow in attractive markets where we can achieve sustainable competitive advantages Reduce the complexity and cyclicality of the overall business Improve long-term returns on invested capital Integrate Environmental, Social, and Governance initiatives (ESG) into our long-term strategy Moving Infrastructure Forward

/ Appendix Moving Infrastructure Forward10

/ Non-GAAP Measures 11 Moving Infrastructure Forward “Pro-Forma Adjusted EBITDA” is defined as StonePoint's net income plus interest expense, income taxes, depreciation, depletion, and amortization, pro-forma adjustments for acquisitions made during the period, acquisition-related and sponsor fees, plus additional adjustments to account for non-recurring items. GAAP does not define Pro-Forma Adjusted EBITDA and it should not be considered as an alternative to earnings measures defined by GAAP, including net income. We use Adjusted EBITDA to assess the operating performance of our businesses, as a metric for incentive-based compensation, as a measure within our lending arrangements, and as a basis for strategic planning and forecasting as we believe that it closely correlates to long-term shareholder value. As a widely used metric by analysts, investors, and competitors in our industry, we believe Pro-Forma Adjusted EBITDA also assists investors in comparing a company's performance on a consistent basis without regard to depreciation, depletion, amortization, and other items which can vary significantly depending on many factors. “Pro-Forma Adjusted EBITDA Margin” is defined as Pro-Forma Adjusted EBITDA divided by Revenues. “Segment EBITDA” is defined as segment operating profit plus depreciation, depletion, and amortization. We adjust Segment EBITDA for certain items that are not reflective of the normal earnings of our business (“Adjusted Segment EBITDA”). GAAP does not define Segment EBITDA or Adjusted Segment EBITDA and they should not be considered as alternatives to earnings measures defined by GAAP, including segment operating profit. We use Adjusted Segment EBITDA to assess the operating performance of our businesses, as a metric for incentive-based compensation, and as a basis for strategic planning and forecasting as we believe that it closely correlates to long-term shareholder value. As a widely used metric by analysts, investors, and competitors in our industry we believe Adjusted Segment EBITDA also assists investors in comparing a company's performance on a consistent basis without regard to depreciation, depletion, amortization, and other items, which can vary significantly depending on many factors. "Adjusted Segment EBITDA Margin" is defined as Adjusted Segment EBITDA divided by Revenues. GAAP does not define “Net Debt” and it should not be considered as an alternative to cash flow or liquidity measures defined by GAAP. The Company uses Net Debt, which it defines as total debt minus cash and cash equivalents to determine the extent to which the Company’s outstanding debt obligations would be satisfied by its cash and cash equivalents on hand. The Company also uses "Net Debt to Adjusted EBITDA", which it defines as Net Debt divided by Adjusted EBITDA for the trailing twelve months as a metric of its current leverage position. We present this metric for the convenience of investors who use such metrics in their analysis and for shareholders who need to understand the metrics we use to assess performance and monitor our cash and liquidity positions. Refer to slides that follow for accompanying reconciliations

/ Reconciliation of StonePoint Pro-Forma Adjusted EBITDA 12 Moving Infrastructure Forward ($’s in millions) (unaudited) December 31, 2019 March 31, 2021 (Forecasted) Revenues $ 147.6 $ 116.6 Net income $ (7.3) $ (7.0) Add: Interest expense, net 6.0 8.9 Provision for income taxes - - Depreciation, depletion and amortization expense 16.7 22.3 Full year pro-forma for 2019 and 2020 acquisitions 8.4 1.6 Acquisition-related and sponsor fees 7.7 5.5 Other non-recurring 1.5 (3.7) Pro-Forma Adjusted EBITDA $ 33.0 $ 27.6 Pro-Forma Adjusted EBITDA Margin 22.4% 23.7% Trailing Twelve Months Ended 2020 2019 2018 Construction Products Operating Profit $ 74.7 $ 52.7 $ 50.4 Add: Depreciation, depletion, and amortization expense 60.1 38.0 21.9 Segment EBITDA 134.8 90.7 72.3 Add: Impact of acquisition-related expenses(1) 2.9 1.4 0.8 Add: Impairment charge 0.8 - - Adjusted Segment EBITDA $ 138.5 $ 92.1 $ 73.1 Adjusted Segment EBITDA Margin 23.3% 20.9% 25.0% Engineered Structures Operating Profit $ 80.2 $ 100.7 $ 28.6 Add: Depreciation and amortization expense 31.5 27.9 29.7 Segment EBITDA 111.7 128.6 58.3 Add: Impact of acquisition-related expenses(1) 2.8 - - Add: Impairment charge 1.3 - 23.2 Adjusted Segment EBITDA $ 115.8 $ 128.6 $ 81.5 Adjusted Segment EBITDA Margin 13.2% 15.4% 10.4% Transportation Products Operating Profit $ 54.6 $ 46.8 $ 48.4 Add: Depreciation and amortization expense 18.0 16.3 15.5 Segment EBITDA 72.6 63.1 63.9 Add: Impact of acquisition-related expenses(1) - 0.6 - Add: Impairment charge 5.0 - - Adjusted Segment EBITDA $ 77.6 $ 63.7 $ 63.9 Adjusted Segment EBITDA Margin 16.6% 13.7% 16.3% Operating Loss - All Other - - (0.1) Operating Loss - Corporate (57.7) (47.3) (32.1) Impact of acquisition-related expenses - Corporate(1) 4.6 - - Eliminations - - (0.3) Add: Corporate depreciation expense 4.9 3.6 0.5 Adjusted EBITDA $ 283.7 $ 240.7 $ 186.5 Year Ended December 31, Reconciliation of Adjusted Segment EBITDA ($’s in millions) (unaudited) (1) Expenses associated with acquisitions, including the cost impact of the fair value markup of acquired inventory and other transaction costs.

/ Reconciliation of Net Debt to Adjusted EBITDA 13 Moving Infrastructure Forward ($’s in millions) (unaudited) (1) Adjusted EBITDA includes 9 month pro forma adjustment of $7.7 million for Strata during Q1-Q3 of 2020, using previously disclosed annualized EBITDA of $10.2M. December 31, 2020 (1) Pro-Forma for StonePoint December 31, 2020 Pro-Forma Total debt 254.5$ Cash and cash equivalents 95.8 Net Debt 158.7$ 375.0$ 533.7$ Adjusted EBITDA (trailing twelve months) 291.4$ 27.6$ 319.0$ Net Debt to Adjusted EBITDA 0.5 1.7 Strata Materials Adjusted EBITDA ($’s in millions) (unaudited) Twelve Months Ended August 31, 2020 Net income $ 5.9 Add: Interest expense, net 0.4 Provision for income taxes - Depreciation, depletion, and amortization expense 2.8 Pro-Forma adjustments, primarily for start-up plant 1.1 EBITDA $ 10.2