Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Energy Transfer LP | d143124dex991.htm |

| 8-K - 8-K - Energy Transfer LP | d143124d8k.htm |

Energy Transfer Acquisition of Enable Midstream Partners, LP February 17, 2021 Exhibit 99.2

Disclaimer Forward-Looking Statements This presentation includes “forward-looking” statements. Forward-looking statements are identified as any statement that does not relate strictly to historical or current facts. Statements using words such as “anticipate,” “believe,” “intend,” “project,” “plan,” “expect,” “continue,” “estimate,” “goal,” “forecast,” “may,” or similar expressions help identify forward-looking statements. Energy Transfer LP (“Energy Transfer” or “ET”) and Enable Midstream Partners, LP (“Enable” or “ENBL”) cannot give any assurance that expectations and projections about future events will prove to be correct. Forward-looking statements are subject to a variety of risks, uncertainties and assumptions. These risks and uncertainties include the risks that the proposed transaction may not be consummated or the benefits contemplated therefrom may not be realized. Additional risks include: the ability to obtain requisite regulatory and stockholder approval and the satisfaction of the other conditions to the consummation of the proposed transaction, the ability of Energy Transfer to successfully integrate Enable’s operations and employees and realize anticipated synergies and cost savings, the potential impact of the announcement or consummation of the proposed transaction on relationships, including with employees, suppliers, customers, competitors and credit rating agencies, the ability to achieve revenue, DCF and EBITDA growth, and volatility in the price of oil, natural gas, and natural gas liquids. Actual results and outcomes may differ materially from those expressed in such forward-looking statements. These and other risks and uncertainties are discussed in more detail in filings made by Energy Transfer and Enable with the Securities and Exchange Commission (the “SEC”), which are available to the public. Energy Transfer and Enable undertake no obligation to update publicly or to revise any forward-looking statements, whether as a result of new information, future events or otherwise. Additional Information and Where to Find It SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND PROXY STATEMENT / PROSPECTUS REGARDING THE TRANSACTION CAREFULLY WHEN IT BECOMES AVAILABLE. These documents (when they become available), and any other documents filed by Energy Transfer and Enable with the SEC, may be obtained free of charge at the SEC’s website, at www.sec.gov. In addition, investors and security holders will be able to obtain free copies of the registration statement and the proxy statement / prospectus by phone, e-mail or written request by contacting the investor relations department of Energy Transfer or Enable. Participants in the Solicitation Energy Transfer, Enable and their respective general partners, directors and executive officers, CNP and OGE and their affiliates may be deemed to be participants in the solicitation of proxies in connection with the proposed merger. Information regarding the directors and executive officers of Energy Transfer is contained in Energy Transfer’s Form 10-K for the year ended December 31, 2019, which was filed with the SEC on February 21, 2020. Information regarding the directors and executive officers of Enable is contained in Enable’s Form 10-K for the year ended December 31, 2019, which was filed with the SEC on February 19, 2020. Additional information regarding the interests of participants in the solicitation of proxies in connection with the proposed merger will be included in the proxy statement / prospectus. No Offer or Solicitation This presentation is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, in any jurisdiction, pursuant to the proposed merger or otherwise, nor shall there be any sale, issuance, exchange or transfer of the securities referred to in this document in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

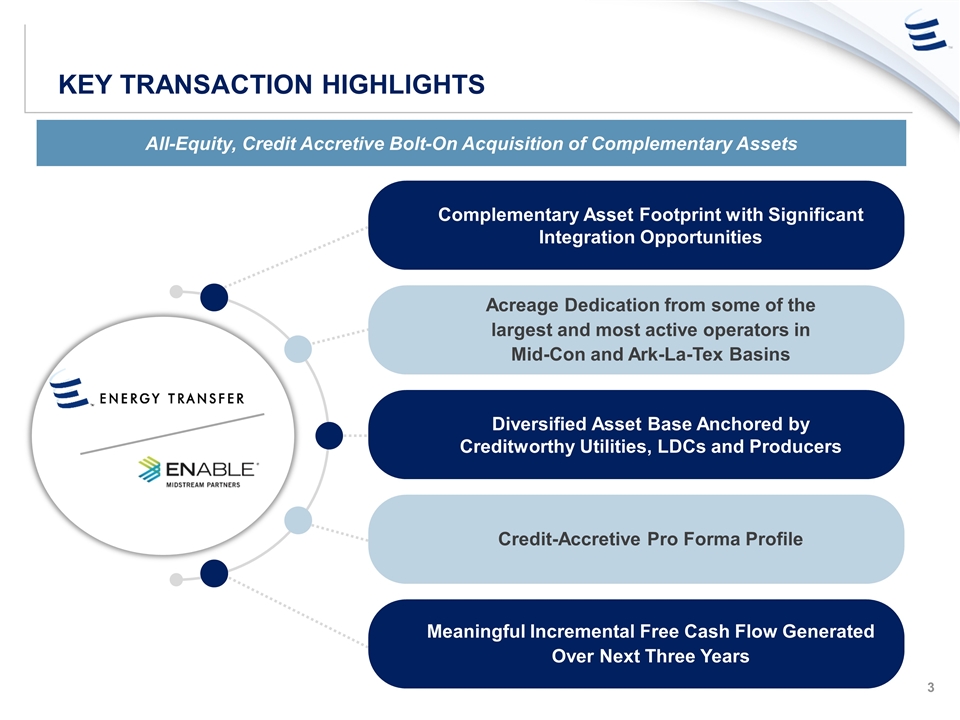

Key Transaction Highlights All-Equity, Credit Accretive Bolt-On Acquisition of Complementary Assets ` Complementary Asset Footprint with Significant Integration Opportunities Acreage Dedication from some of the largest and most active operators in Mid-Con and Ark-La-Tex Basins Diversified Asset Base Anchored by Creditworthy Utilities, LDCs and Producers Meaningful Incremental Free Cash Flow Generated Over Next Three Years Credit-Accretive Pro Forma Profile

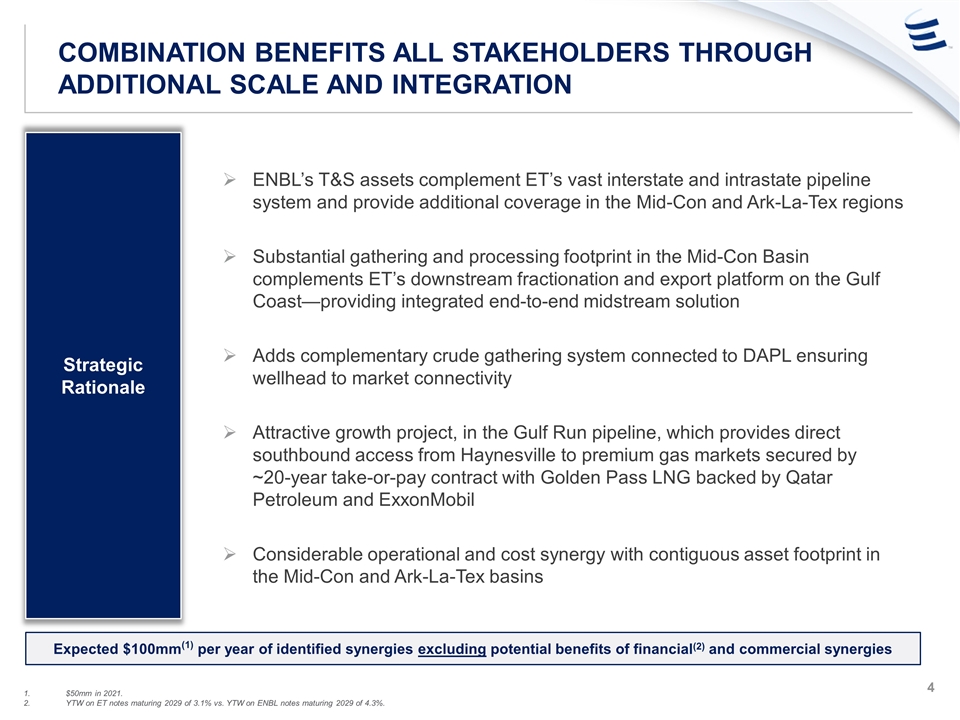

Combination benefits all stakeholders through additional scale and integration ENBL’s T&S assets complement ET’s vast interstate and intrastate pipeline system and provide additional coverage in the Mid-Con and Ark-La-Tex regions Substantial gathering and processing footprint in the Mid-Con Basin complements ET’s downstream fractionation and export platform on the Gulf Coast—providing integrated end-to-end midstream solution Adds complementary crude gathering system connected to DAPL ensuring wellhead to market connectivity Attractive growth project, in the Gulf Run pipeline, which provides direct southbound access from Haynesville to premium gas markets secured by ~20-year take-or-pay contract with Golden Pass LNG backed by Qatar Petroleum and ExxonMobil Considerable operational and cost synergy with contiguous asset footprint in the Mid-Con and Ark-La-Tex basins Strategic Rationale Expected $100mm(1) per year of identified synergies excluding potential benefits of financial(2) and commercial synergies $50mm in 2021. YTW on ET notes maturing 2029 of 3.1% vs. YTW on ENBL notes maturing 2029 of 4.3%. https://www.bamsec.com/filing/159176320000085/1?cik=1591763&hl=162377:164526&hl_id=vjl-ajucf

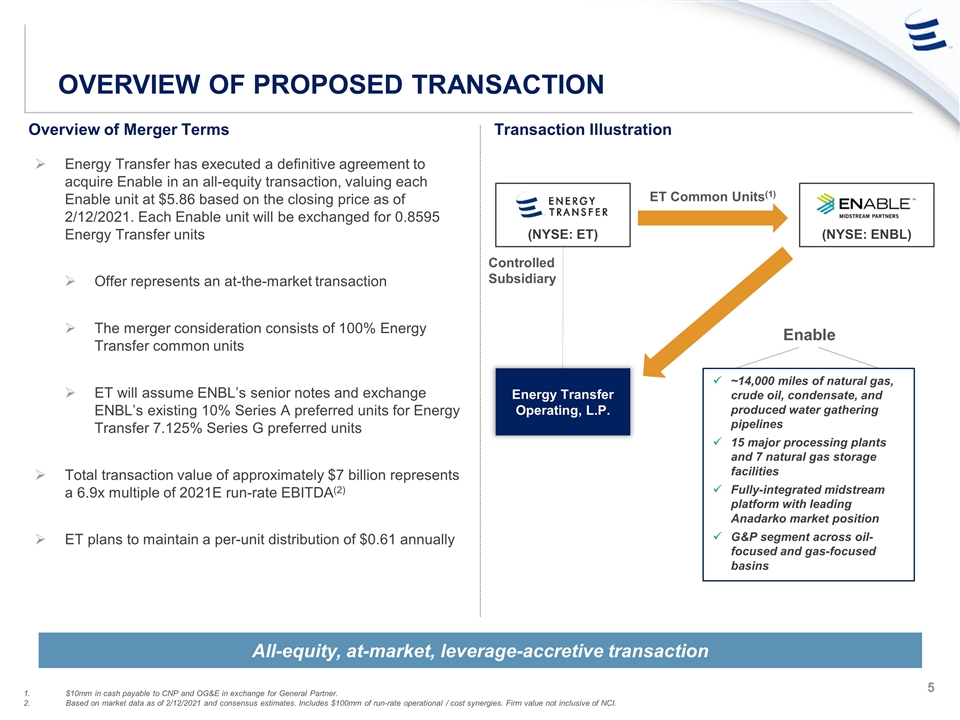

Overview of Proposed Transaction Transaction Illustration ET Common Units(1) Overview of Merger Terms Energy Transfer has executed a definitive agreement to acquire Enable in an all-equity transaction, valuing each Enable unit at $5.86 based on the closing price as of 2/12/2021. Each Enable unit will be exchanged for 0.8595 Energy Transfer units Offer represents an at-the-market transaction The merger consideration consists of 100% Energy Transfer common units ET will assume ENBL’s senior notes and exchange ENBL’s existing 10% Series A preferred units for Energy Transfer 7.125% Series G preferred units Total transaction value of approximately $7 billion represents a 6.9x multiple of 2021E run-rate EBITDA(2) ET plans to maintain a per-unit distribution of $0.61 annually All-equity, at-market, leverage-accretive transaction (NYSE: ET) (NYSE: ENBL) Energy Transfer Operating, L.P. Enable ~14,000 miles of natural gas, crude oil, condensate, and produced water gathering pipelines 15 major processing plants and 7 natural gas storage facilities Fully-integrated midstream platform with leading Anadarko market position G&P segment across oil-focused and gas-focused basins Controlled Subsidiary $10mm in cash payable to CNP and OG&E in exchange for General Partner. Based on market data as of 2/12/2021 and consensus estimates. Includes $100mm of run-rate operational / cost synergies. Firm value not inclusive of NCI.

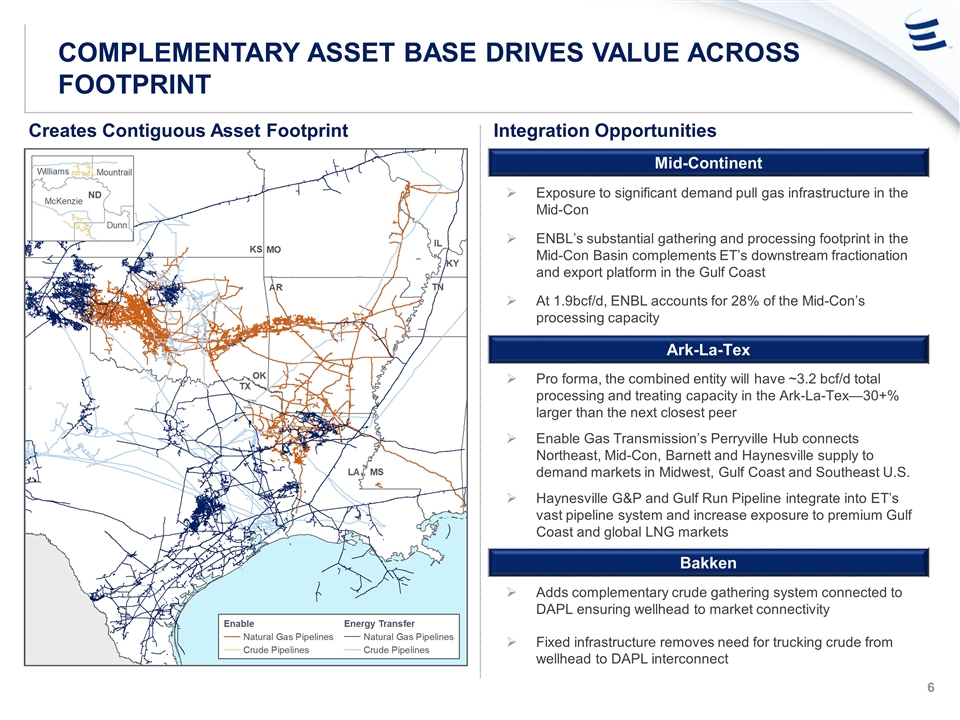

Complementary Asset Base Drives Value Across Footprint Creates Contiguous Asset Footprint Exposure to significant demand pull gas infrastructure in the Mid-Con ENBL’s substantial gathering and processing footprint in the Mid-Con Basin complements ET’s downstream fractionation and export platform in the Gulf Coast At 1.9bcf/d, ENBL accounts for 28% of the Mid-Con’s processing capacity Gathering & Processing segment expands ET’s geographical reach while adding blue-chip producers to customer portfolio ENBL’s substantial processing capacity in the Anadarko Basin complements ET’s downstream fractionation and export platform in the Gulf Coast Adds complementary crude gathering system connected to DAPL ensuring wellhead to market connectivity Transportation & Storage segment anchored by firm contracts with high quality customers (many of whom are investment grade), providing stability during volatile market environments Interconnected T&S system integrates with G&P complex and connects products to downstream markets in the Mid-Con, Southeast and Gulf Coast regions Acquired T&S assets add significant demand-pull investment grade power / utilities, and industrial customers and further complement ET’s NGL fractionation and LNG assets Mid-Continent Ark-La-Tex Bakken Integration Opportunities Adds complementary crude gathering system connected to DAPL ensuring wellhead to market connectivity Fixed infrastructure removes need for trucking crude from wellhead to DAPL interconnect Pro forma, the combined entity will have ~3.2 bcf/d total processing and treating capacity in the Ark-La-Tex—30+% larger than the next closest peer Enable Gas Transmission’s Perryville Hub connects Northeast, Mid-Con, Barnett and Haynesville supply to demand markets in Midwest, Gulf Coast and Southeast U.S. Haynesville G&P and Gulf Run Pipeline integrate into ET’s vast pipeline system and increase exposure to premium Gulf Coast and global LNG markets

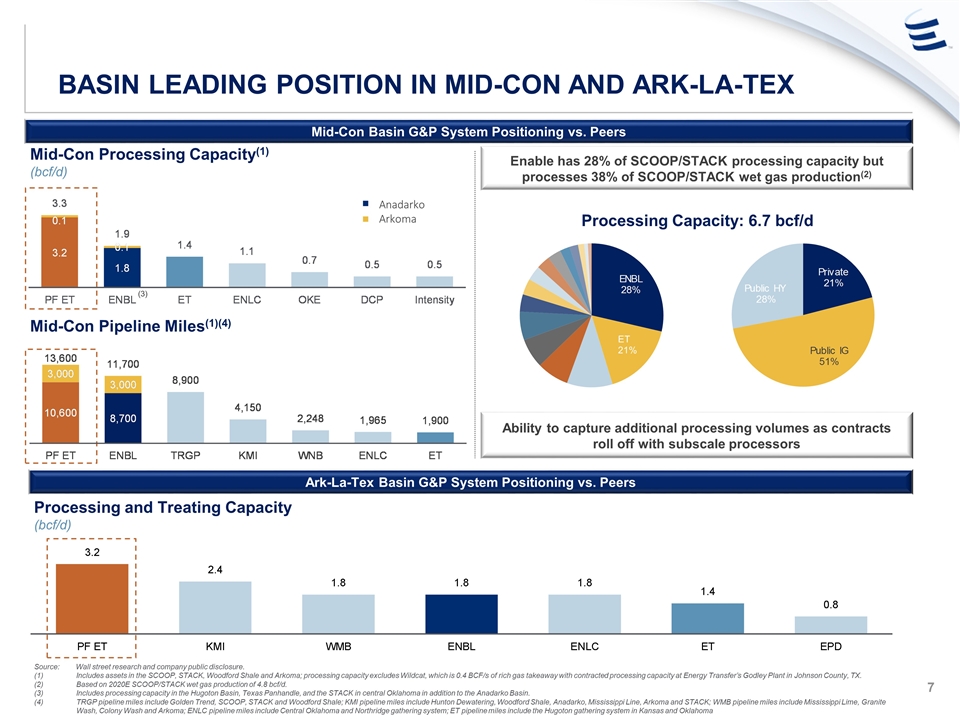

Basin leading position in Mid-Con and ark-la-tex Source: Wall street research and company public disclosure. Includes assets in the SCOOP, STACK, Woodford Shale and Arkoma; processing capacity excludes Wildcat, which is 0.4 BCF/s of rich gas takeaway with contracted processing capacity at Energy Transfer’s Godley Plant in Johnson County, TX. Based on 2020E SCOOP/STACK wet gas production of 4.8 bcf/d. Includes processing capacity in the Hugoton Basin, Texas Panhandle, and the STACK in central Oklahoma in addition to the Anadarko Basin. TRGP pipeline miles include Golden Trend, SCOOP, STACK and Woodford Shale; KMI pipeline miles include Hunton Dewatering, Woodford Shale, Anadarko, Mississippi Line, Arkoma and STACK; WMB pipeline miles include Mississippi Lime, Granite Wash, Colony Wash and Arkoma; ENLC pipeline miles include Central Oklahoma and Northridge gathering system; ET pipeline miles include the Hugoton gathering system in Kansas and Oklahoma Mid-Con Basin G&P System Positioning vs. Peers Mid-Con Pipeline Miles(1)(4) Mid-Con Processing Capacity(1) (bcf/d) Enable has 28% of SCOOP/STACK processing capacity but processes 38% of SCOOP/STACK wet gas production(2) Ark-La-Tex Basin G&P System Positioning vs. Peers Processing and Treating Capacity (bcf/d) Ability to capture additional processing volumes as contracts roll off with subscale processors Processing Capacity: 6.7 bcf/d (3) ET 21% Anadarko Arkoma

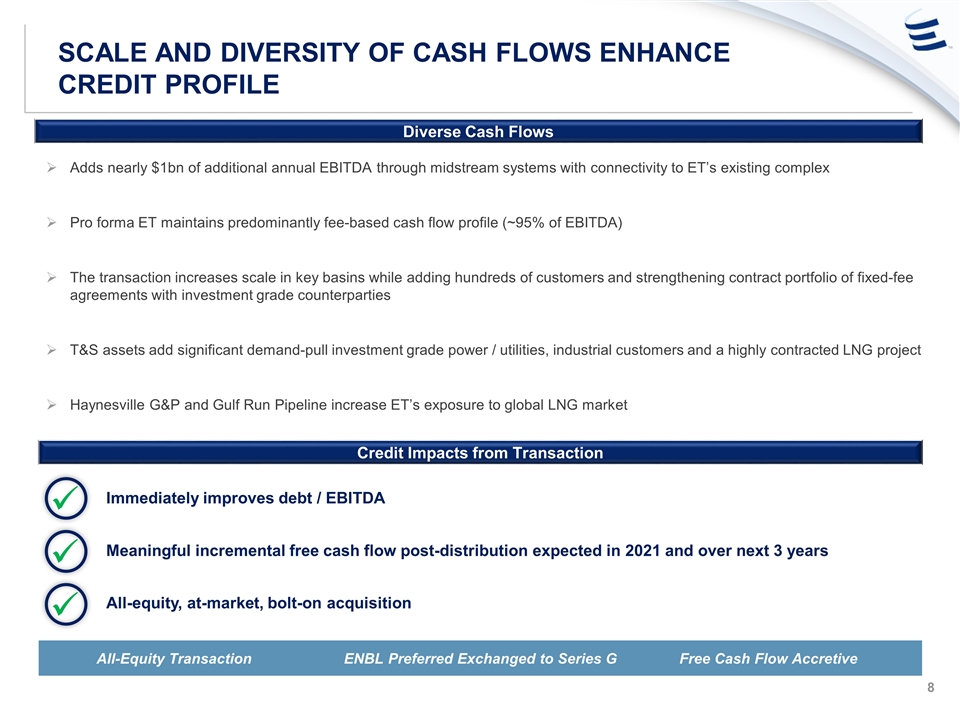

Immediately improves Debt / EBITDA à Equivalent to $600-700mm follow-on equity raise [check math, going off Dylan’s comment on call] with the added benefit of synergies vvv vvv Scale and diversity of cash flows enhance credit profile https://www.bamsec.com/filing/159176320000085/1?cik=1591763&hl=162377:164526&hl_id=vjl-ajucf Adds nearly $1bn of additional annual EBITDA through midstream systems with connectivity to ET’s existing complex Pro forma ET maintains predominantly fee-based cash flow profile (~95% of EBITDA) The transaction increases scale in key basins while adding hundreds of customers and strengthening contract portfolio of fixed-fee agreements with investment grade counterparties T&S assets add significant demand-pull investment grade power / utilities, industrial customers and a highly contracted LNG project Haynesville G&P and Gulf Run Pipeline increase ET’s exposure to global LNG market Immediately improves debt / EBITDA Meaningful incremental free cash flow post-distribution expected in 2021 and over next 3 years All-equity, at-market, bolt-on acquisition Diverse Cash Flows Credit Impacts from Transaction v All-Equity Transaction ENBL Preferred Exchanged to Series G Free Cash Flow Accretive

Large, Diverse and High-Quality Customer base https://www.bamsec.com/filing/159176320000085/1?cik=1591763&hl=162377:164526&hl_id=vjl-ajucf Enable’s revenues are strengthened by a diverse, high-quality customer base, including many investment-grade or affiliates of investment-grade companies Many Enable customers use them for multiple midstream services across both G&P and T&S Loyal customer base through exemplary customer services and reliable project execution Top Enable Customers Source: Bloomberg and Enverus. Note: Standard and Poor’s, Moody’s and Fitch ratings from Bloomberg as of 2/12/2020. Investment grade rated indicates that the company has an investment-grade rating from at least two of Standard and Poor’s, Moody’s or Fitch. 1. Average Continental rig count in Anadarko and average total Anadarko rig counts. Continental – Anadarko Basin Champion Ability to shift drilling between both crude and gas focused wells – ENBL has contracts for both The vast majority of Continental’s acreage position in the Anadarko Basin is dedicated to Enable Continental Has Consistently Favored the Anadarko Continental is the Most Active Customer in the Anadarko(1) MIDCONTINENT EXPRESS PIPELINE LLC Investment Grade Investment Grade Investment Grade Investment Grade Investment Grade Investment Grade Investment Grade Investment Grade

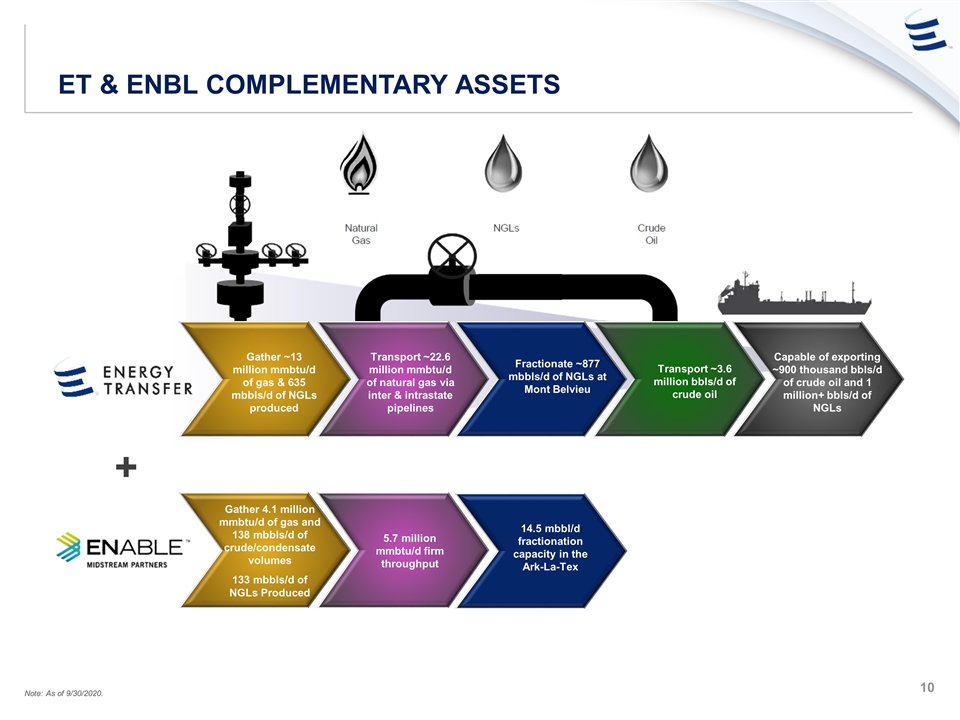

ET & ENBL Complementary assets Gather ~13 million mmbtu/d of gas & 635 mbbls/d of NGLs produced Transport ~22.6 million mmbtu/d of natural gas via inter & intrastate pipelines Fractionate ~877 mbbls/d of NGLs at Mont Belvieu Capable of exporting ~900 thousand bbls/d of crude oil and 1 million+ bbls/d of NGLs + 10,100 miles of Interstate / Intrastate pipelines(2) ~14,000 miles of natural gas, crude oil, condensate, and produced water gathering pipelines(1) Transport ~3.6 million bbls/d of crude oil Note: As of 9/30/2020. 14.5 mbbl/d fractionation capacity in the Ark-La-Tex Gather 4.1 million mmbtu/d of gas and 138 mbbls/d of crude/condensate volumes 133 mbbls/d of NGLs Produced 5.7 million mmbtu/d firm throughput

Successful acquisition track record TUFCO 2004 HPL Houston Pipeline Co. 2005 2006 2011 2012 2012 2012 2014 2015 2017 2016 ET Management has a proven track record of successfully integrating acquisitions Knowledge of respective assets and businesses facilitates integrations of: Operations Commercial Risk Management Finance / Accounting Information Technology Integration plan expected to be substantially complete by the time transaction closes 2019

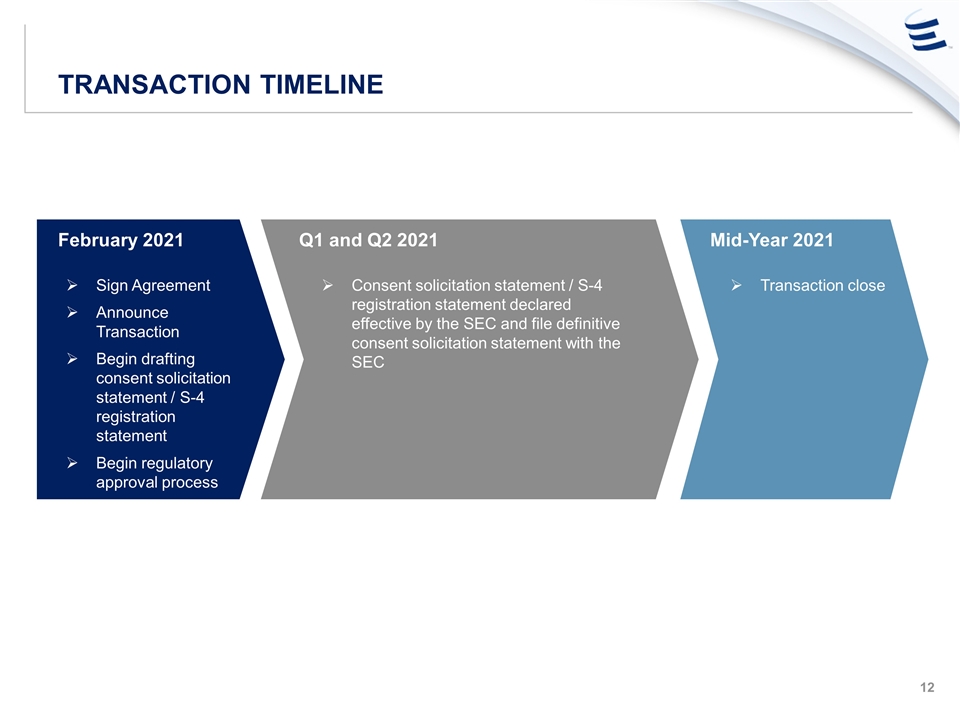

Transaction Timeline February 2021 Q1 and Q2 2021 Sign Agreement Announce Transaction Begin drafting consent solicitation statement / S-4 registration statement Begin regulatory approval process Consent solicitation statement / S-4 registration statement declared effective by the SEC and file definitive consent solicitation statement with the SEC Mid-Year 2021 Transaction close