Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - APACHE OFFSHORE INVESTMENT PARTNERSHIP | aoipex231202010-k.htm |

| EX-31.1 - EX-31.1 - APACHE OFFSHORE INVESTMENT PARTNERSHIP | aoipex311202010-k.htm |

| EX-31.2 - EX-31.2 - APACHE OFFSHORE INVESTMENT PARTNERSHIP | aoipex312202010-k.htm |

| EX-32.1 - EX-32.1 - APACHE OFFSHORE INVESTMENT PARTNERSHIP | aoipex321202010-k.htm |

| 10-K - 10-K - APACHE OFFSHORE INVESTMENT PARTNERSHIP | aoip-20201231.htm |

RYDER SCOTT COMPANY PETROLEUM CONSULTANTS APACHE CORPORATION Estimated Future Reserves and Income Attributable to Certain Leasehold and Royalty Interests In The Shell Offshore Venture SEC Parameters As of December 31, 2020 Ali A. Porbandarwala, P.E. TBPE License No. 107652 Senior Vice President RYDER SCOTT COMPANY, L.P. TBPE Firm Registration No. F-1580

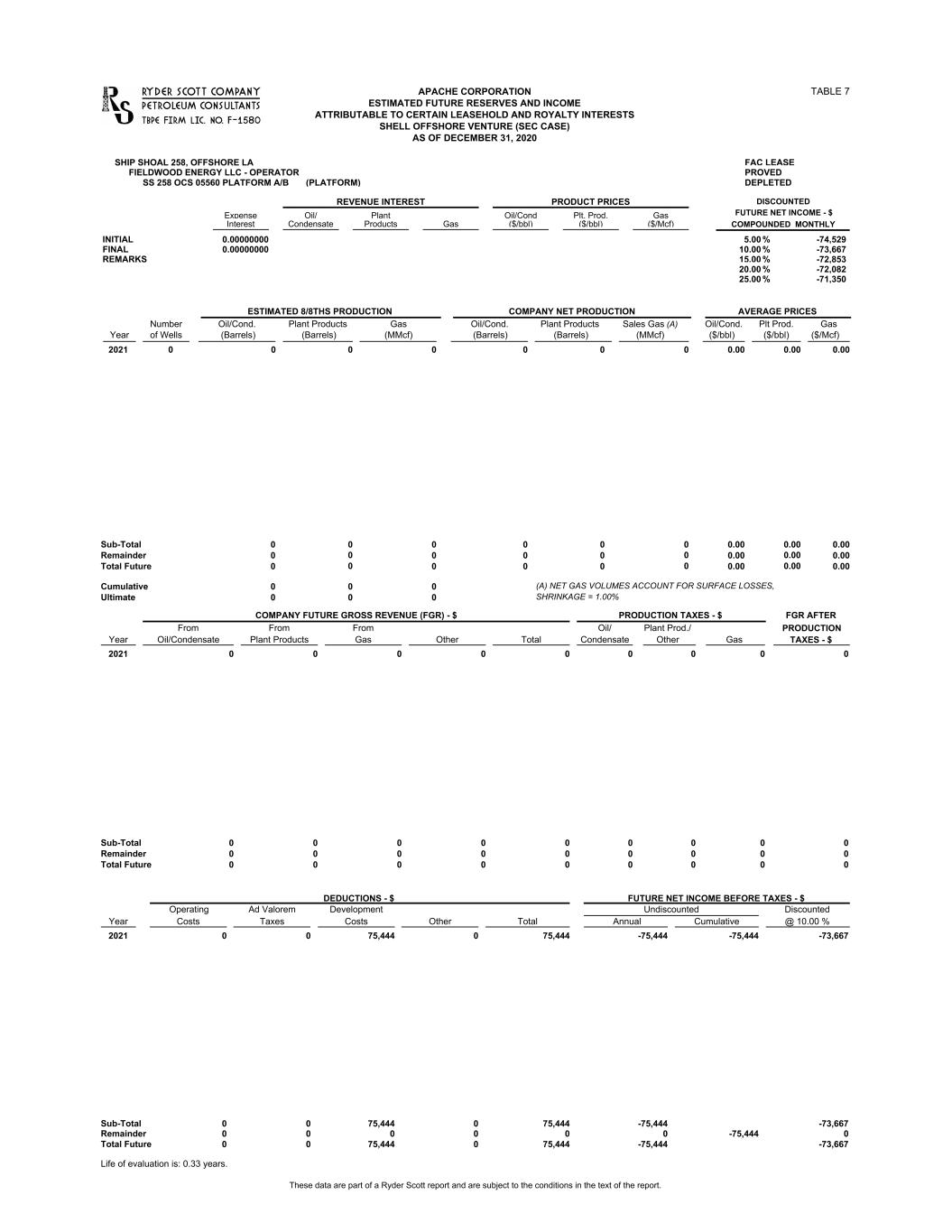

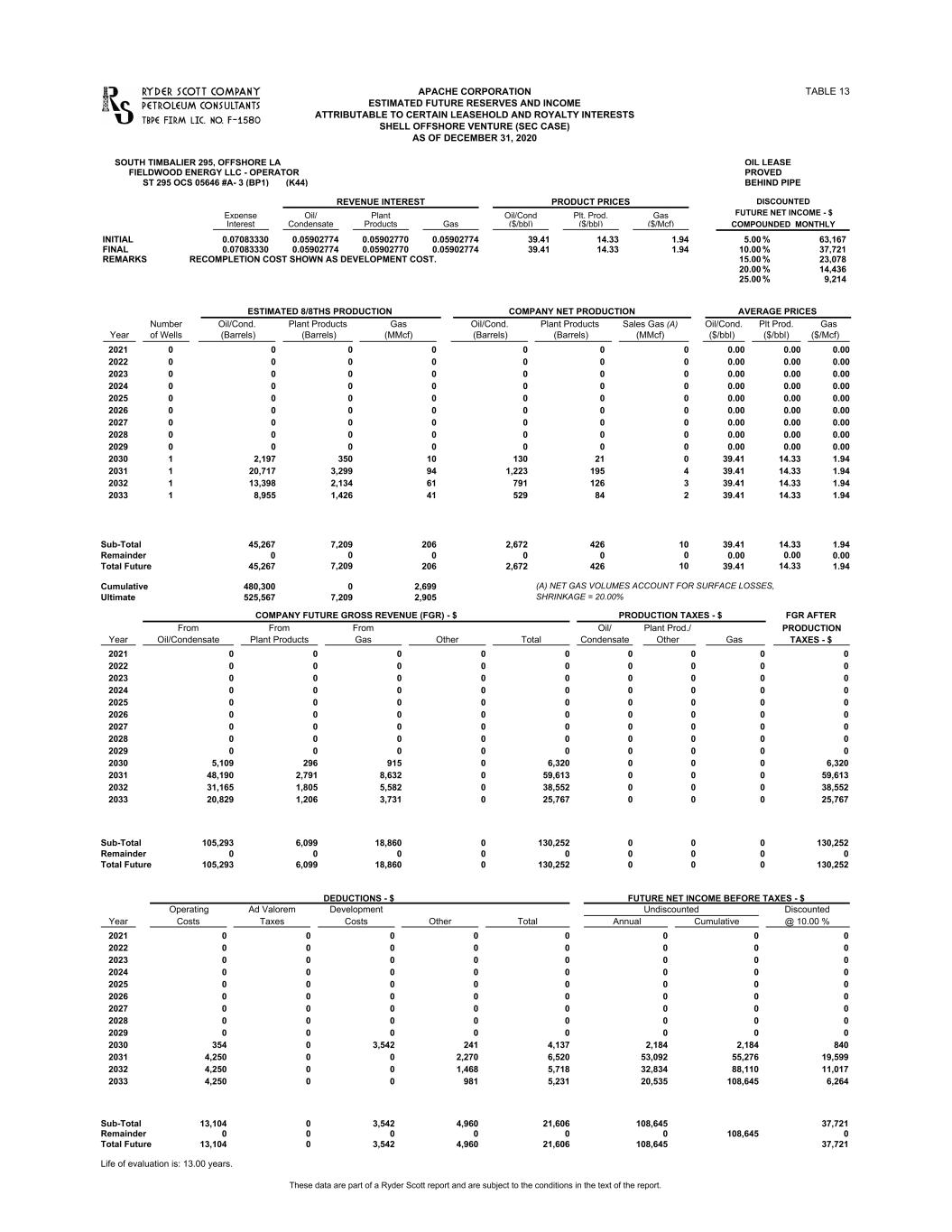

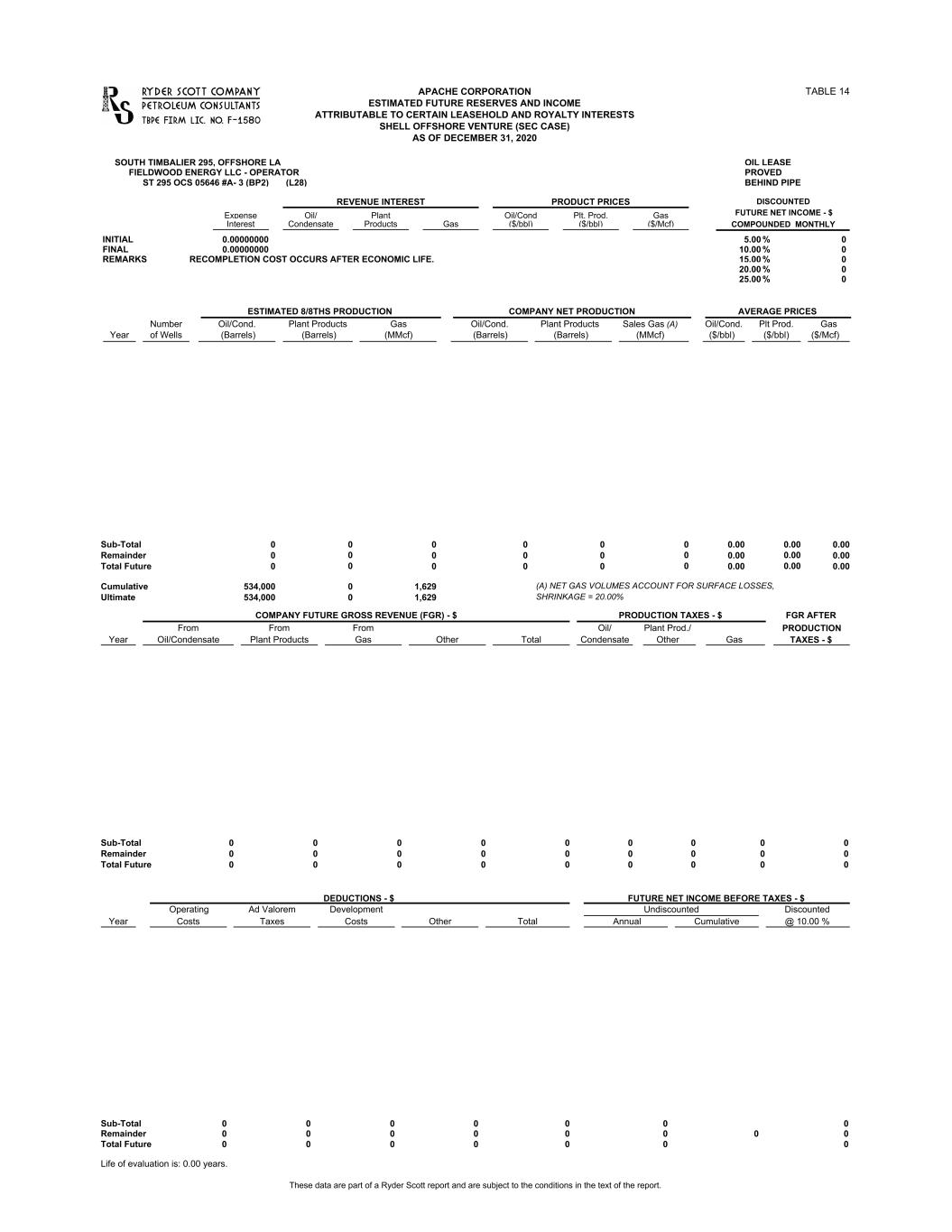

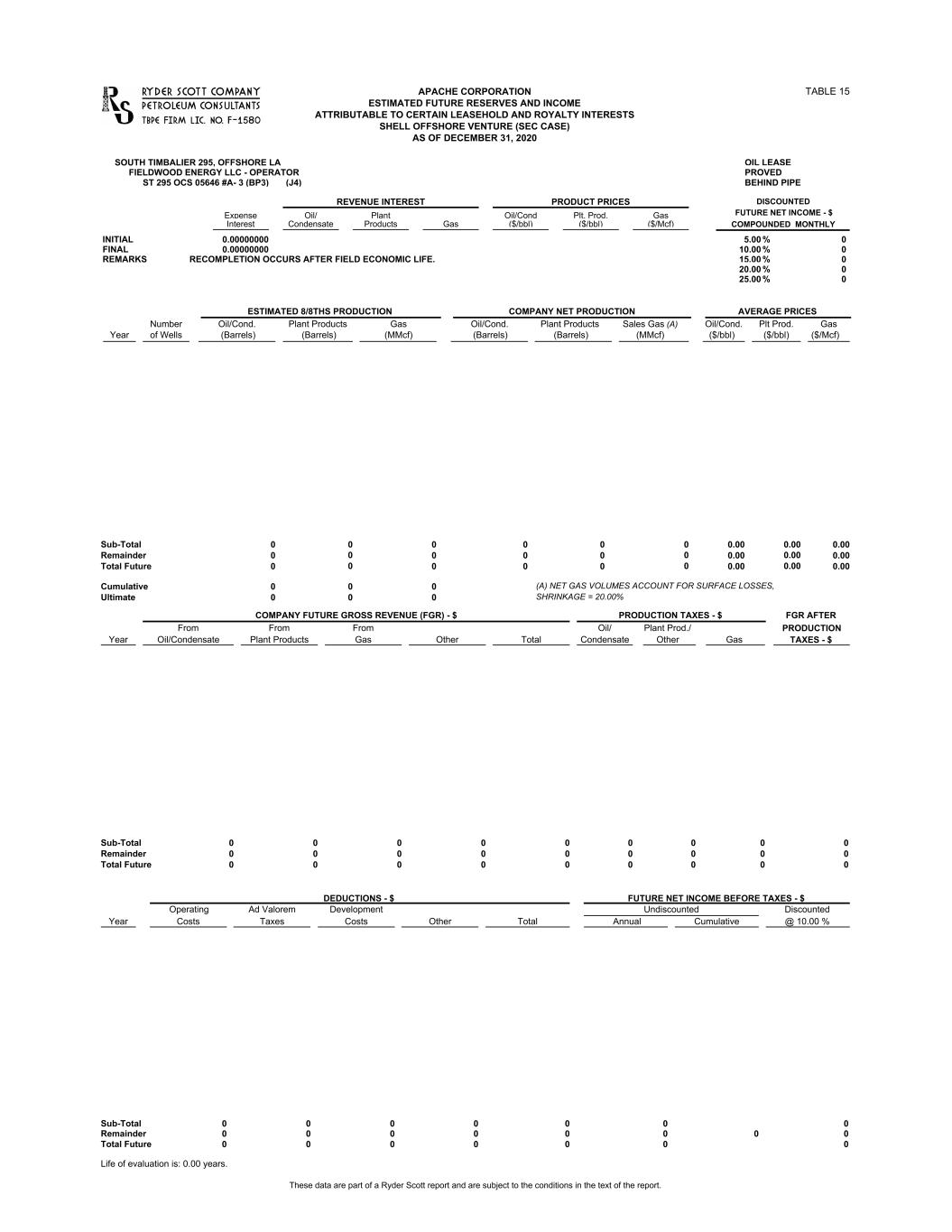

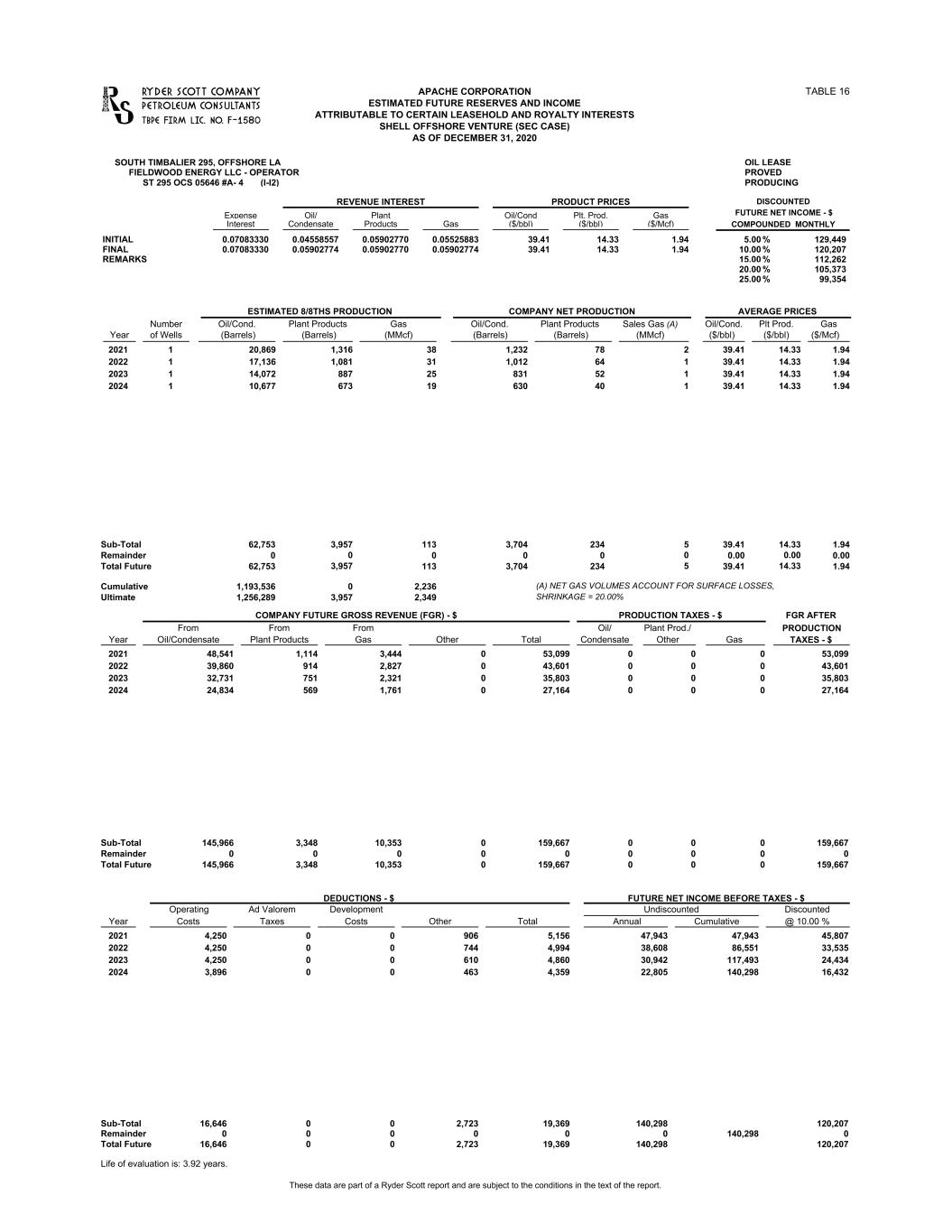

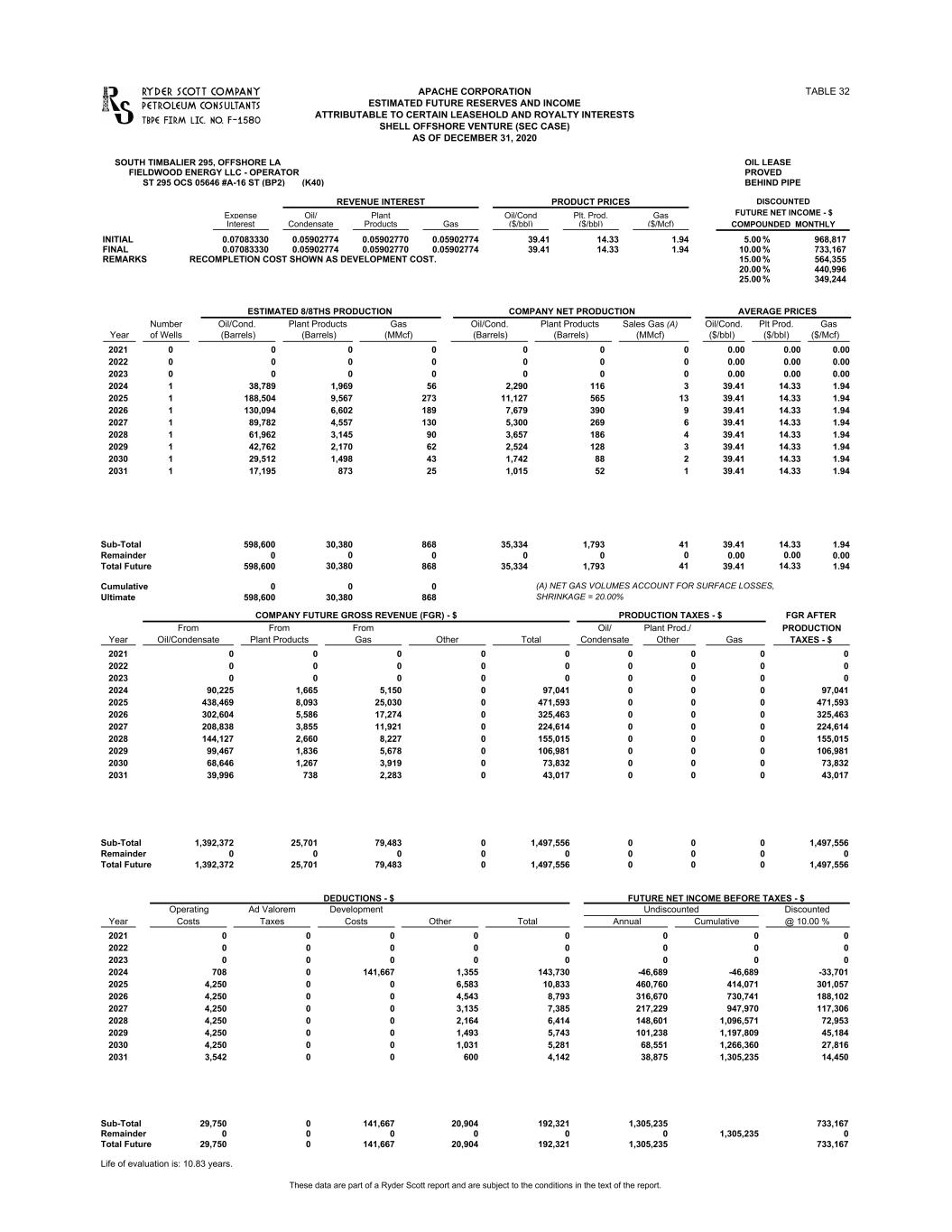

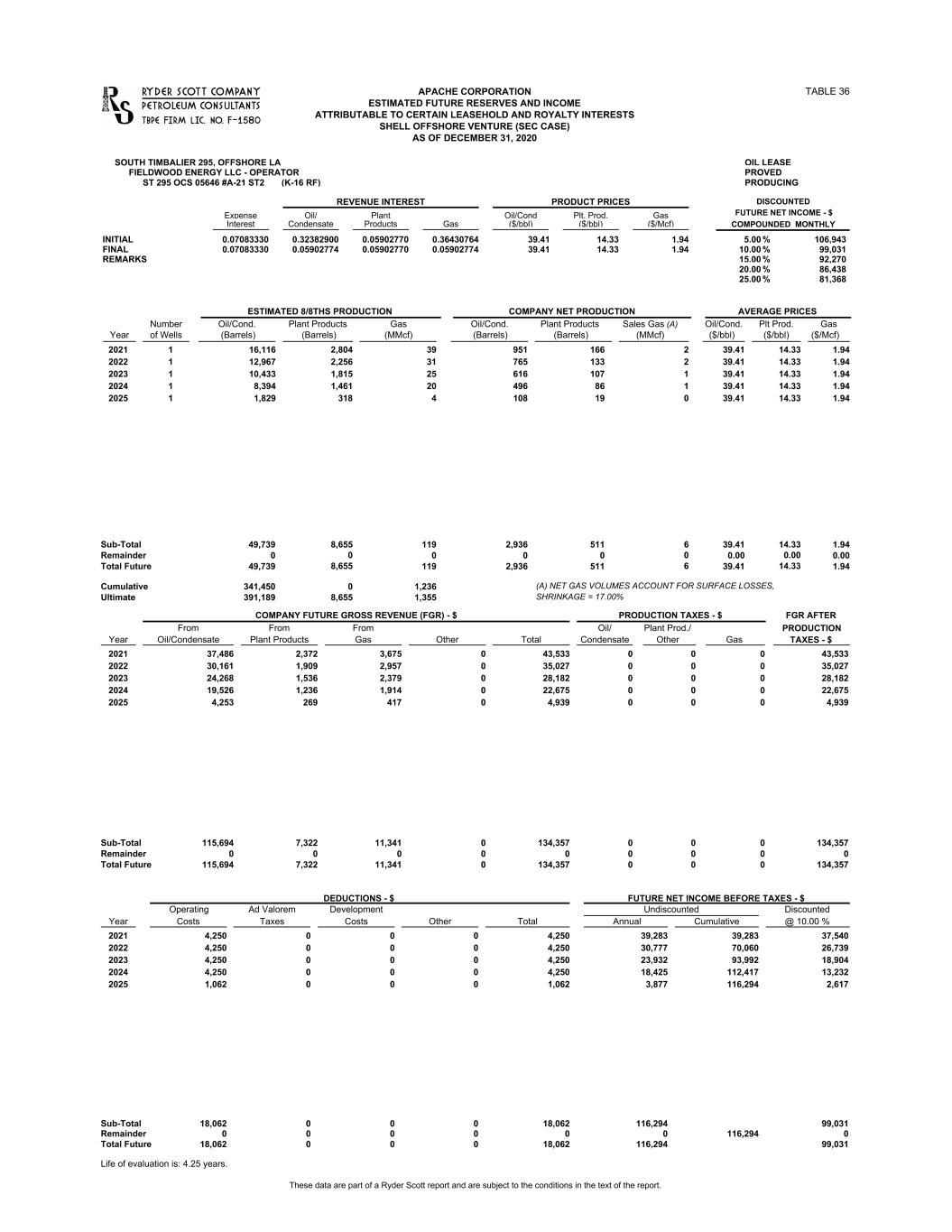

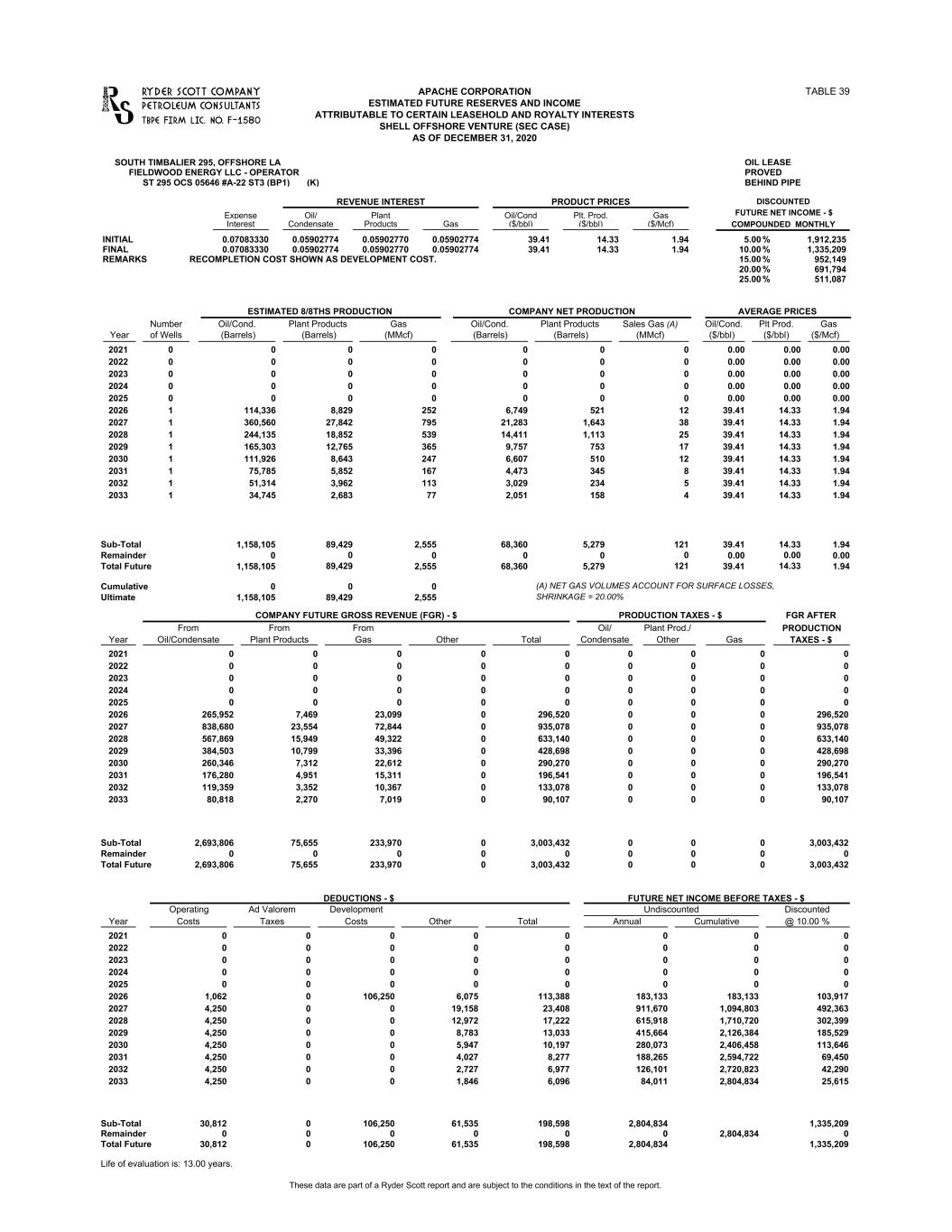

DISCUSSION PETROLEUM RESERVES DEFINITIONS APACHE CORPORATION TABLE OF CONTENTS PROPERTY RANKING . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . SUMMARY OF GROSS AND NET RESERVE AND INCOME DATA . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . SUMMARY OF INITIAL BASIC DATA . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . TABLE NO. A B C GRAND SUMMARIES TOTAL PROVED . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 PROVED PRODUCING . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 PROVED SHUT-IN . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 PROVED BEHIND PIPE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 PROVED DEPLETED . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 SHIP SHOAL 258, OFFSHORE LA FIELD SUMMARY - PROVED DEPLETED . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 SS 258 OCS 05560 PLATFORM A/B - PROVED DEPLETED . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 SOUTH TIMBALIER 295, OFFSHORE LA FIELD SUMMARY - TOTAL PROVED . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 FIELD SUMMARY - PROVED PRODUCING . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 FIELD SUMMARY - PROVED SHUT-IN . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 FIELD SUMMARY - PROVED BEHIND PIPE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11 ST 295 OCS 05646 #A- 3 - PROVED PRODUCING . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12 ST 295 OCS 05646 #A- 3 (BP1) - PROVED BEHIND PIPE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13 ST 295 OCS 05646 #A- 3 (BP2) - PROVED BEHIND PIPE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14 ST 295 OCS 05646 #A- 3 (BP3) - PROVED BEHIND PIPE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15 ST 295 OCS 05646 #A- 4 - PROVED PRODUCING . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 ST 295 OCS 05646 #A- 4 (BP1) - PROVED BEHIND PIPE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17 ST 295 OCS 07780 #A-10 ST - PROVED SHUT-IN . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18 ST 295 OCS 07780 #A-10 ST (BP2) - PROVED BEHIND PIPE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19 ST 295 OCS 07780 #A-10 ST (BP3) - PROVED BEHIND PIPE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20 ST 295 OCS 07780 #A-10 ST (BP4) - PROVED BEHIND PIPE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21 ST 295 OCS 07780 #A-10 ST (BP5) - PROVED BEHIND PIPE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22 ST 295 OCS 05646 #A-11 - PROVED PRODUCING . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23 ST 295 OCS 05646 #A-11 - PROVED SHUT-IN . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24 ST 295 OCS 05646 #A-11 (BP1) - PROVED BEHIND PIPE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25 ST 295 OCS 05646 #A-11 (BP2) - PROVED BEHIND PIPE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26 ST 295 OCS 05646 #A-11 (BP3) - PROVED BEHIND PIPE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27 ST 295 OCS 05646 #A-13 ST - PROVED SHUT-IN . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28 ST 295 OCS 05646 #A-14 - PROVED PRODUCING . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29 ST 295 OCS 05646 #A-15 - PROVED PRODUCING . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30 ST 295 OCS 05646 #A-16 ST - PROVED PRODUCING . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31 ST 295 OCS 05646 #A-16 ST (BP2) - PROVED BEHIND PIPE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32 RYDER SCOTT COMPANY PETROLEUM CONSULTANTS - TBPE FIRM LICENSE No. F-1580

SUITE 2800, 350 7TH AVENUE, S.W. CALGARY, ALBERTA T2P 3N9 TEL (403) 262-2799 633 17TH STREET, SUITE 1700 DENVER, COLORADO 80202 TEL (303) 339-8110 TBPE REGISTERED ENGINEERING FIRM F-1580 FAX (713) 651-0849 1100 LOUISIANA SUITE 4600 HOUSTON, TEXAS 77002-5294 TELEPHONE (713) 651-9191 January 27, 2021 Apache Corporation 2000 Post Oak Boulevard, Suite 100 Houston, Texas 77056 Ladies and Gentlemen: At your request, Ryder Scott Company, L.P. (Ryder Scott) has prepared an estimate of the proved reserves, future production and income attributable to certain leasehold and royalty interests in the Shell Offshore Venture for Apache Corporation (Apache) as of December 31, 2020. Additionally, at Apache’s request, this report includes an estimate of the probable and possible reserves volumes; however, this report does not address the future production or income or economic producibility attributable to the probable and possible reserves quantities contained herein. The subject properties are located in the federal waters offshore Louisiana and Texas. The reserves and income data were estimated based on the definitions and disclosure guidelines of the United States Securities and Exchange Commission (SEC) contained in Title 17, Code of Federal Regulations, Modernization of Oil and Gas Reporting, Final Rule released January 14, 2009 in the Federal Register (SEC regulations). The results of our third party study, completed on January 18, 2021, are presented herein and was prepared for public disclosure by Apache in filings made with the SEC in accordance with the disclosure requirements set forth in the SEC regulations. The properties evaluated by Ryder Scott represent 100 percent of the total net proved, probable and possible liquid hydrocarbon reserves and 100 percent of the total net proved, probable and possible gas reserves of the Shell Offshore Venture for Apache as of December 31, 2020. The estimated reserves and future net income amounts presented in this report, as of December 31, 2020, are related to hydrocarbon prices. The hydrocarbon prices used in the preparation of this report are based on the average prices during the 12-month period prior to the “as of date” of this report, determined as the unweighted arithmetic averages of the prices in effect on the first-day-of-the-month for each month within such period, unless prices were defined by contractual arrangements, as required by the SEC regulations. Actual future prices may vary considerably from the prices required by SEC regulations. The recoverable reserves volumes and the income attributable thereto have a direct relationship to the hydrocarbon prices actually received; therefore, volumes of reserves actually recovered and the amounts of income actually received may differ significantly from the estimated quantities presented in this report. The results of this study are summarized in the following table.

Apache Corporation – Shell Offshore Venture January 27, 2021 Page 2 RYDER SCOTT COMPANY PETROLEUM CONSULTANTS SEC PARAMETERS Apache Corporation Estimated Net Reserves and Income Data Certain Leasehold and Royalty Interests in the Shell Offshore Venture As of December 31, 2020 Proved Developed Total Producing Non-Producing Proved Net Reserves Oil/Condensate – Barrels 48,396 301,599 349,995 Plant Products – Barrels 3,686 22,686 26,372 Gas – MMcf 78 519 597 Income Data Future Gross Revenue $2,111,991 $13,217,128 $15,329,119 Deductions 1,051,432 7,267,653 8,319,085 Future Net Income (FNI) $1,060,559 $ 5,949,475 $ 7,010,034 Discounted FNI @ 10% $ 925,266 $ 3,817,412 $ 4,742,678 Probable Developed Total Producing Non-Producing Probable Net Reserves Oil/Condensate – Barrels 6,798 26,061 32,859 Plant Products – Barrels 339 1,954 2,293 Gas – MMcf 8 45 53 Possible Developed Total Producing Non-Producing Possible Net Reserves Oil/Condensate – Barrels 865 1,930 2,795 Plant Products – Barrels 79 240 319 Gas – MMcf 2 5 7 Liquid hydrocarbons are expressed in standard 42 U.S. gallon barrels. All gas volumes are reported on an “as sold basis” expressed in millions of cubic feet (MMcf) at the official temperature and pressure bases of 60º Fahrenheit and 14.73 psia. In this report, the revenues, deductions, and income data are expressed as U.S. dollars. The estimates of the proved reserves, future production, and income attributable to properties in this report were prepared using the economic software package ARIESTM Petroleum Economics and Reserves Software, a copyrighted program of Halliburton. The program was used at the request of

Apache Corporation – Shell Offshore Venture January 27, 2021 Page 3 RYDER SCOTT COMPANY PETROLEUM CONSULTANTS Apache. Ryder Scott has found this program to be generally acceptable, but notes that certain summaries and calculations may vary due to rounding and may not exactly match the sum of the properties summarized. Furthermore, oneline economic summaries may vary slightly from the more detailed cash flow projections of the same properties, also due to rounding. The rounding differences are not material. The deductions incorporate the normal direct costs of operating the wells, recompletion costs, development costs, transportation costs (incorporated as other costs in the cash flow projections) and certain abandonment costs net of salvage. Since the properties involved are all located on federal leases, there are no production, severance, or ad valorem taxes to be considered. The future net income is before the deduction of state and federal income taxes and general administrative overhead, and has not been adjusted for outstanding loans that may exist, nor does it include any adjustment for cash on hand or undistributed income. Liquid hydrocarbon reserves account for approximately 92.4 percent and gas reserves account for the remaining 7.6 percent of total future gross revenue from proved reserves. The proved discounted future net income shown above was calculated using a discount rate of 10 percent per annum compounded monthly. Proved future net income was discounted at four other discount rates which were also compounded monthly. These results are shown in summary form as follows. Discounted Future Net Income As of December 31, 2020 Discount Rate Total Percent Proved 5 $5,754,710 15 $3,941,706 20 $3,309,841 25 $2,809,341 The results shown above are presented for your information and should not be construed as our estimate of fair market value. Reserves Included in This Report The proved, probable and possible reserves included herein conform to the definitions as set forth in the Securities and Exchange Commission’s Regulations Part 210.4-10(a). An abridged version of the SEC reserves definitions from 210.4-10(a) entitled “PETROLEUM RESERVES DEFINITIONS” is included as an attachment to this report. The various reserves status categories are defined under the attachment entitled “PETROLEUM RESERVES STATUS DEFINITIONS AND GUIDELINES” in this report. The proved, probable and possible developed non-producing reserves included herein consist of the behind pipe status category. There are also certain abandonment costs associated with the proved depleted category and those costs are summarized in the non-producing category in the table above. No attempt was made to quantify or otherwise account for any accumulated gas production imbalances that may exist. The proved, probable and possible gas volumes presented herein do not include volumes of gas consumed in operations as reserves.

Apache Corporation – Shell Offshore Venture January 27, 2021 Page 4 RYDER SCOTT COMPANY PETROLEUM CONSULTANTS Reserves are “estimated remaining quantities of oil and gas and related substances anticipated to be economically producible, as of a given date, by application of development projects to known accumulations.” All reserves estimates involve an assessment of the uncertainty relating the likelihood that the actual remaining quantities recovered will be greater or less than the estimated quantities determined as of the date the estimate is made. The uncertainty depends chiefly on the amount of reliable geologic and engineering data available at the time of the estimate and the interpretation of these data. The relative degree of uncertainty may be conveyed by placing reserves into one of two principal classifications, either proved or unproved. Unproved reserves are less certain to be recovered than proved reserves, and may be further sub-categorized as probable and possible reserves to denote progressively increasing uncertainty in their recoverability. At Apache’s request, this report addresses the proved, probable and possible reserves attributable to the properties evaluated herein. Proved oil and gas reserves are “those quantities of oil and gas which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible from a given date forward.” The SEC has defined reasonable certainty for proved reserves, when based on deterministic methods, as a “high degree of confidence that the quantities will be recovered.” Probable reserves are “those additional reserves that are less certain to be recovered than proved reserves but which, together with proved reserves, are as likely as not to be recovered.” Possible reserves are “those additional reserves which are less certain to be recovered than probable reserves” and thus the probability of achieving or exceeding the proved plus probable plus possible reserves is low. The reserves included herein were estimated using deterministic methods and are presented as incremental quantities. Under the deterministic incremental approach, discrete quantities of reserves are estimated and assigned separately as proved, probable or possible based on their individual level of uncertainty. Because of the differences in uncertainty, caution should be exercised when aggregating quantities of oil and gas from different reserves categories. Furthermore, the reserves and income quantities attributable to the different reserves categories that are included herein have not been adjusted to reflect these varying degrees of risk associated with them and thus are not comparable. Reserves estimates will generally be revised only as additional geologic or engineering data become available or as economic conditions change. For proved reserves, the SEC states that “as changes due to increased availability of geoscience (geological, geophysical, and geochemical), engineering, and economic data are made to the estimated ultimate recovery (EUR) with time, reasonably certain EUR is much more likely to increase or remain constant than to decrease.” Moreover, estimates of proved, probable and possible reserves may be revised as a result of future operations, effects of regulation by governmental agencies or geopolitical or economic risks. Therefore, the proved, probable and possible reserves included in this report are estimates only and should not be construed as being exact quantities. In the case of the proved reserves presented herein, the revenues therefrom, and the actual costs related thereto, could be more or less than the estimated amounts. Apache’s operations may be subject to various levels of governmental controls and regulations. These controls and regulations may include, but may not be limited to, matters relating to land tenure and leasing, the legal rights to produce hydrocarbons, drilling and production practices, environmental protection, marketing and pricing policies, royalties, various taxes and levies including income tax and are subject to change from time to time. Such changes in governmental regulations and policies may cause volumes of proved, probable and possible reserves actually recovered and amounts of proved income actually received to differ significantly from the estimated quantities. The estimates of reserves presented herein were based upon a detailed study of the properties in which Apache owns an interest; however, we have not made any field examination of the properties. No consideration was given in this report to potential environmental liabilities that may exist nor were any

Apache Corporation – Shell Offshore Venture January 27, 2021 Page 5 RYDER SCOTT COMPANY PETROLEUM CONSULTANTS costs included for potential liabilities to restore and clean up damages, if any, caused by past operating practices. Estimates of Reserves The estimation of reserves involves two distinct determinations. The first determination results in the estimation of the quantities of recoverable oil and gas and the second determination results in the estimation of the uncertainty associated with those estimated quantities in accordance with the definitions set forth by the Securities and Exchange Commission’s Regulations Part 210.4-10(a). The process of estimating the quantities of recoverable oil and gas reserves relies on the use of certain generally accepted analytical procedures. These analytical procedures fall into three broad categories or methods: (1) performance-based methods; (2) volumetric-based methods; and (3) analogy. These methods may be used individually or in combination by the reserves evaluator in the process of estimating the quantities of reserves. Reserves evaluators must select the method or combination of methods which in their professional judgment is most appropriate given the nature and amount of reliable geoscience and engineering data available at the time of the estimate, the established or anticipated performance characteristics of the reservoir being evaluated and the stage of development or producing maturity of the property. In many cases, the analysis of the available geoscience and engineering data and the subsequent interpretation of this data may indicate a range of possible outcomes in an estimate, irrespective of the method selected by the evaluator. When a range in the quantity of reserves is identified, the evaluator must determine the uncertainty associated with the incremental quantities of the reserves. If the reserves quantities are estimated using the deterministic incremental approach, the uncertainty for each discrete incremental quantity of the reserves is addressed by the reserves category assigned by the evaluator. Therefore, it is the categorization of reserves quantities as proved, probable and/or possible that addresses the inherent uncertainty in the estimated quantities reported. For proved reserves, uncertainty is defined by the SEC as reasonable certainty wherein the “quantities actually recovered are much more likely to be achieved than not.” The SEC states that “probable reserves are those additional reserves that are less certain to be recovered than proved reserves but which, together with proved reserves, are as likely as not to be recovered.” The SEC states that “possible reserves are those additional reserves that are less certain to be recovered than probable reserves and the total quantities ultimately recovered from a project have a low probability of exceeding proved plus probable plus possible reserves.” All quantities of reserves within the same reserves category must meet the SEC definitions as noted above. Estimates of reserves quantities and their associated reserves categories may be revised in the future as additional geoscience or engineering data become available. Furthermore, estimates of reserves quantities and their associated reserves categories may also be revised due to other factors such as changes in economic conditions, results of future operations, effects of regulation by governmental agencies or geopolitical or economic risks as previously noted herein. The proved, probable and possible reserves for the properties included herein were estimated by performance methods, the volumetric method, analogy, or a combination of methods. Approximately 95 percent of the proved, probable and possible producing reserves attributable to producing wells and/or reservoirs were estimated by performance methods or a combination of methods. These performance methods include, but may not be limited to, decline curve analysis and/or material balance which utilized extrapolations of historical production and pressure data available through November 2020 in those cases where such data were considered to be definitive. The data utilized in this analysis were furnished to Ryder Scott by Apache or obtained from public data sources and were considered sufficient for the purpose thereof. The remaining 5 percent of the producing reserves were estimated by the volumetric

Apache Corporation – Shell Offshore Venture January 27, 2021 Page 6 RYDER SCOTT COMPANY PETROLEUM CONSULTANTS method, analogy, or a combination of methods. These methods were used where there were inadequate historical performance data to establish a definitive trend and where the use of production performance data as a basis for the reserves estimates was considered to be inappropriate. Approximately 100 percent of the proved, probable and possible developed non-producing reserves included herein were estimated by the volumetric method or analogy. The volumetric analysis utilized pertinent well and seismic data furnished to Ryder Scott by Apache or which we have obtained from public data sources that were available through November 2020. The data utilized from the analogues as well as well and seismic data incorporated into our volumetric analysis were considered sufficient for the purpose thereof. To estimate economically recoverable proved, probable and possible oil and gas reserves and related future net cash flows, we consider many factors and assumptions including, but not limited to, the use of reservoir parameters derived from geological, geophysical and engineering data which cannot be measured directly, economic criteria based on current costs and SEC pricing requirements, and forecasts of future production rates. Under the SEC regulations 210.4-10(a)(22)(v) and (26), proved, probable and possible reserves must be anticipated to be economically producible from a given date forward based on existing economic conditions including the prices and costs at which economic producibility from a reservoir is to be determined. While it may reasonably be anticipated that the future prices received for the sale of production and the operating costs and other costs relating to such production may increase or decrease from those under existing economic conditions, such changes were, in accordance with rules adopted by the SEC, omitted from consideration in making this evaluation. Apache has informed us that they have furnished us all of the material accounts, records, geological and engineering data, and reports and other data required for this investigation. In preparing our forecast of future proved production and income, and probable and possible production, we have relied upon data furnished by Apache with respect to property interests owned, production and well tests from examined wells, normal direct costs of operating the wells or leases, other costs such as transportation and/or processing fees, recompletion and development costs, development plans, abandonment costs after salvage, product prices based on the SEC regulations, adjustments or differentials to product prices, geological structural and isochore maps, well logs, core analyses, and pressure measurements. Ryder Scott reviewed such factual data for its reasonableness; however, we have not conducted an independent verification of the data furnished by Apache. We consider the factual data used in this report appropriate and sufficient for the purpose of preparing the estimates of reserves and future net revenues herein. In summary, we consider the assumptions, data, methods and analytical procedures used in this report appropriate for the purpose hereof, and we have used all such methods and procedures that we consider necessary and appropriate to prepare the estimates of reserves herein. The proved, probable and possible reserves included herein were determined in conformance with the United States Securities and Exchange Commission (SEC) Modernization of Oil and Gas Reporting; Final Rule, including all references to Regulation S-X and Regulation S-K, referred to herein collectively as the “SEC Regulations.” In our opinion, the proved, probable and possible reserves presented in this report comply with the definitions, guidelines and disclosure requirements as required by the SEC regulations, except as noted for the probable and possible reserves volumes. Future Production Rates For wells currently on production, our forecasts of future production rates are based on historical performance data. If no production decline trend has been established, future production rates were held

Apache Corporation – Shell Offshore Venture January 27, 2021 Page 7 RYDER SCOTT COMPANY PETROLEUM CONSULTANTS constant, or adjusted for the effects of curtailment where appropriate, until a decline in ability to produce was anticipated. An estimated rate of decline was then applied until depletion of the reserves. If a decline trend has been established, this trend was used as the basis for estimating future production rates. Test data and other related information were used to estimate the anticipated initial production rates for those wells that are not currently producing. For reserves not yet on production, sales were estimated to commence at an anticipated date furnished by Apache. Wells that are not currently producing may start producing earlier or later than anticipated in our estimates due to unforeseen factors causing a change in the timing to initiate production. Such factors may include delays due to weather, the availability of rigs, the sequence of drilling, completing and/or recompleting wells and/or constraints set by regulatory bodies. The future production rates from wells currently on production or wells that are not currently producing may be more or less than estimated because of changes including, but not limited to, reservoir performance, operating conditions related to surface facilities, compression and artificial lift, pipeline capacity and/or operating conditions, producing market demand and/or allowables or other constraints set by regulatory bodies. Hydrocarbon Prices The hydrocarbon prices used herein are based on SEC price parameters using the average prices during the 12-month period prior to the “as of date” of this report, determined as the unweighted arithmetic averages of the prices in effect on the first-day-of-the-month for each month within such period, unless prices were defined by contractual arrangements. For hydrocarbon products sold under contract, the contract prices, including fixed and determinable escalations, exclusive of inflation adjustments, were used until expiration of the contract. Upon contract expiration, the prices were adjusted to the 12-month unweighted arithmetic average as previously described. Apache furnished us with the above mentioned average prices in effect on December 31, 2020. These initial SEC hydrocarbon prices were determined using the 12-month average first-day-of-the- month benchmark prices appropriate to the geographic area where the hydrocarbons are sold. These benchmark prices are prior to the adjustments for differentials as described herein. The table below summarizes the “benchmark prices” and “price reference” used for the geographic area included in the report. In certain geographic areas, the price reference and benchmark prices may be defined by contractual arrangements. The product prices which were actually used to determine the proved future gross revenue for each property reflect adjustments to the benchmark prices for gravity, quality, local conditions, and/or distance from market, referred to herein as “differentials.” The differentials used in the preparation of this report were furnished to us by Apache. The differentials furnished to us were accepted as factual data and reviewed by us for their reasonableness; however, we have not conducted an independent verification of the data used by Apache to determine these differentials. In addition, the following table summarizes the net volume weighted benchmark prices adjusted for differentials and referred to herein as the “average realized prices.” The average realized prices shown in the table below were determined from the total proved future gross revenue before production taxes and the total proved net reserves for the geographic area and presented in accordance with SEC disclosure requirements for each of the geographic areas included in the report.

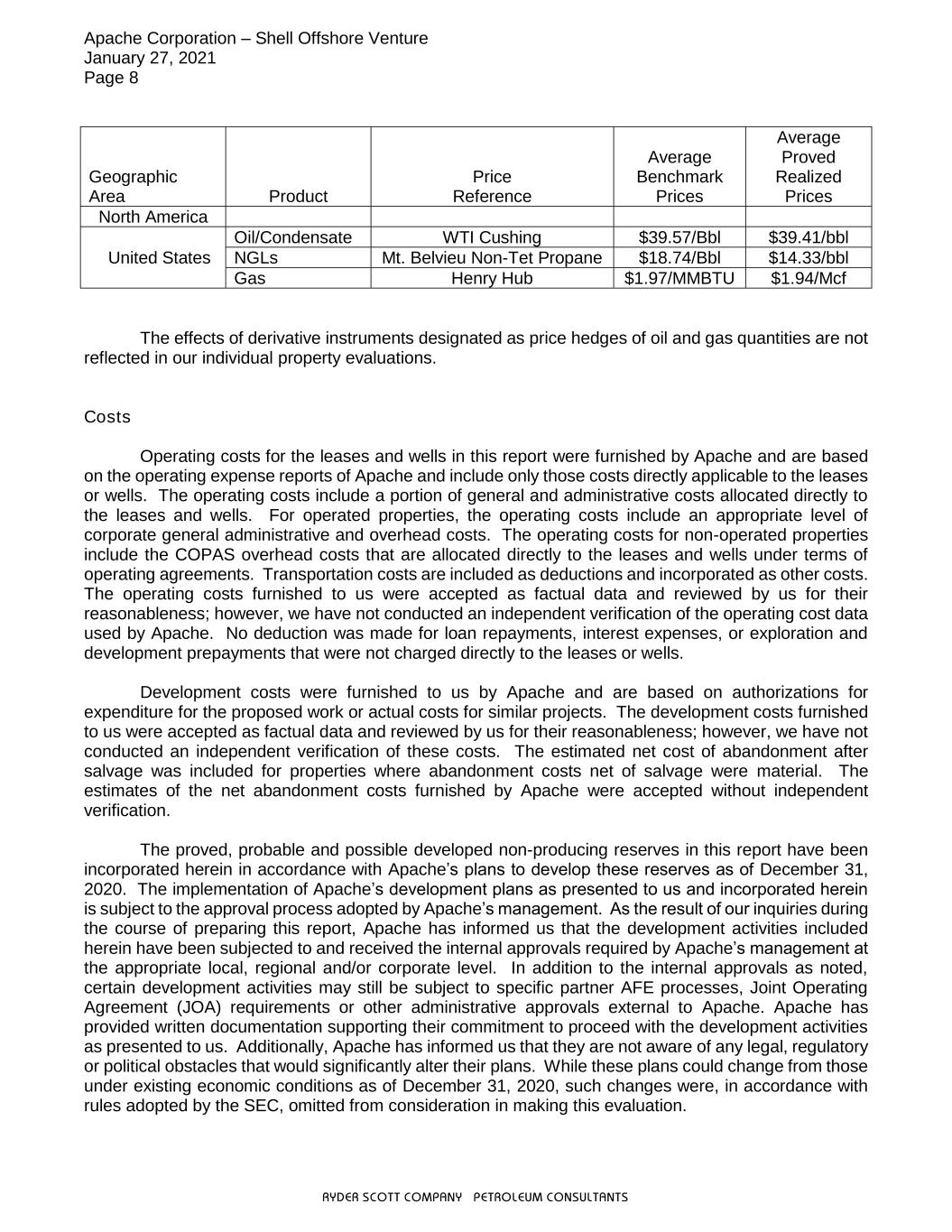

Apache Corporation – Shell Offshore Venture January 27, 2021 Page 8 RYDER SCOTT COMPANY PETROLEUM CONSULTANTS Geographic Area Product Price Reference Average Benchmark Prices Average Proved Realized Prices North America Oil/Condensate WTI Cushing $39.57/Bbl $39.41/bbl United States NGLs Mt. Belvieu Non-Tet Propane $18.74/Bbl $14.33/bbl Gas Henry Hub $1.97/MMBTU $1.94/Mcf The effects of derivative instruments designated as price hedges of oil and gas quantities are not reflected in our individual property evaluations. Costs Operating costs for the leases and wells in this report were furnished by Apache and are based on the operating expense reports of Apache and include only those costs directly applicable to the leases or wells. The operating costs include a portion of general and administrative costs allocated directly to the leases and wells. For operated properties, the operating costs include an appropriate level of corporate general administrative and overhead costs. The operating costs for non-operated properties include the COPAS overhead costs that are allocated directly to the leases and wells under terms of operating agreements. Transportation costs are included as deductions and incorporated as other costs. The operating costs furnished to us were accepted as factual data and reviewed by us for their reasonableness; however, we have not conducted an independent verification of the operating cost data used by Apache. No deduction was made for loan repayments, interest expenses, or exploration and development prepayments that were not charged directly to the leases or wells. Development costs were furnished to us by Apache and are based on authorizations for expenditure for the proposed work or actual costs for similar projects. The development costs furnished to us were accepted as factual data and reviewed by us for their reasonableness; however, we have not conducted an independent verification of these costs. The estimated net cost of abandonment after salvage was included for properties where abandonment costs net of salvage were material. The estimates of the net abandonment costs furnished by Apache were accepted without independent verification. The proved, probable and possible developed non-producing reserves in this report have been incorporated herein in accordance with Apache’s plans to develop these reserves as of December 31, 2020. The implementation of Apache’s development plans as presented to us and incorporated herein is subject to the approval process adopted by Apache’s management. As the result of our inquiries during the course of preparing this report, Apache has informed us that the development activities included herein have been subjected to and received the internal approvals required by Apache’s management at the appropriate local, regional and/or corporate level. In addition to the internal approvals as noted, certain development activities may still be subject to specific partner AFE processes, Joint Operating Agreement (JOA) requirements or other administrative approvals external to Apache. Apache has provided written documentation supporting their commitment to proceed with the development activities as presented to us. Additionally, Apache has informed us that they are not aware of any legal, regulatory or political obstacles that would significantly alter their plans. While these plans could change from those under existing economic conditions as of December 31, 2020, such changes were, in accordance with rules adopted by the SEC, omitted from consideration in making this evaluation.

Apache Corporation – Shell Offshore Venture January 27, 2021 Page 9 RYDER SCOTT COMPANY PETROLEUM CONSULTANTS Current costs used by Apache were held constant throughout the life of the properties. Standards of Independence and Professional Qualification Ryder Scott is an independent petroleum engineering consulting firm that has been providing petroleum consulting services throughout the world since 1937. Ryder Scott is employee-owned and maintains offices in Houston, Texas; Denver, Colorado; and Calgary, Alberta, Canada. We have approximately eighty engineers and geoscientists on our permanent staff. By virtue of the size of our firm and the large number of clients for which we provide services, no single client or job represents a material portion of our annual revenue. We do not serve as officers or directors of any privately-owned or publicly-traded oil and gas company and are separate and independent from the operating and investment decision-making process of our clients. This allows us to bring the highest level of independence and objectivity to each engagement for our services. Ryder Scott actively participates in industry-related professional societies and organizes an annual public forum focused on the subject of reserves evaluations and SEC regulations. Many of our staff have authored or co-authored technical papers on the subject of reserves related topics. We encourage our staff to maintain and enhance their professional skills by actively participating in ongoing continuing education. Prior to becoming an officer of the Company, Ryder Scott requires that staff engineers and geoscientists have received professional accreditation in the form of a registered or certified professional engineer’s license or a registered or certified professional geoscientist’s license, or the equivalent thereof, from an appropriate governmental authority or a recognized self-regulating professional organization. Regulating agencies require that, in order to maintain active status, a certain amount of continuing education hours be completed annually, including an hour of ethics training. Ryder Scott fully supports this technical and ethics training with our internal requirement mentioned above. We are independent petroleum engineers with respect to Apache. Neither we nor any of our employees have any financial interest in the subject properties and neither the employment to do this work nor the compensation is contingent on our estimates of reserves for the properties which were reviewed. The results of this study, presented herein, are based on technical analysis conducted by teams of geoscientists and engineers from Ryder Scott. The professional qualifications of the undersigned, the technical person primarily responsible for overseeing the evaluation of the reserves information discussed in this report, are included as an attachment to this letter. Terms of Usage The results of our third party study, presented in report form herein, were prepared in accordance with the disclosure requirements set forth in the SEC regulations and intended for public disclosure as an exhibit in filings made with the SEC by Apache Corporation. Apache makes periodic filings on Form 10-K with the SEC under the 1934 Exchange Act. Furthermore, Apache has certain registration statements filed with the SEC under the 1933 Securities Act into which any subsequently filed Form 10-K is incorporated by reference. We have consented to the incorporation by reference in the registration statements on Form S-3, Form S-4, and Form S-8 of Apache, of the references to our name, as well as to the references to our third party report for Apache,

Apache Corporation – Shell Offshore Venture January 27, 2021 Page 10 RYDER SCOTT COMPANY PETROLEUM CONSULTANTS which appears in the December 31, 2020 annual report on Form 10-K of Apache. Our written consent for such use is included as a separate exhibit to the filings made with the SEC by Apache. We have provided Apache with a digital version of the original signed copy of this report letter. In the event there are any differences between the digital version included in filings made by Apache and the original signed report letter, the original signed report letter shall control and supersede the digital version. The data and work papers used in the preparation of this report are available for examination by authorized parties in our offices. Please contact us if we can be of further service. Very truly yours, RYDER SCOTT COMPANY, L.P. TBPE Firm Registration No. F-1580 Ali A. Porbandarwala, P.E. TBPE License No. 107652 Senior Vice President AAP (FWZ)/pl

RYDER SCOTT COMPANY PETROLEUM CONSULTANTS Professional Qualifications of Primary Technical Person The conclusions presented in this report are the result of technical analysis conducted by teams of geoscientists and engineers from Ryder Scott Company, L.P. Mr. Ali A. Porbandarwala was the primary technical person responsible for overseeing the estimate of the reserves, future production and income prepared by Ryder Scott presented herein. Mr. Porbandarwala, an employee of Ryder Scott Company, L.P. (Ryder Scott) since 2008, is a Senior Vice President responsible for coordinating and supervising staff and consulting engineers of the company in ongoing reservoir evaluation studies worldwide. Before joining Ryder Scott, Mr. Porbandarwala served in a number of engineering positions with ExxonMobil Corporation. For more information regarding Mr. Porbandarwala’s geographic and job specific experience, please refer to the Ryder Scott Company website at www.ryderscott.com/Company/Employees. Mr. Porbandarwala earned a Bachelor of Science degree in Chemical Engineering from The University of Kansas in 2001 and a Masters in Business Administration from The University of Texas at Austin in 2007 and is a licensed Professional Engineer in the State of Texas. He is also a member of the Society of Petroleum Engineers and a member of the Society of Petroleum Evaluation Engineers as the Chairman for the Houston Chapter. Mr. Porbandarwala also serves as the Chairman of the annual Ryder Scott Reserves Conference in Houston, completing its sixteenth year in the industry. In addition to gaining experience and competency through prior work experience, the Texas Board of Professional Engineers requires a minimum of fifteen hours of continuing education annually, including at least one hour in the area of professional ethics, which Mr. Porbandarwala fulfills. As part of his 2020 continuing education hours, Mr. Porbandarwala attended 25 hours of formalized training including the 2020 Virtual Ryder Scott Reserves Conference and various other professional society presentations specifically relating to the definitions and disclosure guidelines contained in the United States Securities and Exchange Commission Title 17, Code of Federal Regulations, Modernization of Oil and Gas Reporting, Final Rule released January 14, 2009 in the Federal Register. Based on his educational background, professional training and more than 12 years of practical experience in the estimation and evaluation of petroleum reserves, Mr. Porbandarwala has attained the professional qualifications as a Reserves Estimator and Reserves Auditor set forth in Article III of the “Standards Pertaining to the Estimating and Auditing of Oil and Gas Reserves Information” promulgated by the Society of Petroleum Engineers as of February 19, 2007.

RYDER SCOTT COMPANY PETROLEUM CONSULTANTS PETROLEUM RESERVES DEFINITIONS As Adapted From: RULE 4-10(a) of REGULATION S-X PART 210 UNITED STATES SECURITIES AND EXCHANGE COMMISSION (SEC) PREAMBLE On January 14, 2009, the United States Securities and Exchange Commission (SEC) published the “Modernization of Oil and Gas Reporting; Final Rule” in the Federal Register of National Archives and Records Administration (NARA). The “Modernization of Oil and Gas Reporting; Final Rule” includes revisions and additions to the definition section in Rule 4-10 of Regulation S-X, revisions and additions to the oil and gas reporting requirements in Regulation S-K, and amends and codifies Industry Guide 2 in Regulation S-K. The “Modernization of Oil and Gas Reporting; Final Rule”, including all references to Regulation S-X and Regulation S-K, shall be referred to herein collectively as the “SEC regulations”. The SEC regulations take effect for all filings made with the United States Securities and Exchange Commission as of December 31, 2009, or after January 1, 2010. Reference should be made to the full text under Title 17, Code of Federal Regulations, Regulation S-X Part 210, Rule 4-10(a) for the complete definitions (direct passages excerpted in part or wholly from the aforementioned SEC document are denoted in italics herein). Reserves are estimated remaining quantities of oil and gas and related substances anticipated to be economically producible, as of a given date, by application of development projects to known accumulations. All reserve estimates involve an assessment of the uncertainty relating the likelihood that the actual remaining quantities recovered will be greater or less than the estimated quantities determined as of the date the estimate is made. The uncertainty depends chiefly on the amount of reliable geologic and engineering data available at the time of the estimate and the interpretation of these data. The relative degree of uncertainty may be conveyed by placing reserves into one of two principal classifications, either proved or unproved. Unproved reserves are less certain to be recovered than proved reserves and may be further sub-classified as probable and possible reserves to denote progressively increasing uncertainty in their recoverability. Under the SEC regulations as of December 31, 2009, or after January 1, 2010, a company may optionally disclose estimated quantities of probable or possible oil and gas reserves in documents publicly filed with the SEC. The SEC regulations continue to prohibit disclosure of estimates of oil and gas resources other than reserves and any estimated values of such resources in any document publicly filed with the SEC unless such information is required to be disclosed in the document by foreign or state law as noted in §229.1202 Instruction to Item 1202. Reserves estimates will generally be revised only as additional geologic or engineering data become available or as economic conditions change. Reserves may be attributed to either natural energy or improved recovery methods. Improved recovery methods include all methods for supplementing natural energy or altering natural forces in the reservoir to increase ultimate recovery. Examples of such methods are pressure maintenance, natural gas cycling, waterflooding, thermal methods, chemical flooding, and the use of miscible and immiscible displacement fluids. Other improved recovery methods may be developed in the future as petroleum technology continues to evolve. Reserves may be attributed to either conventional or unconventional petroleum accumulations. Petroleum accumulations are considered as either conventional or unconventional based on the nature of their in-place characteristics, extraction method applied, or degree of processing prior to sale.

PETROLEUM RESERVES DEFINITIONS Page 2 RYDER SCOTT COMPANY PETROLEUM CONSULTANTS Examples of unconventional petroleum accumulations include coalbed or coalseam methane (CBM/CSM), basin-centered gas, shale gas, gas hydrates, natural bitumen and oil shale deposits. These unconventional accumulations may require specialized extraction technology and/or significant processing prior to sale. Reserves do not include quantities of petroleum being held in inventory. Because of the differences in uncertainty, caution should be exercised when aggregating quantities of petroleum from different reserves categories. RESERVES (SEC DEFINITIONS) Securities and Exchange Commission Regulation S-X §210.4-10(a)(26) defines reserves as follows: Reserves. Reserves are estimated remaining quantities of oil and gas and related substances anticipated to be economically producible, as of a given date, by application of development projects to known accumulations. In addition, there must exist, or there must be a reasonable expectation that there will exist, the legal right to produce or a revenue interest in the production, installed means of delivering oil and gas or related substances to market, and all permits and financing required to implement the project. Note to paragraph (a)(26): Reserves should not be assigned to adjacent reservoirs isolated by major, potentially sealing, faults until those reservoirs are penetrated and evaluated as economically producible. Reserves should not be assigned to areas that are clearly separated from a known accumulation by a non-productive reservoir (i.e., absence of reservoir, structurally low reservoir, or negative test results). Such areas may contain prospective resources (i.e., potentially recoverable resources from undiscovered accumulations). PROVED RESERVES (SEC DEFINITIONS) Securities and Exchange Commission Regulation S-X §210.4-10(a)(22) defines proved oil and gas reserves as follows: Proved oil and gas reserves. Proved oil and gas reserves are those quantities of oil and gas, which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible—from a given date forward, from known reservoirs, and under existing economic conditions, operating methods, and government regulations—prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are used for the estimation. The project to extract the hydrocarbons must have commenced or the operator must be reasonably certain that it will commence the project within a reasonable time. (i) The area of the reservoir considered as proved includes: (A) The area identified by drilling and limited by fluid contacts, if any, and (B) Adjacent undrilled portions of the reservoir that can, with reasonable certainty, be judged to be continuous with it and to contain economically producible oil or gas on the basis of available geoscience and engineering data.

PETROLEUM RESERVES DEFINITIONS Page 3 RYDER SCOTT COMPANY PETROLEUM CONSULTANTS (ii) In the absence of data on fluid contacts, proved quantities in a reservoir are limited by the lowest known hydrocarbons (LKH) as seen in a well penetration unless geoscience, engineering, or performance data and reliable technology establishes a lower contact with reasonable certainty. (iii) Where direct observation from well penetrations has defined a highest known oil (HKO) elevation and the potential exists for an associated gas cap, proved oil reserves may be assigned in the structurally higher portions of the reservoir only if geoscience, engineering, or performance data and reliable technology establish the higher contact with reasonable certainty. (iv) Reserves which can be produced economically through application of improved recovery techniques (including, but not limited to, fluid injection) are included in the proved classification when: (A) Successful testing by a pilot project in an area of the reservoir with properties no more favorable than in the reservoir as a whole, the operation of an installed program in the reservoir or an analogous reservoir, or other evidence using reliable technology establishes the reasonable certainty of the engineering analysis on which the project or program was based; and (B) The project has been approved for development by all necessary parties and entities, including governmental entities. (v) Existing economic conditions include prices and costs at which economic producibility from a reservoir is to be determined. The price shall be the average price during the 12-month period prior to the ending date of the period covered by the report, determined as an unweighted arithmetic average of the first-day-of-the-month price for each month within such period, unless prices are defined by contractual arrangements, excluding escalations based upon future conditions. PROBABLE RESERVES (SEC DEFINITIONS) Securities and Exchange Commission Regulation S-X §210.4-10(a)(18) defines probable oil and gas reserves as follows: Probable reserves. Probable reserves are those additional reserves that are less certain to be recovered than proved reserves but which, together with proved reserves, are as likely as not to be recovered. (i) When deterministic methods are used, it is as likely as not that actual remaining quantities recovered will exceed the sum of estimated proved plus probable reserves. When probabilistic methods are used, there should be at least a 50% probability that the actual quantities recovered will equal or exceed the proved plus probable reserves estimates. (ii) Probable reserves may be assigned to areas of a reservoir adjacent to proved reserves where data control or interpretations of available data are less certain, even if the interpreted reservoir continuity of structure or productivity does not meet the reasonable certainty criterion. Probable reserves may be assigned to areas that are structurally higher than the proved area if these areas are in communication with the proved reservoir. (iii) Probable reserves estimates also include potential incremental quantities associated with a greater percentage recovery of the hydrocarbons in place than assumed for proved reserves.

PETROLEUM RESERVES DEFINITIONS Page 4 RYDER SCOTT COMPANY PETROLEUM CONSULTANTS (iv) See also guidelines in paragraphs (a)(17)(iv) and (a)(17)(vi) of this section. POSSIBLE RESERVES (SEC DEFINITIONS) Securities and Exchange Commission Regulation S-X §210.4-10(a)(17) defines possible oil and gas reserves as follows: Possible reserves. Possible reserves are those additional reserves that are less certain to be recovered than probable reserves. (i) When deterministic methods are used, the total quantities ultimately recovered from a project have a low probability of exceeding proved plus probable plus possible reserves. When probabilistic methods are used, there should be at least a 10% probability that the total quantities ultimately recovered will equal or exceed the proved plus probable plus possible reserves estimates. (ii) Possible reserves may be assigned to areas of a reservoir adjacent to probable reserves where data control and interpretations of available data are progressively less certain. Frequently, this will be in areas where geoscience and engineering data are unable to define clearly the area and vertical limits of commercial production from the reservoir by a defined project. (iii) Possible reserves also include incremental quantities associated with a greater percentage recovery of the hydrocarbons in place than the recovery quantities assumed for probable reserves. (iv) The proved plus probable and proved plus probable plus possible reserves estimates must be based on reasonable alternative technical and commercial interpretations within the reservoir or subject project that are clearly documented, including comparisons to results in successful similar projects. (v) Possible reserves may be assigned where geoscience and engineering data identify directly adjacent portions of a reservoir within the same accumulation that may be separated from proved areas by faults with displacement less than formation thickness or other geological discontinuities and that have not been penetrated by a wellbore, and the registrant believes that such adjacent portions are in communication with the known (proved) reservoir. Possible reserves may be assigned to areas that are structurally higher or lower than the proved area if these areas are in communication with the proved reservoir. (vi) Pursuant to paragraph (a)(22)(iii) of this section, where direct observation has defined a highest known oil (HKO) elevation and the potential exists for an associated gas cap, proved oil reserves should be assigned in the structurally higher portions of the reservoir above the HKO only if the higher contact can be established with reasonable certainty through reliable technology. Portions of the reservoir that do not meet this reasonable certainty criterion may be assigned as probable and possible oil or gas based on reservoir fluid properties and pressure gradient interpretations.

RYDER SCOTT COMPANY PETROLEUM CONSULTANTS PETROLEUM RESERVES STATUS DEFINITIONS AND GUIDELINES As Adapted From: RULE 4-10(a) of REGULATION S-X PART 210 UNITED STATES SECURITIES AND EXCHANGE COMMISSION (SEC) and 2018 PETROLEUM RESOURCES MANAGEMENT SYSTEM (SPE-PRMS) Sponsored and Approved by: SOCIETY OF PETROLEUM ENGINEERS (SPE) WORLD PETROLEUM COUNCIL (WPC) AMERICAN ASSOCIATION OF PETROLEUM GEOLOGISTS (AAPG) SOCIETY OF PETROLEUM EVALUATION ENGINEERS (SPEE) SOCIETY OF EXPLORATION GEOPHYSICISTS (SEG) SOCIETY OF PETROPHYSICISTS AND WELL LOG ANALYSTS (SPWLA) EUROPEAN ASSOCIATION OF GEOSCIENTISTS & ENGINEERS (EAGE) Reserves status categories define the development and producing status of wells and reservoirs. Reference should be made to Title 17, Code of Federal Regulations, Regulation S-X Part 210, Rule 4- 10(a) and the SPE-PRMS as the following reserves status definitions are based on excerpts from the original documents (direct passages excerpted from the aforementioned SEC and SPE-PRMS documents are denoted in italics herein). DEVELOPED RESERVES (SEC DEFINITIONS) Securities and Exchange Commission Regulation S-X §210.4-10(a)(6) defines developed oil and gas reserves as follows: Developed oil and gas reserves are reserves of any category that can be expected to be recovered: (i) Through existing wells with existing equipment and operating methods or in which the cost of the required equipment is relatively minor compared to the cost of a new well; and (ii) Through installed extraction equipment and infrastructure operational at the time of the reserves estimate if the extraction is by means not involving a well. Developed Producing (SPE-PRMS Definitions) While not a requirement for disclosure under the SEC regulations, developed oil and gas reserves may be further sub-classified according to the guidance contained in the SPE-PRMS as Producing or Non-Producing. Developed Producing Reserves Developed Producing Reserves are expected quantities to be recovered from completion intervals that are open and producing at the effective date of the estimate.

PETROLEUM RESERVES STATUS DEFINITIONS AND GUIDELINES Page 2 RYDER SCOTT COMPANY PETROLEUM CONSULTANTS Improved recovery reserves are considered producing only after the improved recovery project is in operation. Developed Non-Producing Developed Non-Producing Reserves include shut-in and behind-pipe Reserves. Shut-In Shut-in Reserves are expected to be recovered from: (1) completion intervals that are open at the time of the estimate but which have not yet started producing; (2) wells which were shut-in for market conditions or pipeline connections; or (3) wells not capable of production for mechanical reasons. Behind-Pipe Behind-pipe Reserves are expected to be recovered from zones in existing wells that will require additional completion work or future re-completion before start of production with minor cost to access these reserves. In all cases, production can be initiated or restored with relatively low expenditure compared to the cost of drilling a new well. UNDEVELOPED RESERVES (SEC DEFINITIONS) Securities and Exchange Commission Regulation S-X §210.4-10(a)(31) defines undeveloped oil and gas reserves as follows: Undeveloped oil and gas reserves are reserves of any category that are expected to be recovered from new wells on undrilled acreage, or from existing wells where a relatively major expenditure is required for recompletion. (i) Reserves on undrilled acreage shall be limited to those directly offsetting development spacing areas that are reasonably certain of production when drilled, unless evidence using reliable technology exists that establishes reasonable certainty of economic producibility at greater distances. (ii) Undrilled locations can be classified as having undeveloped reserves only if a development plan has been adopted indicating that they are scheduled to be drilled within five years, unless the specific circumstances, justify a longer time. (iii) Under no circumstances shall estimates for undeveloped reserves be attributable to any acreage for which an application of fluid injection or other improved recovery technique is contemplated, unless such techniques have been proved effective by actual projects in the same reservoir or an analogous reservoir, as defined in paragraph (a)(2) of this section, or by other evidence using reliable technology establishing reasonable certainty.

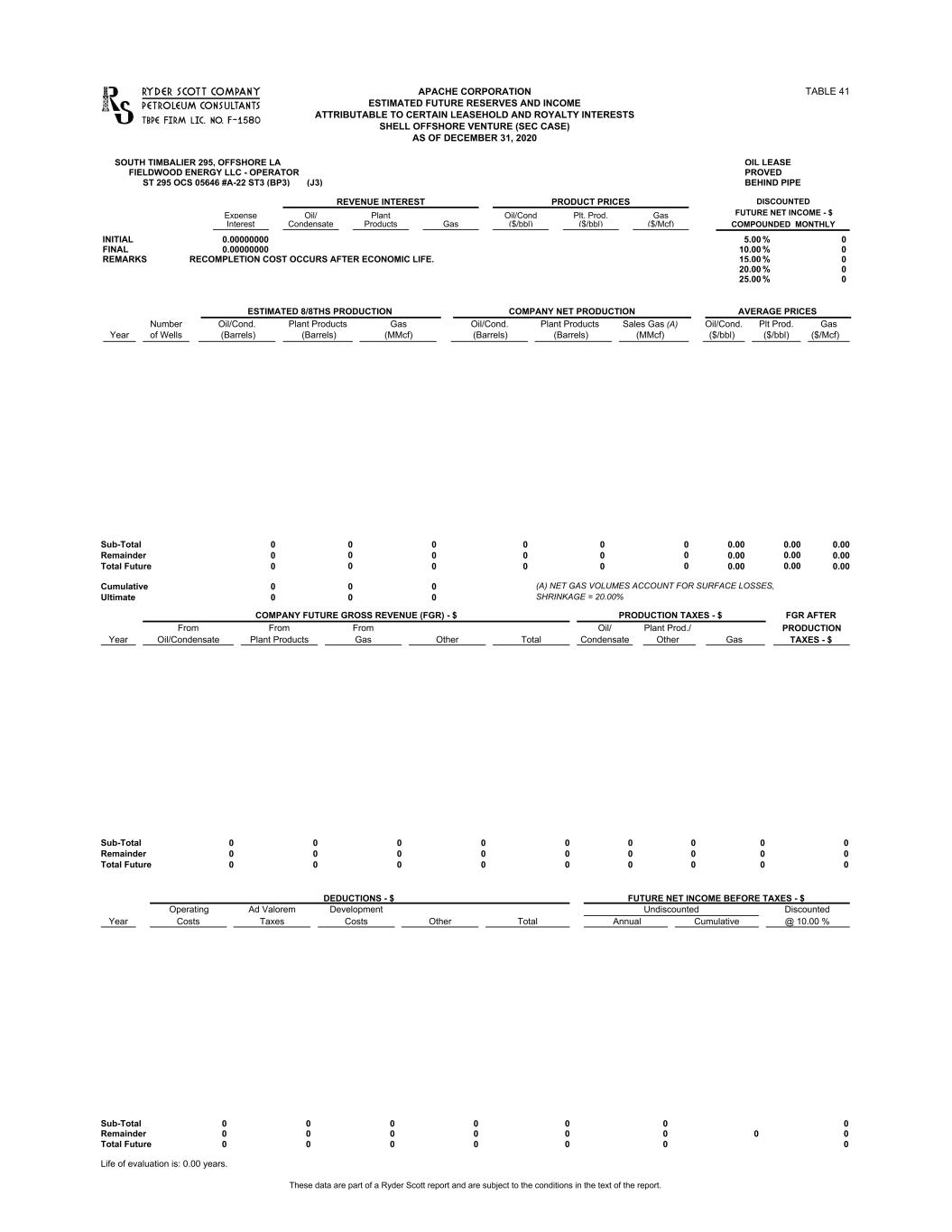

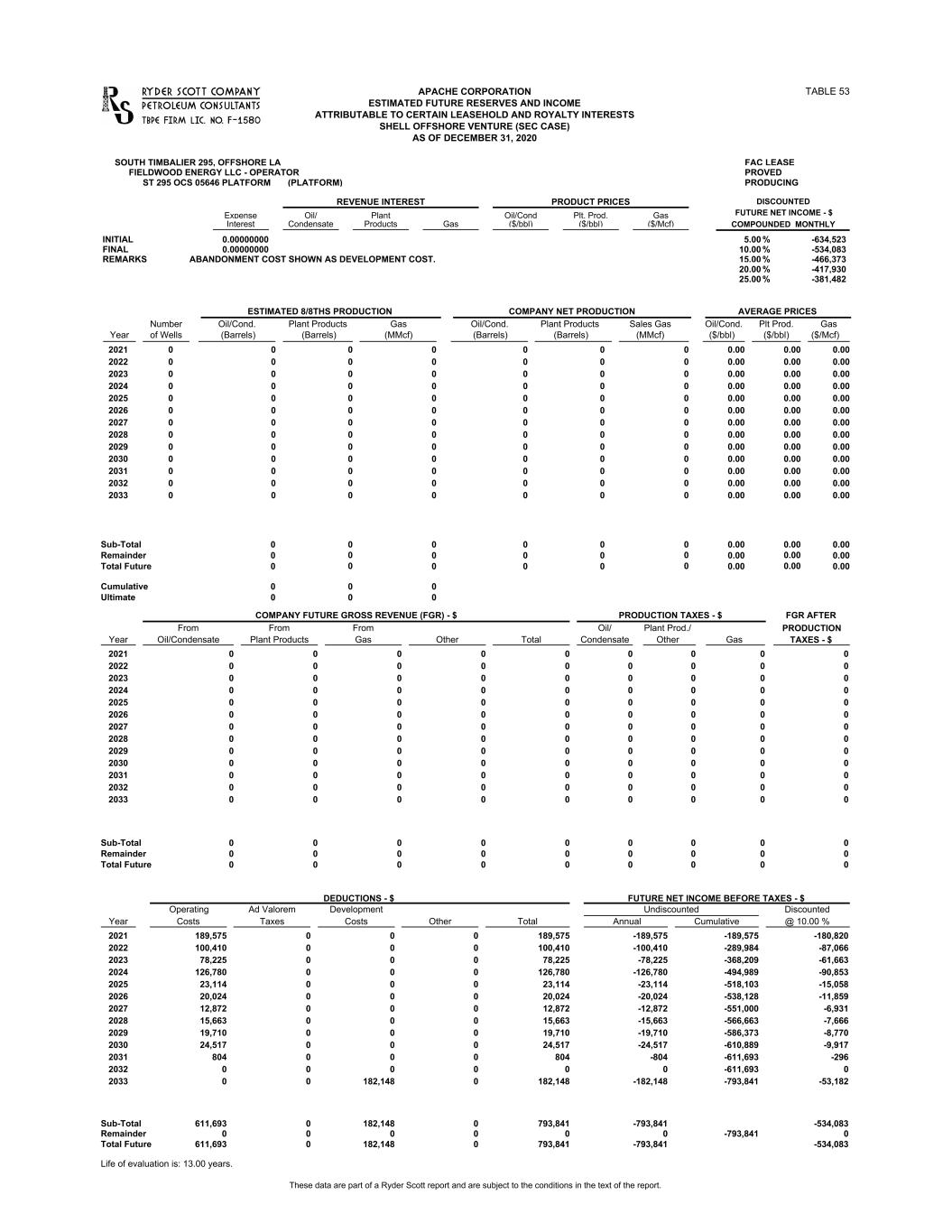

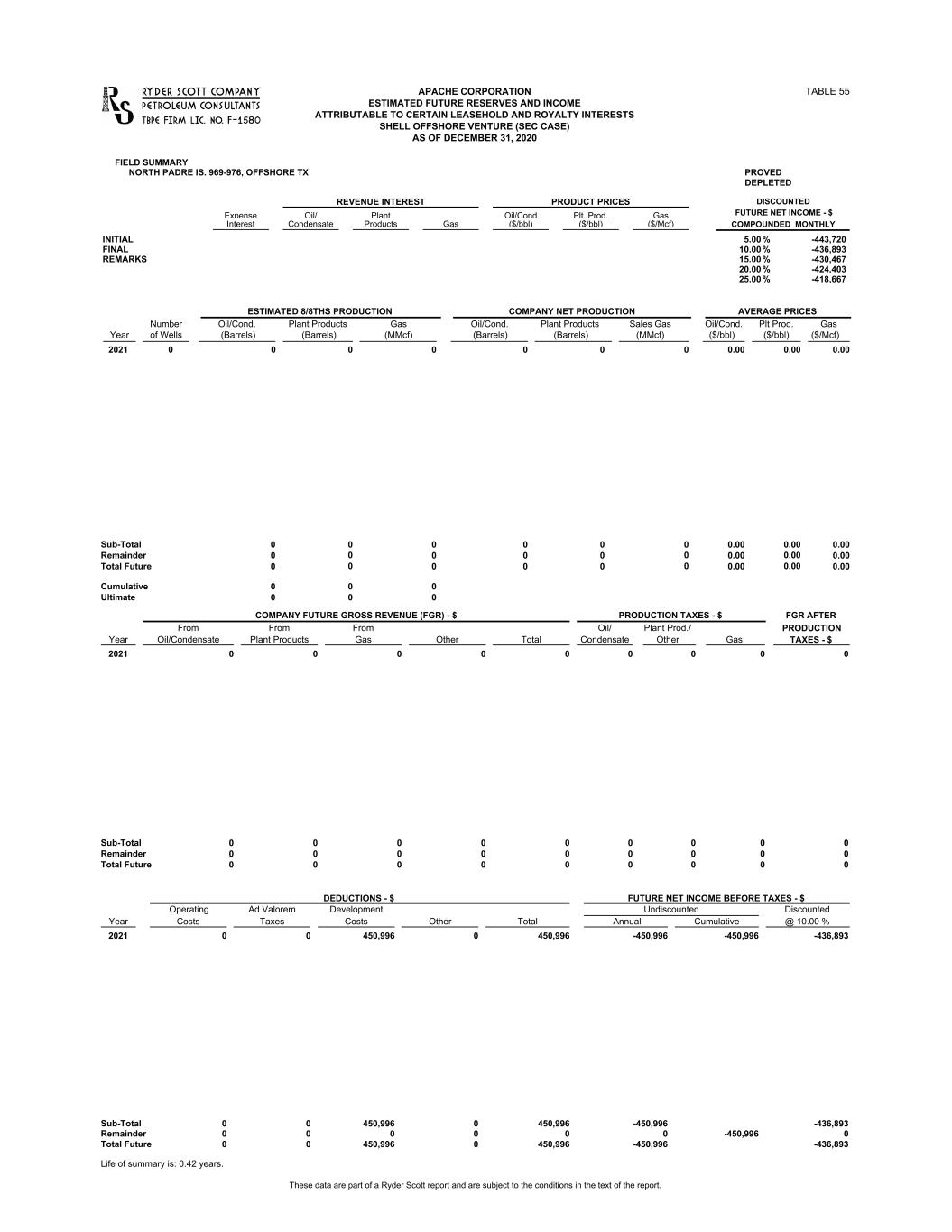

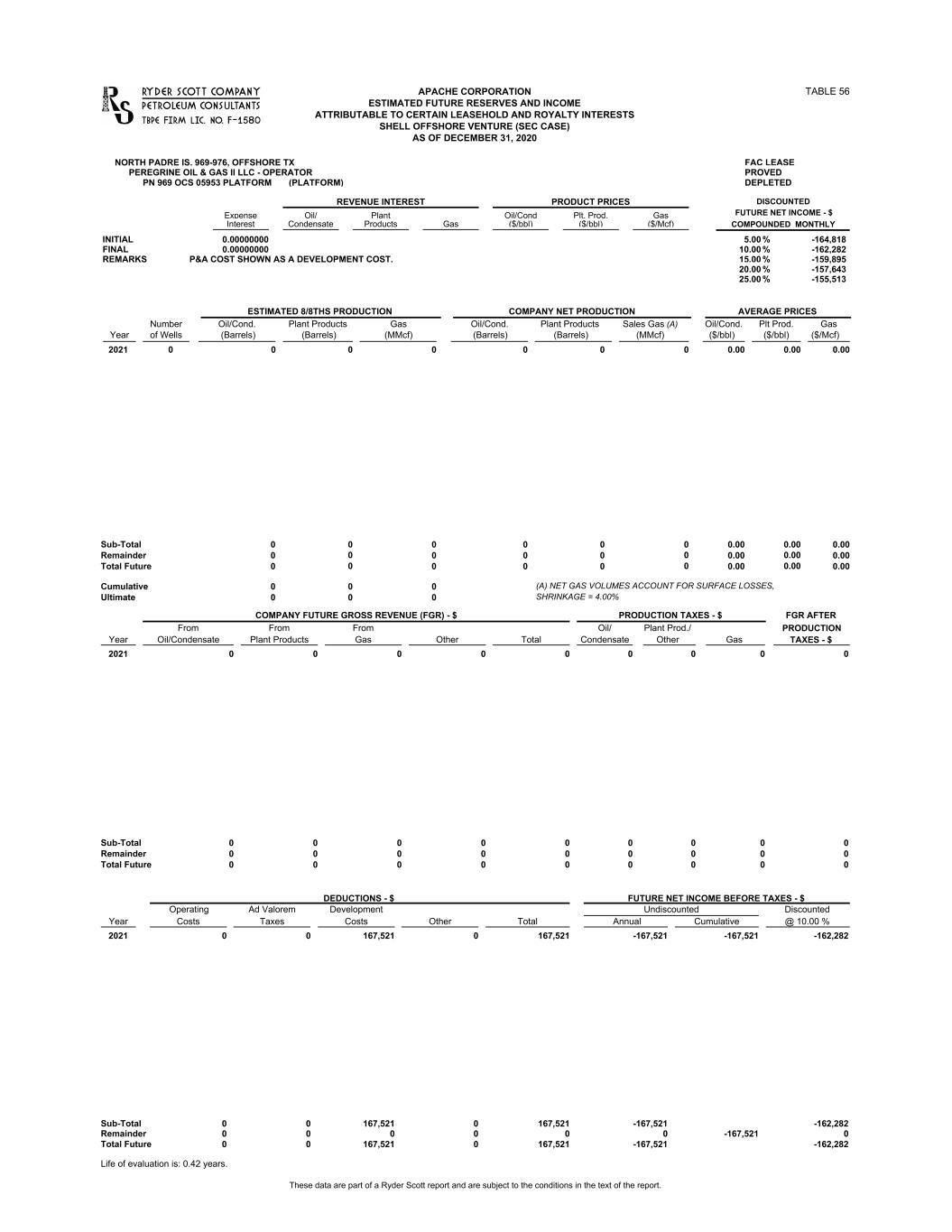

APACHE CORPORATION TABLE OF CONTENTS (CONT.) TABLE NO. SOUTH TIMBALIER 295, OFFSHORE LA (CONT.) ST 295 OCS 05646 #A-16 ST (BP3) - PROVED BEHIND PIPE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33 ST 295 OCS 05646 #A-16 ST (BP4) - PROVED BEHIND PIPE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34 ST 295 OCS 05646 #A-16 ST (BP5) - PROVED BEHIND PIPE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35 ST 295 OCS 05646 #A-21 ST2 - PROVED PRODUCING . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36 ST 295 OCS 05646 #A-21 ST2 (PDNP) - PROVED BEHIND PIPE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37 ST 295 OCS 05646 #A-22 ST3 - PROVED PRODUCING . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38 ST 295 OCS 05646 #A-22 ST3 (BP1) - PROVED BEHIND PIPE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39 ST 295 OCS 05646 #A-22 ST3 (BP2) - PROVED BEHIND PIPE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40 ST 295 OCS 05646 #A-22 ST3 (BP3) - PROVED BEHIND PIPE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41 ST 295 OCS 05646 #A-22 ST3 (BP4) - PROVED BEHIND PIPE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42 ST 295 OCS 05646 #A-25 - PROVED PRODUCING . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43 ST 295 OCS 05646 #A-27 - PROVED PRODUCING . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44 ST 295 OCS 05646 #A-31 - PROVED PRODUCING . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45 ST 295 OCS 05646 #A-32 (BP1) - PROVED BEHIND PIPE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46 ST 295 OCS 05646 #A-32 (BP2) - PROVED BEHIND PIPE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47 ST 295 OCS 05646 #B- 1 - PROVED SHUT-IN . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48 ST 295 OCS 05646 #B- 2 - PROVED PRODUCING . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 49 ST 295 OCS 05646 #B- 5 - PROVED PRODUCING . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 50 ST 295 OCS 05646 #B- 5 (BP2) - PROVED BEHIND PIPE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51 ST 295 OCS 05646 #B- 6ST - PROVED PRODUCING . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 52 ST 295 OCS 05646 PLATFORM - PROVED PRODUCING . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53 ST 295 OCS 05646 PLATFORM - PROVED BEHIND PIPE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 54 NORTH PADRE IS. 969-976, OFFSHORE TX FIELD SUMMARY - PROVED DEPLETED . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 55 PN 969 OCS 05953 PLATFORM - PROVED DEPLETED . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 56 PN 976 OCS 05953 PLATFORM - PROVED DEPLETED . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 57 RYDER SCOTT COMPANY PETROLEUM CONSULTANTS - TBPE FIRM LICENSE No. F-1580

APACHE CORPORATION FIELD RANKING BY PROVED DISCOUNTED FUTURE NET INCOME ATTRIBUTABLE TO CERTAIN LEASEHOLD AND ROYALTY INTERESTS SHELL OFFSHORE VENTURE (SEC CASE) AS OF DECEMBER 31, 2020 CUMULATIVE PERCENT OF TOTAL $ FUTURE NET INCOME (B) $ FUTURE NET INCOME DISC. AT 10.0% (BARRELS) OIL/COND (A)RANK (MMCF) GAS -------------- NET RESERVES ------- PERCENT OF TOTAL TABLE A TABLE NUMBER PAGE 1 OF 1 SOUTH TIMBALIER 295 1 OFFSHORE LA 7,536,474 5,253,238 8 110.765 110.765TOTAL PROVED 597 349,994 SHIP SHOAL 258 2 OFFSHORE LA -75,444 -73,667 6 109.212-1.553TOTAL PROVED 0 0 NORTH PADRE IS. 969-976 3 OFFSHORE TX -450,996 -436,893 55 100.000-9.212TOTAL PROVED 0 0 TOTAL PROVED 349,994 100.000 100.000 597 7,010,035 4,742,678 (A) EXCLUDES PLANT PRODUCTS (B) BEFORE FEDERAL OR STATE INCOME TAXES

APACHE CORPORATION SUMMARY OF GROSS AND NET RESERVES AND INCOME DATA ATTRIBUTABLE TO CERTAIN LEASEHOLD AND ROYALTY INTERESTS SHELL OFFSHORE VENTURE (SEC CASE) AS OF DECEMBER 31, 2020 ------------------------------------ ESTIMATED REMAINING RESERVES ---------------------------------- --------------- ESTIMATED FUTURE DOLLARS, $ --------------- RESV TYPE (A) (BARRELS) OIL/COND(B) (MMCF) GAS ----------------- 100% GROSS ---------------- (BARRELS) OIL/COND(B) (MMCF) SALES GAS ------------------------- NET ------------------------ GROSS REV AFTER PROD TAX TOTAL DEDUCTION UNDISC DISCOUNT AT 10.00% NET INCOME BEFORE FIT TABLE B PAGE 1 OF 2 (BARRELS) PLANT PROD (BARRELS) PLANT PROD OFFSHORE LA SHIP SHOAL 258 OFFSHORE LA PV-DPSS 258 OCS 05560 PLATFORM A/B 0 0 0 0 0 75,444 (75,444) (73,667) 0 0 SOUTH TIMBALIER 295 OFFSHORE LA PV-PDST 295 OCS 05646 #A- 3 9,399 23 478 159,226 428,251 53,650 374,601 254,091 16,719 987 PV-BPST 295 OCS 05646 #A- 3 (BP1) 2,672 10 206 45,267 130,252 21,606 108,645 37,721 7,209 426 PV-BPST 295 OCS 05646 #A- 3 (BP2) 0 0 0 0 0 0 0 0 0 0 PV-BPST 295 OCS 05646 #A- 3 (BP3) 0 0 0 0 0 0 0 0 0 0 PV-PDST 295 OCS 05646 #A- 4 3,704 5 113 62,753 159,667 19,369 140,298 120,207 3,957 234 PV-BPST 295 OCS 05646 #A- 4 (BP1) 32,359 54 1,150 548,200 1,414,490 324,132 1,090,358 600,605 40,249 2,376 PV-SIST 295 OCS 07780 #A-10 ST 0 0 0 0 0 0 0 0 0 0 PV-BPST 295 OCS 07780 #A-10 ST (BP2) 6,369 17 351 107,900 293,959 75,745 218,214 173,826 12,285 725 PV-BPST 295 OCS 07780 #A-10 ST (BP3) 21,716 33 702 367,900 941,709 255,260 686,449 376,379 24,570 1,450 PV-BPST 295 OCS 07780 #A-10 ST (BP4) 3,719 7 139 63,000 163,512 28,838 134,674 47,704 4,851 286 PV-BPST 295 OCS 07780 #A-10 ST (BP5) 2,759 6 117 46,738 123,022 24,772 98,250 29,875 4,090 241 PV-PDST 295 OCS 05646 #A-11 17,875 17 368 302,815 748,942 51,714 697,229 534,276 12,876 760 PV-SIST 295 OCS 05646 #A-11 0 0 0 0 0 0 0 0 0 0 PV-BPST 295 OCS 05646 #A-11 (BP1) 25,223 80 1,703 427,300 1,200,288 204,285 996,003 861,484 59,605 3,518 PV-BPST 295 OCS 05646 #A-11 (BP2) 14,580 22 475 247,000 632,094 40,835 591,258 362,513 16,625 981 PV-BPST 295 OCS 05646 #A-11 (BP3) 10,058 15 319 170,400 435,014 46,287 388,728 169,682 11,165 659 PV-SIST 295 OCS 05646 #A-13 ST 0 0 0 0 0 0 0 0 0 0 PV-PDST 295 OCS 05646 #A-14 15 0 5 250 1,189 1,112 76 75 175 10 PV-PDST 295 OCS 05646 #A-15 587 3 55 9,942 29,752 18,671 11,081 9,632 1,914 113 PV-PDST 295 OCS 05646 #A-16 ST 2,270 5 100 38,451 101,510 18,691 82,819 70,962 3,487 206 PV-BPST 295 OCS 05646 #A-16 ST (BP2) 35,334 41 868 598,600 1,497,556 192,321 1,305,235 733,167 30,380 1,793 PV-BPST 295 OCS 05646 #A-16 ST (BP3) 2,343 4 81 39,700 102,160 23,555 78,605 26,951 2,835 167 PV-BPST 295 OCS 05646 #A-16 ST (BP4) 11,070 26 559 187,542 503,914 36,472 467,441 144,973 19,549 1,154 PV-BPST 295 OCS 05646 #A-16 ST (BP5) 0 0 0 0 0 0 0 0 0 0 PV-PDST 295 OCS 05646 #A-21 ST2 2,936 6 119 49,739 134,357 18,062 116,294 99,031 8,655 511 PV-BPST 295 OCS 05646 #A-21 ST2 (PDNP) 4,249 8 180 71,991 189,264 29,126 160,138 92,599 6,299 372 PV-PDST 295 OCS 05646 #A-22 ST3 7,648 8 161 129,565 320,826 28,304 292,523 246,212 5,619 332 PV-BPST 295 OCS 05646 #A-22 ST3 (BP1) 68,360 121 2,555 1,158,105 3,003,432 198,598 2,804,834 1,335,209 89,429 5,279 PV-BPST 295 OCS 05646 #A-22 ST3 (BP2) 0 0 0 0 0 0 0 0 0 0 PV-BPST 295 OCS 05646 #A-22 ST3 (BP3) 0 0 0 0 0 0 0 0 0 0 PV-BPST 295 OCS 05646 #A-22 ST3 (BP4) 0 0 0 0 0 0 0 0 0 0 PV-PDST 295 OCS 05646 #A-25 313 1 13 5,300 13,934 5,986 7,948 7,491 464 27 PV-PDST 295 OCS 05646 #A-27 1,250 3 53 21,181 55,683 17,213 38,471 33,496 1,853 109 PV-PDST 295 OCS 05646 #A-31 1,813 8 167 30,707 91,603 16,760 74,843 66,307 5,828 344 PV-BPST 295 OCS 05646 #A-32 (BP1) 49,040 46 980 830,800 2,051,236 210,602 1,840,634 1,310,126 34,300 2,025 PV-BPST 295 OCS 05646 #A-32 (BP2) 0 0 0 0 0 0 0 0 0 0 PV-SIST 295 OCS 05646 #B- 1 0 0 0 0 0 0 0 0 0 0 PV-PDST 295 OCS 05646 #B- 2 165 1 13 2,789 8,072 4,211 3,861 3,723 458 27 PV-PDST 295 OCS 05646 #B- 5 423 1 13 7,163 18,206 3,848 14,357 13,845 446 26 PV-BPST 295 OCS 05646 #B- 5 (BP2) 11,747 28 597 199,000 535,227 51,919 483,308 388,327 20,895 1,233 PV-PDST 295 OCS 05646 #B- 6ST 0 0 0 0 0 0 0 0 0 0 PV-PDST 295 OCS 05646 PLATFORM 0 0 0 0 0 793,841 (793,841) (534,083) 0 0 PV-BPST 295 OCS 05646 PLATFORM 0 0 0 0 0 4,976,860 (4,976,860) (2,363,169) 0 0

APACHE CORPORATION SUMMARY OF GROSS AND NET RESERVES AND INCOME DATA ATTRIBUTABLE TO CERTAIN LEASEHOLD AND ROYALTY INTERESTS SHELL OFFSHORE VENTURE (SEC CASE) AS OF DECEMBER 31, 2020 ------------------------------------ ESTIMATED REMAINING RESERVES ---------------------------------- --------------- ESTIMATED FUTURE DOLLARS, $ --------------- RESV TYPE (A) (BARRELS) OIL/COND(B) (MMCF) GAS ----------------- 100% GROSS ---------------- (BARRELS) OIL/COND(B) (MMCF) SALES GAS ------------------------- NET ------------------------ GROSS REV AFTER PROD TAX TOTAL DEDUCTION UNDISC DISCOUNT AT 10.00% NET INCOME BEFORE FIT TABLE B PAGE 2 OF 2 (BARRELS) PLANT PROD (BARRELS) PLANT PROD OFFSHORE LA (CONT.) SOUTH TIMBALIER 295 (CONT.) OFFSHORE LA PROVED PRODUCING 78 1,656 2,111,991 1,051,432 819,880 48,396 1,060,560 925,266 3,686 62,449 PROVED SHUT-IN 0 0 0 0 0 0 0 0 0 0 PROVED BEHIND PIPE 519 10,981 13,217,128 6,741,214 5,109,442 301,599 6,475,915 4,327,972 22,686 384,334 TOTAL PROVED 597 12,637 15,329,120 7,792,645 5,929,322 349,994 7,536,474 5,253,238 26,373 446,783 OFFSHORE TX NORTH PADRE IS. 969-976 OFFSHORE TX PV-DPPN 969 OCS 05953 PLATFORM 0 0 0 0 0 167,521 (167,521) (162,282) 0 0 PV-DPPN 976 OCS 05953 PLATFORM 0 0 0 0 0 283,475 (283,475) (274,610) 0 0 TOTAL PROVED 0 0 0 450,996 0 0 (450,996) (436,893) 0 0 GRAND SUMMARIES PROVED PRODUCING 78 1,656 2,111,991 1,051,432 819,880 48,396 1,060,560 925,266 3,686 62,449 PROVED BEHIND PIPE 519 10,981 13,217,128 6,741,214 5,109,442 301,599 6,475,915 4,327,972 22,686 384,334 PROVED DEPLETED 0 0 0 526,439 0 0 (526,439) (510,560) 0 0 TOTAL PROVED 597 12,637 15,329,120 8,319,085 5,929,322 349,994 7,010,035 4,742,678 26,373 446,783 DP = DEPLETED PB = PAYBACK NP = NON-PRODUCING PD = PRODUCING BP = BEHIND PIPE SI = SHUT IN UD = UNDEVELOPED PV = PROVED PB = PROBABLE PS = POSSIBLE (A) RESERVE TYPES: STATUS: (B) EXCLUDES PLANT PRODUCTS

GROSS COST $/MONTH PRIM PROD (A) RESV TYPE NO. OF WELLS LOCATION SEC TWP RNG W.I. N.R.I. LIQUIDS PRICE $/bbl GAS PRICE $/bbl TABLE C ---- INTERESTS ----- ---- EVALUATED ---- APACHE CORPORATION SUMMARY OF INITIAL BASIC DATA ATTRIBUTABLE TO CERTAIN LEASEHOLD AND ROYALTY INTERESTS SHELL OFFSHORE VENTURE (SEC CASE) AS OF DECEMBER 31, 2020 PRICE $/Mcf PAGE 1 OF 1 NGL SHIP SHOAL 258 OFFSHORE LA 0FAC 0.000000 0.000000 - -0SS 258 OCS 05560 PLATFORM A/B PV-DP - SOUTH TIMBALIER 295 OFFSHORE LA 0OIL 0.054103 0.070833 39.41 1.941ST 295 OCS 05646 #A- 3 PV-PD 14.33 0OIL 0.059028 0.070833 39.41 1.941ST 295 OCS 05646 #A- 3 (BP1) PV-BP 14.33 0OIL 0.000000 0.000000 39.41 1.940ST 295 OCS 05646 #A- 3 (BP2) PV-BP - 0OIL 0.000000 0.000000 39.41 1.940ST 295 OCS 05646 #A- 3 (BP3) PV-BP - 0OIL 0.045586 0.070833 39.41 1.941ST 295 OCS 05646 #A- 4 PV-PD 14.33 0OIL 0.059028 0.070833 39.41 1.941ST 295 OCS 05646 #A- 4 (BP1) PV-BP 14.33 0GAS 0.000000 0.000000 - -0ST 295 OCS 07780 #A-10 ST PV-SI - 0OIL 0.059028 0.070833 39.41 1.971ST 295 OCS 07780 #A-10 ST (BP2) PV-BP 14.33 0OIL 0.059028 0.070833 39.41 1.971ST 295 OCS 07780 #A-10 ST (BP3) PV-BP 14.33 0OIL 0.059028 0.070833 39.41 1.971ST 295 OCS 07780 #A-10 ST (BP4) PV-BP 14.33 0OIL 0.059028 0.070833 39.41 1.971ST 295 OCS 07780 #A-10 ST (BP5) PV-BP 14.33 0OIL 0.279251 0.070833 39.41 1.941ST 295 OCS 05646 #A-11 PV-PD 14.33 0OIL 0.000000 0.000000 - -0ST 295 OCS 05646 #A-11 PV-SI - 0GAS 0.059028 0.070833 39.41 1.941ST 295 OCS 05646 #A-11 (BP1) PV-BP 14.33 0OIL 0.059028 0.070833 39.41 1.941ST 295 OCS 05646 #A-11 (BP2) PV-BP 14.33 0GAS 0.059028 0.070833 39.41 1.941ST 295 OCS 05646 #A-11 (BP3) PV-BP 14.33 0GAS 0.000000 0.000000 - -0ST 295 OCS 05646 #A-13 ST PV-SI - 0GAS 0.009177 0.070833 - -1ST 295 OCS 05646 #A-14 PV-PD 14.33 0OIL 0.049858 0.070833 39.41 1.941ST 295 OCS 05646 #A-15 PV-PD 14.33 0OIL 0.044221 0.070833 39.41 1.941ST 295 OCS 05646 #A-16 ST PV-PD 14.33 0OIL 0.059028 0.070833 39.41 1.941ST 295 OCS 05646 #A-16 ST (BP2) PV-BP 14.33 0OIL 0.059028 0.070833 39.41 1.941ST 295 OCS 05646 #A-16 ST (BP3) PV-BP 14.33 0OIL 0.059028 0.070833 39.41 1.941ST 295 OCS 05646 #A-16 ST (BP4) PV-BP 14.33 0OIL 0.000000 0.000000 39.41 1.940ST 295 OCS 05646 #A-16 ST (BP5) PV-BP - 0OIL 0.323829 0.070833 39.41 1.941ST 295 OCS 05646 #A-21 ST2 PV-PD 14.33 0OIL 0.059028 0.070833 39.41 1.941ST 295 OCS 05646 #A-21 ST2 (PDNP) PV-BP 14.33 0OIL 0.057773 0.070833 39.41 1.941ST 295 OCS 05646 #A-22 ST3 PV-PD 14.33 0OIL 0.059028 0.070833 39.41 1.941ST 295 OCS 05646 #A-22 ST3 (BP1) PV-BP 14.33 0OIL 0.000000 0.000000 39.41 1.940ST 295 OCS 05646 #A-22 ST3 (BP2) PV-BP - 0OIL 0.000000 0.000000 39.41 1.940ST 295 OCS 05646 #A-22 ST3 (BP3) PV-BP - 0OIL 0.000000 0.000000 39.41 1.940ST 295 OCS 05646 #A-22 ST3 (BP4) PV-BP - 0OIL 0.072482 0.070833 39.41 1.941ST 295 OCS 05646 #A-25 PV-PD 14.33 0OIL 0.067832 0.070833 39.41 1.941ST 295 OCS 05646 #A-27 PV-PD 14.33 0OIL 0.039115 0.070833 39.41 1.941ST 295 OCS 05646 #A-31 PV-PD 14.33 0OIL 0.059028 0.070833 39.41 1.941ST 295 OCS 05646 #A-32 (BP1) PV-BP 14.33 0OIL 0.000000 0.000000 39.41 1.940ST 295 OCS 05646 #A-32 (BP2) PV-BP - 0OIL 0.000000 0.000000 - -0ST 295 OCS 05646 #B- 1 PV-SI - 0OIL 0.008834 0.070833 39.41 1.941ST 295 OCS 05646 #B- 2 PV-PD 14.33 0OIL 0.008239 0.070833 39.41 1.941ST 295 OCS 05646 #B- 5 PV-PD 14.33 0OIL 0.059028 0.070833 39.41 1.941ST 295 OCS 05646 #B- 5 (BP2) PV-BP 14.33 0OIL 0.002574 0.070833 39.41 1.940ST 295 OCS 05646 #B- 6ST PV-PD - 0FAC 0.000000 0.000000 - -0ST 295 OCS 05646 PLATFORM PV-PD - 0FAC 0.000000 0.000000 - -0ST 295 OCS 05646 PLATFORM PV-BP - NORTH PADRE IS. 969-976 OFFSHORE TX 0FAC 0.000000 0.000000 - -0PN 969 OCS 05953 PLATFORM PV-DP - 0FAC 0.000000 0.000000 - -0PN 976 OCS 05953 PLATFORM PV-DP - STATUS:(A) RESERVE TYPES: PV = PROVED PB = PROBABLE PS = POSSIBLE PD = PRODUCING BP = BEHIND PIPE SI = SHUT IN UD = UNDEVELOPED DP = DEPLETED PB = PAYBACK NP = NON-PRODUCING

ALL CATEGORIES TOTAL PROVED APACHE CORPORATION ESTIMATED FUTURE RESERVES AND INCOME ATTRIBUTABLE TO CERTAIN LEASEHOLD AND ROYALTY INTERESTS SHELL OFFSHORE VENTURE (SEC CASE) AS OF DECEMBER 31, 2020 TABLE 1 GRAND SUMMARY 25.00 20.00 15.00 10.00 5.00 2,809,341 3,309,841 3,941,706 4,742,678 5,754,710 REVENUE INTEREST PRODUCT PRICES Expense Oil/ Plant Oil/Cond Plt. Prod. Gas FUTURE NET INCOME - $ Interest Condensate Products Gas ($/bbl) ($/bbl) ($/Mcf) COMPOUNDED MONTHLY INITIAL FINAL REMARKS % % % % % DISCOUNTED Year AVERAGE PRICESESTIMATED 8/8THS PRODUCTION COMPANY NET PRODUCTION Number Oil/Cond. Plt Prod. GasOil/Cond.GasPlant ProductsOil/Cond. Plant Products Sales Gas of Wells ($/bbl) ($/bbl) ($/Mcf) (Barrels)(MMcf) (Barrels) (Barrels) (Barrels) (MMcf) 446,516 47,749 1,323 26,357 2,819 63 39.41 14.33 1.94 142021 574,697 50,192 1,401 33,923 2,963 66 39.41 14.33 1.94 132022 521,879 38,884 1,084 30,805 2,295 51 39.41 14.33 1.94 132023 405,940 28,351 788 23,962 1,674 37 39.41 14.33 1.94 122024 839,568 52,804 1,504 49,558 3,117 71 39.41 14.33 1.94 102025 690,078 44,885 1,282 40,734 2,649 61 39.41 14.33 1.94 102026 742,894 51,749 1,479 43,851 3,055 70 39.41 14.33 1.94 92027 516,315 35,950 1,027 30,477 2,122 49 39.41 14.33 1.94 92028 353,759 24,805 709 20,882 1,464 33 39.41 14.33 1.94 92029 234,365 16,929 484 13,834 999 23 39.41 14.33 1.94 72030 200,371 16,296 466 11,827 962 22 39.41 14.33 1.94 52031 179,202 16,097 460 10,578 950 22 39.41 14.33 1.94 52032 223,738 22,093 631 13,207 1,304 30 39.41 14.33 1.94 42033 39,056 Sub-Total Remainder Total Future 5,929,322 446,783 12,637 349,994 26,373 597 39.41 14.33 1.94 5,929,322 446,783 12,637 349,994 26,373 597 39.41 14.33 1.94 0 0 0 0 0 0 0.00 0.00 0.00 Cumulative Ultimate 12,321,547 0 18,250,868 446,783 51,694 COMPANY FUTURE GROSS REVENUE (FGR) - $ PRODUCTION TAXES - $ FGR AFTER From From From Oil/ Plant Prod./ PRODUCTION TAXES - $OtherCondensateOtherPlant ProductsYear TotalOil/Condensate Gas Gas 1,200,328 1,038,617 40,395 121,316 0 0 0 1,200,328 02021 1,507,777 1,336,772 42,462 128,544 0 0 0 1,507,777 02022 1,346,295 1,213,915 32,895 99,485 0 0 0 1,346,295 02023 1,040,578 944,236 23,985 72,357 0 0 0 1,040,578 02024 2,135,612 1,952,874 44,671 138,067 0 0 0 2,135,612 02025 1,760,789 1,605,154 37,972 117,663 0 0 0 1,760,789 02026 1,907,320 1,728,007 43,779 135,534 0 0 0 1,907,320 02027 1,325,531 1,200,973 30,413 94,145 0 0 0 1,325,531 02028 908,797 822,859 20,984 64,953 0 0 0 908,797 02029 603,790 545,143 14,321 44,325 0 0 0 603,790 02030 522,615 466,073 13,786 42,755 0 0 0 522,615 02031 472,622 416,831 13,618 42,173 0 0 0 472,622 02032 597,067 520,425 18,691 57,951 0 0 0 597,067 02033 Remainder Total Future Sub-Total 13,791,881 1,159,267 377,972 0 15,329,120 0 0 15,329,120 13,791,881 15,329,120 377,972 1,159,267 0 0 0 0 0 0 0 0 0 0 0 15,329,120 0 0 0 DEDUCTIONS - $ FUTURE NET INCOME BEFORE TAXES - $ Operating Ad Valorem Development DiscountedUndiscounted Year Costs Taxes Costs Other Total Annual Cumulative @ 10.00 % 1,162,918 0 743,898 388,094 30,926 37,410 20,384 37,4102021 574,858 0 155,833 386,040 32,984 932,920 804,034 970,3302022 412,255 0 0 386,749 25,506 934,040 739,456 1,904,3692023 810,772 0 410,833 381,436 18,503 229,805 171,085 2,134,1752024 644,218 0 233,750 374,353 36,115 1,491,395 967,124 3,625,5692025 509,009 0 106,250 371,874 30,885 1,251,780 739,668 4,877,3492026 423,065 0 17,708 369,749 35,608 1,484,255 802,419 6,361,6042027 394,485 0 0 369,749 24,737 931,045 457,566 7,292,6492028 386,108 0 0 369,040 17,068 522,689 233,865 7,815,3382029 377,501 0 3,542 362,311 11,648 226,289 92,208 8,041,6272030 401,149 0 35,417 354,519 11,213 121,465 44,820 8,163,0922031 380,116 0 17,708 351,332 11,076 92,506 30,348 8,255,5982032 1,842,629 0 1,478,929 348,499 15,202 -1,245,563 -360,297 7,010,0352033 Remainder Total Future Sub-Total 4,813,743 8,319,085 0 3,203,867 301,474 7,010,035 4,742,678 4,813,743 0 3,203,867 301,474 8,319,085 4,742,678 7,010,035 0 0 0 0 0 0 0 7,010,035 Life of summary is: 13.00 years. These data are part of a Ryder Scott report and are subject to the conditions in the text of the report.