Attached files

| file | filename |

|---|---|

| 8-K - 8-K - GOLDEN GRAIN ENERGY | aredecember2020newsletter.htm |

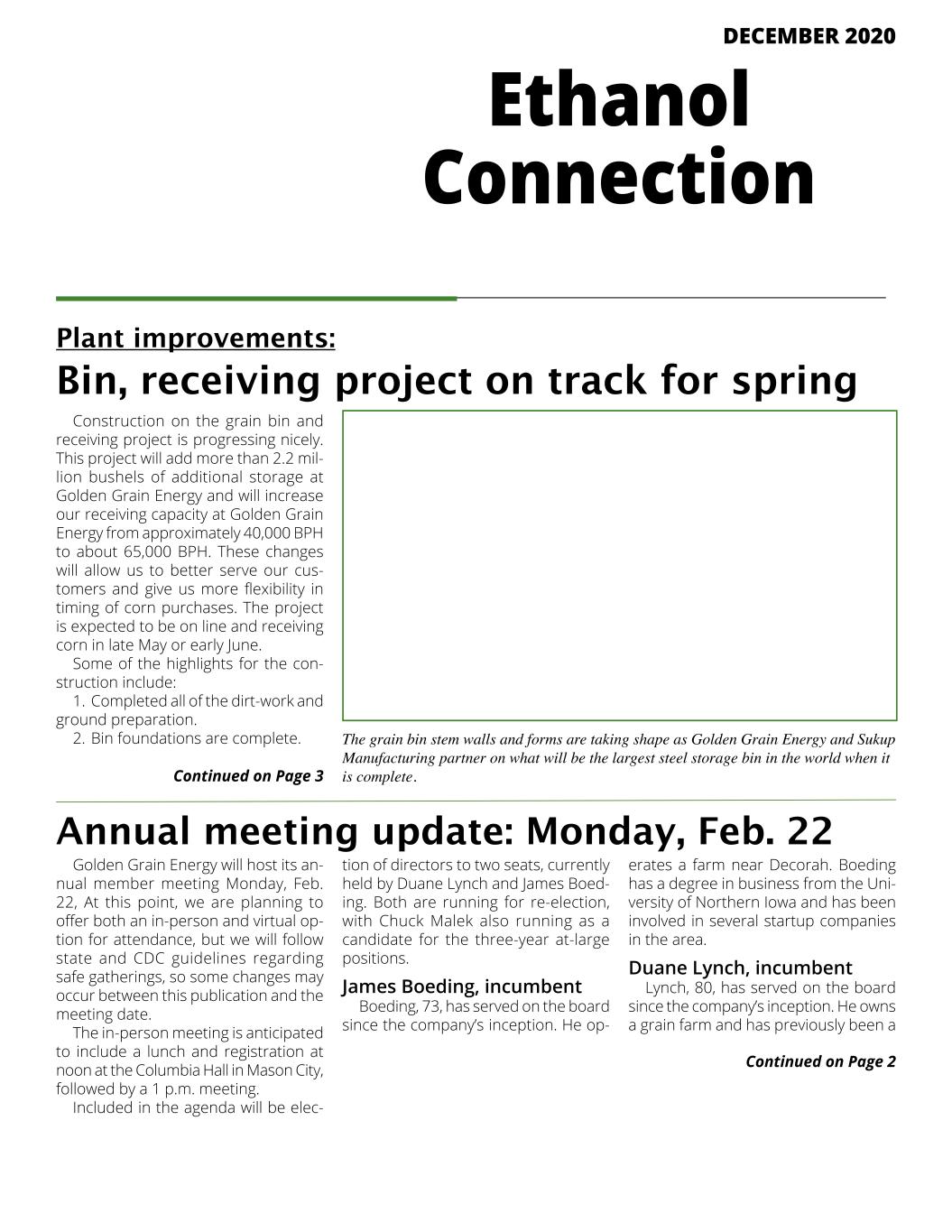

DECEMBER 2020 Ethanol Connection Continued on Page 3 Plant improvements: Bin, receiving project on track for spring Construction on the grain bin and receiving project is progressing nicely. This project will add more than 2.2 mil- lion bushels of additional storage at Golden Grain Energy and will increase our receiving capacity at Golden Grain Energy from approximately 40,000 BPH to about 65,000 BPH. These changes will allow us to better serve our cus- tomers and give us more flexibility in timing of corn purchases. The project is expected to be on line and receiving corn in late May or early June. Some of the highlights for the con- struction include: 1. Completed all of the dirt-work and ground preparation. 2. Bin foundations are complete. The grain bin stem walls and forms are taking shape as Golden Grain Energy and Sukup Manufacturing partner on what will be the largest steel storage bin in the world when it is complete. Annual meeting update: Monday, Feb. 22 Golden Grain Energy will host its an- nual member meeting Monday, Feb. 22, At this point, we are planning to offer both an in-person and virtual op- tion for attendance, but we will follow state and CDC guidelines regarding safe gatherings, so some changes may occur between this publication and the meeting date. The in-person meeting is anticipated to include a lunch and registration at noon at the Columbia Hall in Mason City, followed by a 1 p.m. meeting. Included in the agenda will be elec- tion of directors to two seats, currently held by Duane Lynch and James Boed- ing. Both are running for re-election, with Chuck Malek also running as a candidate for the three-year at-large positions. James Boeding, incumbent Boeding, 73, has served on the board since the company’s inception. He op- erates a farm near Decorah. Boeding has a degree in business from the Uni- versity of Northern Iowa and has been involved in several startup companies in the area. Duane Lynch, incumbent Lynch, 80, has served on the board since the company’s inception. He owns a grain farm and has previously been a Continued on Page 2

Page 2 Golden Grain Energy December 2020 2020 ends on a positive for GGE Board approves early 2021 distribution; 2020 year-end shows $5.8M income Following on the heels of a chal- lenging 2019 fiscal year that saw Golden Grain Energy post the first year-end loss of its history, 2020 re- bounded against the economic odds of a global pandemic. Along with a $0.10 per unit distri- bution issued in 2020, the Golden Grain Energy board of directors has approved a $0.20 distribution to be paid in January 2021. The ethanol industry experienced record low ethanol prices through- out most of 2018 and 2019 due to reduced demand and high industry inventory levels. This continued into 2020 and was compounded by the Covid-19 crisis. In response to these conditions, we reduced ethanol production early in 2020 which im- pacted our total ethanol production for the fiscal year, which ended Oct. 31, 2020. Despite the pro- duction cutback and a sizeable in- vestment in new storage and re- ceiving capacity at the plant, both the balance sheet and income statement show improved performance over 2019. Total revenue was down in 2020 compared to 2019, primarily due to decreased ethanol revenue. The average price received per gallon of ethanol was approximately 3.4% less in FY2020 than 2019. This decrease in the average price was due to significantly lower ethanol demand early in 2020 as a result of the CO- VID-19 pandemic. We anticipate that the impacts of the pandemic will continue in FY2021. GGE sold approximately 2.2% fewer gallons of ethanol in 2020 com- pared to the prior year, but expects to increase in 2021, provided there are not additional reductions in fuel demand due to travel restrictions. Prices received for distillers grains were slightly higher in 2020, while corn oil prices were similar to those from the year before. More detailed discussion is avail- able in the complete 10-K annual re- port which can be found on the SEC website or by following the investor link at www.ggecorn.com. — Brooke Peters, CFO INCOME STATEMENT Year Ended 10/31/20 Year Ended 10/31/19 Year Ended 10/31/18 Revenue $194,329,476 $203,793,847 $179,501,244 Gross Profit (Loss) $5,546,497 $(176,016) $5,355,585 Equity in Net Income (Loss) from Investments $3,042,793 $1,716,200 $5,263,755 Net Income (Loss) $5,878,663 $(1,712,402) $6,371,299 Net Income (Loss) Per Unit $0.30 $(0.09) $0.32 Distribution Paid $0.10 $0.25 $0.75 BALANCE SHEET October 31, 2020 October 31, 2019 Current Assets $42,422,107 $32,093,425 Total Assets $139,088,941 $130,030,383 Current Liabilities $11,194,110 $9,140,200 Long-term Liabilities $3,582,326 $469,040 Members Equity $124,312,505 $120,421,143 Book Value per Unit $6.26 $6.06 seed salesman with Dekalb and Latham. Charles L. Malek Sr., nominee Malek, 58, owns Malek Builders Inc.. He serves on the CUSB Bank Board of Directors and is also a member of Cresco Industrial Development Corp., Howard County Business and Tourism and Howard County Assessors Board of Review. Operating agreement amendment At the annual meeting, we are also presenting a pro- posed amendment to GGE’s operating agreement. The primary purpose of the amendment is to incorporate a new Iowa statute that mirrors federal tax rules for auditing partnerships such as GGE. In 2018, members approved a similar amendment which incorporated new federal law changes for auditing partnerships. In addition to the state audit law language, the agreement clarifies that video conferences qualify for electronic meetings under our operating agreement, just as teleconferences are allowed. We believe our current operating agree- ment allows for video conferences, but we wanted to make it clear. Complete language included in the amendment will be in proxy information available later this month. Continued from Page 1 Three candidates seeking two board of directors seats

Page 3 Golden Grain Energy December 2020 Ethanol margins remain tight with lower demand As I write this, corn is working on its 13th day in a row of trading higher, which does not happen very often. I believe the last time it hap- pened was in 2008. Turns out the rally in 2008 didn’t have a lot to do with fundamentals either. It seems like this market is driven by fears of inflation, dollar weakness, money flow, and perhaps a bit of a percep- tion that the demand will get better than it currently is with additional Chinese buying. We typically don’t spend a lot of time at these levels. Spreads have narrowed not giving any incentive to carry corn. That certainly doesn’t mean we can’t go higher—we cer- tainly can, but it just doesn’t last very long so I will encourage you to take advantage of these levels. I’m sure you are aware that etha- nol margins have been suffering for a while now, mainly due to the fact that gas demand has decreased sig- nificantly since the onset of Covid-19. Hopefully the vaccine well help get this under control and we will see improvements in gas demand. The first quarter of next year does look brighter than what we are looking at today. We continue to strive for efficien- cies in grain deliveries and remain your end user of choice. The changes made to our office and both inbound and outbound scale system have gone a long ways toward reducing congestion and wait times. The ad- ditional receiving capacity explained in other parts of this newsletter will make the process even more ef- ficient. If you are interested in selling corn directly to Golden Grain Energy, please call us at 888-443-2676. —Scott Gudbaur, commodity manager Corn rally offers opportunity for farmers Continued from Page 1 See more updates on social media 3. Concrete for the stem-wall is complete. 4. The fill on the foundations is complete. 5. Concrete cap on the foundation is complete. 6. Shell for the receiving building is complete. 7. The receiving leg and tower structure have been started as well. After the holidays, we expect to complete the floor on the bin and start construction on the roof. Crews will begin jacking up the side-walls in January. Please be sure and follow us on social media for more updates and information (Facebook, Instagram, LinkedIn, Youtube and TikTok). If you go to the company website (www. ggecorn.com), we have a link to our Youtube page where you can see the construction of the bin taking place in a time-lapsed video. We update this video every couple of days, so please be sure and check back regularly. —Chad Kuhlers, CEO K-1 tax statements expected in late February Golden Grain Energy antici- pates a positive estimated tax- able income for 2020, so mem- bers should plan accordingly with their tax professional. The specific amount is still undeter- mined. The company will again be utilizing the online portal to distribute K-1 tax documents; if you have not used this system in the past, please contact us for information about how to sign up for more efficient receipt of your tax materials. Golden Grain Energy’s new receiving building, shown above, will increase efficiency at the plant with hopes of making GGE the delivery point of choice for North Iowa corngrowers.

Board of Directors Dave Sovereign, Chairman Steve Sukup, Vice Chairman Stan Laures, Secretary Jim Boeding Jerry Calease Dave Reinhart Leslie Hansen Duane Lynch Dustin Petersen Roger Shaffer Management Team Chad Kuhlers, CEO Brooke Peters, CFO Scott Gudbaur, Commodity Manager This newsletter contains forward-looking statements. We undertake no responsibility to update any forward looking statement. When used, the words “believe”, “hope”, “ex- pect”, “anticipate” and similar expressions are intended to identify forward-looking statements. Readers should not place undue reliance on any forward-looking statements and recognize that the statements are not predictions of actual future results, which could and likely will differ materially from those anticipated in the forward-looking statements due to risks and uncertainties, including those described in our Securities and Exchange Commission filings, copies of which are available through our website or upon request. Golden Grain Energy, LLC Golden Grain Energy 1822 27th St. SW Mason City, IA 50401 641-423-8525 888-GGE-CORN Fax: 641-421-8457 www.ggecorn.com info@ggecorn.com Until next time ... Chairman thanks GGE team, looks ahead I want to thank the managers and all of Golden Grain’s staff for the extra effort they put forth and the inconveniences they endured over the last year to deal with the impacts of the Covid-19 pandemic. From reworking traffic flow and receiving procedures, to segregating employee groups and adjusting to numerous changes in daily routine, 2020 was anything but business as usual, yet they made it a successful year. I am optimistic about how well we are positioned for the future as the delivery point of choice for Mason City area corn growers with the new storage and receiving facility, as well as our ability to take advantage of opportunities involving low carbon ethanol thanks to additional efficiencies in the plant. I look forward to seeing what 2021 offers. —Dave Sovereign, chairman OUR MISSION: Add value to the corn production of the area and enhance the incomes of our investor partners while providing economic growth to the area we serve.