Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - EYENOVIA, INC. | tm219377d2_8k.htm |

Exhibit 99.1

Making it Possible March 2021

Except for historical information, all of the statements, expectations and assumptions contained in this presentation are for war d - looking statements. Forward - looking statements include, but are not limited to, statements that express our intentions, beliefs, expecta tions, strategies, predictions or any other statements relating to our future activities or other future events or conditions, inclu din g estimated market opportunities for our product candidates and platform technology. These statements are based on current expectations, estimates and projections about our business based, in part, on assumptions made by management. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, a ctu al outcomes and results may, and are likely to, differ materially from what is expressed or forecasted in the forward - looking state ments due to numerous factors discussed from time to time in documents which we file with the U.S. Securities and Exchange Commissi on. In addition, such statements could be affected by risks and uncertainties related to, among other things: volatility and unce rta inty in the global economy and financial markets in light of the COVID - 19 pandemic and uncertainties arising from the U.S. elections; fluctu ations in our financial results; the timing and our ability or the ability of our licensees to submit applications for, obtain and m ain tain regulatory approvals for our product candidates; changes in legal, regulatory and legislative environments in the markets in which we op era te and the impact of these changes on our ability to obtain regulatory approval for our products; the potential impacts of COVID - 19 on our supply chain; the potential advantages of our product candidates and platform technology and potential revenues from licensin g transactions; the rate and degree of market acceptance and clinical utility of our product candidates; our estimates regardin g t he potential market opportunity for our product candidates; reliance on third parties to develop and commercialize certain of ou r p roduct candidates; the ability of us and our partners to timely develop, implement and maintain manufacturing, commercialization and marketing capabilities and strategies for certain of our product candidates; risks of our ongoing clinical trials, including, bu t not limited to, the costs, design, initiation and enrollment (which could still be adversely impacted by COVID - 19 and resulting social dista ncing), timing, progress and results of such trials; our ability to raise additional capital; intellectual property risks; and our co mpe titive position. Any forward - looking statements speak only as of the date on which they are made, and except as may be required under applicable securities laws, Eyenovia does not undertake any obligation to update any forward - looking statements. 1 Forward - Looking Statements

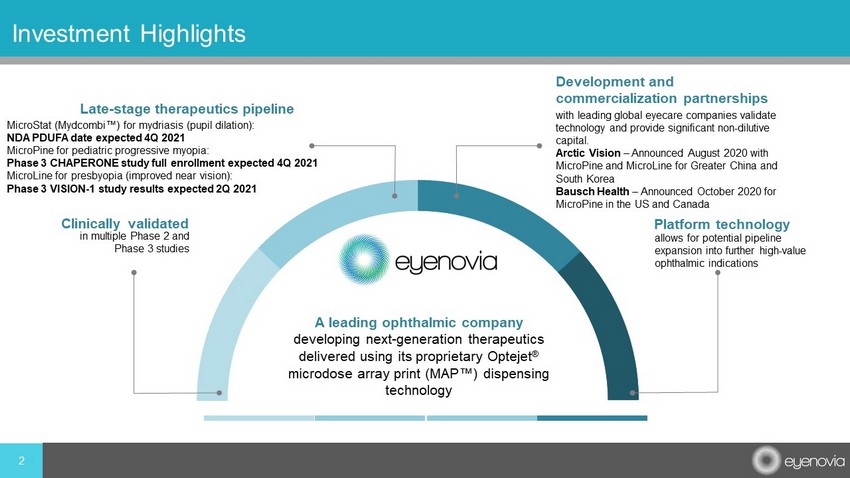

2 Investment Highlights Clinically validated in multiple Phase 2 and Phase 3 studies Late - stage therapeutics pipeline MicroStat ( Mydcombi Œ ) for mydriasis (pupil dilation): NDA PDUFA date expected 4Q 2021 MicroPine for pediatric progressive myopia: Phase 3 CHAPERONE study full enrollment expected 4Q 2021 MicroLine for presbyopia (improved near vision): Phase 3 VISION - 1 study results expected 2Q 2021 Development and commercialization partnerships with leading global eyecare companies validate technology and provide significant non - dilutive capital. Arctic Vision – Announced August 2020 with MicroPine and MicroLine for Greater China and South Korea Bausch Health – Announced October 2020 for MicroPine in the US and Canada Platform technology allows for potential pipeline expansion into further high - value ophthalmic indications A leading ophthalmic company developing next - generation therapeutics delivered using its proprietary Optejet ® microdose array print (MAP Œ ) dispensing technology

3 Leadership Team Dr. Sean Ianchulev , MD, MPH CEO, CMO and Co - Founder • Head of ophthalmology research and directed development and FDA approval of Lucentis, most successful ophthalmic drug for Genentech • IanTech founder for cataract device approved by FDA in 2016 and inventor of Intra - operative Aberrometry at Wavetec - Alcon/Novartis • CMO of Transcend Medical (acquired by Alcon/Novartis) John Gandolfo CFO Michael Rowe CCO Jennifer Clasby VP Regulatory and Clinical Luke Clauson VP R&D, Manufacturing

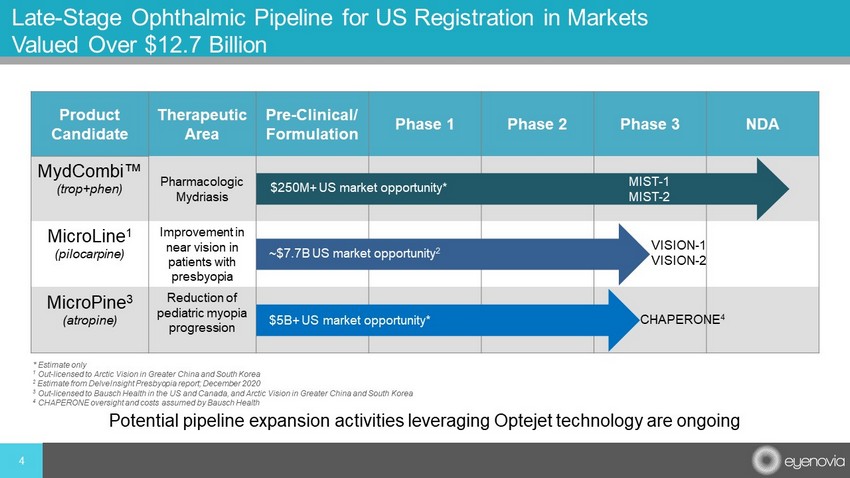

4 Late - Stage Ophthalmic Pipeline for US Registration in Markets Valued Over $12.7 Billion Product Candidate Therapeutic Area Pre - Clinical/ Formulation Phase 1 Phase 2 Phase 3 NDA MydCombi Π( trop+phen ) Pharmacologic Mydriasis MicroLine 1 (pilocarpine) Improvement in near vision in patients with presbyopia MicroPine 3 (atropine) Reduction of pediatric myopia progression Potential pipeline expansion activities leveraging Optejet technology are ongoing * Estimate only 1 Out - licensed to Arctic Vision in Greater China and South Korea 2 Estimate from DelveInsight Presbyopia report; December 2020 3 Out - licensed to Bausch Health in the US and Canada, and Arctic Vision in Greater China and South Korea 4 CHAPERONE oversight and costs assumed by Bausch Health $250M+ US market opportunity* MIST - 1 MIST - 2 ~$7.7B US market opportunity 2 VISION - 1 VISION - 2 $5B+ US market opportunity* CHAPERONE 4

5 Potential Topical US Ophthalmic Market For Platform Technology* Lifestyle Enhancement Glaucoma: ~$3 Billion 3 Prescription Dry Eye: ~$1.6 Billion 2 Anti - Inflammatories: ~$1.4 Billion 1 Reduce IOP spikes due to high doses of steroids. Anti - Infectives: ~$650 Million 1 Eliminate contamination from poor usage of eyedropper bottles. *All potential market opportunities are estimates only 4 Estimate from Delveinsight Presbyopia Report, December 2020 1 IMS, 2015 2 Mixture of public information, IQVIA , Market Scope and estimates – Feb 2020 3 IQVIA, 2019 Improve systemic safety profile and allow for development of PGA + BB fixed combinations. Improvement in topical (e.g., hyperemia) and systemic AE profile. Multi - dose preservative free options. Improve clinical probability of success. Enable patients, especially the elderly, to better instill medication for improved results. Multi - dose preservative free options. Current Portfolio: ~$12.9 Billion* Existing Eyenovia portfolio in mydriasis, presbyopia, and myopia, with late - stage, first - in - class therapeutics. $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 $8.0 Market Size Estimates for the United States (in US$ Billions)

Potential overexposure to drug and preservatives • Conventional droppers can overdose the eye by as much as 300%+ 1 • Known to cause ocular and systemic side effects 1 Protruding tip may create cross - contamination risk • More than 50% of administrations touch ocular surface 2 More difficult to use with poor compliance • Requires head tilting and aiming which may be compromised in pediatric and elderly populations • No dosage reminders or tracking which may lead to missed doses 6 Standard Eyedroppers Have Limited Therapeutic Approaches 1 Abelson, M., 2020. The Hows And Whys Of Pharmacokinetics. ReviewofOphthalmology.com; accessed 11/3/20 2 Brown MM, Brown GC, Spaeth GL. Improper topical self - administration of ocular medication among patients with glaucoma. Can J Ophthalmol . 1984 Feb;19(1):2 - 5. PMID: 6608974.

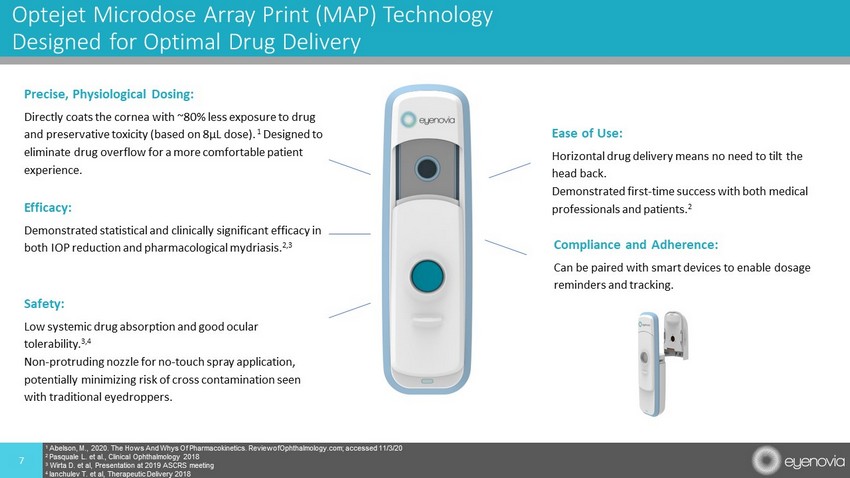

7 Optejet Microdose Array Print (MAP) Technology Designed for Optimal Drug Delivery Precise, Physiological Dosing: Directly coats the cornea with ~80% less exposure to drug and preservative toxicity (based on 8µL dose). 1 Designed to eliminate drug overflow for a more comfortable patient experience. Efficacy: Demonstrated statistical and clinically significant efficacy in both IOP reduction and pharmacological mydriasis. 2,3 Safety: Low systemic drug absorption and good ocular tolerability. 3,4 Non - protruding nozzle for no - touch spray application, potentially minimizing risk of cross contamination seen with traditional eyedroppers. Ease of Use: Horizontal drug delivery means no need to tilt the head back. Demonstrated first - time success with both medical professionals and patients. 2 Compliance and Adherence: Can be paired with smart devices to enable dosage reminders and tracking. 1 Abelson, M., 2020. The Hows And Whys Of Pharmacokinetics. ReviewofOphthalmology.com; accessed 11/3/20 2 Pasquale L. et al., Clinical Ophthalmology 2018 3 Wirta D. et al, Presentation at 2019 ASCRS meeting 4 Ianchulev T. et al, Therapeutic Delivery 2018

8 Optejet : Significant Clinical Experience and Validation Five Phase 2 or Phase 3 clinical trials to date featured in dozens of publications and major meetings including ASCRS, AAO, AAOpt , OIS and EYEcelerator .

9 Optejet : Clinical Experience and Validation 0 50 100 150 200 250 300 350 PE 2.5% PE 10% PE 10% μ D Plasma PE ( pg /ml) 101.6 316.3 201.5 p = 0.003 p = 0.021 Drugs in traditional eyedroppers can enter systemic blood circulation and may cause significant side effects . 1 Microdose delivery of phenylephrine 10% (PE - µD) was associated with significantly less systemic exposure than traditional eye drops (PE 10%). 2 Reduced Systemic Levels 1 Muller, M., van der Velpe , N., Jaap, W., van der Cammen , T.; Syncope and falls due to timolol eye drops. BMJ, 2006 April; 332:960 - 961 2 Ianchulev, I. High - precision piezo - ejection ocular microdosing : Phase II study on local and systemic effects of topical phenylephrine. Ther Deliv , 2018 Jan;9(1):17 - 27

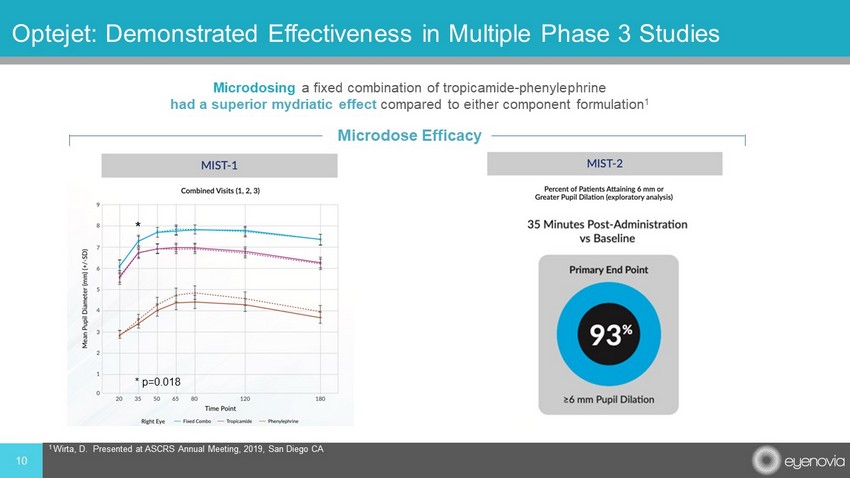

10 Optejet : Demonstrated Effectiveness in Multiple Phase 3 Studies Microdosing a fixed combination of tropicamide - phenylephrine had a superior mydriatic effect compared to either component formulation 1 Microdose Efficacy 1 Wirta , D. Presented at ASCRS Annual Meeting, 2019, San Diego CA * * p=0.018

11 Optejet Platform: Potential High - Value Opportunities Estimated Gross Margins Based on $100/Month Price 1 >90% Next - Generation Ophthalmic Therapeutics • Eyenovia’s microdose therapeutics follow the 505(b)(2) registration pathway and are not currently regulated as medical devices or drug - device combinations • The FDA categorizes the Optejet as a container closure system Eyenovia Products Aim to Provide Competitive Pharmaceutical Margins: • All pipeline products are Eyenovia’s own proprietary micro - formulations • Eyenovia currently owns the pharma - economics of the entire prescription value chain • MicroLine has strong potential as a cash - pay cosmeceutical 82% - 94% 1 Estimates for “at scale” (250,000 annual units minimum)

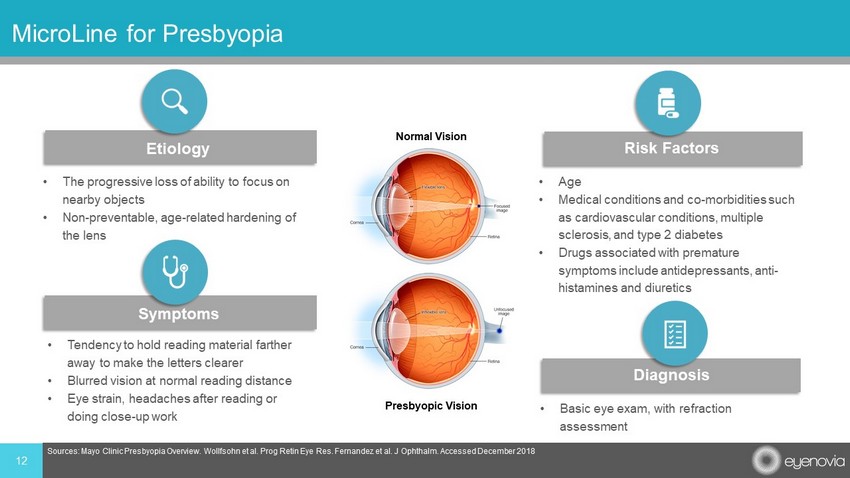

12 MicroLine for Presbyopia Etiology • The progressive loss of ability to focus on nearby objects • Non - preventable, age - related hardening of the lens Sources: Mayo Clinic Presbyopia Overview. Wollfsohn et al. Prog Retin Eye Res. Fernandez et al. J Ophthalm . Accessed December 2018 Symptoms • Tendency to hold reading material farther away to make the letters clearer • Blurred vision at normal reading distance • Eye strain, headaches after reading or doing close - up work Risk Factors • Age • Medical conditions and co - morbidities such as cardiovascular conditions, multiple sclerosis, and type 2 diabetes • Drugs associated with premature symptoms include antidepressants, anti - histamines and diuretics Diagnosis • Basic eye exam, with refraction assessment Normal Vision Presbyopic Vision

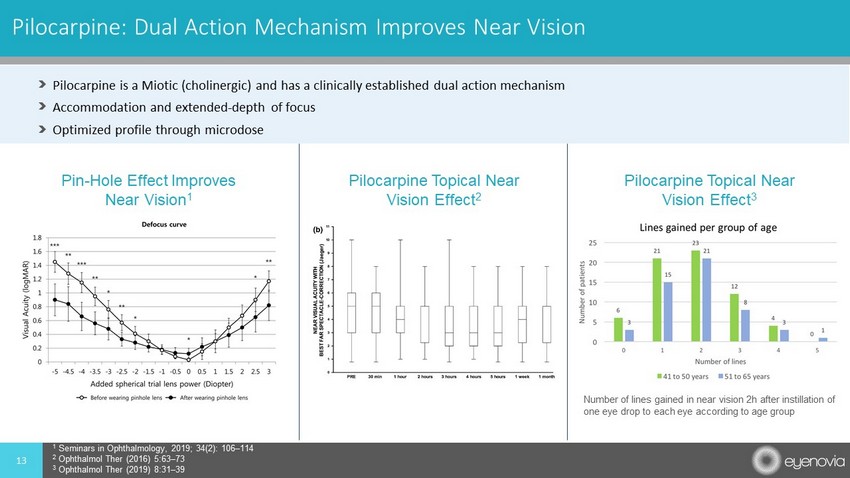

Pilocarpine: Dual Action Mechanism Improves Near Vision Pin - Hole Effect Improves Near Vision 1 Pilocarpine Topical Near Vision Effect 2 Pilocarpine Topical Near Vision Effect 3 1 Seminars in Ophthalmology, 2019; 34(2): 106 – 114 2 Ophthalmol Ther (2016) 5:63 – 73 3 Ophthalmol Ther (2019) 8:31 – 39 Number of lines gained in near vision 2h after instillation of one eye drop to each eye according to age group 13 Pilocarpine is a Miotic (cholinergic) and has a clinically established dual action mechanism Accommodation and extended - depth of focus Optimized profile through microdose

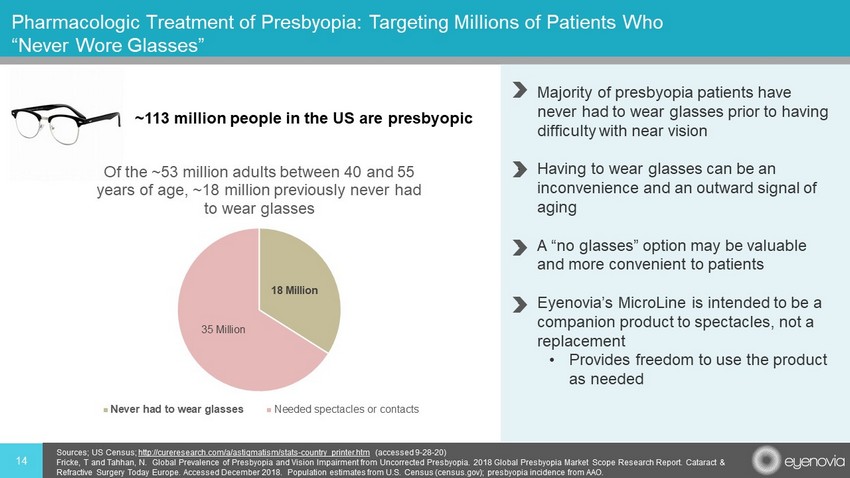

14 Pharmacologic Treatment of Presbyopia: Targeting Millions of Patients Who “Never Wore Glasses” • Majority of presbyopia patients have never had to wear glasses prior to having difficulty with near vision • Having to wear glasses can be an inconvenience and an outward signal of aging • A “no glasses” option may be valuable and more convenient to patients • Eyenovia’s MicroLine is intended to be a companion product to spectacles, not a replacement • Provides freedom to use the product as needed Sources; US Census; http://cureresearch.com/a/astigmatism/stats - country_printer.htm (accessed 9 - 28 - 20) Fricke, T and Tahhan , N. Global Prevalence of Presbyopia and Vision Impairment from Uncorrected Presbyopia. 2018 Global Presbyopia Market Scope Res earch Report. Cataract & Refractive Surgery Today Europe. Accessed December 2018. Population estimates from U.S. Census (census.gov); presbyopia inci den ce from AAO. 18 Million 35 Million Of the ~53 million adults between 40 and 55 years of age, ~18 million previously never had to wear glasses Never had to wear glasses Needed spectacles or contacts ~113 million people in the US are presbyopic

15 MicroLine : Phase 3 Program • Two double - masked, placebo - controlled, cross - over superiority trials • Phase 3 ( microdosed pilocarpine dose 1, dose 2 and placebo) • Primary endpoint: binocular distance corrected near visual acuity • First patient enrolled in VISION 1: December 2020 VISION 1 Screening: Age 40 – 60 With Presbyopia VISION 2 Enrollment (N=120) Enrollment (N=120) MicroLine dose 1 MicroLine dose 2 Placebo MicroLine Placebo 4Q 2020 1Q 2021 2Q 2021 2H 2021 1H 2022 Anticipated Timeline VISION1 Initiation VISION1 Topline Data

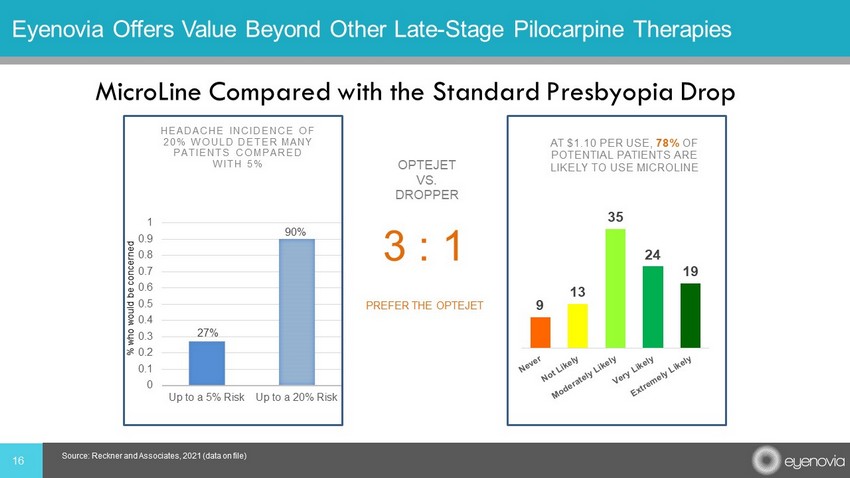

16 Eyenovia Offers Value Beyond Other Late - Stage Pilocarpine Therapies Source: Reckner and Associates, 2021 (data on file) MicroLine Compared with the Standard Presbyopia Drop 27% 90% 0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1 Up to a 5% Risk Up to a 20% Risk HEADACHE INCIDENCE OF 20% WOULD DETER MANY PATIENTS COMPARED WITH 5% % who would be concerned OPTEJET VS. DROPPER 3 : 1 PREFER THE OPTEJET 9 13 35 24 19 AT $1.10 PER USE, 78% OF POTENTIAL PATIENTS ARE LIKELY TO USE MICROLINE

17 Late Stage Presbyopia Competitive Landscape Trial Compound Company 3 - line gain 2 - line gain Safety Completion date NDA Status GEMINI - 1 PIII Pilo 1.25% ALLERGAN/ ABBVIE MET (40 – 55 YO) Headache No serious AEs Q3 2020 Filed 2/2021 GEMINI - 2 PIII Pilo 1.25% ALLERGAN/ ABBVIE MET (40 – 55 YO) Headache No serious AEs Q3 2020 NEAR 1 PIII Pilo + ORASIS Recruiting 45 – 64 YO Q2 2021 NEAR 2 PIII Pilo + ORASIS Recruiting 45 – 64 YO Q2 2021 VISION 1 PIII Pilo 1%, 2% EYEN Recruiting 40 – 60 YO Study results expected Q2 2021 Source: Company press releases and clinicaltrials.gov

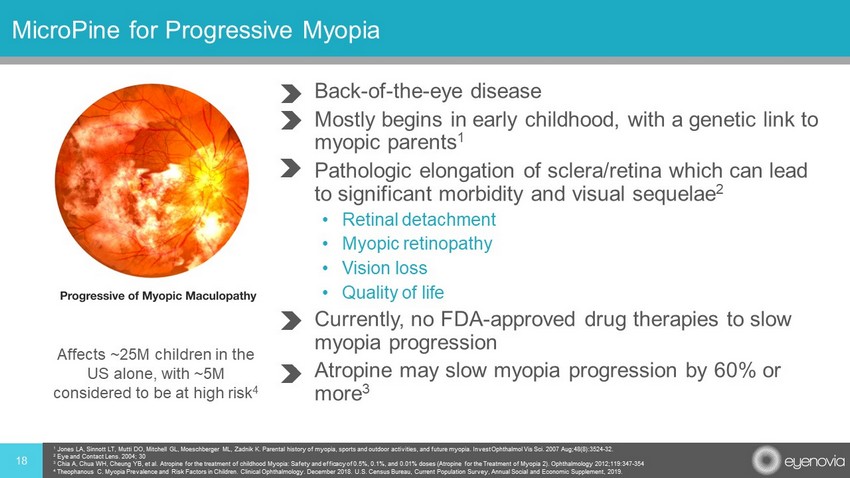

18 MicroPine for Progressive Myopia • Back - of - the - eye disease • Mostly begins in early childhood, with a genetic link to myopic parents 1 • Pathologic elongation of sclera/retina which can lead to significant morbidity and visual sequelae 2 • Retinal detachment • Myopic retinopathy • Vision loss • Quality of life • Currently, no FDA - approved drug therapies to slow myopia progression • Atropine may slow myopia progression by 60% or more 3 1 Jones LA, Sinnott LT, Mutti DO, Mitchell GL, Moeschberger ML, Zadnik K. Parental history of myopia, sports and outdoor activities, and future myopia. Invest Ophthalmol Vis Sci. 2007 Aug;48(8):3524 - 32. 2 Eye and Contact Lens. 2004; 30 3 Chia A, Chua WH, Cheung YB, et al. Atropine for the treatment of childhood Myopia: Safety and efficacy of 0.5%, 0.1%, and 0.0 1% doses (Atropine for the Treatment of Myopia 2). Ophthalmology 2012;119:347 - 354 4 Theophanous C. Myopia Prevalence and Risk Factors in Children. Clinical Ophthalmology. December 2018. U.S. Census Bureau, Cur re nt Population Survey, Annual Social and Economic Supplement, 2019. Affects ~25M children in the US alone, with ~5M considered to be at high risk 4

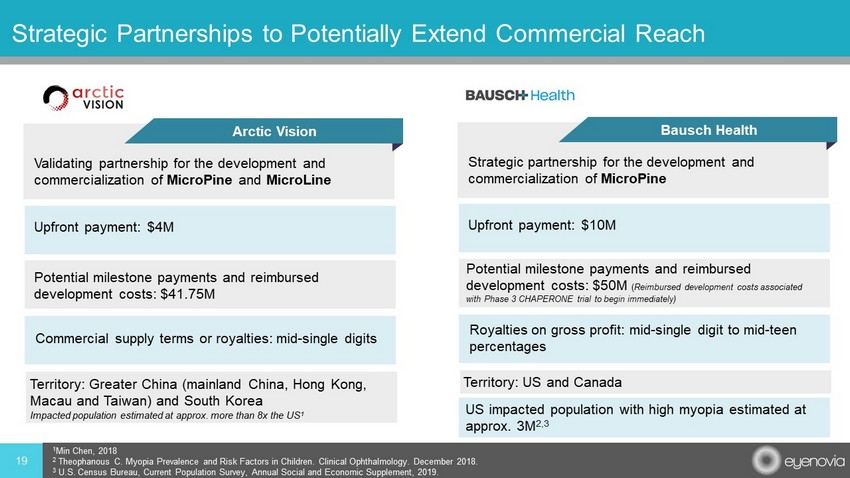

19 Strategic Partnerships to Potentially Extend Commercial Reach Bausch Health Modern PowerPoint Presentation Arctic Vision Validating partnership for the development and commercialization of MicroPine and MicroLine Upfront payment: $4M Potential milestone payments and reimbursed development costs: $41.75M Commercial supply terms or royalties: mid - single digits Territory: Greater China (mainland China, Hong Kong, Macau and Taiwan) and South Korea Impacted population estimated at approx. more than 8x the US 1 Bausch Health Strategic partnership for the development and commercialization of MicroPine Upfront payment: $10M Potential milestone payments and reimbursed development costs: $50M ( Reimbursed development costs associated with Phase 3 CHAPERONE trial to begin immediately) Royalties on gross profit: mid - single digit to mid - teen percentages Territory: US and Canada US impacted population with high myopia estimated at approx. 3M 2,3 1 Min Chen, 2018 2 Theophanous C. Myopia Prevalence and Risk Factors in Children. Clinical Ophthalmology. December 2018. 3 U.S. Census Bureau, Current Population Survey, Annual Social and Economic Supplement, 2019.

20 Future Licensing Opportunities MydCombi MicroLine MydCombi MicroLine MicroPine Canada United States Central America South America Europe Australia New Zealand Africa Russia Middle East

• Pharmacologic mydriasis (pupil dilation) is part of the comprehensive eye exam • Estimated 80 million office - based comprehensive and diabetic eye exams and 4 million ophthalmic surgical dilations performed annually in the United States • Essential for diabetic retinopathy, glaucoma and retina disease screening • An estimated $250 million US market opportunity 1 • Places technology at the initial point - of - care with prescribers (ophthalmologists and optometrists) • No direct contact increases patient safety by reducing potential cross contamination associated with the use of shared dilating drops in OD/OPH offices • No anticipated reimbursement hurdles; expect to sell directly to ophthalmology and optometry practices • NDA accepted March 2021 21 MydCombi for Mydriasis 1 $160M annual sales of pharmaceutical mydriatic products used during 80M office - based exams ($2 * 80M) + $80M of single bottle m ydriatic agents used cataract replacement surgery ($20 x 4M)

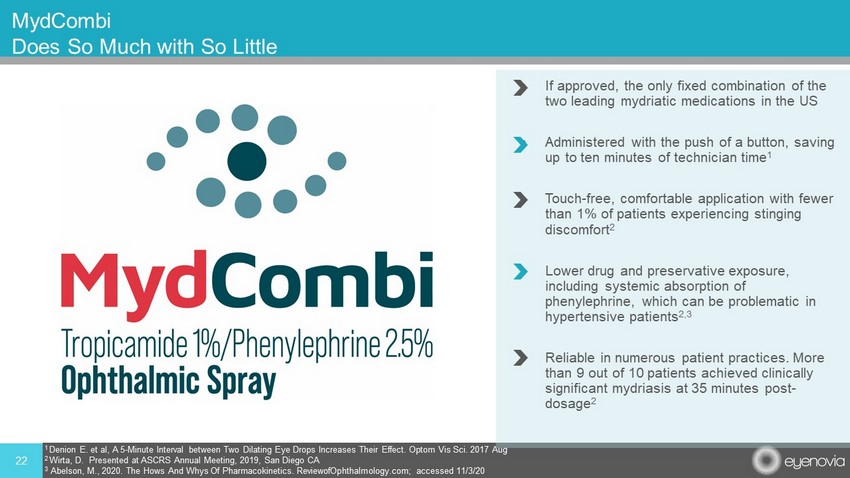

22 MydCombi Does So Much with So Little • If approved, the only fixed combination of the two leading mydriatic medications in the US • Administered with the push of a button, saving up to ten minutes of technician time 1 • Touch - free, comfortable application with fewer than 1% of patients experiencing stinging discomfort 2 • Lower drug and preservative exposure, including systemic absorption of phenylephrine, which can be problematic in hypertensive patients 2,3 • Reliable in numerous patient practices. More than 9 out of 10 patients achieved clinically significant mydriasis at 35 minutes post - dosage 2 1 Denion E. et al, A 5 - Minute Interval between Two Dilating Eye Drops Increases Their Effect. Optom Vis Sci. 2017 Aug 2 Wirta , D. Presented at ASCRS Annual Meeting, 2019, San Diego CA 3 Abelson, M., 2020. The Hows And Whys Of Pharmacokinetics. ReviewofOphthalmology.com; accessed 11/3/20

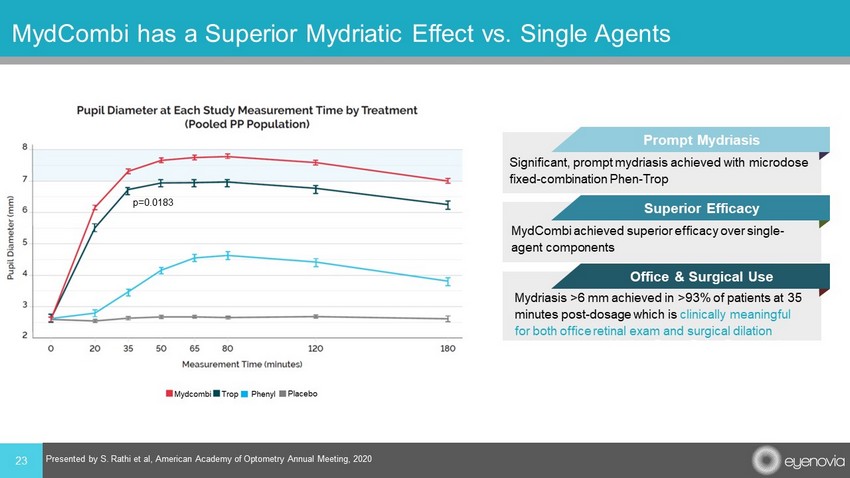

23 MydCombi has a Superior Mydriatic Effect vs. Single Agents Significant, prompt mydriasis achieved with microdose fixed - combination Phen - Trop Prompt Mydriasis Superior Efficacy Office & Surgical Use Modern PowerPoint Presentation MydCombi achieved superior efficacy over single - agent components Mydriasis >6 mm achieved in >93% of patients at 35 minutes post - dosage which is clinically meaningful for both office retinal exam and surgical dilation Presented by S. Rathi et al, American Academy of Optometry Annual Meeting, 2020 p=0.0183

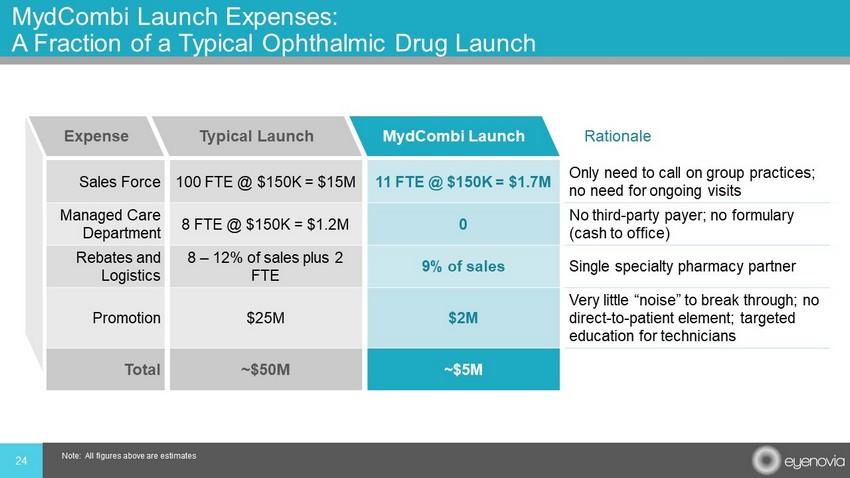

Expense Typical Launch MydCombi Launch Rationale Sales Force 100 FTE @ $150K = $15M 11 FTE @ $150K = $1.7M Only need to call on group practices; no need for ongoing visits Managed Care Department 8 FTE @ $150K = $1.2M 0 No third - party payer; no formulary (cash to office) Rebates and Logistics 8 – 12% of sales plus 2 FTE 9% of sales Single specialty pharmacy partner Promotion $25M $2M Very little “noise” to break through; no direct - to - patient element; targeted education for technicians Total ~$50M ~$5M 24 MydCombi Launch Expenses: A Fraction of a Typical Ophthalmic Drug Launch Note: All figures above are estimates

25 Intellectual Property An additional barrier is the clinical and regulatory hurdles a competitor would have to meet to gain approval for an 8µ dose Worldwide patents are granted on the dispenser, the drop size, velocity of delivery and data capture from the base unit are in effect until late 2031 Provisional patents have been filed on the Gen 2 dispenser and if approved will bring protection through 2040 Technology that has Multiple Layers of IP, Clinical and Regulatory Protection

Financial Snapshot 26 Nasdaq: EYEN Common Shares Outstanding 24.9M Equity Grants Outstanding Under Stock Plans 3.5M Warrants 2.3M Fully Diluted Shares 30.7M Cash $22.9M Debt None All figures as of September 30, 2020

27 Appendix

Board of Directors Dr. Fred Eshelman Chairman Founder and former CEO of PPDI, founding chairman of Furiex Pharmaceuticals, and founder of Eshelman Ventures Dr. Ernest Mario Board Member Former Chairman and CEO of Reliant Pharmaceuticals, ALZA, and Glaxo Holdings Dr. Curt LaBelle Board Member Managing Director of GHIF venture fund and Co - Founder of Eyenovia General partner of Hatteras Venture Partners Kenneth Lee Jr. Board Member Managing Director, Equity Capital Markets at Suntrust Robinson Humphrey Charles Mather IV Board Member CEO, Zentalis Pharmaceuticals, Inc. Dr. Anthony Sun Board Member 28 CEO, CMO and Co - Founder of Eyenovia Dr. Sean Ianchulev Board Member

Making it Possible March 2021