Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Trinseo S.A. | tm219194d2_ex99-1.htm |

| 8-K - FORM 8-K - Trinseo S.A. | tm219194d2_8k.htm |

Exhibit 99.2

SUMMARY

This summary highlights material information about our business and about this offering of Notes. This is a summary of material information contained elsewhere in this Offering Memorandum, is not complete and does not contain all of the information that may be important to you. For a more complete understanding of our business, this offering and the terms of the Notes, you should read this entire Offering Memorandum, including the sections entitled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and related notes, which are included in this Offering Memorandum.

Unless otherwise indicated or required by context, as used in this Offering Memorandum, the term “Trinseo” refers to Trinseo S.A. (NYSE: TSE), a public limited liability company (société anonyme) existing under the laws of Luxembourg, the indirect parent company of the Issuers, and not its subsidiaries. The terms “Company,” “we,” “us” and “our” refer to Trinseo and its consolidated subsidiaries, taken as a consolidated entity unless otherwise required by context. The terms “Issuers,” “Trinseo Materials Operating S.C.A.” and “Trinseo Materials Finance, Inc.” refer to Trinseo’s indirect subsidiaries, Trinseo Materials Operating S.C.A., a Luxembourg partnership limited by shares incorporated under the laws of Luxembourg, and Trinseo Materials Finance, Inc., a Delaware corporation, and not their subsidiaries. All financial data provided in this Offering Memorandum is the financial data of the Company, unless otherwise indicated.

The historical PMMA business to be acquired from Arkema also included the operations of a manufacturing site in South Korea. This manufacturing site is not within the scope of the PMMA Acquisition. However, the audited combined carve-out financial statements of the Arkema business include the results of the South Korea operations. As such, within this document, we distinguish between the historical operations of the acquired business, inclusive of South Korea operations, as the “Arkema business” and the results of the business to be acquired, excluding the South Korea operations, as the “PMMA business.”

Our Company

Trinseo is a public limited liability company (société anonyme) formed in 2010 and existing under the laws of Luxembourg. Prior to our formation, our business was wholly owned by The Dow Chemical Company, which, together with its affiliates, we refer to as “Dow,” and we refer to our predecessor business as “the Styron business.” In 2010, investment funds advised or managed by affiliates of Bain Capital Partners, LP (“Bain Capital”) acquired the Styron business and Dow Europe Holding B.V. (the “Acquisition”). During 2016, Bain Capital divested its entire ownership in the Company in a series of secondary offerings to the market.

We are a leading global materials company and manufacturer of plastics, latex binders and synthetic rubber, including various advanced specialty products and sustainable solutions. We have leading positions in many of the markets in which we compete. Our products are incorporated into a wide range of our customers’ products throughout the world, including products for automotive applications, tires, carpet and artificial turf backing, coated paper, specialty paper and packaging board, food packaging, appliances, medical devices, consumer electronics and construction applications, among others. We have long-standing relationships with a diverse base of global customers, many of whom are leaders in their respective markets and rely on us for formulation, technological differentiation, and compounding expertise to find sustainable solutions for their businesses. Many of our products represent only a small portion of a finished product’s manufacturing costs, but provide critical functionality to the finished product and are often specifically developed to customer specifications. Therefore, we seek to regularly develop new and improved products and processes, supported by our intellectual property portfolio, designed to enhance our customers’ product offerings. We believe these product traits result in substantial customer loyalty.

We have significant manufacturing and production operations around the world, which allow us to serve our global customer base. As of December 31, 2020, our production facilities included 32 manufacturing plants (which included a total of 75 production units) at 24 sites across 12 countries, including the Company’s joint venture. Additionally, as of December 31, 2020, we operated 9 research and development (“R&D”) facilities globally, including technology and innovation development centers, which we believe are critical to our global presence and innovation capabilities. Our significant global operations also provide diversity in the end markets for our products.

For the year ended December 31, 2020, our net sales by geography and by end market were as follows:

(a) Sales breakdown by geographical origin of products.

PMMA Business Overview

On December 14, 2020, we entered into a binding offer to acquire from Arkema, a leader in specialty chemicals, its PMMA business. The PMMA business currently operates in two main geographies: Americas and Europe.

PMMA is a transparent and rigid plastic with a wide range of end uses, and complements Trinseo’s existing offerings across several end markets including automotive, building & construction, medical and consumer electronics. MMA is a raw material used to create PMMA and is also used in the areas of acrylic emulsions and plastic additives. The PMMA business has established brand names such as Plexiglas® in the Americas, Altuglas®, Solarkote® and Oroglas®, and a number of niche applications.

The PMMA business holds top positions in most of its products and geographies. Based on installed capacity for 2019 for PMMA Resins, it held the number 1 position in the Americas and number 2 position in Europe. For molding/extrusion pellets, it held the number 1 position in the Americas and number 2 position in Europe, for cast sheets, it held the number 2 position in Europe and the number 3 position in the Americas and for extruded sheets, it held the number 3 position in the Americas and number 4 position in Europe. It has a strong long-term customer base that has remained stable over the last decade, with no major losses. The PMMA business has targeted growth in its primary market segments through customer intimacy, innovation and technical service.

The PMMA business operates across Europe and the Americas with seven manufacturing sites and shares distribution back-office networks in Europe (four) and the Americas (three). The European region includes: (i) the production sites of Rho, Italy; Porto Marghera, Italy; St Avold, France; and Bronderslev, Denmark, and (ii) distribution facilities in Germany, the Netherlands, Poland, the United Kingdom, Hungary, Russia, Romania, Brazil, Canada, and the Czech Republic. The Americas region includes: (i) Louisville, Kentucky (USA); Bristol, Pennsylvania (USA); and Matamoros, Mexico production sites, (ii) distribution facilities in the U.S. and Mexico, and (iii) a capacity reservation contract (CRC), which benefits the PMMA business by providing an integrated production chain from MMA to resins and sheets.

Strategic Rationale for the PMMA Business Combination

We believe Trinseo and the PMMA business are highly complementary and the combination is strategically and financially compelling. The PMMA business has consistently delivered attractive margins and we expect the acquisition will increase our growth and margin potential as well as decrease our earnings cyclicality. The acquisition serves as a catalyst for our portfolio transformation toward becoming a higher margin, less cyclical specialty solutions provider.

The products manufactured by the PMMA business have a wide range of end uses and represent an attractive adjacent chemistry that complements Trinseo’s existing offerings across several end markets including automotive, building & construction, medical and consumer electronics, thus enabling Trinseo to leverage its strong existing knowledge and capabilities in each of these industries. Moreover, the acquisition will augment and enhance Trinseo’s existing offerings in plastics and engineered materials, thereby reinforcing our strategic ambition to be a leading provider of specialty materials and solutions.

The transaction is expected to generate approximately $50.0 million in annual pretax cost synergies by 2023 and additional revenue synergies by leveraging Trinseo’s market overlap and existing Asia organization to accelerate growth. In addition, it is expected that, as a result of harmonizing global ERP systems between Trinseo and the PMMA business, there is an opportunity to realize at least an additional $25.0 million in IT-related productivity savings over the next few years.

Our Segments

Effective October 1, 2020, we realigned our reporting segments to reflect the new model under which the business will be managed and results will be reviewed by the chief executive officer, who is the Company’s chief operating decision maker. Following this change, our Company has reporting operating results for seven segments, five of which remain unchanged from our Company’s previous segmentation: Latex Binders, Synthetic Rubber, Feedstocks, Polystyrene, and Americas Styrenics. Our Company’s former Performance Plastics segment, which included a variety of compounds and blends as well as the results of the acrylonitrile-butadiene-styrene (“ABS”), styrene-acrylonitrile (“SAN”), thermoplastic elastomers “(TPE”), and polycarbonate (“PC”) businesses, was reorganized into two standalone reporting segments, Engineered Materials and Base Plastics. The Engineered Materials segment includes our Company’s compounds and blends products sold into higher growth and value applications, such as consumer electronics and medical, as well as our Company’s TPE products which are sold into a variety of applications including footwear and automotive. Following the completion of the proposed PMMA Acquisition, our Engineered Materials segment will also include the results of the PMMA business, including PMMA Resins, PMMA Sheets, and MMA products. The Base Plastics segment contains the results of the remaining businesses from the prior Performance Plastics segment, including the ABS, SAN, and PC businesses, as well as compounds and blends for automotive and other applications. This segmentation change provides enhanced clarity to investors by placing the results of our Company’s products sold into engineered materials applications into a single reporting segment, which aligns with our Company’s strategy to focus our efforts and investments in these applications, as they tend to be less cyclical and offer significantly higher growth and margin potential.

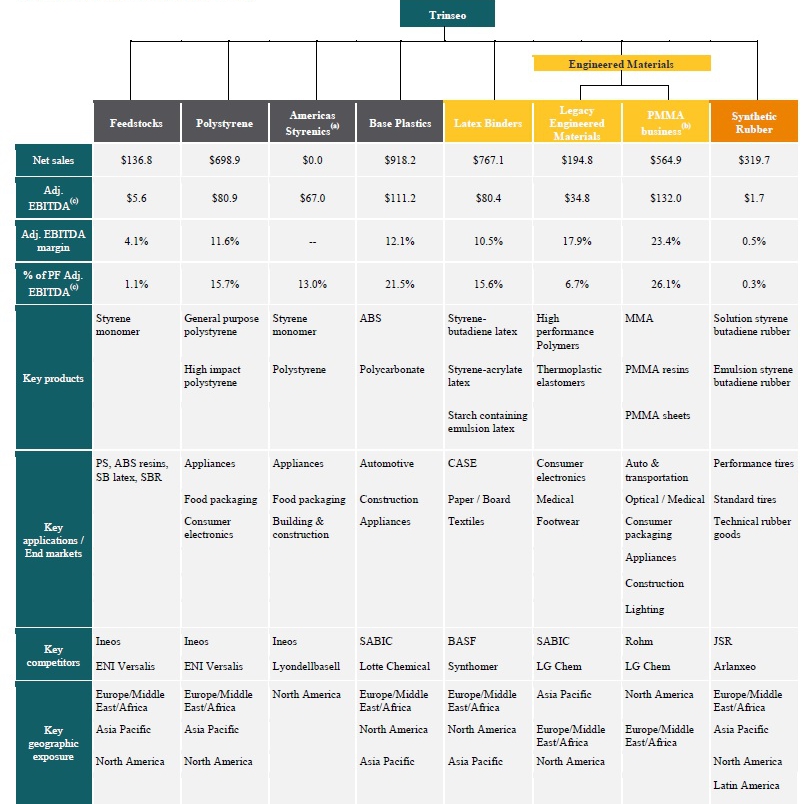

The following chart outlines key information relating to Trinseo’s segments, including key segment financial information, applications, products, and geographies. The information relating to the PMMA business, which is expected to be included within the Company’s Engineered Materials reporting segment, has also been included.

Year ended December 31, 2020 (dollars in millions)

| (a) | The results of this segment are comprised entirely of earnings from Americas Styrenics, our 50%-owned equity investment. | |

| (b) |

PMMA business data derived from the audited combined carve-out financial statements of the Arkema business, and exclude the results of the South Korea component and certain other policy conformance estimates, and are converted from euros to U.S dollars at the exchange rate of 1.1383. |

|

| (c) | Amounts exclude $(82.1) million of corporate unallocated Adjusted EBITDA for Trinseo as well as $50.0 million of estimated run-rate cost synergies. Amounts include estimated Adjusted EBITDA adjustments to reflect the PMMA business on the same basis as Trinseo. For a definition of Adjusted EBITDA, a description of its importance and relevance to management and investors, and a reconciliation to income before income taxes, refer to Note 19 in the Trinseo consolidated financial statements, included elsewhere within this Offering Memorandum. |

Our Strategy

We believe that there are significant opportunities to improve our business and enhance our position as a leading global materials company and advanced specialty and sustainable solutions provider. The Company’s strategy is to grow margins and reduce earnings volatility through both organic investment and the pursuit of strategic acquisitions and joint ventures, targeting differentiated technologies focused on providing solutions that meet the evolving needs of our customers. The strategic acquisitions and investments that we pursue will have attractive risk-adjusted returns in markets and geographies that we believe have the best opportunity for growth, while also achieving cost efficiencies across our businesses. In conjunction with our pursuit of targeted growth opportunities, our strategy may also include targeted divestures of underperforming businesses or those less suitable to our portfolio. The Company’s organic growth will be developed through strategic capital investments to extend our leadership position in select market segments and by innovation that provides technological differentiation to our customers who seek our technological and development capabilities to create specialty grades, new and sustainable products, and technologically-differentiated formulations. Supporting this strategy is the Company’s Business Excellence program, first implemented in 2019, which is focused on business process optimization and increasing our operational efficiency and effectiveness. Through this program and other cost savings initiatives, the Company achieved $30.0 million of cost savings in 2020. Approximately half of these were structural, long-term savings that are expected to result in an annual cost benefit of $25.0 million. The remainder were shorter-term initiatives implemented in response to COVID-19, some of which could extend into 2021 or longer.

In 2020, we continued to focus our efforts and investments in product offerings serving the following applications, which are less cyclical and offer significantly higher growth and margin potential: coatings, adhesives, sealants, and elastomers (“CASE”) applications within the Latex Binders segment and engineered materials (“Engineered Materials”) applications, including consumer electronics, medical, and TPE applications. In December 2020, we announced the proposed PMMA Acquisition (including its PMMA and MMA product portfolios), which we expect to further increase our margin potential and decrease earnings cyclicality. PMMA is a transparent and rigid plastic with a wide range of end uses and is an attractive adjacent chemistry that complements Trinseo’s existing offerings across several end markets including automotive, building & construction, medical and consumer electronics.

The PMMA Acquisition is consistent with these efforts given the business’ leading market position in PMMA and MMA, strong margin and cash flow profile and through the significant cost savings and revenue synergy opportunities that we believe the transaction provides. Notably, this acquisition is expected to serve as a catalyst within our portfolio transformation towards becoming a higher margin, less cyclical solutions provider and that this portfolio transformation may also result in the separation of some of our commodity businesses over time. In addition, the combination of our existing portfolio with the PMMA business will enable greater focus on future growth markets such as Asia, which represents approximately 70% of the global PMMA market.

In order to support our Company’s growth strategy, we remain committed to maintaining a strong financial position with appropriate financial flexibility and liquidity. Our Company employs a disciplined approach to capital allocation and deployment of cash that strives to balance the growth of our business, funding for targeted acquisitions, and continued cash generation, while providing attractive returns to our shareholders. For 2020, this included distributing a quarterly dividend to shareholders of $0.40 per share, and using $25.0 million in cash to repurchase approximately 0.8 million ordinary shares, about 2% of our ordinary shares outstanding at the beginning of the year. In conjunction with our announcement of the proposed PMMA Acquisition, we announced the implementation of a dividend reduction and suspension of our share repurchase program, to preserve cash for the transaction and reduce the need for additional indebtedness.

The priorities for uses of available cash include completion of the proposed PMMA Acquisition, the servicing of our debt, the continued return of capital to our shareholders via quarterly dividends, the funding of targeted growth initiatives, and the repurchase of our ordinary shares, when deemed appropriate. Management believes that strong cash flow generation, continued profitability, and spending discipline are critical to providing the Company with the ongoing flexibility to pursue our business strategy.

Our Strengths

We believe we have a number of competitive strengths that differentiate us from our competitors, including:

Global Leadership Across Key Business Segments

We have leading positions in several of the markets and applications in which we compete. We are a global leader in styrene-butadiene latex (“SB latex”), holding the number 2 position in SB latex capacity in Europe and the number 1 position in capacity in North America, based on third party data. We hold the number 1 position for supplying latex binders for the coated paper and board market globally.

We are a leading producer of ABS in Europe and are one of the few global producers, with a presence in both North America and China. We are also a leading producer of polystyrene and our STYRON™ brand is one of the longest established brands in the industry and is widely recognized in the global marketplace. We are a significant producer of styrene-butadiene rubber products and we have a leading European market position, providing approximately 44% of Western Europe’s SSBR capacity available for sale. We are also one of the largest suppliers of functionalized SSBR in Europe with a leading position in functionalization technology. We attribute our strong market positions to our technologically differentiated products, the scale of our global manufacturing base, our long-standing customer relationships and our competitive cost positions.

The PMMA business is a leading PMMA Resins producer holding the number 1 position in North America and number 2 position in Europe. It is also a leading producer of molding / extrusion pellets as well as cast and extruded sheets.

Transformational Plastics Portfolio with Strategic Shift into Sustainable, High Value Engineered Materials

With the acquisition of the PMMA business, we will increase the breadth and depth of our plastics portfolio, significantly enhancing our current product offering and bolstering our market position in high value engineered materials. The acquisition is also in-line with our strategy of focusing on businesses that are less cyclical and offer significantly higher growth and margin potential. Additionally, the acquisition serves as a catalyst for our broader portfolio transformation toward becoming a higher margin, less cyclical specialty solutions provider.

Highly Diversified Customer Base with Strong, Long-standing Relationships

We have long-standing relationships with a diverse base of global customers, many of whom are leaders in their markets and rely on us for formulation, technological differentiation, and compounding expertise. We believe we have developed strong relationships through our highly collaborative processes, whereby we work with our customers, particularly in high-value segments such as specialized plastics and latex binders for CASE applications, to develop products that meet their specific needs. We have also won numerous supplier awards across our segments.

Additionally, our global manufacturing capabilities are key in serving customers cost-effectively and we believe that our global network of service and manufacturing facilities is highly valued by our customers. Our reputation as a knowledgeable and reliable supplier, our broad product mix, high quality customer service and our customer collaboration has translated in us achieving a high success rate of retaining customers. As of December 31, 2020, we served approximately 1,200 customers in 79 countries with no single customer accounting for more than 10% of our total net sales in 2020.

As of December 31, 2019, the PMMA business served approximately 300 customers across Americas and Europe. The PMMA business also has low customer concentration. For example, in the resins business, no single customer accounted for more than 6% of total net sales in 2019.

Technological Advantage and Product Innovation

Most of our products are critical inputs that significantly influence the functionality and quality of our customers’ products. Many of our products are also differentiated by their performance, reliability, customization and value, which are critical factors in our customers’ selection and retention of materials suppliers.

Our lightweight plastics materials allow automotive companies to reduce weight in vehicles by substituting heavier structural parts with our products and thereby improving fuel efficiency for cars. Higher end automotive interior applications have also benefitted from utilizing our technology that has high aesthetic appeal and excellent scratch resistant characteristics. Energy use is also substantially reduced by using our plastic in lighting and other consumer applications.

We believe our Latex Binders segment is able to differentiate itself by offering customers value-added formulations and product development expertise. Our R&D team and Technical Services and Development (“TS&D”) team are able to use our pilot coating facility, paper fabrication and testing labs, carpet technology centers located near carpet producers, and product development and process research centers to assist customers in designing new products and enhancing their manufacturing processes. Many of our major customers rely on our dedicated R&D and TS&D teams to complement their limited in-house resources for formulation and reformulation tests and trials. We believe that this capability allows us to capture new business, strengthen our existing customer relationships and broaden our technological expertise.

Our innovation and technology centers support our technological and R&D/TS&D capabilities. In addition, our R&D/TS&D efforts are also supported by certain “mini-plants” and a plastics research center, which integrates two existing technical support centers and research lab operations in a single location at our Terneuzen, The Netherlands office location. Further, we operate pilot plants to facilitate new production technology, including a new TPE pilot facility in Hsinchu, Taiwan where we commenced operations in December 2020. The new TPE facility will enable faster innovation cycles in close collaboration with Asia Pacific customers for sustainably advantaged materials in targeted markets including consumer electronics, medical, footwear, and automotive.

High-Quality Asset Base Strategically Located Near Customers and in High Growth Regions

As of December 31, 2020, our production facilities included 32 manufacturing plants (which included 75 production units) at 24 sites in 12 countries, inclusive of joint ventures and contract manufacturers. We believe our diverse locations provide us with a competitive advantage in meeting and anticipating the needs of our global and local customers in both well-established and growing markets. Additionally, as of December 31, 2020, we operated 9 R&D facilities globally, including technology and innovation development centers, which we believe are critical to our global presence and innovation capabilities. As of December 31, 2020, the PMMA business had 7 manufacturing plants across 5 countries and 2 R&D facilities in Europe and 1 in North America.

We believe that our asset footprint is an advantage, allowing us to provide customers with a diverse portfolio of products and positioning us to strategically serve growth economies.

Attractive and Complementary End-markets with Favorable Growth Outlook

We serve customers in a diversified mix of end-markets including automotive, construction, appliances, consumer electronics and packaging, amongst others. Demand in these end markets are supported by favorable global trends, which support long-term volume growth such as improving living standards in emerging markets, improving fuel efficiency and the increasing use of lightweight materials. We believe that the core end-markets that we serve will grow at rates exceeding the rate of global gross domestic product, or GDP growth.

The end markets served by the PMMA business complement Trinseo’s existing offerings across the automotive, building & construction, medical and consumer electronics markets which should enable Trinseo to leverage its mutual expertise and capabilities to deploy best practices and enhanced solutions to customers.

Strong Free Cash Flow Profile

Trinseo has a history of strong cash generation and its business has relatively low capital requirements. For example, despite the challenges of COVID-19, for the year ended December 31, 2020, the Company had cash provided by operating activities of $255.4 million, tightly managed capital expenditures to $82.3 million, and had resulting Free Cash Flow of $173.1 million. The PMMA business has similar traits for cash generation, which is one of the reasons that the business represents an attractive acquisition. We believe that the acquisition of the PMMA business, and the resulting cost savings and IT optimization opportunities, will enhance our cash flow profile over going forward.

Experienced Management Team

Our executive leadership team averages more than 20 years of industry experience, including leadership positions within our business units, and significant public company leadership experience at other chemical companies.

Overview of the Transactions

In connection with this offering, we intend to refinance our existing revolving credit facility under the Existing Credit Agreement (as defined below) as well as enter into an Incremental Term Loan Facility. The proceeds of this offering, along with anticipated borrowings under our Incremental Term Loan Facility and cash on hand will be used to:

| · | fund the cash purchase price for the PMMA Acquisition; and |

| · | pay all related fees and expenses in connection with the Transactions. |

The issuance and sale of the Notes offered hereby, the closing of the Incremental Term Loan Facility, the refinancing of our existing revolving credit facility under the Existing Credit Agreement, the closing of the PMMA Acquisition and the other transactions described above, together with the payment of the related fees and expenses, are referred to collectively herein as the “Transactions.” For a summary of the estimated sources and uses of funds relating to the Transactions, see “—Use of Proceeds.”

PMMA Acquisition

On December 14, 2020, we entered into a binding offer to acquire the PMMA business for a purchase price of €1.137 billion. Pursuant to such offer, we entered into a put option agreement with Arkema (the “Put Option”) which includes a securities purchase agreement (“SPA”) and warranty agreement (“Warranty Agreement”). The Put Option provides Arkema the right to deliver a put option exercise notice within 10 business days of the completion of certain consultation processes with works councils, upon which we will execute and deliver the SPA and Warranty Agreement on the date and location set forth in the put option exercise notice.

On March 12, 2021, we received notice from Arkema that the consultation process with all relevant works councils had been completed. We expect that Arkema will shortly exercise the Put Option pursuant to the put option agreement dated December 14, 2020 between the parties. We expect to execute the SPA promptly following receipt of such notice.

Incremental Term Loan Facility

Concurrently with the closing of the PMMA Acquisition, the Issuers will enter into an amendment to the existing credit agreement dated as of September 6, 2017 (as previously amended prior to the date hereof, the “Existing Credit Agreement”), by and among the Issuers, the subsidiary guarantors identified therein, the senior lenders named therein, and Deutsche Bank AG New York Branch, as administrative agent (the “Administrative Agent”) pursuant to which the Issuers will borrow a new tranche of term loans in an aggregate amount of $750.0 million (the “Incremental Term Loan Facility”) . a portion of which will be used to fund the purchase price of the PMMA Acquisition. The Incremental Term Loan Facility will be evidenced by the 2021 Incremental Amendment (the “2021 Incremental Amendment”) to be dated as of the date of the closing of the PMMA Acquisition and entered into by the Lead Issuer, the Co-Issuer, the guarantors party thereto and Deutsche Bank AG New York Branch. The Existing Credit Agreement as amended by the 2021 Incremental Amendment is referred to herein as the Amended Credit Agreement. In addition to the Incremental Term Loan Facility, the existing revolving credit facility under the Existing Credit Agreement is expected to be refinanced with a new revolving credit facility in an aggregate amount of $375.0 million (the “Refinancing Revolver Facility”) which will mature on the earlier of (i) five years from the date of the establishment and (ii) ninety-one days prior to the maturity date of the Existing Senior Secured Term Loan Credit Facility. See “Description of Other Indebtedness— Senior Secured Credit Facility.”