Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AZZ INC | azz-20201124.htm |

AZZ Inc. Strategy and Governance Update Fall 2020

STRATEGY AND GOVERNANCE UPDATE PRESENTATION Safe Harbor Statement 2 Certain statements herein about our expectations of future events or results constitute forward-looking statements for purposes of the safe harbor provisions of The Private Securities Litigation Reform Act of 1995, including the statements regarding our strategic and financial initiatives. You can identify forward-looking statements by terminology such as “may,” “should,” “expects,” “plans,” “intends,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue,” or the negative of these terms or other comparable terminology. Such forward-looking statements are based on currently available competitive, financial and economic data and management’s views and assumptions regarding future events. Such forward-looking statements are inherently uncertain, and investors must recognize that actual results may differ from those expressed or implied in the forward-looking statements. Certain factors could affect the outcome of the matters described herein. This presentation may contain forward-looking statements that involve risks and uncertainties including, but not limited to, changes in customer demand for our products and services, including demand by the power generation markets, electrical transmission and distribution markets, the industrial markets, and the metal coatings markets. In addition, within each of the markets we serve, our customers and our operations could potentially be adversely impacted by the ongoing COVID-19 pandemic. We could also experience fluctuations in prices and raw material cost, including zinc and natural gas which are used in the hot-dip galvanizing process; supply-chain vendor delays; customer requested delays of our products or services; delays in additional acquisition opportunities; currency exchange rates; availability of experienced management and employees to implement AZZ’s growth strategy; a downturn in market conditions in any industry relating to the products we inventory or sell or the services that we provide; economic volatility or changes in the political stability in the United States and other foreign markets in which we operate; acts of war or terrorism inside the United States or abroad; and other changes in economic and financial conditions. AZZ has provided additional information regarding risks associated with the business in AZZ’s Annual Report on Form 10-K for the fiscal year ended February 29, 2020 and other filings with the Securities and Exchange Commission (“SEC”), available for viewing on AZZ’s website at www.azz.com and on the SEC’s website at www.sec.gov. You are urged to consider these factors carefully in evaluating the forward-looking statements herein and are cautioned not to place undue reliance on such forward-looking statements, which are qualified in their entirety by this cautionary statement. These statements are based on information as of the date hereof and AZZ assumes no obligation to update any forward-looking statements, whether as a result of new information, future events, or otherwise.

STRATEGY AND GOVERNANCE UPDATE PRESENTATION 3 Our Board is Implementing Initiatives to Enhance Shareholder Value ■ Execution: Board and management are building on a strong foundation to advance our strategic and financial initiatives ► Highly attractive metal coatings segment with resilient performance through COVID-19 pandemic ► Driving margin improvement across infrastructure solutions segment and divesting low performing / low value creation businesses ■ Strategic and Financial Review: Board is leading a review of the Company’s portfolio and capital allocation ► Retained industry-leading independent financial, legal and tax advisors in support of this review ► Review accelerating AZZ’s strategy to become a focused metal coatings company ■ Capital Return: Share repurchases are currently an attractive use of capital ► Repurchased over 600,000 shares over the past five months ► Authorized a new stock repurchase program of $100 million that we intend to complete by the end of fiscal year 2022 ■ Board Refreshment: AZZ is adding Board members to align with our strategy, challenges and opportunities ► Engaged a leading independent search firm to further our Board refreshment process ■ Shareholder Engagement: We will continue to welcome shareholder input in executing our strategy and in our ESG programs and policies ■ Focus on Sustainability: We will continue to integrate human capital and environmental initiatives into our operations and culture

STRATEGY AND GOVERNANCE UPDATE PRESENTATION 4 Vision and Values GUIDING VALUES ■ We Value Our Dedicated Employees and their communities by fully training and equipping them, and providing a safe environment to grow ■ We Value Our Customers by reliably providing high- quality products and services with outstanding customer service ■ We Value Our Shareholders by striving to consistently provide solid returns Environmental, Social and Governance “ESG” Integrating Sustainability into our Operations and Company Culture Continued Commitment to Employee Safety, Development and Diversity Experienced Board from a Range of Relevant Backgrounds

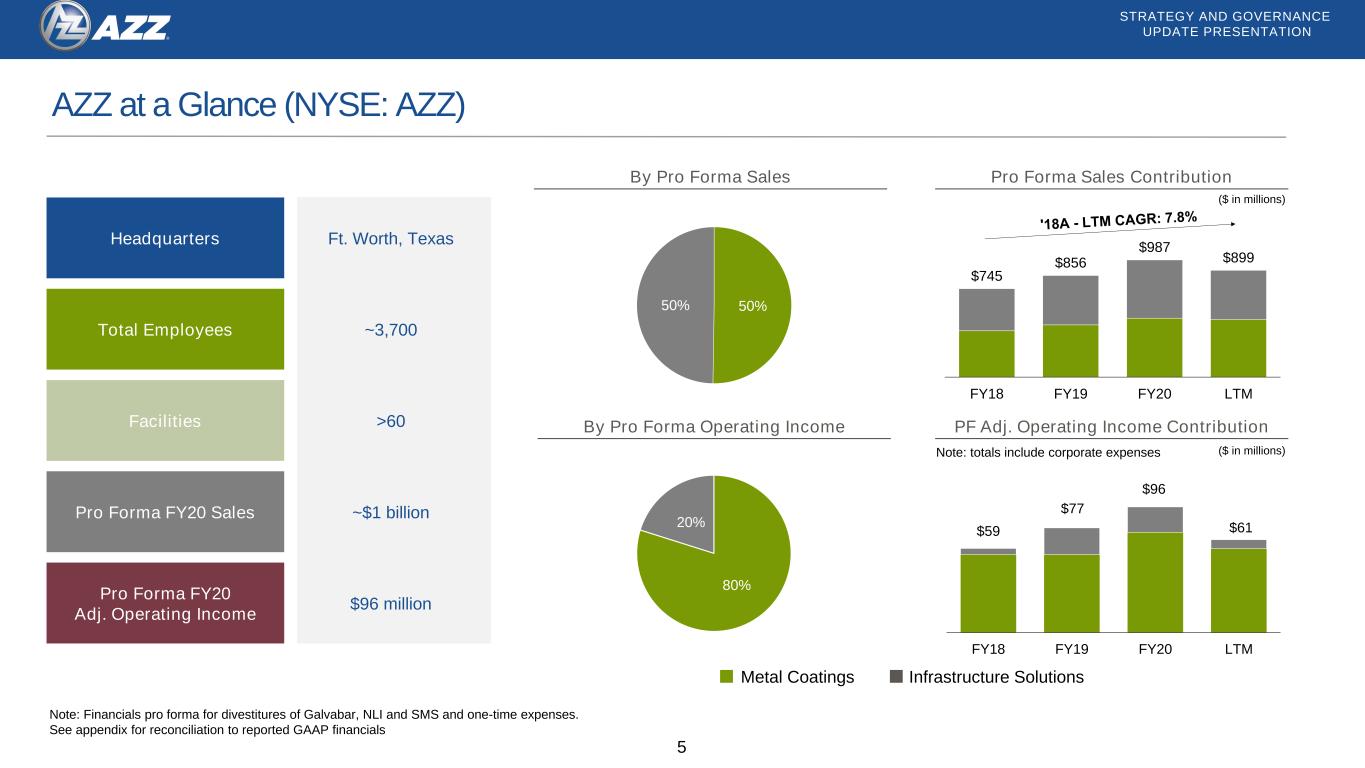

STRATEGY AND GOVERNANCE UPDATE PRESENTATION $59 $77 $96 $61 FY18 FY19 FY20 LTM $745 $856 $987 $899 FY18 FY19 FY20 LTM 5 AZZ at a Glance (NYSE: AZZ) Headquarters Facilities Total Employees Note: Financials pro forma for divestitures of Galvabar, NLI and SMS and one-time expenses. See appendix for reconciliation to reported GAAP financials 50%50% 80% 20% Pro Forma FY20 Sales ~3,700 $96 million By Pro Forma Sales ($ in millions) ~$1 billion Pro Forma FY20 Adj. Operating Income >60 Ft. Worth, Texas Pro Forma Sales Contribution By Pro Forma Operating Income PF Adj. Operating Income Contribution Infrastructure SolutionsMetal Coatings Note: totals include corporate expenses ($ in millions)

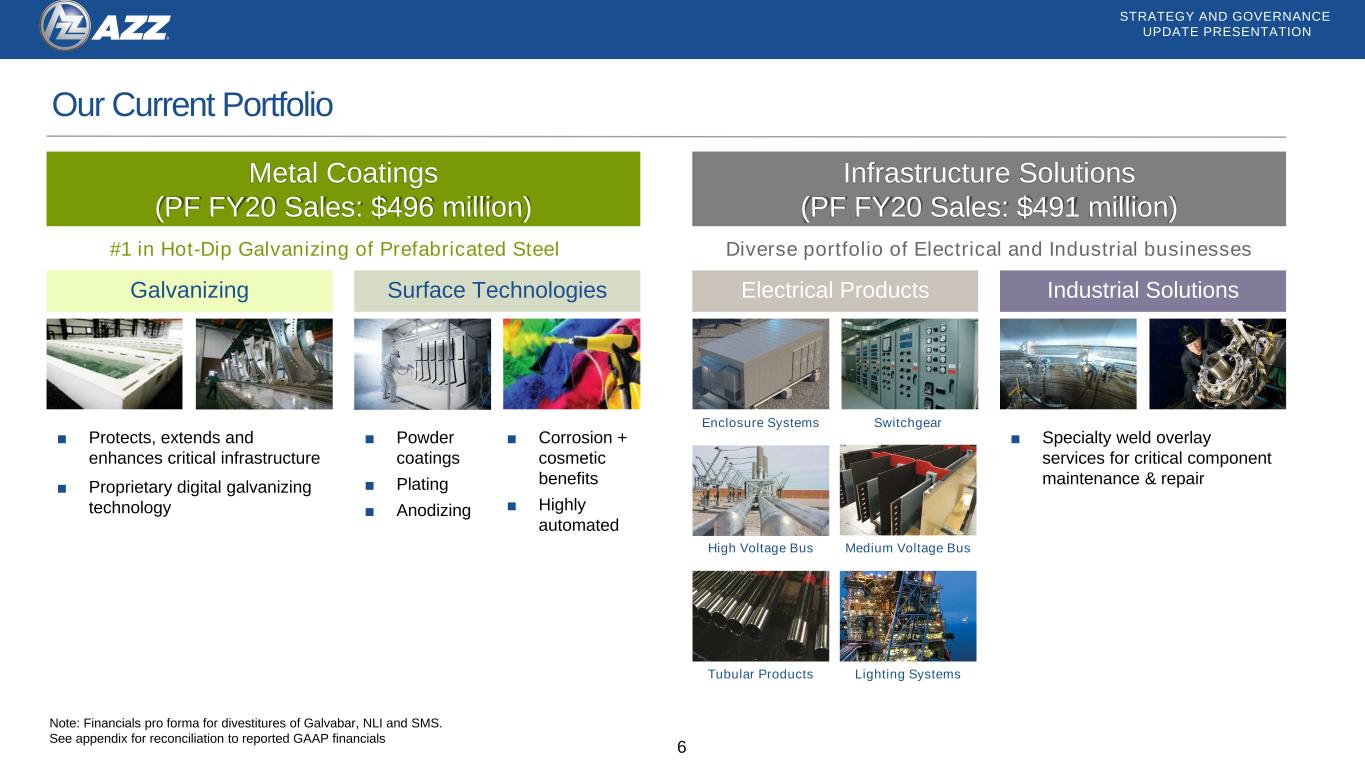

STRATEGY AND GOVERNANCE UPDATE PRESENTATION 6 Our Current Portfolio Metal Coatings (PF FY20 Sales: $496 million) Infrastructure Solutions (PF FY20 Sales: $491 million) Galvanizing Surface Technologies Electrical Products Industrial Solutions ■ Protects, extends and enhances critical infrastructure ■ Proprietary digital galvanizing technology ■ Powder coatings ■ Plating ■ Anodizing ■ Specialty weld overlay services for critical component maintenance & repair ■ Corrosion + cosmetic benefits ■ Highly automated Note: Financials pro forma for divestitures of Galvabar, NLI and SMS. See appendix for reconciliation to reported GAAP financials #1 in Hot-Dip Galvanizing of Prefabricated Steel Diverse portfolio of Electrical and Industrial businesses Enclosure Systems Switchgear Medium Voltage BusHigh Voltage Bus Lighting SystemsTubular Products

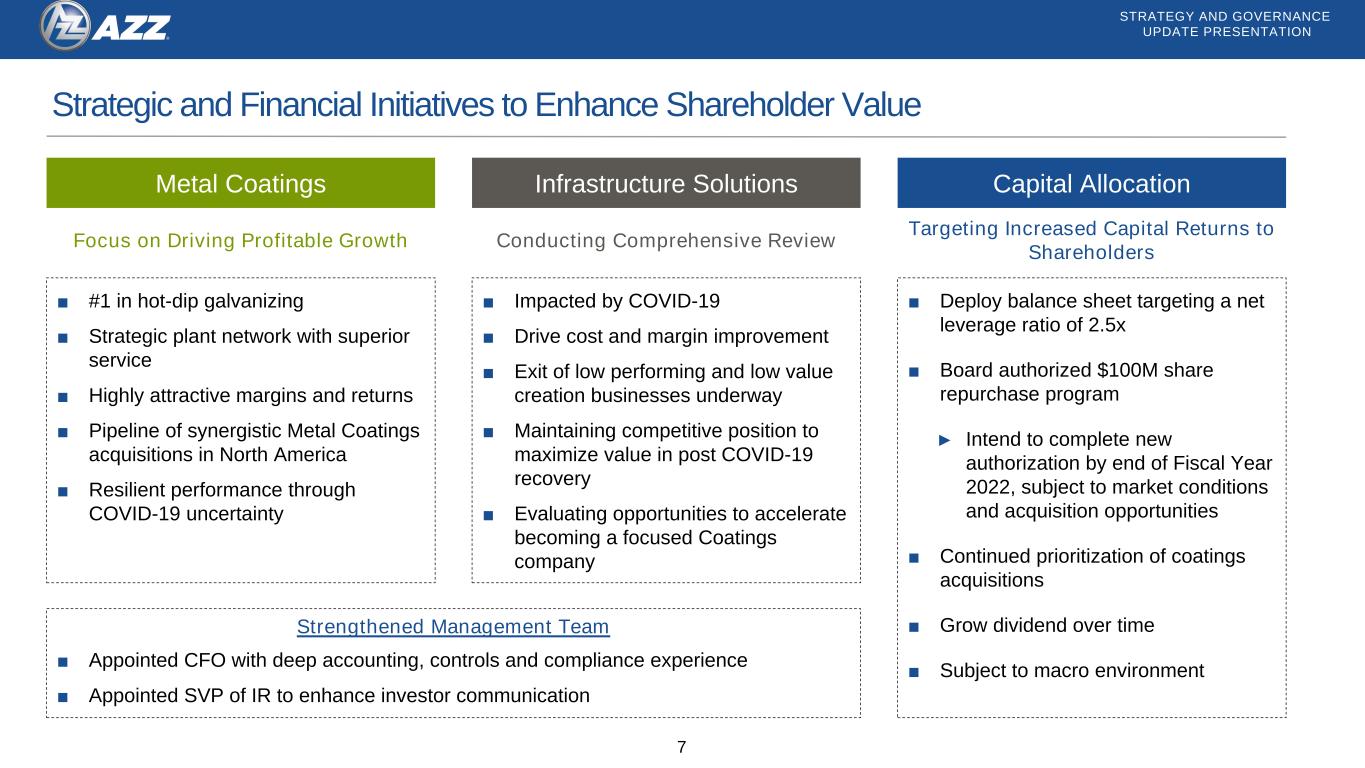

STRATEGY AND GOVERNANCE UPDATE PRESENTATION 7 Strategic and Financial Initiatives to Enhance Shareholder Value Metal Coatings ■ #1 in hot-dip galvanizing ■ Strategic plant network with superior service ■ Highly attractive margins and returns ■ Pipeline of synergistic Metal Coatings acquisitions in North America ■ Resilient performance through COVID-19 uncertainty Infrastructure Solutions Capital Allocation ■ Impacted by COVID-19 ■ Drive cost and margin improvement ■ Exit of low performing and low value creation businesses underway ■ Maintaining competitive position to maximize value in post COVID-19 recovery ■ Evaluating opportunities to accelerate becoming a focused Coatings company ■ Deploy balance sheet targeting a net leverage ratio of 2.5x ■ Board authorized $100M share repurchase program ► Intend to complete new authorization by end of Fiscal Year 2022, subject to market conditions and acquisition opportunities ■ Continued prioritization of coatings acquisitions ■ Grow dividend over time ■ Subject to macro environment Focus on Driving Profitable Growth Conducting Comprehensive Review Targeting Increased Capital Returns to Shareholders ■ Appointed CFO with deep accounting, controls and compliance experience ■ Appointed SVP of IR to enhance investor communication Strengthened Management Team

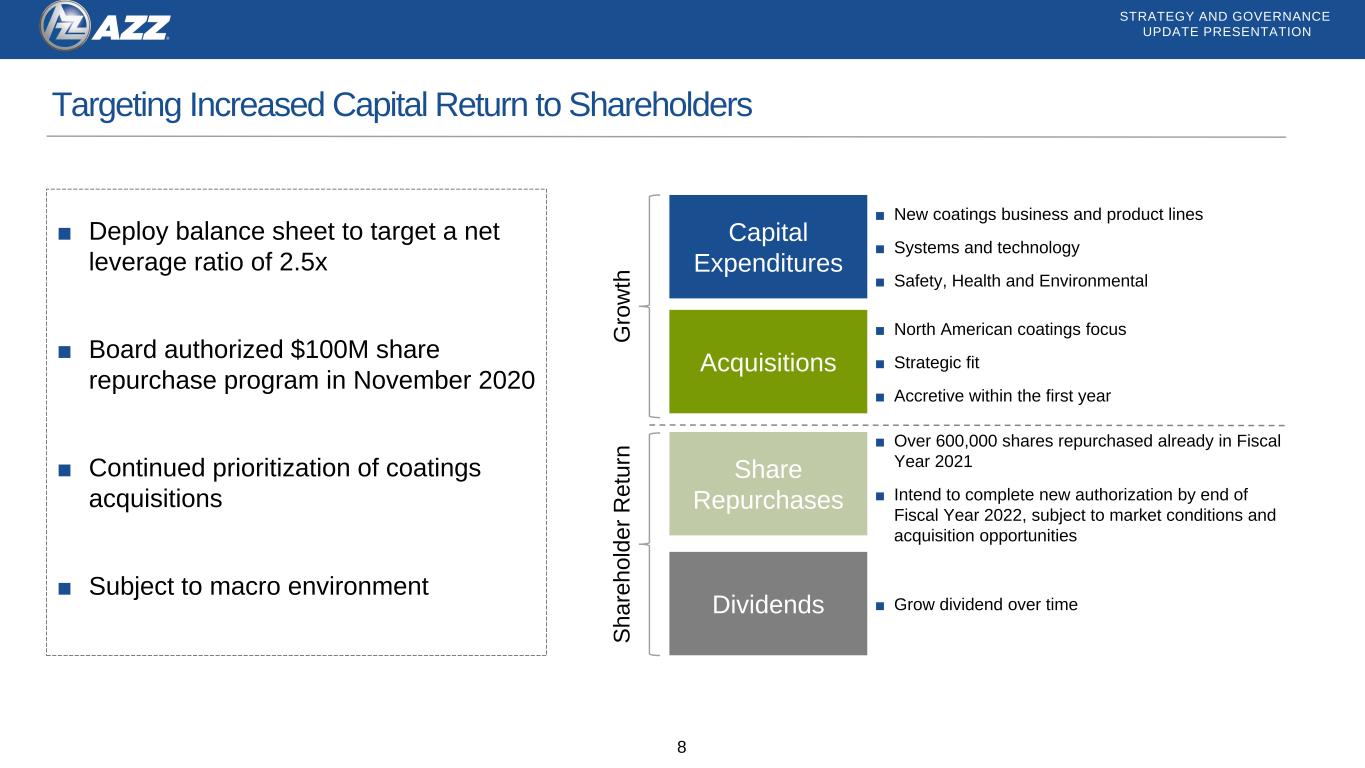

STRATEGY AND GOVERNANCE UPDATE PRESENTATION 8 Targeting Increased Capital Return to Shareholders ■ Deploy balance sheet to target a net leverage ratio of 2.5x ■ Board authorized $100M share repurchase program in November 2020 ■ Continued prioritization of coatings acquisitions ■ Subject to macro environment Capital Expenditures Acquisitions Share Repurchases Dividends ■ New coatings business and product lines ■ Systems and technology ■ Safety, Health and Environmental ■ North American coatings focus ■ Strategic fit ■ Accretive within the first year ■ Over 600,000 shares repurchased already in Fiscal Year 2021 ■ Intend to complete new authorization by end of Fiscal Year 2022, subject to market conditions and acquisition opportunities ■ Grow dividend over time G ro w th S h a re h o ld e r R e tu rn

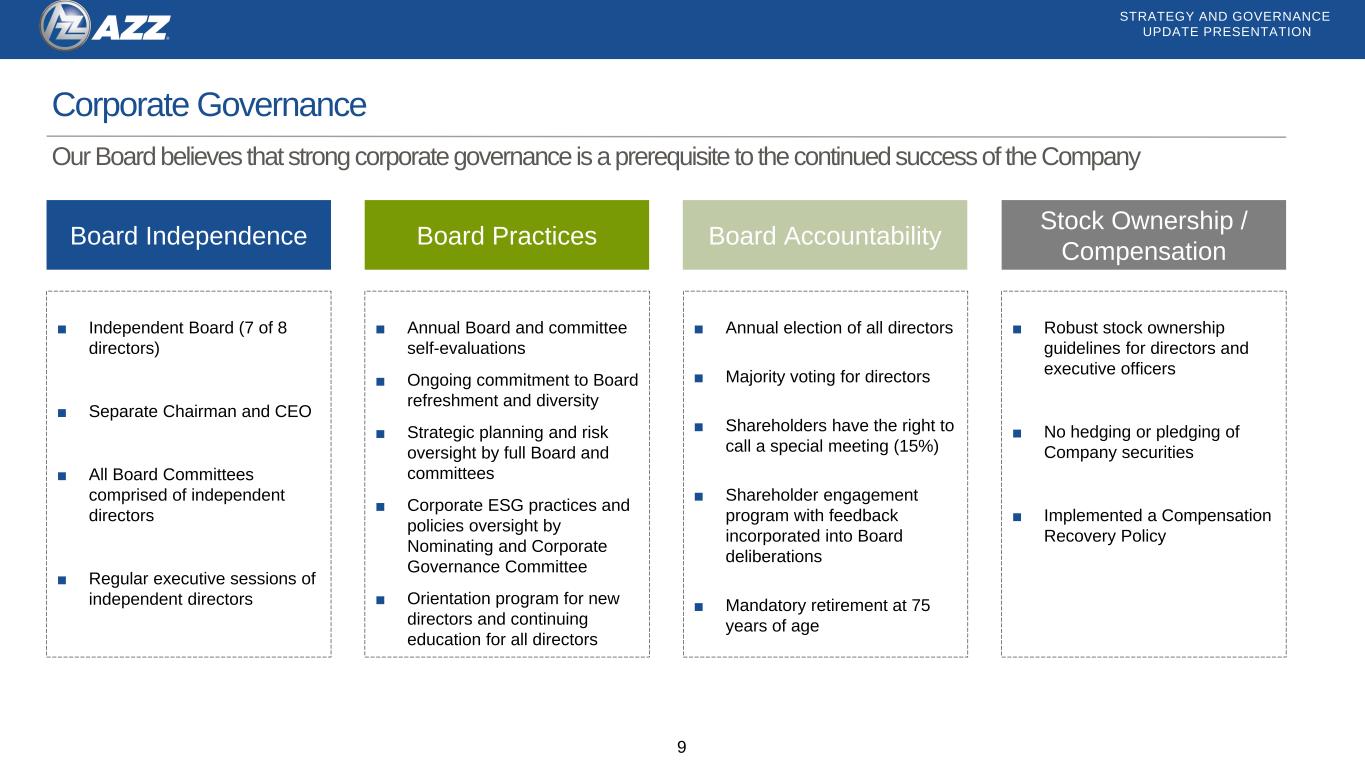

STRATEGY AND GOVERNANCE UPDATE PRESENTATION 9 Corporate Governance Board Independence ■ Independent Board (7 of 8 directors) ■ Separate Chairman and CEO ■ All Board Committees comprised of independent directors ■ Regular executive sessions of independent directors Board Practices Board Accountability ■ Annual Board and committee self-evaluations ■ Ongoing commitment to Board refreshment and diversity ■ Strategic planning and risk oversight by full Board and committees ■ Corporate ESG practices and policies oversight by Nominating and Corporate Governance Committee ■ Orientation program for new directors and continuing education for all directors ■ Annual election of all directors ■ Majority voting for directors ■ Shareholders have the right to call a special meeting (15%) ■ Shareholder engagement program with feedback incorporated into Board deliberations ■ Mandatory retirement at 75 years of age Stock Ownership / Compensation ■ Robust stock ownership guidelines for directors and executive officers ■ No hedging or pledging of Company securities ■ Implemented a Compensation Recovery Policy Our Board believes that strong corporate governance is a prerequisite to the continued success of the Company

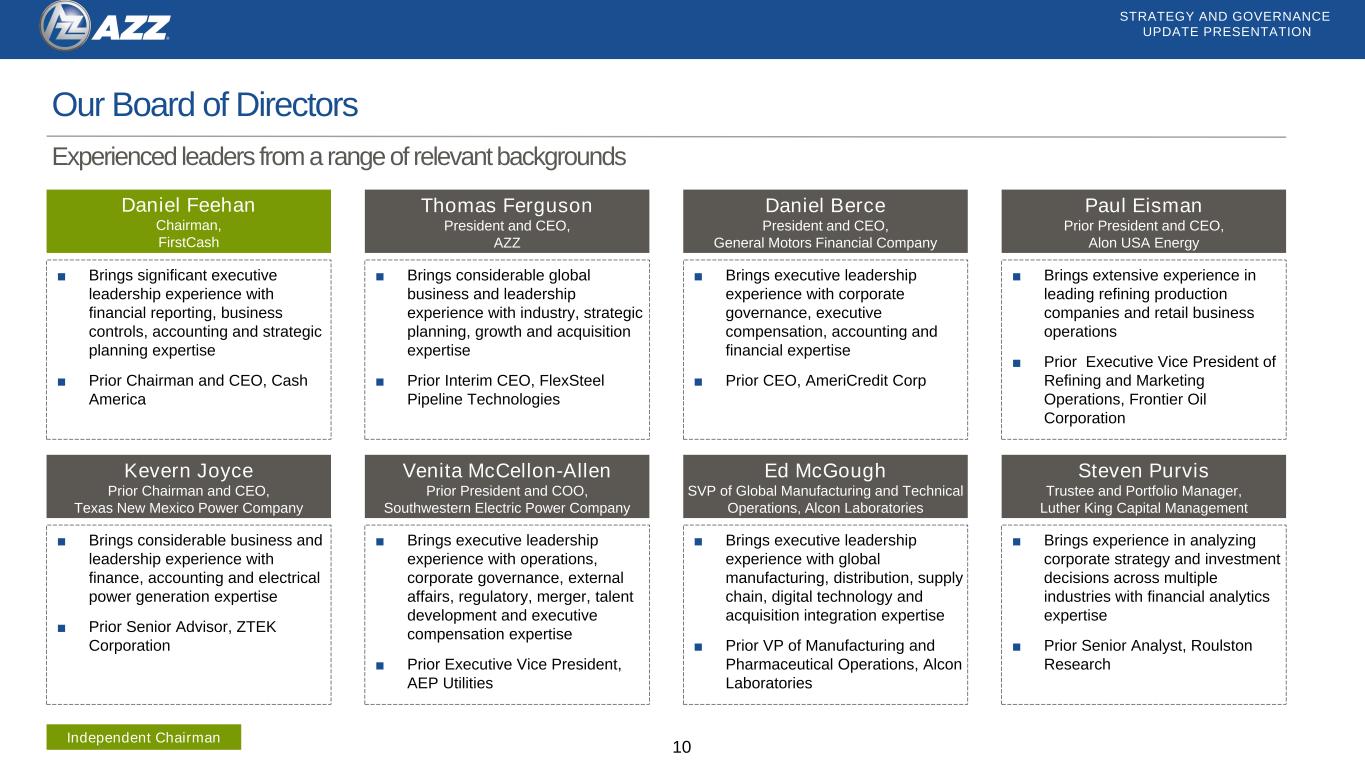

STRATEGY AND GOVERNANCE UPDATE PRESENTATION 10 Our Board of Directors Daniel Feehan Chairman, FirstCash ■ Brings significant executive leadership experience with financial reporting, business controls, accounting and strategic planning expertise ■ Prior Chairman and CEO, Cash America Experienced leaders from a range of relevant backgrounds ■ Brings considerable global business and leadership experience with industry, strategic planning, growth and acquisition expertise ■ Prior Interim CEO, FlexSteel Pipeline Technologies ■ Brings executive leadership experience with corporate governance, executive compensation, accounting and financial expertise ■ Prior CEO, AmeriCredit Corp ■ Brings extensive experience in leading refining production companies and retail business operations ■ Prior Executive Vice President of Refining and Marketing Operations, Frontier Oil Corporation ■ Brings considerable business and leadership experience with finance, accounting and electrical power generation expertise ■ Prior Senior Advisor, ZTEK Corporation ■ Brings executive leadership experience with operations, corporate governance, external affairs, regulatory, merger, talent development and executive compensation expertise ■ Prior Executive Vice President, AEP Utilities ■ Brings executive leadership experience with global manufacturing, distribution, supply chain, digital technology and acquisition integration expertise ■ Prior VP of Manufacturing and Pharmaceutical Operations, Alcon Laboratories ■ Brings experience in analyzing corporate strategy and investment decisions across multiple industries with financial analytics expertise ■ Prior Senior Analyst, Roulston Research Thomas Ferguson President and CEO, AZZ Daniel Berce President and CEO, General Motors Financial Company Paul Eisman Prior President and CEO, Alon USA Energy Kevern Joyce Prior Chairman and CEO, Texas New Mexico Power Company Venita McCellon-Allen Prior President and COO, Southwestern Electric Power Company Ed McGough SVP of Global Manufacturing and Technical Operations, Alcon Laboratories Steven Purvis Trustee and Portfolio Manager, Luther King Capital Management Independent Chairman

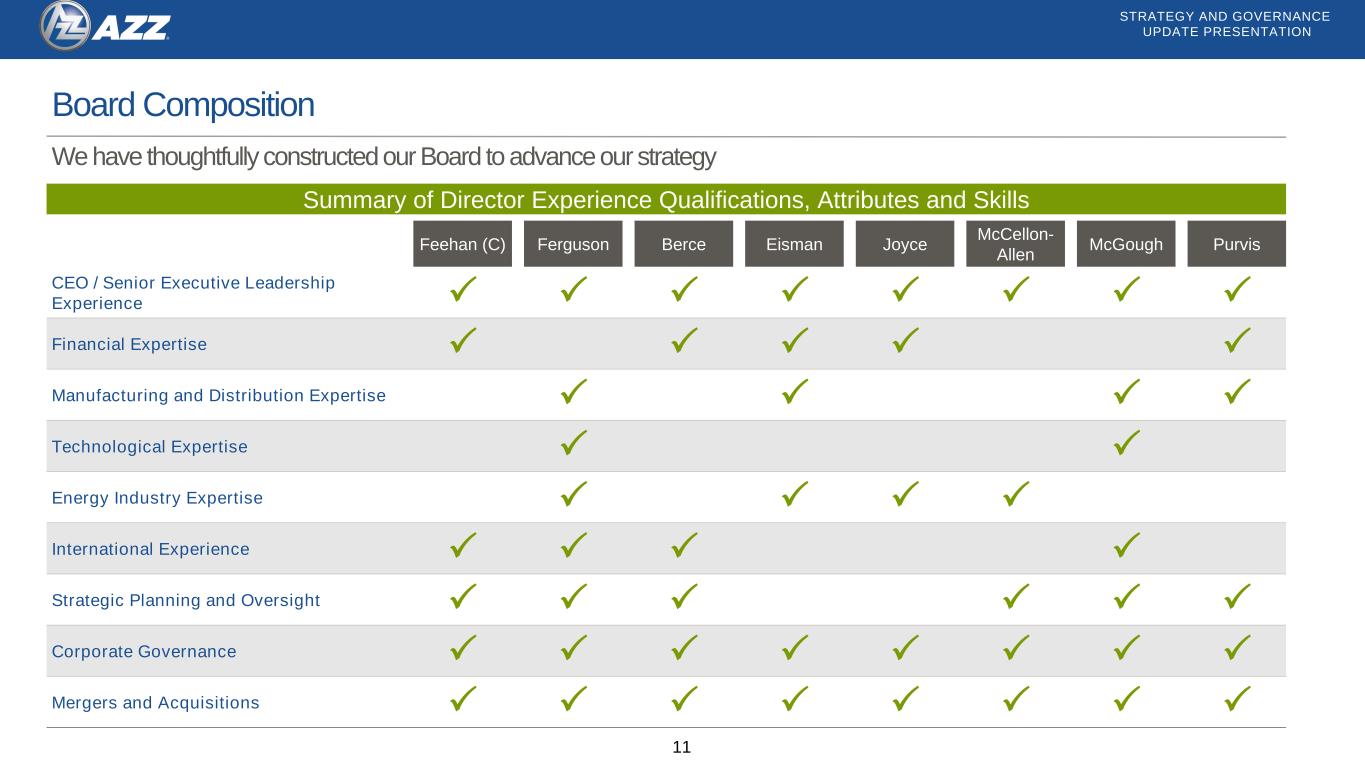

STRATEGY AND GOVERNANCE UPDATE PRESENTATION 11 Board Composition Feehan (C) Ferguson Berce Eisman Joyce McCellon- Allen McGough Purvis CEO / Senior Executive Leadership Experience P P P P P P P P Financial Expertise P P P P P Manufacturing and Distribution Expertise P P P P Technological Expertise P P Energy Industry Expertise P P P P International Experience P P P P Strategic Planning and Oversight P P P P P P Corporate Governance P P P P P P P P Mergers and Acquisitions P P P P P P P P We have thoughtfully constructed our Board to advance our strategy Summary of Director Experience Qualifications, Attributes and Skills

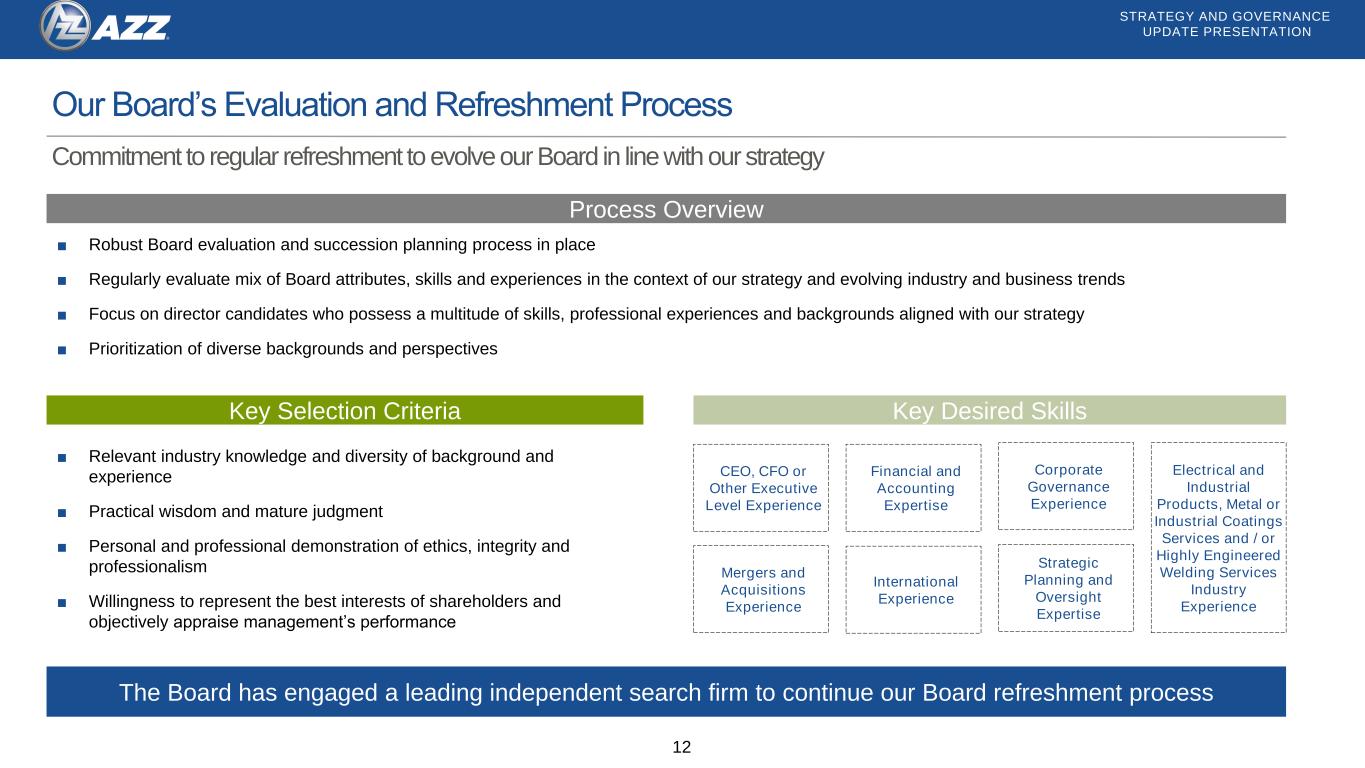

STRATEGY AND GOVERNANCE UPDATE PRESENTATION 12 Our Board’s Evaluation and Refreshment Process Process Overview Commitment to regular refreshment to evolve our Board in line with our strategy Key Selection Criteria ■ Relevant industry knowledge and diversity of background and experience ■ Practical wisdom and mature judgment ■ Personal and professional demonstration of ethics, integrity and professionalism ■ Willingness to represent the best interests of shareholders and objectively appraise management’s performance Key Desired Skills Financial and Accounting Expertise CEO, CFO or Other Executive Level Experience Mergers and Acquisitions Experience Corporate Governance Experience International Experience Electrical and Industrial Products, Metal or Industrial Coatings Services and / or Highly Engineered Welding Services Industry Experience Strategic Planning and Oversight Expertise ■ Robust Board evaluation and succession planning process in place ■ Regularly evaluate mix of Board attributes, skills and experiences in the context of our strategy and evolving industry and business trends ■ Focus on director candidates who possess a multitude of skills, professional experiences and backgrounds aligned with our strategy ■ Prioritization of diverse backgrounds and perspectives The Board has engaged a leading independent search firm to continue our Board refreshment process

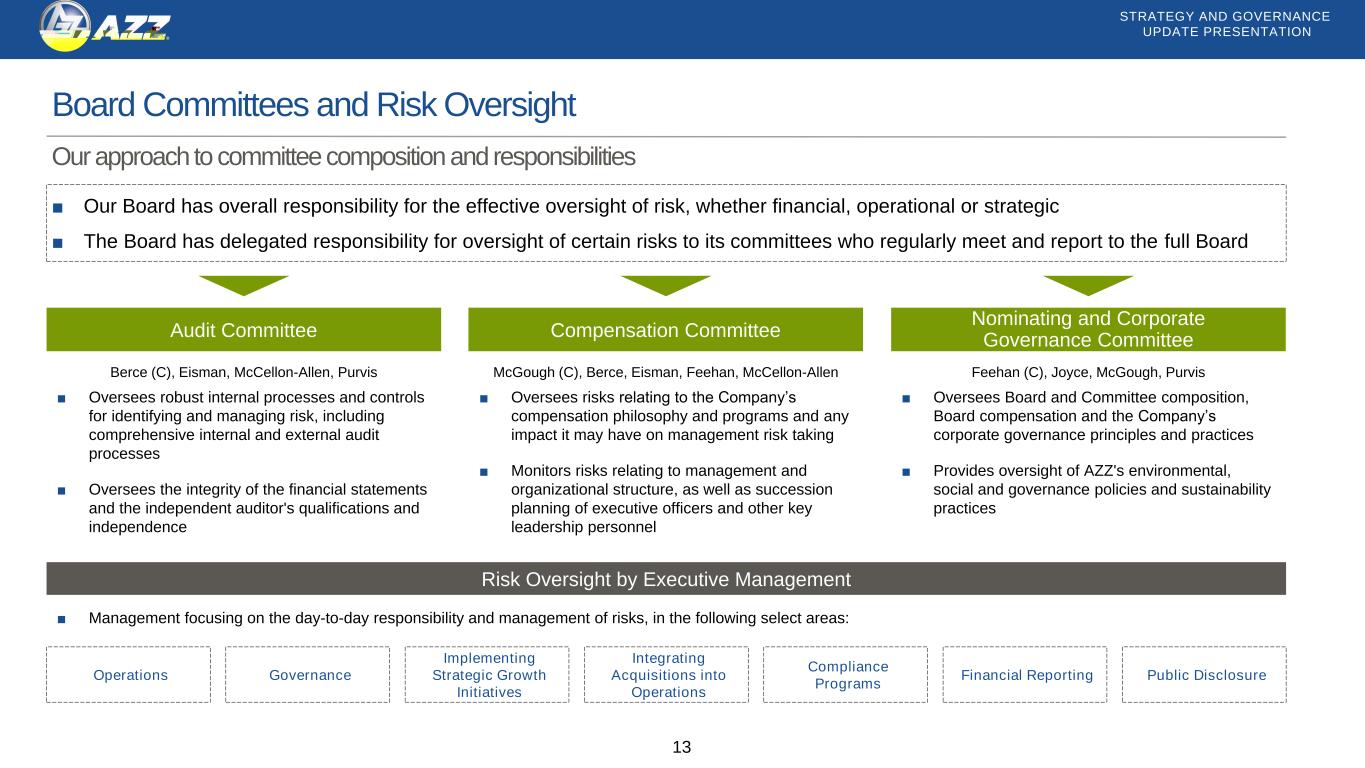

STRATEGY AND GOVERNANCE UPDATE PRESENTATION 13 Board Committees and Risk Oversight Our approach to committee composition and responsibilities ■ Our Board has overall responsibility for the effective oversight of risk, whether financial, operational or strategic ■ The Board has delegated responsibility for oversight of certain risks to its committees who regularly meet and report to the full Board Berce (C), Eisman, McCellon-Allen, Purvis Audit Committee ■ Oversees robust internal processes and controls for identifying and managing risk, including comprehensive internal and external audit processes ■ Oversees the integrity of the financial statements and the independent auditor's qualifications and independence Compensation Committee ■ Oversees risks relating to the Company’s compensation philosophy and programs and any impact it may have on management risk taking ■ Monitors risks relating to management and organizational structure, as well as succession planning of executive officers and other key leadership personnel Nominating and Corporate Governance Committee ■ Oversees Board and Committee composition, Board compensation and the Company’s corporate governance principles and practices ■ Provides oversight of AZZ's environmental, social and governance policies and sustainability practices Risk Oversight by Executive Management ■ Management focusing on the day-to-day responsibility and management of risks, in the following select areas: McGough (C), Berce, Eisman, Feehan, McCellon-Allen Feehan (C), Joyce, McGough, Purvis Operations Governance Implementing Strategic Growth Initiatives Integrating Acquisitions into Operations Compliance Programs Financial Reporting Public Disclosure

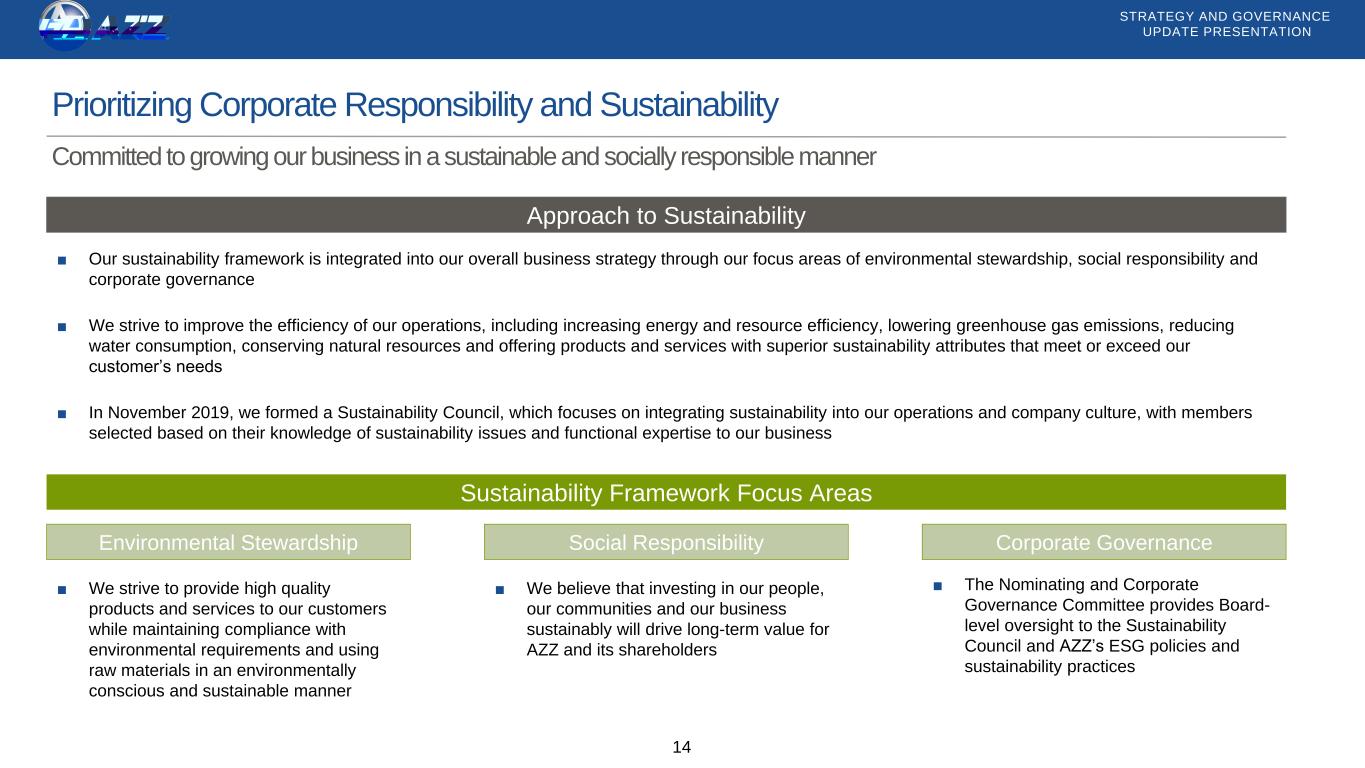

STRATEGY AND GOVERNANCE UPDATE PRESENTATION 14 Prioritizing Corporate Responsibility and Sustainability Approach to Sustainability Committed to growing our business in a sustainable and socially responsible manner ■ We strive to provide high quality products and services to our customers while maintaining compliance with environmental requirements and using raw materials in an environmentally conscious and sustainable manner ■ Our sustainability framework is integrated into our overall business strategy through our focus areas of environmental stewardship, social responsibility and corporate governance ■ We strive to improve the efficiency of our operations, including increasing energy and resource efficiency, lowering greenhouse gas emissions, reducing water consumption, conserving natural resources and offering products and services with superior sustainability attributes that meet or exceed our customer’s needs ■ In November 2019, we formed a Sustainability Council, which focuses on integrating sustainability into our operations and company culture, with members selected based on their knowledge of sustainability issues and functional expertise to our business Corporate GovernanceSocial ResponsibilityEnvironmental Stewardship Sustainability Framework Focus Areas ■ We believe that investing in our people, our communities and our business sustainably will drive long-term value for AZZ and its shareholders ■ The Nominating and Corporate Governance Committee provides Board- level oversight to the Sustainability Council and AZZ’s ESG policies and sustainability practices

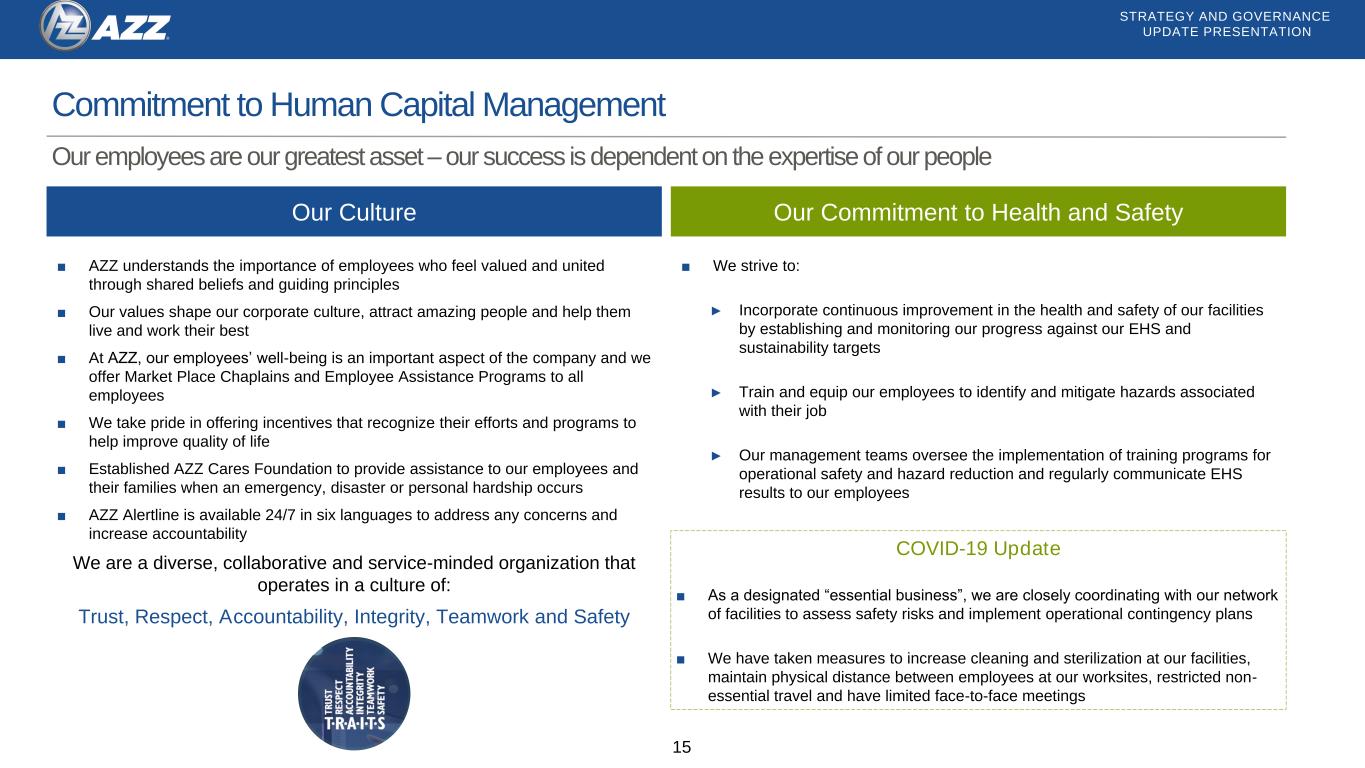

STRATEGY AND GOVERNANCE UPDATE PRESENTATION 15 Commitment to Human Capital Management Our Culture Our employees are our greatest asset – our success is dependent on the expertise of our people ■ AZZ understands the importance of employees who feel valued and united through shared beliefs and guiding principles ■ Our values shape our corporate culture, attract amazing people and help them live and work their best ■ At AZZ, our employees’ well-being is an important aspect of the company and we offer Market Place Chaplains and Employee Assistance Programs to all employees ■ We take pride in offering incentives that recognize their efforts and programs to help improve quality of life ■ Established AZZ Cares Foundation to provide assistance to our employees and their families when an emergency, disaster or personal hardship occurs ■ AZZ Alertline is available 24/7 in six languages to address any concerns and increase accountability We are a diverse, collaborative and service-minded organization that operates in a culture of: Trust, Respect, Accountability, Integrity, Teamwork and Safety ■ We strive to: ► Incorporate continuous improvement in the health and safety of our facilities by establishing and monitoring our progress against our EHS and sustainability targets ► Train and equip our employees to identify and mitigate hazards associated with their job ► Our management teams oversee the implementation of training programs for operational safety and hazard reduction and regularly communicate EHS results to our employees COVID-19 Update ■ As a designated “essential business”, we are closely coordinating with our network of facilities to assess safety risks and implement operational contingency plans ■ We have taken measures to increase cleaning and sterilization at our facilities, maintain physical distance between employees at our worksites, restricted non- essential travel and have limited face-to-face meetings Our Commitment to Health and Safety

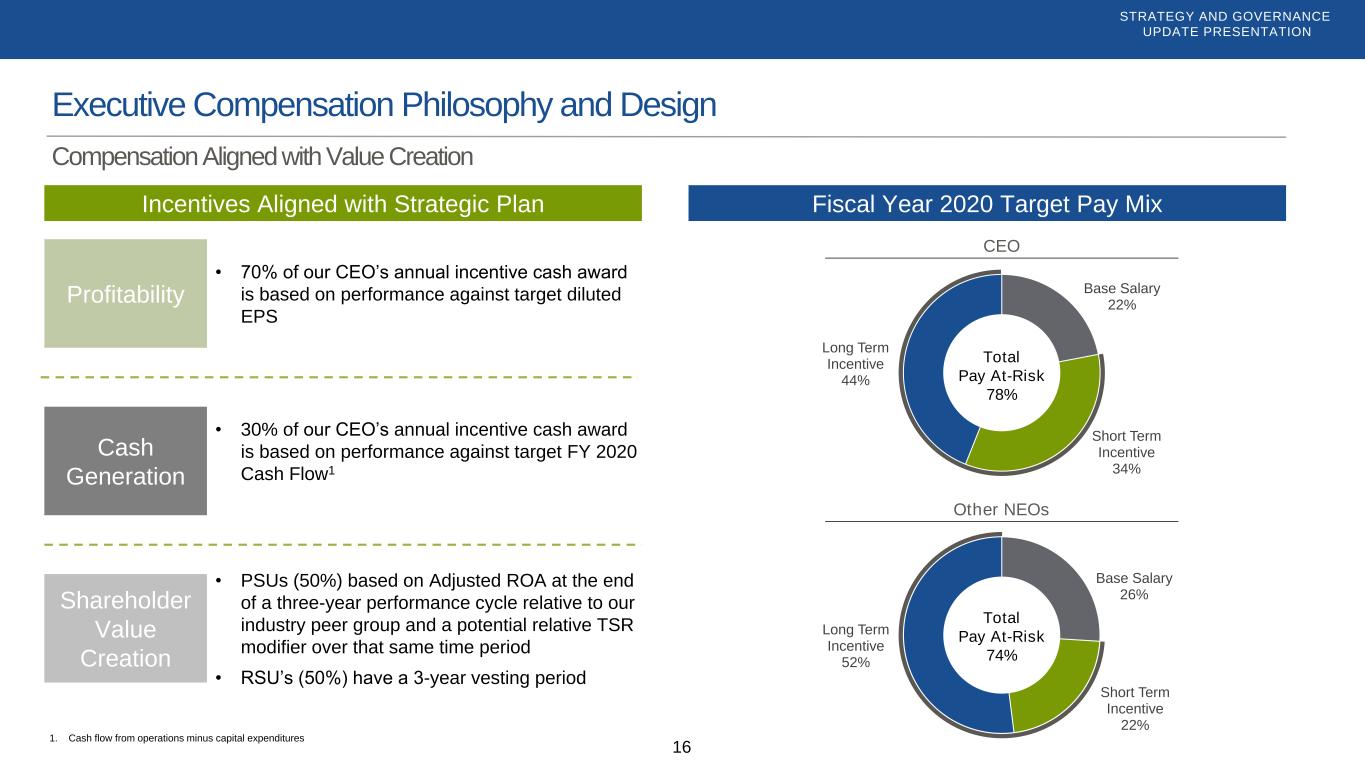

STRATEGY AND GOVERNANCE UPDATE PRESENTATION 16 Executive Compensation Philosophy and Design Compensation Aligned with Value Creation Fiscal Year 2020 Target Pay MixIncentives Aligned with Strategic Plan Base Salary 22% Short Term Incentive 34% Long Term Incentive 44% Base Salary 26% Short Term Incentive 22% Long Term Incentive 52% CEO Other NEOs Total Pay At-Risk 78% Total Pay At-Risk 74% 1. Cash flow from operations minus capital expenditures Profitability Cash Generation Shareholder Value Creation • 70% of our CEO’s annual incentive cash award is based on performance against target diluted EPS • 30% of our CEO’s annual incentive cash award is based on performance against target FY 2020 Cash Flow1 • PSUs (50%) based on Adjusted ROA at the end of a three-year performance cycle relative to our industry peer group and a potential relative TSR modifier over that same time period • RSU’s (50%) have a 3-year vesting period

STRATEGY AND GOVERNANCE UPDATE PRESENTATION 17 A Compelling Long-Term Investment Experienced Board is Advising on Strategy, Overseeing Risk and Supporting Long-Term Value Creation Conducting Comprehensive Review in Infrastructure Solutions Focusing on Driving Profitable Growth in Metal Coatings Targeting Increased Capital Returns to Shareholders Integrating Human Capital and Environmental Initiatives into our Operations and Culture Ensuring Shareholder Engagement is Incorporated into the Alignment of our ESG Programs with our Strategic Goals

Appendix and Additional Information

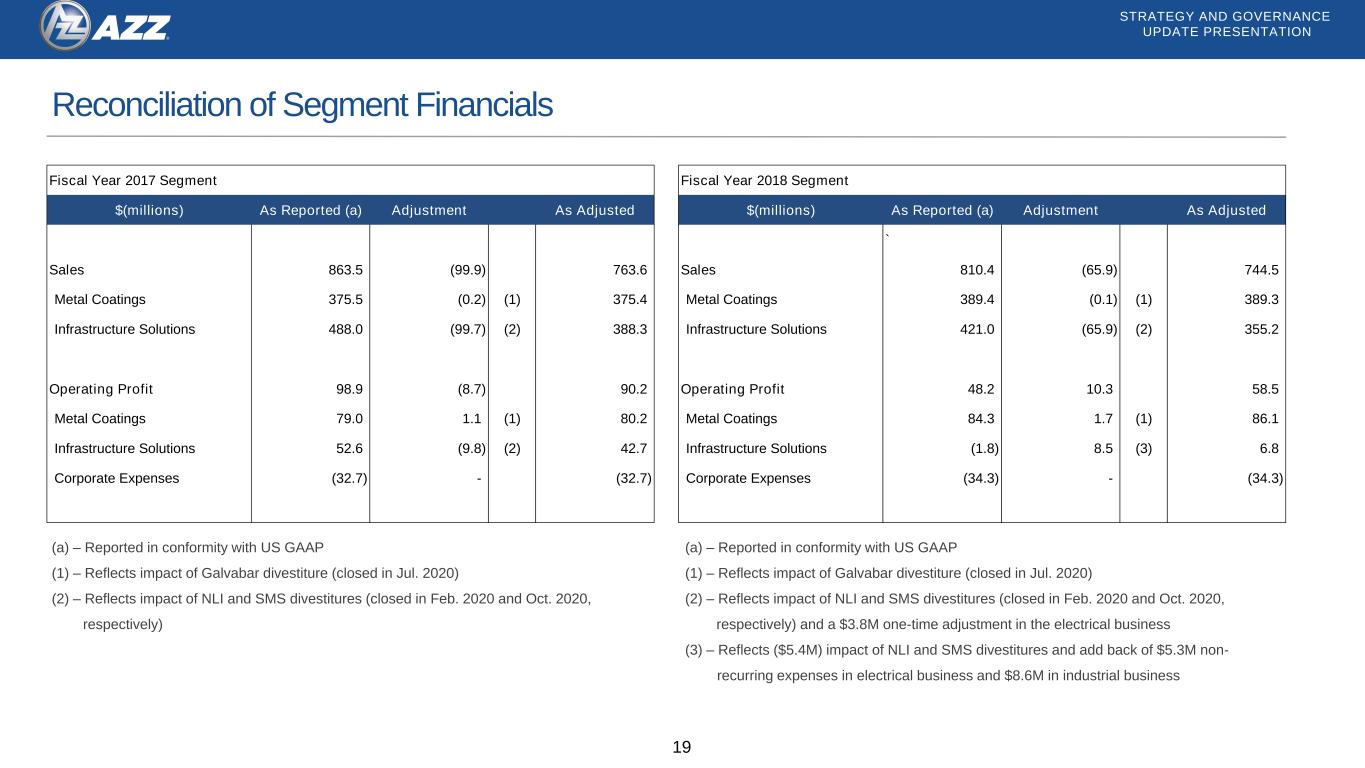

STRATEGY AND GOVERNANCE UPDATE PRESENTATION 19 Reconciliation of Segment Financials Fiscal Year 2017 Segment $(millions) As Reported (a) Adjustment As Adjusted Sales 863.5 (99.9) 763.6 Metal Coatings 375.5 (0.2) (1) 375.4 Infrastructure Solutions 488.0 (99.7) (2) 388.3 Operating Profit 98.9 (8.7) 90.2 Metal Coatings 79.0 1.1 (1) 80.2 Infrastructure Solutions 52.6 (9.8) (2) 42.7 Corporate Expenses (32.7) - (32.7) Fiscal Year 2018 Segment $(millions) As Reported (a) Adjustment As Adjusted ` Sales 810.4 (65.9) 744.5 Metal Coatings 389.4 (0.1) (1) 389.3 Infrastructure Solutions 421.0 (65.9) (2) 355.2 Operating Profit 48.2 10.3 58.5 Metal Coatings 84.3 1.7 (1) 86.1 Infrastructure Solutions (1.8) 8.5 (3) 6.8 Corporate Expenses (34.3) - (34.3) (a) – Reported in conformity with US GAAP (1) – Reflects impact of Galvabar divestiture (closed in Jul. 2020) (2) – Reflects impact of NLI and SMS divestitures (closed in Feb. 2020 and Oct. 2020, respectively) (a) – Reported in conformity with US GAAP (1) – Reflects impact of Galvabar divestiture (closed in Jul. 2020) (2) – Reflects impact of NLI and SMS divestitures (closed in Feb. 2020 and Oct. 2020, respectively) and a $3.8M one-time adjustment in the electrical business (3) – Reflects ($5.4M) impact of NLI and SMS divestitures and add back of $5.3M non- recurring expenses in electrical business and $8.6M in industrial business

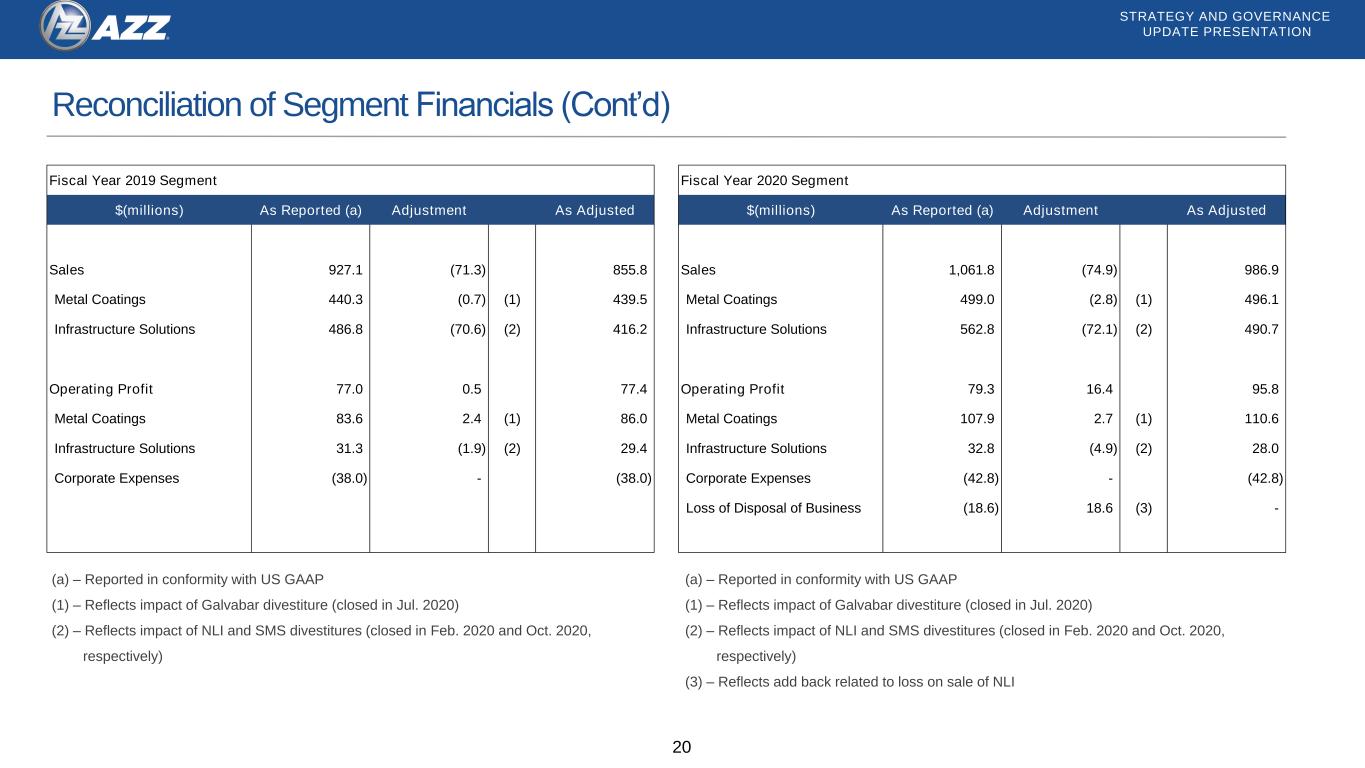

STRATEGY AND GOVERNANCE UPDATE PRESENTATION 20 Reconciliation of Segment Financials (Cont’d) Fiscal Year 2019 Segment $(millions) As Reported (a) Adjustment As Adjusted Sales 927.1 (71.3) 855.8 Metal Coatings 440.3 (0.7) (1) 439.5 Infrastructure Solutions 486.8 (70.6) (2) 416.2 Operating Profit 77.0 0.5 77.4 Metal Coatings 83.6 2.4 (1) 86.0 Infrastructure Solutions 31.3 (1.9) (2) 29.4 Corporate Expenses (38.0) - (38.0) Fiscal Year 2020 Segment $(millions) As Reported (a) Adjustment As Adjusted Sales 1,061.8 (74.9) 986.9 Metal Coatings 499.0 (2.8) (1) 496.1 Infrastructure Solutions 562.8 (72.1) (2) 490.7 Operating Profit 79.3 16.4 95.8 Metal Coatings 107.9 2.7 (1) 110.6 Infrastructure Solutions 32.8 (4.9) (2) 28.0 Corporate Expenses (42.8) - (42.8) Loss of Disposal of Business (18.6) 18.6 (3) - (a) – Reported in conformity with US GAAP (1) – Reflects impact of Galvabar divestiture (closed in Jul. 2020) (2) – Reflects impact of NLI and SMS divestitures (closed in Feb. 2020 and Oct. 2020, respectively) (a) – Reported in conformity with US GAAP (1) – Reflects impact of Galvabar divestiture (closed in Jul. 2020) (2) – Reflects impact of NLI and SMS divestitures (closed in Feb. 2020 and Oct. 2020, respectively) (3) – Reflects add back related to loss on sale of NLI

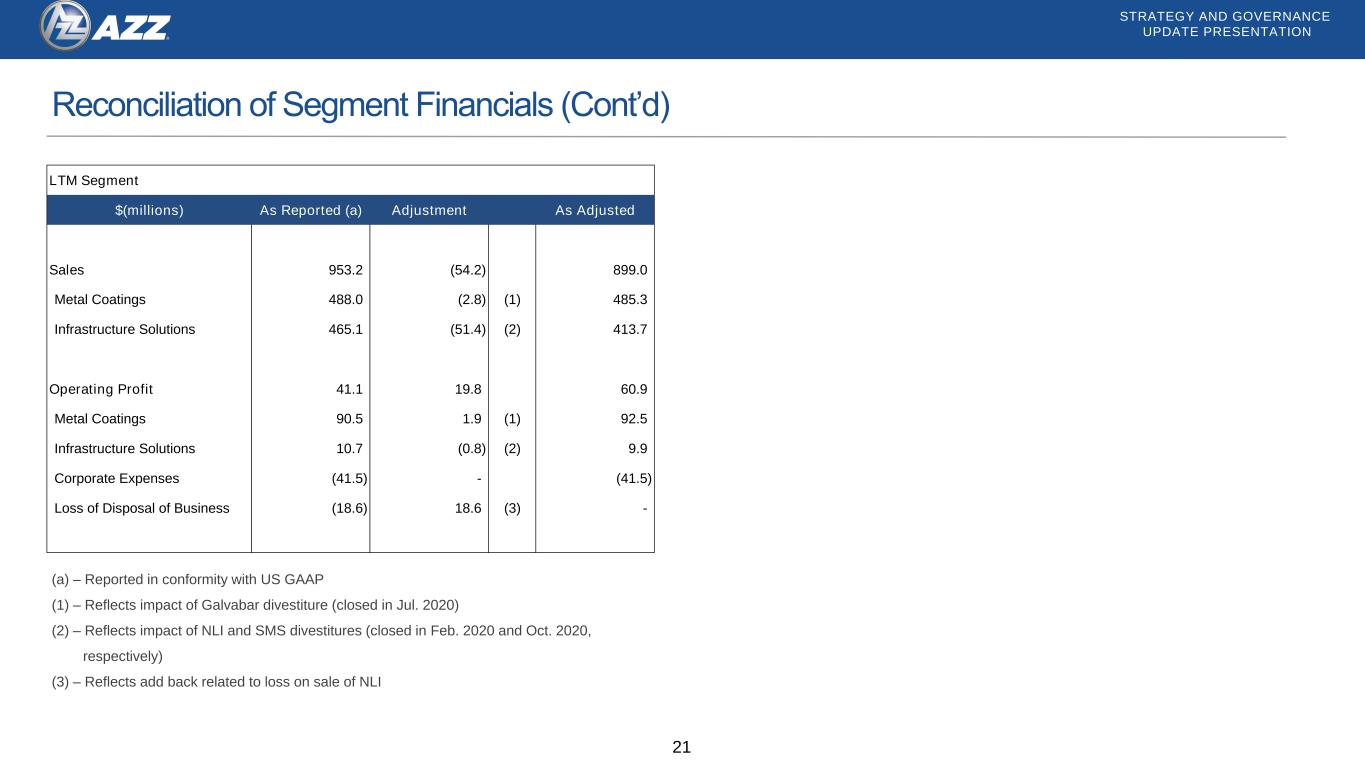

STRATEGY AND GOVERNANCE UPDATE PRESENTATION 21 Reconciliation of Segment Financials (Cont’d) LTM Segment $(millions) As Reported (a) Adjustment As Adjusted Sales 953.2 (54.2) 899.0 Metal Coatings 488.0 (2.8) (1) 485.3 Infrastructure Solutions 465.1 (51.4) (2) 413.7 Operating Profit 41.1 19.8 60.9 Metal Coatings 90.5 1.9 (1) 92.5 Infrastructure Solutions 10.7 (0.8) (2) 9.9 Corporate Expenses (41.5) - (41.5) Loss of Disposal of Business (18.6) 18.6 (3) - (a) – Reported in conformity with US GAAP (1) – Reflects impact of Galvabar divestiture (closed in Jul. 2020) (2) – Reflects impact of NLI and SMS divestitures (closed in Feb. 2020 and Oct. 2020, respectively) (3) – Reflects add back related to loss on sale of NLI

Thank You