Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Service Properties Trust | ex991svcq42020er.htm |

| 8-K - 8-K - Service Properties Trust | svc-20210226.htm |

Royal Sonesta Chase Park Plaza St. Louis, MO FOURTH QUARTER 2020 Supplemental Operating and Financial Data ALL AMOUNTS IN THIS REPORT ARE UNAUDITED. Exhibit 99.2

Supplemental Q4 2020 2 Table of Contents CORPORATE INFORMATION Company Profile............................................................................................................................................................................................. 3 Investor Information....................................................................................................................................................................................... 4 Research Coverage........................................................................................................................................................................................ 5 FINANCIALS Key Financial Data.......................................................................................................................................................................................... 6 Consolidated Balance Sheets....................................................................................................................................................................... 7 Consolidated Statements of Income (Loss)................................................................................................................................................ 8 Calculation of FFO and Normalized FFO.................................................................................................................................................... 9 Calculation of EBITDA, EBITDAre and Adjusted EBITDAre...................................................................................................................... 10 Notes to Consolidated Statements of Income (Loss), and calculations of FFO, Normalized FFO, EBITDA, EBITDAre, Adjusted EBITDAre, Hotel EBITDA and Adjusted Hotel EBITDA.......................................................................................................................... 11 Debt Summary................................................................................................................................................................................................ 12 Debt Maturity Schedule................................................................................................................................................................................. 13 Leverage Ratios, Coverage Ratios and Public Debt Covenants............................................................................................................... 14 Capital Expenditures and Restricted Cash Activity.................................................................................................................................... 15 Property Acquisitions and Dispositions Information Since January 1, 2020.......................................................................................... 16 PORTFOLIO INFORMATION Portfolio Summary.......................................................................................................................................................................................... 17 Consolidated Portfolio by Brand Affiliation................................................................................................................................................ 18 Consolidated Portfolio Diversification by Industry.................................................................................................................................... 19 Hotel Portfolio by Brand................................................................................................................................................................................ 20 Hotel Operating Statistics by Service Level - Comparable Hotels........................................................................................................... 21 Hotel Operating Statistics by Service Level - All Hotels............................................................................................................................ 22 Calculation and Reconciliation of Hotel EBITDA and Adjusted Hotel EBITDA - Comparable Hotels................................................. 23 Calculation and Reconciliation of Hotel EBITDA and Adjusted Hotel EBITDA - All Hotels.................................................................. 24 Net Lease Portfolio by Brand........................................................................................................................................................................ 25 Net Lease Portfolio by Industry.................................................................................................................................................................... 26 Net Lease Portfolio by Tenant (Top 10)....................................................................................................................................................... 27 Net Lease Portfolio Expiration Schedule..................................................................................................................................................... 28 Net Lease Portfolio Occupancy Summary................................................................................................................................................... 29 Non-GAAP FINANCIAL MEASURES AND CERTAIN DEFINITIONS................................................................................................................................. 30 WARNING CONCERNING FORWARD-LOOKING STATEMENTS................................................................................................................................... 32 Please refer to Non-GAAP Financial Measures and Certain Definitions for terms used throughout this document. SVC Nasdaq Listed

Supplemental Q4 2020 3 Corporate Headquarters: Two Newton Place 255 Washington Street, Suite 300 Newton, MA 02458-1634 (t) (617) 964-8389 Stock Exchange Listing: Nasdaq Trading Symbol: Common Shares: SVC Key Data (as of and for the three months ended December 31, 2020): (dollars in 000s) Total properties: 1,109 Hotels 310 Net lease properties 799 Number of hotel rooms/suites 49,014 Total net lease square feet 13,455,405 Q4 2020 Total revenues $ 270,043 Q4 2020 Net loss $ (137,740) Q4 2020 Normalized FFO $ (22,474) Q4 2020 Adjusted EBITDAre $ 64,953 The Company: Service Properties Trust, or SVC, we, our or us, is a real estate investment trust, or REIT, which owns a diverse portfolio of hotels and net lease service and necessity-based retail properties across the United States and in Puerto Rico and Canada with 142 distinct brands across 23 distinct industries. SVC is a component of 131 market indices and it comprises more than 1% of the following index as of December 31, 2020: Bloomberg REIT Hotels Index (BBREHOTL). Management: SVC is managed by The RMR Group LLC, or RMR LLC, the operating subsidiary of The RMR Group Inc. (Nasdaq: RMR). RMR is an alternative asset management company that is focused on commercial real estate and related businesses. RMR primarily provides management services to publicly traded real estate companies, privately held real estate funds and real estate related operating businesses. As of December 31, 2020, RMR had $32.0 billion of real estate assets under management and the combined RMR managed companies had approximately $10 billion of annual revenues, nearly 2,100 properties and approximately 43,000 employees. We believe that being managed by RMR is a competitive advantage for SVC because of RMR’s depth of management and experience in the real estate industry. We also believe RMR provides management services to us at costs that are lower than we would have to pay for similar quality services if we were self-managed. Company Profile RETURN TO TABLE OF CONTENTS

Supplemental Q4 2020 4 Board of Trustees Laurie B. Burns Robert E. Cramer Donna D. Fraiche Independent Trustee Independent Trustee Independent Trustee John L. Harrington William A. Lamkin John G. Murray Lead Independent Trustee Independent Trustee Managing Trustee Adam D. Portnoy Chair of the Board & Managing Trustee Senior Management John G. Murray Brian E. Donley Todd W. Hargreaves President and Chief Executive Officer Chief Financial Officer and Treasurer Vice President and Chief Investment Officer Contact Information Investor Relations Inquiries Service Properties Trust Financial, investor and media inquiries should be directed to: Two Newton Place Kristin Brown, Director, Investor Relations at 255 Washington Street/Suite 300 (617) 796-8232, or kbrown@rmrgroup.com. Newton, MA 02458-1634 (t) (617) 964-8389 (email) info@svcreit.com (website) www.svcreit.com Investor Information RETURN TO TABLE OF CONTENTS

Supplemental Q4 2020 5 Equity Research Coverage B. Riley Securities, Inc. BTIG Janney Montgomery Scott Wells Fargo Securities Bryan Maher James Sullivan Tyler Batory Dori Kesten (646) 885-5423 (212) 738-6139 (215) 665-4448 (617) 603-4233 bmaher@brileyfin.com jsullivan@btig.com tbatory@janney.com dori.kesten@wellsfargo.com Rating Agencies Senior Unsecured Debt Ratings Moody’s Investors Service S&P Global Standard & Poor's: BB-/BB Reed Valutas Michael Souers Moody's: Ba2/ Ba1 (1) (212) 553-4169 (212) 438-2508 (1) BB/ Ba1 rating assigned to guaranteed Senior Unsecured Notes. reed.valutas@moodys.com michael.souers@spglobal.com Research Coverage SVC is followed by the analysts and its publicly held debt is rated by the rating agencies listed above. Please note that any opinions, estimates or forecasts regarding SVC's performance made by these analysts or agencies do not represent opinions, forecasts or predictions of SVC or its management. SVC does not by its reference above imply its endorsement of or concurrence with any information, conclusions or recommendations provided by any of these analysts or agencies. RETURN TO TABLE OF CONTENTS

Supplemental Q4 2020 6 As of and For the Three Months Ended 12/31/2020 9/30/2020 6/30/2020 3/31/2020 12/31/2019 Selected Balance Sheet Data: Total gross assets $ 11,967,429 $ 12,009,267 $ 12,026,904 $ 12,206,842 $ 12,154,728 Total assets $ 8,687,319 $ 8,796,673 $ 8,879,545 $ 8,996,623 $ 9,033,967 Total liabilities $ 6,584,529 $ 6,554,589 $ 6,533,824 $ 6,614,357 $ 6,528,089 Total shareholders' equity $ 2,102,790 $ 2,242,084 $ 2,345,721 $ 2,382,266 $ 2,505,878 Selected Income Statement Data: Total revenues $ 270,043 $ 296,495 $ 214,940 $ 483,766 $ 580,906 Net loss $ (137,740) $ (102,642) $ (37,349) $ (33,650) $ (14,893) FFO $ (43,124) $ 23,195 $ 117,924 $ 123,084 $ 147,830 Normalized FFO $ (22,474) $ 23,195 $ 78,158 $ 123,084 $ 151,622 Adjusted EBITDAre $ 64,953 $ 103,611 $ 152,166 $ 195,137 $ 227,013 Per Common Share Data (basic and diluted): Net loss $ (0.84) $ (0.62) $ (0.23) $ (0.20) $ (0.09) FFO $ (0.26) $ 0.14 $ 0.72 $ 0.75 $ 0.90 Normalized FFO $ (0.14) $ 0.14 $ 0.48 $ 0.75 $ 0.92 Dividend Data: Annualized dividends paid per share during the period $ 0.04 $ 0.04 $ 0.04 $ 2.16 $ 2.16 Annualized dividend yield (at end of period) 0.3 % 0.5 % 0.6 % 40.0 % 8.9 % Normalized FFO payout ratio (7.1) % 7.1 % 2.1 % 72.0 % 58.7 % (dollars in thousands, except per share data) Key Financial Data RETURN TO TABLE OF CONTENTS

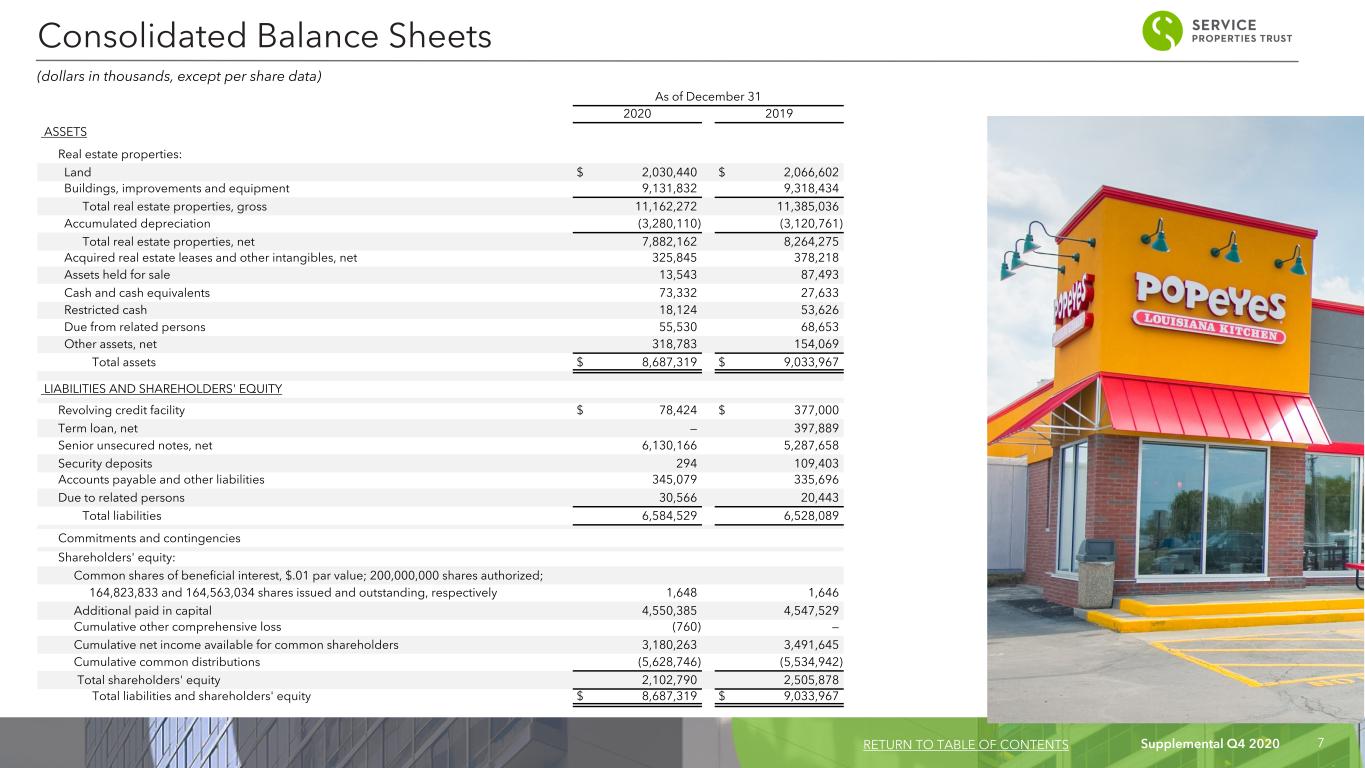

Supplemental Q4 2020 7 As of December 31 2020 2019 ASSETS Real estate properties: Land $ 2,030,440 $ 2,066,602 Buildings, improvements and equipment 9,131,832 9,318,434 Total real estate properties, gross 11,162,272 11,385,036 Accumulated depreciation (3,280,110) (3,120,761) Total real estate properties, net 7,882,162 8,264,275 Acquired real estate leases and other intangibles, net 325,845 378,218 Assets held for sale 13,543 87,493 Cash and cash equivalents 73,332 27,633 Restricted cash 18,124 53,626 Due from related persons 55,530 68,653 Other assets, net 318,783 154,069 Total assets $ 8,687,319 $ 9,033,967 LIABILITIES AND SHAREHOLDERS' EQUITY Revolving credit facility $ 78,424 $ 377,000 Term loan, net — 397,889 Senior unsecured notes, net 6,130,166 5,287,658 Security deposits 294 109,403 Accounts payable and other liabilities 345,079 335,696 Due to related persons 30,566 20,443 Total liabilities 6,584,529 6,528,089 Commitments and contingencies Shareholders' equity: Common shares of beneficial interest, $.01 par value; 200,000,000 shares authorized; 164,823,833 and 164,563,034 shares issued and outstanding, respectively 1,648 1,646 Additional paid in capital 4,550,385 4,547,529 Cumulative other comprehensive loss (760) — Cumulative net income available for common shareholders 3,180,263 3,491,645 Cumulative common distributions (5,628,746) (5,534,942) Total shareholders' equity 2,102,790 2,505,878 Total liabilities and shareholders' equity $ 8,687,319 $ 9,033,967 Consolidated Balance Sheets (dollars in thousands, except per share data) RETURN TO TABLE OF CONTENTS

Supplemental Q4 2020 8 Three Months Ended December 31, Year Ended December 31, 2020 2019 2020 2019 Revenues: Hotel operating revenues (1) $ 174,520 $ 467,805 $ 875,098 $ 1,989,173 Rental income (3) 95,523 111,727 389,955 322,236 FF&E reserve income (4) — 1,374 201 4,739 Total revenues 270,043 580,906 1,265,254 2,316,148 Expenses: Hotel operating expenses (1)(2)(12)(13)(15) 204,998 334,916 697,904 1,410,927 Other operating expenses 4,179 3,938 15,208 8,357 Depreciation and amortization 121,351 126,727 498,908 428,448 General and administrative 13,046 17,733 50,668 54,639 Transaction related costs (5) — 1,795 — 1,795 Loss on asset impairment (6) 254 39,296 55,756 39,296 Total expenses 343,828 524,405 1,318,444 1,943,462 Gain on sale of real estate, net (7) 11,916 — 2,261 159,535 Unrealized gains (losses) on equity securities, net (8) 15,473 3,300 19,882 (40,461) Gain on insurance settlement (9) — — 62,386 — Dividend income — — — 1,752 Interest income 1 441 284 2,215 Interest expense (including amortization of debt issuance costs and debt discounts and premiums of $4,220, $3,288, $14,870 and $11,117, respectively) (82,811) (73,384) (306,490) (225,126) Loss on early extinguishment of debt (10) (2,424) — (9,394) (8,451) Income (loss) before income taxes and equity in earnings (losses) of an investee (131,630) (13,142) (284,261) 262,150 Income tax expense (9) (505) (1,527) (17,211) (2,793) Equity in earnings (losses) of an investee (11) (5,605) (224) (9,910) 393 Net income (loss) $ (137,740) $ (14,893) $ (311,382) $ 259,750 Weighted average common shares outstanding (basic) 164,498 164,364 164,422 164,312 Weighted average common shares outstanding (diluted) 164,498 164,364 164,422 164,340 Net income (loss) per common share (basic and diluted) $ (0.84) $ (0.09) $ (1.89) $ 1.58 (dollars in thousands, except per share data) Consolidated Statements of Income (Loss) RETURN TO TABLE OF CONTENTS See accompanying notes on page 11.

Supplemental Q4 2020 9 For the Three Months Ended For the Year Ended 12/31/2020 9/30/2020 6/30/2020 3/31/2020 12/31/2019 12/31/2020 12/31/2019 Net income (loss) $ (137,740) $ (102,642) $ (37,349) $ (33,650) $ (14,893) $ (311,382) $ 259,750 Add (Less): Depreciation and amortization 121,351 122,204 127,427 127,926 126,727 498,908 428,448 (Gain) loss on sale of real estate, net (7) (11,916) (109) 2,853 6,911 — (2,261) (159,535) Loss on asset impairment (6) 254 10,248 28,514 16,740 39,296 55,756 39,296 Unrealized (gains) losses on equity securities, net (8) (15,473) (5,606) (3,848) 5,045 (3,300) (19,882) 40,461 Adjustments to reflect our share of FFO attributable to an investee (11) 400 (900) 327 112 — (61) — FFO (43,124) 23,195 117,924 123,084 147,830 221,078 608,420 Add (Less): Transaction related costs (5) — — — — 1,795 — 1,795 Loss on early extinguishment of debt (10) 2,424 — 6,970 — — 9,394 8,451 Loss contingency (12) 3,962 — — — 1,997 3,962 1,997 Gain on insurance settlement, net of tax (9) (1,800) — (46,736) — — (48,536) — Hotel manager transition related costs (13) 15,100 — — — — 15,100 — Adjustments to reflect our share of Normalized FFO attributable to an investee (11) 964 — — — — 964 — Normalized FFO $ (22,474) $ 23,195 $ 78,158 $ 123,084 $ 151,622 $ 201,962 $ 620,663 Weighted average shares outstanding (basic) 164,498 164,435 164,382 164,370 164,364 164,422 164,312 Weighted average shares outstanding (diluted) 164,498 164,435 164,382 164,370 164,364 164,422 164,340 Basic and diluted per share common share amounts: Net income (loss) $ (0.84) $ (0.62) $ (0.23) $ (0.20) $ (0.09) $ (1.89) $ 1.58 FFO $ (0.26) $ 0.14 $ 0.72 $ 0.75 $ 0.90 $ 1.34 $ 3.70 Normalized FFO $ (0.14) $ 0.14 $ 0.48 $ 0.75 $ 0.92 $ 1.23 $ 3.78 Calculation of FFO and Normalized FFO (dollars in thousands, except per share data) RETURN TO TABLE OF CONTENTS See accompanying notes on page 11.

Supplemental Q4 2020 10 For the Three Months Ended For the Year Ended 12/31/2020 9/30/2020 6/30/2020 3/31/2020 12/31/2019 12/31/2020 12/31/2019 Net income (loss) $ (137,740) $ (102,642) $ (37,349) $ (33,650) $ (14,893) $ (311,382) $ 259,750 Add (Less): Interest expense 82,811 80,532 72,072 71,075 73,384 306,490 225,126 Income tax expense (benefit) (9) 505 (296) 16,660 342 1,527 17,211 2,793 Depreciation and amortization 121,351 122,204 127,427 127,926 126,727 498,908 428,448 EBITDA 66,927 99,798 178,810 165,693 186,745 511,227 916,117 Add (Less): (Gain) loss on sale of real estate, net (7) (11,916) (109) 2,853 6,911 — (2,261) (159,535) Loss on asset impairment (7) 254 10,248 28,514 16,740 39,296 55,756 39,296 EBITDAre 55,265 109,937 210,177 189,344 226,041 564,722 795,878 Add (Less): General and administrative expense paid in common shares (14) 920 863 832 590 480 3,206 2,849 Transaction related costs (5) — — — — 1,795 — 1,795 Adjustments to reflect our share of EBITDA attributable to an investee (11) 2,755 (1,583) 421 158 — 1,751 — Loss on early extinguishment of debt (10) 2,424 — 6,970 — — 9,394 8,451 Gain on insurance settlement (9) — (62,386) — — (62,386) — Unrealized (gains) losses on equity securities, net (8) (15,473) (5,606) (3,848) 5,045 (3,300) (19,882) 40,461 Loss contingency (12) 3,962 — — — 1,997 3,962 1,997 Hotel manager transition related costs (13) 15,100 — — — — 15,100 — Adjusted EBITDAre $ 64,953 $ 103,611 $ 152,166 $ 195,137 $ 227,013 $ 515,867 $ 851,431 Calculation of EBITDA, EBITDAre and Adjusted EBITDAre (dollars in thousands) See accompanying notes on page 11. RETURN TO TABLE OF CONTENTS

Supplemental Q4 2020 11 (1) As of December 31, 2020, we owned 310 hotels; 305 of these hotels were managed by hotel operating companies. We have entered into an agreement to sell five hotels and we have entered into a short term lease with the buyer in anticipation of the sale. Our consolidated statements of income (loss) include hotel operating revenues and expenses of managed hotels and rental income from our leased hotels. (2) When managers of our hotels are required to fund the shortfalls of minimum returns under the terms of our management agreements or their guarantees, we reflect such fundings (including security deposit applications) in our consolidated statements of income (loss) as a reduction of hotel operating expenses. The net reduction to hotel operating expenses was $13,387 and $15,907 for the three months ended December 31, 2020 and 2019, respectively, and $235,522 and $29,162 for the year ended December 31, 2020 and 2019, respectively. (3) We reduced rental income by $416 and $3,351 for the three months ended December 31, 2020 and 2019, respectively, and reduced rental income by $714 and $10,719 for the years ended December 31, 2020 and 2019, respectively, to record scheduled rent changes under certain of our leases, the deferred rent obligations under our leases with TA and the estimated future payments to us under our leases with TA for the cost of removing underground storage tanks on a straight-line basis. (4) Various percentages of total sales at certain of our hotels are escrowed as reserves for future renovations or refurbishments, or FF&E reserve escrows. We own all the FF&E reserve escrows for our hotels. We report deposits by our tenants into the escrow accounts under our hotel leases as FF&E reserve income. We do not report the amounts which are escrowed as FF&E reserves for our managed hotels as FF&E reserve income. (5) Transaction related costs represents costs related to exploration of possible financing transactions. (6) We recorded a $254 loss on asset impairment during the three months ended December 31, 2020 to reduce the carrying value of five net lease properties to their estimated fair value. We recorded a $55,756 loss on asset impairment during the year ended December 31, 2020 to reduce the carrying value of 18 hotels and 13 net lease properties to their estimated fair value. We recorded a $39,296 loss on asset impairment during the three months and year ended December 31, 2019 to reduce the carrying value of 19 net lease properties to their estimated fair value less costs to sell and two hotels to their estimated fair value. (7) We recorded an $11,916 net gain on sale of real estate during the three months ended December 31, 2020 in connection with the sales of 18 hotels and six net lease properties. We recorded a $2,261 net gain on sale of real estate during the year ended December 31, 2020 in connection with the sales of 18 hotels and 21 net lease properties. We recorded a $159,535 gain on sale of real estate during the year ended December 31, 2019 in connection with the sale of 20 travel centers. (8) Unrealized gains (losses) on equity securities, net represents the adjustment required to adjust the carrying value of our former investment in RMR Inc. common stock and our investment in TA common shares to their fair value. We sold our RMR Inc. shares in July 2019. (9) We recorded a $62,386 gain on insurance settlement during the year ended December 31, 2020 for insurance proceeds received for our leased hotel in San Juan, PR related to Hurricane Maria. Under GAAP, we are required to increase the building basis of our San Juan hotel for the amount of the insurance proceeds. We also recorded a $13,850 deferred tax liability as a result of the book value to tax basis difference related to this accounting in the year ended December 31, 2020. (10) We recorded a loss of $2,424 and $6,970 during the quarters ended December 31, 2020 and June 30, 2020, respectively, on extinguishment of debt relating to our repayment of our $400 million term loan and certain unsecured senior notes. We recorded a $8,451 loss on early extinguishment of debt in the year ended December 31, 2019 related to the termination of a term loan commitment we arranged in connection with the acquisition of a net lease portfolio. (11) Represents our proportionate share of our equity investment in Sonesta during the three months and year ended December 31, 2020 and Affiliates Insurance Company during the three months and year ended December 31, 2019. (12) Hotel operating expenses for the three months and year ended December 31, 2020 includes a $3,962 loss contingency related to a litigation matter at certain hotels. We recorded a $1,997 loss contingency during the three months ended December 31, 2019 for an expected settlement of a historical pension withdrawal liability for a hotel we rebranded. (13) Hotel operating expenses for the three months and year ended December 31, 2020 includes $15,100 of hotel manager transition related costs resulting from the rebranding of 112 hotels during the periods. (14) Amounts represent the equity compensation for our Trustees, officers and certain other employees of our manager. (15) We are amortizing a liability we recorded for the fair value of our initial investment in Sonesta as a reduction to hotel operating expenses in our consolidated statements of income (loss). We reduced hotel operating expenses by $621 and $2,070 for the three months and year ended December 31, 2020, respectively, for this liability. Notes to Consolidated Statements of Income (Loss) and Calculations of FFO, Normalized FFO, EBITDA, EBITDAre, Adjusted EBITDAre, Hotel EBITDA and Adjusted Hotel EBITDA (dollar in thousands, except share data) RETURN TO TABLE OF CONTENTS

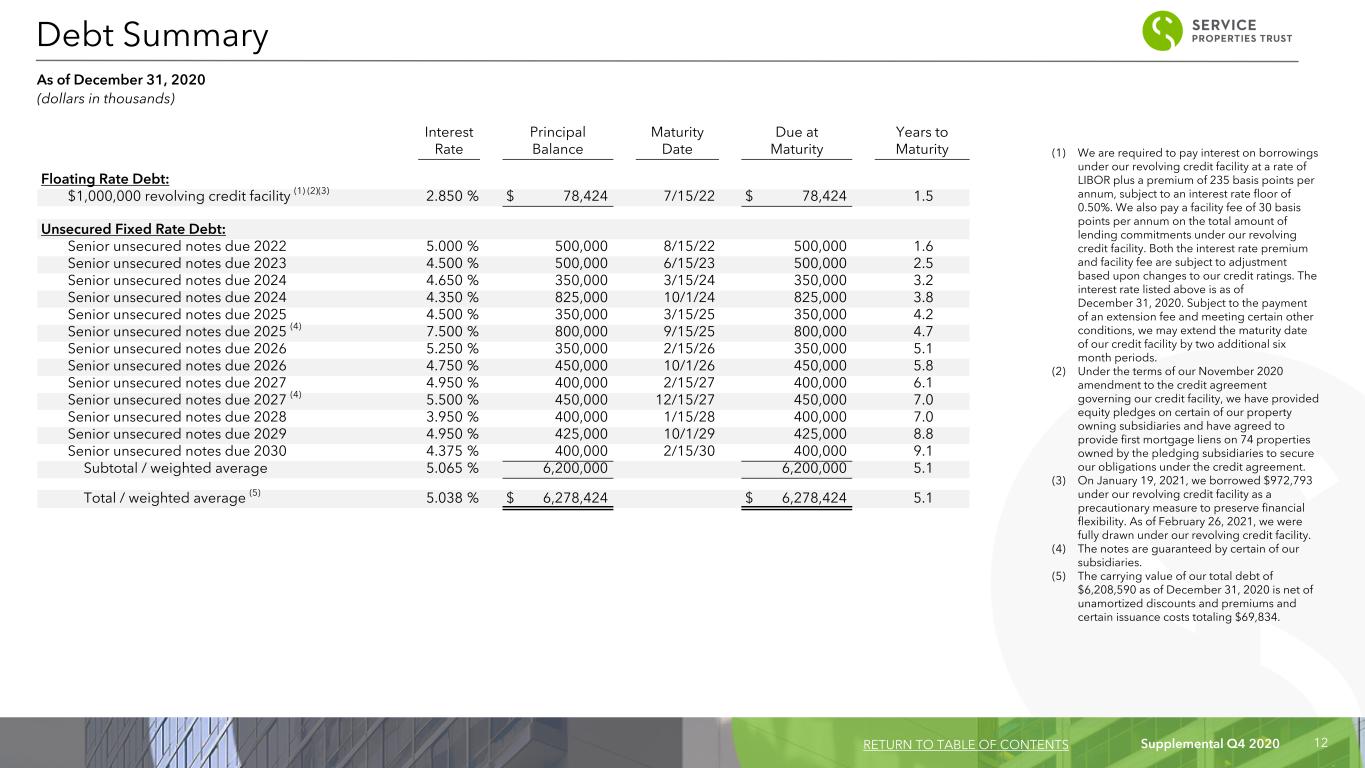

Supplemental Q4 2020 12 (1) We are required to pay interest on borrowings under our revolving credit facility at a rate of LIBOR plus a premium of 235 basis points per annum, subject to an interest rate floor of 0.50%. We also pay a facility fee of 30 basis points per annum on the total amount of lending commitments under our revolving credit facility. Both the interest rate premium and facility fee are subject to adjustment based upon changes to our credit ratings. The interest rate listed above is as of December 31, 2020. Subject to the payment of an extension fee and meeting certain other conditions, we may extend the maturity date of our credit facility by two additional six month periods. (2) Under the terms of our November 2020 amendment to the credit agreement governing our credit facility, we have provided equity pledges on certain of our property owning subsidiaries and have agreed to provide first mortgage liens on 74 properties owned by the pledging subsidiaries to secure our obligations under the credit agreement. (3) On January 19, 2021, we borrowed $972,793 under our revolving credit facility as a precautionary measure to preserve financial flexibility. As of February 26, 2021, we were fully drawn under our revolving credit facility. (4) The notes are guaranteed by certain of our subsidiaries. (5) The carrying value of our total debt of $6,208,590 as of December 31, 2020 is net of unamortized discounts and premiums and certain issuance costs totaling $69,834. Interest Principal Maturity Due at Years to Rate Balance Date Maturity Maturity Floating Rate Debt: $1,000,000 revolving credit facility (1) (2)(3) 2.850 % $ 78,424 7/15/22 $ 78,424 1.5 Unsecured Fixed Rate Debt: Senior unsecured notes due 2022 5.000 % 500,000 8/15/22 500,000 1.6 Senior unsecured notes due 2023 4.500 % 500,000 6/15/23 500,000 2.5 Senior unsecured notes due 2024 4.650 % 350,000 3/15/24 350,000 3.2 Senior unsecured notes due 2024 4.350 % 825,000 10/1/24 825,000 3.8 Senior unsecured notes due 2025 4.500 % 350,000 3/15/25 350,000 4.2 Senior unsecured notes due 2025 (4) 7.500 % 800,000 9/15/25 800,000 4.7 Senior unsecured notes due 2026 5.250 % 350,000 2/15/26 350,000 5.1 Senior unsecured notes due 2026 4.750 % 450,000 10/1/26 450,000 5.8 Senior unsecured notes due 2027 4.950 % 400,000 2/15/27 400,000 6.1 Senior unsecured notes due 2027 (4) 5.500 % 450,000 12/15/27 450,000 7.0 Senior unsecured notes due 2028 3.950 % 400,000 1/15/28 400,000 7.0 Senior unsecured notes due 2029 4.950 % 425,000 10/1/29 425,000 8.8 Senior unsecured notes due 2030 4.375 % 400,000 2/15/30 400,000 9.1 Subtotal / weighted average 5.065 % 6,200,000 6,200,000 5.1 Total / weighted average (5) 5.038 % $ 6,278,424 $ 6,278,424 5.1 Debt Summary As of December 31, 2020 (dollars in thousands) RETURN TO TABLE OF CONTENTS

Supplemental Q4 2020 13 (1) Represents amounts outstanding under our $1.0 billion revolving credit facility at December 31, 2020. (2) On January 19, 2021, we borrowed $972.8 million under our revolving credit facility as a precautionary measure to preserve financial flexibility. As of February 26, 2021, we were fully drawn under our revolving credit facility. $78 Debt Maturity Schedule As of December 31, 2020 RETURN TO TABLE OF CONTENTS (1) (2)

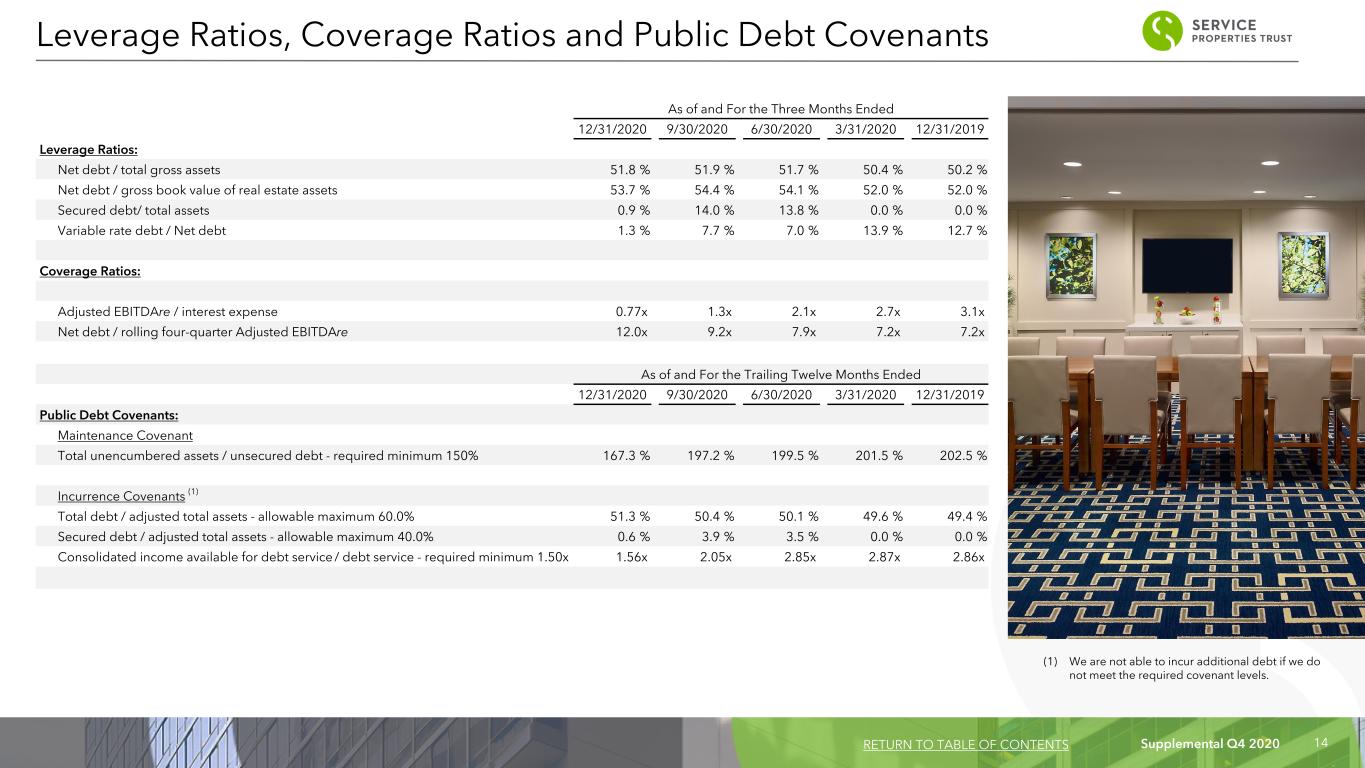

Supplemental Q4 2020 14 As of and For the Three Months Ended 12/31/2020 9/30/2020 6/30/2020 3/31/2020 12/31/2019 Leverage Ratios: Net debt / total gross assets 51.8 % 51.9 % 51.7 % 50.4 % 50.2 % Net debt / gross book value of real estate assets 53.7 % 54.4 % 54.1 % 52.0 % 52.0 % Secured debt/ total assets 0.9 % 14.0 % 13.8 % 0.0 % 0.0 % Variable rate debt / Net debt 1.3 % 7.7 % 7.0 % 13.9 % 12.7 % Coverage Ratios: Adjusted EBITDAre / interest expense 0.77x 1.3x 2.1x 2.7x 3.1x Net debt / rolling four-quarter Adjusted EBITDAre 12.0x 9.2x 7.9x 7.2x 7.2x As of and For the Trailing Twelve Months Ended 12/31/2020 9/30/2020 6/30/2020 3/31/2020 12/31/2019 Public Debt Covenants: Maintenance Covenant Total unencumbered assets / unsecured debt - required minimum 150% 167.3 % 197.2 % 199.5 % 201.5 % 202.5 % Incurrence Covenants (1) Total debt / adjusted total assets - allowable maximum 60.0% 51.3 % 50.4 % 50.1 % 49.6 % 49.4 % Secured debt / adjusted total assets - allowable maximum 40.0% 0.6 % 3.9 % 3.5 % 0.0 % 0.0 % Consolidated income available for debt service / debt service - required minimum 1.50x 1.56x 2.05x 2.85x 2.87x 2.86x Leverage Ratios, Coverage Ratios and Public Debt Covenants RETURN TO TABLE OF CONTENTS (1) We are not able to incur additional debt if we do not meet the required covenant levels.

Supplemental Q4 2020 15 Capital Expenditures For the Three Months Ended 12/31/2020 9/30/2020 6/30/2020 3/31/2020 12/31/2019 Hotel capital improvements & FF&E Reserve fundings (1) $ 32,153 $ 29,874 $ 39,085 $ 35,015 $ 119,380 Net lease capital improvements 265 18 221 4,179 2,295 Total capital improvements & FF&E Reserve fundings $ 32,418 $ 29,892 $ 39,306 $ 39,194 $ 121,675 Restricted Cash As of and For the Three Months Ended 12/31/2020 9/30/2020 6/30/2020 3/31/2020 12/31/2019 Total restricted cash (beginning of period) $ 38,130 $ 29,652 $ 44,537 $ 53,626 $ 53,519 Manager deposits into FF&E Reserve 2,782 18,735 — 18,806 18,100 SVC fundings into FF&E Reserve: IHG — — 3,900 — 25,100 Marriott 15,400 21,500 28,600 5,800 10,877 Radisson 1,985 — — — — Hotel improvements funded from FF&E Reserves (26,269) (31,757) (47,385) (48,695) (53,970) FF&E reserves (end of period) 32,028 38,130 29,652 29,537 53,626 Hotel manager deposit (withdrawal) of insurance proceeds (13,904) — — 15,000 — Total restricted cash (end of period) $ 18,124 $ 38,130 $ 29,652 $ 44,537 $ 53,626 (1) Includes amounts we funded into our FF&E reserves and amounts directly reimbursed to our hotel managers for capital expenditures. (dollars in thousands) Capital Expenditures and Restricted Cash Activity RETURN TO TABLE OF CONTENTS

Supplemental Q4 2020 16 ACQUISITIONS: Square Footage Purchase Price (1) Average Purchase Price per Room or Suite / Square FootDate Acquired Properties Brand Location Operating Agreement 3/12/2020 3 Taco Bell Various 6,696 AG Bells LLC $ 7,071 $ 1,056 DISPOSITIONS: Rooms or Suites/ Square Footage Former Operating Agreement Average Sales Price per Room or Suite / Square FootDate Disposed Properties Brand Location Sales Price (1) 01/28/2020 1 Vacant Gothenburg, NE 31,978 Vacant $ 585 $ 18 02/06/2020 1 Vacant Rochester, MN 90,503 Vacant 2,600 29 02/13/2020 1 Vacant Ainsworth, NE 32,901 Vacant 775 24 02/14/2020 1 Vacant Dekalb, IL 5,052 Vacant 1,050 208 03/02/2020 1 HOM Furniture, Inc. Eau Claire, MI 98,824 HOM Furniture, Inc. 2,600 26 03/28/2020 1 Vacant Stillwater, OK 33,018 Vacant 400 12 05/26/2020 1 Vacant Pawtucket, RI 22,027 Vacant 1,610 73 05/28/2020 1 Destination XL Group, Inc. Canton, MA 755,992 Destination XL Group, Inc. 51,000 67 05/28/2020 1 Vacant Phoenix, AZ 29,434 Vacant 2,900 99 06/25/2020 1 Vacant Bellefontaine, OH 2,267 Vacant 440 194 07/17/2020 1 Pizza Hut Clinton, MD 2,935 ADF Midatlantic LLC 700 239 08/20/2020 1 Pizza Hut Lancaster, PA 3,014 Chaac Pizza Northeast, LLC 775 257 08/26/2020 1 Vacant Baton Rouge, LA 2,334 Vacant 750 321 08/26/2020 1 Vacant Winston-Salem, NC 32,816 Vacant 1,300 40 09/17/2020 1 Vacant Hillard, OH 5,316 Vacant 2,350 442 10/06/2020 1 Vacant Cabot, AR 18,165 Vacant 550 30 10/08/2020 1 The Forge Bar and Grill Lander, WY 8,900 The Forge Bar and Grill 350 39 11/02/2020 1 Vacant Raleigh, NC 55,558 Vacant 3,900 70 11/18/2020 8 TownePlace Suites Various 834 Marriott 44,800 54 12/15/2020 1 Pizza Hut Fredrick, MD 3,000 Chaac Pizza 800 267 12/22/2020 1 Vacant O'Neill, NE 31,374 Vacant 850 27 12/29/2020 10 Hawthorne Suites Various 1,212 Wyndham 40,987 34 12/30/2020 1 Vacant Morrisville, PA 110,075 Vacant 12,100 110 39 2,046 /1,375,483 $ 174,172 $42 /$64 Property Acquisitions and Dispositions Information Since January 1, 2020 (dollars in thousands, except per room and per sq. ft. data) (1) Represents cash purchase or sale price and excludes acquisition and closing related costs, respectively. RETURN TO TABLE OF CONTENTS

Supplemental Q4 2020 17 Number of Properties Hotel Properties 310 Number of hotel rooms 49,014 Net Lease Properties 799 Square feet 13,455,405 Total Properties 1,109 Average hotel property size 158 rooms Average net lease property size 16,840 sq. feet Investments Diversification Facts Hotels $ 6,961,748 Tenants/Operators 177 Net Lease Properties 5,157,426 Brands 142 Total Investments $ 12,119,174 Industries 23 States 47 (37 States, DC, PR, ON) Portfolio Summary As of December 31, 2020 (dollars in thousands) RETURN TO TABLE OF CONTENTS (1) Based on investment (1) (1)

Supplemental Q4 2020 18 Brand Affiliation Segment Number of Properties Percent of Total Number of Properties Number of Rooms or Suites (Hotels) / Square Footage (Net Lease) Percent of Total Number of Rooms or Suites (Hotels) / Square Footage (Net Lease) Investment (1) Percent of Total Investment Investment Per Room / SF Sonesta Hotels 168 15.1 % 28,325 57.7 % $ 4,498,559 37.1 % $ 159 TravelCenters of America Net Lease 134 12.1 % 3,720,693 27.7 % 2,281,589 18.8 % 613 Marriott Hotels 105 9.5 % 15,101 30.7 % 1,721,763 14.2 % 114 Petro Stopping Centers Net Lease 45 4.1 % 1,470,004 10.9 % 1,021,226 8.4 % 695 Hyatt Hotels 22 2.0 % 2,724 5.6 % 301,942 2.5 % 111 Radisson Hotels 9 0.8 % 1,939 4.0 % 291,123 2.4 % 150 IHG Hotels 1 0.1 % 495 1.0 % 123,283 1.0 % 249 AMC Theatres Net Lease 11 1.0 % 575,967 4.3 % 102,580 0.8 % 178 The Great Escape Net Lease 14 1.3 % 542,666 4.0 % 98,242 0.8 % 181 Life Time Fitness Net Lease 3 0.3 % 420,335 3.1 % 92,617 0.8 % 220 Buehler's Fresh Foods Net Lease 5 0.5 % 502,727 3.7 % 76,536 0.6 % 152 Heartland Dental Net Lease 59 5.3 % 234,274 1.7 % 61,120 0.5 % 261 Pizza Hut Net Lease 58 5.2 % 189,609 1.4 % 58,312 0.5 % 308 Regal Cinemas Net Lease 6 0.5 % 266,546 2.0 % 44,476 0.4 % 167 Express Oil Change Net Lease 23 2.1 % 83,825 0.6 % 49,724 0.4 % 593 Other (2) Net Lease 446 40.1 % 5,449,189 41.6 % 1,296,082 10.8 % 238 Total/Average 1,109 100.0 % 49,014/13,455,405 100%/100% $ 12,119,174 100.0 % $142,036 /$383 (1) Includes five hotels with 430 rooms, with an aggregate carrying value of $10,699 classified as held for sale and six net lease properties with 46,799 square feet with an aggregate carrying value of $2,844 classified as held for sale. (2) Consists of 117 distinct brands with an average investment of $10,863. Consolidated Portfolio by Brand Affiliation As of December 31, 2020 (Amounts in thousands) RETURN TO TABLE OF CONTENTS

Supplemental Q4 2020 19 Industry No. of Properties Rooms/ Square Footage Investments (1) Percent of Total Investment 1. Hotels 310 49,014 $ 6,961,748 57.4% 2. Travel Centers 182 5,238,765 3,344,496 27.6% 3. Restaurants-Quick Service 239 743,933 319,335 2.6% 4. Restaurants-Casual Dining 56 391,163 198,932 1.7% 5. Health and Fitness 14 870,841 189,215 1.6% 6. Movie Theaters 20 1,047,804 168,970 1.4% 7. Grocery 19 1,020,819 129,219 1.1% 8. Medical/Dental Office 72 409,706 118,098 1.0% 9. Miscellaneous Retail 19 598,731 114,433 0.9% 10. Automotive Parts and Service 63 210,152 96,496 0.8% 11. Automotive Dealers 9 172,251 64,756 0.5% 12. Entertainment 4 199,853 61,436 0.5% 13. Sporting Goods 3 331,864 52,022 0.4% 14. Educational Services 8 169,074 41,012 0.3% 15. Miscellaneous Manufacturing 6 758,146 31,824 0.3% 16. Building Materials 27 430,164 30,036 0.2% 17. Car Washes 5 41,456 28,658 0.2% 18. Drug Stores and Pharmacies 8 82,543 23,970 0.2% 19. Home Furnishings 3 96,388 12,946 0.1% 20. Legal Services 5 25,429 11,362 0.1% 21. Apparel 1 89,305 11,027 0.1% 22. General Merchandise 3 99,233 7,492 0.1% 23. Dollar Stores 3 27,593 2,971 —% 24. Other 12 252,834 56,218 0.5% 25. Vacant 18 147,358 42,502 0.4% Total 1,109 49,014 /13,455,405 $ 12,119,174 100.0% (1) Includes five hotels with 430 rooms, with an aggregate carrying value of $10,699 classified as held for sale and six net lease properties with 46,799 square feet with an aggregate carrying value of $2,844 classified as held for sale. Consolidated Portfolio Diversification by Industry As of December 31, 2020 (Amounts in thousands) RETURN TO TABLE OF CONTENTS

Supplemental Q4 2020 20 Brand Service Level Chain Scale Number of Hotels Percent of Total Number of Hotels Number of Rooms or Suites Percent of Total Number of Rooms or Suites Investment (1) Percent of Total Hotel Investment Investment Per Room or Suite Royal Sonesta Hotels® Full Service Luxury 15 4.8 % 4,947 10.1 % $ 1,632,669 23.5 % $ 330 Sonesta Hotels & Resorts® Full Service Upper Upscale 23 7.4 % 7,349 15.0 % 1,132,146 16.3 % 154 Sonesta ES Suites® Extended Stay Upscale 60 19.4 % 7,326 14.9 % 1,016,111 14.6 % 139 Courtyard by Marriott® Select Service Upscale 62 20.1 % 9,115 18.7 % 933,621 13.3 % 102 Simply Suites Extended Stay Midscale 61 19.7 % 7,553 15.4 % 606,899 8.7 % 80 Residence Inn by Marriott® Extended Stay Upscale 35 11.3 % 4,488 9.2 % 577,640 8.3 % 129 Hyatt Place® Select Service Upscale 22 7.1 % 2,724 5.6 % 301,942 4.3 % 111 Radisson® Hotels & Resorts Full Service Upscale 5 1.6 % 1,149 2.3 % 159,707 2.3 % 139 Marriott® Hotel Full Service Upper Upscale 2 0.6 % 748 1.5 % 132,928 1.9 % 178 Crowne Plaza® Full Service Upscale 1 0.3 % 495 1.0 % 123,283 1.8 % 249 Sonesta Select Select Service Upscale 9 2.9 % 1,150 2.3 % 110,734 1.6 % 96 Radisson Blu® Full Service Upper Upscale 1 0.3 % 360 0.7 % 77,340 1.1 % 215 Country Inns & Suites® by Radisson Full Service Upper Midscale 3 1.0 % 430 0.9 % 54,076 0.8 % 126 TownePlace Suites by Marriott® Extended Stay Upper Midscale 4 1.3 % 487 1.0 % 50,579 0.7 % 104 SpringHill Suites by Marriott® Select Service Upscale 2 0.6 % 263 0.5 % 26,995 0.4 % 103 Other (2) 5 1.6 % 430 0.9 % 25,078 0.4 % 58 Total/Average Hotels 310 100.0 % 49,014 100.0 % $ 6,961,748 100.0 % $ 142 (1) Includes five hotels with 430 rooms, with an aggregate carrying value of $10,699 classified as held for sale. (2) We have entered into an agreement to sell five hotels and we have entered a short-term lease of these properties with the buyer in anticipation of the sale. Hotel Portfolio by Brand As of December 31, 2020 (dollars in thousands) RETURN TO TABLE OF CONTENTS

Supplemental Q4 2020 21 All operating data presented are based upon the operating results provided by our managers and tenants for the indicated periods. We have not independently verified our managers' or tenants' operating data. (1) Includes operating data for periods prior to when certain hotels were managed by Sonesta. (2) We have entered into an agreement to sell five hotels and we have entered a short- term lease of these properties with the buyer in anticipation of the sale. Occupancy ADR RevPAR No. of Hotels No. of Rooms or Suites Three Months Ended December 31, Three Months Ended December 31, Three Months Ended December 31, Brand Service Level 2020 2019 Change 2020 2019 Change 2020 2019 Change Sonesta (1) Full Service 22 7,130 26.2 % 71.2 % (45.0) pts $ 105.27 $ 129.12 (18.5) % $ 27.58 $ 91.93 (70.0) % Royal Sonesta (1) Full Service 11 3,531 17.8 % 73.3 % (55.5) pts 130.93 197.46 (33.7) % 23.31 144.74 (83.9) % Radisson Hotel Full Service 5 1,149 28.4 % 71.3 % (42.9) pts 88.13 121.51 (27.5) % 25.03 86.64 (71.1) % Crowne Plaza Full Service 1 495 31.9 % 46.0 % (14.1) pts 87.10 135.61 (35.8) % 27.78 62.38 (55.5) % Country Inn and Suites Full Service 3 430 23.5 % 60.8 % (37.3) pts 83.86 111.99 (25.1) % 19.71 68.09 (71.1) % Marriott Hotel Full Service 1 392 34.5 % 78.8 % (44.3) pts 111.11 159.33 (30.3) % 38.33 125.55 (69.5) % Radisson Blu Full Service 1 360 13.1 % 69.7 % (56.6) pts 89.06 146.19 (39.1) % 11.67 101.89 (88.6) % Full Service Total / Average 44 13,487 24.2 % 70.7 % (46.5) pts 106.97 148.14 (27.8) % 25.89 104.73 (75.3) % Courtyard Select Service 62 9,115 31.7 % 65.5 % (33.8) pts 89.97 132.78 (32.2) % 28.52 86.97 (67.2) % Hyatt Place Select Service 22 2,724 44.0 % 72.5 % (28.5) pts 80.42 103.08 (22.0) % 35.38 74.73 (52.7) % Sonesta Select (1) Select Service 9 1,150 22.7 % 65.4 % (42.7) pts 76.71 100.16 (23.4) % 17.41 65.50 (73.4) % SpringHill Suites Select Service 2 263 27.6 % 60.2 % (32.6) pts 87.21 130.28 (33.1) % 24.07 78.43 (69.3) % Select Service Total / Average 95 13,252 33.4 % 66.8 % (33.4) pts 86.56 123.34 (29.8) % 28.91 82.39 (64.9) % Sonesta ES Suites (1) Extended Stay 60 7,326 57.1 % 69.0 % (11.9) pts 85.79 116.61 (26.4) % 48.99 80.46 (39.1) % Simply Suites (1) Extended Stay 59 7,309 59.0 % 74.6 % (15.6) pts 62.80 81.25 (22.7) % 37.05 60.61 (38.9) % Residence Inn Extended Stay 35 4,488 51.1 % 70.6 % (19.5) pts 108.06 133.73 (19.2) % 55.22 94.41 (41.5) % TownePlace Suites Extended Stay 4 487 43.0 % 70.3 % (27.3) pts 93.34 114.87 (18.7) % 40.14 80.75 (50.3) % Other (2) Extended Stay 5 430 51.3 % 73.1 % (21.8) pts 57.35 70.48 (18.6) % 29.42 51.52 (42.9) % Extended Stay Total / Average 163 20,040 56.0 % 71.5 % (15.5) pts 81.08 105.88 (23.4) % 45.40 75.70 (40.0) % 302 46,779 40.4 % 69.9 % (29.5) pts $ 86.84 $ 122.93 (29.4) % $ 35.08 $ 85.93 (59.2) % Hotel Operating Statistics by Service Level - Comparable Hotels RETURN TO TABLE OF CONTENTS

Supplemental Q4 2020 22 All operating data presented are based upon the operating results provided by our managers and tenants for the indicated periods. We have not independently verified our managers' or tenants' operating data. (1) Includes operating data for periods prior to when certain hotels were managed by Sonesta. (2) We have entered into an agreement to sell five hotels and we have entered a short-term lease of these properties with the buyer in anticipation of the sale. No. of Hotels No. of Rooms or Suites Occupancy ADR RevPAR Three Months Ended December 31, Three Months Ended December 31, Three Months Ended December 31, Brand Service Level 2020 2019 Change 2020 2019 Change 2020 2019 Change Sonesta (1) Full Service 23 7,349 26.2 % 71.5 % (45.3) pts $ 105.27 $ 129.65 (18.8) % $ 27.58 $ 92.70 (70.2) % Royal Sonesta (1) Full Service 15 4,947 18.0 % 62.4 % (44.4) pts 133.67 197.01 (32.2) % 24.06 122.93 (80.4) % Radisson Hotel Full Service 5 1,149 28.4 % 71.3 % (42.9) pts 88.13 121.51 (27.5) % 25.03 86.64 (71.1) % Marriott Hotel Full Service 2 748 23.9 % 82.3 % (58.4) pts 144.72 229.80 (37.0) % 34.59 189.13 (81.7) % Crowne Plaza Full Service 1 495 31.9 % 46.0 % (14.1) pts 87.10 135.61 (35.8) % 27.78 62.38 (55.5) % Country Inn and Suites Full Service 3 430 23.5 % 60.8 % (37.3) pts 83.86 111.99 (25.1) % 19.71 68.09 (71.1) % Radisson Blu Full Service 1 360 13.1 % 69.7 % (56.6) pts 89.06 146.19 (39.1) % 11.67 101.89 (88.6) % Full Service Total / Average 50 15,478 23.4 % 67.9 % (44.5) pts 113.43 155.50 (27.1) % 26.02 105.13 (75.2) % Courtyard Select Service 62 9,115 31.7 % 65.5 % (33.8) pts 89.97 132.78 (32.2) % 28.52 86.97 (67.2) % Hyatt Place Select Service 22 2,724 44.0 % 72.5 % (28.5) pts 80.42 103.08 (22.0) % 35.38 74.73 (52.7) % Sonesta Select (1) Select Service 9 1,150 22.7 % 65.4 % (42.7) pts 76.71 100.16 (23.4) % 17.41 65.50 (73.4) % SpringHill Suites Select Service 2 263 27.6 % 60.2 % (32.6) pts 87.21 130.28 (33.1) % 24.07 78.43 (69.3) % Select Service Total / Average 95 13,252 33.4 % 66.8 % (33.4) pts 86.56 123.34 29.8 % 28.91 82.39 (64.9) % Simply Suites (1) Extended Stay 61 7,553 59.0 % 72.5 % (13.5) pts 62.54 81.18 (23.0) % 36.90 58.86 (37.3) % Sonesta ES Suites (1) Extended Stay 60 7,326 57.1 % 69.0 % (11.9) pts 85.79 116.61 (26.4) % 48.99 80.46 (39.1) % Residence Inn Extended Stay 35 4,488 51.1 % 70.6 % (19.5) pts 108.06 133.73 (19.2) % 55.22 94.41 (41.5) % TownePlace Suites Extended Stay 4 487 43.0 % 70.3 % (27.3) pts 93.34 114.87 (18.7) % 40.14 80.75 (50.3) % Other (2) Extended Stay 5 430 51.3 % 73.1 % (21.8) pts 57.35 70.48 (18.6) % 29.42 51.52 (42.9) % Extended Stay Total / Average 165 20,284 56.0 % 71.5 % (15.5) pts 81.08 105.88 (23.4) % 45.40 75.70 (40.0) % 310 49,014 39.8 % 68.8 % (29.0) pts $ 87.53 $ 125.61 (30.3) % $ 34.84 $ 86.42 (59.7) % Hotel Operating Statistics by Service Level - All Hotels RETURN TO TABLE OF CONTENTS

Supplemental Q4 2020 23 (dollars in thousands) For the Three Months Ended For the Year Ended 12/31/2020 9/30/2020 6/30/2020 3/31/2020 12/31/2019 12/31/2020 12/31/2019 Number of hotels 302 302 302 302 302 285 285 Room revenues $ 150,857 $ 172,950 $ 103,736 $ 295,503 $ 369,818 $ 662,714 $ 1,365,349 Food and beverage revenues 7,484 6,554 2,351 42,135 59,329 40,188 143,181 Other revenues 8,647 11,220 5,541 13,004 14,511 27,435 41,818 Hotel operating revenues - comparable hotels 166,988 190,724 111,628 350,642 443,658 730,337 1,550,348 Rooms expenses 56,529 55,775 41,198 95,456 106,120 222,959 370,426 Food and beverage expenses 9,241 9,219 6,762 37,158 44,618 41,313 108,269 Other direct and indirect expenses 107,844 94,238 76,188 139,896 148,369 363,801 507,672 Management fees 2,214 1,709 968 2,646 3,390 5,759 8,359 Real estate taxes, insurance and other 27,066 26,352 26,922 27,822 26,263 90,319 89,204 FF&E reserves (4) 390 262 3 9,992 16,034 10,270 66,272 Hotel operating expenses - comparable hotels 203,284 187,555 152,041 312,970 344,794 734,421 1,150,202 Hotel EBITDA $ (36,296) $ 3,169 $ (40,413) $ 37,672 $ 98,864 $ (4,084) $ 400,146 Loss contingency (12) 3,962 — — — — 3,962 — Hotel manager transition costs (13) 14,212 — — — — 12,743 — Adjusted Hotel EBITDA $ (18,122) $ 3,169 $ (40,413) $ 37,672 $ 98,864 $ 12,621 $ 400,146 Adjusted Hotel EBITDA Margin (11) % 2 % (36) % 11 % 22 % 2 % 26 % Hotel operating revenues (GAAP) (1) $ 174,520 $ 199,719 $ 117,356 $ 383,503 $ 467,805 $ 875,098 $ 1,989,173 Hotel operating revenues from non-comparable hotels (7,532) (8,995) (5,728) (32,861) (24,147) (144,761) (438,825) Hotel operating revenues - comparable hotels $ 166,988 $ 190,724 $ 111,628 $ 350,642 $ 443,658 $ 730,337 $ 1,550,348 Hotel operating expenses (GAAP) (1) $ 204,998 $ 174,801 $ 46,957 $ 271,148 $ 334,916 $ 697,904 $ 1,410,927 Add (less) Hotel operating expenses from non-comparable hotels (16,112) (18,603) (16,695) (39,833) (25,169) (211,345) (345,157) Reduction for security deposit and guaranty fundings, net 13,387 30,474 121,155 70,506 15,907 235,522 29,162 Management and incentive management fees paid from cashflows in excess of minimum returns and rents — — — — 3,106 — (11,002) FF&E reserves from managed hotel operations (4) 390 262 3 10,942 16,034 10,270 66,272 Other (15) 621 621 621 207 — 2,070 — Hotel operating expenses - comparable hotels $ 203,284 $ 187,555 $ 152,041 $ 312,970 $ 344,794 $ 734,421 $ 1,150,202 Calculation and Reconciliation of Hotel EBITDA and Adjusted Hotel EBITDA - Comparable Hotels RETURN TO TABLE OF CONTENTS See accompanying notes on page 11.

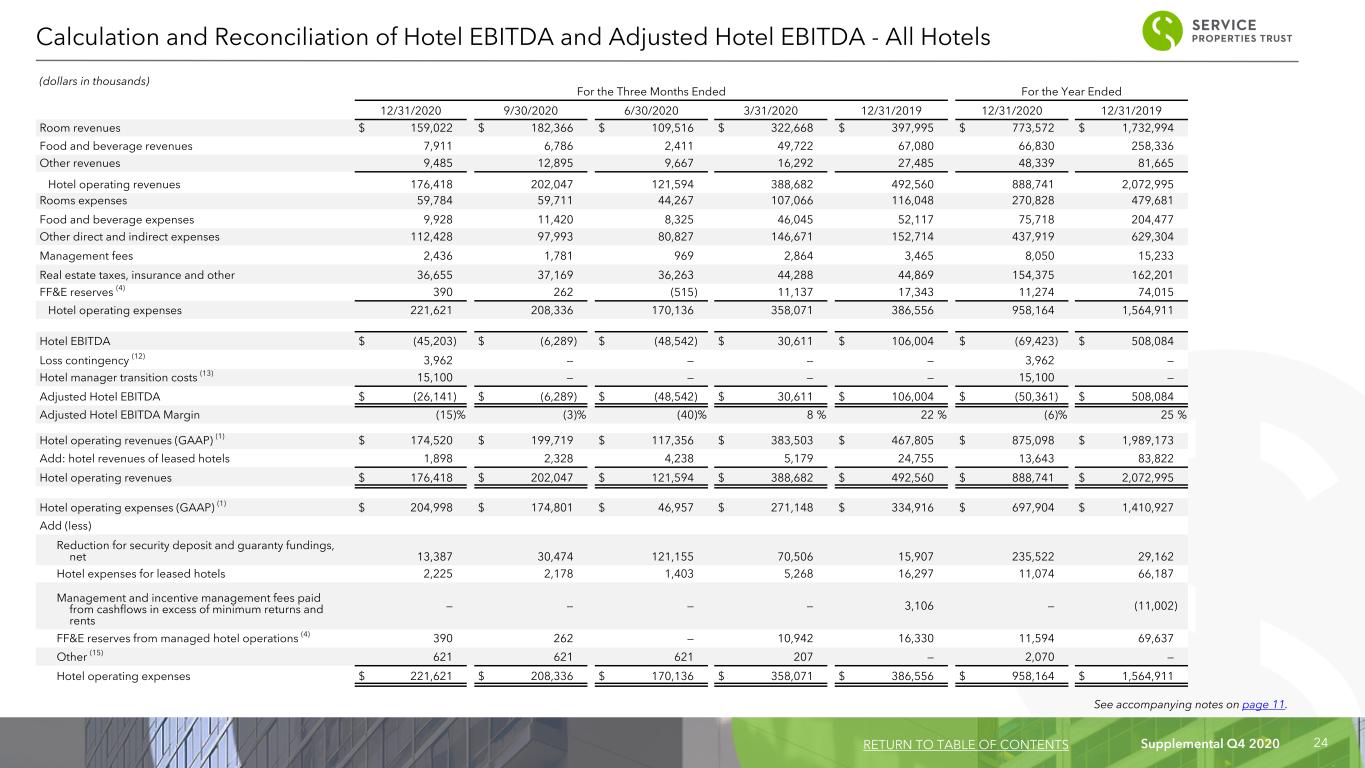

Supplemental Q4 2020 24 (dollars in thousands) For the Three Months Ended For the Year Ended 12/31/2020 9/30/2020 6/30/2020 3/31/2020 12/31/2019 12/31/2020 12/31/2019 Room revenues $ 159,022 $ 182,366 $ 109,516 $ 322,668 $ 397,995 $ 773,572 $ 1,732,994 Food and beverage revenues 7,911 6,786 2,411 49,722 67,080 66,830 258,336 Other revenues 9,485 12,895 9,667 16,292 27,485 48,339 81,665 Hotel operating revenues 176,418 202,047 121,594 388,682 492,560 888,741 2,072,995 Rooms expenses 59,784 59,711 44,267 107,066 116,048 270,828 479,681 Food and beverage expenses 9,928 11,420 8,325 46,045 52,117 75,718 204,477 Other direct and indirect expenses 112,428 97,993 80,827 146,671 152,714 437,919 629,304 Management fees 2,436 1,781 969 2,864 3,465 8,050 15,233 Real estate taxes, insurance and other 36,655 37,169 36,263 44,288 44,869 154,375 162,201 FF&E reserves (4) 390 262 (515) 11,137 17,343 11,274 74,015 Hotel operating expenses 221,621 208,336 170,136 358,071 386,556 958,164 1,564,911 Hotel EBITDA $ (45,203) $ (6,289) $ (48,542) $ 30,611 $ 106,004 $ (69,423) $ 508,084 Loss contingency (12) 3,962 — — — — 3,962 — Hotel manager transition costs (13) 15,100 — — — — 15,100 — Adjusted Hotel EBITDA $ (26,141) $ (6,289) $ (48,542) $ 30,611 $ 106,004 $ (50,361) $ 508,084 Adjusted Hotel EBITDA Margin (15) % (3) % (40) % 8 % 22 % (6) % 25 % Hotel operating revenues (GAAP) (1) $ 174,520 $ 199,719 $ 117,356 $ 383,503 $ 467,805 $ 875,098 $ 1,989,173 Add: hotel revenues of leased hotels 1,898 2,328 4,238 5,179 24,755 13,643 83,822 Hotel operating revenues $ 176,418 $ 202,047 $ 121,594 $ 388,682 $ 492,560 $ 888,741 $ 2,072,995 Hotel operating expenses (GAAP) (1) $ 204,998 $ 174,801 $ 46,957 $ 271,148 $ 334,916 $ 697,904 $ 1,410,927 Add (less) Reduction for security deposit and guaranty fundings, net 13,387 30,474 121,155 70,506 15,907 235,522 29,162 Hotel expenses for leased hotels 2,225 2,178 1,403 5,268 16,297 11,074 66,187 Management and incentive management fees paid from cashflows in excess of minimum returns and rents — — — — 3,106 — (11,002) FF&E reserves from managed hotel operations (4) 390 262 — 10,942 16,330 11,594 69,637 Other (15) 621 621 621 207 — 2,070 — Hotel operating expenses $ 221,621 $ 208,336 $ 170,136 $ 358,071 $ 386,556 $ 958,164 $ 1,564,911 Calculation and Reconciliation of Hotel EBITDA and Adjusted Hotel EBITDA - All Hotels RETURN TO TABLE OF CONTENTS See accompanying notes on page 11.

Supplemental Q4 2020 25 Brand No. of Buildings Square Feet Investment (1) Percent of Total Investment Annualized Minimum Rent (1) Percent of Total Annualized Minimum Rent Coverage 1. TravelCenters of America 134 3,720,693 $ 2,281,589 44.2 % $ 168,011 45.5 % 1.95x 2. Petro Stopping Centers 45 1,470,004 1,021,226 19.8 % 78,099 21.1 % 1.55x 3. AMC Theatres 11 575,967 102,580 2.0 % 6,750 1.8 % 0.46x 4. The Great Escape 14 542,666 98,242 1.9 % 7,140 1.9 % 1.70x 5. Life Time Fitness 3 420,335 92,617 1.8 % 5,770 1.6 % 1.08x 6. Buehler's Fresh Foods 5 502,727 76,536 1.5 % 5,657 1.5 % 4.79x 7. Heartland Dental 59 234,274 61,120 1.2 % 4,493 1.2 % 3.24x 8. Pizza Hut 58 189,609 58,312 1.1 % 3,954 1.1 % 1.42x 9. Express Oil Change 23 83,825 49,724 1.0 % 3,379 0.9 % 4.03x 10. Regal Cinemas 6 266,546 44,476 0.9 % 3,658 1.0 % 0.85x 11. Flying J Travel Plaza 3 48,069 41,681 0.8 % 3,151 0.9 % 3.75x 12. Courthouse Athletic Club 4 193,659 39,688 0.8 % 2,400 0.6 % 0.89x 13. Fleet Farm 1 218,248 37,802 0.7 % 2,622 0.7 % 3.57x 14. Church's Chicken 45 59,523 35,995 0.7 % 2,587 0.7 % 2.02x 15. America's Auto Auction 6 72,338 34,314 0.7 % 2,992 0.8 % 4.85x 16. Burger King 21 68,710 34,289 0.7 % 2,066 0.6 % 1.65x 17. Hardee's 19 62,792 31,844 0.6 % 2,077 0.6 % 0.77x 18. Martin's 16 81,909 31,144 0.6 % 2,080 0.6 % 1.73x 19. Creme de la Creme 4 81,929 29,131 0.6 % 2,429 0.7 % 0.73x 20. Mister Car Wash 5 41,456 28,658 0.6 % 2,086 0.6 % 4.88x 21. Popeye's Chicken & Biscuits 20 45,708 28,434 0.6 % 1,900 0.5 % 3.47x 22. United Supermarkets 6 236,178 26,121 0.5 % 1,686 0.5 % 5.09x 23. Golden Corral 6 60,185 25,816 0.5 % 1,759 0.5 % 0.85x 24. Pike Nursery 5 56,065 16,192 0.3 % 1,752 0.5 % 3.17x 25. Mealey's Furniture 2 95,684 12,952 0.3 % 1,434 0.4 % 0.72x 26. Other (2) 278 4,026,306 816,943 15.6 % 49,661 13.2 % 3.49x Total 799 13,455,405 $ 5,157,426 100.0 % $ 369,593 100.0 % 2.14x (1) Includes six net lease properties with an aggregate carrying value of $2,844 classified as held for sale. (2) Consists of 102 distinct brands with an average investment of $2,939 per building. Net Lease Portfolio by Brand As of December 31, 2020 (dollars in thousands) RETURN TO TABLE OF CONTENTS

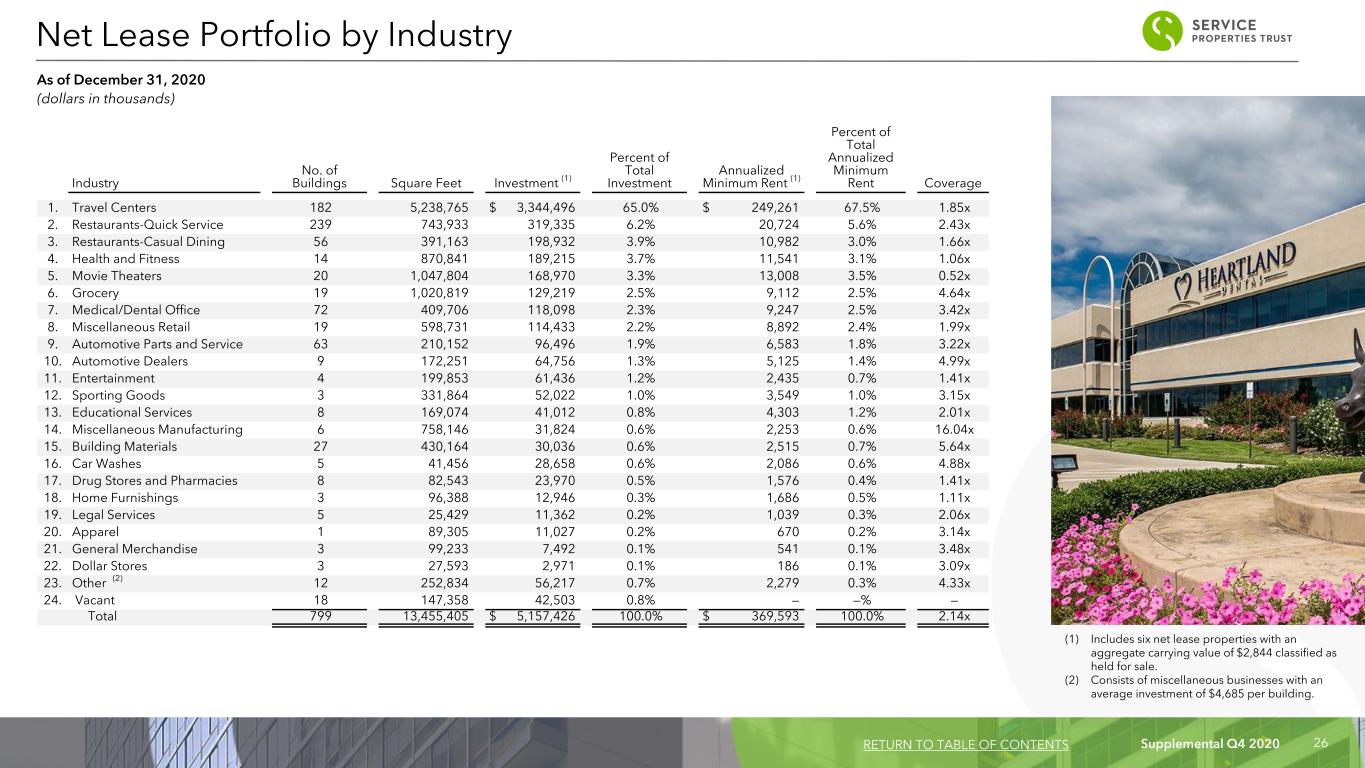

Supplemental Q4 2020 26 Industry No. of Buildings Square Feet Investment (1) Percent of Total Investment Annualized Minimum Rent (1) Percent of Total Annualized Minimum Rent Coverage 1. Travel Centers 182 5,238,765 $ 3,344,496 65.0% $ 249,261 67.5% 1.85x 2. Restaurants-Quick Service 239 743,933 319,335 6.2% 20,724 5.6% 2.43x 3. Restaurants-Casual Dining 56 391,163 198,932 3.9% 10,982 3.0% 1.66x 4. Health and Fitness 14 870,841 189,215 3.7% 11,541 3.1% 1.06x 5. Movie Theaters 20 1,047,804 168,970 3.3% 13,008 3.5% 0.52x 6. Grocery 19 1,020,819 129,219 2.5% 9,112 2.5% 4.64x 7. Medical/Dental Office 72 409,706 118,098 2.3% 9,247 2.5% 3.42x 8. Miscellaneous Retail 19 598,731 114,433 2.2% 8,892 2.4% 1.99x 9. Automotive Parts and Service 63 210,152 96,496 1.9% 6,583 1.8% 3.22x 10. Automotive Dealers 9 172,251 64,756 1.3% 5,125 1.4% 4.99x 11. Entertainment 4 199,853 61,436 1.2% 2,435 0.7% 1.41x 12. Sporting Goods 3 331,864 52,022 1.0% 3,549 1.0% 3.15x 13. Educational Services 8 169,074 41,012 0.8% 4,303 1.2% 2.01x 14. Miscellaneous Manufacturing 6 758,146 31,824 0.6% 2,253 0.6% 16.04x 15. Building Materials 27 430,164 30,036 0.6% 2,515 0.7% 5.64x 16. Car Washes 5 41,456 28,658 0.6% 2,086 0.6% 4.88x 17. Drug Stores and Pharmacies 8 82,543 23,970 0.5% 1,576 0.4% 1.41x 18. Home Furnishings 3 96,388 12,946 0.3% 1,686 0.5% 1.11x 19. Legal Services 5 25,429 11,362 0.2% 1,039 0.3% 2.06x 20. Apparel 1 89,305 11,027 0.2% 670 0.2% 3.14x 21. General Merchandise 3 99,233 7,492 0.1% 541 0.1% 3.48x 22. Dollar Stores 3 27,593 2,971 0.1% 186 0.1% 3.09x 23. Other (2) 12 252,834 56,217 0.7% 2,279 0.3% 4.33x 24. Vacant 18 147,358 42,503 0.8% — —% — Total 799 13,455,405 $ 5,157,426 100.0% $ 369,593 100.0% 2.14x (1) Includes six net lease properties with an aggregate carrying value of $2,844 classified as held for sale. (2) Consists of miscellaneous businesses with an average investment of $4,685 per building. Net Lease Portfolio by Industry As of December 31, 2020 (dollars in thousands) RETURN TO TABLE OF CONTENTS

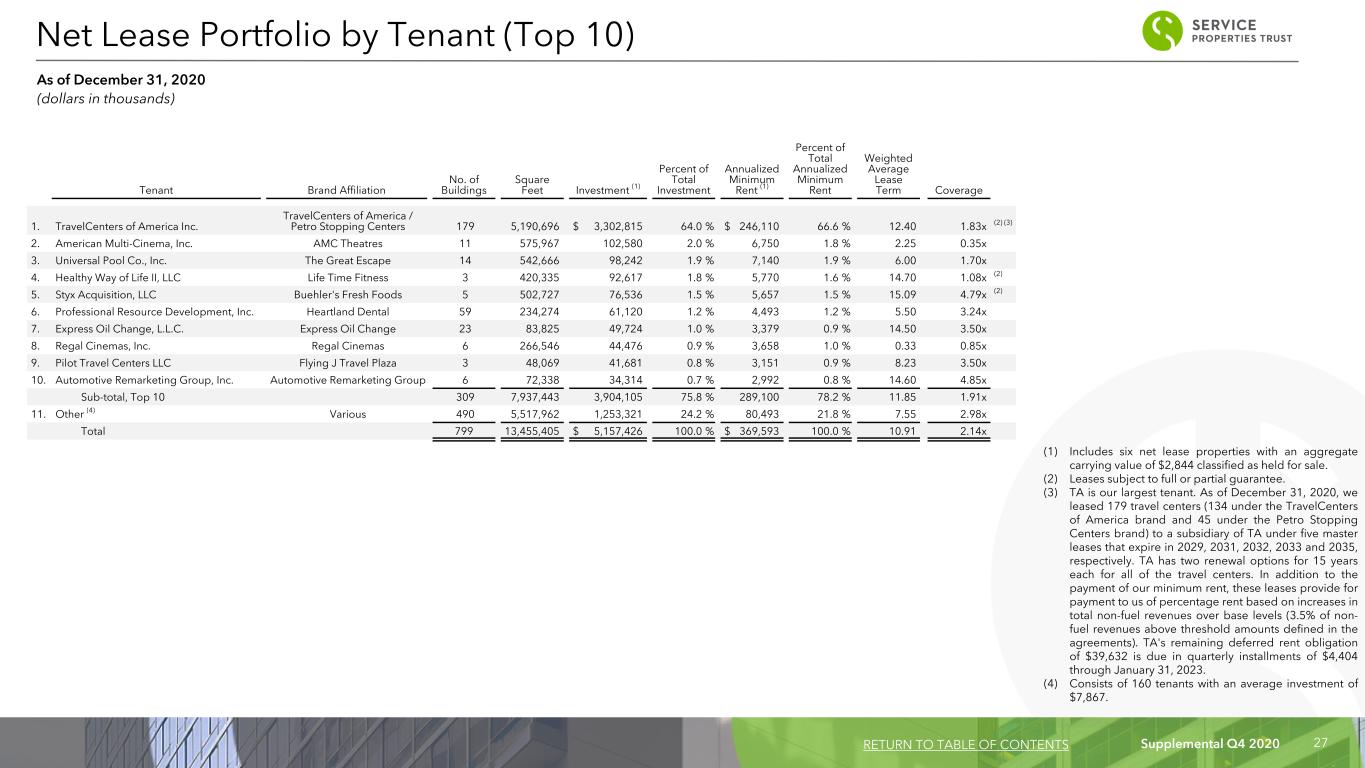

Supplemental Q4 2020 27 Tenant Brand Affiliation No. of Buildings Square Feet Investment (1) Percent of Total Investment Annualized Minimum Rent (1) Percent of Total Annualized Minimum Rent Weighted Average Lease Term Coverage 1. TravelCenters of America Inc. TravelCenters of America / Petro Stopping Centers 179 5,190,696 $ 3,302,815 64.0 % $ 246,110 66.6 % 12.40 1.83x (2) (3) 2. American Multi-Cinema, Inc. AMC Theatres 11 575,967 102,580 2.0 % 6,750 1.8 % 2.25 0.35x 3. Universal Pool Co., Inc. The Great Escape 14 542,666 98,242 1.9 % 7,140 1.9 % 6.00 1.70x 4. Healthy Way of Life II, LLC Life Time Fitness 3 420,335 92,617 1.8 % 5,770 1.6 % 14.70 1.08x (2) 5. Styx Acquisition, LLC Buehler's Fresh Foods 5 502,727 76,536 1.5 % 5,657 1.5 % 15.09 4.79x (2) 6. Professional Resource Development, Inc. Heartland Dental 59 234,274 61,120 1.2 % 4,493 1.2 % 5.50 3.24x 7. Express Oil Change, L.L.C. Express Oil Change 23 83,825 49,724 1.0 % 3,379 0.9 % 14.50 3.50x 8. Regal Cinemas, Inc. Regal Cinemas 6 266,546 44,476 0.9 % 3,658 1.0 % 0.33 0.85x 9. Pilot Travel Centers LLC Flying J Travel Plaza 3 48,069 41,681 0.8 % 3,151 0.9 % 8.23 3.50x 10. Automotive Remarketing Group, Inc. Automotive Remarketing Group 6 72,338 34,314 0.7 % 2,992 0.8 % 14.60 4.85x Sub-total, Top 10 309 7,937,443 3,904,105 75.8 % 289,100 78.2 % 11.85 1.91x 11. Other (4) Various 490 5,517,962 1,253,321 24.2 % 80,493 21.8 % 7.55 2.98x Total 799 13,455,405 $ 5,157,426 100.0 % $ 369,593 100.0 % 10.91 2.14x (1) Includes six net lease properties with an aggregate carrying value of $2,844 classified as held for sale. (2) Leases subject to full or partial guarantee. (3) TA is our largest tenant. As of December 31, 2020, we leased 179 travel centers (134 under the TravelCenters of America brand and 45 under the Petro Stopping Centers brand) to a subsidiary of TA under five master leases that expire in 2029, 2031, 2032, 2033 and 2035, respectively. TA has two renewal options for 15 years each for all of the travel centers. In addition to the payment of our minimum rent, these leases provide for payment to us of percentage rent based on increases in total non-fuel revenues over base levels (3.5% of non- fuel revenues above threshold amounts defined in the agreements). TA's remaining deferred rent obligation of $39,632 is due in quarterly installments of $4,404 through January 31, 2023. (4) Consists of 160 tenants with an average investment of $7,867. Net Lease Portfolio by Tenant (Top 10) As of December 31, 2020 (dollars in thousands) RETURN TO TABLE OF CONTENTS

Supplemental Q4 2020 28 Year (1) Square Feet Annualized Minimum Rent Expiring (2) Percent of Total Annualized Minimum Rent Expiring Cumulative % of Total Annualized Minimum Rent Expiring 2021 352,091 $ 4,059 1.1% 1.1% 2022 440,333 5,502 1.5% 2.6% 2023 320,538 3,511 0.9% 3.5% 2024 779,868 10,040 2.7% 6.2% 2025 431,461 8,980 2.4% 8.6% 2026 872,759 9,967 2.7% 11.3% 2027 954,731 13,372 3.6% 14.9% 2028 552,913 9,420 2.5% 17.4% 2029 1,321,924 47,699 12.9% 30.3% 2030 216,663 4,290 1.2% 31.5% 2031 1,469,746 50,022 13.5% 45.0% 2032 1,233,445 51,866 14.1% 59.1% 2033 1,105,889 53,301 14.5% 73.6% 2034 135,978 4,557 1.2% 74.8% 2035 2,577,853 83,802 22.8% 97.6% 2036 320,792 5,357 1.4% 99.0% 2037 — — — 99.0% 2038 10,183 416 0.1% 99.1% 2039 185,437 3,278 0.9% 100.0% 2040 1,739 154 —% 100.0% Total 13,284,343 $ 369,593 100.0% Weighted Average Lease Term 9.4 years 10.9 years (1) The year of lease expiration is pursuant to contract terms. (2) Includes six net lease properties with an aggregate carrying value of $2,844 and annual minimum rent of $121 classified as held for sale. Net Lease Portfolio - Expiration Schedule As of December 31, 2020 (dollars in thousands) RETURN TO TABLE OF CONTENTS

Supplemental Q4 2020 29 As of and For the Three Months Ended 12/31/2020 9/30/2020 6/30/2020 3/31/2020 12/31/2019 Properties (end of period) 799 804 809 813 816 Total square feet 13,455,405 13,682,477 13,728,893 14,511,567 14,886,967 Square feet leased 13,284,343 13,424,005 13,548,122 14,262,947 14,539,128 Percentage leased 98.7 % 98.1 % 98.7 % 98.3 % 97.7 % As of and For the Three Months Ended 12/31/2020 9/30/2020 6/30/2020 3/31/2020 12/31/2019 Vacant properties beginning of period 14 15 17 17 — Vacant property sales (4) (3) (4) (5) — Lease terminations 8 2 2 5 — Vacant properties end of the period 18 14 15 17 17 Net Lease Portfolio - Occupancy Summary As of December 31, 2020 (dollars in thousands) RETURN TO TABLE OF CONTENTS

Supplemental Q4 2020 30 Non-GAAP Financial Measures We present certain “non-GAAP financial measures” within the meaning of applicable Securities and Exchange Commission, or SEC, rules, including FFO, Normalized FFO, EBITDA, Hotel EBITDA, Adjusted Hotel EBITDA, EBITDAre and Adjusted EBITDAre. These measures do not represent cash generated by operating activities in accordance with GAAP and should not be considered alternatives to net income (loss) as indicators of our operating performance or as measures of our liquidity. These measures should be considered in conjunction with net income (loss) as presented in our consolidated statements of income (loss). We consider these non-GAAP measures to be appropriate supplemental measures of operating performance for a REIT, along with net income (loss). We believe these measures provide useful information to investors because by excluding the effects of certain historical amounts, such as depreciation and amortization expense, they may facilitate a comparison of our operating performance between periods and with other REITs. FFO and Normalized FFO: We calculate funds from operations, or FFO, and Normalized FFO as shown on page 9. FFO is calculated on the basis defined by The National Association of Real Estate Investment Trusts, or Nareit, which is net income (loss), calculated in accordance with GAAP, excluding any gain or loss on sale of properties and loss on impairment of real estate assets, if any, plus real estate depreciation and amortization, less any unrealized gains and losses on equity securities, as well as certain other adjustments currently not applicable to us. In calculating Normalized FFO, we adjust for the item shown on page 9 and include business management incentive fees, if any, only in the fourth quarter versus the quarter when they are recognized as an expense in accordance with GAAP due to their quarterly volatility not necessarily being indicative of our core operating performance and the uncertainty as to whether any such business management incentive fees will be payable when all contingencies for determining such fees are known at the end of the calendar year. FFO and Normalized FFO are among the factors considered by our Board of Trustees when determining the amount of distributions to our shareholders. Other factors include, but are not limited to, requirements to maintain our qualification for taxation as a REIT, limitations in our credit agreement and public debt covenants, the availability to us of debt and equity capital, our distribution rate as a percentage of the trading price of our common shares, or dividend yield, and to the dividend yield of other REITs, our expectation of our future capital requirements and operating performance and our expected needs for and availability of cash to pay our obligations. Other real estate companies and REITs may calculate FFO and Normalized FFO differently than we do. EBITDA, EBITDAre and Adjusted EBITDAre: We calculate earnings before interest, taxes, depreciation and amortization, or EBITDA, EBITDA for real estate, or EBITDAre, and Adjusted EBITDAre as shown on page 10. EBITDAre is calculated on the basis defined by Nareit, which is EBITDA, excluding gains and losses on the sale of real estate, loss on impairment of real estate assets, if any, as well as certain other adjustments currently not applicable to us. In calculating Adjusted EBITDAre, we adjust for the items shown on page 10 and include business management incentive fees, if any, only in the fourth quarter versus the quarter when they are recognized as an expense in accordance with GAAP due to their quarterly volatility not necessarily being indicative of our core operating performance and the uncertainty as to whether any such business management incentive fees will be payable when all contingencies for determining such fees are known at the end of the calendar year. Other real estate companies and REITs may calculate EBITDA, EBITDAre and Adjusted EBITDAre differently than we do. Other Definitions Adjusted Total Assets and Total Unencumbered Assets: Adjusted total assets and total unencumbered assets include original cost of real estate assets calculated in accordance with GAAP before impairment write-downs, if any, and exclude depreciation and amortization, accounts receivable and intangible assets. Adjusted Hotel EBITDA Margin: is the percentage of Adjusted Hotel EBITDA of hotel operating revenues. Annualized Dividend Yield: Annualized dividend yield is the annualized dividend paid during the period divided by the closing price of our common shares at the end of the period. Average Daily Rate: ADR represents rooms revenue divided by the total number of room nights sold in a given period. ADR provides useful insight on pricing at our hotels and is a measure widely used in the hotel industry. Chain Scale: As characterized by STR, a data benchmark and analytics provider for the lodging industry. Comparable Hotels Data: We present RevPAR, ADR and occupancy for the periods presented on a comparable basis to facilitate comparisons between periods. We generally define comparable hotels as those that we owned and were open and operating for the entire periods being compared. For the three months ended December 31, 2020 and 2019, we excluded eight hotels from our comparable results. One of these hotels was not owned for the entire periods, three were closed for major renovations and four suspended operations during part of the periods presented. For the year ended December 31, 2020 and 2019, we excluded 25 hotels from our comparable results. Three of these hotels were not owned for the entire periods, three were closed for major renovations and 19 suspended operations during part of the periods presented. Consolidated Income Available for Debt Service: Consolidated income available for debt service, as defined in our debt agreements, is earnings from operations excluding interest expense, unrealized gains and losses on equity securities, depreciation and amortization, loss on asset impairment, unrealized appreciation on assets held for sale, gains and losses on early extinguishment of debt, gains and losses on sales of property and amortization of deferred charges. Non-GAAP Financial Measures and Certain Definitions RETURN TO TABLE OF CONTENTS

Supplemental Q4 2020 31 Coverage: We define net lease coverage as earnings before interest, taxes, depreciation, amortization and rent, or EBITDAR, divided by the annual minimum rent due to us weighted by the minimum rent of the property to total minimum rents of the net lease portfolio. EBITDAR amounts used to determine rent coverage are generally for the latest twelve month period reported based on the most recent operating information, if any, furnished by the tenant. Operating statements furnished by the tenant often are unaudited and, in certain cases, may not have been prepared in accordance with GAAP and are not independently verified by us. Tenants that do not report operating information are excluded from the coverage calculations. Coverage amounts include data for certain properties for periods prior to when we acquired them. In instances where we do not have financial information for the most recent quarter from our tenants, we have calculated an implied EBITDAR for the 2020 fourth quarter using industry benchmark data to more accurately reflect the impact of COVID-19 on our tenants’ operations. We believe using only financial information from the earlier periods could be misleading as it would not reflect the negative impact those tenants experienced as a result of the COVID-19 pandemic. As a result, we believe using this industry benchmark data provides a more accurate estimated representation of recent operating results and coverage for those tenants. Debt: Debt amounts reflect the principal balance as of the date reported. Net debt means total debt less unrestricted cash and cash equivalents as of the date reported. FF&E Reserve: Most of our hotel operating agreements require the deposit of a percentage of gross hotel revenues into escrows to fund FF&E reserves. We own all the FF&E reserve escrows for our hotels. Our net lease agreements do not require FF&E escrow deposits; however, certain tenants may request that we fund capital improvements in return for increases in the annual minimum rent. Our tenants are generally not obligated to request and we are not obligated to fund any such improvements. FF&E Reserve Deposits Not Funded by Hotel Operations: The operating agreements for our hotels generally provide that, if necessary, we will provide FF&E funding in excess of escrowed reserves. To the extent we make such fundings, our contractual annual minimum returns or rents generally increase by a percentage of the amounts we fund. Gross Book Value of Real Estate Assets: Gross book value of real estate assets is real estate properties at cost plus acquisition related costs, if any, before purchase price allocations, less impairment write-downs, if any. Hotel EBITDA and Adjusted Hotel EBITDA: We define Hotel EBITDA, a non-GAAP financial measure, as hotel operating revenues less hotel operating expenses of all managed and leased hotels, prior to any adjustments required for presentation in our consolidated statements of income (loss) in accordance with GAAP. Adjusted Hotel EBITDA excludes certain items we believe do not reflect the ongoing operating performance of our hotels. We believe that Hotel EBITDA and Adjusted Hotel EBITDA provide useful information to management and investors as key measures of the profitability of our hotel operations. Investment: We define hotel investment as historical cost of our properties plus capital improvements funded by us less impairment write-downs, if any, and excludes capital improvements made from FF&E reserves funded from hotel operations that do not result in increases in minimum returns or rents. We define net lease investment as historical cost of our properties plus capital improvements funded by us less impairment write-downs, if any. Minimum Return/Rent: Each of our management agreements or leases with hotel operators provides for payment to us of an annual minimum return or minimum rent, respectively. Certain of these minimum payment amounts are secured by full or limited guarantees or security deposits. In addition, certain of our hotel management agreements provide for payment to us of additional amounts to the extent of available cash flows as defined in the management agreement. Payments of these additional amounts are not guaranteed or secured by deposits. Each of our agreements with our net lease tenants provides for payment to us of minimum rent. Certain of these minimum payment amounts are secured by full or limited guarantees. Annualized minimum rent amounts represent cash rent amounts due to us and exclude adjustments, if any, necessary to record scheduled rent changes under certain of our leases, the deferred rent obligations payable to us under our leases with TA and the estimated future payments to us under our TA leases for the cost of removing underground storage tanks at our travel centers on a straight line basis or any reimbursement of expenses paid by us. Occupancy: Occupancy represents the total number of room nights sold divided by the total number of room nights available at a hotel or group of hotels. Occupancy is an important measure of the utilization rate and demand of our hotels. Revenue per Available Room: RevPAR represents rooms revenue divided by the total number of room nights available to guests for a given period. RevPAR is an industry metric correlated to occupancy and ADR and helps measure performance over comparable periods. Total Gross Assets: Total gross assets is total assets plus accumulated depreciation. Non-GAAP Financial Measures and Certain Definitions (Continued) RETURN TO TABLE OF CONTENTS

Supplemental Q4 2020 32 This supplemental operating and financial data may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws. Whenever we use words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “will,” “may” and negatives or derivatives of these or similar expressions, we are making forward-looking statements. These forward-looking statements are based upon our present intent, beliefs or expectations, but forward-looking statements are not guaranteed to occur and may not occur. Actual results may differ materially from those contained in or implied by our forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors, some of which are beyond our control. The information contained in our filings with the SEC, including under “Risk Factors” in our periodic reports, or incorporated therein, identifies important factors that could cause our actual results to differ materially from those stated in or implied by our forward-looking statements. Our filings with the SEC are available on the SEC's website at www.sec.gov. You should not place undue reliance upon our forward-looking statements. Except as required by law, we do not intend to update or change any forward-looking statements as a result of new information, future events or otherwise. Warning Concerning Forward-Looking Statements RETURN TO TABLE OF CONTENTS