Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - TriState Capital Holdings, Inc. | tsc-stonepointxnewsrelease.htm |

| EX-10.2 - EX-10.2 - TriState Capital Holdings, Inc. | exhibit102-amendmenttoinve.htm |

| 8-K - 8-K - TriState Capital Holdings, Inc. | tsc-20201229.htm |

CERTIFICATE OF DESIGNATION

OF THE

SERIES C PERPETUAL NON-CUMULATIVE CONVERTIBLE

NON-VOTING PREFERRED STOCK

OF

TRISTATE CAPITAL HOLDINGS, INC.

Pursuant to the provisions of the Amended and Restated Articles of Incorporation, as amended (the “Articles of Incorporation”), of TriState Capital Holdings, Inc., a Pennsylvania corporation (the “Company”), and Section 1522 of the Pennsylvania Business Corporation Law, the undersigned officer of the Company does hereby submit for filing this Certificate of Designation:

FIRST: The name of the Company is TriState Capital Holdings, Inc.

SECOND: 788 shares of the authorized preferred stock of the Company are hereby designated “Series C Perpetual Non-Cumulative Convertible Non-Voting Preferred Stock”.

The preferences, limitations, voting powers and relative rights of the Series C Perpetual Non-Cumulative Convertible Non-Voting Preferred Stock are as follows:

DESIGNATION

Section 1. Designation. There is hereby created out of the authorized and unissued shares of such preferred stock of the Company a series of preferred stock designated as the “Series C Perpetual Non-Cumulative Convertible Non-Voting Preferred Stock” (the “Series C Preferred Stock”). The number of shares constituting such series shall be 788. The par value of the Series C Preferred Stock shall be none, and the liquidation preference of the Series C Preferred Stock shall be $100,000 per share.

Section 2. Ranking. The Series C Preferred Stock will, with respect to dividend and distribution rights and rights on liquidation, winding-up and dissolution, rank (a) junior to all existing and future indebtedness and other liabilities of the Company and any class or series of preferred stock that expressly provides in the articles of amendment or certificate of designation creating such preferred stock that it ranks senior to the Series C Preferred Stock (subject to any requisite consents prior to issuance), (b) equally with any existing and future series of preferred stock that does not by its terms rank junior or senior to the Series C Preferred Stock, including the (x) 6.75% Fixed-to-Floating Rate Series A Non-Cumulative Perpetual Preferred Stock (the “Series A Preferred Stock”) and (y) the 6.375% Fixed-to-Floating Rate Series B Non-Cumulative Perpetual Preferred Stock (the “Series B Preferred Stock”) (any such existing and future series of preferred stock, the “Parity Securities”) and (c) senior to (i) any existing or future class of the voting common stock, no par value, of the Company (the “Voting Common Stock”), and, if any, the non-voting common stock, no par value, of the Company (the “Non-Voting Common Stock” and, together with the Voting Common Stock, the “Common Stock”) and (ii) any existing and future class or series of preferred stock of the Company that by its terms ranks junior to the Series C Preferred Stock ((i) and (ii) collectively referred to as “Junior Securities”). The

Company has the right to authorize and/or issue additional shares or classes or series of Junior Securities or Parity Securities without the consent of the Holders.

Section 3. Definitions. Unless the context or use indicates another meaning or intent, the following terms shall have the following meanings, whether used in the singular or the plural:

(a) “Affiliate” means, with respect to any Person, any Person directly or indirectly controlling, controlled by or under common control with, such other Person. For purposes of this definition, “control” (including, with correlative meanings, the terms “controlled by” and “under common control with”) when used with respect to any Person, means the possession, directly or indirectly, of the power to cause the direction of the management or policies of such Person, whether through the ownership of voting securities, by contract or otherwise, provided that “Affiliate” shall not include any portfolio company of any investment fund affiliated with or managed by such Person.

(b) “Articles of Incorporation” has the meaning set forth in the preamble.

(c) “BHC Act” means the Bank Holding Company Act of 1956, as amended.

(d) “Board of Directors” means the board of directors of the Company or any committee thereof duly authorized to act on behalf of such board of directors.

(e) “Business Day” means any day other than a Saturday, Sunday or any other day on which banks in New York City, New York are generally required or authorized by law to be closed.

(f) “Certificate of Designation” means this Certificate of Designation of the Series C Perpetual Non-Cumulative Convertible Non-Voting Preferred Stock of the Company, dated December 29, 2020.

(g) “CBC Act” means Change in Bank Control Act of 1978, as amended.

(h) “Closing Price” of the Common Stock on any date of determination means the closing sale price or, if no closing sale price is reported, the last reported sale price of the shares of the Common Stock on The NASDAQ Global Select Market on such date. If the Common Stock is not traded on The NASDAQ Global Select Market on any date of determination, the Closing Price of the Common Stock on such date of determination means the closing sale price as reported in the composite transactions for the principal U.S. national or regional securities exchange on which the Common Stock is so listed or quoted, or, if no closing sale price is reported, the last reported sale price on the principal U.S. national or regional securities exchange on which the Common Stock is so listed or quoted, or if the Common Stock is not so listed or quoted on a U.S. national or regional securities exchange, the last quoted bid price for the Common Stock in the over-the-counter market as reported by Pink Sheets LLC or similar organization, or, if that bid price is not available, the market price of the Common Stock on that date as determined by a nationally recognized independent investment banking firm retained by the Company for this purpose.

2

For purposes of this Certificate of Designation, all references herein to the “Closing Price” and “last reported sale price” of the Common Stock on The NASDAQ Global Select Market shall be such closing sale price and last reported sale price as reflected on the website of The NASDAQ Global Select Market (http://www.nasdaq.com) and as reported by Bloomberg Professional Service; provided that in the event that there is a discrepancy between the closing sale price or last reported sale price as reflected on the website of The NASDAQ Global Select Market and as reported by Bloomberg Professional Service, the closing sale price and last reported sale price on the website of The NASDAQ Global Select Market shall govern.

(i) “Common Stock” has the meaning set forth in Section 2.

(j) “Company” has the meaning set forth in the preamble.

(k) “Conversion Date” has the meaning set forth in Section 9(e).

(l) “Conversion Price” means, for each share of Series C Preferred Stock, $13.75, as the same may be adjusted from time to time in accordance with the terms of this Certificate of Designation.

(m) “Current Market Price” means, on any date, the average of the daily Closing Price per share of the Common Stock or other securities on each of the five consecutive Trading Days preceding the earlier of the day before the date of the issuance, dividend or distribution in question and the day before the Ex-Date with respect to the issuance or distribution, giving rise to an adjustment to the Conversion Price pursuant to Section 11.

(n) “Dividend Payment Date” has the meaning set forth in Section 4(b).

(o) “Dividend Period” means the period from, and including, each Dividend Payment Date to, but excluding, the next succeeding Dividend Payment Date, except for the initial Dividend Period, which shall be the period from, and including, the Effective Date to, but excluding, the next succeeding Dividend Payment Date.

(p) “Effective Date” means the date on which shares of the Series C Preferred Stock are first issued.

(q) “Exchange Act” means the Securities Exchange Act of 1934, as amended, or any successor statute, and the rules and regulations promulgated thereunder.

(r) “Exchange Property” has the meaning set forth in Section 12(a).

(s) “Ex-Date” when used with respect to any issuance, dividend or distribution giving rise to an adjustment to the Conversion Price pursuant to Section 11, means the first date on which the Common Stock or other securities trade without the right to receive the issuance, dividend or distribution.

(t) “Holder” means the Person in whose name the shares of the Series C Preferred Stock are registered, which may be treated by the Company as the absolute owner of the shares

3

of Series C Preferred Stock for the purpose of making payment and settling the related conversions and for all other purposes.

(u) “Investment Agreement” means the Investment Agreement, dated as of October 10, 2020, as may be amended from time to time, between the Company and Purchaser.

(v) “Junior Securities” has the meaning set forth in Section 2.

(w) “Liquidation Preference” means, as to the Series C Preferred Stock, $100,000 per share (as adjusted for any split, subdivision, combination, consolidation, recapitalization or similar event with respect to the Series C Preferred Stock).

(x) “Mandatory Conversion” has the meaning set forth in Section 10(a).

(y) “Mandatory Conversion Date” has the meaning set forth in Section 10(a).

(z) “Non-Voting Common Stock” has the meaning set forth in Section 2.

(aa) “Officer” means the Chief Executive Officer, the Chief Operating Officer, any Senior Vice President, the Chief Financial Officer, the Treasurer, any Assistant Treasurer, the Secretary or any Assistant Secretary of the Company.

(bb) “Parity Securities” has the meaning set forth in Section 2.

(cc) “Permitted Regulatory Transfer” means any transfer (i) in a Widespread Public Distribution; (ii) to the Company; (iii) in a transfer in which no transferee (or group of associated transferees) would receive 2% or more of the outstanding securities of any class of voting securities of the issuing company; or (iv) to a transferee that would control more than 50% of every class of voting securities of the issuing company without any transfer from the person. For the avoidance of doubt, a Permitted Regulatory Transfer does not include a Transfer to any Affiliate of Purchaser or to any other person with which Purchaser is presumed to be acting in concert under 12 C.F.R. § 303.82(b)(2).

(dd) “Person” means any individual, corporation, estate, partnership, joint venture, association, joint-stock company, limited liability company or trust.

(ee) “Preferred Stock” means the preferred stock, no par value, of the Company.

(ff) “Purchaser” means T-VIII PubOpps LP, a Delaware limited partnership.

(gg) “Record Date” has the meaning set forth in Section 4(e).

(hh) “Reorganization Event” has the meaning set forth in Section 12(a).

(ii) “Requisite Shareholder Approval” has the meaning set forth in the Investment Agreement.

4

(jj) “Securities” has the meaning set forth in the Investment Agreement.

(kk) “Securities Act” means the Securities Act of 1933, as amended, or any successor statute, and the rules and regulations promulgated thereunder.

(ll) “Series A Preferred Stock” has the meaning set forth in Section 2.

(mm) “Series B Preferred Stock” has the meaning set forth in Section 2.

(nn) “Series C Preferred Stock” has the meaning set forth in Section 1.

(oo) “Subsidiary” means, with respect to any person, any corporation, partnership, joint venture, limited liability company or other entity of which such first person (i) is, or directly or indirectly has the power to appoint, a general partner, manager or managing member or others performing similar functions or (ii) directly or indirectly owns or controls at least a majority of the securities or other interests having by their terms voting power to elect a majority of the board of directors or others performing similar functions.

(pp) “Trading Day” means a day on which the shares of Common Stock:

(i) are not suspended from trading on any national or regional securities exchange or association or over-the-counter market at the close of business; and

(ii) have traded at least once on the national or regional securities exchange or association or over-the-counter market that is the primary market for the trading of the Common Stock.

(qq) “Widespread Public Distribution” means any widespread public offering (including, without limitation, in a Block Trade (as defined in the Registration Rights Agreement), an Underwritten Shelf Take-Down (as defined in the Registration Rights Agreement) or any other transfer to an underwriter for the purpose of conducting a widespread public distribution or sale of securities, or sales pursuant to Rule 144 under the Securities Act).

Section 4. Dividends.

(a) From and after the Effective Date, each Holder shall be entitled to receive, when, as and if declared by the Board of Directors or a duly authorized committee of the Board of Directors, out of assets legally available therefor, non-cumulative dividends, in accordance with the terms set forth in this Section 4, based on the aggregate Liquidation Preference of all shares of Series C Preferred Stock held by such Holder, at a per share rate equal to 6.75% per annum, for each quarterly Dividend Period occurring from, and including, the Effective Date, payable in cash and/or, at the option of such Holder, in kind in additional shares of Series C Preferred Stock (such in kind dividend, a “PIK Dividend”). The Holders shall be entitled to share in the distributions referred to in Section 4(l).

(b) Commencing on and including the Effective Date, dividends shall accrue on each share of Series C Preferred Stock based on the Liquidation Preference of such share of Series C

5

Preferred Stock at the rate set forth in Section 4(a) and shall be payable quarterly in arrears on January 1, April 1, July 1 and October 1 of each year (each, a “Dividend Payment Date”) or, if any such day is not a Business Day, the next Business Day.

(c) With respect to any dividends declared by the Board of Directors (or a duly authorized committee thereof), each Holder shall have the right to elect to receive, with respect to all or any portion of the shares of Series C Preferred Stock held by such Holder, a PIK Dividend in lieu of a cash dividend. With respect to the payment of any PIK Dividend, the number of shares of Series C Preferred Stock to be issued in payment of such PIK Dividend with respect to each outstanding share of Series C Preferred Stock shall be determined by dividing (i) the amount of the dividend so declared by (ii) the Liquidation Preference. To the extent that any PIK Dividend would result in the issuance of a fractional share of Series C Preferred Stock to any Holder, then the amount of such fraction multiplied by the Liquidation Preference shall be paid in cash (unless there are no legally available funds with which to make such cash payment, in which event such cash payment shall be made as soon as possible thereafter). The Company shall at all times reserve and keep available out of its authorized and unissued Series C Preferred Stock, the full number of shares of Series C Preferred Stock required for purposes of paying all PIK Dividends that may become payable.

(d) Dividends payable pursuant to Section 4 will be computed on the basis of a 360-day year of twelve 30-day months and, for any Dividend Period less than a full Dividend Period, will be computed on the basis of the actual number of days elapsed in the period divided by 360.

(e) Each dividend will be payable to Holders of record as they appear in the records of the Company on the applicable record date (each, a “Record Date”), which with respect to dividends payable pursuant to this Section 4, shall be on the fifteenth day prior to the relevant Dividend Payment Date or, if such date is not a Business Day, the next day that is a Business Day.

(f) Dividends on the Series C Preferred Stock are non-cumulative. Subject to Section 4(g) and Section 4(h), if the Board of Directors does not declare a dividend on the Series C Preferred Stock for a Dividend Period prior to the related Dividend Payment Date, the Holders will have no right to receive any dividend for the Dividend Period, and the Company will have no obligation to pay a dividend for that Dividend Period, whether or not dividends are declared and paid for any future Dividend Period with respect to the Series C Preferred Stock, the Common Stock or any other class or series of the Company’s preferred stock.

(g) So long as any share of Series C Preferred Stock remains outstanding, the Company shall not and shall cause each of its Subsidiaries not to, during any Dividend Period (a “Relevant Dividend Period”), directly or indirectly:

(i) (A) declare, pay or make any dividend or distribution on any Junior Securities (other than a dividend payable solely in shares of Junior Securities or any dividend in connection with the implementation of a shareholder rights plan or the redemption or repurchase of any rights under such a plan, including with respect to any successor shareholder rights plan)

6

or (B) set aside any amounts for the payment of any dividend or distribution on any Junior Securities;

(ii) repurchase, redeem or otherwise acquire for consideration any shares of Junior Securities (other than as a result of a reclassification of Junior Securities for or into other Junior Securities, or the exchange for or conversion into Junior Securities, through the use of the proceeds of a substantially contemporaneous sale of other shares of Junior Securities or pursuant to a contractually binding requirement to buy Junior Securities pursuant to a binding stock repurchase plan existing prior to the most recently completed Dividend Period), or pay any amounts to or make any amounts available to a sinking fund for the redemption of any such Junior Securities; or

(iii) repurchase, redeem or otherwise acquire for consideration any shares of Parity Securities (other than pursuant to pro rata offers to purchase all, or a pro rata portion, of the Series C Preferred Stock and such Parity Securities, through the use of the proceeds of a substantially contemporaneous sale of other shares of Parity Securities or Junior Securities, as a result of a reclassification of Parity Securities for or into other Parity Securities, or by conversion into or exchange for Junior Securities),

unless, in each case of clauses (i), (ii) and (iii) above, the full dividends for such Relevant Dividend Period and for the most recently completed Dividend Period on all outstanding shares of the Series C Preferred Stock have been declared and paid in full or, in the case of clause (i)(B) above, declared and a sum sufficient for the payment of those dividends has been set aside. The foregoing limitations in clauses (i), (ii) and (iii) above shall not apply to purchases or acquisitions of the Company’s Junior Securities pursuant to any employee or director incentive or benefit plan or arrangement (including any of the Company’s employment, severance, or consulting agreements) of the Company or of any of the Company’s Subsidiaries heretofore or hereafter adopted.

(h) Except as provided below, for so long as any share of Series C Preferred Stock remains outstanding, the Company shall not, during any Dividend Period, (i) declare, pay or make full dividends on any Parity Securities or (ii) set aside any amounts for payment of full dividends on any Parity Securities unless the Company has declared and paid in full all accumulated dividends for all Dividend Periods, including the then-current Dividend Period for all outstanding shares of Series C Preferred Stock (the “Required Amount”) or, in the case of the foregoing clause (ii), set aside such Required Amount. To the extent that the Company declares dividends on the Series C Preferred Stock and on any Parity Securities but cannot make full payment of such declared dividends, the Company shall allocate the dividend payments on a pro rata basis among the holders of the shares of Series C Preferred Stock and the holders of any Parity Securities then outstanding. For purposes of calculating the pro rata allocation of partial dividend payments, the Company shall allocate dividend payments based on the ratio between the then current and the accumulated and unpaid dividend payments due on the shares of Series C Preferred Stock and (i) in the case of cumulative Parity Securities the aggregate of the unpaid dividends due on any such Parity Securities and (ii) in the case of non-cumulative Parity Securities the aggregate of the declared but unpaid dividends due on any such Parity Securities.

7

No interest shall be payable in respect of any dividend payment on Series C Preferred Stock that may be in arrears.

(i) Payments of cash for dividends will be delivered to the Holder at their addresses listed in the stock record books maintained by the Company.

(j) If a Conversion Date on which a Holder elects to convert Series C Preferred Stock is prior to the Record Date for any declared dividend for the Dividend Period, such Holder will not have the right to receive any declared dividend for that Dividend Period. If a Conversion Date on which a Holder elects to convert Series C Preferred Stock is on or after the Record Date for any declared dividend and prior to the Dividend Payment Date, such Holder shall receive that dividend on the relevant Dividend Payment Date if such Holder was the Holder of record on the Record Date for that dividend.

(k) Notwithstanding any provision to the contrary contained in this Certificate of Designation, any PIK Dividend to be paid pursuant to this Certificate of Designation shall be paid to the extent (but only to the extent) that payment of such PIK Dividend would not cause or result in any Holder (other than a transferee in a Permitted Regulatory Transfer and any subsequent transferee) being presumed to control the Company for purposes of the BHC Act, including through the ownership of one-third or more of the “total equity” of the Company for purposes of the BHC Act.

(l) If the Company makes a distribution to all holders of shares of Common Stock consisting of capital stock of any class or series, or similar equity interests of, or relating to, a subsidiary or other business unit, the Holders of Series C Preferred Stock may, at such Holder’s election, be entitled to participate in such distribution. The number of shares of such capital stock or equity interests to which each Holder of Series C Preferred Stock shall be entitled shall be the number to which such Holder would have been entitled had such Holder converted such Holder’s shares of Series C Preferred Stock immediately prior to the record date for such distribution.

(m) If the Company makes a distribution to all holders of shares of Common Stock consisting of cash, the Holders of Series C Preferred Stock shall be entitled to participate in such distribution. The amount of cash to which each Holder of any shares of Series C Preferred Stock shall be entitled shall be the amount to which such Holder would have been entitled had such Holder converted such Holder’s shares of Series C Preferred Stock immediately prior to the record date for such distribution.

(n) The Company may, with the prior written consent of Purchaser, in satisfaction of its obligation to issue Preferred Stock under any provision of this Certificate of Designation to any Holder, in order to minimize the number of its authorized and unissued shares of Preferred Stock used for such purpose, issue depositary shares for such Preferred Stock, with such depositary shares and underlying Preferred Stock being in such denominations as the Company and such Holder shall mutually agree.

Section 5. Liquidation.

8

(a) In the event the Company voluntarily or involuntarily liquidates, dissolves or winds up, the Holders at the time shall be entitled to receive liquidating distributions in the amount of the Liquidation Preference per share of Series C Preferred Stock, plus an amount equal to any declared but unpaid dividends thereon for all Dividend Periods to and including the date of such liquidation, out of assets legally available for distribution to the Company’s shareholders, before any distribution of assets is made to the holders of the Common Stock or any other Junior Securities. After payment of the full amount of such liquidating distributions, the Holders shall be entitled to participate in all further distributions of the remaining assets of the Company as if each share of Series C Preferred Stock had been converted into Common Stock in accordance with the terms hereof immediately prior to such liquidating distributions.

(b) In the event the assets of the Company available for distribution to shareholders upon any liquidation, dissolution or winding-up of the affairs of the Company, whether voluntary or involuntary, shall be insufficient to pay in full the amounts payable with respect to all outstanding shares of the Series C Preferred Stock and the corresponding amounts payable on any Parity Securities, the Holders and the holders of such Parity Securities shall share ratably in any distribution of assets of the Company in proportion to the full respective liquidating distributions to which they would otherwise be respectively entitled.

(c) The Company’s consolidation or merger with or into any other entity, the consolidation or merger of any other entity with or into the Company, or the sale of all or substantially all of the Company’s property or business will not be deemed to constitute its liquidation, dissolution or winding up.

Section 6. Maturity. The Series C Preferred Stock shall be perpetual unless converted in accordance with this Certificate of Designation.

Section 7. Redemption. The Series C Preferred Stock may not be redeemed by the Company.

Section 8. Conversion.

(a) The shares of Series C Preferred Stock shall not be convertible into any other class of capital stock of the Company, except in accordance with this Section 8 or Section 10. Unless otherwise determined by Purchaser, the shares of Series C Preferred Stock shall, upon the consummation of a Permitted Regulatory Transfer, automatically convert into shares of Voting Common Stock in accordance with this Section 8 and Section 9. If the Requisite Shareholder Approval is obtained and the Charter Amendment (as defined in the Investment Agreement) is thereafter declared effective by the Pennsylvania Department of State (as defined in the Investment Agreement), at any time after the two-year anniversary date of the Closing Date (as defined in the Investment Agreement), any Holder may, at such Holder’s option, convert all or any portion of the shares of Series C Preferred Stock held by such Holder into shares of Non-Voting Common Stock.

(b) The number of shares of Common Stock into which one share of Series C Preferred Stock shall be convertible under this Section 8 or Section 10, shall be determined by

9

dividing the Liquidation Preference by the Conversion Price (subject to the applicable conversion procedures of Section 9 hereof) plus cash in lieu of fractional shares in accordance with Section 14 hereof.

Section 9. Conversion Procedures.

(a) Effective immediately prior to the close of business on any applicable Conversion Date, dividends shall no longer be declared on any such converted shares of Series C Preferred Stock and such shares of Series C Preferred Stock shall cease to be outstanding, in each case, subject to the right of Holders to receive any declared and unpaid dividends on such shares to the extent provided in Section 4 and any other payments to which such Holder is otherwise entitled pursuant to Section 8, Section 10, Section 12 or Section 14 hereof, as applicable.

(b) Prior to the close of business on any applicable Conversion Date, shares of Common Stock issuable upon conversion of, or other securities issuable upon conversion of, any shares of Series C Preferred Stock shall not be deemed outstanding for any purpose, and the Holders shall have no rights with respect to the Common Stock or other securities issuable upon conversion (including voting rights, rights to respond to tender offers for the Common Stock or other securities issuable upon conversion and rights to receive any dividends or other distributions on the Common Stock or other securities issuable upon conversion) by virtue of holding shares of Series C Preferred Stock.

(c) Shares of Series C Preferred Stock duly converted in accordance with this Certificate of Designation, or reacquired by the Company, will resume the status of authorized and unissued preferred stock, undesignated as to series and available for future issuance.

(d) The Person or Persons entitled to receive the Common Stock and/or cash, securities or other property issuable upon conversion of Series C Preferred Stock shall be treated for all purposes as the record holder(s) of such shares of Common Stock and/or securities and the owners of such cash or other property as of the close of business on the applicable Conversion Date. In the event that the Holders shall not by written notice designate the name in which shares of Common Stock and/or cash, securities or other property (including payments of cash in lieu of fractional shares) to be issued or paid upon conversion of shares of Series C Preferred Stock should be registered or paid or the manner in which such shares should be delivered, the Company shall be entitled to register and deliver such shares, and make such payment, in the name of the Holders and in the manner shown on the records of the Company.

(e) If a Holder’s shares of Series C Preferred Stock that are being converted into Common Stock in accordance with Section 8 or, in the case of clause (ii) and (iii), Section 10 are in certificated form, such Holder must do each of the following:

(i) complete and manually sign the conversion notice provided by the Company, or a facsimile of the conversion notice, and deliver this irrevocable notice to the Company;

(ii) surrender the shares of Series C Preferred Stock to the Company; and

10

(iii) if required, furnish appropriate endorsements documents.

The date on which a Holder complies with the procedures in this Section 9(e) is the “Conversion Date”.

(iv) The Company shall take all corporate action to give effect to any conversion hereunder.

Section 10. Mandatory Conversion.

(a) If the Requisite Shareholder Approval is obtained at the Company’s annual meeting of shareholders to be held in 2021 and the Charter Amendment is thereafter filed and declared effective by the Pennsylvania Department of State in accordance with the Investment Agreement, the Company may, at any time after the 36-month anniversary of the Closing Date, effectuate a conversion of the Series C Preferred Stock held by Purchaser into shares of Non-Voting Common Stock in accordance with the applicable terms of this Certificate of Designation (a “Mandatory Conversion” and such right a “Mandatory Conversion Right”) only if the Mandatory Conversion Conditions (as defined below) are satisfied as of the Conversion Date for such Mandatory Conversion. In order to validly exercise the Mandatory Conversion Right, the Company must deliver to Purchaser a written notice exercising the Mandatory Conversion Right at least 5 Trading Days prior to the proposed Conversion Date for such Mandatory Conversion, which such notice shall state the proposed Conversion Date for such Mandatory Conversion (the “Mandatory Conversion Date”), and a second written notice on the last Trading Day prior to the proposed Conversion Date (each such notice, a “Mandatory Conversion Notice”). Such second notice must provide reasonable supporting detail demonstrating that the Mandatory Conversion Conditions have been satisfied and must be duly executed by an executive officer of the Company. Each Mandatory Conversion Notice must state: (i) that the Company has exercised its Mandatory Conversion Right to cause the Mandatory Conversion of the shares of Series C Preferred Stock; (ii) the date scheduled for the settlement of such Mandatory Conversion; and (iii) the Conversion Price in effect on the Mandatory Conversion Date for such Mandatory Conversion.

(b) Any purported exercise of the Mandatory Conversion Right, or any purported delivery of a Mandatory Conversion Notice, at a time when the Mandatory Conversion Conditions are not satisfied shall be null and void and ineffective for purposes of Section 10(a). Notwithstanding the exercise of the Mandatory Conversion Right, the Company acknowledges and agrees that the shares of Series C Preferred Stock subject to the proposed Mandatory Conversion may be converted earlier at the option of the Holders thereof pursuant to Section 8 at any time before the close of business on the Mandatory Conversion Date; and “Mandatory Conversion Conditions” means (x) the Stock Price Condition (as defined below) and (y) the Common Stock Liquidity Conditions (as defined below).

(i) “Stock Price Condition” shall mean and be satisfied if and only if the daily volume-weighted average price (as reported by Bloomberg L.P. or, if not reported therein, in another authoritative source mutually selected by the Holder and the Company) on The NASDAQ Global Select Market of the Common Stock (“VWAP”) exceeds 100% of the then

11

applicable Conversion Price for twenty Trading Days (whether or not consecutive) during the period of thirty consecutive Trading Days ending on, and including, the Trading Day immediately before the Conversion Dare for such Mandatory Conversion; provided that such thirty Trading Day period shall not commence prior to the 36-month anniversary of the Closing Date.

(ii) “Common Stock Liquidity Conditions” shall mean and be satisfied if and only if:

(A) each share of Non-Voting Common Stock to be issued upon such Mandatory Conversion of any share of Series C Preferred Stock will, when issued, be duly authorized, validly issued, fully paid and non-assessable, free and clear of all Liens (as defined in the Investment Agreement) and listed and admitted for trading, without suspension or material limitation on trading, on The NASDAQ Global Select Market, and

(B) the Company has not received any notice of delisting or suspension by The NASDAQ Global Select Market.

(c) If the Requisite Shareholder Approval is not obtained at the Company’s annual meeting of shareholders to be held in 2021 or, thereafter, the Certificate of Amendment is not filed or declared effective in accordance with the Investment Agreement, then this Section 10 (other than this Section 10(c)) shall be null and void and of no further force or effect, and, notwithstanding anything herein to the contrary, the Mandatory Conversion Right shall no longer apply.

(d) If the Company duly exercises, in accordance with this Section 10, its Mandatory Conversion Right with respect to any share of Series C Preferred Stock, then the shares of Non-Voting Common Stock due upon such Mandatory Conversion will be registered in the name of, and, if applicable, the cash due upon such Mandatory Conversion will be delivered to, the Holder(s) of such share of Convertible Preferred Stock as of the close of business on the related Mandatory Conversion Date.

Section 11. Anti-Dilution Adjustments.

(a) The Conversion Price shall be subject to the adjustments described in this Section 11(a); provided, however, that any adjustment (or portion thereof) prohibited pursuant to this Section 11(a) shall be postponed and implemented on the first date on which such implementation would not result in the condition described above in this Section 11(a):

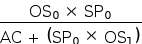

(i) Stock Dividends and Distributions. If the Company pays dividends or other distributions on the Common Stock in shares of Common Stock, then the Conversion Price will be adjusted by multiplying the Conversion Price in effect at 5:00 p.m., New York City time on the Trading Day immediately prior to the Ex-Date for such dividend or distribution by the following fraction:

12

Where,

OS0 = the number of shares of Common Stock outstanding immediately prior to Ex-Date for such dividend or distribution.

OS1 = the sum of the number of shares of Common Stock outstanding immediately prior to the Ex-Date for such dividend or distribution plus the total number of shares of Common Stock constituting such dividend or distribution.

The adjustment pursuant to this clause (i) shall become effective at 9:00 a.m., New York City time on the Ex-Date for such dividend or distribution. For the purposes of this clause (i), the number of shares of Common Stock at the time outstanding shall not include shares held in treasury by the Company. If any dividend or distribution described in this clause (i) is declared but not so paid or made, the Conversion Price shall be readjusted, effective as of the date the Board of Directors publicly announces its decision not to make such dividend or distribution, to such Conversion Price that would be in effect if such dividend or distribution had not been declared.

(ii) Subdivisions, Splits and Combination of the Common Stock. If the Company subdivides, splits or combines the shares of Common Stock, then the Conversion Price will be adjusted by multiplying the Conversion Price in effect at 5:00 p.m., New York City time on the Trading Day immediately prior to the effective date of such share subdivision, split or combination by the following fraction:

Where,

OS0 = the number of shares of Common Stock outstanding immediately prior to the effective date of such share subdivision, split or combination.

OS1 = the number of shares of Common Stock outstanding immediately after the opening of business on the effective date of such share subdivision, split or combination.

The adjustment pursuant to this clause (ii) shall become effective at 9:00 a.m., New York City time on the effective date of such subdivision, split or combination. For the purposes of this clause (ii), the number of shares of Common Stock at the time outstanding shall not include shares held in treasury by the Company. If any subdivision, split or combination described in this clause (ii) is announced but the outstanding shares of Common Stock are not subdivided, split or combined, the Conversion Price shall be readjusted, effective as of the date the Board of Directors publicly announces its decision not to subdivide, split or combine the outstanding

13

shares of Common Stock, to such Conversion Price that would be in effect if such subdivision, split or combination had not been announced.

(iii) Issuance of Stock Purchase Rights. If the Company issues to all holders of the shares of Common Stock rights or warrants (other than rights or warrants issued pursuant to a dividend reinvestment plan or share purchase plan or other similar plans) entitling them, for a period of up to 45 days from the date of issuance of such rights or warrants, to subscribe for or purchase the shares of Common Stock at less than the Current Market Price on the date immediately preceding the Ex-Date for such issuance, then the Conversion Price will be adjusted by multiplying the Conversion Price in effect at 5:00 p.m., New York City time on the Trading Day immediately prior to the Ex-Date for such issuance by the following fraction:

Where,

OS0 = the number of shares of Common Stock outstanding immediately prior to the Ex-Date for such distribution.

X = the total number of shares of Common Stock issuable pursuant to such rights or warrants.

Y = the number of shares of Common Stock equal to the aggregate price payable to exercise such rights or warrants divided by the Current Market Price on the date immediately preceding the Ex-Date for the issuance of such rights or warrants.

Any adjustment pursuant to this clause (iii) shall become effective immediately prior to 9:00 a.m., New York City time, on the Ex-Date for such issuance. For the purposes of this clause (iii), the number of shares of Common Stock at the time outstanding shall not include shares held in treasury by the Company. The Company shall not issue any such rights or warrants in respect of shares of the Common Stock held in treasury by the Company. In the event that such rights or warrants described in this clause (iii) are not so issued, the Conversion Price shall be readjusted, effective as of the date the Board of Directors publicly announces its decision not to issue such rights or warrants, to the Conversion Price that would then be in effect if such issuance had not been declared. To the extent that such rights or warrants are not exercised prior to their expiration or shares of Common Stock are otherwise not delivered pursuant to such rights or warrants upon the exercise of such rights or warrants, the Conversion Price shall be readjusted to such Conversion Price that would then be in effect had the adjustment made upon the issuance of such rights or warrants been made on the basis of the delivery of only the number of shares of Common Stock actually delivered. In determining the aggregate offering price payable for such shares of Common Stock, there shall be taken into account any consideration received for such rights or warrants and the value of such consideration (if other than cash, to be reasonably determined by the Board of Directors).

(iv) Debt or Asset Distributions. If the Company distributes to all holders of shares of Common Stock evidences of indebtedness, shares of capital stock, securities, cash or

14

other assets (excluding any dividend or distribution referred to in clause (i) above, any rights or warrants referred to in clause (iii) above, any dividend or distribution paid exclusively in cash, any consideration payable in connection with a tender or exchange offer made by the Company or any of its subsidiaries, and any dividend of shares of capital stock of any class or series, or similar equity interests, of or relating to a subsidiary or other business unit in the case of certain spin-off transactions as described below regardless of whether a Holder participates in such distribution as provided for in Section 4(l)), then the Conversion Price will be adjusted by multiplying the Conversion Price in effect at 5:00 p.m., New York City time on the Trading Day immediately prior to the Ex-Date for such distribution by the following fraction:

Where,

SP0 = the Current Market Price per share of Common Stock on such date.

FMV = the fair market value of the portion of the distribution applicable to one share of Common Stock on such date as reasonably determined by the Board of Directors.

In a “spin-off”, where the Company makes a distribution to all holders of shares of Common Stock consisting of capital stock of any class or series, or similar equity interests of, or relating to, a subsidiary or other business unit, if a Holder did not participate in such distribution as provided for in Section 4(l), the Conversion Price with respect to such Holder will be adjusted on the 15th Trading Day after the effective date of the distribution by multiplying such Conversion Price in effect immediately prior to such 15th Trading Day by the following fraction:

Where,

MP0 = the average of the Closing Prices of the Common Stock over the first 10 Trading Days commencing on and including the fifth Trading Day following the effective date of such distribution.

MPs = the average of the Closing Prices of the capital stock or equity interests representing the portion of the distribution applicable to one share of Common Stock over the first 10 Trading Days commencing on and including the fifth Trading Day following the effective date of such distribution, or, if not traded on a national or regional securities exchange or over-the-counter market, the fair market value of the capital stock or equity interests representing the portion of the distribution applicable to one share of Common Stock on such date as reasonably determined by the Board of Directors.

15

Any adjustment pursuant to this clause (iv) shall become effective immediately prior to 9:00 a.m., New York City time, on the Ex-Date for such distribution. In the event that such distribution described in this clause (iv) is not so paid or made, the Conversion Price shall be readjusted, effective as of the date the Board of Directors publicly announces its decision not to pay or make such dividend or distribution, to the Conversion Price that would then be in effect if such dividend or distribution had not been declared.

(v) Self Tender Offers and Exchange Offers. If the Company or any of its subsidiaries successfully completes a tender or exchange offer for the Common Stock where the cash and the value of any other consideration included in the payment per share of the Common Stock exceeds the Closing Price per share of the Common Stock on the Trading Day immediately succeeding the expiration of the tender or exchange offer, then the Conversion Price will be adjusted by multiplying the Conversion Price in effect at 5:00 p.m., New York City time prior to the commencement of the offer by the following fraction:

Where,

SP0 = the Closing Price per share of Common Stock on the Trading Day immediately succeeding the commencement of the tender or exchange offer.

OS0 = the number of shares of Common Stock outstanding immediately prior to the expiration of the tender or exchange offer, including any shares validly tendered and not withdrawn.

OS1= the number of shares of Common Stock outstanding immediately after the expiration of the tender or exchange offer (after giving effect to such tender offer or exchange offer).

AC = the aggregate cash and fair market value of the other consideration payable in the tender or exchange offer, as reasonably determined by the Board of Directors.

Any adjustment made pursuant to this clause (v) shall become effective immediately prior to 9:00 a.m., New York City time, on the Trading Day immediately following the expiration of the tender or exchange offer. In the event that the Company or one of its subsidiaries is obligated to purchase shares of Common Stock pursuant to any such tender offer or exchange offer, but the Company or such subsidiary is permanently prevented by applicable law from effecting any such purchases, or all such purchases are rescinded, then the Conversion Price shall be readjusted to be such Conversion Price that would then be in effect if such tender offer or exchange offer had not been made.

(vi) Rights Plans. To the extent that the Company has a rights plan in effect with respect to the Common Stock on any Conversion Date, upon conversion of any shares of the Series C Preferred Stock, the Holders will receive, in addition to the shares of Common Stock,

16

the rights under the rights plan, unless, prior to such Conversion Date, the rights have separated from the shares of Common Stock, in which case the Conversion Price will be adjusted at the time of separation as if the Company had made a distribution to all holders of the Common Stock as described in clause (iv) above, subject to readjustment in the event of the expiration, termination or redemption of such rights.

(b) The Company may make such decreases in the Conversion Price, in addition to any other decreases required by this Section 11, if the Board of Directors deems it advisable to avoid or diminish any income tax to holders of the Common Stock resulting from any dividend or distribution of shares of Common Stock (or issuance of rights or warrants to acquire shares of Common Stock) or from any event treated as such for income tax purposes or for any other reason.

(c) (i) All adjustments to the Conversion Price shall be calculated to the nearest 1/10th of a cent. No adjustment in the Conversion Price shall be required if such adjustment would be less than $0.01; provided that any adjustments which by reason of this subparagraph are not required to be made shall be carried forward and taken into account in any subsequent adjustment; provided, further that on any Conversion Date adjustments to the Conversion Price will be made with respect to any such adjustment carried forward and which has not been taken into account before such date.

(ii) No adjustment to the Conversion Price shall be made if the Holders may participate in the transaction that would otherwise give rise to an adjustment, as a result of holding the Series C Preferred Stock (including without limitation pursuant to Section 4(b) hereof), without having to convert the Series C Preferred Stock, as if they held the full number of shares of Common Stock into which each share of the Series C Preferred Stock held by them may then be converted.

(d) Whenever the Conversion Price is to be adjusted in accordance with Section 11(a) or Section 11(b), the Company shall: (i) compute the Conversion Price in accordance with Section 11(a) or Section 11(b), taking into account the $0.01 threshold set forth in Section 11(c) hereof; (ii) as soon as practicable following the occurrence of an event that requires an adjustment to the Conversion Price pursuant to Section 11(a) or Section 11(b), taking into account the one percent threshold set forth in Section 11(c) hereof (or if the Company is not aware of such occurrence, as soon as practicable after becoming so aware), provide, or cause to be provided, a written notice to the Holders of the occurrence of such event; and (iii) as soon as practicable following the determination of the revised Conversion Price in accordance with Section 11(a) or Section 11(b) hereof, provide, or cause to be provided, a written notice to the Holders setting forth in reasonable detail the method by which the adjustment to the Conversion Price was determined and setting forth the revised Conversion Price.

Section 12. Reorganization Events.

(a) In the event of:

17

(i) any consolidation, merger or other similar business combination of the Company with or into another Person, or of any Person with or into the Company, in each case pursuant to which the Common Stock will be converted into cash, securities or other property of the Company or another Person;

(ii) any sale, transfer, lease or conveyance to another Person of all or substantially all of the property and assets of the Company or any of its subsidiaries, in each case pursuant to which the Common Stock will be converted into cash, securities or other property of the Company or another Person;

(iii) any reclassification of the Common Stock into securities, including securities other than the Common Stock; or

(iv) any statutory exchange of the outstanding shares of Common Stock for securities of another Person (other than in connection with a merger or acquisition);

(any such event specified in this Section 12(a), a “Reorganization Event”), each share of Series C Preferred Stock outstanding immediately prior to such Reorganization Event shall, without the consent of the Holders thereof, remain outstanding but shall become convertible, at the option of the Holders, into the kind of securities, cash and other property receivable in such Reorganization Event by a holder (other than the counterparty to the Reorganization Event or an Affiliate of such other party) of the number of shares of Common Stock into which each share of Series C Preferred Stock would be convertible, including in a Permitted Regulatory Transfer, immediately prior to such Reorganization Event (such securities, cash and other property, the “Exchange Property”).

(b) In the event that holders of the shares of Common Stock have the opportunity to elect the form of consideration to be received in such transaction, the Company shall ensure that the Holders have the same opportunity to elect the form of consideration in accordance with the same procedures and pro ration mechanics that apply to the election to be made by the holders of Common Stock. The amount of Exchange Property receivable upon conversion of any Series C Preferred Stock in accordance with Sections 8, 9 and 10 shall be determined based upon the Conversion Price in effect on the date on which such Reorganization Event is consummated.

(c) The above provisions of this Section 12(c) shall similarly apply to successive Reorganization Events or any series of transactions that results in a Reorganization Event and the provisions of Section 12 shall apply to any shares of capital stock of the Company (or any successor) received by the holders of the Common Stock in any such Reorganization Event.

(d) The Company (or any successor) shall, at least 20 days prior to the occurrence of any Reorganization Event, provide written notice to the Holders of such occurrence of such event and of the kind and amount of the cash, securities or other property that constitutes the Exchange Property. Failure to deliver such notice shall not affect the operation of this Section 12(d).

Section 13. Voting Rights.

18

(a) The Holders will not have any voting rights, including the right to elect any directors, except (i) voting rights, if any, required by applicable law and (ii) voting rights, if any, described in this Section 13. The foregoing shall not limit or modify the rights of the Purchaser set forth in Section 4.2 of the Investment Agreement.

(b) So long as any shares of Series C Preferred Stock are outstanding, the vote or consent of the Holders of at least 66 2/3% of the shares of Series C Preferred Stock at the time outstanding, voting as a single class with all other classes and series of Parity Securities having similar voting rights then outstanding and with each series or class having a number of votes proportionate to the aggregate liquidation preference of the outstanding shares of such class or series, given in person or by proxy, either in writing without a meeting or by vote at any meeting called for the purpose, will be necessary for effecting or validating any of the following actions, whether or not such approval is required by Pennsylvania law:

(i) any amendment, alteration or repeal of any provision of the Articles of Incorporation (including this Certificate of Designation) or the Company’s bylaws that would significantly and adversely alter or change the powers, preferences or special rights of the Series C Preferred Stock;

(ii) any amendment or alteration of the Articles of Incorporation (including this Certificate of Designation) to authorize or create, or increase the authorized amount of, any shares of, or any securities convertible into shares of, any class or series of the Company’s capital stock ranking prior to the Series C Preferred Stock in the payment of dividends or in the distribution of assets on any liquidation, dissolution or winding up of the Company; or

(iii) any voluntary liquidation, dissolution or winding up of the Company; provided, however, that any increase in the amount of the authorized or issued Series C Preferred Stock or any securities convertible into Series C Preferred Stock or the creation and issuance, or an increase in the authorized or issued amount, of other series of Preferred Stock (including the Series C Preferred Stock), or any securities convertible into Preferred Stock ranking equally with and/or junior to the Series C Preferred Stock with respect to the payment of dividends (whether such dividends are cumulative or non-cumulative) and/or the distribution of assets upon the Company’s liquidation, dissolution or winding up will not, in and of itself, be deemed to adversely affect the voting powers, preferences or special rights of the Series C Preferred stock and, notwithstanding any provision of Pennsylvania law, the Holders will have no right to vote solely by reason of such an increase, creation or issuance.

(c) Notwithstanding the foregoing, the Holders shall not have any voting rights if, at or prior to the effective time of the act with respect to which such vote would otherwise be required, all outstanding shares of Series C Preferred Stock shall have been converted into shares of Common Stock.

Section 14. Fractional Shares.

(a) No fractional shares of Common Stock will be issued as a result of any conversion of shares of Series C Preferred Stock.

19

(b) In lieu of any fractional share of Common Stock otherwise issuable in respect of any conversion pursuant to Section 8 or Section 10 hereof, the Company shall pay an amount in cash (computed to the nearest cent) equal to the same fraction of the Closing Price of the Common Stock determined as of the second Trading Day immediately preceding the effective date of conversion.

(c) If more than one share of the Series C Preferred Stock is surrendered for conversion at one time by or for the same Holder, the number of full shares of Common Stock issuable upon conversion thereof shall be computed on the basis of the aggregate number of shares of the Series C Preferred Stock so surrendered.

Section 15. Reservation of Common Stock.

(a) The Company shall at all times reserve and keep available out of its authorized and unissued Common Stock or shares acquired by the Company, solely for issuance upon the conversion of shares of Series C Preferred Stock as provided in this Certificate of Designation, free from any preemptive or other similar rights, such number of shares of Common Stock as shall from time to time be issuable upon the conversion of all the shares of Series C Preferred Stock then outstanding. For purposes of this Section 15(a), the number of shares of Common Stock that shall be deliverable upon the conversion of all outstanding shares of Series C Preferred Stock shall be computed as if at the time of computation all such outstanding shares were held by a single Holder.

(b) Notwithstanding the foregoing, the Company shall be entitled to deliver upon conversion of shares of Series C Preferred Stock, as herein provided, shares of the applicable Common Stock previously acquired by the Company (in lieu of the issuance of authorized and unissued shares of Common Stock), so long as any such acquired shares are free and clear of all liens, charges, security interests or encumbrances (other than liens, charges, security interests and other encumbrances created by the Holders).

(c) All shares of Common Stock delivered upon conversion of the Series C Preferred Stock shall be duly authorized, validly issued, fully paid and non-assessable, free and clear of all liens, claims, security interests and other encumbrances (other than liens, charges, security interests and other encumbrances created by the Holders) and not issued in violation of any applicable preemptive right or applicable law.

(d) Prior to the delivery of any securities that the Company shall be obligated to deliver upon conversion of the Series C Preferred Stock, the Company shall use its reasonable best efforts to comply with all federal and state laws and regulations thereunder requiring the registration of such securities with, or any approval of or consent to the delivery thereof by, any governmental authority.

(e) The Company hereby covenants and agrees that, for so long as the Common Stock is listed on The NASDAQ Global Select Market or any other national securities exchange or automated quotation system, the Company will, if permitted by the rules of such exchange or automated quotation system, list and keep listed, so long as the Common Stock shall be so listed

20

on such exchange or automated quotation system, all the Common Stock issuable upon conversion of the Series C Preferred Stock; provided, however, that if the rules of such exchange or automated quotation system permit the Company to defer the listing of such Common Stock until the first conversion of Series C Preferred Stock into Common Stock in accordance with the provisions hereof, the Company covenants to list such Common Stock issuable upon conversion of the Series C Preferred Stock in accordance with the requirements of such exchange or automated quotation system at such time.

Section 16. Replacement Certificates.

(a) If physical certificates are issued, the Company shall replace any mutilated certificate at the Holder’s expense upon surrender of that certificate to the Company. The Company shall replace certificates that become destroyed, stolen or lost at the Holder’s expense upon delivery to the Company of satisfactory evidence that the certificate has been destroyed, stolen or lost, together with any indemnity that may be required by the Company.

(b) If physical certificates are issued, the Company shall not be required to issue any certificates representing the Series C Preferred Stock on or after the applicable Conversion Date. In place of the delivery of a replacement certificate following the applicable Conversion Date, the Company, upon delivery of the evidence and indemnity described in clause (a) above, shall deliver the shares of Common Stock pursuant to the terms of the Series C Preferred Stock formerly evidenced by the certificate.

Section 17. Miscellaneous.

(a) All notices referred to herein shall be in writing, and, unless otherwise specified herein, all notices hereunder shall be deemed to have been given upon the earlier of receipt thereof or three Business Days after the mailing thereof if sent by registered or certified mail (unless first-class mail shall be specifically permitted for such notice under the terms of this Certificate of Designation) with postage prepaid, e-mail or facsimile, or by private courier service addressed: (i) if to the Company, Attention: General Counsel, to its office at One Oxford Center, 301 Grant Street, Pittsburgh PA, 15219, e-mail: KFriedman@tscbank.com, facsimile: (412) 304-0391 (ii) if to any Holder or holder of shares of Common Stock, as the case may be, to such Holder or holder at the address listed in the stock record books of the Company or (iii) to such other address as the Company or any such Holder or holder, as the case may be, shall have designated by notice similarly given.

(b) The Company shall pay any and all stock transfer and documentary stamp taxes that may be payable in respect of any issuance or delivery of shares of Series C Preferred Stock or shares of Common Stock or other securities issued on account of Series C Preferred Stock pursuant hereto or certificates representing such shares or securities. The Company shall not, however, be required to pay any such tax that may be payable in respect of any transfer involved in the issuance or delivery of shares of Series C Preferred Stock or Common Stock or other securities in a name other than that in which the shares of Series C Preferred Stock with respect to which such shares or other securities are issued or delivered were registered, or in respect of any payment to any Person other than a payment to the registered holder thereof, and shall not be

21

required to make any such issuance, delivery or payment unless and until the Person otherwise entitled to such issuance, delivery or payment has paid to the Company the amount of any such tax or has established, to the satisfaction of the Company, that such tax has been paid or is not payable.

(c) No share of Series C Preferred stock shall have any rights of preemption whatsoever pursuant to this Certificate of Designation as to any securities of the Company, or any warrants, rights or options issued or granted with respect thereto, regardless of how such securities, or such warrants, rights or options, may be designated issued or granted.

THIRD: This Certificate of Designation does not provide for an exchange, reclassification or cancellation of any issued shares.

FOURTH: This Certificate of Designation was adopted on December 29, 2020.

FIFTH: This Certificate of Designation to the Articles of Incorporation was duly adopted by the Board of Directors of the Company.

SIXTH: No shareholder action was required.

22

IN WITNESS WHEREOF, this Certificate of Designation has been duly executed and delivered by the duly authorized officers of the undersigned as of the date first herein above written.

TRISTATE CAPITAL HOLDINGS, INC.

By: /s/ James F. Getz

Name: James F. Getz

Title: Chairman, President, Chief Executive Officer and Director

[Signature Page to Certificate of Designation]