Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - People's United Financial, Inc. | d54940dex991.htm |

| 8-K - 8-K - People's United Financial, Inc. | d54940d8k.htm |

Partnership of Leading, High-Performing Superregional Banks February 22, 2021 Exhibit 99.2

Disclaimer Cautionary Note Regarding Forward-Looking Statements This presentation includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are based on current expectations, estimates and projections about M&T Bank Corporation’s (“M&T”) and People’s United Financial Inc.’s (“People’s United”) businesses, beliefs of M&T’s and People’s United’s management and assumptions made by M&T’s and People’s United’s management. Any statement that does not describe historical or current facts is a forward-looking statement, including statements regarding the expected timing, completion and effects of the proposed transactions and M&T’s and People’s United’s expected financial results, prospects, targets, goals and outlook. Forward-looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “target,” “estimate,” “continue,” “positions,” “prospects” or “potential,” by future conditional verbs such as “will,” “would,” “should,” “could,” or “may,” or by variations of such words or by similar expressions. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions (“Future Factors”) which are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. Future Factors include, among others: the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the definitive merger agreement between M&T and People’s United; the outcome of any legal proceedings that may be instituted against M&T or People’s United; the possibility that the proposed transaction will not close when expected or at all because required regulatory, shareholder or other approvals are not received or other conditions to the closing are not satisfied on a timely basis or at all, or are obtained subject to conditions that are not anticipated; the risk that any announcements relating to the proposed combination could have adverse effects on the market price of the common stock of either or both parties to the combination; the possibility that the anticipated benefits of the transaction will not be realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where M&T and People’s United do business; certain restrictions during the pendency of the merger that may impact the parties’ ability to pursue certain business opportunities or strategic transactions; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; diversion of management’s attention from ongoing business operations and opportunities; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the transaction; M&T’s and People’s United’s success in executing their respective business plans and strategies and managing the risks involved in the foregoing; the dilution caused by M&T’s issuance of additional shares of its capital stock in connection with the proposed transaction; and other factors that may affect future results of M&T and People’s United; the business, economic and political conditions in the markets in which the parties operate; the risk that the proposed combination and its announcement could have an adverse effect on either or both parties’ ability to retain customers and retain or hire key personnel and maintain relationships with customers; the risk that the proposed combination may be more difficult or time-consuming than anticipated, including in areas such as sales force, cost containment, asset realization, systems integration and other key strategies; revenues following the proposed combination may be lower than expected, including for possible reasons such as unexpected costs, charges or expenses resulting from the transactions; the unforeseen risks relating to liabilities of M&T or People’s United that may exist; and uncertainty as to the extent of the duration, scope, and impacts of the COVID-19 pandemic on People’s United, M&T and the proposed combination. These are representative of the Future Factors that could affect the outcome of the forward-looking statements. In addition, such statements could be affected by general industry and market conditions and growth rates, general economic and political conditions, either nationally or in the states in which M&T, People’s United or their respective subsidiaries do business, including interest rate and currency exchange rate fluctuations, changes and trends in the securities markets, and other Future Factors. M&T provides further detail regarding these risks and uncertainties in its latest Form 10-K and any subsequent Form 10-Qs, including in the respective Risk Factors sections of such reports, as well as in subsequent SEC filings. Forward-looking statements speak only as of the date made, and M&T does not assume any duty and does not undertake to update forward-looking statements Additional Information and Where to Find It In connection with the proposed transaction, M&T will file with the SEC a registration statement on Form S-4 to register the shares of M&T’s capital stock to be issued in connection with the proposed transaction. The registration statement will include a joint proxy statement of M&T and People’s United which will be sent to the shareholders of M&T and People’s United seeking their approval of the proposed transaction. This presentation does not constitute an offer to sell or a solicitation of an offer to buy any securities or a solicitation of any vote or approval. INVESTORS AND SHAREHOLDERS OF M&T AND PEOPLE’S UNITED AND THEIR RESPECTIVE AFFILIATES ARE URGED TO READ, WHEN AVAILABLE, THE REGISTRATION STATEMENT ON FORM S-4, THE JOINT PROXY STATEMENT/PROSPECTUS TO BE INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S-4 AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT M&T, PEOPLE’S UNITED AND THE PROPOSED TRANSACTION. Investors will be able to obtain a free copy of the registration statement, including the joint proxy statement/prospectus, as well as other relevant documents filed with the SEC containing information about M&T and People’s United, without charge, at the SEC’s website (http://www.sec.gov). Copies of the registration statement, including the joint proxy statement/prospectus, and the filings with the SEC that will be incorporated by reference in the joint proxy statement/prospectus can also be obtained, without charge, by directing a request to Investor Relations, M&T Bank Corporation, One M&T Plaza, Buffalo, New York 14203, telephone (716) 635-4000, or Steven Bodakowski, People’s United Financial, Inc., 850 Main Street, Bridgeport, Connecticut 06604, telephone (203) 338-4202. Participants in Solicitation M&T, People’s United and certain of their respective directors, executive officers and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction under the rules of the SEC. Information regarding M&T’s directors and executive officers is available in its definitive proxy statement, which was filed with the SEC on March 9, 2020, and certain of its Current Reports on Form 8-K. Information regarding People’s United’s directors and executive officers is available in its definitive proxy statement, which was filed with the SEC on April 6, 2020, and certain of its Current Reports on Form 8-K. Other information regarding the participants in the solicitation of proxies in respect of the proposed transaction and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC. Free copies of these documents, when available, may be obtained as described in the preceding paragraph.

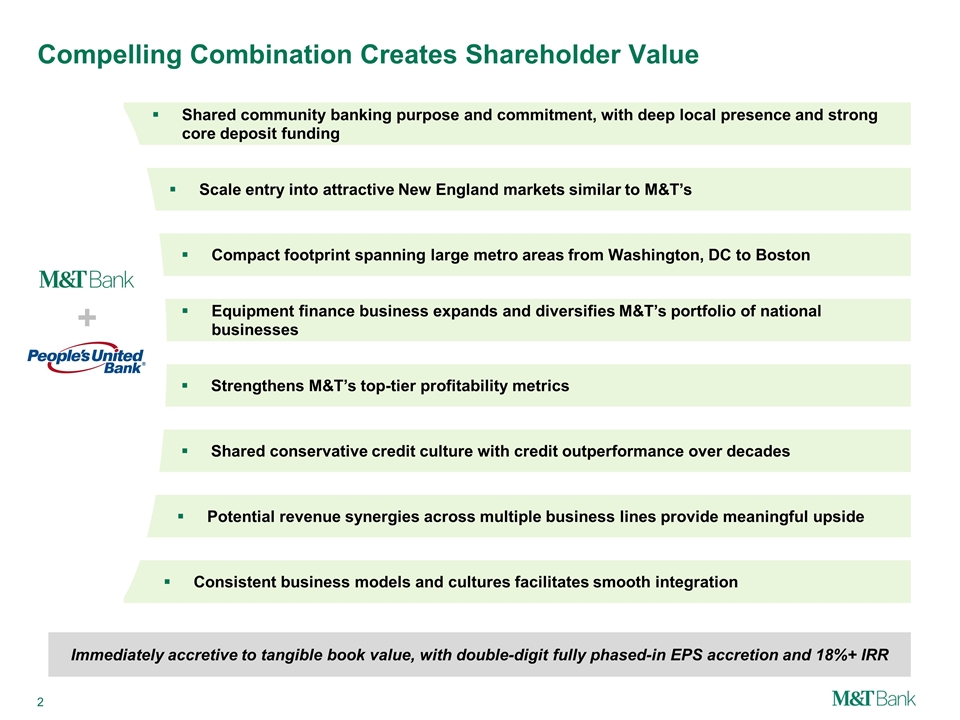

Shared conservative credit culture with credit outperformance over decades Compelling Combination Creates Shareholder Value Equipment finance business expands and diversifies M&T’s portfolio of national businesses Shared community banking purpose and commitment, with deep local presence and strong core deposit funding Scale entry into attractive New England markets similar to M&T’s Strengthens M&T’s top-tier profitability metrics Compact footprint spanning large metro areas from Washington, DC to Boston Potential revenue synergies across multiple business lines provide meaningful upside Consistent business models and cultures facilitates smooth integration + Immediately accretive to tangible book value, with double-digit fully phased-in EPS accretion and 18%+ IRR

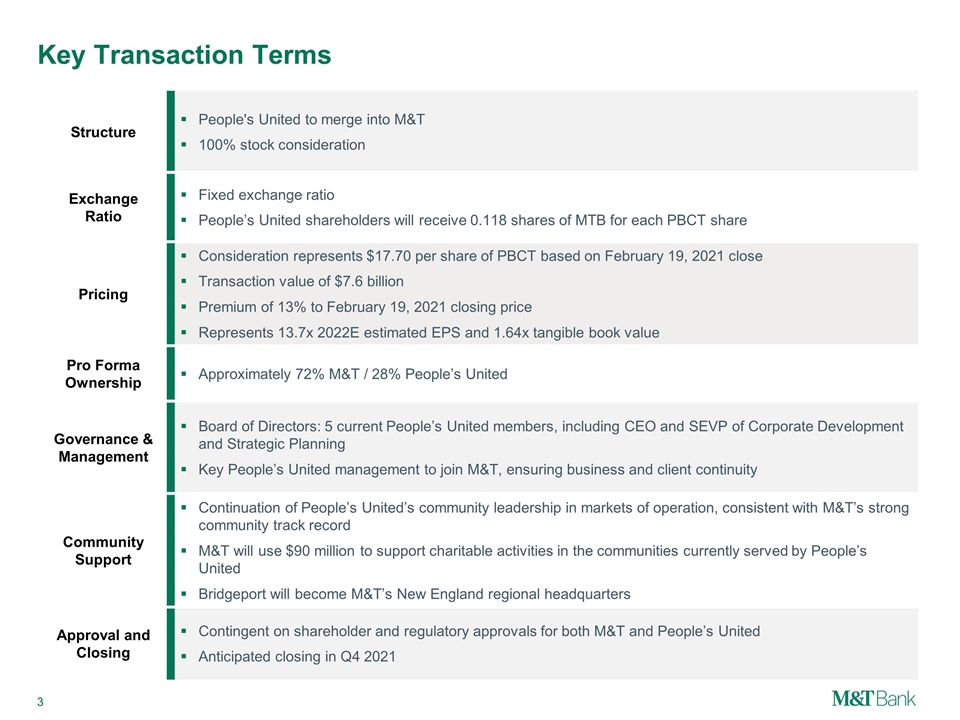

Key Transaction Terms Structure People's United to merge into M&T 100% stock consideration Exchange Ratio Fixed exchange ratio People’s United shareholders will receive 0.118 shares of MTB for each PBCT share Pricing Consideration represents $17.70 per share of PBCT based on February 19, 2021 close Transaction value of $7.6 billion Premium of 13% to February 19, 2021 closing price Represents 13.7x 2022E estimated EPS and 1.64x tangible book value Pro Forma Ownership Approximately 72% M&T / 28% People’s United Governance & Management Board of Directors: 5 current People’s United members, including CEO and SEVP of Corporate Development and Strategic Planning Key People’s United management to join M&T, ensuring business and client continuity Community Support Continuation of People’s United’s community leadership in markets of operation, consistent with M&T’s strong community track record M&T will use $90 million to support charitable activities in the communities currently served by People’s United Bridgeport will become M&T’s New England regional headquarters Approval and Closing Contingent on shareholder and regulatory approvals for both M&T and People’s United Anticipated closing in Q4 2021

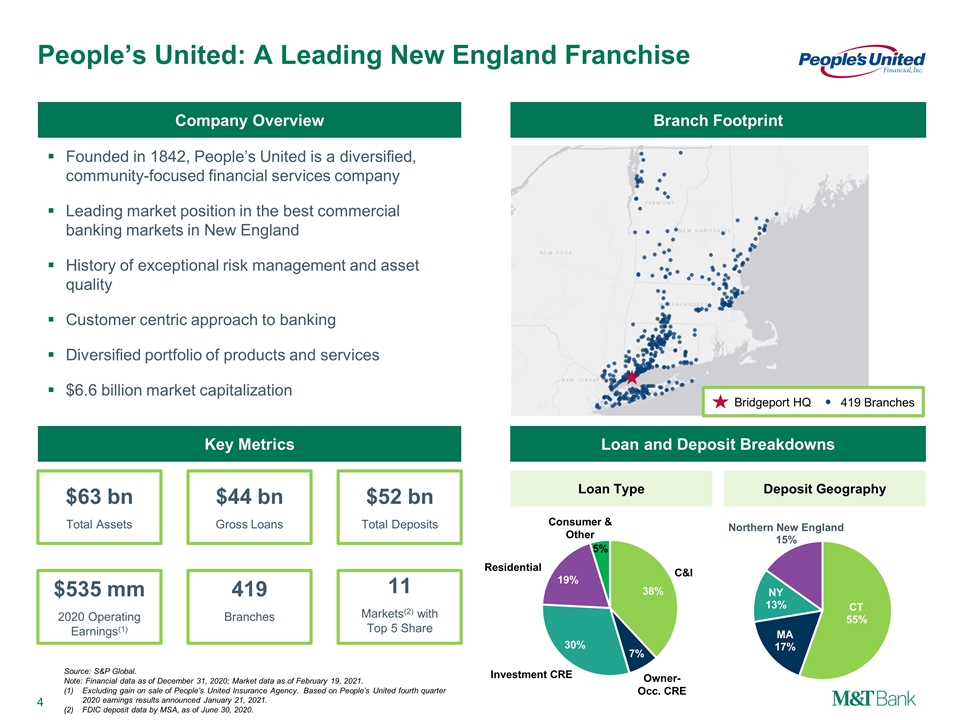

$535 mm 2020 Operating Earnings(1) People’s United: A Leading New England Franchise Company Overview Loan Type Branch Footprint Key Metrics $44 bn Gross Loans $52 bn Total Deposits 11 Markets(2) with Top 5 Share $63 bn Total Assets 419 Branches Source: S&P Global. Note: Financial data as of December 31, 2020; Market data as of February 19, 2021. (1)Excluding gain on sale of People’s United Insurance Agency. Based on People’s United fourth quarter 2020 earnings results announced January 21, 2021. (2)FDIC deposit data by MSA, as of June 30, 2020. Loan and Deposit Breakdowns Deposit Geography Founded in 1842, People’s United is a diversified, community-focused financial services company Leading market position in the best commercial banking markets in New England History of exceptional risk management and asset quality Customer centric approach to banking Diversified portfolio of products and services $6.6 billion market capitalization C&I Investment CRE Residential Consumer & Other Owner-Occ. CRE Bridgeport HQ 419 Branches

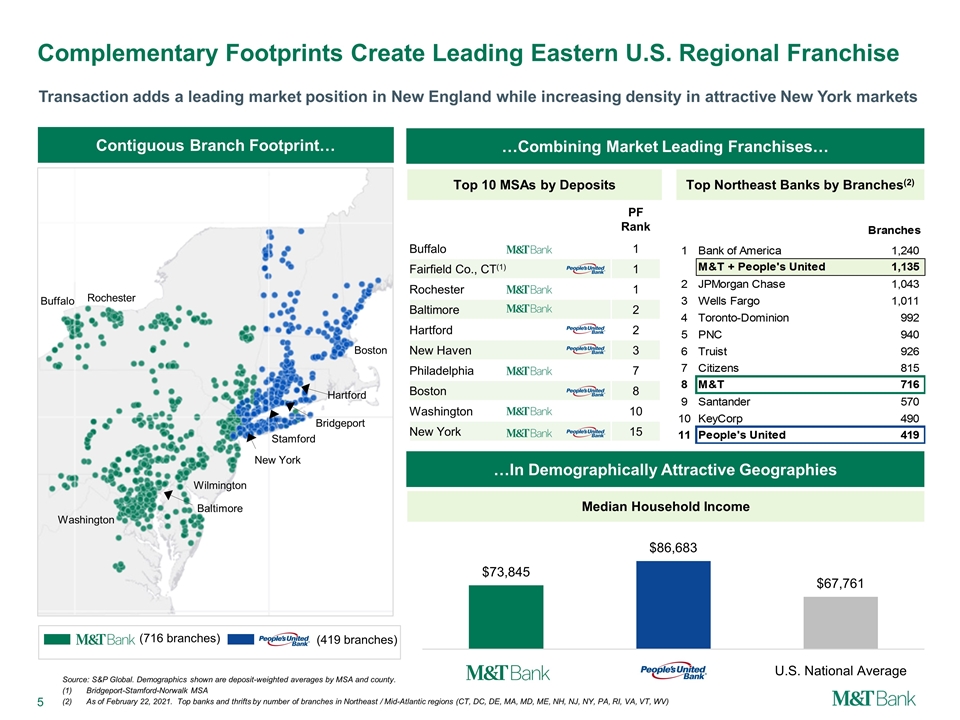

Hartford PF Rank Buffalo 1 Fairfield Co., CT(1) 1 Rochester 1 Baltimore 2 Hartford 2 New Haven 3 Philadelphia 7 Boston 8 Washington 10 New York 15 Complementary Footprints Create Leading Eastern U.S. Regional Franchise Source: S&P Global. Demographics shown are deposit-weighted averages by MSA and county. Bridgeport-Stamford-Norwalk MSA As of February 22, 2021. Top banks and thrifts by number of branches in Northeast / Mid-Atlantic regions (CT, DC, DE, MA, MD, ME, NH, NJ, NY, PA, RI, VA, VT, WV) (716 branches) (419 branches) Buffalo Baltimore Wilmington Stamford Bridgeport Boston Contiguous Branch Footprint… Transaction adds a leading market position in New England while increasing density in attractive New York markets …Combining Market Leading Franchises… Top 10 MSAs by Deposits Top Northeast Banks by Branches(2) …In Demographically Attractive Geographies Median Household Income New York Washington Rochester

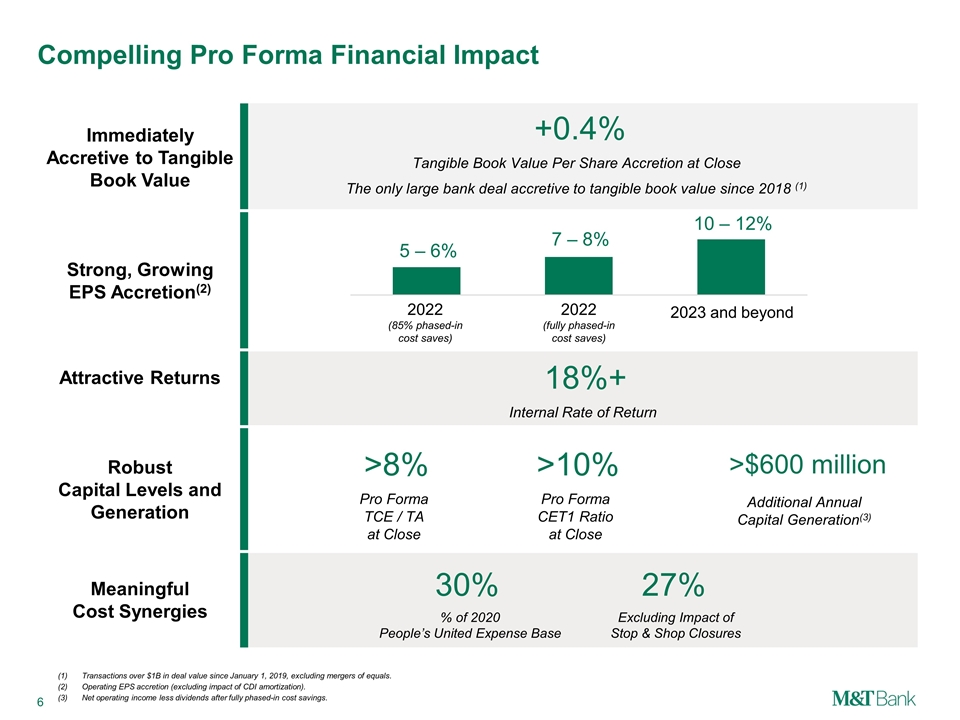

Immediately Accretive to Tangible Book Value Strong, Growing EPS Accretion(2) Attractive Returns Robust Capital Levels and Generation Meaningful Cost Synergies Compelling Pro Forma Financial Impact Transactions over $1B in deal value since January 1, 2019, excluding mergers of equals. Operating EPS accretion (excluding impact of CDI amortization). Net operating income less dividends after fully phased-in cost savings. Pro Forma TCE / TA at Close >8% Internal Rate of Return 18%+ Pro Forma CET1 Ratio at Close >10% Additional Annual Capital Generation(3) >$600 million Tangible Book Value Per Share Accretion at Close The only large bank deal accretive to tangible book value since 2018 (1) +0.4% % of 2020 People’s United Expense Base 30% Excluding Impact of Stop & Shop Closures 27% 5 – 6% 10 – 12% 7 – 8% 2022 (85% phased-in cost saves) 2022 (fully phased-in cost saves) 2023 and beyond

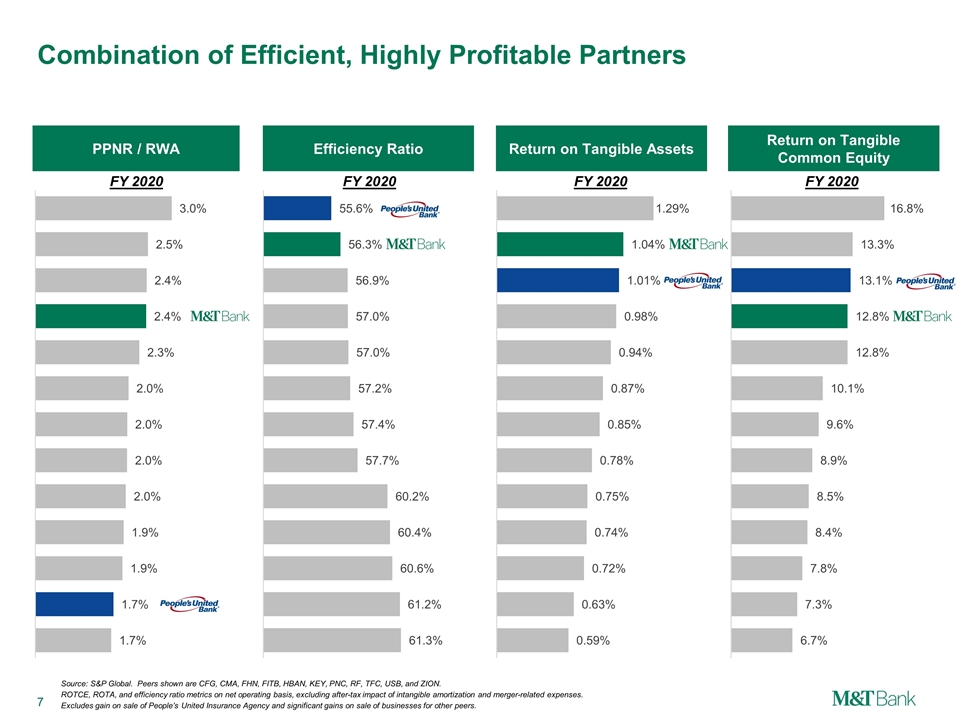

Combination of Efficient, Highly Profitable Partners Source: S&P Global. Peers shown are CFG, CMA, FHN, FITB, HBAN, KEY, PNC, RF, TFC, USB, and ZION. ROTCE, ROTA, and efficiency ratio metrics on net operating basis, excluding after-tax impact of intangible amortization and merger-related expenses. Excludes gain on sale of People’s United Insurance Agency and significant gains on sale of businesses for other peers. Efficiency Ratio PPNR / RWA Return on Tangible Common Equity Return on Tangible Assets FY 2020 FY 2020 FY 2020 FY 2020

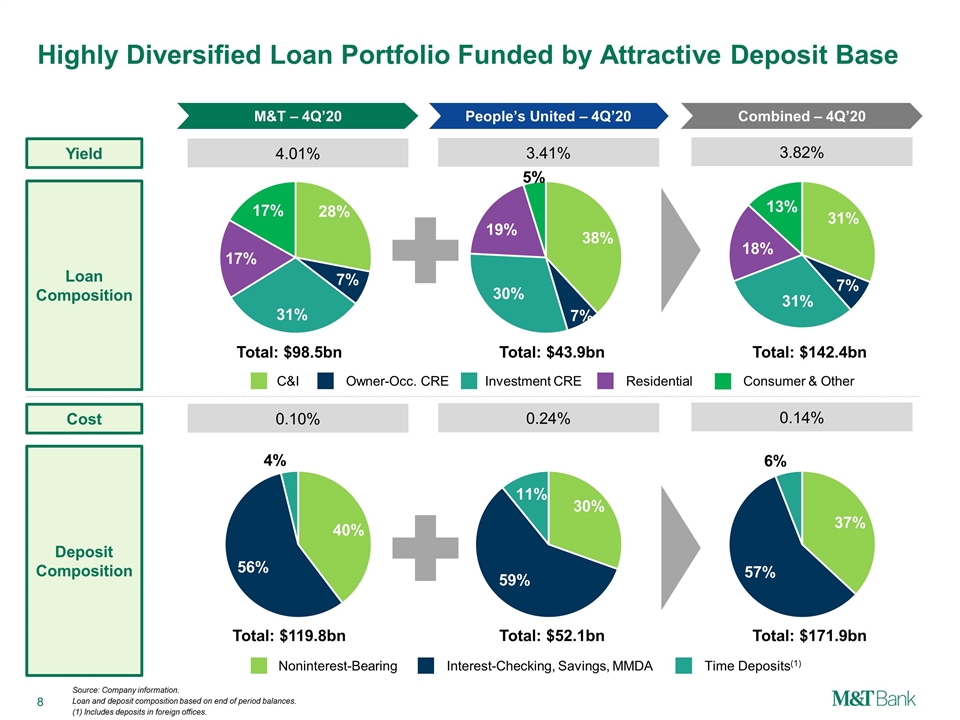

Total: $142.4bn Highly Diversified Loan Portfolio Funded by Attractive Deposit Base M&T – 4Q’20 People’s United – 4Q’20 Combined – 4Q’20 Loan Composition Deposit Composition Total: $119.8bn Total: $52.1bn Total: $171.9bn Total: $98.5bn Total: $43.9bn Noninterest-Bearing Interest-Checking, Savings, MMDA Time Deposits(1) C&I Investment CRE Residential Consumer & Other Source: Company information. Loan and deposit composition based on end of period balances. (1) Includes deposits in foreign offices. Owner-Occ. CRE Yield Cost 4.01% 3.41% 3.82% 0.10% 0.24% 0.14%

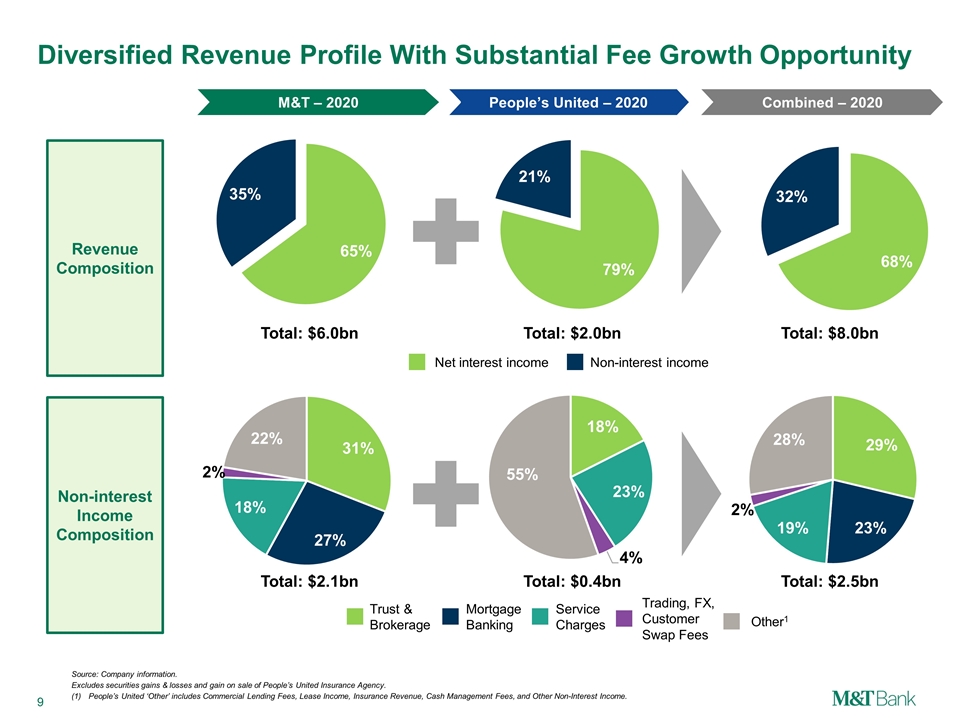

Diversified Revenue Profile With Substantial Fee Growth Opportunity M&T – 2020 People’s United – 2020 Combined – 2020 Revenue Composition Non-interest Income Composition Total: $2.1bn Total: $0.4bn Total: $2.5bn Total: $6.0bn Total: $2.0bn Total: $8.0bn Net interest income Non-interest income Source: Company information. Excludes securities gains & losses and gain on sale of People’s United Insurance Agency. (1) People’s United ‘Other’ includes Commercial Lending Fees, Lease Income, Insurance Revenue, Cash Management Fees, and Other Non-Interest Income. Trust & Brokerage Mortgage Banking Service Charges Trading, FX, Customer Swap Fees Other1

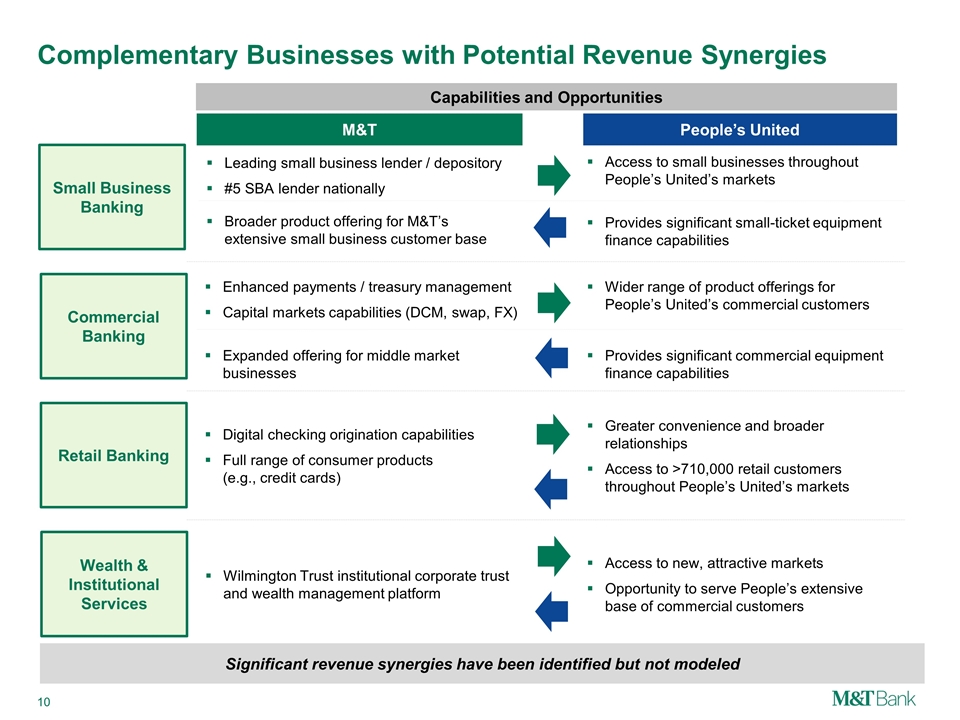

Complementary Businesses with Potential Revenue Synergies M&T Wealth & Institutional Services Wilmington Trust institutional corporate trust and wealth management platform Access to new, attractive markets Opportunity to serve People’s extensive base of commercial customers People’s United Significant revenue synergies have been identified but not modeled Small Business Banking Leading small business lender / depository #5 SBA lender nationally Access to small businesses throughout People’s United’s markets Provides significant small-ticket equipment finance capabilities Commercial Banking Enhanced payments / treasury management Capital markets capabilities (DCM, swap, FX) Expanded offering for middle market businesses Wider range of product offerings for People’s United’s commercial customers Provides significant commercial equipment finance capabilities Retail Banking Digital checking origination capabilities Full range of consumer products (e.g., credit cards) Greater convenience and broader relationships Access to >710,000 retail customers throughout People’s United’s markets Broader product offering for M&T’s extensive small business customer base Capabilities and Opportunities

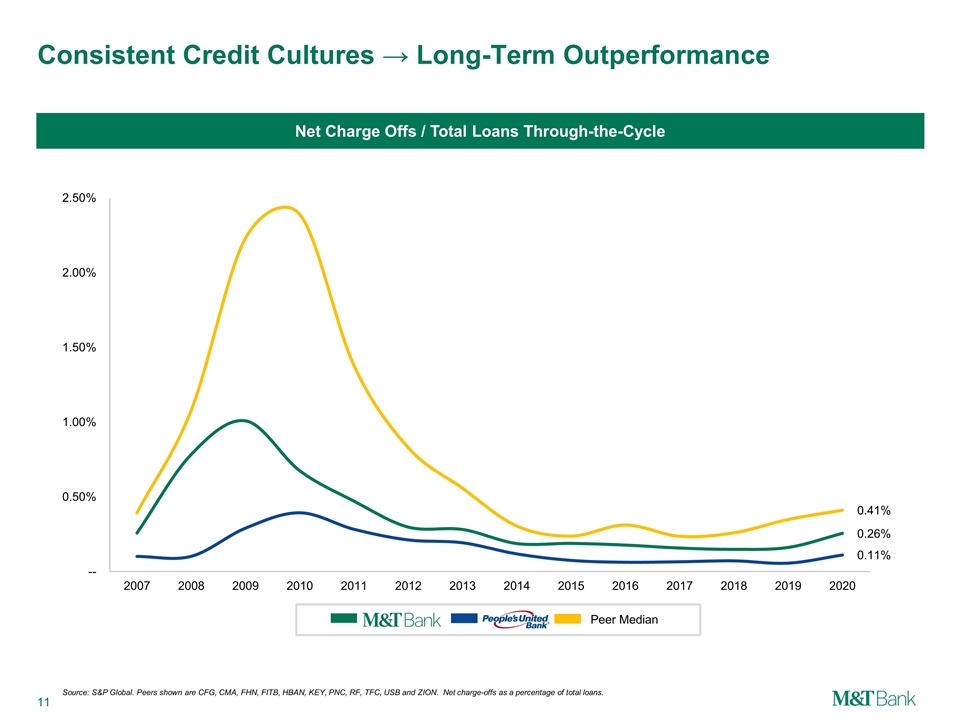

Consistent Credit Cultures → Long-Term Outperformance Net Charge Offs / Total Loans Through-the-Cycle Peer Median Source: S&P Global. Peers shown are CFG, CMA, FHN, FITB, HBAN, KEY, PNC, RF, TFC, USB and ZION. Net charge-offs as a percentage of total loans.

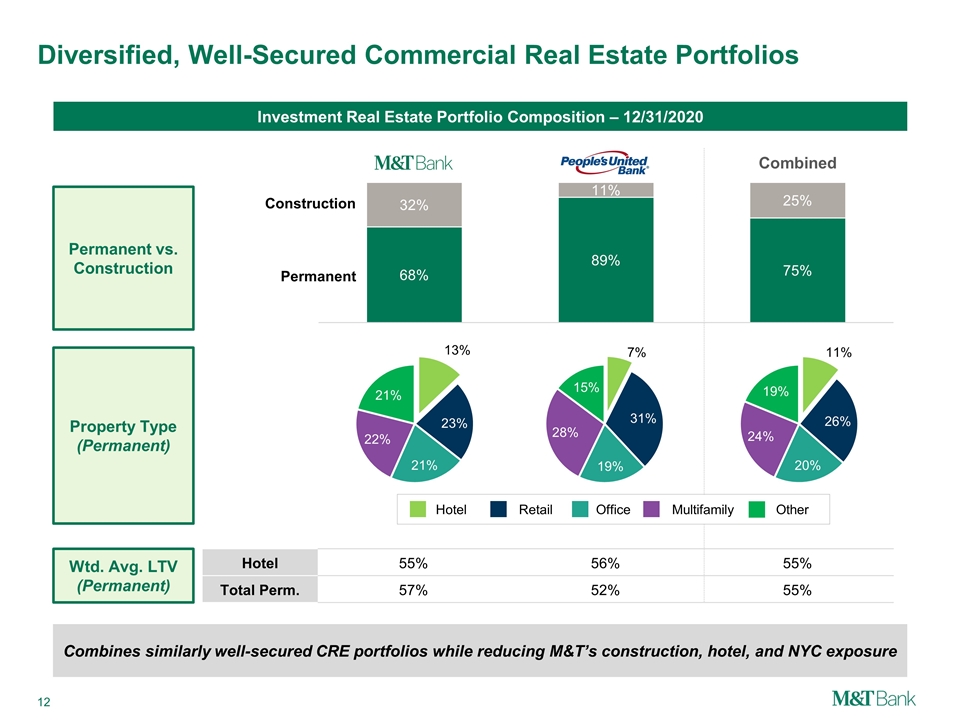

Diversified, Well-Secured Commercial Real Estate Portfolios Investment Real Estate Portfolio Composition – 12/31/2020 Construction Permanent Hotel 55% 56% 55% Total Perm. 57% 52% 55% Wtd. Avg. LTV (Permanent) Property Type (Permanent) Hotel Office Multifamily Other Retail Permanent vs. Construction Combines similarly well-secured CRE portfolios while reducing M&T’s construction, hotel, and NYC exposure

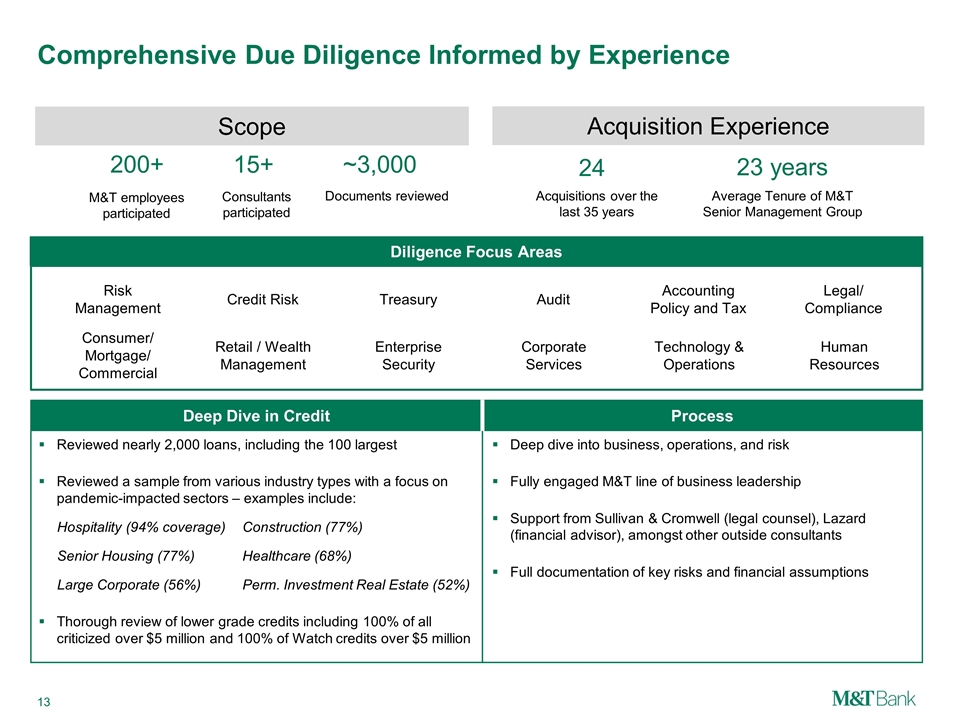

Comprehensive Due Diligence Informed by Experience Deep Dive in Credit Process Reviewed nearly 2,000 loans, including the 100 largest Reviewed a sample from various industry types with a focus on pandemic-impacted sectors – examples include: Hospitality (94% coverage)Construction (77%) Senior Housing (77%)Healthcare (68%) Large Corporate (56%) Perm. Investment Real Estate (52%) Thorough review of lower grade credits including 100% of all criticized over $5 million and 100% of Watch credits over $5 million Deep dive into business, operations, and risk Fully engaged M&T line of business leadership Support from Sullivan & Cromwell (legal counsel), Lazard (financial advisor), amongst other outside consultants Full documentation of key risks and financial assumptions Risk Management Credit Risk Treasury Audit Accounting Policy and Tax Legal/ Compliance Consumer/ Mortgage/ Commercial Retail / Wealth Management Enterprise Security Corporate Services Technology & Operations Human Resources M&T employees participated Documents reviewed Acquisitions over the last 35 years Average Tenure of M&T Senior Management Group Acquisition Experience Scope 24 23 years 200+ 15+ ~3,000 Consultants participated Diligence Focus Areas

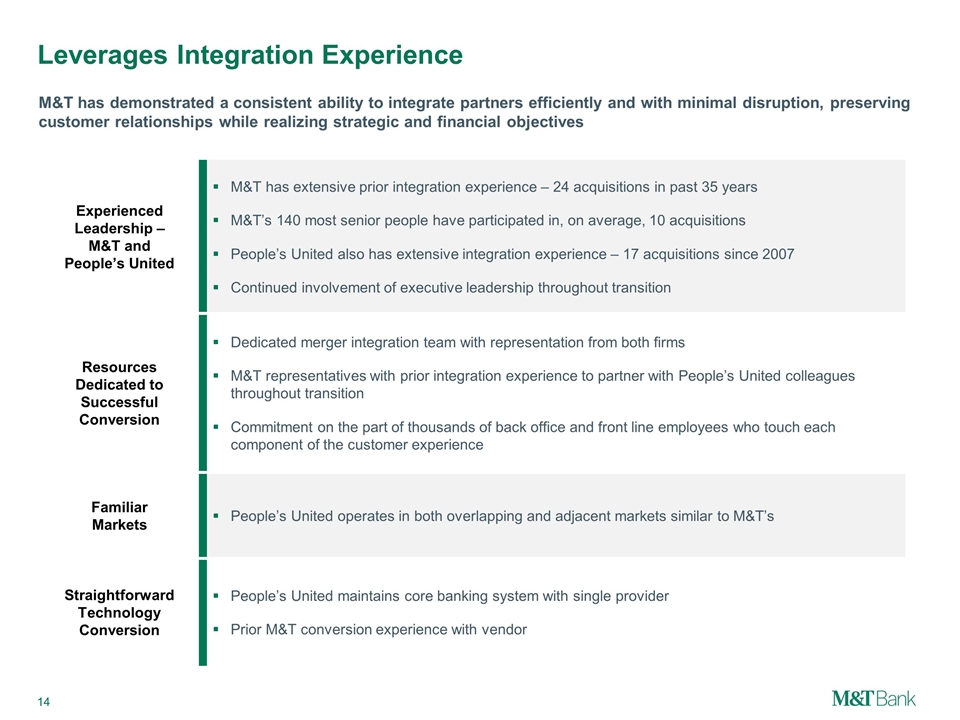

Leverages Integration Experience Experienced Leadership – M&T and People’s United M&T has extensive prior integration experience – 24 acquisitions in past 35 years M&T’s 140 most senior people have participated in, on average, 10 acquisitions People’s United also has extensive integration experience – 17 acquisitions since 2007 Continued involvement of executive leadership throughout transition Resources Dedicated to Successful Conversion Dedicated merger integration team with representation from both firms M&T representatives with prior integration experience to partner with People’s United colleagues throughout transition Commitment on the part of thousands of back office and front line employees who touch each component of the customer experience Familiar Markets People’s United operates in both overlapping and adjacent markets similar to M&T’s Straightforward Technology Conversion People’s United maintains core banking system with single provider Prior M&T conversion experience with vendor M&T has demonstrated a consistent ability to integrate partners efficiently and with minimal disruption, preserving customer relationships while realizing strategic and financial objectives

Shared Commitment to Our Communities Commitment to Underserved Markets CRA: M&T has maintained outstanding rating since 1982 Community Development: M&T committed over $1.6 billion of community development loans in 2020 Supported affordable housing, community services, and economic development across our footprint Community development investment portfolio totaled $1.24 billion at year-end 2020 Products: Secured credit card and MyWay no-overdraft checking account Giving Back to Our Communities Volunteering: M&T and People’s United employees combined for over 270,000 hours volunteering in 2019 M&T employees receive 40 hours of paid volunteer time annually Charitable Giving: M&T has donated more than $263 million to not-for-profits over the past decade In 2020, M&T contributed nearly $35 million to 2,800+ not-for-profit organizations across its footprint People’s United foundations have granted $40 million since inception Through the foundations, M&T will use $90 million to support charitable activities in the communities currently served by People’s United Supporting Small Business PPP: M&T and People’s United together #6 nationally with $12 billion funded during Round 1 >75,000 loans submitted to both firms M&T ranked #1 by Greenwich in their Crisis Response Index (PPP) SBA: M&T #5 lender nationwide – #1 or #2 in 9 of 12 markets M&T earned 25 Greenwich Excellence Awards for Small Business and Commercial Banking in 2020 People’s United earned 3 Greenwich Excellence Awards in 2020 for its performance in serving middle market customers

Appendix

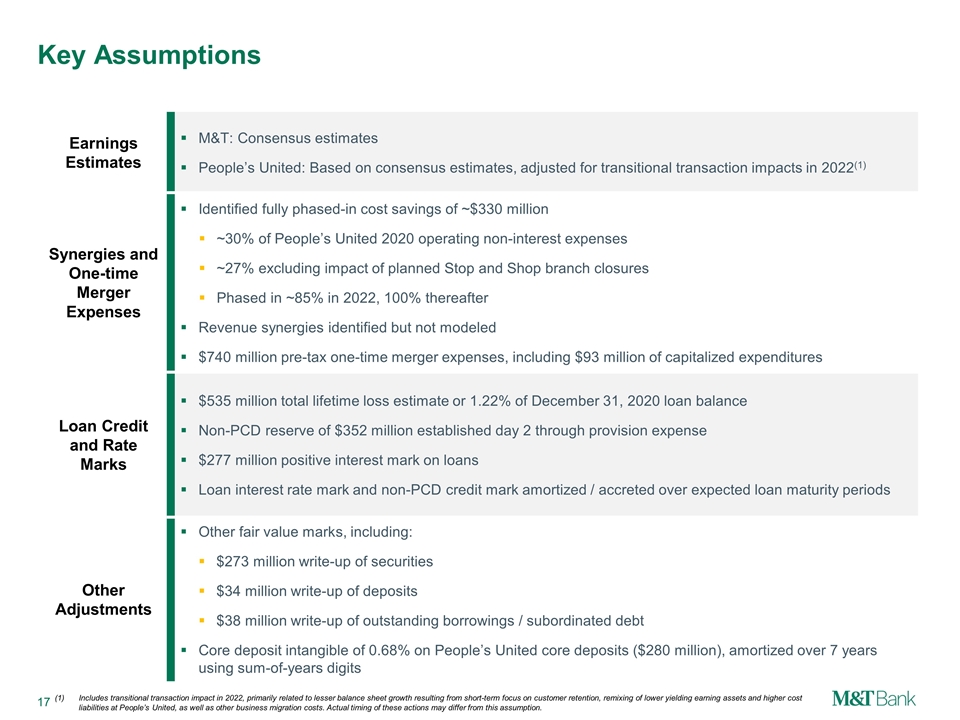

Key Assumptions Earnings Estimates M&T: Consensus estimates People’s United: Based on consensus estimates, adjusted for transitional transaction impacts in 2022(1) Synergies and One-time Merger Expenses Identified fully phased-in cost savings of ~$330 million ~30% of People’s United 2020 operating non-interest expenses ~27% excluding impact of planned Stop and Shop branch closures Phased in ~85% in 2022, 100% thereafter Revenue synergies identified but not modeled $740 million pre-tax one-time merger expenses, including $93 million of capitalized expenditures Loan Credit and Rate Marks $535 million total lifetime loss estimate or 1.22% of December 31, 2020 loan balance Non-PCD reserve of $352 million established day 2 through provision expense $277 million positive interest mark on loans Loan interest rate mark and non-PCD credit mark amortized / accreted over expected loan maturity periods Other Adjustments Other fair value marks, including: $273 million write-up of securities $34 million write-up of deposits $38 million write-up of outstanding borrowings / subordinated debt Core deposit intangible of 0.68% on People’s United core deposits ($280 million), amortized over 7 years using sum-of-years digits Includes transitional transaction impact in 2022, primarily related to lesser balance sheet growth resulting from short-term focus on customer retention, remixing of lower yielding earning assets and higher cost liabilities at People’s United, as well as other business migration costs. Actual timing of these actions may differ from this assumption.

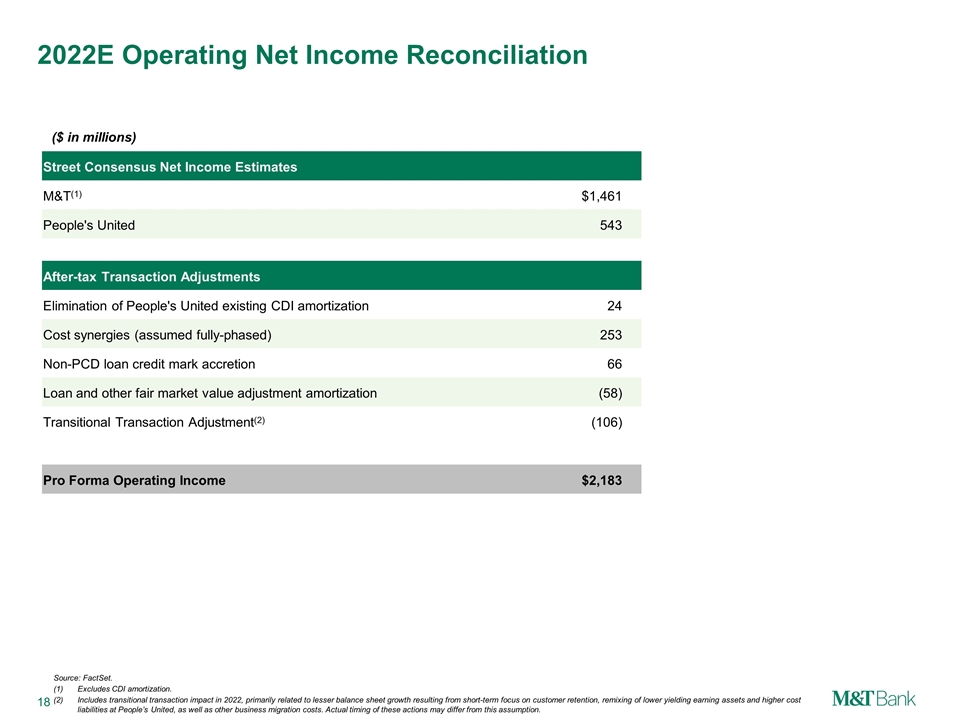

2022E Operating Net Income Reconciliation Source: FactSet. Excludes CDI amortization. Includes transitional transaction impact in 2022, primarily related to lesser balance sheet growth resulting from short-term focus on customer retention, remixing of lower yielding earning assets and higher cost liabilities at People’s United, as well as other business migration costs. Actual timing of these actions may differ from this assumption. ($ in millions) Street Consensus Net Income Estimates M&T(1) $1,461 People's United 543 After-tax Transaction Adjustments Elimination of People's United existing CDI amortization 24 Cost synergies (assumed fully-phased) 253 Non-PCD loan credit mark accretion 66 Loan and other fair market value adjustment amortization (58) Transitional Transaction Adjustment(2) (106) Pro Forma Operating Income $2,183

High Quality Specialty Lines of Business Total Loans Traditional equipment finance, specializing in nationwide vendor-focused equipment financing Focused on transportation, manufacturing, construction, healthcare, waste management, mining, and retail sectors Average annual charge-offs ~30 basis points since 2010 $1.9 bn Direct origination equipment finance, located primarily in Connecticut, Texas, California, and Illinois, with a national sales structure Focused on construction, transportation, and refuse sectors Average annual charge-offs <10 basis points since 2011 $1.2 bn Small ticket equipment finance company, based in Philadelphia with offices in 23 states and a national sales structure Highly scalable platform, with tech-enabled origination system Significant source of growth in recent years with balances increasing from $730 million at acquisition in 2017 to $1.9 billion Average annual charge-offs of ~70 basis points since 2011 $1.9 bn Mortgage Warehouse Lending Primarily based in Louisville, KY, supporting large residential mortgage originators, with 195 clients Significant source of fee income and deposits No losses since group created in 2010 Commitments $4.9 bn Outstanding $3.4 bn Growth and diversification provided by specialized lines of business, while remaining true to the wider credit culture of People’s United

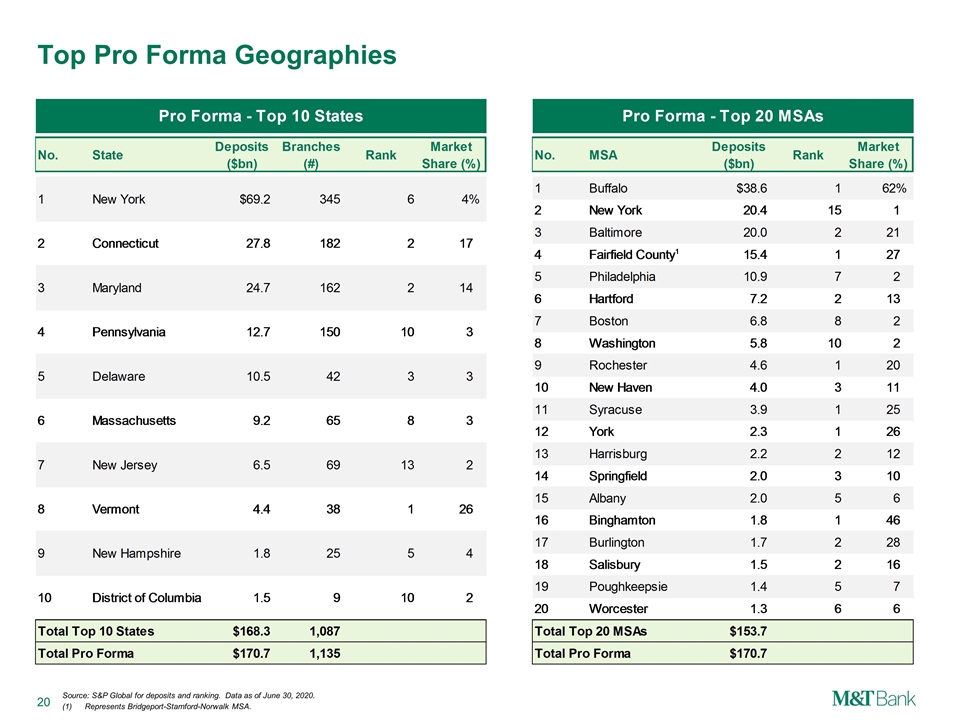

Top Pro Forma Geographies Source: S&P Global for deposits and ranking. Data as of June 30, 2020. (1)Represents Bridgeport-Stamford-Norwalk MSA.

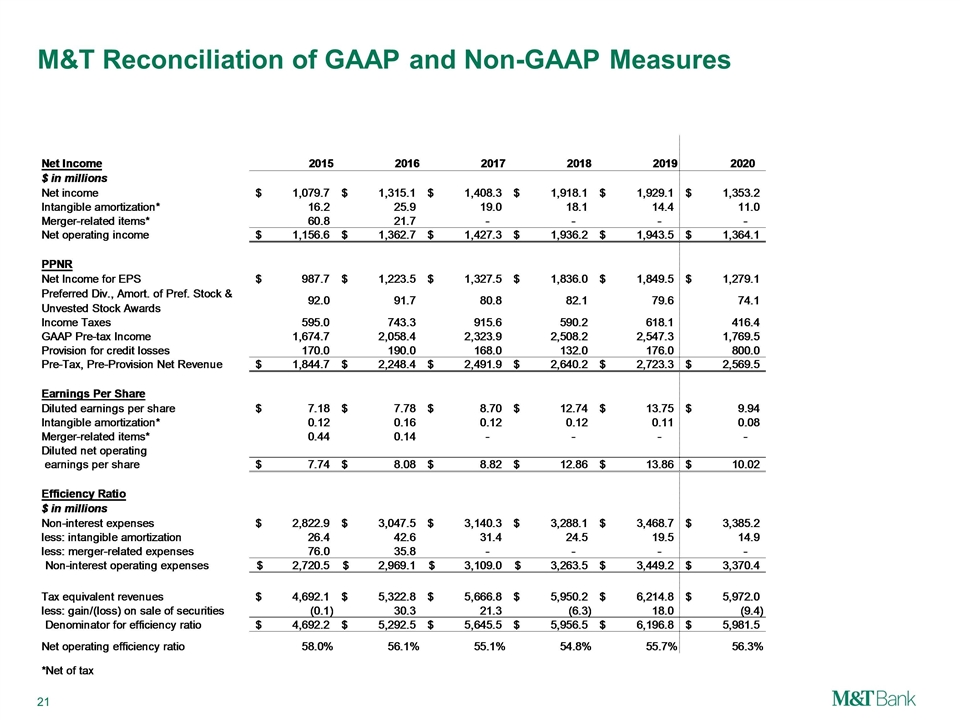

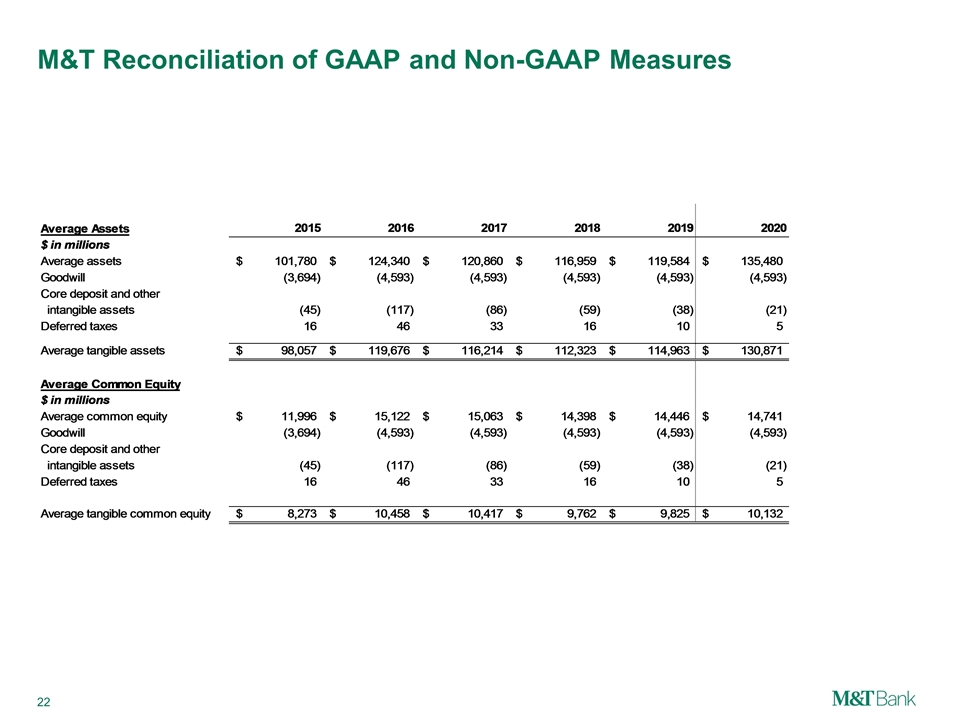

M&T Reconciliation of GAAP and Non-GAAP Measures

M&T Reconciliation of GAAP and Non-GAAP Measures