Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Triumph Bancorp, Inc. | tbk-ex991_6.htm |

| 8-K - 8-K - Triumph Bancorp, Inc. | tbk-8k_20210121.htm |

Q4 2020 Earnings Release January 21, 2021 Exhibit 99.2

DISCLAIMER Forward-Looking Statements This presentation contains forward-looking statements. Any statements about our expectations, beliefs, plans, predictions, forecasts, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. You can identify forward-looking statements by the use of forward-looking terminology such as “believes,” “expects,” “could,” “may,” “will,” “should,” “seeks,” “likely,” “intends,” “plans,” “pro forma,” “projects,” “estimates” or “anticipates” or the negative of these words and phrases or similar words or phrases that are predictions of or indicate future events or trends and that do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions. Forward-looking statements involve numerous risks and uncertainties and you should not rely on them as predictions of future events. Forward-looking statements depend on assumptions, data or methods that may be incorrect or imprecise and we may not be able to realize them. We do not guarantee that the transactions and events described will happen as described (or that they will happen at all). The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements: business and economic conditions generally and in the bank and non-bank financial services industries, nationally and within our local market areas; the impact of COVID-19 on our business, including the impact of the actions taken by governmental authorities to try and contain the virus or address the impact of the virus on the United States economy (including, without limitation, the CARES Act), and the resulting effect of all of such items on our operations, liquidity and capital position, and on the financial condition of our borrowers and other customers; our ability to mitigate our risk exposures; our ability to maintain our historical earnings trends; changes in management personnel; interest rate risk; concentration of our products and services in the transportation industry; credit risk associated with our loan portfolio; lack of seasoning in our loan portfolio; deteriorating asset quality and higher loan charge-offs; time and effort necessary to resolve nonperforming assets; inaccuracy of the assumptions and estimates we make in establishing reserves for probable loan losses and other estimates; risks related to the integration of acquired businesses (including developments related to our acquisition of Transport Financial Solutions and the related over-formula advances) and any future acquisitions; our ability to successfully identify and address the risks associated with our possible future acquisitions, and the risks that our prior and possible future acquisitions make it more difficult for investors to evaluate our business, financial condition and results of operations, and impairs our ability to accurately forecast our future performance; lack of liquidity; fluctuations in the fair value and liquidity of the securities we hold for sale; impairment of investment securities, goodwill, other intangible assets or deferred tax assets; our risk management strategies; environmental liability associated with our lending activities; increased competition in the bank and non-bank financial services industries, nationally, regionally or locally, which may adversely affect pricing and terms; the accuracy of our financial statements and related disclosures; material weaknesses in our internal control over financial reporting; system failures or failures to prevent breaches of our network security; the institution and outcome of litigation (including related to our pending litigation with the United States Postal Service and a counterparty relating to certain misdirected payments) and other legal proceedings against us or to which we become subject; changes in carry-forwards of net operating losses; changes in federal tax law or policy; the impact of recent and future legislative and regulatory changes, including changes in banking, securities and tax laws and regulations, such as the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and their application by our regulators; governmental monetary and fiscal policies; changes in the scope and cost of FDIC, insurance and other coverages; failure to receive regulatory approval for future acquisitions; and increases in our capital requirements. While forward-looking statements reflect our good-faith beliefs, they are not guarantees of future performance. All forward-looking statements are necessarily only estimates of future results. Accordingly, actual results may differ materially from those expressed in or contemplated by the particular forward-looking statement, and, therefore, you are cautioned not to place undue reliance on such statements. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events or circumstances, except as required by applicable law. For a discussion of such risks and uncertainties, which could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” and the forward-looking statement disclosure contained in Triumph’s Annual Report on Form 10-K, filed with the Securities and Exchange Commission on February 11, 2020 and its Quarterly Report on Form 10-Q, filed with the SEC on October 20, 2020. Non-GAAP Financial Measures This presentation includes certain non‐GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of non‐GAAP financial measures to GAAP financial measures are provided at the end of the presentation. Numbers in this presentation may not sum due to rounding. Unless otherwise referenced, all data presented is as of December 31, 2020. PAGE 2

COMPANY OVERVIEW PAGE 3 Triumph Bancorp, Inc. (NASDAQ: TBK) (“Triumph”) is a financial holding company headquartered in Dallas, Texas. Triumph offers a diversified line of community banking, national lending, and commercial finance products through its bank subsidiary, TBK Bank, SSB. www.triumphbancorp.com TOTAL ASSETS $5.9 billion MARKET CAP(1) $1.4 billion TOTAL LOANS $5.0 billion TOTAL DEPOSITS $4.7 billion Data is as of December 31, 2020, except as noted below (1) Data is as of January 19, 2021

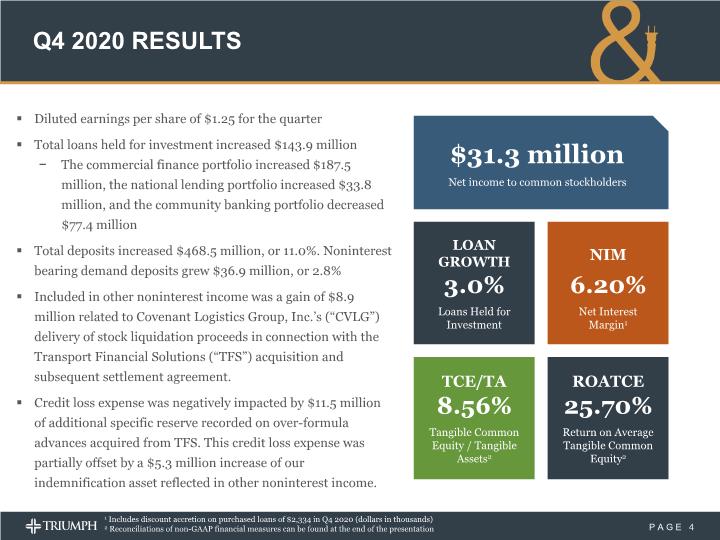

Q4 2020 RESULTS PAGE 4 Diluted earnings per share of $1.25 for the quarter Total loans held for investment increased $143.9 million The commercial finance portfolio increased $187.5 million, the national lending portfolio increased $33.8 million, and the community banking portfolio decreased $77.4 million Total deposits increased $468.5 million, or 11.0%. Noninterest bearing demand deposits grew $36.9 million, or 2.8% Included in other noninterest income was a gain of $8.9 million related to Covenant Logistics Group, Inc.’s (“CVLG”) delivery of stock liquidation proceeds in connection with the Transport Financial Solutions (“TFS”) acquisition and subsequent settlement agreement. Credit loss expense was negatively impacted by $11.5 million of additional specific reserve recorded on over-formula advances acquired from TFS. This credit loss expense was partially offset by a $5.3 million increase of our indemnification asset reflected in other noninterest income. $31.3 million Net income to common stockholders LOAN GROWTH 3.0% Loans Held for Investment NIM 6.20% Net Interest Margin1 ROATCE 25.70% Return on Average Tangible Common Equity2 TCE/TA 8.56% Tangible Common Equity / Tangible Assets2 1 Includes discount accretion on purchased loans of $2,334 in Q4 2020 (dollars in thousands) 2 Reconciliations of non-GAAP financial measures can be found at the end of the presentation

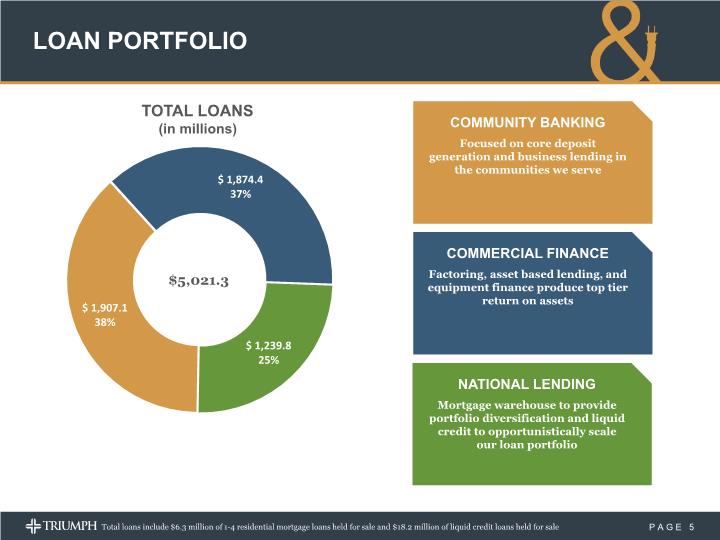

LOAN PORTFOLIO TOTAL LOANS (in millions) COMMUNITY BANKING Focused on core deposit generation and business lending in the communities we serve COMMERCIAL FINANCE Factoring, asset based lending, and equipment finance produce top tier return on assets NATIONAL LENDING Mortgage warehouse to provide portfolio diversification and liquid credit to opportunistically scale our loan portfolio $5,021.3 Total loans include $6.3 million of 1-4 residential mortgage loans held for sale and $18.2 million of liquid credit loans held for sale PAGE 5 Community Banking $1,907.1 38% Commercial Finance $1,874.4 37% National Lending $1,239.8 25%

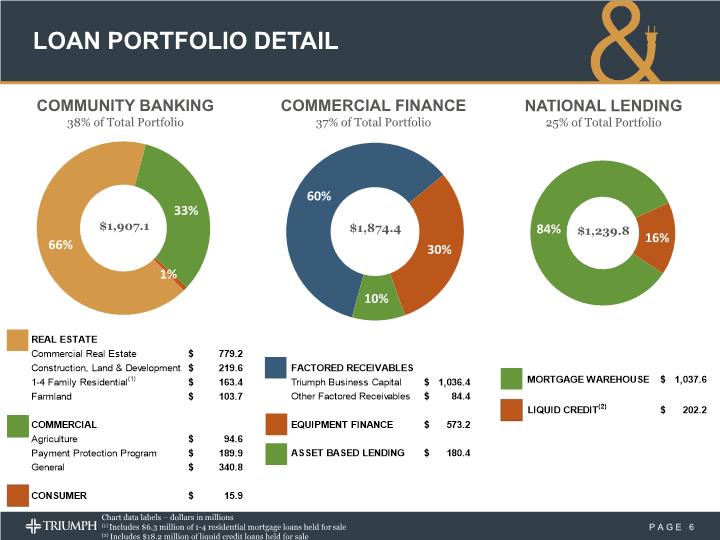

LOAN PORTFOLIO DETAIL COMMUNITY BANKING 38% of Total Portfolio NATIONAL LENDING 25% of Total Portfolio COMMERCIAL FINANCE 37% of Total Portfolio $1,907.1 $1,239.8 $1,874.4 Chart data labels – dollars in millions (1) Includes $6.3 million of 1-4 residential mortgage loans held for sale (2) Includes $18.2 million of liquid credit loans held for sale PAGE 6 66% 33% 1% — 60% 31% 10% — 84% 16% 0% REAL ESTATE FACTORED RECEIVABLES Commercial Real Estate $779.2 Triumph Business Capital $1,036.4 Construction, Land & Development $219.6 Other Factored Receivables $84.4 1-4 Family Residential(1) $163.4 Farmland $103.7 EQUIPMENT FINANCE $573.2 COMMERCIAL ASSET BASED LENDING $180.4 Agriculture $94.6 Payment Protection Program $189.9 General $340.8 $1,874.4 CONSUMER $15.9 MORTGAGE WAREHOUSE $1,037.6 LIQUID CREDIT(2) $202.2

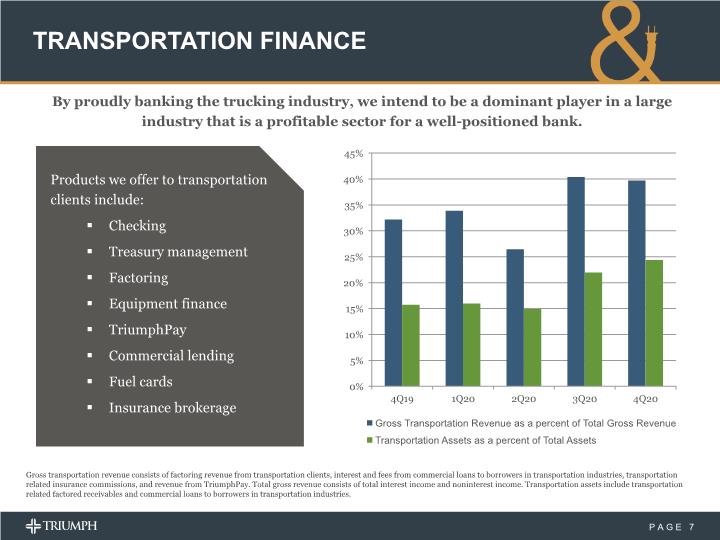

TRANSPORTATION FINANCE Gross transportation revenue consists of factoring revenue from transportation clients, interest and fees from commercial loans to borrowers in transportation industries, transportation related insurance commissions, and revenue from TriumphPay. Total gross revenue consists of total interest income and noninterest income. Transportation assets include transportation related factored receivables and commercial loans to borrowers in transportation industries. By proudly banking the trucking industry, we intend to be a dominant player in a large industry that is a profitable sector for a well-positioned bank. Products we offer to transportation clients include: Checking Treasury management Factoring Equipment finance TriumphPay Commercial lending Fuel cards Insurance brokerage PAGE 7

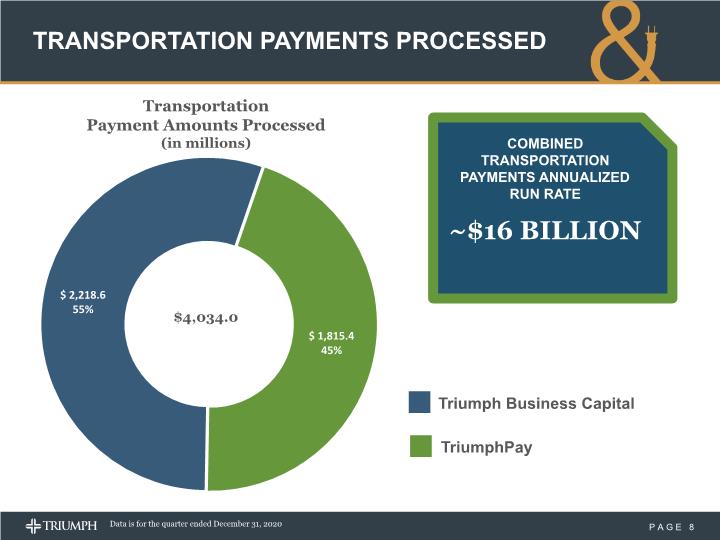

Transportation Payment Amounts Processed (in millions) TRANSPORTATION PAYMENTS PROCESSED $4,034.0 PAGE 8 Triumph Business Capital TriumphPay COMBINED TRANSPORTATION PAYMENTS ANNUALIZED RUN RATE ~$16 BILLION Data is for the quarter ended December 31, 2020 Triumph Business Capital $2,218.6 55% TriumphPay $1,815.4 45%

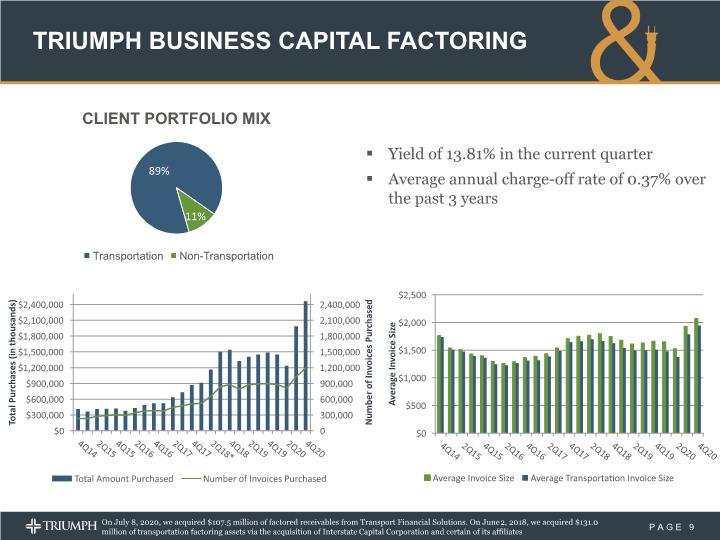

TRIUMPH BUSINESS CAPITAL FACTORING Yield of 13.81% in the current quarter Average annual charge-off rate of 0.37% over the past 3 years On July 8, 2020, we acquired $107.5 million of factored receivables from Transport Financial Solutions. On June 2, 2018, we acquired $131.0 million of transportation factoring assets via the acquisition of Interstate Capital Corporation and certain of its affiliates [Pie Chart] Transportation Non-Transportation 89% 11% [Bar/Line Chart] Total Purchases Number of Invoices Purchased [Bar Chart] Average Invoice Size PAGE 9

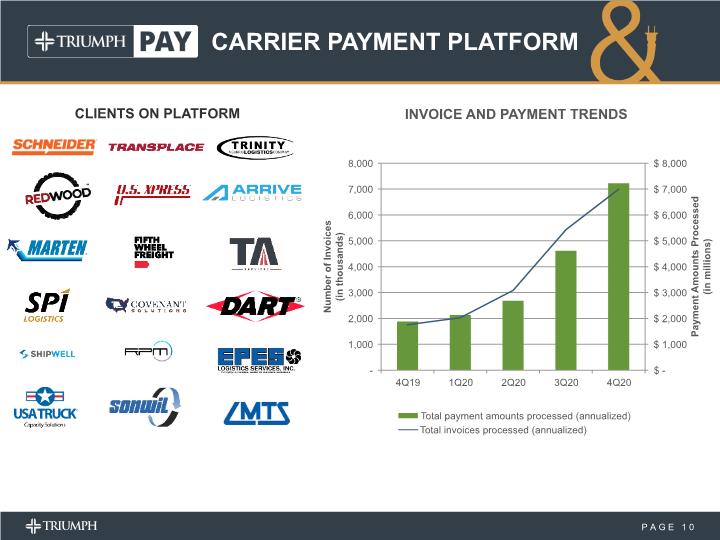

CARRIER PAYMENT PLATFORM CLIENTS ON PLATFORM [Bar/Line Chart] Invoice and Payment Trends Number of Invoices Payment Amounts Processed Total payment amounts processed (annualized) Total invoices processed (annualized) PAGE 10

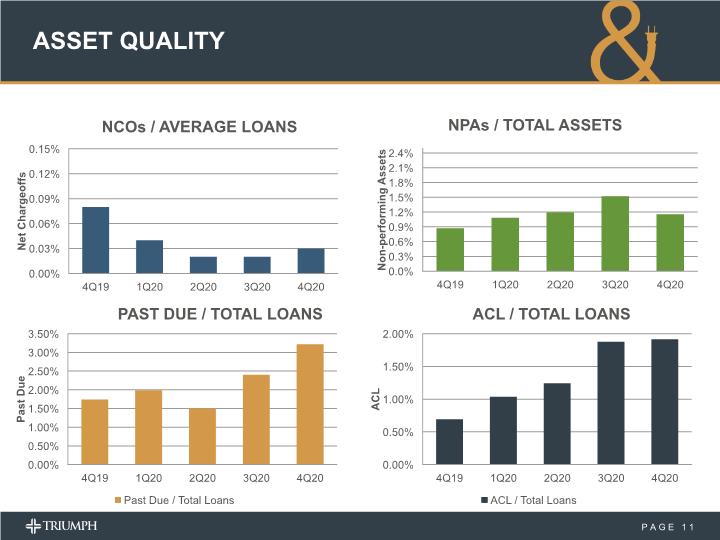

ASSET QUALITY PAGE 11

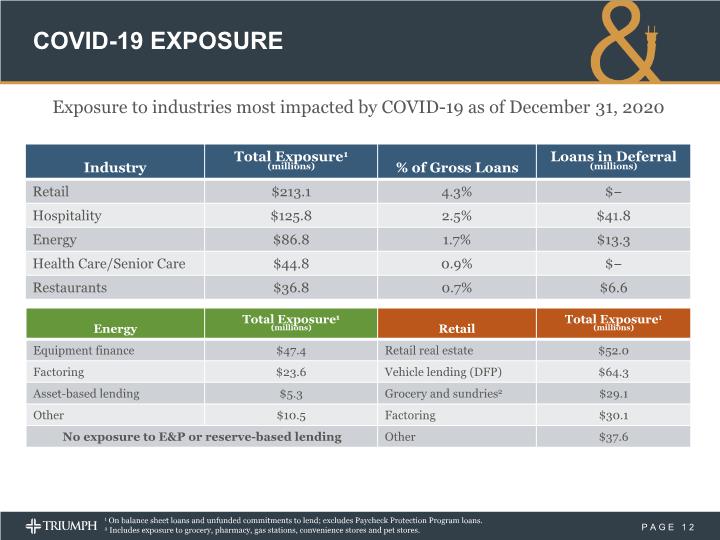

COVID-19 EXPOSURE Exposure to industries most impacted by COVID-19 as of December 31, 2020 1 On balance sheet loans and unfunded commitments to lend; excludes Paycheck Protection Program loans. 2 Includes exposure to grocery, pharmacy, gas stations, convenience stores and pet stores. PAGE 12

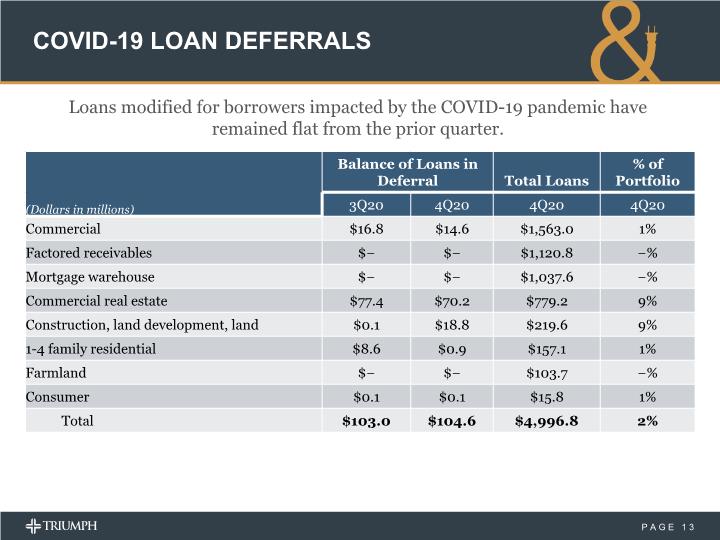

COVID-19 LOAN DEFERRALS Loans modified for borrowers impacted by the COVID-19 pandemic have remained flat from the prior quarter. PAGE 13

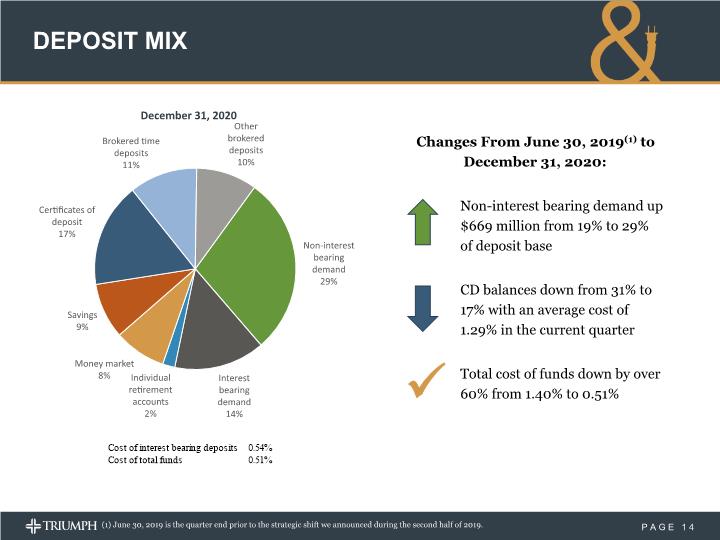

DEPOSIT MIX PAGE 14 (1) June 30, 2019 is the quarter end prior to the strategic shift we announced during the second half of 2019. Non-interest bearing demand Interest bearing demand Individual retirement accounts Money market Savings Certificates of deposit Brokered time deposits Other brokered deposits 29% 14% 2% 8% 9% 17% 11% 10% Cost of interest bearing deposits 0.54% Cost of total funds 0.51%

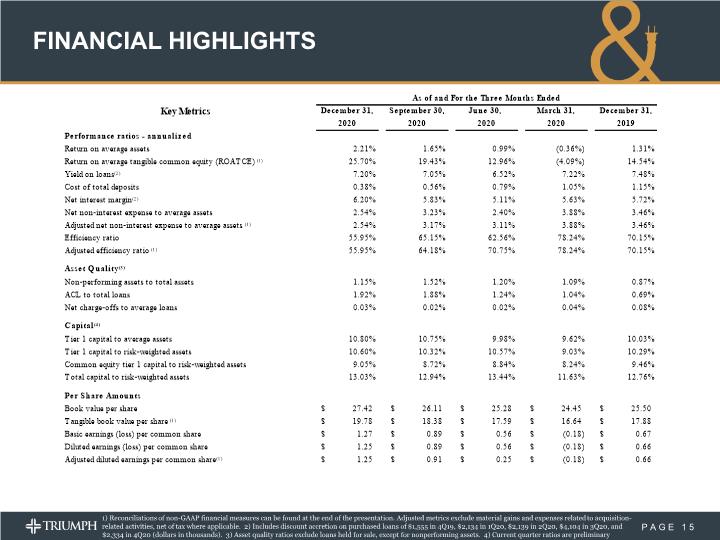

FINANCIAL HIGHLIGHTS 1) Reconciliations of non-GAAP financial measures can be found at the end of the presentation. Adjusted metrics exclude material gains and expenses related to acquisition-related activities, net of tax where applicable. 2) Includes discount accretion on purchased loans of $1,555 in 4Q19, $2,134 in 1Q20, $2,139 in 2Q20, $4,104 in 3Q20, and $2,334 in 4Q20 (dollars in thousands). 3) Asset quality ratios exclude loans held for sale, except for nonperforming assets. 4) Current quarter ratios are preliminary PAGE 15 As of and For the Three Months Ended Key Metrics December 31, September 30, June 30, March 31, December 31, 2020 2020 2020 2020 2019 Performance ratios - annualized Return on average assets 2.21% 1.65% 0.99% (0.36%) 1.31% Return on average tangible common equity (ROATCE) (1) 25.70% 19.43% 12.96% (4.09%) 14.54% Yield on loans(2) 7.20% 7.05% 6.52% 7.22% 7.48% Cost of total deposits 0.38% 0.56% 0.79% 1.05% 1.15% Net interest margin(2) 6.20% 5.83% 5.11% 5.63% 5.72% Net non-interest expense to average assets 2.54% 3.23% 2.40% 3.88% 3.46% Adjusted net non-interest expense to average assets (1) 2.54% 3.17% 3.11% 3.88% 3.46% Efficiency ratio 55.95% 65.15% 62.56% 78.24% 70.15% Adjusted efficiency ratio (1) 55.95% 64.18% 70.75% 78.24% 70.15% Asset Quality(3) Non-performing assets to total assets 1.15% 1.52% 1.20% 1.09% 0.87% ACL to total loans 1.92% 1.88% 1.24% 1.04% 0.69% Net charge-offs to average loans 0.03% 0.02% 0.02% 0.04% 0.08% Capital(4) Tier 1 capital to average assets 10.80% 10.75% 9.98% 9.62% 10.03% Tier 1 capital to risk-weighted assets 10.60% 10.32% 10.57% 9.03% 10.29% Common equity tier 1 capital to risk-weighted assets 9.05% 8.72% 8.84% 8.24% 9.46% Total capital to risk-weighted assets 13.03% 12.94% 13.44% 11.63% 12.76% Per Share Amounts Book value per share $27.42 $26.11 $25.28 $24.45 $25.50 Tangible book value per share (1) $19.78 $18.38 $17.59 $16.64 $17.88 Basic earnings (loss) per common share $1.27 $0.89 $0.56 $(0.18) $0.67 Diluted earnings (loss) per common share $1.25 $0.89 $0.56 $(0.18) $0.66 Adjusted diluted earnings per common share(1) $1.25 $0.91 $0.25 $(0.18) $0.66

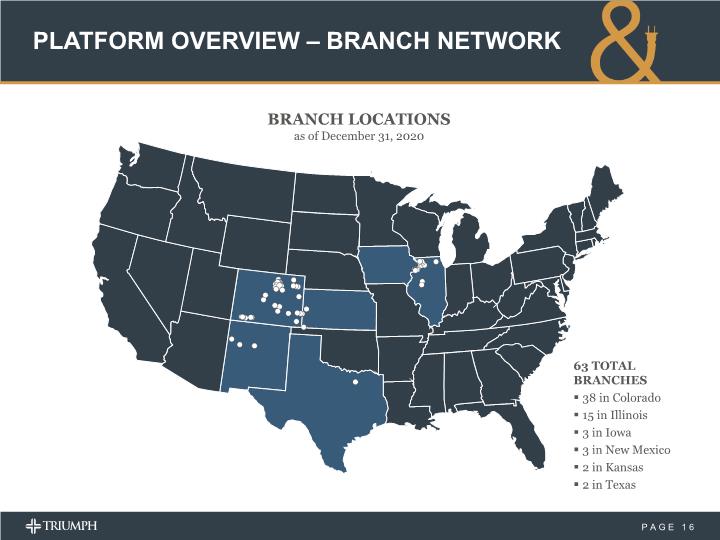

PLATFORM OVERVIEW – BRANCH NETWORK 63 TOTAL BRANCHES 38 in Colorado 15 in Illinois 3 in Iowa 3 in New Mexico 2 in Kansas 2 in Texas BRANCH LOCATIONS as of December 31, 2020 PAGE 16

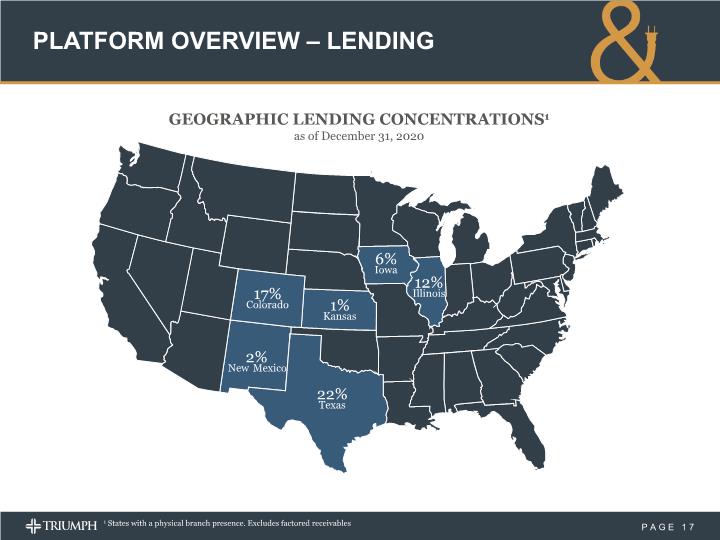

PLATFORM OVERVIEW – LENDING 22% Texas GEOGRAPHIC LENDING CONCENTRATIONS1 as of December 31, 2020 17% Colorado 1% Kansas 6% Iowa 12% Illinois 2% New Mexico 1 States with a physical branch presence. Excludes factored receivables PAGE 17

COVID-19 RESPONSE We are supporting our customers and communities affected by the COVID-19 pandemic. Loan payment deferral program and participation in the Paycheck Protection Program (PPP). As of December 31st, our balance sheet reflected short-term deferrals on outstanding loan balances of $104.6 million to assist customers impacted by COVID-19. These deferred balances carried accrued interest of $0.7 million and the modifications were not considered troubled debt restructurings. As of December 31st, we carried 1,913 PPP loans with a total balance of $189.9 million classified as commercial loans. We have received approximately $7.7 million in total fees from the SBA, $2.0 million and $4.6 million of which were recognized in earnings during the three and twelve months ended December 31, 2020, respectively. The remaining fees will be amortized over the respective lives of the loans. We waived a variety of deposit fees during the second quarter and continue to support the prompt processing of payments including such payments for non-bank customers. We continue to invest in, serve, and care for our communities. Local teams have made donations and purchased meals for those in need, including first responders. Most branches remain open with drive-through access. Over 90% of non-retail staff team members are working from home with minimal impact to our operations and service levels. PAGE 18

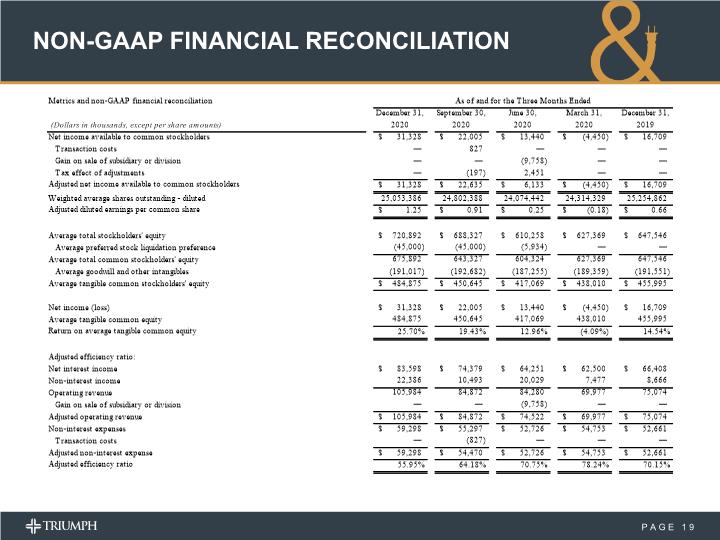

NON-GAAP FINANCIAL RECONCILIATION PAGE 19 Metrics and non-GAAP financial reconciliation As of and for the Three Months Ended December 31, September 30, June 30, March 31, December 31, (Dollars in thousands, except per share amounts) 2020 2020 2020 2020 2019 Net income available to common stockholders $31,328 $22,005 $13,440 $(4,450) $16,709 Transaction costs — 827 — — — Gain on sale of subsidiary or division — — (9,758) — — Tax effect of adjustments — (197) 2,451 — — Adjusted net income available to common stockholders $31,328 $22,635 $6,133 $(4,450) $16,709 Weighted average shares outstanding - diluted 25,053,386 24,802,388 24,074,442 24,314,329 25,254,862 Adjusted diluted earnings per common share $1.25 $0.91 $0.25 $(0.18) $0.66 Average total stockholders' equity $720,892 $688,327 $610,258 $627,369 $647,546 Average preferred stock liquidation preference (45,000) (45,000) (5,934) — — Average total common stockholders' equity 675,892 643,327 604,324 627,369 647,546 Average goodwill and other intangibles (191,017) (192,682) (187,255) (189,359) (191,551) Average tangible common stockholders' equity $484,875 $450,645 $417,069 $438,010 $455,995 Net income (loss) $31,328 $22,005 $13,440 $(4,450) $16,709 Average tangible common equity 484,875 450,645 417,069 438,010 455,995 Return on average tangible common equity 25.70% 19.43% 12.96% (4.09%) 14.54% Adjusted efficiency ratio: Net interest income $83,598 $74,379 $64,251 $62,500 $66,408 Non-interest income 22,386 10,493 20,029 7,477 8,666 Operating revenue 105,984 84,872 84,280 69,977 75,074 Gain on sale of subsidiary or division — — (9,758) — — Adjusted operating revenue $105,984 $84,872 $74,522 $69,977 $75,074 Non-interest expenses $59,298 $55,297 $52,726 $54,753 $52,661 Transaction costs — (827) — — — Adjusted non-interest expense $59,298 $54,470 $52,726 $54,753 $52,661 Adjusted efficiency ratio 55.95% 64.18% 70.75% 78.24% 70.15%

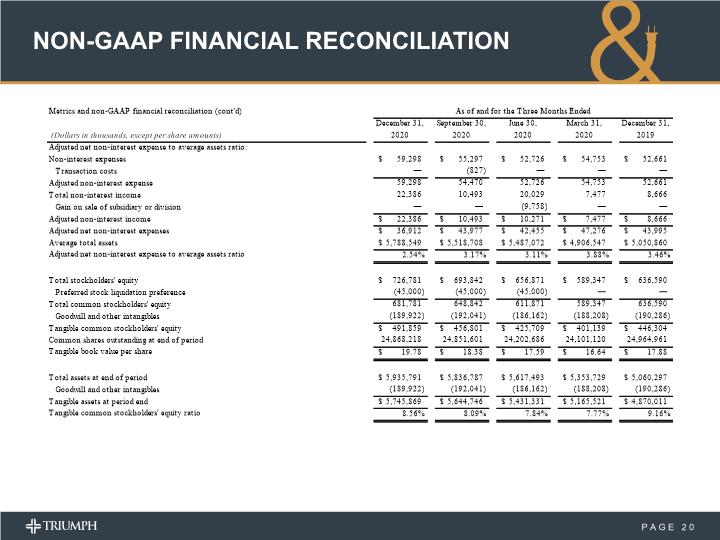

NON-GAAP FINANCIAL RECONCILIATION PAGE 20 Metrics and non-GAAP financial reconciliation (cont'd) As of and for the Three Months Ended December 31, September 30, June 30, March 31, December 31, (Dollars in thousands, except per share amounts) 2020 2020 2020 2020 2019 Adjusted net non-interest expense to average assets ratio: Non-interest expenses $59,298 $55,297 $52,726 $54,753 $52,661 Transaction costs — (827) — — — Adjusted non-interest expense 59,298 54,470 52,726 54,753 52,661 Total non-interest income 22,386 10,493 20,029 7,477 8,666 Gain on sale of subsidiary or division — — (9,758) — — Adjusted non-interest income $22,386 $10,493 $10,271 $7,477 $8,666 Adjusted net non-interest expenses $36,912 $43,977 $42,455 $47,276 $43,995 Average total assets $5,788,549 $5,518,708 $5,487,072 $4,906,547 $5,050,860 Adjusted net non-interest expense to average assets ratio 2.54% 3.17% 3.11% 3.88% 3.46% Total stockholders' equity $726,781 $693,842 $656,871 $589,347 $636,590 Preferred stock liquidation preference (45,000) (45,000) (45,000) — — Total common stockholders' equity 681,781 648,842 611,871 589,347 636,590 Goodwill and other intangibles (189,922) (192,041) (186,162) (188,208) (190,286) Tangible common stockholders' equity $491,859 $456,801 $425,709 $401,139 $446,304 Common shares outstanding at end of period 24,868,218 24,851,601 24,202,686 24,101,120 24,964,961 Tangible book value per share $19.78 $18.38 $17.59 $16.64 $17.88 Total assets at end of period $5,935,791 $5,836,787 $5,617,493 $5,353,729 $5,060,297 Goodwill and other intangibles (189,922) (192,041) (186,162) (188,208) (190,286) Tangible assets at period end $5,745,869 $5,644,746 $5,431,331 $5,165,521 $4,870,011 Tangible common stockholders' equity ratio 8.56% 8.09% 7.84% 7.77% 9.16%