Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - Blueprint Medicines Corp | bpmc-20210108xex99d2.htm |

| EX-10.2 - EX-10.2 - Blueprint Medicines Corp | bpmc-20210108xex10d2.htm |

| EX-10.1 - EX-10.1 - Blueprint Medicines Corp | bpmc-20210108xex10d1.htm |

| 8-K - 8-K - Blueprint Medicines Corp | bpmc-20210108x8k.htm |

Exhibit 99.1

| © 2021 Blueprint Medicines Corporation R.S., living with systemic mastocytosis PRECISION THAT MOVES™ Staying one step ahead of disease JANUARY 2021 COMPANY OVERVIEW |

| Forward-looking statements 2 This presentation contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995, as amended. The words "aim," "may," "will," "could," "would," "should," "expect," "plan," "anticipate," "intend," "believe," "estimate," "predict," "project," "potential," "continue," "target" and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. In this presentation, forward-looking statements include, without limitation, statements regarding 2021 goals and anticipated milestones for Blueprint Medicines Corporation (the “Company”); plans, strategies, timelines and expectations for the Company’s current or future approved drugs and drug candidates, including timelines for marketing applications and approvals, the initiation of clinical trials, or results of ongoing and planned clinical trials; the potential benefits of any of the Company’s current or future approved drugs or drug candidates in treating patients; and the Company’s strategy, goals and anticipated milestones, business plans and focus. The Company has based these forward-looking statements on management's current expectations, assumptions, estimates and projections. While the Company believes these expectations, assumptions, estimates and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks, uncertainties and other important factors, many of which are beyond the Company's control and may cause actual results, performance or achievements to differ materially from those expressed or implied by any forward-looking statements. These risks and uncertainties include, without limitation, risks and uncertainties related to the impact of the COVID-19 pandemic to the Company's business, operations, strategy, goals and anticipated milestones, including the Company's ongoing and planned research and discovery activities, ability to conduct ongoing and planned clinical trials, clinical supply of current or future drug candidates, commercial supply of current or future approved drugs, and launching, marketing and selling current or future approved drugs; the Company’s ability and plans in establishing a commercial infrastructure, and successfully launching, marketing and selling current or future approved products; the Company’s ability to successfully expand the approved indications for AYVAKIT™/AYVAKYT® (avapritinib) and GAVRETO™(pralsetinib) or obtain marketing approval for AYVAKIT/AYVAKYT in additional geographies in the future; the delay of any current or planned clinical trials or the development of the Company's drug candidates or the licensed drug candidate; the Company's advancement of multiple early-stage efforts; the Company's ability to successfully demonstrate the efficacy and safety of its drug candidates and gain approval of its drug candidates on a timely basis, if at all; the preclinical and clinical results for the Company's drug candidates, which may not support further development of such drug candidates; actions or decisions of regulatory agencies or authorities, which may affect the initiation, timing and progress of clinical trials or marketing applications; the Company's ability to obtain, maintain and enforce patent and other intellectual property protection for AYVAKIT/AYVAKYT, GAVRETO or any drug candidates it is developing; the Company's ability to develop and commercialize companion diagnostic tests for any of the Company's current or future approved drugs or drug candidates; and the success of the Company's current and future collaborations, partnerships and licenses. These and other risks and uncertainties are described in greater detail under "Risk Factors" in the Company's filings with the Securities and Exchange Commission ("SEC"), including its most recent Annual Report on Form 10-K, as supplemented by its most recent Quarterly Report on Form 10-Q, and any other filings it has made or may make with the SEC in the future. The Company cannot guarantee future results, outcomes, levels of activity, performance, developments, or achievements, and there can be no assurance that its expectations, intentions, anticipations, beliefs, or projections will result or be achieved or accomplished. The forward-looking statements in this presentation are made only as of the date hereof, and except as required by law, the Company undertakes no obligation to update any forward-looking statements contained in this presentation as a result of new information, future events or otherwise. This presentation also contains estimates, projections and other statistical data made by independent parties and by the Company relating to market size and growth and other data about the Company's industry. These data involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions and estimates of the Company's future performance and the future performance of the markets in which the Company operates are necessarily subject to a high degree of uncertainty and risk. Blueprint Medicines, AYVAKIT, AYVAKYT, GAVRETO and associated logos are trademarks of Blueprint Medicines Corporation. |

| Hopeful foundation A new precision therapy platform 2010 Hopeful reality ~2,600 patients treated with an approved or investigational Blueprint Medicines therapy 2021 Rob T. Living with GIST |

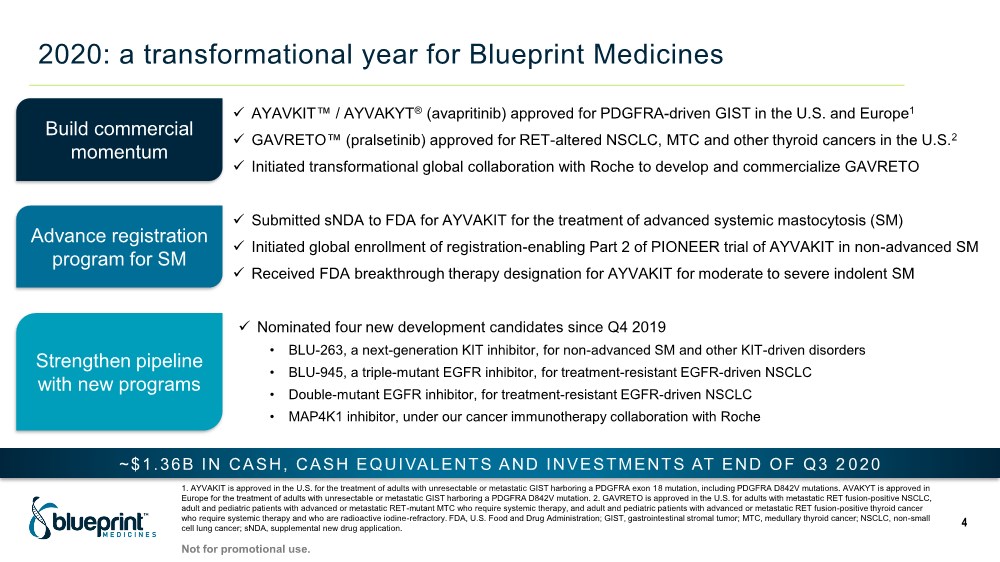

| 2020: a transformational year for Blueprint Medicines 4 Build commercial momentum Advance registration program for SM Strengthen pipeline with new programs ✓ AYAVKIT™ / AYVAKYT® (avapritinib) approved for PDGFRA-driven GIST in the U.S. and Europe1 ✓ GAVRETO™ (pralsetinib) approved for RET-altered NSCLC, MTC and other thyroid cancers in the U.S.2 ✓ Initiated transformational global collaboration with Roche to develop and commercialize GAVRETO ✓ Submitted sNDA to FDA for AYVAKIT for the treatment of advanced systemic mastocytosis (SM) ✓ Initiated global enrollment of registration-enabling Part 2 of PIONEER trial of AYVAKIT in non-advanced SM ✓ Received FDA breakthrough therapy designation for AYVAKIT for moderate to severe indolent SM ✓ Nominated four new development candidates since Q4 2019 • BLU-263, a next-generation KIT inhibitor, for non-advanced SM and other KIT-driven disorders • BLU-945, a triple-mutant EGFR inhibitor, for treatment-resistant EGFR-driven NSCLC • Double-mutant EGFR inhibitor, for treatment-resistant EGFR-driven NSCLC • MAP4K1 inhibitor, under our cancer immunotherapy collaboration with Roche 1. AYVAKIT is approved in the U.S. for the treatment of adults with unresectable or metastatic GIST harboring a PDGFRA exon 18 mutation, including PDGFRA D842V mutations. AVAKYT is approved in Europe for the treatment of adults with unresectable or metastatic GIST harboring a PDGFRA D842V mutation. 2. GAVRETO is approved in the U.S. for adults with metastatic RET fusion-positive NSCLC, adult and pediatric patients with advanced or metastatic RET-mutant MTC who require systemic therapy, and adult and pediatric patients with advanced or metastatic RET fusion-positive thyroid cancer who require systemic therapy and who are radioactive iodine-refractory. FDA, U.S. Food and Drug Administration; GIST, gastrointestinal stromal tumor; MTC, medullary thyroid cancer; NSCLC, non-small cell lung cancer; sNDA, supplemental new drug application. ~$1.36B IN CASH, CASH EQUIVALENTS AND INVESTMENTS AT END OF Q3 2 020 Not for promotional use. |

| Blueprint Medicines’ core mission and foundational principles 5 We aim to make real the promise of precision therapy to improve and extend life for as many people with cancer and hematologic disorders as possible TRANSFORMATIVE BENEFIT PRECISION ADAPTIVE ABILITY RELENTLESS DRIVE FOCUS ON URGENT PATIENT NEEDS HIGHLY POTENT AND SELECTIVE INHIBITORS PREVENT AND OVERCOME RESISTANCE FULLY INTEGRATED GLOBAL BIOPHARMACEUTICAL COMPANY Not for promotional use. SCALABLE PLATFORM & COMMERCIALIZATION |

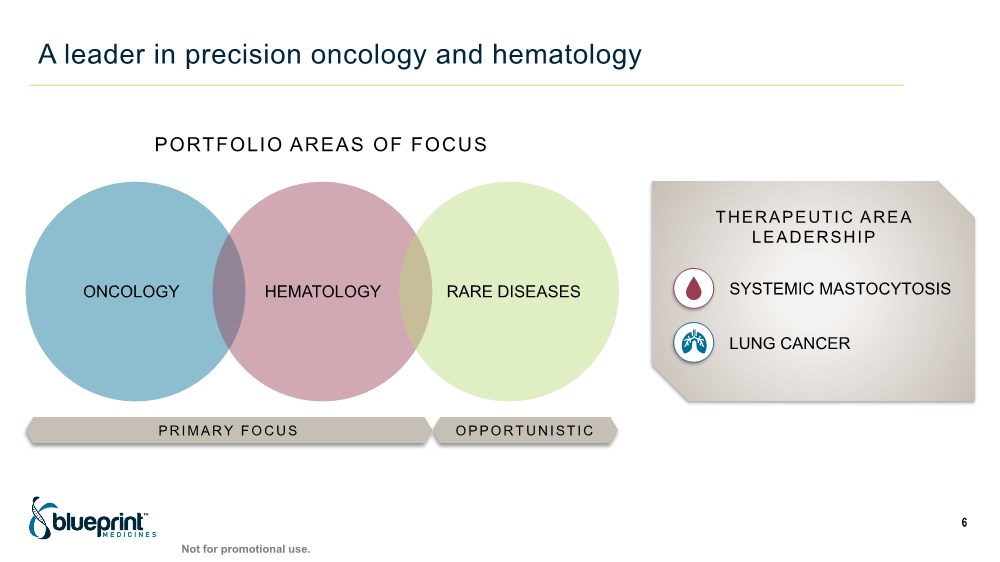

| A leader in precision oncology and hematology 6 ONCOLOGY HEMATOLOGY RARE DISEASES PRIMARY FOCUS OPPORTUNISTIC PORTFOLIO AREAS OF FOCUS SYSTEMIC MASTOCYTOSIS LUNG CANCER THERAPEUTIC AREA LEADERSHIP Not for promotional use. |

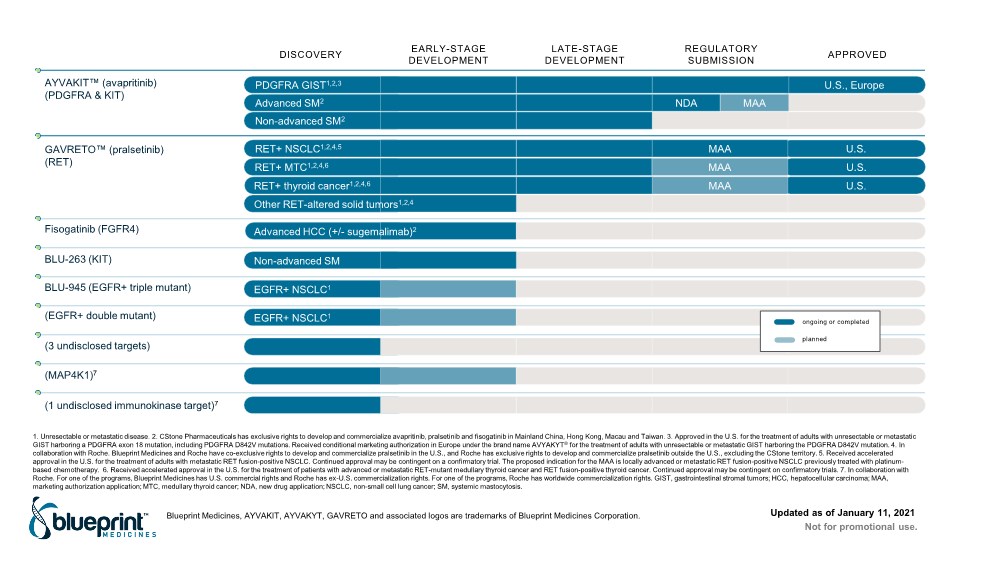

| 1. Unresectable or metastatic disease. 2. CStone Pharmaceuticals has exclusive rights to develop and commercialize avapritinib, pralsetinib and fisogatinib in Mainland China, Hong Kong, Macau and Taiwan. 3. Approved in the U.S. for the treatment of adults with unresectable or metastatic GIST harboring a PDGFRA exon 18 mutation, including PDGFRA D842V mutations. Received conditional marketing authorization in Europe under the brand name AVYAKYT® for the treatment of adults with unresectable or metastatic GIST harboring the PDGFRA D842V mutation. 4. In collaboration with Roche. Blueprint Medicines and Roche have co-exclusive rights to develop and commercialize pralsetinib in the U.S., and Roche has exclusive rights to develop and commercialize pralsetinib outside the U.S., excluding the CStone territory. 5. Received accelerated approval in the U.S. for the treatment of adults with metastatic RET fusion-positive NSCLC. Continued approval may be contingent on a confirmatory trial. The proposed indication for the MAA is locally advanced or metastatic RET fusion-positive NSCLC previously treated with platinum- based chemotherapy. 6. Received accelerated approval in the U.S. for the treatment of patients with advanced or metastatic RET-mutant medullary thyroid cancer and RET fusion-positive thyroid cancer. Continued approval may be contingent on confirmatory trials. 7. In collaboration with Roche. For one of the programs, Blueprint Medicines has U.S. commercial rights and Roche has ex-U.S. commercialization rights. For one of the programs, Roche has worldwide commercialization rights. GIST, gastrointestinal stromal tumors; HCC, hepatocellular carcinoma; MAA, marketing authorization application; MTC, medullary thyroid cancer; NDA, new drug application; NSCLC, non-small cell lung cancer; SM, systemic mastocytosis. DISCOVERY EARLY-STAGE DEVELOPMENT LATE-STAGE DEVELOPMENT REGULATORY SUBMISSION APPROVED U.S., Europe PDGFRA GIST1,2,3 Non-advanced SM2 AYVAKIT™ (avapritinib) (PDGFRA & KIT) Fisogatinib (FGFR4) EGFR+ NSCLC1 BLU-945 (EGFR+ triple mutant) EGFR+ NSCLC1 (EGFR+ double mutant) (3 undisclosed targets) (MAP4K1)7 (1 undisclosed immunokinase target)7 Non-advanced SM BLU-263 (KIT) ongoing or completed planned Advanced HCC (+/- sugemalimab)2 GAVRETO™ (pralsetinib) (RET) Updated as of January 11, 2021 Other RET-altered solid tumors1,2,4 RET+ MTC1,2,4,6 U.S. MAA Not for promotional use. Blueprint Medicines, AYVAKIT, AYVAKYT, GAVRETO and associated logos are trademarks of Blueprint Medicines Corporation. NDA Advanced SM2 MAA RET+ thyroid cancer1,2,4,6 U.S. MAA RET+ NSCLC1,2,4,5 U.S. MAA |

| 2021 roadmap for precision medicine leadership 8 Accelerate global adoption of AYVAKIT and GAVRETO Advance a new wave of therapeutic candidates toward clinical proof-of-concept Further expand the company’s precision therapy pipeline Not for promotional use. |

| 2021 roadmap for precision medicine leadership 9 Accelerate global adoption of AYVAKIT and GAVRETO Advance a new wave of therapeutic candidates toward clinical proof-of-concept Further expand the company’s precision therapy pipeline Not for promotional use. |

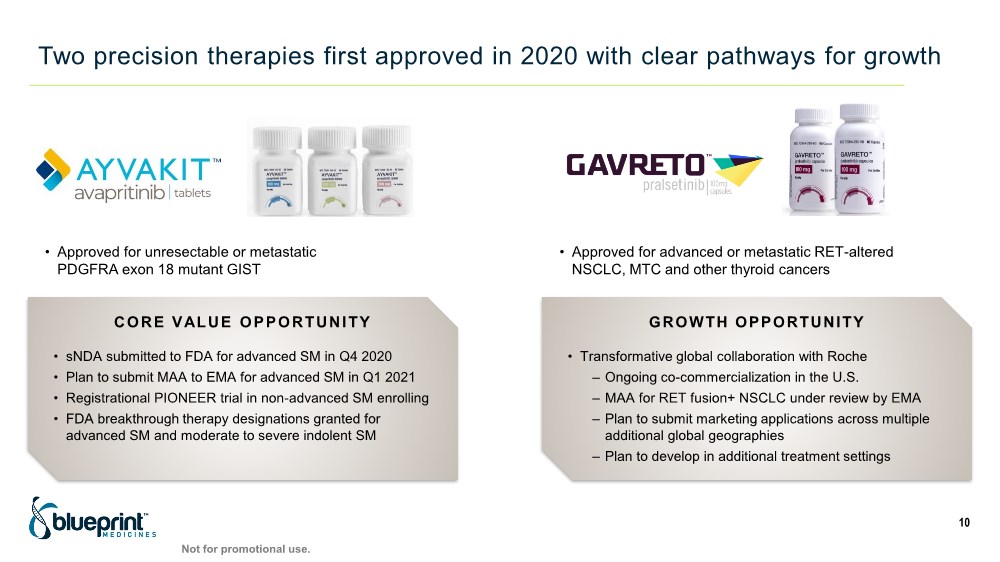

| Two precision therapies first approved in 2020 with clear pathways for growth 10 • Approved for unresectable or metastatic PDGFRA exon 18 mutant GIST • Approved for advanced or metastatic RET-altered NSCLC, MTC and other thyroid cancers CORE VALUE OPPORTUNITY • sNDA submitted to FDA for advanced SM in Q4 2020 • Plan to submit MAA to EMA for advanced SM in Q1 2021 • Registrational PIONEER trial in non-advanced SM enrolling • FDA breakthrough therapy designations granted for advanced SM and moderate to severe indolent SM GROWTH OPPORTUNITY • Transformative global collaboration with Roche – Ongoing co-commercialization in the U.S. – MAA for RET fusion+ NSCLC under review by EMA – Plan to submit marketing applications across multiple additional global geographies – Plan to develop in additional treatment settings Not for promotional use. |

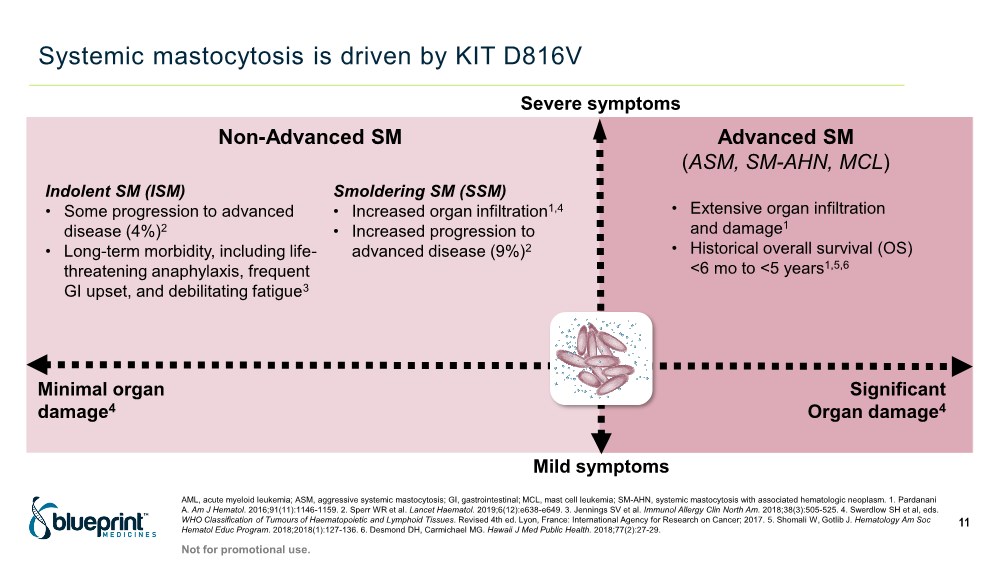

| Systemic mastocytosis is driven by KIT D816V Mild symptoms Non-Advanced SM Severe symptoms Indolent SM (ISM) • Some progression to advanced disease (4%)2 • Long-term morbidity, including life- threatening anaphylaxis, frequent GI upset, and debilitating fatigue3 Smoldering SM (SSM) • Increased organ infiltration1,4 • Increased progression to advanced disease (9%)2 AML, acute myeloid leukemia; ASM, aggressive systemic mastocytosis; GI, gastrointestinal; MCL, mast cell leukemia; SM-AHN, systemic mastocytosis with associated hematologic neoplasm. 1. Pardanani A. Am J Hematol. 2016;91(11):1146-1159. 2. Sperr WR et al. Lancet Haematol. 2019;6(12):e638-e649. 3. Jennings SV et al. Immunol Allergy Clin North Am. 2018;38(3):505-525. 4. Swerdlow SH et al, eds. WHO Classification of Tumours of Haematopoietic and Lymphoid Tissues. Revised 4th ed. Lyon, France: International Agency for Research on Cancer; 2017. 5. Shomali W, Gotlib J. Hematology Am Soc Hematol Educ Program. 2018;2018(1):127-136. 6. Desmond DH, Carmichael MG. Hawaii J Med Public Health. 2018;77(2):27-29. Minimal organ damage4 Advanced SM (ASM, SM-AHN, MCL) • Extensive organ infiltration and damage1 • Historical overall survival (OS) <6 mo to <5 years1,5,6 Significant Organ damage4 11 Not for promotional use. |

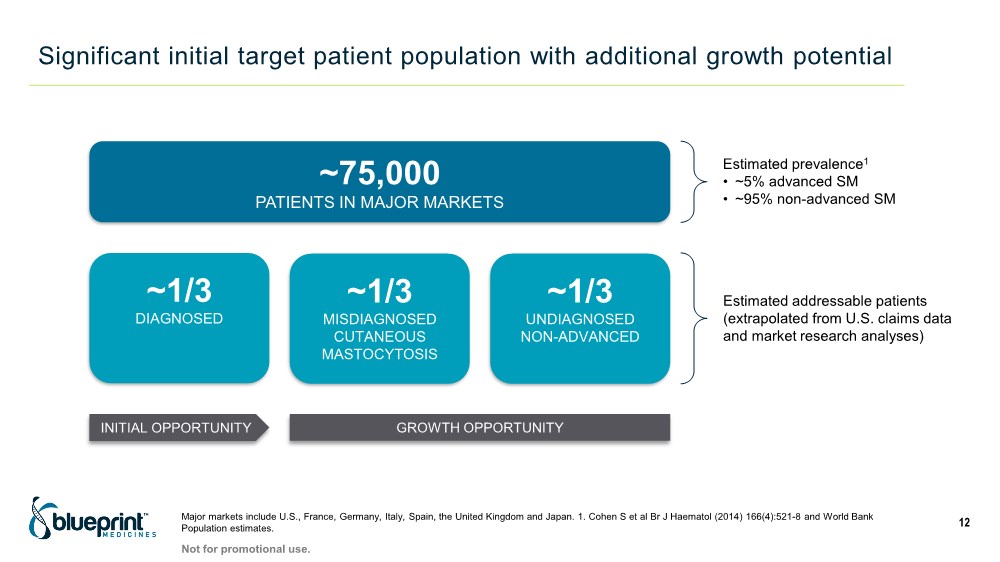

| Significant initial target patient population with additional growth potential Major markets include U.S., France, Germany, Italy, Spain, the United Kingdom and Japan. 1. Cohen S et al Br J Haematol (2014) 166(4):521-8 and World Bank Population estimates. 12 ~75,000 PATIENTS IN MAJOR MARKETS ~1/3 DIAGNOSED INITIAL OPPORTUNITY GROWTH OPPORTUNITY Estimated addressable patients (extrapolated from U.S. claims data and market research analyses) Estimated prevalence1 • ~5% advanced SM • ~95% non-advanced SM ~1/3 MISDIAGNOSED CUTANEOUS MASTOCYTOSIS ~1/3 UNDIAGNOSED NON-ADVANCED Not for promotional use. |

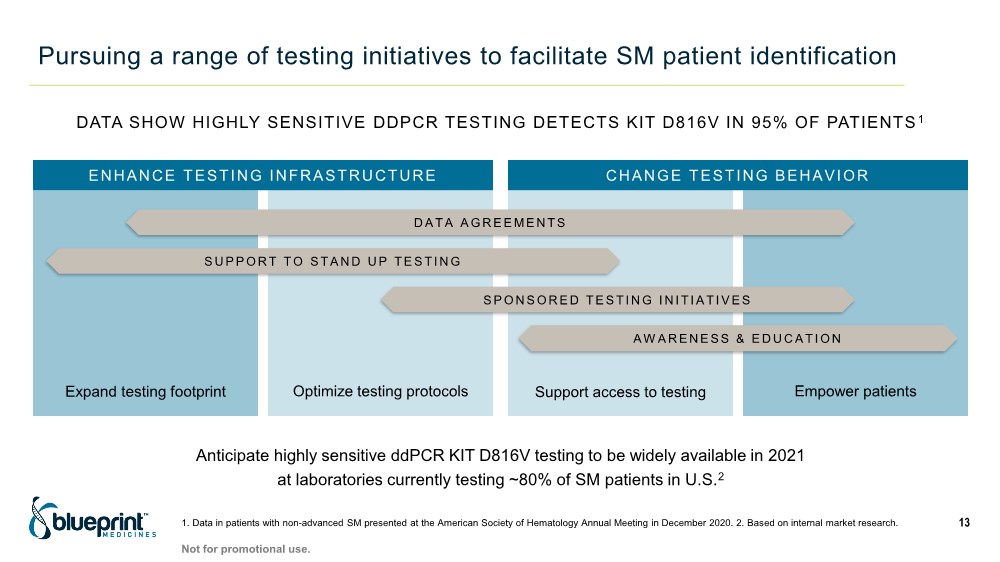

| Pursuing a range of testing initiatives to facilitate SM patient identification 13 ENHANCE TESTING INFRASTRUCTURE CHANGE TESTING BEHAVIOR DATA AGREEMENTS SUPPORT TO STAND UP TESTING SPONSORED TESTING INITIATIVES AWARENESS & EDUCATION Expand testing footprint Optimize testing protocols Support access to testing Empower patients DATA SHOW HIGHLY SENSITIVE DDPCR TESTING DETECTS KIT D816V IN 95% OF PATIENTS 1 Anticipate highly sensitive ddPCR KIT D816V testing to be widely available in 2021 at laboratories currently testing ~80% of SM patients in U.S.2 1. Data in patients with non-advanced SM presented at the American Society of Hematology Annual Meeting in December 2020. 2. Based on internal market research. Not for promotional use. |

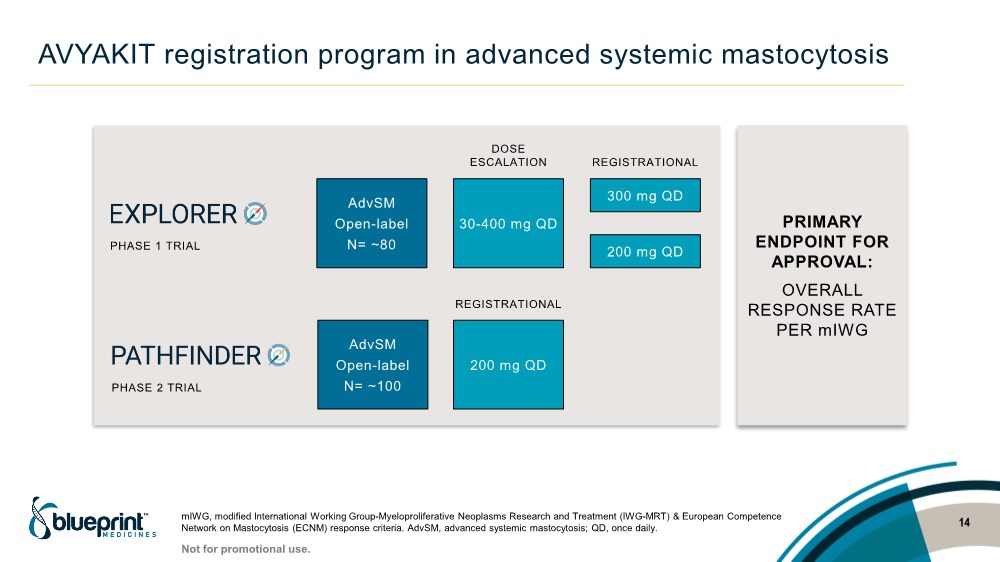

| AVYAKIT registration program in advanced systemic mastocytosis 14 mIWG, modified International Working Group-Myeloproliferative Neoplasms Research and Treatment (IWG-MRT) & European Competence Network on Mastocytosis (ECNM) response criteria. AdvSM, advanced systemic mastocytosis; QD, once daily. AdvSM Open-label N= ~80 AdvSM Open-label N= ~100 30-400 mg QD 300 mg QD 200 mg QD 200 mg QD DOSE ESCALATION REGISTRATIONAL PHASE 1 TRIAL PHASE 2 TRIAL PRIMARY ENDPOINT FOR APPROVAL: OVERALL RESPONSE RATE PER mIWG Not for promotional use. REGISTRATIONAL |

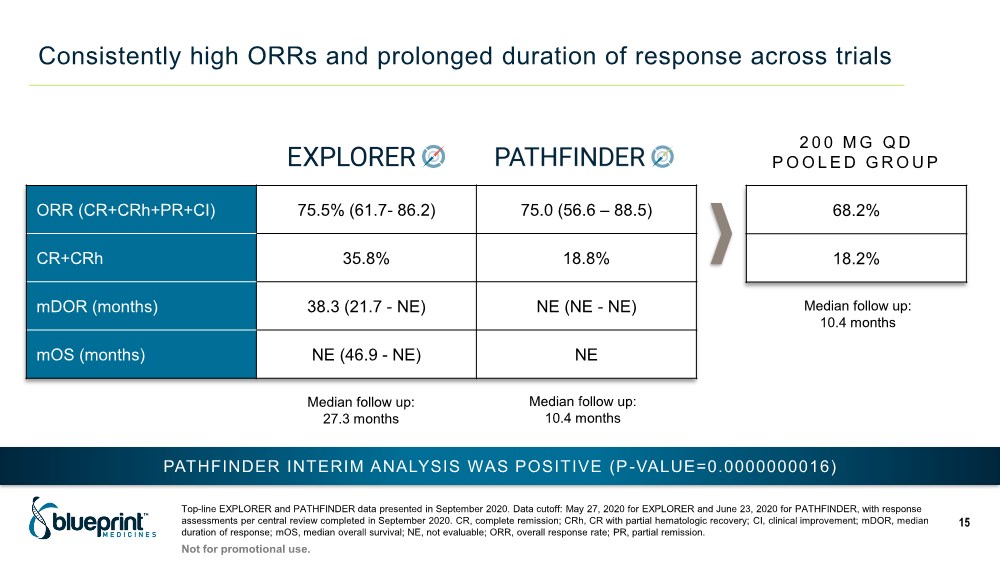

| Consistently high ORRs and prolonged duration of response across trials Top-line EXPLORER and PATHFINDER data presented in September 2020. Data cutoff: May 27, 2020 for EXPLORER and June 23, 2020 for PATHFINDER, with response assessments per central review completed in September 2020. CR, complete remission; CRh, CR with partial hematologic recovery; CI, clinical improvement; mDOR, median duration of response; mOS, median overall survival; NE, not evaluable; ORR, overall response rate; PR, partial remission. 15 ORR (CR+CRh+PR+CI) 75.5% (61.7- 86.2) 75.0 (56.6 – 88.5) CR+CRh 35.8% 18.8% mDOR (months) 38.3 (21.7 - NE) NE (NE - NE) mOS (months) NE (46.9 - NE) NE 68.2% 18.2% PATHFINDER INTERIM ANALYSIS WAS POSITIVE (P-VALUE=0.0000000016) Median follow up: 27.3 months Median follow up: 10.4 months Median follow up: 10.4 months 2 0 0 M G Q D POOLED GROUP Not for promotional use. |

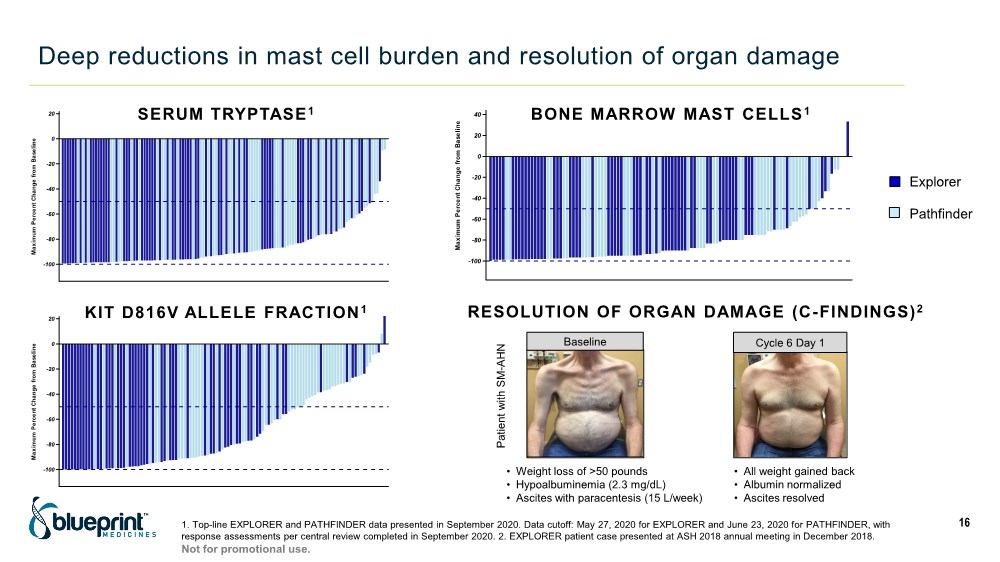

| Deep reductions in mast cell burden and resolution of organ damage 16 -100 -80 -60 -40 -20 0 20 M a x i m u m P e r c e n t C h a n g e f r o m B a s e l i n e BLU-285-2202 BLU-285-2101 Study SERUM TRYPTASE1 -100 -80 -60 -40 -20 0 20 40 60 M a x i m u m P e r c e n t C h a n g e f r o m B a s e l i n e BLU-285-2202 BLU-285-2101 Study BONE MARROW MAST CELLS 1 -100 -80 -60 -40 -20 0 20 M a x i m u m P e r c e n t C h a n g e f r o m B a s e l i n e BLU-285-2202 BLU-285-2101 Study KIT D816V ALLELE FRACTION 1 Explorer Pathfinder 1. Top-line EXPLORER and PATHFINDER data presented in September 2020. Data cutoff: May 27, 2020 for EXPLORER and June 23, 2020 for PATHFINDER, with response assessments per central review completed in September 2020. 2. EXPLORER patient case presented at ASH 2018 annual meeting in December 2018. Baseline Cycle 6 Day 1 RESOLUTION OF ORGAN DAMAGE (C-FINDINGS)2 • Weight loss of >50 pounds • Hypoalbuminemia (2.3 mg/dL) • Ascites with paracentesis (15 L/week) • All weight gained back • Albumin normalized • Ascites resolved Patient with SM - AHN Not for promotional use. |

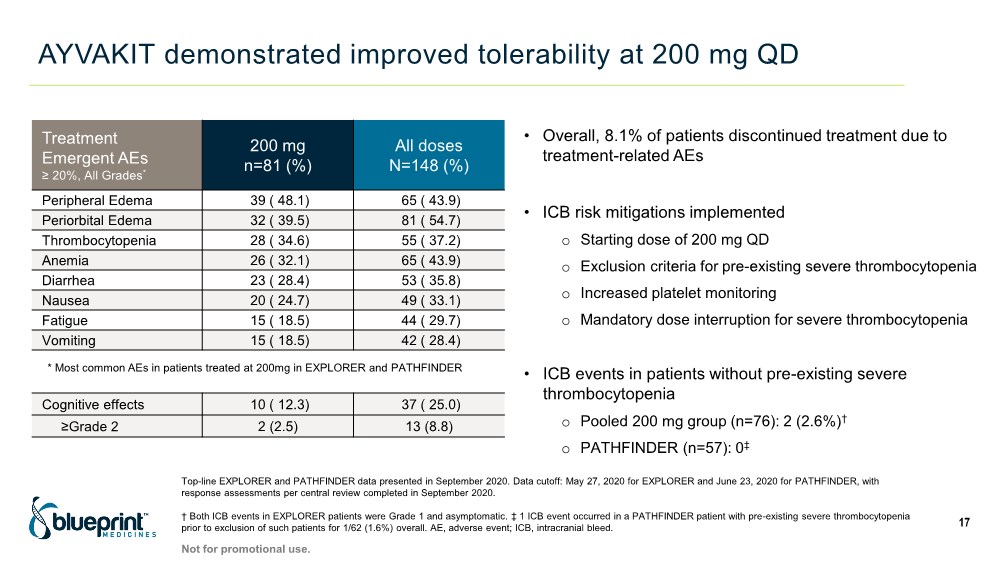

| AYVAKIT demonstrated improved tolerability at 200 mg QD 17 Treatment Emergent AEs ≥ 20%, All Grades* 200 mg n=81 (%) All doses N=148 (%) Peripheral Edema 39 ( 48.1) 65 ( 43.9) Periorbital Edema 32 ( 39.5) 81 ( 54.7) Thrombocytopenia 28 ( 34.6) 55 ( 37.2) Anemia 26 ( 32.1) 65 ( 43.9) Diarrhea 23 ( 28.4) 53 ( 35.8) Nausea 20 ( 24.7) 49 ( 33.1) Fatigue 15 ( 18.5) 44 ( 29.7) Vomiting 15 ( 18.5) 42 ( 28.4) • Overall, 8.1% of patients discontinued treatment due to treatment-related AEs • ICB risk mitigations implemented o Starting dose of 200 mg QD o Exclusion criteria for pre-existing severe thrombocytopenia o Increased platelet monitoring o Mandatory dose interruption for severe thrombocytopenia • ICB events in patients without pre-existing severe thrombocytopenia o Pooled 200 mg group (n=76): 2 (2.6%)† o PATHFINDER (n=57): 0‡ Cognitive effects 10 ( 12.3) 37 ( 25.0) ≥Grade 2 2 (2.5) 13 (8.8) Top-line EXPLORER and PATHFINDER data presented in September 2020. Data cutoff: May 27, 2020 for EXPLORER and June 23, 2020 for PATHFINDER, with response assessments per central review completed in September 2020. † Both ICB events in EXPLORER patients were Grade 1 and asymptomatic. ‡ 1 ICB event occurred in a PATHFINDER patient with pre-existing severe thrombocytopenia prior to exclusion of such patients for 1/62 (1.6%) overall. AE, adverse event; ICB, intracranial bleed. * Most common AEs in patients treated at 200mg in EXPLORER and PATHFINDER Not for promotional use. |

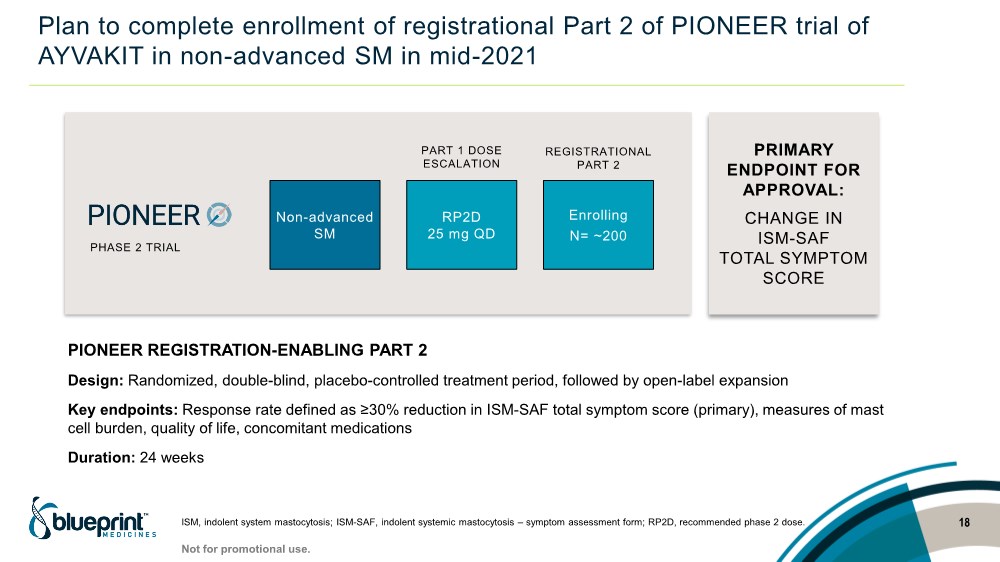

| Plan to complete enrollment of registrational Part 2 of PIONEER trial of AYVAKIT in non-advanced SM in mid-2021 18 ISM, indolent system mastocytosis; ISM-SAF, indolent systemic mastocytosis – symptom assessment form; RP2D, recommended phase 2 dose. Non-advanced SM RP2D 25 mg QD PART 1 DOSE ESCALATION REGISTRATIONAL PART 2 PHASE 2 TRIAL PRIMARY ENDPOINT FOR APPROVAL: CHANGE IN ISM-SAF TOTAL SYMPTOM SCORE PIONEER REGISTRATION-ENABLING PART 2 Design: Randomized, double-blind, placebo-controlled treatment period, followed by open-label expansion Key endpoints: Response rate defined as ≥30% reduction in ISM-SAF total symptom score (primary), measures of mast cell burden, quality of life, concomitant medications Duration: 24 weeks Enrolling N= ~200 Not for promotional use. |

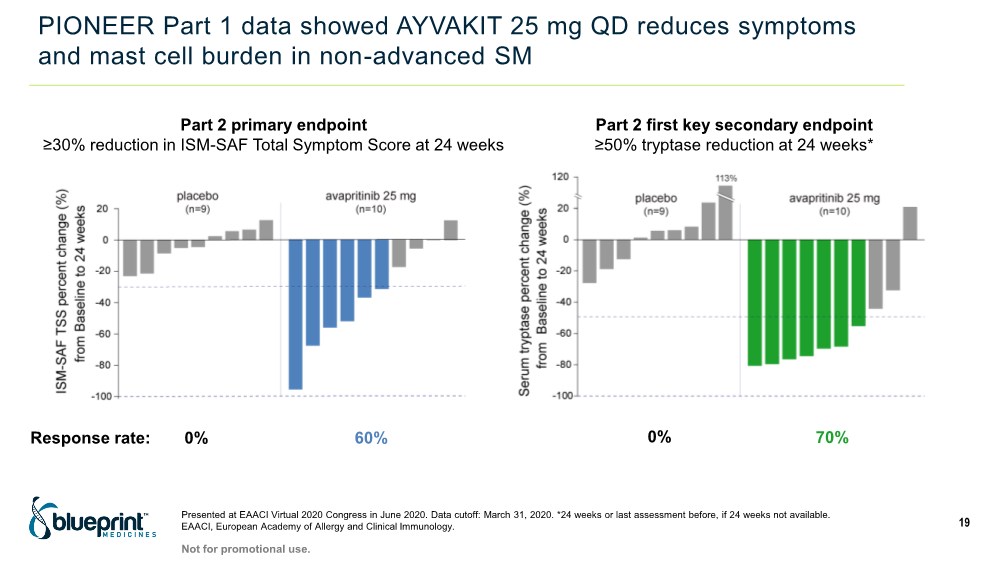

| PIONEER Part 1 data showed AYVAKIT 25 mg QD reduces symptoms and mast cell burden in non-advanced SM Presented at EAACI Virtual 2020 Congress in June 2020. Data cutoff: March 31, 2020. *24 weeks or last assessment before, if 24 weeks not available. EAACI, European Academy of Allergy and Clinical Immunology. 19 Part 2 primary endpoint ≥30% reduction in ISM-SAF Total Symptom Score at 24 weeks 60% 0% Response rate: Part 2 first key secondary endpoint ≥50% tryptase reduction at 24 weeks* 70% 0% Not for promotional use. |

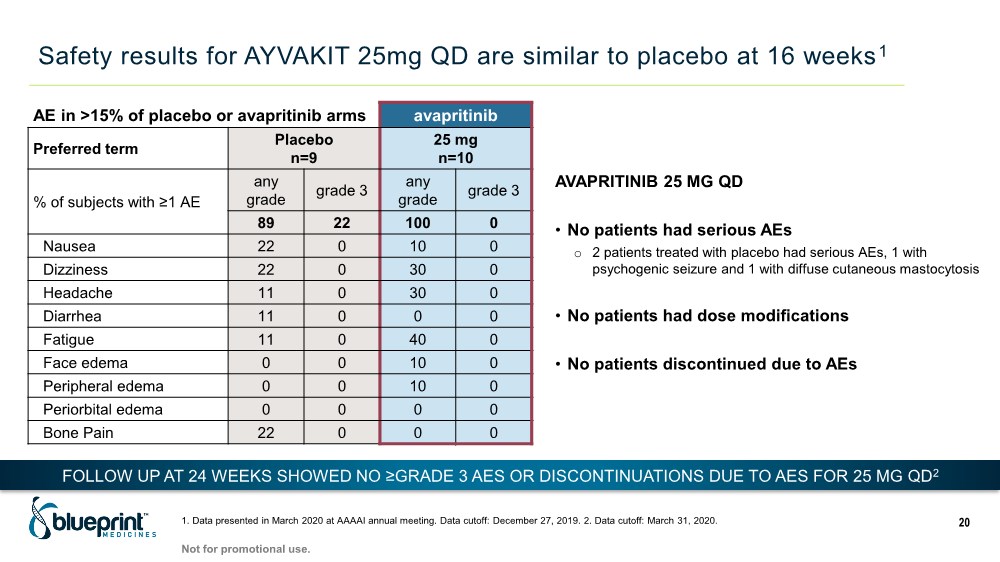

| Safety results for AYVAKIT 25mg QD are similar to placebo at 16 weeks1 1. Data presented in March 2020 at AAAAI annual meeting. Data cutoff: December 27, 2019. 2. Data cutoff: March 31, 2020. 20 AE in >15% of placebo or avapritinib arms avapritinib Preferred term Placebo n=9 25 mg n=10 % of subjects with ≥1 AE any grade grade 3 any grade grade 3 89 22 100 0 Nausea 22 0 10 0 Dizziness 22 0 30 0 Headache 11 0 30 0 Diarrhea 11 0 0 0 Fatigue 11 0 40 0 Face edema 0 0 10 0 Peripheral edema 0 0 10 0 Periorbital edema 0 0 0 0 Bone Pain 22 0 0 0 AVAPRITINIB 25 MG QD • No patients had serious AEs o 2 patients treated with placebo had serious AEs, 1 with psychogenic seizure and 1 with diffuse cutaneous mastocytosis • No patients had dose modifications • No patients discontinued due to AEs FOLLOW UP AT 24 WEEKS SHOWED NO ≥GRADE 3 AES OR DISCONTINUATIONS DUE TO AES FOR 25 MG QD2 Not for promotional use. |

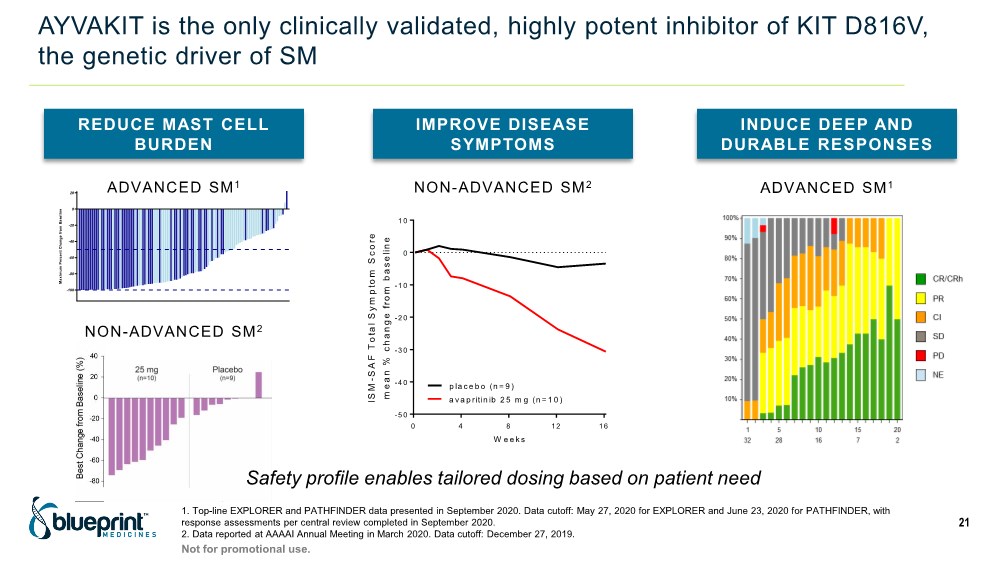

| AYVAKIT is the only clinically validated, highly potent inhibitor of KIT D816V, the genetic driver of SM 1. Top-line EXPLORER and PATHFINDER data presented in September 2020. Data cutoff: May 27, 2020 for EXPLORER and June 23, 2020 for PATHFINDER, with response assessments per central review completed in September 2020. 2. Data reported at AAAAI Annual Meeting in March 2020. Data cutoff: December 27, 2019. 21 REDUCE MAST CELL BURDEN IMPROVE DISEASE SYMPTOMS INDUCE DEEP AND DURABLE RESPONSES -100 -80 -60 -40 -20 0 20 M a x i m u m P e r c e n t C h a n g e f r o m B a s e l i n e BLU-285-2202 BLU-285-2101 Study -5 0 -4 0 -3 0 -2 0 -1 0 0 1 0 W e e k s I S M - S A F T o t a l S y m p t o m S c o r e m e a n % c h a n g e f r o m b a s e l i n e 0 4 8 12 16 a v a p ritin ib 2 5 m g (n = 1 0 ) p la c e b o (n = 9 ) NON-ADVANCED SM2 ADVANCED SM1 Safety profile enables tailored dosing based on patient need ADVANCED SM1 NON-ADVANCED SM2 Not for promotional use. |

| 2021 roadmap for precision medicine leadership 22 Accelerate global adoption of AYVAKIT and GAVRETO Advance a new wave of therapeutic candidates toward clinical proof-of-concept Further expand the company’s precision therapy pipeline Not for promotional use. |

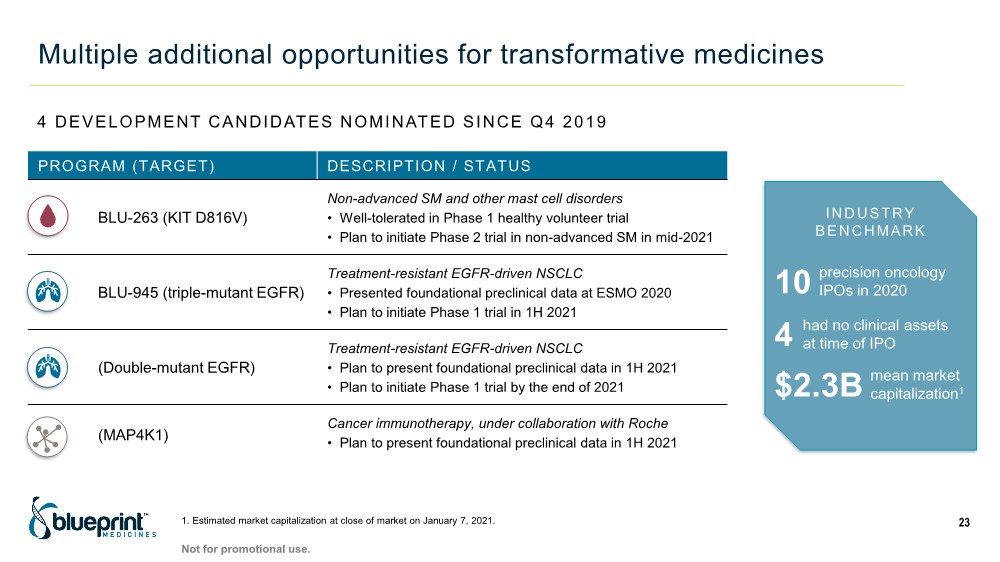

| Multiple additional opportunities for transformative medicines 23 PROGRAM (TARGET) DESCRIPTION / STATUS BLU-263 (KIT D816V) Non-advanced SM and other mast cell disorders • Well-tolerated in Phase 1 healthy volunteer trial • Plan to initiate Phase 2 trial in non-advanced SM in mid-2021 BLU-945 (triple-mutant EGFR) Treatment-resistant EGFR-driven NSCLC • Presented foundational preclinical data at ESMO 2020 • Plan to initiate Phase 1 trial in 1H 2021 (Double-mutant EGFR) Treatment-resistant EGFR-driven NSCLC • Plan to present foundational preclinical data in 1H 2021 • Plan to initiate Phase 1 trial by the end of 2021 (MAP4K1) Cancer immunotherapy, under collaboration with Roche • Plan to present foundational preclinical data in 1H 2021 10 precision oncology IPOs in 2020 4 had no clinical assets at time of IPO $2.3B mean market capitalization1 Not for promotional use. 4 DEVELOPMENT CANDIDATES NOMINATED SINCE Q4 2019 1. Estimated market capitalization at close of market on January 7, 2021. INDUSTRY BENCHMARK |

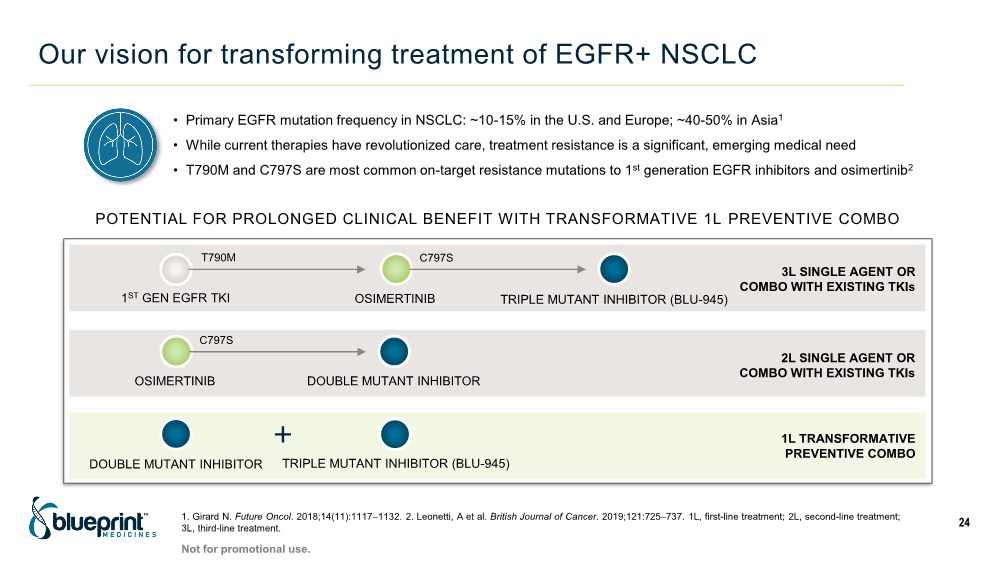

| Our vision for transforming treatment of EGFR+ NSCLC 1. Girard N. Future Oncol. 2018;14(11):1117–1132. 2. Leonetti, A et al. British Journal of Cancer. 2019;121:725–737. 1L, first-line treatment; 2L, second-line treatment; 3L, third-line treatment. 24 1ST GEN EGFR TKI OSIMERTINIB TRIPLE MUTANT INHIBITOR (BLU-945) T790M C797S OSIMERTINIB DOUBLE MUTANT INHIBITOR C797S DOUBLE MUTANT INHIBITOR TRIPLE MUTANT INHIBITOR (BLU-945) 1L TRANSFORMATIVE PREVENTIVE COMBO 2L SINGLE AGENT OR COMBO WITH EXISTING TKIs 3L SINGLE AGENT OR COMBO WITH EXISTING TKIs POTENTIAL FOR PROLONGED CLINICAL BENEFIT WITH TRANSFORMATIVE 1L PREVENTIVE COMBO • Primary EGFR mutation frequency in NSCLC: ~10-15% in the U.S. and Europe; ~40-50% in Asia1 • While current therapies have revolutionized care, treatment resistance is a significant, emerging medical need • T790M and C797S are most common on-target resistance mutations to 1st generation EGFR inhibitors and osimertinib2 Not for promotional use. |

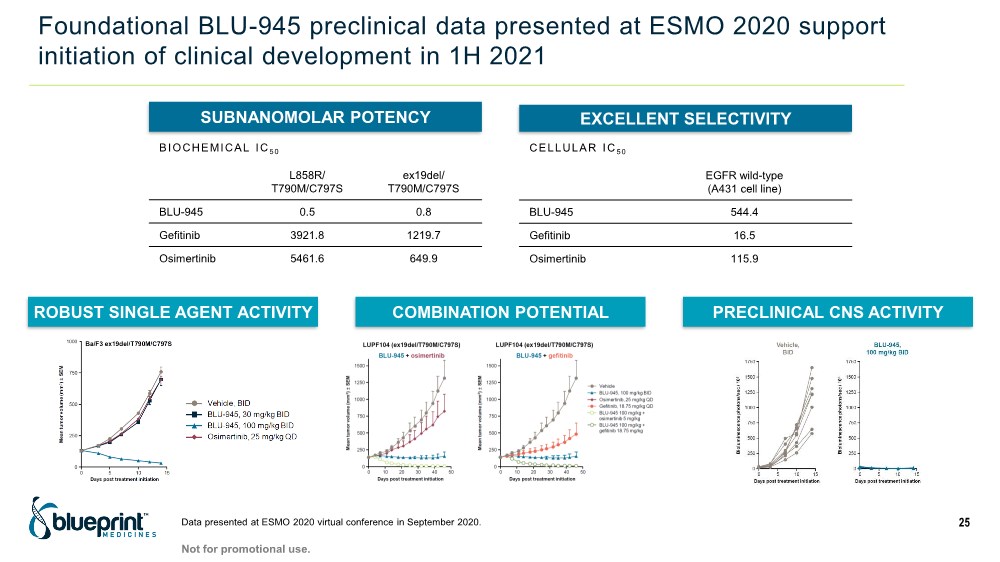

| Foundational BLU-945 preclinical data presented at ESMO 2020 support initiation of clinical development in 1H 2021 Data presented at ESMO 2020 virtual conference in September 2020. 25 SUBNANOMOLAR POTENCY EXCELLENT SELECTIVITY ROBUST SINGLE AGENT ACTIVITY COMBINATION POTENTIAL PRECLINICAL CNS ACTIVITY L858R/ T790M/C797S ex19del/ T790M/C797S BLU-945 0.5 0.8 Gefitinib 3921.8 1219.7 Osimertinib 5461.6 649.9 BIOCHEMICAL IC 50 EGFR wild-type (A431 cell line) BLU-945 544.4 Gefitinib 16.5 Osimertinib 115.9 CELLULAR IC 50 Not for promotional use. |

| 2021 roadmap for precision medicine leadership 26 Accelerate global adoption of AYVAKIT and GAVRETO Advance a new wave of therapeutic candidates toward clinical proof-of-concept Further expand the company’s precision therapy pipeline Not for promotional use. |

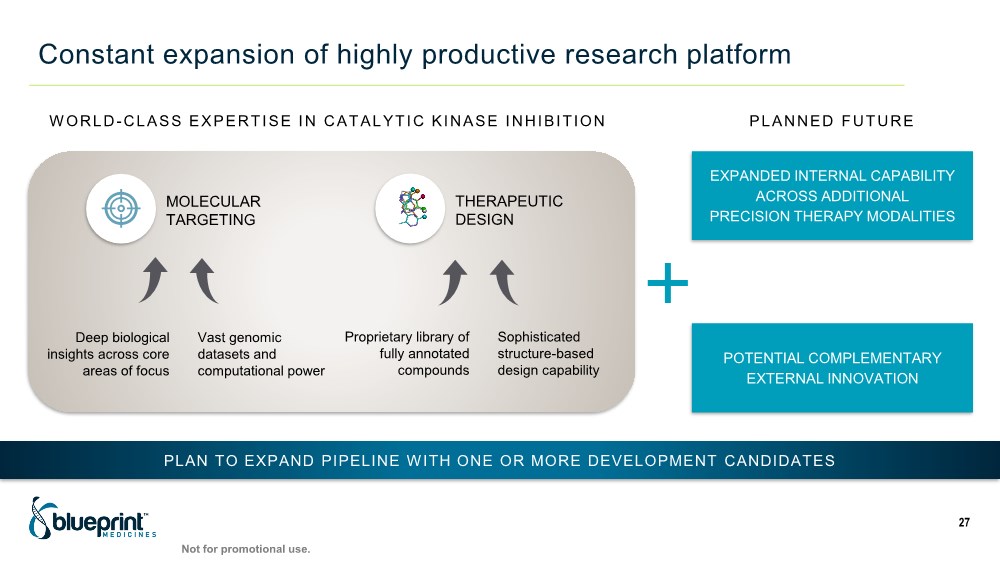

| Constant expansion of highly productive research platform 27 PLAN TO EXPAND PIPELINE WITH ONE OR MORE DEVELOPMENT CANDIDATES WORLD-CLASS EXPERTISE IN CATALYTIC KINASE INHIBITION MOLECULAR TARGETING THERAPEUTIC DESIGN Deep biological insights across core areas of focus Vast genomic datasets and computational power Proprietary library of fully annotated compounds Sophisticated structure-based design capability EXPANDED INTERNAL CAPABILITY ACROSS ADDITIONAL PRECISION THERAPY MODALITIES POTENTIAL COMPLEMENTARY EXTERNAL INNOVATION PLANNED FUTURE Not for promotional use. |

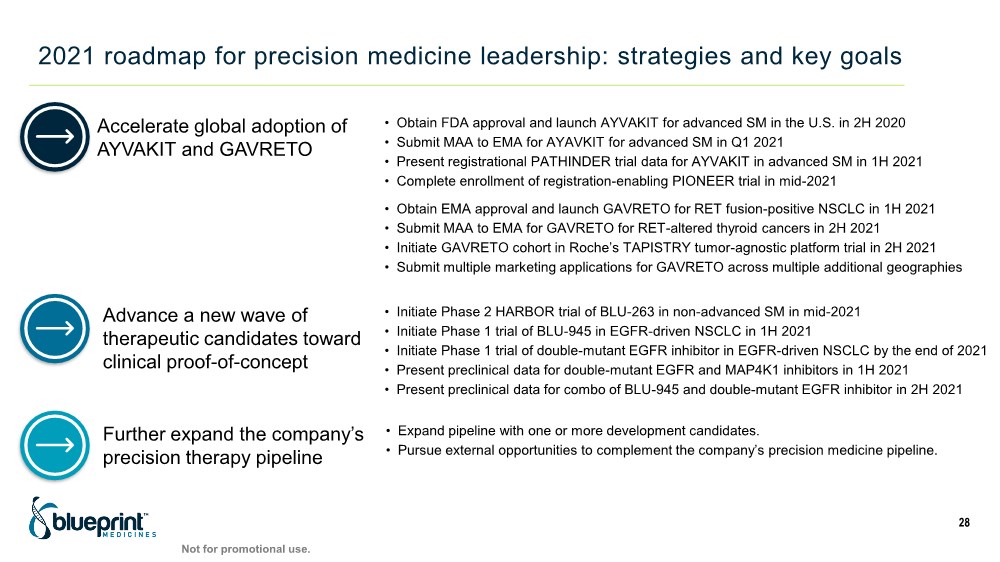

| 2021 roadmap for precision medicine leadership: strategies and key goals 28 Accelerate global adoption of AYVAKIT and GAVRETO Advance a new wave of therapeutic candidates toward clinical proof-of-concept Further expand the company’s precision therapy pipeline • Obtain FDA approval and launch AYVAKIT for advanced SM in the U.S. in 2H 2020 • Submit MAA to EMA for AYAVKIT for advanced SM in Q1 2021 • Present registrational PATHINDER trial data for AYVAKIT in advanced SM in 1H 2021 • Complete enrollment of registration-enabling PIONEER trial in mid-2021 • Obtain EMA approval and launch GAVRETO for RET fusion-positive NSCLC in 1H 2021 • Submit MAA to EMA for GAVRETO for RET-altered thyroid cancers in 2H 2021 • Initiate GAVRETO cohort in Roche’s TAPISTRY tumor-agnostic platform trial in 2H 2021 • Submit multiple marketing applications for GAVRETO across multiple additional geographies • Initiate Phase 2 HARBOR trial of BLU-263 in non-advanced SM in mid-2021 • Initiate Phase 1 trial of BLU-945 in EGFR-driven NSCLC in 1H 2021 • Initiate Phase 1 trial of double-mutant EGFR inhibitor in EGFR-driven NSCLC by the end of 2021 • Present preclinical data for double-mutant EGFR and MAP4K1 inhibitors in 1H 2021 • Present preclinical data for combo of BLU-945 and double-mutant EGFR inhibitor in 2H 2021 • Expand pipeline with one or more development candidates. • Pursue external opportunities to complement the company’s precision medicine pipeline. Not for promotional use. |

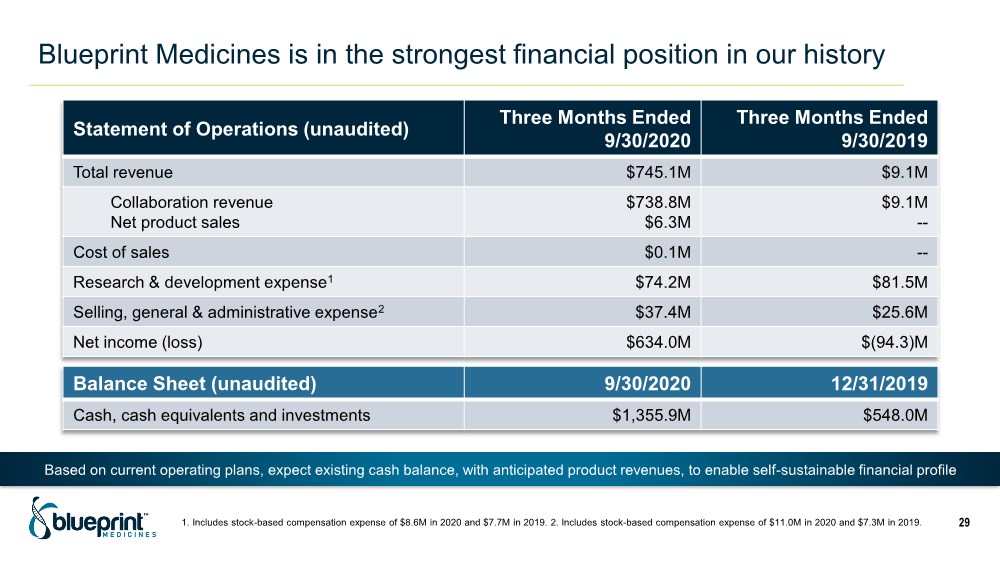

| Blueprint Medicines is in the strongest financial position in our history 1. Includes stock-based compensation expense of $8.6M in 2020 and $7.7M in 2019. 2. Includes stock-based compensation expense of $11.0M in 2020 and $7.3M in 2019. 29 Statement of Operations (unaudited) Three Months Ended 9/30/2020 Three Months Ended 9/30/2019 Total revenue $745.1M $9.1M Collaboration revenue Net product sales $738.8M $6.3M $9.1M -- Cost of sales $0.1M -- Research & development expense1 $74.2M $81.5M Selling, general & administrative expense2 $37.4M $25.6M Net income (loss) $634.0M $(94.3)M Balance Sheet (unaudited) 9/30/2020 12/31/2019 Cash, cash equivalents and investments $1,355.9M $548.0M Based on current operating plans, expect existing cash balance, with anticipated product revenues, to enable self-sustainable financial profile |