Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - ATLANTIC POWER CORP | tm213166d1_ex99-3.htm |

| EX-99.1 - EXHIBIT 99.1 - ATLANTIC POWER CORP | tm213166d1_ex99-1.htm |

| EX-10.1 - EXHIBIT 10.1 - ATLANTIC POWER CORP | tm213166d1_ex10-1.htm |

| EX-2.1 - EXHIBIT 2.1 - ATLANTIC POWER CORP | tm213166d1_ex2-1.htm |

| 8-K - FORM 8-K - ATLANTIC POWER CORP | tm213166d1_8k.htm |

Exhibit 99.2

CONFIDENTIAL Agreement to be Acquired by I Squared Capital Conference Call January 15, 2021

Cautionary Note Regarding Forward - Looking Statements 2 To the extent any statements made in this presentation contain information that is not historical, these statements are forwa rd - looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exch ang e Act of 1934, as amended, and under Canadian securities law (collectively, “forward - looking statements”). Certain statements in this presentation may constitute forward - looking statements, which reflect the expectations of the managem ent of Atlantic Power Corporation (“AT”, “Atlantic Power” or the “Company”) regarding the future growth, results of operations, performance and bus ine ss prospects and opportunities of the Company and its projects and the proposed transaction. These statements, which are based on certain assu mpt ions and describe the Company’s future plans, strategies and expectations, can generally be identified by the use of the words “plans”, “expect s”, “does not expect”, “is expected”, “budget”, “estimates”, “forecasts”, “targets”, “intends”, “anticipates” or “does not anticipate”, “believes”, “out loo k”, “objective”, or “continue”, or equivalents or variations, including negative variations, of such words and phrases, or state that certain actions, events or results, “may”, “could”, “would”, “should”, “might” or “will” be taken, occur or be achieved. Examples of such statements in this presentation include , b ut are not limited to, statements with respect to the following: the anticipated benefits of the transaction; the anticipated receipt of required re gul atory, court and securityholder approvals for the transaction; the receipt of third - party consents necessary to satisfy closing conditions to the transaction; the ability of the parties to satisfy the other conditions to, and to complete, the transaction; the Company’s intention to hold securityholder meetings; the mailing of the management information circular and proxy statement and/or consent solicitation documents; and the anticipated timing of the closing of the transaction . Forward - looking statements involve significant risks and uncertainties, should not be read as guarantees of future performance o r results, and will not necessarily be accurate indications of whether or not or the times at or by which such performance or results will be achieve d. Risks and uncertainties inherent in the nature of the transaction include, without limitation, the failure of the Company, APLP, APPEL and the purcha ser s to obtain necessary securityholder , regulatory and court approvals, obtain third - party consents, or to otherwise satisfy the conditions to the completion of the t ransaction, in a timely manner, or at all, failure to realize the expected benefits of the transaction and general economic conditions. Fail ure to so obtain required approvals or consents, or the failure of the parties to otherwise satisfy the conditions to or complete the transaction, may res ult in the transaction not being completed on the proposed terms, or at all. Please also refer to the factors discussed under “Risk Factors” and “Forwar d - L ooking Information” in the Company’s periodic reports as filed with the SEC from time to time for a detailed discussion of the risks and uncertaint ies affecting the Company. The anticipated dates provided may change for a number of reasons, including unforeseen delays in preparing securityholder meeting or consent solicitation materials, the inability to secure necessary securityholder , regulatory, court or other third - party approvals or consents in the time assumed, delays resulting from the impact of the COVID - 19 pandemic, or the need for additional time to satisfy the other conditions to th e completion of the transaction. Although the forward - looking statements contained in this news release are based upon what are believed to be reaso nable assumptions, investors cannot be assured that actual results will be consistent with these forward - looking statements, and the differences ma y be material. These forward - looking statements are made as of the date of this presentation and, except as expressly required by applicable law, the Company assumes no obligation to update or revise them to reflect new events or circumstances.

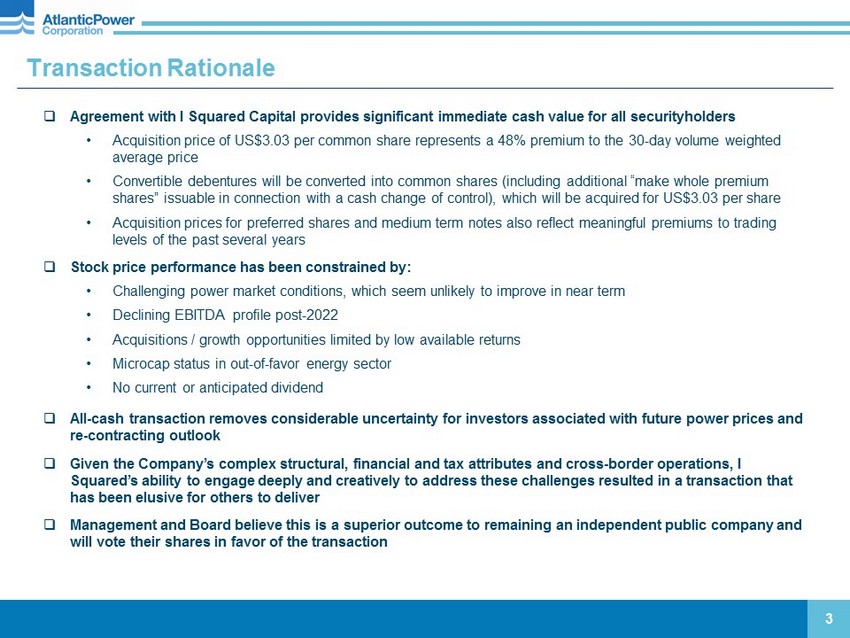

Transaction Rationale 3 □ Agreement with I Squared Capital provides significant immediate cash value for all securityholders • Acquisition price of US$3.03 per common share represents a 48% premium to the 30 - day volume weighted average price • Convertible debentures will be converted into common shares (including additional “make whole premium shares” issuable in connection with a cash change of control), which will be acquired for US$3.03 per share • Acquisition prices for preferred shares and medium term notes also reflect meaningful premiums to trading levels of the past several years □ Stock price performance has been constrained by: • Challenging power market conditions, which seem unlikely to improve in near term • Declining EBITDA profile post - 2022 • Acquisitions / growth opportunities limited by low available returns • Microcap status in out - of - favor energy sector • No current or anticipated dividend □ All - cash transaction removes considerable uncertainty for investors associated with future power prices and re - contracting outlook □ Given the Company’s complex structural, financial and tax attributes and cross - border operations, I Squared’s ability to engage deeply and creatively to address these challenges resulted in a transaction that has been elusive for others to deliver □ Management and Board believe this is a superior outcome to remaining an independent public company and will vote their shares in favor of the transaction

Transaction Highlights 4 Agreement □ I Squared Capital would acquire all publicly - traded securities of Atlantic Power for cash, subject to conditions and approvals □ Transaction has an enterprise value of approximately US$961 million (1) Consideration □ Common shareholders to receive US$3.03 per share □ Preferred shareholders to receive Cdn$22.00 per share □ Medium term noteholders to receive 106.071% of par (2) □ Convertible debentures converted into common shares, including make whole premium Conditions and Approvals □ Approval by two - thirds of votes cast by each class of security holders ▪ Holders of convertible debentures and medium term notes may approve by written consent of two - thirds principal amount outstanding, as applicable □ Approval by Supreme Court of British Columbia; regulatory approvals in both the US and Canada □ Other customary closing conditions and certain third - party consents □ No financing condition Timeline □ Management information circular and proxy statement to provide additional information □ Shareholder meetings / votes and consent solicitations □ Closing expected second quarter 2021 (1) Canadian dollar - denominated debt was converted to U.S. dollars using the January 14, 2021 exchange rate of 1.2654. (2) Medium term noteholders who deliver a written consent to proposed amendments to receive an additional consent fee equal to 0.25% of par, conditional on c los ing of the transaction.

5 Additional Information About the Arrangement and Where to Find It This presentation is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. This presentation is being made in respect of the transaction involving Atlantic Power, APPEL and the purchasers pursuant to the terms of the Arrangement Agreement by and among Atlantic Power, APPEL and the purcha ser s and may be deemed to be soliciting material relating to the transaction. In connection with the transaction, Atlantic Power will file a management information circular and proxy statement relating to a special meeting of its common shareholders with the SEC and Canadian Securities Ad min istrators. Additionally, Atlantic Power will file other relevant materials in connection with the transaction with the SEC. Securityholders of Atlantic Power are urged to read the management information circular and proxy statement regarding the transaction and any other relevant materials carefully in their entirety when they become available before making any voting or investment decision with respect to the transaction because t hey will contain important information about the transaction and the parties to the Arrangement Agreement. The definitive management informati on circular and proxy statement will be mailed to Atlantic Power’s common shareholders. Securityholders of Atlantic Power will be able to obtain a copy of the management information circular and proxy statement, and the filings with the SEC and Canadian Securities Administrators that will be in cor porated by reference into the proxy statement as well as other filings containing information about the transaction and the parties to the Arrangement Agreement made by Atlantic Power with the SEC and Canadian Securities Administrators free of charge on EDGAR at www.sec.gov, on SEDAR at www.se dar .com, or on Atlantic Power’s website at www.atlanticpower.com. Information contained on, or that may be accessed through, the websites re fer enced in this communication is not incorporated into and does not constitute a part of this presentation. We have included these website ad dre sses only as inactive textual references and do not intend them to be active links. Participants in the Solicitation Atlantic Power and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the holders of Atlantic Power’s common shares in respect of the transaction. Information about Atlantic Power’s directors and executive officers is s et forth in the proxy statement and proxy circular for Atlantic Power’s 2020 Annual General Meeting of Shareholders, which was filed with the SEC a nd Canadian Securities Administrators on April 28, 2020. Investors may obtain additional information regarding the interest of such parti cip ants by reading the management information circular and proxy statement regarding the transaction when it becomes available.