Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Hippo Holdings Inc. | d117122d8k.htm |

| EX-10.4 - EX-10.4 - Hippo Holdings Inc. | d117122dex104.htm |

| EX-10.3 - EX-10.3 - Hippo Holdings Inc. | d117122dex103.htm |

| EX-10.2 - EX-10.2 - Hippo Holdings Inc. | d117122dex102.htm |

| EX-10.1 - EX-10.1 - Hippo Holdings Inc. | d117122dex101.htm |

| EX-2.1 - EX-2.1 - Hippo Holdings Inc. | d117122dex21.htm |

Exhibit 99.1

|

|

Proprietary and Confidential | 1

|

|

Disclaimer (1/2) About this Presentation This presentation (“Presentation”) is for informational purposes only. This Presentation shall not constitute an offer to sell, or the solicitation of an offer to buy, any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale would be unlawful. This Presentation has been prepared to assist interested parties in making their own evaluation with respect to a potential business combination between Hippo Enterprises, Inc. (“Hippo”) and Reinvent Technology Partners Z (“Reinvent”) and the related transactions (the “Proposed Business Combination”) and for no other purpose. … Neither the Securities and Exchange Commission nor any securities commission of any other U.S. or non-U.S. jurisdiction has approved or disapproved of the Proposed Business Combination presented herein, or determined that this Presentation is truthful or complete. No representations or warranties, express or implied are given in, or in respect of, this Presentation. To the fullest extent permitted by law in no circumstances will Hippo, Reinvent or any of their respective subsidiaries, stockholders, affiliates, representatives, directors, officers, employees, advisers, or agents by responsible or liable for a direct, indirect, or consequential loss or loss of profit arising from the use of this Presentation its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. Industry and market data used in this Presentation have been obtained from third-party industry publications and sources as well as from research reports prepared for other purposes. Neither Hippo nor Reinvent has independently verified the data obtained from these sources and cannot assure you of the data’s accuracy or completeness. This data is subject to change. In addition, this Presentation does not purport to be all-inclusive or to contain all of the information that may be required to make a full analysis of Hippo or the Proposed Business Combination. Viewers of this Presentation should each make their own evaluation of Hippo and of the relevance and adequacy of the information and should make such other investigations as they deem necessary. Forward Looking Statements Certain statements included in this Presentation that are not historical facts are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of other financial and performance metrics and projections of market opportunity. These statements are based on various assumptions, whether or not identified in this Presentation, and on the current expectations of the respective management of Hippo and Reinvent and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by an investor as, a guarantee, an assurance, a prediction, or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Hippo and Reinvent. These forward-looking statements are subject to a number of risks and uncertainties, including changes in domestic and foreign business, market, financial, political, and legal conditions; natural or man-made catastrophes such as hurricanes, typhoons, earthquakes, floods, climate change (including effects on weather patterns; greenhouse gases; sea, land and air temperatures; sea levels; and rain and snow), nuclear accidents, pandemics (including COVID-19), or terrorism; continued impact of COVID-19 and related risks; ability to collect reinsurance recoverable, credit developments of reinsurers, and any delays with respect thereto and changes in the cost, quality, or availability of reinsurance; effects of data privacy or cyber laws or regulation; actual amount of new and renewal business, market acceptance of products, and risks associated with the introduction of new products and services and entering new markets; ability to increase use of data analytics and technology as part of business strategy; ability to attract, retain, and expand customer base; ability to compete effectively in the industry; effects of seasonal trends on results of operations; the inability of the parties to successfully or timely consummate the Proposed Business Combination, including the risk that any regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the Proposed Business Combination or that the approval of the stockholders of Hippo or Reinvent is not obtained; failure to realize the anticipated benefits of the Proposed Business Combination; risks relating to the uncertainty of the projected financial information with respect to Hippo; risks related to the performance of Hippo’s business and the timing of expected business or revenue milestones; the effects of competition on Hippo’s business; the amount of redemption requests made by Reinvent’s stockholders; the ability of Hippo or Reinvent to issue equity or equity-linked securities or obtain debt financing in connection with the Proposed Business Combination or in the future, and those factors discussed in Reinvent’s prospectus on Form S-1 filed with the SEC on November 18, 2020 under the heading “Risk Factors,” and other documents Reinvent has filed, or will file, with the SEC. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that neither Hippo nor Reinvent presently know, or that Hippo nor Reinvent currently believe are immaterial, that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Hippo’s and Reinvent’s expectations, plans, or forecasts of future events and views as of the date of this Presentation. Reinvent and Hippo anticipate that subsequent events and developments will cause Hippo’s and Reinvent’s assessments to change. However, while Hippo and Reinvent may elect to update these forward-looking statements at some point in the future, Hippo and Reinvent specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing Hippo’s and Reinvent’s assessments of any date subsequent to the date of his Presentation. Accordingly, undue reliance should not be placed upon the forward-looking statements. Use of Projections This Presentation contains projected financial information. Such projected financial information constitutes forward-looking information, and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underling such financial forecast information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive, and other risks and uncertainties. See “Forward-Looking Statements” above. Actual results may differ materially from the results contemplated by the financial forecast information contained in this Presentation, and the inclusion of such information in this Presentation should not be regarded as a representation by any person that the results reflected in such forecasts will be achieved. Proprietary and Confidential | 2

|

|

Disclaimer (2/2) Use of Data The data contained herein is derived from various internal and external sources. No representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any projections or modeling or any other information contained herein. Any data on past performance or modeling contained herein is not an indication as to future performance. Hippo and Reinvent assume no obligation to update the information in this presentation. Use of Non-GAAP Financial Metrics and Other Key Financial Metrics This presentation includes certain non-GAAP financial measures (including on a forward-looking basis) such as Adjusted Gross Profit (“AGP”), Adjusted EBITDA and Total Written Premium (”TWP”). Hippo defines Adjusted Gross Profit, a Non-GAAP metric, as Gross Profit excluding investment income, plus channel distribution cost and overhead associated with Hippo’s underwriting operations including employee-related expense and professional fees, plus depreciation, amortization, stock-based compensation and other non-cash expenses associated with Hippo’s cost of revenue, plus pro-forma synergy adjustments for the acquisition of Spinnaker. Hippo believes the resulting calculation is inclusive of the variable costs of revenue incurred to successfully service a policy, irrespective of the distribution channel or the underwriting insurance carrier, and is therefore a key measure of the profitability of its underlying book of business. Hippo defines Adjusted EBITDA, a Non-GAAP metric, as net loss excluding income tax expense, interest expense, depreciation, amortization, stock-based compensation, net investment income, and other non-cash adjustments such as fair value, contingent consideration and pro-forma synergy adjustments for the acquisition of Spinnaker, and other transactions that Hippo would consider to be unique in nature. Hippo excludes these items from Adjusted EBITDA because it does not consider them to be directly attributable to its underlying operating performance. Hippo defines Total Written Premium as the Gross Written Premium of policies underwritten by Hippo and its affiliates plus the premium of policies placed with third-party insurance carriers where Hippo earns a recurring commission payment. These non-GAAP measures are an addition, and not a substitute for or superior to measures of financial performance prepared in accordance with GAAP and should not be considered as an alternative to net income, operating income or any other performance measures derived in accordance with GAAP. Reconciliations of non-GAAP measures to their most directly comparable GAAP counterparts are included in the Appendix to this presentation. Hippo believes that these non-GAAP measures of financial results (including on a forward-looking basis) provide useful supplemental information to investors about Hippo. Hippo’s management uses forward looking non-GAAP measures to evaluate Hippo’s projected financial and operating performance. However, there are a number of limitations related to the use of these non-GAAP measures and their nearest GAAP equivalents. For example other companies may calculate non-GAAP measures differently, or may use other measures to calculate their financial performance, and therefore Hippo’s non-GAAP measures may not be directly comparable to similarly titled measures of other companies. This Presentation also includes certain projections of non-GAAP financial measures. Due to the high variability and difficulty in making accurate forecasts and projections of some of the information excluded from these projected measures, together with some of the excluded information not being ascertainable or accessible, Hippo is unable to quantify certain amounts that would be required to be included in the most directly comparable GAAP financial measures without unreasonable effort. Consequently, no disclosure of estimated comparable GAAP measures is included and no reconciliation of the forward looking non-GAAP financial measures is included. Participants in Solicitation Hippo and Reinvent and their respective directors and executive officers, under SEC rules, may be deemed to be participants in the solicitation of proxies of Reinvent’s shareholders in connection with the proposed business combination. Investors and security holders may obtain more detailed information regarding the names and interests in the proposed business combination of Reinvent’s directors and officers in Reinvent’s filings with the SEC, including Reinvent’s registration statement on Form S-1, which was originally filed with the SEC on November 20, 2020. To the extent that holdings of Reinvent’s securities have changed from the amounts reported in Reinvent’s registration statement on Form S-1, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to Reinvent’s shareholders in connection with the proposed business combination is set forth in the proxy statement/prospectus on Form S-4 for the proposed business combination, which is expected to be filed by Reinvent with the SEC. Investors and security holders of Reinvent and Hippo are urged to read the proxy statement/prospectus and other relevant documents that will be filed with the SEC carefully and in their entirety when they become available because they will contain important information about the proposed business combination. Investors and security holders will be able to obtain free copies of the proxy statement and other documents containing important information about Hippo and Reinvent through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by Reinvent can be obtained free of charge by visiting the SEC’s website at https://www.sec.gov/cgi-bin/browse-edgar?CIK=1828105 , the investor relations page of Reinvent’s website at https://z.reinventtechnologypartners.com/investor-relations/sec-filings, or by directing a written request via email to contact@reinventtechnologypartners.com with the subject line “RTPZ SEC Filings Request.” Proprietary and Confidential | 3

|

|

Today’s Presenters Reid Hoffman Michael Thompson Assaf Wand Richard McCathron Stewart Ellis Co-Lead Director of RTPZ President and CEO of RTPZ

|

|

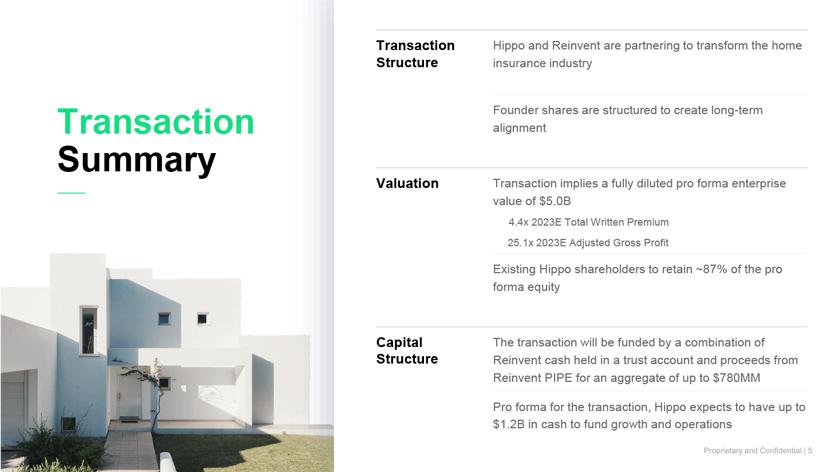

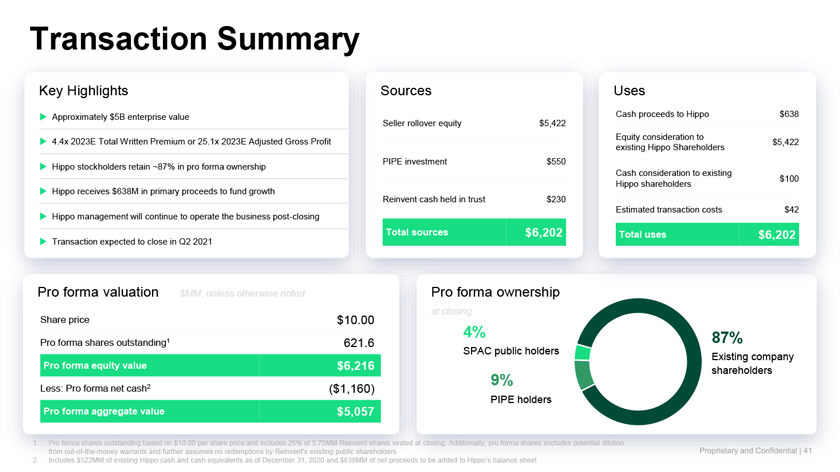

Transaction Summary Transaction Hippo and Reinvent are partnering to transform the home Structure insurance industry Founder shares are structured to create long-term alignment Valuation Transaction implies a fully diluted pro forma enterprise value of $5.0B 4.4x 2023E Total Written Premium 25.1x 2023E Adjusted Gross Profit Existing Hippo shareholders to retain ~87% of the pro forma equity Capital The transaction will be funded by a combination of Structure Reinvent cash held in a trust account and proceeds from Reinvent PIPE for an aggregate of up to $780MM Pro forma for the transaction, Hippo expects to have up to $1.2B in cash to fund growth and operations

|

|

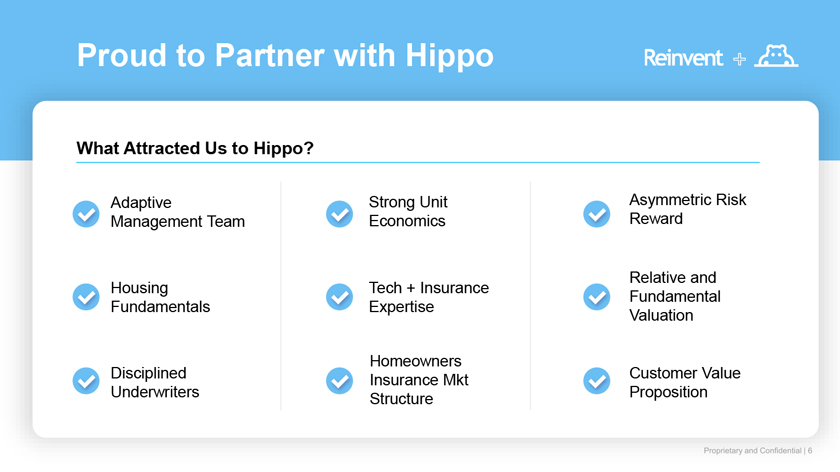

Proud to Partner with Hippo What Attracted Us to Hippo? Adaptive Strong Unit Asymmetric Risk Management Team Economics Reward Relative and Housing Tech + Insurance Fundamental Fundamentals Expertise Valuation Homeowners Disciplined Insurance Mkt Customer Value Underwriters Structure Proposition

|

|

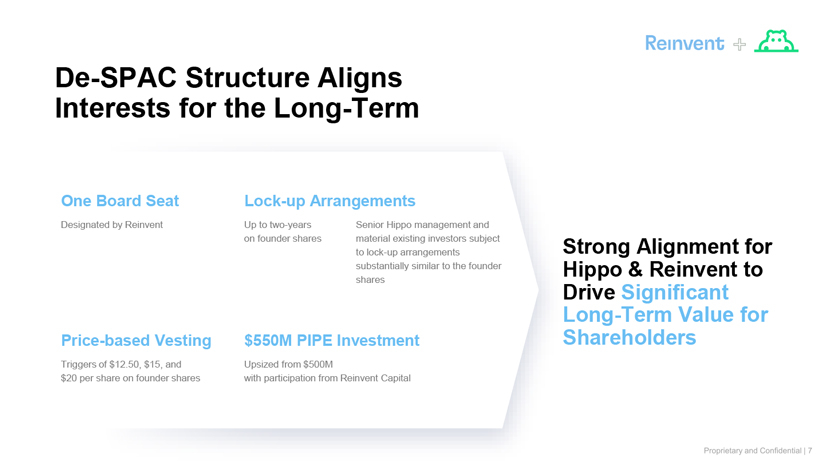

De-SPAC Structure Aligns Interests for the Long-Term One Board Seat Lock-up Arrangements Designated by Reinvent Up to two-years Senior Hippo management and on founder shares material existing investors subject Strong Alignment for to lock-up arrangements substantially similar to the founder Hippo & Reinvent to shares Drive Significant Long-Term Value for Price-based Vesting $550M PIPE Investment Shareholders Triggers of $12.50, $15, and Upsized from $500M $20 per share on founder shares with participation from Reinvent Capital

|

|

V I S I O N Hippo exists to protect the joy of homeownership M I S S I O N Delivering intuitive and proactive protection for homeowners, combining the power of technology with a human touch Proprietary and Confidential | 8

|

|

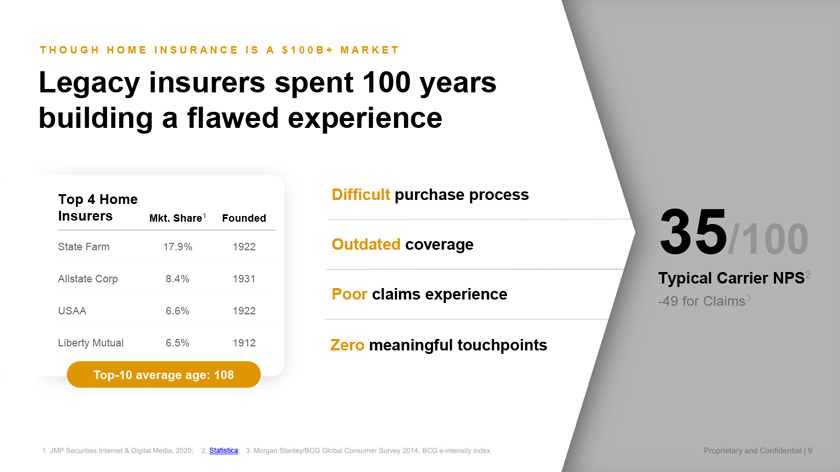

T H O U G H H O M E I N S U R A N C E I S A $ 1 0 0 B + M A R K E T Legacy insurers spent 100 years building a flawed experience Top 4 Home Difficult purchase process Insurers Mkt. Share1 Founded State Farm 17.9% 1922 Outdated coverage 35/100 Allstate Corp 8.4% 1931 Typical Carrier NPS2 Poor claims experience -49 for Claims3 USAA 6.6% 1922 Liberty Mutual 6.5% 1912 Zero meaningful touchpoints Top-10 average age: 108 Statistica

|

|

The entire system creates a transactional, adversarial relationship between insurers and customers r When one wins, the other loses We believe there is a better way | 10

|

|

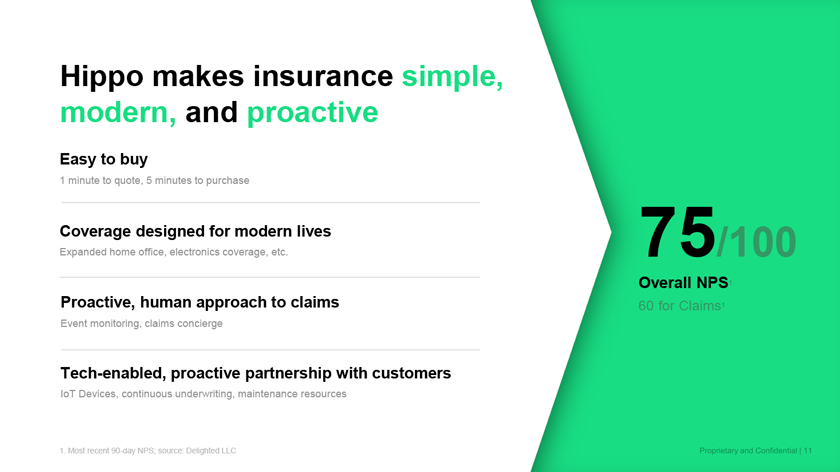

Hippo makes insurance simple, modern, and proactive Easy to buy 1 minute to quote, 5 minutes to purchase Coverage designed for modern lives Expanded home office, electronics coverage, etc. 75/100 Overall NPS1 Proactive, human approach to claims 60 for Claims1 Event monitoring, claims concierge Tech-enabled, proactive partnership with customers IoT Devices, continuous underwriting, maintenance resources 1. Most recent 90-day NPS; source: Delighted LLC

|

|

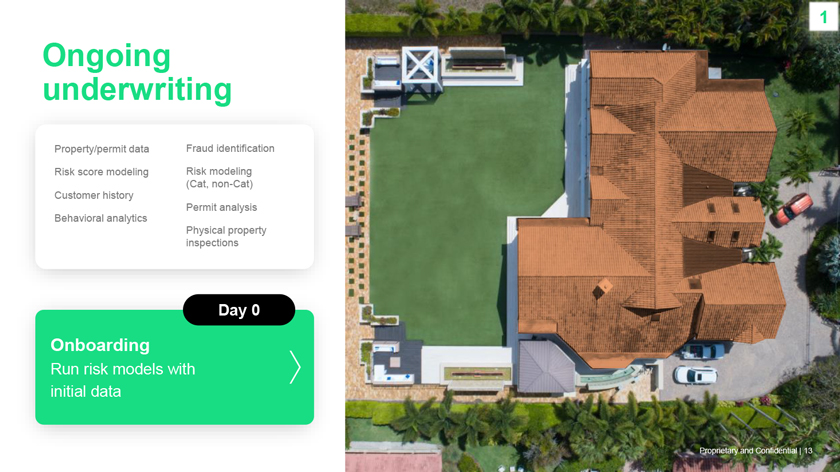

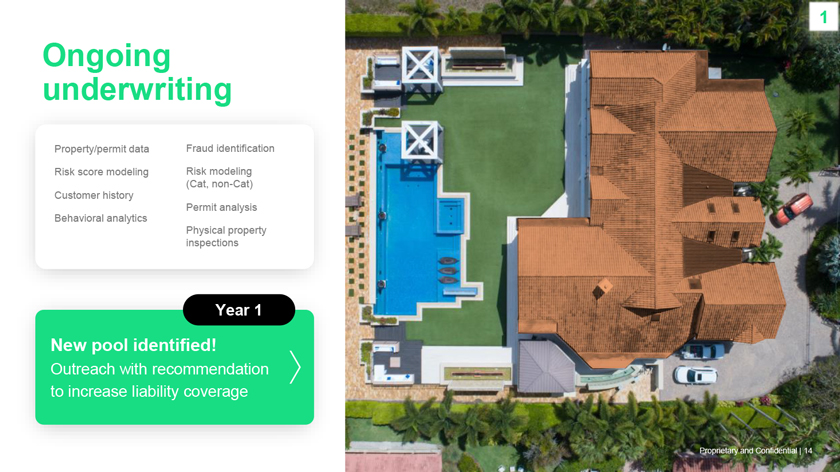

Hippo takes a proactive approach to drive better outcomes for homeowners 1 Ongoing Underwriting 2 Smart Home Devices 3 Maintenance Support

|

|

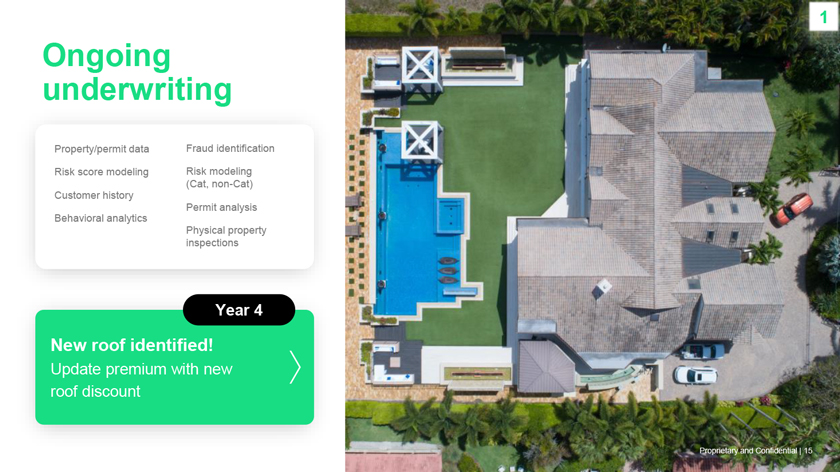

Ongoing underwriting Property/permit data Fraud identification Risk score modeling Risk modeling (Cat, non-Cat) Customer history Permit analysis Behavioral analytics Physical property inspections Day 0 Onboarding Run risk models with initial data Proprietary and Confidential | 13

|

|

Ongoing underwriting Property/permit data Fraud identification Risk score modeling Risk modeling (Cat, non-Cat) Customer history Permit analysis Behavioral analytics Physical property inspections Year 1 New pool identified! Outreach with recommendation to increase liability coverage Proprietary and Confidential | 14

|

|

Ongoing underwriting Property/permit data Fraud identification Risk score modeling Risk modeling (Cat, non-Cat) Customer history Permit analysis Behavioral analytics Physical property inspections Year 4 New roof identified! Update premium with new roof discount Proprietary and Confidential | 15

|

|

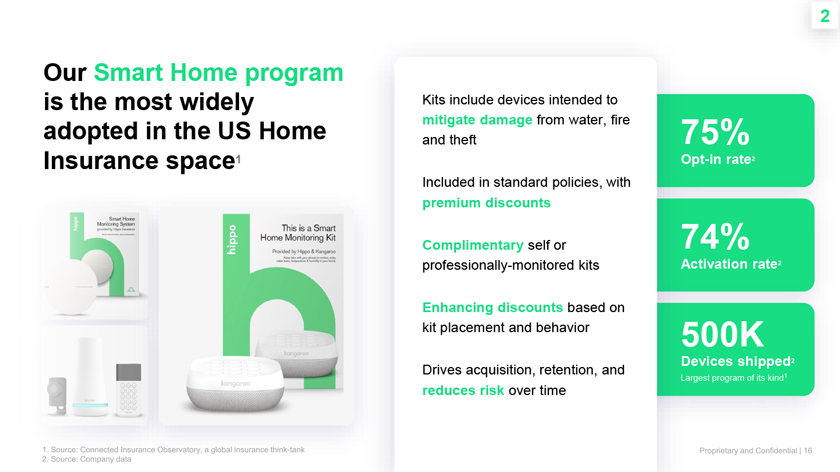

Our Smart Home program is the most widely Kits include devices intended to adopted in the US Home mitigate damage from water, fire 75% and theft Insurance space1 pt-in rate2 Included in standard policies, with premium discounts Complimentary self or 74% professionally-monitored kits ctivation rate2 Enhancing discounts based on kit placement and behavior 500K ices shipped2 Drives acquisition, retention, and gest program of its kind1 reduces risk over time

|

|

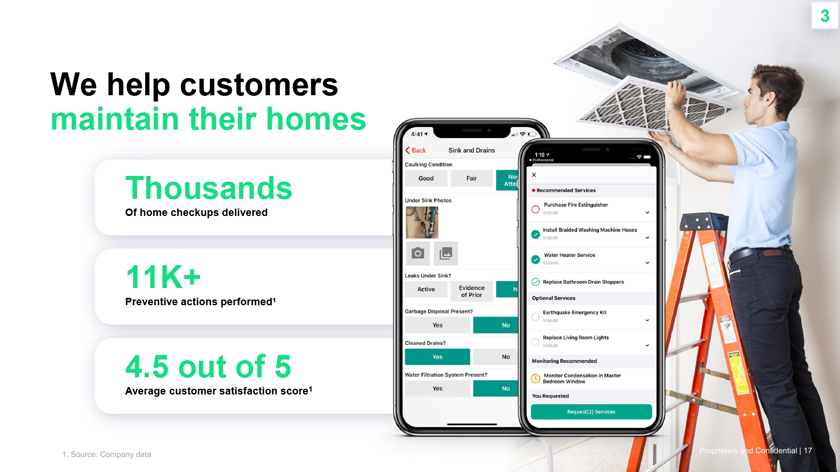

3 We help customers maintain their homes Thousands Of home checkups delivered 11K+ Preventive actions performed1 4.5 out of 5 Average customer satisfaction score1

|

|

Hippo’s proactive approach turns an adversarial customer relationship into a partnership And average risk into better risk

|

|

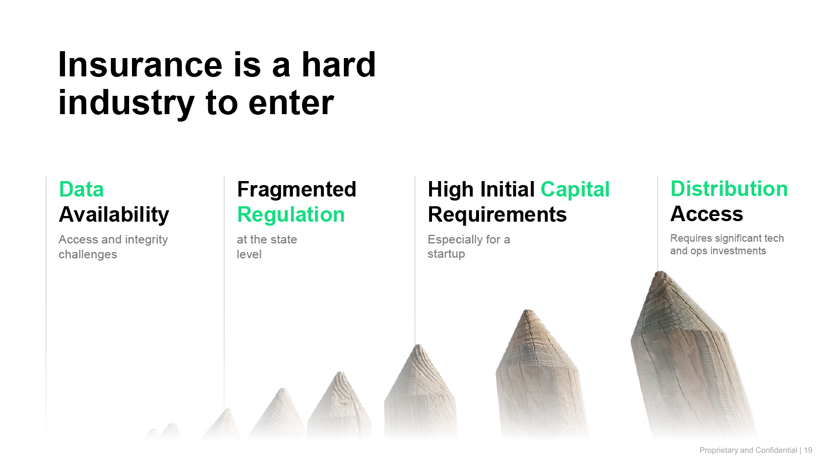

Insurance is a hard industry to enter Data Fragmented High Initial Capital Distribution Availability Regulation Requirements Access Access and integrity at the state Especially for a Requires significant tech challenges level startup and ops investments

|

|

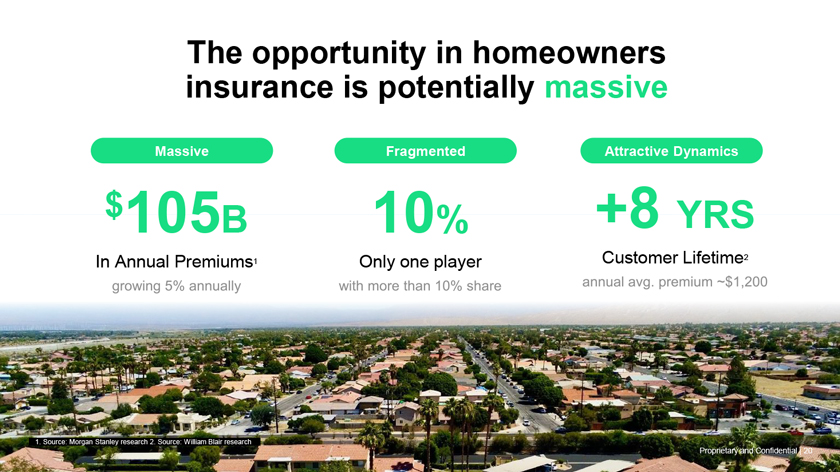

The opportunity in homeowners insurance is potentially massive Massive Fragmented Attractive Dynamics $105B 10% +8 YRS Customer Lifetime2 In Annual Premiums1 Only one player Source: Morgan Stanley research 2. Source: William Blair research Proprietary and Confidential | 20

|

|

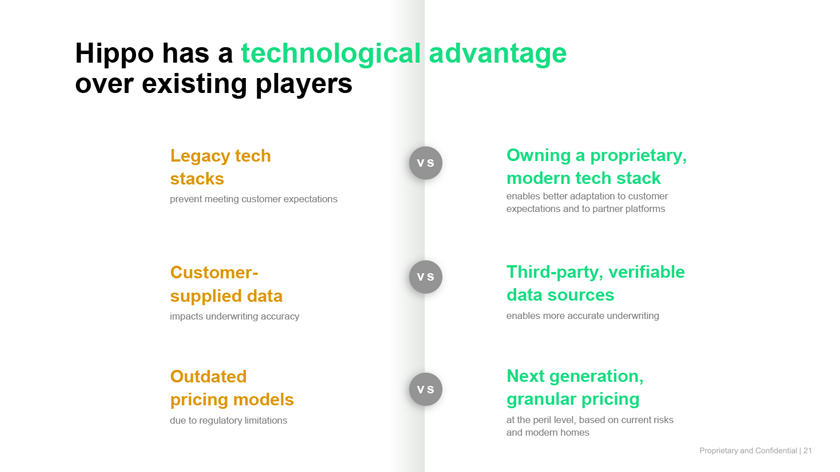

Hippo has a technological advantage over existing players Legacy tech v s Owning a proprietary, stacks modern tech stack prevent meeting customer expectations enables better adaptation to customer expectations and to partner platforms Customer- v s Third-party, verifiable supplied data data sources impacts underwriting accuracy enables more accurate underwriting Outdated Next generation, v s pricing models granular pricing due to regulatory limitations at the peril level, based on current risks and modern homes

|

|

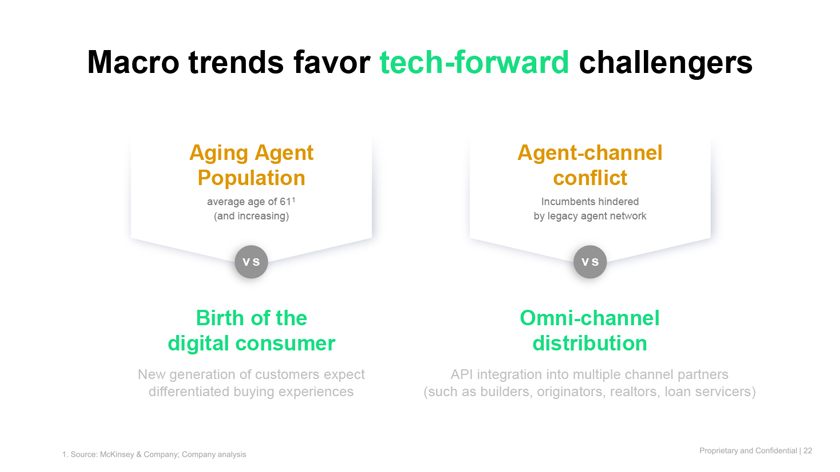

Macro trends favor tech-forward challengers Aging Agent Agent-channel Population conflict average age of 611 Incumbents hindered (and increasing) by legacy agent network v s v s Birth of the Omni-channel digital consumer distribution New generation of customers expect API integration into multiple channel partners differentiated buying experiences (such as builders, originators, realtors, loan servicers)

|

|

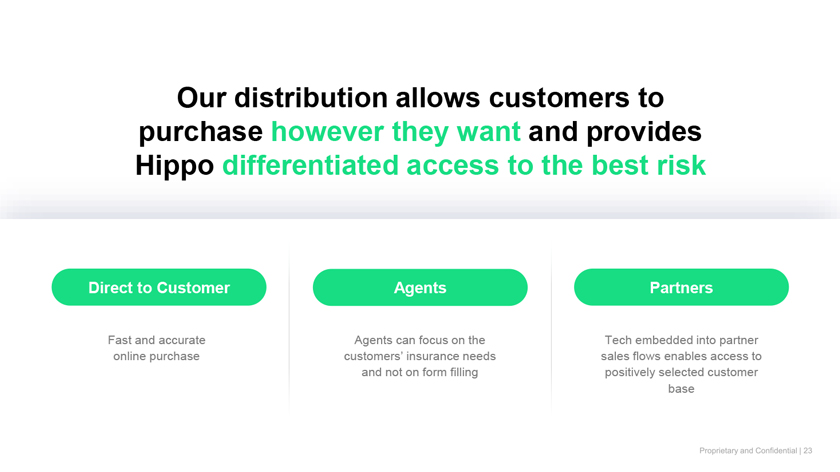

Our distribution allows customers to purchase however they want and provides Hippo differentiated access to the best risk Direct to Customer Agents Partners Fast and accurate Agents can focus on the Tech embedded into partner online purchase customers’ insurance needs sales flows enables access to and not on form filling positively selected customer base

|

|

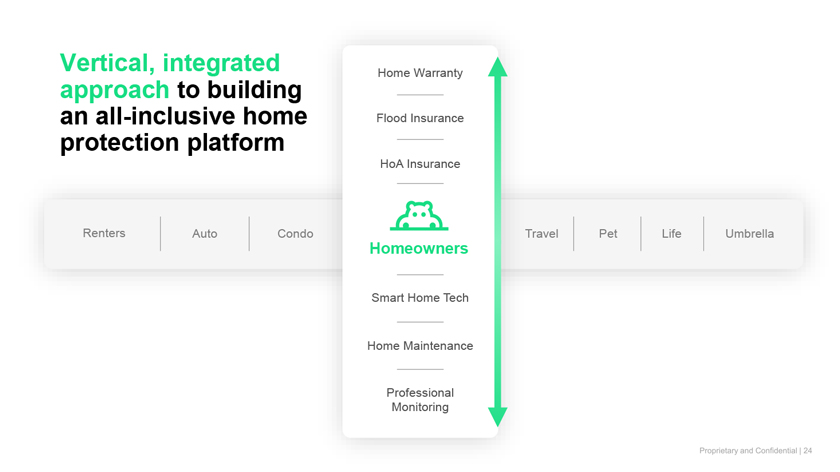

Vertical, integrated Home Warranty approach to building an all-inclusive home Flood Insurance protection platform HoA Insurance Renters Auto Condo ravel Pet Life Umbrella Homeowners Smart Home Tech Home Maintenance Professional Monitoring

|

|

Financial Overview

|

|

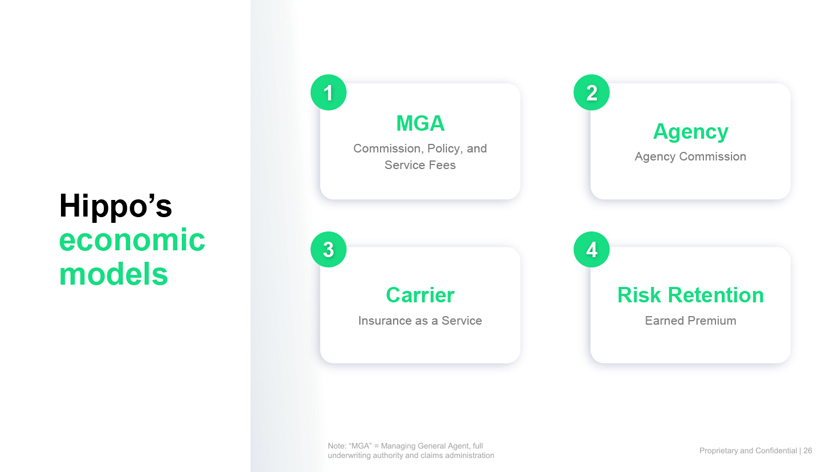

1 2 MGA Agency Commission, Policy, and Agency Commission Service Fees Hippo’s economic 3 4 models Carrier Risk Retention Insurance as a Service Earned Premium

|

|

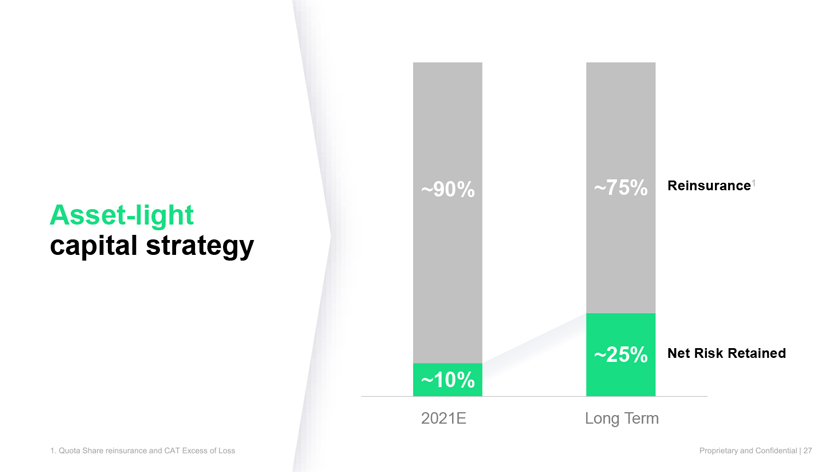

~90% ~75% Reinsurance1 Asset-light capital strategy ~25% Net Risk Retained ~10% 2021E Long Term

|

|

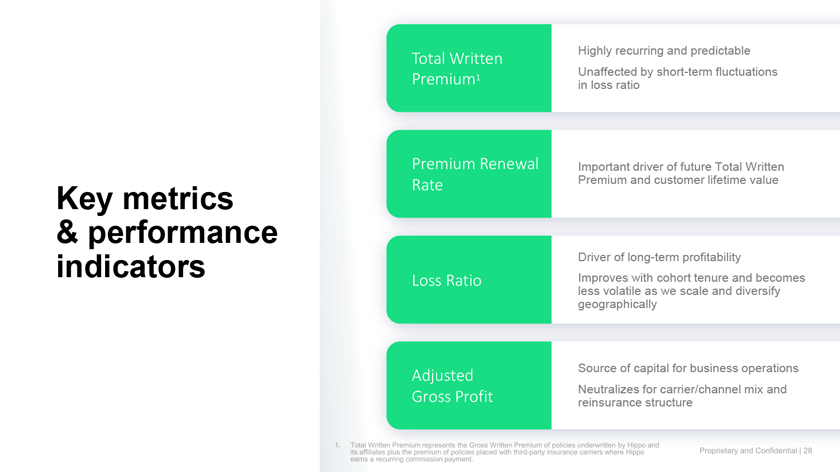

Highly recurring and predictable Total Written Unaffected by short-term fluctuations Premium1 in loss ratio Premium Renewal Important driver of future Total Written Rate Premium and customer lifetime value Key metrics & performance indicators Driver of long-term profitability Loss Ratio Improves with cohort tenure and becomes less volatile as we scale and diversify geographically Source of capital for business operations Adjusted Neutralizes for carrier/channel mix and Gross Profit reinsurance structure

|

|

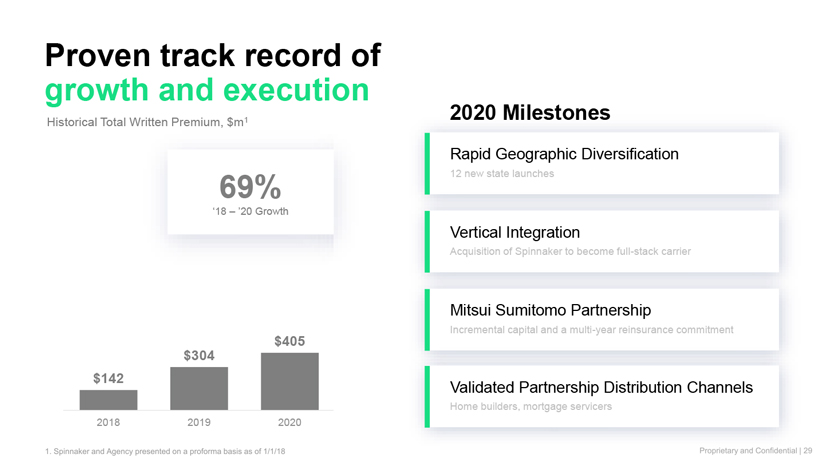

Proven track record of growth and execution 1 2020 Milestones Historical Total Written Premium, $m Rapid Geographic Diversification 69% 12 new state launches ‘18 – ’20 Growth Vertical Integration Acquisition of Spinnaker to become full-stack carrier Mitsui Sumitomo Partnership Incremental capital and a multi-year reinsurance commitment $405 $304 $142 Validated Partnership Distribution Channels Home builders, mortgage servicers 2018 2019 2020

|

|

Solid foundation for continued topline growth $2,279 Historical & Projected Total Written Premium, $m1 $1,628 69% 43% ‘18 – ’20 Growth ’21 – ’25 CAGR $1,145 $796 $544 $405 $304 $142 2018 2019 2020 2021F 2022F 2023F 2024F 2025F

|

|

Increased Scale Improved Unit Economics, More Data, More Profits Deeper Insights Reinvested in Growth Our business strengthens as we scale Increasingly Predictable & Profitable Higher Customer More Accurate Pricing, Satisfaction & Retention Better Underwriting Results

|

|

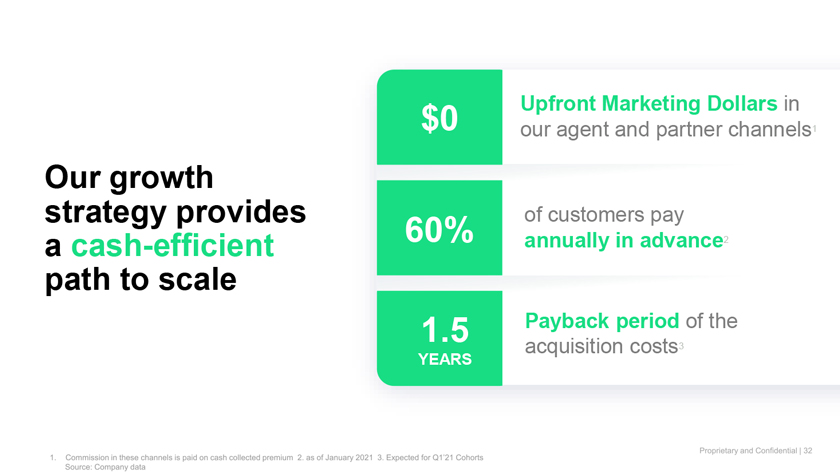

$0 Upfront Marketing Dollars in our agent and partner channels1 Our growth strategy provides 60% of customers pay a cash-efficient annually in advance2 path to scale 1.5 Payback period of the acquisition costs3 YEARS

|

|

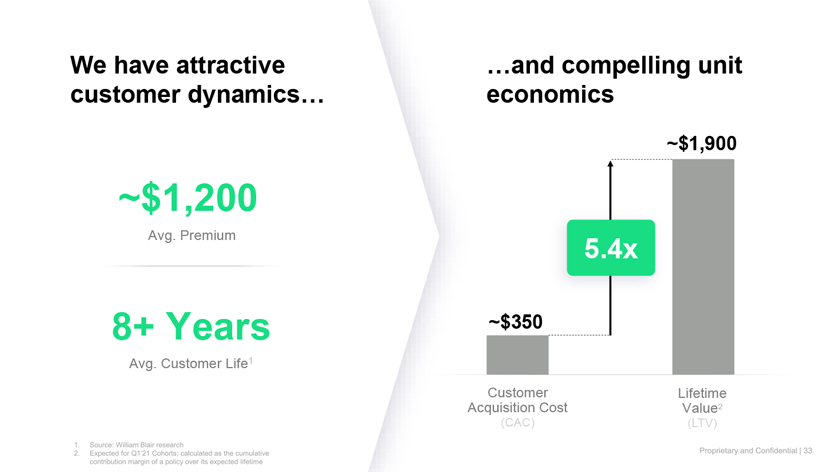

We have attractive …and compelling unit customer dynamics… economics ~$1,900 ~$1,200 Avg. Premium 5.4x 8+ Years ~$350 Avg. Customer Life1 Customer Lifetime Acquisition Cost Value2 (CAC) (LTV)

|

|

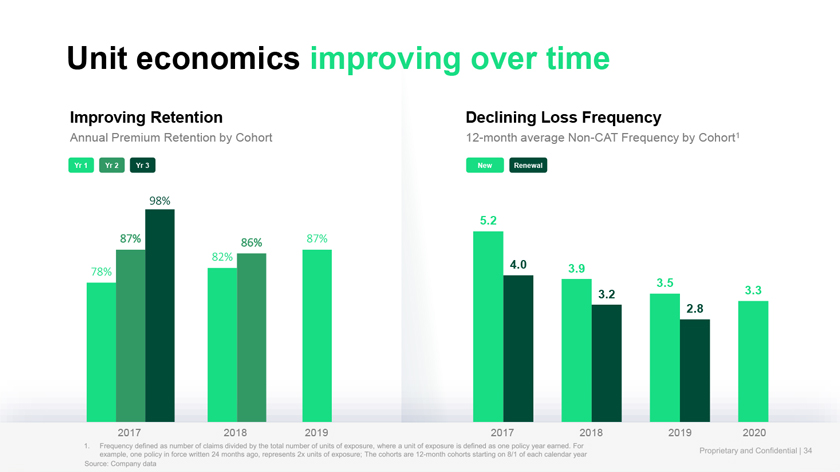

Unit economics improving over time Improving Retention Declining Loss Frequency Annual Premium Retention by Cohort 12-month average Non-CAT Frequency by Cohort1 Yr 1 Yr 2 Yr 3 New Renewal 98% 5.2 87% 86% 87% 82% 4.0 3.9 78% 3.5 3.2 3.3 2.8 2017 2018 2019 2017 2018 2019 2020

|

|

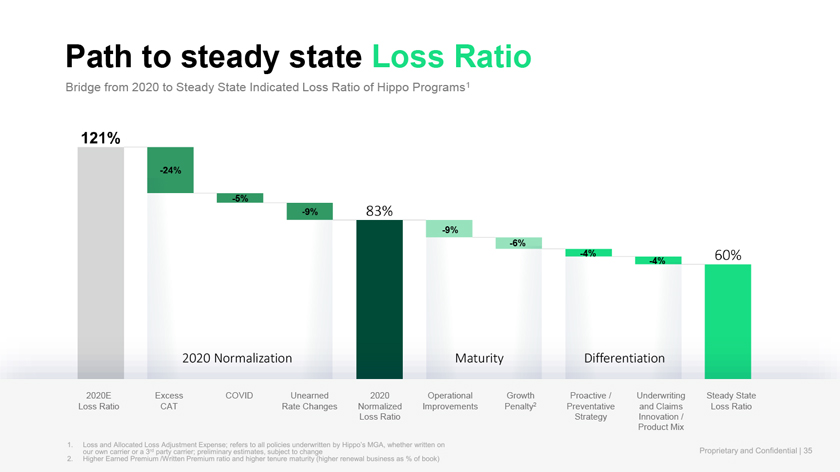

Path to steady state Loss Ratio Bridge from 2020 to Steady State Indicated Loss Ratio of Hippo Programs1 -5% -6% -9% -6% -4% -4% 2020 Normalization Maturity Differentiation 2020E Excess COVID Unearned 2020 Operational Growth Proactive / Underwriting Steady State Loss Ratio CAT Rate Changes Normalized Improvements Penalty2 Preventative and Claims Loss Ratio Loss Ratio Strategy Innovation / Product Mix

|

|

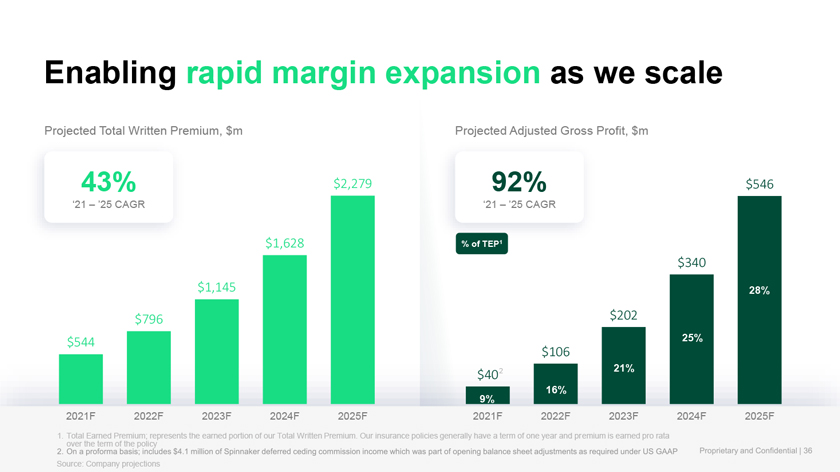

Enabling rapid margin expansion as we scale Projected Total Written Premium, $m Projected Adjusted Gross Profit, $m 43% $2,279 92% $546 ‘21 – ’25 CAGR ‘21 – ’25 CAGR $1,628 % of TEP1 $340 $1,145 28% $796 $202 $544 25% $106 2 21% $40 9% 16% 2021F 2022F 2023F 2024F 2025F 2021F 2022F 2023F 2024F 2025F 1. Total Earned Premium; represents the earned portion of our Total Written Premium. Our insurance policies generally have a term of one year and premium is earned pro rata over the term of the policy Source: Company projections

|

|

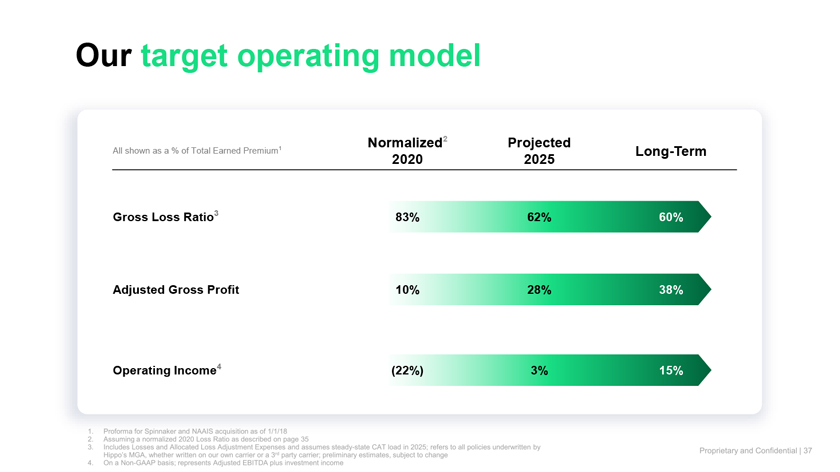

Our target operating model Normalized2 Projected All shown as a % of Total Earned Premium1 Long-Term 2020 2025 Gross Loss Ratio3 83% 62% 60% Adjusted Gross Profit 10% 28% 38% Operating Income4 (22%) 3% 15%

|

|

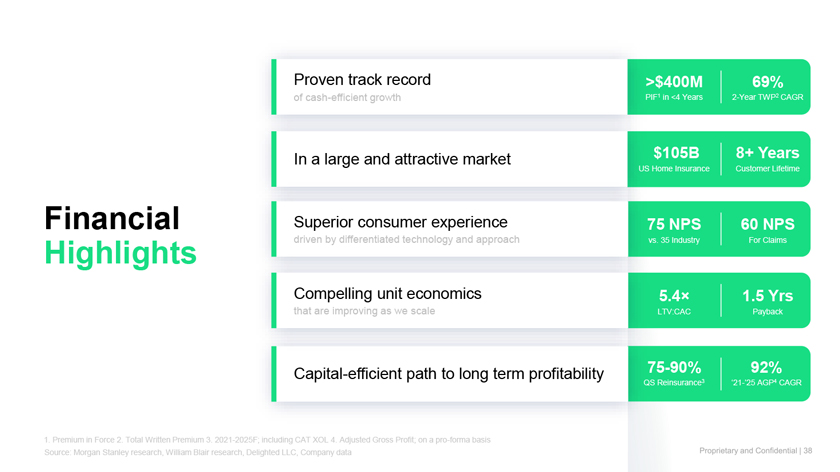

Proven track record >$400M 69% Z00 of cash-efficient growth PIF1 in <4 Years 2-Year TWP2 CAGR In a large and attractive Z00 market $105B 8+ Years US Home Insurance Customer Lifetime Financial Superior consumer experience 75 NPS 60 NPS Z00 Highlights driven by differentiated technology and approach vs. 35 Industry For Claims Compelling unit economics 5.4× 1.5 Yrs Z00 that are improving as we scale LTV:CAC Payback 75-90% 92% Capital-efficient path Z00 to long term profitability QS Reinsurance3 ‘21-’25 AGP4 CAGR 1. Premium in Force 2. Total Written Premium 3. 2021-2025F; including CAT XOL 4. Adjusted Gross Profit; on a pro-forma basis Source: Morgan Stanley research, William Blair research, Delighted LLC, Company data

|

|

Hippo exists to protect the joy of homeownership 1 Radically improved customer experience Policies built for modern lives, powered by data 2 and technology Proactive services that reinforce our core product 3 and strengthen our relationship with customers

|

|

Appendix

|

|

Transaction Summary Key Highlights Sources Uses ïµ Approximately $5B enterprise value Cash proceeds to Hippo $638 Seller rollover equity $5,422 Equity consideration to ïµ 4.4x 2023E Total Written Premium or 25.1x 2023E Adjusted Gross Profit $5,422 existing Hippo Shareholders PIPE investment $550ïµ Hippo stockholders retain ~87% in pro forma ownership Cash consideration to existing $100ïµ Hippo receives $638M in primary proceeds to fund growth Hippo shareholders Reinvent cash held in trust $230 Estimated transaction costs $42ïµ Hippo management will continue to operate the business post-closing Total sources $6,202 Total uses $6,202 ïµ Transaction expected to close in Q2 2021 Pro forma valuation $MM, unless otherwise noted Pro forma ownership at closing Share price $10.00 4% Pro forma shares outstanding1 621.6 87% SPAC public holders Pro forma equity value Existing company $6,216 shareholders 9% Less: Pro forma net cash2 ($1,160) PIPE holders Pro forma aggregate value $5,057 1. Pro forma shares outstanding based on $10.00 per share price and includes 25% of 5.75MM Reinvent shares vested at closing. Additionally, pro forma shares excludes potential dilution from out-of-the-money warrants and further assumes no redemptions by Reinvent’s existing public shareholders 2. Includes $522MM of existing Hippo cash and cash equivalents as of December 31, 2020 and $638MM of net proceeds to be added to Hippo’s balance sheet

|

|

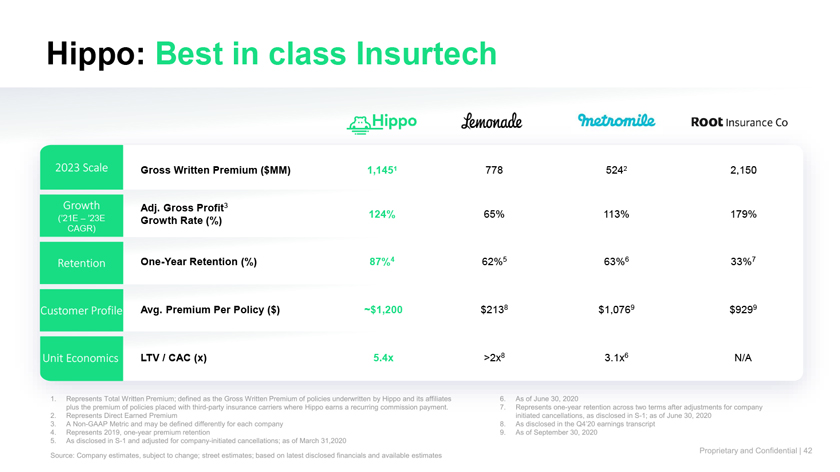

Hippo: Best in class Insurtech 2023 Scale Gross Written Premium ($MM) 1,1451 778 5242 2,150 Growth Adj. Gross Profit3 124% 65% 113% 179% (’21E – ’23E Growth Rate (%) CAGR) Retention One-Year Retention (%) 87%4 62%5 63%6 33%7 Customer Profile Avg. Premium Per Policy ($) ~$1,200 $2138 $1,0769 $9299 Unit Economics LTV / CAC (x) 5.4x >2x8 3.1x6 N/A

|

|

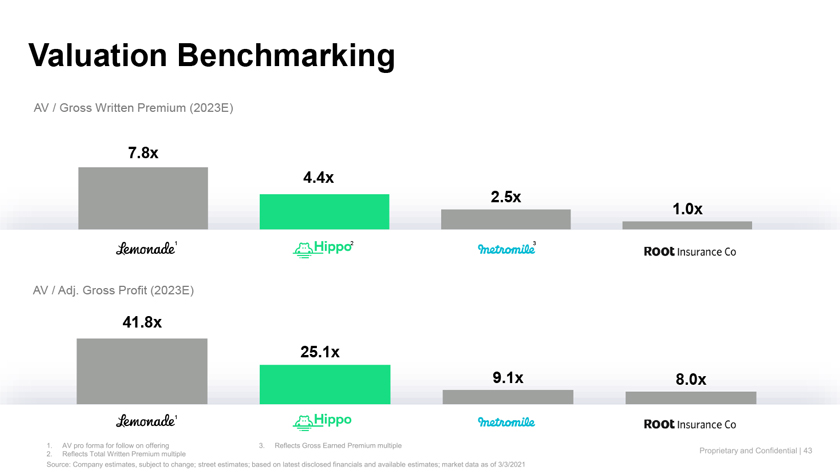

Valuation Benchmarking AV / Gross Written Premium (2023E) 7.8x 4.4x 2.5x 1.0x 1 2 3 AV / Adj. Gross Profit (2023E) 41.8x 25.1x 9.1x 8.0x 1

|

|

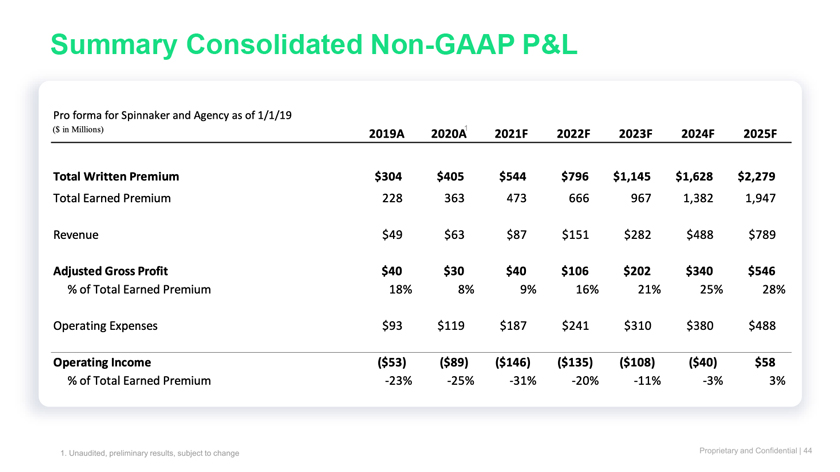

Summary Consolidated Non-GAAP P&L

|

|

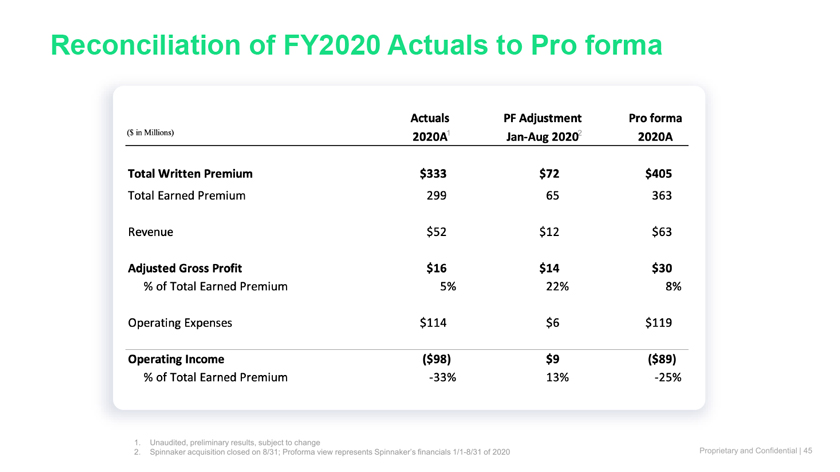

Reconciliation of FY2020 Actuals to Pro forma

|

|

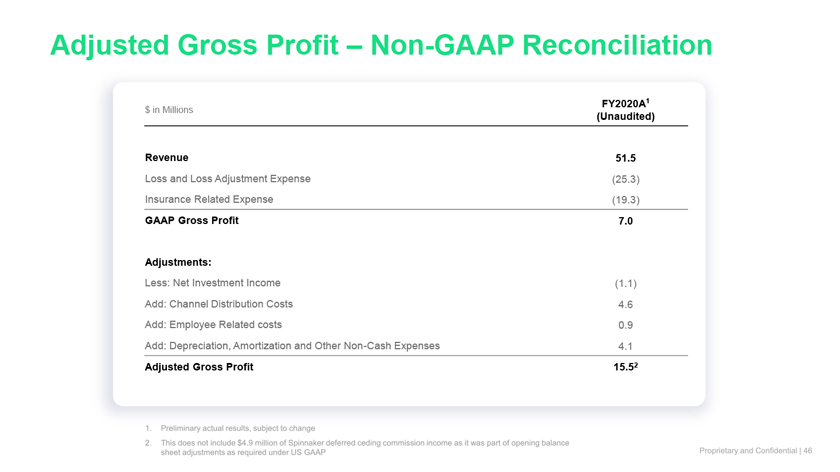

Adjusted Gross Profit – Non-GAAP Reconciliation FY2020A1 $ in Millions (Unaudited) Revenue 51.5 Loss and Loss Adjustment Expense (25.3) Insurance Related Expense (19.3) GAAP Gross Profit 7.0 Adjustments: Less: Net Investment Income (1.1) Add: Channel Distribution Costs 4.6 Add: Employee Related costs 0.9 Add: Depreciation, Amortization and Other Non-Cash Expenses 4.1 Adjusted Gross Profit 15.52

|

|

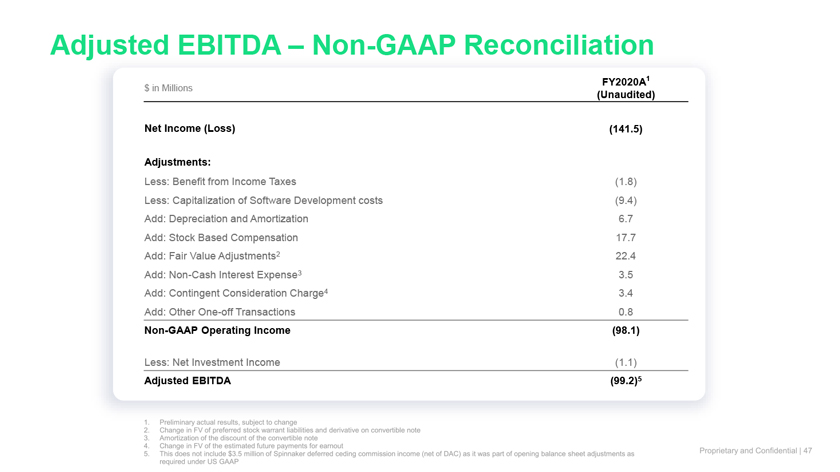

Adjusted EBITDA – Non-GAAP Reconciliation FY2020A1 $ in Millions (Unaudited) Net Income (Loss) (141.5) Adjustments: Less: Benefit from Income Taxes (1.8) Less: Capitalization of Software Development costs (9.4) Add: Depreciation and Amortization 6.7 Add: Stock Based Compensation 17.7 Add: Fair Value Adjustments2 22.4 Add: Non-Cash Interest Expense3 3.5 Add: Contingent Consideration Charge4 3.4 Add: Other One-off Transactions 0.8 Non-GAAP Operating Income (98.1) Less: Net Investment Income (1.1) Adjusted EBITDA (99.2)5

|

|

Summary of Risks (1/3) Investing in our common stock involves a high degree of risk. You should carefully consider the following risks, together with all of the other information contained in this prospectus, before deciding to invest in our common stock. Our business, financial condition, results of operations or prospects could be materially and adversely affected by any of these risks or uncertainties, as well as by risks or uncertainties not currently known to us, or that we do not currently believe are material. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

|

|

Summary of Risks (2/3) Risks Relating to Our Business 1. We have a history of net losses and we may not achieve or maintain profitability in the future. 2. Our success and ability to grow our business depend on retaining and expanding our customer base. If we fail to add new customers or retain current customers, our business, revenue, operating results and financial condition could be harmed. 3. The “Hippo” brand may not become as widely known as incumbents’ brands or the brand may become tarnished. 4. Denial of claims or our failure to accurately and timely pay claims could materially and adversely affect our business, financial condition, results of operations and prospects. 5. Our limited operating history makes it difficult to evaluate our current business performance, implementation of our business model and our future prospects. 6. We may not be able to manage our growth effectively. 7. Intense competition in the segments of the insurance industry in which we operate could negatively affect our ability to attain or increase profitability. 8. Reinsurance may be unavailable at current coverage, limits or pricing, which may limit our ability to write new or renew existing business. Furthermore, reinsurance subjects our insurance company subsidiaries to counterparty credit and performance risk and may not be adequate to protect us against losses, which could have a material effect on our results of operations and financial condition. 9. Failure to maintain our risk-based capital at the required levels could adversely affect the ability of our insurance subsidiaries to maintain regulatory authority to conduct our business. 10. Failure to maintain our financial ratings could adversely affect the ability of our insurance company subsidiaries to conduct our business as currently conducted. 11. If we are unable to expand our product offerings, our prospects for future growth may be adversely affected. 12. Our proprietary technology, which relies on third party data, may not operate properly or as we expect it to. 13. Our technology platform may not operate properly or as we expect it to operate. 14. Our future success depends on our ability to continue to develop and implement our technology, and to maintain the confidentiality of this technology. 15. New legislation or legal requirements may affect how we communicate with our customers, which could have a material adverse effect on our business model, financial condition, and results of operations. 16. We rely on external data and our digital platform to collect and evaluate information that we utilize in producing, pricing and underwriting our insurance policies (in accordance with the rates, rules, and forms filed with our regulators, where required), managing claims and customer support, and improving business processes. Any legal or regulatory requirements that might restrict our ability to collect or utilize this data or our digital platform, or an outage by a data vendor could thus materially and adversely affect our business, financial condition, results of operations and prospects. 17. We depend on search engines, content based online advertising, other online sources to attract consumers to our website, which may be affected by third party interference beyond our control. In addition, our producer and partner distribution channels are significant sources of new customers and could be impacted by third party interference or other factors. As we grow our customer acquisition costs may increase. 18. We may require additional capital to grow our business, which may not be available on terms acceptable to us or at all. 19. Interruptions or delays in the services provided by our providers of third-party technology platforms or our internet service providers could impair the operability of our website and may cause our business to suffer. 20. Security incidents or real or perceived errors, failures or bugs in our systems or website could impair our operations, result in loss of personal customer information, damage our reputation and brand, and harm our business and operating results. 21. Misconduct or fraudulent acts by employees, agents or third parties may expose us to financial loss, disruption of business, regulatory assessments and reputational harm. 22. Our success depends, in part, on our ability to establish and maintain relationships with quality and trustworthy service professionals. 23. We may be unable to prevent, monitor or detect fraudulent activity, including policy acquisitions or payments of claims that are fraudulent in nature. 24. We are periodically subject to examinations by our primary state insurance regulators, which could result in adverse examination findings and necessitate remedial actions. 25. We collect, process, store, share, disclose and use customer information and other data, and our actual or perceived failure to protect such information and data, respect customers’ privacy or comply with data privacy and security laws and regulations could damage our reputation and brand and harm our business and operating results. 26. We employ third-party licensed software for use in our business, and the inability to maintain these licenses, errors in the software we license or the terms of open source licenses could result in increased costs or reduced service levels, which would adversely affect our business. 27. We may be unable to prevent or address the misappropriation of our data. 28. We rely on the experience and expertise of our founder, senior management team, highly-specialized insurance experts, key technical employees and other highly skilled personnel. 29. If our customers were to claim that the policies they purchased failed to provide adequate or appropriate coverage, we could face claims that could harm our business, results of operations and financial condition. 30. We may become subject to claims under Israeli law for remuneration or royalties for assigned service invention rights by our Israel-based contractors or employees, which could result in litigation and adversely affect our business. 31. Our company culture has contributed to our success and if we cannot maintain this culture as we grow, our business could be harmed. 32. If we are unable to underwrite risks accurately and charge competitive yet profitable rates to our customers, our business, results of operations and financial condition will be adversely affected. 33. Our exposure to loss activity and regulation may be greater in states where we currently have most of our customers or where we are domiciled. 34. Our product development cycles are complex and subject to regulatory approval, and we may incur significant expenses before we generate revenues, if any, from new products. 35. New lines of business or new products and services may subject us to additional risks. 36. Litigation and legal proceedings filed by or against us and our subsidiaries could have a material adverse effect on our business, results of operations and financial condition. 37. Failure to protect or enforce our intellectual property rights could harm our business, results of operations and financial condition.

|

|

Summary of Risks (3/3) 38. Claims by others that we infringed their proprietary technology or other intellectual property rights could harm our business. 39. If we are unable to make acquisitions and investments, or successfully integrate them into our business, our business, results of operations and financial condition could be adversely affected. 40. Recent U.S. tax legislation may materially adversely affect our financial condition, results of operations and cash flows. 41. We may not be able to utilize a portion of our net operating loss carryforwards (“NOLs”) to offset future taxable income for U.S. federal income tax purposes, which could adversely affect our net income and cash flows. 42. Our expansion strategy will subject us to additional costs and risks and our plans may not be successful. 43. Fluctuations in foreign currency exchange rates may adversely affect our financial results. Risks Relating to Our Industry 44. The insurance business, including the market for homeowners insurance, is historically cyclical in nature, and we may experience periods with excess underwriting capacity and unfavorable premium rates, which could adversely affect our business. 45. We are subject to extensive insurance industry regulations. 46. A regulatory environment that requires rate increases to be approved and that can dictate underwriting practices and mandate participation in loss sharing arrangements may adversely affect our results of operations and financial condition. 47. State insurance regulators impose additional reporting requirements regarding enterprise risk on insurance holding company systems, with which we must comply as an insurance holding company. 48. The increasing adoption by states of cybersecurity regulations could impose additional compliance burdens on us and expose us to additional liability. 49. The COVID-19 pandemic has caused disruption to our operations and may negatively impact our business, key metrics, or results of operations in numerous ways that remain unpredictable. 50. Severe weather events and other catastrophes, including the effects of climate change, global pandemics and terrorism, are inherently unpredictable and may have a material adverse effect on our financial results and financial condition. 51. We expect our results of operations to fluctuate on a quarterly and annual basis. In addition, our operating results and operating metrics are subject to seasonality and volatility, which could result in fluctuations in our quarterly revenues and operating results or in perceptions of our business prospects. 52. An overall decline in economic activity could have a material adverse effect on the financial condition and results of operations of our business. 53. We rely on data from our customers and third parties for pricing and underwriting our insurance policies and handling claims, the unavailability or inaccuracy of which could limit the functionality of our products and disrupt our business. 54. Our results of operations and financial condition may be adversely affected due to limitations in the analytical models used to assess and predict our exposure to catastrophe losses. 55. We are subject to payment processing risk. 56. Our success depends upon the continued growth and acceptance of our products and services. 57. Our actual incurred losses may be greater than our loss and loss adjustment expense reserves, which could have a material adverse effect on our financial condition and results of operations. 58. Our insurance company subsidiaries are subject to minimum capital and surplus requirements, and failure to meet these requirements could subject us to regulatory action. 59. Our insurance company subsidiaries are subject to assessments and other surcharges from state guaranty funds, and mandatory state insurance facilities, which may reduce our profitability. 60. Performance of our investment portfolio is subject to a variety of investment risks that may adversely affect our financial results. 61. Unexpected changes in the interpretation of our coverage or provisions, including loss limitations and exclusions, in our policies could have a material adverse effect on our financial condition and results of operations. Risks Relating to Ownership of Our Common Stock 62. There may not be an active trading market for our common stock, which may make it difficult to sell shares of our common stock. 63. The market price of our common stock may be highly volatile, which could cause the value of your investment to decline. 64. There can be no assurance that the Company’s securities will be approved for listing on NYSE or Nasdaq, as the case may be, or that the Company will be able to comply with the continued listing standards of such exchange. 65. If securities or industry analysts do not publish or cease publishing research or reports about us, our business or our markets, or if they adversely change their recommendations or publish negative reports regarding our business or our stock, our stock price and trading volume could materially decline. 66. Some provisions of our charter documents and Delaware law may have anti-takeover effects that could discourage an acquisition of us by others, even if an acquisition would be beneficial to our stockholders, and may prevent attempts by our stockholders to replace or remove our current management. 67. Applicable insurance laws may make it difficult to effect a change of control. 68. Our Amended Charter designates the Court of Chancery of the State of Delaware as the exclusive forum for certain litigation that may be initiated by our stockholders, which could limit our stockholders’ ability to obtain a favorable judicial forum for disputes with us. 69. Claims for indemnification by our directors and officers may reduce our available funds to satisfy successful third-party claims against us and may reduce the amount of money available to us. 70. Taking advantage of the reduced disclosure requirements applicable to “emerging growth companies” may make our common stock less attractive to investors. 71. Failure to establish and maintain effective internal controls in accordance with Section 404 of the Sarbanes-Oxley Act could have a material adverse effect on our business and stock price. 72. We depend on the ability of our subsidiaries to transfer funds to us to meet our obligations, and our insurance company subsidiaries ability to pay dividends to us is restricted by law. 73. We do not currently expect to pay any cash dividends. 74. The requirements of being a public company, including compliance with the reporting requirements of the Exchange Act, the requirements of the Sarbanes-Oxley Act and the Dodd-Frank Act and the listing standards of NYSE, may strain our resources, increase our costs, and divert management’s attention, and we may be unable to comply with these requirements in a timely or cost-effective manner. In addition, key members of our management team have limited experience managing a public company.