Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - FIRST BANCSHARES INC /MS/ | a52368257ex99_1.htm |

| 8-K - THE FIRST BANCSHARES, INC. 8-K - FIRST BANCSHARES INC /MS/ | a52368257.htm |

Exhibit 99.2

1 Investor PresentationJanuary 26, 2021 NASDAQ: FBMS

2 Forward Looking Statements This slide presentation and certain of our other filings with the

Securities and Exchange Commission contain statements that constitute “forward-looking statements” within the meaning of, and subject to the protections of, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are forward-looking statements. Such statements can generally be identified by such words as “believes,” “anticipates,” “expects,” “may,”

“will,” “assumes,” “should,” “predicts,” “could,” “would,” “intends,” “targets,” “estimates,” “projects,” “plans,” “potential” and other similar words and expressions of the future or otherwise regarding the outlook for the Company’s future

business and financial performance and/or the performance of the banking industry and economy in general. Prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve known

and unknown risks and uncertainties which may cause the actual results, performance or achievements of the Company to be materially different from the future results, performance or achievements expressed or implied by such forward-looking

statements. Forward-looking statements are based on the information known to, and current beliefs and expectations of, the Company’s management and are subject to significant risks and uncertainties. Actual results may differ materially from

those contemplated by such forward-looking statements. Factors that might cause such differences include, but are not limited to: (1) competitive pressures among financial institutions increasing significantly; (2) changes in economic or

political conditions, either nationally or locally, particularly in areas in which the Company conducts operations; (3) interest rate risk; (4) changes in applicable laws, rules, or regulations, including changes to statutes, regulations or

regulatory policies or practices as a result of, or in response to COVID-19; (5) risks related to the Company’s recently completed acquisitions, including that the anticipated benefits from the recently completed acquisitions are not realized

in the time frame anticipated or at all as a result of changes in general economic and market conditions or other unexpected factors or events; (6) changes in management’s plans for the future; (7) credit risk associated with our lending

activities; changes in interest rates, loan demand, real estate values, or competition; (8) changes in accounting principles, policies, or guidelines; (9) adverse results from current or future litigation, regulatory examinations or other legal

and/or regulatory actions, including as a result of the Company’s participation in and execution of government programs related to the COVID-19 pandemic; (10) the impact of the COVID-19 pandemic on the Company’s assets, business, cash flows,

financial condition, liquidity, prospects and results of operations; (11) potential increases in the provision for loan losses resulting from the COVID-19 pandemic; and (12) other general competitive, economic, political, and market factors,

including those affecting our business, operations, pricing, products, or services. These and other factors that could cause results to differ materially from those described in the forward-looking statements, as well as a discussion of the

risks and uncertainties that may affect our business, can be found in our Annual Report on Form 10-K and in other filings we make with the Securities and Exchange Commission, which are available on the SEC’s website, http://www.sec.gov. Undue

reliance should not be placed on forward-looking statements. The Company disclaims any obligation to update such factors or to publicly announce the results of any revisions to any of the forward-looking statements included herein to reflect

future events or developments. Statements about the potential effects of the COVID-19 pandemic on the Company’s assets, business, liquidity, financial condition, prospects, and results of operations may constitute forward-looking statements and

are subject to the risks that the actual effects may differ, possibly materially, from what is reflected in these forward-looking statements due to factors and future developments that are uncertain, unpredictable and in many cases beyond our

control, including the depth, dispersion and duration of the pandemic, actions taken by governmental authorities in response to the pandemic, and the direct and indirect impact of the pandemic on customers, employees, third parties and the

Company.

3 Response to Covid-19 Enacted the Pandemic section of our internal Business Continuity Plan Informed

employees of CDC and internal recommendations, procedures and protocols concerning: social distancing, business travel, sanitation and disinfection; weekly system wide calls to re-enforce procedures and keep team members up to date on current

developments Distributed inventory of masks, sanitizers and disinfectants system-wide Increased the frequency of facility janitorial services Originally restricted access to lobbies to “by appointment only” and maintained full drive thru

service – lobbies resumed normal hours and access early October THE FIRST ACTED QUICKLY TO ENSURE SAFETY OF EMPLOYEES AND CLIENTS

4 Response to Covid-19 Continued Moved as many as practical employees to work by remote

access Rotated access as much as practical for employees who’s function could not be performed remotely Provided lunch daily to on site personnel to limit their off premise exposure during the day; rotate purchasing our meals to our restaurant

clients in each market to help support them during this emergency Improved and upgraded electronic delivery and execution of documents system wide to limit in person exposure but maintain business volume

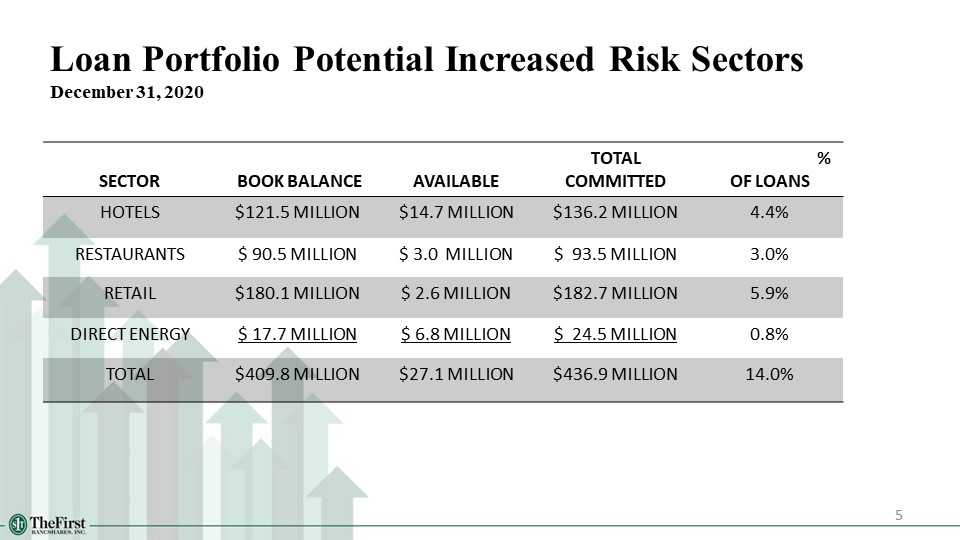

5 Loan Portfolio Potential Increased Risk SectorsDecember 31, 2020 SECTOR BOOK BALANCE AVAILABLE

TOTAL COMMITTED % OF LOANS HOTELS $121.5 MILLION $14.7 MILLION $136.2 MILLION 4.4% RESTAURANTS $ 90.5 MILLION $ 3.0 MILLION $ 93.5 MILLION 3.0% RETAIL $180.1 MILLION $ 2.6 MILLION $182.7 MILLION 5.9% DIRECT ENERGY $ 17.7

MILLION $ 6.8 MILLION $ 24.5 MILLION 0.8% TOTAL $409.8 MILLION $27.1 MILLION $436.9 MILLION 14.0%

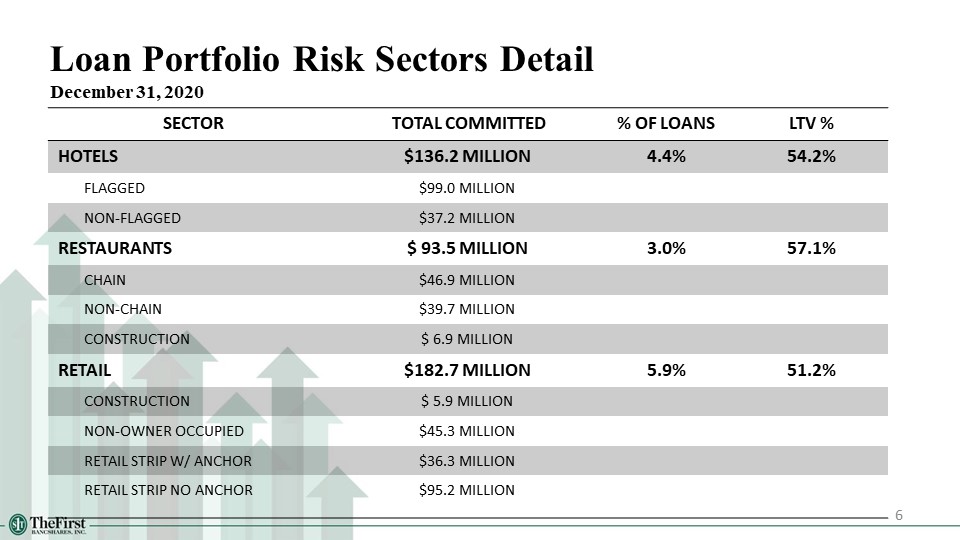

6 Loan Portfolio Risk Sectors DetailDecember 31, 2020 SECTOR TOTAL COMMITTED % OF LOANS LTV

% HOTELS $136.2 MILLION 4.4% 54.2% FLAGGED $99.0 MILLION NON-FLAGGED $37.2 MILLION RESTAURANTS $ 93.5 MILLION 3.0% 57.1% CHAIN $46.9 MILLION NON-CHAIN $39.7 MILLION CONSTRUCTION $ 6.9

MILLION RETAIL $182.7 MILLION 5.9% 51.2% CONSTRUCTION $ 5.9 MILLION NON-OWNER OCCUPIED $45.3 MILLION RETAIL STRIP W/ ANCHOR $36.3 MILLION RETAIL STRIP NO ANCHOR $95.2 MILLION

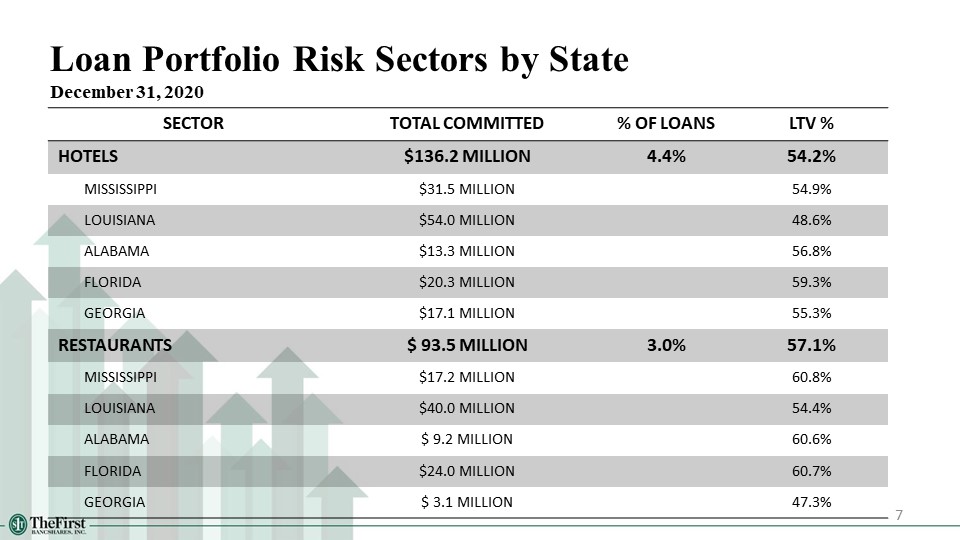

7 Loan Portfolio Risk Sectors by StateDecember 31, 2020 SECTOR TOTAL COMMITTED % OF LOANS LTV

% HOTELS $136.2 MILLION 4.4% 54.2% MISSISSIPPI $31.5 MILLION 54.9% LOUISIANA $54.0 MILLION 48.6% ALABAMA $13.3 MILLION 56.8% FLORIDA $20.3 MILLION 59.3% GEORGIA $17.1 MILLION 55.3% RESTAURANTS $ 93.5

MILLION 3.0% 57.1% MISSISSIPPI $17.2 MILLION 60.8% LOUISIANA $40.0 MILLION 54.4% ALABAMA $ 9.2 MILLION 60.6% FLORIDA $24.0 MILLION 60.7% GEORGIA $ 3.1 MILLION 47.3%

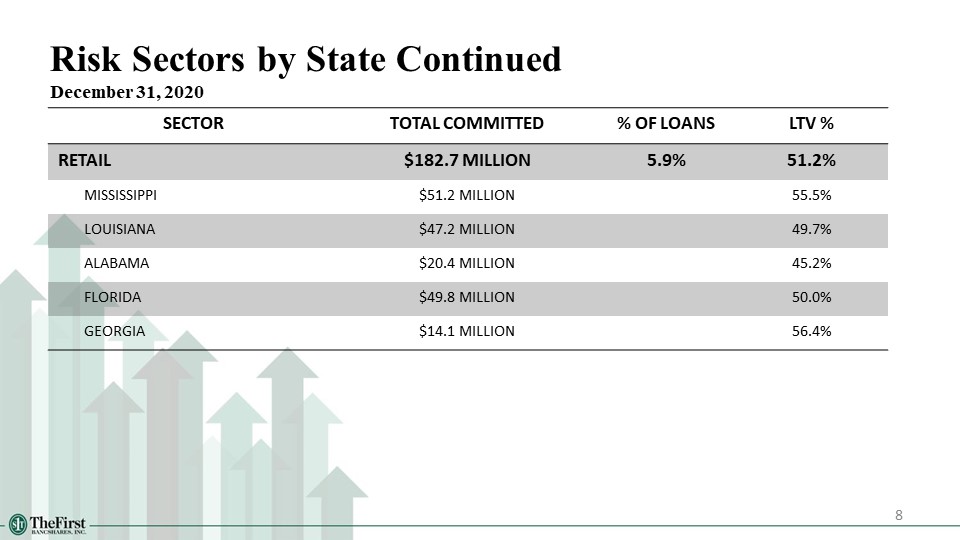

8 Risk Sectors by State ContinuedDecember 31, 2020 SECTOR TOTAL COMMITTED % OF LOANS LTV

% RETAIL $182.7 MILLION 5.9% 51.2% MISSISSIPPI $51.2 MILLION 55.5% LOUISIANA $47.2 MILLION 49.7% ALABAMA $20.4 MILLION 45.2% FLORIDA $49.8 MILLION 50.0% GEORGIA $14.1 MILLION 56.4%

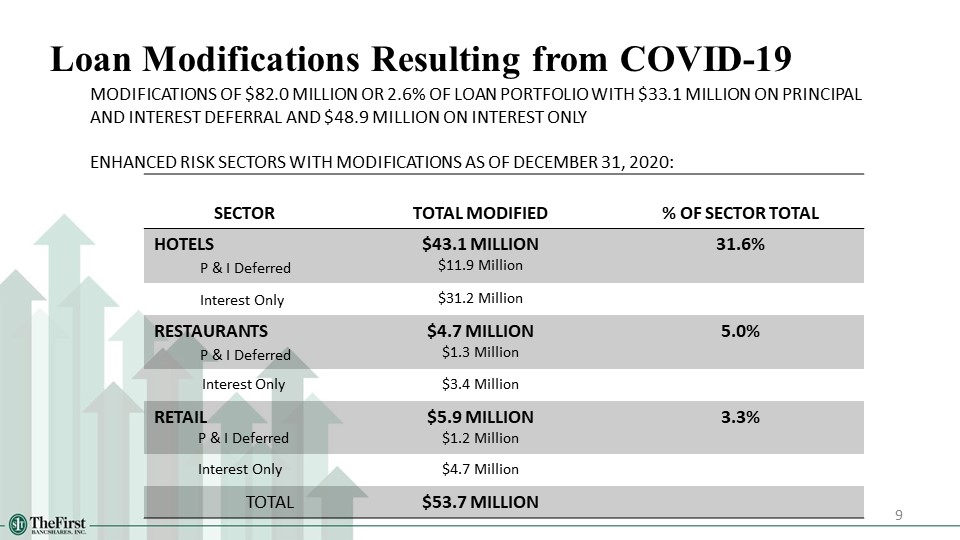

Modifications of $82.0 million or 2.6% of loan portfolio with $33.1 million on principal and interest

deferral and $48.9 million on interest onlyEnhanced Risk Sectors with modifications as Of December 31, 2020: 9 Loan Modifications Resulting from COVID-19 SECTOR TOTAL MODIFIED % OF SECTOR TOTAL HOTELS P & I Deferred $43.1

MILLION$11.9 Million 31.6% Interest Only $31.2 Million RESTAURANTS P & I Deferred $4.7 MILLION$1.3 Million 5.0% Interest Only $3.4 Million RETAIL P & I Deferred $5.9 MILLION$1.2 Million 3.3% Interest Only $4.7

Million TOTAL $53.7 MILLION

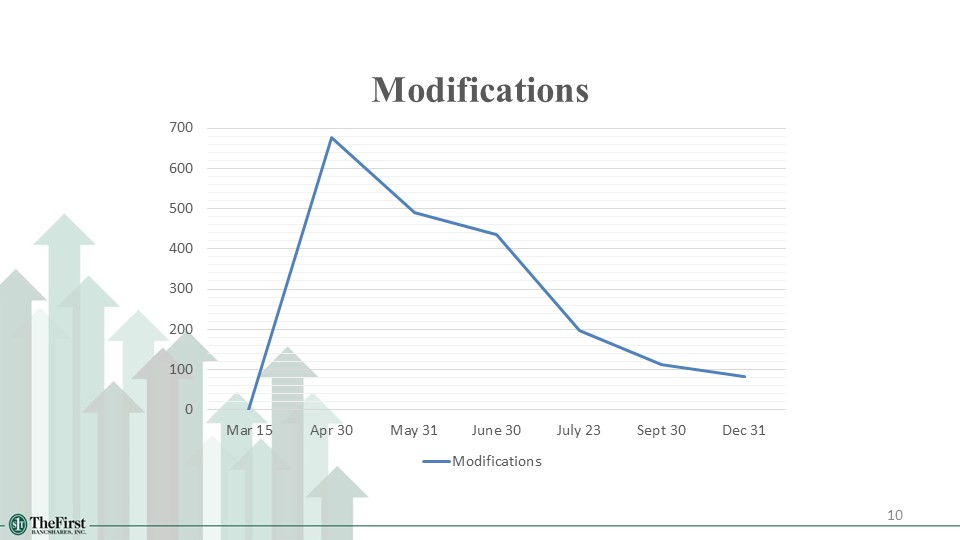

10

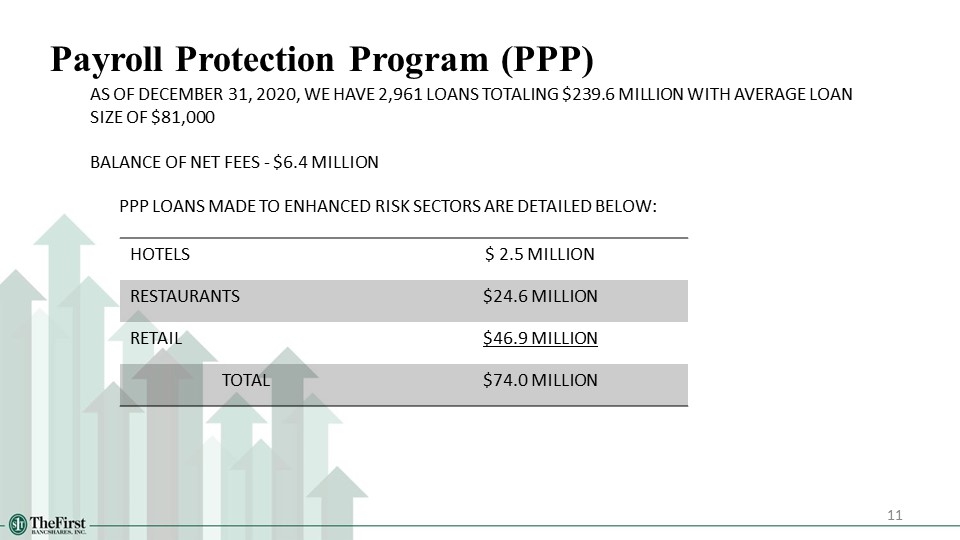

As of December 31, 2020, we have 2,961 loans totaling $239.6 million with average loan size of $81,000

BALANCE OF Net Fees - $6.4 million ppp loans made to Enhanced Risk sectors are detailed below: 11 Payroll Protection Program (PPP) HOTELS $ 2.5 MILLION RESTAURANTS $24.6 MILLION RETAIL $46.9 MILLION TOTAL $74.0 MILLION

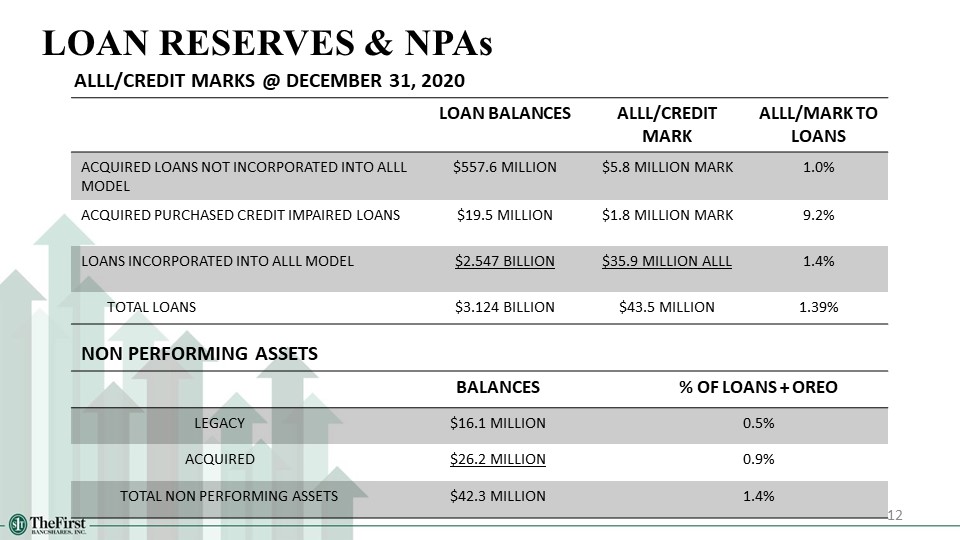

12 LOAN RESERVES & NPAs LOAN BALANCES ALLL/CREDIT MARK ALLL/MARK TO LOANS ACQUIRED LOANS NOT

INCORPORATED INTO ALLL MODEL $557.6 MILLION $5.8 MILLION MARK 1.0% ACQUIRED PURCHASED CREDIT IMPAIRED LOANS $19.5 MILLION $1.8 MILLION MARK 9.2% LOANS INCORPORATED INTO ALLL MODEL $2.547 BILLION $35.9 MILLION ALLL 1.4% TOTAL

LOANS $3.124 BILLION $43.5 MILLION 1.39% ALLL/CREDIT MARKS @ DECEMBER 31, 2020 NON PERFORMING ASSETS BALANCES % OF LOANS + OREO LEGACY $16.1 MILLION 0.5% ACQUIRED $26.2 MILLION 0.9% TOTAL NON PERFORMING ASSETS $42.3

MILLION 1.4%

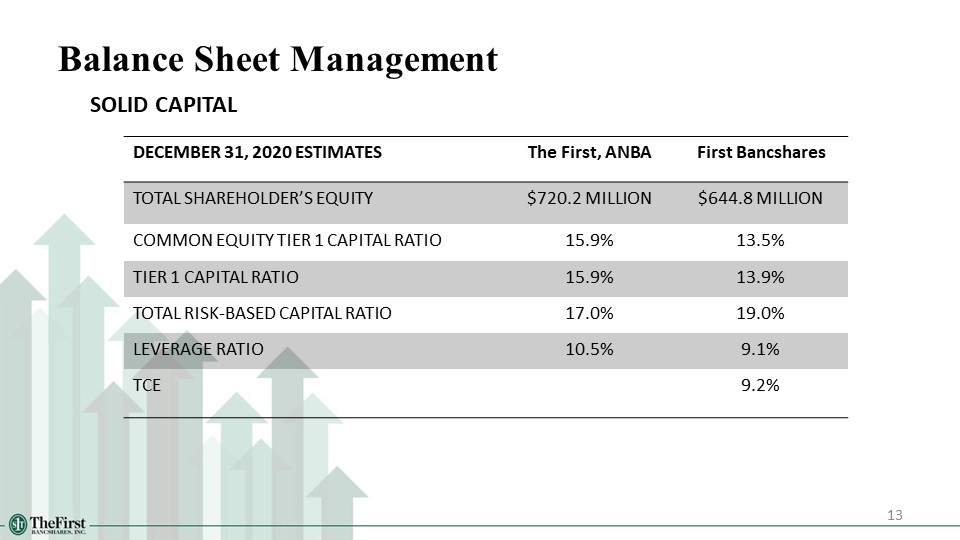

solid capital 13 Balance Sheet Management DECEMBER 31, 2020 ESTIMATES The First, ANBA First

Bancshares TOTAL SHAREHOLDER’S EQUITY $720.2 MILLION $644.8 MILLION COMMON EQUITY TIER 1 CAPITAL RATIO 15.9% 13.5% TIER 1 CAPITAL RATIO 15.9% 13.9% TOTAL RISK-BASED CAPITAL RATIO 17.0% 19.0% LEVERAGE

RATIO 10.5% 9.1% TCE 9.2%

14 NASDAQ: FBMS