Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Evofem Biosciences, Inc. | evfm8-kq4earningscalldeck.htm |

Evofem Biosciences’ Q4 and Year-End 2020 Financial Results Call Nasdaq: EVFM Thursday, March 4, 2021

Forward-Looking Statements This presentation contains forward looking statements within the meaning of The Private Securities Litigation Reform Act of 1995 and other federal securities laws. In some cases, you can identify forward looking statements by terms such as “may,” ”will,” “should,” “expect,” “plan,” “aim,” “anticipate,” “strategy,” “objective,” “designed,” “suggest,” “currently,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these terms or other similar expressions. Each of these forward-looking statements involves risks and uncertainties. Evofem may not actually achieve the plans, intentions or expectations expressed or implied in these forward-looking statements, and you should not place undue reliance on these forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations expressed or implied in the forward-looking statements made in this presentation. Factors that may cause differences between current expectations and actual results include, but are not limited to, the following: o the rate and degree of market acceptance of Phexxi® (lactic acid, citric acid and potassium bitartrate) vaginal gel o Evofem’s ability to achieve profitability from the sale of Phexxi o Evofem’s ability to successfully commercialize Phexxi and its ability to develop sales and marketing capabilities o Evofem’s ability to maintain and protect its intellectual property o Evofem’s ability to rely on existing cash reserves to fund its current development plans and operations and to raise additional capital when needed o Evofem’s reliance on third-party providers, such as third-party manufacturers and clinical research organizations o the presence or absence of any adverse events or side effects relating to the use of Phexxi and EVO100 o the outcome or success of Evofem’s clinical trials, including EVOGUARD o Evofem’s ability to retain members of its management and other key personnel o general risks to the economy represented by spread of the COVID-19 virus o Evofem’s ability to obtain the necessary regulatory approvals for its product candidates and the timing of such approvals, and, o any other risk factors detailed in Evofem’s filings from time to time with the US Securities and Exchange Commission including, without limitation, the Annual Report on Form 10-K filed on March 4, 2021 and subsequent filings. All forward-looking statements in this presentation are qualified in their entirety by this cautionary statement. To date, only one of Evofem’s products, Phexxi, has been approved by the U.S. Food and Drug Administration, or the FDA, for marketing in the United States. The other investigational product candidates discussed in this presentation have not been approved or licensed by the FDA or by any other regulatory authority, and they are not commercially available in any market. This presentation also contains estimates and other statistical data made by independent parties and by Evofem relating to market size and growth and other data about its industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. The forward looking statements in this presentation represent Evofem’s views only as of the date of this presentation, March 4, 2021, and Evofem expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in Evofem’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statements are based for any reason, except as required by law, even as new information becomes available or other events occur in the future.

FOR INVESTOR DISCUSSIONS ONLY. NOT FOR PROMOTIONAL USE.3 • Phexxi FDA approved and launched in U.S. •Ongoing prescription growth, expansion of prescriber base, market access execution • Two Phexxi patents listed in FDA’s Orange Book •Raised over $150M from respected institutional investors • Initiated pivotal Phase 3 trial of EVO100 for prevention of chlamydia and gonorrhea in women 2020 Highlights Foundation for Ongoing Success March 4, 2021

FOR INVESTOR DISCUSSIONS ONLY. NOT FOR PROMOTIONAL USE.4 Financial Highlights March 4, 2021 • Net product revenue for Q4 and FY 2020 reflected strong co-pay card utilization, as expected • Beat or met guidance on expense and cash burn for Q4 and FY 2020 • At December 31, 2020 o$48.9M in unrestricted cash and equivalents o$22.2M in restricted cash from Adjuvant Capital

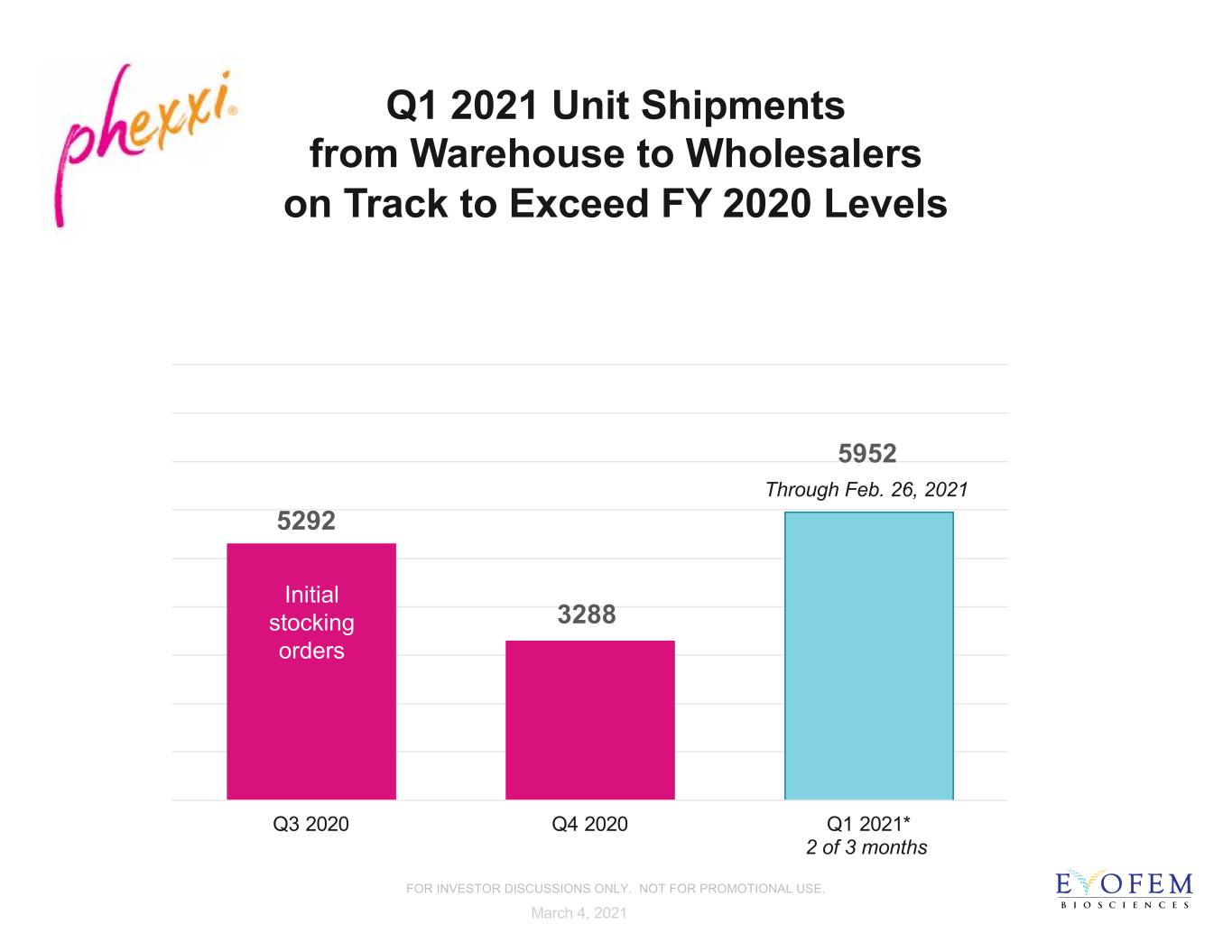

5292 3288 5952 Q3 2020 Q4 2020 Q1 2021* Through Feb. 26, 2021 Q1 2021 Unit Shipments from Warehouse to Wholesalers on Track to Exceed FY 2020 Levels March 4, 2021 Initial stocking orders FOR INVESTOR DISCUSSIONS ONLY. NOT FOR PROMOTIONAL USE. 2 of 3 months

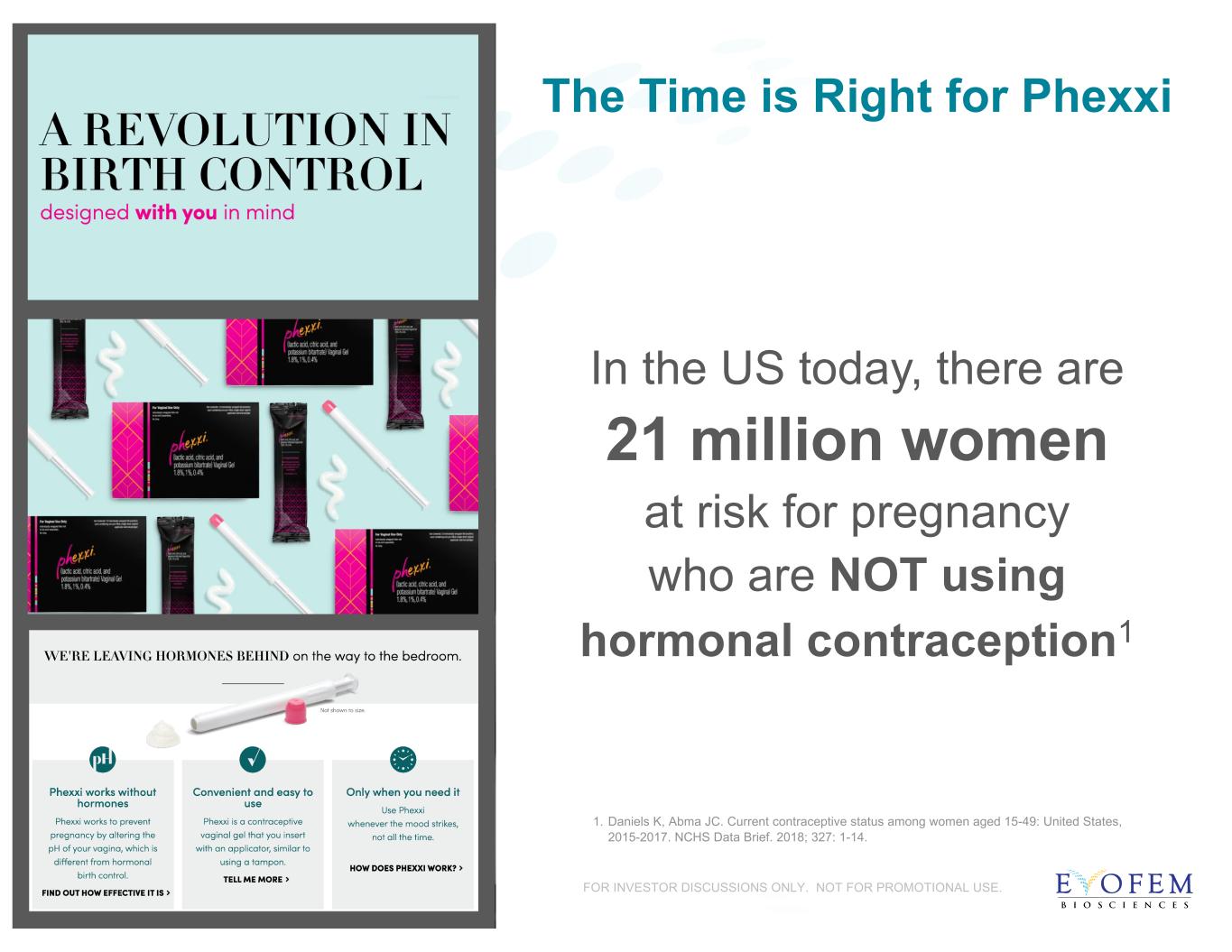

FOR INVESTOR DISCUSSIONS ONLY. NOT FOR PROMOTIONAL USE. The Time is Right for Phexxi In the US today, there are 21 million women at risk for pregnancy who are NOT using hormonal contraception1 6 1. Daniels K, Abma JC. Current contraceptive status among women aged 15-49: United States, 2015-2017. NCHS Data Brief. 2018; 327: 1-14.

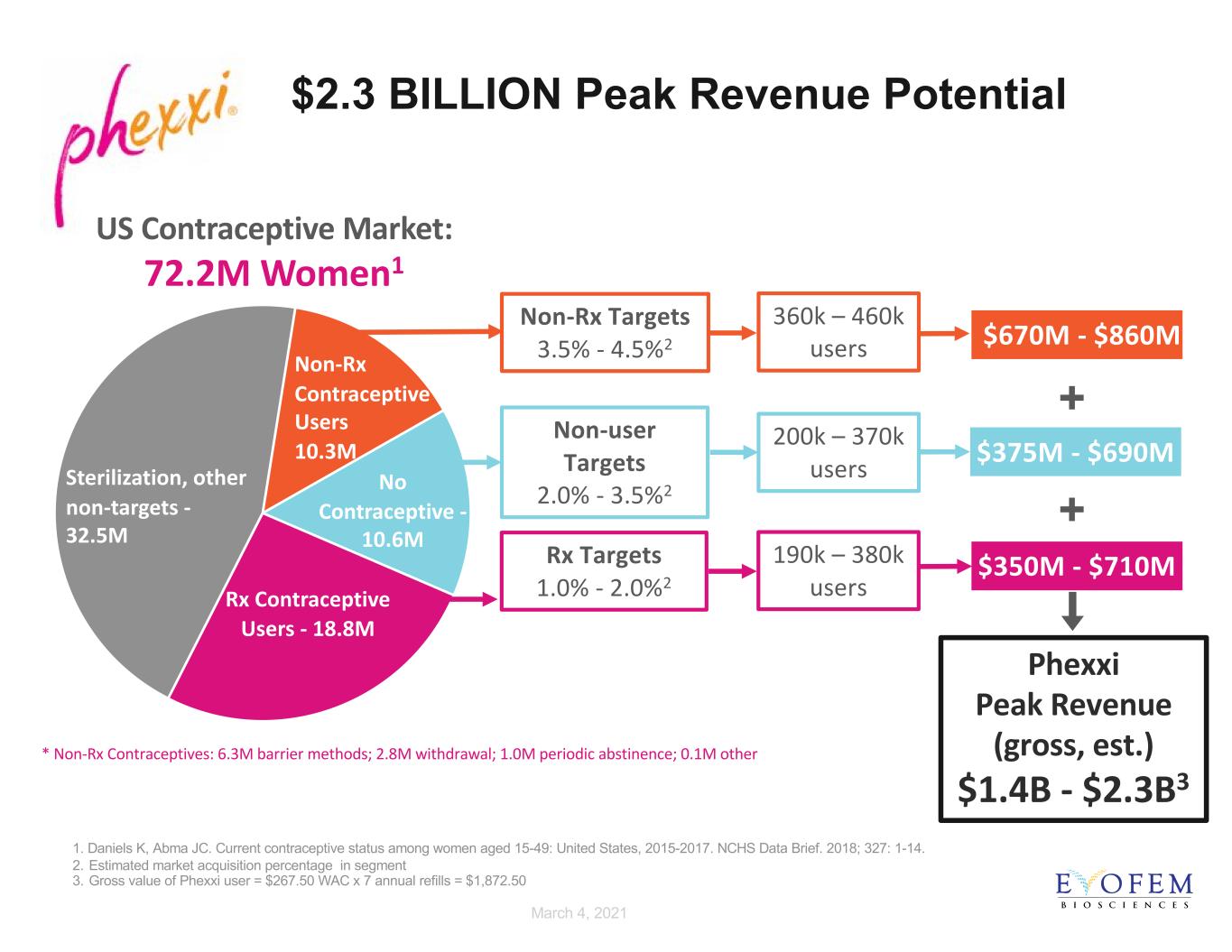

Sterilization, other non-targets - 32.5M Non-Rx Contraceptive Users 10.3M No Contraceptive - 10.6M Rx Contraceptive Users - 18.8M US Contraceptive Market: 72.2M Women1 $2.3 BILLION Peak Revenue Potential $670M - $860M $375M - $690M Phexxi Peak Revenue (gross, est.) $1.4B - $2.3B3 Rx Targets 1.0% - 2.0%2 Non-Rx Targets 3.5% - 4.5%2 $350M - $710M 1. Daniels K, Abma JC. Current contraceptive status among women aged 15-49: United States, 2015-2017. NCHS Data Brief. 2018; 327: 1-14. 2. Estimated market acquisition percentage in segment 3. Gross value of Phexxi user = $267.50 WAC x 7 annual refills = $1,872.50 + + * Non-Rx Contraceptives: 6.3M barrier methods; 2.8M withdrawal; 1.0M periodic abstinence; 0.1M other Non-user Targets 2.0% - 3.5%2 200k – 370k users 360k – 460k users 190k – 380k users March 4, 2021

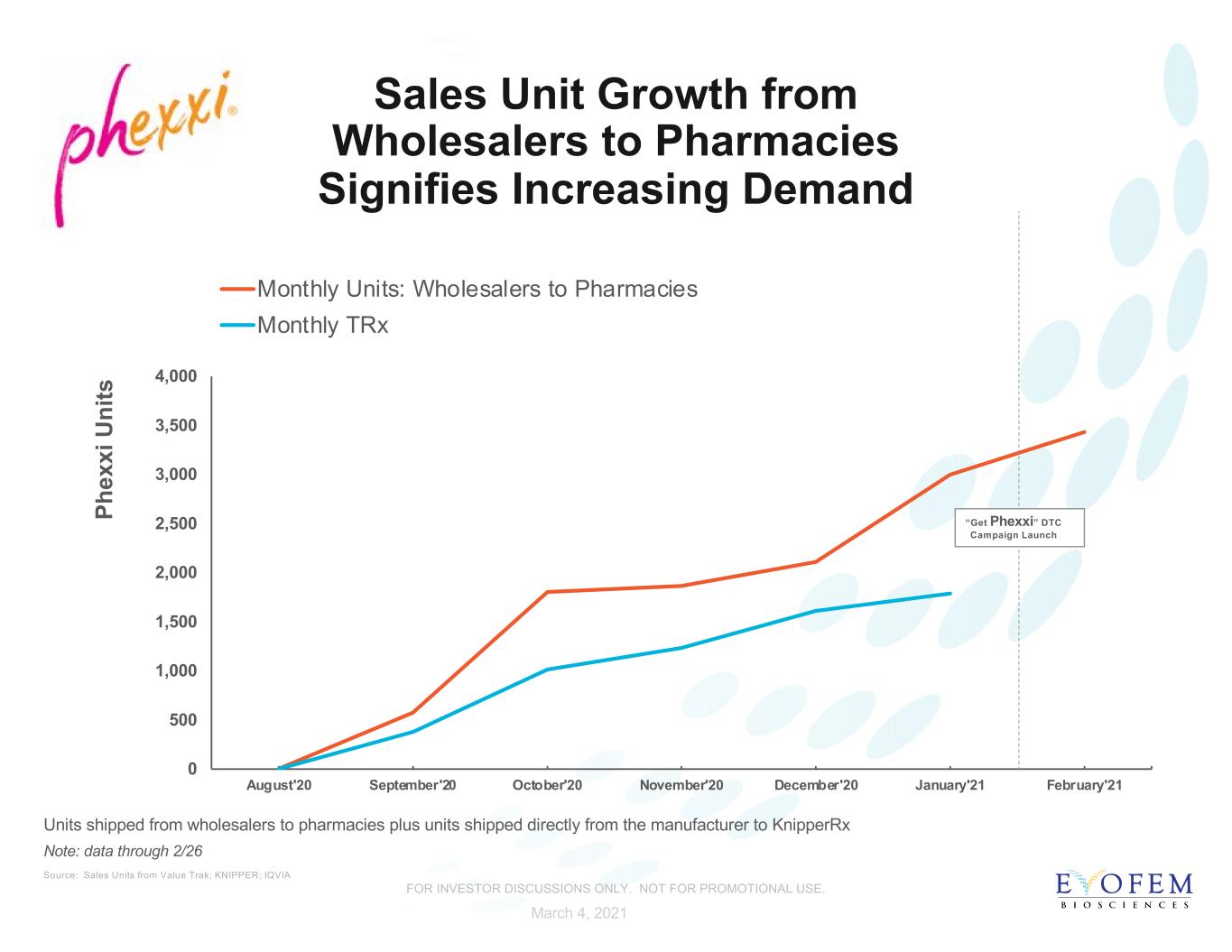

Sales Unit Growth from Wholesalers to Pharmacies Signifies Increasing Demand 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 August'20 September'20 October'20 November'20 December'20 January'21 February'21 P he xx i U ni ts Monthly Units: Wholesalers to Pharmacies Monthly TRx Source: Sales Units from Value Trak; KNIPPER; IQVIA Note: data through 2/26 Units shipped from wholesalers to pharmacies plus units shipped directly from the manufacturer to KnipperRx March 4, 2021 “Get Phexxi” DTC Campaign Launch FOR INVESTOR DISCUSSIONS ONLY. NOT FOR PROMOTIONAL USE.

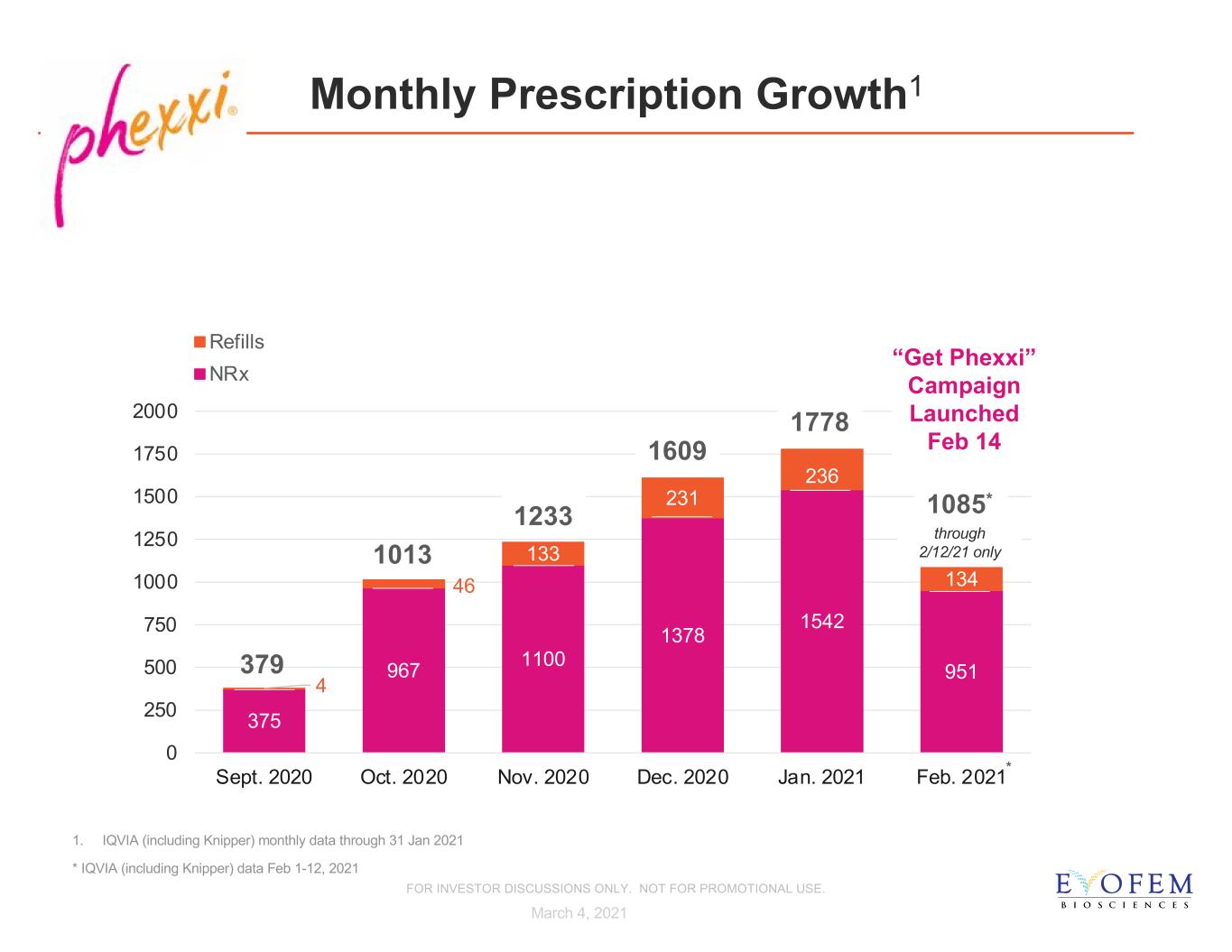

Monthly Prescription Growth1 375 967 1100 1378 1542 951 4 46 133 231 236 134 0 250 500 750 1000 1250 1500 1750 2000 Sept. 2020 Oct. 2020 Nov. 2020 Dec. 2020 Jan. 2021 Feb. 2021 Refills NRx 1233 379 1013 1609 1. IQVIA (including Knipper) monthly data through 31 Jan 2021 * IQVIA (including Knipper) data Feb 1-12, 2021 1778 “Get Phexxi” Campaign Launched Feb 14 * March 4, 2021 through 2/12/21 only FOR INVESTOR DISCUSSIONS ONLY. NOT FOR PROMOTIONAL USE. 1085*

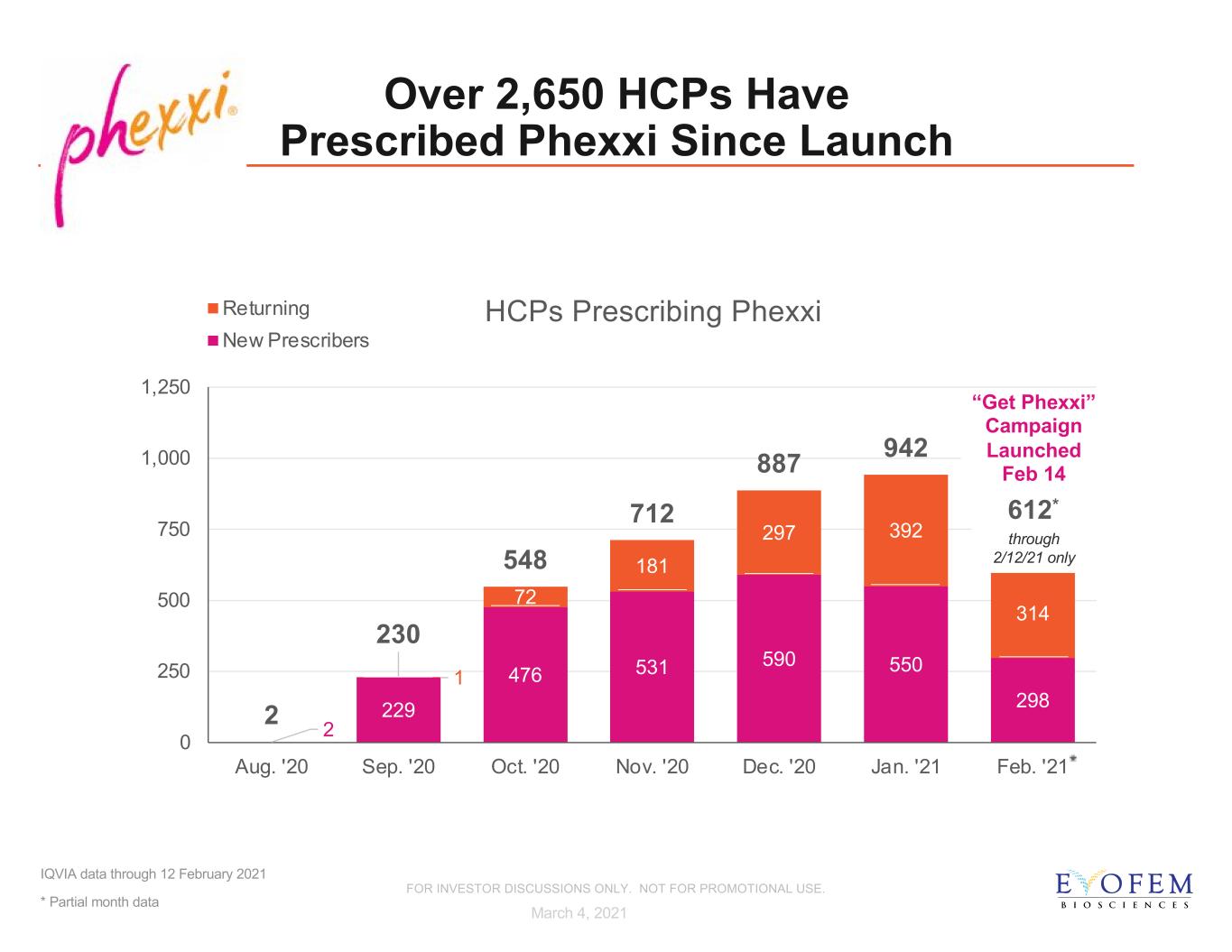

2 229 476 531 590 550 298 1 72 181 297 392 314 2 230 548 712 887 942 0 250 500 750 1,000 1,250 Aug. '20 Sep. '20 Oct. '20 Nov. '20 Dec. '20 Jan. '21 Feb. '21 HCPs Prescribing Phexxi Returning New Prescribers through 2/12/21 only Over 2,650 HCPs Have Prescribed Phexxi Since Launch IQVIA data through 12 February 2021 * Partial month data * March 4, 2021 “Get Phexxi” Campaign Launched Feb 14 612* FOR INVESTOR DISCUSSIONS ONLY. NOT FOR PROMOTIONAL USE.

TELEVISION YOUTUBE SOCIAL MEDIA PHEXXI.COM DIGITAL MEDIA PRINT MATERIALS GET PHEXXI – ROLLOUT

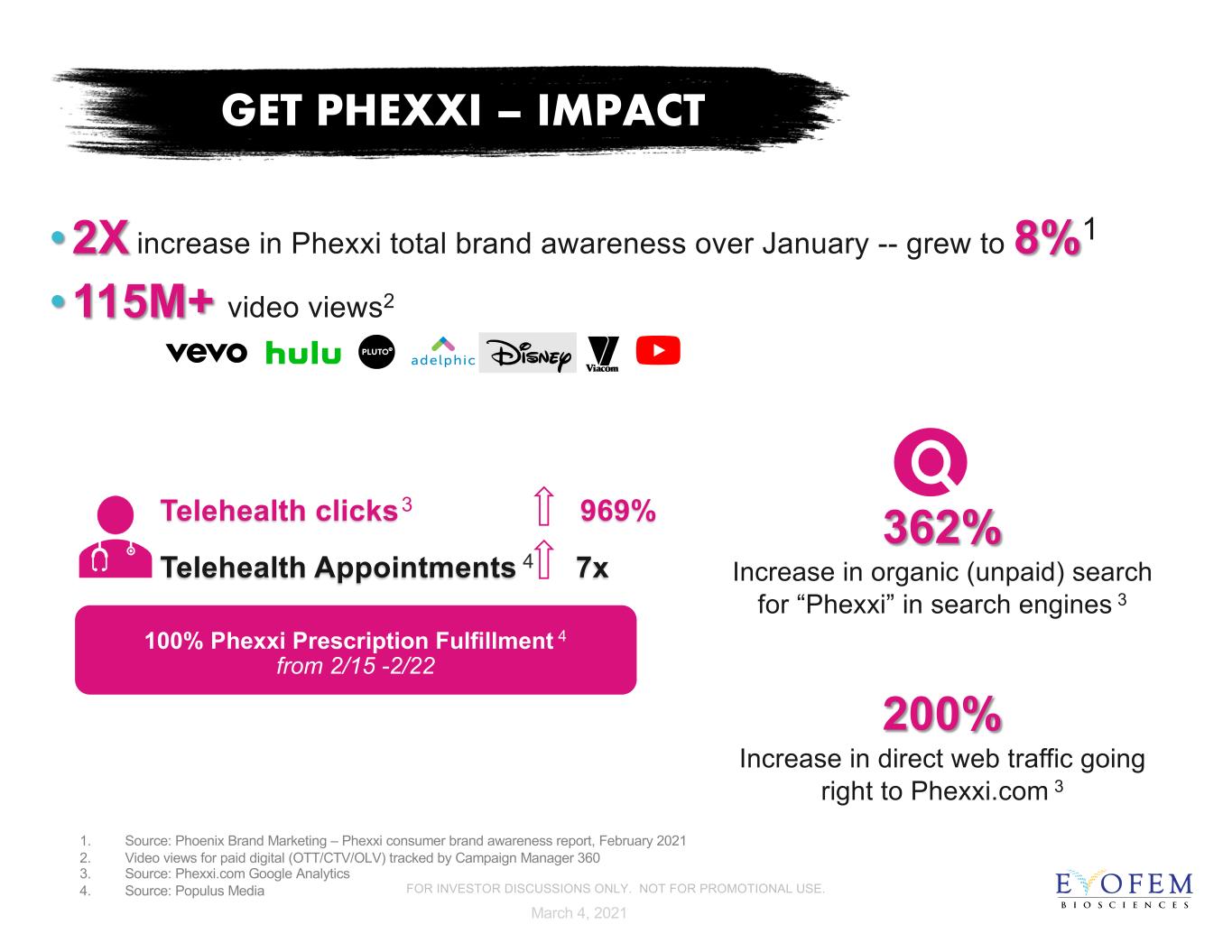

•2X increase in Phexxi total brand awareness over January -- grew to 8%1 •115M+ video views2 GET PHEXXI – IMPACT Telehealth clicks3 969% Telehealth Appointments 4 7x 100% Phexxi Prescription Fulfillment 4 from 2/15 -2/22 362% Increase in organic (unpaid) search for “Phexxi” in search engines 3 200% Increase in direct web traffic going right to Phexxi.com 3 March 4, 2021 1. Source: Phoenix Brand Marketing – Phexxi consumer brand awareness report, February 2021 2. Video views for paid digital (OTT/CTV/OLV) tracked by Campaign Manager 360 3. Source: Phexxi.com Google Analytics 4. Source: Populus Media FOR INVESTOR DISCUSSIONS ONLY. NOT FOR PROMOTIONAL USE.

Phexxi for Cancer Patients: NCODA Collaboration • ~800,000 new cases of cancer reported annually among women1 • Many women with cancer are contraindicated to hormones • Collaboration to develop and share resources and educational information for medically-integrated oncology pharmacy teams involved in the care of female oncology patients who may be prescribed Phexxi for pregnancy prevention oPositive Quality Intervention (PQI) in connection with Phexxi oWhite papers oVirtual education platforms oNational meetings and initiatives Source: 1. U.S. Cancer Statistics: Highlights from 2017 Incidence. U.S. Cancer Statistics Data Briefs, No. 17, June 2020. https://www.cdc.gov/cancer/uscs/about/data-briefs/no17-USCS-highlights-2017-incidence.htm March 4, 2021 FOR INVESTOR DISCUSSIONS ONLY. NOT FOR PROMOTIONAL USE.

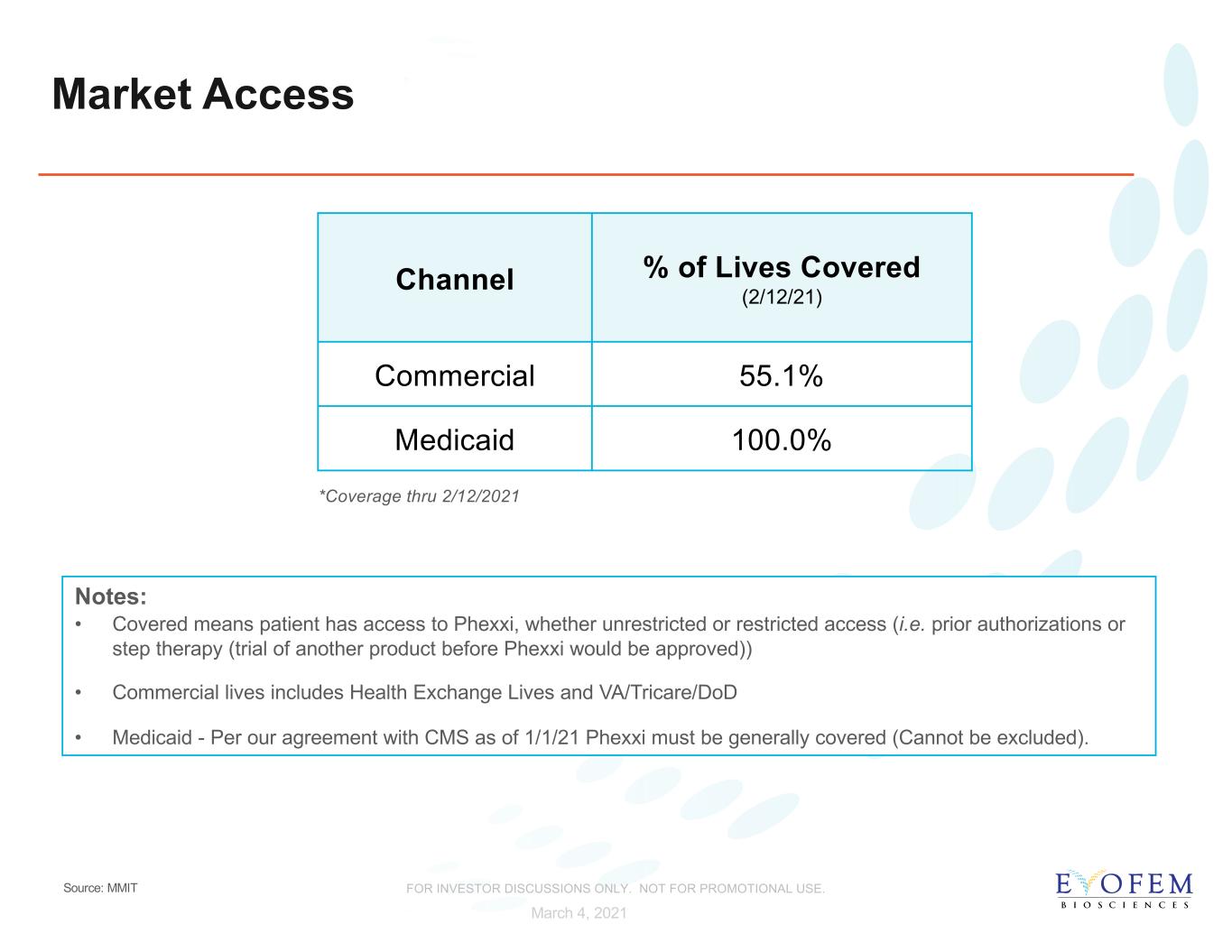

Market Access Channel % of Lives Covered (2/12/21) Commercial 55.1% Medicaid 100.0% Notes: • Covered means patient has access to Phexxi, whether unrestricted or restricted access (i.e. prior authorizations or step therapy (trial of another product before Phexxi would be approved)) • Commercial lives includes Health Exchange Lives and VA/Tricare/DoD • Medicaid - Per our agreement with CMS as of 1/1/21 Phexxi must be generally covered (Cannot be excluded). *Coverage thru 2/12/2021 March 4, 2021 Source: MMIT FOR INVESTOR DISCUSSIONS ONLY. NOT FOR PROMOTIONAL USE.

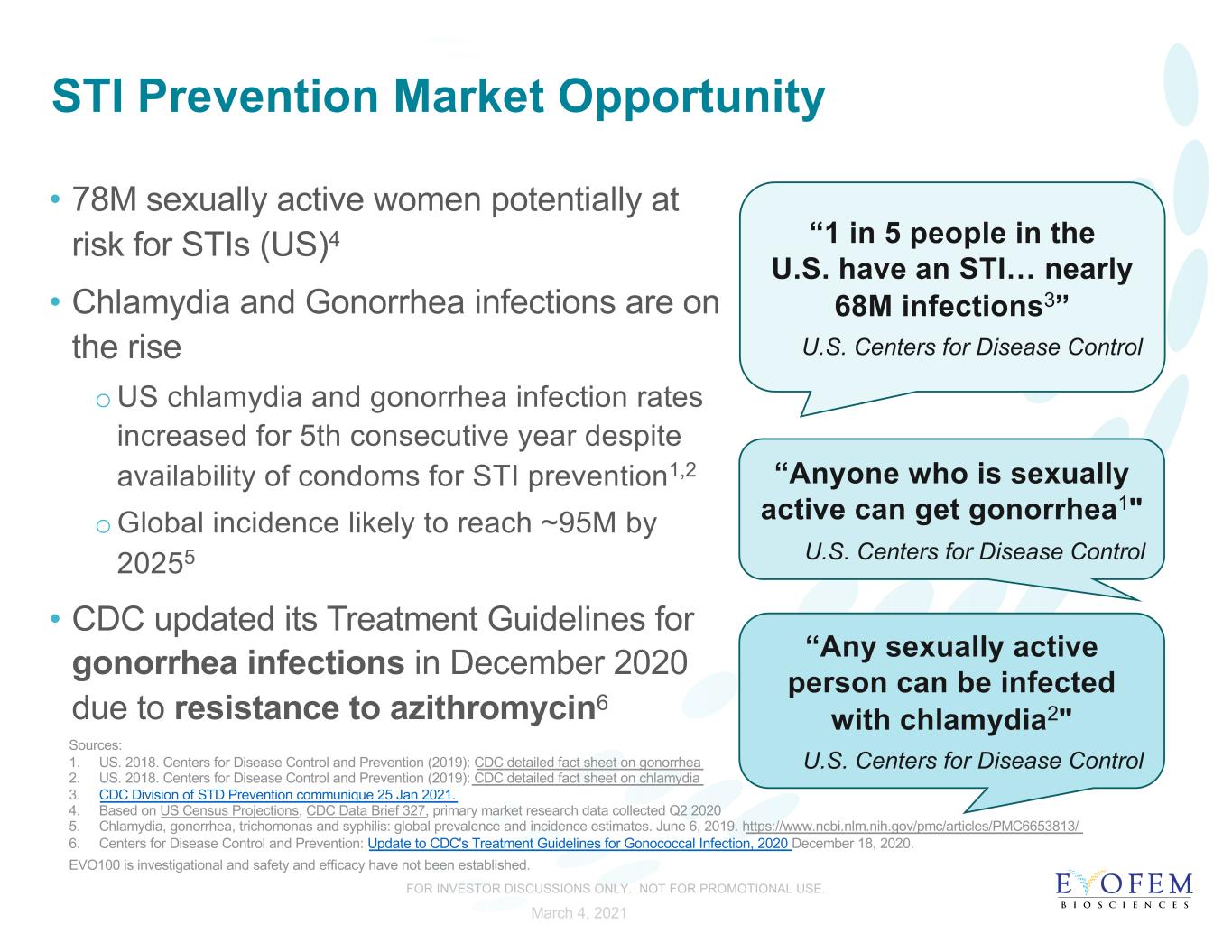

STI Prevention Market Opportunity • 78M sexually active women potentially at risk for STIs (US)4 • Chlamydia and Gonorrhea infections are on the rise oUS chlamydia and gonorrhea infection rates increased for 5th consecutive year despite availability of condoms for STI prevention1,2 oGlobal incidence likely to reach ~95M by 20255 • CDC updated its Treatment Guidelines for gonorrhea infections in December 2020 due to resistance to azithromycin6 Sources: 1. US. 2018. Centers for Disease Control and Prevention (2019): CDC detailed fact sheet on gonorrhea 2. US. 2018. Centers for Disease Control and Prevention (2019): CDC detailed fact sheet on chlamydia 3. CDC Division of STD Prevention communique 25 Jan 2021. 4. Based on US Census Projections, CDC Data Brief 327, primary market research data collected Q2 2020 5. Chlamydia, gonorrhea, trichomonas and syphilis: global prevalence and incidence estimates. June 6, 2019. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6653813/ 6. Centers for Disease Control and Prevention: Update to CDC's Treatment Guidelines for Gonococcal Infection, 2020 December 18, 2020. EVO100 is investigational and safety and efficacy have not been established. “Any sexually active person can be infected with chlamydia2" U.S. Centers for Disease Control “Anyone who is sexually active can get gonorrhea1" U.S. Centers for Disease Control “1 in 5 people in the U.S. have an STI… nearly 68M infections3” U.S. Centers for Disease Control March 4, 2021 FOR INVESTOR DISCUSSIONS ONLY. NOT FOR PROMOTIONAL USE.

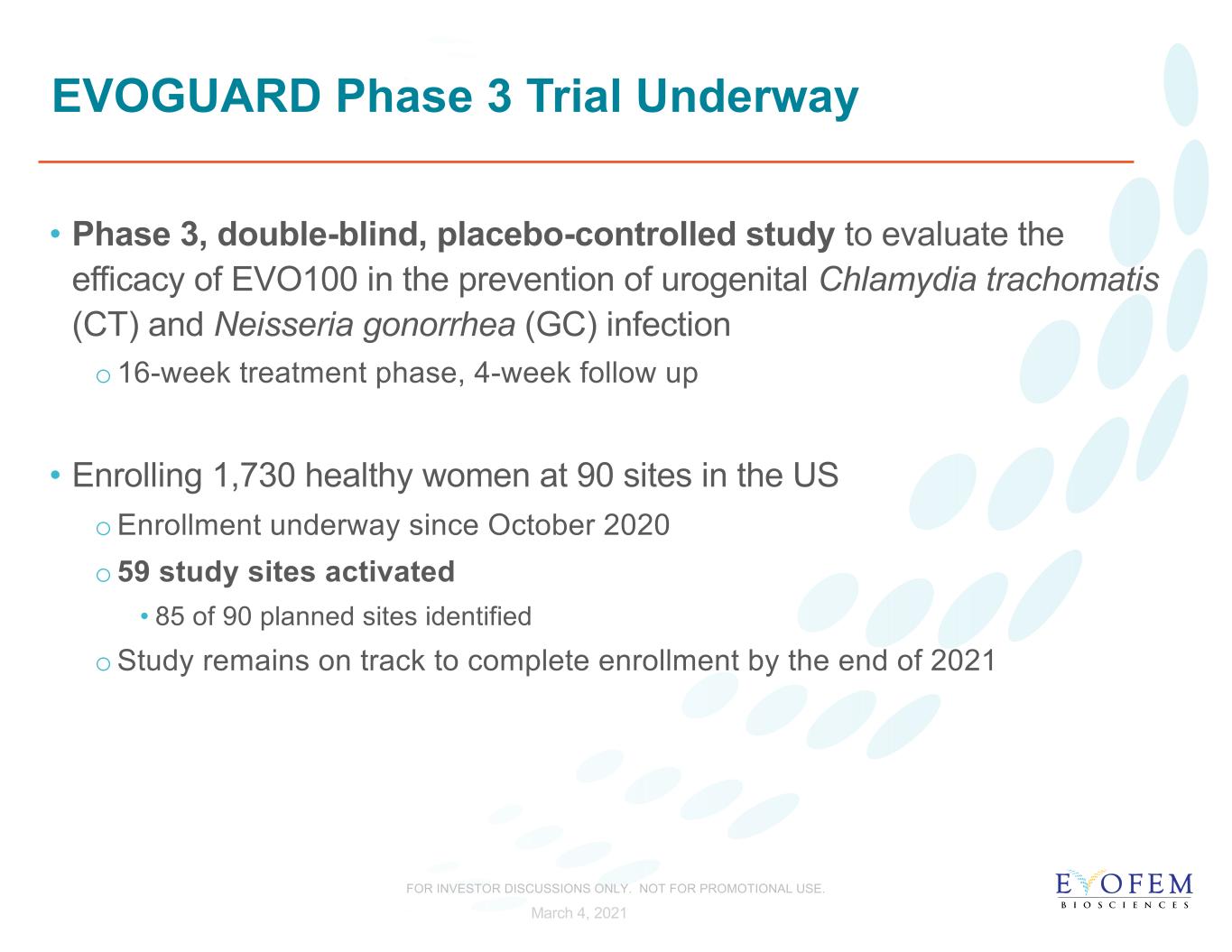

EVOGUARD Phase 3 Trial Underway • Phase 3, double-blind, placebo-controlled study to evaluate the efficacy of EVO100 in the prevention of urogenital Chlamydia trachomatis (CT) and Neisseria gonorrhea (GC) infection o16-week treatment phase, 4-week follow up • Enrolling 1,730 healthy women at 90 sites in the US oEnrollment underway since October 2020 o59 study sites activated • 85 of 90 planned sites identified oStudy remains on track to complete enrollment by the end of 2021 March 4, 2021 FOR INVESTOR DISCUSSIONS ONLY. NOT FOR PROMOTIONAL USE.

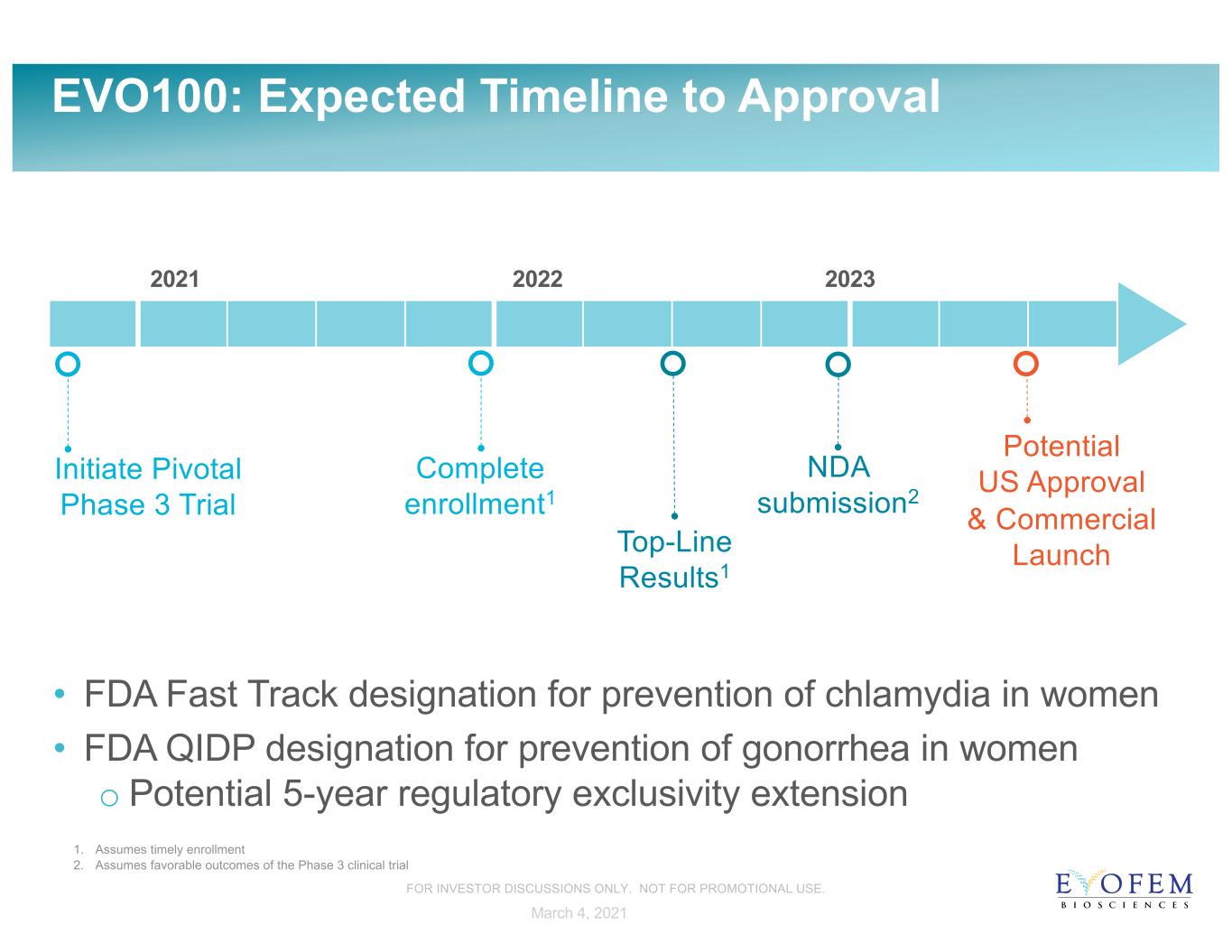

EVO100: Expected Timeline to Approval 2021 2022 2023 Potential US Approval & Commercial Launch NDA submission2 Top-Line Results1 Initiate Pivotal Phase 3 Trial • FDA Fast Track designation for prevention of chlamydia in women • FDA QIDP designation for prevention of gonorrhea in women o Potential 5-year regulatory exclusivity extension Complete enrollment1 1. Assumes timely enrollment 2. Assumes favorable outcomes of the Phase 3 clinical trial March 4, 2021 FOR INVESTOR DISCUSSIONS ONLY. NOT FOR PROMOTIONAL USE.

FOR INVESTOR DISCUSSIONS ONLY. NOT FOR PROMOTIONAL USE. 18 DO IT on the floor. G E T P H E X X I® , T H A T I S .

QUESTIONS AND ANSWERS