Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FLUSHING FINANCIAL CORP | ffic-20210106x8k.htm |

Exhibit 99.1

| December Update January 6, 2021 contact: susan.cullen@flushingbank.com | phone: (516) 209-3622 | website: www.flushingbank.com |

| Safe Harbor Statement 2 This presentation contains “forward-looking statements” within the meaning of the federal securities laws. These forward-looking statements may include management plans relating to the Empire merger; any statements of the plans and objectives of management for future operations, products or services, including the execution of integration plans relating thereto; any statements of expectation or belief; projections related to certain financial metrics; and any statements of assumptions underlying any of the foregoing. Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time and are beyond our control. Forward- looking statements speak only as of the date they are made. Flushing assumes no duty and does not undertake to update any forward-looking statements. Because forward-looking statements are by their nature, to different degrees, uncertain and subject to assumptions, actual results or future events could differ, possibly materially, from those that Flushing anticipates in its forward-looking statements, and future results could differ materially from historical performance. Factors that could cause or contribute to such differences include, but are not limited to, those included in Flushing’s Annual Report on Form 10-K as of December 31, 2019 and those disclosed in Flushing’s other periodic reports filed with the Securities and Exchange Commission (the “SEC”). Certain of these risks, as well as other risks associated with the merger, are more fully discussed in the proxy statement/prospectus included in the registration statement on Form S-4 filed with the SEC in connection with the merger. For any forward-looking statements made in this presentation, Flushing claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. |

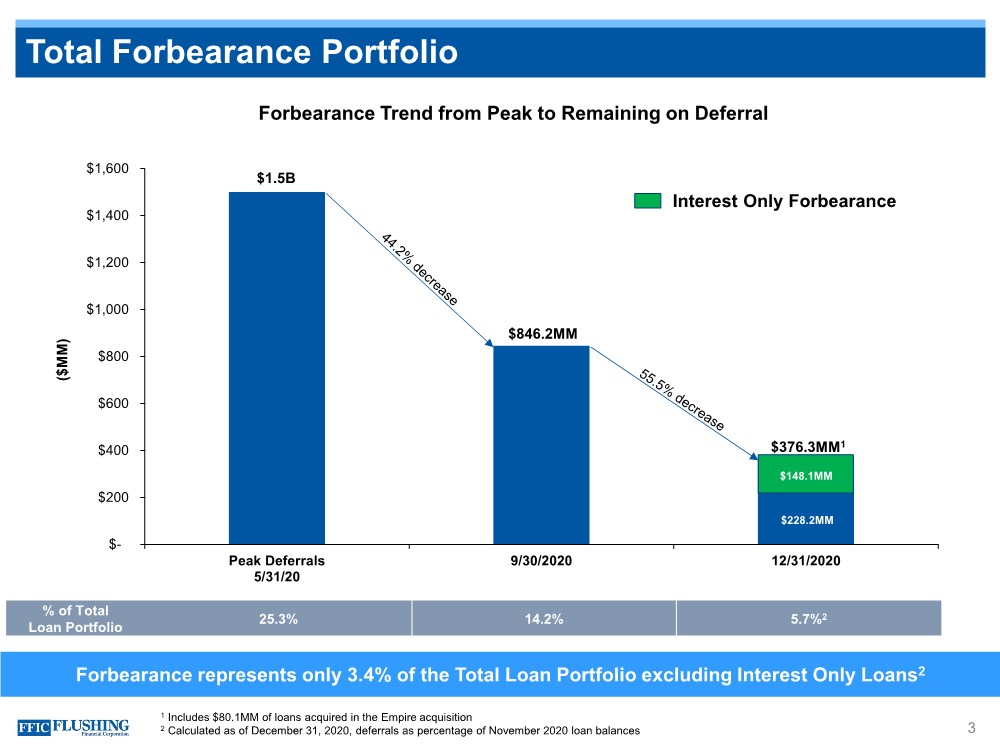

| Total Forbearance Portfolio 3 Forbearance Trend from Peak to Remaining on Deferral $- $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 Peak Deferrals 5/31/20 9/30/2020 12/31/2020 ($MM) $1.5B $846.2MM $376.3MM1 Forbearance represents only 3.4% of the Total Loan Portfolio excluding Interest Only Loans2 % of Total Loan Portfolio 25.3% 14.2% 5.7%2 $148.1MM $228.2MM Interest Only Forbearance 1 Includes $80.1MM of loans acquired in the Empire acquisition 2 Calculated as of December 31, 2020, deferrals as percentage of November 2020 loan balances |

| Balance Sheet Restructuring 4 . Prepaid $291.0MM of FHLB advances in December to further reduce funding costs – Weighted average coupon on the repaid debt was 1.93% – Maturities ranged from 0.8 years to 2.9 years – Pre-payment penalty totaled $7.8MM (pre-tax) – Earnback of 1.5 years . Sold approximately $89.5MM of securities, recognizing a pre-tax loss of $0.6MM – Reinvested proceeds into higher yielding investment securities . Benefits include: – 7 bps improvement to net interest margin for 2021 – Improved earnings of estimated $0.12 per diluted share for 2021 |

| Contact Details | Flushing Financial Corporation 5 Susan Cullen SEVP, CFO & Treasurer (516) 209-3622 susan.cullen@flushingbank.com NASDAQ: FFIC |

|