Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Original Bark Co | d136763dex991.htm |

| 8-K - 8-K - Original Bark Co | d136763d8k.htm |

Exhibit 99.2 Management Presentation February 2021Exhibit 99.2 Management Presentation February 2021

Disclaimer (1/2) This presentation (this “Presentation”) is provided for informational purposes only and has been prepared to assist interested parties in making their own evaluation with respect to a potential business combination between Barkbox Inc. (“Barkbox”) and Northern Star Acquisition Corp. (“Northern Star”) and related transactions (the “Potential Business Combination”) and for no other purpose. By reviewing or reading this Presentation, you will be deemed to have agreed to the obligations and restrictions set out below. Without the express prior written consent of Northern Star and Barkbox, this Presentation and any information contained within it may not be (i) reproduced (in whole or in part), (ii) copied at any time, (iii) used for any purpose other than your evaluation of Barkbox or (iv) provided to any other person, except your employees and advisors with a need to know who are advised of the confidentiality of the information. This Presentation supersedes and replaces all previous oral or written communications between the parties hereto relating to the subject matter hereof. This Presentation and any oral statements made in connection with this Presentation do not constitute an offer to sell, or a solicitation of an offer to buy, or a recommendation to purchase, any securities in any jurisdiction, or the solicitation of any vote, consent or approval in any jurisdiction in connection with the Potential Business Combination or any related transactions, nor shall there be any sale, issuance or transfer of any securities in any jurisdiction where, or to any person to whom, such offer, solicitation or sale may be unlawful under the laws of such jurisdiction. This Presentation does not constitute either advice or a recommendation regarding any securities No representations or warranties, express or implied are given in, or in respect of, this Presentation. Industry and market data used in this Presentation have been obtained from third-party industry publications and sources as well as from research reports prepared for other purposes. Neither Northern Star nor Barkbox has independently verified the data obtained from these sources and cannot assure you of the data’s accuracy or completeness. This data is subject to change. Recipients of this Presentation are not to construe its contents, or any prior or subsequent communications from or with Northern Star, Barkbox or their respective representatives as investment, legal or tax advice. In addition, this Presentation does not purport to be all-inclusive or to contain all of the information that may be required to make a full analysis of Barkbox or the Potential Business Combination. Recipients of this Presentation should each make their own evaluation of Barkbox and of the relevance and adequacy of the information and should make such other investigations as they deem necessary. Forward Looking Statements Certain statements included in this Presentation are not historical facts but are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of other financial and performance metrics and projections of market opportunity. These statements are based on various assumptions, whether or not identified in this Presentation, and on the current expectations of Barkbox’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Barkbox. Some important factors that could cause actual results to differ materially from those in any forward-looking statements could include changes in domestic and foreign business, market, financial, political and legal conditions. These forward-looking statements are subject to a number of risks and uncertainties; the inability of the parties to successfully or timely consummate the Potential Business Combination, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the Potential Business Combination is not obtained; failure to realize the anticipated benefits of the Potential Business Combination; risks relating to the uncertainty of the projected financial information with respect to the Barkbox; the risk that spending on pets may not increase at projected rates; that Barkbox subscriptions may not increase their spending with Barkbox; Barkbox’s ability to continue to convert social media followers and contacts into customers; Barkbox’s ability to successfully expand its product lines and channel distribution; competition; the uncertain effects of the COVID-19 pandemic; and those factors discussed in documents of Northern Star filed, or to be filed, with SEC. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that neither Northern Star nor Barkbox presently know or that Northern Star and Barkbox currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Northern Star’s and Barkbox’s expectations, plans or forecasts of future events and views as of the date of this Presentation. Northern Star and Barkbox anticipate that subsequent events and developments will cause Northern Star’s and Barkbox’s assessments to change. However, while Northern Star and Barkbox may elect to update these forward-looking statements at some point in the future, Northern Star and Barkbox specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing Northern Star’s and Barkbox’s assessments as of any date subsequent to the date of this Presentation. Accordingly, undue reliance should not be placed upon the forward-looking statements. Use of Data The data contained herein is derived from various internal and external sources. No representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any projections or modeling or any other information contained herein. Any data on past performance or modeling contained herein is not an indication as to future performance. Northern Star and Barkbox assume no obligation to update the information in this presentation Trademarks Northern Star and Barkbox own or have rights to various trademarks, service marks and trade names that they use in connection with the operation of their respective businesses. This presentation may also contain trademarks, service marks, trade names and copyrights of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this presentation is not intended to, and does not imply, a relationship with Northern Star or Barkbox, or an endorsement or sponsorship by or of Northern Star or Barkbox. Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this presentation may appear without the TM, SM, ® or © symbols, but such references are not intended to indicate, in any way, that Northern Star or Barkbox will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks, trade names and copyrights. Use of Projections The projections, estimates and targets in this Presentation are forward-looking statements that are based on assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond Northern Star’s and Barkbox’s control. While all projections, estimates and targets are necessarily speculative, Northern Star and Barkbox believe that the preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection, estimate or target extends from the date of preparation. The assumptions and estimates underlying the projected, expected or target results are inherently uncertain and are subject to a wide variety of significant business, economic, regulatory and competitive risks and uncertainties that could cause actual results to differ materially from those contained in such projections, estimates and targets. The inclusion of projections, estimates and targets in this presentation should not be regarded as an indication that Northern Star and Barkbox, or their representatives, considered or consider the financial projections, estimates and targets to be a reliable prediction of future events. 2Disclaimer (1/2) This presentation (this “Presentation”) is provided for informational purposes only and has been prepared to assist interested parties in making their own evaluation with respect to a potential business combination between Barkbox Inc. (“Barkbox”) and Northern Star Acquisition Corp. (“Northern Star”) and related transactions (the “Potential Business Combination”) and for no other purpose. By reviewing or reading this Presentation, you will be deemed to have agreed to the obligations and restrictions set out below. Without the express prior written consent of Northern Star and Barkbox, this Presentation and any information contained within it may not be (i) reproduced (in whole or in part), (ii) copied at any time, (iii) used for any purpose other than your evaluation of Barkbox or (iv) provided to any other person, except your employees and advisors with a need to know who are advised of the confidentiality of the information. This Presentation supersedes and replaces all previous oral or written communications between the parties hereto relating to the subject matter hereof. This Presentation and any oral statements made in connection with this Presentation do not constitute an offer to sell, or a solicitation of an offer to buy, or a recommendation to purchase, any securities in any jurisdiction, or the solicitation of any vote, consent or approval in any jurisdiction in connection with the Potential Business Combination or any related transactions, nor shall there be any sale, issuance or transfer of any securities in any jurisdiction where, or to any person to whom, such offer, solicitation or sale may be unlawful under the laws of such jurisdiction. This Presentation does not constitute either advice or a recommendation regarding any securities No representations or warranties, express or implied are given in, or in respect of, this Presentation. Industry and market data used in this Presentation have been obtained from third-party industry publications and sources as well as from research reports prepared for other purposes. Neither Northern Star nor Barkbox has independently verified the data obtained from these sources and cannot assure you of the data’s accuracy or completeness. This data is subject to change. Recipients of this Presentation are not to construe its contents, or any prior or subsequent communications from or with Northern Star, Barkbox or their respective representatives as investment, legal or tax advice. In addition, this Presentation does not purport to be all-inclusive or to contain all of the information that may be required to make a full analysis of Barkbox or the Potential Business Combination. Recipients of this Presentation should each make their own evaluation of Barkbox and of the relevance and adequacy of the information and should make such other investigations as they deem necessary. Forward Looking Statements Certain statements included in this Presentation are not historical facts but are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of other financial and performance metrics and projections of market opportunity. These statements are based on various assumptions, whether or not identified in this Presentation, and on the current expectations of Barkbox’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Barkbox. Some important factors that could cause actual results to differ materially from those in any forward-looking statements could include changes in domestic and foreign business, market, financial, political and legal conditions. These forward-looking statements are subject to a number of risks and uncertainties; the inability of the parties to successfully or timely consummate the Potential Business Combination, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the Potential Business Combination is not obtained; failure to realize the anticipated benefits of the Potential Business Combination; risks relating to the uncertainty of the projected financial information with respect to the Barkbox; the risk that spending on pets may not increase at projected rates; that Barkbox subscriptions may not increase their spending with Barkbox; Barkbox’s ability to continue to convert social media followers and contacts into customers; Barkbox’s ability to successfully expand its product lines and channel distribution; competition; the uncertain effects of the COVID-19 pandemic; and those factors discussed in documents of Northern Star filed, or to be filed, with SEC. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that neither Northern Star nor Barkbox presently know or that Northern Star and Barkbox currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Northern Star’s and Barkbox’s expectations, plans or forecasts of future events and views as of the date of this Presentation. Northern Star and Barkbox anticipate that subsequent events and developments will cause Northern Star’s and Barkbox’s assessments to change. However, while Northern Star and Barkbox may elect to update these forward-looking statements at some point in the future, Northern Star and Barkbox specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing Northern Star’s and Barkbox’s assessments as of any date subsequent to the date of this Presentation. Accordingly, undue reliance should not be placed upon the forward-looking statements. Use of Data The data contained herein is derived from various internal and external sources. No representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any projections or modeling or any other information contained herein. Any data on past performance or modeling contained herein is not an indication as to future performance. Northern Star and Barkbox assume no obligation to update the information in this presentation Trademarks Northern Star and Barkbox own or have rights to various trademarks, service marks and trade names that they use in connection with the operation of their respective businesses. This presentation may also contain trademarks, service marks, trade names and copyrights of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this presentation is not intended to, and does not imply, a relationship with Northern Star or Barkbox, or an endorsement or sponsorship by or of Northern Star or Barkbox. Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this presentation may appear without the TM, SM, ® or © symbols, but such references are not intended to indicate, in any way, that Northern Star or Barkbox will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks, trade names and copyrights. Use of Projections The projections, estimates and targets in this Presentation are forward-looking statements that are based on assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond Northern Star’s and Barkbox’s control. While all projections, estimates and targets are necessarily speculative, Northern Star and Barkbox believe that the preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection, estimate or target extends from the date of preparation. The assumptions and estimates underlying the projected, expected or target results are inherently uncertain and are subject to a wide variety of significant business, economic, regulatory and competitive risks and uncertainties that could cause actual results to differ materially from those contained in such projections, estimates and targets. The inclusion of projections, estimates and targets in this presentation should not be regarded as an indication that Northern Star and Barkbox, or their representatives, considered or consider the financial projections, estimates and targets to be a reliable prediction of future events. 2

Disclaimer (2/2) Important Information and Where to Find It This Presentation is being made in respect of the proposed merger transaction involving Northern Star and BARK. Northern Star has filed a registration statement on Form S-4 with the Securities and Exchange Commission (the SEC ), which includes a proxy statement/prospectus of Northern Star, and certain related documents, to be used at the meeting of shareholders to approve the proposed business combination and related matters. Investors and security holders of Northern Star are urged to read the proxy statement/prospectus, and any amendments thereto and other relevant documents that will be filed with the SEC, carefully and in their entirety when they become available because they will contain important information about BARK, Northern Star and the business combination. The definitive proxy statement will be mailed to shareholders of Northern Star as of a record date to be established for voting on the proposed business combination. Investors and security holders will also be able to obtain copies of the registration statement and other documents containing important information about each of the companies once such documents are filed with the SEC, without charge, at the SEC's web site at www.sec.gov. The information contained on, or that may be accessed through, the websites referenced in this Presentation is not incorporated by reference into, and is not a part of, this Presentation. Participants in the Solicitation Northern Star, BARK and certain of their respective directors and executive officers may be deemed participants in the solicitation of proxies from the shareholders of Northern Star in favor of the approval of the business combination and related matters. Shareholders may obtain more detailed information regarding the names, affiliations and interests of certain of Northern Star's executive officers and directors in the solicitation by reading Northern Star's Final Prospectus dated November 10, 2020, filed with the SEC on November 12, 2020, and the proxy statement and other relevant materials filed with the SEC in connection with the business combination when they become available. Information concerning the interests of Northern Star's participants in the solicitation, which may, in some cases, be different than those of their stockholders generally, will be set forth in the proxy statement relating to the business combination when it becomes available. Use of Non-GAAP Financial Measures BARK reports its financial results in accordance with GAAP. However, BARK’s management believes that Adjusted EBITDA and Adjusted EBITDA margin, both non-GAAP financial measures, provide investors with additional useful information in evaluating its performance. Adjusted EBITDA and Adjusted EBITDA margin are financial measures that are not required by, or presented in accordance with GAAP. BARK believe that Adjusted EBITDA and Adjusted EBITDA margin, when taken together with its financial results presented in accordance with GAAP, provides meaningful supplemental information regarding its operating performance and facilitates internal comparisons of its historical operating performance on a more consistent basis by excluding certain items that may not be indicative of its business, results of operations or outlook. In particular, BARK believe that the use of Adjusted EBITDA and Adjusted EBITDA margin are helpful to its investors as it is a measure used by management in assessing the health of its business, determining incentive compensation and evaluating its operating performance, as well as for internal planning and forecasting purposes. Adjusted EBITDA and Adjusted EBITDA margin are presented for supplemental informational purposes only, have limitations as an analytical tool and should not be considered in isolation or as a substitute for financial information presented in accordance with GAAP. Some of the limitations of Adjusted EBITDA and Adjusted EBITDA margin include that (1) the measures do not properly reflect capital commitments to be paid in the future, (2) although depreciation and amortization are non-cash charges, the underlying assets may need to be replaced and Adjusted EBITDA and Adjusted EBITDA margin do not reflect these capital expenditures, (3) the measures do not consider the impact of stock-based compensation expense, which is an ongoing expense for BARK and (4) the measures do not reflect other non-operating expenses, including interest expense. In addition, its use of Adjusted EBITDA and Adjusted EBITDA margin may not be comparable to similarly titled measures of other companies because they may not calculate Adjusted EBITDA or Adjusted EBITDA margin in the same manner, limiting its usefulness as a comparative measure. Because of these limitations, when evaluating BARK’s performance, you should consider Adjusted EBITDA and Adjusted EBITDA margin alongside other financial measures, including its net income (loss) and other results stated in accordance with GAAP. Cautionary Statement Regarding Preliminary Estimated Results The preliminary estimated results for the third quarter ended December 31, 2021 are preliminary, unaudited and subject to completion. They reflect BARK management’s current views and may change as a result of BARK’s review of results and other factors, including a wide variety of significant business, economic and competitive risks and uncertainties. Such preliminary results are subject to the finalization and closing of BARK’s accounting books and records (which have yet to be performed), and should not be viewed as a substitute for full quarterly financial statements prepared in accordance with GAAP. Northern Star and BARK caution you that these preliminary results are not guarantees of future performance or outcomes and that actual results may differ materially from those described above. For more information regarding factors that could cause actual results to differ from those described above, please see “Cautionary Statement Regarding Forward-Looking Statements” below. The preliminary estimated results have been prepared by, and are the responsibility of, BARK’s management. Deloitte & Touche LLP, BARK’s independent registered public accounting firm, has not audited, reviewed, compiled, or applied agreed-upon procedures with respect to the preliminary estimated financial information. Accordingly, Deloitte & Touche LLP does not express an opinion or any other form of assurance with respect thereto. INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE 3Disclaimer (2/2) Important Information and Where to Find It This Presentation is being made in respect of the proposed merger transaction involving Northern Star and BARK. Northern Star has filed a registration statement on Form S-4 with the Securities and Exchange Commission (the SEC ), which includes a proxy statement/prospectus of Northern Star, and certain related documents, to be used at the meeting of shareholders to approve the proposed business combination and related matters. Investors and security holders of Northern Star are urged to read the proxy statement/prospectus, and any amendments thereto and other relevant documents that will be filed with the SEC, carefully and in their entirety when they become available because they will contain important information about BARK, Northern Star and the business combination. The definitive proxy statement will be mailed to shareholders of Northern Star as of a record date to be established for voting on the proposed business combination. Investors and security holders will also be able to obtain copies of the registration statement and other documents containing important information about each of the companies once such documents are filed with the SEC, without charge, at the SEC's web site at www.sec.gov. The information contained on, or that may be accessed through, the websites referenced in this Presentation is not incorporated by reference into, and is not a part of, this Presentation. Participants in the Solicitation Northern Star, BARK and certain of their respective directors and executive officers may be deemed participants in the solicitation of proxies from the shareholders of Northern Star in favor of the approval of the business combination and related matters. Shareholders may obtain more detailed information regarding the names, affiliations and interests of certain of Northern Star's executive officers and directors in the solicitation by reading Northern Star's Final Prospectus dated November 10, 2020, filed with the SEC on November 12, 2020, and the proxy statement and other relevant materials filed with the SEC in connection with the business combination when they become available. Information concerning the interests of Northern Star's participants in the solicitation, which may, in some cases, be different than those of their stockholders generally, will be set forth in the proxy statement relating to the business combination when it becomes available. Use of Non-GAAP Financial Measures BARK reports its financial results in accordance with GAAP. However, BARK’s management believes that Adjusted EBITDA and Adjusted EBITDA margin, both non-GAAP financial measures, provide investors with additional useful information in evaluating its performance. Adjusted EBITDA and Adjusted EBITDA margin are financial measures that are not required by, or presented in accordance with GAAP. BARK believe that Adjusted EBITDA and Adjusted EBITDA margin, when taken together with its financial results presented in accordance with GAAP, provides meaningful supplemental information regarding its operating performance and facilitates internal comparisons of its historical operating performance on a more consistent basis by excluding certain items that may not be indicative of its business, results of operations or outlook. In particular, BARK believe that the use of Adjusted EBITDA and Adjusted EBITDA margin are helpful to its investors as it is a measure used by management in assessing the health of its business, determining incentive compensation and evaluating its operating performance, as well as for internal planning and forecasting purposes. Adjusted EBITDA and Adjusted EBITDA margin are presented for supplemental informational purposes only, have limitations as an analytical tool and should not be considered in isolation or as a substitute for financial information presented in accordance with GAAP. Some of the limitations of Adjusted EBITDA and Adjusted EBITDA margin include that (1) the measures do not properly reflect capital commitments to be paid in the future, (2) although depreciation and amortization are non-cash charges, the underlying assets may need to be replaced and Adjusted EBITDA and Adjusted EBITDA margin do not reflect these capital expenditures, (3) the measures do not consider the impact of stock-based compensation expense, which is an ongoing expense for BARK and (4) the measures do not reflect other non-operating expenses, including interest expense. In addition, its use of Adjusted EBITDA and Adjusted EBITDA margin may not be comparable to similarly titled measures of other companies because they may not calculate Adjusted EBITDA or Adjusted EBITDA margin in the same manner, limiting its usefulness as a comparative measure. Because of these limitations, when evaluating BARK’s performance, you should consider Adjusted EBITDA and Adjusted EBITDA margin alongside other financial measures, including its net income (loss) and other results stated in accordance with GAAP. Cautionary Statement Regarding Preliminary Estimated Results The preliminary estimated results for the third quarter ended December 31, 2021 are preliminary, unaudited and subject to completion. They reflect BARK management’s current views and may change as a result of BARK’s review of results and other factors, including a wide variety of significant business, economic and competitive risks and uncertainties. Such preliminary results are subject to the finalization and closing of BARK’s accounting books and records (which have yet to be performed), and should not be viewed as a substitute for full quarterly financial statements prepared in accordance with GAAP. Northern Star and BARK caution you that these preliminary results are not guarantees of future performance or outcomes and that actual results may differ materially from those described above. For more information regarding factors that could cause actual results to differ from those described above, please see “Cautionary Statement Regarding Forward-Looking Statements” below. The preliminary estimated results have been prepared by, and are the responsibility of, BARK’s management. Deloitte & Touche LLP, BARK’s independent registered public accounting firm, has not audited, reviewed, compiled, or applied agreed-upon procedures with respect to the preliminary estimated financial information. Accordingly, Deloitte & Touche LLP does not express an opinion or any other form of assurance with respect thereto. INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE 3

01 Transaction Overview 401 Transaction Overview 4

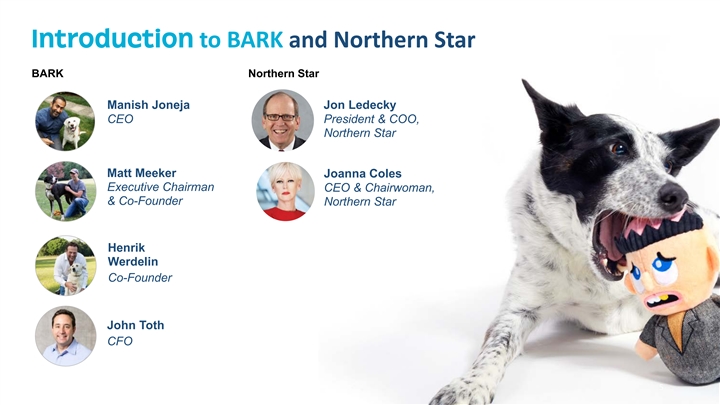

Introduction to BARK and Northern Star BARK Northern Star Manish Joneja Jon Ledecky CEO President & COO, Northern Star Matt Meeker Joanna Coles Executive Chairman CEO & Chairwoman, & Co-Founder Northern Star Henrik Werdelin Co-Founder John Toth CFO 5Introduction to BARK and Northern Star BARK Northern Star Manish Joneja Jon Ledecky CEO President & COO, Northern Star Matt Meeker Joanna Coles Executive Chairman CEO & Chairwoman, & Co-Founder Northern Star Henrik Werdelin Co-Founder John Toth CFO 5

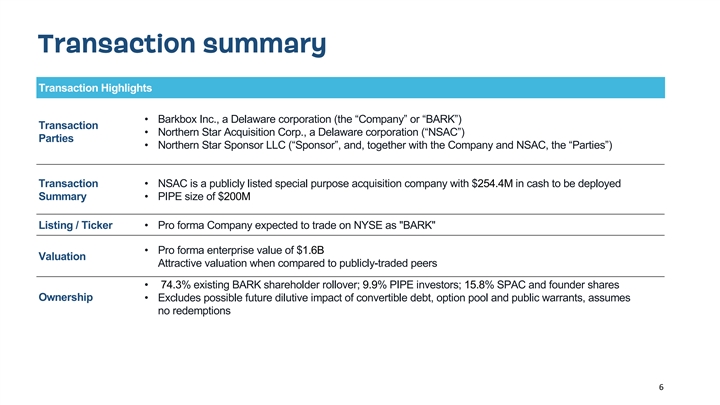

Transaction summary Transaction Highlights • Barkbox Inc., a Delaware corporation (the “Company” or “BARK”) Transaction • Northern Star Acquisition Corp., a Delaware corporation (“NSAC”) Parties • Northern Star Sponsor LLC (“Sponsor”, and, together with the Company and NSAC, the “Parties”) Transaction • NSAC is a publicly listed special purpose acquisition company with $254.4M in cash to be deployed Summary • PIPE size of $200M Listing / Ticker • Pro forma Company expected to trade on NYSE as BARK • Pro forma enterprise value of $1.6B Valuation Attractive valuation when compared to publicly-traded peers • 74.3% existing BARK shareholder rollover; 9.9% PIPE investors; 15.8% SPAC and founder shares Ownership • Excludes possible future dilutive impact of convertible debt, option pool and public warrants, assumes no redemptions 6Transaction summary Transaction Highlights • Barkbox Inc., a Delaware corporation (the “Company” or “BARK”) Transaction • Northern Star Acquisition Corp., a Delaware corporation (“NSAC”) Parties • Northern Star Sponsor LLC (“Sponsor”, and, together with the Company and NSAC, the “Parties”) Transaction • NSAC is a publicly listed special purpose acquisition company with $254.4M in cash to be deployed Summary • PIPE size of $200M Listing / Ticker • Pro forma Company expected to trade on NYSE as BARK • Pro forma enterprise value of $1.6B Valuation Attractive valuation when compared to publicly-traded peers • 74.3% existing BARK shareholder rollover; 9.9% PIPE investors; 15.8% SPAC and founder shares Ownership • Excludes possible future dilutive impact of convertible debt, option pool and public warrants, assumes no redemptions 6

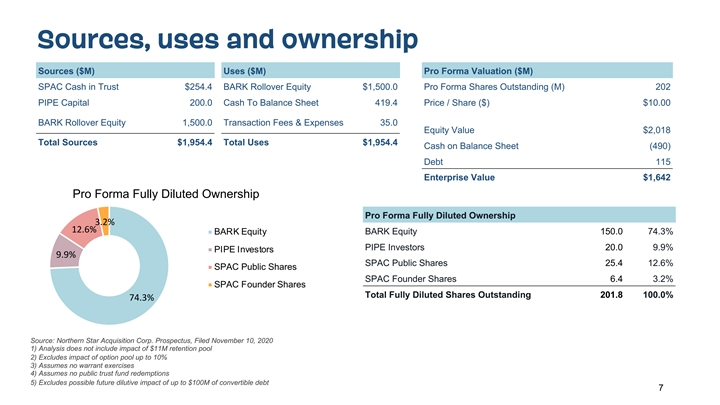

Sources, uses and ownership Sources ($M) Uses ($M) Pro Forma Valuation ($M) SPAC Cash in Trust $254.4 BARK Rollover Equity $1,500.0 Pro Forma Shares Outstanding (M) 202 PIPE Capital 200.0 Cash To Balance Sheet 419.4 Price / Share ($) $10.00 BARK Rollover Equity 1,500.0 Transaction Fees & Expenses 35.0 Equity Value $2,018 Total Sources $1,954.4 Total Uses $1,954.4 Cash on Balance Sheet (490) Debt 115 Enterprise Value $1,642 Pro Forma Fully Diluted Ownership Pro Forma Fully Diluted Ownership 3.2% 12.6% BARK Equity 150.0 74.3% BARK Equity PIPE Investors 20.0 9.9% PIPE Investors 9.9% SPAC Public Shares 25.4 12.6% SPAC Public Shares SPAC Founder Shares 6.4 3.2% SPAC Founder Shares Total Fully Diluted Shares Outstanding 201.8 100.0% 74.3% Source: Northern Star Acquisition Corp. Prospectus, Filed November 10, 2020 1) Analysis does not include impact of $11M retention pool 2) Excludes impact of option pool up to 10% 3) Assumes no warrant exercises 4) Assumes no public trust fund redemptions 5) Excludes possible future dilutive impact of up to $100M of convertible debt 7Sources, uses and ownership Sources ($M) Uses ($M) Pro Forma Valuation ($M) SPAC Cash in Trust $254.4 BARK Rollover Equity $1,500.0 Pro Forma Shares Outstanding (M) 202 PIPE Capital 200.0 Cash To Balance Sheet 419.4 Price / Share ($) $10.00 BARK Rollover Equity 1,500.0 Transaction Fees & Expenses 35.0 Equity Value $2,018 Total Sources $1,954.4 Total Uses $1,954.4 Cash on Balance Sheet (490) Debt 115 Enterprise Value $1,642 Pro Forma Fully Diluted Ownership Pro Forma Fully Diluted Ownership 3.2% 12.6% BARK Equity 150.0 74.3% BARK Equity PIPE Investors 20.0 9.9% PIPE Investors 9.9% SPAC Public Shares 25.4 12.6% SPAC Public Shares SPAC Founder Shares 6.4 3.2% SPAC Founder Shares Total Fully Diluted Shares Outstanding 201.8 100.0% 74.3% Source: Northern Star Acquisition Corp. Prospectus, Filed November 10, 2020 1) Analysis does not include impact of $11M retention pool 2) Excludes impact of option pool up to 10% 3) Assumes no warrant exercises 4) Assumes no public trust fund redemptions 5) Excludes possible future dilutive impact of up to $100M of convertible debt 7

BARK’s investment highlights ü Big, resilient and growing pet category ü Digitally-led DTC brand ü Personalized, data driven subscription experience with strong retention ü Clear levers for accelerating growth – category and product diversification, channel expansion, and cross-sell ü Strong incremental margins, powerful operating leverage ü Visionary and passionate team to scale the business 8BARK’s investment highlights ü Big, resilient and growing pet category ü Digitally-led DTC brand ü Personalized, data driven subscription experience with strong retention ü Clear levers for accelerating growth – category and product diversification, channel expansion, and cross-sell ü Strong incremental margins, powerful operating leverage ü Visionary and passionate team to scale the business 8

02 Who We Are and Who We Serve02 Who We Are and Who We Serve

We are here to make all dogs happy. We aspire to be the world’s favorite dog brand. We believe that dogs and humans are better together. We are committed to satisfying each individual dog’s distinct personality and preferences. 10We are here to make all dogs happy. We aspire to be the world’s favorite dog brand. We believe that dogs and humans are better together. We are committed to satisfying each individual dog’s distinct personality and preferences. 10

Currently serving over 1M happy dog subscribers every month 11Currently serving over 1M happy dog subscribers every month 11

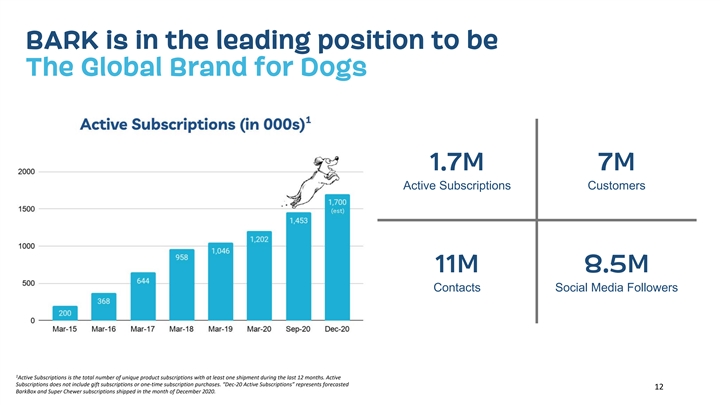

BARK is in the leading position to be The Global Brand for Dogs 1.7M 7M Active Subscriptions Customers 11M 8.5M Contacts Social Media Followers 1 Active Subscriptions is the total number of unique product subscriptions with at least one shipment during the last 12 months. Active Subscriptions does not include gift subscriptions or one-time subscription purchases. “Dec-20 Active Subscriptions” represents forecasted 12 BarkBox and Super Chewer subscriptions shipped in the month of December 2020.BARK is in the leading position to be The Global Brand for Dogs 1.7M 7M Active Subscriptions Customers 11M 8.5M Contacts Social Media Followers 1 Active Subscriptions is the total number of unique product subscriptions with at least one shipment during the last 12 months. Active Subscriptions does not include gift subscriptions or one-time subscription purchases. “Dec-20 Active Subscriptions” represents forecasted 12 BarkBox and Super Chewer subscriptions shipped in the month of December 2020.

Reiterate 2021 Outlook: Strong Financial Performance 65% 60% $369M Gross Margins Net revenue in FY2021E Net Revenue Growth FY21E/20 13Reiterate 2021 Outlook: Strong Financial Performance 65% 60% $369M Gross Margins Net revenue in FY2021E Net Revenue Growth FY21E/20 13

Dogs are a huge, growing and global market According to 2019-20 APPA Survey, dogs are the most popular pet in the U.S., with more than 63 million households having a dog as a member of their family. Resilient Wide Open Huge Growing Our industry & total The market is growing rapidly, with The industry is economically There is not a clear and addressable market are huge. a variety of thematic tailwinds. resilient through the cycle. dominant leader in the space. 14 BARK 2018Dogs are a huge, growing and global market According to 2019-20 APPA Survey, dogs are the most popular pet in the U.S., with more than 63 million households having a dog as a member of their family. Resilient Wide Open Huge Growing Our industry & total The market is growing rapidly, with The industry is economically There is not a clear and addressable market are huge. a variety of thematic tailwinds. resilient through the cycle. dominant leader in the space. 14 BARK 2018

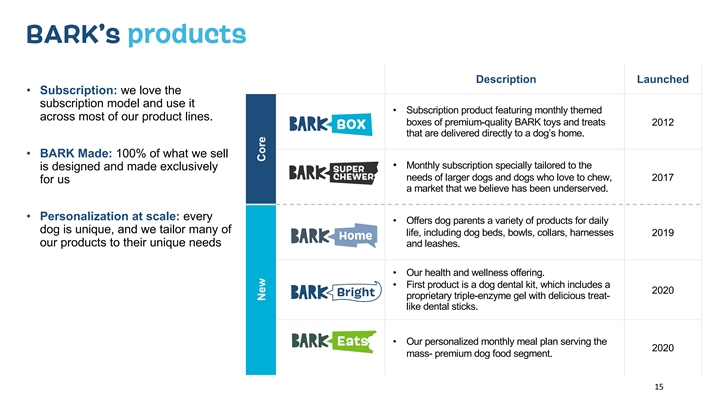

BARK’s products Description Launched • Subscription: we love the subscription model and use it • Subscription product featuring monthly themed across most of our product lines. boxes of premium-quality BARK toys and treats 2012 that are delivered directly to a dog’s home. • BARK Made: 100% of what we sell • Monthly subscription specially tailored to the is designed and made exclusively needs of larger dogs and dogs who love to chew, 2017 for us a market that we believe has been underserved. • Personalization at scale: every • Offers dog parents a variety of products for daily dog is unique, and we tailor many of life, including dog beds, bowls, collars, harnesses 2019 our products to their unique needs and leashes. • Our health and wellness offering. • First product is a dog dental kit, which includes a 2020 proprietary triple-enzyme gel with delicious treat- like dental sticks. • Our personalized monthly meal plan serving the 2020 mass- premium dog food segment. 15 New CoreBARK’s products Description Launched • Subscription: we love the subscription model and use it • Subscription product featuring monthly themed across most of our product lines. boxes of premium-quality BARK toys and treats 2012 that are delivered directly to a dog’s home. • BARK Made: 100% of what we sell • Monthly subscription specially tailored to the is designed and made exclusively needs of larger dogs and dogs who love to chew, 2017 for us a market that we believe has been underserved. • Personalization at scale: every • Offers dog parents a variety of products for daily dog is unique, and we tailor many of life, including dog beds, bowls, collars, harnesses 2019 our products to their unique needs and leashes. • Our health and wellness offering. • First product is a dog dental kit, which includes a 2020 proprietary triple-enzyme gel with delicious treat- like dental sticks. • Our personalized monthly meal plan serving the 2020 mass- premium dog food segment. 15 New Core

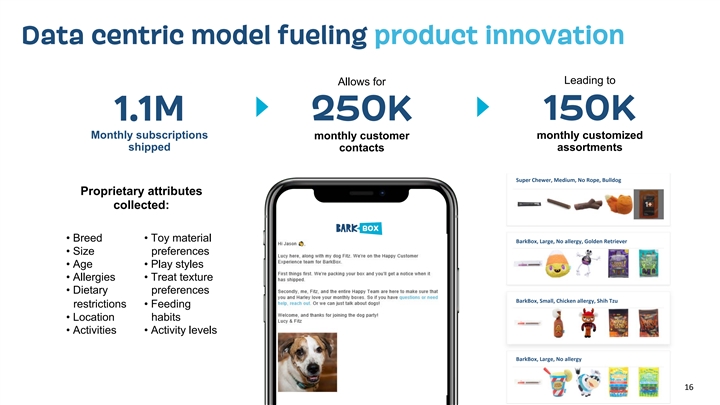

Data centric model fueling product innovation Leading to Allows for Allows for Leading to 1.1M 250K 150K Monthly subscriptions monthly customer monthly customized shipped contacts assortments Super Chewer, Medium, No Rope, Bulldog Proprietary attributes collected: • Breed • Toy material BarkBox, Large, No allergy, Golden Retriever • Size preferences • Age • Play styles • Allergies • Treat texture • Dietary preferences BarkBox, Small, Chicken allergy, Shih Tzu restrictions • Feeding • Location habits • Activities • Activity levels BarkBox, Large, No allergy 16 16Data centric model fueling product innovation Leading to Allows for Allows for Leading to 1.1M 250K 150K Monthly subscriptions monthly customer monthly customized shipped contacts assortments Super Chewer, Medium, No Rope, Bulldog Proprietary attributes collected: • Breed • Toy material BarkBox, Large, No allergy, Golden Retriever • Size preferences • Age • Play styles • Allergies • Treat texture • Dietary preferences BarkBox, Small, Chicken allergy, Shih Tzu restrictions • Feeding • Location habits • Activities • Activity levels BarkBox, Large, No allergy 16 16

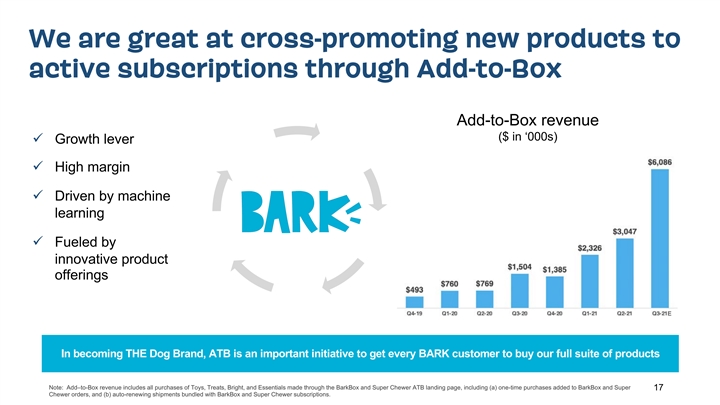

We are great at cross-promoting new products to active subscriptions through Add-to-Box Add-to-Box revenue ($ in ‘000s) ü Growth lever ü High margin ü Driven by machine learning ü Fueled by innovative product offerings E In becoming THE Dog Brand, ATB is an important initiative to get every BARK customer to buy our full suite of products Note: Add–to-Box revenue includes all purchases of Toys, Treats, Bright, and Essentials made through the BarkBox and Super Chewer ATB landing page, including (a) one-time purchases added to BarkBox and Super 17 Chewer orders, and (b) auto-renewing shipments bundled with BarkBox and Super Chewer subscriptions.We are great at cross-promoting new products to active subscriptions through Add-to-Box Add-to-Box revenue ($ in ‘000s) ü Growth lever ü High margin ü Driven by machine learning ü Fueled by innovative product offerings E In becoming THE Dog Brand, ATB is an important initiative to get every BARK customer to buy our full suite of products Note: Add–to-Box revenue includes all purchases of Toys, Treats, Bright, and Essentials made through the BarkBox and Super Chewer ATB landing page, including (a) one-time purchases added to BarkBox and Super 17 Chewer orders, and (b) auto-renewing shipments bundled with BarkBox and Super Chewer subscriptions.

03 Our Growth Strategies 1803 Our Growth Strategies 18

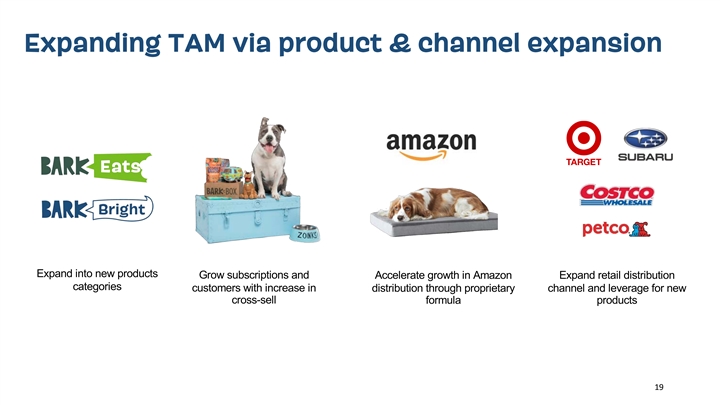

Expanding TAM via product & channel expansion Expand into new products Grow subscriptions and Accelerate growth in Amazon Expand retail distribution categories customers with increase in distribution through proprietary channel and leverage for new cross-sell formula products 19Expanding TAM via product & channel expansion Expand into new products Grow subscriptions and Accelerate growth in Amazon Expand retail distribution categories customers with increase in distribution through proprietary channel and leverage for new cross-sell formula products 19

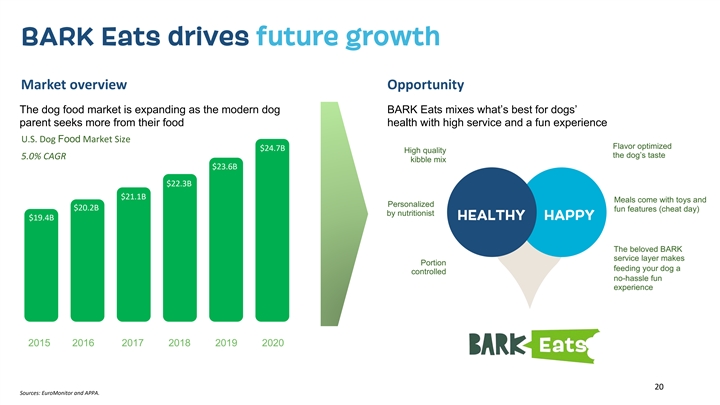

BARK Eats drives future growth Market overview Opportunity The dog food market is expanding as the modern dog BARK Eats mixes what’s best for dogs’ parent seeks more from their food health with high service and a fun experience U.S. Dog Food Market Size Flavor optimized $24.7B High quality the dog’s taste 5.0% CAGR kibble mix $23.6B $22.3B $21.1B Meals come with toys and Personalized $20.2B fun features (cheat day) by nutritionist HEALTHY HAPPY $19.4B The beloved BARK service layer makes Portion feeding your dog a controlled no-hassle fun experience 2015 2016 2017 2018 2019 2020 20 Sources: EuroMonitor and APPA.BARK Eats drives future growth Market overview Opportunity The dog food market is expanding as the modern dog BARK Eats mixes what’s best for dogs’ parent seeks more from their food health with high service and a fun experience U.S. Dog Food Market Size Flavor optimized $24.7B High quality the dog’s taste 5.0% CAGR kibble mix $23.6B $22.3B $21.1B Meals come with toys and Personalized $20.2B fun features (cheat day) by nutritionist HEALTHY HAPPY $19.4B The beloved BARK service layer makes Portion feeding your dog a controlled no-hassle fun experience 2015 2016 2017 2018 2019 2020 20 Sources: EuroMonitor and APPA.

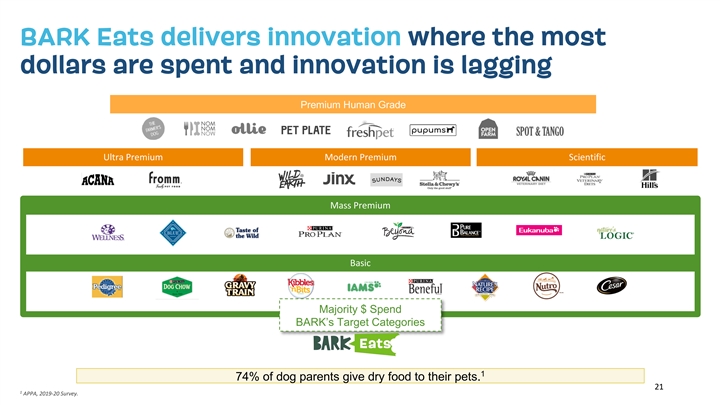

BARK Eats delivers innovation where the most dollars are spent and innovation is lagging Premium Human Grade Ultra Premium Modern Premium Scientific Mass Premium Basic Majority $ Spend BARK’s Target Categories 1 74% of dog parents give dry food to their pets. 21 1 APPA, 2019-20 Survey.BARK Eats delivers innovation where the most dollars are spent and innovation is lagging Premium Human Grade Ultra Premium Modern Premium Scientific Mass Premium Basic Majority $ Spend BARK’s Target Categories 1 74% of dog parents give dry food to their pets. 21 1 APPA, 2019-20 Survey.

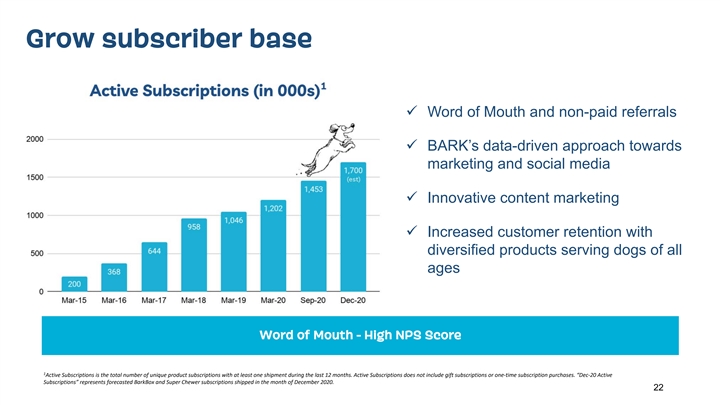

Grow subscriber base ü Word of Mouth and non-paid referrals ü BARK’s data-driven approach towards marketing and social media ü Innovative content marketing ü Increased customer retention with diversified products serving dogs of all ages Word of Mouth – High NPS Score 1 Active Subscriptions is the total number of unique product subscriptions with at least one shipment during the last 12 months. Active Subscriptions does not include gift subscriptions or one-time subscription purchases. “Dec-20 Active Subscriptions” represents forecasted BarkBox and Super Chewer subscriptions shipped in the month of December 2020. 22Grow subscriber base ü Word of Mouth and non-paid referrals ü BARK’s data-driven approach towards marketing and social media ü Innovative content marketing ü Increased customer retention with diversified products serving dogs of all ages Word of Mouth – High NPS Score 1 Active Subscriptions is the total number of unique product subscriptions with at least one shipment during the last 12 months. Active Subscriptions does not include gift subscriptions or one-time subscription purchases. “Dec-20 Active Subscriptions” represents forecasted BarkBox and Super Chewer subscriptions shipped in the month of December 2020. 22

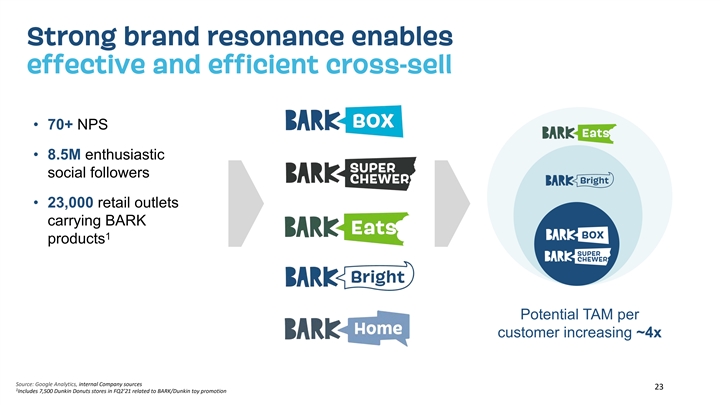

Strong brand resonance enables effective and efficient cross-sell • 70+ NPS • 8.5M enthusiastic social followers • 23,000 retail outlets carrying BARK 1 products Potential TAM per customer increasing ~4x Source: Google Analytics, internal Company sources 23 1 Includes 7,500 Dunkin Donuts stores in FQ2’21 related to BARK/Dunkin toy promotion BARK 2018Strong brand resonance enables effective and efficient cross-sell • 70+ NPS • 8.5M enthusiastic social followers • 23,000 retail outlets carrying BARK 1 products Potential TAM per customer increasing ~4x Source: Google Analytics, internal Company sources 23 1 Includes 7,500 Dunkin Donuts stores in FQ2’21 related to BARK/Dunkin toy promotion BARK 2018

BARK’s distribution channels provide leverage to seamlessly introduce new products Holistic omni-channel presence Collaboration with retail partners creates additional tailwinds creates new opportunities ü Platform to drive brand awareness and product discovery. ü focused on strong retail and marketplaces partnerships through highly curated products. • Bluestone Lane & Glossier • Dunkin’ Donuts partnership • Urban Outfitters • Amazon Barketplace partnerships • PetSmart, CVS, Petco, Costco partnership • Target retail & other partnerships • BARK Park shared experience • Q, Subaru, Meijer partnerships 24BARK’s distribution channels provide leverage to seamlessly introduce new products Holistic omni-channel presence Collaboration with retail partners creates additional tailwinds creates new opportunities ü Platform to drive brand awareness and product discovery. ü focused on strong retail and marketplaces partnerships through highly curated products. • Bluestone Lane & Glossier • Dunkin’ Donuts partnership • Urban Outfitters • Amazon Barketplace partnerships • PetSmart, CVS, Petco, Costco partnership • Target retail & other partnerships • BARK Park shared experience • Q, Subaru, Meijer partnerships 24

04 Financial Highlights 2504 Financial Highlights 25

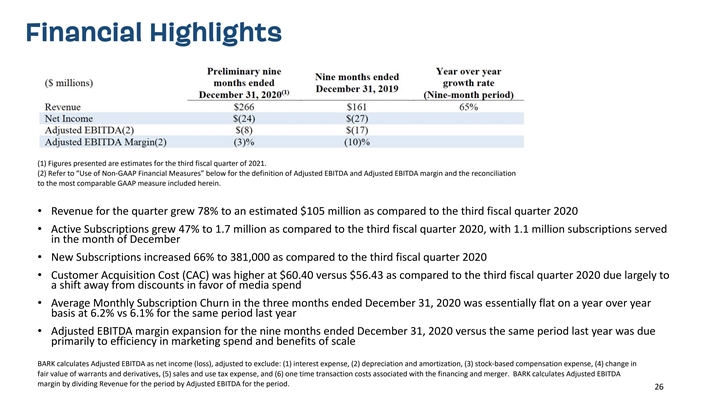

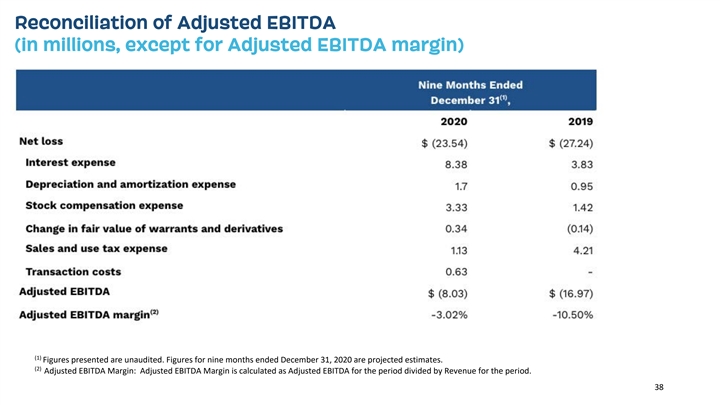

Financial Highlights (1) Figures presented are estimates for the third fiscal quarter of 2021. (2) Refer to “Use of Non-GAAP Financial Measures” below for the definition of Adjusted EBITDA and Adjusted EBITDA margin and the reconciliation to the most comparable GAAP measure included herein. • Revenue for the quarter grew 78% to an estimated $105 million as compared to the third fiscal quarter 2020 • Active Subscriptions grew 47% to 1.7 million as compared to the third fiscal quarter 2020, with 1.1 million subscriptions served in the month of December • New Subscriptions increased 66% to 381,000 as compared to the third fiscal quarter 2020 • Customer Acquisition Cost (CAC) was higher at $60.40 versus $56.43 as compared to the third fiscal quarter 2020 due largely to a shift away from discounts in favor of media spend • Average Monthly Subscription Churn in the three months ended December 31, 2020 was essentially flat on a year over year basis at 6.2% vs 6.1% for the same period last year • Adjusted EBITDA margin expansion for the nine months ended December 31, 2020 versus the same period last year was due primarily to efficiency in marketing spend and benefits of scale BARK calculates Adjusted EBITDA as net income (loss), adjusted to exclude: (1) interest expense, (2) depreciation and amortization, (3) stock-based compensation expense, (4) change in fair value of warrants and derivatives, (5) sales and use tax expense, and (6) one time transaction costs associated with the financing and merger. BARK calculates Adjusted EBITDA margin by dividing Revenue for the period by Adjusted EBITDA for the period. 26Financial Highlights (1) Figures presented are estimates for the third fiscal quarter of 2021. (2) Refer to “Use of Non-GAAP Financial Measures” below for the definition of Adjusted EBITDA and Adjusted EBITDA margin and the reconciliation to the most comparable GAAP measure included herein. • Revenue for the quarter grew 78% to an estimated $105 million as compared to the third fiscal quarter 2020 • Active Subscriptions grew 47% to 1.7 million as compared to the third fiscal quarter 2020, with 1.1 million subscriptions served in the month of December • New Subscriptions increased 66% to 381,000 as compared to the third fiscal quarter 2020 • Customer Acquisition Cost (CAC) was higher at $60.40 versus $56.43 as compared to the third fiscal quarter 2020 due largely to a shift away from discounts in favor of media spend • Average Monthly Subscription Churn in the three months ended December 31, 2020 was essentially flat on a year over year basis at 6.2% vs 6.1% for the same period last year • Adjusted EBITDA margin expansion for the nine months ended December 31, 2020 versus the same period last year was due primarily to efficiency in marketing spend and benefits of scale BARK calculates Adjusted EBITDA as net income (loss), adjusted to exclude: (1) interest expense, (2) depreciation and amortization, (3) stock-based compensation expense, (4) change in fair value of warrants and derivatives, (5) sales and use tax expense, and (6) one time transaction costs associated with the financing and merger. BARK calculates Adjusted EBITDA margin by dividing Revenue for the period by Adjusted EBITDA for the period. 26

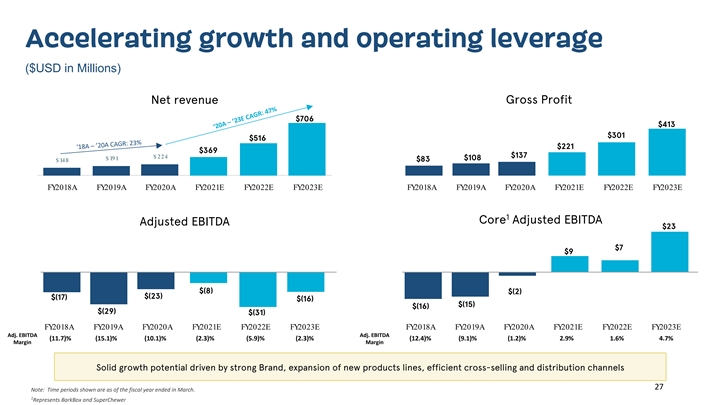

Accelerating growth and operating leverage ($USD in Millions) Net revenue Gross Profit $1,035 $1,035 $706 $413 $646 $3 $60 416 $516 $221 $ 367 $ 367 $369 $137 $224 $224 $191 $1 $10 918 $148 $1 $8 483 FY2018A FY2019A FY2020A FY2021E FY2022E FY2023E FY2018A FY2019A FY2020A FY2021E FY2022E FY2023E 1 Core Adjusted EBITDA Adjusted EBITDA $23 $43 $43 $7 $9 $3 $3 $(8) $(2) $(23) $(17) $ (7) $(16) $ (7) $(12) $(12) $(15) $(16) $(16) $(16) $(19) $(19) $(29) $(31) FY2018A FY2019A FY2020A FY2021E FY2022E FY2023E FY2018A FY2019A FY2020A FY2021E FY2022E FY2023E Adj. EBITDA Adj. EBITDA (11.7)% (15.1)% (10.1)% (2.3)% (5.9)% (2.3)% (12.4)% (9.1)% (1.2)% 2.9% 1.6% 4.7% Margin Margin -selling and distribution channels Solid growth potential driven by strong Brand, expansion of new products lines, efficient cross 27 Note: Time periods shown are as of the fiscal year ended in March. 1 Represents BarkBox and SuperChewer ‘18A – ’20A CAGR: 23% ‘20A – ’23E CAGR: 47%Accelerating growth and operating leverage ($USD in Millions) Net revenue Gross Profit $1,035 $1,035 $706 $413 $646 $3 $60 416 $516 $221 $ 367 $ 367 $369 $137 $224 $224 $191 $1 $10 918 $148 $1 $8 483 FY2018A FY2019A FY2020A FY2021E FY2022E FY2023E FY2018A FY2019A FY2020A FY2021E FY2022E FY2023E 1 Core Adjusted EBITDA Adjusted EBITDA $23 $43 $43 $7 $9 $3 $3 $(8) $(2) $(23) $(17) $ (7) $(16) $ (7) $(12) $(12) $(15) $(16) $(16) $(16) $(19) $(19) $(29) $(31) FY2018A FY2019A FY2020A FY2021E FY2022E FY2023E FY2018A FY2019A FY2020A FY2021E FY2022E FY2023E Adj. EBITDA Adj. EBITDA (11.7)% (15.1)% (10.1)% (2.3)% (5.9)% (2.3)% (12.4)% (9.1)% (1.2)% 2.9% 1.6% 4.7% Margin Margin -selling and distribution channels Solid growth potential driven by strong Brand, expansion of new products lines, efficient cross 27 Note: Time periods shown are as of the fiscal year ended in March. 1 Represents BarkBox and SuperChewer ‘18A – ’20A CAGR: 23% ‘20A – ’23E CAGR: 47%

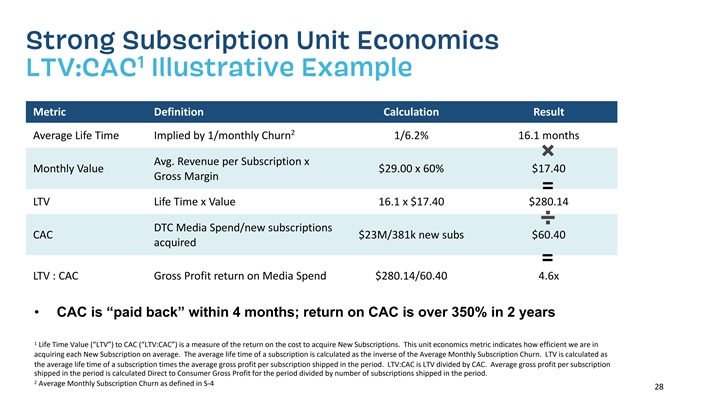

Strong Subscription Unit Economics 1 LTV:CAC Illustrative Example Metric Definition Calculation Result 2 Average Life Time Implied by 1/monthly Churn 1/6.2% 16.1 months ✖ Avg. Revenue per Subscription x Monthly Value $29.00 x 60% $17.40 Gross Margin = LTV Life Time x Value 16.1 x $17.40 $280.14 ➗ DTC Media Spend/new subscriptions CAC $23M/381k new subs $60.40 acquired = LTV : CAC Gross Profit return on Media Spend $280.14/60.40 4.6x • CAC is “paid back” within 4 months; return on CAC is over 350% in 2 years 1 Life Time Value (“LTV”) to CAC (“LTV:CAC”) is a measure of the return on the cost to acquire New Subscriptions. This unit economics metric indicates how efficient we are in acquiring each New Subscription on average. The average life time of a subscription is calculated as the inverse of the Average Monthly Subscription Churn. LTV is calculated as the average life time of a subscription times the average gross profit per subscription shipped in the period. LTV:CAC is LTV divided by CAC. Average gross profit per subscription shipped in the period is calculated Direct to Consumer Gross Profit for the period divided by number of subscriptions shipped in the period. 2 Average Monthly Subscription Churn as defined in S-4 28Strong Subscription Unit Economics 1 LTV:CAC Illustrative Example Metric Definition Calculation Result 2 Average Life Time Implied by 1/monthly Churn 1/6.2% 16.1 months ✖ Avg. Revenue per Subscription x Monthly Value $29.00 x 60% $17.40 Gross Margin = LTV Life Time x Value 16.1 x $17.40 $280.14 ➗ DTC Media Spend/new subscriptions CAC $23M/381k new subs $60.40 acquired = LTV : CAC Gross Profit return on Media Spend $280.14/60.40 4.6x • CAC is “paid back” within 4 months; return on CAC is over 350% in 2 years 1 Life Time Value (“LTV”) to CAC (“LTV:CAC”) is a measure of the return on the cost to acquire New Subscriptions. This unit economics metric indicates how efficient we are in acquiring each New Subscription on average. The average life time of a subscription is calculated as the inverse of the Average Monthly Subscription Churn. LTV is calculated as the average life time of a subscription times the average gross profit per subscription shipped in the period. LTV:CAC is LTV divided by CAC. Average gross profit per subscription shipped in the period is calculated Direct to Consumer Gross Profit for the period divided by number of subscriptions shipped in the period. 2 Average Monthly Subscription Churn as defined in S-4 28

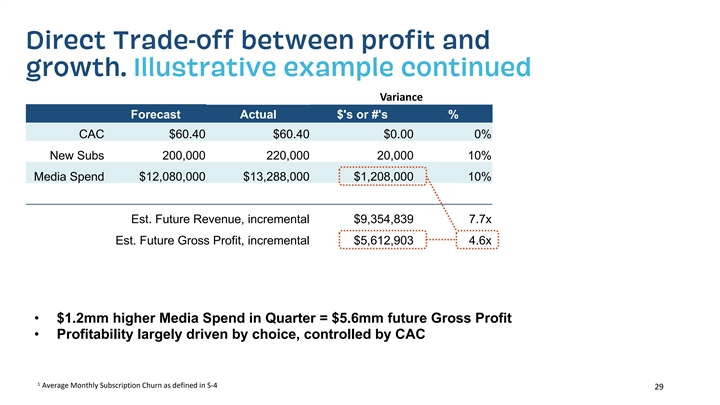

Direct Trade-off between profit and growth. Illustrative example continued Variance Forecast Actual $'s or #'s % CAC $60.40 $60.40 $0.00 0% New Subs 200,000 220,000 20,000 10% Media Spend $12,080,000 $13,288,000 $1,208,000 10% Est. Future Revenue, incremental $9,354,839 7.7x Est. Future Gross Profit, incremental $5,612,903 4.6x • $1.2mm higher Media Spend in Quarter = $5.6mm future Gross Profit • Profitability largely driven by choice, controlled by CAC 1 Average Monthly Subscription Churn as defined in S-4 29Direct Trade-off between profit and growth. Illustrative example continued Variance Forecast Actual $'s or #'s % CAC $60.40 $60.40 $0.00 0% New Subs 200,000 220,000 20,000 10% Media Spend $12,080,000 $13,288,000 $1,208,000 10% Est. Future Revenue, incremental $9,354,839 7.7x Est. Future Gross Profit, incremental $5,612,903 4.6x • $1.2mm higher Media Spend in Quarter = $5.6mm future Gross Profit • Profitability largely driven by choice, controlled by CAC 1 Average Monthly Subscription Churn as defined in S-4 29

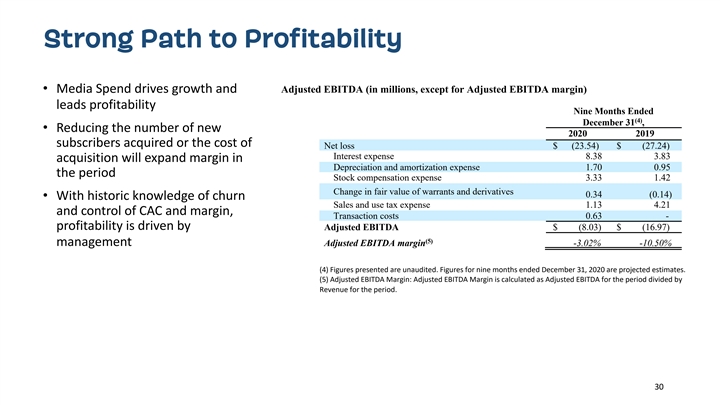

Strong Path to Profitability • Media Spend drives growth and Adjusted EBITDA (in millions, except for Adjusted EBITDA margin) leads profitability Nine Months Ended (4) December 31 , • Reducing the number of new 2020 2019 subscribers acquired or the cost of Net loss $ (23.54) $ (27.24) Interest expense 8.38 3.83 acquisition will expand margin in Depreciation and amortization expense 1.70 0.95 the period Stock compensation expense 3.33 1.42 Change in fair value of warrants and derivatives 0.34 (0.14) • With historic knowledge of churn Sales and use tax expense 1.13 4.21 and control of CAC and margin, Transaction costs 0.63 - profitability is driven by Adjusted EBITDA $ (8.03) $ (16.97) (5) management Adjusted EBITDA margin -3.02% -10.50% (4) Figures presented are unaudited. Figures for nine months ended December 31, 2020 are projected estimates. (5) Adjusted EBITDA Margin: Adjusted EBITDA Margin is calculated as Adjusted EBITDA for the period divided by Revenue for the period. 30Strong Path to Profitability • Media Spend drives growth and Adjusted EBITDA (in millions, except for Adjusted EBITDA margin) leads profitability Nine Months Ended (4) December 31 , • Reducing the number of new 2020 2019 subscribers acquired or the cost of Net loss $ (23.54) $ (27.24) Interest expense 8.38 3.83 acquisition will expand margin in Depreciation and amortization expense 1.70 0.95 the period Stock compensation expense 3.33 1.42 Change in fair value of warrants and derivatives 0.34 (0.14) • With historic knowledge of churn Sales and use tax expense 1.13 4.21 and control of CAC and margin, Transaction costs 0.63 - profitability is driven by Adjusted EBITDA $ (8.03) $ (16.97) (5) management Adjusted EBITDA margin -3.02% -10.50% (4) Figures presented are unaudited. Figures for nine months ended December 31, 2020 are projected estimates. (5) Adjusted EBITDA Margin: Adjusted EBITDA Margin is calculated as Adjusted EBITDA for the period divided by Revenue for the period. 30

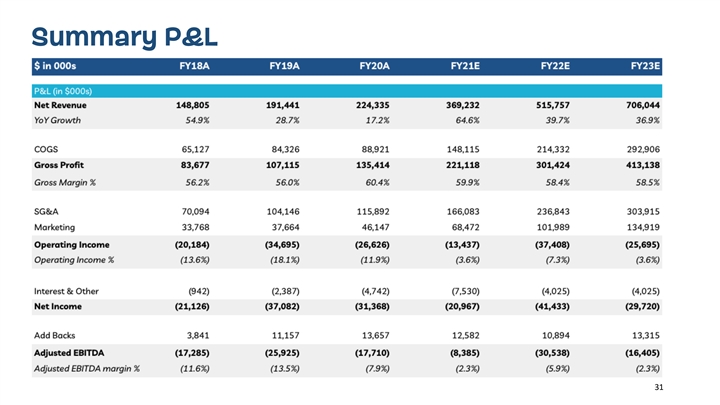

Summary P&L 31Summary P&L 31

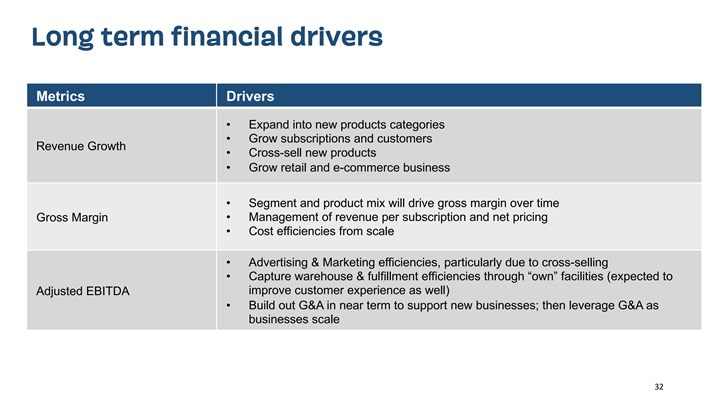

Long term financial drivers Metrics Drivers • Expand into new products categories • Grow subscriptions and customers Revenue Growth • Cross-sell new products • Grow retail and e-commerce business • Segment and product mix will drive gross margin over time • Management of revenue per subscription and net pricing Gross Margin • Cost efficiencies from scale • Advertising & Marketing efficiencies, particularly due to cross-selling • Capture warehouse & fulfillment efficiencies through “own” facilities (expected to improve customer experience as well) Adjusted EBITDA • Build out G&A in near term to support new businesses; then leverage G&A as businesses scale 32Long term financial drivers Metrics Drivers • Expand into new products categories • Grow subscriptions and customers Revenue Growth • Cross-sell new products • Grow retail and e-commerce business • Segment and product mix will drive gross margin over time • Management of revenue per subscription and net pricing Gross Margin • Cost efficiencies from scale • Advertising & Marketing efficiencies, particularly due to cross-selling • Capture warehouse & fulfillment efficiencies through “own” facilities (expected to improve customer experience as well) Adjusted EBITDA • Build out G&A in near term to support new businesses; then leverage G&A as businesses scale 32

BARK’s investment highlights ü Big, relatable and growing pet category ü Digitally-led DTC brand ü Personalized, data driven subscription experience with strong retention ü Clear levers for accelerating growth – new products, cross sales, more channels ü Strong incremental margins, powerful operating leverage ü Visionary and passionate team to scale the business 33BARK’s investment highlights ü Big, relatable and growing pet category ü Digitally-led DTC brand ü Personalized, data driven subscription experience with strong retention ü Clear levers for accelerating growth – new products, cross sales, more channels ü Strong incremental margins, powerful operating leverage ü Visionary and passionate team to scale the business 33

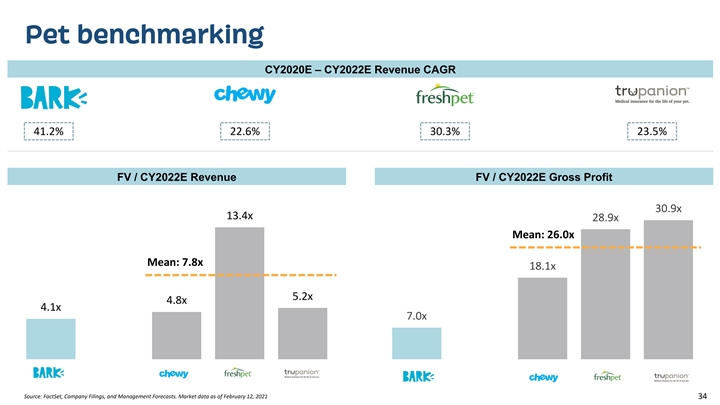

Pet benchmarking CY2020E – CY2022E Revenue CAGR 41.2% 22.6% 30.3% 23.5% FV / CY2022E Revenue FV / CY2022E Gross Profit 30.9x 13.4x 28.9x Mean: 26.0x Mean: 7.8x 18.1x 5.2x 4.8x 4.1x 7.0x Source: FactSet, Company Filings, and Management Forecasts. Market data as of February 12, 2021 34Pet benchmarking CY2020E – CY2022E Revenue CAGR 41.2% 22.6% 30.3% 23.5% FV / CY2022E Revenue FV / CY2022E Gross Profit 30.9x 13.4x 28.9x Mean: 26.0x Mean: 7.8x 18.1x 5.2x 4.8x 4.1x 7.0x Source: FactSet, Company Filings, and Management Forecasts. Market data as of February 12, 2021 34

05 Appendix 3505 Appendix 35

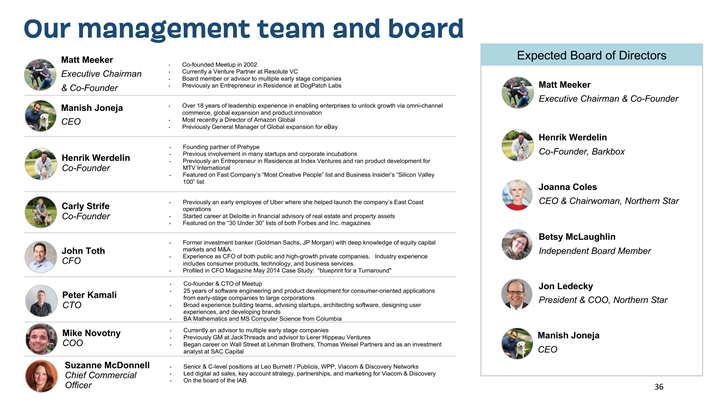

Our management team and board Expected Board of Directors Matt Meeker • Co-founded Meetup in 2002 • Currently a Venture Partner at Resolute VC Executive Chairman • Board member or advisor to multiple early stage companies • Previously an Entrepreneur in Residence at DogPatch Labs Matt Meeker & Co-Founder Executive Chairman & Co-Founder • Over 18 years of leadership experience in enabling enterprises to unlock growth via omni-channel Manish Joneja commerce, global expansion and product innovation • Most recently a Director of Amazon Global CEO • Previously General Manager of Global expansion for eBay Henrik Werdelin • Founding partner of Prehype Co-Founder, Barkbox • Previous involvement in many startups and corporate incubations Henrik Werdelin • Previously an Entrepreneur in Residence at Index Ventures and ran product development for MTV International Co-Founder • Featured on Fast Company’s “Most Creative People” list and Business Insider’s “Silicon Valley 100” list Joanna Coles • Previously an early employee of Uber where she helped launch the company’s East Coast CEO & Chairwoman, Northern Star Carly Strife operations • Started career at Deloitte in financial advisory of real estate and property assets Co-Founder • Featured on the “30 Under 30” lists of both Forbes and Inc. magazines Betsy McLaughlin • Former investment banker (Goldman Sachs, JP Morgan) with deep knowledge of equity capital markets and M&A. John Toth Independent Board Member • Experience as CFO of both public and high-growth private companies. Industry experience CFO includes consumer products, technology, and business services. • Profiled in CFO Magazine May 2014 Case Study: “blueprint for a Turnaround • Co-founder & CTO of Meetup Jon Ledecky • 25 years of software engineering and product development for consumer-oriented applications Peter Kamali from early-stage companies to large corporations President & COO, Northern Star • Broad experience building teams, advising startups, architecting software, designing user CTO experiences, and developing brands • BA Mathematics and MS Computer Science from Columbia • Currently an advisor to multiple early stage companies Mike Novotny Manish Joneja • Previously GM at JackThreads and advisor to Lerer Hippeau Ventures COO • Began career on Wall Street at Lehman Brothers, Thomas Weisel Partners and as an investment CEO analyst at SAC Capital Suzanne McDonnell • Senior & C-level positions at Leo Burnett / Publicis, WPP, Viacom & Discovery Networks • Led digital ad sales, key account strategy, partnerships, and marketing for Viacom & Discovery Chief Commercial • On the board of the IAB Officer 36Our management team and board Expected Board of Directors Matt Meeker • Co-founded Meetup in 2002 • Currently a Venture Partner at Resolute VC Executive Chairman • Board member or advisor to multiple early stage companies • Previously an Entrepreneur in Residence at DogPatch Labs Matt Meeker & Co-Founder Executive Chairman & Co-Founder • Over 18 years of leadership experience in enabling enterprises to unlock growth via omni-channel Manish Joneja commerce, global expansion and product innovation • Most recently a Director of Amazon Global CEO • Previously General Manager of Global expansion for eBay Henrik Werdelin • Founding partner of Prehype Co-Founder, Barkbox • Previous involvement in many startups and corporate incubations Henrik Werdelin • Previously an Entrepreneur in Residence at Index Ventures and ran product development for MTV International Co-Founder • Featured on Fast Company’s “Most Creative People” list and Business Insider’s “Silicon Valley 100” list Joanna Coles • Previously an early employee of Uber where she helped launch the company’s East Coast CEO & Chairwoman, Northern Star Carly Strife operations • Started career at Deloitte in financial advisory of real estate and property assets Co-Founder • Featured on the “30 Under 30” lists of both Forbes and Inc. magazines Betsy McLaughlin • Former investment banker (Goldman Sachs, JP Morgan) with deep knowledge of equity capital markets and M&A. John Toth Independent Board Member • Experience as CFO of both public and high-growth private companies. Industry experience CFO includes consumer products, technology, and business services. • Profiled in CFO Magazine May 2014 Case Study: “blueprint for a Turnaround • Co-founder & CTO of Meetup Jon Ledecky • 25 years of software engineering and product development for consumer-oriented applications Peter Kamali from early-stage companies to large corporations President & COO, Northern Star • Broad experience building teams, advising startups, architecting software, designing user CTO experiences, and developing brands • BA Mathematics and MS Computer Science from Columbia • Currently an advisor to multiple early stage companies Mike Novotny Manish Joneja • Previously GM at JackThreads and advisor to Lerer Hippeau Ventures COO • Began career on Wall Street at Lehman Brothers, Thomas Weisel Partners and as an investment CEO analyst at SAC Capital Suzanne McDonnell • Senior & C-level positions at Leo Burnett / Publicis, WPP, Viacom & Discovery Networks • Led digital ad sales, key account strategy, partnerships, and marketing for Viacom & Discovery Chief Commercial • On the board of the IAB Officer 36

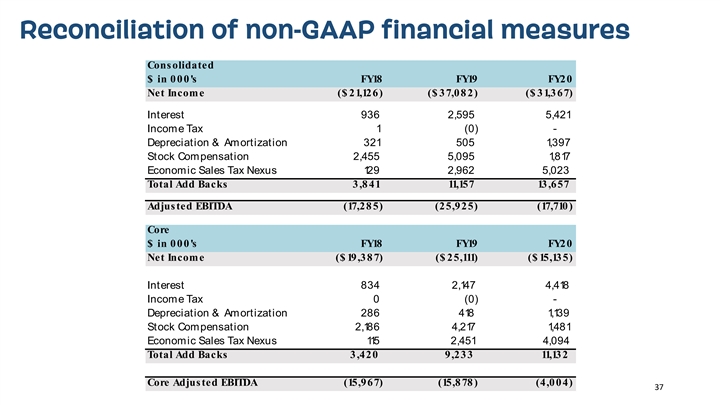

Reconciliation of non-GAAP financial measures Cons olida te d $ in 000's FY18 FY19 FY2 0 Net Income ($ 21,126) ($ 37,082) ($ 31,367) Interest 936 2,595 5,421 Income Tax 1 (0) - Depreciation & Amortization 321 505 1, 3 97 Stock Com pensation 2,455 5,095 1, 8 17 Econom ic Sales Tax Nexus 12 9 2,962 5,023 To ta l Add Ba c ks 3,841 11,15 7 13 ,6 5 7 Adjus te d EBITDA (17,285) (25,925) (17,710) Core $ in 000's FY18 FY19 FY2 0 Net Income ($ 19,387) ($ 25,111) ($ 15,135) Interest 834 2,147 4,418 Income Tax 0 (0) - Depreciation & Amortization 286 418 1, 13 9 Stock Com pensation 2,186 4,217 1, 48 1 Econom ic Sales Tax Nexus 115 2,451 4,094 To ta l Add Ba c ks 3,420 9,233 11,13 2 Core Adjus te d EBITDA (15,967) (15,878) (4,004) 37Reconciliation of non-GAAP financial measures Cons olida te d $ in 000's FY18 FY19 FY2 0 Net Income ($ 21,126) ($ 37,082) ($ 31,367) Interest 936 2,595 5,421 Income Tax 1 (0) - Depreciation & Amortization 321 505 1, 3 97 Stock Com pensation 2,455 5,095 1, 8 17 Econom ic Sales Tax Nexus 12 9 2,962 5,023 To ta l Add Ba c ks 3,841 11,15 7 13 ,6 5 7 Adjus te d EBITDA (17,285) (25,925) (17,710) Core $ in 000's FY18 FY19 FY2 0 Net Income ($ 19,387) ($ 25,111) ($ 15,135) Interest 834 2,147 4,418 Income Tax 0 (0) - Depreciation & Amortization 286 418 1, 13 9 Stock Com pensation 2,186 4,217 1, 48 1 Econom ic Sales Tax Nexus 115 2,451 4,094 To ta l Add Ba c ks 3,420 9,233 11,13 2 Core Adjus te d EBITDA (15,967) (15,878) (4,004) 37

Reconciliation of Adjusted EBITDA (in millions, except for Adjusted EBITDA margin) (1) Figures presented are unaudited. Figures for nine months ended December 31, 2020 are projected estimates. (2) Adjusted EBITDA Margin: Adjusted EBITDA Margin is calculated as Adjusted EBITDA for the period divided by Revenue for the period. 38Reconciliation of Adjusted EBITDA (in millions, except for Adjusted EBITDA margin) (1) Figures presented are unaudited. Figures for nine months ended December 31, 2020 are projected estimates. (2) Adjusted EBITDA Margin: Adjusted EBITDA Margin is calculated as Adjusted EBITDA for the period divided by Revenue for the period. 38