Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - Evolent Health, Inc. | a20210113form8-kexhibit993.htm |

| EX-99.2 - EX-99.2 - Evolent Health, Inc. | a20210113form8-kexhibit992.htm |

| 8-K - 8-K - Evolent Health, Inc. | evh-20210107.htm |

1 J.P. Morgan Healthcare Conference: Evolent Health January 13, 2020 Exhibit 99.1

2 Introductions John Johnson Chief Financial Officer, Evolent Health Seth Blackley Chief Executive Officer and Co-Founder, Evolent Health

3 Evolent in Brief BY THE NUMBERS ~$265M Q3 Revenue 3.5M lives supported 35+ partners $33.5M LTM Q3 2020 Adjusted EBITDA1 1) Non-GAAP measure, See “Non-GAAP Financial Measures” for definition and Appendix B for reconciliation to GAAP. LTM Q3 2020 GAAP net loss to common shareholders was $(517.7). 2) Evolent Health data for the period ending September 30, 2020. Providers includes provider-sponsored health plans. OUR SOLUTIONS 57% / 43% Revenue mix from Providers / Payers2 Administrative Simplification Specialty Care Management Total Cost of Care Management WHAT WE DO Evolent addresses the $1 trillion opportunity to reduce clinical and administrative waste by bridging the divide between payers and providers through value-based care

4 What Makes Evolent Unique: Bridging the Divide Between Payers and Providers Evolent is the bridge between payers and providers helping patients receive high quality care that is cost-effective, evidence-based and seamless Patient Payer Provider

5 Value-Based Care Market Landscape Business Model / Focus Example Companies New Payer Models Bright HealthCare Oscar Health Devoted Health Insurance / Consumers, technology Payer-Provider Enablers Livongo (NYSE: LVGO) Progyny (NYSE: PGNY) Tech-enabled services / Clinical value New Provider Models Oak Street Health (NYSE: OSH) VillageMD ChenMed Risk / Owned practices (NYSE: EVH)

6 Near-Term Potential Market CatalystsLong-Term Industry Trends Momentum in the Market Towards Value-Based Care Evolent is uniquely positioned to serve through Value-Based Solutions CMMI Geographic Contracting Model Growth in Medicaid and State Budget Deficits Driving Need for Cost Savings COVID-19 Driving Innovation in Healthcare Delivery and Payment Medicare and Federal Budget Pressures Aging of US Population Drives Growth in Chronic Illness MA and Managed Medicaid Population Growth Specialty Complexity and Drug Prices Driving Costs

Confidential – Do Not Distribute7 Core Services: Our Portfolio of “Evergreen” Solutions Administrative Simplification Specialty Care Management Clinical Administrative Total Cost of Care Management Solution Target Market Proprietary Technology Platform: CareProSM | Identifi® Scalable Clinical IP and Infrastructure Efficient Services Model Operating Model ~79% ~21% % of Services Revenue4 1) Estimated market size based on internal assessment. Includes MA Part A, Part B and Medicaid. 2) Estimated market size based on internal assessment. Includes MA HMO and MSSP. 3) Estimated market size based on internal assessment. 4) Platform and Operations Services Revenue for three months ended September 30, 2020. Industry Problem Sub-Optimal Network Performance, Rapidly Increasing Medical Complexity Costly and Inefficient Health Plan Administration PCP Financial and Clinical Challenges, Physician Burnout Payers and Risk-Bearing Providers $50B1 Risk-Bearing Providers $60B2 Payers and Risk-Bearing Providers $23B3

Confidential – Do Not Distribute8 Solution Example: Specialty Care Management ROOTED IN CLINICAL EVIDENCE WITH SUBSTANTIAL COST SAVINGS 14 Breast Lung Colorectal 1819 30 19 13 Level 1Level 2 Average Cost Per Treatment $ Thousands BASED FOREMOST ON QUALITY Advisory Board $ Practicing Physicians Physician Trade Organizations National Guidelines Level 2 Pathways Level 1 Precision PathwaysSM Efficacy Toxicity A B C D E G Cost B C E G B E G B E H H Anti-Cancer Regimens Example Options* IF *Sub-optimal regimen options based on efficacy, toxicity and/or cost shown in red (illustrative); Preferred regimen options shown in green. NCH Source: Internal NCH Cost Analysis Q4 2016-Q3 2017 Design evidence-based clinical pathways to drive provider behavior towards improved quality of care at a lower cost

Confidential – Do Not Distribute9 • 8 new partnerships announced in 2020, at the high end of target • Successful 1/1/21 launches with new partners including Florida Blue Medicare, Molina Healthcare of Kentucky, and Maryland Physicians Care • We expect to be within or exceed our previously raised guidance ranges for the full year 2020 of Adj. Revenue between $1,000-1,014M and Adj. EBITDA between $35-38M1 • Strong renewal environment and new business pipeline going into 2021 Recent Updates Growth Non-Core Divestitures On Track De-leveraging • Entered into definitive agreement to sell True Health New Mexico health plan to Bright HealthCare for $22M plus excess surplus capital • Entered into a definitive agreement to sell assets of Miami Children’s Health Plan to Anthem • Both transactions are subject to regulatory approval and standard closing conditions, with closing for both expected to occur during the first half of 2021 • With these announcements, we have now entered into agreements to sell all Health Plan assets • Capital return from Passport ahead of schedule, with $85M received to date. Passport/Molina transaction expected to return $130M-$170M2 in capital to Evolent • Senior term loan paid in full on January 8th, 2021 with associated warrants retired in cash • No outstanding senior debt 1) Additional details will be provided on our Q4 2020 conference call in late February. 2) Inclusive of repayment of $40M surplus note; ultimate inflow to Evolent will depend on plan performance and other factors.

10 Key Investment Themes Profitable, Scalable Financial Model2 Strong Balance Sheet3 Differentiated Products Drive Strong Growth1 Pillars of Our Strategy to Create Shareholder Value *Excludes revenues from Passport for purposes of calculating 2021 growth rate. Passport represented 22.6% of revenue for the nine months ended September 30, 2020. Medium-Term Targets Mid-teens annual growth rate on core Adjusted Services Revenue* Mid-teens Adjusted EBITDA margin via annual 200-300 bps expansion from 2021 base Divest Non-Core Assets and Use Proceeds to De-lever

11 Strong Track Record of Organic Growth $436 $554 $670 $908 2017 2018 2019 2020P Adjusted Services Revenue ($M)1 Adjusted Services Revenue CAGR of 28% since 2017, including 15% average annual organic growth3 a) Add new customers b) Further penetrate existing customers (Same Store Growth): i. Cross-sell ii. Expand into additional geographies Organic Growth Drivers 2 1) Non-GAAP measure, see “Non-GAAP Financial Measures” above for definition and Appendix A for reconciliation to GAAP. GAAP Services Revenue in 2017, 2018, and 2019 was $435.0M, $533.1M, and $674.6M respectively. 2) 2020 represents midpoint of adjusted services revenue guidance for the year ending December 31, 2020. 3) Organic revenue growth excludes the impact of acquired revenue. Calculated through December 31, 2020 (based on midpoint of adjusted services revenue guidance). Same Store Growth has accounted for ~40% of our organic growth since 2017 1

Confidential – Do Not Distribute12 Multiple Growth Channels Cross-Sell Membership Expansion New Partnership Customer Revenue Example Add New Customers • Target six-to-eight per year, with eight announced in 2020 • Broader service offering and end markets provide increased confidence Expand with Existing Customers • Same store growth has accounted for ~40% of our organic growth since 2017 • For example: Two states contracted for cardiovascular services with Molina, with opportunity to expand • Large cross-sell opportunity Cross-Sell to Existing Customers • 40% of specialty care management customers have only one specialty 1

13 Add New Customers Recent New Partnership Examples 1

14 Further Penetrate Existing Customers: Cross-Sell or Expand Geographies (Illustrative Case Study) $908 1) 2020P represents midpoint of reiterated Adjusted Services revenue guidance for the year ending December 31, 2020. Adjusted Services Revenue ($M, 2020P)1 Further Penetrate Existing Customer (Illustrative Annual Revenue Opportunity, $M) Cross-selling specialties or expanding nationally with one existing NCH customer (< 1M Medicare Advantage lives) would yield an additional $462M in annual revenue for Evolent Illustrative Adjusted Services Revenue ($M) Cross-sell cardiology and oncology: expand nationally $447 Cross-sell cardiology: existing markets $15 $908 $462 $1.4B 1

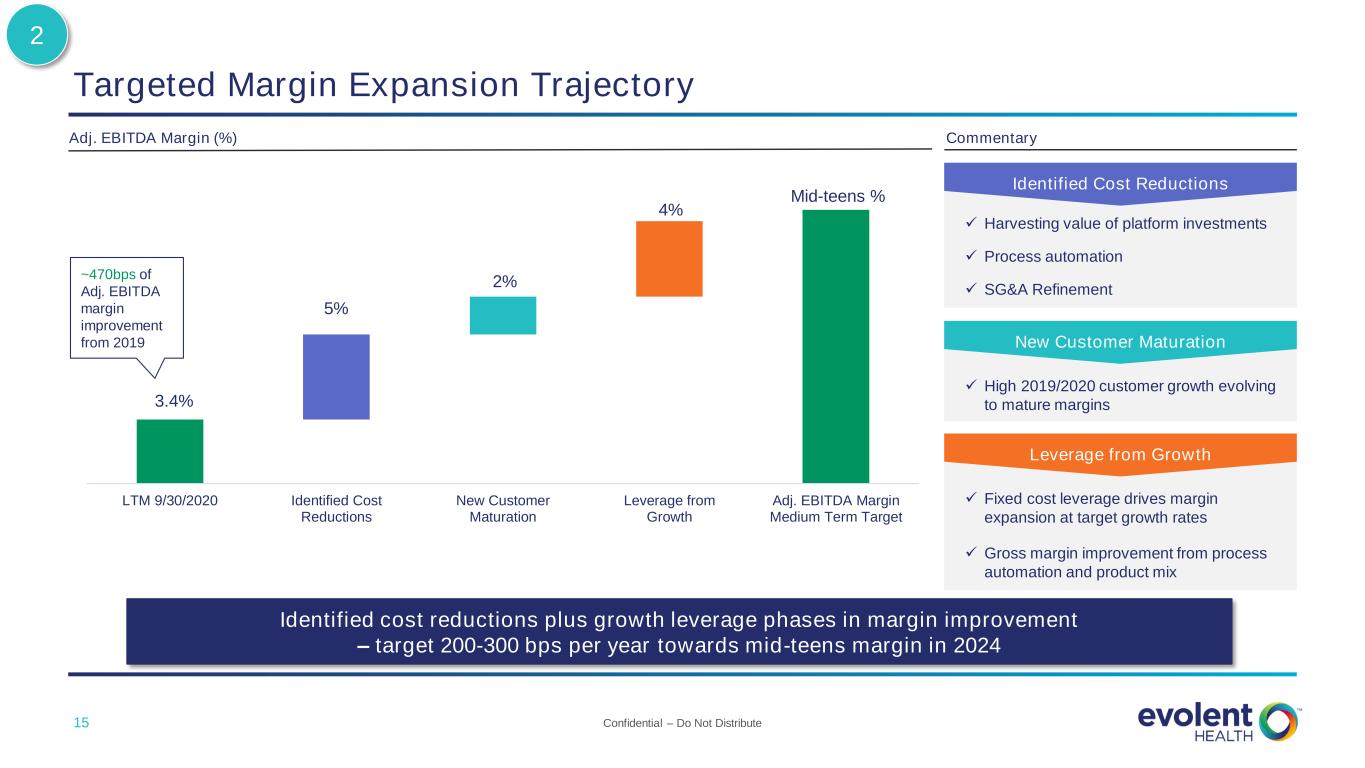

Confidential – Do Not Distribute15 3.4% 2% 4% Mid-teens % LTM 9/30/2020 Identified Cost Reductions New Customer Maturation Leverage from Growth Adj. EBITDA Margin Medium Term Target Targeted Margin Expansion Trajectory 5% Identified cost reductions plus growth leverage phases in margin improvement – target 200-300 bps per year towards mid-teens margin in 2024 ✓ Harvesting value of platform investments ✓ Process automation ✓ SG&A Refinement Identified Cost Reductions ✓ High 2019/2020 customer growth evolving to mature margins New Customer Maturation ✓ Fixed cost leverage drives margin expansion at target growth rates ✓ Gross margin improvement from process automation and product mix Leverage from Growth Adj. EBITDA Margin (%) Commentary ~470bps of Adj. EBITDA margin improvement from 2019 2

16 Focused Strategy Driving Significant Deleveraging Divest Non-Core Assets1 Use Proceeds to De-lever Senior Term Loan Paid Off as of January 8th, 2021 True Health New Mexico Florida Medicaid JVs Passport $232 Debt Less Cash on 9/30/2020 Passport Capital Return 9/30/20 Debt Less Cash after Passport Capital Return $130-170 $62-102 Sept 30, 2020 Cash and Investments2: $159.0M 2021 Convertible Notes: $26.7M 2024 Convertible Notes: $117.1M 2025 Convertible Notes: $172.5M 2024 Senior Term Loan: $75.0M Total Debt Less Cash: $232.3M 1) Subject to customary closing conditions 2) Excludes Passport cash/investments 3) Inclusive of repayment of $40M surplus note; ultimate inflow to Evolent will depend on plan performance and other factors 3 3

17 Key Investment Themes Profitable, Scalable Financial Model2 Strong Balance Sheet3 Differentiated Products Drive Strong Growth1 Pillars of Our Strategy to Create Shareholder Value *Excludes revenues from Passport for purposes of calculating 2021 growth rate. Passport represented 22.6% of revenue for the nine months ended September 30, 2020. Medium-Term Targets Mid-teens annual growth rate on core Adjusted Services Revenue* Mid-teens Adjusted EBITDA margin via annual 200-300 bps expansion from 2021 base Divest Non-Core Assets and Use Proceeds to De-lever

Confidential – Do Not Distribute18 Appendix

19 Safe Harbor Statement Certain statements in this presentation and in other written or oral statements made by us or on our behalf are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (“PSLRA”). A forward-looking statement is a statement that is not a historical fact and, without limitation, includes any statement that may predict, forecast, indicate or imply future results, performance or achievements, and may contain words like: “believe,” “anticipate,” “expect,” “estimate,” “aim,” “predict,” “potential,” “continue,” “plan,” “project,” “will,” “should,” “shall,” “may,” “might” and other words or phrases with similar meaning in connection with a discussion of future operating or financial performance. In particular, these include statements relating to future actions, trends in our businesses, prospective services, future performance or financial results and the outcome of contingencies, such as legal proceedings. Weclaim the protection afforded by the safe harbor for forward-looking statements provided by the PSLRA. These statements are only predictions based on our current expectations and projections about future events. Forward-looking statements, including statements relating to our expected 2020 results, our pending sales of True Health New Mexico and Miami Children’s Health Plan, our ability to achieve a mid-teens annual growth rate on Adjusted Services Revenue and mid-teens Adjusted EBITDA margin via annual expansion, and our ability to add new customers and further penetrate existing customers, involve risks and uncertainties that may cause actual results, level of activity, performance or achievements to differ materially from the results contained in the forward-looking statements. Risks and uncertainties that may cause actual results to vary materially, include, among others: the potential negative impact of the COVID-19 pandemic; the economic benefits we expect to receive as a result of the sale of certain assets of Passport may not be realized; the timing and closing of our pending sales of True Health New Mexico and the Miami Children’s Health Plan; the significant portion of revenue we derive from our largest partners, and the potential loss, termination or renegotiation of our relationship or contract with any significant partner, or multiple partners in the aggregate; the structural change in the market for health care in the United States; uncertainty in the health care regulatory framework, including the potential impact of policy changes; uncertainty in the public exchange market; the uncertain impact of CMS waivers to Medicaid rules and changes in membership and rates; the uncertain impact the results of elections may have on health care laws and regulations; our ability to effectively manage our growth and maintain an efficient cost structure, and to successfully implement cost cutting measures; our ability to offer new and innovative products and services; risks related to completed and future acquisitions, investments, alliances and joint ventures, which may be difficult to integrate, divert management resources, or result in unanticipated costs or dilute our stockholders; our ability to consummate opportunities in our pipeline; risks relating to our ability to maintain profitability for our total cost of care and New Century Health’s performance-based contracts and products, including capitation and risk-bearing contracts; the growth and success of our partners, which is difficult to predict and is subject to factors outside of our control, including governmental funding reductions and other policy changes, enrollment numbers for our partners’ plans (including in Florida), premium pricing reductions, selection bias in at-risk membership and the ability to control and, if necessary, reduce health care costs; our ability to attract new partners and successfully capture new growth opportunities; the increasing number of risk-sharing arrangements we enter into with our partners; our ability to recover the significant upfront costs in our partner relationships; our ability to estimate the size of our target markets; our ability to maintain and enhance our reputation and brand recognition; consolidation in the health care industry; competition which could limit our ability to maintain or expand market share within our industry; risks related to governmental payer audits and actions, including whistleblower claims; our ability to partner with providers due to exclusivity provisions in our contracts; restrictions and penalties as a result of privacy and data protection laws; adequate protection of our intellectual property, including trademarks; any alleged infringement, misappropriation or violation of third-party proprietary rights; our use of “open source” software; our ability to protect the confidentiality of our trade secrets, know-how and other proprietary information; our reliance on third parties and licensed technologies; our ability to use, disclose, de-identify or license data and to integrate third-party technologies; data loss or corruption due to failures or errors in our systems and service disruptions at our data centers; online security risks and breaches or failures of our security measures, including with respect to privacy of health information; our reliance on Internet infrastructure, bandwidth providers, data center providers, other third parties and our own systems for providing services to our users; our reliance on third-party vendors to host and maintain our technology platform; our ability to contain health care costs, implement increases in premium rates on a timely basis, maintain adequate reserves for policy benefits or maintain cost effective provider agreements; True Health New Mexico’s ability to enter the individual market; the risk of a significant reduction in the enrollment in our health plan; our ability to accurately underwrite performance-based risk-bearing contracts; risks related to our offshore operations; our dependency on our key personnel, and our ability to attract, hire, integrate and retain key personnel; the impact of additional goodwill and intangible asset impairments on our results of operations; our indebtedness, our ability to service our indebtedness, the impact of covenants in our credit agreement on our business, our ability to access the delayed draw loan under our credit facility and our ability to obtain additional financing; our ability to achieve profitability in the future; the impact of litigation, including the ongoing class action lawsuit; our obligations to make payments to certain of our pre-IPO investors for certain tax benefits we may claim in the future; our ability to utilize benefits under the tax receivables agreement described herein; our obligations to make payments under the tax receivables agreement that may be accelerated or may exceed the tax benefits we realize; the terms of agreements between us and certain of our pre-IPO investors; the conditional conversion features of the 2024 and 2025 convertible notes, which, if triggered, could require us to settle the 2024 or 2025 convertible notes in cash; the impact of the accounting method for convertible debt securities that may be settled in cash; the potential volatility of our Class A common stock price; the potential decline of our Class A common stock price if a substantial number of shares are sold or become available for sale; provisions in our second amended and restated certificate of incorporation and second amended and restated by- laws and provisions of Delaware law that discourage or prevent strategic transactions, including a takeover of us; the ability of certain of our investors to compete with us without restrictions; provisions in our second amended and restated certificate of incorporation which could limit our stockholders’ ability to obtain a favorable judicial forum for disputes with us or our directors, officers or employees; our intention not to pay cash dividends on our Class A common stock; and our ability to remediate our material weaknesses and to maintain effective internal control over certain instances of one of our claims processing systems. The risks included here are not exhaustive. Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance or achievements. Our Annual Report on Form 10-K for the year ended December 31, 2019, our Quarterly Reports on Form 10-Q and other documents filed with the SEC include additional factors that could affect our business and financial performance. Moreover, we operate in a rapidly changing and competitive environment. New risk factors emerge from time to time, and it is not possible for management to predict all such risk factors. Further, it is not possible to assess the effect of all risk factors on our businesses or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual results. In addition, we disclaim any obligation to update any forward-looking statements to reflect events or circumstances that occur after the date of this presentation. This presentation is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to purchase any securities of any nature whatsoever, and it may not be relied upon in connection with the purchase of securities. The contents of this presentation do not constitute legal, tax or business advice. Anyone reading this presentation should seek advice based on their particular circumstances from independent legal, tax and business advisors.

20 Non-GAAP Financial Measures and Disclaimer In addition to disclosing financial results that are determined in accordance with GAAP, we present and discuss Adjusted Revenue, Adjusted Services Revenue, Adjusted Transformation Services Revenue, Adjusted Platform and Operations Services Revenue, Adjusted EBITDA,, which are all non-GAAP financial measures, as supplemental measures to help investors evaluate our fundamental operational performance. Adjusted Services Revenue is defined as the sum of Adjusted Transformation Services Revenue and Adjusted Platform and Operations Services Revenue. Adjusted Revenue is defined as the sum of Adjusted Services Revenue and True Health premiums revenue, less relevant intersegment eliminations. Management uses Adjusted Revenue, Adjusted Services Revenue, Adjusted Transformation Services Revenue and Adjusted Platform and Operations Services Revenue as supplemental performance measures because they reflect a complete view of the operational results. The measures are also useful to investors because they reflect the full view of our operational performance in line with how we generate our long term forecasts. Adjusted EBITDA is defined as EBITDA (net loss attributable to common shareholders of Evolent Health, Inc. before interest income, interest expense, (provision) benefit for income taxes, depreciation and amortization expenses), adjusted to exclude equity method investment impairment, loss on extinguishment of debt, gain (loss) from equity method investees, gain (loss) on disposal of assets, goodwill impairment, changes in fair value of contingent consideration and indemnification asset, other income (expense), net, net loss attributable to non-controlling interests, purchase accounting adjustments, stock-based compensation expense, severance costs, amortization of contract cost assets and acquisition-related costs. Adjusted EBITDA margin is defined as Adjusted EBITDA divided by Adjusted Revenue. Adjusted EBITDA Margin is as defined Adjusted EBITDA divided by Adjusted Revenue. Management uses Adjusted EBITDA as a supplemental performance measure because the removal of acquisition-related costs, one-time or non-cash items (e.g. depreciation, amortization and stock-based compensation expenses) allows us to focus on operational performance. We believe that this measure is also useful to investors because it allows further insight into the period over period operational performance in a manner that is comparable to other organizations in our industry and in the market in general. Management uses Adjusted EBITDA margin as a supplemental performance measure because it allows the investor to understand operational performance compared to revenues over time. We believe that this measure is also useful to investors because it allows further insight into the period over period operational performance in a manner that is comparable to other organizations in our industry and in the market in general. These adjusted measures do not represent and should not be considered as alternatives to GAAP measurements, and our calculations thereof may not be comparable to similarly entitled measures reported by other companies. A reconciliation of these adjusted measures to their most comparable GAAP financial measures is presented in the tables below. We believe these measures are useful across time in evaluating our fundamental core operating performance.

Confidential – Do Not Distribute21 Appendix A – Adjusted Revenue Reconciliation ($ in millions) Evolent Health, Inc. as Reported Evolent Health LLC Operations Adjustments Evolent Health, Inc. as Adjusted Q3 2020 Transformation services $4.8 $- $- $4.8 Platform and operations services 230.3 - - 230.3 Services revenue 235.1 - - 235.1 Premiums 29.5 - - 29.5 Total revenue $264.6 $- $- $264.6 2019 Transformation services $15.2 $- $- $15.2 Platform and operations services(1) 659.4 - 1.9 661.4 Services revenue 674.6 - 1.9 676.5 Premiums 171.7 - - 171.7 Total revenue $846.4 $- $1.9 $848.3 2018 Transformation services(1) $32.9 $- $3.6 $36.5 Platform and operations services(1) 500.2 - 1.7 501.9 Services revenue 533.1 - 5.3 538.4 Premiums 94.0 - - 94.0 Total revenue $627.1 $- $5.3 $632.4 2017 Transformation services $29.5 $- $- $29.5 Platform and operations services(2) 405.5 - 1.4 406.9 Total revenue $435.0 - $1.4 $436.4 ($ in millions) Evolent Health, Inc. as Reported Evolent Health LLC Operations Adjustments Evolent Health, Inc. as Adjusted Guidance – Q4 2020 (3) Services revenue $230.0 $- $- $230.0 Premiums 26.5 - - 26.5 Total revenue $256.5 - - $256.5 Guidance – Full Year 2020 (4) Services revenue $908.3 $- $- $908.3 Premiums 98.7 - - 98.7 Total revenue $1,007.0 - - $1,007.0 (1) Adjustments to platform and operations services revenue include deferred revenue purchase accounting adjustments of approximately $1.9 million and $0.9 million for the years ended December 31, 2019 and 2018, respectively. Adjustments to transformation services revenue and platform and operations services revenue for the year ended December 31, 2018, include approximately $3.6 million and $0.8 million, respectively, resulting from our transition adjustments related to the implementation of ASC 606. (2) Adjustments to platform and operations services revenue include deferred revenue purchase accounting adjustments of approximately $1.4 million for the year ended December 31, 2017, resulting from our acquisitions and business combinations. (3) Represents the mid-point of the guidance range. For the three months ending December 31, 2020, Adjusted Revenue is expected to be in the range of approximately $249.0 million to $264.0 million. The components of Adjusted Revenue include Adjusted Services revenue, which is forecasted to be approximately $225.0 million to $235.0 million, and True Health premiums revenue, which is forecasted to be approximately $28.5 million to $32.5 million; intersegment eliminations are forecasted to be approximately $(4.0) million for the quarter. (4) Represents the mid-point of the guidance range. For the year ending December 31, 2020, Adjusted Revenue is expected to be in the range of approximately $1.000 billion to $1.014 billion. The components of Adjusted Revenue include Adjusted Services revenue, which is forecasted to be approximately $903.3 million to $913.3 million, and True Health premiums revenue, which is forecasted to be approximately $116.0 million to $120.0 million; intersegment eliminations are forecasted to be approximately $(19.3) million for the full year.

Confidential – Do Not Distribute22 Appendix B – Evolent Health, Inc. Adjusted EBITDA Reconciliation LTM Ended Year Ended Guidance 9/30/2020 12/31/2019 Q4 2020 FY 2020 Net loss attributable to common shareholders of Evolent Health, Inc. ($517.7) $(302.0) ($19.2) ($338.8) GAAP Margin (52.5)% (35.7)% (7.3)% (33.6)% Less: Interest income 4.1 4.0 1.3 4.3 Interest expense (23.7) (14.5) (9.2) (29.2) (Provision) benefit for income taxes 24.6 21.5 — 3.1 Depreciation and amortization expenses (62.6) (60.9) (16.5) (63.1) EBITDA (460.1) (252.0) 5.3 (253.9) Less: Impairment of equity method investments (47.1) - — (47.1) Goodwill impairment (414.9) (199.8) — (215.1) Gain (loss) from equity method investees 7.7 (9.5) (0.5) 10.5 Net loss attributable to non-controlling interests 2.0 3.6 — 0.8 Loss on extinguishment of debt (4.8) - — (4.8) Gain (loss) on disposal of assets (6.4) 9.6 — (6.4) Change in fair value of contingent consideration and indemnification asset (4.2) 4.0 — 0.5 Other income (expense), net (0.2) (0.5) — 0.2 Purchase accounting adjustments (1.0) (1.9) — — Stock-based compensation expense (11.0) (15.6) (3.8) (14.1) Severance costs (10.3) (17.4) (0.5) (8.4) Amortization of contract cost assets (4.0) (2.9) (0.5) (4.3) Acquisition-related costs (7.8) (10.8) (1.0) (2.5) Adjusted EBITDA $33.5 $(11.0) $11.5 $36.9 Adjusted EBITDA Margin 3.4% (1.3)% 4.3% 3.7%