Attached files

| file | filename |

|---|---|

| EX-23.2 - EX-23.2 - DUCK CREEK TECHNOLOGIES, INC. | d108158dex232.htm |

| EX-5.1 - EX-5.1 - DUCK CREEK TECHNOLOGIES, INC. | d108158dex51.htm |

| EX-1.1 - EX-1.1 - DUCK CREEK TECHNOLOGIES, INC. | d108158dex11.htm |

Table of Contents

As filed with the Securities and Exchange Commission on January 26, 2021.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Duck Creek Technologies, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware (State or Other Jurisdiction of Incorporation or Organization) |

7372 (Primary Standard Industrial Classification Code Number) |

84-3723837 (I.R.S. Employer | ||

| Identification Number) | ||||

| 22 Boston Wharf Road, Floor 10 Boston, MA 02210 (888) 724-3509 |

||||

| (Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices) | ||||

Michael Jackowski

Chief Executive Officer

Duck Creek Technologies, Inc.

22 Boston Wharf Road, Floor 10

Boston, MA 02210

(888) 724-3509

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Michael J. Zeidel, Esq. Skadden, Arps, Slate, Meagher & Flom LLP One Manhattan West New York, New York 10001 (212) 735-3000 |

Arthur D. Robinson, Esq. Xiaohui (Hui) Lin, Esq. Simpson Thacher & Bartlett LLP 425 Lexington Avenue New York, New York 10017 (212) 455-2000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 under the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| (Do not check if a smaller reporting company) | Emerging Growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☒

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Shares to be Registered(1) |

Proposed Maximum Offering Price Per Share(2) |

Proposed Maximum Aggregate Offering Price(2) |

Amount Of Registration Fee | ||||

| Common stock, $0.01 par value per share |

9,200,000 | $49.96 | $459,632,000 | $50,145.85 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes shares which may be sold pursuant to the underwriters’ option to purchase additional shares. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(a) under the Securities Act of 1933. |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933, AS AMENDED, OR UNTIL THIS REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE SECURITIES AND EXCHANGE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated January 26, 2021

Preliminary prospectus

8,000,000 shares

Duck Creek Technologies, Inc.

Common stock

We are offering 80,000 shares of our common stock and the selling stockholders named in this prospectus are offering 7,920,000 shares of our common stock. We will not receive any proceeds from the sale of the shares being sold by the selling stockholders.

Our common stock is listed on the Nasdaq Global Select Stock Market (“Nasdaq”) under the symbol “DCT.” On January 22, 2021, the closing sales price of our common stock as reported on the Nasdaq was $49.96 per share.

Certain of the selling stockholders have granted the underwriters a 30-day option to purchase up to an additional 1,200,000 shares of common stock. We will not receive any proceeds from the sale of our common stock by the selling stockholders pursuant to any exercise of the underwriters’ option to purchase additional shares.

We are an “emerging growth company” as that term is defined in the Jumpstart Our Business Startups Act of 2012 and, as such, are subject to certain reduced public company reporting requirements. See “Prospectus summary—Implications of being an emerging growth company.”

Investing in our common stock involves risks. See “Risk factors” beginning on page 20 of this prospectus and the risk factors in the documents incorporated by reference in this prospectus to read about certain factors you should consider before buying our common stock.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Per share | Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||

| Proceeds, before expenses, to Duck Creek Technologies, Inc. |

$ | $ | ||||||

| Proceeds, before expenses, to the selling stockholders |

$ | $ | ||||||

|

|

|

|

|

|

||||

| (1) | See “Underwriting” for a description of the compensation payable to the underwriters. |

The underwriters expect to deliver the shares of common stock against payment on or about , 2021.

| Goldman Sachs & Co. LLC | J.P. Morgan | |

| BofA Securities | ||

Prospectus dated , 2021

Table of Contents

| 1 | ||||

| 20 | ||||

| 30 | ||||

| 32 | ||||

| 33 | ||||

| 34 | ||||

| 39 | ||||

| 42 | ||||

| 48 | ||||

| 50 | ||||

| 53 | ||||

| 62 | ||||

| 62 | ||||

| 62 | ||||

| 62 | ||||

Through and including , 2021 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

Neither we nor the selling stockholders have authorized anyone to provide you with any information other than that contained in this prospectus or incorporated by reference, any amendment or supplement to this prospectus and any free writing prospectus we prepare or authorize. We, the selling stockholders and the underwriters have not authorized anyone to provide you with different or additional information or to make any representations other than those contained or incorporated by reference in this prospectus or in any free writing prospectuses we have authorized for use with respect to this offering. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you or any representation that others may make to you. We are not making an offer of these securities in any state, country or other jurisdiction where the offer is not permitted. You should not assume that the information in this prospectus, any prospectus supplement or in any related free writing prospectus we prepare or authorize is accurate as of any date other than the respective dates thereof or on the date or dates which are specified in such documents. Any information in documents that we have incorporated by reference is only accurate as of the date of such document incorporated by reference, regardless of its time of delivery or the time of any sales of our common stock. Any statement made in this prospectus or in a document incorporated by reference in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or in any other subsequently filed document that is also incorporated by reference in this prospectus modifies or supersedes that statement. Our business, financial condition, results of operations or cash flows may have changed since the date of the applicable document or the dates specified in such document.

Table of Contents

This summary highlights information contained elsewhere in this prospectus or incorporated by reference in this prospectus from our filings with the SEC listed under “Incorporation by reference” and does not contain all the information you should consider before making an investment decision. You should carefully read the entire prospectus and information incorporated by reference in this prospectus, including any free writing prospectus prepared by us or on our behalf, including the sections entitled “Risk Factors,” “Special note regarding forward-looking statements” and “—Summary consolidated financial information” included in this prospectus and sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the audited consolidated financial statements and related notes thereto included in our Annual Report on Form 10-K for the fiscal year ended August 31, 2020, filed with the SEC on November 3, 2020 (our “Annual Report”) and our Quarterly Report on Form 10-Q for the three months ended November 30, 2020, filed with the SEC on January 13, 2021 (our “Quarterly Report”), each of which is incorporated by reference in this prospectus, before making an investment decision.

Unless otherwise indicated or the context otherwise requires, all references in this prospectus to “we,” “us,” “our,” the “Company,” “Duck Creek” and similar terms refer to Duck Creek Technologies, Inc. and its consolidated subsidiaries. See “—About this prospectus—Basis of presentation” for additional terms and the basis for certain information used herein. Unless otherwise noted, any reference to a year preceded by the word “fiscal” refers to the fiscal year ended August 31 of that year.

Our Mission

We empower property and casualty insurance carriers to transform their information technology, business practices, insurance products, and customer experiences, making their organizations stronger and their customers safer and more satisfied. The SaaS solutions we provide are helping to modernize one of the most important industries in the world and, ultimately, revolutionizing insurance for the greater good.

Company Overview

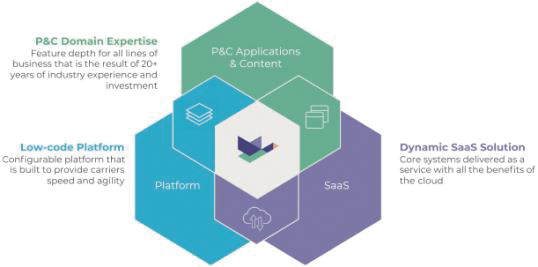

We are the leading Software-as-a-Service (“SaaS”) provider of core systems for the property and casualty (“P&C”) insurance industry. We have achieved our leadership position by combining over twenty years of deep domain expertise with the differentiated SaaS capabilities and low-code configurability of our technology platform. We believe we are the first company to provide carriers with an end-to-end suite of enterprise-scale core system software that is purpose-built as a SaaS solution. Our product portfolio is built on our modern technology foundation, the Duck Creek Platform, and works cohesively to improve the operational efficiency of carriers’ core processes (policy administration, claims management and billing) as well as other critical functions. The Duck Creek Platform enables our customers to be agile and rapidly capitalize on market opportunities, while reducing their total cost of technology ownership.

The core business functions of carriers are complex and data intensive, requiring large ongoing investments in domain specific technology. Heightened end-user expectations, increased competition, and new and evolving risks pose new challenges for carriers, creating the need for software that fosters agility, innovation and speed to market. However, a large portion of the P&C insurance market continues to rely on legacy technology systems that are costly and inefficient to maintain, difficult to upgrade, and lacking in functional flexibility. In recent years, some carriers have turned to newer alternatives to legacy systems. These systems have been designed for on-premise environments and lack the inherent benefits of purpose-built SaaS solutions,

1

Table of Contents

perpetuating the limitations, inflexibility and cost of legacy systems. By contrast, our SaaS solutions, offered through Duck Creek OnDemand, accelerate carriers’ agility and speed to market by enabling rapid, low-code product development, and protecting carriers’ unique content configurations and integrations while providing upgrades and updates via continuous delivery. We have developed a substantial SaaS customer base and believe that we have established a meaningful first-mover advantage by demonstrating the superiority of SaaS solutions for core systems in the P&C insurance industry. We began offering SaaS solutions for core systems in the P&C insurance industry in 2013 and signed our first customer in 2014.

Our deep understanding of the P&C insurance industry has enabled us to develop a single, unified suite of insurance software products that is tailored to address the key challenges faced by carriers. Our solutions promote carriers’ nimbleness by enabling rapid integration and streamlining the ability to capture, access and utilize data more effectively. The Duck Creek Suite includes several products that support the P&C insurance process lifecycle, such as:

| • | Duck Creek Policy: enables carriers to develop and launch new insurance products and manage all aspects of policy administration, from product definition to quoting, binding and servicing |

| • | Duck Creek Billing: supports fundamental payment and invoicing capabilities (such as billing and collections, commission processing, disbursement management and general ledger capabilities) for all insurance lines and bill types |

| • | Duck Creek Claims: supports the entire claims lifecycle from first notice of loss through investigation, payments, negotiations, reporting and closure |

In addition, we offer other innovative solutions, such as Duck Creek Rating, Duck Creek Insights, Duck Creek Digital Engagement, Duck Creek Distribution Management, Duck Creek Reinsurance Management, Duck Creek Anywhere Managed Integrations and Duck Creek Industry Content, which provide additional features and functionalities that further help our customers meet the increasing and evolving demands of the P&C industry. Our customers purchase and deploy Duck Creek OnDemand, our SaaS solution, either individually or as a suite. Historically, we have also sold our products through perpetual and term license arrangements, substantially all of which include maintenance and support arrangements. We offer professional services, primarily related to implementation of our products, in connection with both our SaaS solutions and perpetual and term license arrangements. Substantially all of our new bookings come from the sale of SaaS subscriptions of Duck Creek OnDemand. For the fiscal years ended August 31, 2018, 2019 and 2020, SaaS ACV bookings represented 71%, 86% and 96% of our total ACV bookings, respectively. For the three months ended November 30, 2019 and 2020, SaaS ACV bookings represented 98% and 95% of our total ACV bookings, respectively.

Our customer base is comprised of a range of carriers, including some of the largest companies in the P&C insurance industry, such as Progressive, Liberty Mutual, AIG, The Hartford, Berkshire Hathaway Specialty Insurance, GEICO and Munich Re Specialty Insurance, as well as regional carriers, such as UPC, Coverys, Avant Mutual, IAT Insurance Group and Mutual Benefit Group. We have over 150 insurance customers worldwide, including the top five North American carriers.

We have a broad partner ecosystem that includes third-party solution partners who provide complementary capabilities as well as system integrators (“SIs”) who provide implementation and other related services to our customers. These partnerships help us grow our business more efficiently by enhancing our sales force through co-marketing efforts and giving us scale to service our growing customer base. We maintain longstanding partnerships with leading SIs, such as Accenture, Capgemini and Cognizant, as well as leading technology

2

Table of Contents

companies, such as Microsoft and FICO, and Insurtech start-ups, such as Arity, Friss, SPLICE Software, and Cape Analytics.

Our subscription revenues have grown significantly in recent years, both in absolute terms and as a percentage of our business. For the fiscal year ended August 31, 2020, we generated subscription revenues of $84.0 million, an increase of 50% compared to subscription revenues of $55.9 million for the fiscal year ended August 31, 2019. For the three months ended November 30, 2020, we generated subscription revenues of $27.9 million, an increase of 59% compared to subscription revenues of $17.5 million for the three months ended November 30, 2019. We generated total revenues of $211.7 million for the fiscal year ended August 31, 2020, an increase of 24% compared to total revenues of $171.3 million for the fiscal year ended August 31, 2019. In addition, we generated total revenues of $58.9 million for the three months ended November 30, 2020, an increase of 26% compared to total revenues of $46.6 million for the three months ended November 30, 2019. We have made significant investments in our software platform and sales and marketing organization, and incurred net losses of $29.9 million and $16.9 million for the fiscal years ended August 31, 2020 and 2019, respectively. We incurred net losses of $4.7 million and $4.0 million for the three months ended November 30, 2020 and 2019, respectively. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report and Quarterly Report, incorporated by reference in this prospectus, for more information.

P&C insurance industry overview

The P&C insurance industry is large, complex and highly regulated. In 2019, the industry serviced approximately $2.4 trillion of DWP spanning thousands of carriers globally. In addition to being one of the largest global industries, we believe it is also one of the most resilient. For a majority of businesses and consumers, insurance is a necessity rather than an amenity. As a result, overall spend on insurance products has continued to grow steadily over the long-term, even across periods of economic volatility.

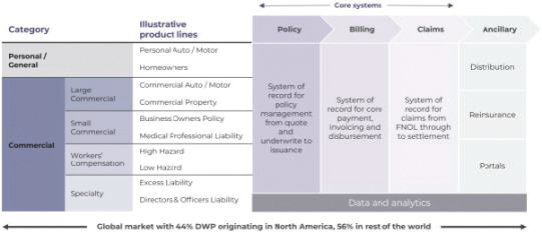

Core systems, including policy, billing and claims, power carriers’ critical operations. Core systems house the insurance product structure, such as rates, rules and forms, and generate data that allows the actuarial and underwriting staff of carriers to continuously modify and improve product offerings and provide more personalized customer service. They also manage the claims lifecycle, from first notice of loss to settlement. In addition, core systems integrate with agent and broker portals, operational data stores and data warehouses as well as business intelligence and analytics systems.

3

Table of Contents

It is not uncommon for a single carrier to use multiple vendors (or internally developed applications) to provide core systems for different insurance lines or geographies, or for discrete core system processes (e.g., policy, billing, claims) within a single insurance line and geography. A carrier may use our software for certain parts of its business, and deploy solutions from different vendors for other parts of its business. As a result, we have a market opportunity to both achieve greater penetration within our existing customer base as well as increase our customer base by servicing new customers who are not currently using our products. The following diagram provides a framework for understanding the multifaceted processes of carriers:

Our market opportunity

Carriers invest substantial time and resources to develop and maintain their information technology (“IT”) operations. We estimate that our total addressable market, representing the portion of this spending that is focused specifically on core system software, is approximately $5.5 billion in the United States and $15 billion globally. To estimate our total addressable market, we categorized the P&C insurance market into tiers based on DWP per carrier as reported by S&P Global, A.M. Best and Swiss Re, both within the United States and globally. We then estimated average price per DWP for our core systems solutions, accounting for tiered price discounts at different tiers, and multiplied the price per DWP by the total amount of DWP at each tier available both in the United States and globally.

Challenges facing the P&C insurance industry and the limitations of legacy systems

We believe reliance on legacy systems and other systems designed for on-premise environments limit carriers’ ability to respond to many of the significant challenges facing their industry, including:

| • | Heightened end-user expectations |

| • | Increased competition in the marketplace |

| • | New and evolving risks |

| • | Increased size of losses in assets and the number of catastrophic events |

| • | The rise of the Internet of Things, or IoT |

| • | Emerging capabilities and advancing technologies |

4

Table of Contents

These challenges are placing increased pressure on insurance carriers to improve consumer experience, business agility and speed to market. However, many carriers rely on legacy systems or alternatives designed for on-premise environments that are difficult to change, update or integrate without significant incremental custom-code development. Carriers relying upon these systems are generally unable to manage and analyze data at the pace required to effectively guide operational and risk decisions. These systems are difficult to update without significant IT spend and efforts, resulting in higher operating costs and slower speed to market for carriers.

We believe that carriers will increasingly look to adopt SaaS solutions, like Duck Creek OnDemand, that are designed to enhance their organizational agility, product innovation and consumer experience, allowing them to react quickly to evolving consumer preferences and efficiently capture market opportunity, while reducing their total cost of ownership. According to an October 2020 Novarica survey, nearly two-thirds of insurance carriers plan to expand their migration of applications to the cloud in 2021.

The Duck Creek approach

Our solutions provide us with a sustainable competitive advantage by helping our customers overcome the limitations of existing systems to meet the challenges of the current P&C insurance industry.

| • | Deep domain expertise. With more than twenty years of operating experience in the P&C insurance industry, we have developed deep industry-specific domain expertise. This enables us to offer a broad range of integrated solutions embedded with smart, intuitive pre-built functionality, designed to meet the precise use-case requirements of carriers. |

| • | Comprehensive, future-ready offerings. Our comprehensive suite of enterprise-scale core system software is comprised of leading applications that are designed to meet the full range of our customers’ needs. We deliver upgrades that can be applied across our suite, improving common functionality across our customers’ systems. We continuously update industry content, allowing our customers to efficiently keep pace with market and regulatory changes. |

| • | Scalability for all carriers. Our solutions are designed to meet the most complex and sophisticated technology needs of the largest carriers, but can also be scaled to cost-effectively serve the needs of smaller carriers. |

5

Table of Contents

| • | Low-code configurability. Using low-code tools designed for ease, speed and accuracy, both technical and non-technical users can tailor our solutions to meet their business needs. These intuitive tools allow our customers to create new products and make changes to existing products and related workflows without custom coding, accelerating their speed to market and improving productivity. |

| • | Differentiated SaaS architecture. Our technical architecture is designed to keep our customers’ content configuration and business rules separated from our primary Duck Creek application and platform code. This framework allows continuous delivery of updates and upgrades to our software without disrupting a carrier’s specific business rules and definitions. By contrast, existing legacy systems and alternatives to legacy systems designed for on-premise environments typically require costly and disruptive system-wide re-coding and testing projects with each upgrade cycle. |

| • | Open architecture. Our Duck Creek Anywhere integration strategy provides fast, easy access to the third-party data and services that customers need, all designed to enable our customers to efficiently leverage the services that best match their strategy. |

| • | Unique insights. We enable carriers to use data as a strategic asset. Using Duck Creek Insights, carriers are able to efficiently gather a consolidated picture of their business across internal and third-party data sources, deliver critical information to execute business decisions and employ new methods of automated decision making. |

| • | Mission-focused organization. We are driven by our mission to empower carriers to extend and improve the coverage they provide to their customers and to enhance the end-user experience. Our strong culture and organizational ethos, coupled with a management team that has decades of leadership in the insurance software industry and is actively involved in the development of our products, drives our company to continue to innovate and deliver high-quality solutions to our customers. |

Our growth strategy

We intend to extend our position as the leading provider of SaaS solutions for the core systems of the P&C insurance industry. The key components of our strategy are:

| • | Growing our customer base. We believe there is substantial opportunity to continue to grow our customer base across the P&C insurance industry. We are investing in our sales and marketing force, specifically targeting key accounts and leveraging current customers as references. |

| • | Deepening relationships with our existing customers. We have deep engagement with our customers; on average, each of our customers uses 2.8 of our products, with each SaaS customer using 5.2 of our products. In addition to pursuing new customers, we intend to leverage our track record of success with our existing customers by selling additional products and targeting new opportunities within these carriers. |

| • | Expanding our partner ecosystem. We have a large and expanding network of partnerships that is comprised of third-party solution partners who provide complementary capabilities as well as third-party SIs who provide implementation and other related services to our customers. We intend to extend our network of partners who are able to drive meaningful interest in, and adoption of, our products. |

| • | Continuing to innovate and add new solutions. We have made significant investments in research and development and intend to continue to do so. We are focused on enhancing the functionality and breadth of our current solutions as well as developing and launching new products and tools to address the evolving needs of the P&C insurance industry. |

6

Table of Contents

| • | Broadening our geographical presence. We believe there is significant need for our solutions on a global basis and, accordingly, opportunity for us to grow our business through further international expansion. We are broadening our global footprint and intend to establish a presence in additional international markets. |

| • | Transitioning our term and perpetual license customers to SaaS. Some of our customers use versions of our solutions that were purchased via perpetual or term licenses and typically are installed on-premise. We will seek to transition these customers to our current SaaS solutions, which we believe will generate increased long-term economic value. |

| • | Pursuing acquisitions. We have acquired and successfully integrated several businesses complementary to our own to enhance our software and technology capabilities. We intend to continue to pursue targeted acquisitions that further complement our product portfolio or provide us access to new markets. |

Recent Developments

On January 15, 2021, our board of directors appointed Julie Dodd as an independent member of our board of directors. Ms. Dodd will serve as a member of the class of directors whose terms expire at the 2022 annual meeting of stockholders. Ms. Dodd has not yet been appointed to any of the board of directors’ committees. The board of directors will consider the committees to which Ms. Dodd will be appointed at subsequent board meetings.

COVID-19 update

In December 2019, a novel strain of coronavirus (“COVID-19”) was reported to have surfaced in Wuhan, China. In January 2020, COVID-19 spread to other countries, including the United States and others in which we operate, and efforts to contain the spread of COVID-19 intensified. In March 2020, the World Health Organization declared COVID-19 a global pandemic. The outbreak and certain preventative or protective actions that governments, businesses and individuals have taken in respect of COVID-19 have resulted in extended global business disruptions. The severity and duration of these business disruptions remain largely fluid and ultimately will depend on many factors, including the speed and effectiveness of containment efforts throughout the world.

In March 2020, we implemented various measures to ensure the safety of our employees, customers and suppliers. Over a two day period, we shifted 100% of our employee base to work from home, which continues to be in effect. Additionally, our operational model has enabled us to minimize the impact to sales productivity or delivery of our solutions to customers to date. Since shifting to working remotely, we have successfully completed several product live launches and initiated new projects applying a fully virtual model.

While the full impact of COVID-19 remains unknown and COVID-19 has impacted certain companies’ decisions regarding technology spending, we have not experienced a material disruption on our bookings or sales to date. For the fiscal year ended August 31, 2020, we generated growth of 24% in total revenue, 50% in subscription revenue and 85% in SaaS ARR (as defined below) as compared to the fiscal year ended August 31, 2019. For the three months ended November 30, 2020, we generated growth of 27% in total revenue, 59% in subscription revenue and 72% in SaaS ARR as compared to the three months ended November 30, 2019. Our ability to grow revenue within our existing customer accounts has remained strong, with a SaaS Net Dollar Retention Rate (as defined below) of 118% for the three months ended November 30, 2020. Additionally, we generated net cash provided by operating activities of $25.7 million and Free Cash Flow (as defined below) of $18.9 million for the fiscal year ended August 31, 2020, compared to $14.8 million and $6.6 million, respectively, for the fiscal year

7

Table of Contents

ended August 31, 2019. For the three months ended November 30, 2020, we had net cash used in operating activities of $22.2 million and negative Free Cash Flow of $22.9 million, compared to $8.1 million and $10.6 million, respectively, for the three months ended November 30, 2019. However, due to COVID-19 we delayed certain of our planned investments, primarily related to our international expansion initiatives.

As of December 31, 2020, we had $396.6 million of liquidity, including $367.6 million in cash and cash equivalents and $29.0 million of availability under our revolving credit facility.

The magnitude of the effect of COVID-19 on our business will depend, in part, on the length and severity of the restrictions and other limitations on our ability to conduct our business in the ordinary course. The longer the pandemic continues or resurges, the more severe the impacts described above may be on our business. The extent, length and consequences of the pandemic on our business, including our customers’ purchasing decisions and other reactions, are uncertain and impossible to predict, but could be material. Any reopenings followed by subsequent restrictions or closings could also have a material impact on us. See “Risk Factors—Risks Related to Our Business and Industry—Public health outbreaks, epidemics or pandemics, including the global COVID-19 outbreak, could harm our business, results of operations, and financial condition.”

Summary risk factors

Our ability to implement our business strategy is subject to numerous risks, as more fully described under the heading “Risk factors” in this prospectus and the section entitled “Risk Factors” in our Annual Report, which is incorporated by reference in this prospectus. These risks include, among others, that:

| • | the global COVID-19 outbreak and the public health measures undertaken to contain the spread have, and continue to, result in global business disruptions that may adversely affect us, our customers and SI partners, which could ultimately impact our own financial performance; |

| • | we have a history of losses and may not achieve or maintain profitability in the future; |

| • | changes in our product revenue mix and gross margins as we continue to focus on sales of our SaaS solutions will cause fluctuations in our results of operations and cash flows between periods; |

| • | we rely on orders and renewals from a relatively small number of customers for a substantial portion of our revenue and our large customers have substantial negotiating leverage; |

| • | our growth strategy focused on SaaS solutions may prove unsuccessful and if we are unable to develop or sell our existing SaaS solutions into new markets or further penetrate existing markets, our revenue may not grow as expected; |

| • | we may not effectively manage our growth of operations; |

| • | we face intense competition in our market; |

| • | third parties may assert that we are infringing or violating their intellectual property rights; |

| • | U.S. and global market and economic conditions may materially impact our operations; |

| • | we will likely face additional complexity, burdens and volatility in connection with our international sales and operations; |

| • | our sales and implementation are lengthy and variable, which could cause us to expend significant time and resources before generating any income; |

8

Table of Contents

| • | we may experience data breaches, unauthorized access to customer data or other disruptions in connection with our solutions; |

| • | the significant influence that the Apax VIII Fund, a global private equity fund (collectively, with its affiliates, “Apax”) and Accenture plc, a public limited company incorporated in Ireland (collectively, with its affiliates, “Accenture”), have on the composition of our board of directors, our management, business plans and policies, and any conflicts of interest between Apax and Accenture, on the one hand, and our other stockholders, on the other hand; and |

| • | our continued reliance on “controlled company” exemptions under Nasdaq listing standards during the applicable phase-in periods. |

Implications of being an emerging growth company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As an emerging growth company, we may take advantage of certain reduced disclosure and other requirements that are otherwise applicable generally to public companies. These provisions include:

| • | not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”); and |

| • | (i) reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and (ii) exemptions from the requirements of holding a non-binding advisory vote on executive compensation, including golden parachute compensation. |

When we are no longer deemed to be an emerging growth company, we will not be entitled to the exemptions provided in the JOBS Act discussed above. We will remain an emerging growth company until the earliest of: (1) the last day of the fiscal year in which we have more than $1.07 billion in annual revenue; (2) the date we qualify as a “large accelerated filer,” which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of the most recently completed second fiscal quarter; (3) the date on which we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt securities; and (4) the last day of the fiscal year ending after the fifth anniversary of our IPO.

We have availed ourselves in this prospectus of the reduced reporting requirements described above. We expect to continue to avail ourselves of the emerging growth company exemptions described above for so long as we remain an emerging growth company. As a result, the information that we provide to stockholders will be less comprehensive than what you might receive from other public companies.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can use the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the “Securities Act”), for complying with new or revised accounting standards. This permits an emerging growth company to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies.

We have irrevocably elected not to avail ourselves of the exemption that allows emerging growth companies to extend the transition period for complying with new or revised financial accounting standards.

9

Table of Contents

Corporate information

Duck Creek Technologies, Inc. was formed as a Delaware corporation on November 15, 2019. The address of our principal executive offices is currently 22 Boston Wharf Road, Floor 10, Boston, MA, 02210 and our phone number is (888) 724-3509. Our website is currently www.duckcreek.com. The information contained in, or that can be accessed through, our website is not incorporated by reference in, and is not part of, this prospectus.

On August 18, 2020, we completed our initial public offering (“IPO”), of 17,500,000 shares of our common stock at a public offering price of $27.00 per share, including 2,500,000 additional shares of our common stock purchased by the underwriters’ at the public offering price, less the underwriting discount, pursuant to the exercise in full of their option to purchase additional shares of our common stock.

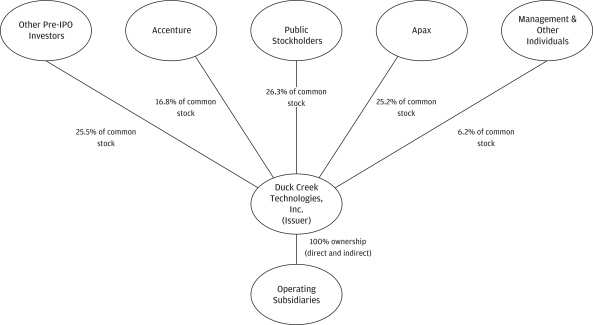

Our structure

The simplified diagram below depicts our organizational structure and ownership immediately following this offering, assuming no exercise by the underwriters of their option to purchase additional shares of common stock.

Immediately following this offering, Apax and Accenture will hold our common stock as follows: 33,010,952 shares of common stock held by Apax (or 32,290,952 shares, if the underwriters exercise their option to purchase additional shares of common stock in full) and 22,007,302 shares of common stock held by Accenture (or 21,527,302 shares, if the underwriters exercise their option to purchase additional shares of common stock in full).

10

Table of Contents

About this prospectus

Basis of presentation

Unless otherwise noted, any reference to a year preceded by the word “fiscal” refers to the fiscal year ended August 31 of that year. For example, references to “fiscal 2020” refer to the fiscal year ended August 31, 2020. Any reference to a year not preceded by “fiscal” refers to a calendar year. Accordingly, our first three fiscal quarters are the three-month periods ended November 30, February 28 and April 30. Certain amounts, percentages and other figures presented in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals, dollars or percentage amounts of changes may not represent the arithmetic summation or calculation of the figures that precede them. When we state that we are the leading SaaS provider of core systems for the P&C insurance industry, we are basing our leadership on our subscription revenue for fiscal 2020.

As used throughout this prospectus, the following terms have the meanings or are calculated as set forth below:

| • | We define “subscription revenue” as the revenue derived from the sale of our SaaS solutions through recurring fee arrangements for the period indicated. |

| • | We define “ACV” as the committed total contract value of new software sales in dollar terms divided by the corresponding minimum number of committed months, with the resultant minimum monthly commitment being multiplied by twelve. |

| • | We define “carriers” as P&C insurance carriers. |

| • | We define “carve-out” as our divestiture from Accenture in August 2016. |

| • | We define “core systems” as the following key functions of carriers: policy administration, claims management and billing. |

| • | We define “customers” as buying entities that contract individually for our products and services. For example, multiple subsidiaries of a single carrier may each constitute a customer if each entity contracts with us separately. By contrast, an carrier that uses our products across multiple subsidiaries under a single enterprise license agreement would constitute a single customer. |

| • | We define “DWP” as the gross dollar value of total premiums paid to carriers by policyholders. |

| • | We define the “pre-IPO Investors” as the direct equity holders of the Operating Partnership (as defined elsewhere in this prospectus) immediately prior to the Reorganization Transactions (as defined elsewhere in this prospectus), including Apax and Accenture. See “Certain relationships and related party transactions—The reorganization transaction.” |

| • | Munich Re Specialty Insurance is a description for the insurance business operations of affiliated companies in the Munich Re Group that share a common directive to offer and deliver specialty property and casualty insurance products and services in North America. |

Market and industry data

Certain market and industry data included in this prospectus has been obtained from third party sources that we believe to be reliable. Market estimates are calculated by using independent industry publications, government publications, and third party forecasts in conjunction with our assumptions about our markets. We

11

Table of Contents

have not independently verified such third party information. While we are not aware of any misstatements regarding any market, industry or similar data presented herein, such data involves risks and uncertainties and is subject to change based on various factors, including those discussed under the headings “Special note regarding forward-looking statements” and “Risk factors” in this prospectus and the section entitled “Risk Factors” in our Annual Report, which is incorporated by reference in this prospectus.

Trademarks, service marks and trade names

We own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our business. We use our Duck Creek trademark and related design marks in this prospectus. This prospectus may also contain trademarks, service marks and trade names of third parties, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or products in this prospectus is not intended to, and does not imply a relationship with, or endorsement or sponsorship by us. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear without the ®, TM or SM symbols, but the omission of such references is not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable owner of these trademarks, service marks and trade names.

Non-GAAP financial measures

We report our financial results in accordance with accounting principles generally accepted in the United States (“GAAP”); however, management believes evaluating the Company’s ongoing operating results may be enhanced if investors have additional non-GAAP financial measures. Specifically, management reviews Adjusted EBITDA, Free Cash Flow, Non-GAAP Gross Margin, Non-GAAP Income from Operations and Non-GAAP Net Income (Loss), each of which is a non-GAAP financial measure, to manage our business, make planning decisions, evaluate our performance and allocate resources and, for the reasons described below, considers them to be effective indicators, for both management and investors, of our financial performance over time.

We believe that Adjusted EBITDA, Free Cash Flow, Non-GAAP Gross Margin, Non-GAAP Income from Operations and Non-GAAP Net Income (Loss) help investors and analysts in comparing our results across reporting periods on a consistent basis by excluding items that we do not believe are indicative of our core operating performance. These non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation from, or as a substitute for, the analysis of other GAAP financial measures, including net income and cash flows from operating activities. For example, with respect to Adjusted EBITDA, some of these limitations include:

| • | it does not reflect our cash expenditures, or future requirements, for capital expenditures or contractual commitments; |

| • | it does not reflect changes in, or cash requirements for, our working capital needs; |

| • | it does not reflect interest expense, or the cash requirements necessary to service interest or principal payments, on our indebtedness; |

| • | it does not reflect our income tax expense or the cash requirements to pay our taxes; and |

| • | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and Adjusted EBITDA does not reflect any cash requirements for such replacements. |

12

Table of Contents

These non-GAAP financial measures are not universally consistent calculations, limiting their usefulness as comparative measures. Other companies may calculate similarly titled financial measures differently than we do or may not calculate them at all. Additionally, these non-GAAP financial measures are not measurements of financial performance or liquidity under GAAP. In order to facilitate a clear understanding of our consolidated historical operating results, you should examine our non-GAAP financial measures in conjunction with our historical combined financial statements and notes thereto included elsewhere in this prospectus.

For definitions of Adjusted EBITDA, Free Cash Flow, Non-GAAP Gross Margin, Non-GAAP Income from Operations and Non-GAAP Net Income (Loss) and a reconciliation of each such non-GAAP financial measure to the most directly comparable GAAP financial measure, see “—Summary consolidated financial information.”

13

Table of Contents

The offering

| Issuer |

Duck Creek Technologies, Inc. |

| Common stock offered by us |

80,000 shares. |

| Selling stockholders |

Apax and Accenture. |

| Common stock offered by the selling stockholders |

7,920,000 shares (or 9,120,000 shares, if the underwriters exercise their option to purchase additional shares of common stock in full). |

| Common stock to be outstanding immediately after this offering |

131,014,672 shares. |

| Option to purchase additional shares of common stock |

The selling stockholders have granted the underwriters an option to purchase up to 1,200,000 additional shares of common stock. The underwriters may exercise this option at any time within 30 days from the date of this prospectus. See “Underwriting.” |

| Use of proceeds |

We estimate that we will receive net proceeds from the sale of shares of our common stock in this offering of approximately $2.8 million, based on an assumed public offering price of $49.96 per share, the last reported sale price of our common stock on Nasdaq on January 22, 2021, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds from this offering to pay certain costs, fees and expenses incurred in effecting the registration of the common stock covered by this prospectus, including, without limitation, all registration and filing fees, Nasdaq listing fees and fees and expenses of our counsel and our independent registered public accountants. We expect to use any remaining net proceeds from this offering for general corporate purposes. We will not receive any of the proceeds from the sale of common stock offered by the selling stockholders, including any common stock sold pursuant to any exercise by the underwriters of their option to purchase additional shares. See “Use of proceeds.” |

| Dividends |

We have never declared or paid, and we do not currently anticipate paying dividends on our common stock. Any declaration and payment of future dividends to holders of our common stock will be at the sole discretion of our board of directors and will depend on many factors, including our financial condition, earnings, capital requirements, level of indebtedness, statutory and contractual restrictions applicable to the payment of dividends and other considerations that our board of directors deems relevant. Because we are a holding company and have no direct operations, we will only be able to pay dividends from our available cash on hand and any funds we receive from our |

14

Table of Contents

| subsidiaries. Certain of our debt agreements limit the ability of certain of our subsidiaries to pay dividends. In addition, Delaware law may impose requirements that may restrict our ability to pay dividends. |

| Stockholders’ agreement |

We have entered into a stockholders’ agreement with Accenture and Apax that provide certain rights to Accenture and Apax. See “Certain relationships and related party transactions—stockholders’ agreement.” |

| Registration rights agreement |

We have entered into a registration rights agreement with Apax, Accenture and certain of our other pre-IPO Investors whereby, upon the expiration of the 180-day lock-up period in connection with our IPO, we may be required to register under the Securities Act the sale of shares of our common stock issued to such pre-IPO Investors. See “Certain relationships and related party transactions—Registration rights agreement.” |

| Nasdaq symbol |

“DCT.” |

| Risk factors |

See “Risk factors” for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

As used in this prospectus, the number of shares of our common stock to be outstanding immediately after this offering is based on 130,934,672 shares of common stock outstanding as of January 22, 2021 and excludes:

| • | 1,795,384 shares of common stock issuable upon exercise of outstanding but unexercised stock options, 1,379,102 of which are vested, issued under our 2020 Omnibus Incentive Plan at an exercise price equal to the fair market value on the date of grant, with a weighted-average exercise price of $27.00 per share; |

| • | 2,524,518 shares of common stock issuable upon vesting of restricted stock awards issued under our 2020 Omnibus Incentive Plan; and |

| • | 10,843,596 shares of common stock reserved for issuance under our 2020 Omnibus Incentive Plan. |

For more information on stock options and restricted stock awards under our 2020 Omnibus Plan, see “Item 11. Executive Compensation—2020 Executive Compensation Program” in our Annual Report. Unless otherwise indicated, the information in this prospectus assumes no exercise by the underwriters of their option to purchase additional shares.

15

Table of Contents

Summary consolidated financial information

The following table presents the selected consolidated financial information of the Company for the periods and as of the dates indicated. The summary consolidated statements of operations and statements of cash flows data for the years ended August 31, 2018, 2019 and 2020 and the summary consolidated balance sheet data as of August 31, 2019 and 2020 have been derived from the audited financial statements of the Company included in the Annual Report and incorporated by reference in this prospectus. The summary consolidated statements of operations data for the three months ended November 30, 2019 and 2020 and the summary consolidated balance sheet data as of November 30, 2020, are derived from the unaudited financial statements of the Company included in the Quarterly Report and incorporated by reference in this prospectus. The unaudited financial statements have been prepared on the same basis as the audited financial statements and reflect, in the opinion of management, all adjustments, consisting only of normal recurring adjustments, necessary for a fair statement of the financial information in those statements. Historical results for any prior period are not necessarily indicative of results to be expected in any future period, and our results for any interim period are not necessarily indicative of results that may be expected for any full fiscal year. You should read the selected financial data presented below in conjunction with the information included under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our historical financial statements and related notes thereto included in our Annual Report and Quarterly Report and incorporated by reference in this prospectus.

| Year Ended August 31, | Three Months Ended November 30, |

|||||||||||||||||||

| ($ in thousands) | 2018 | 2019 | 2020 | 2019 | 2020 | |||||||||||||||

| Consolidated statements of operations data |

||||||||||||||||||||

| Revenue |

||||||||||||||||||||

| Subscription |

$ | 42,451 | $ | 55,909 | $ | 83,999 | $ | 17,537 | $ | 27,909 | ||||||||||

| License |

20,969 | 13,776 | 9,914 | 1,045 | 1,350 | |||||||||||||||

| Maintenance and support |

26,034 | 23,896 | 23,680 | 5,926 | 6,190 | |||||||||||||||

| Professional services |

70,215 | 77,692 | 94,079 | 22,062 | 23,457 | |||||||||||||||

|

|

|

|||||||||||||||||||

| Total revenue |

159,669 | 171,273 | 211,672 | 46,570 | 58,906 | |||||||||||||||

|

|

|

|||||||||||||||||||

| Cost of revenue |

||||||||||||||||||||

| Subscription |

22,272 | 24,199 | 34,902 | 7,277 | 10,084 | |||||||||||||||

| License |

2,121 | 1,970 | 1,853 | 326 | 388 | |||||||||||||||

| Maintenance and support |

2,456 | 2,781 | 3,338 | 878 | 842 | |||||||||||||||

| Professional services |

37,483 | 43,228 | 57,082 | 12,042 | 13,716 | |||||||||||||||

|

|

|

|||||||||||||||||||

| Total cost of revenue |

64,332 | 72,178 | 97,175 | 20,523 | 25,030 | |||||||||||||||

|

|

|

|||||||||||||||||||

| Gross margin |

95,337 | 99,095 | 114,497 | 26,047 | 33,876 | |||||||||||||||

|

|

|

|||||||||||||||||||

| Operating expenses |

||||||||||||||||||||

| Research and development |

36,056 | 35,936 | 44,052 | 9,219 | 11,104 | |||||||||||||||

| Sales and marketing |

34,158 | 40,189 | 50,305 | 10,571 | 12,597 | |||||||||||||||

| General and administrative |

30,670 | 36,493 | 48,662 | 9,985 | 14,418 | |||||||||||||||

| Change in fair value of contingent consideration |

801 | 628 | 133 | 44 | 3 | |||||||||||||||

| Total operating expense |

101,685 | 113,246 | 143,152 | 29,819 | 38,122 | |||||||||||||||

|

|

||||||||||||||||||||

16

Table of Contents

| Year Ended August 31, | Three Months Ended November 30, |

|||||||||||||||||||

| ($ in thousands) | 2018 | 2019 | 2020 | 2019 | 2020 | |||||||||||||||

| Loss from operations |

(6,348 | ) | (14,151 | ) | (28,655 | ) | (3,772 | ) | (4,246 | ) | ||||||||||

| Other (expense) income, net |

(533 | ) | (565 | ) | 641 | 373 | (47 | ) | ||||||||||||

| Interest expense, net |

(567 | ) | (1,030 | ) | (356 | ) | (281 | ) | (43 | ) | ||||||||||

|

|

|

|||||||||||||||||||

| Loss before income taxes |

(7,448 | ) | (15,746 | ) | (28,370 | ) | (3,680 | ) | (4,336 | ) | ||||||||||

| Provision for income taxes |

354 | 1,150 | 1,562 | 334 | 315 | |||||||||||||||

|

|

|

|||||||||||||||||||

| Net loss |

$ | (7,802 | ) | $ | (16,896 | ) | $ | (29,932 | ) | $ | (4,014 | ) | $ | (4,651 | ) | |||||

|

|

|

|||||||||||||||||||

| Consolidated statements of cash flows data |

||||||||||||||||||||

| Net cash provided by operating activities |

$ | 11,833 | $ | 14,833 | $ | 25,725 | $ | (8,141 | ) | $ | (22,172 | ) | ||||||||

| Net cash used in investing activities |

(8,594 | ) | (19,911 | ) | (6,747 | ) | (2,498 | ) | (724 | ) | ||||||||||

| Net cash (used in) provided by financing activities |

(901 | ) | 3,198 | 358,901 | 13,309 | (5,822 | ) | |||||||||||||

|

|

||||||||||||||||||||

| ($ in thousands) | As of August 31, | As of November 30, | ||||||||||||||

| 2018 | 2019 | 2020 | 2020 | |||||||||||||

| Consolidated balance sheets data | ||||||||||||||||

| Cash and cash equivalents |

$ | 13,879 | $ | 11,999 | $ | 389,878 | $ | 361,160 | ||||||||

| Total current assets |

49,100 | 58,514 | 449,334 | 420,702 | ||||||||||||

| Total assets |

449,237 | 467,277 | 861,100 | 827,204 | ||||||||||||

| Total current liabilities |

41,382 | 59,890 | 97,713 | 68,916 | ||||||||||||

| Total liabilities |

47,370 | 78,211 | 127,343 | 95,822 | ||||||||||||

| Total stockholders’ equity/redeemable partners’ interest and partners’ capital |

401,867 | 389,066 | 733,757 | 731,382 | ||||||||||||

|

|

||||||||||||||||

| ($ in thousands) | Year Ended August 31, | Three Months Ended November 30, |

||||||||||||||||||

| 2018 | 2019 | 2020 | 2019 | 2020 | ||||||||||||||||

| Other financial data and key metrics | ||||||||||||||||||||

| Adjusted EBITDA(1) |

$ | 13,659 | $ | 6,829 | $ | 11,704 | $ | 1,439 | $ | 3,630 | ||||||||||

| Free Cash Flow(2) |

3,239 | 6,563 | 18,978 | (10,639 | ) | (22,896 | ) | |||||||||||||

| Non-GAAP Gross Margin(3) |

100,092 | 103,927 | 125,071 | 27,260 | 36,257 | |||||||||||||||

| Non-GAAP Income from Operations(4) |

11,744 | 4,431 | 8,561 | 702 | 2,843 | |||||||||||||||

| Non-GAAP Net Income(5) |

10,290 | 1,686 | 7,284 | 460 | 2,438 | |||||||||||||||

| SaaS Net Dollar Retention Rate(6) |

107% | 114% | 117% | 113% | 118% | |||||||||||||||

| SaaS ARR(7) |

30,138 | 51,650 | 95,646 | 60,389 | 103,860 | |||||||||||||||

|

|

||||||||||||||||||||

| (1) | Adjusted EBITDA is a non-GAAP financial measure and should not be considered an alternative to net loss as a measure of operating performance or as a measure of liquidity. We define Adjusted EBITDA as net loss before interest expense, net; other income (expense), net; provision for income taxes; depreciation of property and equipment; amortization of intangible assets; share-based compensation expense; and the change in fair value of contingent consideration. For additional information regarding non-GAAP financial measures, see “—About this prospectus—Non-GAAP financial measures” elsewhere in this prospectus and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Other Financial Data and Key Metrics” in our Annual Report and Quarterly Report, incorporated by reference in this prospectus, for more information. |

| A reconciliation of Adjusted EBITDA to net loss, the most directly comparable GAAP financial measure, is presented below for the periods indicated. |

17

Table of Contents

| Year Ended August 31, | Three Months Ended November 30, |

|||||||||||||||||||

| ($ in thousands) | 2018 | 2019 | 2020 | 2019 | 2020 | |||||||||||||||

| Net loss |

$ | (7,802 | ) | $ | (16,896 | ) | $ | (29,932 | ) | $ | (4,014 | ) | $ | (4,651 | ) | |||||

| Provision for income taxes |

354 | 1,150 | 1,562 | 334 | 315 | |||||||||||||||

| Other (income) expense, net |

533 | 565 | (641 | ) | (373 | ) | 47 | |||||||||||||

| Interest expense, net |

567 | 1,030 | 356 | 281 | 43 | |||||||||||||||

| Depreciation of property and equipment |

1,915 | 2,398 | 3,143 | 737 | 787 | |||||||||||||||

| Amortization of intangible assets |

15,552 | 15,884 | 15,975 | 3,994 | 3,994 | |||||||||||||||

| Share-based compensation expense |

1,739 | 2,070 | 21,108 | 436 | 3,092 | |||||||||||||||

| Change in fair value of contingent earn out liability |

801 | 628 | 133 | 44 | 3 | |||||||||||||||

|

|

|

|||||||||||||||||||

| Adjusted EBITDA |

$ | 13,659 | $ | 6,829 | $ | 11,704 | $ | 1,439 | $ | 3,630 | ||||||||||

|

|

||||||||||||||||||||

| (2) | Free Cash Flow is a non-GAAP financial measure and should not be considered an alternative to net cash provided by operating activities as a measure of cash generated by operating activities. We define Free Cash Flow as net cash provided by operating activities, less purchases of property and equipment and capitalized internal use software. For additional information regarding non-GAAP financial measures, see “—About this prospectus—Non-GAAP financial measures” elsewhere in this prospectus and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Other Financial Data and Key Metrics” in our Annual Report and Quarterly Report, incorporated by reference in this prospectus, for more information. |

| A reconciliation of Free Cash Flow to net cash provided by operating activities, the most directly comparable GAAP financial measure, is presented below for the periods indicated. |

| Year Ended August 31, | Three Months Ended November 30, |

|||||||||||||||||||

| ($ in thousands) | 2018 | 2019 | 2020 | 2019 | 2020 | |||||||||||||||

| Net cash provided by operating activities |

$ | 11,833 | $ | 14,833 | $ | 25,725 | $ | (8,141 | ) | $ | (22,172 | ) | ||||||||

| Purchases of property and equipment |

(7,138 | ) | (5,314 | ) | (3,854 | ) | (1,636 | ) | (188 | ) | ||||||||||

| Capitalized internal-use software |

(1,456 | ) | (2,956 | ) | (2,893 | ) | (862 | ) | (536 | ) | ||||||||||

|

|

|

|||||||||||||||||||

| Free Cash Flow |

$ | 3,239 | $ | 6,563 | $ | 18,978 | $ | (10,639 | ) | $ | (22,896 | ) | ||||||||

|

|

||||||||||||||||||||

| (3) | Non-GAAP Gross Margin is a non-GAAP financial measure and should not be considered an alternative to gross margin as a measure of operating performance. We define Non-GAAP Gross Margin as GAAP gross margin before the portion of share-based compensation expense; amortization of intangible assets; and amortization of capitalized internal-use software that is included in cost of revenue. For additional information regarding non-GAAP financial measures, see “—About this prospectus—Non-GAAP financial measures” elsewhere in this prospectus and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Other Financial Data and Key Metrics” in our Annual Report and Quarterly Report, incorporated by reference in this prospectus, for more information. |

| A reconciliation of Non-GAAP Gross Margin to gross margin, the most directly comparable GAAP financial measure, is presented below for the periods indicated. |

| Year Ended August 31, | Three Months Ended November 30, |

|||||||||||||||||||

| ($ in thousands) | 2018 | 2019 | 2020 | 2019 | 2020 | |||||||||||||||

| Gross margin |

$ | 95,337 | $ | 99,095 | $ | 114,497 | $ | 26,047 | $ | 33,876 | ||||||||||

| Share-based compensation expense |

233 | 152 | 5,125 | 27 | 697 | |||||||||||||||

| Amortization of intangible assets |

4,522 | 4,680 | 4,746 | 1,186 | 1,186 | |||||||||||||||

| Amortization of capitalized internal-use software |

— | — | 703 | — | 498 | |||||||||||||||

|

|

|

|||||||||||||||||||

| Non-GAAP Gross Margin |

$ | 100,092 | $ | 103,927 | $ | 125,071 | $ | 27,260 | $ | 36,257 | ||||||||||

|

|

||||||||||||||||||||

| (4) | Non-GAAP Income from Operations is a non-GAAP financial measure and should not be considered an alternative to loss from operations as a measure of operating performance. We define Non-GAAP Income from Operations as GAAP loss from operations before share-based compensation expense; amortization of intangible assets; and the change in fair value of contingent consideration. For additional information regarding non-GAAP financial measures, see “—About this prospectus—Non-GAAP financial measures” elsewhere in this prospectus and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Other Financial Data and Key Metrics” in our Annual Report and Quarterly Report, incorporated by reference in this prospectus, for more information. |

| A reconciliation of Non-GAAP Income from Operations to loss from operations, the most directly comparable GAAP financial measure, is presented below for the periods indicated. |

18

Table of Contents

| Year Ended August 31, | Three Months Ended November 30, |

|||||||||||||||||||

| ($ in thousands) | 2018 | 2019 | 2020 | 2019 | 2020 | |||||||||||||||

| Loss from operations |

$ | (6,348 | ) | $ | (14,151 | ) | $ | (28,655 | ) | $ | (3,772 | ) | $ | (4,246 | ) | |||||

| Share-based compensation expense |

1,739 | 2,070 | 21,108 | 436 | 3,092 | |||||||||||||||

| Amortization of intangible assets |

15,552 | 15,884 | 15,975 | 3,994 | 3,994 | |||||||||||||||

| Change in fair value of contingent consideration |

801 | 628 | 133 | 44 | 3 | |||||||||||||||

|

|

|

|||||||||||||||||||

| Non-GAAP Income from Operations |

$ | 11,744 | $ | 4,431 | $ | 8,561 | $ | 702 | $ | 2,843 | ||||||||||

|

|

||||||||||||||||||||

| (5) | Non-GAAP Net Income is a non-GAAP financial measure and should not be considered an alternative to net loss as a measure of operating performance. We define Non-GAAP Net Income as GAAP net loss before share-based compensation expense; amortization of intangible assets; and change in fair value of contingent earnout liability. For additional information regarding non-GAAP financial measures, see “—About this prospectus—Non-GAAP financial measures” elsewhere in this prospectus and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Other Financial Data and Key Metrics” in our Annual Report and Quarterly Report, incorporated by reference in this prospectus, for more information. |

| A reconciliation of Non-GAAP Net Income to net loss, the most directly comparable GAAP financial measure, is presented below for the periods indicated. |

| Year Ended August 31, | Three Months Ended November 30, |

|||||||||||||||||||

| ($ in thousands) | 2018 | 2019 | 2020 | 2019 | 2020 | |||||||||||||||

| Net loss |

$ | (7,802 | ) | $ | (16,896 | ) | $ | (29,932 | ) | $ | (4,014 | ) | $ | (4,651 | ) | |||||

| Share-based compensation expense |

1,739 | 2,070 | 21,108 | 436 | 3,092 | |||||||||||||||

| Amortization of intangible assets |

15,552 | 15,884 | 15,975 | 3,994 | 3,994 | |||||||||||||||

| Change in fair value of contingent consideration |

801 | 628 | 133 | 44 | 3 | |||||||||||||||

| Tax effect of adjustments(a) |

— | — | — | — | — | |||||||||||||||

|

|

|

|||||||||||||||||||

| Non-GAAP Net Income |

$ | 10,290 | $ | 1,686 | $ | 7,284 | $ | 460 | $ | 2,438 | ||||||||||

|

|

||||||||||||||||||||

| (a) | Our tax provision is primarily related to state taxes and income taxes in profitable foreign jurisdictions. We maintain a full valuation allowance against our deferred tax assets in the US. Accordingly, there is no tax impact associated with the non-GAAP adjustments in the U.S. We have not included the insignificant tax benefit associated with the non-GAAP adjustments related to our foreign jurisdictions that are taxed on a cost-plus basis. We previously computed the tax effect of non-GAAP adjustments by multiplying the adjustments by an estimated effective tax rate of 27%. We have revised the August 31, 2019 and 2018 prior years’ presentation in order to conform to the current year method of computing the tax effect of non-GAAP adjustments. |

| (6) | We believe SaaS Net Dollar Retention Rate is an important metric for the Company because, in addition to providing a measure of retention, it indicates our ability to grow revenue within our existing customer accounts. SaaS Net Dollar Retention Rate is included in a set of metrics that we calculate quarterly to review with management as well as periodically with members of our board of directors. We calculate SaaS Net Dollar Retention Rate by annualizing revenue recorded in the last month of the measurement period for those revenue-generating customers in place throughout the entire measurement period (the latest twelve-month period). We divide the result by annualized revenue from the month that is immediately prior to the beginning of the measurement period, for all revenue-generating customers in place at the beginning of the measurement period. Our calculation excludes one existing contract for a service no longer offered on a standalone basis by the Company. The Company is not able to calculate a SaaS Net Dollar Retention Rate for periods prior to fiscal 2018 due to data limitations associated with the carve-out from Accenture. For additional information regarding key metrics, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Other Financial Data and Key Metrics” in our Annual Report and Quarterly Report, incorporated by reference in this prospectus for more information. |

| (7) | We believe SaaS Annual Recurring Revenue (“ARR”) provides important information about our ability to acquire new subscription SaaS customers and to maintain and expand our relationship with existing subscription SaaS customers. SaaS ARR is included in a set of metrics that we calculate quarterly to review with management as well as periodically with members of our board of directors. We calculate SaaS ARR by annualizing the recurring subscription revenue recognized in the last month of the measurement period (the latest twelve-month period). Our calculation excludes one existing contract for a service no longer offered on a standalone basis by the Company. For additional information regarding key metrics, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Other Financial Data and Key Metrics” in our Annual Report and Quarterly Report, incorporated by reference in this prospectus for more information. |

19

Table of Contents

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below together with all of the other information included or incorporated by reference in this prospectus, such as “Prospectus summary—Summary consolidated financial information,” as well as the risks and uncertainties discussed under the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our audited financial statements and related notes thereto, each of which is included in our Annual Report and Quarterly Report that are incorporated by reference in this prospectus, before investing in our common stock. If any of the following risks or uncertainties actually occur, our business, financial condition, prospects, results of operations and cash flow could be materially and adversely affected. In that case, the market price of our common stock could decline and you may lose all or a part of your investment. The risks discussed below are not the only risks we face. Additional risks or uncertainties not currently known to us, or that we currently deem immaterial, may also have a material adverse effect on our business, financial condition, prospects, results of operations or cash flows, as well as the market price of our securities. We cannot assure you that any of the events discussed in the risk factors below will not occur.

Risks related to our business and industry

Public health outbreaks, epidemics or pandemics, including the global COVID-19 outbreak, could harm our business, results of operations, and financial condition.

Public health outbreaks, epidemics or pandemics, could materially and adversely impact our business. For example, in March 2020, the World Health Organization declared the COVID-19 virus outbreak a global pandemic, and numerous countries, including the United States, have declared national emergencies with respect to COVID-19. The outbreak and certain intensified preventative or protective public health measures undertaken by governments, businesses and individuals to contain the spread of COVID-19, including orders to shelter-in-place and restrictions on travel and permitted business operations, have, and continue to, result in global business disruptions that adversely affect workforces, organizations, economies, and financial markets globally, leading to an economic downturn and increased market volatility. The ongoing outbreak has disrupted, and will continue to disrupt, the normal operations of many businesses, including our customers, as well as the ability of our technical support teams and sales force to travel to existing customers and new business prospects, and the operations of our customers and SI partners. We have also limited our in-person marketing activities and expect this will continue for the foreseeable future. For example, we converted our 2020 user conference, Formation, into an online forum. While our business has not, to date, experienced a material disruption in bookings or sales from the COVID-19 pandemic, a continued or intensifying outbreak over the short- or medium-term could result in delays in services delivery, delays in implementations, delays in critical development and commercialization activities, including delays in the introduction of new products and services and further international expansion, interruptions in sales and marketing activity, furloughs of employees and disruptions of supply chains. Additionally, we may incur increased costs in the future when employees return to work and we implement measures to ensure their safety.