Attached files

| file | filename |

|---|---|

| 8-K - 8-K - OWENS & MINOR INC/VA/ | omi-20201201.htm |

Bank of America 2020 Leveraged Finance Conference Bank of America 2020 Leveraged Finance Conference December 1, 2020 | Andrew Long

Bank of America 2020 Leveraged Finance Conference2 Safe Harbor This presentation is intended to be disclosure through methods reasonably designed to provide broad, non-exclusionary distribution to the public in compliance with the SEC's Fair Disclosure Regulation. This presentation contains certain ''forward-looking'' statements made pursuant to the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, the statements in this presentation regarding the impact of COVID-19 on the Company’s results and operations, as well as other statements related to the Company’s expectations regarding the performance of its business and the ability to deliver double- digit adjusted earnings per share growth in 2021. Forward-looking statements involve known and unknown risks and uncertainties that may cause our actual results in future periods to differ materially from those projected or contemplated in the forward-looking statements. Investors should refer to Owens & Minor’s Annual Report on Form 10-K for the year ended December 31, 2019, filed with the SEC including the sections captioned “Cautionary Note Regarding Forward-Looking Statements” and “Item 1A. Risk Factors,” and subsequent annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K filed with or furnished to the SEC, for a discussion of certain known risk factors that could cause the Company’s actual results to differ materially from its current estimates. These filings are available at www.owens-minor.com. Given these risks and uncertainties, Owens & Minor can give no assurance that any forward-looking statements will, in fact, transpire and, therefore, cautions investors not to place undue reliance on them. Owens & Minor specifically disclaims any obligation to update or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. Owens & Minor uses its web site, www.owens-minor.com, as a channel of distribution for material Company information, including news releases, investor presentations and financial information. This information is routinely posted and accessible under the Investor Relations section.

Bank of America 2020 Leveraged Finance Conference3 Our Business DISTRIBUTION Global Solutions Global Products my

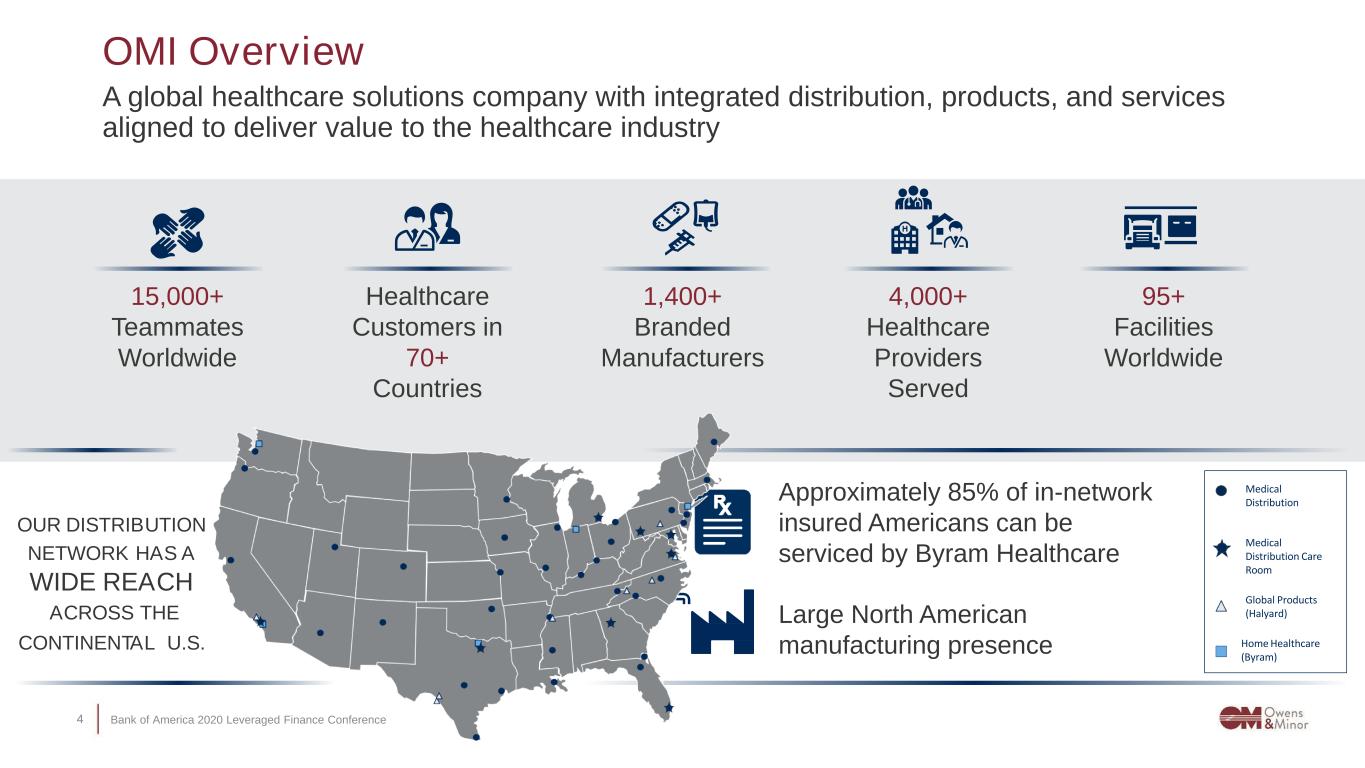

Bank of America 2020 Leveraged Finance Conference4 OMI Overview A global healthcare solutions company with integrated distribution, products, and services aligned to deliver value to the healthcare industry 15,000+ Teammates Worldwide Healthcare Customers in 70+ Countries 1,400+ Branded Manufacturers 4,000+ Healthcare Providers Served 95+ Facilities Worldwide Approximately 85% of in-network insured Americans can be serviced by Byram Healthcare Large North American manufacturing presence OUR DISTRIBUTION NETWORK HAS A WIDE REACH ACROSS THE CONTINENTAL U.S. Medical Distribution Medical Distribution Care Room Global Products (Halyard) Home Healthcare (Byram)

Bank of America 2020 Leveraged Finance Conference5 Investment Highlights Track Record of Consistent Performance 1. Leading PPE Manufacturer with Company Owned Facilities Throughout the Americas 2. Byram Healthcare Serving the Fast Growing Home Healthcare Market, is a Leading Provider in Direct to Patient Products for Chronic Conditions 3. A Leading Distributor of Broad Portfolio of Medical Products in the US Acute Care Space – Fundamental Player in the US Healthcare Infrastructure 4. Strong Demand in Higher Margin, Self-Manufactured Products, Driven by New Healthcare Protocols and Expansion of Portfolio 5. Rapidly Improving Balance Sheet and Cash Flow Generation 6. Continuing to Invest in Infrastructure, Manufacturing Footprint, and Technology to Drive Long-Term, Profitable Growth Results Driven by a Customer Focused Approach to Advance Healthcare

Bank of America 2020 Leveraged Finance Conference6 Recent Financial Performance & Consistency Q3 Highlights • 250%+ INCREASE in adjusted EPS compared to the third quarter of 2019 • 240 basis point adjusted operating MARGIN EXPANSION versus prior year • Global Solutions Segment – REVENUE GROWTH OF $317 MILLION sequentially • $118 million of OPERATING CASH FLOW generated in the quarter • $200 MILLION EQUITY OFFERING completed • Further REDUCED TOTAL DEBT by $70 million • SHIPPED nearly 11 billion units of PPE since January! Track Record of Consistent Performance • 4TH CONSECUTIVE QUARTER of year-over-year adjusted EPS improvement • 6TH CONSECUTIVE QUARTER of year-over-year gross margin expansion • 6TH CONSECUTIVE QUARTER of positive operating cash flow • 3RD CONSECUTIVE QUARTER of adjusted EPS improvement • 300%+ SEQUENTIAL QUARTER INCREASE in adjusted EPS Well Positioned to Deliver Double Digit Adj. EPS Growth in 2021

Bank of America 2020 Leveraged Finance Conference7 2020 Financial Achievements to Date Balance Sheet • Sequential debt reduction of 23% ~ over $400 MILLION for the six quarters ended September 30 • SUCCESSFULLY RAISED EQUITY and used proceeds to reduce term debt by $190M in October • RETIRED OUTSTANDING $179M of 2021 Notes on November 30th • LOWERED INTEREST EXPENSES through September by 13% vs. prior year due to lower debt levels • ENHANCED LEVERAGE PROFILE as we continue to strengthen our balance sheet • UPGRADED CREDIT RATINGS at all major ratings agencies Cash Flow • Generated $268 MILLION of consolidated operating cash flow • IMPROVED PROFITABILTY driving cash flow generation • Stringent WORKING CAPITAL MANAGEMENT leading to great progress through September • Focus on delivering superior service levels towards EFFECTIVE INVENTORY MANAGEMENT • Continue to fund INVESTMENTS in infrastructure, services, and technology to drive long-term growth Implementing Growth Strategy by Continuing to Invest Across our Businesses

Bank of America 2020 Leveraged Finance Conference8 Our value chain delivers benefits to our customers: We control the materials, design, strict quality standards and product specifications in our own facilities, with our own Teammates We self-manufacture most of our proprietary branded products, many in the Americas We have strategically-located distribution centers in North America for rapid deployment We enable our customers to continue the critical work of caring for patients! Our Value Chain is a Key Differentiator Unique Ability to Quickly Deliver Critical Product to the Frontlines

Bank of America 2020 Leveraged Finance Conference9 Home Healthcare Market Outlook & Actions • Home Healthcare Market Dynamics: • Aging population: 10,000 people a day turning 65 • Over 60M Medicare beneficiaries in the US • By 2025, 48% of Medicare beneficiaries will be in Medicare Advantage plans • Rise in chronic conditions requiring regular care via direct-to-patient and home health agencies • Home Health, is the preferred care setting as patients with higher acuity who would have been in hospital, are now being treated in the home • Owens & Minor Home Healthcare: • Leading direct-to-patient distributor of medical supplies in the U. S., reimbursed by health insurance providers • Major product segments: ostomy, diabetes, urology, wound care, incontinence and breast pumps • Largest customer facing sales in direct-to-patient channel • Unrivalled Managed Care contracts….650+ • Product specialization through Centers of Excellence Leading the Home Healthcare Market with a National Scale

Bank of America 2020 Leveraged Finance Conference10 PPE Market Outlook & Actions PPE Production Capacity & Sustainability • Increased PPE Production: • Expanded operations to 24/7 • Continued process improvements and retooling of existing equipment • Installed & continuing to optimize new production lines • Ramp up of our new non-woven fabric machinery • Heightened demand for PPE expected to continue: • Health care protocols calling for increased use of PPE • New regulations for increased adherence of PPE protocols • Healthcare professional preference for medical grade PPE • Stockpile PPE demand expected to continue to grow • New channels for PPE in healthcare, non-healthcare and international markets Americas Based Manufacturing Provides Supply Chain Resiliency Milestone: 11 Billion Units of PPE Shipped from January 2020 through September 2020

Bank of America 2020 Leveraged Finance Conference11 Why OMI? 1. Strong Operational Execution Fueling Solid Financial Performance 2. Re-establishing a Consistent Record of High Quality Service and Customer Dedication 3. Market Demand for Our Products Expected to Remain High; Americas Manufacturing Footprint is a Key Differentiator 4. Ongoing Investment to Best Serve Our Customers for the Long Term 5. Customized Solutions & Control of Our Value Chain with Integrated Production & Distribution Positioned to “Empower our Customers to Advance Healthcare”

Bank of America 2020 Leveraged Finance Conference12 Thank You.