Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - STRATUS PROPERTIES INC | q420exhibit991.htm |

| EX-4.2 - EX-4.2 - STRATUS PROPERTIES INC | exhibit42-strsamendmenttor.htm |

| 8-K - 8-K - STRATUS PROPERTIES INC | strs-20210312.htm |

Investor Presentation March 15, 2021

CAUTIONARY STATEMENT AND REGULATION G DISCLOSURE This presentation contains forward-looking statements in which Stratus discusses factors it believes may affect its future performance. Forward-looking statements are all statements other than statements of historical fact, such as plans, projections or expectations related to the impacts of the COVID-19 pandemic, Stratus’ ability to meet its future debt service and other cash obligations, potential future rent deferrals or other concessions to Stratus' tenants, Stratus' ability to collect rents timely, Stratus' ability to ramp-up operations at Block 21 according to its currently anticipated timeline, Stratus' ability to open and hold events at its venues, future cash flows and liquidity, and Stratus’ ability to comply with or obtain waivers of financial and other covenants in debt agreements, Stratus’ intention to engage in an in-depth exploration of conversion to a REIT, potential steps necessary prior to conversion to a REIT, the potential timing of any REIT conversion, Stratus’ expectations about the Austin and Texas real estate markets, potential changes in governance practices and Board composition, the planning, financing, development, construction, completion and stabilization of Stratus’ development projects, plans to sell, recapitalize, or refinance properties, future operational and financial performance, municipal utility district (MUD) reimbursements for infrastructure costs, regulatory matters, leasing activities, estimated costs and timeframes for development and stabilization of properties, tax rates, the impact of interest rate changes, future capital expenditures and financing plans, possible joint ventures, partnerships, strategic relationships or other arrangements, Stratus’ projections with respect to its obligations under the master lease agreements entered into in connection with the 2017 sale of The Oaks at Lakeway, other plans and objectives of management for future operations and development projects, and future dividend payments and share repurchases. The words “anticipates,” “may,” “can,” “plans,” “believes,” “potential,” “estimates,” “expects,” “projects,” “targets,” “intends,” “likely,” “will,” “should,” “to be” and any similar expressions and/or statements that are not historical facts are intended to identify those assertions as forward-looking statements. Under Stratus’ Comerica Bank credit facility, Stratus is not permitted to pay dividends on common stock without Comerica Bank’s prior written consent. The declaration of dividends is at the discretion of Stratus’ Board of Directors (Board), subject to restrictions under Stratus’ Comerica Bank credit facility, and will depend on Stratus’ financial results, cash requirements, projected compliance with covenants in its debt agreements, outlook and other factors deemed relevant by the Board. Stratus cautions readers that forward-looking statements are not guarantees of future performance, and its actual results may differ materially from those anticipated, expected, projected or assumed in the forward-looking statements. Important factors that can cause Stratus’ actual results to differ materially from those anticipated in the forward-looking statements include, but are not limited to, evolving risks relative to the COVID-19 pandemic and its economic effects, Stratus’ ability to pay or refinance its debt or comply with or obtain waivers of financial and other covenants in debt agreements and to meet other cash obligations, Stratus’ ability to ramp up operations at Block 21 and collect anticipated rental payments, close projected asset sales, the availability and terms of financing for development projects and other corporate purposes, implementation, operational, financing and tax complexities to be evaluated and addressed before Stratus decides whether to pursue a REIT conversion, the ability of Stratus to qualify as a REIT, which involves the application of highly technical and complex provisions of the Internal Revenue Code of 1986, as amended, Stratus’ ability to complete the steps that must be taken in order to convert to a REIT and the timing thereof, the potential costs of converting to and operating as a REIT, whether Stratus’ Board will determine that conversion to a REIT is in the best interests of Stratus’ shareholders, whether shareholders will approve changes to Stratus’ organizational documents consistent with a public REIT structure, Stratus’ ability to enter into and maintain joint ventures, partnerships, strategic relationships or other arrangements, Stratus’ ability to implement its business strategy successfully, including its ability to develop, construct and sell properties at prices its Board considers acceptable, market conditions or corporate developments that could preclude, impair or delay any opportunities with respect to plans to sell, recapitalize or refinance properties, Stratus’ ability to obtain various entitlements and permits, a decrease in the demand for real estate in select markets in Texas where Stratus operates, changes in economic, market and business conditions, reductions in discretionary spending by consumers and businesses, competition from other real estate developers, hotel operators and/or entertainment venue operators and promoters, Stratus' ability to open and hold events at its venues, challenges associated with booking events and selling tickets and event cancellations at Stratus’ entertainment venues, which may result in refunds to customers, the termination of sales contracts or letters of intent because of, among other factors, the failure of one or more closing conditions or market changes, Stratus’ ability to secure qualifying tenants for the space subject to the master lease agreements entered into in connection with the 2017 sale of The Oaks at Lakeway and to assign such leases to the purchaser and remove the corresponding property from the master leases, the failure to attract customers or tenants for its developments or such customers’ or tenants’ failure to satisfy their purchase commitments or leasing obligations, increases in interest rates and the phase out of the London Interbank Offered Rate, declines in the market value of Stratus’ assets, increases in operating costs, including real estate taxes and the cost of building materials and labor, changes in external perception of the W Austin Hotel, unanticipated issues experienced by the third-party operator of the W Austin Hotel, changes in consumer preferences, industry risks, changes in laws, regulations or the regulatory environment affecting the development of real estate, opposition from special interest groups or local governments with respect to development projects, weather-related risks, loss of key personnel, cybersecurity incidents and other factors described in more detail under the heading “Risk Factors” in Stratus’ Annual Report on Form 10-K for the year ended December 31, 2020 (Form 10-K), filed with the U.S. Securities and Exchange Commission (SEC). Investors are cautioned that many of the assumptions upon which Stratus’ forward-looking statements are based are likely to change after the forward-looking statements are made. Further, Stratus may make changes to its business plans that could affect its results. Stratus cautions investors that it does not intend to update its forward-looking statements more frequently than quarterly notwithstanding any changes in its assumptions, business plans, actual experience, or other changes, and Stratus undertakes no obligation to update any forward-looking statements. Stratus can provide no assurance as to when, if at all, it will convert to a REIT. Stratus can give no assurance that its Board will approve a conversion to a REIT, even if there are no impediments to such conversion. Stratus’ exploration of a potential REIT conversion may divert management's attention from traditional business concerns. If Stratus determines to convert to a REIT, Stratus cannot give assurance that it will qualify or remain qualified as a REIT. This presentation also includes net asset value (NAV) which is not recognized under U.S. generally accepted accounting principles (GAAP). NAV estimates the market value of Stratus’ assets (“gross value”) and subtracts the book value of Stratus’ total liabilities reported under GAAP (excluding deferred financing costs presented in liabilities), value attributable to third party owners, estimated HEB profits interests and profit participation incentive plan awards. After-tax NAV, which is a non-GAAP measure, estimates the market value of Stratus’ assets (“gross value”) and subtracts the book value of Stratus’ total liabilities reported under GAAP (excluding deferred financing costs presented in liabilities) and estimated income taxes computed on the difference between the estimated market values and the tax basis of the assets. Stratus also presents the non-GAAP measure after-tax NAV per share, which is after-tax NAV divided by shares of Stratus’ common stock, plus all outstanding stock options and restricted stock units outstanding as of December 31, 2020. Stratus believes these measures can be helpful to investors in evaluating its business. NAV illustrates current embedded value in Stratus' real estate, which is carried on its GAAP balance sheet primarily at cost. Management uses NAV as one of the metrics in evaluating progress on Stratus' active development plan. NAV is intended to be a performance measure that should not be regarded as more meaningful than GAAP measures. Other companies may calculate these measures differently. As required by SEC Regulation G, reconciliations of Stratus' total stockholders' equity in its consolidated balance sheet to after-tax NAV is included on pages 7 and 8 of this presentation, a copy of which is available on Stratus' website, stratusproperties.com. Stratus recommends that you read this presentation along with Stratus’ Form 10-K, filed with the SEC, which include Stratus’ financial information presented in accordance with GAAP and which contain other important information regarding Stratus. 2

Estimated Net Asset Value 3 As of 12/31/20 Property Note Use Ownership % Value ($MMs except per share amounts) 1 Completed Commercial Property 2 Block 21 * (B)(G) MU - - 56,643 251 3,100 100% 4 The Santal (Barton Creek) * (H) MF - 448 - - - 100% 5 West Killeen Market HEB * (H)(I) R - - 44,493 - - 100% 6 Lantana Place * (H)(I) MU - 320 99,379 - - 100% 7 The Saint Mary (Circle C) (H)(J)(K) MF - 240 - - - 63% 8 Total Completed Commercial Property - 1,008 200,515 251 3,100 275.3 444.3 158.8 299.7 144.7 (28.5) 130.3 9 Residential and Commercial Property for Sale 10 Amarra Lots (Barton Creek) (J) SF 5 - - - - 100% 11 Oaks at Lakeway Back Land ** (L) SF 100 - - - - 100% 12 W Austin Condominium (J) SF - 1 - - - 100% 13 Total Residential and Commercial Property for Sale 105 1 - - - 10.0 14.5 14.0 10.9 3.6 (0.8) 13.2 14 Property Under Construction 15 Jones Crossing HEB (College Station) * (H)(I)(L) MU - 275 258,867 - - 100% 16 Amarra Villas (Barton Creek) ** (H)(I)(J) MF - 13 - - - 100% 17 Kingwood Place HEB * (H)(I)(K)(L) MU - 275 151,855 - - 62%8 19 Total Property Under Construction - 563 410,722 - - 80.2 132.9 61.5 81.3 51.6 (9.1) 52.3 20 Property Currently Undergoing Active Planning 21 Barton Creek Section N Multifamily and Commercial ** MU - 1,412 1,560,810 - - 100% 22 Barton Creek Section KLO ** SF 154 - - - - 100% 23 Magnolia Place HEB (Houston) ** (H) MU 194 495 18,410 - - 100% 24 New Caney HEB ** MU - 275 145,000 - - 100% 25 Saint June (Amarra 1A) ** MF - 182 - - - 100% 26 Total Property Currently Undergoing Active Planning 348 2,364 1,724,220 - - 91.2 150.5 145.2 106.4 44.1 (9.3) 135.9 NAV After TaxNAV (C) Tax Basis (D) Built-In Gain (E) Corporate Tax (F) Approved Entitlements Lots Units Square Feet Rooms Seats Carrying Value(A) Gross Value (B)

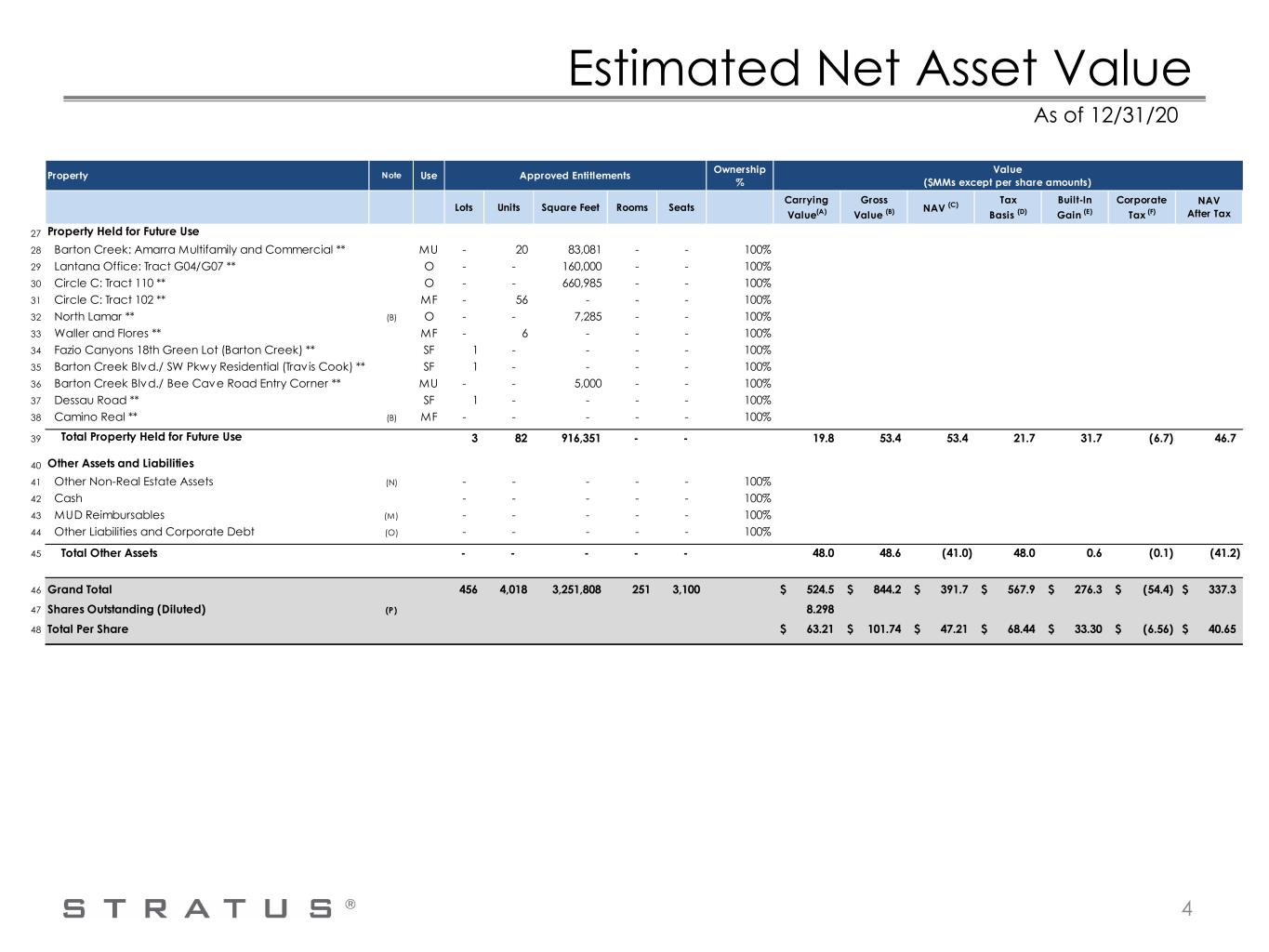

Estimated Net Asset Value 4 As of 12/31/20 Property Note Use Ownership % Value ($MMs except per share amounts) 27 Property Held for Future Use 28 Barton Creek: Amarra Multifamily and Commercial ** MU - 20 83,081 - - 100% 29 Lantana Office: Tract G04/G07 ** O - - 160,000 - - 100% 30 Circle C: Tract 110 ** O - - 660,985 - - 100% 31 Circle C: Tract 102 ** MF - 56 - - - 100% 32 North Lamar ** (B) O - - 7,285 - - 100% 33 Waller and Flores ** MF - 6 - - - 100% 34 Fazio Canyons 18th Green Lot (Barton Creek) ** SF 1 - - - - 100% 35 Barton Creek Blvd./ SW Pkwy Residential (Trav is Cook) ** SF 1 - - - - 100% 36 Barton Creek Blvd./ Bee Cave Road Entry Corner ** MU - - 5,000 - - 100% 37 Dessau Road ** SF 1 - - - - 100% 38 Camino Real ** (B) MF - - - - - 100% 39 Total Property Held for Future Use 3 82 916,351 - - 19.8 53.4 53.4 21.7 31.7 (6.7) 46.7 40 Other Assets and Liabilities 41 Other Non-Real Estate Assets (N) - - - - - 100% 42 Cash - - - - - 100% 43 MUD Reimbursables (M) - - - - - 100% 44 Other Liabilities and Corporate Debt (O) - - - - - 100% 45 Total Other Assets - - - - - 48.0 48.6 (41.0) 48.0 0.6 (0.1) (41.2) 46 Grand Total 456 4,018 3,251,808 251 3,100 524.5$ 844.2$ 391.7$ 567.9$ 276.3$ (54.4)$ 337.3$ 47 Shares Outstanding (Diluted) (P) 8.298 48 Total Per Share 63.21$ 101.74$ 47.21$ 68.44$ 33.30$ (6.56)$ 40.65$ NAV After TaxNAV (C) Tax Basis (D) Built-In Gain (E) Corporate Tax (F) Approved Entitlements Lots Units Square Feet Rooms Seats Carrying Value(A) Gross Value (B)

Footnotes 5 SF=Single-Family MF=Multi-Family O=Office R=Retail MU=Mixed Use For * and **, see Page 9. (A) Carrying values as of December 31, 2020. For a discussion of risks related to our business and properties, including but not limited to risks associated with the evolv ing COVID-19 pandemic, see I tem 1.A. Risk Factors in our Form 10-K. (B) Gross Value is equal to the appraised value for all assets where an appraisal was obtained. I f an alternative valuation method is used, it is described in a corresponding footnote below. All appraisals are dated between 12/8/20 and 2/3/21. All appraisals were commissioned by third party lenders except Camino Real and North Lamar, which are unencumbered. The Block 21 appraisal was commissioned by Stratus from the same appraiser used to underwrite the current loan. (C) See “Cautionary Statement and Regulation G Disclosure." To calculate NAV, the principal amount of project debt reported under GAAP was subtracted from the Gross Value of the related project. (D) Tax basis represents preliminary carrying values for income tax purposes as of December 31, 2020, and are subject to change until the 2020 federal tax return is filed. (E) Built-in gain represents the excess of Gross Value over the Tax Basis for each asset. (F) The estimated after-tax NAV as of December 31, 2020 was calculated using the federal tax rate of 21% effective as of that date. (G) At December 31, 2019, Block 21 was under contract to be sold for $275 million and the Gross Value was equal to the contract price. For the December 31, 2020 Gross Value, an appraisal was obtained. The decrease in the Gross Value reflected for Block 21 is the primary reason for the decrease in Stratus' estimated NAV at December 31, 2020 compared to December 31, 2019. (H) The estimated value of the profit participation incentive plan awards was deducted from the NAV and NAV After Tax. (I ) To estimate the value of West Killeen Market HEB, Lantana Place, Amarra Villas (Barton Creek), Kingwood Place HEB and Jones Crossing HEB (College Station), we used the appraised value of the property as stabilized, as determined by an independent third-party appraisal firm, and subtracted our estimated cost to complete. (J) The Saint Mary (Circle C), W Austin Condominium, one Amarra Villas, five Amarra Lots and one Amarra Multifamily Lot were under contract or had been sold as of February 3, 2021 and the Gross Value reflects their contract prices. (K) The estimated value attributable to third party ownership was deducted from the NAV and NAV After Tax. (L) The net value and corporate tax attributable to estimated HEB profits interests was deducted from the NAV and NAV After Tax. (M) No third-party appraisal was obtained. (N) Includes restricted cash, deferred tax assets, accounts receivable, deposits and prepaids. (O) Includes accounts payable, accrued liabilities, accrued property tax, deposits, other liabilities, corporate revolver and PPP loan. The corporate revolver is secured by all properties without project debt except North Lamar and Camino Real. In prev ious years, Other Liabilities and Corporate Debt were allocated to all properties without project debt. (P) Includes 8.221 million shares of Stratus common stock outstanding and 0.077 million outstanding stock options and restricted stock units as of December 31, 2020.

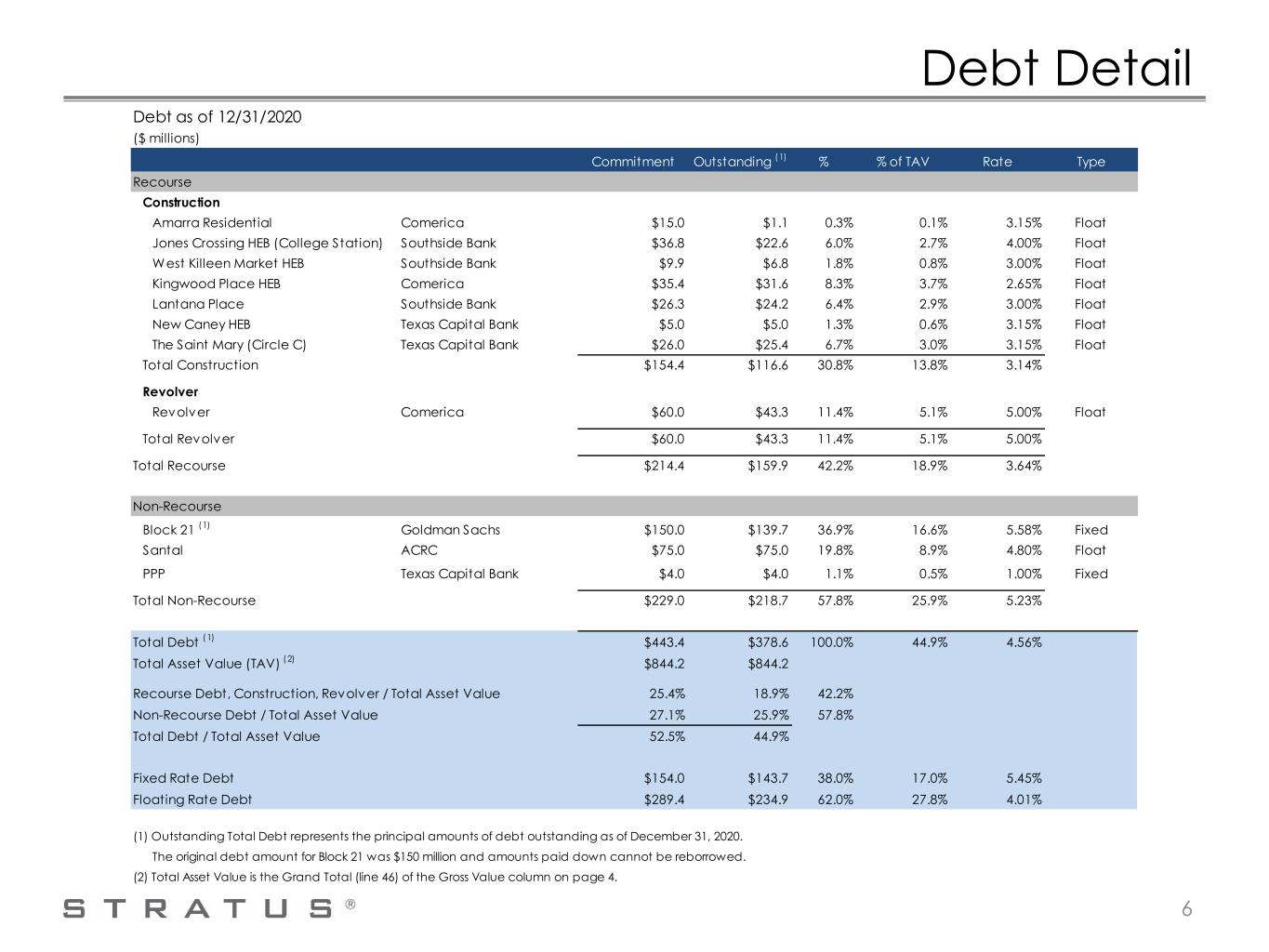

Debt Detail 6 Debt as of 12/31/2020 ($ millions) Commitment Outstanding (1) % % of TAV Rate Type Recourse Construction Amarra Residential Comerica $15.0 $1.1 0.3% 0.1% 3.15% Float Jones Crossing HEB (College Station) Southside Bank $36.8 $22.6 6.0% 2.7% 4.00% Float West Killeen Market HEB Southside Bank $9.9 $6.8 1.8% 0.8% 3.00% Float Kingwood Place HEB Comerica $35.4 $31.6 8.3% 3.7% 2.65% Float Lantana Place Southside Bank $26.3 $24.2 6.4% 2.9% 3.00% Float New Caney HEB Texas Capital Bank $5.0 $5.0 1.3% 0.6% 3.15% Float The Saint Mary (Circle C) Texas Capital Bank $26.0 $25.4 6.7% 3.0% 3.15% Float Total Construction $154.4 $116.6 30.8% 13.8% 3.14% Revolver Revolver Comerica $60.0 $43.3 11.4% 5.1% 5.00% Float Total Revolver $60.0 $43.3 11.4% 5.1% 5.00% Total Recourse $214.4 $159.9 42.2% 18.9% 3.64% Non-Recourse Block 21 (1) Goldman Sachs $150.0 $139.7 36.9% 16.6% 5.58% Fixed Santal ACRC $75.0 $75.0 19.8% 8.9% 4.80% Float PPP Texas Capital Bank $4.0 $4.0 1.1% 0.5% 1.00% Fixed Total Non-Recourse $229.0 $218.7 57.8% 25.9% 5.23% Total Debt (1) $443.4 $378.6 100.0% 44.9% 4.56% Total Asset Value (TAV) (2) $844.2 $844.2 Recourse Debt, Construction, Revolver / Total Asset Value 25.4% 18.9% 42.2% Non-Recourse Debt / Total Asset Value 27.1% 25.9% 57.8% Total Debt / Total Asset Value 52.5% 44.9% Fixed Rate Debt $154.0 $143.7 38.0% 17.0% 5.45% Floating Rate Debt $289.4 $234.9 62.0% 27.8% 4.01% (1) Outstanding Total Debt represents the principal amounts of debt outstanding as of December 31, 2020. The original debt amount for Block 21 was $150 million and amounts paid down cannot be reborrowed. (2) Total Asset Value is the Grand Total (line 46) of the Gross Value column on page 4.

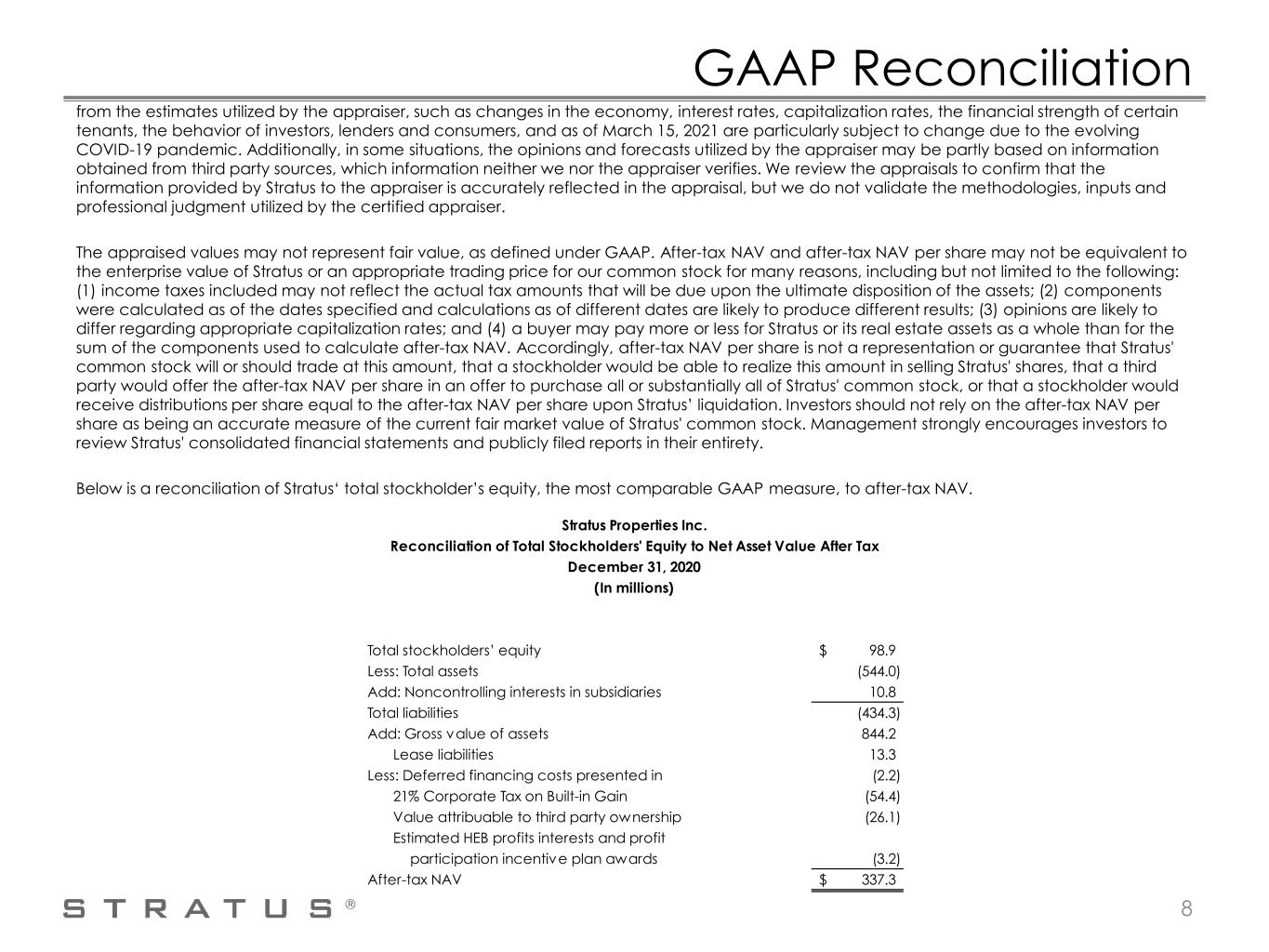

GAAP Reconciliation After-tax NAV estimates the market value of Stratus' assets (“gross value”) and subtracts the book value of Stratus' total liabilities reported under GAAP (excluding deferred financing costs presented in debt), value attributable to third party owners, estimated HEB profits interests and profit participation incentive plan awards, and estimated income taxes computed on Stratus’ share of the difference between the estimated market values and the tax basis of the assets. Stratus also presents the non-GAAP measure after-tax NAV per share, which is after-tax NAV divided by shares of its common stock outstanding, plus all outstanding stock options and restricted stock units as of December 31, 2020. The computation of Stratus' after-tax NAV uses primarily third-party appraisals conducted by independent appraisal firms, which were primarily retained by Stratus' lenders as required under our financing arrangements. The appraisal firms represent in their reports that they employ certified appraisers with local knowledge and expertise who are MAI certified by the Appraisal Institute and/or state certified as a Certified General Real Estate Appraiser. Each appraisal states that it is prepared in conformity with the Uniform Standards of Professional Appraisal Practice and utilizes at least one of the following three approaches to value: a) the cost approach, which establishes value by estimating the current costs of reproducing the improvements (less loss in value from depreciation) and adding land value to it; b) the income capitalization approach, which establishes value based on the capitalization of the subject property’s net operating income; and/or c) the sales comparison approach, which establishes value indicated by recent sales of comparable properties in the market place. One or more of the approaches may be selected by the appraiser depending on its applicability to the property being appraised. To the extent more than one approach is used, the appraiser performs a reconciliation of the indicated values to determine a final opinion of value for the subject property. Significant professional judgment is exercised by the appraiser in determining which inputs are used, which approaches to select, and the weight given to each selected approach in determining a final opinion as to the appraised value of the subject property. We are a diversified real estate company and our portfolio of real estate assets includes commercial, hotel, and entertainment properties, as well as multi- and single-family residential real estate properties. Consequently, each appraisal is unique and certain factors reviewed and evaluated in each appraisal may be particular to the nature of the property being appraised. However, in performing their analyses, the appraisers generally (i) performed site visits to the properties, (ii) performed independent inspections and/or surveys of the market area and neighborhood, (iii) performed a highest and best use analysis, (iv) reviewed property-level information, including, but not limited to, ownership history, location, availability of utilities, topography, land improvements and zoning, and (v) reviewed information from a variety of sources about regional market data and trends applicable to the property being appraised. Depending on the valuation approach utilized, the appraisers may have used one or more of the following: the recent sales prices of comparable properties; market rents for comparable properties; operating and/or holding costs of comparable properties; and market capitalization and discount rates. Our values as of December 31, 2020 for The Saint Mary (Circle C), W Austin Condominium, one Amarra Villas, five Amarra Lots and one Amarra Multifamily lot are based on prices in sales contracts, not appraised values. The appraisals of the specified properties are as of the dates so indicated, and the appraised value may be different if prepared as of a current date. As noted above, the appraisers utilize significant professional judgment in determining the appraisal methodology best suited to a particular property and the weight afforded to the various inputs considered, which could vary depending on the appraiser’s evaluation of the property being appraised. Moreover, the opinions expressed in the appraisals are based on estimates and forecasts that are prospective in nature and subject to certain risks and uncertainties. Events may occur that could cause the performance of the properties to materially differ 7

GAAP Reconciliation from the estimates utilized by the appraiser, such as changes in the economy, interest rates, capitalization rates, the financial strength of certain tenants, the behavior of investors, lenders and consumers, and as of March 15, 2021 are particularly subject to change due to the evolving COVID-19 pandemic. Additionally, in some situations, the opinions and forecasts utilized by the appraiser may be partly based on information obtained from third party sources, which information neither we nor the appraiser verifies. We review the appraisals to confirm that the information provided by Stratus to the appraiser is accurately reflected in the appraisal, but we do not validate the methodologies, inputs and professional judgment utilized by the certified appraiser. The appraised values may not represent fair value, as defined under GAAP. After-tax NAV and after-tax NAV per share may not be equivalent to the enterprise value of Stratus or an appropriate trading price for our common stock for many reasons, including but not limited to the following: (1) income taxes included may not reflect the actual tax amounts that will be due upon the ultimate disposition of the assets; (2) components were calculated as of the dates specified and calculations as of different dates are likely to produce different results; (3) opinions are likely to differ regarding appropriate capitalization rates; and (4) a buyer may pay more or less for Stratus or its real estate assets as a whole than for the sum of the components used to calculate after-tax NAV. Accordingly, after-tax NAV per share is not a representation or guarantee that Stratus' common stock will or should trade at this amount, that a stockholder would be able to realize this amount in selling Stratus' shares, that a third party would offer the after-tax NAV per share in an offer to purchase all or substantially all of Stratus' common stock, or that a stockholder would receive distributions per share equal to the after-tax NAV per share upon Stratus’ liquidation. Investors should not rely on the after-tax NAV per share as being an accurate measure of the current fair market value of Stratus' common stock. Management strongly encourages investors to review Stratus' consolidated financial statements and publicly filed reports in their entirety. Below is a reconciliation of Stratus‘ total stockholder’s equity, the most comparable GAAP measure, to after-tax NAV. 8 Total stockholders’ equity 98.9$ Less: Total assets (544.0) Add: Noncontrolling interests in subsidiaries 10.8 Total liabilities (434.3) Add: Gross value of assets 844.2 Lease liabilities 13.3 Less: Deferred financing costs presented in (2.2) 21% Corporate Tax on Built-in Gain (54.4) Value attribuable to third party ownership (26.1) Estimated HEB profits interests and profit participation incentive plan awards (3.2) After-tax NAV 337.3$ Stratus Properties Inc. Reconciliation of Total Stockholders' Equity to Net Asset Value After Tax December 31, 2020 (In millions)

Key Appraisal Inputs 9 Range In Values Weighted Average * Projects Appraised Primarily Using Income Capitalization Approach Terminal Capitalization Rate 4.75% to 9.25% 6.36% Discount Rate 6.00% to 7.75% 6.85% ** Projects Appraised Primarily Using Sales Comparison Approach Value per Land Square Foot $1.28 to $118.33 $3.54 Value per Entitled Commercial Square Foot $23.40 to $50.00 $29.32 Value per Residential Square Foot $327 to $557 $463 Value per Entitled Multifamily Unit $24,744 to $93,750 $41,018 Value per Residential Lot $125,000 to $2,750,000 $1,170,315

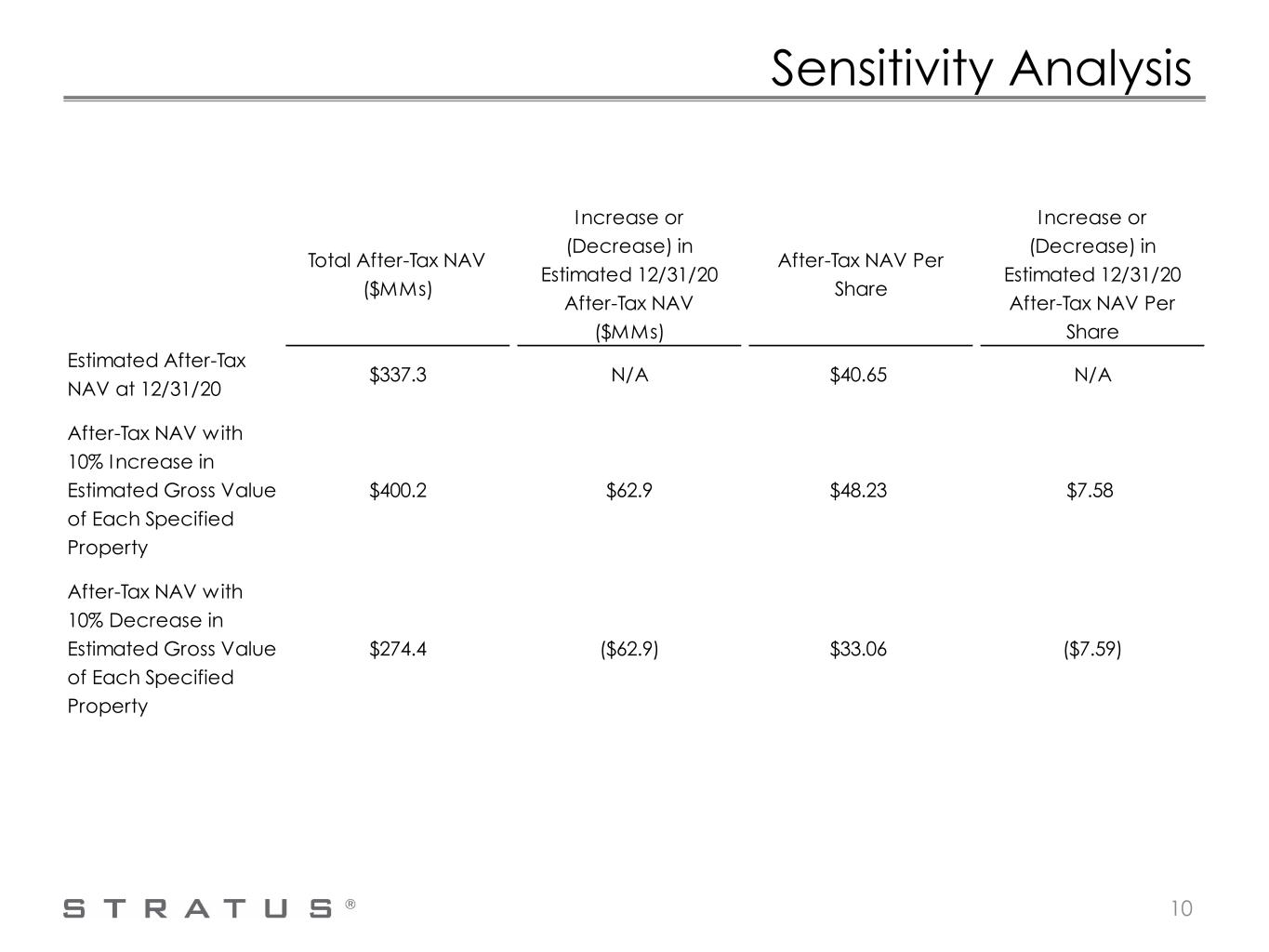

Sensitivity Analysis 10 Total After-Tax NAV ($MMs) Increase or (Decrease) in Estimated 12/31/20 After-Tax NAV ($MMs) After-Tax NAV Per Share Increase or (Decrease) in Estimated 12/31/20 After-Tax NAV Per Share Estimated After-Tax NAV at 12/31/20 $337.3 N/A $40.65 N/A After-Tax NAV with 10% Increase in Estimated Gross Value of Each Specified Property $400.2 $62.9 $48.23 $7.58 After-Tax NAV with 10% Decrease in Estimated Gross Value of Each Specified Property $274.4 ($62.9) $33.06 ($7.59)