Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FUELCELL ENERGY INC | fcel-8k_20210121.htm |

| EX-99.1 - EX-99.1 - FUELCELL ENERGY INC | fcel-ex991_16.htm |

Fourth Quarter and Fiscal 2020 Financial Results & Strategy Update January 21, 2021 Exhibit 99.2

Safe Harbor Statement This presentation contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including, without limitation, statements with respect to the Company’s anticipated financial results and statements regarding the Company’s plans and expectations regarding the continuing development, commercialization and financing of its fuel cell technology and its business plans and strategies. All forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those projected. Factors that could cause such a difference include, without limitation, changes to projected deliveries and order flow, changes to production rate and product costs, general risks associated with product development, manufacturing, changes in the regulatory environment, customer strategies, ability to access certain markets, unanticipated manufacturing issues that impact power plant performance, changes in critical accounting policies, access to and ability to raise capital and attract financing, potential volatility of energy prices, rapid technological change, competition, the Company’s ability to successfully implement its new business strategies and achieve its goals, the Company’s ability to achieve its sales plans and cost reduction targets, changes by the U.S. Small Business Administration or other governmental authorities to, or with respect to the implementation or interpretation of, the Coronavirus Aid, Relief, and Economic Security Act, the Paycheck Protection Program or related administrative matters, and concerns with, threats of, or the consequences of, pandemics, contagious diseases or health epidemics, including the novel coronavirus, and resulting supply chain disruptions, shifts in clean energy demand, impacts to customers’ capital budgets and investment plans, impacts to the Company’s project schedules, impacts to the Company’s ability to service existing projects, and impacts on the demand for the Company’s products, as well as other risks set forth in the Company’s filings with the Securities and Exchange Commission. The forward-looking statements contained herein speak only as of the date of this presentation. The Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any such statement to reflect any change in the Company’s expectations or any change in events, conditions or circumstances on which any such statement is based. The Company refers to non-GAAP financial measures in this presentation. The Company believes that this information is useful to understanding its operating results and assessing performance and highlighting trends on an overall basis. Please refer to the Company’s earnings release and the appendix to this presentation for further disclosure and reconciliation of non-GAAP financial measures. (As used herein, the term “GAAP” refers to generally accepted accounting principles in the U.S.) The information set forth in this presentation is qualified by reference to, and should be read in conjunction with, our Annual Report on Form 10-K for the fiscal year ended October 31, 2020, filed with the SEC on January 21, 2021 and our earnings release for the fourth quarter and the fiscal year ended October 31, 2020, filed as an exhibit to our Current Report on Form 8-K filed with the SEC on January 21, 2021. 2

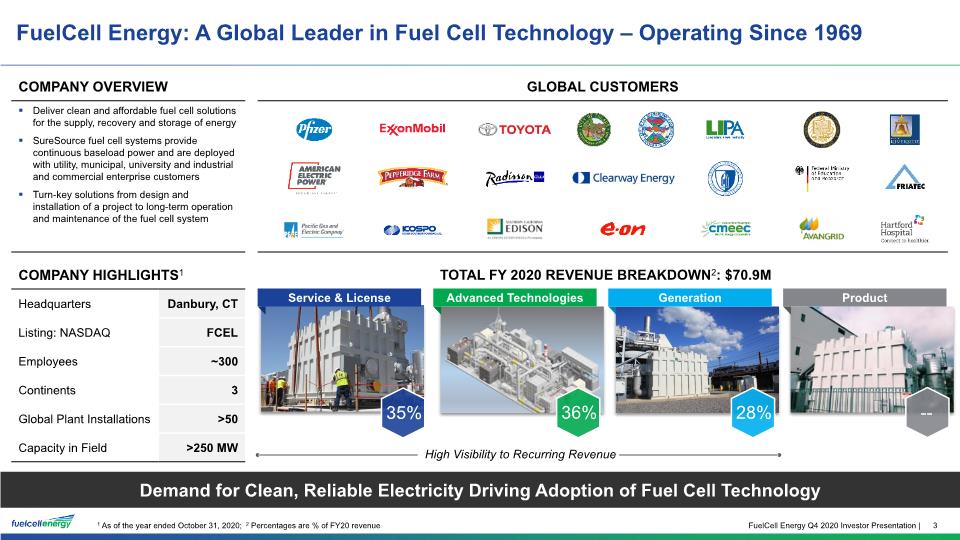

FuelCell Energy: A Global Leader in Fuel Cell Technology – Operating Since 1969 Demand for Clean, Reliable Electricity Driving Adoption of Fuel Cell Technology TOTAL FY 2020 REVENUE BREAKDOWN2: $70.9M Service & License Advanced Technologies Generation Product High Visibility to Recurring Revenue 1 As of the year ended October 31, 2020; 2 Percentages are % of FY20 revenue 3 --

Purpose Statement 4 Enable The World To Live A Life Empowered By Clean Energy

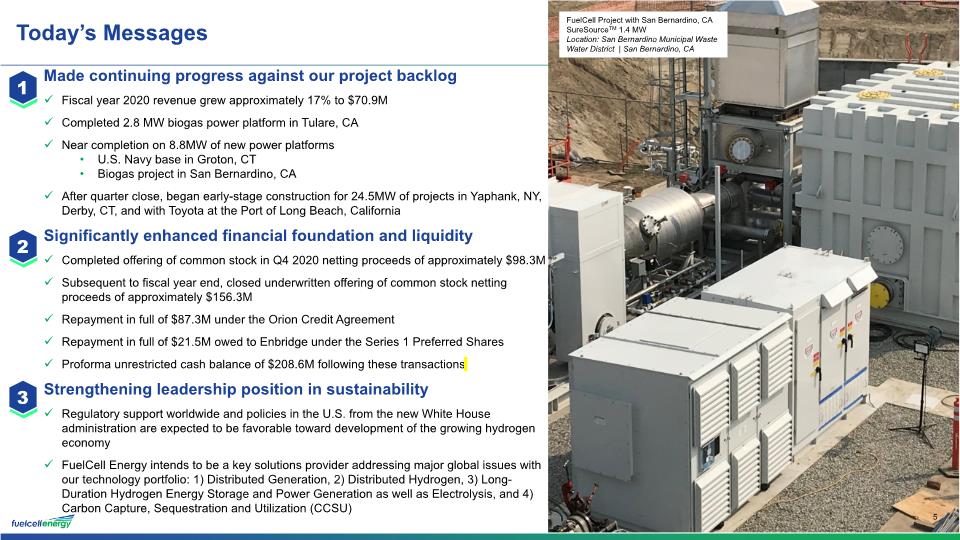

Today’s Messages 5 Made continuing progress against our project backlog Fiscal year 2020 revenue grew approximately 17% to $70.9M Completed 2.8 MW biogas power platform in Tulare, CA Near completion on 8.8MW of new power platforms U.S. Navy base in Groton, CT Biogas project in San Bernardino, CA After quarter close, began early-stage construction for 24.5MW of projects in Yaphank, NY, Derby, CT, and with Toyota at the Port of Long Beach, California Significantly enhanced financial foundation and liquidity Completed offering of common stock in Q4 2020 netting proceeds of approximately $98.3M Subsequent to fiscal year end, closed underwritten offering of common stock netting proceeds of approximately $156.3M Repayment in full of $87.3M under the Orion Credit Agreement Repayment in full of $21.5M owed to Enbridge under the Series 1 Preferred Shares Proforma unrestricted cash balance of $208.6M following these transactions Strengthening leadership position in sustainability Regulatory support worldwide and policies in the U.S. from the new White House administration are expected to be favorable toward development of the growing hydrogen economy FuelCell Energy intends to be a key solutions provider addressing major global issues with our technology portfolio: 1) Distributed Generation, 2) Distributed Hydrogen, 3) Long-Duration Hydrogen Energy Storage and Power Generation as well as Electrolysis, and 4) Carbon Capture, Sequestration and Utilization (CCSU) FuelCell Project with San Bernardino, CA SureSourceTM 1.4 MW Location: San Bernardino Municipal Waste Water District | San Bernardino, CA

Q4 and Fiscal 2020 Financial Performance

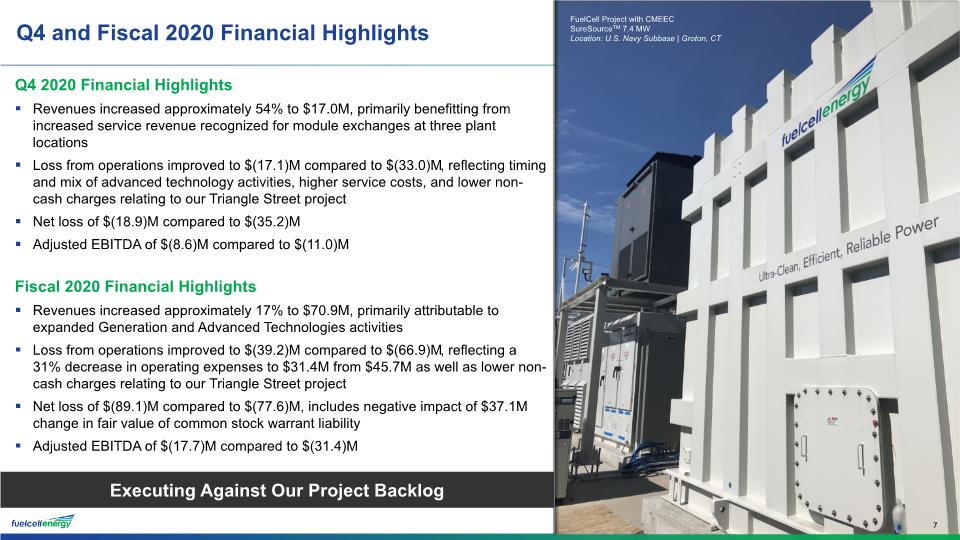

Q4 and Fiscal 2020 Financial Highlights Q4 2020 Financial Highlights Revenues increased approximately 54% to $17.0M, primarily benefitting from increased service revenue recognized for module exchanges at three plant locations Loss from operations improved to $(17.1)M compared to $(33.0)M, reflecting timing and mix of advanced technology activities, higher service costs, and lower non-cash charges relating to our Triangle Street project Net loss of $(18.9)M compared to $(35.2)M Adjusted EBITDA of $(8.6)M compared to $(11.0)M Fiscal 2020 Financial Highlights Revenues increased approximately 17% to $70.9M, primarily attributable to expanded Generation and Advanced Technologies activities Loss from operations improved to $(39.2)M compared to $(66.9)M, reflecting a 31% decrease in operating expenses to $31.4M from $45.7M as well as lower non-cash charges relating to our Triangle Street project Net loss of $(89.1)M compared to $(77.6)M, includes negative impact of $37.1M change in fair value of common stock warrant liability Adjusted EBITDA of $(17.7)M compared to $(31.4)M Executing Against Our Project Backlog FuelCell Project with CMEEC SureSourceTM 7.4 MW Location: U.S. Navy Subbase | Groton, CT 7

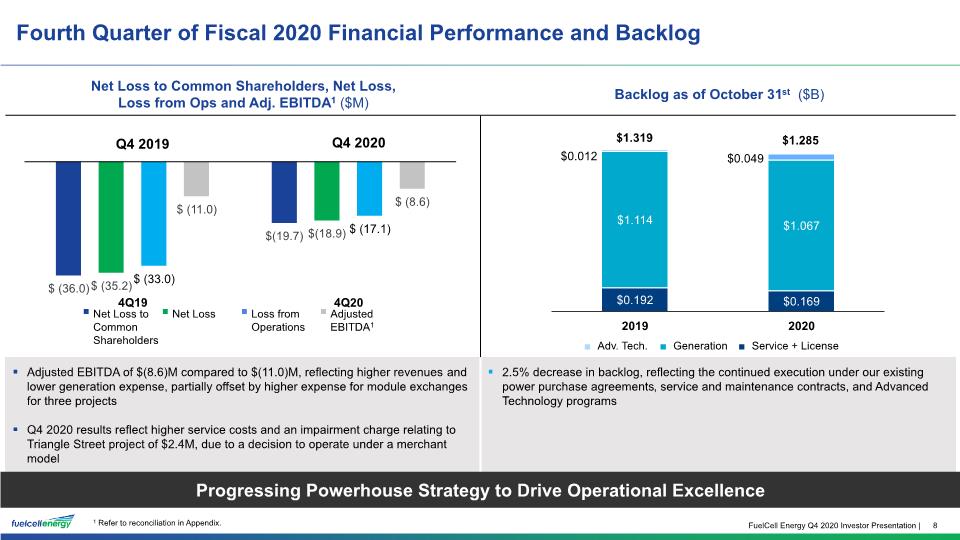

Fourth Quarter of Fiscal 2020 Financial Performance and Backlog 8 1 Refer to reconciliation in Appendix. Progressing Powerhouse Strategy to Drive Operational Excellence

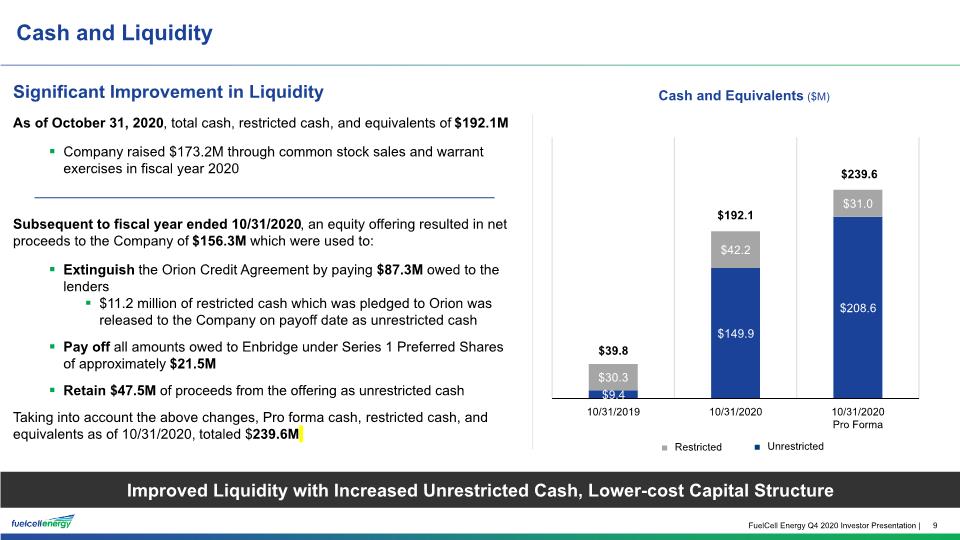

Cash and Liquidity 9 Improved Liquidity with Increased Unrestricted Cash, Lower-cost Capital Structure $39.8 $239.6 Significant Improvement in Liquidity As of October 31, 2020, total cash, restricted cash, and equivalents of $192.1M Company raised $173.2M through common stock sales and warrant exercises in fiscal year 2020 Subsequent to fiscal year ended 10/31/2020, an equity offering resulted in net proceeds to the Company of $156.3M which were used to: Extinguish the Orion Credit Agreement by paying $87.3M owed to the lenders $11.2 million of restricted cash which was pledged to Orion was released to the Company on payoff date as unrestricted cash Pay off all amounts owed to Enbridge under Series 1 Preferred Shares of approximately $21.5M Retain $47.5M of proceeds from the offering as unrestricted cash Taking into account the above changes, Pro forma cash, restricted cash, and equivalents as of 10/31/2020, totaled $239.6M

Operational Update Continued implementation of our Powerhouse Business Strategy is our major focus 10 Made continuing progress against our project backlog During fiscal year 2020 we completed our 2.8 MW biogas power platform in Tulare, CA Near completion on 8.8 MW of new power platforms U.S. Navy base in Groton, CT Biogas project in San Bernardino, CA After fiscal year end, we began early-stage construction for 22.2 MW of projects in Yaphank, NY and Derby, CT Focus on improvement initiatives across the enterprise Improvements in manufacturing processes and capabilities allows the Company to increase annualized production rate to 45 MW on a single production shift FuelCell Project with Pfizer Two SureSourceTM 3000 2.8 MW platforms Location: Groton, CT

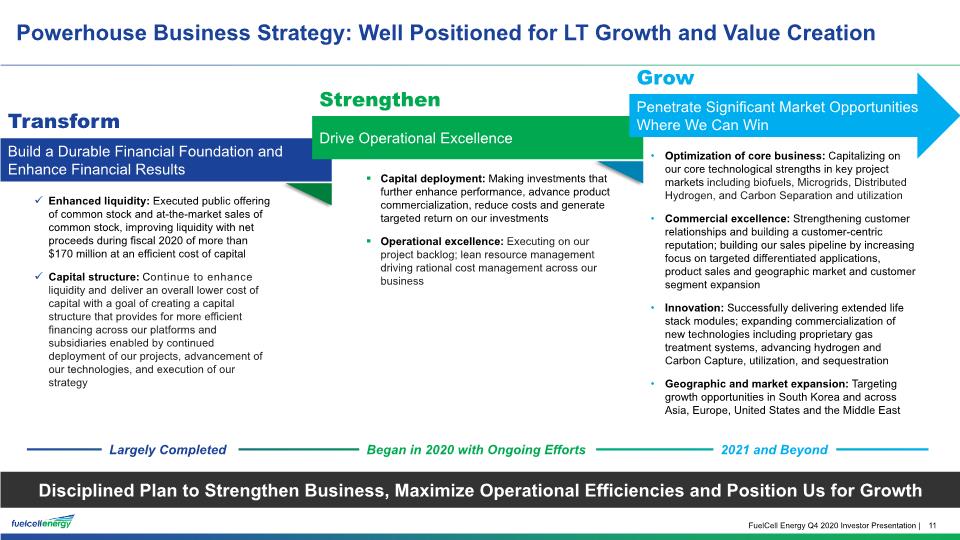

Powerhouse Business Strategy: Well Positioned for LT Growth and Value Creation Disciplined Plan to Strengthen Business, Maximize Operational Efficiencies and Position Us for Growth 11 Build a Durable Financial Foundation and Enhance Financial Results Drive Operational Excellence Penetrate Significant Market Opportunities Where We Can Win Transform Strengthen Grow Enhanced liquidity: Executed public offering of common stock and at-the-market sales of common stock, improving liquidity with net proceeds during fiscal 2020 of more than $170 million at an efficient cost of capital Capital structure: Continue to enhance liquidity and deliver an overall lower cost of capital with a goal of creating a capital structure that provides for more efficient financing across our platforms and subsidiaries enabled by continued deployment of our projects, advancement of our technologies, and execution of our strategy Capital deployment: Making investments that further enhance performance, advance product commercialization, reduce costs and generate targeted return on our investments Operational excellence: Executing on our project backlog; lean resource management driving rational cost management across our business Optimization of core business: Capitalizing on our core technological strengths in key project markets including biofuels, Microgrids, Distributed Hydrogen, and Carbon Separation and utilization Commercial excellence: Strengthening customer relationships and building a customer-centric reputation; building our sales pipeline by increasing focus on targeted differentiated applications, product sales and geographic market and customer segment expansion Innovation: Successfully delivering extended life stack modules; expanding commercialization of new technologies including proprietary gas treatment systems, advancing hydrogen and Carbon Capture, utilization, and sequestration Geographic and market expansion: Targeting growth opportunities in South Korea and across Asia, Europe, United States and the Middle East Largely Completed Began in 2020 with Ongoing Efforts 2021 and Beyond

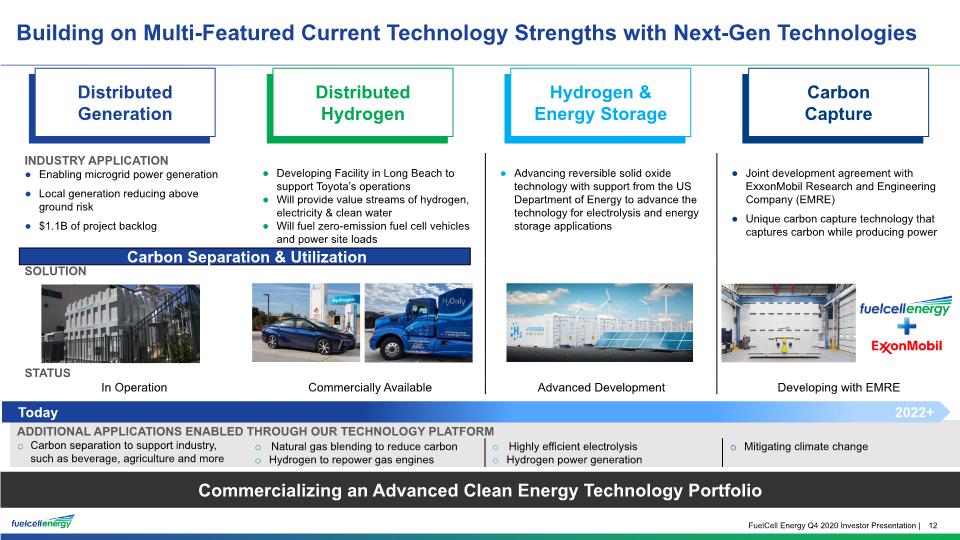

Building on Multi-Featured Current Technology Strengths with Next-Gen Technologies Commercializing an Advanced Clean Energy Technology Portfolio 12 Carbon Separation & Utilization

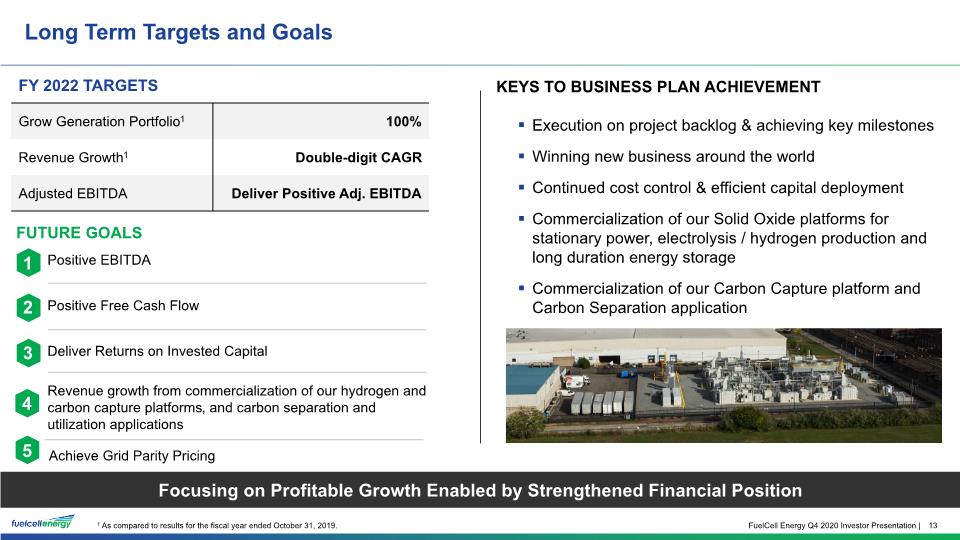

Focusing on Profitable Growth Enabled by Strengthened Financial Position 13 FUTURE GOALS Positive EBITDA Positive Free Cash Flow Deliver Returns on Invested Capital Revenue growth from commercialization of our hydrogen and carbon capture platforms, and carbon separation and utilization applications 1 2 3 4 KEYS TO BUSINESS PLAN ACHIEVEMENT Execution on project backlog & achieving key milestones Winning new business around the world Continued cost control & efficient capital deployment Commercialization of our Solid Oxide platforms for stationary power, electrolysis / hydrogen production and long duration energy storage Commercialization of our Carbon Capture platform and Carbon Separation application 1 As compared to results for the fiscal year ended October 31, 2019. Long Term Targets and Goals Achieve Grid Parity Pricing 5

Key Investment Highlights 14 1 2 3 4 Strengthened balance sheet with liquidity to complete project backlog and accelerate commercialization of new technologies Leadership committed to project execution, achieving financial milestones, and delivering state-of-the-art fuel cell platforms to contribute to decarbonization and global climate change mitigation Innovative technology for clean, reliable and scalable distributed baseload power, distributed hydrogen, long-duration storage and carbon capture, separation and utilization Progressing on our path of execution to Transform, Strengthen and Grow the organization for long-term success 5 A Leader in Sustainability and Environmental Stewardship with our technology platform solutions

Q&A

Appendix

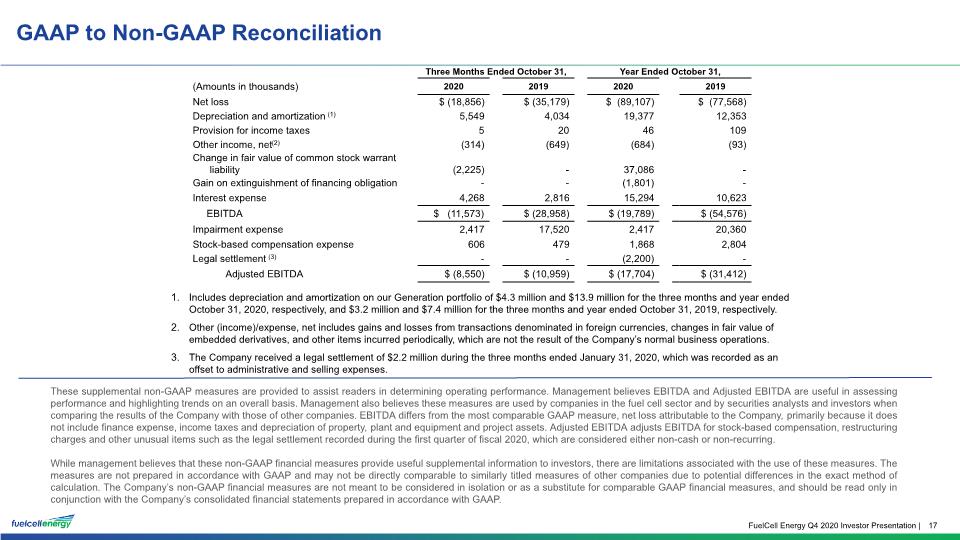

GAAP to Non-GAAP Reconciliation 17 These supplemental non-GAAP measures are provided to assist readers in determining operating performance. Management believes EBITDA and Adjusted EBITDA are useful in assessing performance and highlighting trends on an overall basis. Management also believes these measures are used by companies in the fuel cell sector and by securities analysts and investors when comparing the results of the Company with those of other companies. EBITDA differs from the most comparable GAAP measure, net loss attributable to the Company, primarily because it does not include finance expense, income taxes and depreciation of property, plant and equipment and project assets. Adjusted EBITDA adjusts EBITDA for stock-based compensation, restructuring charges and other unusual items such as the legal settlement recorded during the first quarter of fiscal 2020, which are considered either non-cash or non-recurring. While management believes that these non-GAAP financial measures provide useful supplemental information to investors, there are limitations associated with the use of these measures. The measures are not prepared in accordance with GAAP and may not be directly comparable to similarly titled measures of other companies due to potential differences in the exact method of calculation. The Company’s non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP financial measures, and should be read only in conjunction with the Company’s consolidated financial statements prepared in accordance with GAAP. Includes depreciation and amortization on our Generation portfolio of $4.3 million and $13.9 million for the three months and year ended October 31, 2020, respectively, and $3.2 million and $7.4 million for the three months and year ended October 31, 2019, respectively. Other (income)/expense, net includes gains and losses from transactions denominated in foreign currencies, changes in fair value of embedded derivatives, and other items incurred periodically, which are not the result of the Company’s normal business operations. The Company received a legal settlement of $2.2 million during the three months ended January 31, 2020, which was recorded as an offset to administrative and selling expenses.

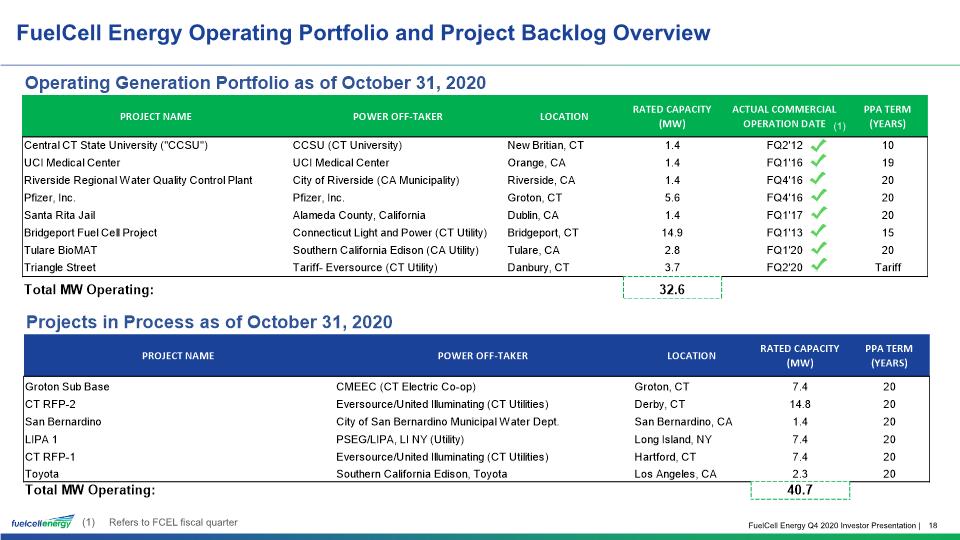

FuelCell Energy Operating Portfolio and Project Backlog Overview 18 Refers to FCEL fiscal quarter (1) (1)