Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - Vectrus, Inc. | exhibit992-earningsdeckq.htm |

| 8-K - 8-K - Vectrus, Inc. | vec-20210302.htm |

Exhibit 99.1 1 PRESS RELEASE CONTACT: Vectrus Mike Smith, CFA 719-637-5773 michael.smith@vectrus.com Vectrus Announces Fourth Quarter and Full-Year 2020 Results • Backlog grew 84% yr/yr to a record high of $5.1 billion • Improved long-term visibility with $882 million five-year OMDAC-SWACA recompete win • Added key clients and capabilities through two key acquisitions, accelerating converged infrastructure strategy • Q4 record high adjusted EBITDA margin1 of 5.0% driven by ongoing performance initiatives • Q4 revenue of $355 million; COVID-19 adversely impacted revenue by $26 million or 7.1% yr/yr; Q4 diluted EPS of $1.42; Adjusted diluted EPS1 of $1.18 • 2020 revenue of $1.4 billion, COVID-19 adversely impacted revenue by $63 million or 4.6% yr/yr; 2020 diluted EPS of $3.14; Adjusted diluted EPS1 of $3.07 • Strong 2020 operating cash flow generation of $51 million excluding CARES Act tax deferrals COLORADO SPRINGS, Colo., March 2, 2021 — Vectrus, Inc. (NYSE:VEC) announced fourth quarter and full-year 2020 financial results. “Our 2020 results reflect the operating and financial resiliency of our business model, the dedication of our team to our clients’ missions, and the advancements we’re making to lead in the converged infrastructure market,” said Chuck Prow, Chief Executive Officer of Vectrus. “Our team did an outstanding job delivering high operational readiness in support of our clients’ critical infrastructures and national security missions across the globe despite the challenging environment.” “We ended 2020 on a high note, achieving several important milestones during the fourth quarter,” said Prow. “In December, Vectrus was formally announced as the winner of the Operations, Maintenance and Defense of Army Communications (“OMDAC-SWACA”) recompete. OMDAC- SWACA adds $882 million in backlog to Vectrus over a five-year period of performance and will represent 30 years of client support associated with this important mission. We are proud of the Army’s continued confidence in Vectrus to provide uninterrupted support, reliability, and protection

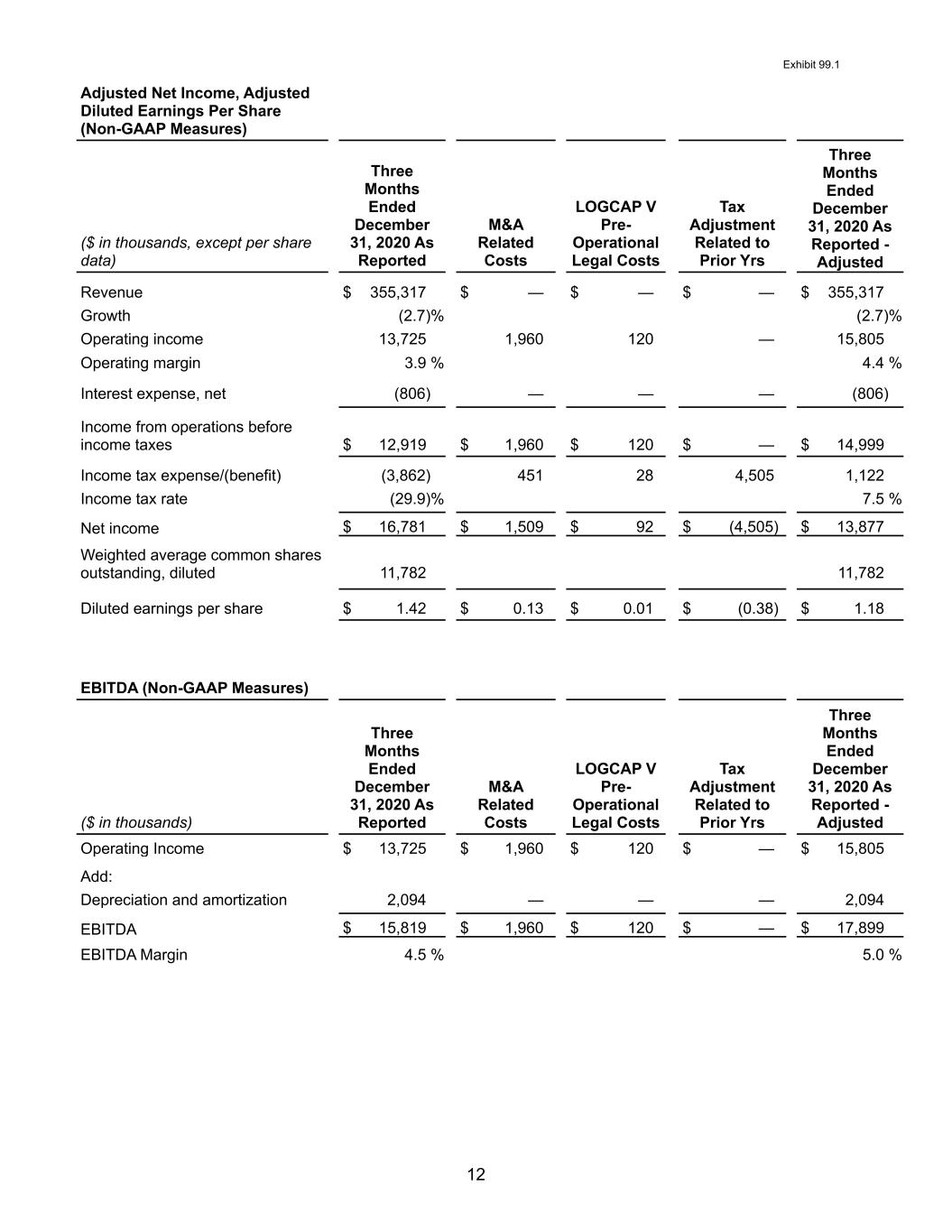

Exhibit 99.1 2 of the largest, most dynamic network ever deployed in combat. We also reported record backlog and adjusted EBITDA margin1 of $5.1 billion and 5.0%, respectively. In addition, we reported strong operating cash flows of $50.9 million excluding the benefit from the CARES Act, a new company high. Finally, on December 31, 2020, Vectrus acquired two companies, Zenetex and HHB, that accelerate our converged infrastructure strategy and enable us to deliver a more integrated and comprehensive suite of solutions to our clients globally.” “Zenetex brings new capabilities including high-end logistics, integrated security, mission-critical readiness services for vital defense aviation programs, while expanding our engineering and digital integration offerings,” said Prow. “Importantly, the acquisition brings unique access to new intelligence and foreign military clients, providing key channels for future growth.” Prow continued, “HHB provides integrated solutions that support physical and digital infrastructures within the intelligence community and enhances our capabilities in computer-aided facility management, engineering, design, and planning. The company also provides asset management, logistics, information technology and cybersecurity solutions.” “I am delighted with the new talent, clients, and capabilities that will enhance the diversification of our business. We look forward to leveraging our combined capabilities to accelerate growth and yield greater opportunities for the business,” said Prow. Fourth Quarter 2020 Results Fourth quarter 2020 revenue of $355.3 million was down year on year by 2.7% mainly due to COVID-19 pandemic-related deferrals of $25.8 million or 7.1%. Revenue was up $2.9 million sequentially or 0.8%. Operating income was $13.7 million or 3.9% margin in the fourth quarter of 2020. Adjusted operating income1 was $15.8 million or 4.4% margin. Fourth quarter operating margin was negatively impacted by 10 basis points due to COVID-19 pandemic-related deferrals. EBITDA1 was $15.8 million or 4.5% margin for the fourth quarter 2020. Adjusted EBITDA1 was $17.9 million or a record 5.0% margin for the fourth quarter 2020. Fourth quarter 2020 EBITDA margin was negatively impacted by 10 basis points due to COVID-19 pandemic-related deferrals. Fully diluted EPS for the fourth quarter of 2020 was $1.42. Diluted EPS was favorably affected by the recognition of a tax benefit in the period relating to 2018, 2019 and 2020 of $0.60. Adjusted diluted EPS1 for the quarter was $1.18. Fully diluted EPS and Adjusted diluted EPS1 were negatively impacted by $0.10 due to COVID-19 pandemic related deferrals.

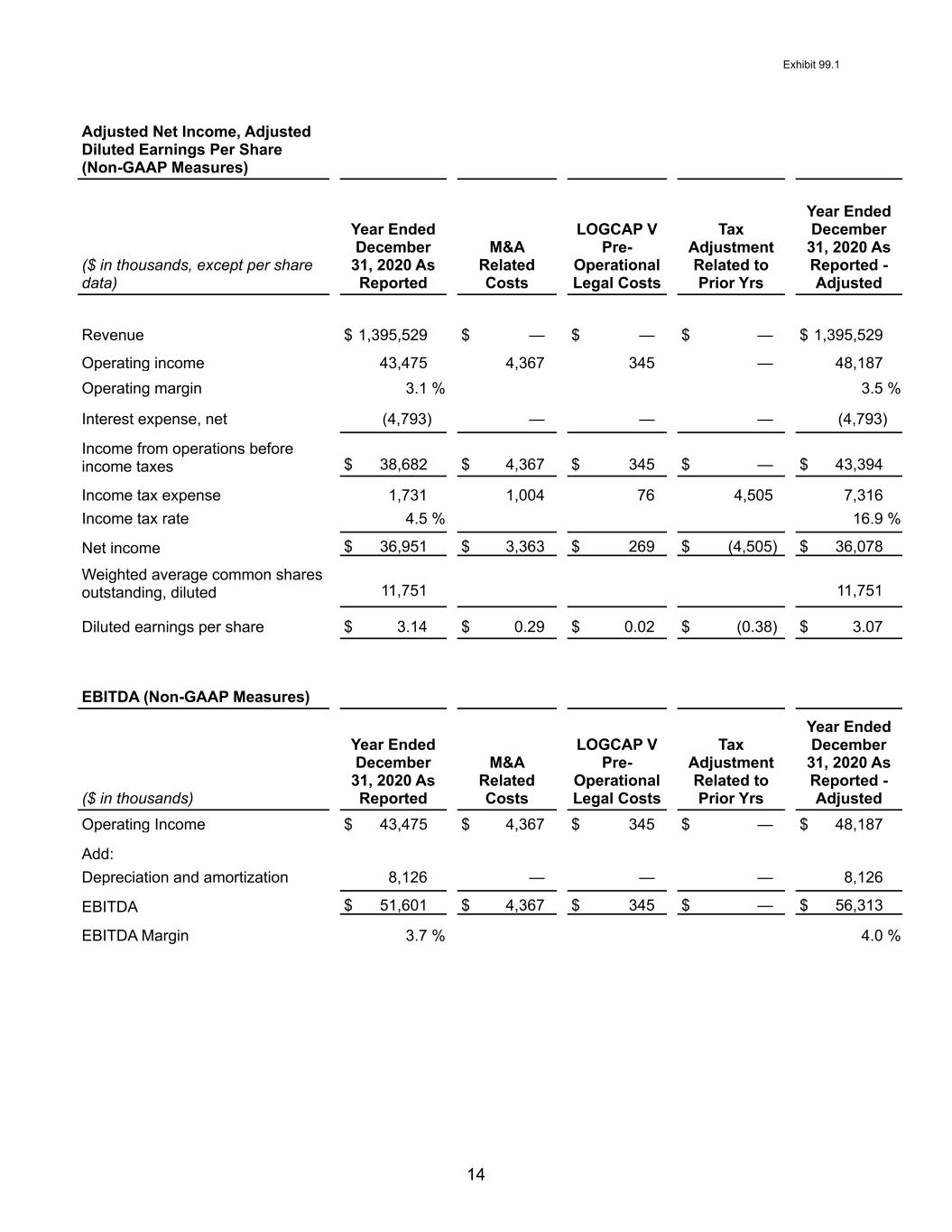

Exhibit 99.1 3 Full-Year 2020 Results Full-year 2020 revenue was $1.396 billion up slightly year on year by 1.0%. COVID-19 adversely impacted revenue $63 million or 4.6% year on year. Operating income for the year was $43.5 million or 3.1% margin. Full-year adjusted operating income1 was $48.2 million or 3.5% margin. Full-year operating margin was negatively impacted by 20 basis points due to COVID-19 pandemic-related deferrals. Full-year 2020 EBITDA1 was $51.6 million or 3.7% margin. Adjusted EBITDA1 for the year was $56.3 million or 4.0%. Full-year EBITDA margin was negatively impacted by 20 basis points due to COVID-19 pandemic-related deferrals. Full-year diluted EPS was $3.14. Diluted EPS was favorably affected by the recognition of a tax benefit in the period relating to 2018, 2019 and 2020 of $0.60. Adjusted diluted EPS1 for the year was $3.07 and includes a $0.22 tax benefit pertaining to 2020. Fully diluted EPS and Adjusted diluted EPS1 was negatively impacted by $0.39 due to COVID-19 pandemic-related deferrals. “We announced a robust end to the year, reporting fourth quarter 2020 adjusted EBITDA margin1 of 5.0%, the highest level in our company’s history. This is a result of our continued focus on automating our core program and support processes, cost efficiencies, supply chain leverage and technology enhancements to modernize our programs and support functions,” said Susan Lynch, Senior Vice President and Chief Financial Officer. “Additionally, we reported record operating cash flows. Excluding the impact of the CARES Act, operating cash flow conversion was 140% as compared to adjusted net income1. Vectrus continues to generate significant positive cash flows, a testament to the resiliency of our business model.” “During the quarter and in conjunction with our acquisitions, we also negotiated and expanded our credit facility, increasing the amount of funding available under our revolver while improving our covenants. This improved facility is indicative of our strong financial position and the substantial visibility associated with our $5.1 billion backlog. Our balance sheet remains strong and provides flexibility for the company to pursue organic and inorganic growth opportunities that align with our strategy,” said Lynch. Cash provided by operating activities through December 31, 2020 was $64.1 million. The company benefitted from the CARES Act tax deferrals by approximately $13.2 million.

Exhibit 99.1 4 Net debt at December 31, 2020 was $112.1 million, up from $35.2 million at December 31, 2019 due to the acquisitions of Zenetex and HHB on December 31, 2020. Total debt at December 31, 2020 was $179.0 million, up $108.5 million from $70.5 million at December 31, 2019. Cash at year- end was $66.9 million, up $31.6 million from $35.3 million at December 31, 2019. Total liquidity on December 31, 2020 was more than $220 million. Total consolidated indebtedness to consolidated EBITDA1 (total leverage ratio) was 2.05x. Total backlog as of December 31, 2020 was $5.1 billion and funded backlog was $0.9 billion. The trailing twelve-month book-to-bill was 2.1x as of December 31, 2020.

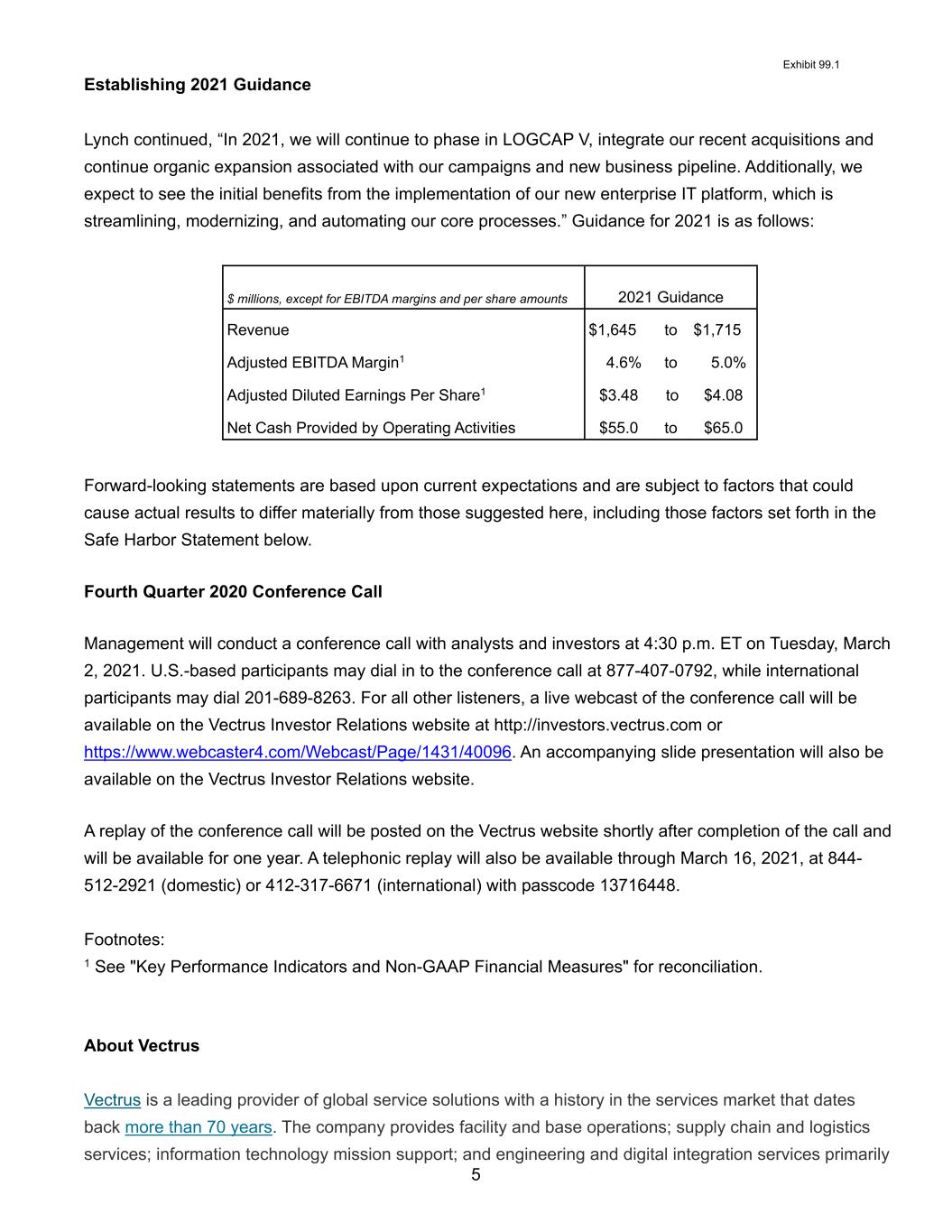

Exhibit 99.1 5 Establishing 2021 Guidance Lynch continued, “In 2021, we will continue to phase in LOGCAP V, integrate our recent acquisitions and continue organic expansion associated with our campaigns and new business pipeline. Additionally, we expect to see the initial benefits from the implementation of our new enterprise IT platform, which is streamlining, modernizing, and automating our core processes.” Guidance for 2021 is as follows: $ millions, except for EBITDA margins and per share amounts 2021 Guidance Revenue $1,645 to $1,715 Adjusted EBITDA Margin1 4.6% to 5.0% Adjusted Diluted Earnings Per Share1 $3.48 to $4.08 Net Cash Provided by Operating Activities $55.0 to $65.0 Forward-looking statements are based upon current expectations and are subject to factors that could cause actual results to differ materially from those suggested here, including those factors set forth in the Safe Harbor Statement below. Fourth Quarter 2020 Conference Call Management will conduct a conference call with analysts and investors at 4:30 p.m. ET on Tuesday, March 2, 2021. U.S.-based participants may dial in to the conference call at 877-407-0792, while international participants may dial 201-689-8263. For all other listeners, a live webcast of the conference call will be available on the Vectrus Investor Relations website at http://investors.vectrus.com or https://www.webcaster4.com/Webcast/Page/1431/40096. An accompanying slide presentation will also be available on the Vectrus Investor Relations website. A replay of the conference call will be posted on the Vectrus website shortly after completion of the call and will be available for one year. A telephonic replay will also be available through March 16, 2021, at 844- 512-2921 (domestic) or 412-317-6671 (international) with passcode 13716448. Footnotes: 1 See "Key Performance Indicators and Non-GAAP Financial Measures" for reconciliation. About Vectrus Vectrus is a leading provider of global service solutions with a history in the services market that dates back more than 70 years. The company provides facility and base operations; supply chain and logistics services; information technology mission support; and engineering and digital integration services primarily

Exhibit 99.1 6 to U.S. government customers around the world. Vectrus is differentiated by operational excellence, superior program performance, a history of long-term customer relationships and a strong commitment to its clients' mission success. Vectrus is headquartered in Colorado Springs, Colo., and includes about 7,100 employees spanning 148 locations in 26 countries and territories across four continents. In 2020, Vectrus generated sales of $1.4 billion. To learn about career opportunities at Vectrus, visit www.vectrus.com/careers. For more information, visit the company's website at www.vectrus.com or connect with Vectrus on Facebook, Twitter, and LinkedIn. Safe Harbor Statement Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995 (the "Act"): Certain material presented herein includes forward-looking statements intended to qualify for the safe harbor from liability established by the Act. These forward-looking statements include, but are not limited to, all of the statements and items listed in the table in "2021 Guidance" above and other assumptions contained therein for purposes of such guidance, other statements about our 2021 performance outlook, five-year growth plan, revenue, DSO, contract opportunities, the potential impact of COVID-19, and any discussion of future operating or financial performance. Whenever used, words such as "may," "are considering," "will," "likely," "anticipate," "estimate," "expect," "project," "intend," "plan," "believe," "target," "could," "potential," "continue," "goal" or similar terminology are forward-looking statements. These statements are based on the beliefs and assumptions of our management based on information currently available to management. These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside our management’s control, that could cause actual results to differ materially from the results discussed in the forward-looking statements. For a discussion of some of the risks and important factors that could cause actual results to differ from such forward-looking statements, see the risks and other factors detailed from time to time our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and other filings with the U.S. Securities and Exchange Commission. We undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

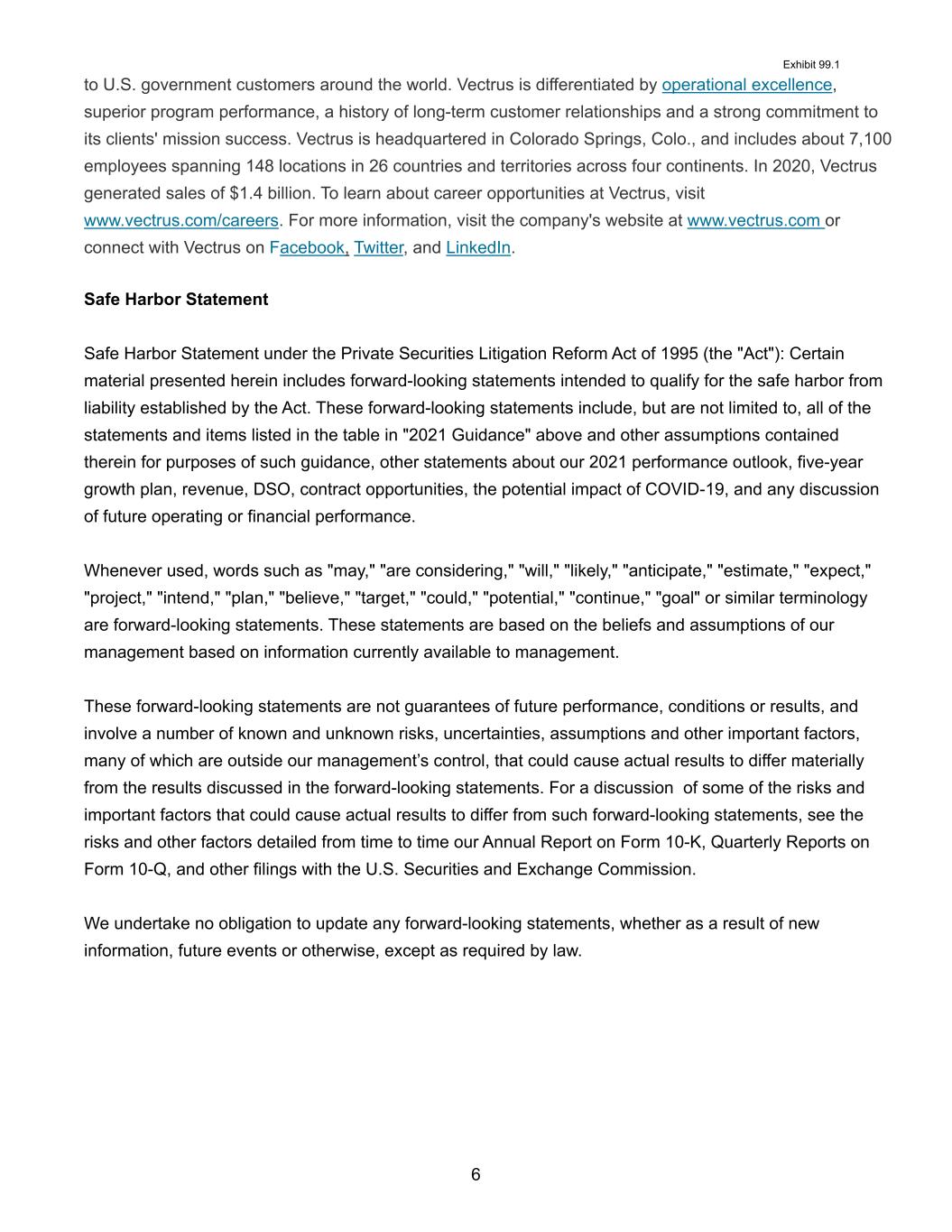

Exhibit 99.1 7 VECTRUS, INC. CONDENSED CONSOLIDATED STATEMENTS OF INCOME Year Ended December 31, (In thousands, except per share data) 2020 2019 2018 Revenue $ 1,395,529 $ 1,382,525 $ 1,279,036 Cost of revenue 1,271,375 1,254,560 1,164,609 Selling, general and administrative expenses 80,679 78,316 66,372 Operating income 43,475 49,649 48,055 Interest expense, net (4,793) (6,470) (5,071) Income from operations before income taxes 38,682 43,179 42,984 Income tax expense 1,731 10,003 7,898 Net income $ 36,951 $ 33,176 $ 35,086 Earnings per share Basic $ 3.19 $ 2.90 $ 3.13 Diluted $ 3.14 $ 2.86 $ 3.08 Weighted average common shares outstanding - basic 11,599 11,444 11,224 Weighted average common shares outstanding - diluted 11,751 11,612 11,378

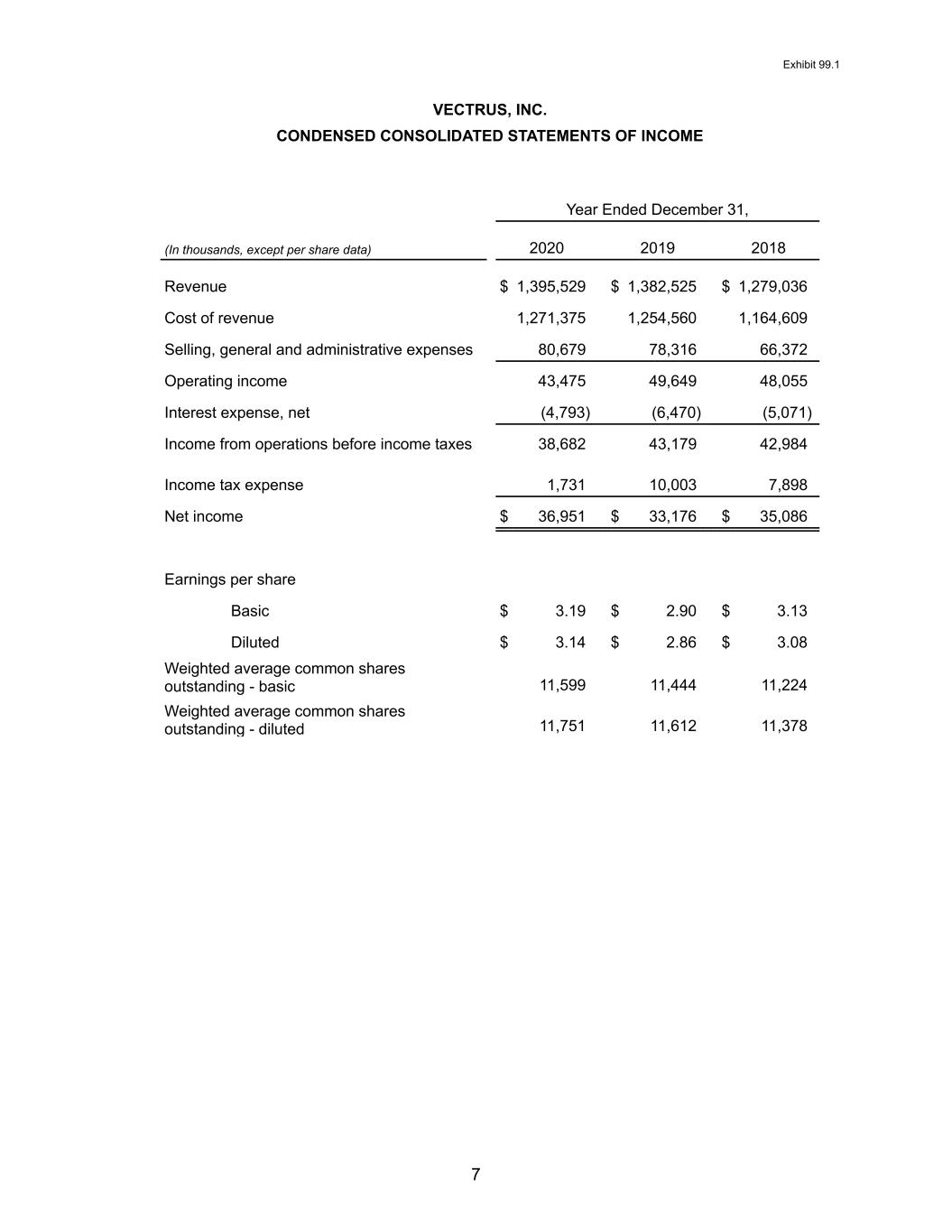

Exhibit 99.1 8 VECTRUS, INC. CONDENSED CONSOLIDATED BALANCE SHEETS December 31, (In thousands, except share information) 2020 2019 Assets Current assets Cash and cash equivalents $ 66,949 $ 35,318 Restricted cash 1,778 — Receivables 314,959 269,144 Other current assets 24,702 16,154 Total current assets 408,388 320,616 Property, plant, and equipment, net 22,573 18,844 Goodwill 339,702 261,983 Intangible assets, net 48,105 14,926 Right-of-use assets 18,718 14,654 Other non-current assets 6,325 5,366 Total non-current assets 435,423 315,773 Total Assets $ 843,811 $ 636,389 Liabilities and Shareholders' Equity Current liabilities Accounts payable $ 159,586 $ 148,015 Compensation and other employee benefits 79,568 53,155 Short-term debt 8,600 6,500 Other accrued liabilities 40,657 37,409 Total current liabilities 288,411 245,079 Long-term debt, net 168,751 63,041 Deferred tax liability 39,386 49,407 Other non-current liabilities 42,325 19,997 Total non-current liabilities 250,462 132,445 Total liabilities 538,873 377,524 Shareholders' Equity Preferred stock; $0.01 par value; 10,000,000 shares authorized; No shares issued and outstanding — — Common stock; $0.01 par value; 100,000,000 shares authorized; 11,624,717 and 11,523,691 shares issued and outstanding as of December 31, 2020 and 2019, respectively 116 115 Additional paid in capital 82,823 78,757 Retained earnings 222,026 185,075 Accumulated other comprehensive loss (27) (5,082) Total shareholders' equity 304,938 258,865 Total Liabilities and Shareholders' Equity $ 843,811 $ 636,389

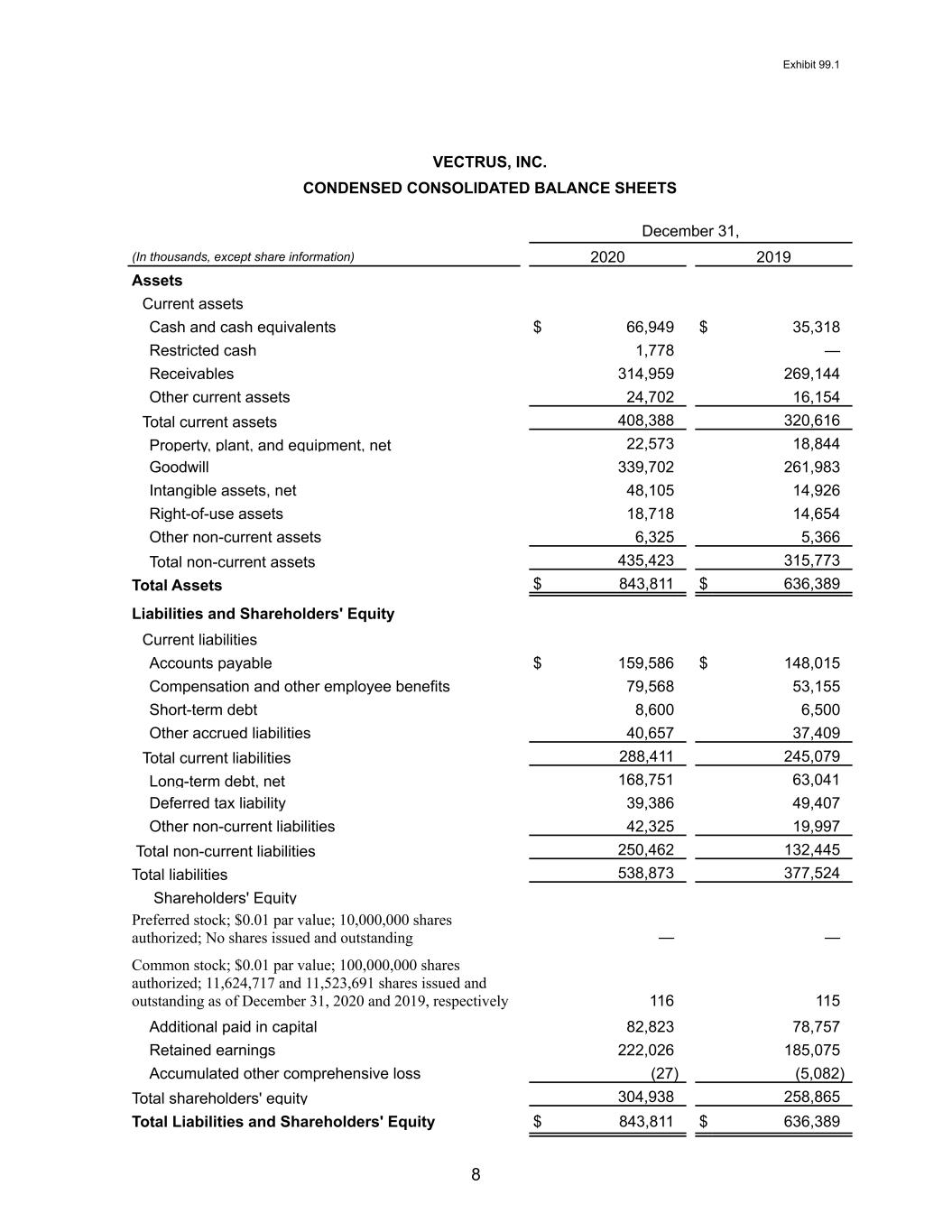

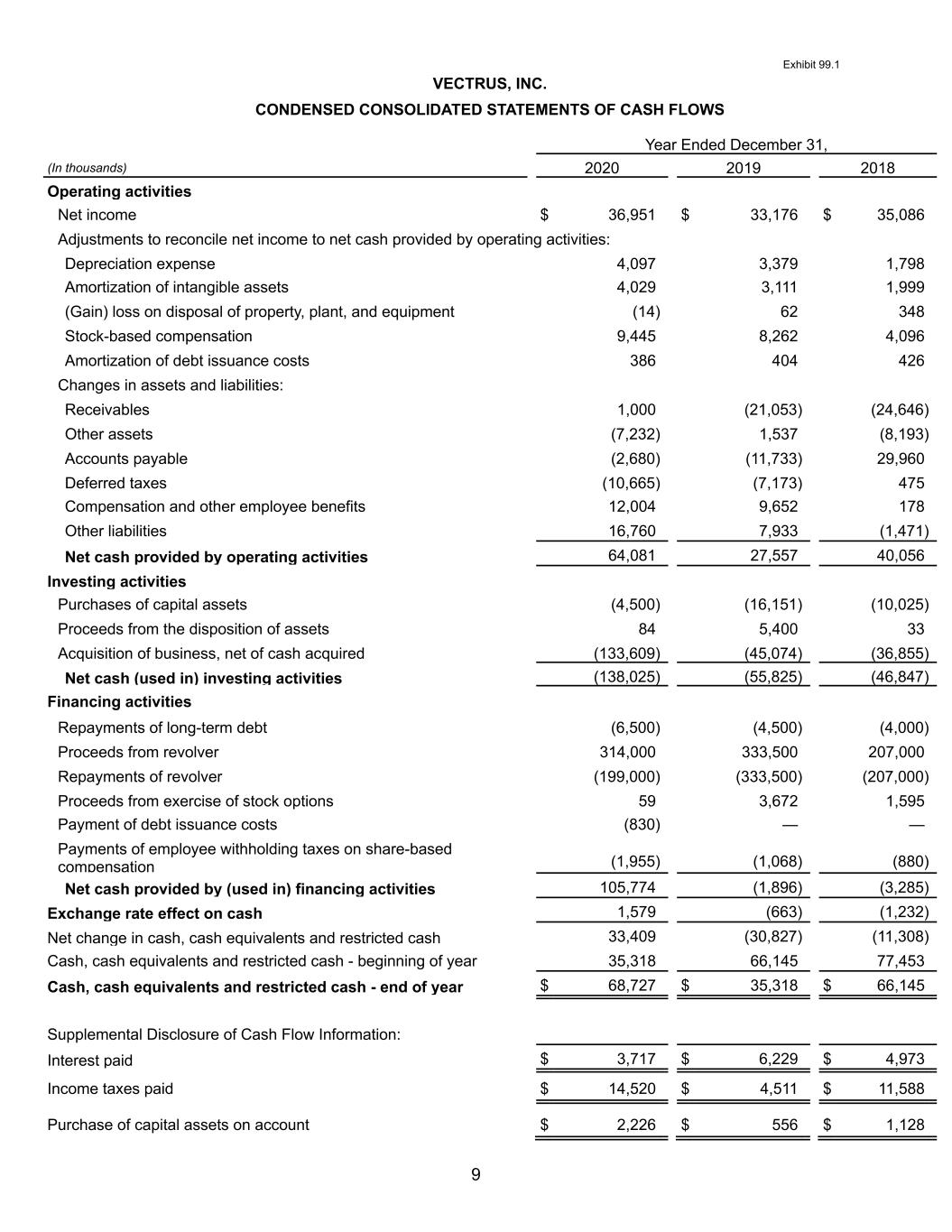

Exhibit 99.1 9 VECTRUS, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS Year Ended December 31, (In thousands) 2020 2019 2018 Operating activities Net income $ 36,951 $ 33,176 $ 35,086 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation expense 4,097 3,379 1,798 Amortization of intangible assets 4,029 3,111 1,999 (Gain) loss on disposal of property, plant, and equipment (14) 62 348 Stock-based compensation 9,445 8,262 4,096 Amortization of debt issuance costs 386 404 426 Changes in assets and liabilities: Receivables 1,000 (21,053) (24,646) Other assets (7,232) 1,537 (8,193) Accounts payable (2,680) (11,733) 29,960 Deferred taxes (10,665) (7,173) 475 Compensation and other employee benefits 12,004 9,652 178 Other liabilities 16,760 7,933 (1,471) Net cash provided by operating activities 64,081 27,557 40,056 Investing activities Purchases of capital assets (4,500) (16,151) (10,025) Proceeds from the disposition of assets 84 5,400 33 Acquisition of business, net of cash acquired (133,609) (45,074) (36,855) Net cash (used in) investing activities (138,025) (55,825) (46,847) Financing activities Repayments of long-term debt (6,500) (4,500) (4,000) Proceeds from revolver 314,000 333,500 207,000 Repayments of revolver (199,000) (333,500) (207,000) Proceeds from exercise of stock options 59 3,672 1,595 Payment of debt issuance costs (830) — — Payments of employee withholding taxes on share-based compensation (1,955) (1,068) (880) Net cash provided by (used in) financing activities 105,774 (1,896) (3,285) Exchange rate effect on cash 1,579 (663) (1,232) Net change in cash, cash equivalents and restricted cash 33,409 (30,827) (11,308) Cash, cash equivalents and restricted cash - beginning of year 35,318 66,145 77,453 Cash, cash equivalents and restricted cash - end of year $ 68,727 $ 35,318 $ 66,145 Supplemental Disclosure of Cash Flow Information: Interest paid $ 3,717 $ 6,229 $ 4,973 Income taxes paid $ 14,520 $ 4,511 $ 11,588 Purchase of capital assets on account $ 2,226 $ 556 $ 1,128

Exhibit 99.1 10 Key Performance Indicators and Non-GAAP Measures The primary financial performance measures we use to manage our business and monitor results of operations are revenue trends and operating income trends. Management believes that these financial performance measures are the primary drivers for our earnings and net cash from operating activities. Management evaluates its contracts and business performance by focusing on revenue, operating income and operating margin. Operating income represents revenue less both cost of revenue and selling, general and administrative (SG&A) expenses. Cost of revenue consists of labor, subcontracting costs, materials, and an allocation of indirect costs, which includes service center transaction costs. SG&A expenses consist of indirect labor costs (including wages and salaries for executives and administrative personnel), bid and proposal expenses and other general and administrative expenses not allocated to cost of revenue. We define operating margin as operating income divided by revenue. We manage the nature and amount of costs at the program level, which forms the basis for estimating our total costs and profitability. This is consistent with our approach for managing our business, which begins with management's assessing the bidding opportunity for each contract and then managing contract profitability throughout the performance period. In addition to the key performance measures discussed above, we consider adjusted operating income, adjusted operating margin, adjusted net income, adjusted diluted earnings per share, EBITDA, adjusted EBITDA, EBITDA margin, adjusted EBITDA margin, and organic revenue to be useful to management and investors in evaluating our operating performance, and to provide a tool for evaluating our ongoing operations. This information can assist investors in assessing our financial performance and measures our ability to generate capital for deployment among competing strategic alternatives and initiatives. We provide this information to our investors in our earnings releases, presentations and other disclosures. Adjusted operating income, adjusted operating margin, adjusted net income, adjusted diluted earnings per share, EBITDA, adjusted EBITDA, EBITDA margin, adjusted EBITDA margin, and organic revenue, however, are not measures of financial performance under GAAP and should not be considered a substitute for operating income, operating margin, net income and diluted earnings per share as determined in accordance with GAAP. Definitions and reconciliations of these items are provided below. • Adjusted operating income is defined as operating income, adjusted to exclude items that may include, but are not limited to significant charges or credits, and unusual and infrequent non-operating items, such as M&A transaction and LOGCAP V pre-operational legal costs that impact current results but are not related to our ongoing operations. • Adjusted operating margin is defined as adjusted operating income divided by revenue.

Exhibit 99.1 11 • Adjusted net income is defined as net income, adjusted to exclude items that may include, but are not limited to, significant charges or credits, and unusual and infrequent non-operating items, such as M&A transaction and LOGCAP V pre-operational legal costs, that impact current results but are not related to our ongoing operations. • Adjusted diluted earnings per share is defined as adjusted net income divided by the weighted average diluted common shares outstanding. • EBITDA is defined as operating income, adjusted to exclude depreciation and amortization. • Adjusted EBITDA is defined as EBITDA, adjusted to exclude items that may include, but are not limited to, significant charges or credits and unusual and infrequent non-operating items, such as M&A transaction and LOGCAP V pre-operational legal costs that impact current results but are not related to our ongoing operations. • EBITDA margin is defined as EBITDA divided by revenue. • Adjusted EBITDA margin is defined as Adjusted EBITDA divided by revenue. • Organic revenue is defined as revenue, adjusted to exclude revenue from acquired companies.

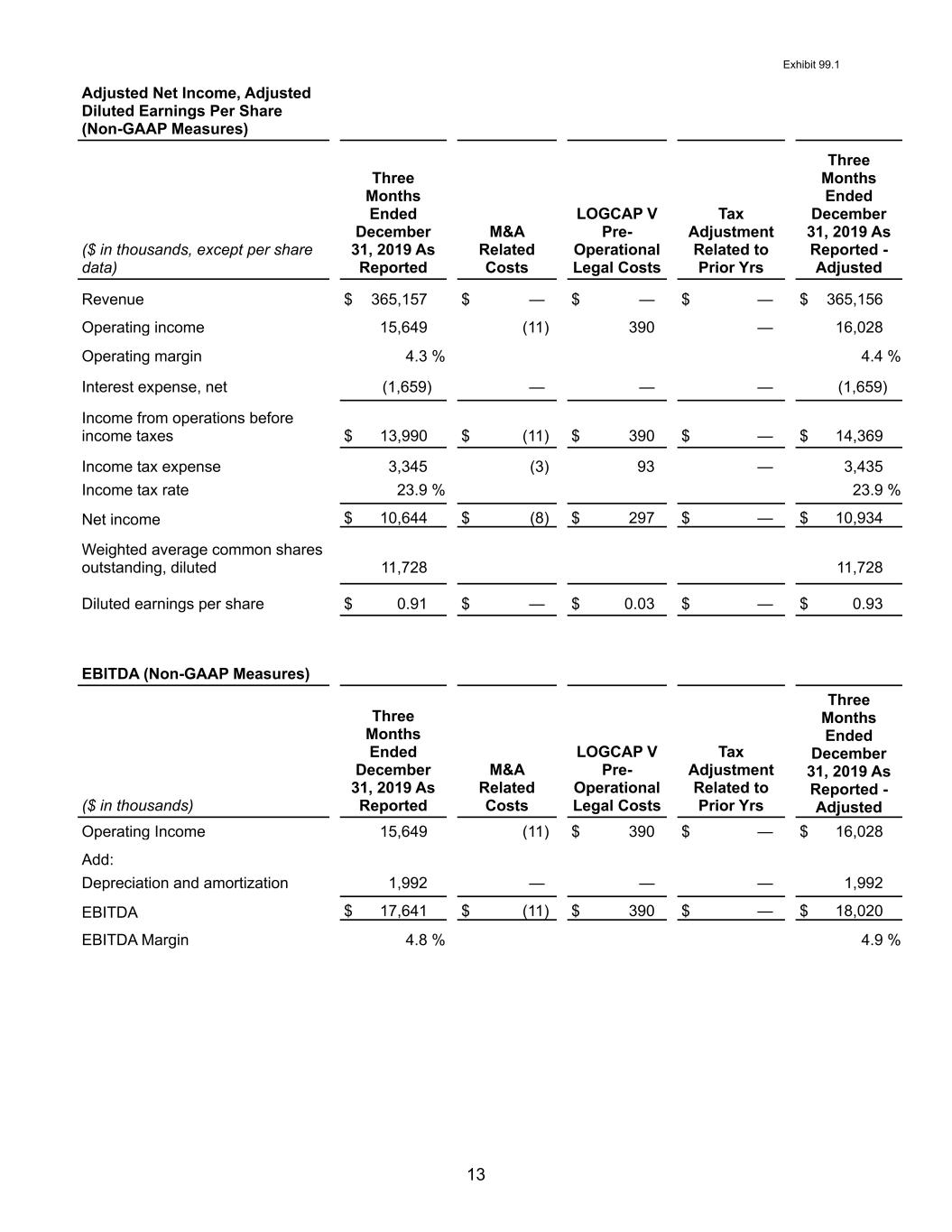

Exhibit 99.1 12 Adjusted Net Income, Adjusted Diluted Earnings Per Share (Non-GAAP Measures) ($ in thousands, except per share data) Three Months Ended December 31, 2020 As Reported M&A Related Costs LOGCAP V Pre- Operational Legal Costs Tax Adjustment Related to Prior Yrs Three Months Ended December 31, 2020 As Reported - Adjusted Revenue $ 355,317 $ — $ — $ — $ 355,317 Growth (2.7)% (2.7)% Operating income 13,725 1,960 120 — 15,805 Operating margin 3.9 % 4.4 % Interest expense, net (806) — — — (806) Income from operations before income taxes $ 12,919 $ 1,960 $ 120 $ — $ 14,999 Income tax expense/(benefit) (3,862) 451 28 4,505 1,122 Income tax rate (29.9)% 7.5 % Net income $ 16,781 $ 1,509 $ 92 $ (4,505) $ 13,877 Weighted average common shares outstanding, diluted 11,782 11,782 Diluted earnings per share $ 1.42 $ 0.13 $ 0.01 $ (0.38) $ 1.18 EBITDA (Non-GAAP Measures) ($ in thousands) Three Months Ended December 31, 2020 As Reported M&A Related Costs LOGCAP V Pre- Operational Legal Costs Tax Adjustment Related to Prior Yrs Three Months Ended December 31, 2020 As Reported - Adjusted Operating Income $ 13,725 $ 1,960 $ 120 $ — $ 15,805 Add: Depreciation and amortization 2,094 — — — 2,094 EBITDA $ 15,819 $ 1,960 $ 120 $ — $ 17,899 EBITDA Margin 4.5 % 5.0 %

Exhibit 99.1 13 Adjusted Net Income, Adjusted Diluted Earnings Per Share (Non-GAAP Measures) ($ in thousands, except per share data) Three Months Ended December 31, 2019 As Reported M&A Related Costs LOGCAP V Pre- Operational Legal Costs Tax Adjustment Related to Prior Yrs Three Months Ended December 31, 2019 As Reported - Adjusted Revenue $ 365,157 $ — $ — $ — $ 365,156 Operating income 15,649 (11) 390 — 16,028 Operating margin 4.3 % 4.4 % Interest expense, net (1,659) — — — (1,659) Income from operations before income taxes $ 13,990 $ (11) $ 390 $ — $ 14,369 Income tax expense 3,345 (3) 93 — 3,435 Income tax rate 23.9 % 23.9 % Net income $ 10,644 $ (8) $ 297 $ — $ 10,934 Weighted average common shares outstanding, diluted 11,728 11,728 Diluted earnings per share $ 0.91 $ — $ 0.03 $ — $ 0.93 EBITDA (Non-GAAP Measures) ($ in thousands) Three Months Ended December 31, 2019 As Reported M&A Related Costs LOGCAP V Pre- Operational Legal Costs Tax Adjustment Related to Prior Yrs Three Months Ended December 31, 2019 As Reported - Adjusted Operating Income 15,649 (11) $ 390 $ — $ 16,028 Add: Depreciation and amortization 1,992 — — — 1,992 EBITDA $ 17,641 $ (11) $ 390 $ — $ 18,020 EBITDA Margin 4.8 % 4.9 %

Exhibit 99.1 14 Adjusted Net Income, Adjusted Diluted Earnings Per Share (Non-GAAP Measures) ($ in thousands, except per share data) Year Ended December 31, 2020 As Reported M&A Related Costs LOGCAP V Pre- Operational Legal Costs Tax Adjustment Related to Prior Yrs Year Ended December 31, 2020 As Reported - Adjusted Revenue $ 1,395,529 $ — $ — $ — $ 1,395,529 Operating income 43,475 4,367 345 — 48,187 Operating margin 3.1 % 3.5 % Interest expense, net (4,793) — — — (4,793) Income from operations before income taxes $ 38,682 $ 4,367 $ 345 $ — $ 43,394 Income tax expense 1,731 1,004 76 4,505 7,316 Income tax rate 4.5 % 16.9 % Net income $ 36,951 $ 3,363 $ 269 $ (4,505) $ 36,078 Weighted average common shares outstanding, diluted 11,751 11,751 Diluted earnings per share $ 3.14 $ 0.29 $ 0.02 $ (0.38) $ 3.07 EBITDA (Non-GAAP Measures) ($ in thousands) Year Ended December 31, 2020 As Reported M&A Related Costs LOGCAP V Pre- Operational Legal Costs Tax Adjustment Related to Prior Yrs Year Ended December 31, 2020 As Reported - Adjusted Operating Income $ 43,475 $ 4,367 $ 345 $ — $ 48,187 Add: Depreciation and amortization 8,126 — — — 8,126 EBITDA $ 51,601 $ 4,367 $ 345 $ — $ 56,313 EBITDA Margin 3.7 % 4.0 %

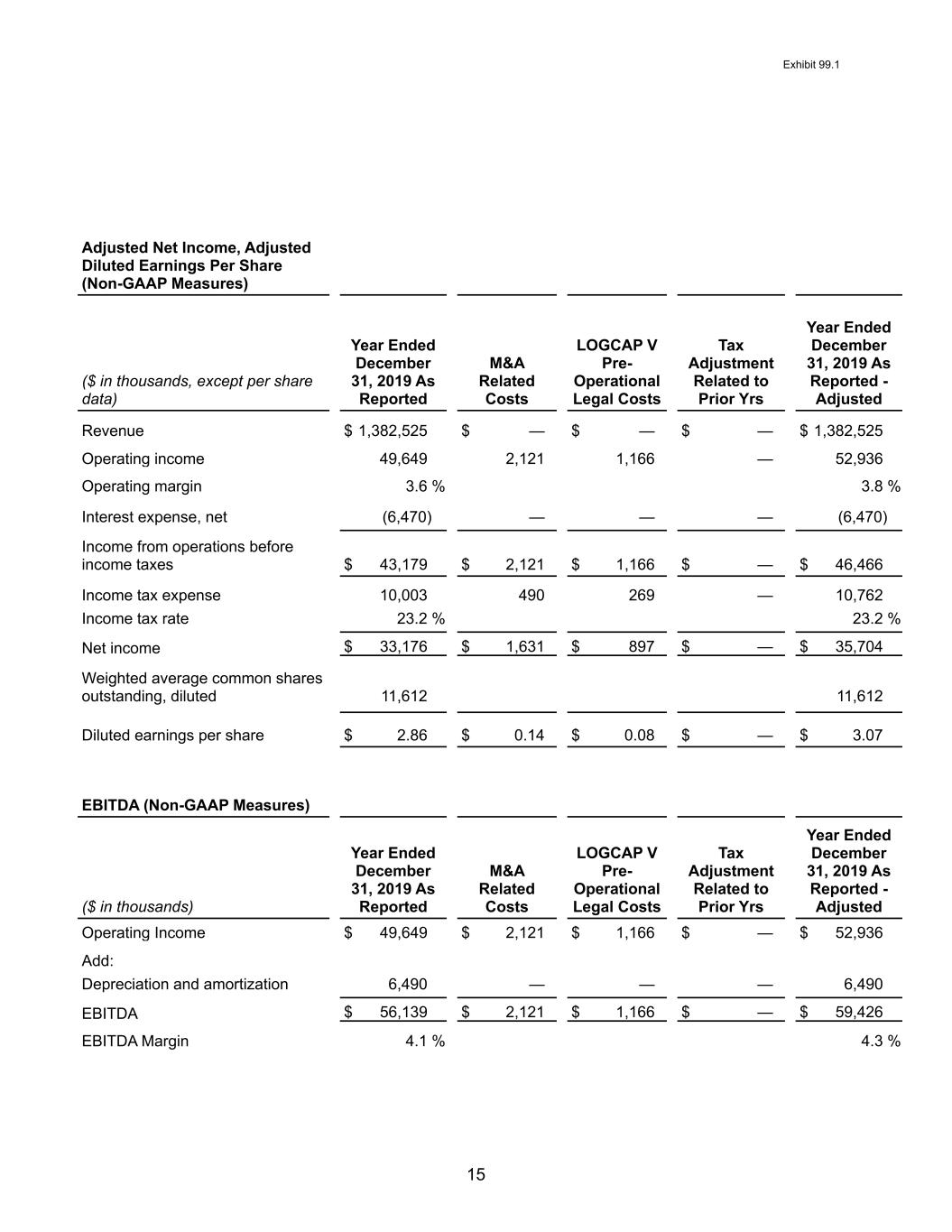

Exhibit 99.1 15 Adjusted Net Income, Adjusted Diluted Earnings Per Share (Non-GAAP Measures) ($ in thousands, except per share data) Year Ended December 31, 2019 As Reported M&A Related Costs LOGCAP V Pre- Operational Legal Costs Tax Adjustment Related to Prior Yrs Year Ended December 31, 2019 As Reported - Adjusted Revenue $ 1,382,525 $ — $ — $ — $ 1,382,525 Operating income 49,649 2,121 1,166 — 52,936 Operating margin 3.6 % 3.8 % Interest expense, net (6,470) — — — (6,470) Income from operations before income taxes $ 43,179 $ 2,121 $ 1,166 $ — $ 46,466 Income tax expense 10,003 490 269 — 10,762 Income tax rate 23.2 % 23.2 % Net income $ 33,176 $ 1,631 $ 897 $ — $ 35,704 Weighted average common shares outstanding, diluted 11,612 11,612 Diluted earnings per share $ 2.86 $ 0.14 $ 0.08 $ — $ 3.07 EBITDA (Non-GAAP Measures) ($ in thousands) Year Ended December 31, 2019 As Reported M&A Related Costs LOGCAP V Pre- Operational Legal Costs Tax Adjustment Related to Prior Yrs Year Ended December 31, 2019 As Reported - Adjusted Operating Income $ 49,649 $ 2,121 $ 1,166 $ — $ 52,936 Add: Depreciation and amortization 6,490 — — — 6,490 EBITDA $ 56,139 $ 2,121 $ 1,166 $ — $ 59,426 EBITDA Margin 4.1 % 4.3 %

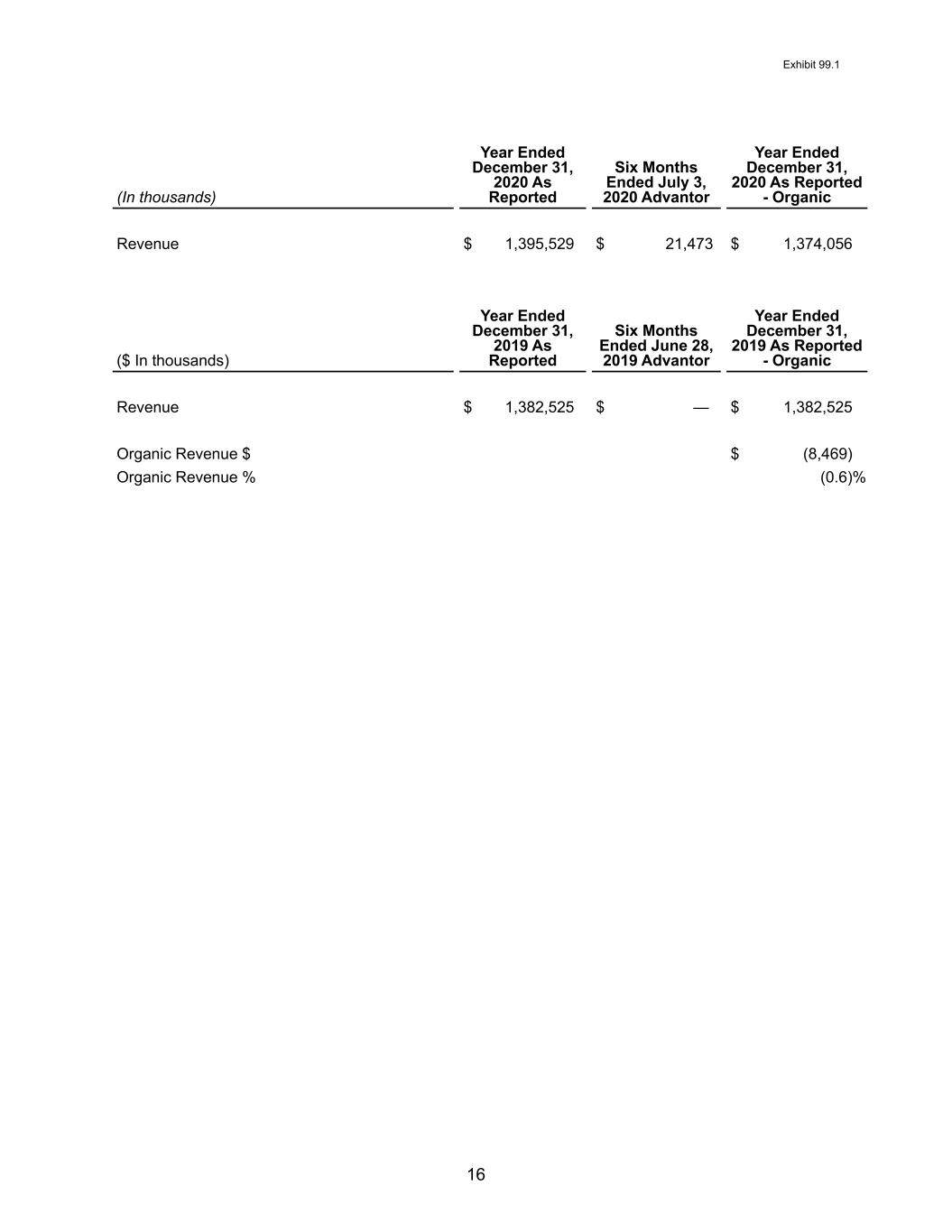

Exhibit 99.1 16 (In thousands) Year Ended December 31, 2020 As Reported Six Months Ended July 3, 2020 Advantor Year Ended December 31, 2020 As Reported - Organic Revenue $ 1,395,529 $ 21,473 $ 1,374,056 ($ In thousands) Year Ended December 31, 2019 As Reported Six Months Ended June 28, 2019 Advantor Year Ended December 31, 2019 As Reported - Organic Revenue $ 1,382,525 $ — $ 1,382,525 Organic Revenue $ $ (8,469) Organic Revenue % (0.6)%

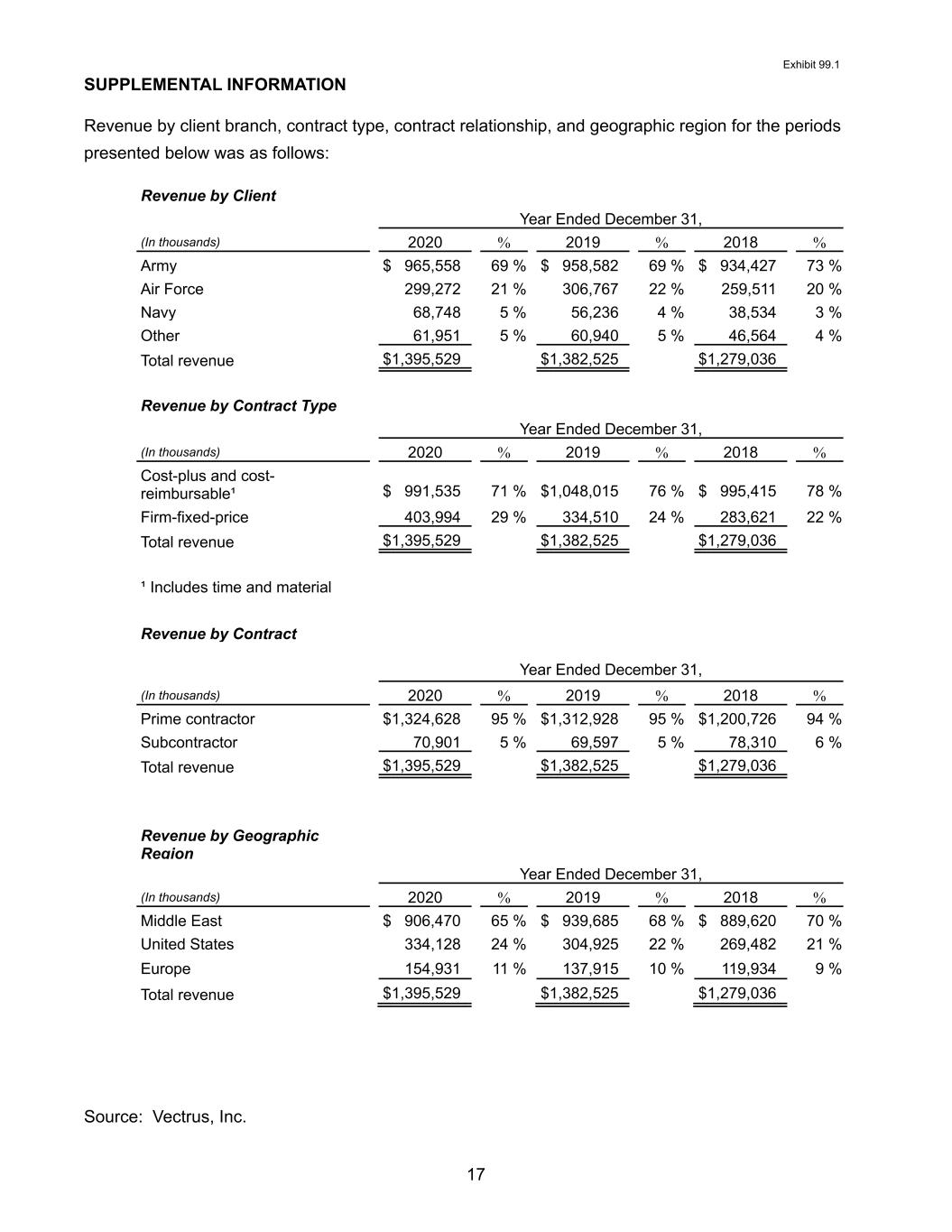

Exhibit 99.1 17 SUPPLEMENTAL INFORMATION Revenue by client branch, contract type, contract relationship, and geographic region for the periods presented below was as follows: Revenue by Client Year Ended December 31, (In thousands) 2020 % 2019 % 2018 % Army $ 965,558 69 % $ 958,582 69 % $ 934,427 73 % Air Force 299,272 21 % 306,767 22 % 259,511 20 % Navy 68,748 5 % 56,236 4 % 38,534 3 % Other 61,951 5 % 60,940 5 % 46,564 4 % Total revenue $1,395,529 $1,382,525 $ 1,279,036 Revenue by Contract Type Year Ended December 31, (In thousands) 2020 % 2019 % 2018 % Cost-plus and cost- reimbursable¹ $ 991,535 71 % $1,048,015 76 % $ 995,415 78 % Firm-fixed-price 403,994 29 % 334,510 24 % 283,621 22 % Total revenue $1,395,529 $1,382,525 $ 1,279,036 ¹ Includes time and material Revenue by Contract Year Ended December 31, (In thousands) 2020 % 2019 % 2018 % Prime contractor $1,324,628 95 % $1,312,928 95 % $ 1,200,726 94 % Subcontractor 70,901 5 % 69,597 5 % 78,310 6 % Total revenue $1,395,529 $1,382,525 $ 1,279,036 Revenue by Geographic Region Year Ended December 31, (In thousands) 2020 % 2019 % 2018 % Middle East $ 906,470 65 % $ 939,685 68 % $ 889,620 70 % United States 334,128 24 % 304,925 22 % 269,482 21 % Europe 154,931 11 % 137,915 10 % 119,934 9 % Total revenue $1,395,529 $1,382,525 $ 1,279,036 Source: Vectrus, Inc.