Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Nuveen Churchill Direct Lending Corp. | form2020q4investorpresenta.htm |

Nuveen Churchill Direct Lending Corp. Quarter Ended December 31, 2020 15 March 2021

2Nuveen Churchill Direct Lending Corp. Disclaimer This presentation is for informational purposes only. It does not convey an offer of any type and is not intended to be, and should not be construed as, an offer to sell, or the solicitation of an offer to buy, any securities of Nuveen Churchill Direct Lending Corp. (the “Company,” “we,” “us” or “our”). Any such offering can be made only at the time a qualified offeree receives a confidential private placement memorandum and other operative documents which contain significant details with respect to risks and should be carefully read. In addition, the information in this presentation is qualified in its entirety by reference to all of the information in the Company’s confidential private placement memorandum and the Company’s public filings with the Securities and Exchange Commission (the “SEC”), including without limitation, the risk factors. Nothing in this presentation constitutes investment advice. The Company’s securities have not been registered under the Securities Act of 1933 or listed on any securities exchange. You or your clients may lose money by investing in the Company. The Company is not intended to be a complete investment program and, due to the uncertainty inherent in all investments, there can be no assurance that the Company will achieve its investment objectives. The information contained herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Prospective investors should also seek advice from their own independent tax, accounting, financial, investment and legal advisors to properly assess the merits and risks associated with an investment in the Company in light of their own financial condition and other circumstances. These materials and the presentations of which they are a part, and the summaries contained herein, do not purport to be complete and no obligation to update or otherwise revise such information is being assumed. Nothing shall be relied upon as a promise or representation as to the future performance of the Company. Such information is qualified in its entirety by reference to the more detailed discussions contained elsewhere in the Company’s confidential private placement memorandum and public filings with the SEC. An investment in the Company is speculative and involves a high degree of risk. There can be no guarantee that the Company’s investment objective will be achieved. The Company may engage in other investment practices that may increase the risk of investment loss. An investor could lose all or substantially all of his, her or its investment. The Company may not provide periodic valuation information to investors, and there may be delays in distributing important tax information. The Company’s fees and expenses may be considered high and, as a result, such fees and expenses may offset the Company’s profits. For a summary of certain of these and other risks, please see the Company’s confidential private placement memorandum and public filings with the SEC. There is no guarantee that any of the estimates, targets or projections illustrated in these materials and any presentation of which they form a part will be achieved. Any references herein to any of the Company’s past or present investments or its past or present performance, have been provided for illustrative purposes only. It should not be assumed that these investments were or will be profitable or that any future investments by the Company will be profitable or will equal the performance of these investments. This presentation contains forward-looking statements that involve substantial risks and uncertainties. Such statements involve known and unknown risks, uncertainties and other factors and undue reliance should not be placed thereon. These forward-looking statements are not historical facts, but rather are based on current expectations, estimates and projections about the Company, our current and prospective portfolio investments, our industry, our beliefs and opinions, and our assumptions. Words such as “anticipates,” “expects,” “intends,” “plans,” “will,” “may,” “continue,” “believes,” “seeks,” “estimates,” “would,” “could,” “should,” “targets,” “projects,” “outlook,” “potential,” “predicts” and variations of these words and similar expressions are intended to identify forward- looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors that are outlined in the Company’s confidential private placement memorandum and public filings with the SEC, some of which are beyond our control and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. The Company is providing the information as of this date (unless otherwise specified) and assumes no obligations to update or revise any forward- looking statements, whether as a result of new information, future events or otherwise. Additionally, our actual results and financial condition may differ materially as a result of the continued impact of the novel coronavirus (“COVID-19”) pandemic, including without limitation: the length and duration of the COVID-19 outbreak in the United States as well as worldwide and the magnitude of the economic impact of that outbreak; the effect of the COVID-19 pandemic on our business prospects and the prospects of our portfolio companies, including our and their ability to achieve our respective objectives; and the effect of the disruptions caused by the COVID-19 pandemic on our ability to continue to effectively manage our business (including on our ability to source and close new investment opportunities) and on the availability of equity and debt capital and our use of borrowed money to finance a portion of our investments. All capitalized terms in the presentation have the same definitions as the Company’s 10-K for the year ended December 31, 2020.

3Nuveen Churchill Direct Lending Corp. Overview Investment Activity Churchill and the Company closed out 2020 with a record level of investment activity. Churchill’s platform achieved its fourth consecutive record-breaking year of investment activity, closing and/or committing $6.0 billion, while maintaining a conservative selectivity ratio. Portfolio Update COVID-19 continues to impact the capital markets as we are proactively managing our portfolio and supporting our portfolio companies. Our experienced investment teams are working hard to preserve investor capital. The Company’s investment portfolio has not experienced any principal and/or interest defaults since inception and none of the Company’s investments are on non-accrual. Liquidity The Company has ample liquidity of $437M1 available through uncalled committed equity capital and debt financing capacity to execute on attractive new investment opportunities.

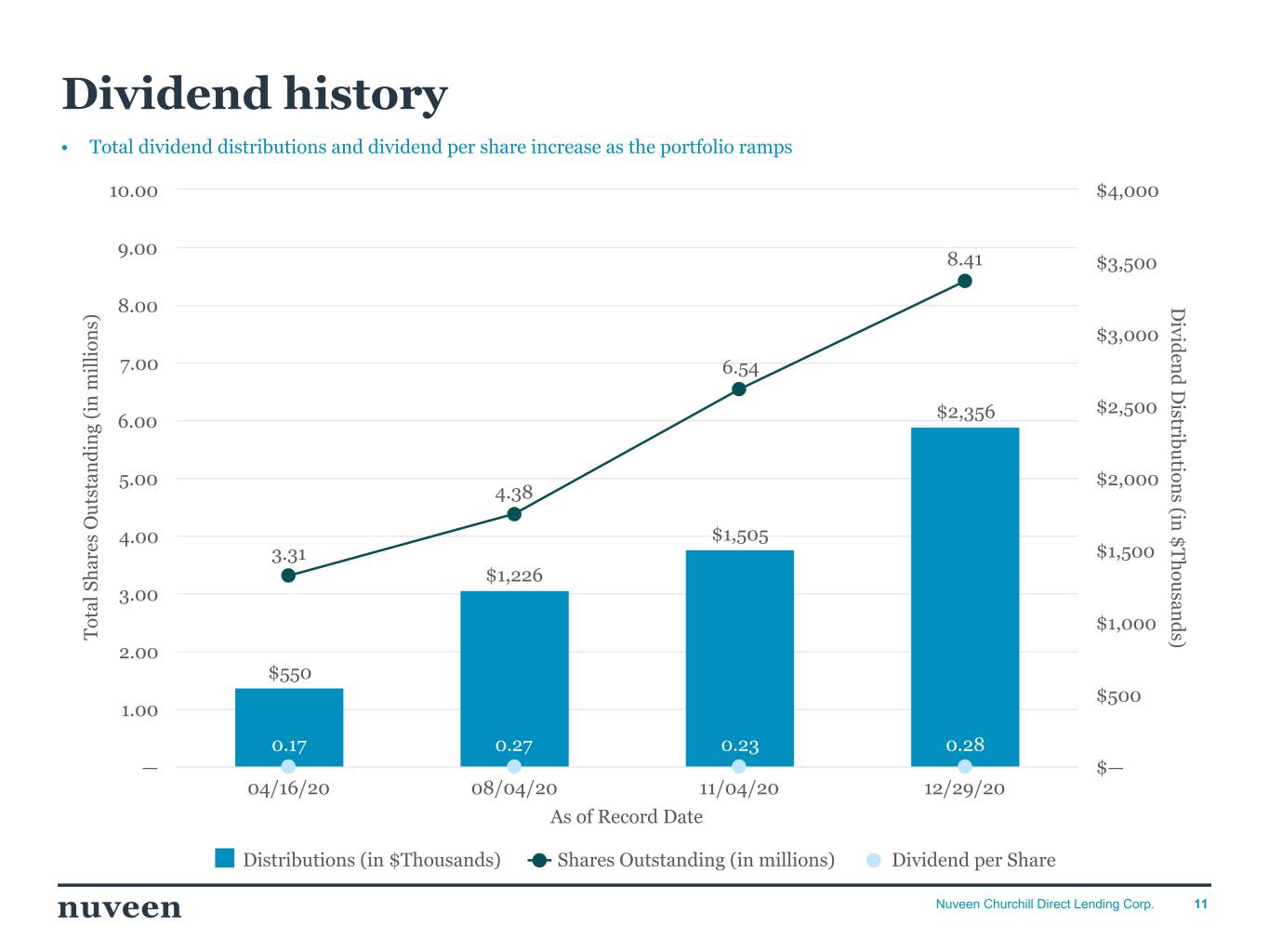

4Nuveen Churchill Direct Lending Corp. Investment Activity Dividends / NAV Liquidity 4Q20 Highlights $162M Investment Volume2 5.90% Average Spread3 24 Investments 93% First Lien4 Upward trend in total dividend distributions since inception • Declared dividend of $2.4M (57% increase from 3Q20) • NAV per share (as of 12/31/20): $18.74 Record quarter of investment activity • Investment volume increased from $71M to $162M (+129%) • Number of new investments increased from 12 to 24 (100%) • Average spread of floating rate investments of 5.90% Well-positioned with ample liquidity to support portfolio growth • Closed approximately $50M of equity commitments • Increased existing credit facility to $275M and opened an additional credit facility of $150M • Liquidity: $437M1 ◦ Unfunded equity commitments: $191M ◦ Financing Facilities’ availability: $245M5 $6.7M Avg. Investment Size

5Nuveen Churchill Direct Lending Corp. Record level of investment activity • Closed 20 new portfolio investments and 4 add-ons totaling $162M2 • Average spread of new floating rate investments of 5.90%3 V o lu m e (i n $ M il li o n s) S p read (in b p s) New Investment Activity (QoQ) $71M $162M 598 590 Volume (in $Millions) Spread (in bps) 09/30/20 12/31/20 $0M $50M $100M $150M $200M $250M $300M 400 450 500 550 600 650 4Q20 Investment activity 12 Investments 24 Investments +129% investment volume

6Nuveen Churchill Direct Lending Corp. Portfolio overview First Lien Term Loan (including DDTLs) Subordinated Debt Equity High Tech Industries Services: Business Containers, Packaging & Glass Consumer Goods: Non-durable Banking, Finance, Insurance & Real Estate Beverage, Food & Tobacco Transportation: Cargo Aerospace & Defense Telecommunications Services: Consumer Other Industries (11) 17.4 % 15.4 % 9.8 % 7.7 % 7.3 % 7.0 % 5.9 % 5.7 % 3.7 % 3.4 % 16.7 % 96 % 3 % 1 % 10 • 96% of the portfolio invested in first lien senior secured term loans • Highly diversified portfolio across 21 industries ◦ Average investment size of less than 1% of total committed capital Average Asset Yield7 6.7% Investment Portfolio at Fair Value6 $335M Average Position Size8 Portfolio Companies 61 Key Portfolio Statistics Portfolio composition by investment type 9 Portfolio Diversification by Moody’s Industry 96% First Lien <1%

7Nuveen Churchill Direct Lending Corp. Capital summary Equity (46% drawn) $353M committed $161M drawn $191M unfunded Debt (42% drawn) $455M committed11 $192M drawn $245M available5 Overall (44% drawn) $437M liquidity1 + $808M committed $353M drawn = • $437M1 of liquidity through unfunded equity commitments and Financing Facilities • Asset Coverage Ratio of 182% (debt-to-equity ratio of 1.22x) + = + =

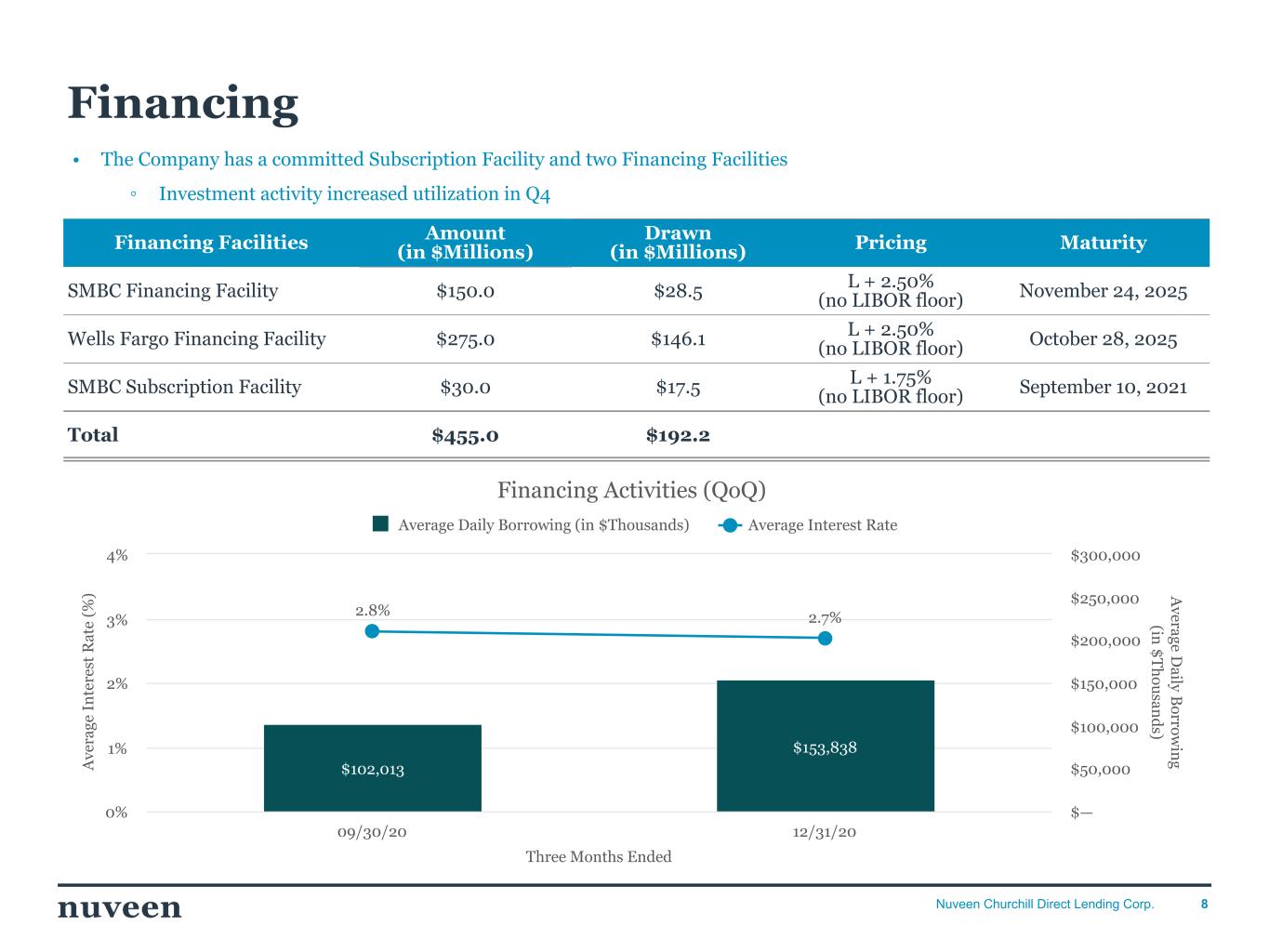

8Nuveen Churchill Direct Lending Corp. Financing Financing Facilities Amount (in $Millions) Drawn (in $Millions) Pricing Maturity SMBC Financing Facility $150.0 $28.5 L + 2.50% (no LIBOR floor) November 24, 2025 Wells Fargo Financing Facility $275.0 $146.1 L + 2.50% (no LIBOR floor) October 28, 2025 SMBC Subscription Facility $30.0 $17.5 L + 1.75% (no LIBOR floor) September 10, 2021 Total $455.0 $192.2 • The Company has a committed Subscription Facility and two Financing Facilities ◦ Investment activity increased utilization in Q4 Three Months Ended A ve ra g e In te re st R at e (% ) Averag e D aily B o rro w in g (in $ T h o u san d s) Financing Activities (QoQ) $102,013 $153,838 2.8% 2.7% Average Daily Borrowing (in $Thousands) Average Interest Rate 09/30/20 12/31/20 0% 1% 2% 3% 4% $— $50,000 $100,000 $150,000 $200,000 $250,000 $300,000

9Nuveen Churchill Direct Lending Corp. Net Asset Value As of Quarter End $18.96 $18.28 $18.86 $18.74 NAV per Share 03/31/20 06/30/20 09/30/20 12/31/20 $— $2.50 $5.00 $7.50 $10.00 $12.50 $15.00 $17.50 $20.00 $22.50 • QoQ decrease in NAV per share was primarily due to the $0.28 per share dividend declared in December

10Nuveen Churchill Direct Lending Corp. Internal risk rating Portfolio risk ratings ($ thousands) December 31, 2020 September 30, 2020 June 30, 2020 March 31, 2020 Fair Value % of Portfolio Fair Value % of Portfolio Fair Value % of Portfolio Fair Value % of Portfolio 1 — — — — — — — — 2 — — — — — — — — 3 — — — — — — — — 4 315,246 94.0 188,509 87.4 135,180 83.6 142,814 85.4 5 2,381 0.7 9,175 4.3 8,405 5.2 12,212 7.3 6 17,632 5.3 17,980 8.3 18,116 11.2 12,153 7.3 7 — — — — — — — — 8 — — — — — — — — 9 — — — — — — — — 10 — — — — — — — — Total 335,259 100.0 215,664 100.0 161,701 100.0 167,179 100.0 Rating Definition Rating Definition 1 Performing – Superior 6 Watch List – Low Maintenance 2 Performing – High 7 Watch List – Medium Maintenance 3 Performing – Low Risk 8 Watch List – High Maintenance 4 Performing – Stable Risk (Initial Rating Assigned at Origination) 9 Watch List – Possible Loss 5 Performing – Management Notice 10 Watch List – Probable Loss • Weighted average rating improved from 4.2 to 4.1 • No interest and/or principal defaults since inception • No investments on non-accrual

11Nuveen Churchill Direct Lending Corp. Dividend history As of Record Date T o ta l S h ar es O u ts ta n d in g ( in m il li o n s) D ivid en d D istrib u tio n s (in $ T h o u san d s) $550 $1,226 $1,505 $2,356 3.31 4.38 6.54 8.41 0.17 0.27 0.23 0.28 Distributions (in $Thousands) Shares Outstanding (in millions) Dividend per Share 04/16/20 08/04/20 11/04/20 12/29/20 — 1.00 2.00 3.00 4.00 5.00 6.00 7.00 8.00 9.00 10.00 $— $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 • Total dividend distributions and dividend per share increase as the portfolio ramps

12Nuveen Churchill Direct Lending Corp. Share issuance and distribution activity Issuance Date Share Issuance Aggregate Offering Price Issuance Price per Share November 6, 2020 1,870,660 $35,000,000 $18.71 October 16, 2020 1,057,641 $20,000,000 $18.91 August 6, 2020 1,105,425 $20,000,000 $18.09 May 7, 2020 1,069,522 $20,000,000 $18.70 December 31, 2019 3,310,540 $66,210,800 $20.00 December 19, 2019 50 $1,000 $20.00 Share issuance Date Declared Record Date Payment Date Dividend per Share December 29, 2020 December 29, 2020 January 18, 2021 $0.28 November 4, 2020 November 4, 2020 November 11, 2020 $0.23 August 4, 2020 August 4, 2020 August 11, 2020 $0.28 April 16, 2020 April 16, 2020 April 21, 2020 $0.17 Dividend distribution • As of December 31, 2020, the Company had 8,413,970 shares outstanding On February 25, 2021, we delivered a drawdown notice to our shareholders relating to the issuance of 785,751 shares of our common stock, par value $0.01 per share, for an aggregate offering price of $15.0 million. The shares were issued on March 11, 2021. 12 12

13Nuveen Churchill Direct Lending Corp. Endnotes Note: All information is as of December 31, 2020, unless otherwise noted. Numbers may not sum due to rounding. 1. Represents the sum of unfunded equity commitments of $191M and Financing Facilities Available of $245M. 2. Reflects the par amount of total new investment activity for the three months ended December 31, 2020. Investment Activity does not include existing draws on Delayed Draw Term Loans and partial paydowns. 3. Average Spread is calculated based off of par amount. 4. 37% of first lien terms loans are unitranche positions. 5. Available for borrowing based on the computation of collateral to support the borrowings and subject to compliance with applicable covenants and financial ratios. 6. Represents total investment portfolio at Fair Value. Total par value of investment commitments is $372M which includes approximately $30M of unfunded delayed draw term loan commitments. 7. Weighted average yield on debt and income producing investments, at fair value. The weighted average yield of the Company’s debt and income producing securities is not the same as a return on investment for our shareholders but, rather, relates to our investment portfolio and is calculated before the payment of all of our and our subsidiaries’ fees and expenses. The weighted average yield was computed using the effective interest rates as of each respective date, including accretion of original issue discount. 8. Average Position Size (at fair value) is calculated as a percentage of Committed Capital. Committed Capital includes Equity Commitment of $353M as of December 31, 2020 and $455M from Financing Facilities. 9. Investment Type reflects classification at issuance. 10. 34% of first lien term loans are unitranche positions. 11. Represents current Financing Facilities amount. 12. Shares held by an affiliate of the Company, TIAA.

14Nuveen Churchill Direct Lending Corp. Company website churchillam.com/NCDL Investor Relations NCDL-IR@churchillam.com Contact us