Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MEDIFAST INC | tm212058d1_8k.htm |

Exhibit 99.1

JANUARY 2021 INVESTOR PRESENTATION 1

Safe Harbor Statement Certain information included in this presentation may constitute “forward - looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These forward - looking statements generally can be identified by use of phrases or terminology such as "intend" or other similar words or the negative of such terminology. Similarly, descriptions of Medifast's objectives, strategies, plans, goals or targets contained herein are also considered forward - looking statements. These statements are based on the current expectations of the management of Medifast and are subject to certain events, risks, uncertainties, and other factors. Some of these factors include, among others, the impact of the COVID - 19 pandemic on Medifast’s results, the severity, length and ultimate impact of COVID - 19 on people and economies, Medifast's inability to attract and retain independent OPTA VIA Coaches and Clients, increases in competition, litigation, regulatory changes, and Medifast’s planned growth into domestic and international markets and new channels of distribution . Although Medifast believes that the expectations, statements, and assumptions reflected in these forward - looking statements are reasonable, it cautions readers to always consider all of the risk factors and any other cautionary statements carefully in evaluating each forward - looking statement in this presentation, as well as those set forth in its Annual Report on Form 10 - K for the fiscal year ended December 31, 2019, and Quarterly Reports on Form 10 - Q, for the quarters ended March 31, 2020, June 30, 2020 and September 30, 2020, and other filings filed with the United States Securities and Exchange Commission, including its current reports on Form 8 - K. All of the forward - looking statements contained herein speak only as of the date of this presentation. 2

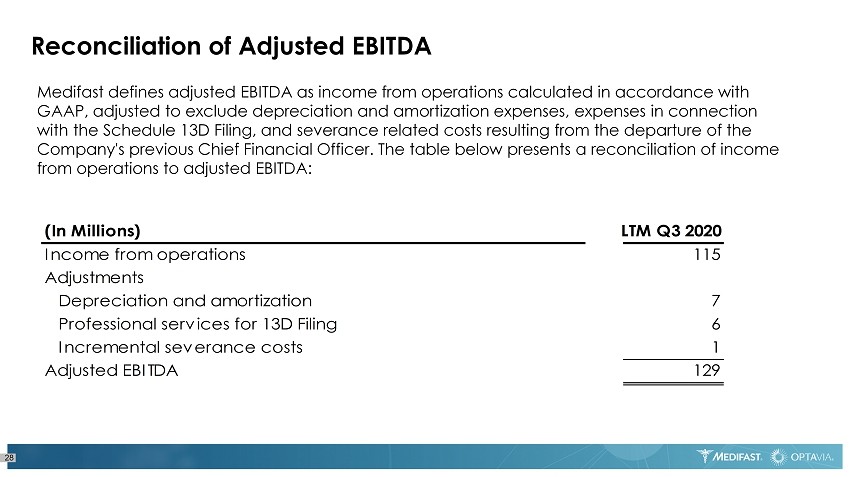

Non - GAAP Financial Measures We disclose adjusted EBITDA, a non - GAAP financial measure in this investor relations presentation and other public disclosures. This non - GAAP financial measure excludes the impact of certain non - recurring items and items that, in the judgment of management, are not indicative of its core ongoing operational performance. A reconciliation of this non - GAAP financial measure to its most comparable GAAP financial measure is included herein. This non - GAAP financial measure is not intended to replace its most comparable GAAP financial measure. We use this non - GAAP financial measure internally to evaluate and manage the Company's operations because we believe it provides useful supplemental information regarding the Company's on - going economic performance. We have chosen to provide this information to investors to enable them to perform more meaningful comparisons of operating results and as a means to emphasize the results of on - going operations . 3

4 AGENDA OPTA VIA Transition And Performance Highlights 2 Summary 3 Medifast At A Glance 1 Appendix 4

MEDIFAST AT A GLANCE 5

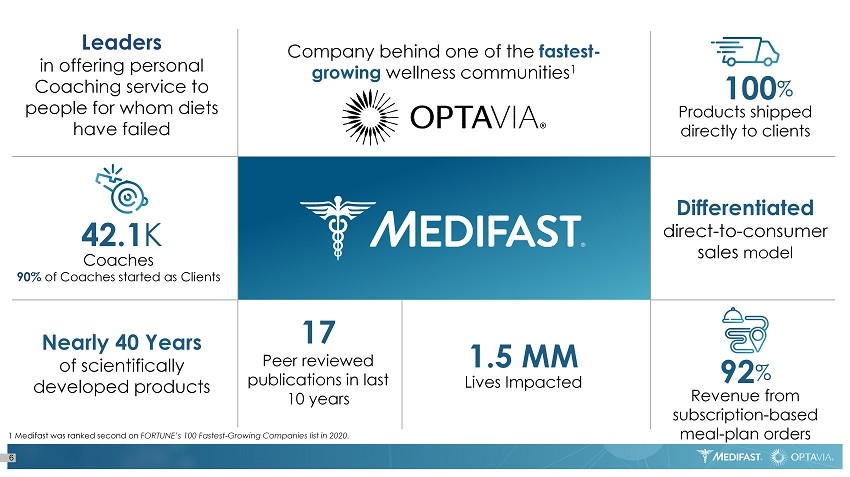

6 Differentiated direct - to - consumer sales model Peer reviewed publications in last 10 years 17 Lives Impacted 1.5 MM Leaders in offering personal Coaching service to people for whom diets have failed Nearly 40 Years of scientifically developed products Company behind one of the fastest - growing wellness communities 1 Coaches 90% of Coaches started as Clients 42.1 K Revenue from subscription - based meal - plan orders 92 % Products shipped directly to clients 100 % 1 Medifast was ranked second on FORTUNE’s 100 Fastest - Growing Companies list in 2020.

OUR COMPETITIVE ADVANTAGE VS. DIRECT SELLING MODEL OPTA VIA COACH MODEL DIRECT SELLING MODEL Client - centric one price direct - to - consumer model; 90% of revenue from clients Distributor - centric tiered price wholesale/retail model; revenue mix leans to distributor entities Coaches Coach support clients, do not hold inventory, or manage cash Distributors Sell Wholesale and Retail Selling, hold inventory and manage cash Health and Wellness Community holistic health and wellness program, Coaches come from client base Selling and Recruiting Network product sales, heavy distributor recruiting with high attrition Unified Training System in the Field Diverse Training Systems 7

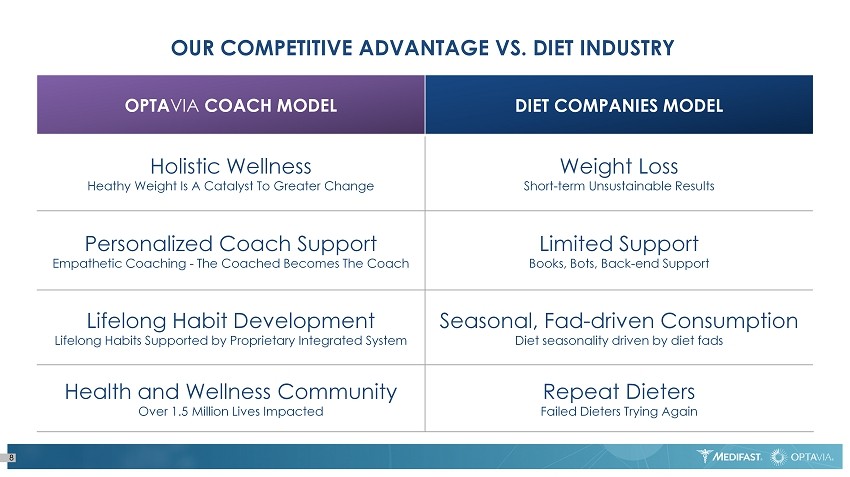

OUR COMPETITIVE ADVANTAGE VS. DIET INDUSTRY OPTA VIA COACH MODEL DIET COMPANIES MODEL Holistic Wellness Heathy Weight Is A Catalyst To Greater Change Weight Loss Short - term Unsustainable Results Personalized Coach Support Empathetic Coaching - The Coached Becomes The Coach Limited Support Books, Bots, Back - end Support Lifelong Habit Development Lifelong Habits Supported by Proprietary Integrated System Seasonal, Fad - driven Consumption Diet seasonality driven by diet fads Health and Wellness Community Over 1.5 Million Lives Impacted Repeat Dieters Failed Dieters Trying Again 8

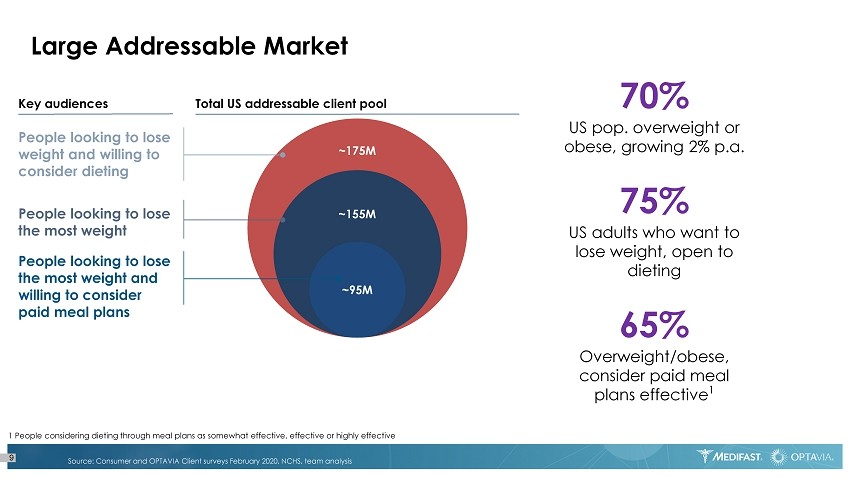

Source: Consumer and OPTAVIA Client surveys February 2020, NCHS, team analysis 1 People considering dieting through meal plans as somewhat effective, effective or highly effective Key audiences People looking to lose weight and willing to consider dieting People looking to lose the most weight People looking to lose the most weight and willing to consider paid meal plans ~155M ~175M ~95M Total US addressable client pool Large Addressable Market 70% US pop. overweight or obese, growing 2% p.a. 75% US adults who want to lose weight, open to dieting 65% Overweight/obese, consider paid meal plans effective 1 9

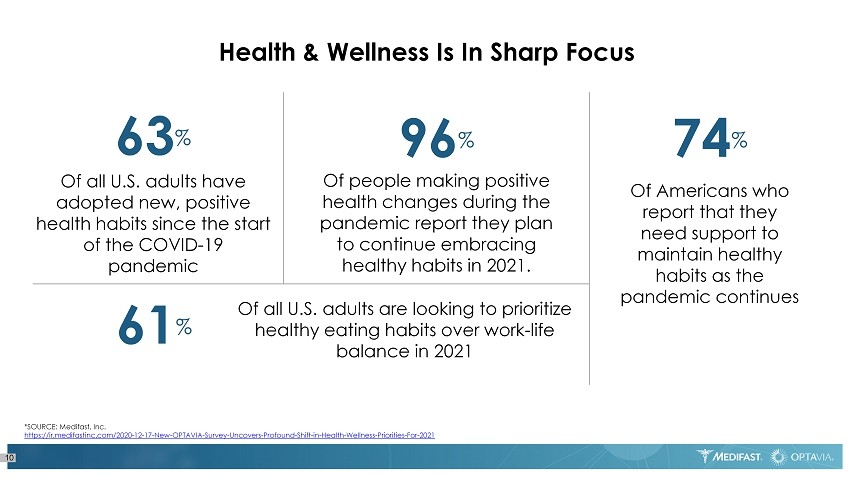

Health & Wellness Is In Sharp Focus 10 Of people making positive health changes during the pandemic report they plan to continue embracing healthy habits in 2021. 96 % 74 % Of all U.S. adults have adopted new, positive health habits since the start of the COVID - 19 pandemic 63 % Of Americans who report that they need support to maintain healthy habits as the pandemic continues Of all U.S. adults are looking to prioritize healthy eating habits over work - life balance in 2021 61 % *SOURCE: Medifast , Inc. https://ir.medifastinc.com/2020 - 12 - 17 - New - OPTAVIA - Survey - Uncovers - Profound - Shift - in - Health - Wellness - Priorities - For - 2021

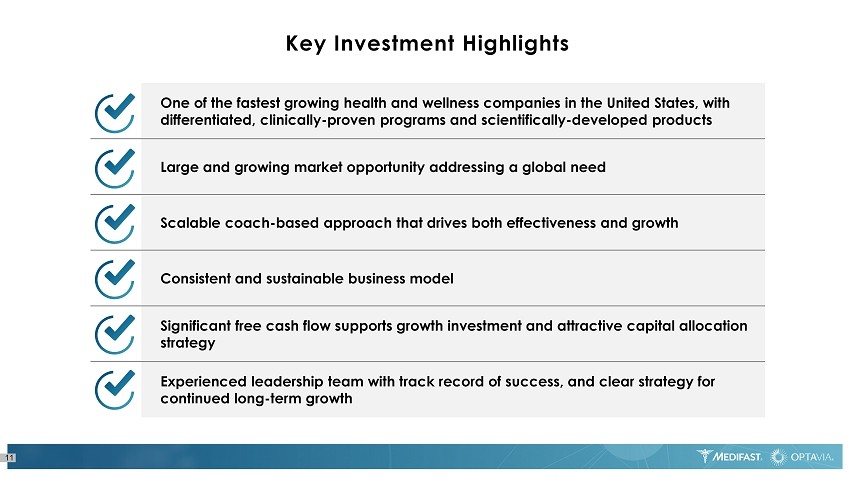

One of the fastest growing health and wellness companies in the United States, with differentiated, clinically - proven programs and scientifically - developed products Large and growing market opportunity addressing a global need Scalable coach - based approach that drives both effectiveness and growth Consistent and sustainable business model Significant free cash flow supports growth investment and attractive capital allocation strategy Experienced leadership team with track record of success, and clear strategy for continued long - term growth Key Investment Highlights 11

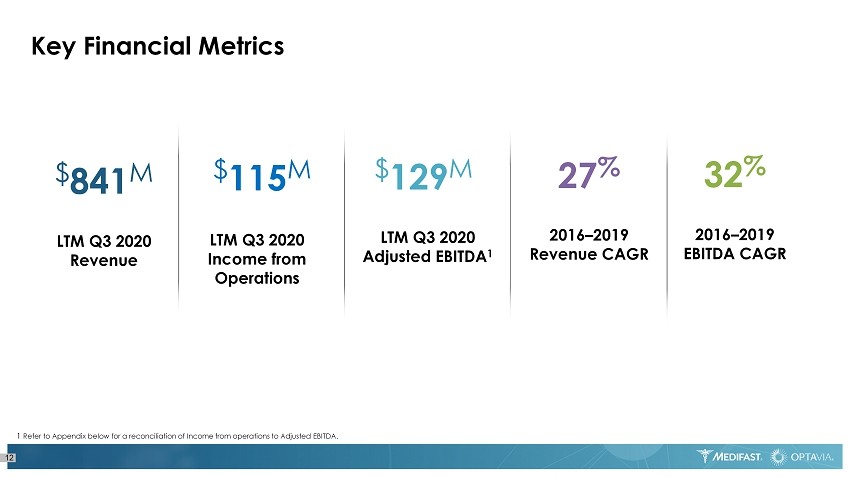

12 Key Financial Metrics LTM Q3 2020 Adjusted EBITDA 1 $ 129 M LTM Q3 2020 Revenue $ 841 M 2016 – 2019 EBITDA CAGR 32 % 2016 – 2019 Revenue CAGR 27 % 1 Refer to Appendix below for a reconciliation of Income from operations to Adjusted EBITDA. LTM Q3 2020 Income from Operations $ 115 M

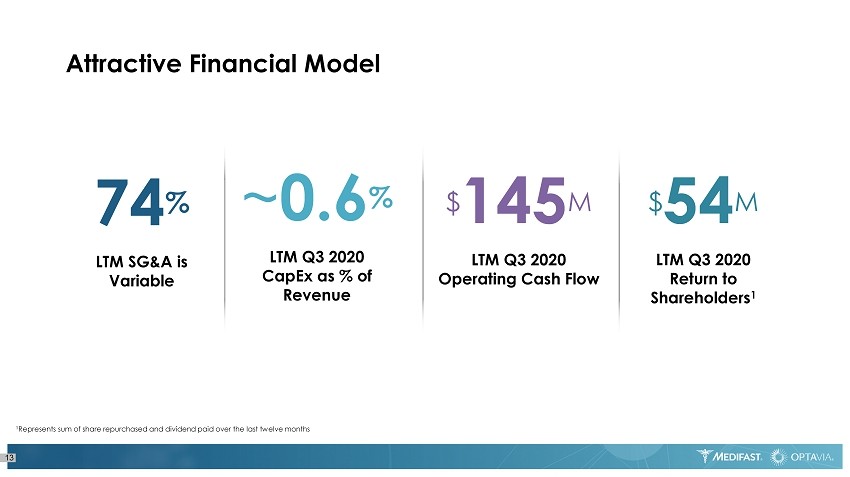

13 Attractive Financial Model 1 Represents sum of share repurchased and dividend paid over the last twelve months LTM Q3 2020 CapEx as % of Revenue ~ 0.6 % LTM SG&A is Variable 74 % LTM Q3 2020 Operating Cash F low $ 145 M LTM Q3 2020 Return to Shareholders 1 $ 54 M

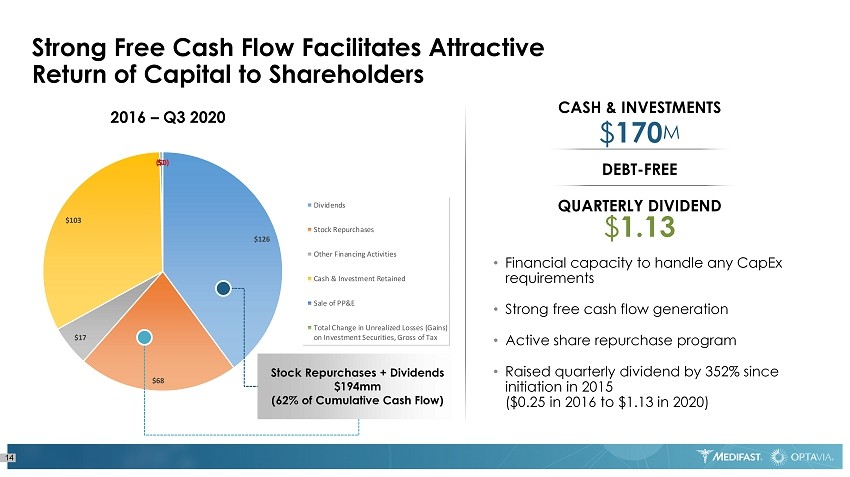

14 Strong Free Cash Flow Facilitates Attractive Return of Capital to Shareholders QUARTERLY DIVIDEND $ 1.13 DEBT - FREE CASH & INVESTMENTS $ 170 M • Financial capacity to handle any CapEx requirements • Strong free cash flow generation • Active share repurchase program • Raised quarterly dividend by 352% since initiation in 2015 ($0.25 in 2016 to $1.13 in 2020) $126 $68 $17 $103 $1 ($0) Dividends Stock Repurchases Other Financing Activities Cash & Investment Retained Sale of PP&E Total Change in Unrealized Losses (Gains) on Investment Securities, Gross of Tax Stock Repurchases + Dividends $194mm (62% of Cumulative Cash Flow) 2016 – Q3 2020

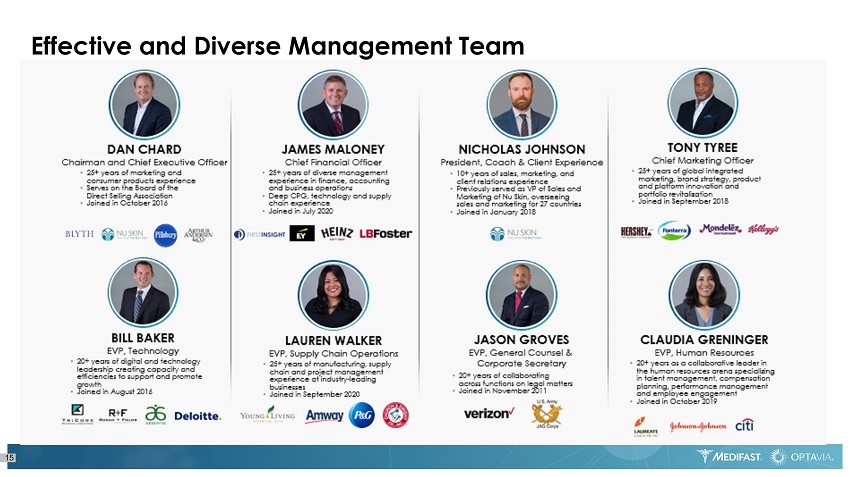

15 Effective and Diverse Management Team

OPTA VIA TRANSITION AND PERFORMANCE HIGHLIGHTS 16

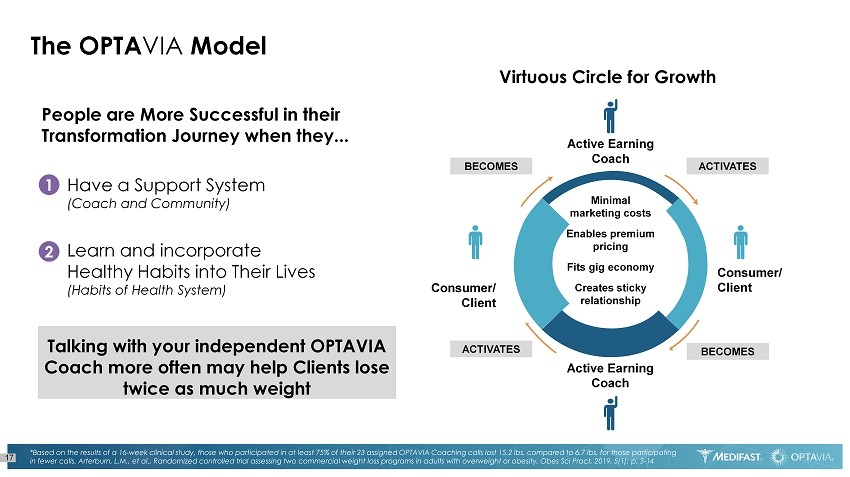

17 The OPTA VIA Model People are More Successful in their Transformation Journey when they... • Have a Support System (Coach and Community) • Learn and incorporate Healthy Habits into Their Lives (Habits of Health System) 1 2 Consumer/ Client Virtuous Circle for Growth PROVEN NUTRITION gets you where you want to go. OPTA VIA COACHES TM BECOMES ACTIVATES ACTIVATES BECOMES Active Earning Coach Minimal marketing costs Enables premium pricing Fits gig economy Creates sticky relationship Consumer/ Client Active Earning Coach Talking with your independent OPTAVIA Coach more often may help Clients lose twice as much weight *Based on the results of a 16 - week clinical study, those who participated in at least 75% of their 23 assigned OPTAVIA Coaching calls lost 15.2 lbs. compared to 6.7 lbs. for those participating in fewer calls. Arterburn , L.M., et al., Randomized controlled trial assessing two commercial weight loss programs in adults with overweight or obesit y. Obes Sci Pract , 2019. 5(1): p. 3 - 14

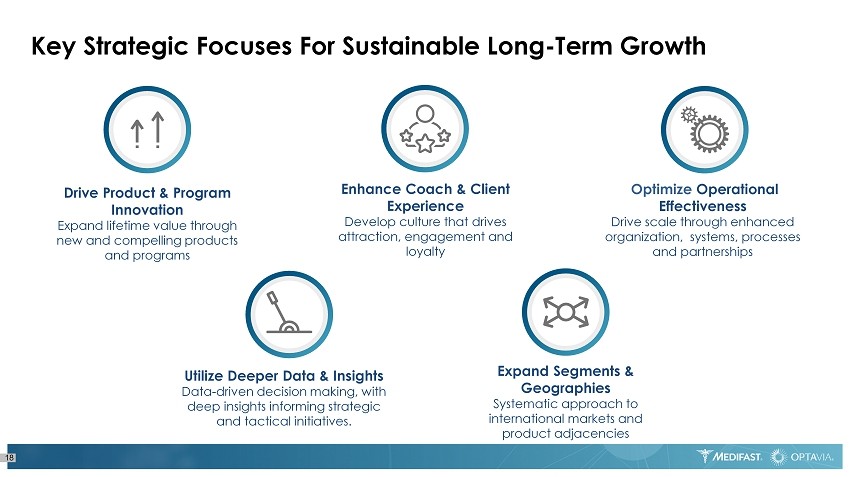

18 Key Strategic Focuses For Sustainable Long - Term Growth Expand Segments & Geographies Systematic approach to international markets and product adjacencies Enhance Coach & Client Experience Develop culture that drives attraction, engagement and loyalty Optimize Operational Effectiveness Drive scale through enhanced organization, systems, processes and partnerships Drive Product & Program Innovation Expand lifetime value through new and compelling products and programs Utilize Deeper Data & Insights Data - driven decision making, with deep insights informing strategic and tactical initiatives.

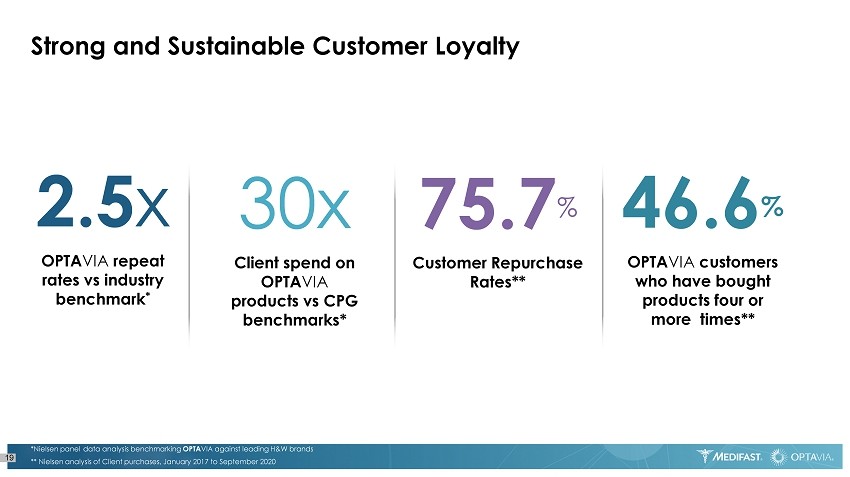

19 Strong and Sustainable Customer Loyalty Client spend on OPTA VIA products vs CPG benchmarks* 30x OPTA VIA repeat rates vs industry benchmark * 2.5 x Customer Repurchase Rates** 75.7 % *Nielsen panel data analysis benchmarking OPTA VIA against leading H&W brands ** Nielsen analysis of Client purchases, January 2017 to September 2020 OPTA VIA customers who have bought products four or more times** 46.6 %

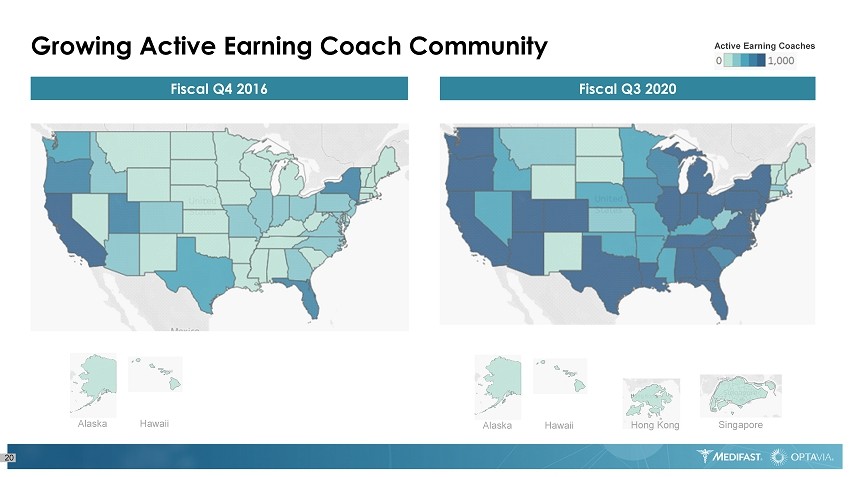

Growing Active Earning Coach Community 20 Fiscal Q4 2016 Fiscal Q3 2020 Hong Kong Singapore Alaska Hawaii Alaska Hawaii Active Earning Coaches

• Efficient direct - to - consumer business • Consistent patterns create strong forward visibility • High percentage of clients on continuity shipments ( ≈92% of revenue ) • High lifetime value • Variable cost model 21 A Resilient Business Model

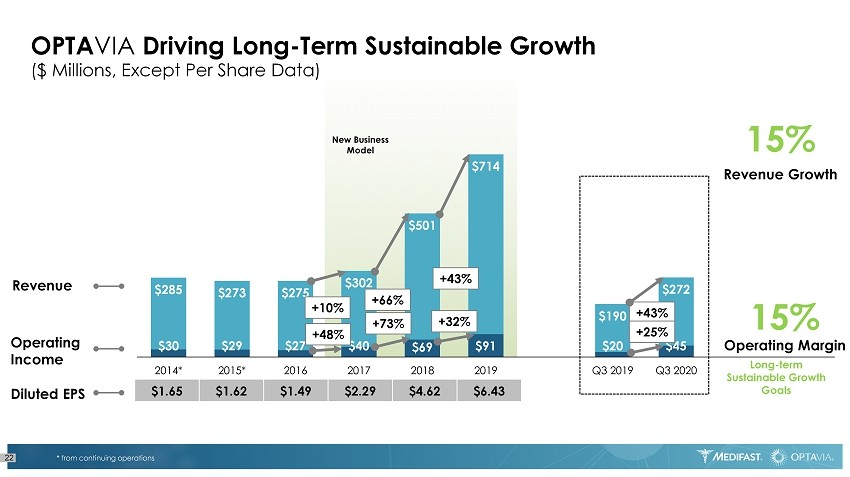

$30 $29 $27 $40 $69 $91 $20 $45 $285 $273 $275 $302 $501 $714 $190 $272 2014* 2015* 2016 2017 2018 2019 Q3 2019 Q3 2020 GOAL New Business Model 22 ($ Millions, Except Per Share Data) OPTA VIA Driving Long - Term Sustainable Growth Revenue Operating Income $1.65 $1.62 $1.49 $2.29 $4.62 $6.43 +66% +73% +48% Diluted EPS +43% +32% +10% +43% +25% Operating Margin 15% Revenue Growth 15% Long - term Sustainable Growth Goals * from continuing operations

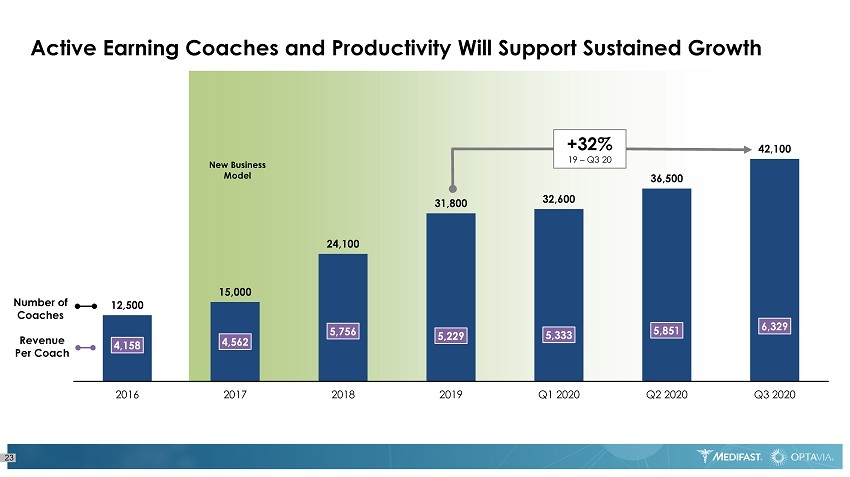

Active Earning Coaches and Productivity Will Support Sustained Growth 23 12,500 15,000 24,100 31,800 32,600 36,500 42,100 2016 2017 2018 2019 Q1 2020 Q2 2020 Q3 2020 4,158 4,562 5,756 5,229 5,333 5,851 6,329 Number of Coaches Revenue Per Coach +32% 19 – Q3 20 New Business Model

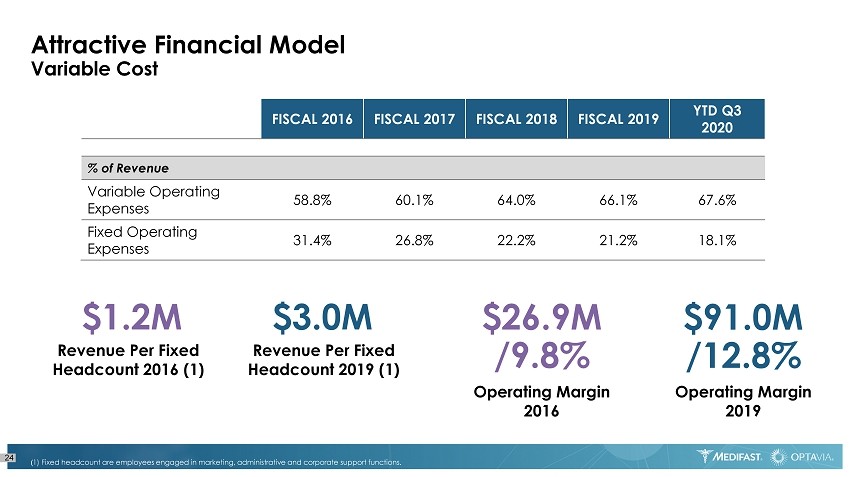

Attractive Financial Model Variable Cost 24 2 1 1 FISCAL 2016 FISCAL 2017 FISCAL 2018 FISCAL 2019 YTD Q3 2020 % of Revenue Variable Operating Expenses 58.8% 60.1% 64.0% 66.1% 67.6% Fixed Operating Expenses 31.4% 26.8% 22.2% 21.2% 18.1% ( 1) Fixed headcount are employees engaged in marketing, administrative and corporate support functions. Revenue Per Fixed Headcount 2019 (1) $3.0M Revenue Per Fixed Headcount 2016 ( 1) $1.2M Operating Margin 2019 $91.0M /12.8% Operating Margin 2016 $26.9M /9.8%

SUMMARY 25

One of the fastest growing health and wellness companies in the United States, with differentiated, clinically - proven programs and scientifically - developed products Large and growing market opportunity addressing a global need Scalable coach - based approach that drives both effectiveness and growth Consistent and sustainable business model Significant free cash flow supports growth investment and attractive capital allocation strategy Experienced leadership team with track record of success, and clear strategy for continued long - term growth Key Investment Highlights 26

APPENDIX 27

28 Reconciliation of Adjusted EBITDA Medifast defines adjusted EBITDA as income from operations calculated in accordance with GAAP, adjusted to exclude depreciation and amortization expenses, expenses in connection with the Schedule 13D Filing, and severance related costs resulting from the departure of the Company's previous Chief Financial Officer. The table below presents a reconciliation of income from operations to adjusted EBITDA: (In Millions) LTM Q3 2020 Income from operations 115 Adjustments Depreciation and amortization 7 Professional services for 13D Filing 6 Incremental severance costs 1 Adjusted EBITDA 129

Thank You 29