Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - CDK Global, Inc. | a10-qq2fy21exhibit322.htm |

| EX-32.1 - EX-32.1 - CDK Global, Inc. | a10-qq2fy21exhibit321.htm |

| EX-31.2 - EX-31.2 - CDK Global, Inc. | a10-qq2fy21exhibit312.htm |

| EX-31.1 - EX-31.1 - CDK Global, Inc. | a10-qq2fy21exhibit311.htm |

| 10-Q - 10-Q - CDK Global, Inc. | cdk-20201231.htm |

Exhibit 10.1

EXECUTION COPY

SHARE SALE AND PURCHASE AGREEMENT

by and among

cdk global, inc.,

CDK GLOBAL HOLDINGS (UK) LIMITED,

Solely for the limited purposes set forth herein,

THE OTHER RESTRICTED ENTITIES PARTY HERETO

and

Concorde Bidco limited,

with respect to all of the issued share capital of

CDK Global Holdings (UK) Limited

Dated as of November 27, 2020

739009450 20652562

Table of Contents

Page

i

739009450 20652562

Table of Contents

(continued)

Page

ii

739009450 20652562

Table of Contents

(continued)

Page

iii

739009450 20652562

EXHIBITS

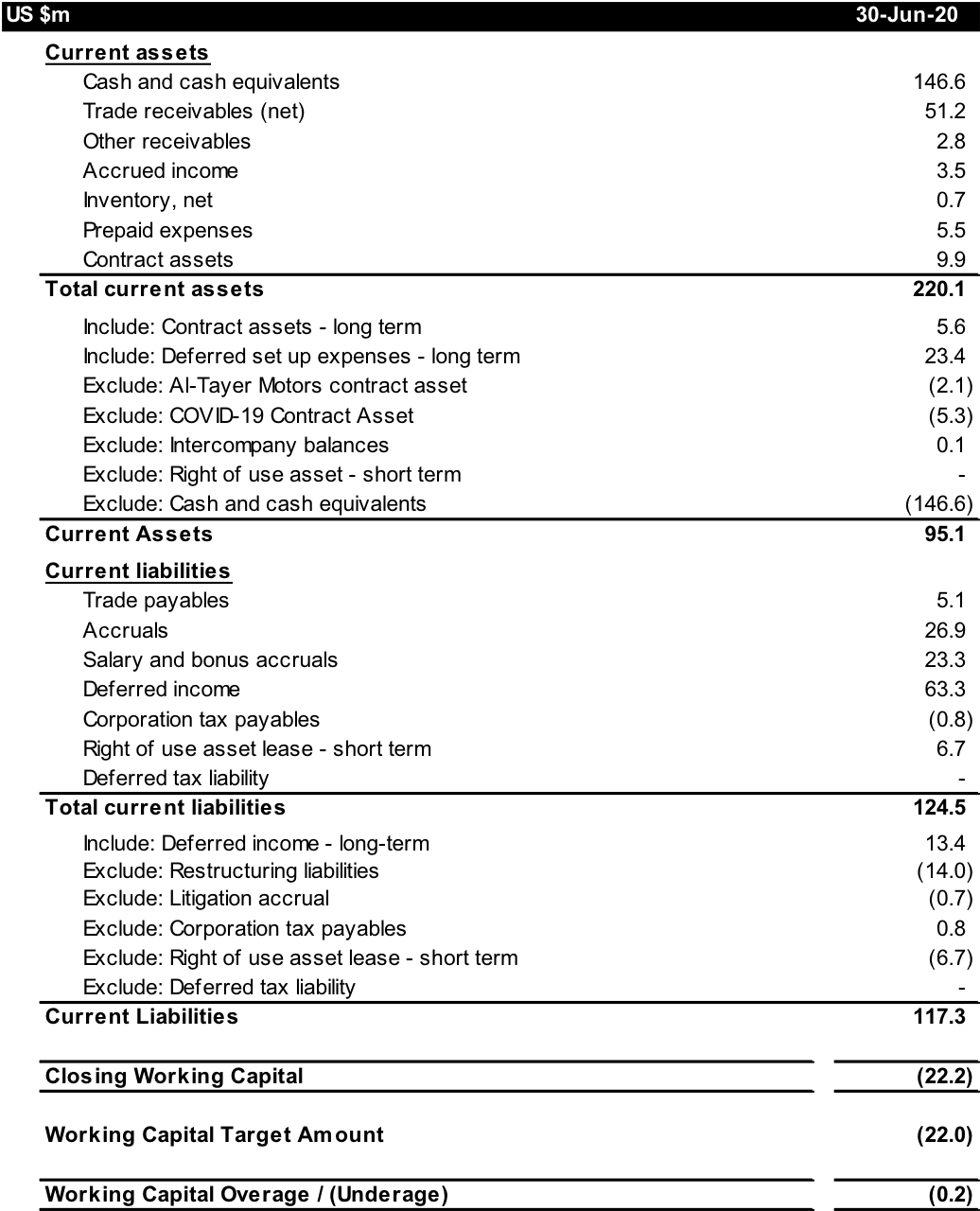

Exhibit A Accounting Principles and Illustrative Calculation

Exhibit B Form of Company Stock Transfer Form

Exhibit C Form of Transition Services Agreement

Exhibit D Form of India Services Agreement

Exhibit E Form of License Agreement (to CDK)

Exhibit F Form of License Agreement (to Concorde)

Exhibit G Form of Thailand Stock Transfer Form

Exhibit H Form of Power of Attorney

SCHEDULES

DISCLOSURE SCHEDULE

iv

739009450 20652562

SHARE SALE AND PURCHASE AGREEMENT

This SHARE SALE AND PURCHASE AGREEMENT is made as of November 27, 2020 by and among CDK Global, Inc., a Delaware corporation (“Seller”), CDK Global Holdings (UK) Limited, a private company limited by shares incorporated in England and Wales with registered number 09347879 (the “Company”), solely for the purposes of Sections 7.9, 10.2, 11.3, 11.5, 11.7, 11.8, 11.9, 11.10, 11.11, 11.12 and 11.14 and Article 1, the other members of the Company Group that are signatories hereto (together with the Company, the “Restricted Entities”), and Concorde Bidco Limited, a private limited company registered in England and Wales with registered number 13025706 (“Buyer”). Seller, Buyer and the Company are referred to collectively as the “Parties” and each individually as a “Party.”

RECITALS

WHEREAS, CDK Global (UK) LP, a limited partnership registered in England and Wales with registered number LP018164 (the “Company Shareholder”), and an indirect wholly-owned subsidiary of Seller, is the registered owner of 1,004 ordinary shares of £1.00 each in the share capital of the Company, which comprise the entire issued share capital of the Company (the “Shares”);

WHEREAS, Seller wishes to cause the Company Shareholder to sell, and Buyer wishes to purchase from the Company Shareholder, all of the Shares on the terms and subject to the conditions set forth in this Agreement; and

WHEREAS, prior to or concurrently with the execution and delivery of this Agreement and as a condition and inducement to Seller’s willingness to enter into this Agreement, each of Francisco Partners VI, L.P., a Cayman Island exempted limited partnership, Francisco Partners VI-A, L.P., a Cayman Island exempted limited partnership, Francisco Partners VI-B, L.P., a Cayman Island exempted limited partnership, Francisco Partners VI-C, L.P., a Delaware limited partnership, and Francisco Partners VI-D, L.P., a Delaware limited partnership (collectively, the “Guarantor”) has entered into a limited guarantee, dated as of the date hereof (the “Guaranty”), pursuant to which the Guarantor has guaranteed certain obligations of Buyer hereunder.

NOW, THEREFORE, in consideration of the foregoing and the mutual covenants, agreements and warranties herein contained, the Parties agree as follows:

ARTICLE 1

DEFINITIONS & INTERPRETATION

1.1 Definitions. The following terms shall have the following meanings for the purposes of this Agreement:

“Accounting Firm” means PricewaterhouseCoopers or, if such firm is unable or unwilling to act, such other nationally recognized independent firm that (a) is capable of serving as an accounting expert with relevant experience and (b) is mutually agreeable to Buyer and Seller.

“Accounting Principles” has the meaning set forth on Exhibit A.

1

739009450 20652562

“Acquired DMS Product” means each dealer management system product listed on Schedule 1.1A and any product that is derived in whole or in part from the software code constituting such dealer management system product.

“Acquisition Transaction” has the meaning set forth in Section 7.14.

“Action” means any action, suit, arbitration or proceeding (whether civil, criminal or administrative) commenced, brought, conducted or heard by or before any court or other Governmental Authority or arbitrator.

“Additional Subsidiary” means the Thailand Entity.

“Affiliate” means, with respect to any specified Person, any other Person which, directly or indirectly, controls, is under common control with or is controlled by, such specified Person. The term “control” (including the terms “controlling,” “under common control with” and “controlled by”) means possession, direct or indirect, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of a majority of the outstanding voting securities, by Contract or otherwise.

“Affiliated Group” means an affiliated group as defined in Section 1504 of the Code (or analogous combined, consolidated, or unitary group defined under state, local or non-U.S. Law).

“Aggregate Excess Other Country Cash Amount” has the meaning set forth on Exhibit A.

“Aggregate Excess Specified Country Cash Amount” has the meaning set forth on Exhibit A.

“Agreement” means this Agreement, including the Disclosure Schedule and all other exhibits and schedules hereto, as it and they may be amended, restated or otherwise modified from time to time.

“AJCA” has the meaning set forth in Section 4.11(q).

“Allocation Schedule” has the meaning set forth in Section 7.16.

“Ancillary Financing Documents” means each of the following: (a) customary perfection certificates, corporate organizational documents and good standing certificates, in each case to the extent required to be delivered to a Debt Financing Source to satisfy a financing condition and (b) all documentation and other information required to be delivered to the Debt Financing Sources in relation to the Company Group by bank regulatory authorities under applicable “know-your-customer” and anti-money laundering rules and regulations.

“Anti-Corruption Laws” means all Laws relating to the prevention of corruption or bribery, including the U.S. Foreign Corrupt Practices Act of 1977 and the UK Bribery Act 2010.

“Anti-Money Laundering Laws” means all applicable anti-money laundering Laws of jurisdictions where any member of the Company Group is organized or conducts business.

2

739009450 20652562

“Antitrust Approvals” has the meaning set forth in Section 8.1(a).

“Antitrust Law” means all antitrust and competition Laws applicable to the transactions contemplated hereby and by the Related Agreements, including any Laws that are designed or intended to require notification of, or prohibit, restrict or regulate actions having the purpose or effect of monopolization or restraint of trade or lessening of competition through, merger or acquisition.

“Antitrust Termination Fee” has the meaning set forth in Section 9.2(b)(i).

“Applicable Excess Other Country Cash Amount” has the meaning set forth on Exhibit A.

“Applicable Excess Specified Country Cash Amount” has the meaning set forth on Exhibit A.

“Applicable Other Country Percentage” has the meaning set forth on Exhibit A.

“Applicable Specified Country Percentage” has the meaning set forth on Exhibit A.

“ASC” has the meaning set forth on Exhibit A.

“Associated Person” means, with respect to a Party, any of such Party’s former, current and future Affiliates and other Representatives.

“Available Insurance Policies” has the meaning set forth in Section 7.11(b).

“Barbados Entity” means Automotive Systems (Barbados) SRL, a Barbados society with restricted liability.

“Barbados Repayment” has the meaning set forth in Section 2.3.

“Benefit Plans” has the meaning set forth in Section 4.9(a).

“Business Day” means any day other than a Saturday, Sunday or other day on which banking institutions in San Francisco, California, Chicago, Illinois or in London, United Kingdom are authorized or required by Law or other action of a Governmental Authority to close.

“Business Portion” means the portion of a Contract arising out of, or relating to, the conduct of the business of the Company Group as conducted in the International Territory as of the Closing.

“Business Systems” means: (a) all Software (including the Owned Software) and computer hardware (whether general or special purpose); (b) electronic data processing, information, record keeping, communications, and telecommunications systems; and (c) networks, interfaces, platforms, servers, peripherals, and computer systems, including any outsourced systems and processes, in each case to the extent used by the Company Group in the conduct of its business in the International Territory as of the date hereof.

“Buyer” has the meaning set forth in the Preamble.

3

739009450 20652562

“Buyer Group Members” has the meaning set forth in Section 11.15.

“Buyer Plans” has the meaning set forth in Section 7.2(c).

“CARES Act” means the Coronavirus Aid, Relief, and Economic Security Act.

“Cash” has the meaning set forth on Exhibit A.

“Cash Provisions” has the meaning set forth on Exhibit A.

“Cash Repatriation Plan” has the meaning set forth on Section 6.2 of the Disclosure Schedule.

“Cash Repatriation Term” has the meaning set forth on Exhibit A.

“Cash Shortfall” has the meaning set forth on Exhibit A.

“CDK India Entity” means CDK Global (India) Private Limited, an India private limited company.

“CDK Insurance Arrangements” means Insurance Arrangements of Seller or any of its Affiliates that cover Seller or any of its Affiliates (other than the Company Group), on the one hand, and any member of the Company Group, on the other hand.

“CDK Local Counsel” means each of the Persons set forth on Schedule 1.1B.

“CDK Names” means (a) any trademark, service mark, logo, trade name, domain name, service name, brand name, slogan, corporate name or other identifier of source or goodwill that includes the words “CDK,” “CDK Global,” “CDK International,” “CDK North America,” “CDKI” or “CDKNA,” including the CDK Global logo, (b) any and all other derivatives of the words “CDK,” “CDK Global,” “CDK International,” “CDK North America,” “CDKI,” “CDKNA” and (c) any terms confusingly similar to “CDK,” “CDK Global,” “CDK International,” “CDK North America,” “CDKI” or “CDKNA”.

“Closing” means the closing of the sale and purchase of the Shares contemplated hereby.

“Closing Cash” has the meaning set forth on Exhibit A.

“Closing Date” has the meaning set forth in Section 2.2(a).

“Closing Indebtedness” has the meaning set forth on Exhibit A.

“Closing Payment” has the meaning set forth in Section 2.3.

“Closing Working Capital” has the meaning set forth on Exhibit A.

“Code” means the United States Internal Revenue Code of 1986, as amended (including any successor Law thereto).

4

739009450 20652562

“Company” has the meaning set forth in the Preamble.

“Company Group” means the Company, each of the Company Subsidiaries and the Additional Subsidiary but, for the avoidance of doubt, does not include the Non-Majority Owned Entities.

“Company In-Licensed IP” means all Intellectual Property owned by any other Person that is licensed or sublicensed to a member of the Company Group pursuant to a Company In-License.

“Company In-Licenses” means, as of any particular time, any and all Executory Contracts to which a member of the Company Group is a party as of such time pursuant to which any member of the Company Group is granted or receives an inbound license, sublicense, covenant not to sue or similar right with respect to any Intellectual Property owned by any other Person, including the License Agreement (to Concorde). Without limiting the foregoing, the Company In-Licenses include any Contracts to which a Seller Group Entity (excluding the Company Group) is a party that is used or held for use primarily in, or primarily related to, the business of any member of the Company Group.

“Company Owned Intellectual Property” has the meaning set forth in Section 4.6(a).

“Company Registered Intellectual Property” has the meaning set forth in Section 4.6(a).

“Company Shareholder” has the meaning set forth in the Recitals.

“Company Stock Transfer Form” has the meaning set forth in Section 2.2(b)(i).

“Company Subsidiary” means each Subsidiary of the Company, other than the Excluded Subsidiaries.

“Concorde India Employees” has the meaning given to the term “Employees” set forth on Exhibit D.

“Concorde India Entity” means Charnham India Private Limited, a private limited company incorporated under the Laws of India, or such other Company Subsidiary incorporated under the Laws of India that is formed or acquired “off-the-shelf” as a Company Subsidiary prior to the Closing.

“Confidential Information Presentation” means the Confidential Information Presentation provided to Buyer in connection with the transactions contemplated hereby and by the Related Agreements.

“Confidentiality Agreement” means the non-disclosure agreement, dated as of August 27, between Seller and Francisco Partners Management L.P., a Delaware partnership, relating to the transactions contemplated hereby and by the Related Agreements, as amended, restated or otherwise modified from time to time.

“Contamination” or “Contaminated” means the presence of Hazardous Substances in, on or under the soil, groundwater, surface water or other environmental media at concentrations such that

5

739009450 20652562

Response Action is legally required by any Governmental Authority under any Environmental Law with respect to such presence of Hazardous Substances.

“Continuing Employees” has the meaning set forth in Section 7.2(a).

“Contract” means any written executory contract, subcontract, agreement, license, sublicense, lease, sublease, instrument, purchase order, undertaking, note, bond, mortgage, indenture or other agreement or binding obligation of any kind or character that is legally binding.

“Covered Affiliates” has the meaning set forth in Section 7.4(b).

“Covered Global Individuals” has the meaning set forth in Section 7.9(b).

“Covered India Individuals” has the meaning set forth in Section 7.9(b).

“Covered Individuals” has the meaning set forth in Section 7.9(b).

“Currency Exchange Principles” has the meaning set forth on Exhibit A.

“D&O Costs” has the meaning set forth in Section 7.4(b).

“D&O Expenses” has the meaning set forth in Section 7.4(b).

“D&O Indemnifiable Claim” has the meaning set forth in Section 7.4(b).

“D&O Indemnifying Party” has the meaning set forth in Section 7.4(b).

“D&O Indemnitee” and “D&O Indemnitees” have the meaning set forth in Section 7.4(b).

“Data Room” means the online data room maintained by Seller or its Affiliates through Intralinks for purposes of the transactions contemplated hereby and by the Related Agreements, including any separate data room or folders marked “clean room,” in each case to the extent made available to Buyer or any of its Representatives.

“Data Security Requirements” means, collectively, (a) all of the following to the extent relating to the collection, storage, disclosure, or other processing of any personal data (whether in electronic or any other form or medium) or otherwise relating to privacy or data protection and applicable either to the Company Group or to the conduct of its business as conducted as of the date hereof in the International Territory: (i) all applicable Laws; (ii) customer Contracts by which any member of the Company Group is bound; (iii) Material Contracts; and (iv) the Payment Card Industry Data Security Standards; and (b) all of the following to the extent relating to the security of confidential information (whether in electronic or any other form or medium) and applicable either to the Company Group or to the conduct of its business as conducted as of the date hereof in the International Territory: (A) all applicable Laws; or (B) Company In-Licenses; and (C) Material Contracts pursuant to which the Company Group licenses data used in the conduct of its business as conducted as of the date hereof in the International Territory.

6

739009450 20652562

“Debt Financing” means the debt financing incurred or intended to be incurred pursuant to the Debt Financing Commitment Letters.

“Debt Financing Commitment Letters” means the debt commitment letters pursuant to which the financial institutions party thereto have agreed, or may agree, to provide or cause to be provided, subject to the terms and conditions set forth therein, the debt financing set forth therein for the purposes of financing a portion of the transactions contemplated hereby and by the Related Agreements, including the payment of the Purchase Price.

“Debt Financing Documents” means the credit agreements, mezzanine note purchase agreements and any related security agreements pursuant to which the Debt Financing will be governed.

“Debt Financing Sources” means the Persons that have committed to provide or arrange and have entered into agreements in connection with the Debt Financing or alternative debt financings in connection with the transactions contemplated hereby and by the Related Agreements, including the parties named in the Debt Financing Commitment Letters and any joinder agreements, indentures or credit agreements entered into pursuant thereto or relating thereto (together with their respective Representatives and successors and assigns).

“Designated Contacts” has the meaning set forth in Section 6.1(a).

“Determination Time” has the meaning set forth on Exhibit A.

“Disclosure Schedule” means the disclosure schedule with respect to this Agreement delivered by Seller and the Company to Buyer on the date hereof.

“Disputed Item” has the meaning set forth in Section 2.4(e).

“Dollar” or “$” means the lawful currency of the United States of America.

“Employees” means the individuals employed by each member of the Company Group.

“Enforceability Exceptions” means principles of equity and bankruptcy, insolvency, reorganization, moratorium, receivership and similar Laws affecting the enforcement of creditors’ rights generally.

“Environmental Law” means any applicable Law pertaining to the protection of the environment and any applicable decisions by laws, circulars, codes, guidance, plans, notices, demands, injunctions, orders, judgments, decrees or Permits under such Laws, each as in existence on the date hereof.

“Equity Financing” means the equity financing incurred or to be incurred pursuant to the Equity Financing Commitment Letter.

“Equity Financing Commitment Letter” means the equity financing commitment letter delivered to Seller on the date hereof, between Buyer and the Persons named therein, pursuant to

7

739009450 20652562

which such Persons have committed to invest or cause to be invested in the equity capital of Buyer as set forth therein.

“Estimated Cash” has the meaning set forth in Section 2.4(a).

“Estimated Cash Shortfall” has the meaning set forth in Section 2.4(a).

“Estimated Indebtedness” has the meaning set forth in Section 2.4(a).

“Estimated Working Capital” has the meaning set forth in Section 2.4(a).

“Excess Cash” has the meaning set forth on Exhibit A.

“Excluded Subsidiary” means each of the entities set forth on Schedule 1.1C.

“Executory Contract” means a Contract that has any material obligation on the part of a member of the Company Group, Seller or any of its Affiliates remaining unperformed under such Contract or any continuing license of Intellectual Property, excluding (a) any Contract having as its sole remaining obligations indemnification, warranty or confidentiality obligations that have not expired and (b) any purchase orders or sales orders entered into in the ordinary course of business.

“FDI Approvals” means any necessary permits, approvals, clearances, confirmations, licenses and consents or filings with respect to Investment Laws applicable to the transactions contemplated hereby.

“Final Cash” has the meaning set forth in Section 2.4(e).

“Final Cash Shortfall” has the meaning set forth in Section 2.4(e).

“Final Indebtedness” has the meaning set forth in Section 2.4(e).

“Final Post-Closing Statement” has the meaning set forth in Section 2.4(e).

“Final Working Capital” has the meaning set forth in Section 2.4(e).

“Financial Statements” means the audited combined financial statements set forth in the November 20, 2020 audit report from Deloitte & Touche LLP entitled “International Business of CDK Global, Inc.”, which comprise the combined balance sheets as of June 30, 2020 and 2019, and the related combined statements of operations, comprehensive income, changes in business equity, and cash flows for the years then ended, and the related notes to the combined financial statements.

“France Subsidiary” means CDK Global (France) SAS, a France simplified joint-stock company.

“Fraud” means a representation or warranty expressly and specifically made by Seller in Article 3 or expressly and specifically made by the Company in Article 4, in each case, as qualified by the Disclosure Schedule, that: (a) was false when made; (b) was made with Knowledge that such representation or warranty was false when made, with such individual making such representation or warranty with the specific intention of inducing Buyer to enter into this Agreement; and (c) was

8

739009450 20652562

actually and justifiably relied upon by Buyer in entering into this Agreement, which reliance caused Buyer to suffer actual material damage by reason of such actual reliance. For the avoidance of doubt, “Fraud” shall not include equitable fraud, promissory fraud, unfair dealings fraud, constructive fraud or other claims based on constructive knowledge, negligence, recklessness, misrepresentation or similar torts, causes of action or crimes. Any claim for Fraud brought under this Agreement shall require proving each of the elements set forth in clauses (a) through (c) of the foregoing sentence with respect to each individual purported to be involved.

“Fundamental Representations” means the representations and warranties contained in Sections 3.1, 3.2, 3.4, 4.1, 4.2 and 4.17.

“GAAP” means United States generally accepted accounting principles as of the date hereof (or, for the purposes of Section 4.4), as of the date of such Financial Statements referred to therein.

“General Partner” has the meaning set forth in Section 1.2(f).

“General Termination Fee” has the meaning set forth in Section 9.2(b)(ii).

“Governing Documents” means the legal document(s) by which any Person (other than an individual) establishes its legal existence or which govern its internal affairs. For example, the “Governing Documents” of (a) a Delaware corporation are its certificate of incorporation and bylaws, (b) a Delaware limited liability company are its certificate of formation and limited liability company agreement or operating agreement and (c) a United Kingdom limited company are its certificate of incorporation and articles of association.

“Governmental Authority” means any applicable governmental, regulatory, tax or administrative body, agency or authority, any court or judicial authority, whether national, federal, state or local or otherwise, including any taxing authority.

“Governmental Official” means (a) any officer or employee of any Governmental Authority, or of a public international organization, such as the International Monetary Fund, the United Nations or the World Bank, or any person acting in an official capacity for or on behalf of any such Governmental Authority or public international organization or (b) candidate for public office, political party or political campaign.

“Governmental Order” means any order, judgment, injunction, decree, writ, stipulation, determination, decision, ruling or award, in each case, entered by, with or under the supervision of any Governmental Authority.

“Group Relief” means any relief (including any deduction, set-off, allowance, refund or credit) available whether by transfer, surrender, Tax sharing or otherwise between companies treated for the purposes of determining the amount of or liability for or relief from any Tax as being members of the same group or fiscal unity.

9

739009450 20652562

“Guarantor” has the meaning set forth in the Recitals.

“Guaranty” has the meaning set forth in the Recitals.

“Hazardous Substance” means petroleum, any petroleum-based product and any hazardous substance, hazardous waste or hazardous material as defined, listed or regulated under any Environmental Law.

“IDR” has the meaning set forth in Section 4.9(g).

“iLearn CDK Marks” means the trademark and service mark ILEARN@CDKGLOBAL and ILEARN@CDKGLOBAL (and design) and any other trademark or service mark that includes both the terms “ILEARN” and “CDK”, including the registrations therefor owned by any member of the Company Group or any other Affiliate of Seller, as applicable.

“iLearn Marks” means the trademark and service mark “ILEARN”, whether alone or in combination with other terms (in word mark and design forms), including the registrations therefor owned by any member of the Company Group or any other Affiliate of Seller, as applicable, but in each case excluding the CDK Marks and the iLearn CDK Marks.

“Illustrative Calculation” has the meaning set forth on Exhibit A.

“Income Tax” means any Tax imposed on, or with reference to, net income or gross receipts, including any corporation tax levied by the United Kingdom.

“Income Tax Return” means a Tax Return filed or required to be filed in connection with the determination, assessment or collection of any Income Tax or the administration of any laws, regulations or administrative requirements relating to any such Tax.

“India Services Agreement” has the meaning set forth in Section 2.2(b)(v).

“Insurance Arrangements” means all policies of or agreements for insurance and interests in insurance pools and programs covering risks of the Company Group (in each case including self-insurance and insurance from Affiliates) and all rights of any nature with respect to any of the foregoing, including in each case all recoveries thereunder and rights to assert claims seeking any such recoveries.

“Insurance Policies” has the meaning set forth in Section 4.8.

“Intellectual Property” means any and all of the following and all rights of the following types arising under the Laws of any jurisdiction throughout the world or pursuant to any international convention: (a) all patents, patent applications, continuations, divisionals, continuations-in-part, revisions, provisionals and patents issuing on any of the foregoing, and any renewals, reexaminations, substitutions, extensions, reissues and counterparts of any of the foregoing, together with all prosecution files, utility models and invention disclosures, (b) all trademarks, service marks, product and service names, brands, trade dress, logos, trade names, designs, business symbols, corporate names, and other source or business identifiers, whether registered or unregistered, (including all rights to sue in passing off), and all applications,

10

739009450 20652562

registrations and renewals and extensions of or in connection therewith and common law trademarks and service marks, together with all of the goodwill associated with any of the foregoing, (c) all copyrights, moral rights, topography rights, rights in databases and design rights, and all applications, registrations, renewals and reversions of or in connection therewith, and all works of authorship (published and unpublished), including Software, (d) domain names, domain name registrations, websites, website content, and social media identifiers, names and tags (including accounts therefor and registrations thereof), (e) all trade secrets, proprietary information, data, know-how and other confidential business or technical information (including research and development, compositions, manufacturing and production processes, technical data, designs, specifications and business and marketing plans and proposals), (f) publicity and privacy rights, (g) all other forms of rights in technology (whether or not embodied in any tangible form) and including all tangible embodiments of the foregoing, and (h) all other intellectual property, proprietary and other rights and forms of protection of a similar nature or having equivalent or similar effect to any of these anywhere in the world.

“Interim Financial Statements” means the unaudited statement of operations of the CDKI segment of Seller, as reported on a SEC segment reporting basis for the quarter ended September 30, 2020.

“International Competitive Business” has the meaning set forth in Section 7.9(a)(i).

“International Territory” means the jurisdictions identified on Schedule 1.1D.

“Investment Law” means any applicable Law governing foreign direct investment or Law that provides for review of national security or defense matters.

“Knowledge of the Company” means the actual knowledge, without independent investigation (and will in no event encompass constructive, imputed or similar concepts of knowledge) of Neil Packham, Leon Goodman, Steve Jones, Cath Sibbald and Russell Alexander.

“Latest Balance Sheet” means the most recent balance sheet included in the Financial Statements.

“Law” means any laws, statutes, orders, rules, regulations and ordinances of Governmental Authorities, and judgments, decisions or orders entered by any Governmental Authority.

“Leased Real Property” has the meaning set forth in Section 4.15(a).

“License Agreement (to CDK)” has the meaning set forth in Section 2.2(b)(vi).

“License Agreement (to Concorde)” has the meaning set forth in Section 2.2(b)(vii).

“Lien” means any lien, encumbrance, mortgage, charge, claim, restriction, pledge, security interest, title defect, easement, right of way, covenant or encroachment.

“Loss” means any loss, liability, claim, damage, demand, action, suit, proceeding, fine, cost, expense, interest, award, judgment, penalty, Tax, amount paid in settlement, reasonable and documented attorneys’ fees and other costs and expenses.

11

739009450 20652562

“Marketing Efforts” means (a) participation by the senior management team of the Company Group in (i) the preparation of the Marketing Material and any due diligence sessions related thereto, (ii) a customary bank meeting and (iii) preparation of customary rating agency presentations and meetings with one or more rating agencies and (b) the delivery of customary authorization letters and confirmations in connection with the Marketing Material with respect to presence or absence of material non-public information and material accuracy of the information contained therein; provided, however, that such letters and confirmations shall state that (i) Seller, the Company Group and their respective Affiliates shall not have any liability of any kind or nature resulting from the use of information contained in the Marketing Material or otherwise in connection with the Marketing Efforts and (ii) the recipient of such letters or authorizations agrees that the Debt Financing Sources shall be entitled to rely only on the representations and warranties contained in any executed Debt Financing Documents.

“Marketing Material” means a customary “public side” bank book, a customary “private side” bank book and a customary lender presentation regarding the business, operations, financial condition, projections and prospects of the Company Group to be used by Buyer and the Debt Financing Sources in connection with a syndication of the Debt Financing.

“Material Adverse Effect” means any event, circumstance, change, occurrence, condition, development or effect that, individually or in the aggregate, has had or would reasonably be expected to have a material adverse effect on (x) the assets, liabilities, financial condition, operations or results of operations of the Company Group taken as a whole, or (y) the ability of Seller or the Company Group to consummate the transactions contemplated hereunder; provided, however, that none of the following (and no effect arising out of or resulting from any of the following) shall, either alone or in combination, constitute or be taken into account in determining whether a Material Adverse Effect has occurred under clause (x) hereof: (a) general economic, business, political, industry, trade or credit, financial or capital market conditions (whether in the United States or any other jurisdiction), including any conditions affecting generally the industries or markets in which the Company Group operates; (b) earthquakes, tornados, hurricanes, floods, acts of God and other force majeure events; (c) any Public Health Event; (d) acts of war (whether declared or not declared), sabotage, terrorism, military actions, civil unrest or the escalation thereof; (e) any changes or prospective changes in Law, regulations or accounting rules, including the interpretations thereof, or any changes or prospective changes in the interpretation or enforcement of any of the foregoing, or any changes in general legal, regulatory, trade or political conditions; (f) strikes, slowdowns or work stoppages; (g) any bankruptcy, insolvency or other financial distress of any customer, supplier or other counterparty of any member of the Company Group; (h) the taking of any action required or permitted by this Agreement or the Related Agreements; (i) the negotiation, entry into or public announcement of this Agreement or pendency of the transactions contemplated hereby and by the Related Agreements, including (x) any suit, action or proceeding in connection with the transactions contemplated hereby and by the Related Agreements, (y) any actions taken by or losses of employees, customers, suppliers or other counterparties of any member of the Company Group, including as a result of the identity of Buyer or any communication regarding plans or intentions with respect to the business conducted by the Company Group or (z) any delays or cancellations of orders for products or services; (j) the taking of any action at the request of, or with the approval (or deemed approval) from, Buyer; (k) any existing event, occurrence or circumstance set forth in the Disclosure Schedule; (l) the failure by any member of the Company Group to meet any projections,

12

739009450 20652562

estimates or budgets for any period prior to, on or after the date hereof (provided that the underlying cause of such failure may be taken into account in determining whether a Material Adverse Effect has occurred or would reasonably be expected to occur); (m) any actions of competitors; (n) any actions taken in connection with obtaining regulatory consents as contemplated and required by this Agreement; (o) the actions of Buyer or any of its Affiliates; (p) the omissions of Buyer or any of its Affiliates in breach of this Agreement, any Related Agreement or the Confidentiality Agreement; and (q) actions required to be taken under any Material Contracts. Notwithstanding the foregoing, it is understood and agreed that in the case of clauses (a)-(e) and (g) above, to the extent that any such event, circumstance, change, occurrence, condition, development or effect has a disproportionate and adverse effect on the Company Group, taken as a whole, relative to other businesses in the industry in which the Company Group operates, such disproportionate extent of such event, circumstance, change, occurrence, condition, development or effect may be taken into account in determining whether a Material Adverse Effect has occurred.

“Material Contracts” has the meaning set forth in Section 4.7(a).

“Material Customers” has the meaning set forth in Section 4.20(a).

“Material IP Contract” means the Material Scheduled IP Contracts and the Material Unscheduled IP Contracts.

“Material Scheduled IP Contract” means: (i) any (1) Company In-License and (2) any other Executory Contract pursuant to which any other Seller Group Entity (other than the Company Group) receives a license to Intellectual Property that is (x) incorporated into or necessary for any product or service of the business of the Company Group (including any Acquired DMS Products) as conducted in the International Territory as of the date hereof or (y) otherwise material to and used or held for use in the business of the Company Group as conducted in the International Territory as of the date hereof, but in each of (1) and (2) excluding (A) Open Source Software and (B) any non-exclusive licenses of generally commercially available Software in the form of “off the shelf,” “shrink wrap” or “click wrap” agreements entered into in the ordinary course of business where the replacement cost for the annual license, subscription and maintenance fee(s) attributable to the business of the Company Group is less than one hundred thousand Dollars ($100,000) or such generally commercially available Software is not material to the business of any member of the Company Group (including any Acquired DMS Products); (ii) any Executory Contract pursuant to which (1) a member of the Company Group or (2) any other Seller Group Entity (other than the Company Group), in each of (1) and (2) grants to any Person any license, sublicense or non-assertion commitment under or with respect to any Company Owned Intellectual Property or Acquired DMS Product, excluding nonexclusive licenses or sublicenses granted to third party distributors, customers and end users of Acquired DMS Products, third party service providers of the business of the Company Group for the purpose of performing or providing services to or on behalf of the business of the Company Group and non-disclosure agreements, in each case, in the ordinary course of business; and (iii) any Executory Contract entered into within the past two (2) years (1) by any member of the Company Group or (2) by any other member of the Seller Group Entity (other than the Company Group) with any third party involving development of any Company Owned Intellectual Property that is material to the business of the Company Group, in each of (1) and (2) excluding Contracts entered into by a member of the Company Group in the ordinary course of business and pursuant to which a member of the Company Group owns all Company Owned

13

739009450 20652562

Intellectual Property created by either party under such Contract or such Intellectual Property is assigned to a member of the Company Group pursuant to the Restructuring.

“Material Unscheduled IP Contract” means: (i) any (1) Company In-License and (2) any other Executory Contract pursuant to which any other Seller Group Entity (other than the Company Group) receives a license to Intellectual Property that is (x) incorporated into or necessary for any product or service of the business of the Company Group (including any Acquired DMS Products) as conducted in the International Territory as of the date hereof or (y) otherwise material to and used or held for use in the business of the Company Group as conducted in the International Territory as of the date hereof; (ii) any Executory Contract pursuant to which (1) a member of the Company Group or (2) any other Seller Group Entity (other than the Company Group), in each of (1) and (2) grants to any Person any license, sublicense or non-assertion commitment under or with respect to any Company Owned Intellectual Property or Acquired DMS Product; and (iii) any Executory Contract entered into within the past two (2) years (1) by any member of the Company Group or (2) by any other member of the Seller Group Entity (other than the Company Group) with any third party involving development of any Company Owned Intellectual Property that is material to the business of the Company Group, but in each of (i), (ii), and (iii) excluding any Material Scheduled IP Contract.

“Material OEMs” has the meaning set forth in Section 4.20(a).

“Material Vendors” has the meaning set forth in Section 4.20(b).

“Mayer Brown” means Mayer Brown LLP and its associated legal practices that are separate entities.

“Minimum Cash Amount” has the meaning set forth on Exhibit A.

“Non-Business Portion” means the portion of a Contract other than the Business Portion.

“Non-Majority Owned Entities” means any entity as to which the Company Group owns, directly or indirectly, less than fifty percent (50%) of the outstanding voting equity interests of such entity.

“Non-Majority Owned Entity Equity Interests” has the meaning set forth in Section 4.19(a).

“Nonqualified Deferred Compensation Plan” has the meaning set forth in Section 4.11(q).

“North America Competitive Business” has the meaning set forth in Section 7.9(a)(ii).

“North America Territory” means the United States of America, Canada and the other jurisdictions identified on Schedule 1.1E.

“Objection Notice” has the meaning set forth in Section 2.4(e).

“Open Source Software” means any Software licensed to any member of the Company Group or the CDK India Entity (solely with respect to the Concorde India Employees) that (a) is distributed as “free software” (as defined by the Free Software Foundation), “open source software

14

739009450 20652562

or pursuant to any license identified as an “open source license” by the Open Source Initiative (www.opensource.org/licenses) or other license that substantially conforms to the Open Source Definition (opensource.org/osd), (b) under any similar licensing or distribution model or (c) requires as a condition of use, modification and/or distribution (including under an ASP or “Software as a Service” model) of such Software that other Software used or distributed with such Software owned or licensed by any member of the Company Group or the CDK India Entity (solely with respect to the Concorde India Employees) (i) be disclosed or distributed in (source code form), (ii) be licensed for the purpose of making derivative works, (iii) be redistributable at no charge, or (iv) that constitute derivative works based on such Software to be publicly available under the same license. “Open Source Software” includes Software licensed or distributed under any of the following licenses or distribution models, or licenses or distribution models similar to any of the following: (1) the Apache Software Foundation License, (2) GNU’s General Public License (GPL) or Lesser/Library GPL (LGPL), (3) The Artistic License (e.g., PERL), (4) the Mozilla Public License, (5) the Netscape Public License, (6) the Sun Community Source License (SCSL), (7) the Sun Industry Standards License (SISL), (8) Affero General Public License (AGPL), (9) Common Development and Distribution License (CDDL) or (10) any license or distribution agreement or arrangement now listed as open source licenses on www.opensource.org or any successor website thereof or in the Free Software Directory maintained by the Free Software Foundation on http://directory.fsf.org/ or any successor website thereof.

“Other Countries” has the meaning set forth on Exhibit A.

“Owned Real Property” has the meaning set forth in Section 4.15(b).

“Owned Software” has the meaning set forth in Section 4.6(g).

“Partially Transferred Contracts” means the Contracts set forth in Schedule 1.1F, including the Partially Transferred TSA Contracts.

“Partially Transferred TSA Contracts” means those Partially Transferred Contracts identified as “Partially Transferred TSA Contracts” on Schedule 1.1F.

“Parties” and “Party” have the meaning set forth in the Preamble.

“Payment Card Industry Data Security Standards” means the data security standards, as amended, required by the major payment card associations, including MasterCard, Visa, Discover, JCB and American Express.

“Permits” has the meaning set forth in Section 4.13(b).

“Permitted Liens” means (a) Liens for Taxes, assessments and governmental charges or levies not yet due and payable or which are being contested in good faith by appropriate proceedings and for which adequate reserves have been established in accordance with GAAP; (b) Liens imposed by Law, such as materialmen’s, mechanics’, carriers’, workmen’s and repairmen’s liens and other similar liens arising or incurred in the ordinary course of business for amounts which are not yet due or payable or which are being contested in good faith by appropriate proceedings and for which adequate reserves have been established in accordance with GAAP; (c) Liens arising under worker’s

15

739009450 20652562

compensation, unemployment insurance, social security, retirement or similar legislation or to secure public or statutory obligations; (d) with respect to the Owned Real Property, (i) all matters of record, including survey exceptions, reciprocal easement agreements and other encumbrances on title to real property, (ii) all applicable zoning, entitlement, building, conservation restrictions and other land use and environmental regulations and (iii) all exceptions, restrictions, easements, charges, rights-of-way and other Liens set forth in any permits, any deed restrictions, groundwater or land use limitations or other institutional controls utilized in connection with any required environmental remedial actions, or other state, local or municipal franchise applicable to any member of the Company Group or any of its properties; (e) purchase money Liens and Liens securing rental payments under capital lease arrangements; (f) Liens of lessors arising under lease agreements or arrangements; (g) any restriction on transfer arising under any applicable securities laws; (h) non-exclusive licenses of Intellectual Property granted in the ordinary course of business; (i) Liens arising under or created by this Agreement or any of the Related Agreements; (j) Liens that affect the underlying fee interest of any Leased Real Property; (k) Liens set forth in Schedule 1.1G; (l) Liens that are immaterial to the Company Group taken as a whole and (m) Liens granted to any lender at the Closing in connection with any financing by Buyer of the transactions contemplated hereby.

“Person” means an individual, corporation, partnership, joint venture, trust, association, estate, joint stock company, limited liability company, works council or employee representative body (whether or not having separate legal personality), Governmental Authority or any other entity of any kind.

“Post-Closing Statement” has the meaning set forth in Section 2.4(c).

“Power of Attorney Form” has the meaning set forth in Section 2.2(b)(ix).

“Pre-Closing Distributions” has the meaning set forth in Section 6.2(a).

“Pre-Closing Event” has the meaning set forth in Section 7.11(a).

“Pre-Closing Tax Period” means any Taxable period ending on or before the Closing Date and the portion of any Straddle Period ending on and including the Closing Date.

“Pre-Closing Statement” has the meaning set forth in Section 2.4(a).

“Preparer” has the meaning set forth in Section 7.16.

“Protected Communications” means, at any time, any and all communications in whatever form, whether written, oral, video, electronic or otherwise, that shall have occurred between or among any of Seller, any member of the Company Group or any of their respective Associated Persons (including Mayer Brown or CDK Local Counsel) relating to or in connection with this Agreement, the events and negotiations leading to this Agreement, any of the transactions contemplated hereby and by the Related Agreements or any other potential sale or transfer of control transaction involving the Company Group.

“Public Health Event” means any disease outbreak, cluster, epidemic, pandemic or plague, regardless of stage, including the outbreak or escalation of the COVID-19 coronavirus.

16

739009450 20652562

“Public Health Measures” means any quarantine, “shelter in place,” “stay at home,” workforce reduction, social distancing, shut down, closure, sequester or any other Law, Governmental Order, Action, directive, guidelines or recommendations by any Governmental Authority in connection with or in response to a Public Health Event.

“Purchase Price” has the meaning set forth in Section 2.3.

“Real Property Leases” has the meaning set forth in Section 4.15(a).

“Related Agreement” means the Transition Services Agreement, the Company Stock Transfer Form, the India Services Agreement, the License Agreement (to CDK), the License Agreement (to Concorde), the Thailand Stock Transfer Form and the Power of Attorney Form. The Related Agreements executed by a specified Person shall be referred to as “such Person’s Related Agreements,” “its Related Agreements,” “the Related Agreements of such Person” or another similar expression.

“Related Party” and “Related Parties” have the meaning set forth in Section 9.3.

“Release” shall mean any spilling, emitting, emptying, escaping, pouring, leaking, pumping, injecting, disposal, dumping, discharging or leaching into the environment.

“Relevant Periods” has the meaning set forth in Section 7.5(e).

“Representatives” means, with respect to any Person, such Person’s Affiliates and its and their respective directors, officers, employees, agents, attorneys, accountants and other advisors.

“Response Action” means any action taken to investigate, abate, maintain, restore, remediate, remove or mitigate any Release of Hazardous Substances (as applicable), including any action that would be a response to Environmental Law.

“Restricted Entities” has the meaning set forth in the Preamble.

“Restructuring” has the meaning set forth in Section 6.6.

“Retained DMS Product” means each dealer management system (DMS) product listed on Schedule 1.1H and any product that is derived in whole or in part from the software code constituting such dealer management system product.

“Retained Shared Contracts” means the Contracts set forth on Schedule 1.1I.

“Reviewer” has the meaning set forth in Section 7.16.

“Securities Act” means the Securities Act of 1933, as amended.

“Seller” has the meaning set forth in the Preamble.

“Seller Group Entities” means Seller and each of its Affiliates, including the Company Group but only with respect to the period ending upon the Closing.

17

739009450 20652562

“Seller Group Members” has the meaning set forth in Section 11.15.

“Seller Guarantee” means any guarantee, indemnity, insurance requirement, performance bond, letter of credit, deposit or other security or contingent obligation in the nature of a financial obligation, including letters of comfort or support, entered into or granted by Seller or any of its Affiliates (other than the Company Group) in relation to or arising out of any liabilities or obligations of the Company Group or its business, including those set forth on Schedule 1.1J.

“Seller Indemnitee” has the meaning set forth in Section 7.6.

“Seller PSU” means restricted stock units granted to any Continuing Employee pursuant to any equity plan maintained by Seller that have a performance-based vesting schedule and are held and remain outstanding by such Continuing Employee as of immediately prior to the Closing.

“Seller RSU” means restricted stock units granted to any Continuing Employee pursuant to any equity plan maintained by Seller that have a time-based vesting schedule and are held and remain outstanding by such Continuing Employee as of immediately prior to the Closing.

“Seller Taxes” means (a) any Taxes arising or resulting from the Restructuring or any Pre-Closing Distributions, (b) any Taxes of any Person other than the Company Group imposed on any member of the Company Group as a result of such member of the Company Group being a member of any Affiliated Group on or before the Closing Date pursuant to Treasury Regulation Section 1.1502-6 or any similar state, local, or non-U.S. Law, (c) any liability of any member of the Company Group to make a payment, or to make a repayment of the whole or any part of any payment, to any person other than another member of the Company Group in respect of Group Relief under any arrangement or agreement entered into by a member of the Company Group on or before Closing, (d)(i) any Indian goods and services Tax of Buyer or any member of the Company Group, and (ii) any capital gains Tax of Seller and its Affiliates (other than the Company Group), in each case of clauses (i) and (ii) arising in connection with the transfer of the Concorde India Employees to Buyer pursuant to the India Services Agreement; provided, in each case of clauses (i) and (ii) that Buyer complies, and causes the Company Group to comply, with the obligations set forth in Section 7.5(g), and (e) an amount equal to the aggregate liability for Income Taxes of the Company Group unpaid as of the Closing Date that are first due after the Closing Date for each Pre-Closing Tax Period, in each case, calculated for (i) each jurisdiction in which any member of the Company Group filed an Income Tax Return for the last Tax year for which an Income Tax Return was due in such jurisdiction (taking into account any applicable extensions) and (ii) each jurisdiction in which any member of the Company Group commenced activities after the end of such Tax year, provided, however, for the avoidance of doubt that any amounts calculated under this clause (e) shall (i) assume all amounts payable pursuant to clause (h) of the definition of Closing Indebtedness were paid prior to the Closing Date to the extent such amounts would be treated as deductible in a Pre-Closing Tax Period under a “more likely than not” standard under applicable law and (ii) be determined as the sum of the separate liabilities of each member of the Company Group for each applicable jurisdiction, which amount shall not be less than zero for any taxpayer in any jurisdiction for any Tax Period. Notwithstanding the foregoing, “Seller Taxes” shall not include any Taxes imposed on or with respect to the Company Group as a result of any breach by Buyer or the Company Group of Section 7.5(c).

18

739009450 20652562

“Seller’s Group” means Seller and any other company or companies which are members of the same group as, or are otherwise connected or associated in any way with, Seller for Tax purposes, immediately prior to Closing (excluding the members of the Company Group). “Shared Resources” means (a) the accounting, finance, treasury, human resources, information security and technology, hosting and network, legal, commercial, marketing, research and development and real estate personnel of Seller and its Affiliates (other than the Company Group) who provide services to the Company Group or its business, together with the real and tangible personal property used by such personnel, and (b) the Retained Shared Contracts.

“Shares” has the meaning set forth in the Recitals.

“Software” means any and all: (a) computer programs and software systems, including any operating system, platforms, applications software and software of computerized implementation of algorithms, models and methodologies, APIs, apps, tools, modules, user interfaces and other program interfaces, subroutines, network configurations and architectures, in source code and object code form, and whether embodied in software, firmware, software compilations or software tool sets, (b) databases and data compilations, and (c) including, with respect to any of the foregoing, all error corrections, updates, translations, versions and releases (including ported versions), and other modifications and enhancements thereto (including all of the foregoing that is installed on computer hardware); and (b) any documentation, comments and any procedural code, including user manuals and other training materials, for or related to any of the foregoing.

“Solvent” has the meaning set forth in Section 5.9.

“Specified Country Cash” has the meaning set forth on Exhibit A.

“Specified Country Cash Cap Amount” has the meaning set forth on Exhibit A.

“Specific Policies” has the meaning set forth on Exhibit A.

“Specified Countries” has the meaning set forth on Exhibit A.

“Specified Courts” has the meaning set forth in Section 11.9.

“Straddle Period” means any Taxable period beginning on or before the Closing Date and ending after the Closing Date.

“Subsidiary” means, with respect to any Person, any corporation, general or limited partnership, limited liability company, joint venture or other entity in which such Person (a) owns, directly or indirectly, fifty percent (50%) or more of the outstanding voting securities, equity securities, profits interest or capital interest, (b) is entitled to elect at least one-half of the board of directors or similar governing body or (c) in the case of a limited partnership or limited liability company, is a general partner or managing member and has the power to direct the policies, management and affairs of such entity, respectively.

“Target Working Capital” has the meaning set forth on Exhibit A.

19

739009450 20652562

“Tax” (and, with correlative meaning, “Taxes,” “Taxable” and “Taxing”) means any United States federal, state or local or non-United States net income, capital gains, gross income, gross receipts, sales, use, transfer, ad valorem, franchise, profits, license, capital stock, withholding, payroll, estimated, employment, disability, excise, goods and services, severance, stamp, occupation, premium, property national insurance contributions or social security, alternative or add-on, value added, registration, customs duties, escheat or unclaimed property (whether or not considered a tax under applicable Law), windfall profits or other taxes, duties, charges, fees, levies, contributions or other assessments or liabilities, imposed by any Governmental Authority, including any interest, penalties or additions to tax incurred under Law with respect to any of the foregoing or with respect to any failure to timely or properly file a Tax Return.

“Tax Returns” means any and all reports, declarations, claims for refund, returns (including any information return), statements or other filings required or permitted to be supplied to any Governmental Authority with respect to Taxes, including any schedules, amendments or attachments to such reports, returns, declarations or other filings that are filed with or submitted to, or that are required to be filed with or submitted to, any Taxing authority.

“Tax Sharing Agreements” means any Tax sharing agreements, Tax distribution agreements or Tax indemnification agreements or arrangements (other than customary Tax indemnifications contained in credit or other commercial agreements the primary purpose of which does not relate to Taxes).

“TC Contact” has the meaning set forth on Exhibit A.

“Termination Date” has the meaning set forth in Section 9.1(b).

“Termination Fee” has the meaning set forth in Section 9.2(b).

“Thailand Entity” means CDK Global (Thailand) Limited, a Thailand private limited company.

“Thailand Stock Transfer Form” has the meaning set forth in Section 2.2(b)(viii).

“Transfer Taxes” has the meaning set forth in Section 7.5(a).

“Transition Services Agreement” has the meaning set forth in Section 2.2(b)(iv).

“Unspecified Shared Contract” has the meaning set forth in Section 7.12(c).

“VAT” means any tax imposed in conformity with the Council Directive of 28 November 2006 on the common system of value added tax (EC Directive 2006/112) and any other tax of a similar fiscal nature (whether in the European Union, or elsewhere in any jurisdiction), together with any interest and penalties thereon.

“Works Council Condition” has the meaning set forth in Section 8.1(c).

20

739009450 20652562

1.2 Interpretation.

(a) The table of contents and the headings of the Articles, Sections and subsections included in this Agreement and the various headings of the Disclosure Schedule are for convenience only and shall not be deemed part of this Agreement or the Disclosure Schedule or be given any effect in interpreting this Agreement, the Disclosure Schedule or any Exhibits hereto. Unless the context otherwise requires, references in this Agreement to: (i) Articles, Sections, Exhibits and Schedules shall be deemed references to Articles and Sections of, and Exhibits and Schedules to, this Agreement; (ii) “paragraphs” or “clauses” shall be deemed references to separate paragraphs or clauses of the Section or Subsection in which the reference occurs; (iii) any Contract (including this Agreement) or Law shall be deemed references to such Contract or Law as amended, supplemented or modified from time to time in accordance with its terms and the terms hereof, as applicable, and in effect at any given time (and, in the case of any Law, to any successor provisions); (iv) any Person shall be deemed references to such Person’s successors and permitted assigns, and in the case of any Governmental Authority, to any Person(s) succeeding to its functions and capacities; and (v) any statute or other Law of the United States or other jurisdiction (whether federal, state or local) shall be deemed references to all rules and regulations promulgated thereunder. Underscored references to Articles, Sections, Exhibits or Schedules shall refer to those portions of this Agreement.

(b) The use of the masculine, feminine or neuter gender herein shall not limit any provision of this Agreement. Unless the context otherwise clearly indicates, each defined term used in this Agreement shall have a comparable meaning when used in its plural or singular form. The words “including,” “includes,” or “include” are to be read as listing non-exclusive examples of the matters referred to, whether or not words such as “without limitation” or “but not limited to” are used in each instance. The words such as “herein,” “hereinafter,” “hereof” and “hereunder” that are used in this Agreement refer to this Agreement as a whole and not merely to a subdivision in which such words appear unless the context otherwise requires.

(c) Where this Agreement states that a Party “shall,” “will” or “must” perform in some manner or otherwise act or omit to act, it means that such Party is legally obligated to do so in accordance with this Agreement.

(d) Any Contract, document, list or other item shall be deemed to have been “provided” or “made available” to Buyer for all purposes of this Agreement if such Contract, document, list or other item was posted in the Data Room at least one (1) day prior to the date hereof.

(e) The Parties acknowledge and agree that, to the extent the terms and provisions of this Agreement are in any way inconsistent with or in conflict with any term, condition or provision of any other agreement, document or instrument contemplated hereby, this Agreement shall govern and control.

(f) All references to the Company Shareholder herein shall be deemed to refer to the Company Shareholder acting by its general partner, CDK Global UK GP Holdings, LLC, a Delaware limited liability company (the “General Partner”).

21

739009450 20652562

ARTICLE 2

Purchase and Sale

2.1 Purchase and Sale of the Shares. At the Closing, Seller shall cause the Company Shareholder to sell to Buyer, and Buyer shall purchase from the Company Shareholder, all right, title and interest in and to the Shares, in exchange for the payment of the Purchase Price by Buyer and the mutual covenants and agreements contained herein.

2.2 Closing.

(a) Subject to the following sentence, the Closing shall take place at the offices of Mayer Brown LLP, 71 South Wacker Drive, Chicago, Illinois, at 9:00 A.M. (Central Time), on the date that is two (2) Business Days after the satisfaction (or waiver thereof by the Party or Parties entitled to benefit therefrom) of the conditions precedent set forth in Article 8 (excluding the conditions that by their nature can only be satisfied at the Closing, but subject to the satisfaction of such conditions at the Closing or waiver (if permitted) of such conditions by the Party or Parties entitled to the benefit therefrom) or on such other date, and at such other time and place, as may be agreed in writing by Buyer and Seller; provided, however, that the Closing may occur remotely by exchange of documents and signatures via email or other manner as may be mutually agreed upon by Buyer and Seller. Notwithstanding the foregoing, (x) the Closing shall not occur prior to February 12, 2021, and (y) if requested by Seller, the Closing shall occur (i) on the last Business Day of the month during which the Closing would otherwise be required to occur pursuant to the immediately preceding sentence, or (ii) on the first Business Day of the month next following the month during which the Closing would otherwise be required to occur pursuant to the immediately preceding sentence. Once the Closing occurs, the Closing, and all transactions to occur at the Closing, shall be deemed to have taken place at, and shall be effective as of, 12:01 A.M. (Central Time) on the Closing Date; provided, however, that if the Closing occurs on the last Business Day of the month, then the Closing, and all transactions to occur at the Closing, shall be deemed to have taken place at, and shall be effective as of, 11:59 A.M. (Central Time) on the Closing Date. Except as otherwise set forth herein, all actions to be taken and all documents to be executed and delivered by all Parties at the Closing will be deemed to have been taken and executed simultaneously and no actions will be deemed to have been taken nor documents executed or delivered until all have been taken, executed and delivered. The date on which the Closing occurs in accordance with the preceding sentence is referred to in this Agreement as the “Closing Date.”

(b) At or prior to the Closing, Seller shall deliver the following to Buyer:

(i) a stock transfer form in the form of Exhibit B (the “Company Stock Transfer Form”), duly executed by the Company Shareholder, together with the related share certificate(s), for the Shares (or a lost share certificate affidavit in form reasonably satisfactory to Buyer in the case of any lost share certificate(s));

(ii) a certificate, dated as of the Closing Date, duly executed by an officer of Seller certifying that the conditions set forth in Section 8.2(a)(i) and, solely with respect to Seller, Section 8.2(b) have been satisfied;

22

739009450 20652562

(iii) a certificate, dated as of the Closing Date, duly executed by an officer of Seller certifying that the conditions set forth in Section 8.2(a)(ii) and, solely with respect to the Company, Sections 8.2(b) and 8.2(c) have been satisfied;

(iv) the Transition Services Agreement, duly executed by CDK Global, LLC, on the one hand, and the Company, on the other hand, in the form of Exhibit C (the “Transition Services Agreement”);

(v) the India Services Agreement, duly executed by the CDK India Entity and CDK Global, LLC, on the one hand, and Buyer, the Company and the Concorde India Entity, on the other hand, in the form of Exhibit D (the “India Services Agreement”);

(vi) the License Agreement (to CDK), duly executed by Seller, on the one hand, and the Company, on the other hand, in the form of Exhibit E (the “License Agreement (to CDK)”);

(vii) the License Agreement (to Concorde), duly executed by Seller, on the one hand, and the Company, on the other hand, in the form of Exhibit F (the “License Agreement (to Concorde)”);

(viii) a stock transfer form in the form of Exhibit G (the “Thailand Stock Transfer Form”), duly executed by each of CDK Global, LLC, CDK Global International Holdings, Inc. and the General Partner, together with the related share certificate(s), providing for the transfer of the equity interests of the Thailand Entity (or a lost share certificate affidavit in form reasonably satisfactory to Buyer in the case of any lost share certificate(s)) to Buyer or an Affiliate of Buyer designated by Buyer in writing;

(ix) a power of attorney, in the form of Exhibit H (the “Power of Attorney Form”), in favor of the Buyer duly executed by the Company Shareholder, authorizing the Buyer to exercise all rights of the Company Shareholder in respect of the Shares;

(x) written resignations from (or other removal of) the directors and/or other officers of each member of the Company Group, but only if such Person is an employee of Seller or any of its Subsidiaries (other than the Company Group), resigning their offices who are designated by Buyer to Seller in writing at least five (5) Business Days prior to the Closing Date, which may be effective as of and conditioned upon the Closing; and

(xi) a certificate executed by the Secretary of Seller and the Secretary of the Company certifying as of the Closing that attached hereto are true and complete copies of resolutions of Seller’s and the Company’s board of directors authorizing the execution, delivery, and performance of this Agreement and consummation of the Agreement, which resolutions have not been modified, rescinded, or revoked.

(c) At or prior to the Closing, Buyer shall deliver to Seller a certificate, dated as of the Closing Date, duly executed by an officer of Buyer certifying with respect to Buyer that the conditions set forth in Section 8.3(a) and Section 8.3(b) with respect to Buyer have been satisfied.

23

739009450 20652562

2.3 Calculation of Purchase Price and Closing Payment. At the Closing, Buyer shall pay by wire transfer of immediately available funds to an account designated in the Pre-Closing Statement, the following amount as calculated in the Pre-Closing Statement (the “Closing Payment”): (a) one billion four hundred forty-six million Dollars ($1,446,000,000); plus (b) the difference between the Target Working Capital and the Estimated Working Capital, expressed as (i) a positive number if the Estimated Working Capital is greater than the Target Working Capital, or (ii) a negative number if the Estimated Working Capital is less than the Target Working Capital; provided, that, if such difference, pursuant to clause (i) or (ii) hereof, is less than the absolute value of three million Dollars ($3,000,000), there shall be no adjustment pursuant to this Section 2.3(b), and if such difference is more than the absolute value of three million Dollars ($3,000,000), only the amount, if such amount is a positive number, in excess of three million Dollars ($3,000,000), or if such amount is a negative number, less than negative three million Dollars (-$3,000,000) shall be included in the adjustment, minus (c) Estimated Indebtedness minus (d) the Estimated Cash Shortfall (if any). The Closing Payment, as adjusted after the Closing pursuant to Section 2.4 hereof, is referred to herein as the “Purchase Price.” In addition at the Closing, the Buyer shall procure that a member of the Company Group repay, by wire transfer of immediately available funds to an account designated in the Pre-Closing Statement, the outstanding principal and interest balance of the intercompany debt (less any applicable withholdings) owing from the Company Group to the Barbados Entity as of the Closing Date (the “Barbados Repayment”).

2.4 Purchase Price Adjustment.

(a) At least two (2) Business Days prior to the Closing Date, the Company shall deliver to Buyer a statement (the “Pre-Closing Statement”) setting forth its good faith estimates of (i) Closing Cash (the “Estimated Cash”) and the Cash Shortfall (if any) (the “Estimated Cash Shortfall”), (ii) Closing Working Capital (the “Estimated Working Capital”), (iii) Closing Indebtedness (the “Estimated Indebtedness”), and (iv) the Closing Payment calculated in accordance with Section 2.3.

(b) Subsequent to the Closing and subject to this Section 2.4, the Closing Payment shall be:

(i) increased by an amount (if any) by which Final Working Capital exceeds Estimated Working Capital, or decreased by the amount (if any) by which Estimated Working Capital exceeds Final Working Capital, in each case, taking into account the proviso in Section 2.3(b);

(ii) increased by the amount (if any) by which Estimated Cash Shortfall exceeds Final Cash Shortfall, or decreased by the amount (if any) by which Final Cash Shortfall exceeds Estimated Cash Shortfall;

(iii) increased by the amount (if any) by which Estimated Indebtedness exceeds Closing Indebtedness, or decreased by the amount (if any) by which Closing Indebtedness exceeds Estimated Indebtedness.

24

739009450 20652562

(c) As soon as reasonably practicable, but not later than sixty (60) calendar days after the Closing Date, Buyer shall prepare, and deliver to Seller, a statement of the calculation of Closing Cash, Excess Cash and/or Cash Shortfall (if any), Closing Working Capital and Closing Indebtedness and, based upon the calculations in Section 2.4(b), the Purchase Price (the “Post-Closing Statement”). The Post-Closing Statement (and the determinations and calculations set forth therein) shall be prepared in good faith in accordance with the Accounting Principles, and shall include a reconciliation of any differences between the calculations set forth in the Pre-Closing Statement and the Post-Closing Statement, together with reasonable supporting materials used in the preparation of the Post-Closing Statement. The Parties agree that: (i) in determining the Final Working Capital and the related adjustment contemplated by this Section 2.4, no Party will be permitted to introduce judgments, accounting methods, policies, principles, practices, procedures, assumptions, conventions, categorizations, definitions, techniques (including in respect of management’s exercise of judgment), classifications or estimation methodologies different than the Accounting Principles; (ii) no new class or classes of liabilities, asset reserves, or valuation allowances shall be introduced in the preparation of the Post-Closing Statement that were not set forth in the Pre-Closing Statement or the Illustrative Calculation; (iii) there shall be no additional provision or accrual or increase in any existing provision or accrual included in the Post-Closing Statement except to the extent new facts or events have arisen before the Closing Date that, applying the same management judgment, methodologies, practices, classification, policies and procedures, justify such a provision, accrual or increase; and (iv) the Post-Closing Statement shall not be impacted by any changes requested by Buyer between the date hereof and the Closing or any action of Buyer, any member of the Company Group or any of their respective Affiliates after the Closing. If, for any reason, Buyer fails to deliver the Post-Closing Statement to Seller within the period contemplated by the first sentence of this Section 2.4(c), then the Pre-Closing Statement delivered by the Company to Buyer pursuant to Section 2.4(a) shall be deemed to be the Post-Closing Statement; provided, for the avoidance of doubt, that all of the rights of Seller under this Section 2.4 with respect to the Post-Closing Statement shall continue to apply thereto, including the right to dispute the calculations set forth therein in accordance with the provisions set forth in this Section 2.4.

(d) In connection with the review of the Post-Closing Statement by Seller or in the event Buyer fails to deliver a Post-Closing Statement in accordance with Section 2.4(c), Buyer shall provide Seller and its Representatives with prompt and reasonable access to the books and records, personnel, facilities and Representatives of the Company Group. Furthermore, Seller shall have the right to review the work papers of Buyer underlying or utilized in preparing the Post-Closing Statement and the calculation of the Purchase Price; provided, however, that the independent accountants of the Company, if any, shall not be obligated to make any such work papers available to Seller unless and until Seller has signed a customary confidentiality and hold harmless agreement relating to such access to such work papers in form and substance reasonably acceptable to such independent accountants.

(e) Within sixty (60) calendar days after its receipt of the Post-Closing Statement, Seller shall inform Buyer in writing either (i) that the Post-Closing Statement is acceptable or (ii) of any good faith objection to the Post-Closing Statement, setting forth in reasonable detail the basis for such objection and the specific adjustment to amounts, determinations and calculations set forth on the Post-Closing Statement that Seller believes should be made (an “Objection Notice”). The deadline for an Objection Notice shall be extended in the case of any undue delay by Buyer in

25

739009450 20652562