Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - AMERICAN PUBLIC EDUCATION INC | apei-ex993_94.htm |

| EX-99.1 - EX-99.1 - AMERICAN PUBLIC EDUCATION INC | d150322dex991.htm |

| 8-K - 8-K - AMERICAN PUBLIC EDUCATION INC | apei-8k_20210309.htm |

PRESENTED BY Angela Selden President and CEO Richard Sunderland, CPA Executive VP and CFO American Public Education, Inc. Fourth Quarter & Full Year 2020 Results Exhibit 99.2

Safe Harbor Statement Statements made in this presentation regarding APEI or its subsidiaries that are not historical facts are forward-looking statements based on current expectations, assumptions, estimates and projections about APEI and the industry. Forward-looking statements can be identified by words such as “anticipate,” “believe,” “seek,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “should,” “will” and “would.” These forward-looking statements include, without limitation, statements regarding benefits of the acquisition of Rasmussen University, the timing of the closing of the transaction, expected growth, expected registration and enrollments, expected revenues, earnings and expected income, expenses, expected financial results for Rasmussen University, expected capital structure, the ability to deliver a return on learners’ educational investment, and plans with respect to recent, current and future initiatives. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Such risks and uncertainties include, among others, risks related to: the satisfaction of closing conditions, including the failure or delay in obtaining required regulatory and accreditor approvals; APEI’s ability to obtain financing to fund the transaction; the significant transaction and integration costs APEI has incurred and expects to incur in connection with the acquisition; the integration of Rasmussen’s business and APEI’s ability to realize the expected benefits of the acquisition; that Rasmussen may have liabilities that are not known to APEI; other events that could impact the transaction and its closing; APEI’s dependence on the effectiveness of its ability to attract students who persist in its institutions’ programs; impacts of the COVID-19 pandemic; APEI’s ability to effectively market its institutions’ programs; adverse effects of changes APEI makes to improve the student experience and enhance the ability to identify and enroll students who are likely to succeed; APEI’s ability to maintain strong relationships with the military and maintain enrollments from military students; APEI’s ability to comply with regulatory and accrediting agency requirements and to maintain institutional accreditation; APEI’s reliance on Department of Defense tuition assistance, Title IV programs, and other sources of financial aid; APEI’s dependence on its technology infrastructure; strong competition in the postsecondary education market and from non-traditional offerings; and the various risks described in the “Risk Factors” section and elsewhere in APEI’s Annual Report on Form 10-K for the year ended December 31, 2020 and other filings with the SEC. You should not place undue reliance on any forward-looking statements. APEI undertakes no obligation to update publicly any forward-looking statements for any reason, unless required by law, even if new information becomes available or other events occur in the future. 2

2020 in Review – A Year of Transformation and Acceleration Setting adult learners on the path toward achieving their dreams and helping maximize the return on their higher education investment Nearly Doubles Size of APEI & Adds Significant Scale Strength in Nursing - largest national ADN/RN nursing school HCN + Rasmussen = $165MM of Nursing Revenue2 32 Campuses Across 9 States with 10,000+ Nursing Students3 Strong Demand for Nurses: 175k annual RN openings over next decade APUS: 5 Straight Quarters of YoY Growth 18% New and 11.5% Total Course Registration Growth in FY’20 HCN: Turnaround Complete +50% Nursing Starts Growth in FY’20 Scale driving strong incremental profit performance, disciplined capital allocation framework Angela Selden named APEI CEO in September 2019 New core business chief executives at APUS and HCN New SVP Strategy & Corporate Development; new CHRO Diversifying Revenue: Approximately 1/3 Military, 1/3 Nursing, 1/3 Adult Online3 #1 Market Positions: Active-Duty Military, Veterans, Pre-licensure Nursing3 APEI Poised for Additional Acquisitions The acquisition is expected to close in the third quarter of 2021subject to closing conditions that include review by the Department of Education, approval by the Higher Learning Commission and approval of or notices to other regulatory and accrediting bodies.. Rasmussen nursing revenue based on FYE9/30/20 and HCN nursing revenue based on FYE12/31/2020. Expected at the time of closing of Rasmussen acquisition.

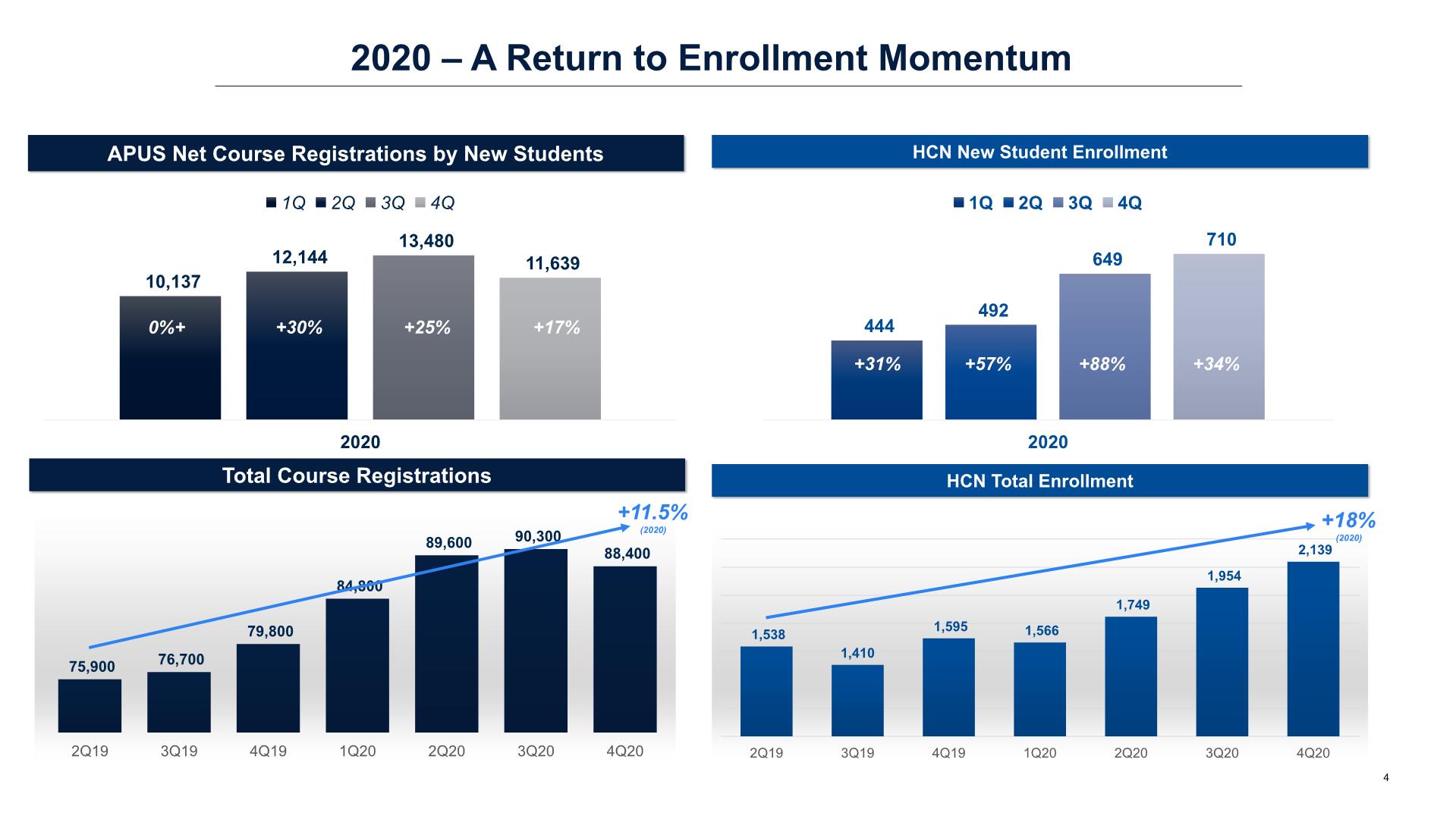

2020 – A Return to Enrollment Momentum

Increased investment in marketing, especially in micro-segments where HEROITM resonates Expanded APUS-funded Freedom Grant® for active-duty military in graduate programs which helps eliminate out-of-pocket expenses Technology transformation to improve student experience and drive increased referral rates Driven by Targeted Investments in Marketing & Student Experience Nimble and flexible in adapting to COVID Campuses remained open per guidelines Virtual course/learning capabilities added New Direct-Entry program driving rebound in ADN programs Launched institutional affordability grants – generally limits payments to $200 per month* Improved admissions/onboarding processes All admissions processes fully online Improved conversion driven by Salesforce integration *After consideration of financial aid and other resources. Minimums apply.

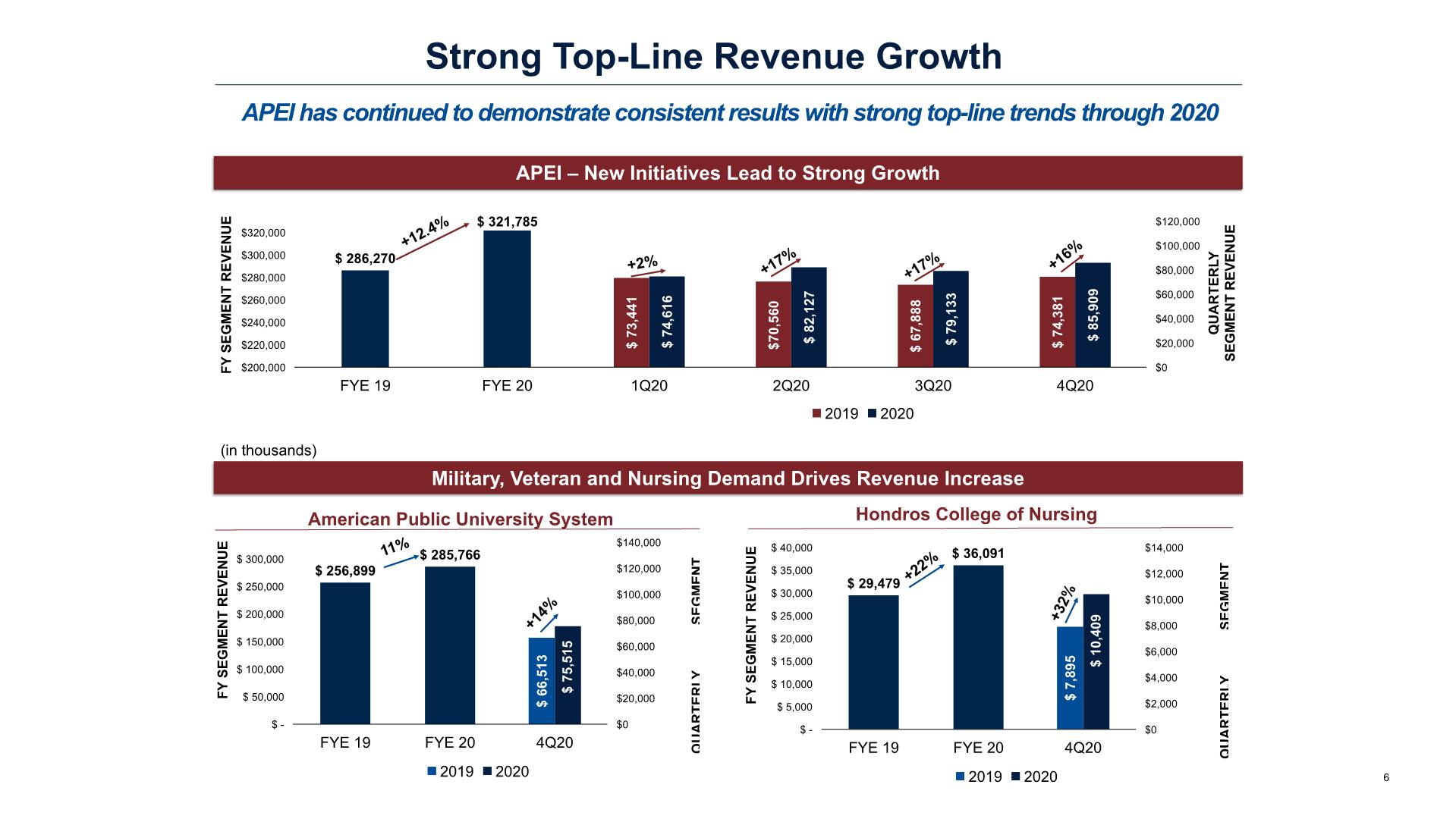

Strong Top-Line Revenue Growth +17% +12.4% +16% Military, Veteran and Nursing Demand Drives Revenue Increase 11% +14% APEI – New Initiatives Lead to Strong Growth APEI has continued to demonstrate consistent results with strong top-line trends through 2020 (in thousands) +2% +17% Hondros College of Nursing +32% +22%

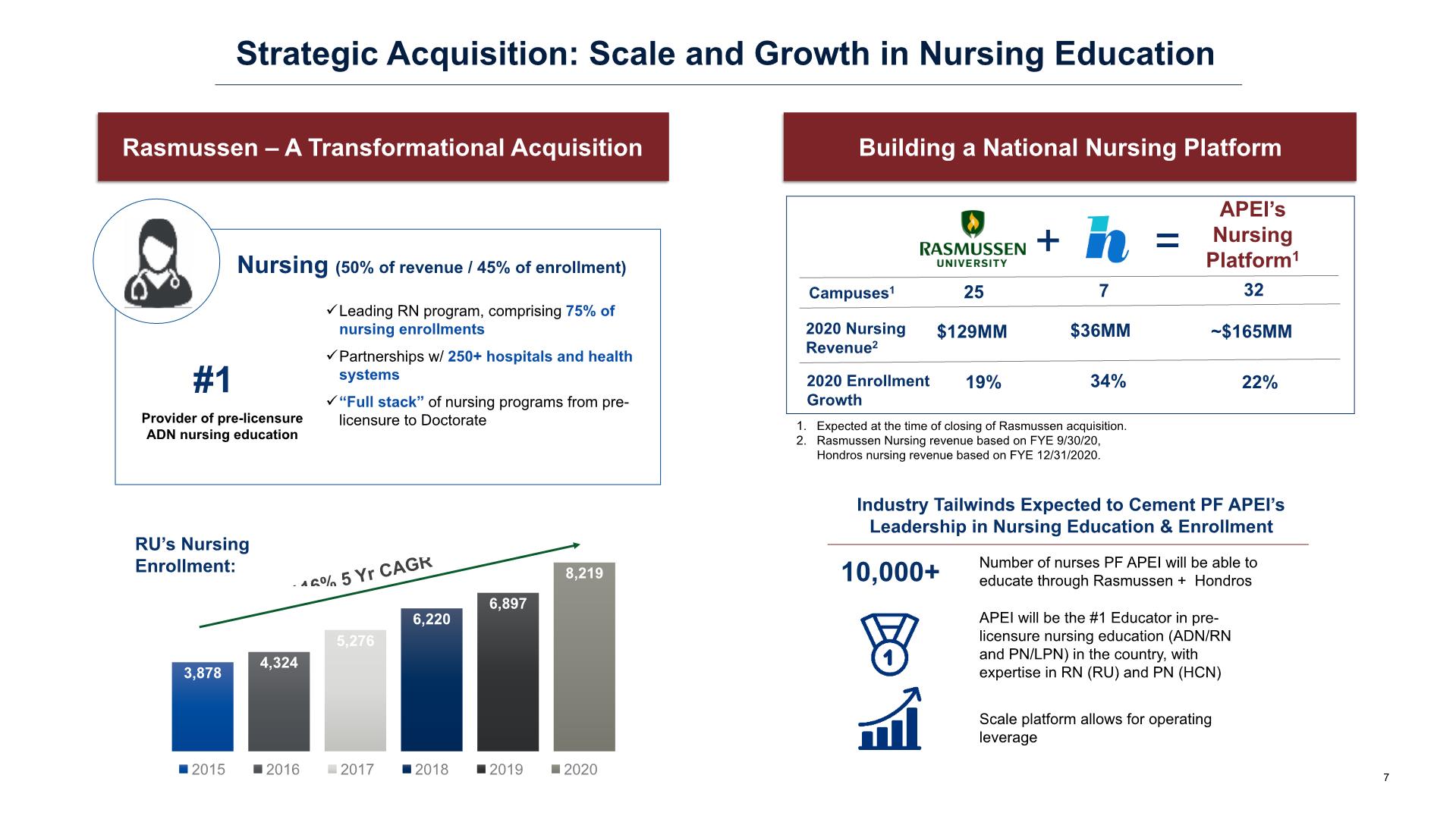

Strategic Acquisition: Scale and Growth in Nursing Education Building a National Nursing Platform Rasmussen – A Transformational Acquisition Campuses1 2020 Nursing Revenue2 7 $36MM 25 $129MM 32 ~$165MM 2020 Enrollment Growth 34% 19% 22% = APEI’s Nursing Platform1 + Expected at the time of closing of Rasmussen acquisition. Rasmussen Nursing revenue based on FYE 9/30/20, Hondros nursing revenue based on FYE 12/31/2020. Industry Tailwinds Expected to Cement PF APEI’s Leadership in Nursing Education & Enrollment 10,000+ Number of nurses PF APEI will be able to educate through Rasmussen + Hondros APEI will be the #1 Educator in pre-licensure nursing education (ADN/RN and PN/LPN) in the country, with expertise in RN (RU) and PN (HCN) Scale platform allows for operating leverage

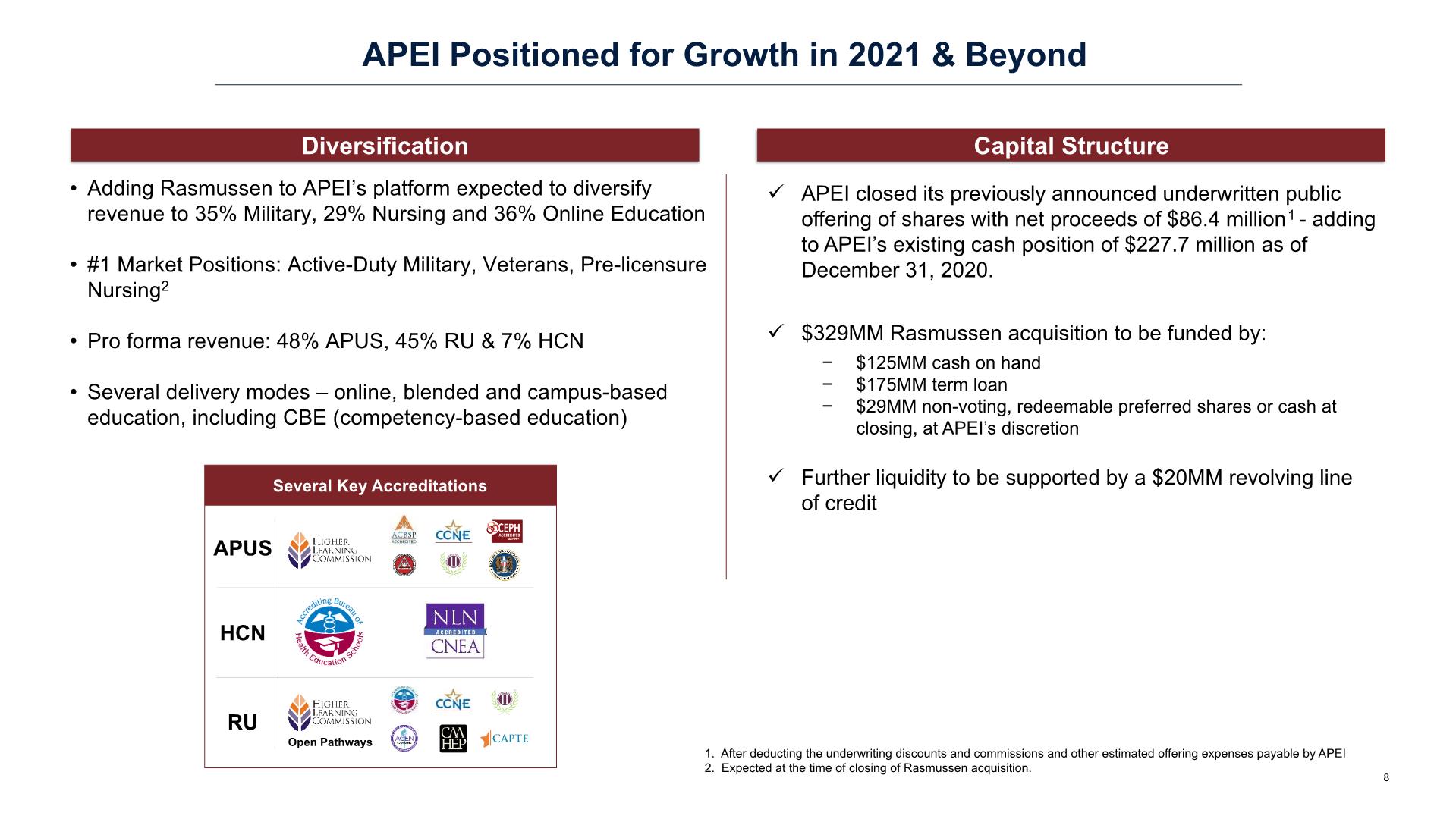

APEI Positioned for Growth in 2021 & Beyond Capital Structure Diversification Adding Rasmussen to APEI’s platform expected to diversify revenue to 35% Military, 29% Nursing and 36% Online Education #1 Market Positions: Active-Duty Military, Veterans, Pre-licensure Nursing2 Pro forma revenue: 48% APUS, 45% RU & 7% HCN Several delivery modes – online, blended and campus-based education, including CBE (competency-based education) Several Key Accreditations APUS HCN RU APEI closed its previously announced underwritten public offering of shares with net proceeds of $86.4 million1 - adding to APEI’s existing cash position of $227.7 million as of December 31, 2020. $329MM Rasmussen acquisition to be funded by: $125MM cash on hand $175MM term loan $29MM non-voting, redeemable preferred shares or cash at closing, at APEI’s discretion Further liquidity to be supported by a $20MM revolving line of credit 1. After deducting the underwriting discounts and commissions and other estimated offering expenses payable by APEI 2. Expected at the time of closing of Rasmussen acquisition.

Fourth Quarter 2020 Highlights 9 Fifth Consecutive Quarter of YoY Enrollment Growth at APUS & Record Enrollment at HCN APUS Net Course Registrations. New student registrations at APUS increased 17% yr/yr. Total net course registrations increased 11% yr/yr. Net Income. APEI net income increased to $7.1 million, an increase of 25% compared to the prior year period. Record Enrollment at Hondros. New and total enrollment increased 34% yr/yr. In 1Q’21, total and new enrollment increased 45% - the highest total enrollment in school history. Adjusted EBITDA. APEI adjusted EBITDA increased to $15.8 million, an increase of 17.9% compared to the prior year period.

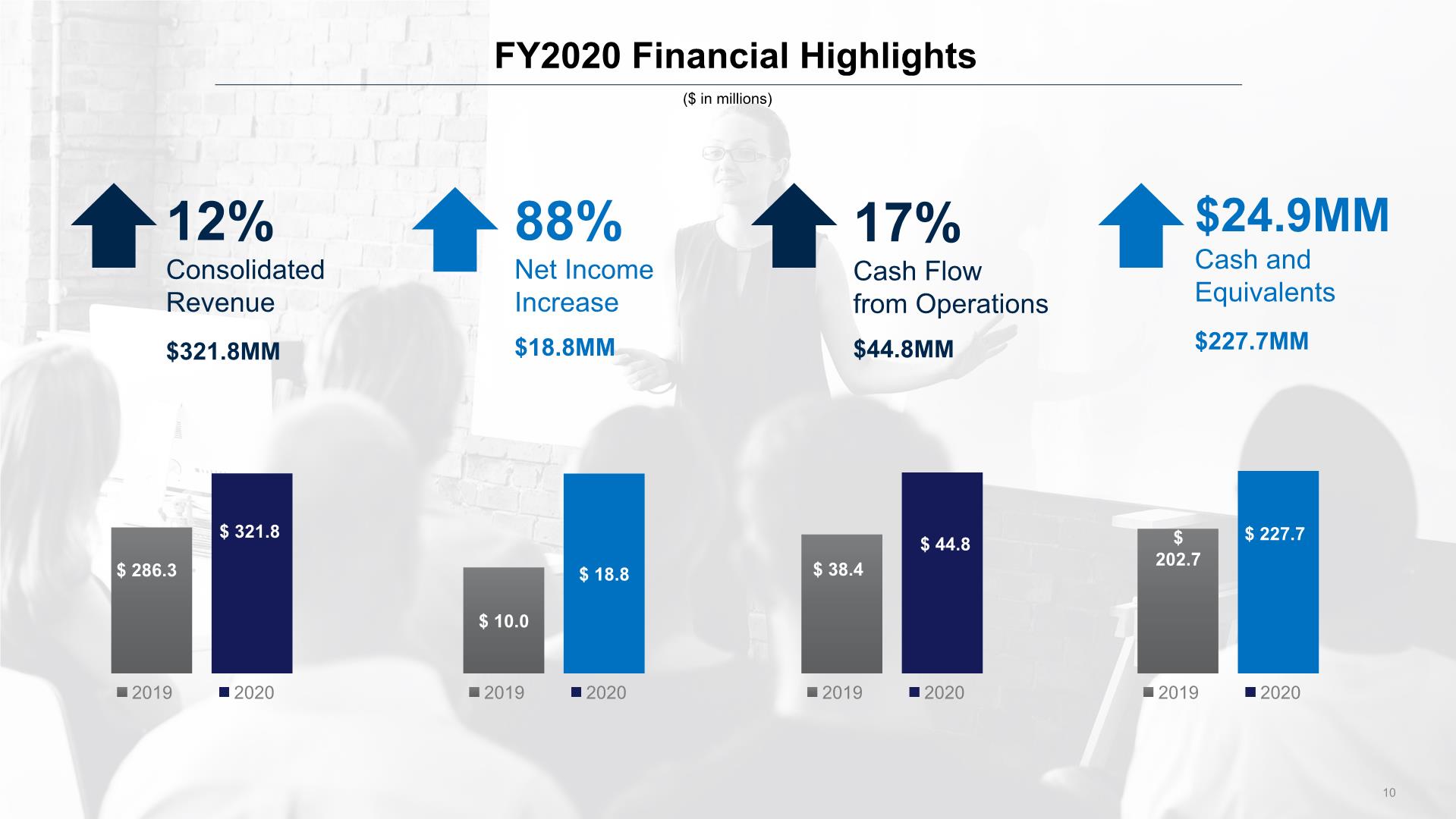

12% Consolidated Revenue $321.8MM 88% Net Income Increase $18.8MM 17% Cash Flow from Operations $44.8MM FY2020 Financial Highlights $24.9MM Cash and Equivalents $227.7MM 10 ($ in millions)

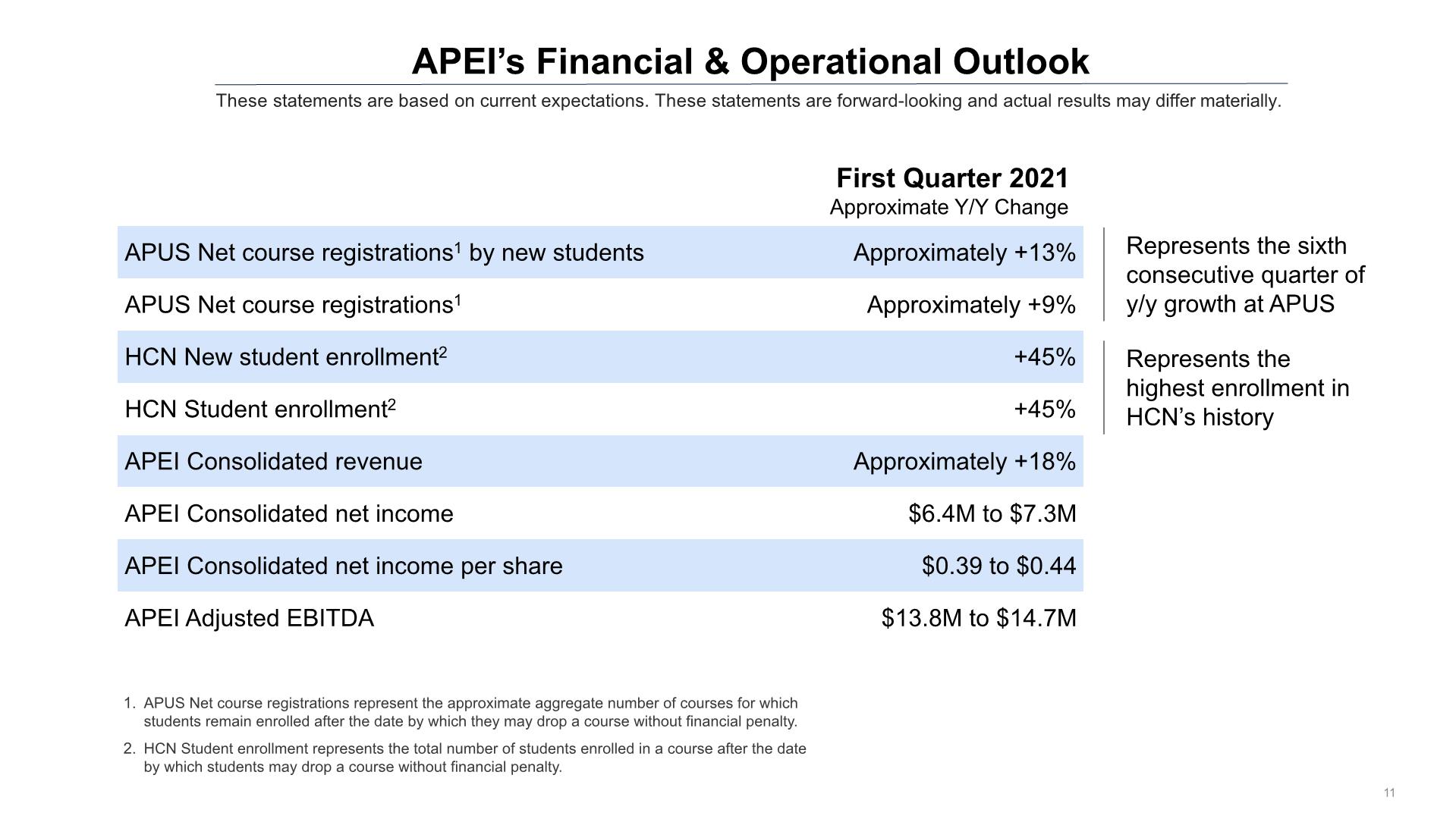

APEI’s Financial & Operational Outlook 11 These statements are based on current expectations. These statements are forward-looking and actual results may differ materially. APUS Net course registrations represent the approximate aggregate number of courses for which students remain enrolled after the date by which they may drop a course without financial penalty. HCN Student enrollment represents the total number of students enrolled in a course after the date by which students may drop a course without financial penalty. Represents the sixth consecutive quarter of y/y growth at APUS Represents the highest enrollment in HCN’s history

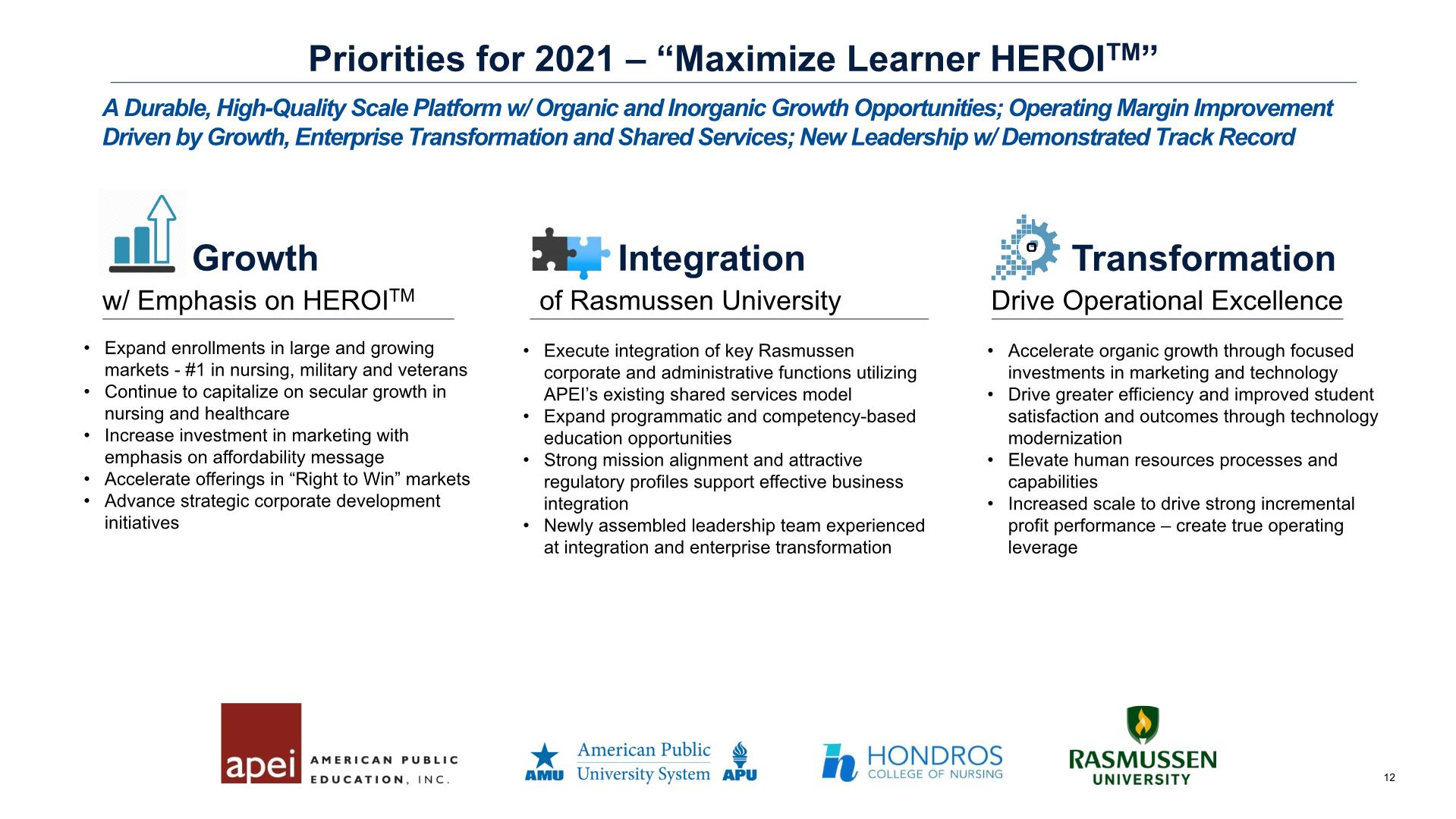

Priorities for 2021 – “Maximize Learner HEROITM” A Durable, High-Quality Scale Platform w/ Organic and Inorganic Growth Opportunities; Operating Margin Improvement Driven by Growth, Enterprise Transformation and Shared Services; New Leadership w/ Demonstrated Track Record Growth w/ Emphasis on HEROITM Expand enrollments in large and growing markets - #1 in nursing, military and veterans Continue to capitalize on secular growth in nursing and healthcare Increase investment in marketing with emphasis on affordability message Accelerate offerings in “Right to Win” markets Advance strategic corporate development initiatives Integration of Rasmussen University Execute integration of key Rasmussen corporate and administrative functions utilizing APEI’s existing shared services model Expand programmatic and competency-based education opportunities Strong mission alignment and attractive regulatory profiles support effective business integration Newly assembled leadership team experienced at integration and enterprise transformation Accelerate organic growth through focused investments in marketing and technology Drive greater efficiency and improved student satisfaction and outcomes through technology modernization Elevate human resources processes and capabilities Increased scale to drive strong incremental profit performance – create true operating leverage Transformation Drive Operational Excellence

Thank You 13

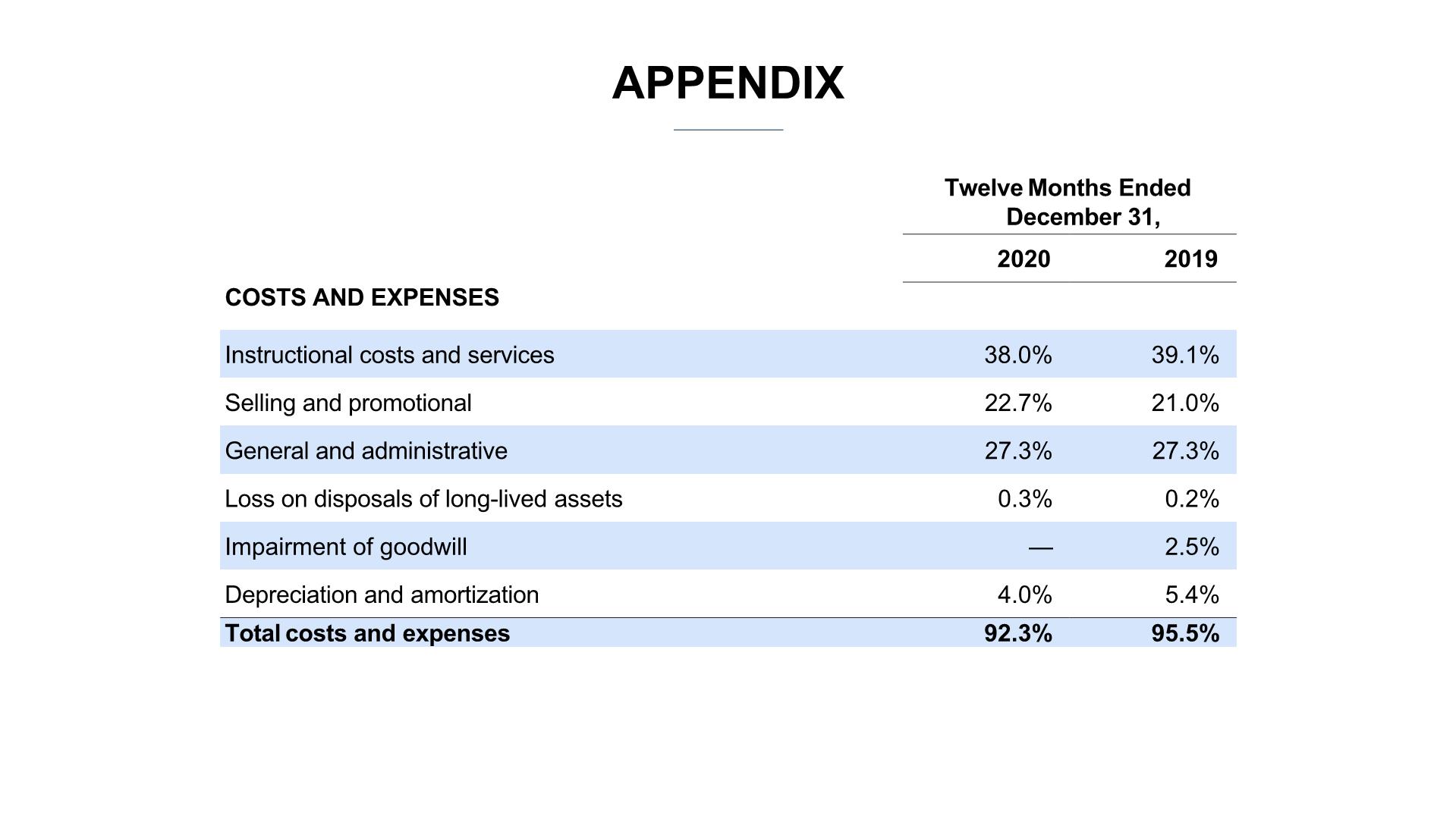

APPENDIX 14

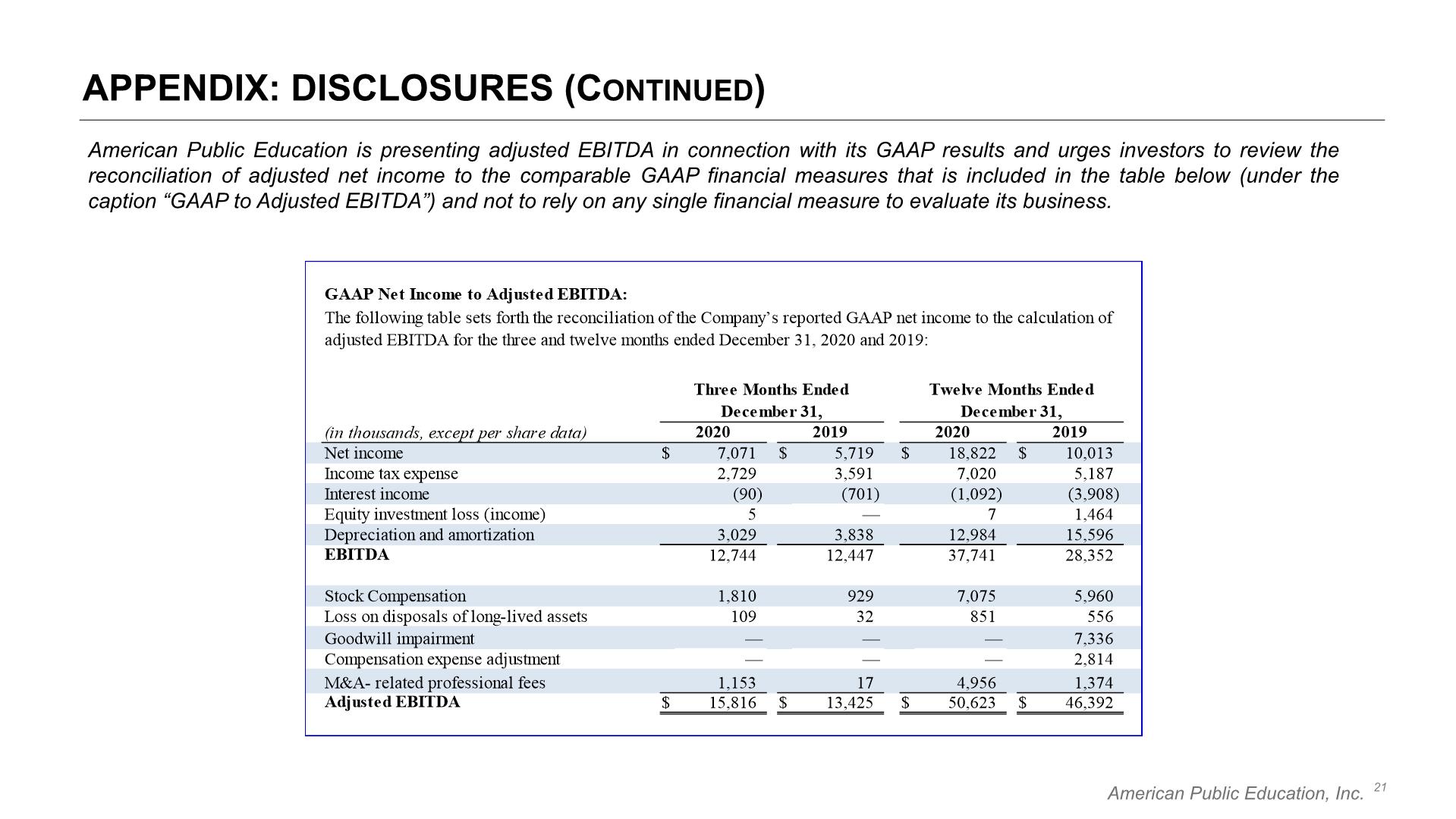

APPENDIX: DISCLOSURES (Continued) American Public Education is presenting adjusted EBITDA in connection with its GAAP results and urges investors to review the reconciliation of adjusted net income to the comparable GAAP financial measures that is included in the table below (under the caption “GAAP to Adjusted EBITDA”) and not to rely on any single financial measure to evaluate its business. 21

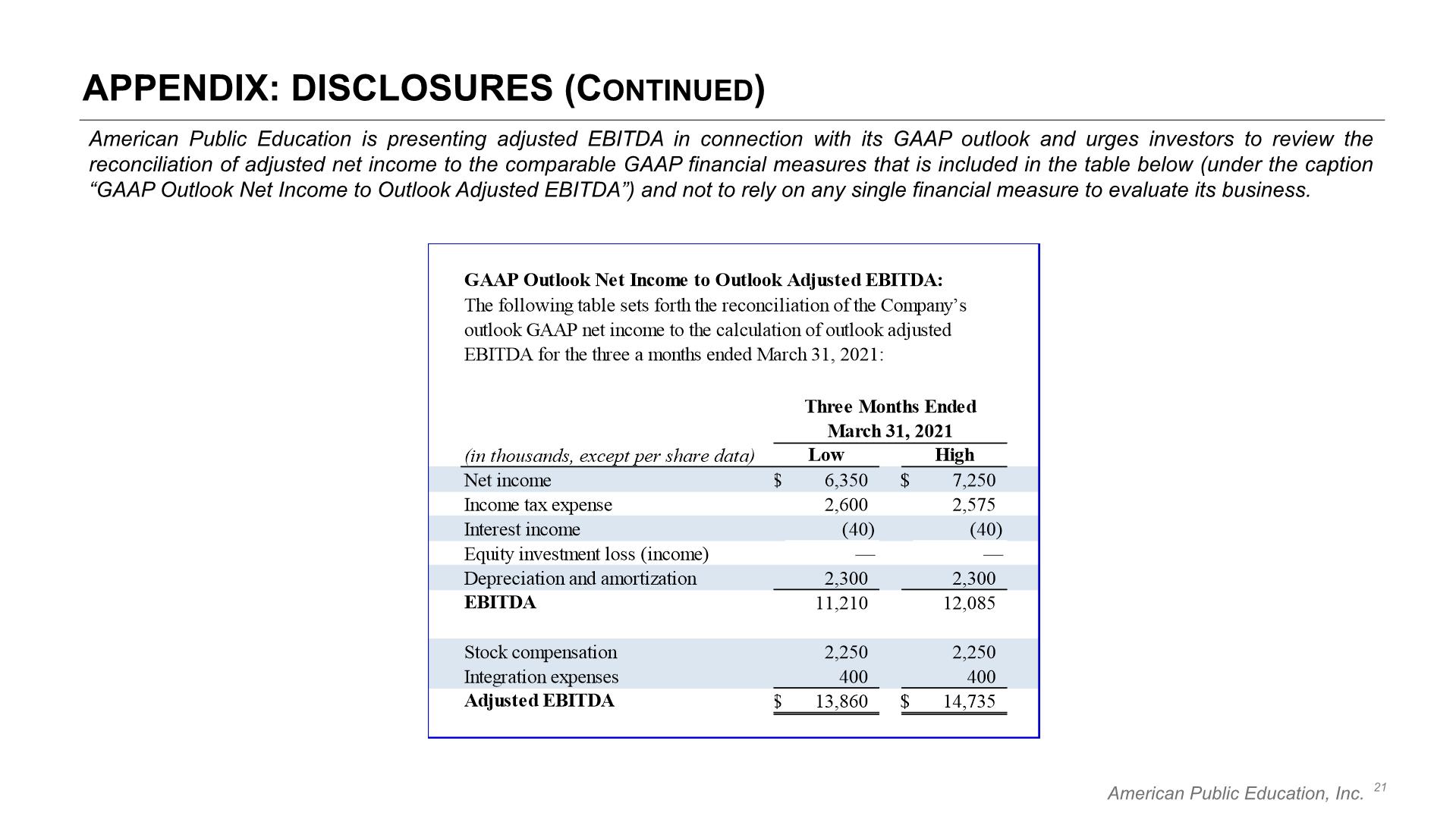

APPENDIX: DISCLOSURES (Continued) American Public Education is presenting adjusted EBITDA in connection with its GAAP outlook and urges investors to review the reconciliation of adjusted net income to the comparable GAAP financial measures that is included in the table below (under the caption “GAAP Outlook Net Income to Outlook Adjusted EBITDA”) and not to rely on any single financial measure to evaluate its business. 21