Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LCI INDUSTRIES | lcii-20210304.htm |

LCI INDUSTRIES 1 LCI Industries Investor Presentation March 2021

LCI INDUSTRIES 2 Forward-Looking Statements This presentation contains certain “forward-looking statements” with respect to our financial condition, results of operations, business strategies, operating efficiencies or synergies, competitive position, growth opportunities, acquisitions, plans and objectives of management, markets for the Company’s common stock, the impact of legal proceedings, and other matters. Statements in this presentation that are not historical facts are “forward-looking statements” for the purpose of the safe harbor provided by Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended, and involve a number of risks and uncertainties. Forward-looking statements, including, without limitation, those relating to the Company's future business prospects, net sales, expenses and income (loss), capital expenditures, tax rate, cash flow, financial condition, liquidity, covenant compliance, retail and wholesale demand, integration of acquisitions, R&D investments, and industry trends, whenever they occur in this presentation are necessarily estimates reflecting the best judgment of the Company's senior management at the time such statements were made. There are a number of factors, many of which are beyond the Company’s control, which could cause actual results and events to differ materially from those described in the forward-looking statements. These factors include, in addition to other matters described in this presentation, the impacts of COVID-19, or other future pandemics, on the global economy and on the Company's customers, suppliers, employees, business and cash flows, pricing pressures due to domestic and foreign competition, costs and availability of, and tariffs on, raw materials (particularly steel and aluminum) and other components, seasonality and cyclicality in the industries to which we sell our products, availability of credit for financing the retail and wholesale purchase of products for which we sell our components, inventory levels of retail dealers and manufacturers, availability of transportation for products for which we sell our components, the financial condition of our customers, the financial condition of retail dealers of products for which we sell our components, retention and concentration of significant customers, the costs, pace of and successful integration of acquisitions and other growth initiatives, availability and costs of production facilities and labor, team member benefits, team member retention, realization and impact of expansion plans, efficiency improvements and cost reductions, the disruption of business resulting from natural disasters or other unforeseen events, the successful entry into new markets, the costs of compliance with environmental laws, laws of foreign jurisdictions in which we operate, other operational and financial risks related to conducting business internationally, and increased governmental regulation and oversight, information technology performance and security, the ability to protect intellectual property, warranty and product liability claims or product recalls, interest rates, oil and gasoline prices and availability, the impact of international, national and regional economic conditions and consumer confidence on the retail sale of products for which we sell our components, and other risks and uncertainties discussed more fully under the caption “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020, and in the Company’s subsequent filings with the Securities and Exchange Commission. Readers of this presentation are cautioned not to place undue reliance on these forward-looking statements, since there can be no assurance that these forward-looking statements will prove to be accurate. The Company disclaims any obligation or undertaking to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made, except as required by law. This presentation includes certain non-GAAP financial measures, such as adjusted diluted earnings per share, EBITDA, adjusted EBITDA, net debt to EBITDA leverage, and free cash flow. These non-GAAP financial measures should not be considered a substitute for the comparable GAAP financial measures. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measure are included in the Appendix to this presentation. This presentation also includes certain forward-looking non-GAAP financial measures, such as forward-looking targets for net debt to EBITDA leverage. The Company is unable to provide a reconciliation of forward-looking non-GAAP financial measures to their most directly comparable GAAP financial measures because the Company is unable to provide, without unreasonable effort, a meaningful or accurate calculation or estimation of amounts that would be necessary for the reconciliation due to the complexity and inherent difficulty in forecasting and quantifying future amounts or when they may occur. Such unavailable information could be significant to future results.

LCI INDUSTRIES 3 Operational and Industry Update Taking steps to ensure the safety of team members while meeting increased demand brought on by COVID-19 Increased DemandHealth and Safety Measures ◦ Heightened health and safety measures continued through the fourth quarter • Screening team members for potential symptoms • Extensive and frequent disinfecting of workspaces • Social distancing restrictions for production personnel • Providing masks and hand sanitizer stations for team members ◦ Instituted a dedicated and industry first drive-thru rapid COVID testing site for our team members, and invited select team members to participate in a Johnson & Johnson COVID-19 vaccine trial phase ◦ Donated to our local hospitals to help them hire mental health experts to aid the hardworking men and women on the front lines ◦ Increased demand for RVs and outdoor recreational products as consumers seek safe alternatives to travel for vacations and getaways ◦ Industry wholesale RV shipments for the year totaled roughly 430,000 units per RVIA, which was the fourth highest wholesale year on record ◦ Peer-to-peer RV rental companies seeing a surge in interest, creating new opportunities for consumers to try RVing, ultimately bringing them into the lifestyle over the long-term ▪ Outdoorsy, one of the largest peer-to-peer rental companies, reported a more than 4,500% increase in bookings throughout the course of the pandemic ◦ Increased retail demand also bolsters pipeline for future Aftermarket demand as more units enter the replacement and upgrade cycles

LCI INDUSTRIES 4 8% OPERATING MARGIN $1.92 DILUTED EPS $783.0M IN NET SALES $88.1M ADJUSTED EBITDA* LCI at a Glance Fourth Quarter 2020 Key Metrics A leading supplier of highly engineered components primarily to the OEMs of recreational vehicles, buses, trailers, trucks, boats, trains, manufactured housing, and their related aftermarkets. * See the Appendix to this presentation for reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures. +39% Year-over-Year Growth +68% +54% +143 BPS

LCI INDUSTRIES 5 Leading market share with unmatched depth and breadth of products Strong track record of financial performance Leadership team of 27 senior leaders with over 350 years aggregate experience at LCI Deep culture rooted in innovation, technology, and operational excellence Compelling industry tailwinds, including high-margin growing aftermarket, robust millennial demand, and recent trends in adventure camping Proven strategy to support global expansion and diversification Expansion opportunities leveraging core strengths in attractive adjacent industries Extensive track record of accretive M&A Strong balance sheet and balanced capital deployment strategy Investment Case

LCI INDUSTRIES 6 High Variation / Short Runs at Scale Specialized / Engineered Components Mid-Spec Requirements Small batch manufacturing with the benefits of scale Products require some level of design / engineering Non-commoditized products that meet mid-spec tolerances Metal Fabrication & Welding Lamination Glass Fabrication Cut & Sew Power & Motion Systems Electronics Plastics Forming Recreational Vehicle Marine Transit & School Bus Equestrian & Cargo Trailers Heavy & Light Trucking Housing and Building Products Other (e.g. Rail and Industrials) OEMs Aftermarket Scaled High-Variation Production LCI serves 3 critical customer needs With 7 core competencies Applicable across a number of customer segments Business Overview

LCI INDUSTRIES 7 Breadth and Depth of Product Offerings • Towable RV Chassis • Furniture • Windows and Windshields • Entry and Baggage Doors • Mattresses • Slide-Out Mechanisms • Awnings • Axles • Steps • Leveling Systems • Suspension Enhancements • Showers and Sinks • Electronic Components • Branded Towing Products • Truck Accessories • RV • Aftermarket • Marine • Bus • Freight/Fleet • College/Hospitality • Heavy & Light Truck • Manufactured Homes • Modular Housing • Cargo • Train Product Lines Industries

LCI INDUSTRIES 8 EBITDA* ($M) 158 247 269 266 276 321 2015 2016 2017 2018 2019 2020 Sales Trend ($M) 1,403 1,679 2,148 2,476 2,371 2,796 2015 2016 2017 2018 2019 2020 Free Cash Flow* ($M) 66 159 68 37 211 174 2015 2016 2017 2018 2019 2020 Financial Performance • FY 2020 net sales were up 18% year-over-year, driven by RV shipments increasing 9% over the same period as retail demand rebounded sharply following COVID-19 shutdowns 12% C AGR 13% CAGR * See the Appendix to this presentation for reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures. Diluted EPS, Adjusted in 2017 - 2020 $3.02 $5.20 $5.76 $5.86 $5.84 $6.49 2015 2016 2017* 2018* 2019 2020* 14% CAG R 18% C AGR

LCI INDUSTRIES 9 • Our passion to win, coupled with a robust growth strategy, drive us to be a leader in every market we enter • We believe our industry-leading innovation, the quality of our products, and customer relationships will drive sales and profitability • We strive to leverage the manufacturing skill sets and capabilities of our strong and tenured leadership teams, combined with our extensive purchasing expertise, technologies and processes, geographic coverage, and wide-reaching customer base to rapidly grow sales in our targeted channels • We believe our strong cash flows and extensive acquisition knowledge enable us to strategically target companies to drive growth and innovation in addition to overall strategic business diversification LCI Leadership From left to right: Andrew Namenye - EVP & CLO, Jamie Schnur - Group President - Aftermarket, Nick Fletcher - EVP & Chief HR Officer, Jason Lippert - President & CEO, Brian Hall - EVP & CFO, Ryan Smith - Group President - North America, Andy Murray - Chief Sales Officer Vision and Values To be a leading supplier for component parts manufacturing in the markets in which we compete

LCI INDUSTRIES 10 • R&D expertise and innovation remains a core component of LCI's long-term strategy • Expanding OneControl capabilities to integrate into customer support; success continues as customers increasingly seek technologically sophisticated products • Announced new Vice President of Innovation, responsible for overseeing LCI’s new product innovation and driving improvements across existing offerings Culture of Innovation and Technology

LCI INDUSTRIES 11 World-Class Operations Driven by a Culture of Caring Our Social Impact Philosophy • Bringing our core values to life through leadership development and the LCI Dream Achiever program • Supporting hundreds of nonprofit organizations by donating our time and talents • Encouraging our team members to support their communities through charitable giving and volunteer work • Integrating social responsibility into our business processes to continue to build a better work environment

LCI INDUSTRIES 12 Driving Sustainability Through Eco-Friendly Operations We are committed to the safety of our environment and our communities through conscious resource selection and process improvements that aim to lessen the impact of manufacturing processes. Current environmental initiatives include: • Implementation of solar energy at four facilities as a safe and renewable energy alternative • Replacement of harsh, solvent-borne liquid coatings with environmentally-friendly materials in our manufacturing processes • Use of eco-friendly coating processes on metal products to reduce smog production, creating a healthier environment for our team members • Use of scrap metal, plastic, and cardboard recycling programs within our facilities 400 2.2m 1,100+ Tons of toxic chemicals eliminated annually Solar KW hours powered each year Tons of ABS plastic scraps reground annually

LCI INDUSTRIES 13 a. Amounts (in millions) represent Management’s estimate of the size of the addressable market, excluding the Company’s current net sales to those markets. (1) Amounts in millions. "Opportunity" amounts represent Managem nt's estim te of the size of the addr ssable market based on current products as of Q419, excluding the Company's current net sales to those markets. The estimates above have been revised to exclude actual and potential Furrion sales. These graphs include CURT pro forma 2019 net sales of approximately $268 million. Expanding Our Growth Potential(1)

LCI INDUSTRIES 14 Growing End Markets to Reduce Cyclicality Our goal is to grow adjacent, aftermarket, and international to be approximately 60% of sales by the end of 2022 to reduce cyclical impacts of North American RV industry 2022E Sales2016 Sales North America RV - OEM Adjacent Industries Aftermarket Europe / International 2020 Sales

LCI INDUSTRIES 15 Positioned to Capitalize on Industry Tailwinds • Great American Outdoors Act signed into law in August 2020 to provide needed maintenance for facilities and infrastructure in national parks, forests, wildlife refuges, and recreation areas, as well as annual funding to invest in conservation and recreation opportunities across the United States • Millennials continue to fuel growth, making up 31% of the total U.S. population and 37% of all campers • 46 million Americans likely to take an RV road trip over the next 12 months, per RVIA survey • Vibrant secondary RV market - approximately two-thirds of the over nine million RV owners purchased their RV previously owned • Outdoor Recreation Industry - 22% of GDP, representing a larger industry than agriculture, mining, and utilities Statistics provided by Kampgrounds of America (“KOA”) in 2019. * Adjacent Markets include marine, bus, rail, freight/fleet, modular housing, and college/hospitality. Outdoor recreation industry $734 billion 15 2020 SALES BY END MARKET N.A. RV Adjacent Markets * Aftermarket International RV MARKET SHARE BY AGE 25-34 35-44 45-54 55-64 65-74 75+ 2014 2015 2016 2017 2018 2019 —% 20% North American Outdoor Recreation Industry $734 billion

LCI INDUSTRIES 16 RV Wholesale/Retail/Inventory Change Retail Wholesale Inventory Linear (Inventory) Q1 17 Q2 17 Q3 17 Q4 17 Q1 18 Q2 18 Q3 18 Q4 18 Q1 19 Q2 19 Q3 19 Q4 19 Q1 20 Q2 20 Q3 20 Q4 20 — 25,000 50,000 75,000 100,000 125,000 150,000 175,000 200,000 (80,000) (60,000) (40,000) (20,000) — 20,000 40,000 60,000 RV Industry Trends Retail provided by Statistical Surveys, Wholesale/RV provided by RVIA, Marine provided by Statistical Surveys, Trucks provided by Bureau of Economic Analysis U.S. Department of Commerce. Strong Recovery in Retail Demand - Record High Revenue and Run Rates in June through December 2020 RVIA currently estimates demand of 523,000 - 544,000 wholesale units for FY 2021

LCI INDUSTRIES 17 (in m ill io ns ) AFT Segment Net Sales 2012 2013 2014 2015 2016 2017 2018 2019 2020 $— $200.0 $400.0 $600.0 Growing Aftermarket Segment • Multiple channels including wholesale distributors, direct to dealer, and direct to consumer (e-commerce) • Multiple product categories including functional accessories, repair parts, replacement parts, and upgrades • Strong service department established on the supply side • Dealers rely on LCI as a key technical resource to provide a high level of satisfaction to customers • Used RV market is estimated to be double the size of the new RV market each year

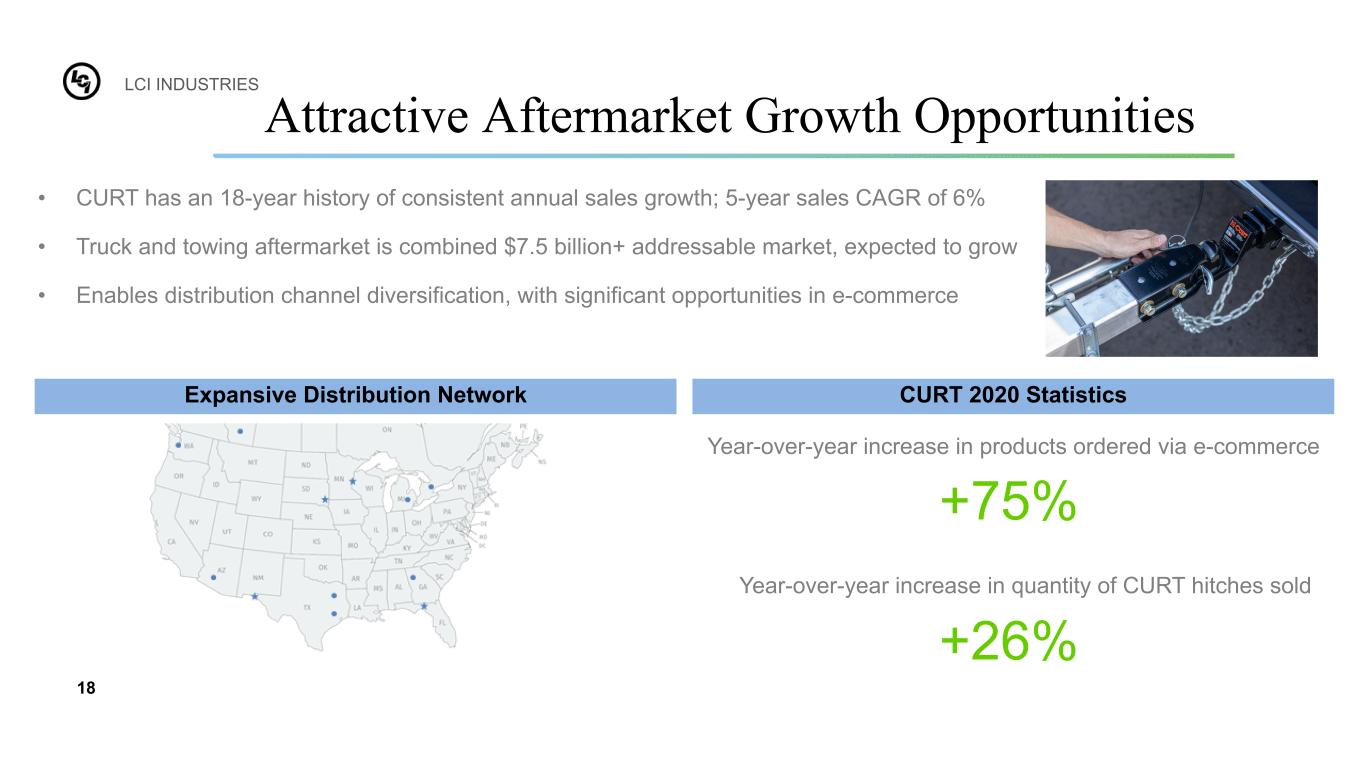

LCI INDUSTRIES 18 • CURT has an 18-year history of consistent annual sales growth; 5-year sales CAGR of 6% • Truck and towing aftermarket is combined $7.5 billion+ addressable market, expected to grow • Enables distribution channel diversification, with significant opportunities in e-commerce Expansive Distribution Network Attractive Aftermarket Growth Opportunities 13.7%14.1% 15.0% 14.8%11.4% 13.2% CURT 2020 Statistics +75% +26% Year-over-year increase in products ordered via e-commerce Year-over-year increase in quantity of CURT hitches sold

LCI INDUSTRIES 19 Global Expansion Opportunity • Grew year-over-year International sales by 60% in Q4 2020 • Working closely with Erwin Hymer Group, owned by Thor Industries, to further expand LCI products and technologies in European markets • Acquired Lavet in 2019 - Expanding European presence • Acquired Lewmar in 2019 - Provides core marine products to build upon in Europe • Acquired Ciesse in 2019 - Railway interior products and systems • Acquired Polyplastic in 2020 - A premier window supplier to the caravaning industry (in m ill io ns ) International Net Sales 2016 2017 2018 2019 2020 $— $100.0 $200.0

LCI INDUSTRIES 20 Acquisition Strategy • Over 50 acquisitions in the last 20 years ◦ Majority of last 20 acquisitions focused outside of North American RV industry • Look for: ◦ Great leadership ◦ Product innovation ◦ Consistency with our core manufacturing disciplines ◦ Niche markets ◦ Favorable competitive landscape • Typical synergies to improve EBITDA turns 2x ◦ Purchasing power ◦ Cross-selling opportunities ◦ Capital infusion to drive growth

LCI INDUSTRIES 21 Financial Overview L C I I N D U S T R I E S

LCI INDUSTRIES 22 Consolidated Net Sales $564,021 $783,002 Fourth Quarter 2019 Fourth Quarter 2020 Operating Margin 6.7% 8.1% Fourth Quarter 2019 Fourth Quarter 2020 Q4 2020 Financial Performance Consolidated Net Sales by Market (in thousands) +29% RV OEM +20% ADJACENT OEM +129% AFTERMARKET SEGMENT +60% INTERNATIONAL MARKETS Consolidated Net Income $28,807 $48,693 Fourth Quarter 2019 Fourth Quarter 2020 (in thousands) Adjusted EBITDA $57,121 $88,067 Fourth Quarter 2019 Fourth Quarter 2020 (in thousands) Additional information regarding adjusted EBITDA, as well as reconciliation of this non-GAAP financial measure to the most directly comparable GAAP financial measure, is provided in the Appendix.

LCI INDUSTRIES 23 Consolidated Financials ($ in millions except per share data) 2015 2016 2017 2018 2019 2020 Net Sales $ 1,403 $ 1,679 $ 2,148 $ 2,476 $ 2,371 $ 2,796 Operating Profit $ 116 $ 201 $ 214 $ 199 $ 200 $ 223 % of sales 8.3 % 12.0 % 10.0 % 8.0 % 8.4 % 8.0 % Net Income $ 74 $ 130 $133 $ 149 $ 147 $ 158 Diluted EPS $ 3.02 $ 5.20 $ 5.24 $ 5.83 $ 5.84 $ 6.27 Cash Dividends (per share) $ 2.00 $ 1.40 $ 2.05 $ 2.35 $ 2.55 $ 2.80

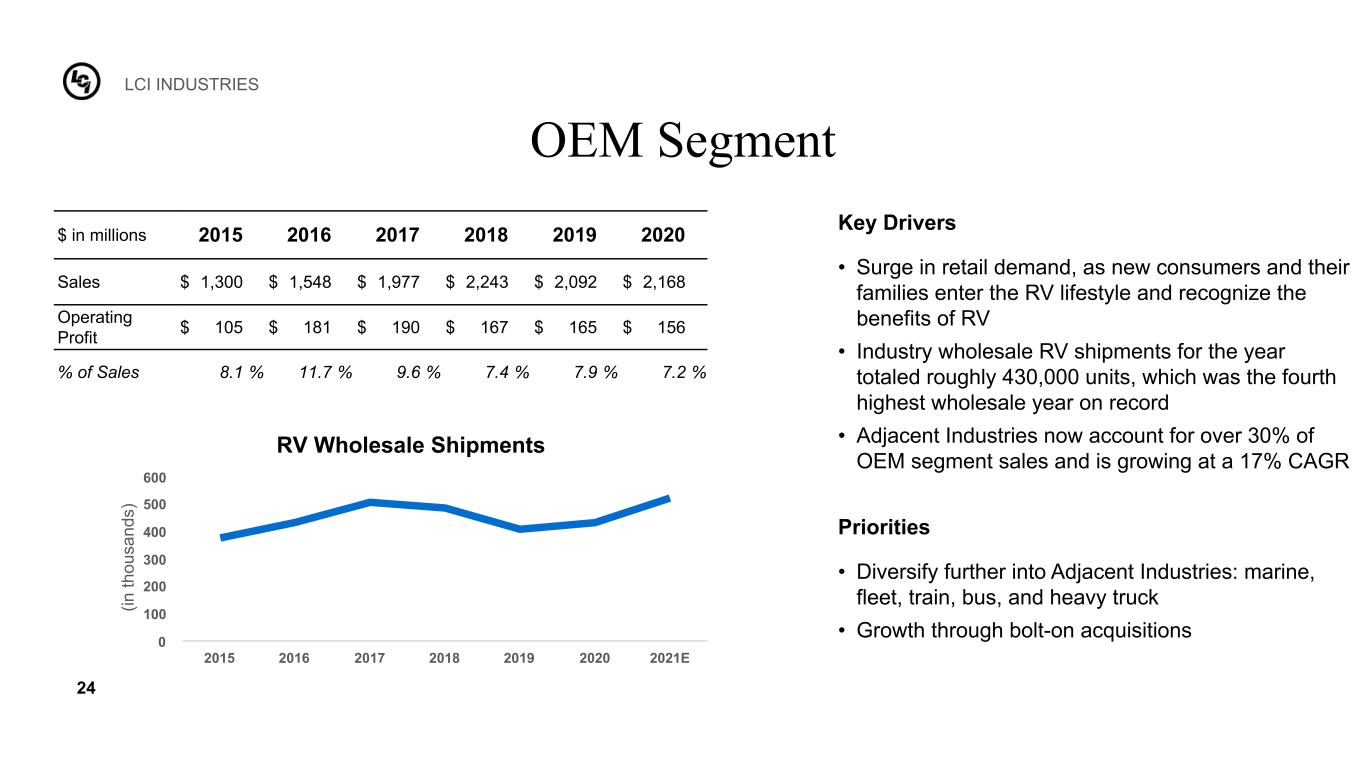

LCI INDUSTRIES 24 $ in millions 2015 2016 2017 2018 2019 2020 Sales $ 1,300 $ 1,548 $ 1,977 $ 2,243 $ 2,092 $ 2,168 Operating Profit $ 105 $ 181 $ 190 $ 167 $ 165 $ 156 % of Sales 8.1 % 11.7 % 9.6 % 7.4 % 7.9 % 7.2 % OEM Segment Key Drivers • Surge in retail demand, as new consumers and their families enter the RV lifestyle and recognize the benefits of RV • Industry wholesale RV shipments for the year totaled roughly 430,000 units, which was the fourth highest wholesale year on record • Adjacent Industries now account for over 30% of OEM segment sales and is growing at a 17% CAGR Priorities • Diversify further into Adjacent Industries: marine, fleet, train, bus, and heavy truck • Growth through bolt-on acquisitions (in th ou sa nd s) RV Wholesale Shipments 2015 2016 2017 2018 2019 2020 2021E 0 100 200 300 400 500 600

LCI INDUSTRIES 25 OEM Content Per Vehicle At industry production levels for the period ended September 2018, each $100 increase in content adds approximately $43 million in sales for LCII. New Towable RV • Approximately 61% of OEM Segment net sales are for Travel Trailer and Fifth-Wheel OEMs • 100% market share in existing products, excluding Furrion, would yield an estimated $5,800 per Towable RV, 58% penetration New Motorhome RV • Approximately 7% of OEM Segment net sales are for Motorhome OEM's • 100% market share in existing products, excluding Furrion, would yield an estimated $6,400 per Motorhome RV, 39% penetration In August 2019, the Company and Furrion agreed to terminate the agreement effective December 31, 2019, and transition all sale and distribution of Furrion products then handled by the Company to Furrion. Effective January 1, 2020, Furrion is responsible for distributing its products directly to the customer and assumed all responsibilities previously carried out by the Company relating to Furrion products. The content numbers reported above exclude all Furrion product sales from the applicable periods. Content per New Towable RV $2,690 $2,713 $2,816 $2,987 $3,022 $3,106 $3,230 $3,346 $3,390 2012 2013 2014 2015 2016 2017 2018 2019 2020 Content per New Motorhome RV $1,227 $1,272 $1,602 $1,810 $2,011 $2,193 $2,435 $2,287 $2,479 2012 2013 2014 2015 2016 2017 2018 2019 2020

LCI INDUSTRIES 26 Aftermarket Segment $ in millions 2015 2016 2017 2018 2019(1) 2020(1)(2) Sales $ 103 $ 131 $ 171 $ 233 $ 279 $ 628 Operating Profit(2) $ 15 $ 20 $ 24 $ 31 $ 35 $ 67 % of Sales 14.6 % 15.3 % 14.0 % 13.3 % 12.5 % 10.6 % Key Drivers • Robust Aftermarket is estimated to be double the size of the new RV market each year with higher margins • CURT outperforming their pre-COVID targets for FY 2020 • CURT acquisition opens up over $7.5 billion of addressable market growth Priorities • Position LCI as the premier aftermarket supplier and expand supplier/dealer relationships • Growth through bolt-on acquisitions (1) CURT amortization expense did not materially impact 2019, but is approximately $9M annually beginning in 2020. (2) 2020 results include a non-cash charge for inventory fair value step-up of $7.3 million related to CURT purchase accounting.

LCI INDUSTRIES 27 $ in millions 2015 2016 2017 2018 2019 2020 Cash & Equivalents $ 12 $ 86 $ 26 $ 15 $ 35 $ 52 Accounts Receivable 42 57 82 122 200 269 Inventory 171 189 275 341 394 494 Other Assets 398 455 563 766 1,234 1,483 Total Assets $ 623 $ 787 $ 946 $ 1,244 $ 1,863 $ 2,298 Accounts Payable $ 30 $ 51 $ 79 $ 78 $ 99 $ 185 Total Debt * 50 50 50 294 631 738 Other Liabilities 104 136 164 166 332 467 Total Liabilities $ 184 $ 237 $ 293 $ 538 $ 1,062 $ 1,390 Total Equity $ 439 $ 550 $ 653 $ 706 $ 801 $ 908 Balance Sheet Supports Growth • Debt increase in 2019 and 2020 due to funding recent acquisitions and liquidity for COVID-19 shutdowns.

LCI INDUSTRIES 28 Reduce Leverage Disciplined Reinvestment to Drive Growth Acquisitions that Align to Strategy and Financial Targets Return Capital to Shareholders Attractive Dividend Yield Opportunistic Share Repurchases Target Net Debt / EBITDA Leverage of 1.0x to 1.5x Capital Deployment Strategy Future Use of Cash Dividends Acquisitions Capex Repurchases Dividends - 30% Acquisitions - 40% Capex - 30% Historical Use of Cash Cash Priorities

LCI INDUSTRIES 29 Operating Cash Flow ($M) 82.68 95.02 155.08 156.61 269.53 231.40 2012 2014 2016 2018 2020 Net Debt / EBITDA* -0.63 0.24 0.09 1.05 2.16 2.14 2012 2014 2016 2018 2020 *See the Appendix to this presentation for reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures.

LCI INDUSTRIES 30 Appendix L C I I N D U S T R I E S

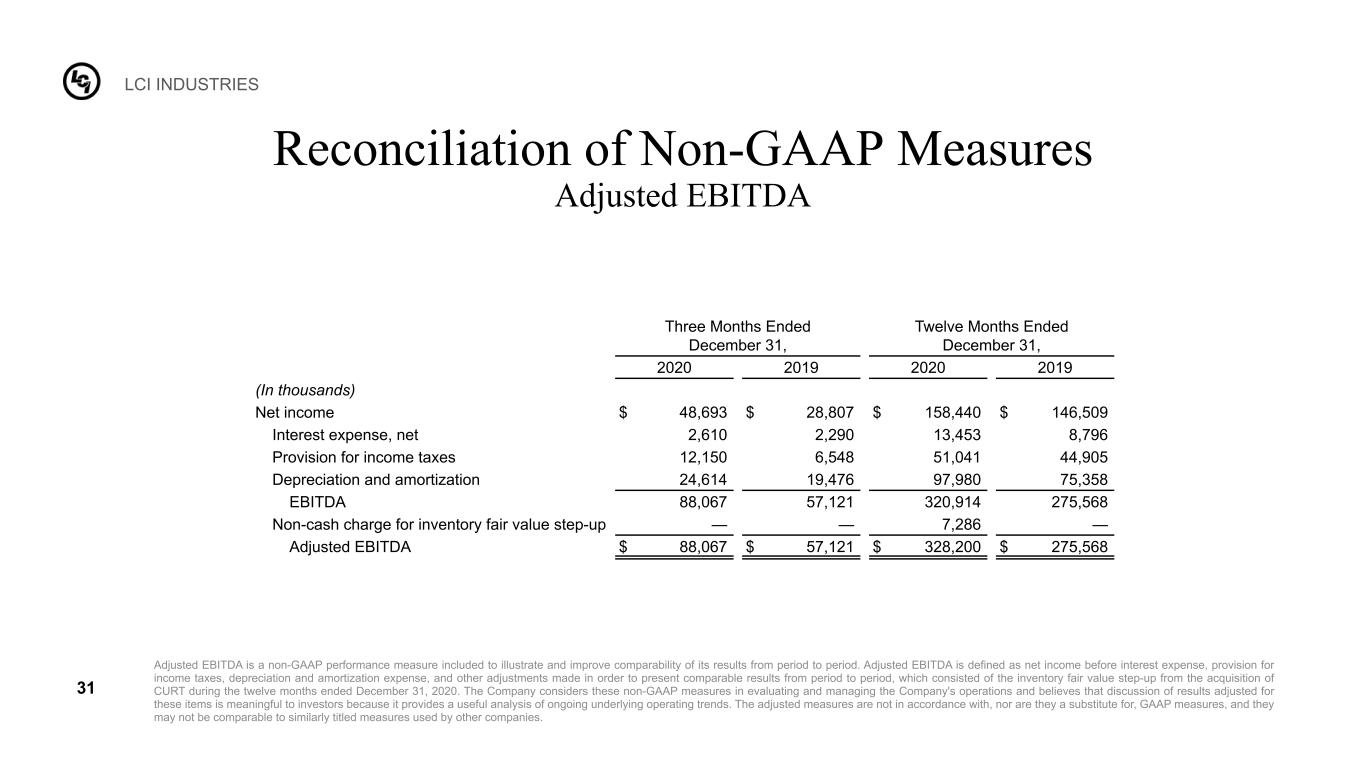

LCI INDUSTRIES 31 Reconciliation of Non-GAAP Measures Adjusted EBITDA Three Months Ended December 31, Twelve Months Ended December 31, 2020 2019 2020 2019 (In thousands) Net income $ 48,693 $ 28,807 $ 158,440 $ 146,509 Interest expense, net 2,610 2,290 13,453 8,796 Provision for income taxes 12,150 6,548 51,041 44,905 Depreciation and amortization 24,614 19,476 97,980 75,358 EBITDA 88,067 57,121 320,914 275,568 Non-cash charge for inventory fair value step-up — — 7,286 — Adjusted EBITDA $ 88,067 $ 57,121 $ 328,200 $ 275,568 Adjusted EBITDA is a non-GAAP performance measure included to illustrate and improve comparability of its results from period to period. Adjusted EBITDA is defined as net income before interest expense, provision for income taxes, depreciation and amortization expense, and other adjustments made in order to present comparable results from period to period, which consisted of the inventory fair value step-up from the acquisition of CURT during the twelve months ended December 31, 2020. The Company considers these non-GAAP measures in evaluating and managing the Company's operations and believes that discussion of results adjusted for these items is meaningful to investors because it provides a useful analysis of ongoing underlying operating trends. The adjusted measures are not in accordance with, nor are they a substitute for, GAAP measures, and they may not be comparable to similarly titled measures used by other companies.

LCI INDUSTRIES 32 Reconciliation of Non-GAAP Measures Adjusted Net Income and Adjusted Diluted Net Income Per Common Share Twelve Months Ended December 31, 2020 2019 (In thousands, except per share amounts) Net income $ 158,440 $ 146,509 Non-cash charge for inventory fair value step-up 7,286 — Income tax impact of inventory fair value step-up (1,772) — Adjusted net income $ 163,954 $ 146,509 Diluted net income per common share $ 6.27 $ 5.84 Non-cash charge for inventory fair value step-up 0.29 — Income tax impact of inventory fair value step-up (0.07) — Adjusted diluted net income per common share $ 6.49 $ 5.84 Adjusted net income and adjusted diluted net income per common share are non-GAAP performance measures included to illustrate and improve comparability of its results from period to period. Adjusted net income is defined as net income adjusted for items that impact the comparability of the Company's results from period to period, which consisted of the inventory fair value step-up from the acquisition of CURT and related tax impacts during the twelve months ended December 31, 2020. Adjusted diluted net income per common share is defined as net income per common share adjusted for items that impact the comparability of the Company's results from period to period, which consisted of the inventory fair value step-up from the acquisition of CURT and related tax impacts during the twelve months ended December 31, 2020. The Company considers these non-GAAP measures in evaluating and managing the Company's operations and believes that discussion of results adjusted for these items is meaningful to investors because it provides a useful analysis of ongoing underlying operating trends. The adjusted measures are not in accordance with, nor are they a substitute for, GAAP measures, and they may not be comparable to similarly titled measures used by other companies.

LCI INDUSTRIES 33 Reconciliation of Non-GAAP Measures Adjusted Net Income and Adjusted Diluted Net Income Per Common Share $ in millions, except per share amounts Income before income taxes Provision for income taxes Net income Effective tax rate Diluted earnings per share Year ended December 31, 2018 As reported GAAP $ 192.4 $ 43.8 $ 148.6 23 % $ 5.83 Impact of TCJA(1) — (0.6) 0.6 (1)% 0.03 Adjusted non-GAAP $ 192.4 $ 43.2 $ 149.2 22 % $ 5.86 Year ended December 31, 2017 As reported GAAP $ 212.84 $ 79.96 $ 132.88 38 % $ 5.24 Impact of TCJA(1) — (13.2) 13.2 (7)% 0.52 Adjusted non-GAAP $ 212.8 $ 66.8 $ 146.1 31 % $ 5.76 (1) The Company recorded one-time non-cash charges related to adjustments to deferred tax amounts from the December 2017 enactment of the Tax Cuts and Jobs Act (“TCJA”). In addition to reporting financial results in accordance with U.S. GAAP, the Company also provides non-GAAP measures that adjust for the impact of enactment of the TCJA. These items represent significant charges that impacted the Company’s financial results. Net income, diluted earnings per share, and the effective tax rate are all measures for which the Company provides the reported GAAP measure and an adjusted measure. The adjusted measures are not in accordance with, nor are they a substitute for, GAAP measures. The Company considers these non-GAAP measures in evaluating and managing the Company’s operations. The Company believes that discussion of results adjusted for these items is meaningful to investors as it provides a useful analysis of underlying operating trends. The determination of these items may not be comparable to similarly titled measures used by other companies.

LCI INDUSTRIES 34 $ in millions 2012 2013 2014 2015 2016 2017 2018 2019 2020 Long-term indebtedness $ — $ — $ 15.7 $ 50.0 $ 49.9 $ 49.9 $ 293.5 $ 612.9 $ 720.4 Current portion of long-term debt — — — — — — 0.6 17.9 17.8 Total Debt — — 15.7 50.0 49.9 49.9 294.1 630.8 738.2 Less: Cash and cash equivalents (9.9) (66.3) (4.0) (12.3) (86.2) (26.0) (14.9) (35.4) (51.8) Net Debt $ (9.9) $ (66.3) $ 11.7 $ 37.7 $ (36.2) $ 23.9 $ 279.2 $ 595.4 $ 686.4 Net income (loss), as reported GAAP $ 37.3 $ 50.1 $ 62.3 $ 74.3 $ 129.7 $ 132.9 $ 148.6 $ 146.5 $ 158.4 Add back: Interest expense (net) 0.3 0.4 0.4 1.9 1.7 1.4 6.4 8.8 13.5 Income taxes 20.5 27.8 32.8 40.0 69.5 80.0 43.8 44.9 51.0 Depreciation and amortization 25.7 27.5 32.6 41.6 46.2 54.7 67.5 75.4 98.0 EBITDA $ 83.8 $ 105.8 $ 128.1 $ 157.9 $ 247.0 $ 269.0 $ 266.3 $ 275.6 $ 320.9 Net Debt to EBITDA ratio (0.12) (0.63) 0.09 0.24 (0.15) 0.09 1.05 2.16 2.14 Total Debt to Net Income ratio — — 0.25 0.67 0.39 0.38 1.98 4.31 4.66 Reconciliation of Non-GAAP Measures Leverage Ratio (Net Debt to EBITDA) The Leverage Ratio (or Net Debt to EBITDA ratio) is a non-GAAP measure of the use of debt. The Leverage Ratio is calculated by dividing the total of long-term indebtedness, plus current portion of long-term debt, less cash and cash equivalents, by EBITDA. EBITDA, which is also a non-GAAP financial measure, is defined as the trailing twelve months earnings before interest, taxes, depreciation, and amortization. The Company uses the Leverage Ratio (or Net Debt to EBITDA ratio) as a metric to assess liquidity and the flexibility of its balance sheet. Consistent with other liquidity metrics, the Company monitors the Leverage Ratio as a measure to determine the appropriate level of debt the Company believes is optimal to operate its business, and accordingly, to quantify debt capacity available for strategic capital allocation and deployment through investments in the business (capital expenditures, acquisitions, and strategic investments) and for returning capital to the shareholders (dividends and share repurchases). The priorities for capital allocation and deployment will change as circumstances dictate for the business, and the Leverage Ratio can be significantly impacted by the amount and timing of large expenditures requiring debt financing, as well as changes in profitability. The Leverage Ratio is a non-GAAP measure and should not be considered an alternative to cash flows provided by operating activities as a measure of liquidity. The Company's calculation of the Leverage Ratio may differ from similar calculations used by other companies, and therefore, comparability may be limited. The GAAP measure of Total Debt to Net Income ratio is calculated by dividing total debt by net income.

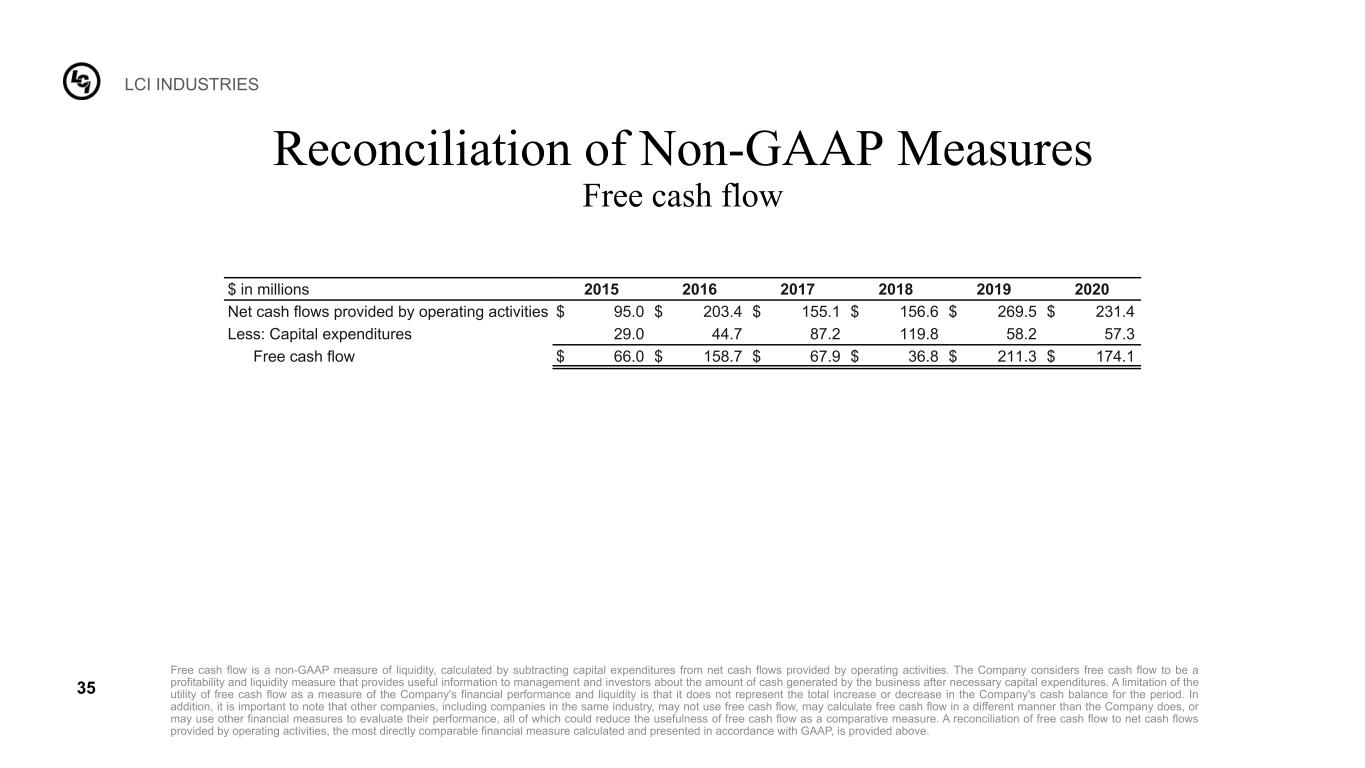

LCI INDUSTRIES 35 $ in millions 2015 2016 2017 2018 2019 2020 Net cash flows provided by operating activities $ 95.0 $ 203.4 $ 155.1 $ 156.6 $ 269.5 $ 231.4 Less: Capital expenditures 29.0 44.7 87.2 119.8 58.2 57.3 Free cash flow $ 66.0 $ 158.7 $ 67.9 $ 36.8 $ 211.3 $ 174.1 Reconciliation of Non-GAAP Measures Free cash flow Free cash flow is a non-GAAP measure of liquidity, calculated by subtracting capital expenditures from net cash flows provided by operating activities. The Company considers free cash flow to be a profitability and liquidity measure that provides useful information to management and investors about the amount of cash generated by the business after necessary capital expenditures. A limitation of the utility of free cash flow as a measure of the Company's financial performance and liquidity is that it does not represent the total increase or decrease in the Company's cash balance for the period. In addition, it is important to note that other companies, including companies in the same industry, may not use free cash flow, may calculate free cash flow in a different manner than the Company does, or may use other financial measures to evaluate their performance, all of which could reduce the usefulness of free cash flow as a comparative measure. A reconciliation of free cash flow to net cash flows provided by operating activities, the most directly comparable financial measure calculated and presented in accordance with GAAP, is provided above.

LCI INDUSTRIES 36