Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Grayscale Ethereum Trust (ETH) | d43915d8k.htm |

Exhibit 99.1

Digital Asset Investment Report Q4 2020 grayscale.co

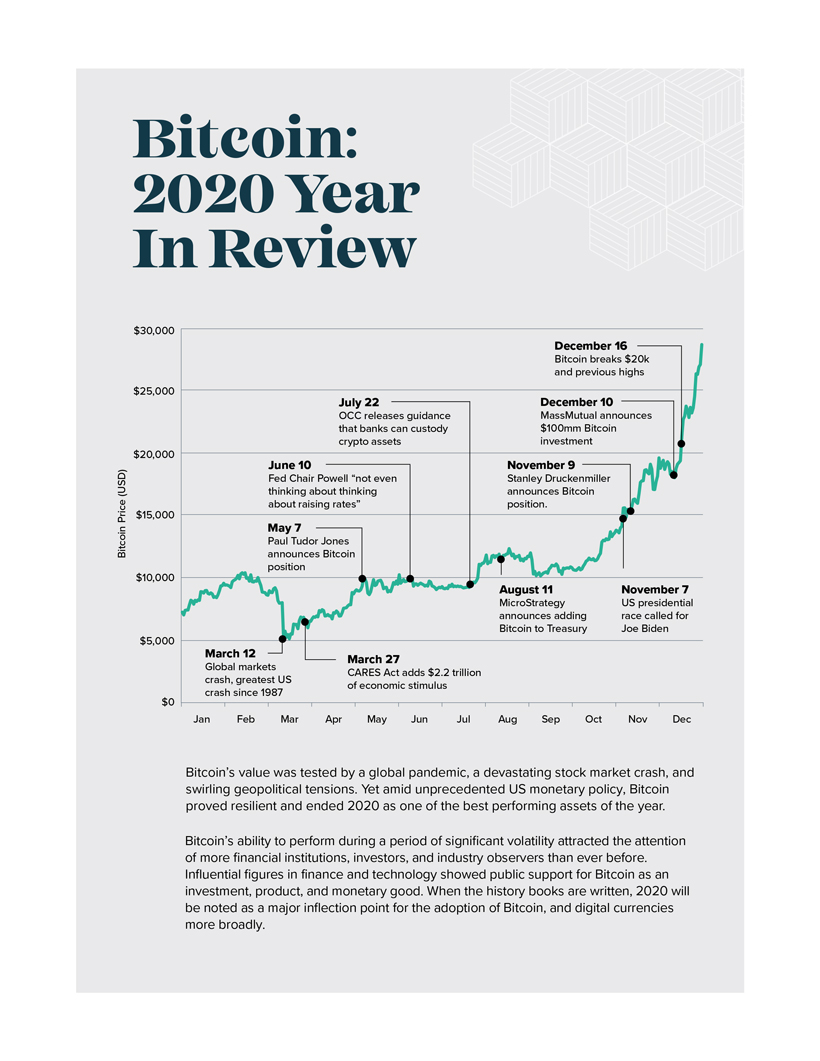

Bitcoin: 2020 Year In Review $30,000 December 16 Bitcoin breaks $20k and previous highs $25,000 July 22 December 10 OCC releases guidance MassMutual announces that banks can custody $100mm Bitcoin crypto assets investment $20,000 June 10 November 9 Fed Chair Powell “not even Stanley Druckenmiller (USD) thinking about thinking announces Bitcoin about raising rates” position. Price $15,000 May 7 Paul Tudor Jones Bitcoin announces Bitcoin $10,000 position August 11 November 7 MicroStrategy US presidential announces adding race called for Bitcoin to Treasury Joe Biden $5,000 March 12 March 27 Global markets CARES Act adds $2.2 trillion crash, greatest US of economic stimulus crash since 1987 $0 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Bitcoin’s value was tested by Bitcoin’s ability to perform during a period of a global pandemic, a devas- significant volatility attracted the attention of more tating stock market crash, and financial institutions, investors, and industry observ-swirling geopolitical tensions. ers than ever before. Influential figures in finance Yet amid unprecedented US and technology showed public support for Bitcoin monetary policy, Bitcoin proved as an investment, product, and monetary good. resilient and ended 2020 as When the history books are written, 2020 will be one of the best performing noted as a major inflection point for the adoption of assets of the year. Bitcoin, and digital currencies more broadly.

Grayscale 2021 Outlook • A Bitcoin arms race - Bitcoin is becoming a widely-used diversifier in portfolios. Major investors, advisory firms, and even banks are shifting their view on Bitcoin. The career risk of allocating to Bitcoin has turned into a career risk of being a laggard. In 2020 we saw institutions adding Bitcoin to treasuries—in 2021 we may see nation states follow suit. • Financial advisor interest - RIA interest surged in Q4 2020, and more financial advisors are receiving questions about digital currencies than ever before. With the performance of major digital currencies like Bitcoin in 2020, it’s reasonable to expect that more investors and advisors alike will be considering how to best fit this asset class within a larger portfolio. Wealth managers advise on approximately $80 trillion in assets and most have not yet recommended digital assets.1 • Bitcoin rewards could become a significant source of demand for Bitcoin - US credit cards account for $4 trillion in annual spending and debit cards account for over $3 trillion in annual spending.2 Fold, CashApp, and BlockFi are among the businesses that launched cards with Bit-coin rewards in 2020. We expect major credit card companies could follow suit as they see the success of these Bitcoin products. • Bitcoin recognized as a clean energy incentive—Energy consumption and geographical concentration of mining in China have long been hot topics for Bitcoin. That narrative is changing rapidly. North America is becoming a mining powerhouse, with the likes of Foundry, by integrating Bitcoin mining into the most efficient energy infrastructure across the continent. Energy companies are making a purely economical decision to put their previously wasted energy to good use and get paid for it. Bitcoin mining is helping to subsidize underutilized energy infrastructure and may be integrated into public green energy initiatives. • Decentralized Finance is emerging—Billions in liquid lending, borrowing, and exchange have made decentralized finance (DeFi) the strongest non-Bitcoin use case in the digital currency ecosystem. As the search for yield intensifies in traditional markets, we expect major financial firms to consider integrating with decentralized protocols. • Nation-state adoption of digital currencies—While many countries have laws around digital currencies, few have seriously introduced or incorporated them into the set of financial tools governments have at their disposal. Recent guidance from the OCC suggests that US banks may look to incorporate digital currencies into their settlement infrastructure.3 In 2021 we may see the beginning of digital currencies integrating into national banking infrastructures. 1. “Evolution Revolution, A Profile of the Investment Advisor Profession”, Investment Advisor Association, 2019, https://higherlogicdownload.s3.amazonaws. com/INVESTMENTADVISER/aa03843e-7981-46b2-aa49-c572f2ddb7e8/UploadedImages/publications/Evolution_Revolution_2019_FINAL.pdf 2. “The Federal Reserve Payments Study”, Board of Governors of the Federal Reserve System, 2019, https://www.federalreserve.gov/paymentsystems/2019-December-The-Federal-Reserve-Payments-Study.htm. 3. “Federally Chartered Banks and Thrifts May Participate in Independent Node Verification Networks and Use Stablecoins for Payment Activities,” OCC, January 4, 2021, https://www.occ.gov/news-issuances/news-releases/2021/nr-occ-2021-2.html.

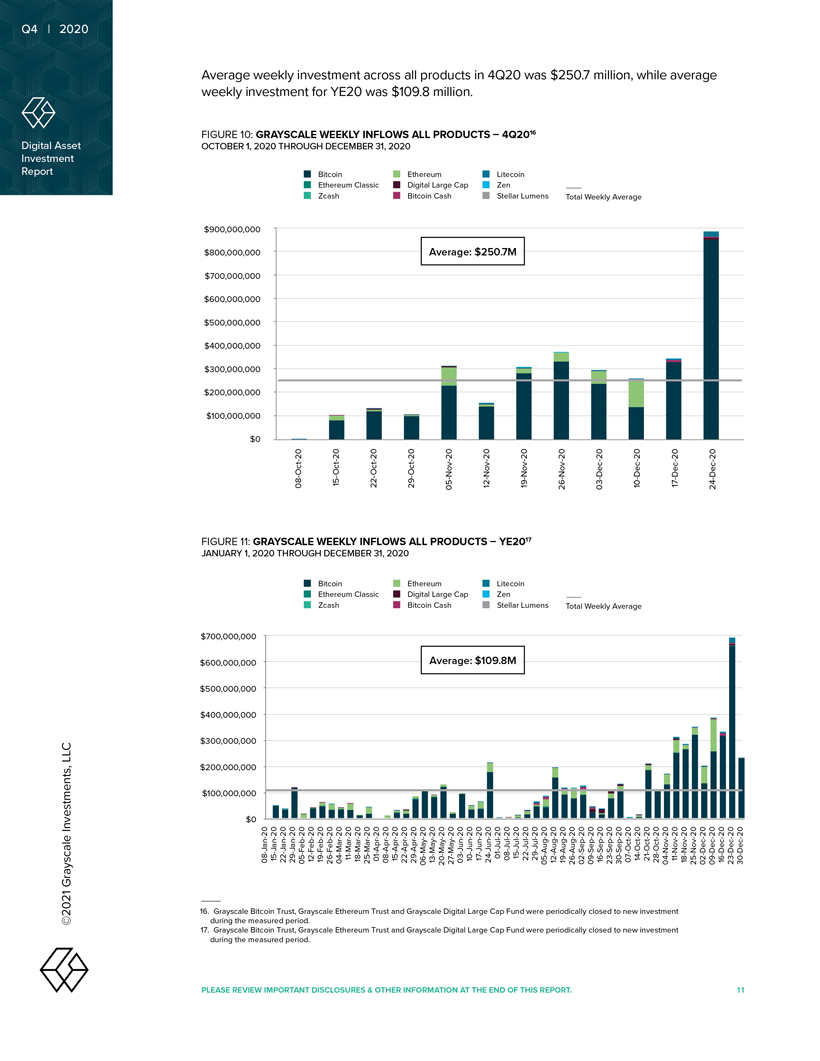

Q4 | 2020 Digital Asset Investment Report LLC Investments, Grayscale ©2021 Digital Asset Investment TOTAL AUM4 $20.2B Report 4Q20 Highlights5 • Total Investment into Grayscale Products6: $3.3 billion • Average Weekly Investment – All Products: $250.7 million • Average Weekly Investment – Grayscale® Bitcoin Trust: $217.1 million • Average Weekly Investment – Grayscale® Ethereum Trust: $26.3 million • Average Weekly Investment – Grayscale® Digital Large Cap Fund: $1.6 million • Average Weekly Investment – Grayscale Products ex Bitcoin Trust7: $33.6 million • Majority of investment (93%) came from institutional investors, dominated by asset managers. Year Ended 2020 (“YE20”) Highlights8 • Total Investment into Grayscale Products: $5.7 billion • Average Weekly Investment – All Products: $109.8 million • Average Weekly Investment – Grayscale® Bitcoin Trust: $90.0 million • Average Weekly Investment – Grayscale® Ethereum Trust: $15.2 million • Average Weekly Investment – Grayscale® Digital Large Cap Fund: $1.4 million • Average Weekly Investment – Grayscale Products ex Bitcoin Trust9: $19.8 million • Majority of investment (86%) came from institutional investors, dominated by asset managers. The Takeaway 2020 was a hallmark year for Grayscale and digital assets more broadly. Thank you to the community and our investors for making it possible. We are proud to share data that reflects the astonishing adoption throughout 2020, and specifically, 4Q20. 4. As of December 31, 2020. 5. For the period from October 1, 2020 through December 31, 2020. 6. On December 23, 2020, the Sponsor announced that it had ceased accepting new subscriptions for the Grayscale XRP Trust (XRP) (“XRP Trust”) private placement following the Securities and Exchange Commission’s December 22, 2020 decision to file a federal court action against certain third parties as-serting that XRP is a “security” under federal securities law. On January 13, 2021, the Sponsor announced that it had commenced dissolution of XRP Trust. As a result of the foregoing, XRP Trust is not reflected in this report. 7. “Grayscale Products ex Bitcoin Trust’’ include Grayscale Bitcoin Cash Trust, Grayscale Ethereum Trust, Grayscale Ethereum Classic Trust, Grayscale Horizen Trust, Grayscale Litecoin Trust, Grayscale Stellar Lumens Trust, Grayscale Zcash Trust, and Grayscale Digital Large Cap Fund. 8. For the period from January 1, 2020 through December 31, 2020. 9. See footnote 7. PLEASE REVIEW IMPORTANT DISCLOSURES & OTHER INFORMATION AT THE END OF THIS REPORT. ASSETS UNDER MANAGEMENT (AUM), INFLOWS, TOTAL INVESTMENT AND AVERAGE WEEKLY INVESTMENT ARE CALCULATED USING THE DIGITAL ASSET REFERENCE RATE FOR EACH PRODUCT, WHICH ARE NOT MEASURES CALCULATED IN ACCORDANCE WITH GAAP. SEE NON-GAAP MEASURES FOR MORE INFORMATION. UNLESS OTHERWISE NOTED, ALL FIGURES INCLUDED HEREIN ARE CALCULATED USING NON-GAAP METHODOLOGIES. 4

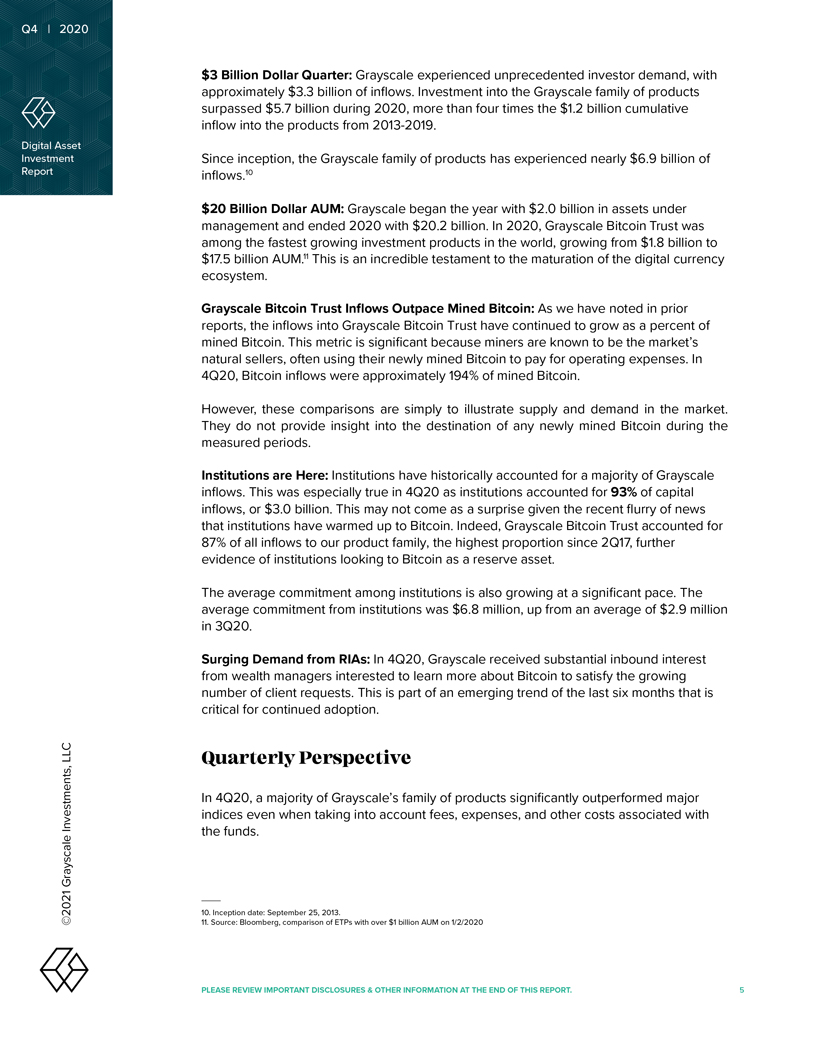

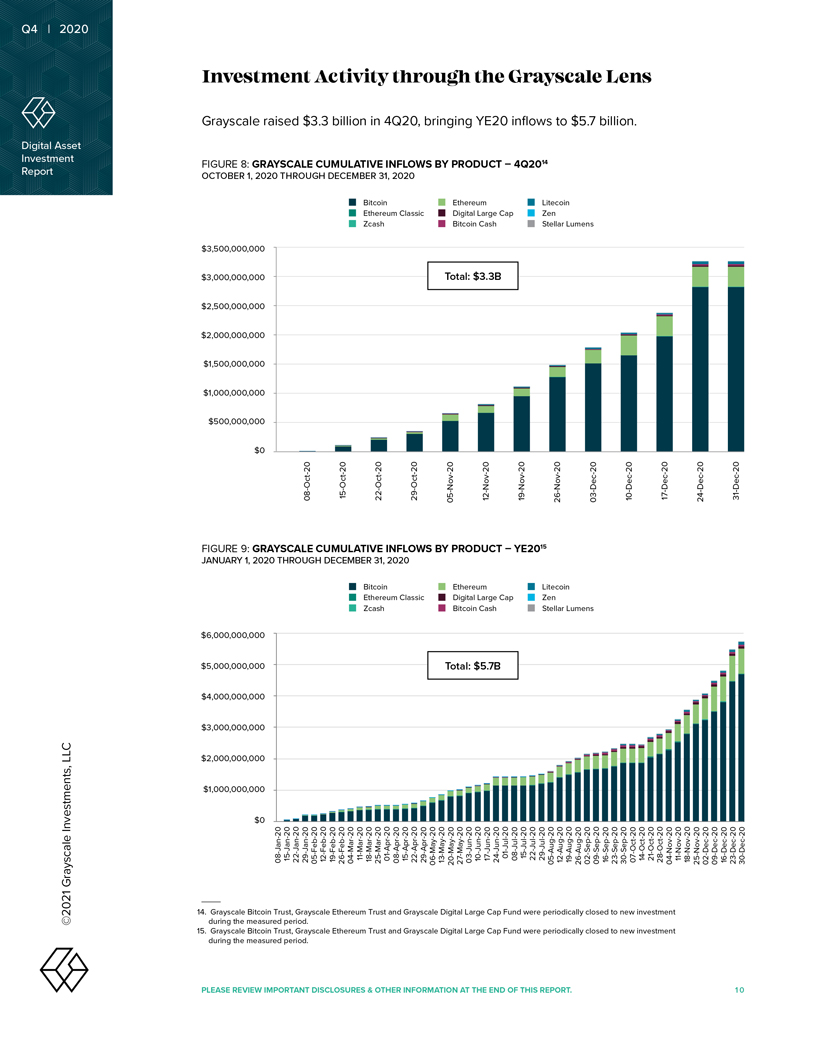

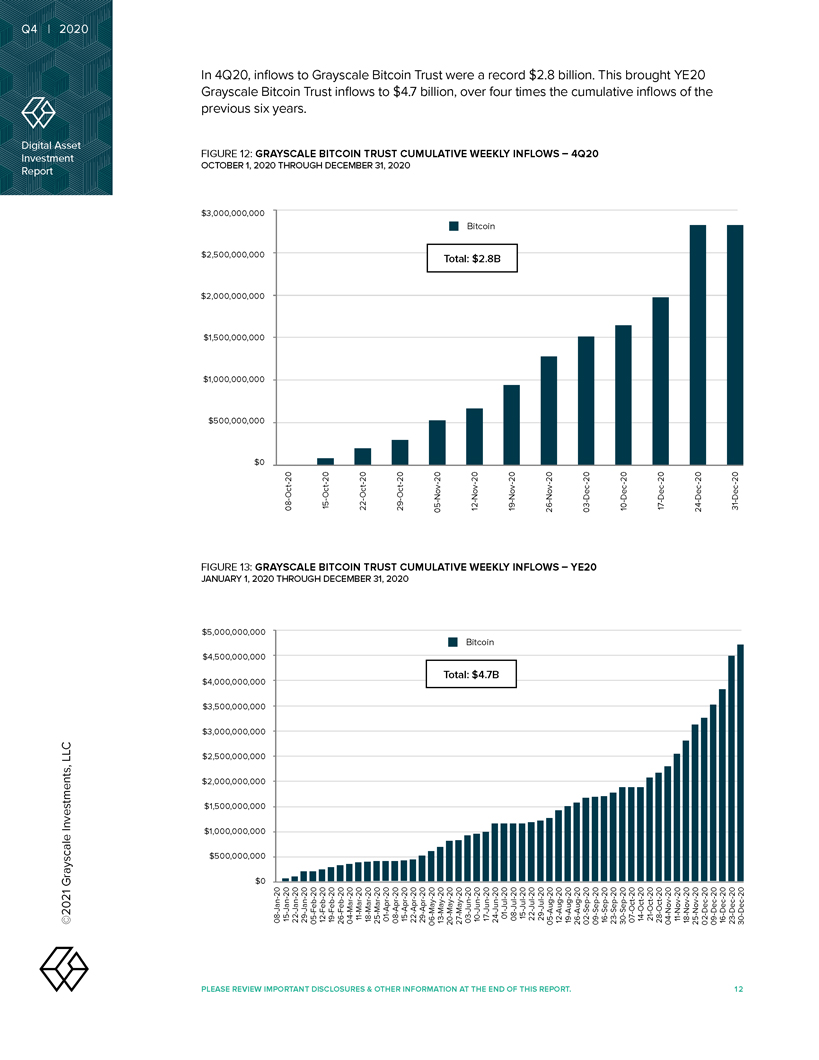

Q4 | 2020 Digital Asset Investment Report LLC Investments, Grayscale ©2021 $3 Billion Dollar Quarter: Grayscale experienced unprecedented investor demand, with approximately $3.3 billion of inflows. Year-to-date investment into the Grayscale family of products surpassed $5.7 billion, more than four times the $1.2 billion cumulative inflow into the products from 2013-2019. Since inception, the Grayscale family of products has experienced nearly $6.9 billion of inflows.10 $20 Billion Dollar AUM: Grayscale began the year with $2.0 billion in assets under management and ended 2020 with $20.2 billion. In 2020, Grayscale Bitcoin Trust was the fastest growing investment product in the world, growing from $1.8 billion to $17.5 billion AUM.11 This is an incredible testament to the maturation of the digital currency ecosystem. Grayscale Bitcoin Trust Inflows Outpace Mined Bitcoin: As we have noted in prior reports, the inflows into Grayscale Bitcoin Trust have continued to grow as a percent of mined Bitcoin. This metric is significant because miners are known to be the market’s natural sellers, often using their newly mined Bitcoin to pay for operating expenses. In 4Q20, Bitcoin inflows were approximately 194% of mined Bitcoin. However, these comparisons are simply to illustrate supply and demand in the market. They do not provide insight into the destination of any newly mined Bitcoin during the measured periods. Institutions are Here: Institutions have historically accounted for a majority of Grayscale inflows. This was especially true in 4Q20 as institutions accounted for 93% of capital inflows, or $3.0 billion. This may not come as a surprise given the recent flurry of news that institutions have warmed up to Bitcoin. Indeed, Grayscale Bitcoin Trust accounted for 87% of all inflows to our product family, the highest proportion since 2Q17, further evidence of institutions looking to Bitcoin as a reserve asset. The average commitment among institutions is also growing at a significant pace. The average commitment from institutions was $6.8 million, up from an average of $2.9 million in 3Q20. Surging Demand from RIAs: In 4Q20, Grayscale received substantial inbound interest from wealth managers interested to learn more about Bitcoin to satisfy the growing number of client requests. This is part of an emerging trend of the last six months that is critical for continued adoption. Quarterly Perspective In 4Q20, a majority of Grayscale’s family of products significantly outperformed major indices even when taking into account fees, expenses, and other costs associated with the funds. 10. Inception date: September 25, 2013. 11. Source: Bloomberg, comparison of ETPs with over $1 billion AUM on 1/2/2020 PLEASE REVIEW IMPORTANT DISCLOSURES & OTHER INFORMATION AT THE END OF THIS REPORT. 5

Q4 | 2020 Digital Asset Investment Report LLC Investments, Grayscale ©2021 FIGURE 1: MULTI-ASSET CLASS PERFORMANCE – 4Q2012 OCTOBER 1, 2020 THROUGH DECEMBER 31, 2020 Bitcoin (BTC) 174% Litecoin (LTC) 170% Grayscale Digital Large Cap Fund 154% Horizen (ZEN) 115% Ethereum (ETH) 110% Stellar Lumens (XLM) 76% Bitcoin Cash (BCH) 52% MSCI Emerging Markets Index 19% MSCI World Index 16% Nasdaq Composite 16% MSCI EAFE Index 16% Bloomberg Commodity Index 12% Brazilian Real (BRL) 9% Russian Ruble (RUB) 6% Ethereum Classic (ETC) 5% Canadian Dollar (CAD) 5% Euro (EUR) 4% Bloomberg Barclays Global Bond Index 3% Zcash (ZEC) -1% Argentine Peso (ARS) -8% VIX Index -18% Grayscale’s assets under management reached all-time highs during 4Q20 as prices rose and capital flowed in from institutions. YTD, Grayscale’s AUM went from $2.0 billion to $20.2 billion, an approximately 10x increase. FIGURE 2: GRAYSCALE AUM SINCE INCEPTION SEPTEMBER 25, 2013 THROUGH DECEMBER 31, 2020 Index Grayscale AUM Growth (Cumulative) 180,585.0x AUM Growth (Annualized) 4.3x $21,000 $18,000 $15,000 MM) $12,000 ( $ AUM $9,000 $6,000 $3,000 $0 13 13 14 14 14 14 15 15 15 15 16 16 16 16 17 17 17 17 18 18 18 18 19 19 19 19 - Sep—Dec Mar—Jun — Sep Dec — Mar Jun — Sep Dec—Mar — Jun—Sep—Dec Mar — Jun—Sep Dec — Mar Jun—Sep—Dec—Mar—Jun — Sep—Dec—20 20—20—20 -Mar Jun Sep Dec 12. Source: Bloomberg, CoinMarketCap.com, Grayscale. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RETURNS. PLEASE REVIEW IMPORTANT DISCLOSURES & OTHER INFORMATION AT THE END OF THIS REPORT. 6

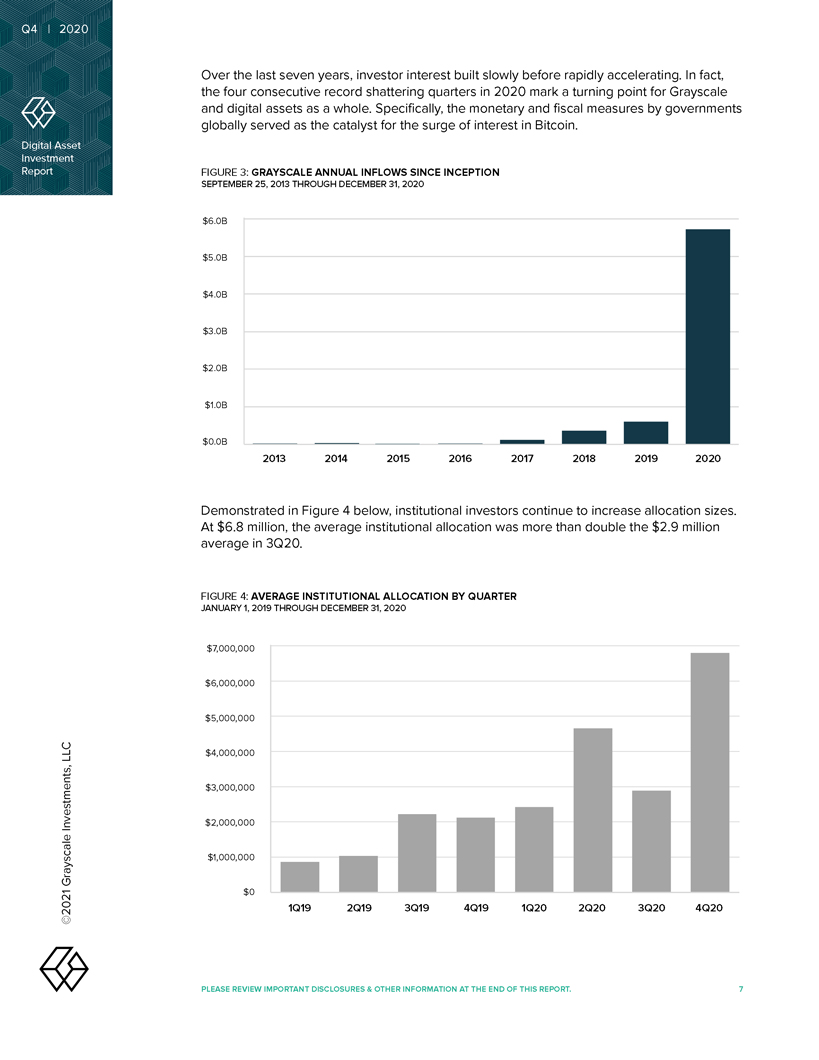

Q4 | 2020 Digital Asset Investment Report LLC Investments, Grayscale ©2021 Over the last seven years, investor interest built slowly before rapidly accelerating. In fact, the four consecutive record shattering quarters in 2020 mark a turning point for Grayscale and digital assets as a whole. Specifically, the monetary and fiscal measures by governments globally served as the catalyst for the surge of interest in Bitcoin. FIGURE 3: GRAYSCALE ANNUAL INFLOWS SINCE INCEPTION SEPTEMBER 25, 2013 THROUGH DECEMBER 31, 2020 $6.0B $5.0B $4.0B $3.0B $2.0B $1.0B $0.0B 2013 2014 2015 2016 2017 2018 2019 2020 Demonstrated in Figure 4 below, institutional investors continue to increase allocation sizes. At $6.8 million, the average institutional allocation was more than double the $2.9 million average in 3Q20. FIGURE 4: AVERAGE INSTITUTIONAL ALLOCATION BY QUARTER JANUARY 1, 2019 THROUGH DECEMBER 31, 2020 $7,000,000 $6,000,000 $5,000,000 $4,000,000 $3,000,000 $2,000,000 $1,000,000 $0 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 PLEASE REVIEW IMPORTANT DISCLOSURES & OTHER INFORMATION AT THE END OF THIS REPORT. 7

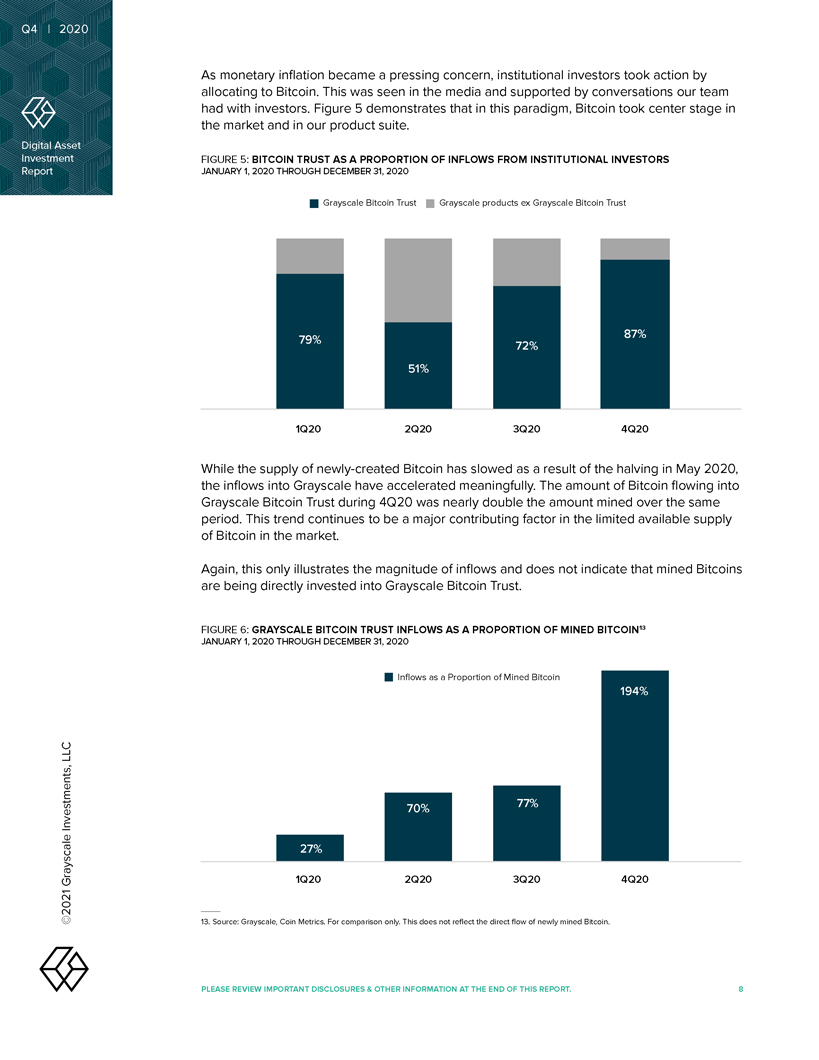

ReportDigital ©2021 Grayscale Investments, LLC Investment Asset As monetary inflation became a pressing concern, institutional investors took action by allocating to Bitcoin. This was seen in the media and supported by conversations our team had with investors. Figure 5 demonstrates that in this paradigm, Bitcoin took center stage in the market and in our product suite. FIGURE 5: BITCOIN TRUST AS A PROPORTION OF INFLOWS FROM INSTITUTIONAL INVESTORS JANUARY 1, 2020 THROUGH DECEMBER 31, 2020 Grayscale Bitcoin Trust Grayscale products ex Grayscale Bitcoin Trust 79% 87% 72% 51% 1Q20 2Q20 3Q20 4Q20 While the supply of newly-created Bitcoin has slowed as a result of the halving in May 2020, the inflows into Grayscale have accelerated meaningfully. The amount of Bitcoin flowing into Grayscale Bitcoin Trust during 4Q20 was nearly double the amount mined over the same period. This trend continues to be a major contributing factor in the limited available supply of Bitcoin in the market. Again, this only illustrates the magnitude of inflows and does not indicate that mined Bitcoins are being directly invested into Grayscale Bitcoin Trust. FIGURE 6: GRAYSCALE BITCOIN TRUST INFLOWS AS A PROPORTION OF MINED BITCOIN13 JANUARY 1, 2020 THROUGH DECEMBER 31, 2020 Inflows as a Proportion of Mined Bitcoin 194% 70% 77% 27% 1Q20 2Q20 3Q20 4Q20 13. Source: Grayscale, Coin Metrics. For comparison only. This does not reflect the direct flow of newly mined Bitcoin. PLEASE REVIEW IMPORTANT DISCLOSURES & OTHER INFORMATION AT THE END OF THIS REPORT. 8

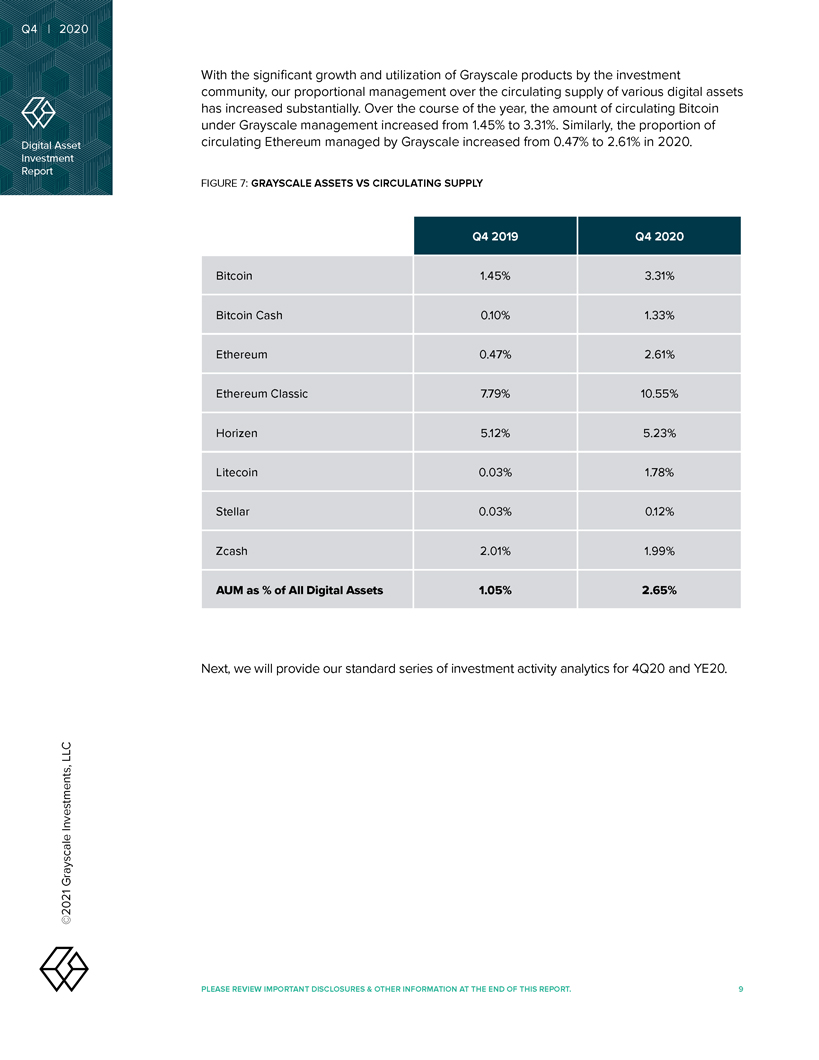

Q4 | 2020 Digital Asset Investment Report LLC Investments, Grayscale ©2021 With the significant growth and utilization of Grayscale products by the investment community, our proportional management over the circulating supply of various digital assets has increased substantially. Over the course of the year, the amount of circulating Bitcoin under Grayscale management increased from 1.45% to 3.31%. Similarly, the proportion of circulating Ethereum managed by Grayscale increased from 0.47% to 2.61% in 2020. FIGURE 7: GRAYSCALE ASSETS VS CIRCULATING SUPPLY Q4 2019 Q4 2020 Bitcoin 1.45% 3.31% Bitcoin Cash 0.10% 1.33% Ethereum 0.47% 2.61% Ethereum Classic 7.79% 10.55% Horizen 5.12% 5.23% Litecoin 0.03% 1.78% Stellar 0.03% 0.12% Zcash 2.01% 1.99% AUM as % of All Digital Assets 1.05% 2.65% Next, we will provide our standard series of investment activity analytics for 4Q20 and YE20. PLEASE REVIEW IMPORTANT DISCLOSURES & OTHER INFORMATION AT THE END OF THIS REPORT. 9

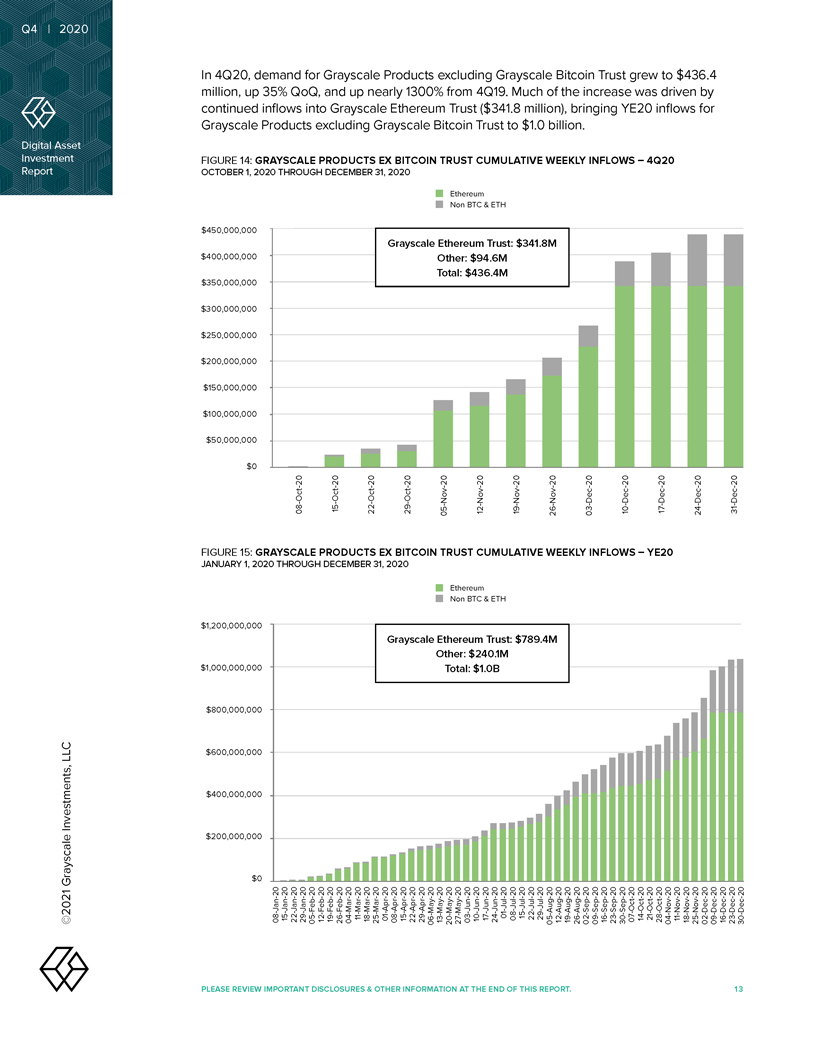

In 4Q20, demand for Grayscale Products excluding Grayscale Bitcoin Trust grew to $436.4 million, up 35% QoQ, and up nearly 1300% from 4Q19. Much of the increase was driven by continued inflows into Grayscale Ethereum Trust ($341.8 million), bringing YE20 inflows for Grayscale Products excluding Grayscale Bitcoin Trust to $1.0 billion.

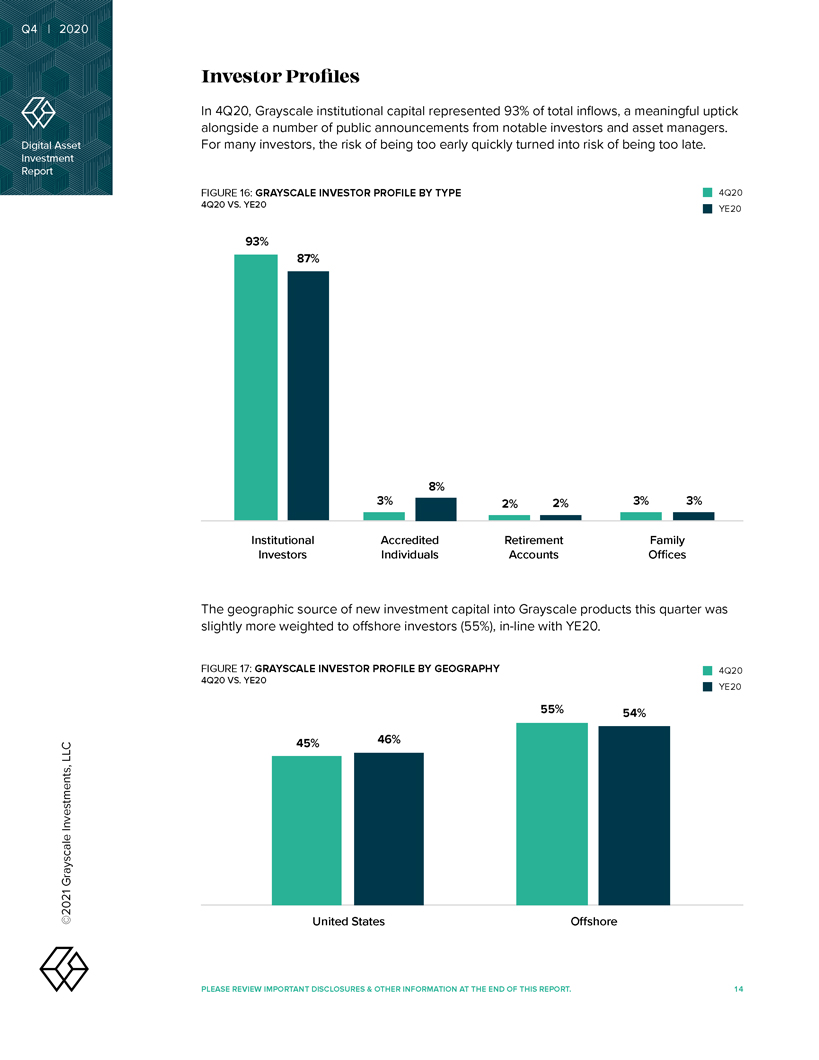

In 4Q20, Grayscale institutional capital represented 93% of total inflows, a meaningful uptick alongside a number of public announcements from notable investors and asset managers. For many investors, the risk of being too early quickly turned into risk of being too late.

To quote Thomas Jefferson, “Paper money is liable to be abused, has been, is, and forever will be abused, in every country in which

it is permitted.” 2020 was the year institutional investors recognized that Bitcoin is a viable option for offsetting the abundance of paper money and the cumbersome nature of gold. In a world with over $17 trillion of negative yielding debt,

we expect Bitcoin to continue becoming a cornerstone of investors’ portfolios in 2021.

Bitcoin took center stage in the investment community, and Grayscale

was fortunate to be one of the main avenues for investment in 2020, with approximately $5.7 billion in total inflows. We are proud to be one of the fastest growing asset managers in the world, and continue to be grateful to investors for entrusting

us with over $20 billion worth of their investments in our products. We look forward to continuing to serve the investment community as adoption of digital assets accelerates in 2021.

Conclusion

About Grayscale Investments®

Grayscale Investments is the world’s largest digital currency asset manager, with more than $20.2B in assets under management as of December 31, 2020. Through

its family of 9 investment products, Grayscale provides access and exposure to the digital currency asset class in the form of a traditional security without the challenges of buying, storing, and safekeeping digital currencies directly. With a

proven track record and unrivaled experience, Grayscale’s products operate within existing regulatory frameworks, creating secure and compliant exposure for investors.

For more information, please visit www.grayscale.co and follow @Grayscale.

Non-GAAP Measures

“Assets under

management” (AUM), “inflows”, “total investment” and “average weekly investment” are calculated using the Digital Asset Reference Rate for each Grayscale Product, which are not measures calculated in accordance

with U.S. generally accepted accounting principles (“GAAP”). The net asset value of each Product determined on a GAAP basis is referred to in this Report as “NAV.” Each Product’s digital assets are carried, for financial

statement purposes, at fair value, as required by GAAP.

Each Product determines the fair value of the digital assets it holds based on the price provided by the

applicable Digital Asset Exchange that the relevant Product considers its principal market as of 4:00 p.m., New York time, on the valuation date. The cost basis of investments in the applicable digital asset recorded by the applicable Product is the

fair value of such digital asset, as determined by such Product, at 4:00 p.m., New York time, on the date of transfer to such Product by the Authorized Participant based on the creation Baskets. The cost basis recorded by a Product may differ from

proceeds collected by the Authorized Participant from the sale of each Product’s Share to investors.

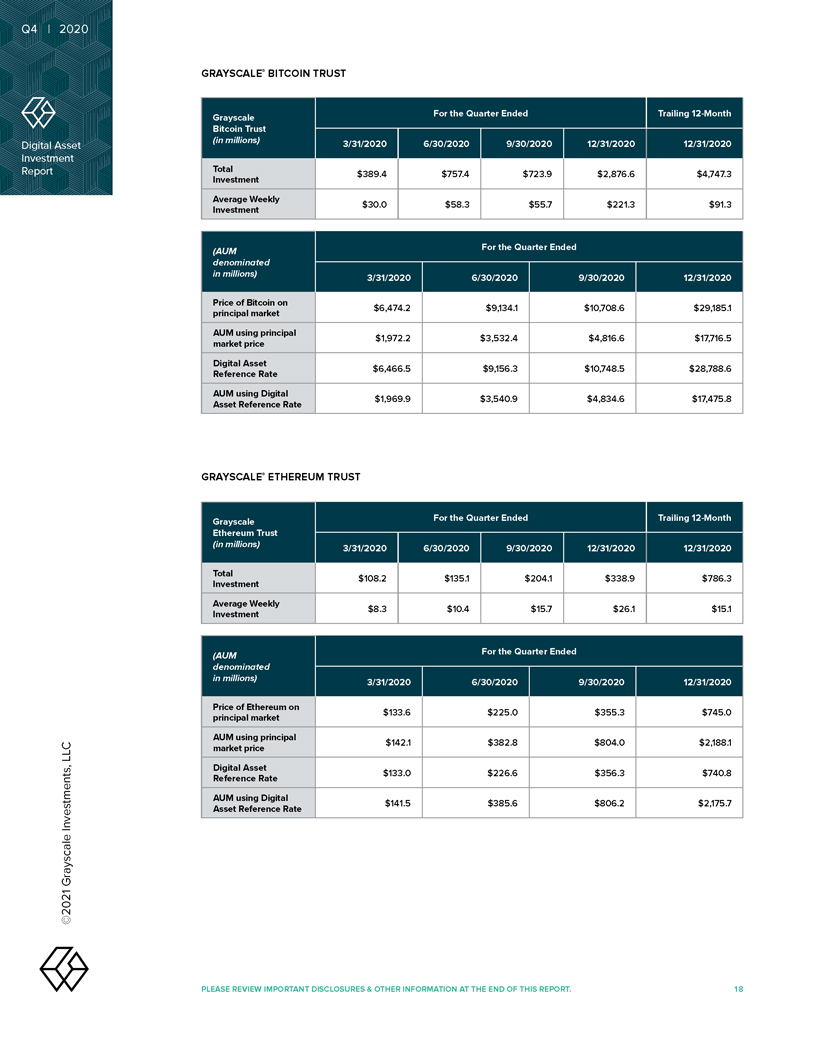

GRAYSCALE® BITCOIN TRUST

Total Investment

Average Investment Weekly

Price principal of Bitcoin market on

GRAYSCALE® ETHEREUM TRUST

Important Disclosures & Other Information

©Grayscale Investments, LLC. All content is original and has been researched and produced by Grayscale Investments, LLC (“Grayscale”) unless

otherwise stated herein. No part of this content may be reproduced in any form, or referred to in any other publication, without the express consent of Grayscale.

Note On Hypothetical Simulated Performance Results

HYPOTHETICAL SIMULATED PERFORMANCE RESULTS HAVE CERTAIN INHERENT LIMITATIONS. There is no guarantee that the market conditions during the past period will be

present in the future. Rather, it is most likely that the future market conditions will differ significantly from those of this past period, which could have a materially adverse impact on future returns. Unlike an actual performance record,

simulated results do not represent actual trading or the costs of managing the portfolio. Also, since the trades have not actually been executed, the results may have under or over compensated for the impact, if any, of certain market factors, such

as lack of liquidity.

Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. NO

REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

Certain Risk Factors

Each Product is a private,

unregistered investment vehicle and not subject to the same regulatory requirements as exchange traded funds or mutual funds, including the requirement to provide certain periodic and standardized pricing and valuation information to investors.

There are substantial risks in investing in a Product or in digital assets directly, including but not limited to:

• PRICE VOLATILITY

Digital assets have historically experienced significant intraday and long-term price swings. In addition, none of the Products currently operates a redemption program and may halt

creations from time to time or, in the case of Grayscale Bitcoin Trust (BTC) and Grayscale Digital Large Cap Fund, periodically. There can be no assurance that the value of the common units of fractional undivided beneficial interest

(“Shares”) of any Product will approximate the value of the digital assets held by such Product and such Shares may trade at a substantial premium over or discount to the value of the digital assets held by such Product. At this time, none

of the Products is operating a redemption program and therefore Shares are not redeemable by any Product. Subject to receipt of regulatory approval from the SEC and approval by Grayscale, in its sole discretion, any Product may in the future operate

a redemption program. Because none of the Products believes that the SEC would, at this time, entertain an application for the waiver of rules needed in order to operate an ongoing redemption program, none of the Products currently has any intention

of seeking regulatory approval from the SEC to operate an ongoing redemption program.

being offered in a private placement pursuant to Rule 506(c) under Regulation D of the Securities Act of 1933, as amended (the

“Securities Act”). As a result, the Shares of each Product are restricted Shares and are subject to a one-year holding period in accordance with Rule 144 under the Securities Act. In addition, none of the Products currently operates a

redemption program. Because of the one-year holding period and the lack of an ongoing redemption program, Shares should not be purchased by any investor who is not willing and able to bear the risk of investment and lack of liquidity for at least

one year. No assurances are given that after the one year holding period, there will be any market for the resale of Shares of any Product, or, if there is such a market, as to the price at such Shares may be sold into such a market.

• POTENTIAL RELIANCE ON THIRD-PARTY MANAGEMENT; CONFLICTS OF INTEREST

Products and their

sponsors or managers and advisors may rely on the trading expertise and experience of third-party sponsors, managers or advisors, the identity of which may not be fully disclosed to investors. The Products and their sponsors or managers and advisors

and agents may be subject to various conflicts of interest.

• FEES AND EXPENSES

Each Product’s fees and expenses (which may be substantial regardless of any returns on investment) will offset each Product’s trading profits.

Additional General Disclosures

Investors must have the financial ability,

sophistication/experience and willingness to bear the risks of an investment. This document is intended for those with an in-depth understanding of the high risk nature of investments in digital assets and these investments may not be suitable for

you. This document may not be distributed in either excerpts or in its entirety beyond its intended audience and the Products and Grayscale will not be held responsible if this document is used or is distributed beyond its initial recipient or if it

is used for any unintended purpose.

General Inquiries:

info@grayscale.co

Address: 250 Park Ave S 5th floor, New York, NY 10003 Phone: (212) 668-1427 @Grayscale