Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Exela Technologies, Inc. | tm219888d1_8k.htm |

| EX-99.2 - EXHIBIT 99.2 - Exela Technologies, Inc. | tm219888d1_ex99-2.htm |

| EX-99.1 - EXHIBIT 99.1 - Exela Technologies, Inc. | tm219888d1_ex99-1.htm |

Exhibit 99.3

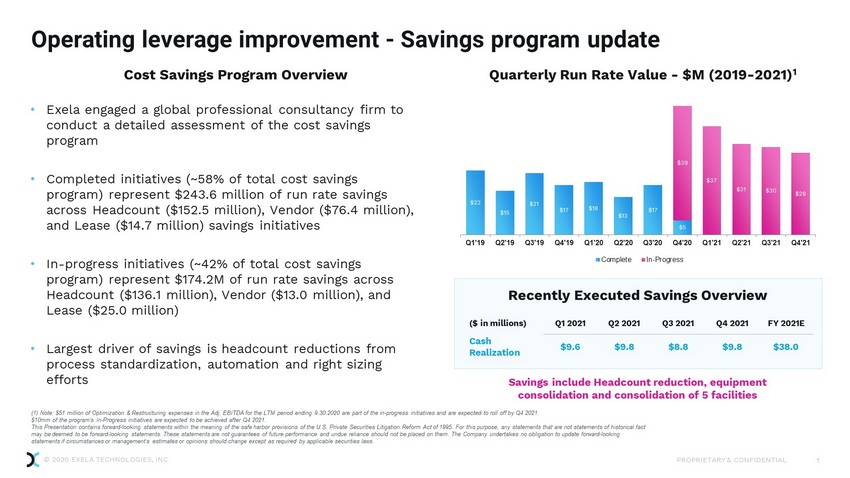

© 2020 EXELA TECHNOLOGIES, INC PROPRIETARY & CONFIDENTIAL Operating leverage improvement - Savings program update 1 (1) Note: $51 million of Optimization & Restructuring expenses in the Adj. EBITDA for the LTM period ending 9.30.2020 are par t o f the in - progress initiatives and are expected to roll off by Q4 2021. $10mm of the program's In - Progress initiatives are expected to be achieved after Q4 2021. This Presentation contains forward - looking statements within the meaning of the safe harbor provisions of the U.S. Private Secur ities Litigation Reform Act of 1995. For this purpose, any statements that are not statements of historical fact may be deemed to be forward - looking statements. These statements are not guarantees of future performance and undue reliance sho uld not be placed on them. The Company undertakes no obligation to update forward - looking statements if circumstances or management’s estimates or opinions should change except as required by applicable securities l aws . Recently Executed Savings Overview ($ in millions) Q1 2021 Q2 2021 Q3 2021 Q4 2021 FY 2021E Cash Realization $9.6 $9.8 $8.8 $9.8 $38.0 Cost Savings Program Overview Quarterly Run Rate Value - $M (2019 - 2021) 1 • Exela engaged a global professional consultancy firm to conduct a detailed assessment of the cost savings program • Completed initiatives (~58% of total cost savings program) represent $243.6 million of run rate savings across Headcount ($152.5 million), Vendor ($76.4 million), and Lease ($14.7 million) savings initiatives • In - progress initiatives (~42% of total cost savings program) represent $174.2M of run rate savings across Headcount ($136.1 million), Vendor ($13.0 million), and Lease ($25.0 million) • Largest driver of savings is headcount reductions from process standardization, automation and right sizing efforts $22 $15 $21 $17 $18 $13 $17 $5 $39 $37 $31 $30 $28 Q1'19 Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Complete In-Progress Savings include Headcount reduction, equipment consolidation and consolidation of 5 facilities