Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Great Ajax Corp. | exhibit991-123120.htm |

| 8-K - 8-K - Great Ajax Corp. | ajx-20210304.htm |

Fourth Quarter and Year-End 2020 Investor Presentation March 4, 2021

Safe Harbor Disclosure 2 We make forward-looking statements in this presentation that are subject to risks and uncertainties. These forward-looking statements include information about possible or assumed future results of our business, financial condition, liquidity, results of operations, cash flow and plans and objectives. When we use the words “believe,” “expect,” “anticipate,” “estimate,” “plan,” “continue,” “intend,” “should,” “may” or similar expressions, we intend to identify forward-looking statements. Statements regarding the following subjects, among others, may be forward-looking: market trends in our industry, interest rates, real estate values, the debt financing markets or the general economy or the demand for and availability of residential and small-balance commercial real estate loans; our business and investment strategy; our projected operating results; actions and initiatives of the U.S. government and changes to U.S. government policies and the execution and impact of these actions, initiatives and policies; the state of the U.S. economy generally or in specific geographic regions; economic trends and economic recoveries; our ability to obtain and maintain financing arrangements; changes in the value of our mortgage portfolio; changes to our portfolio of properties; impact of and changes in governmental regulations, tax law and rates, accounting guidance and similar matters; our ability to satisfy the real estate investment trust qualification requirements for U.S. federal income tax purposes; availability of qualified personnel; estimates relating to our ability to make distributions to our stockholders in the future; general volatility of the capital markets and the market price of our shares of common stock; and the degree and nature of our competition. The forward-looking statements included in this presentation are based on our current beliefs, assumptions and expectations of our future performance. Forward-looking statements are not predictions of future events. Our beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are currently known to us or reasonably expected to occur at this time. If a change in our beliefs, assumptions or expectations occurs, our business, financial condition, liquidity and results of operations may vary materially from the forward-looking statements included in this presentation. Forward-looking statements are subject to risks and uncertainties, including, among other things, those resulting from the pandemic caused by the global novel coronavirus outbreak and those described under Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2020, which can be accessed through the link to our Securities and Exchange Commission ("SEC") filings on our website (www.greatajax.com) or at the SEC's website (www.sec.gov). Other risks, uncertainties and factors that could cause actual results to differ materially from the forward-looking statements included in this presentation may be described from time to time in reports we file with the SEC. Any forward-looking statement speaks only as of the date on which it is made. New risks and uncertainties arise over time, and it is not possible for us to predict those events or how they may affect us. Except as required by law, we are not obligated to, and do not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Unless stated otherwise, financial information included in this presentation is as of December 31, 2020.

Business Overview 3 Leverage longstanding relationships to acquire mortgage loans through privately negotiated transactions from a diverse group of customers and in joint venture investments with institutional investors – Acquisitions made in 326 transactions since inception. Twelve transactions closed in Q4 2020 Use our manager’s proprietary analytics to price each mortgage pool on an asset-by-asset basis – We own 19.8% of our manager – Adjust individual loan bid price to accumulate clusters of loans in attractive demographic metropolitan areas Our affiliated servicer services the loans asset-by-asset and borrower-by-borrower – We own 8% and hold warrants to purchase up to an additional 12% of our affiliated servicer – Analytics and processes of our manager and servicer enable us to broaden our reach through joint ventures with third-party institutional investors We use modest mark to market leverage to fund our investments in debt securities and primarily non mark to market leverage to fund our mortgage portfolio We own a 23% equity interest in Gaea Real Estate Corp., an equity REIT that invests in multifamily and mixed use properties with a focus on property appreciation and triple net lease pet clinics

Highlights – Quarter Ended December 31, 2020 4 Purchased $12.7 million re-performing mortgage loans ("RPLs"), with unpaid principal balance ("UPB") of $13.5 million and 52.3% of property value, $13.4 million of non-performing mortgage loans ("NPLs"), with UPB of $15.3 million and 50.0% of property value, and $18.0 million small-balance commercial loans ("SBCs") with UPB of $18.4 million and 53.5% of property value, to end the quarter with $1.1 billion in net mortgage loans Interest income of $25.1 million; net interest income of $14.3 million excluding the impact of a net $7.6 million reversal of our provision for credit losses Net income attributable to common stockholders of $10.8 million Basic earnings per common share of $0.47 Book value per common share of $15.59 at December 31, 2020 Taxable income of $0.47 per common share Collected total cash of $63.7 million from loan payments, sales of real estate owned ("REO") and investments in debt securities and beneficial interests Held $107.1 million of cash and cash equivalents at December 31, 2020; average daily cash balance for the quarter was $128.7 million At December 31, 2020, approximately 71.9% of portfolio based on current UPB made at least 12 out of the last 12 payments

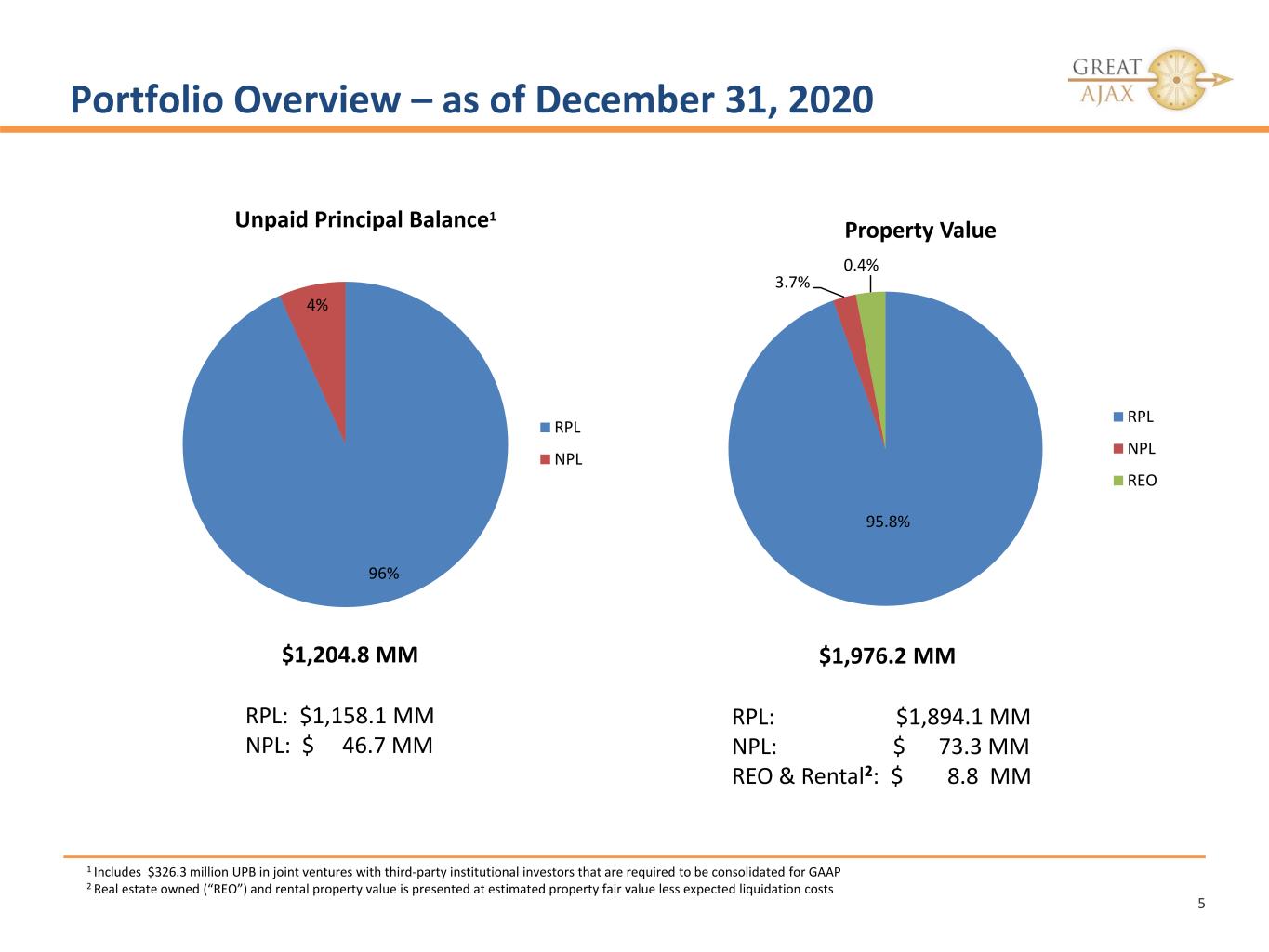

Portfolio Overview – as of December 31, 2020 5 $1,204.8 MM RPL: $1,158.1 MM NPL: $ 46.7 MM $1,976.2 MM RPL: $1,894.1 MM NPL: $ 73.3 MM REO & Rental2: $ 8.8 MM 1 Includes $326.3 million UPB in joint ventures with third-party institutional investors that are required to be consolidated for GAAP 2 Real estate owned (“REO”) and rental property value is presented at estimated property fair value less expected liquidation costs 96% 4% Unpaid Principal Balance1 RPL NPL 95.8% 3.7% 0.4% Property Value RPL NPL REO

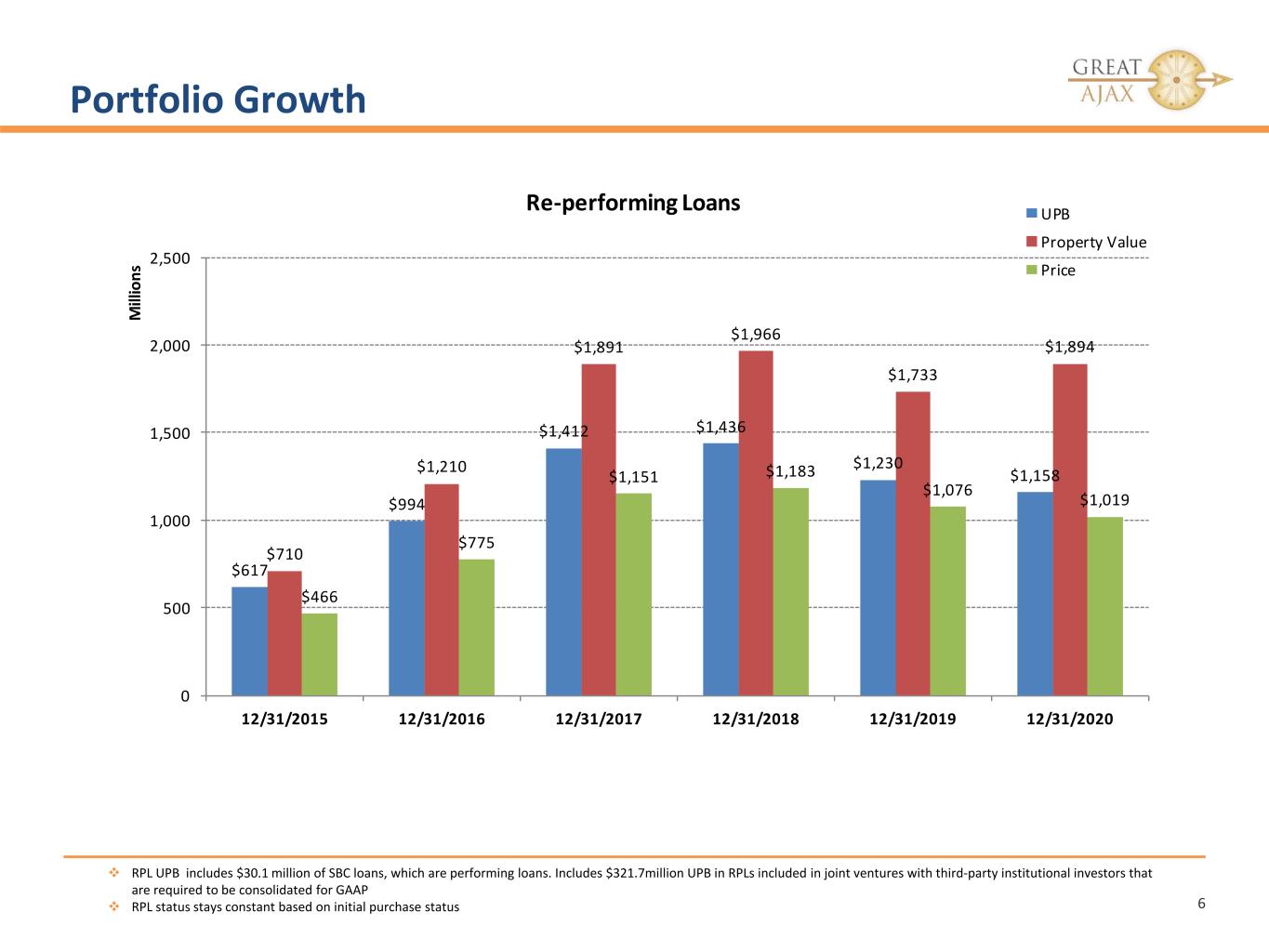

Portfolio Growth 6 RPL UPB includes $30.1 million of SBC loans, which are performing loans. Includes $321.7million UPB in RPLs included in joint ventures with third-party institutional investors that are required to be consolidated for GAAP RPL status stays constant based on initial purchase status $617 $994 $1,412 $1,436 $1,230 $1,158 $710 $1,210 $1,891 $1,966 $1,733 $1,894 $466 $775 $1,151 $1,183 $1,076 $1,019 0 500 1,000 1,500 2,000 2,500 12/31/2015 12/31/2016 12/31/2017 12/31/2018 12/31/2019 12/31/2020 M ill io ns Re-performing Loans UPB Property Value Price

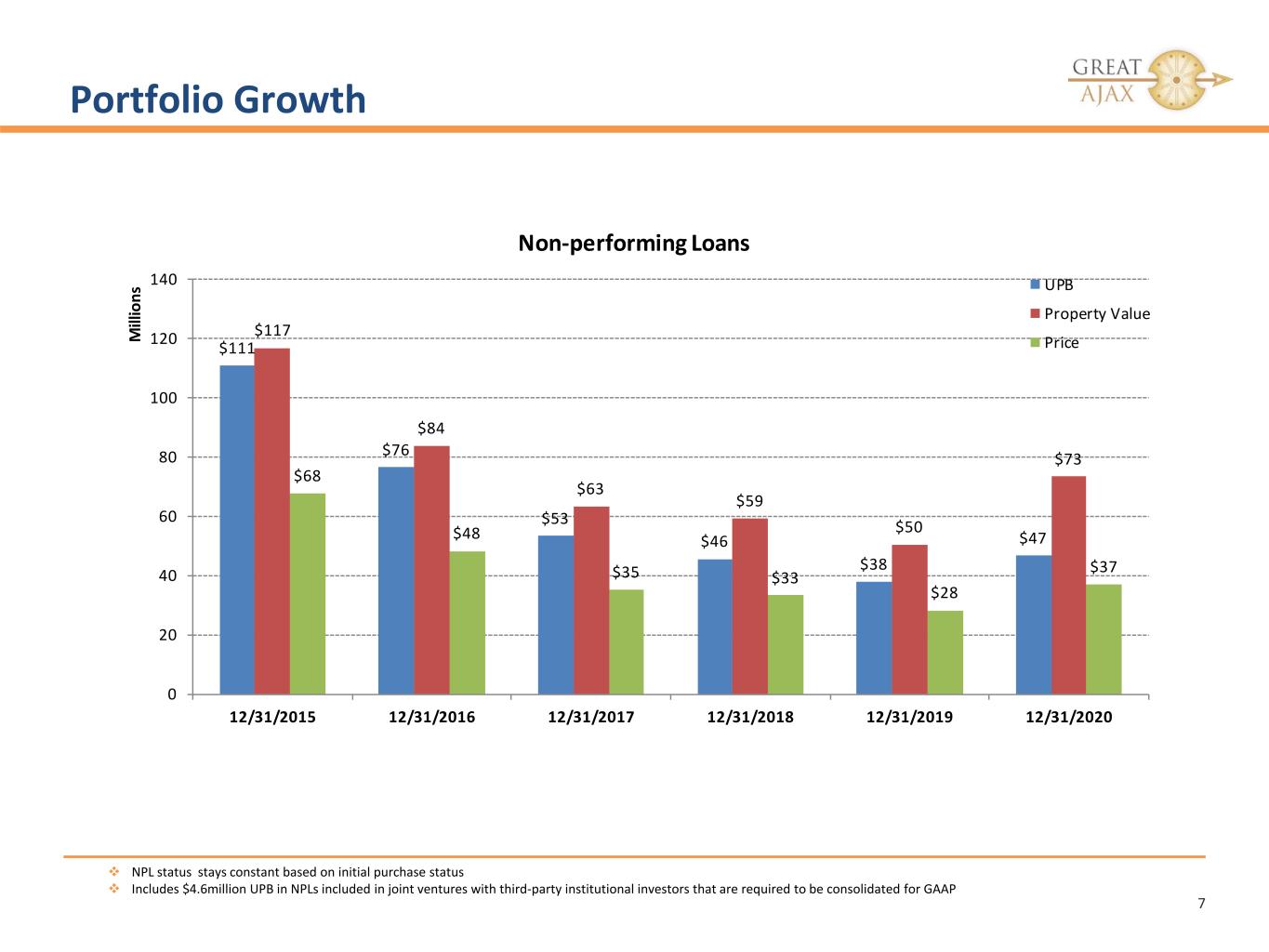

Portfolio Growth 7 NPL status stays constant based on initial purchase status Includes $4.6million UPB in NPLs included in joint ventures with third-party institutional investors that are required to be consolidated for GAAP $111 $76 $53 $46 $38 $47 $117 $84 $63 $59 $50 $73 $68 $48 $35 $33 $28 $37 0 20 40 60 80 100 120 140 12/31/2015 12/31/2016 12/31/2017 12/31/2018 12/31/2019 12/31/2020 M ill io ns Non-performing Loans UPB Property Value Price

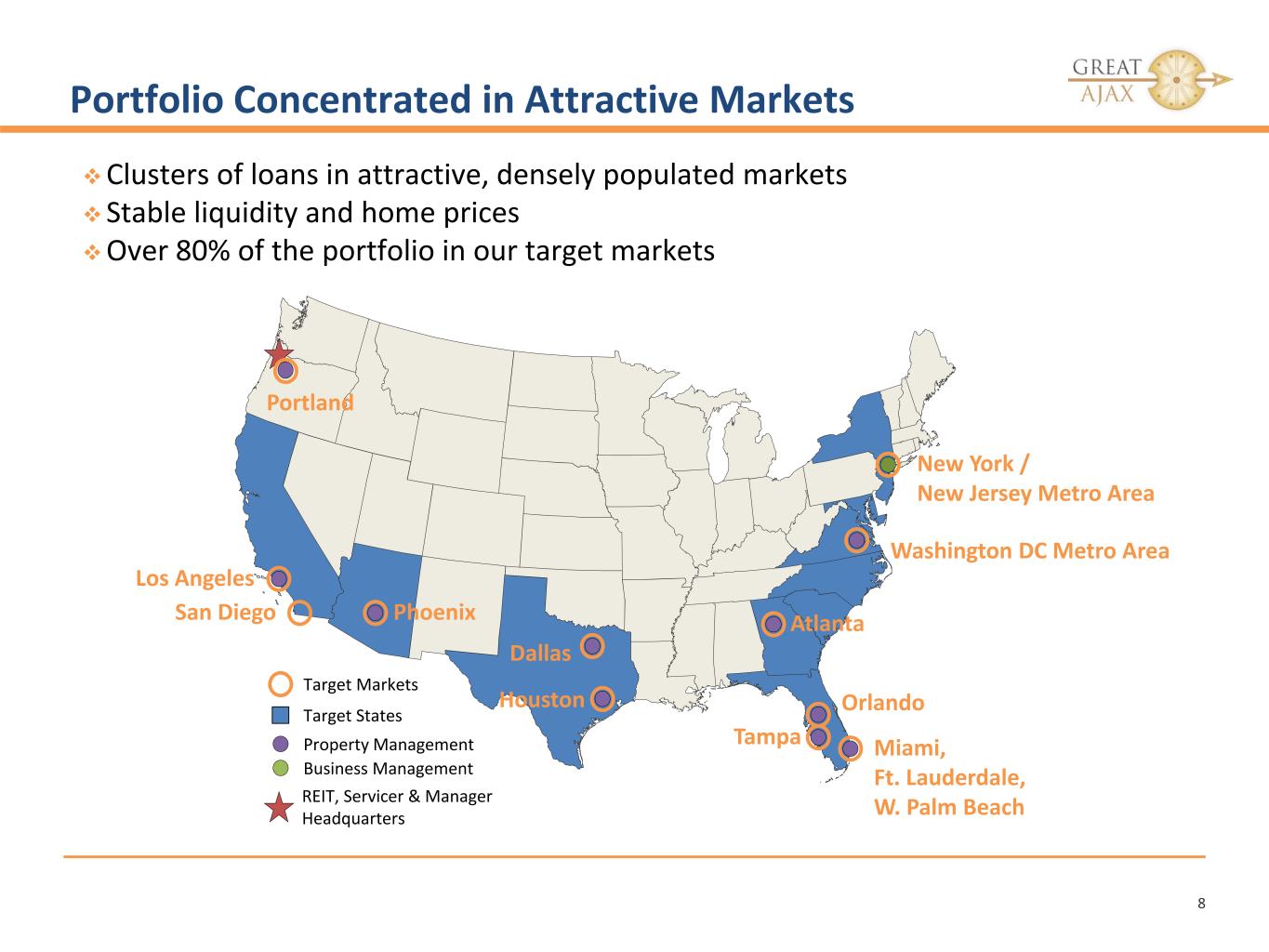

Portfolio Concentrated in Attractive Markets 8 Clusters of loans in attractive, densely populated markets Stable liquidity and home prices Over 80% of the portfolio in our target markets Target States Target Markets Los Angeles San Diego Dallas Portland Phoenix Washington DC Metro Area Atlanta Orlando Tampa Miami, Ft. Lauderdale, W. Palm Beach New York / New Jersey Metro Area REIT, Servicer & Manager Headquarters Property Management Business Management Houston

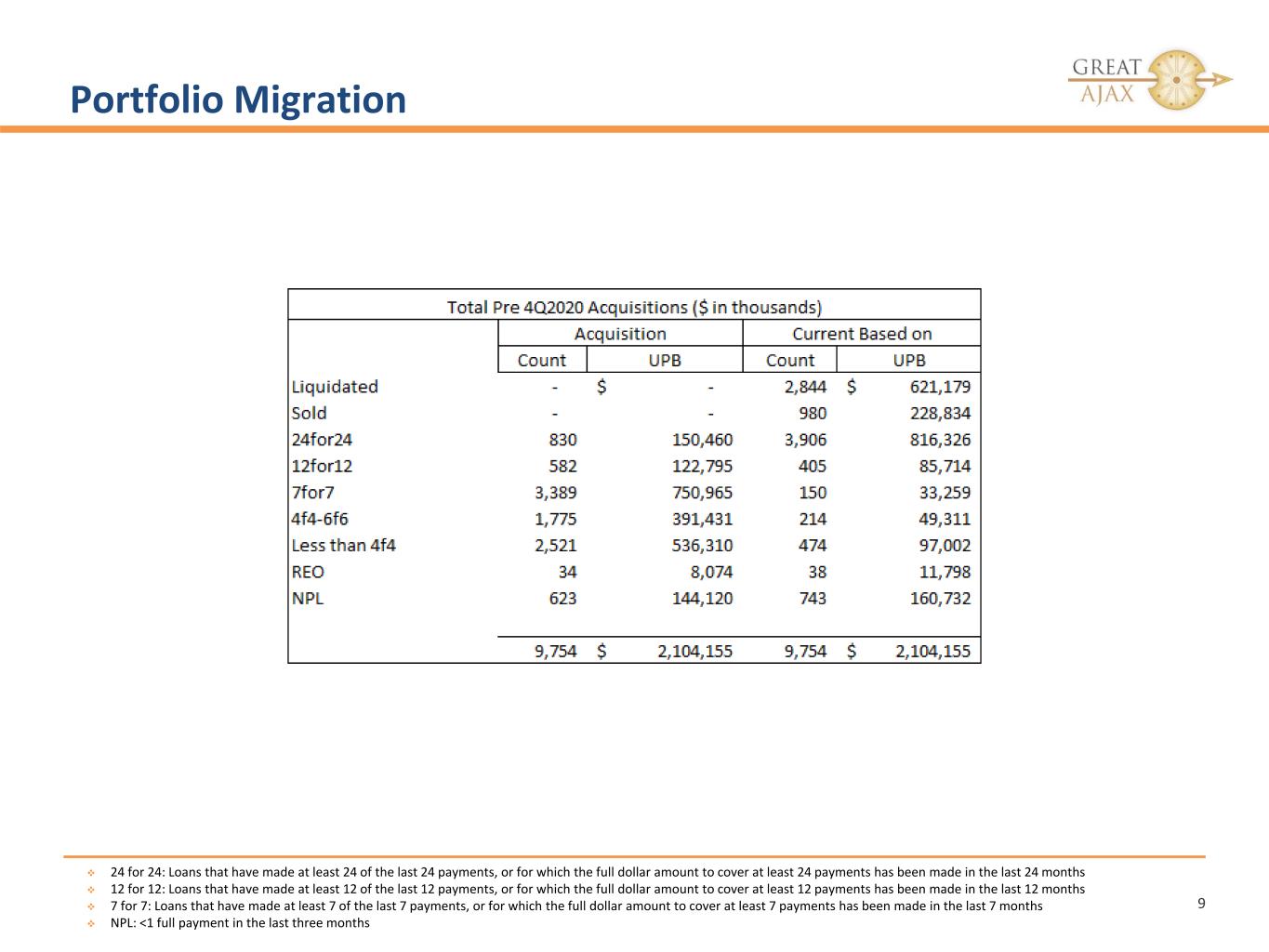

Portfolio Migration 9 24 for 24: Loans that have made at least 24 of the last 24 payments, or for which the full dollar amount to cover at least 24 payments has been made in the last 24 months 12 for 12: Loans that have made at least 12 of the last 12 payments, or for which the full dollar amount to cover at least 12 payments has been made in the last 12 months 7 for 7: Loans that have made at least 7 of the last 7 payments, or for which the full dollar amount to cover at least 7 payments has been made in the last 7 months NPL: <1 full payment in the last three months

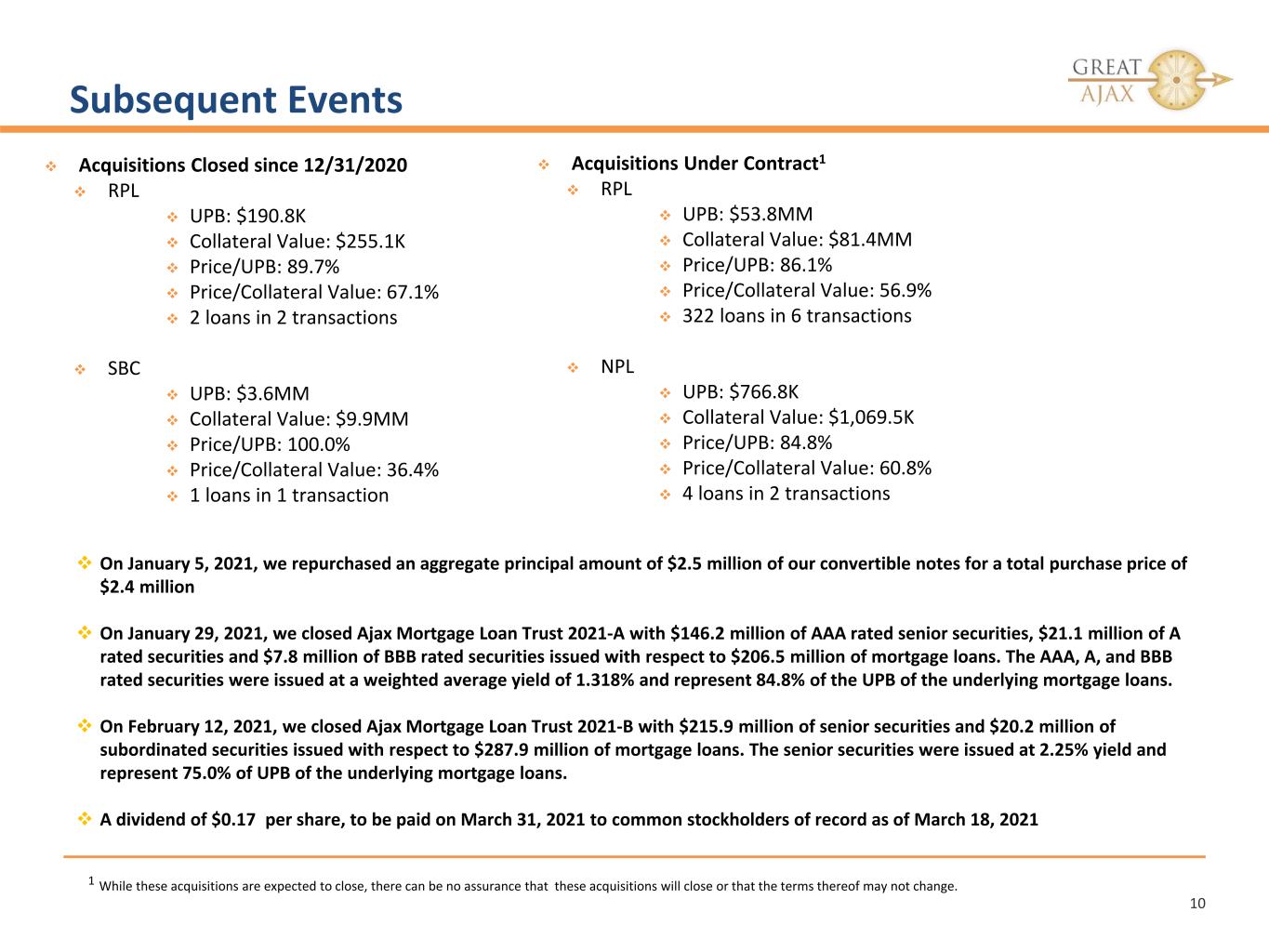

Subsequent Events 10 1 While these acquisitions are expected to close, there can be no assurance that these acquisitions will close or that the terms thereof may not change. Acquisitions Under Contract1 RPL UPB: $53.8MM Collateral Value: $81.4MM Price/UPB: 86.1% Price/Collateral Value: 56.9% 322 loans in 6 transactions NPL UPB: $766.8K Collateral Value: $1,069.5K Price/UPB: 84.8% Price/Collateral Value: 60.8% 4 loans in 2 transactions Acquisitions Closed since 12/31/2020 RPL UPB: $190.8K Collateral Value: $255.1K Price/UPB: 89.7% Price/Collateral Value: 67.1% 2 loans in 2 transactions SBC UPB: $3.6MM Collateral Value: $9.9MM Price/UPB: 100.0% Price/Collateral Value: 36.4% 1 loans in 1 transaction On January 5, 2021, we repurchased an aggregate principal amount of $2.5 million of our convertible notes for a total purchase price of $2.4 million On January 29, 2021, we closed Ajax Mortgage Loan Trust 2021-A with $146.2 million of AAA rated senior securities, $21.1 million of A rated securities and $7.8 million of BBB rated securities issued with respect to $206.5 million of mortgage loans. The AAA, A, and BBB rated securities were issued at a weighted average yield of 1.318% and represent 84.8% of the UPB of the underlying mortgage loans. On February 12, 2021, we closed Ajax Mortgage Loan Trust 2021-B with $215.9 million of senior securities and $20.2 million of subordinated securities issued with respect to $287.9 million of mortgage loans. The senior securities were issued at 2.25% yield and represent 75.0% of UPB of the underlying mortgage loans. A dividend of $0.17 per share, to be paid on March 31, 2021 to common stockholders of record as of March 18, 2021

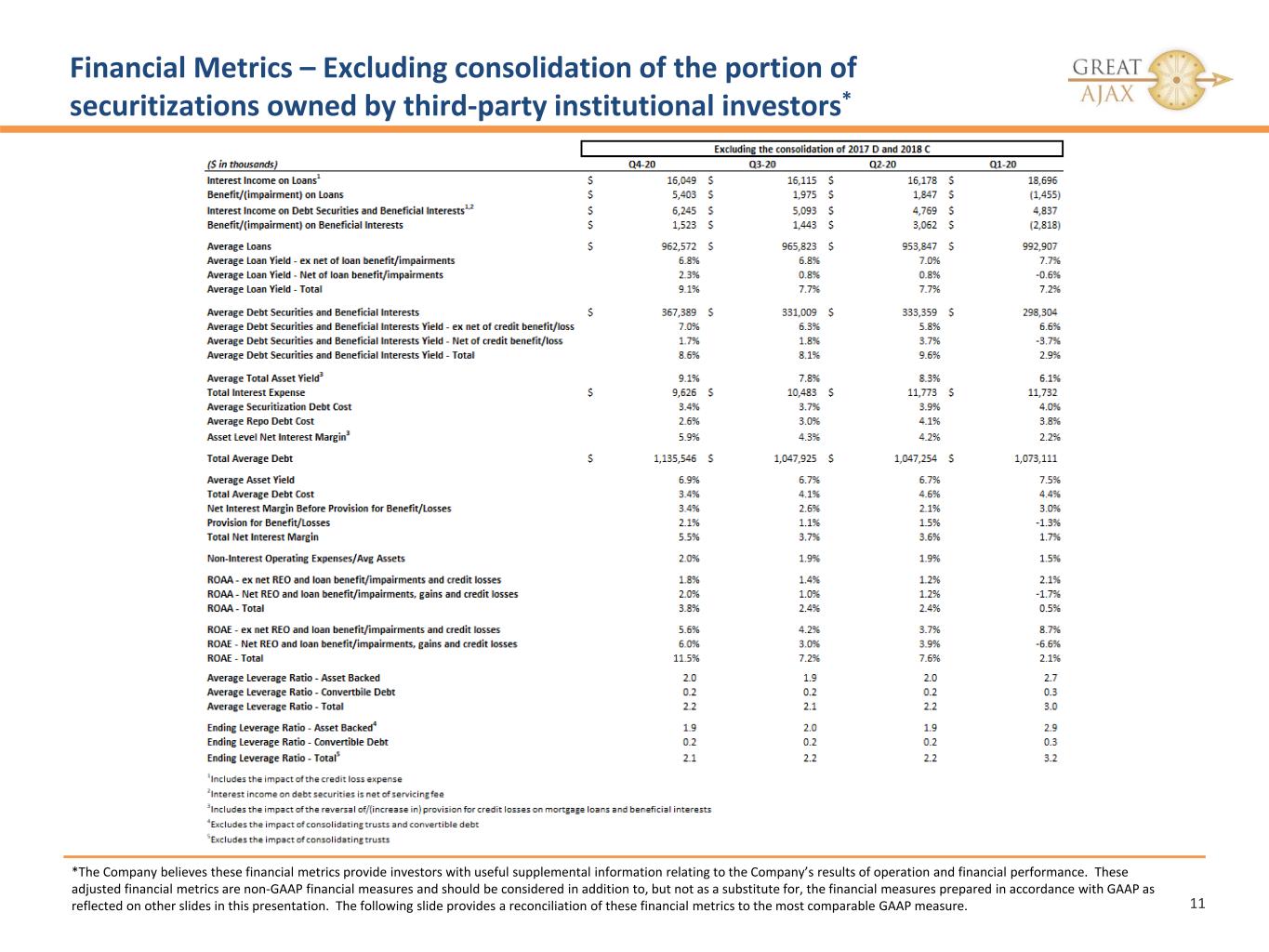

Financial Metrics – Excluding consolidation of the portion of securitizations owned by third-party institutional investors* 11 *The Company believes these financial metrics provide investors with useful supplemental information relating to the Company’s results of operation and financial performance. These adjusted financial metrics are non-GAAP financial measures and should be considered in addition to, but not as a substitute for, the financial measures prepared in accordance with GAAP as reflected on other slides in this presentation. The following slide provides a reconciliation of these financial metrics to the most comparable GAAP measure.

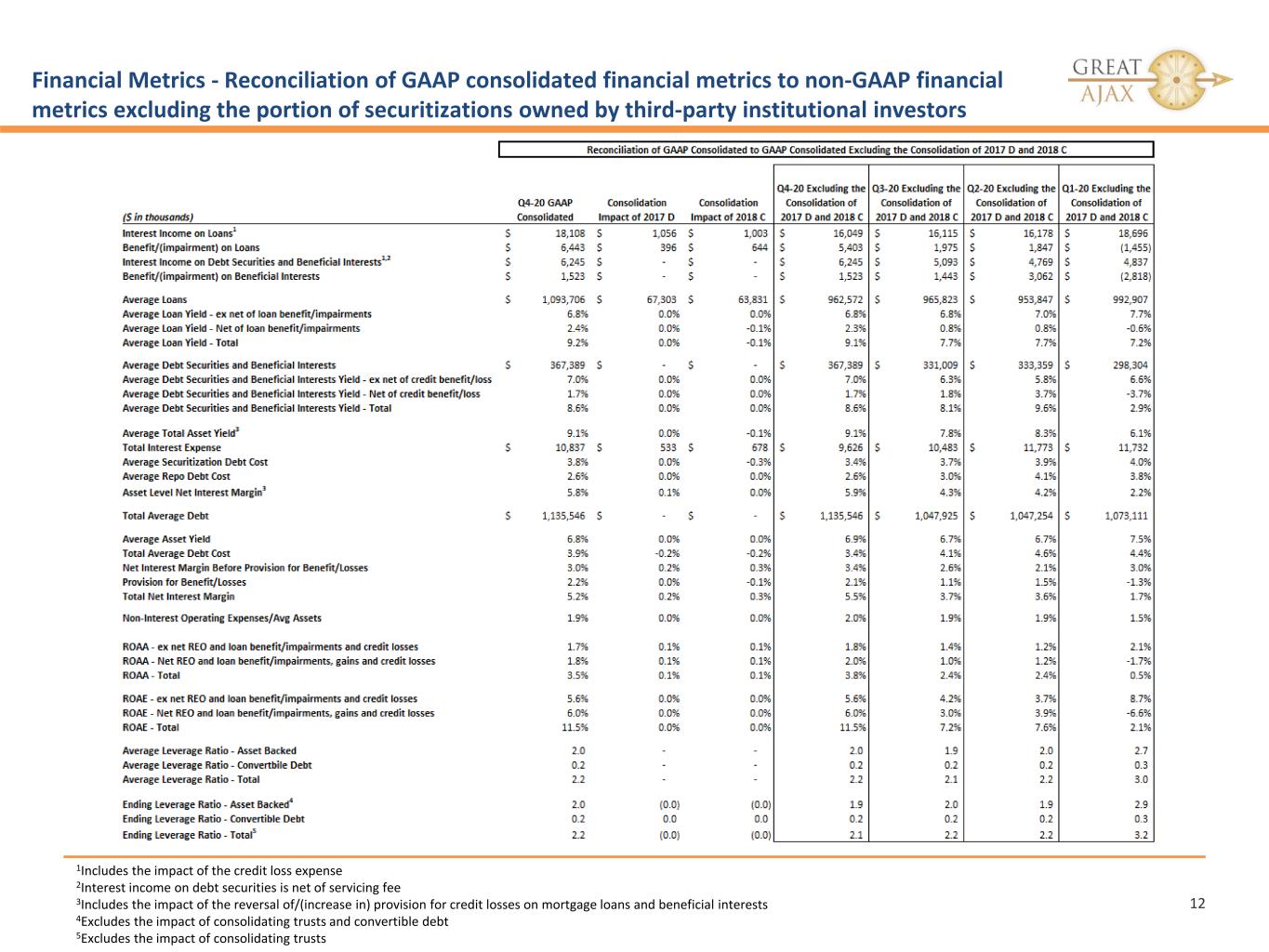

Financial Metrics - Reconciliation of GAAP consolidated financial metrics to non-GAAP financial metrics excluding the portion of securitizations owned by third-party institutional investors 12 1Includes the impact of the credit loss expense 2Interest income on debt securities is net of servicing fee 3Includes the impact of the reversal of/(increase in) provision for credit losses on mortgage loans and beneficial interests 4Excludes the impact of consolidating trusts and convertible debt 5Excludes the impact of consolidating trusts

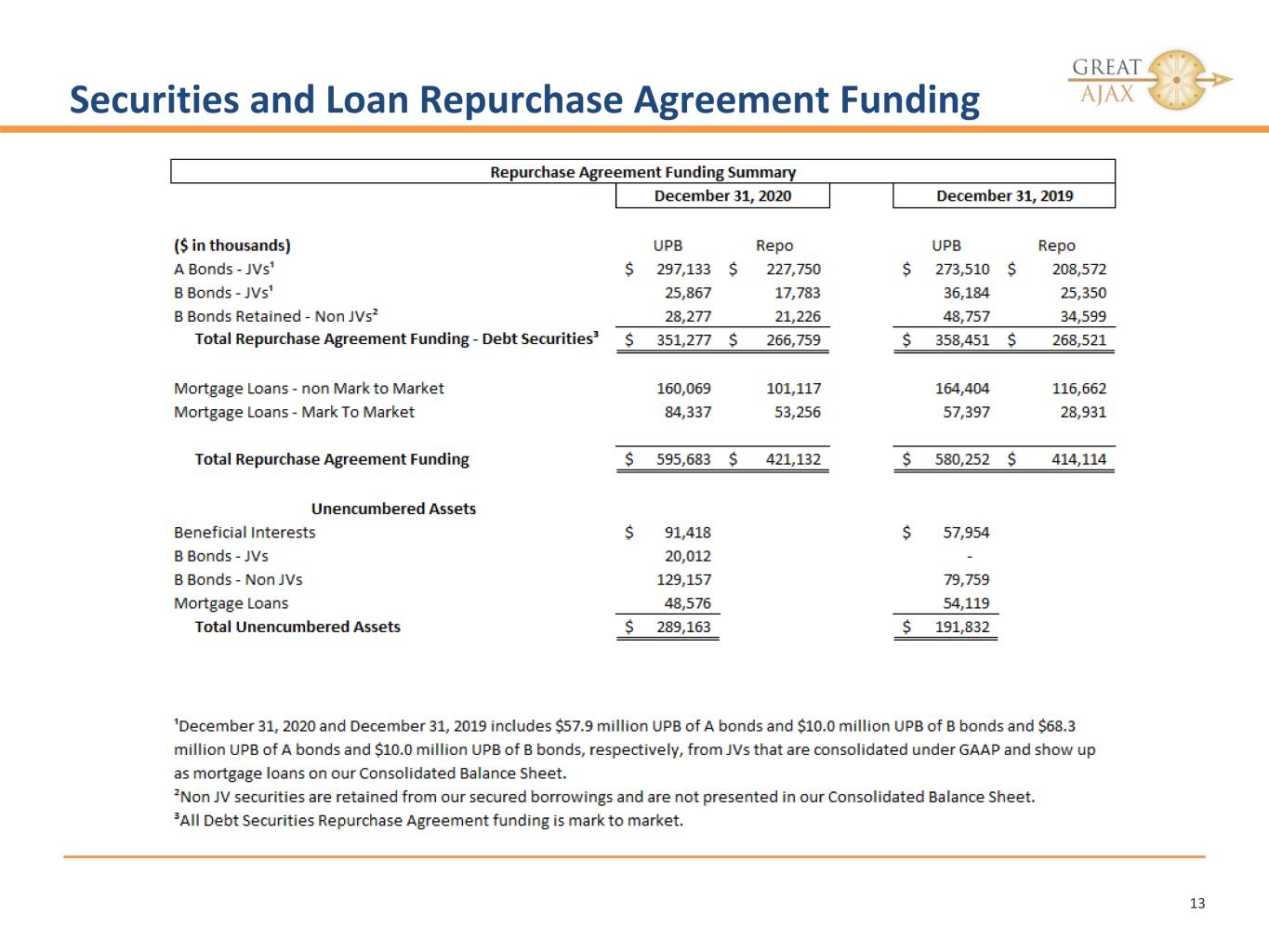

Securities and Loan Repurchase Agreement Funding 13

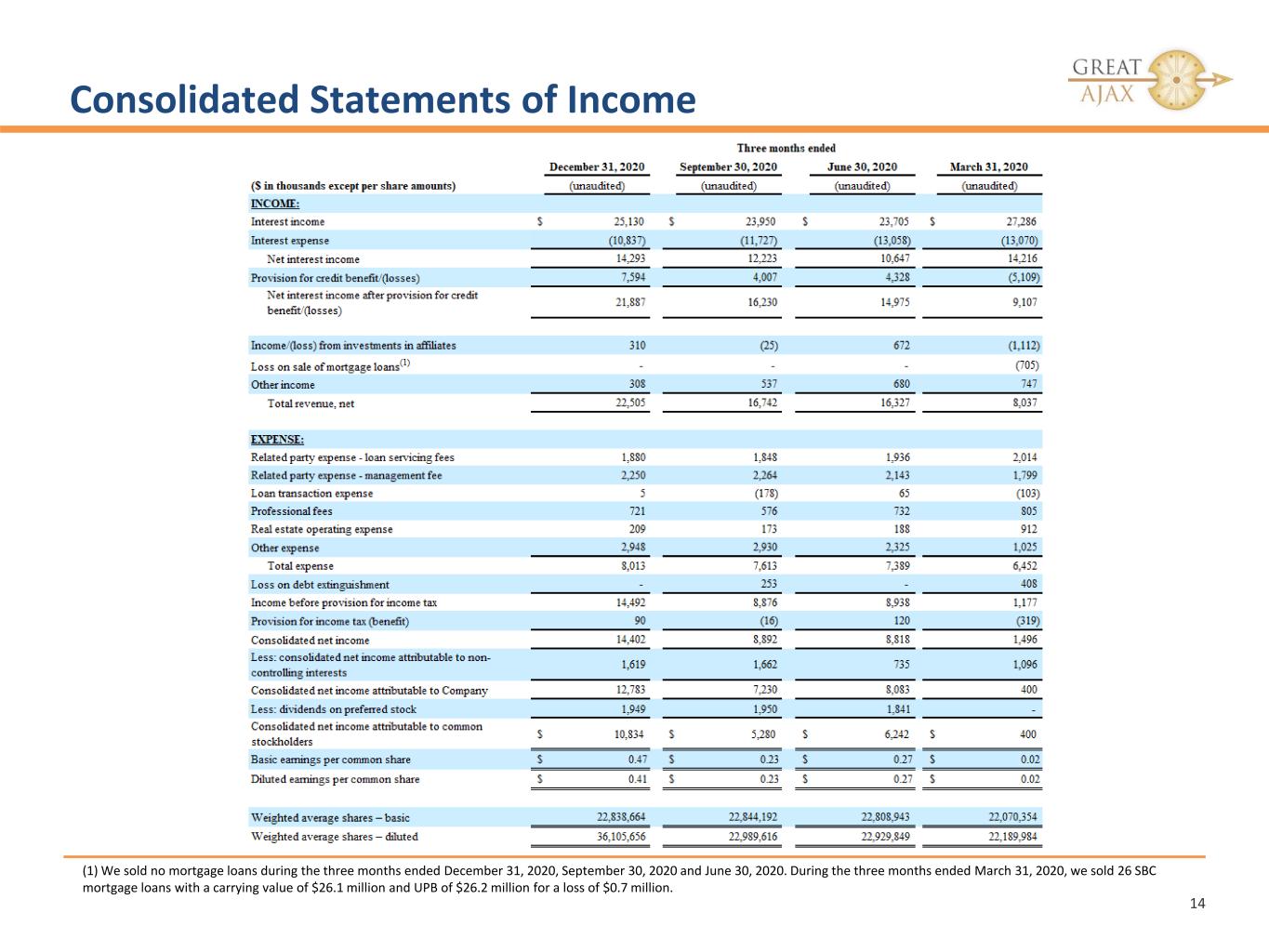

Consolidated Statements of Income 14 (1) We sold no mortgage loans during the three months ended December 31, 2020, September 30, 2020 and June 30, 2020. During the three months ended March 31, 2020, we sold 26 SBC mortgage loans with a carrying value of $26.1 million and UPB of $26.2 million for a loss of $0.7 million.

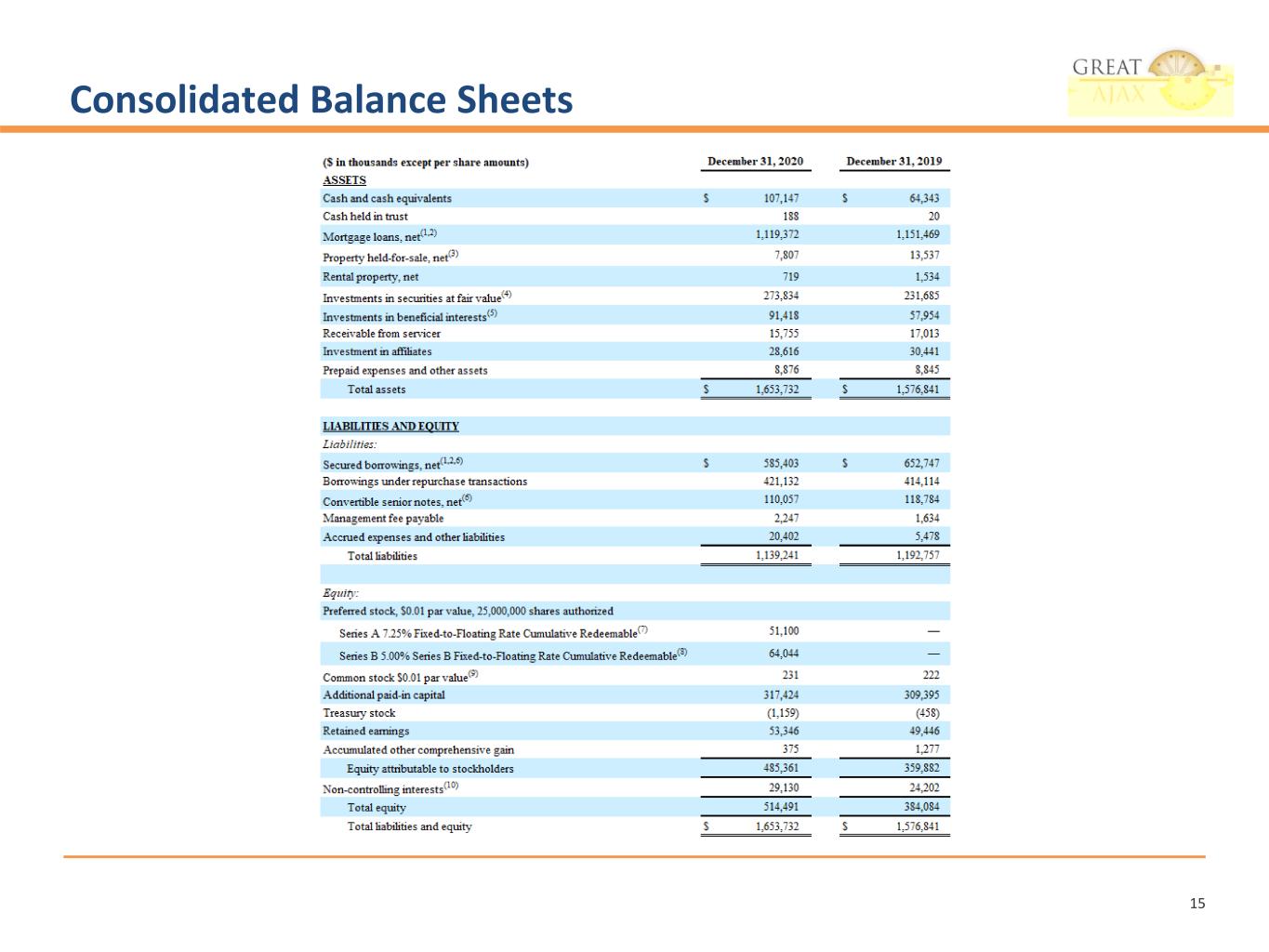

Consolidated Balance Sheets 15

Consolidated Balance Sheets Footnotes 16 (1) Mortgage loans net include $842.2 million and $908.6 million of loans at December 31, 2020 and December 31, 2019, respectively, transferred to securitization trusts that are variable interest entities (“VIEs”); these loans can only be used to settle obligations of the VIEs. Secured borrowings consist of notes issued by VIEs that can only be settled with the assets and cash flows of the VIEs. The creditors do not have recourse to the primary beneficiary (Great Ajax Corp.). Mortgage loans, net include $13.7 million and $2.0 million of allowance for loan credit losses at December 31, 2020 and December 31, 2019, respectively. (2) As of December 31, 2020, balances for Mortgage loans, net includes $307.1 million and Secured borrowings, net of deferred costs includes $250.6 million from the 50% and 63% owned joint ventures, respectively. As of December 31, 2019, balances for Mortgage loans, net include $341.8 million and Secured borrowings, net of deferred costs includes $284.8 million from a 50% and 63% owned joint ventures, all of which the Company consolidates under U.S. Generally Accepted Accounting Principles ("U.S. GAAP"). (3) Property held-for-sale, net, includes valuation allowances of $1.4 million and $1.8 million at December 31, 2020 and December 31, 2019, respectively. (4) As of December 31, 2020 and December 31, 2019 Investments in securities at fair value include amortized cost basis of $273.4 million and $230.4 million, respectively, and unrealized gains of $0.4 million and $1.3 million, respectively. (5) Investments in beneficial interests includes allowance for credit losses of $4.5 million at December 31, 2020. No allowance for credit losses were recorded as of December 31, 2019. (6) Secured borrowings and convertible senior notes are presented net of deferred issuance costs. (7) $25.00 liquidation preference per share, 2,307,400 shares issued and outstanding at December 31, 2020 and no shares issued and outstanding at December 31, 2019. (8) $25.00 liquidation preference per share, 2,892,600 shares issued and outstanding at December 31, 2020 and no shares issued and outstanding at December 31, 2019. (9) 125,000,000 shares authorized, 22,978,339 shares issued and outstanding at December 31, 2020 and 22,142,143 shares issued and outstanding at December 31, 2019. (10) As of December 31, 2020 and December 31, 2019 non-controlling interests includes $27.4 million and $22.4 million, respectively, from the 50% and 63% owned joint ventures, which the Company consolidates under U.S. GAAP.

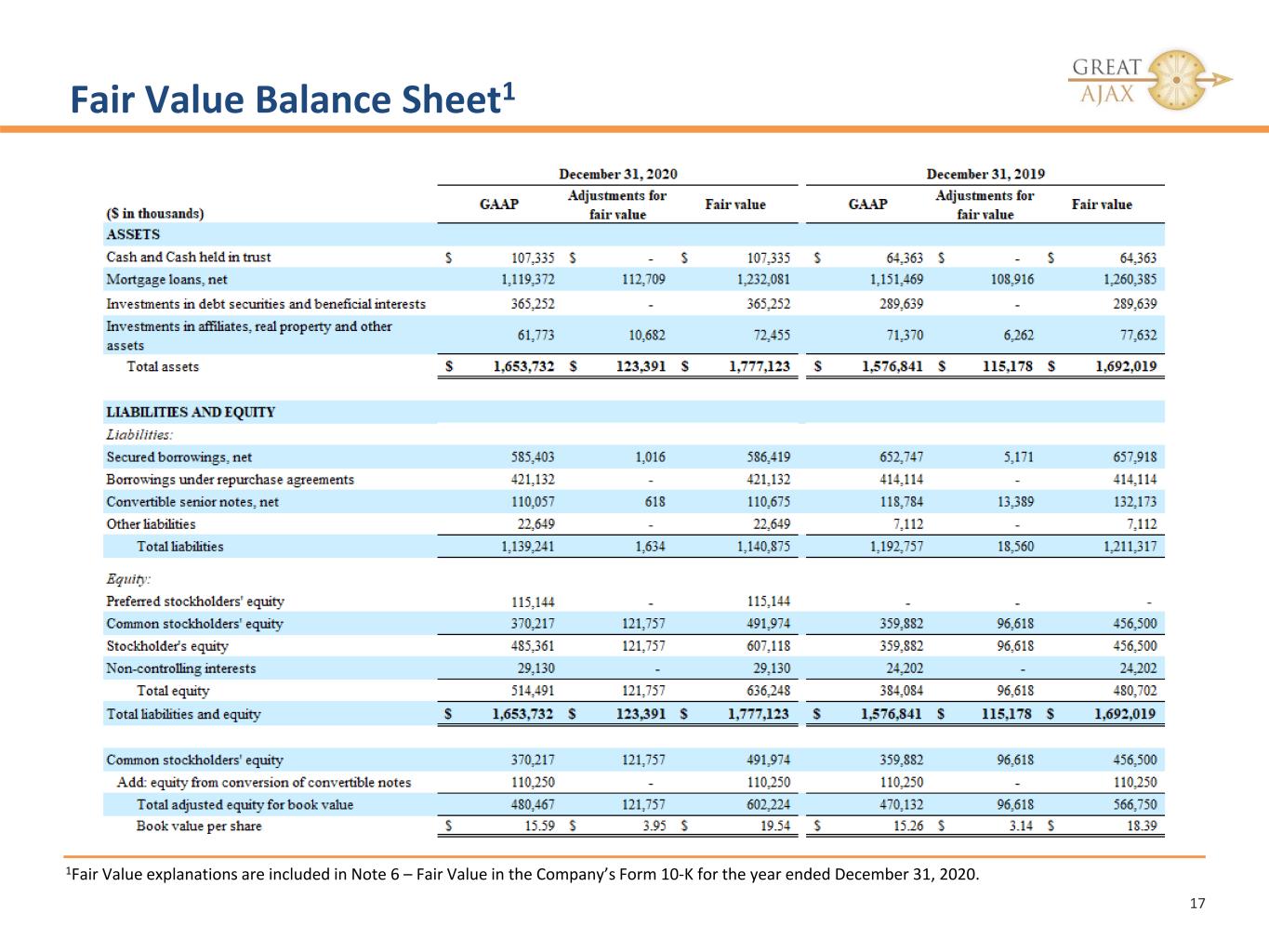

Fair Value Balance Sheet1 17 1Fair Value explanations are included in Note 6 – Fair Value in the Company’s Form 10-K for the year ended December 31, 2020.