Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ALLIANCE DATA SYSTEMS CORP | form_8k.htm |

Alliance Data Goldman Sachs 2020 US Financial Services ConferenceDecember 8, 2020Ralph Andretta –

President & CEOVal Greer – Chief Commercial Officer Tim King – EVP & CFO Exhibit 99.1

Forward-Looking StatementsThis presentation contains forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements give our expectations or forecasts of future events and can generally be identified by the use of words such as

“believe,” “expect,” “anticipate,” “estimate,” “intend,” “project,” “plan,” “likely,” “may,” “should” or other words or phrases of similar import. Similarly, statements that describe our business strategy, outlook, objectives, plans, intentions

or goals also are forward-looking statements. Examples of forward-looking statements include, but are not limited to, statements we make regarding, and the guidance we give with respect to, our anticipated operating or financial results,

initiation or completion of strategic initiatives, future dividend declarations, and future economic conditions, including, but not limited to, fluctuation in currency exchange rates, market conditions and COVID-19 impacts related to relief

measures for impacted borrowers and depositors, labor shortages due to quarantine, reduction in demand from clients, supply chain disruption for our reward suppliers and disruptions in the airline or travel industries.We believe that our

expectations are based on reasonable assumptions. Forward-looking statements, however, are subject to a number of risks and uncertainties that could cause actual results to differ materially from the projections, anticipated results or other

expectations expressed in this presentation, and no assurances can be given that our expectations will prove to have been correct. These risks and uncertainties include, but are not limited to, factors set forth in the Risk Factors section in

our Annual Report on Form 10-K for the most recently ended fiscal year, which may be updated in Item 1A of, or elsewhere in, our Quarterly Reports on Form 10-Q filed for periods subsequent to such Form 10-K. Our forward-looking statements speak

only as of the date made, and we undertake no obligation, other than as required by applicable law, to update or revise any forward-looking statements, whether as a result of new information, subsequent events, anticipated or unanticipated

circumstances or otherwise.

Agenda Presentation (15 minutes)Ralph Andretta – President & CEO Opening Remarks 2020 Action Items

Card Services Business Update Card Services 4Q20 UpdateVal Greer – Chief Commercial Officer Brand Partner Framework Business Enhancement Highlights Strategic Acquisition of BreadFireside chat with Ralph, Val, and Tim (25 minutes) 3

Leader in payment and lending solutions Branded private label and cobrand credit card programs with over

40 million active cardmembersDiversified across growing verticals, including beauty, pet, and homeBrand-centric programs supported by data and analytics, digital capabilities, and our balanced risk approach in underwriting 4 Alliance Data

OverviewLeading provider of data-driven solutions to drive growth for partners 8,500 associates worldwideFounded in 1996 LoyaltyOne® Segment Recently acquired point-of-sale technology platform offering installment loans & buy now, pay

later solutions White-label solutions with over 400 partners Global leader in shopper analytics and loyalty program strategy, solutions, and servicesAIR MILES® has nearly 11 million active Collectors representing approximately 2/3 of Canadian

householdsBrandLoyalty is the global leader in short-term campaigns targeting mainly the grocery (or high frequency) retail vertical located in 20 locations in Europe, Asia Pacific, and the Americas Top 3 in PLCC IndustryFORTUNE 500 company

Expand digital offeringsEnhanced Digital SuitePOS payment solutionsTechnology flexibility &

upgradesCore processing platformEnhance data & analyticsPrudent Balance Sheet Management Associate safety & healthRecession readiness planRight-size expense baseDisciplined risk management Review partner economics 5 2020 Action

ItemsDeliberate and thoughtful progress balancing the pandemic and future growth Rebuild Recover These action items aim to restore profitable growth & drive enhanced long-term shareholder value Focused investmentAlign with

recovery trendFurther digital enhancementsSustained, profitable growthExpense flexibility and disciplineDrive shareholder value Regrow

Card Services Business UpdateCredit sales continue to gradually recover from pandemic lows 6 The more

measured sales recovery and lower pandemic-related 2020 new account acquisition are expected to continue to pressure YoY Card Services A/R growth in 2021 New account volume was down 44% & 29% year-over-year in 2Q20 & 3Q20 respectively

Year-over-year credit sales continue to improve at a modest pace *October and November figures are estimates based on current data and will not be finalized until after quarter-end

7 Card Services 4Q20 UpdateContinued progress on the execution of our strategic initiatives Credit

sales and Card Services A/R improving on a sequential basis as seasonal holiday spend ramps up Card Services gross yields expected to remain near the 3Q20 rangeOperating expenses expected to increase sequentially driven by the normal seasonal

increase in marketing investments of approximately $50 million and an approximately $50 million non-cash charge related to the ongoing optimization of our real estate footprint Credit metrics remain in line with our expectations for 4Q20Bread

acquisition completed in December 2020 and active dialogue with existing partners on integration beginning 1Q21 TechnologyInnovation Product Diversification and Development DigitalAdvancement Data Science and Analytics Active risk

management Prudent balance sheet management Disciplined expense management Key Foundational Elements

Val Greer – Chief Commercial Officer

9 Brand Partner FrameworkBrand-centric approach with partnership based on growth and profitability From

a tier-based strategy… … to strategic decisions based on performance MaintainKey material partners, likely to face future performance headwinds Improve Programs with low performance in portfolio Invest Partners with higher potential

opportunity GrowStrong partners expected to succeed in current market and over the long term Deprioritize partners w/ a history of underperformance Expected Company/Vertical Performance ADS Return High High Low Low Transition to

General Manager portfolio management modelResponsible for growth, profitability, and retention of portfolio and brand partner relationshipAccountability and authority with the necessary levers to drive changePortfolio metrics, profitability,

and consumer-level segmentation & analyticsCross functional allocated support including finance, marketing, analytics & risk managementClarified metrics and targets

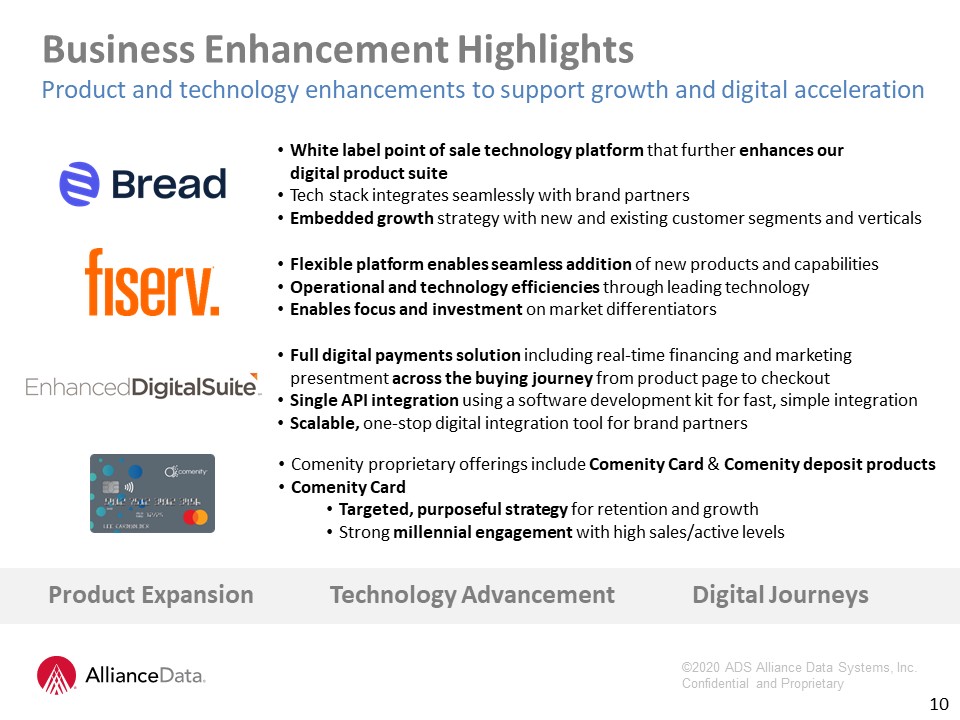

Flexible platform enables seamless addition of new products and capabilitiesOperational and technology

efficiencies through leading technologyEnables focus and investment on market differentiators Business Enhancement HighlightsProduct and technology enhancements to support growth and digital acceleration 10 White label point of sale

technology platform that further enhances our digital product suiteTech stack integrates seamlessly with brand partnersEmbedded growth strategy with new and existing customer segments and verticals Full digital payments solution including

real-time financing and marketing presentment across the buying journey from product page to checkoutSingle API integration using a software development kit for fast, simple integrationScalable, one-stop digital integration tool for brand

partners Technology Advancement Digital Journeys Product Expansion Comenity proprietary offerings include Comenity Card & Comenity deposit productsComenity CardTargeted, purposeful strategy for retention and growthStrong millennial

engagement with high sales/active levels

11 Bread’s talented team of ~200 associates joined Alliance DataBread’s development team will focus on

current priorities and partners as well as spearheading a new digital innovation hub in NYC, driving ADS digital initiatives Expand product suite with existing ADS partners to capture larger share of point of sale transactions and drive

incremental salesCross-sell private label and cobrand products to existing Bread customers to provide access to creditGrow new partners with differentiated, white label product offering across buy now, pay later, installment lending, private

label, and cobrandActive cross-sell partner discussions in progress with target of 1Q21Buy now, pay later product appeals to younger, digital native consumer; provides more access to millennials who increasingly rely on ecommerce for their

purchasesProduct strategy enabled seamlessly through Enhanced Digital Suite, allowing product presentation flexibility to meet the needs of a broad set of consumer segmentsAbility to provide partners with incremental consumer data and analytic

insights to drive sales Talent PartnerExpansion Strategic Acquisition of Bread Expands digital capabilities with installment loan and buy now, pay later products CustomerNeeds

Questions & Answers