Attached files

| file | filename |

|---|---|

| 8-K - 8-K - VIEMED HEALTHCARE, INC. | a8-kmarch2021investordeck.htm |

LEADING THE HEALTHCARE INDUSTRY IN HOME RESPIRATORY CARE IR PRESENTATION / MARCH 2021

DISCLAIMERS 2 Disclaimers and Other Important Information This presentation (the “Presentation”) about Viemed Healthcare, Inc. (“Viemed”) is dated as of March 2021. It is information in a summary form and does not purport to be complete. The data contained herein is derived from various internal and external sources. It This Presentation is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any particular investor. No representation or warranty, express or implied, is made or given by or on behalf of Viemed or any of its affiliates, directors, officers or employees as to the accuracy, completeness or fairness of the information or opinions contained in this Presentation and no responsibility or liability is accepted by any person for such information or opinions. Viemed does not undertake or agree to update this Presentation or to correct any inaccuracies in, or omissions from, this Presentation that may become apparent. No person has been authorized to give any information or make any representations other than those contained in this Presentation and, if given and/or made, such information or representations must not be relied upon as having been so authorized. The contents of this Presentation are not to be construed as legal, financial or tax advice. Forward Looking Statements Certain statements contained in this Presentation may constitute “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 or “forward-looking information” as such term is defined in applicable Canadian securities legislation (collectively, “forward-looking statements”). Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “potential”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, “believes”, or “projects”, or the negatives thereof or variations of such words and phrases or statements that certain actions, events or results “will”, “should”, “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved” or the negative of these terms or comparable terminology. All statements other than statements of historical fact, including those that express, or involve discussions as to, expectations, beliefs, plans, objectives, assumptions or future events or performance, including projected US DME expenditures and Viemed’s technology and marketing initiatives and goals for the next 24 months, are not historical facts and may be forward-looking statements and may involve estimates, assumptions and uncertainties that could cause actual results or outcomes to differ materially from those expressed in the forward-looking statements. Such statements reflect Viemed's current views and intentions with respect to future events, and current information available to Viemed, and are subject to certain risks, uncertainties and assumptions. Many factors could cause the actual results, performance or achievements that may be expressed or implied by such forward-looking statements to vary from those described herein should one or more of these risks or uncertainties materialize. These factors include, without limitation: the general business, market and economic conditions in the regions in which Viemed operates; Viemed may be subject to significant capital requirements and operating risks; the ability of Viemed to implement business strategies and pursue business opportunities; volatility in the market price of shares in the capital of Viemed; Viemed’s novel business model; the risk that the clinical application of treatments that demonstrate positive results in a study may not be positively replicated or that such test results may not be predictive of actual treatment results or may not result in the adoption of such treatments by providers; the state of the capital markets; the availability of funds and resources to pursue operations; decline of reimbursement rates; dependence on few payors; possible new drug discoveries; dependence on key suppliers; granting of permits and licenses in a highly regulated business; competition; low profit market segments; disruptions in or attacks (including cyber-attacks) on Viemed's information technology, internet, network access or other voice or data communications systems or services; the evolution of various types of fraud or other criminal behavior to which Viemed is exposed; the failure of third parties to comply with their obligations; difficulty integrating newly acquired businesses; the impact of new and changes to, or application of, current laws and regulations; the overall difficult litigation and regulatory environment; increased competition; changes in foreign currency rates; increased funding costs and market volatility due to market illiquidity and competition for funding; critical accounting estimates and changes to accounting standards, policies, and methods used by Viemed; the impact of the previously disclosed restatement and correction of our previously issued financial statements; the previously disclosed identified material weakness in our internal control over financial reporting and our ability to remediate that material weakness; the initiation of legal or regulatory proceedings with respect to the restatement and corrections; the adverse effects on our business, results of operations, financial condition and stock price, as a result of the restatement and correction process; Viemed’s status as an emerging growth company and a foreign private issuer; and the occurrence of natural and unnatural catastrophic events or health epidemics or concerns, such as the recent COVID-19 outbreak, and claims resulting from such events or concerns; as well as those risk factors discussed or referred to in Viemed’s disclosure documents filed with the U.S. Securities and Exchange Commission (the “SEC”) available on the SEC’s website at www.sec.gov, including Viemed’s most recent Annual Report on Form 10-K, and with the securities regulatory authorities in certain provinces of Canada available at www.sedar.com. Should any factor affect Viemed in an unexpected manner, or should assumptions underlying the forward-looking statements prove incorrect, the actual results or events may differ materially from the results or events predicted. Any such forward-looking statements are expressly qualified in their entirety by this cautionary statement. Moreover, Viemed does not assume responsibility for the accuracy or completeness of such forward-looking statements. The forward-looking statements included in this Presentation are made as of the date of this Presentation and Viemed undertakes no obligation to publicly update or revise any forward-looking statements, other than as required by applicable law. Market and Industry Data Industry and market data used in this Presentation is unaudited and have been obtained from third-party industry publications and sources as well as from research reports prepared for other purposes. Viemed has not independently verified the data obtained from these sources and cannot assure you of the data’s accuracy or completeness. This data is subject to change and cannot always be verified with complete certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey of market or industry data. You are cautioned not to give undue weight to such industry and market data. Non-GAAP and Other Financial Information This Presentation includes references to financial measures that are calculated and presented on the basis of methodologies other than in accordance with generally accepted accounting principles in the United States of America (“GAAP”), including the measures Net Revenue and Adjusted EBITDA. A reconciliation of certain of these non-GAAP financial measures to the nearest GAAP measure can be found in the Appendix to this Presentation. No Offer or Solicitation This Presentation does not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of the securities of Viemed in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. Recipients of this Presentation who are considering acquiring securities of Viemed are referred to the entire body of publicly disclosed information regarding Viemed. The information is subject to material updating, revision and further amendment, and is qualified entirely by reference to Viemed’s publicly disclosed information.

VIEMED AT A GLANCE Largest independent specialized provider of ventilation (NIV) in the US home respiratory health care industry Highly profitable with a 45% CAGR in revenue growth since 2010 Service offering includes 24x7 in home respiratory care including specialized respiratory therapists and medical devices Headquartered in Lafayette, Louisiana Currently serving over 27,000 patients Listed on NASDAQ (VMD) as well as listed on TSX (VMD.TO) 3

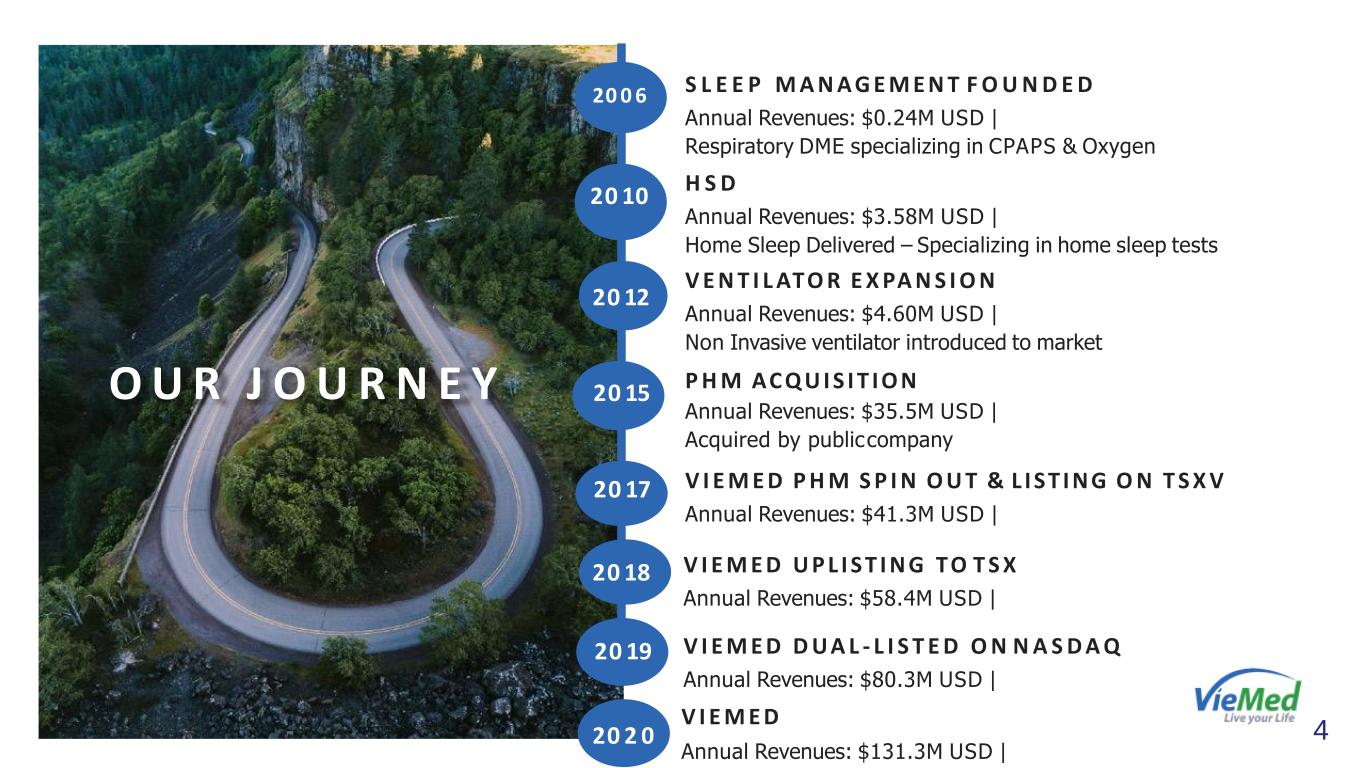

V I E M E D D U A L - L I S T E D O N N A S D A Q Annual Revenues: $80.3M USD | 20 19 20 15 20 12 20 10 20 0 6 O U R J O U R N E Y V I E M E D U P L I S T I N G TO T S X Annual Revenues: $58.4M USD | 20 18 S L E E P M A N A G E M E N T F O U N D E D Annual Revenues: $0.24M USD | Respiratory DME specializing in CPAPS & Oxygen H S D Annual Revenues: $3.58M USD | Home Sleep Delivered – Specializing in home sleep tests V E N T I L ATO R E X PA N S I O N Annual Revenues: $4.60M USD | Non Invasive ventilator introduced to market P H M AC Q U I S I T I O N Annual Revenues: $35.5M USD | Acquired by publiccompany V I E M E D P H M S P I N O U T & L I ST I N G O N T S X V Annual Revenues: $41.3M USD | 20 17 420 2 0 V I E M E D Annual Revenues: $131.3M USD |

Specialized US based respiratory healthcare services company • Focused on Chronic Obstructive Pulmonary Disease (COPD) and growing aging population • $50 billion of annual healthcare cost in the U.S. spent on COPD Significant Market Growth Opportunity • 10,000 baby boomers are turning 65 everyday (26% of the US population) • Expansion of service to underserved VA patients Favorable Market Trend • Increasing need supported by Government for effective homecare solutions to reduce patient hospital re-admissions • increase system efficiency • offer better comfort and family lifestyle options • save money for patients, insurers, government KEY INVESTMENT CONSIDERATION 5

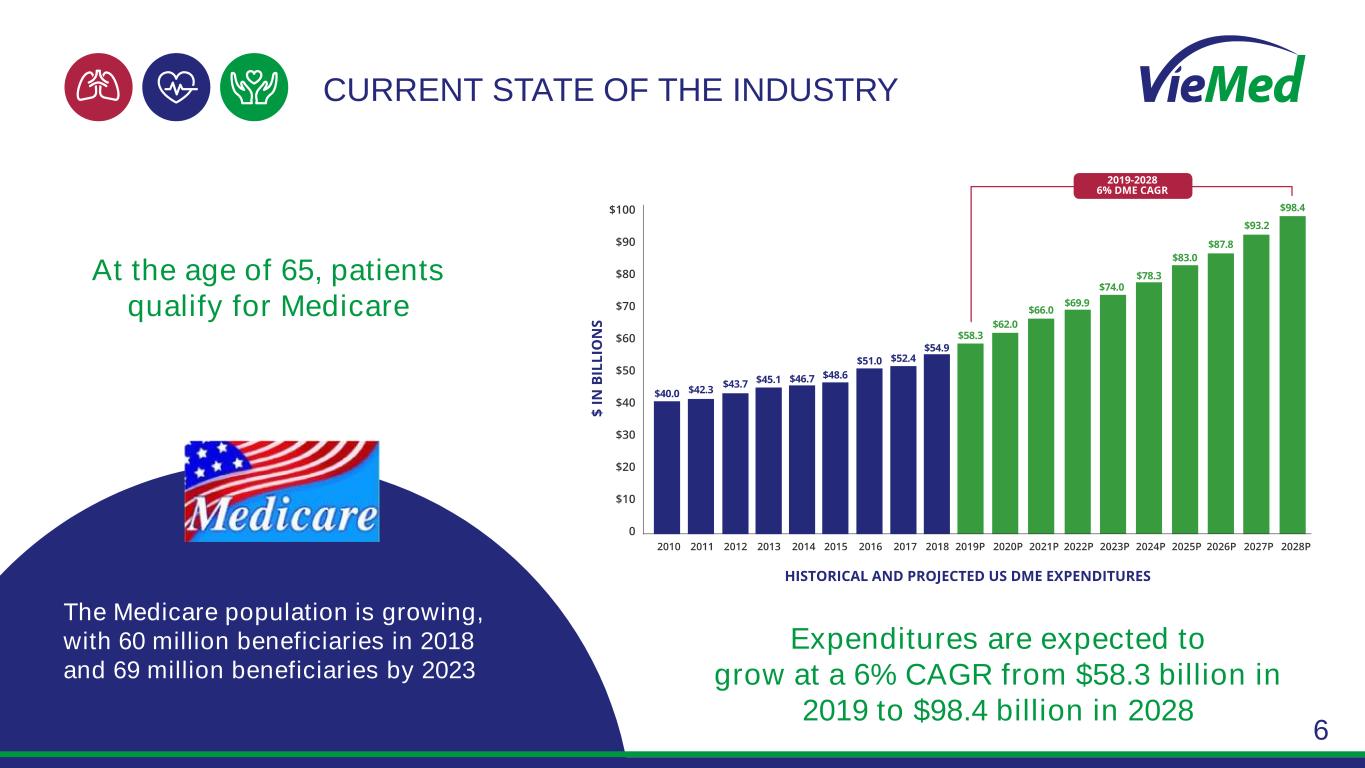

CURRENT STATE OF THE INDUSTRY The Medicare population is growing, with 60 million beneficiaries in 2018 and 69 million beneficiaries by 2023 At the age of 65, patients qualify for Medicare Expenditures are expected to grow at a 6% CAGR from $58.3 billion in 2019 to $98.4 billion in 2028 6

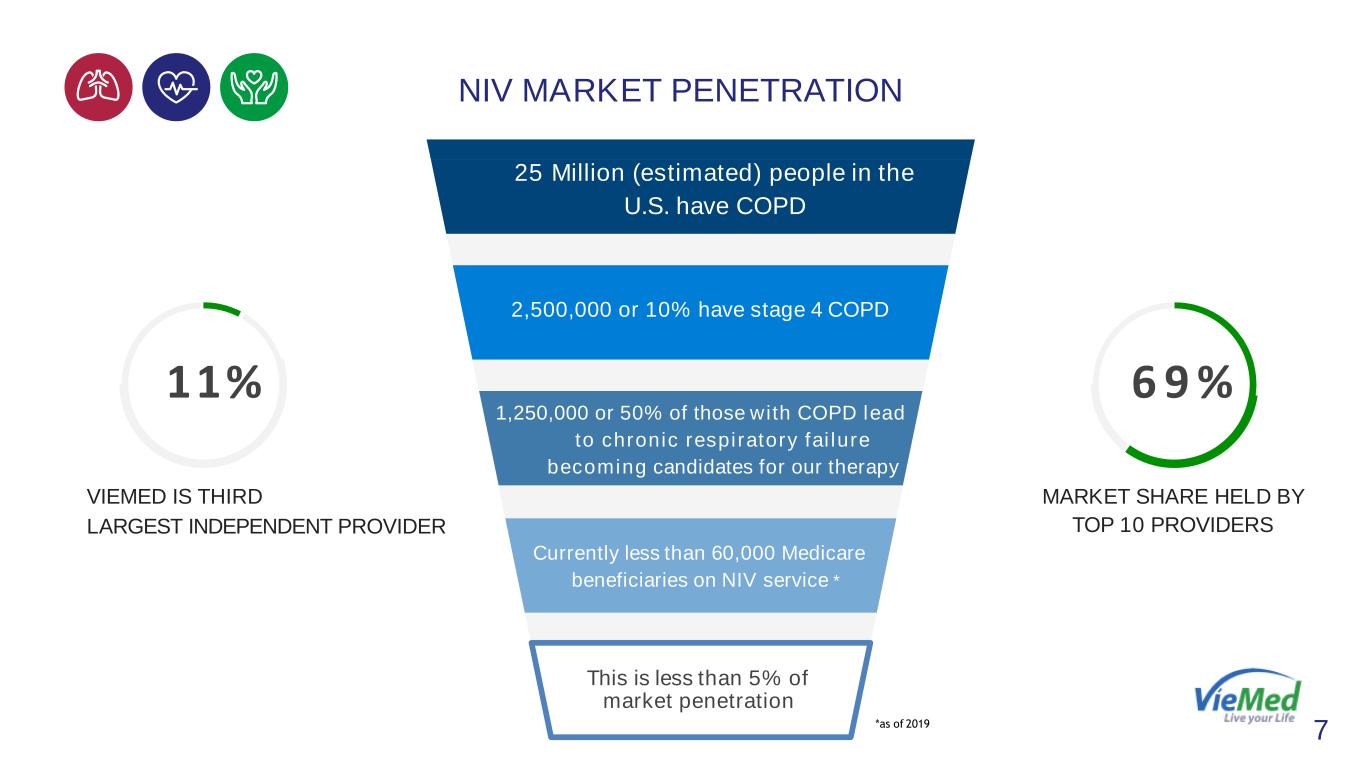

MARKET SHARE HELD BY TOP 10 PROVIDERS VIEMED IS THIRD LARGEST INDEPENDENT PROVIDER 6 9 %11% *as of 2019 25 Million (estimated) people in the U.S. have COPD 2,500,000 or 10% have stage 4 COPD 1,250,000 or 50% of those with COPD lead to chronic respiratory failure becoming candidates for our therapy Currently less than 60,000 Medicare beneficiaries on NIV service * This is less than 5% of market penetration 7 NIV MARKET PENETRATION

Registered Respiratory Therapists (RT’s) assigned to each patient and on call 24X7 • All RT's are COPD educators • Assess and service medical equipment • Overseen by pulmonologists on staff Each patient is given a customized in-home care plan based off Activities of Daily Living (ADL’s) assessments. Subsequent visits educate and assist patients – build trust and on-going relationship with patient Provide affordability for patients • Majority of plans covered by Medicare and private insurance THE VIEMED SOLUTION 8

A D E D I C A T E D 24/7 R E S P I R A T O R Y T H E R A P I S T PERCUSSION VESTS OXYGEN THERAPY VENTILATORS COUGH ASSISTS comes w i th al l our VieMed products. SLEEP THERAPY 9 REMOTE PATIENT MONITORING

Location selection • Based on high COPD rates • Target hospitals and facilities with high readmission rates and near existing service area • Leverage existing relationships and operate on the outskirts of large metropolitan areas Unique lean deployment model • No costly retail stores • Sales reps and RT's operate out of vehicles that are monitored by GPS High service model • Certified RT’s delivering a high touch service model to a non-compliant patient demographic base. • Providing education and assessment to patients in their homes and through Telehealth PROVEN GROWTH STRATEGY 10

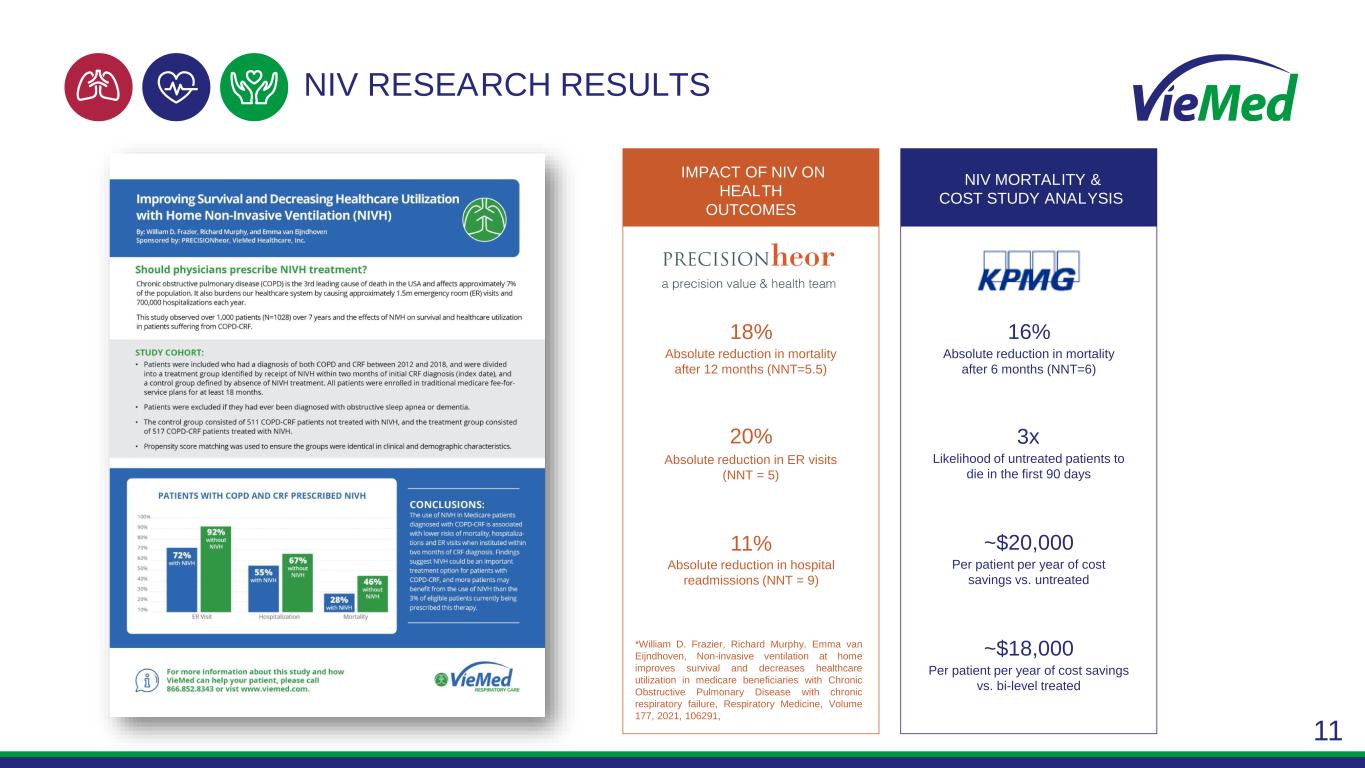

18% Absolute reduction in mortality after 12 months (NNT=5.5) 16% Absolute reduction in mortality after 6 months (NNT=6) 3x Likelihood of untreated patients to die in the first 90 days ~$20,000 Per patient per year of cost savings vs. untreated ~$18,000 Per patient per year of cost savings vs. bi-level treated IMPACT OF NIV ON HEALTH OUTCOMES NIV MORTALITY & COST STUDY ANALYSIS 20% Absolute reduction in ER visits (NNT = 5) 11% Absolute reduction in hospital readmissions (NNT = 9) *William D. Frazier, Richard Murphy, Emma van Eijndhoven, Non-invasive ventilation at home improves survival and decreases healthcare utilization in medicare beneficiaries with Chronic Obstructive Pulmonary Disease with chronic respiratory failure, Respiratory Medicine, Volume 177, 2021, 106291, NIV RESEARCH RESULTS 11

Vision of becoming a leading healthcare technology company coupled with high touch human interaction in the home Goal is to improve quality of life and length of time patients spend with loved ones Increase efficiency of clinicians through improved remote workflow and proactive care patient engagement solutions Increase patient and caregiver engagement Capture key data elements, analysis and insights from patient’s home to improve care Clinicians Patients Caregivers RT Care Team TECHNOLOGY & REMOTE CARE INITIATIVES 12

OBJECTIVES FOR NEXT 24 MONTHS Grow active patient base while entering new target states through geographic expansion Roll out results of the third-party KPMG and Precision Health Economics research studies referral sources and payors in order to save more lives and increase penetration Diversify payor base – specific focus of bringing our solution to the VA and other commercial payors Expand technology capabilities in order to capture useful patient data and increase length of stay Expand service offerings and home-based product offerings to service additional disease states Pursue strategic acquisitions to augment strong organic growth model Provide holistic patient care through Viemed Clinical Services 13

FINANCIALS

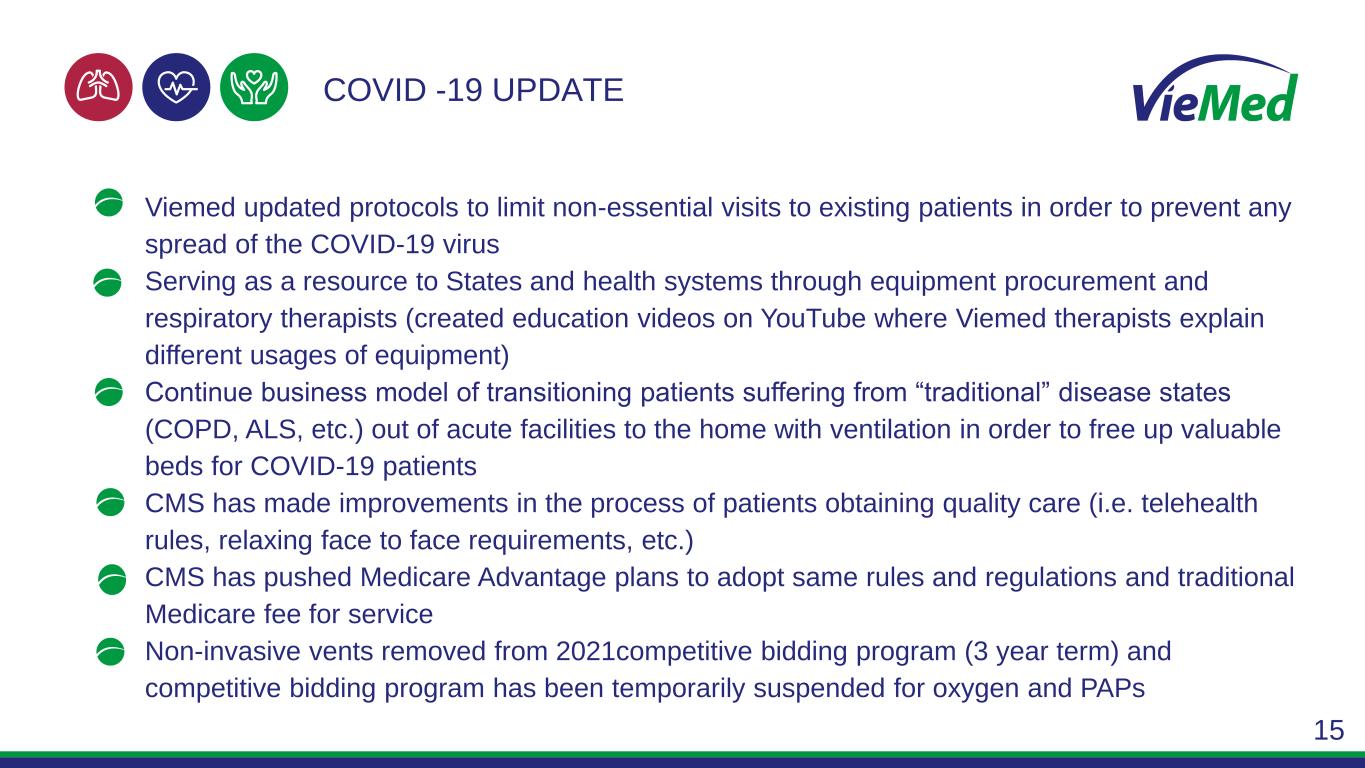

COVID -19 UPDATE 15 • Viemed updated protocols to limit non-essential visits to existing patients in order to prevent any spread of the COVID-19 virus • Serving as a resource to States and health systems through equipment procurement and respiratory therapists (created education videos on YouTube where Viemed therapists explain different usages of equipment) • Continue business model of transitioning patients suffering from “traditional” disease states (COPD, ALS, etc.) out of acute facilities to the home with ventilation in order to free up valuable beds for COVID-19 patients • CMS has made improvements in the process of patients obtaining quality care (i.e. telehealth rules, relaxing face to face requirements, etc.) • CMS has pushed Medicare Advantage plans to adopt same rules and regulations and traditional Medicare fee for service • Non-invasive vents removed from 2021competitive bidding program (3 year term) and competitive bidding program has been temporarily suspended for oxygen and PAPs

REVENUE MODEL Monthly rental fee – reimbursed by insurance and covered by Medicare Uncapped rental contract Average monthly client revenue is ~US$950 (all providers paid same rate by Medicare) Pricing includes equipment rental, RT service, supplies and maintenance of equipment 16

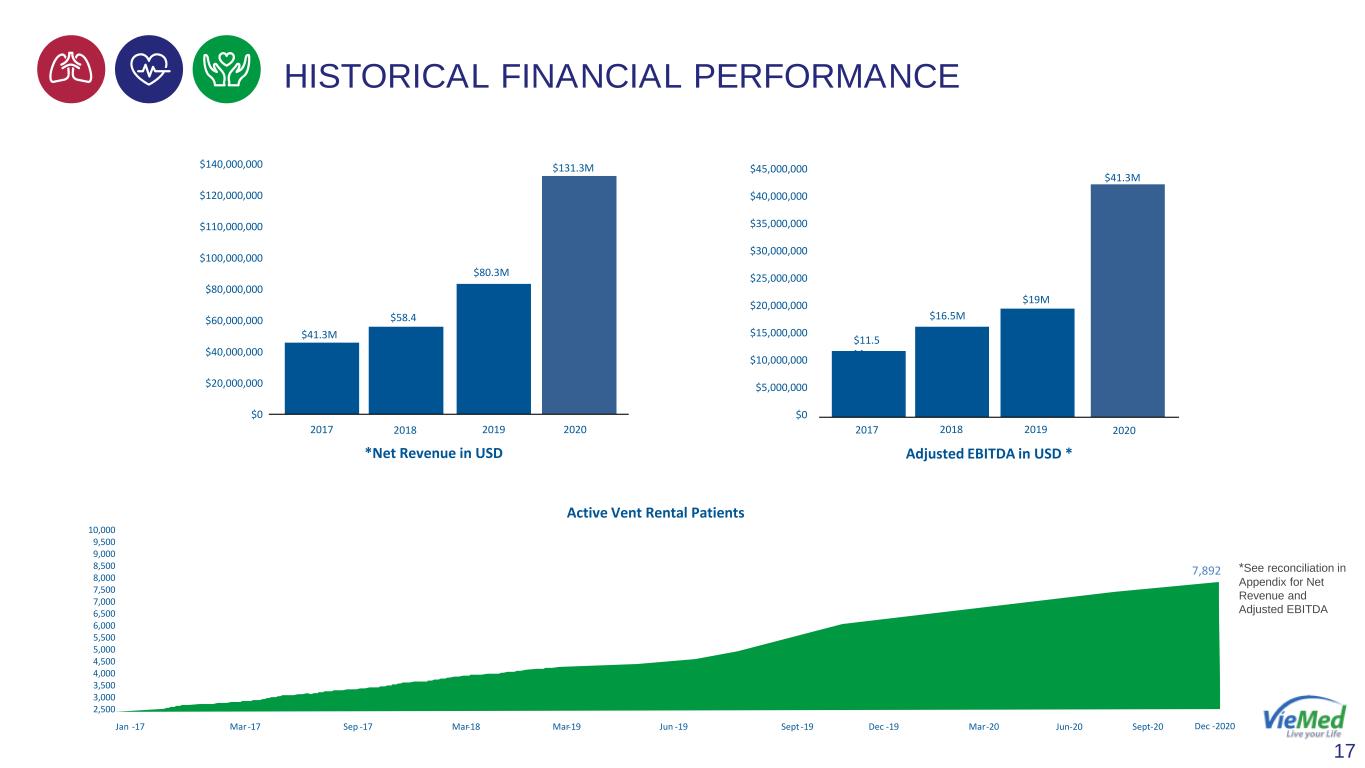

*Net Revenue in USD 2017 2018 2019 2020 17 HISTORICAL FINANCIAL PERFORMANCE $41.3M $58.4M $80.3M $131.3M$140,000,000 $120,000,000 $110,000,000 $100,000,000 $80,000,000 $60,000,000 $40,000,000 $20,000,000 $0 Adjusted EBITDA in USD * 2017 $11.5 M 2018 $16.5M $19M 2019 2020 $41.3M $45,000,000 $40,000,000 $35,000,000 $30,000,000 $25,000,000 $20,000,000 $15,000,000 $10,000,000 $5,000,000 $0 *See reconciliation in Appendix for Net Revenue and Adjusted EBITDA Active Vent Rental Patients Jan -17 Mar -17 Sep -17 Mar-18 Mar-19 Jun -19 Sept -19 Dec -19 Mar-20 Jun-20 Sept-20 7,892 10,000 9,500 9,000 8,500 8,000 7,500 7,000 6,500 6,000 5,500 5,000 4,500 4,000 3,500 3,000 2,500 Dec -2020 $41.3M $58.4

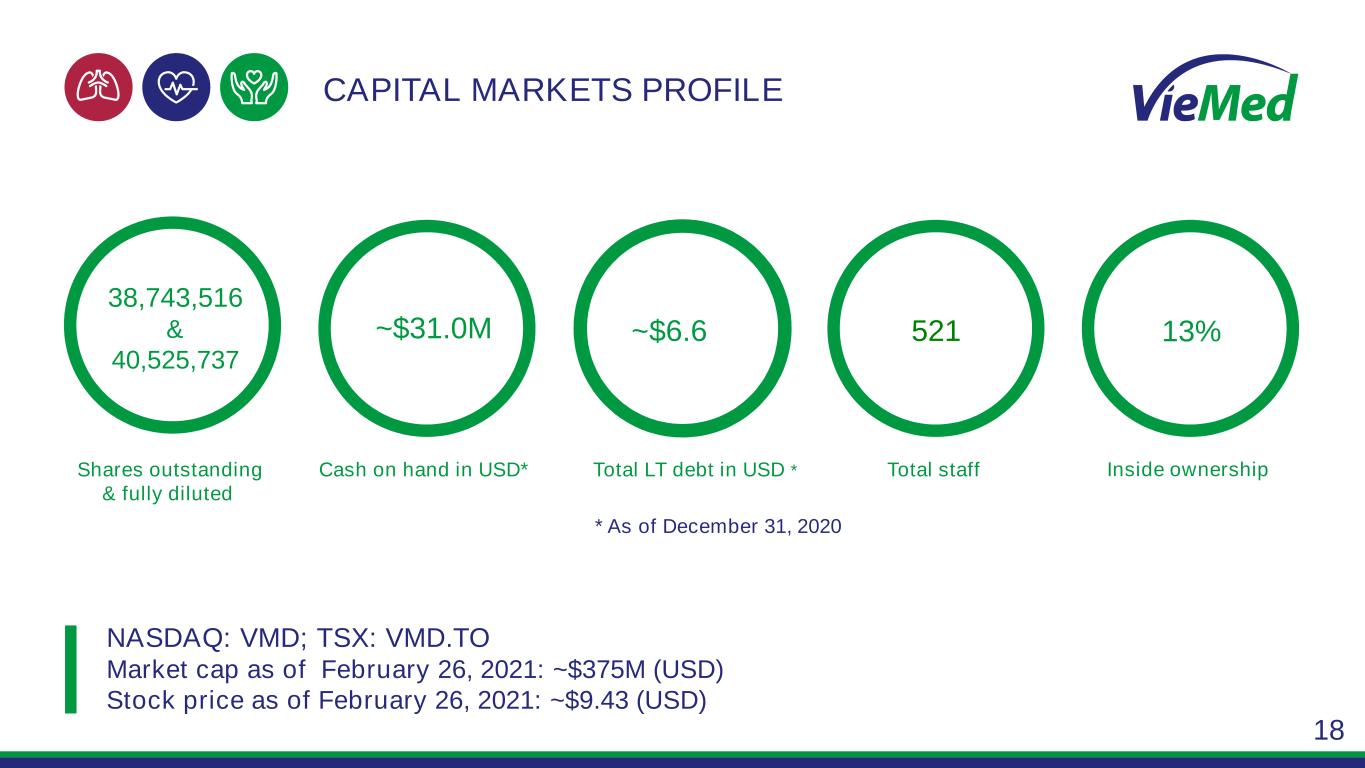

CAPITAL MARKETS PROFILE 38,743,516 & 40,525,737 Shares outstanding & fully diluted ~$31.0M 13% Inside ownership NASDAQ: VMD; TSX: VMD.TO Market cap as of February 26, 2021: ~$375M (USD) Stock price as of February 26, 2021: ~$9.43 (USD) Cash on hand in USD* Total LT debt in USD * ~$6.6 Total staff 521 * As of December 31, 2020 18

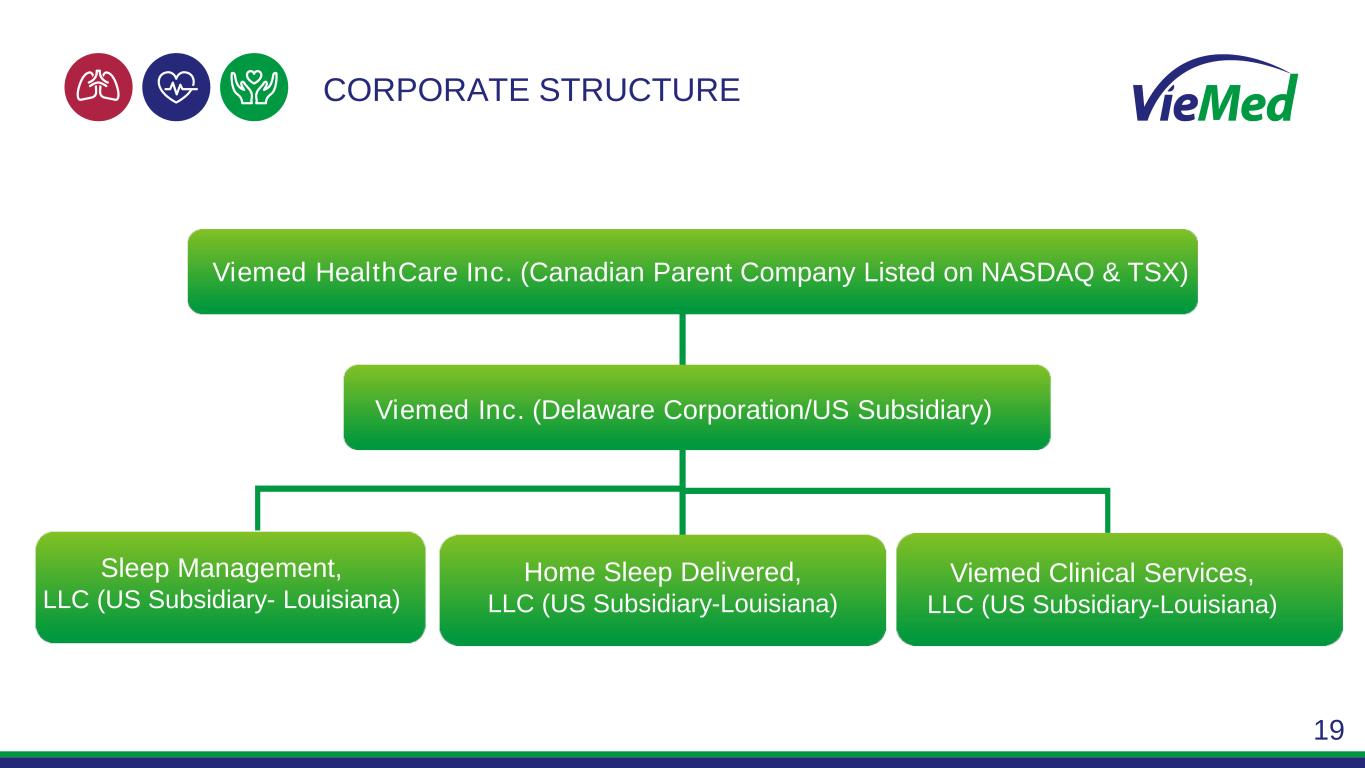

CORPORATE STRUCTURE Viemed HealthCare Inc. (Canadian Parent Company Listed on NASDAQ & TSX) Viemed Inc. (Delaware Corporation/US Subsidiary) Home Sleep Delivered, LLC (US Subsidiary-Louisiana) Sleep Management, LLC (US Subsidiary- Louisiana) 19 Viemed Clinical Services, LLC (US Subsidiary-Louisiana)

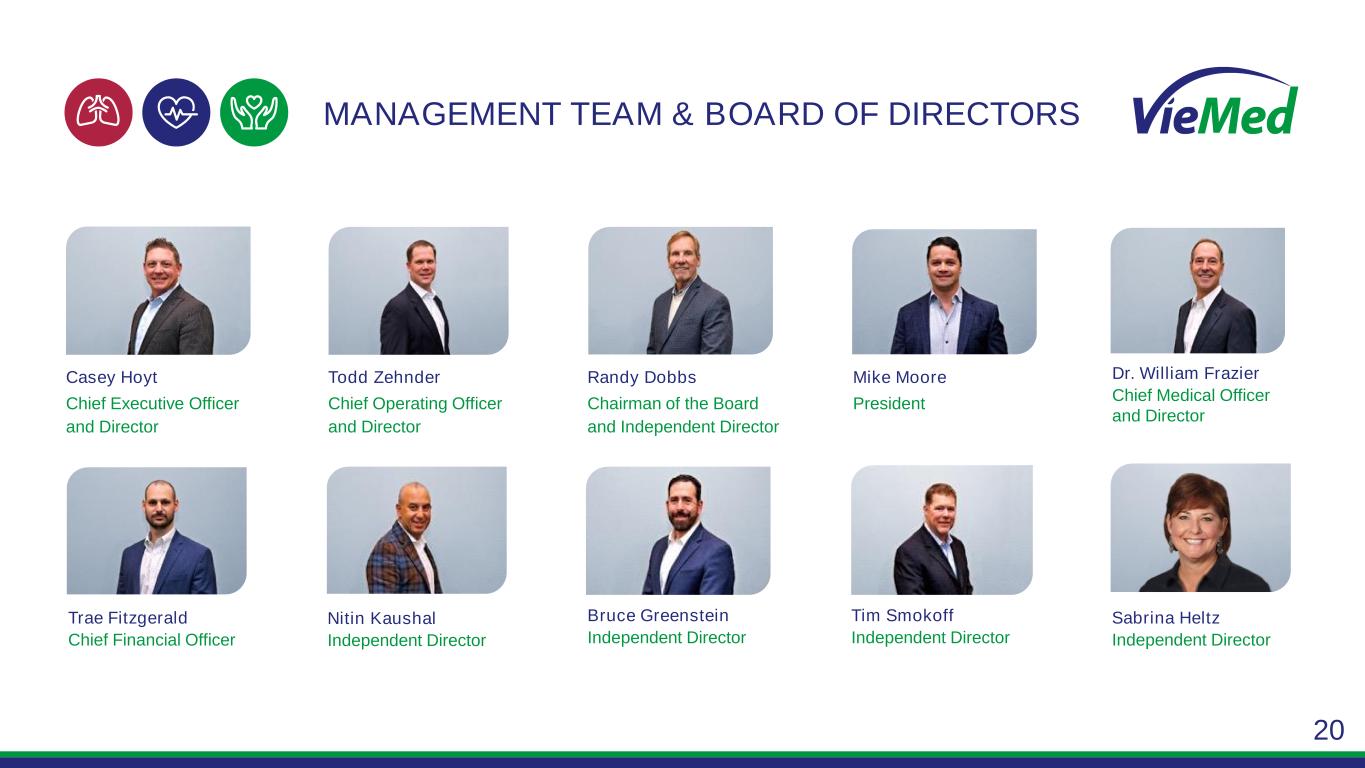

Trae Fitzgerald Chief Financial Officer Casey Hoyt Chief Executive Officer and Director Randy Dobbs Chairman of the Board and Independent Director Todd Zehnder Chief Operating Officer and Director MANAGEMENT TEAM & BOARD OF DIRECTORS 20 Nitin Kaushal Independent Director Bruce Greenstein Independent Director Tim Smokoff Independent Director Dr. William Frazier Chief Medical Officer and Director Mike Moore President Sabrina Heltz Independent Director

Glen Akselrod Bristol Capital IR glen@bristolir.com Tel: 905 - 326 - 1888 Thank you 21

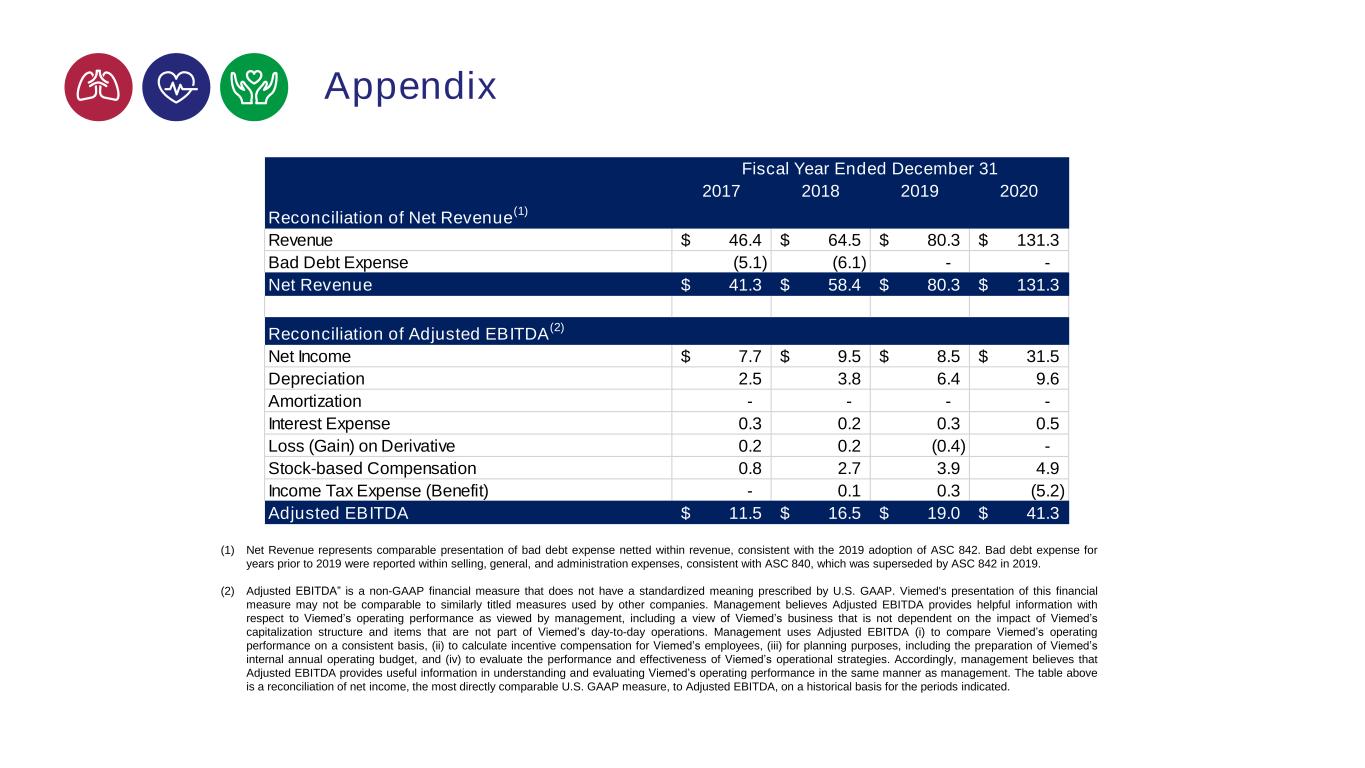

Appendix (1) Net Revenue represents comparable presentation of bad debt expense netted within revenue, consistent with the 2019 adoption of ASC 842. Bad debt expense for years prior to 2019 were reported within selling, general, and administration expenses, consistent with ASC 840, which was superseded by ASC 842 in 2019. (2) Adjusted EBITDA” is a non-GAAP financial measure that does not have a standardized meaning prescribed by U.S. GAAP. Viemed's presentation of this financial measure may not be comparable to similarly titled measures used by other companies. Management believes Adjusted EBITDA provides helpful information with respect to Viemed’s operating performance as viewed by management, including a view of Viemed’s business that is not dependent on the impact of Viemed’s capitalization structure and items that are not part of Viemed’s day-to-day operations. Management uses Adjusted EBITDA (i) to compare Viemed’s operating performance on a consistent basis, (ii) to calculate incentive compensation for Viemed’s employees, (iii) for planning purposes, including the preparation of Viemed’s internal annual operating budget, and (iv) to evaluate the performance and effectiveness of Viemed’s operational strategies. Accordingly, management believes that Adjusted EBITDA provides useful information in understanding and evaluating Viemed’s operating performance in the same manner as management. The table above is a reconciliation of net income, the most directly comparable U.S. GAAP measure, to Adjusted EBITDA, on a historical basis for the periods indicated. 2017 2018 2019 2020 Reconciliation of Net Revenue (1) Revenue 46.4$ 64.5$ 80.3$ 131.3$ Bad Debt Expense (5.1) (6.1) - - Net Revenue 41.3$ 58.4$ 80.3$ 131.3$ Reconciliation of Adjusted EBITDA (2) Net Income 7.7$ 9.5$ 8.5$ 31.5$ Depreciation 2.5 3.8 6.4 9.6 Amortization - - - - Interest Expense 0.3 0.2 0.3 0.5 Loss (Gain) on Derivative 0.2 0.2 (0.4) - Stock-based Compensation 0.8 2.7 3.9 4.9 Income Tax Expense (Benefit) - 0.1 0.3 (5.2) Adjusted EBITDA 11.5$ 16.5$ 19.0$ 41.3$ Fiscal Year Ended December 31