Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Karuna Therapeutics, Inc. | d138277d8k.htm |

Exhibit 99.1

SUBLEASE

SUBLEASE dated as of the 5th day of March, 2021, between WORKABLE, INC., a Delaware corporation, having an office at 99 High Street, Boston, Massachusetts 02110 (“Sublandlord”), and KARUNA THERAPEUTICS, INC., a Delaware corporation, having an office at 33 Arch Street, Suite 3110, Boston, Massachusetts 02110 (“Subtenant”).

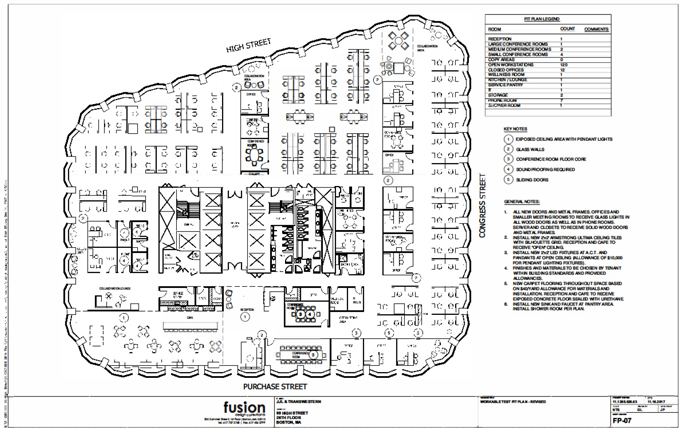

1. DEMISE AND TERM. Subject to issuance of the Arch Street Consent pursuant to Section 2(b) below and the Consent as set forth in Section 3 below, Sublandlord hereby leases to Subtenant, and Subtenant hereby leases from Sublandlord, the approximately 25,445 rentable square feet of space on the twenty-sixth (26th) floor, as more particularly shown on Exhibit A attached hereto (the “Subleased Premises”), of the building known as and numbered as 99 High Street, Boston, Massachusetts (the “Building”). The term of this Sublease (the “Sublease Term”) shall commence upon the date that is the latest to occur of (a) the date on which Sublandlord has received the Consent of the Prime Landlord (as defined in Section 3 below) to this Sublease, (b) the date on which Sublandlord delivers the Subleased Premises to Subtenant in the condition required pursuant to Section 13 below, (c) the issuance of the Arch Street Consent, and (d) April 1, 2021 (the “Commencement Date”), and expire on December 31, 2025 (the “Expiration Date”). Notwithstanding the foregoing, provided that Prime Landlord has issued the Consent on or before such date and Subtenant has paid the Security Deposit and first month’s Sublease Rent due hereunder and provided to Sublandlord and Prime Landlord a certificate of insurance demonstrating that Subtenant has procured and is maintaining the insurance coverages required hereunder, Subtenant may, without obligation to pay Sublease Rent, enter the Subleased Premises from and after March 19, 2021 solely for the purpose of installing its furniture, fixtures, tel/data, and equipment therein, provided that in the event Subtenant commences its business operations in any portion of the Subleased Premises prior to the Commencement Date as set forth above, the Commencement Date shall be the date on which Subtenant commences its business operations in the Subleased Premises.

2. SUBORDINATE TO PRIME LEASE; CONDITION PRECEDENT.

(a) This Sublease is subject and subordinate to (a) that certain Office Lease (the “Prime Lease”), dated January 31, 2018, by and between TREA 99 High Street LLC, as successor-in-interest to, Teachers Insurance and Annuity Association of America f/b/o Its Separate Real Estate Account (“Prime Landlord”), as landlord, and Sublandlord, as tenant, and (b) the matters to which the Prime Lease is or shall be subject and subordinate. A true and complete copy of the Prime Lease, with financial terms redacted, is attached hereto as Exhibit B and has been previously delivered to Subtenant, and Subtenant agrees that it has reviewed the Prime Lease and is fully familiar with the terms thereof.

(b) Notwithstanding any provision herein to the contrary, it shall be a condition precedent to the effectiveness of this Sublease that Subtenant’s current landlord, T-C 33 Arch Street LLC (“Arch Street Landlord”), owner of the building located at 33 Arch Street, Boston, Massachusetts, in which Subtenant is leasing certain premises (the “Arch Street Premises”) pursuant to that certain lease by and between said landlord and Subtenant dated November 2, 2018, as amended pursuant to a First Amendment to Lease dated January 22, 2020,

1

shall consent in writing (the “Arch Street Consent”) to the sublease by Sublandlord of the Arch Street Premises on terms and conditions set forth in the letter of intent between Sublandlord and Subtenant dated December 8, 2020, for a sublease term commencing on or around the Commencement Date set forth hereunder. In the event that the Arch Street Landlord has not issued the Arch Street Consent on or before the date that is sixty (60) days following the full execution and delivery of this Sublease, either Sublandlord or Subtenant shall have the right to terminate this Sublease upon thirty (30) days’ written notice to the other, and upon expiration of such thirty (30)-day period, this Sublease shall terminate and be of no further force and effect, unless the Arch Street Consent is issued within such thirty (30)-day period, in which case this Sublease shall continue in full force and effect. In the event of termination pursuant to this Section 2(b), Sublandlord shall promptly return to Subtenant the Security and the first month of Sublease Rent paid hereunder.

3. CONSENT OF PRIME LANDLORD. Sublandlord and Subtenant acknowledge and agree that this Sublease is subject to the consent of Prime Landlord and that this Sublease shall convey no rights to Subtenant until the Prime Landlord shall have given its written consent hereto in accordance with the terms of the Prime Lease (the “Consent”). Notwithstanding any provision of this Sublease to the contrary, in the event that Prime Landlord terminates the Prime Lease pursuant to Section 11(b) of the Prime Lease, or denies in writing Sublandlord’s request for the Consent, or otherwise fails to issue the Consent on or before the date that is sixty (60) days following the full execution and delivery of this Sublease by Sublandlord and Subtenant and the delivery by Sublandlord to Prime Landlord of any other documents required by Article 11 of the Prime Lease in connection with Prime Landlord’s evaluation of a proposed sublease, then (i) Sublandlord shall not be obligated to take any further action to obtain the Consent, provided Sublandlord shall use commercially reasonable efforts to obtain the Consent during such sixty (60)-day period, and (ii) either Sublandlord and Subtenant may terminate this Sublease by written notice delivered to the other within thirty (30) days following the expiration of such sixty (60)-day period, whereupon this Sublease shall be deemed null and void and of no further effect (except for those provisions expressly stated herein to survive such termination shall so survive), unless Prime Landlord issues the Consent within such thirty (30)-day period, in which case, this Sublease shall continue in full force and effect. In the event of termination of this Sublease by either party pursuant to this Section 3(a), the parties shall have no liability whatsoever to each other on account of such termination, except that promptly following such termination, Sublandlord shall return the Security Deposit held by it pursuant to Section 21 below and the first month’s Sublease Rent held by it pursuant to Section 10(c) below.

4. INCORPORATION BY REFERENCE.

(a) The terms, covenants and conditions of the Prime Lease are incorporated herein by reference so that, except as set forth in Section 4(b) below, and except to the extent that such incorporated provisions are inapplicable to the provisions of this Sublease, all of the terms, covenants and conditions of the Prime Lease that bind or inure to the benefit of the landlord thereunder shall, in respect to this Sublease, bind or inure to the benefit of Sublandlord, and all of the terms, covenants and conditions of the Prime Lease that bind or inure to the benefit of the tenant thereunder shall, in respect of this Sublease, bind or inure to the benefit of Subtenant, with the same force and effect as if such incorporated terms, covenants and conditions were completely set forth in this Sublease, and as if the words “Landlord” and “Tenant” or words of

2

similar import, wherever the same appear in the Prime Lease, are construed to mean, respectively, “Sublandlord” and “Subtenant” in this Sublease, and as if the words “Premises,” “leased premises” and “demised premises” or words of similar import, wherever the same appear in the Prime Lease, are construed to mean “Subleased Premises” in this Sublease, and as if the word “Lease” or words of similar import, wherever the same appear in the Prime Lease, are construed to mean this “Sublease,” and as if the words “Term” or words of similar import, wherever the same appear in the Prime Lease, are construed to mean “Sublease Term” in this Sublease. Notwithstanding the foregoing, the time limits contained in the Prime Lease for the giving of notices, making of demands or performing of any act, condition or covenant on the part of the tenant thereunder, or for the exercise by the tenant thereunder of any right or remedy, are changed for the purposes of incorporation herein by reference by shortening the same in each instance by five (5) days, so that in each instance Subtenant shall have five (5) days less time to observe or perform hereunder than Sublandlord has as the tenant under the Prime Lease, unless such period is five (5) or fewer days, in which instance Subtenant shall have two (2) days less time to observe or perform hereunder than Sublandlord has as the tenant thereunder.

(b) The following provisions of the Prime Lease shall not be incorporated herein by reference and shall not apply to this Sublease:

Basic Lease Provisions, Items 5, 6, 7, 9, 10, 11, 12, 14, and 15

Paragraph 1

Paragraph 2(a) – (b)

Paragraph 4(a) – (f)

Paragraph 19(c) and (k)

Paragraph 20

Paragraph 21

Exhibits D, E, and G

5. PERFORMANCE BY SUBLANDLORD. Any obligation of Sublandlord that is contained in this Sublease by incorporating the provisions of the Prime Lease shall be observed or performed by Sublandlord’s using commercially reasonable efforts, after written notice from Subtenant, to cause the Prime Landlord to observe and/or perform the same, and Sublandlord shall have the same period of time as set forth in the Prime Lease to enforce its rights to cause such observance or performance. Sublandlord shall not be required to perform any obligation of the Prime Landlord under the Prime Lease, and Sublandlord shall have no liability to Subtenant for the failure of the Prime Landlord to perform any obligation under the Prime Lease, except for Sublandlord’s obligation to use commercially reasonable efforts, upon receipt of written request of Subtenant, to cause the Prime Landlord to observe and/or perform its obligations under the Prime Lease, and upon the reasonable request of Subtenant, to exercise Sublandlord’s rights and remedies as set forth in the Prime Lease on account of any such default of Prime Landlord. Notwithstanding the foregoing or any provision of the Prime Lease to the contrary, Sublandlord shall have no obligation hereunder to commence any action or file any claim with any court having jurisdiction over the Subleased Premises with respect to any default of Prime Landlord under the Prime Lease. Sublandlord shall not be responsible for any failure or interruption for any reason whatsoever of the services or facilities that are appurtenant to, or supplied at or to, the Subleased Premises, including, without limitation, electricity, heat, air conditioning, water, elevator service and cleaning service, if any, unless the same arises solely from Sublandlord’s

3

failure to pay when due any amounts owed to the Prime Landlord or the utility provider (but only in the event that Subtenant has paid such amounts to Sublandlord). No failure to furnish, or interruption of, any such services or facilities shall give rise to any (a) abatement or reduction of Subtenant’s obligations under this Sublease; provided, however, Subtenant shall be entitled to equitably share in any abatements of Base Rent and Additional Rent relating solely to the Subleased Premises as a result thereof that actually are enjoyed by Sublandlord pursuant to the Prime Lease, or (b) liability on the part of Sublandlord except to the extent such failure is attributable to Sublandlord’s gross negligence or willful misconduct, or a default by Sublandlord under the Prime Lease, and with respect to any such default by Sublandlord, such default was not caused by the actions or omissions of Subtenant. Notwithstanding anything in this Sublease to the contrary, wherever term “Landlord” is used in the Prime Lease in connection with Landlord’s ownership, sale, or management of, or rights to install signage for, alter, modify, or improve, the Premises, Common Areas, Building, or Land, “Landlord’s” right to promulgate rules and regulations, and the like, such term shall be deemed to refer to Prime Landlord. For the avoidance of doubt, Sublandlord shall have no right to collect from Subtenant a property management fee, interest on amortized capital improvements, supervision or oversight fees in connection with Alterations, or administration fees in connection with this Sublease, separate and apart from those due from Sublandlord to Prime Landlord pursuant to the terms and provisions of the Prime Lease.

6. NO BREACH OF PRIME LEASE; NO AMENDMENTS TO PRIME LEASE. Neither Sublandlord nor Subtenant shall do or permit to be done any act or thing that will constitute a breach or violation of any term, covenant or condition of the Prime Lease by the tenant thereunder or that could cause the Prime Lease to be terminated, whether or not such act or thing is permitted under the provisions of this Sublease. So long as Subtenant makes timely payment to Sublandlord of all Sublease Rent payable by Subtenant under this Sublease, Sublandlord shall make timely payment of all Rent due to Prime Landlord under the Prime Lease. Sublandlord shall not agree to amend or modify the Prime Lease without the prior written consent of Subtenant in its reasonable discretion; provided, however, it shall be reasonable, without limitation, for Subtenant to withhold its consent to a proposed amendment or modification that affects the term of the Prime Lease, increases “Tenant’s Proportionate Share” (as such phrase is used in the Prime Lease), or otherwise diminishes Subtenant’s rights or increases Subtenant’s obligations under this Sublease.

7. NO PRIVITY OF ESTATE. Nothing contained in this Sublease shall be construed to create privity of estate or of contract between Subtenant and the Prime Landlord.

8. INDEMNITY; INSURANCE.

(a) Subtenant shall indemnify, defend and hold harmless Sublandlord from and against all claims, actions, losses, costs, damages, expenses and liabilities, including, without limitation, reasonable attorneys’ fees and expenses (collectively, “Claims”), which Sublandlord may incur or pay by reason of (i) any accidents, damages or injuries to persons or property occurring in or on the Subleased Premises during Subtenant’s occupancy thereof, whether caused or claimed by Subtenant or its employees, agents, customers, contractors, invitees, or any other person claiming through or under Subtenant, (ii) any work done in or to the Subleased Premises by Subtenant and/or Subtenant’s employees, agents, contractors, invitees or any other person

4

claiming through or under Subtenant, (iii) any violation of the terms of this Sublease or default hereunder by Subtenant that causes a default under the Prime Lease, or (iv) any negligence or intentional misconduct on the part of Subtenant and/or Subtenant’s employees, agents, customers, contractors, invitees, or any other person claiming through or under Subtenant.

(b) Before taking possession of the Subleased Premises, Subtenant shall procure and throughout the Sublease Term it shall maintain all insurance that Sublandlord is required to maintain under the Prime Lease, naming Sublandlord and Prime Landlord (and its designees) and any mortgagee of Prime Landlord, and any other parties required pursuant to the Prime Lease, as additional insureds.

(c) Sublandlord shall indemnify, defend and hold harmless Subtenant from and against all Claims that Subtenant may incur or pay solely by reason of the gross negligence or intentional misconduct on the part of Sublandlord and/or its employees, agents, contractors or any other person claiming through or under Sublandlord.

(d) Notwithstanding any provision herein to the contrary, the provisions of this Section 8 shall survive expiration of the Sublease Term or earlier termination of this Sublease.

9. MUTUAL WAIVER OF SUBROGATION. Notwithstanding any provision hereof to the contrary, including without limitation Sections 8(a) and (c) above, Sublandlord and Subtenant each hereby release and relieve the other, and waive their entire right to recover damages against the other, for loss or damage to its property arising out of or incident to the perils required to be insured against herein to the extent of recoverable insurance proceeds, even in the event such loss or damage is caused by the negligence of the released party. The parties agree to have their respective property damage insurance carriers waive any right to subrogation that such companies may have against Sublandlord or Subtenant, as the case may be, so long as the insurance is not invalidated thereby.

10. SUBLEASE RENT AND ADDITIONAL RENT.

(a) Subtenant shall pay to Sublandlord rent (“Sublease Base Rent”) on the first day of each month during the Sublease Term (and proportionately on a per diem basis for any partial month of the Sublease Term) as follows:

| Months of Sublease Term |

Sublease Base Rent per RSF |

Sublease Base Rent per annum |

Sublease Base Rent per month |

|||||||||

| Months 1 - 3 |

$ | 0 | $ | 0 | $ | 0 | ||||||

| Months 4 – 12 |

$ | 60.00 | $ | 1,526,700.00 | $ | 127,225.00 | ||||||

| Months 13 – 24 |

$ | 61.00 | $ | 1,552,145.00 | $ | 129,345.42 | ||||||

| Months 25 – 36 |

$ | 62.00 | $ | 1,577,590.00 | $ | 131,465.83 | ||||||

| Months 37 – 48 |

$ | 63.00 | $ | 1,603,035.00 | $ | 133,586.25 | ||||||

| Months 49 – Expiration Date |

$ | 64.00 | $ | 1,628,480.00 | $ | 135,706.67 | ||||||

5

(b) As shown above, Sublease Base Rent shall be abated for the first three months of the Sublease Term (the “Sublease Base Rent Abatement Period”). The first day of Month 4 of the Sublease Term shall be referred to herein as the “Sublease Base Rent Commencement Date.” The Sublease Base Rent due for any partial calendar month immediately following the Sublease Base Rent Abatement Period shall be prorated based on the number of days in that month. If there occur two (2) monetary “events of default” (as defined in Section 12 of the Prime Lease) of Subtenant in any twelve (12) month period under this Sublease, then Subtenant’s right to abate the Sublease Base Rent as provided in this Section 10(b) shall immediately terminate and be of no further force and effect and any and all Sublease Base Rent which had been abated in accordance with this Section 10(b) prior to such second (2nd) event of default shall immediately become due and payable. Any provisions in the Prime Lease incorporated herein by reference referring to “Base Rent,” or words of similar import shall be deemed to refer to Sublease Base Rent due under this Sublease. For the avoidance of doubt, the Base Rent set forth in Item 2 of the Basic Lease Provisions in the Prime Lease shall be replaced with the Sublease Base Rent provided in Section 10(a).

(c) The first full monthly installment of Sublease Base Rent that is due hereunder following expiration of the Sublease Base Rent Abatement Period shall be paid upon the signing of this Sublease.

(d) If Prime Landlord provides additional services to the Subleased Premises at Subtenant’s request of Sublandlord, including without limitation those Extra Services listed in Section 7(b) of the Prime Lease, Subtenant shall pay all charges payable to the Prime Landlord therefor within fifteen (15) days following written demand of Prime Landlord or Sublandlord.

(e) For purposes of Additional Rent due from Subtenant hereunder (the “Sublease Additional Rent”), Section 3 of the Prime Lease shall apply, except that: (i) the Base Year for Operating Expenses shall be calendar 2021 and the Base Year for Real Estate Taxes shall be Fiscal Year 2022 (i.e., July 1, 2021 to June 30, 2022); (ii) for purpose of calculation of Subtenant’s obligation to pay Additional Rent, the Base Years set forth in Item 8 of the Basic Lease Provisions shall be revised accordingly; and (iii) notwithstanding anything in this Sublease to the contrary, wherever the term “Landlord” is used in Section 3 of the Prime Lease in connection with Landlord’s discretion or the calculation Operating Expenses and Real Estate Taxes, such term shall be deemed to refer to Prime Landlord. Commencing on July 1, 2022 (following expiration of the Base Year for Real Estate Taxes), Subtenant shall pay to Sublandlord all Taxes Additional Rent due from Sublandlord under the Prime Lease, and commencing on January 1, 2022 (following expiration of the Base Year for Operating Expenses), Subtenant shall pay to Sublandlord all Operating Expenses Additional Rent due from Sublandlord under the Prime Lease. For the avoidance of doubt, Sublandlord shall have no obligation to prepare the annual Statement pursuant to Section 3(g) of the Prime Lease, but shall provide Subtenant with a copy of the annual Statement prepared by Prime Landlord promptly upon Sublandlord’s receipt thereof.

(f) Sublease Rent and other amounts payable by Subtenant to Sublandlord under the provisions of this Sublease shall be paid promptly when due, without notice or demand therefor (except as expressly set forth herein), and without deduction, abatement, counterclaim or setoff, except as expressly set forth herein. Sublease Rent shall be paid to Sublandlord in lawful

6

money of the United States at the address of Sublandlord set forth at the beginning of this Sublease, or to such other person and/or at such other address as Sublandlord may from time to time designate by written notice to Subtenant. As used herein, the term “Sublease Rent” shall include Sublease Base Rent and Sublease Additional Rent. Any provisions in the Prime Lease incorporated herein by reference referring to “Additional Rent,” “Rent,” or words of similar import, wherever the same appear in the Prime Lease, are construed to mean, respectively, “Sublease Additional Rent” and “Sublease Rent” in this Sublease.

11. UTILITIES AND OTHER CHARGES.

(a) Per Section 7(b)(vi) of the Prime Lease, Subtenant shall pay Sublandlord (or at Prime Landlord’s option and upon written notice to Sublandlord and Subtenant, Prime Landlord directly) for all electricity consumed in the Subleased Premises, as measured by an existing submeter.

(b) Subtenant’s use of electric current in the Subleased Premises shall not at any time exceed the capacity of any of the electrical conductors, feeders or risers and equipment in the Building or otherwise serving the Subleased Premises identified in Section 7(a)(v) of the Prime Lease. Sublandlord shall not be liable in any way to Subtenant for any failure or defect in the supply or character of electric current distributed to the Subleased Premises or for any loss or damage or expense which Subtenant may sustain or incur if either the said supply or character of electric current either fails or changes or is no longer available for Subtenant’s requirements.

12. USE. Subtenant shall use and occupy the Subleased Premises only for general office purposes, and for no other purpose, pursuant to Section 6 of the Prime Lease. Subtenant shall not violate the prohibitions on use contained in the Prime Lease, and shall not engage in any Prohibited Use (as defined in said Section 6). Subtenant shall comply with all provisions of the Prime Lease and all present and future laws, statutes, ordinances, orders, rules, regulations and requirements of all Federal, state and municipal governments asserting jurisdiction over the Subleased Premises.

13. CONDITION OF SUBLEASED PREMISES. Subtenant is subleasing the Subleased Premises “AS IS,” and Sublandlord shall have no obligation to furnish, render or supply any work, labor, services, fixtures, equipment, decorations or other items to make the Subleased Premises ready or suitable for Subtenant’s occupancy. Sublandlord has not made and does not make any representations or warranties as to the physical condition of the Subleased Premises, or any other matter affecting or relating to the Subleased Premises. Notwithstanding anything in this Section to the contrary, Sublandlord shall deliver the Subleased Premises vacant, free of all trash, debris, and personal property other than the Furniture (as defined below), and in broom clean condition, on the Commencement Date.

14. CONSENTS AND APPROVALS. In any instance when Sublandlord’s consent or approval is required under this Sublease, Sublandlord’s refusal to consent to or approve any matter or thing shall be deemed reasonable if, inter alia, such consent or approval has not been obtained from the Prime Landlord under the Prime Lease (if such consent of Prime Landlord is required). If Subtenant shall seek the approval or consent of Sublandlord and Sublandlord shall fail or refuse to give such consent or approval, Subtenant shall not be entitled to any damages for any withholding or delay of such approval or consent by Sublandlord, it being intended that Subtenant’s sole remedy shall be an action for injunction or specific performance.

7

15. TERMINATION OF PRIME LEASE. Except as required or expressly permitted in the Prime Lease, Sublandlord will not take any action which would constitute a voluntary surrender under, or termination of, the Prime Lease. If for any other reason the term of the Prime Lease shall terminate prior to the expiration of the Sublease Term, this Sublease shall thereupon be terminated (except provisions that expressly survive expiration of the Sublease Term or earlier termination of the Sublease shall so survive). Sublandlord shall not be liable to Subtenant by reason of such termination of the Prime Lease and Sublease unless all the following conditions are true: (a) Sublandlord caused such termination as a result of its breach of the Prime Lease, (b) Prime Landlord fails to accept this Sublease as a direct lease between Prime Landlord and Subtenant on substantially the same terms hereof, and (c) Subtenant did not cause any event of default under the Prime Lease in contravention of this Sublease. Notwithstanding the foregoing, nothing herein requires Prime Landlord to accept this Sublease as a direct lease nor is to be construed as any guarantee that the Prime Landlord will do so.

16. ASSIGNMENT AND SUBLETTING. Subtenant shall not, without the prior written consent of Sublandlord and Prime Landlord pursuant to the terms of Section 11 of the Prime Lease, assign, sell, mortgage, pledge or in any other manner transfer or encumber this Sublease or any interest therein, or sublease the Subleased Premises or any part or parts thereof, or grant any concession or license or otherwise permit occupancy of all or any part of the Subleased Premises by any person (each such event, a “Transfer”). Sublandlord shall not unreasonably withhold, condition, or delay its consent to any such Transfer, provided that Prime Landlord consents to such Transfer in accordance with the provisions of the Prime Lease, otherwise, it shall not be unreasonable for Sublandlord to withhold such consent. Without limitation, the sale of all or substantially all of Subtenant’s assets, or the sale of 50% or more of any class of its capital stock, voting securities, or member interests, by operation of law or otherwise, shall not be considered a Transfer and shall not require the prior written consent of Sublandlord; provided, however, that such a sale shall be subject to the prior written consent of Prime Landlord if and to the extent required pursuant to the Prime Lease or the Consent. Notwithstanding approval of any Transfer by Sublandlord and Prime Landlord as required hereunder, Subtenant shall at all times remain directly, primarily and fully responsible and liable for the payment of all sums payable hereunder and for compliance with all the obligations of Subtenant hereunder. Notwithstanding anything in this Sublease to the contrary, wherever term “Landlord” is used in Section 11 of the Prime Lease in connection with Landlord’s recapture rights, such term shall be deemed to refer to Prime Landlord.

17. ALTERATIONS. Subtenant shall not make, cause, or permit the making of any Alterations (as defined in the Prime Lease) in or to the Subleased Premises, unless Sublandlord provides written consent thereto, which consent shall not be unreasonably withheld, conditioned, or delayed if Prime Landlord consents to such Alteration in accordance with the provisions of Section 4 of the Prime Lease. Notwithstanding the foregoing, it shall not be unreasonable for Sublandlord to deny approval for such Alterations proposed by Subtenant if Prime Landlord requires such Alterations to be removed on or before the end of the Term of the Prime Lease, and Subtenant refuses to commit in writing to perform at its expense such removal and restoration of any such Alterations made by it.

8

18. BROKERAGE. Subtenant and Sublandlord each represents to the other that it has not dealt with any broker or finder other than Jones Lang LaSalle (the “Broker”) in connection with this sublease transaction. Subtenant and Sublandlord each agree to indemnify, defend and hold the other harmless from and against any costs and expenses (including, without limitation, reasonable attorneys’ fees) resulting from a breach or claimed breach by the indemnifying party of the foregoing representation. Sublandlord shall pay any commission due to the Broker in connection with this Sublease pursuant to the terms of separate agreements. The provisions of this Section 18 shall survive the expiration or earlier termination of this Sublease.

19. WAIVER OF JURY TRIAL AND RIGHT TO COUNTERCLAIM. Subtenant hereby waives all right to trial by jury in any summary or other action, proceeding, or counterclaim arising out of or in any way connected with this Sublease. Subtenant also hereby waives all right to assert or interpose a counterclaim (but not the right to raise or assert valid defenses and excepting any mandatory counterclaims) in any summary proceeding or other action or proceeding to recover or obtain possession of the Subleased Premises or for nonpayment of Sublease Rent. The provisions of this Section 19 shall survive the expiration or earlier termination of this Sublease.

20. HOLDOVER. If Subtenant remains in possession of the Subleased Premises after the Expiration Date or other termination of the Sublease Term without a new written lease or written extension of the Sublease Term approved by Prime Landlord, Subtenant shall be deemed a tenant at sufferance on the terms and provisions set forth in Section 19(f) of the Prime Lease, and Subtenant shall pay to Sublandlord the holdover rent required by said Section 19(f) as applicable to the Sublease Rent and all other charges or obligations of tenant of any kind contained in the Prime Lease, including, without limitation all charges and damages pursuant thereto.

21. SECURITY DEPOSIT. Subtenant shall deliver to Sublandlord simultaneously with the execution of this Sublease a security deposit (the “Security”) in the amount of $381,675.00. The Security shall secure performance and observance by Subtenant of the terms, covenants and conditions of this Sublease. Upon an event of default by Subtenant under this Sublease, Sublandlord may use, apply or retain the whole or any part of the Security so deposited to the extent required for the payment of any Sublease Rent or any other sum attributable to the event of default, or for reimbursement of any sum that Sublandlord may be required to expend by reason of the event of default in respect of this Sublease, including, but not limited to, any damages or deficiency in re-subletting the Subleased Premises. The Security, less any amounts deducted pursuant to this Section, shall be returned to Subtenant within thirty (30) days after the Expiration Date and after delivery of possession of the entire Subleased Premises to Sublandlord in the condition required hereunder. Subtenant further covenants that it will not assign or encumber or attempt to assign or encumber the monies deposited herein as Security.

22. SURRENDER. Subtenant shall, on the expiration or earlier termination of this Sublease, comply with all of the provisions of the Prime Lease relating to the condition and surrender of the Subleased Premises at the expiration of the term of the Prime Lease. Subtenant agrees to reimburse Sublandlord for all costs and expenses incurred in removing and storing Subtenant’s property, or repairing any damage to the Subleased Premises caused by or resulting from Subtenant’s failure to comply with the provisions of this Section 22. The provisions of this Section 22 shall survive the expiration or earlier termination of this Sublease.

9

23. NO WAIVER. Sublandlord’s receipt and acceptance of Sublease Rent, or Sublandlord’s acceptance of performance of any other obligation by Subtenant, with knowledge of Subtenant’s breach of any provision of this Sublease, shall not be deemed a waiver of such breach. No waiver by either party hereto of any term, covenant or condition of this Sublease shall be deemed to have been made unless expressed in writing and signed by such party.

24. SUCCESSORS AND ASSIGNS. The provisions of this Sublease, except as herein otherwise specifically provided, shall extend to, bind and inure to the benefit of the parties hereto and their respective successors and permitted assigns.

25. LIABILITY OF PARTIES. Each party’s employees, officers, directors and shareholders, disclosed or undisclosed, shall have no personal liability under this Sublease.

26. NOTICES. All notices, requests, demands and other communications with respect to this Sublease shall be in writing, shall be delivered personally or sent by registered or certified mail, return receipt requested or nationally recognized overnight courier (against signed receipt) and shall be deemed to have been given or made when received at the following addresses:

If to Sublandlord:

Workable, Inc.

99 High Street

Boston, MA 02110

Attention: Craig DiForte, CFO

Following Sublease Term Commencement:

Workable, Inc.

33 Arch Street

Suite 3110

Boston, MA 02110

Attention: Craig DiForte, CFO

With copy to:

Jennifer A. Jester, Esq.

Saul Ewing Arnstein & Lehr LLP

131 Dartmouth Street

Suite 501

Boston, MA 02116

jennifer.jester@saul.com

10

If to Subtenant:

Karuna Therapeutics, Inc.

33 Arch Street

Suite 3110

Boston, MA 02110

Attn: Christine Cutting

Following Sublease Term Commencement:

Karuna Therapeutics, Inc.

99 High Street

Boston, MA 02110

Attention: Christine Cutting

With copy to:

David L. Wiener, Esq.

Anderson & Kreiger LLP

50 Milk Street, 21st Floor

Boston, Massachusetts 02109

dwiener@andersonkreiger.com

Either party may designate, by similar written notice to the other party, any other address for such purposes.

27. SIGNS. Subtenant may not install any signs, except as may be consented to by Prime Landlord, if and to the extent such consent is required, in accordance with the provisions of the Prime Lease. Upon the written request of Subtenant, Sublandlord shall request, but has no obligation to obtain, Prime Landlord’s consent to signage for Subtenant generally consistent with the signage of current tenants in the Building, which (if Prime Landlord so consents) shall be installed and removed by Subtenant at its sole cost and expense consistently with the requirements hereof and of the Prime Lease. Sublandlord makes no representations or warranties as to Prime Landlord’s approval or disapproval of Subtenant’s signage, directory, or listing requests.

28. PRIME LEASE REQUIREMENTS. In the event of Prime Landlord’s termination, re-entry, or dispossession of the Premises under the Prime Lease, Prime Landlord may, at its option, take over all of the right, title, and interest of Sublandlord, as sublandlord, under this Sublease, and Subtenant shall, at Prime Landlord’s option, attorn to Prime Landlord, except that Prime Landlord shall not (a) be liable for any previous act or omission of Sublandlord under the Sublease, unless and to the extent of a continuing nature and Prime Landlord shall have prior written notice of the same, (b) be subject to any counterclaim, offset, or defense, not expressly provided in this Sublease that theretofore accrued to Subtenant against Sublandlord, (c) be bound by any previous modification of this Sublease not approved by Prime Landlord in writing or by any previous prepayment of more than one (1) months’ Sublease Rent, and all such Sublease Rent shall remain due and owing, notwithstanding such advance payment of any more than one (1) months’ rent, or (d) be obligated to perform any work in the Subleased Premises or to prepare for occupancy, and in connection with such attornment, Subtenant shall execute and

11

deliver to Prime Landlord any instruments that Prime Landlord may reasonably request to evidence and confirm such attornment. The provisions of this Section 28 are self-operative and no further instrument is required to give effect to this provision.

29. FURNITURE. Simultaneously with the execution of this Sublease, Sublandlord and Subtenant shall execute the Bill of Sale attached hereto as Exhibit D (the “Bill of Sale”) pursuant to which Sublandlord shall convey to Subtenant, for consideration of Nineteen Thousand Six Hundred and 00/100 Dollars ($19,600.00), all of Sublandlord’s right, title, and interest in and to all furniture, fixtures and equipment (including without limitation all tel/data cabling and wiring) currently located in the Subleased Premises, owned by Sublandlord and identified in Exhibit C attached hereto (the “Furniture”). Subtenant hereby accepts the Furniture in its “as-is,” “where-is” condition, and Sublandlord makes no representations or warranties whatsoever as to the condition, merchantability or fitness for any particular purpose of the Furniture, except as otherwise set forth in the Bill of Sale. Notwithstanding any provision of this Sublease to the contrary, Subtenant shall be responsible for removal of the Furniture from the Subleased Premises on or before the expiration or earlier termination of the Sublease Term.

30. PARKING. Subtenant shall be entitled to use of six (6) parking spaces during the Sublease Term, at the then-current rate charged by Prime Landlord, subject to and in compliance with the terms of Section 18 of the Prime Lease. Notwithstanding anything in this Sublease to the contrary, wherever term “Landlord” is used in Section 18 of the Prime Lease in connection with the management of the Parking Area, such term shall be deemed to refer to Prime Landlord.

31. COUNTERPARTS. This Sublease may be executed in one or more counterparts by the parties hereto, and: (a) each such counterpart shall be considered an original, and all of which together shall constitute a single agreement; (b) the exchange of executed copies of this Sublease by facsimile or so-called “portable document format” (“PDF”) transmission shall constitute effective execution and delivery of this Sublease as to the parties for all purposes; and (c) signatures of the parties transmitted by facsimile or PDF shall be deemed to be their original signatures for all purposes.

[INTENTIONALLY BLANK; SIGNATURE PAGE FOLLOWS]

12

IN WITNESS WHEREOF, Sublandlord and Subtenant have executed this Sublease as of the day and year first above written.

| SUBLANDLORD | ||

| WORKABLE, INC., | ||

| a Delaware corporation | ||

| By: | /s/ Nikolaos Moraitakis | |

| Name: Nikolaos Moraitakis | ||

| Title: CEO | ||

| SUBTENANT | ||

| KARUNA THERAPEUTICS INC., | ||

| a Delaware corporation | ||

| By: | /s/ Andrew Miller | |

| Name: Andrew Miller | ||

| Title: COO | ||

13

EXHIBIT A

Subleased Premises

14

EXHIBIT B

Redacted Lease

15

OFFICE LEASE

By and Between

TEACHERS INSURANCE AND ANNUITY ASSOCIATION OF AMERICA

F/B/O ITS SEPARATE REAL ESTATE ACCOUNT,

a New York Corporation

(“Landlord”)

and

WORKABLE INC.,

a Delaware corporation

(“Tenant”)

dated as of

January 31, 2018

TABLE OF CONTENTS

| LEASE OF PREMISES |

1 | |||||

| BASIC LEASE PROVISIONS |

1 | |||||

| STANDARD LEASE PROVISIONS |

6 | |||||

| 1. |

TERM |

6 | ||||

| 2. |

BASE RENT |

7 | ||||

| 3. |

ADDITIONAL RENT |

7 | ||||

| 4. |

IMPROVEMENTS AND ALTERATIONS; DELIVERY |

14 | ||||

| 5. |

REPAIRS |

18 | ||||

| 6. |

USE OF PREMISES |

19 | ||||

| 7. |

UTILITIES AND SERVICES |

23 | ||||

| 8. |

INDEMNIFICATION; INSURANCE |

27 | ||||

| 9. |

FIRE OR CASUALTY |

31 | ||||

| 10. |

EMINENT DOMAIN |

32 | ||||

| 11. |

ASSIGNMENT AND SUBLETTING |

33 | ||||

| 12. |

DEFAULT |

39 | ||||

| 13. |

ACCESS; CONSTRUCTION |

44 | ||||

| 14. |

BANKRUPTCY |

45 | ||||

| 15. |

LANDLORD DEFAULTS |

46 | ||||

| 16. |

SUBORDINATION; ATTORNMENT; ESTOPPEL CERTIFICATES |

46 | ||||

| 17. |

SALE BY LANDLORD; TENANT’S REMEDIES; NONRECOURSE LIABILITY |

48 | ||||

| 18. |

PARKING; COMMON AREAS |

49 | ||||

| 19. |

MISCELLANEOUS |

51 | ||||

| 20. |

LETTER OF CREDIT |

59 | ||||

| 21. |

RENEWAL OPTION |

61 | ||||

LIST OF EXHIBITS

| Exhibit A-l | Floor Plan | |

| Exhibit A-2 | Legal Description of the Land | |

| Exhibit B | Building Rules and Regulations | |

| Exhibit C | Form of Tenant Estoppel Certificate | |

| Exhibit D | Form of Commencement Letter | |

| Exhibit E | Form of Letter of Credit | |

| Exhibit F | Tenant Insurance Requirements | |

| Exhibit G | Schematic Plan/Description of Landlord’s Work | |

| Exhibit H | Cleaning Specifications |

-i-

OFFICE LEASE

THIS OFFICE LEASE (this “Lease”) is made between TEACHERS INSURANCE AND ANNUITY ASSOCIATION OF AMERICA F/B/O ITS SEPARATE REAL ESTATE ACCOUNT, a New York Corporation (“Landlord”), and the Tenant described in Item 1 of the Basic Lease Provisions.

LEASE OF PREMISES

Landlord hereby leases to Tenant and Tenant hereby leases from Landlord, subject to all of the terms and conditions set forth herein, those certain premises (the “Premises”) described in Item 3 of the Basic Lease Provisions and as shown in the drawing attached hereto as Exhibit A-l. The Premises are located in the Building described in Item 2 of the Basic Lease Provisions. The Building is located on that certain land (the “Land”) more particularly described on Exhibit A-2 attached hereto, which is also improved with landscaping and other improvements, fixtures and common areas and appurtenances now or hereafter placed, constructed or erected on the Land.

| BASIC LEASE PROVISIONS

| ||||

| 1. | Tenant: | Workable Inc., a Delaware corporation (“Tenant”) | ||

| 2. | Building: | 99 High Street Boston, Massachusetts 02110 | ||

| 3. | Description of Premises: | 25,445 rentable square feet, constituting the entire rentable area on the twenty-sixth (26th) floor of the Building.

The Premises do not include the area above dropped ceilings, below the upper surface of floor slabs or the areas outside of the inner surface of walls and plate glass (the areas above dropped ceilings and outside the inner surface of interior walls are referred to in this Lease as “Installation Areas”). | ||

| Rentable Area of the Premises: | 25,445 rentable square feet | |||

| Rentable Area of Building: | 731,204 rentable square feet | |||

| 4. | Tenant’s Proportionate Share: | 3.479% (25,445 rsf/731,204 rsf) (See Paragraph 3) | ||

-1-

| 5. | Base Rent: (See Paragraph 2) |

For and with respect to the period of time commencing on the Rent Commencement Date through and including the day immediately preceding the first (1st) anniversary of the Rent Commencement Date (both dates inclusive), at the rate of per annum ( per month). | ||

| For and with respect to the period of time commencing on the first (lst) anniversary of the Rent Commencement Date through and including the day immediately preceding the day which is one hundred eighty (180) days after the first (1st) anniversary of the Rent Commencement Date (both dates inclusive), at the rate of per annum ( per month). | ||||

| For and with respect to the period of time commencing on the day which is one hundred eighty (180) days after the first (1st) anniversary of the Rent Commencement Date through and including the day immediately preceding the second (2nd) anniversary of the Rent Commencement Date (both dates inclusive), at the rate of per annum ( per month). | ||||

| For and with respect to the period of time commencing on the second (2nd) anniversary of the Rent Commencement Date through and including the day immediately preceding the third (3rd) anniversary of the Rent Commencement Date (both dates inclusive), at the rate of per annum ( Per month). | ||||

| For and with respect to the period of time commencing on third (3rd) anniversary of the Rent Commencement Date through and including the day immediately preceding the fourth (4th) anniversary of the Rent Commencement Date (both dates inclusive), at the rate of per annum ( per month). | ||||

-2-

| For and with respect to the period of time commencing on fourth (4th) anniversary of the Rent Commencement Date through and including the day immediately preceding the fifth (5th) anniversary of the Rent Commencement Date (both dates inclusive), at the of per annuam ( per month). | ||

| For and with respect to the period of time commencing on fifth (5th) anniversary of the Rent Commencement Date through and including the day immediately preceding the sixth (6th) anniversary of the Rent Commencement Date (both dates inclusive), at the rate of per annum ( per month). | ||

| For and with respect to the period of time commencing on sixth (6th) anniversary of the Rent Commencement Date through and including the Expiration Date (both dates inclusive), at the rate of Per annuam ($ per month). | ||

| 6. First Month’s Base Rent Payable Upon Execution: |

||

| 7. Letter of Credit Amount: |

(See Paragraph 20) | |

| 8. Base Year for Operating Expenses: |

Calendar Year 2018 (See Paragraph 3) | |

| Base Year for Real Estate Taxes: |

Fiscal Year 2019 (i.e., July 1, 2018 - June 30, 2019) (See Paragraph 3) | |

| 9. Term: |

The period of time commencing on the Commencement Date and expiring on the last day of the calendar month in which the day immediately preceding the seventh (7th) anniversary of the Rent Commencement Date occurs (the “Expiration Date”), unless earlier terminated in accordance with the provisions of this Lease or renewed in accordance with the provisions of Paragraph 21 of this Lease. | |

-3-

| 10. Commencement Date: |

The date on which the Premises are delivered to Tenant in the Delivery’ Condition. | |

| Rent Commencement Date: |

The date which is six (6) months after the Commencement Date. | |

| Scheduled Commencement Date: |

The date which is six (6) months after the Effective Date. | |

| 11. Brokert(s) (See Paragraph 19(k)) |

||

| Landlord’s Broker: |

Jones Lang LaSalle New England, L.L.C. | |

| Tenant’s Broker: |

Jones Lang LaSalle New England, L.L.C. | |

| 12. Number of Parking Spaces: |

Six (6) Parking Spaces, on the terms and conditions set forth in Paragraph 18 | |

| 13. Address for Notices: |

||

| To: TENANT: |

To: LANDLORD: | |

| Prior to the Commencement Date: |

Office of the Building: | |

| 33-41 Farnsworth Street Boston, Massachusetts 02210

After the Commencement Date:

At the premises |

Jones Lang LaSalle Building Management Office 99 High Street Boston, Massachusetts, 02110 Attention: General Manager | |

|

With copies to: | ||

|

Teachers Insurance and Annuity Association of America f/b/o its separate real estate account c/o TH Real Estate 730 Third Avenue, 4th Floor New York, New York 10017 Attn: Asset Manager, Fixed Income and Real Estate | ||

| -and- | ||

| Goulston & Storrs PC 400 Atlantic Avenue Boston, Massachusetts 02110 Attn: Frank E. Litwin, Esq. | ||

-4-

| 14. Address for Payment of Rent: |

All payments payable under this Lease shall be sent to Landlord at: | |

| c/o Jones Lang LaSalle Office of the Building 99 High Street Boston, Massachusetts 02110 | ||

| Or to such other address as Landlord may designate to Tenant from time to time in writing. | ||

| 15. Effective Date: |

January 31, 2018 | |

| 16. The “State” |

The Commonwealth of Massachusetts. | |

This Lease consists of the foregoing introductory paragraphs and Basic Lease Provisions, the provisions of the Standard Lease Provisions (the “Standard Lease Provisions”) (consisting of Paragraph 1 through Paragraph 21 which follow) and Exhibit A through Exhibit H, all of which are incorporated herein by this reference. In the event of any conflict between the provisions of the Basic Lease Provisions and the provisions of the Standard Lease Provisions, the Standard Lease Provisions shall control.

-5-

STANDARD LEASE PROVISIONS

| 1. | TERM |

(a) The Term of this Lease shall commence on the Commencement Date (as defined in Item 10 of the Basic Lease Provisions. Unless earlier terminated in accordance with the provisions hereof, the Term of this Lease shall be the period shown in Item 9 of the Basic Lease Provisions. As used herein, “Lease Term” shall mean the Term referred to in Item 9 of the Basic Lease Provisions, subject to any extension of the Term hereof exercised in accordance with the terms and conditions expressly set forth herein, and any early termination thereof and “Expiration Date” shall be the last day of the Lease Term. The first “Lease Year” shall commence on the Rent Commencement Date and shall end on the last day of the calendar month preceding the month in which the first anniversary of the Rent Commencement Date occurs. Each succeeding Lease Year shall commence on the day following the end of the preceding Lease Year and shall extend for twelve (12) consecutive months; provided, however, the last Lease Year shall expire on the Expiration Date. Unless Landlord terminates this Lease prior to the Expiration Date in accordance with the provisions hereof, Landlord shall not be required to provide notice to Tenant of the Expiration Date. This Lease shall be a binding contractual obligation effective upon execution hereof by Landlord and Tenant, notwithstanding the later commencement of the Term of this Lease.

(b) Upon delivery of the Premises to Tenant, Landlord shall prepare and deliver to Tenant, Tenant’s Commencement Letter substantially in the form of Exhibit D attached hereto (the “Commencement Letter”) which Tenant shall acknowledge by executing a copy and returning it to Landlord. If Tenant fails to sign and return the Commencement Letter to Landlord or to provide any objection to Landlord as to any of the matters set forth in the Commencement Letter within ten (10) business days of its receipt from Landlord, the Commencement Letter as sent by Landlord shall be deemed to have correctly set forth the Commencement Date, the Rent Commencement Date, and the other matters addressed in the Commencement Letter. Failure of Landlord to send the Commencement Letter shall have no effect on the Commencement Date, the Rent Commencement Date, and the other matters addressed in the Commencement Letter.

(c) Notwithstanding the foregoing, if (i) the Commencement Date has not occurred by the date which is one hundred eighty (180) days after the Scheduled Commencement Date (as the same may be extended for delays arising out of or resulting from Tenant Delays and/or Force Majeure, the “Lease Cancellation Date”), and (ii) not less than five (5) Business Days prior to the delivery of a Termination Notice (as hereinafter defined) Tenant shall have delivered a Reminder Notice (as hereinafter defined) to Landlord, then at any time after the Lease Cancellation Date and prior to the date on which possession of the Premises is tendered to Tenant, Tenant may elect, as liquidated damages and its sole and exclusive remedy on account thereof, to terminate this Lease by giving Landlord a Termination Notice, which Termination Notice may be given not earlier than the Lease Cancellation Date and not later than thirty (30) Business Days following the Lease Cancellation Date, with such termination to be effective immediately upon the giving by Tenant of such Termination Notice. If Tenant validly terminates this Lease in accordance with the foregoing provisions, this Lease shall be null and void and of no further force and effect, and except as expressly and specifically set forth herein, the parties shall have no further liabilities, responsibilities or obligations hereunder. If this Lease is terminated in accordance with the

-6-

provisions of this Paragraph 1(c), then Landlord shall return the Letter of Credit to Tenant not later than five (5) Business Days after such termination. Notwithstanding any provision contained herein, if possession of the Premises is tendered to Tenant in the Delivery Condition at any time prior to the valid termination of this Lease in accordance with the foregoing provisions, then Tenant shall have no further right to terminate this Lease pursuant to this Paragraph 1(c).

A “Reminder Notice” shall mean a written notice delivered by Tenant to Landlord stating the following in capitalized and bold type on the first page of such notice: “IN ACCORDANCE WITH AND SUBJECT TO PARAGRAPH 1(c) OF THE LEASE, IF POSSESSION OF THE PREMISES HAS NOT BEEN TENDERED TO TENANT BY THE LEASE CANCELLATION DATE, THE TENANT MAY TERMINATE THE LEASE. LANDLORD IS HEREBY NOTIFIED THAT POSSESSION OF THE PREMISES HAS NOT BEEN TENDERED TO TENANT AS OF THE DATE OF THIS NOTICE.” A “Termination Notice” shall mean a written notice delivered by Tenant to Landlord stating the following in capitalized and bold type on the first page of such notice: “IN ACCORDANCE WITH AND SUBJECT TO THE TERMS AND CONDITIONS OF PARAGRAPH 1(c) OF THE LEASE, TENANT HEREBY ELECTS TO TERMINATE THE LEASE.”

| 2. | BASE RENT |

(a) Tenant agrees to pay with respect to each calendar month (and proportionately on a per diem basis for any partial calendar month of the Lease Term) from and after the Rent Commencement Date as Base Rent for the Premises the sums shown for such periods in Item 5 of the Basic Lease Provisions. The Term “Base Rent” when used in this Lease shall mean the Base Rent payable during the given period.

(b) Base Rent shall be payable in consecutive monthly installments, in advance, without demand, deduction or offset, commencing on the Rent Commencement Date and continuing on the first (1st) business day of each calendar month thereafter until the expiration of the Lease Term. The obligation of Tenant to pay Rent and other sums to Landlord and the obligations of Landlord under this Lease are independent obligations.

(c) The parties agree that for all purposes hereunder the Premises and the Building shall be stipulated to contain the number of square feet of Rentable Area respectively described in Item 3 of the Basic Lease Provisions.

(d) Base Rent shall be paid to Landlord absolutely net of all costs and expenses. The provisions for payment of Operating Expenses by means of periodic payment of Tenant’s Proportionate Share of estimated Operating Expenses Excess (as defined in Paragraph 3 of this Lease) and the year end adjustment of such payments are intended to pass on to Tenant and reimburse Landlord for Tenant’s Proportionate Share of the Operating Expenses Excess described in Paragraph 3 of this Lease.

| 3. | ADDITIONAL RENT |

(a) If Operating Expenses (defined below) for any calendar year during the Lease Term exceed Base Operating Expenses (defined below), Tenant shall pay to Landlord, concurrent

-7-

with each installment of Base Rent, as additional rent (“Operating Expenses Additional Rent”) an amount equal to Tenant’s Proportionate Share (defined below) of such excess (“Operating Expenses Excess”). If Real Estate Taxes (defined below) for any tax fiscal year during the Lease Term exceed Base Real Estate Taxes (defined below), Tenant shall pay to Landlord concurrent with each installment of Base Rent, as additional rent (“Taxes Additional Rent”) an amount equal to Tenant’s Proportionate Share of such excess (“Taxes Excess”). The term “Additional Rent” shall mean, collectively, the Operating Expenses Additional Rent, the Taxes Additional Rent, and all other amounts (excepting only Base Rent) payable by Tenant under this Lease.

(b) “Tenant’s Proportionate Share” is, subject to the provisions of Paragraph 18, the percentage number described in Item 4 of the Basic Lease Provisions. Tenant’s Proportionate Share represents, subject to the provisions of Paragraph 18, a fraction, the numerator of which is the number of square feet of Rentable Area in the Premises and the denominator of which is the number of square feet of Rentable Area in the Building, as determined by Landlord in its reasonable discretion from time to time.

(c) “Base Operating Expenses” means all Operating Expenses incurred or payable by Landlord during the calendar year specified as Tenant’s Base Year for Operating Costs in Item 8 of the Basic Lease Provisions. The term “Base Real Estate Taxes” shall mean all Real Estate Taxes incurred or payable by Landlord during the fiscal year specified as Tenant’s Base Year for Real Estate Taxes in Item 8 of the Basic Lease Provisions.

(d) “Operating Expenses” means all costs, expenses and obligations incurred or payable by Landlord in connection with the operation, ownership, management, repair or maintenance of the Land and Building during or allocable to the Lease Term, including without limitation, the cost of services and utilities (including taxes and other charges incurred in connection therewith) provided to the Premises (other than separately metered utilities for which Tenant is responsible), the Building or the Land, including, without limitation, water, power, gas, sewer, waste disposal, telephone and cable television facilities, fuel, supplies, equipment, tools, materials, service contracts, janitorial service, waste and refuse disposal, window cleaning, maintenance and repair of sidewalks and Building exterior and services areas, gardening and landscaping; insurance, including, but not limited to, public liability, fire, property damage, wind, hurricane, earthquake, terrorism, flood, rental loss, rent continuation, boiler machinery, business interruption, contractual indemnification and property/casualty coverage insurance for the Land and/or Building and such other insurance as is carried by Landlord in its commercially reasonable discretion, and any commercially reasonable deductible portion of any insured loss otherwise covered by such insurance; the cost of compensation, including employment, welfare and social security taxes, paid vacation days, disability, pension, medical and other fringe benefits of all persons (including independent contractors) who perform services connected with the operation, maintenance, repair or replacement of the Land and/or Building; any personal property taxes on and maintenance and repair of equipment and other personal property used in connection with the operation, maintenance or repair of the Land and/or Building; repair and replacement of window coverings provided by Landlord to the tenants in the Building; such reasonable auditors’ fees and legal fees as are incurred in connection with the operation, maintenance or repair of the Land and/or Building; a commercially reasonable property management fee not in excess of four percent (4%) of the gross revenues of the Building (which fee may be imputed if Landlord has internalized management or otherwise acts as its own

-8-

property manager); the maintenance of any easements or ground leases benefiting the Land and/or Building, whether by Landlord or by an independent contractor; license, permit and inspection fees (excepting only such fees in connection with the build-out of premises for other tenants at the Building); all costs and expenses required by any governmental or quasi-governmental authority or by applicable Law not in effect as of the Effective Date, for any reason, including capital improvements; the cost of any capital improvements made to the Land or Building by Landlord that are intended to comply with Laws not in effect as of the Effective Date, or are intended to reduce environmental impacts, or are intended to reduce Operating Expenses (such costs to be amortized over such reasonable periods of time as Landlord may reasonably determine, together with interest thereon at the rate of eight percent (8%) per annum; the cost of maintenance, operation and repair of air conditioning, heating, ventilating, plumbing, and elevator systems and equipment (to include the replacement of components which are in the nature of repairs as hereinafter described) and other mechanical and electrical systems repair and maintenance (including the replacement of components of the systems which are in the nature of repairs and are not required to be considered capital expenses under first class office building accounting standards even if such item might be classified as a capital expenditure under generally accepted accounting principles (such costs to be amortized over the useful life thereof, which useful life shall be determined by Landlord in accordance with customary practices in the real estate industry); sign maintenance; and Common Area (defined below) repair, resurfacing, operation and maintenance; the reasonable cost for temporary lobby displays and events commensurate with the operation of a similar class building, and the cost of providing security services, if any, deemed appropriate by Landlord from time to time.

Notwithstanding the foregoing, the following items shall be excluded from Operating Expenses:

(A) leasing commissions, attorneys’ fees, costs and disbursements and other expenses incurred in connection with leasing, renovating or improving vacant space in the Building for tenants or prospective tenants of the Building;

(B) costs (including permit, license and inspection fees) incurred in renovating or otherwise improving, decorating, painting or redecorating space for tenants or vacant space;

(C) Landlord’s costs of any services provided to tenants to the extent Landlord is entitled to be reimbursed by such tenants as an additional charge or rental over and above the base rent and operating expenses payable under the lease with such tenant or other occupant;

(D) any depreciation or amortization of the Building except as expressly permitted herein;

(E) principal and interest on debt or amortization payments on any mortgages or deeds of trust or any other debt for borrowed money;

-9-

(F) repairs or other work occasioned by fire, windstorm or other work to the extent paid for through insurance or condemnation proceeds (excluding any deductible);

(G) legal fees and expenses or other professional or consulting fees and expenses incurred for (i) negotiating lease terms for prospective tenants, (ii) negotiating termination or extension of leases with existing tenants, or (iii) proceedings against any other specific tenant relating solely to the collection of rent or other sums due to Landlord from such tenant;

(H) charitable or political contributions;

(I) income and franchise taxes of Landlord;

(J) capital expenditures (other than the portion to be included in Operating Expenses as described above);

(K) ground rent under ground leases;

(L) interest and penalties incurred due to violation by Landlord of the terms of any lease, ground or underlying lease, mortgage, or other agreement affecting the Building or the Land;

(M) Landlord’s legal existence and general corporate overhead and general administrative expenses;

(N) salaries and bonuses of officers, executives of Landlord and administrative employees above the grade of property manager or building supervisor, and if a property manager or building supervisor are shared with other buildings or has other duties not related to the Building, only the allocable portion of such person or persons salary shall be included in Operating Expenses

(O) reserves of any kind;

(P) any cost included in Operating Expenses representing an amount paid to a person, firm, corporation or other entity related to Landlord which is in excess of the amount which would have been paid on an arm’s length basis in the absence of such relationship;

(Q) costs of disputes of any kind or nature with other tenants;

(R) costs incurred in connection with any sale, financing, syndicating, reorganization or restructuring of ownership of the Building; and

(S) marketing of the Building and/or vacant space in the Building, of any kind.

-10-

(e) “Real Estate Taxes” means any form of assessment, license fee, license tax, business license fee, levy, charge, improvement bond, tax, water and sewer rents and charges, utilities and communications taxes and charges or similar or dissimilar imposition imposed by any authority having the direct power to tax, including any city, county, state or federal government, or any school, agricultural, lighting, drainage or other improvement or special assessment district thereof, or any other governmental charge, general and special, ordinary and extraordinary, foreseen and unforeseen, which may be assessed against any legal or equitable interest of Landlord in the Premises, Building or the Land. Real Estate Taxes shall also include, without limitation:

(i) any hereafter adopted assessment, tax, fee, levy or charge in substitution, partially or totally, of any assessment, tax, fee, levy or charge previously included within the ad valorem real property taxes. It is the intention of Tenant and Landlord that all such new and increased assessments, taxes, fees, levies and charges be included within the definition of “Real Estate Taxes” for the purposes of this Lease;

(ii) any assessment, tax, fee, levy or charge allocable to or measured by the area of the Premises or other premises in the Building or the rent payable by Tenant hereunder or other tenants of the Building, including, without limitation, any gross receipts tax or excise tax levied by state, city or federal government, or any political subdivision thereof, with respect to the receipt of such rent, or upon or with respect to the possession, leasing, operation, management, maintenance, alteration, repair, use or occupancy by Tenant of the Premises, or any portion thereof but not on Landlord’s other operations;

(iii) any assessment, tax, fee, levy or charge upon this transaction or any document to which Tenant is a party, creating or transferring an interest or an estate in the Premises, and any business improvement district assessments or charges, or PILOT (i.e., payments in lieu of taxes payments);

(iv) any assessment, tax, fee, levy or charge by any governmental agency related to any transportation plan, fund or system (including assessment districts) instituted within the geographic area of which the Land is a part; and/or

(v) any costs and expenses (including, without limitation, reasonable attorneys’ fees) incurred in attempting to protest, reduce or minimize Real Estate Taxes.

Notwithstanding the foregoing, Real Estate Taxes shall not include: (x) municipal, state and federal income taxes (if any) assessed against Landlord; (y) municipal, state or federal capital levy, gift, estate, succession, inheritance or transfer taxes of Landlord; or (z) corporation excess profits or franchise taxes imposed upon any corporate owner of the Land or Building.

(f) For any calendar year during which actual occupancy of the Building is less than ninety five percent (95%) of the Rentable Area of the Building (including, without limitation, the Tenant’s Base Year for Operating Expenses), those Operating Expenses for services which vary based on the level of occupancy of the Building (such as cleaning services) shall be appropriately adjusted to reflect ninety five percent (95%) occupancy of the existing Rentable Area of the Building during such period. In determining Operating Expenses, if any services or utilities are separately charged to tenants of the Building or others, Operating Expenses shall be adjusted by

-11-

Landlord to reflect the amount of expense which would have been incurred for such services or utilities on a full time basis for normal Building operating hours. Operating Expenses for the Tenant’s Base Year for Operating Expenses shall not include Operating Expenses attributable to temporary market-wide labor-rate increases and/or utility rate increases due to extraordinary circumstances, including, but not limited to Force Majeure, conservation surcharges, boycotts, embargoes, or other shortages. In the event (i) the Commencement Date shall be a date other than January 1, (ii) the date fixed for the expiration of the Lease Term shall be a date other than December 31, (iii) of any early termination of this Lease, or (iv) of any increase or decrease in the size of the Premises, then in each such event, an appropriate adjustment in the application of this Paragraph 3 shall, subject to the provisions of this Lease, be made to reflect such event on a basis determined by Landlord in its reasonable discretion to be consistent with the principles underlying the provisions of this Paragraph 3. Landlord shall also have the right, in its reasonable discretion, to allocate and prorate any portion or portions of the Operating Expenses in any reasonable manner. Without limiting the generality of the foregoing, Landlord shall have the right, from time to time, to equitably allocate and prorate some or all of the Operating Expenses among different tenants (the “Cost Pools”), adjusting Tenant’s Proportionate Share as to each of the separately allocated costs based on the ratio of the Rentable Area of the Premises to the Rentable Area of all of the premises to which such costs are equitably allocated. Such Cost Pools may include, without limitation, differentiation of the office space tenants and retail space tenants of the Building.

(g) In connection with each calendar year and/or fiscal year (as applicable) of the Lease Term following the Commencement Date, Landlord shall give to Tenant a written estimate of Tenant’s Proportionate Share of Operating Expenses Excess and/or Taxes Excess, if any, for the Building and/or Land for the ensuing year. Tenant shall pay such estimated amount to Landlord in equal monthly installments, in advance on the first day of each month, concurrent with each payment of Base Rent. Within one hundred twenty (120) days after the end of each calendar year and/or fiscal year (as applicable), Landlord shall furnish Tenant a statement (each, a “Statement”) indicating in reasonable detail the excess or shortfall of (i) Operating Expenses over Base Operating Expenses for such period, and (ii) Real Estate Taxes over Base Real Estate Taxes for such period, and the parties shall, within thirty (30) days thereafter, make any payment or allowance necessary to adjust Tenant’s estimated payments to Tenant’s actual share of such excess or shortfall as indicated by such annual Statement. Each such Statement shall constitute an account stated, subject to the provisions of Paragraph 3(i) below. Any payment due Landlord shall be payable by Tenant within thirty (30) days after delivery of an invoice thereafter from Landlord. Any amount due Tenant as a result of such overpayments shall be credited against installments next becoming due under this Paragraph 3(g) or refunded to Tenant, if requested by Tenant. The provisions of this Paragraph 3(g) shall survive the expiration or earlier termination of this Lease.

(h) Tenant shall pay, within thirty (30) days after receipt of a bill or invoice therefor, all taxes and assessments (i) levied against any personal property, fixtures, tenant improvements or trade fixtures of Tenant in or about the Premises, (ii) based upon this Lease or any document to which Tenant is a party creating or transferring an interest in this Lease or an estate in all or any portion of the Premises, and (iii) levied for any business, professional, or occupational license fees. If any such taxes or assessments are levied against Landlord or Landlord’s property or if the assessed value of the Land and Building is increased as a result of the inclusion therein

-12-

of a value placed upon the personal property or trade fixtures of Tenant, then Tenant shall upon demand reimburse Landlord for the taxes and assessments so levied against Landlord, or such taxes, levies and assessments resulting from such increase in assessed value. To the extent that any such taxes are not separately assessed or billed to Tenant, Tenant shall pay, within thirty (30) days after receipt of a bill or invoice therefor, the amount thereof.

(i) Any delay or failure of Landlord in (i) delivering any estimate or statement described in this Paragraph 3, or (ii) computing or billing Tenant’s Proportionate Share of Operating Expenses Excess and/or Taxes Excess shall not constitute a waiver of its right to require an increase in Additional Rent, or in any way impair the continuing obligations of Tenant under this Paragraph 3. In the event of any dispute as to any Additional Rent due under this Paragraph 3, Tenant, an officer of Tenant or Tenant’s independent certified public accountant (but (a) in no event shall Tenant hire or employ an accounting firm or any other person to audit Landlord as set forth under this Paragraph 3 who is compensated or paid for such audit on a contingency basis and (b) in the event Tenant hires or employs an independent certified public accountant to perform such audit, Tenant shall provide Landlord with a copy of the engagement letter) shall have the right after reasonable notice and at reasonable times to inspect Landlord’s accounting records at Landlord’s accounting office. If, after such inspection, Tenant still disputes such Additional Rent, upon Tenant’s written request therefor, a certification as to the proper amount of Operating Expenses and/or Real Estate Taxes and the amount due to or payable by Tenant shall be made by an independent mutually acceptable certified public accountant. Such certification shall be final and conclusive as to all parties. If the certification reflects that Tenant has overpaid Tenant’s Proportionate Share of Operating Expenses and/or Real Estate Taxes for the period in question, then Landlord shall credit such excess to Tenant’s next payment of Operating Expenses and/or Real Estate Taxes or, at the request of Tenant, promptly refund such excess to Tenant and conversely, if Tenant has underpaid Tenant’s Proportionate Share of Operating Expenses and/or Real Estate Taxes, Tenant shall promptly pay such additional Operating Expenses and/or Real Estate Taxes to Landlord. Tenant agrees to pay the cost of such certification and the investigation with respect thereto unless it is determined that Landlord’s original Statement was in error by more than three percent (3%). Tenant waives the right to dispute any matter relating to the calculation of Operating Expenses and/or Real Estate Taxes or Additional Rent under this Paragraph 3 if any claim or dispute with respect thereto is not asserted in writing to Landlord within ninety (90) days after delivery to Tenant of the original billing Statement with respect thereto and unless Tenant asserts a claim or dispute in writing within said ninety (90) day period. Such Statement shall be considered an account slated and shall be final in all respects. Notwithstanding the foregoing, Tenant shall maintain strict confidentiality of all of Landlord’s accounting records and shall not disclose the same to any other person or entity except for Tenant’s professional advisory representatives (such as Tenant’s employees, accountants, advisors, attorneys and consultants) with a need to know such accounting information, who agree to similarly maintain the confidentiality of such financial information.

(j) After the Lease Term has expired and Tenant has vacated the Premises, when the final determination is made of Tenant’s Proportionate Share of Operating Expenses Excess and/or Taxes Excess for the year in which this Lease terminates, Tenant shall pay, within thirty (30) days after receipt of a final statement therefor, any increase due over the estimated Operating Expenses and/or Real Estate Taxes paid, and conversely, any overpayment made by Tenant shall be refunded promptly to Tenant by Landlord. This Paragraph 3(i) shall survive the expiration or earlier termination of this Lease.

-13-

(k) The Base Rent, Additional Rent, late fees, and other amounts required to be paid by Tenant to Landlord hereunder (including the Operating Expenses Excess and Taxes Excess) are sometimes collectively referred to as, and shall constitute, “Rent”.

| 4. | IMPROVEMENTS AND ALTERATIONS; DELIVERY |

(a) The “Delivery Condition” shall mean that (i) the Premises are free and clear of other tenants and occupants, (ii) the Landlord’s Work (as hereinafter defined) has been Substantially Completed in accordance with the provisions of this Paragraph 4, (iii) the Premises and the Building Systems serving the Premises are in good working condition and repair; (iv) the Premises and Landlord’s Work are in compliance with all applicable Laws, including without limitation the ADA (as defined below); and (v) all inspections of Landlord’s Work required to be performed by the Inspectional Services Department of the City of Boston have been completed and Tenant is permitted to lawfully occupy the Premises for the use permitted pursuant to this Lease.