Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - MGP INGREDIENTS INC | ex992pressreleasedatejanua.htm |

| EX-2.2 - EX-2.2 - MGP INGREDIENTS INC | ex22joindertomergeragreeme.htm |

| EX-2.1 - EX-2.1 - MGP INGREDIENTS INC | ex21mergeragreementexecuti.htm |

| 8-K - 8-K - MGP INGREDIENTS INC | mgpi-20210122.htm |

INVESTOR PRESENTATION MGP Ingredients, Inc. Announces Definitive Merger Agreement with Luxco, Inc. January 25th 2021

FORWARD LOOKING STATEMENTS Certain of the comments made in this presentation and in the question and answer session that follows may contain forward-looking statements in relation to operations, financial condition and operating results of MGP Ingredients, Inc., and Luxco, Inc. and its affiliates (“Luxco”), and such statements involve a number of risks and uncertainties. The forward-looking statements contained herein include, but are not limited to, statements about the expected effects on the Company of the proposed acquisition of Luxco, the expected timing and conditions precedent relating to the proposed acquisition of Luxco, anticipated earnings enhancements, synergies and other strategic options. Forward-looking statements are usually identified by or are associated with such words as “intend,” “plan,” “believe,” “estimate,” “expect,” “anticipate,” “hopeful,” “should,” “may,” “will,” “could,” “encouraged,” “opportunities,” “potential,” and/or the negatives or variations of these terms or similar terminology. These forward-looking statements reflect management’s current beliefs and estimates of future economic circumstances, industry conditions, Company and Luxco performance, and Company and Luxco financial results and financial condition and are not guarantees of future performance. All such forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those contemplated by the relevant forward-looking statements. Important factors that could cause actual results to differ materially from our expectations include, among others: (i) the satisfaction of the conditions to closing the transaction to acquire Luxco in the anticipated timeframe or at all; (ii) the failure to obtain necessary regulatory approvals related to the acquisition of Luxco; (iii) the ability to realize the anticipated benefits of the acquisition of Luxco; (iv) the ability to successfully integrate the businesses; (v) disruption from the acquisition of Luxco making it more difficult to maintain business and operational relationships; (vi) significant transaction costs and unknown liabilities; (vii) litigation or regulatory actions related to the proposed acquisition of Luxco, and (viii) the financing of the acquisition of Luxco. Additional factors that could cause results to differ materially include, among others: (i) disruptions in operations at our Atchison facility or our Indiana facility or Luxco’s facilities, (ii) the availability and cost of grain and flour, and fluctuations in energy costs, (iii) the effectiveness of our grain purchasing program to mitigate our exposure to commodity price fluctuations, (iv) the effectiveness or execution of our strategic plan, (v) potential adverse effects to operations and our system of internal controls related to the loss of key management personnel, (vi) the competitive environment and related market conditions, (vii) the ability to effectively pass raw material price increases on to customers, (viii) our ability to maintain compliance with all applicable loan agreement covenants, (ix) our ability to realize operating efficiencies, (x) actions of governments, and (xi) consumer tastes and preferences. For further information on these and other risks and uncertainties that may affect our business, including risks specific to our Distillery Products and Ingredient Solutions segments, see Item 1A. Risk Factors of our Annual Report on Form 10-K for the year ended December 31, 2019 and Form 10-Q for the quarter ended September 30, 2020. 2

Brandon Gall Vice President of Finance and Chief Financial Officer TODAY’S PRESENTERS Dave Colo President and Chief Executive Officer 3

AGENDA FOR TODAY’S DISCUSSION A. Transaction Summary B. MGP Overview and Strategic Priorities C. Financial Highlights D. Q&A

TRANSACTION SUMMARY

TRANSACTION SUMMARY ■ MGP Ingredients, Inc. (“MGP” or the “Company”) announces Definitive Merger Agreement with Luxco for $475 MM1 ̶ Luxco is a leading branded beverage alcohol company across various categories with 60+ years of heritage ̶ Purchase price represents 16.9x LTM Oct 2020 Adjusted EBITDA2,3,5 and 13.8x LTM Oct 2020 run-rate synergized Adjusted EBITDA3,4,5 ■ Increases MGP’s scale and market position in the branded spirits sector and establishes an additional platform for future growth ̶ Luxco represents a unique and attractive independent spirits platform ̶ Consistent with MGP’s strategy of shifting into higher value-added products ̶ Financially attractive transaction and significantly diversifies the MGP business ■ Transaction expected to be financed with existing credit facilities and issuance of MGP shares ̶ 5.0MM6 of common shares to be issued to the current owners of Luxco ̶ Luxco shareholders will have the right to nominate up to two of MGP’s nine Board directors, subject to certain conditions ̶ Pro forma leverage of ~3.0x at closing7, expected to de-lever to 2.5x by the end of year one ■ Anticipated to be completed during the first half of 2021, subject to regulatory approvals and customary closing conditions 1. See MGP’s January 25, 2021 press releases and Form 8-Ks for further details. Stock consideration value based on a 20-day volume-weighted average price as of January 11, 2021. 2. Multiple of 16.9x represents: (i) purchase price of $475MM, divided by (ii) Luxco LTM Oct-20 Adjusted EBITDA of $28MM. 3. All Luxco financials shown throughout this presentation are unaudited. 4. Multiple of 13.8x represents: (i) purchase price, divided by (ii) Luxco LTM Oct-20 Adjusted EBITDA plus $6.4MM expected run-rate synergies (inclusive of one-time costs to achieve synergies). 5. See appendix for GAAP to non-GAAP reconciliations. 6. Based on a 20-day volume-weighted average price as of January 11, 2021. 7. Does not include any synergies. Addition of significant branded spirits platform 6

LUXCO OVERVIEW Company Overview ■ Formed in 1958 when Paul A. Lux and David Sherman Sr. established the David Sherman Corporation (“DSC”), which has since grown into a producer, bottler, importer and marketer of a broad portfolio of well-known spirits brands ̶ David Sherman was bought out by the Lux family in 2004 and re-branded to Luxco as a tribute to its founder, Paul Lux, in 2006 ■ Attractive portfolio driven by its fast-growing focus brands and supported by the strong cash flow generating legacy brands ■ Offers competitive marketing, new product development, sales and distribution capabilities to grow MGP’s branded business ■ Recently opened two new facilities: Lux Row Distillers, a Bourbon distillery in Kentucky, and DGL, the third largest tequila distillery in Mexico ̶ Also recently purchased Niche Drinks in Northern Ireland ■ Luxco products are sold in all 50 states and internationally, with annual sales of ~4.7 million 9-Liter Cases in 2019 An independent branded spirits platform of well-known brands 7

Focus Brands (~46% of LTM Oct 2020 Net Revenue) Select Other Brands (~54% of LTM Oct 2020 Net Revenue) LUXCO BRAND PORTFOLIO Established portfolio with a strategic approach to growing high potential, high margin Focus Brands 8 BOURBON TEQUILA IRISH WHITE SPIRITS BOURBON TEQUILA IRISH WHITE SPIRITS CORDIALS & RTDS Ezra Brooks Minor Case David Nicholson Rebel Yell Yellowstone Exotico Dos Primos El Mayor The Quiet Man Saint Brendan’s Bowling & Burch Gin Everclear Bellows Bourbon Supreme Azteca Juarez Brady’s Paramount YagoPearl Tvarscki Wolf-Schmidt Blood Oath Daviess County

LUXCO OPERATIONAL FOOTPRINT AND SALES NETWORK Platform with extensive operational capabilities and comprehensive national sales footprint Operational Capabilities Bottling / Blending Various bottling lines with cream, spirits and RTD processing capabilities National Sales Platform All Others: 10 MarketsSGWS: 31 Markets RNDC: 9 Markets OH IA OK TX LA GA AZ UT CA NV WY MOKSCO AR MS AL SC FL NCTN KY IN MN WI MI WV PA VA NY NE NDMT ID WA OR NM SD VT NH ME MA RI DE AK MD NJ CT DC HI IL ■ Sales / Distributor representation in every state across the United States and a dedicated international sales team ■ Dedicated sales and marketing team of 43 spanning from coast to coast with decades of experience in the liquor industry ■ Strong relationships with all major US distributors NATIONAL DISTRIBUTOR ALIGNMENT 9 3 Distilleries Limestone Distillery Lebanon, KY Lux Row Distillery Bardstown, KY DGL Distillery (JV) Arandas, Mexico 3 Other Facilities1 Bottling & Distribution St. Louis, MO Bottling Cleveland, OH Bottling & Blending Northern Ireland Distilleries Extensive operational capacity with plans in place to increase production in 2021 Distribution Center 210,000 square feet with customs bond space in St. Louis 1. Other Facilities include bottling, blending, distribution and others.

LUXCO FINANCIAL OVERVIEW Adjusted Shipment Volume1 (MM 9-Liter Cases) Adjusted Net Revenue1 ($MM) Adjusted Gross Profit1 ($MM) and Margin (%) Adjusted EBITDA1 ($MM) and Margin (%) Stable and cash generative business with track record of consistent performance. Margin improvement driven by operational efficiencies and business mix shifts towards higher margin focus brands 1. Adjustments relate to exceptional items, impact from MGP ownership, COVID impact and others; Refer to GAAP to non-GAAP reconciliations in the appendix. 10 4.6 4.7 4.8 2018 2019 LTM Oct-20 $172 $183 $202 2018 2019 LTM Oct-20 $16 $20 $28 9.1% 10.9% 13.9% 2018 2019 LTM Oct-20 $56 $64 $76 32.7% 35.1% 37.3% 2018 2019 LTM Oct-20

TRANSACTION RATIONALE The proposed transaction is attractive and consistent with MGP’s strategy Provides immediate scale and infrastructure to MGP’s Branded Spirits business Experienced team to support long-term growth Financially attractive combination Significant diversification into higher value-added products 2 3 5 1 Additional upside from potential cost and revenue synergies4 11

SIGNIFICANT DIVERSIFICATION INTO HIGHER VALUE-ADDED PRODUCTS 1 White Goods: Vodka White Goods: Gin Brown Goods: New Distillate Whiskey Industrial Alcohol Branded Spirits Products Brown Goods: Aged Whiskey Move Up the Gross Profit Ladder MGP Portfolio Diversification Transaction is consistent with MGP’s strategy of shifting its business mix toward higher value-added products 2019 Gross Profit of $77MM Combined 2019 Adj. Gross Profit of $141MM $64 $11 $2 $77 2019 Distillery Products Ingredient Solutions Branded Spirits 12 $64 $11 $66 $141 PF 2019

PROVIDES IMMEDIATE SCALE AND INFRASTRUCTURE TO MGP’S BRANDED SPIRITS BUSINESS 2 Luxco provides MGP’s branded spirits business with a step change in scale and a stable platform for future growth Established Branded Spirits Platform Proven Brand Building Capability TRACK RECORD OF DEVELOPING INNOVATIVE, PREMIUM PACKAGING PROGRAMS IN PLACE TO OPTIMIZE ON AND OFF- PREMISE DISPLAY WITH ACCOUNTS IN-HOUSE MARKETING TEAM MANAGING WEBSITE, SOCIAL MEDIA AND DIGITAL MEDIA ADVERTISING CONTENT COMMITTED TO CONTINUING ITS INVESTMENT IN TV ADVERTISING TASTINGS AND PROMOTIONS AT VARIOUS EVENTS AND VENUES ~4.7MM 9-Liter Cases Sold in PF 2019 25+ Complementary Main Brands Portfolio ~$186MM Combined Adj. Net Revenue in 2019 Brands sold in 50 States Strong Relationship with the 2 largest distributors: SGWS and RNDC Growing International Footprint 40+ Dedicated Sales and Marketing Workforce 3 Distilleries and Additional Blending and Bottling Facilities R&D Capabilities for Product Development 13

David Bratcher – President of Luxco Appointed to current role in 2013 ‒ Oversees all day-to-day business of Luxco, including sales, marketing, operations, IT and finance Luxco team to remain involved and continue to drive the performance of the business Donn Lux – Chairman of Luxco Longstanding tenure within Luxco ‒ Oversees strategy, works closely with the President and represents Luxco on industry and trade relationships EXPERIENCED TEAM TO SUPPORT LONG-TERM GROWTH3 Board Member 14 Management Seasoned operational team provides infrastructure to support growth Experienced sales and marketing organization with national footprint Well-established supply chain team with track record of manufacturing and customer service excellence

ADDITIONAL UPSIDE FROM POTENTIAL COST AND REVENUE SYNERGIES 4 15 Revenue Synergies Cost Synergies ■ Incremental sales by expanding MGP brands through Luxco’s distribution channel ■ Incremental sourced sales due to addition of Luxco bottling capabilities ■ Back office functions and warehousing savings on MGP brands ■ Bottling savings for MGP brands ■ Dry Goods savings for MGP brands ■ Other savings related to duplicative services and functions Expected run-rate synergies of approximately $6.4MM by the third fiscal year post-closing

16.2% 2019 FINANCIALLY ATTRACTIVE COMBINATION5 Enhances Profitability and Improves Cash Flow G ro ss M ar gi n E B IT D A M ar gi n Transaction generates value for MGP’s shareholders across a range of metrics 21.1% 2019 FC F C on ve rs io n 1 71.6% 2019 1. FCF Conversion calculated as (EBITDA – Capex) / EBITDA. 16 13.9% LTM Oct-20 86.7% LTM Oct-20 (Pre-synergies) (Pre-synergies) (Pre-synergies) (As Reported) (As Adjusted) 37.3% LTM Oct-20

MGP OVERVIEW AND STRATEGIC PRIORITIES

MISSION STATEMENT Secure our future by consistently delivering superior financial results by more fully participating in all levels of the alcohol and food ingredients segments for the betterment of our shareholders, employees, partners, consumers and communities. 18

Capitalize on unique expertise within Ingredient Solutions Maintain conservative capital structure, disciplined approach to M&A and focus on shareholder value creation Focus on maintaining and strengthening the core business units 5 1 Develop and expand Branded Spirits platform 4 Explore additional avenues of long-term growth and profitability in Distillery Products 2 MGP STRATEGY MGP’s vision is to build on its core strengths to generate long-term shareholder value 19 3

■ Leading supplier of distilled spirits, facilitating the creation of bourbons, rye whiskeys, distilled gins and vodkas ■ Continued strategic position within MGP as legacy producer of food grade alcohol ■ Capacity and capability provide key competitive advantage ■ Shifting business mix towards higher margin opportunities as a supplier to our increasingly diverse range of customers ■ Becoming a “solutions provider” to our customers MGP OVERVIEW1 Post-transaction, MGP will have a portfolio of highly attractive business units centered around its historic core ■ Attractive and growing portfolio of spirit brands in fastest growing categories ■ A natural evolution to leverage MGP’s expertise in production to target the highly attractive branded spirits market ■ Combination with Luxco provides step change in scale and a platform ■ Core portfolio positioned at affordable price points and provides stable cash flows ■ Award winning premium and super premium brands offer a significant long-term upside ■ Largest U.S. supplier of specialty wheat proteins and starches ■ Rapidly growing category with significant long-term upside ■ Aligned with several important consumer trends (e.g. clean label, better for you) ■ Particular focus on specialty starches and proteins ■ MGP’s history affords unique know- how in the specialty ingredient category and we are widely regarded as experts in the industry DISTILLERY PRODUCTS Sales: $294MM (54% of Total) GP Margin: 22% BRANDED SPIRITS Adj. Sales: $186MM (34% of Total) Adj. GP Margin: 35% INGREDIENT SOLUTIONS Sales: $66MM (12% of Total) GP Margin: 16% 20 1. All financials based on pro forma combined 2019 results.

EXPANSIVE BRAND FAMILY Highly complementary fit between Luxco brands and MGP’s premium spirits portfolio REMUS VOLSTEAD RESERVE Straight Bourbon whiskey SRP: $199.99 REMUS REPEAL RESERVE Straight Bourbon whiskey SRP: $84.99 ROSSVILLE UNION Barrel Proof Straight Rye Whiskey SRP: $69.99 GREEN HAT Distilled Gin SRP: $29.99 GEORGE REMUS Straight Bourbon Whiskey SRP: $39.99 EIGHT & SAND Blended Bourbon Whiskey SRP: $29.99 ROSSVILLE UNION Master Crafted Straight Rye Whiskey SRP: $39.99 21 EZRA BROOKS Straight Rye Whiskey SRP: $21.99 DAVID NICHOLSON Straight Bourbon Whiskey SRP: $22.99 YELLOWSTONE Blended Bourbon Whiskey SRP: $39.99 MINOR CASE Straight Rye Whiskey SRP: $49.99 EL MAYOR Blanco Tequila SRP: $26.99 EXOTICO Blanco Tequila SRP: $24.99 THE QUIET MAN Irish Whiskey SRP: $32.99 ST. BRENDAN’S Irish Cream SRP: $13.99 BOWLING & BURCH Distilled Gin SRP: $33.99 EVERCLEAR Clear Grain Spirit SRP: $18.29

FINANCIAL HIGHLIGHTS

FINANCING OVERVIEW Prudent transaction financing with subsequent deleveraging anticipated Transaction Financing Summary Credit Highlights • Anticipated financing is expected to be comprised of $246MM drawn on the existing revolving credit facility and assumed debt, and $238MM common equity issuance • MGP currently has $300MM of availability under its existing revolving credit facility • Pro forma leverage of ~3.0x at closing1, expected to de-lever to 2.5x by the end of year one • MGP is expected to remain in compliance with the requirements and covenants of its Credit Agreement • The transaction is not subject to financing conditions • Transaction supports MGP’s plan to expand its Branded Spirits business and to move up the margin ladder • Luxco provides a national platform with strong go-to-market and branding capabilities for MGP to leverage for its existing brands as well as significant potential cost saving opportunities through shared resources • Provides material diversification benefits across customers, channels and categories • Strong expected free cash flow generation will support deleveraging post-transaction • Plans to maintain current dividend levels 23 1. Does not include any synergies.

COMBINED FINANCIAL HIGHLIGHTS Illustrative overview of MGP financials and reporting segments (pre-synergies) Pro Forma 24 ($MM) DISTILLERY PRODUCTS BRANDED SPIRITS INGREDIENT SOLUTIONS PF MGP (Combined) MGP (Standalone) 2019A PF Net Sales $294.2 $185.7 $65.5 $545.5 $362.7 % of Total Net Sales 53.9% 34.0% 12.0% 2019A PF Gross Profit $64.4 $65.7 $10.6 $140.7 $76.5 % Margin 21.9% 35.4% 16.2% 25.8% 21.1% 2019A SG&A $81.1 $29.3 % of Sales 14.9% 8.1% 2019A PF Operating Income $59.6 $47.2 % Margin 10.9% 13.0% 2019A PF EBITDA $79.6 $58.8 % Margin 14.6% 16.2% 2019A PF Adjusted EBITDA $78.7 $58.8 % Margin 14.4% 16.2% 2019A Capex $19.9 $16.7 % of Sales 3.7% 4.6%

CONCLUDING REMARKS The combination with Luxco is in line with the core MGP strategy and represents an important step for the business Operational Financial Strategic ■ Meaningful branded spirits business which provides scale and infrastructure to MGP ■ Vertical integration opportunities with white goods and brown goods, accelerating the development of new products ■ Ability to meet customers’ requests for bottling capability and brand needs ■ Establishes a branded platform for future M&A opportunities ■ Significant brand portfolio with track record of growth in priority Focus Brands ■ New platform for growth with new product innovations and brand launches ■ Extensive direct-to-consumer expertise with social media and e-commerce presence ■ Increased operating leverage through MGP’s existing distillery, blending and warehousing footprint ■ Strong financial track record provides a solid platform ■ Improves customer, channel and category diversification and lowers risk profile ■ Potential revenue and cost synergies resulting in opportunity for further margin uplift ■ Expected to enhance the free cash flow profile and be accretive by low to mid-single digits percentage to EPS in first full year following transaction1 ■ Substantial free cash flow generation for deleveraging 25 1. Excludes one-time transaction expenses.

Q&A

APPENDIX

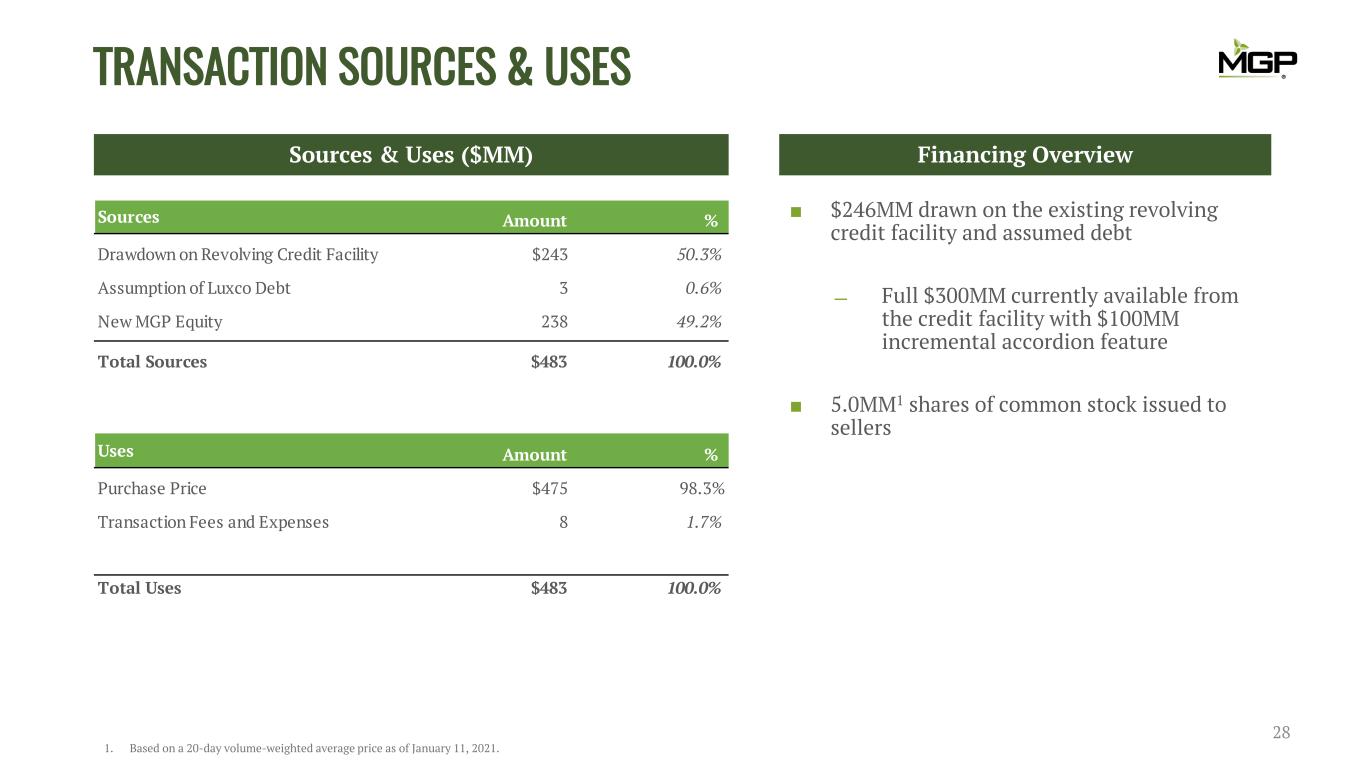

TRANSACTION SOURCES & USES Sources & Uses ($MM) Financing Overview ■ $246MM drawn on the existing revolving credit facility and assumed debt ̶ Full $300MM currently available from the credit facility with $100MM incremental accordion feature ■ 5.0MM1 shares of common stock issued to sellers 28 Sources Amount % Drawdown on Revolving Credit Facility $243 50.3% Assumption of Luxco Debt 3 0.6% New MGP Equity 238 49.2% Total Sources $483 100.0% Uses Amount % Purchase Price $475 98.3% Transaction Fees and Expenses 8 1.7% Total Uses $483 100.0% 1. Based on a 20-day volume-weighted average price as of January 11, 2021.

RECONCILIATION OF GAAP TO NON-GAAP 291. Adjustments relate to exceptional items, impact from MGP ownership, COVID impact and others. 1 Luxco Reconciliation of GAAP to Non GAAP Measures (Unaudited) (Dollars in Thousands) 2018 2019 LTM Oct-20 Net Income $6,862 $7,380 $24,188 % of Revenue 4.0% 4.0% 12.0% Income Tax Expense $52 $619 $619 Net Interest (Income) / Expense $3,063 $3,434 $2,629 EBIT $9,977 $11,432 $27,436 % of Revenue 5.8% 6.3% 13.6% Depreciation & Amortization $4,905 $9,363 $9,141 EBITDA $14,882 $20,795 $36,577 % of Revenue 8.6% 11.4% 18.1% Adjusted to remove: One-time Non-recurring Items $852 ($856) ($8,485) Adjusted EBITDA $15,735 $19,939 $28,092 % of Revenue 9.1% 10.9% 13.9% Capital Expenditures ($8,327) ($3,208) ($3,738) Free Cash Flow $7,408 $16,731 $24,354 % Free Cash Flow Conversion 47.1% 83.9% 86.7%

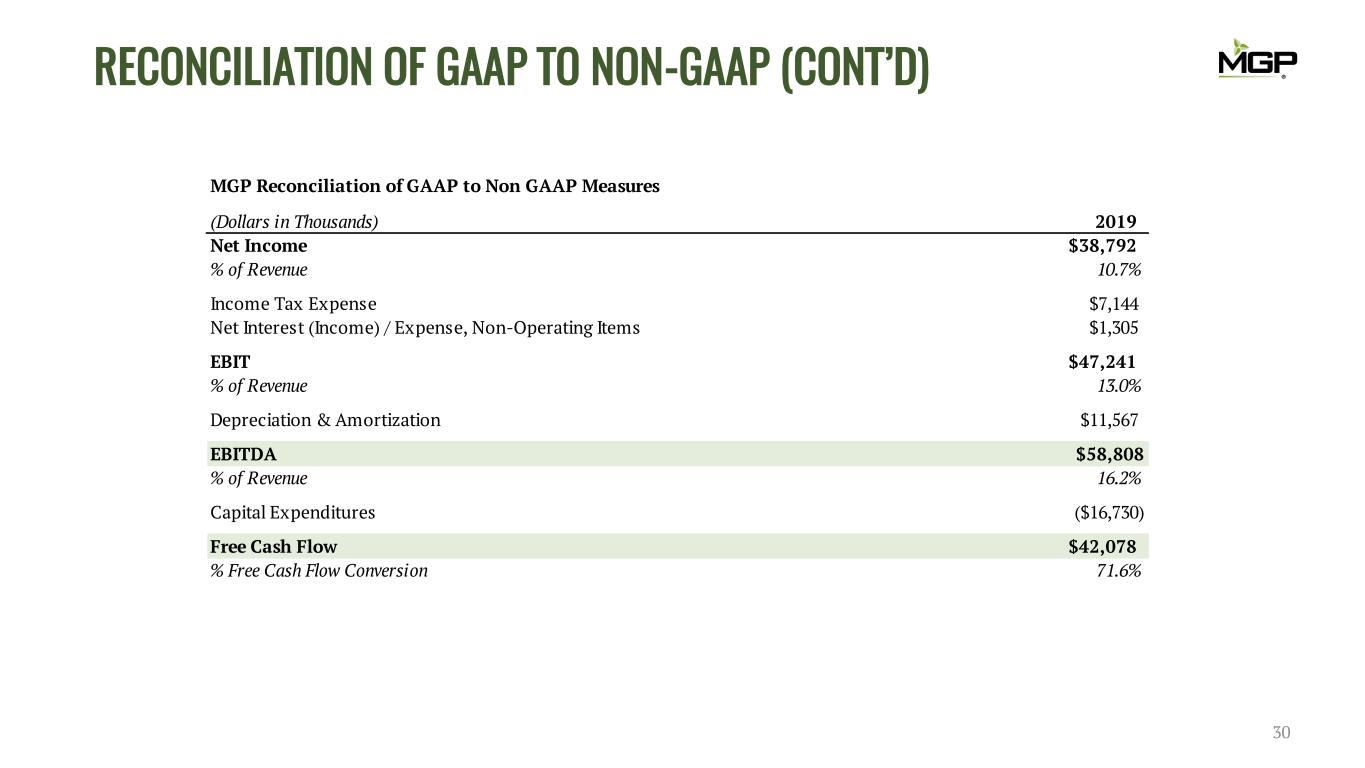

RECONCILIATION OF GAAP TO NON-GAAP (CONT’D) 30 MGP Reconciliation of GAAP to Non GAAP Measures (Dollars in Thousands) 2019 Net Income $38,792 % of Revenue 10.7% Income Tax Expense $7,144 Net Interest (Income) / Expense, Non-Operating Items $1,305 EBIT $47,241 % of Revenue 13.0% Depreciation & Amortization $11,567 EBITDA $58,808 % of Revenue 16.2% Capital Expenditures ($16,730) Free Cash Flow $42,078 % Free Cash Flow Conversion 71.6%

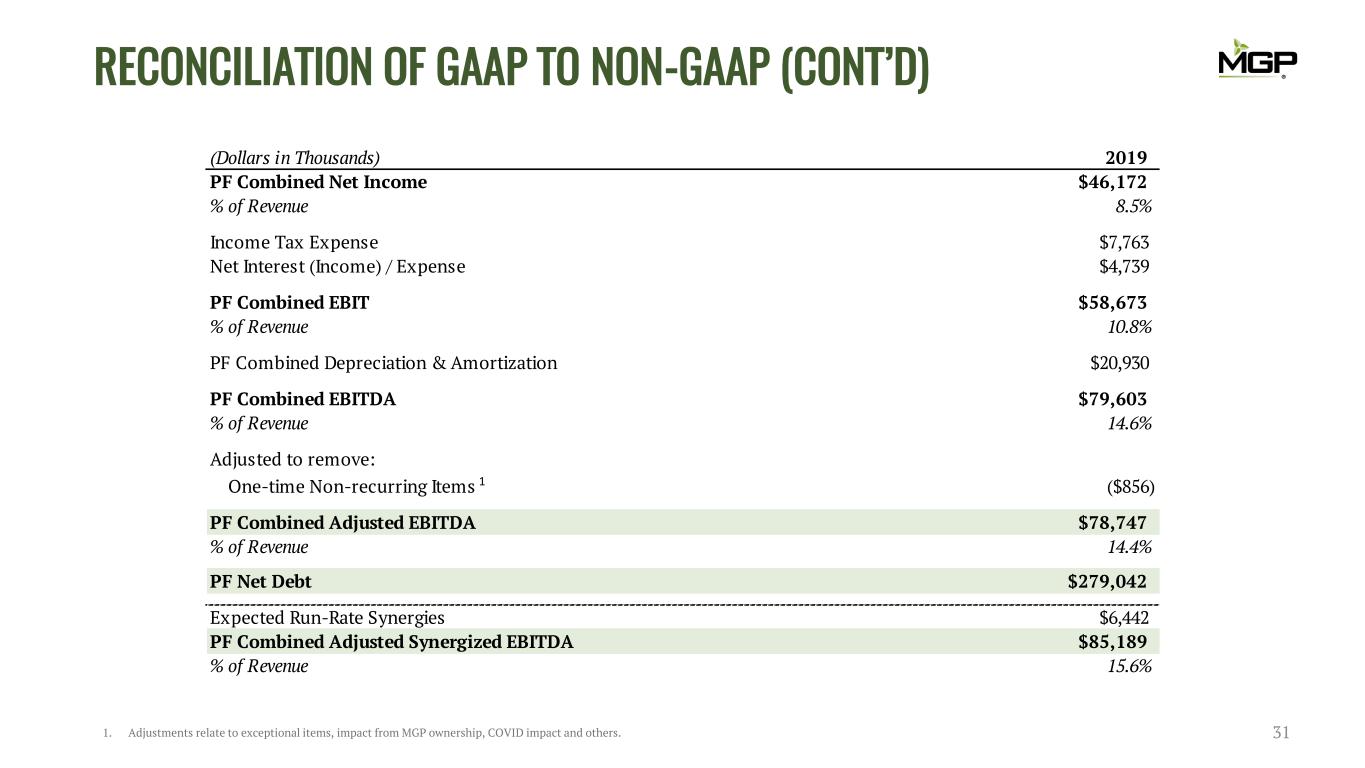

RECONCILIATION OF GAAP TO NON-GAAP (CONT’D) 31 (Dollars in Thousands) 2019 PF Combined Net Income $46,172 % of Revenue 8.5% Income Tax Expense $7,763 Net Interest (Income) / Expense $4,739 PF Combined EBIT $58,673 % of Revenue 10.8% PF Combined Depreciation & Amortization $20,930 PF Combined EBITDA $79,603 % of Revenue 14.6% Adjusted to remove: One-time Non-recurring Items ($856) PF Combined Adjusted EBITDA $78,747 % of Revenue 14.4% PF Net Debt $279,042 Expected Run-Rate Synergies $6,442 PF Combined Adjusted Synergized EBITDA $85,189 % of Revenue 15.6% 1. Adjustments relate to exceptional items, impact from MGP ownership, COVID impact and others. 1