Attached files

| file | filename |

|---|---|

| 8-K - 8-K - UNITED STATES STEEL CORP | x-20210129.htm |

Fourth Quarter and Full Year 2020 Earnings Call January 29, 2021 David Burritt President and Chief Executive Officer Christie Breves Senior Vice President and Chief Financial Officer Rich Fruehauf Senior Vice President, Chief Strategy and Development Officer Kevin Lewis Vice President, Investor Relations and Corporate FP&A

2 Forward-looking statements These slides are being provided to assist readers in understanding the results of operations, financial condition and cash flows of United States Steel Corporation for the fourth quarter and full year of 2020. Financial results as of December 31, 2020 provided herein are preliminary unaudited results based on current information available to management. They should be read in conjunction with the consolidated financial statements and Notes to the Consolidated Financial Statements contained in our Annual Report on Form 10-K to be filed with the Securities and Exchange Commission. This presentation contains information that may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We intend the forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in those sections. Generally, we have identified such forward-looking statements by using the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “target,” “forecast,” “aim,” “should,” “will,” “may” and similar expressions or by using future dates in connection with any discussion of, among other things, operating performance, trends, events or developments that we expect or anticipate will occur in the future, statements relating to volume changes, share of sales and earnings per share changes, anticipated cost savings, potential capital and operational cash improvements, anticipated disruptions to our operations and industry due to the COVID-19 pandemic, changes in global supply and demand conditions and prices for our products, international trade duties and other aspects of international trade policy, the integration of Big River Steel in our existing business, business strategies related to the combined business and statements expressing general views about future operating results. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. Forward-looking statements are not historical facts, but instead represent only the Company’s beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside of the Company’s control. It is possible that the Company’s actual results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in these forward-looking statements. Management believes that these forward-looking statements are reasonable as of the time made. However, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date when made. Our Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our Company's historical experience and our present expectations or projections. These risks and uncertainties include, but are not limited to our ability to realize the level of cost savings, productivity improvement, growth or other anticipated benefits and additional future synergies, including in the time period anticipated, of the acquisition of Big River Steel; our ability to successfully integrate the businesses of Big River Steel into our existing businesses, including uncertainties associated with maintaining relationships with customers, vendors and employees, as well as differences in operating technologies, cultures, and management philosophies that may delay successful integration; additional debt, which we assumed in connection with the acquisition of Big River Steel and incurred to enhance our liquidity during the COVID- 19 pandemic, may negatively impact our credit profile and limit our financial flexibility; business strategies for the combined company's operations; the diversion of management’s attention from ongoing business operations; our ability to retain and hire key personnel, including within the Big River Steel business, and to access our distribution channels, including the availability of workforce and subcontractors; potential adverse reactions or changes to business relationships resulting from the completion of the acquisition of Big River Steel; unknown or underestimated liabilities and unforeseen increased expenses or delays associated with the acquisition and integration beyond current estimates; and the risks and uncertainties described in “Item 1A. Risk Factors” of our Annual report on Form 10-K, quarterly reports on Form 10-Q and those described from time to time in our future reports filed with the Securities and Exchange Commission. References to "we," "us," "our," the "Company," and "U. S. Steel," refer to United States Steel Corporation and its consolidated subsidiaries.

3 We present adjusted net (loss) earnings, adjusted net (loss) earnings per diluted share, (loss) earnings before interest, income taxes, depreciation and amortization (EBITDA) and adjusted EBITDA, which are non-GAAP measures, as additional measurements to enhance the understanding of our operating performance. We believe that EBITDA and segment EBITDA, considered along with net (loss) earnings and segment (loss) earnings before interest and income taxes, are relevant indicators of trends relating to our operating performance and provide management and investors with additional information for comparison of our operating results to the operating results of other companies. Net debt is a non-GAAP measure calculated as total debt less cash and cash equivalents. We believe net debt is a useful measure in calculating enterprise value. Both EBITDA and net debt are used by analysts to refine and improve the accuracy of their financial models which utilize enterprise value. Adjusted net earnings (loss) and adjusted net earnings (loss) per diluted share are non-GAAP measures that exclude the effects of items that include: the asset impairment charge, restructuring and other charges, the Fairless property sale, the Big River Steel options mark to market, the December 24, 2018 Clairton coke making facility fire, the tax valuation allowance, loss on extinguishment of debt and other related costs, the USW labor agreement signing bonus and related costs, Granite City Works restart and related costs and gain on equity investee transactions that are not part of the Company's core operations (Adjustment Items). Adjusted EBITDA is also a non-GAAP measure that excludes the effects of certain Adjustment Items. We present adjusted net earnings (loss), adjusted net earnings (loss) per diluted share and adjusted EBITDA to enhance the understanding of our ongoing operating performance and established trends affecting our core operations, by excluding the effects of events that can obscure underlying trends. U. S. Steel's management considers adjusted net earnings (loss), adjusted net earnings (loss) per diluted share and adjusted EBITDA as alternative measures of operating performance and not alternative measures of the Company's liquidity. U. S. Steel’s management considers adjusted net earnings (loss), adjusted net earnings (loss) per diluted share and adjusted EBITDA useful to investors by facilitating a comparison of our operating performance to the operating performance of our competitors. Additionally, the presentation of adjusted net earnings (loss), adjusted net earnings (loss) per diluted share and adjusted EBITDA provides insight into management’s view and assessment of the Company’s ongoing operating performance, because management does not consider the adjusting items when evaluating the Company’s financial performance. Adjusted net earnings (loss), adjusted net earnings (loss) per diluted share and adjusted EBITDA should not be considered a substitute for net earnings (loss), earnings (loss) per diluted share or other financial measures as computed in accordance with U.S. GAAP and is not necessarily comparable to similarly titled measures used by other companies. Explanation of use of non-GAAP measures

4 Business update Creating Value in the Trough Big River Steel: The Future is Now 2021 Outlook: Optimism, Optionality, & Opportunity What you will hear on today’s call:

Creating value in the trough 2020 accomplishments 5 Executed on our #1 strategic priority; creating a Best of BothSM footprint through completion of the Big River Steel acquisition Acquired Big River Steel Divested non- core assets Delivered on our commitment to extract value from our attractive portfolio of real estate assets Created incremental value from our iron ore competitive advantage Monetized excess iron ore Progressed towards ~$200 million of run-rate fixed cost reduction Reduced fixed costs Insourced substrate for seamless pipe production allowing us to be more responsive to customers’ needs Commissioned Fairfield EAF ✓✓ ✓ ✓ ✓

Big River Steel the future is now 6 Full ownership unlocks additional opportunities Full collaboration to maximize customer value and develop new products Increased flexibility to serve the growing Southern U.S. and Mexico markets Low-GHG1 emission steelmaking to provide the sustainable steel customers want 1 GHG = greenhouse gas.

Big River Steel phase 2-A expansion 7 7 The start up and ramp up of Big River’s Phase 2-A expansion is the fastest ever achieved worldwide with SMS group CSP-Mill Technology. The Big River and SMS teams should be proud of this tremendous achievement.

Big River Steel strong end to 2020 8 8 Phase 2-A expansion already running near 90% raw steel capability Month of December 2020 Statistics 2 Excludes $62 million of restricted cash for the completion of Phase 2-A expansion. 3 Includes unrestricted cash and ABL availability. Excludes $62 million of restricted cash. ~$30M EBITDA1 $47M Ending Cash2 $267M Ending Liquidity3 $33M Net Income1 1 Net income and EBITDA is 100% of Big River Steel results. Not included in U. S. Steel’s 2020 results. $1,738M Net Debt Note: For reconciliation of non-GAAP amounts see Appendix. Results for 12/31/2020 are preliminary, based on current information available to management.

2021 outlook reasons we are confident 9 Optimism Low inventories across the supply chain Improving demand in key end-markets Optionality Lower capital intensity Differentiated capabilities 1 Advanced High Strength Steel. Opportunity Proprietary AHSS1 finishing technology Sustainable steel offerings

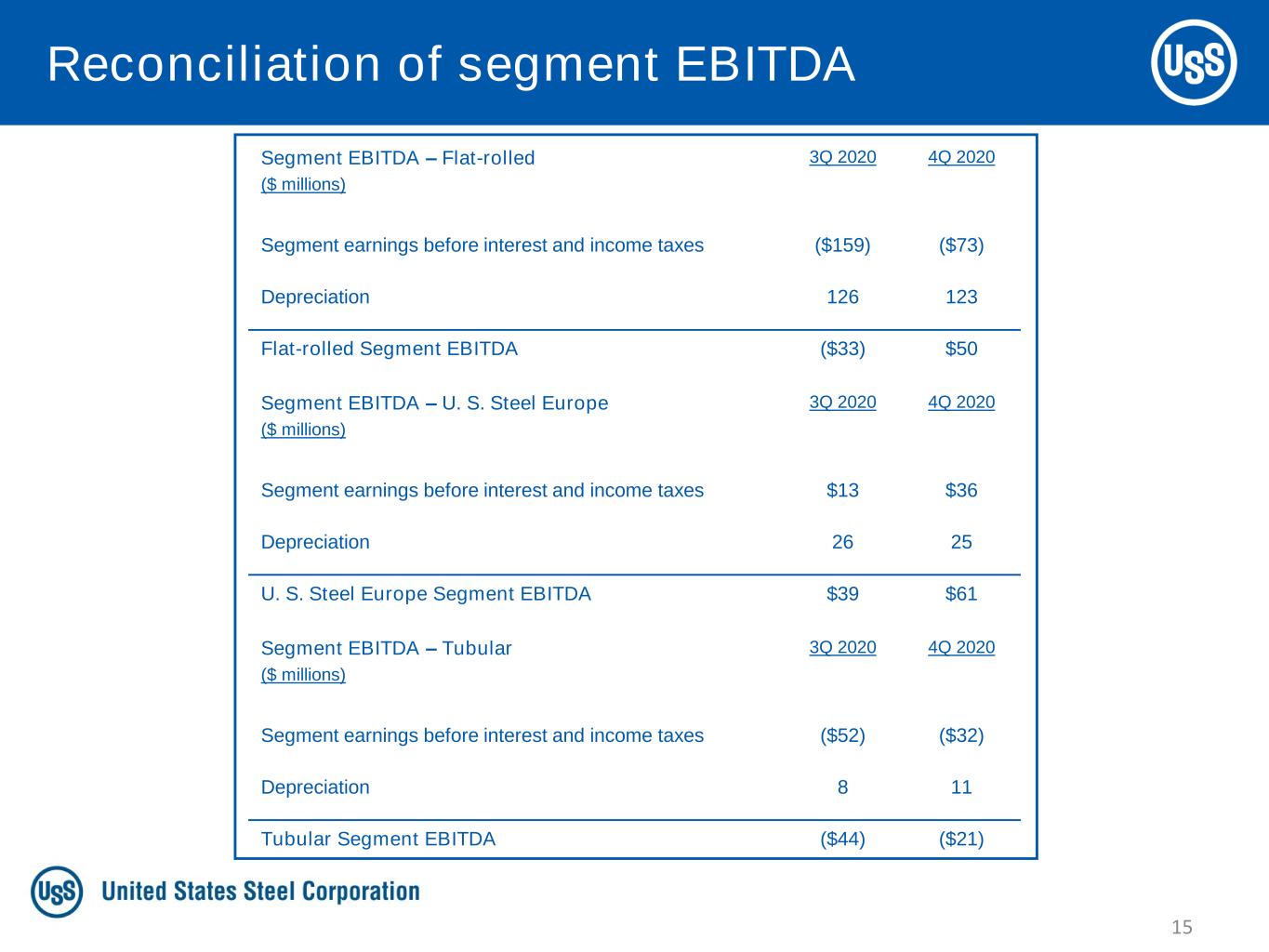

• Total fourth quarter adjusted EBITDA1 of $87 million, ahead of our guidance on December 17 • Full year adjusted EBITDA of ($162) million • Ending liquidity of ~$3.2 billion • Cash and cash equivalents of ~$2.0 billion • Pension and OPEB funded status strong at 98% and 115%, respectively • Average realized selling prices beginning to reflect strong market environment ($33) $50 3Q 2020 4Q 2020 Flat-rolled Segment EBITDA1 $ Millions EBITDA1 Margin: (2%) 3% $39 $61 3Q 2020 4Q 2020 U. S. Steel Europe Segment EBITDA1 $ Millions EBITDA1 Margin: 8% 11% ($44) ($21) 3Q 2020 4Q 2020 Tubular Segment EBITDA1 $ Millions EBITDA1 Margin: (46%) (20%) 10 1 Earnings before interest, income taxes, depreciation and amortization. Note: For reconciliation of non-GAAP amounts see Appendix. Strong finish to 2020 fourth quarter 2020 financial highlights

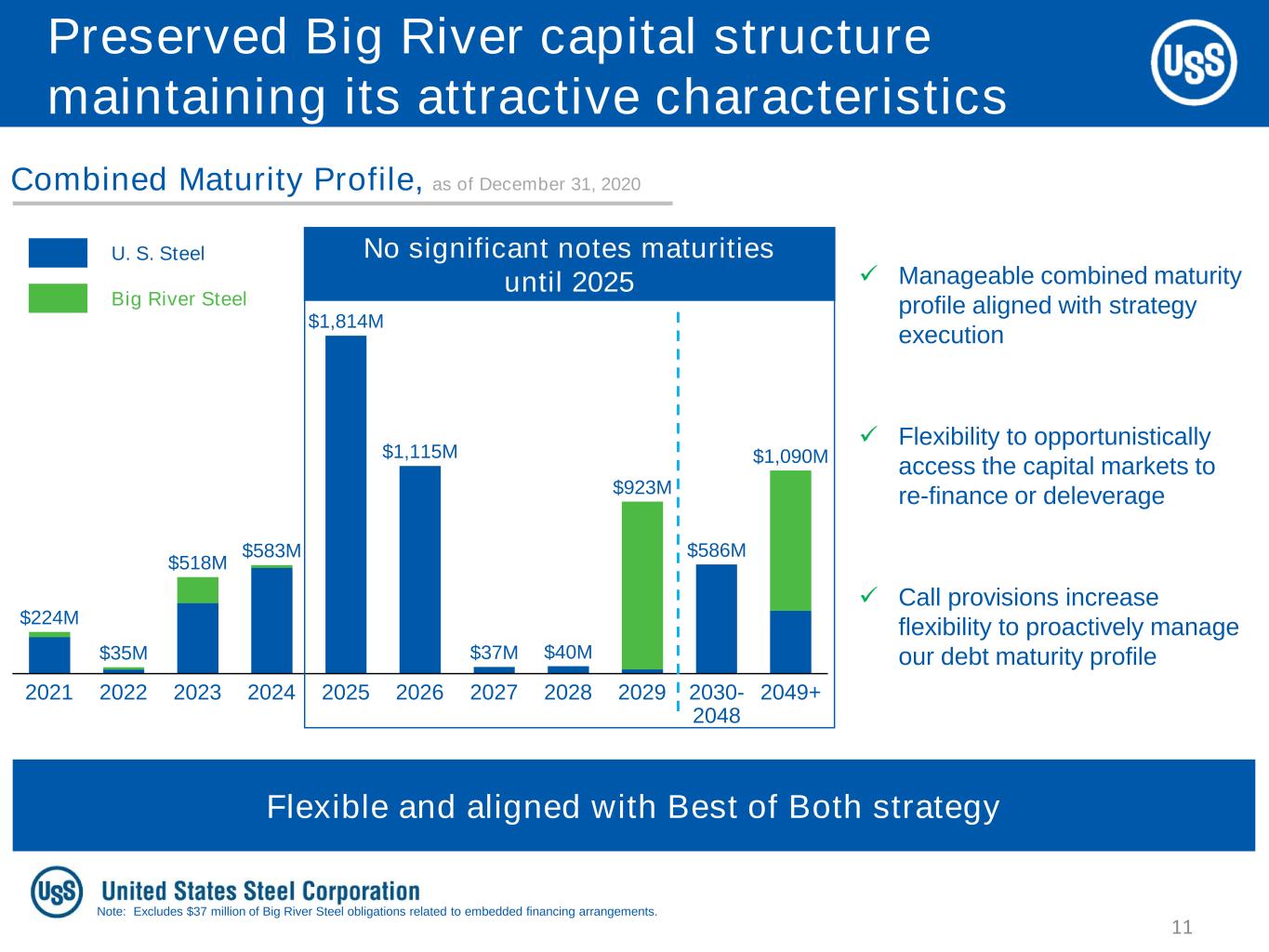

Combined Maturity Profile, as of December 31, 2020 Flexible and aligned with Best of Both strategy Preserved Big River capital structure maintaining its attractive characteristics 20262021 2049+20242022 $518M $35M 2023 2025 $224M $583M $1,814M $1,115M 2027 2028 $1,090M $40M$37M 2029 2030- 2048 $586M $923M No significant notes maturities until 2025 ✓ Manageable combined maturity profile aligned with strategy execution ✓ Flexibility to opportunistically access the capital markets to re-finance or deleverage ✓ Call provisions increase flexibility to proactively manage our debt maturity profile U. S. Steel Big River Steel Note: Excludes $37 million of Big River Steel obligations related to embedded financing arrangements. 11

Recap • Created value in the trough • Executed our #1 strategic priority … marking the beginning of our Best of Both future • Strong 2021 poised for earnings growth and value 12

Q&A

Closing Remarks

Segment EBITDA – Flat-rolled ($ millions) 3Q 2020 4Q 2020 Segment earnings before interest and income taxes ($159) ($73) Depreciation 126 123 Flat-rolled Segment EBITDA ($33) $50 Segment EBITDA – U. S. Steel Europe ($ millions) 3Q 2020 4Q 2020 Segment earnings before interest and income taxes $13 $36 Depreciation 26 25 U. S. Steel Europe Segment EBITDA $39 $61 Segment EBITDA – Tubular ($ millions) 3Q 2020 4Q 2020 Segment earnings before interest and income taxes ($52) ($32) Depreciation 8 11 Tubular Segment EBITDA ($44) ($21) 15 Reconciliation of segment EBITDA

($ millions) 3Q 2020 4Q 2020 Reported net (loss) earnings attributable to U. S. Steel ($234) $49 Income tax provision (benefit) (24) (94) Net interest and other financial costs 47 88 Reported (loss) earnings before interest and income taxes ($211) $43 Depreciation, depletion and amortization expense 162 162 EBITDA ($49) $205 Restructuring and other charges ─ 8 Big River Steel debt extinguishment charges ─ 18 Big River Steel transaction and other related costs ─ 3 Fairless property sale ─ (145) December 24, 2018 Clairton coke making facility fire ─ (2) Adjusted EBITDA ($49) $87 Reconciliation of adjusted EBITDA 16

17 ($ millions) December 2020 Reported net earnings $33 Income tax provision 1 Net interest and other financial costs (18) Reported (loss) earnings before interest and income taxes $16 Depreciation and amortization expense 13 EBITDA $29 Reconciliation of Big River Steel December EBITDA

18 Net Debt ($ millions) YE 2020 Short-term debt and current maturities of long-term debt $0 Long-term debt, less deferred revenue 1,848 Total Debt $1,848 Less: Cash and cash equivalents1 110 Net Debt $1,738 Reconciliation of Big River Steel net debt 1 Unrestricted and restricted cash

INVESTOR RELATIONS Kevin Lewis Vice President 412-433-6935 klewis@uss.com Eric Linn Senior Manager 412-433-2385 eplinn@uss.com www.ussteel.com